Don't wanna be here? Send us removal request.

Text

https://www.psbloansin59minutes.com/knowledge-hub/global-barcoding-standards-msmes

Unlocking Growth: How Global Barcoding Standards Empower MSMEs Micro, Small, and Medium Enterprises (MSMEs) can boost efficiency, gain global market access, and build trust through standardized barcoding systems like GS1. Discover how adopting global barcoding standards helps MSMEs streamline operations, reduce errors, and meet international trade requirements with ease.

#psbloansin59minutes#psb59#loans#onlinepsbloans#digitalloanapproval#business loan#msme loan#digital approval#small business#business

0 notes

Text

Skip the Bank, Not the Loan!

No more waiting in long queues—get business loan approval digitally in just 59 minutes with the PSB59 App. Simple, fast, and paperless!

#digitalloanapproval#business loan#digital approval#onlinepsbloans#business#small business#psb59#psbloansin59minutes#loans#msme loan

0 notes

Text

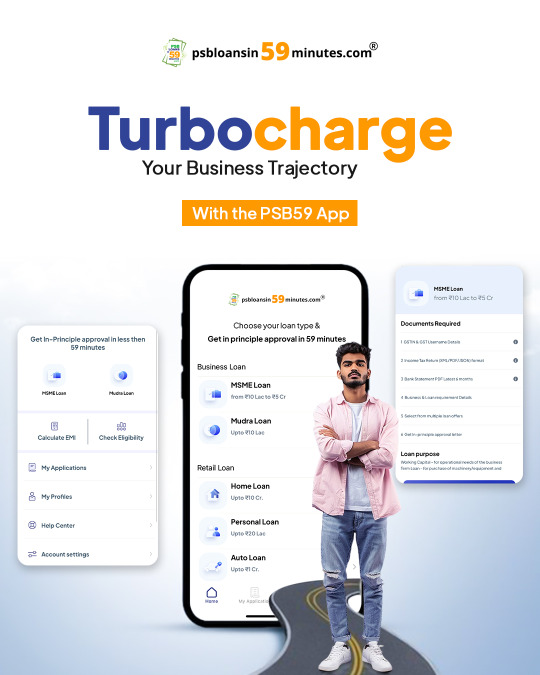

Turbocharge Your Business Trajectory with PSB59

Accelerate your business growth with instant loan approvals through the PSB59 app. Get collateral-free MSME loans up to ₹5 crore in just 59 minutes. Simple process. Fast tracking. Trusted banks.

#psbloansin59minutes#psb59#loans#onlinepsbloans#digital approval#business loan#digitalloanapproval#small business#business#msme loan

0 notes

Text

https://www.psbloansin59minutes.com/knowledge-hub/expectations-of-msmes-from-upcoming-budget-2025-2026

MSME Expectations from Union Budget 2025-26: A Hope for Growth and Support

With Budget 2025-26 on the horizon, MSMEs across India are looking forward to policy support, easier credit access, tax reliefs, and digital infrastructure upgrades. As a sector contributing nearly 30% to India’s GDP and employing over 20 crore people, MSMEs are hopeful that Finance Minister Nirmala Sitharaman will announce measures that empower small businesses, foster innovation, and accelerate inclusive growth.

#UnionBudget2025#MSMEIndia#BudgetExpectations#SupportForMSMEs#IndianEconomy#NirmalaSitharaman#Budget2025#SmallBusinessSupport#DigitalIndia#CreditForMSMEs#MakeInIndia#JobCreation#InclusiveGrowth#StartupIndia

0 notes

Text

Just One App. 59-Minute Loan Approval.

What if one app could get your business loan approved in just 59 minutes? Well, it can! ✅ Instant digital loan approval ✅ Loans up to ₹5 crore ✅ No collateral required ✅ Designed for MSMEs & entrepreneurs Say hello to the PSBLOANIN59MINUTES app – your one-stop solution for fast and easy business loans. Download now and get funded without the wait!

#digitalloanapproval#business loan#digital approval#small business#onlinepsbloans#loans#psb59#psbloansin59minutes#business#msme loan

0 notes

Text

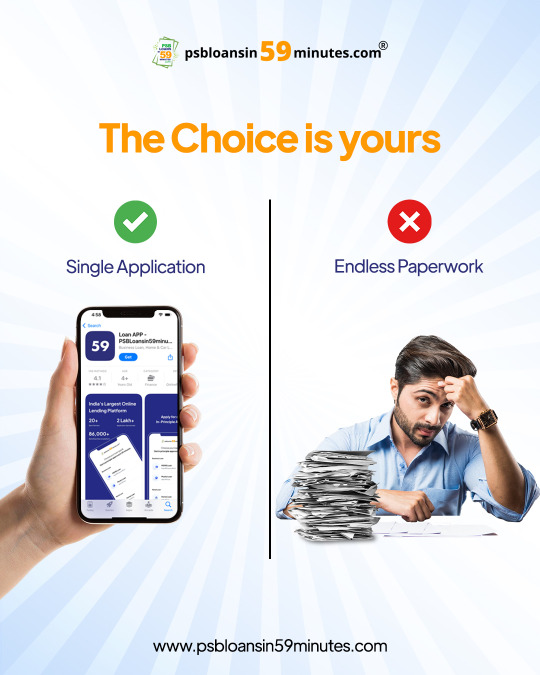

Simple Form vs Stack of Paperwork – What Will You Choose

Why get stuck in endless paperwork when you can apply for a loan with just one simple form on the PSB59 App?

On the Left: Fast, Digital, Effortless. On the Right: Slow, Complicated, Paper-heavy.

✅ Get business loan approval in just 59 minutes ✅ Loans up to ₹5 crore ✅ No lengthy paperwork ✅ MSME-friendly platform

Choose smart. Choose PSB59.

#PSB59#LoanIn59Minutes#BusinessLoan#MSMEIndia#DigitalLoan#FastLoanApproval#LoanMadeEasy#CollateralFreeLoan#GrowYourBusiness#InstantLoan#StartupSupport#MSMELoan#EntrepreneurIndia

0 notes

Text

Loan Approval Ka Shortcut – 59 Minutes Mein

Tired of waiting endlessly for loan approvals? Get business loans approved digitally in just 59 minutes! No more paperwork chaos, just fast, simple, and secure processing through the PSB59 portal. ✅ Collateral-free loans ✅ Upto ₹5 crore ✅ MSME-friendly Apply now and break free from the approval delay!

#PSB59#LoanIn59Minutes#BusinessLoan#MSMEIndia#DigitalLoan#FastLoanApproval#LoanMadeEasy#CollateralFreeLoan#GrowYourBusiness#InstantLoan#StartupSupport#MSMELoan#EntrepreneurIndia

0 notes

Text

https://www.psbloansin59minutes.com/knowledge-hub/private-medicine-wholesaler-msme-loans

Are Private Medicine Wholesalers Eligible for MSME Loans?

Yes, private medicine wholesalers can avail MSME loans if they meet the eligibility criteria set by banks and government schemes. These loans empower pharmaceutical wholesalers to grow their business, streamline logistics, and strengthen their market position. Recognized as MSMEs, such businesses receive strong financial support under various government initiatives aimed at promoting small and medium enterprises in India.

#MSMELoan#MedicineWholesaler#PharmaBusiness#BusinessLoan#MSMESupport#GrowWithMSME#GovernmentSchemes#MSMEIndia#LoanForBusiness#SmallBusinessLoan#PharmaMSME#DigitalLoan#PSB59#CollateralFreeLoan#MSMEFinance

0 notes

Text

One App. 59 Minutes. Unlimited Possibilities!

If only one app could simplify your loan journey — now it does! Say hello to the PSB59 App, your gateway to digital loan approvals in just 59 minutes. ✅ MSME, Business, Auto & Personal Loans ✅ Paperless Process ✅ Trusted by 25+ Banks & NBFCs

#digitalloanapproval#business loan#digital approval#small business#onlinepsbloans#business#msme loan#psb59#loans#psbloansin59minutes

0 notes

Text

Unlock Opportunities in Just 59 Minutes!

Need funding to fuel your business goals? With PSB59, get digital loan approval of up to ₹5 crore in just 59 minutes! Fast, paperless, and hassle-free—unlock the door to growth today.

#PSB59#BusinessLoan#UnlockOpportunities#DigitalLoan#InstantLoanApproval#MSMEIndia#GrowWithPSB59#StartupFunding#59MinutesLoan#EntrepreneurSupport#LoanSimplified#FinanceYourDreams#BusinessGrowth

0 notes

Text

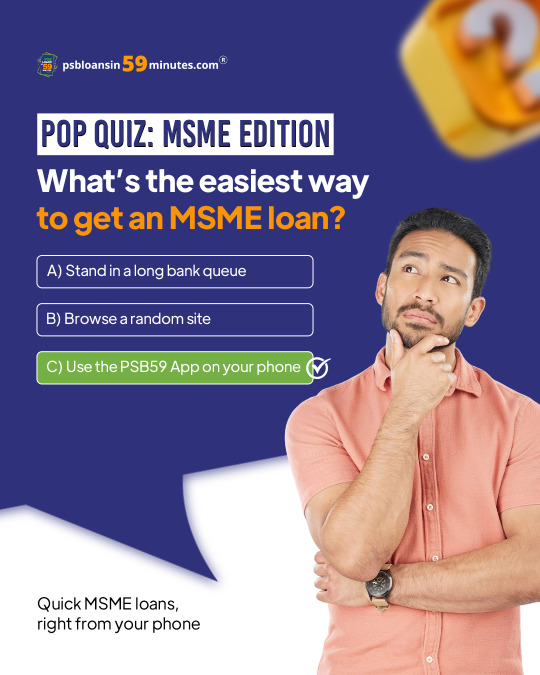

POP QUIZ Time: MSME Edition!

Think getting an MSME loan is complicated? Let’s bust that myth with a quick quiz!

What’s the easiest way to get an MSME loan? A) Wait in long bank queues B) Browse a random site C) Use the Mercant App on your phone

Correct Answer: C! That’s embedded finance made simple — powered by PSB Loans in 59 Minutes. Get loan approvals digitally, quickly, and seamlessly.

Apply Smart. Grow Fast.

#MSMEQuiz#PSB59#EmbeddedFinance#MercantApp#BusinessLoanMadeEasy#DigitalLending#MSMELoan#FintechIndia#LoanIn59Minutes#SmartBusinessFunding#EntrepreneurIndia#QuizTime

0 notes

Text

https://www.psbloansin59minutes.com/knowledge-hub/sme-business-loan-default-consequences

What Happens If You Default on an SME Business Loan?

Defaulting on an SME loan can have serious consequences—ranging from a damaged credit score and legal action to asset seizure and business shutdown. Understand what happens when repayments stop, how lenders respond, and what steps you can take to manage or avoid the fallout. Stay informed and make smarter financial decisions to protect your business future.

#psbloansin59minutes#SMELoan#BusinessLoan#LoanDefault#FinancialAwareness#SmallBusinessTips#CreditScore#LoanRepayment#MSMEIndia#BusinessFinance#ProtectYourBusiness#EntrepreneurTips#BusinessGrowth#SMEAdvice#LoanRecovery#FinancialLiteracy

0 notes

Text

No Sweat Loans – From Heat to Ease in Minutes!

Why wait in long queues and sweat it out for a business loan? Switch to instant digital approvals from the comfort of your home. Cool process. Quick approvals. Big success. Apply now — no sweat, just success.

#loans#onlinepsbloans#psb59#psbloansin59minutes#digital approval#business loan#digitalloanapproval#small business#business#msme loan

0 notes

Text

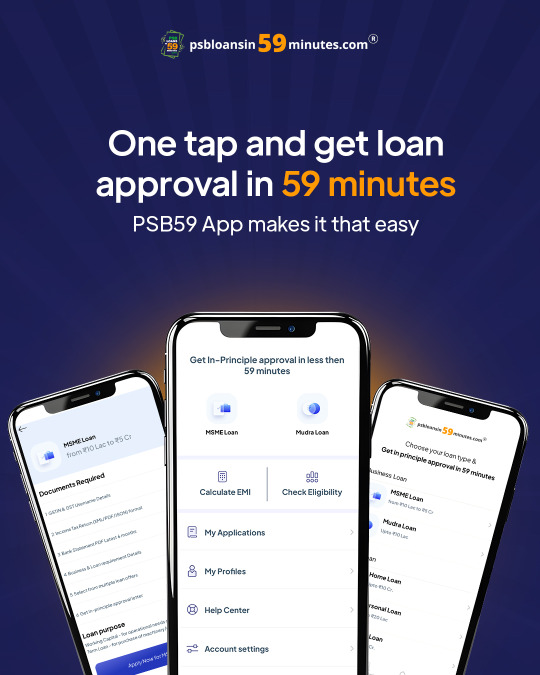

Loan Approval in Just 59 Minutes – One Tap is All It Takes!

No more waiting in long queues or dealing with endless paperwork. With the PSB59 App, you can get your business or personal loan approved digitally in just 59 minutes. Fast, secure, and hassle-free – the future of borrowing is here!

#PSB59#InstantLoanApproval#OneTapLoan#DigitalLoan#BusinessLoan#LoanIn59Minutes#FastLoan#EasyLoanApp#MSMELoan#NoMorePaperwork#DigitalIndia#LoanSimplified#GetLoanFast#OnlineLoanApproval

0 notes

Text

The Choice is Yours: One Form or Endless Paperwork?

Say goodbye to stacks of documents and multiple visits. With a single digital application, unlock multiple loan options—fast, simple, and hassle-free. Choose convenience. Choose smart.

#TheChoiceIsYours#SingleApplication#NoMorePaperwork#DigitalLoans#SmartBanking#LoanMadeEasy#HassleFreeLoans#ApplyOnline#OneFormManyOptions#PSB59#GovernmentSchemes#LoanWithoutStress#PaperlessProcess#InstantLoanApproval

0 notes

Text

https://www.psbloansin59minutes.com/knowledge-hub/do-restaurants-and-hotels-come-under-msme-a-guide-to-msme-loans

Do Restaurants and Hotels Come Under MSME? Your Guide to Hospitality Business Loans

Yes, restaurants and hotels are classified as MSMEs and are eligible for MSME loans. Whether it’s managing operational costs, upgrading infrastructure, or expanding services, MSME loans offer tailored financial support to hospitality businesses. These loans empower hotels and eateries to thrive in a competitive industry by providing access to funding for renovations, growth, and day-to-day expenses. Learn how your hospitality venture can benefit from MSME classification and unlock new opportunities for success.

#onlinepsbloans#business loan#digitalloanapproval#psb59#digital approval#loans#psbloansin59minutes#small business#business#msme loan

0 notes

Text

Get Loan Approval in Just 59 Minutes with One App!

Why wait days for a loan? With the PSB59 App, you can get digital loan approval in just 59 minutes! Whether it's for business, personal, auto, or home—your loan journey starts here. ✅ Fast approval ✅ Multiple lenders ✅ Completely online

#PSB59#LoanIn59Minutes#InstantLoanApproval#DigitalLoan#BusinessLoan#PersonalLoan#AutoLoan#HomeLoan#EasyLoanProcess#LoanMadeSimple#FinanceMadeEasy#DigitalIndia#MSMELoan#StartupLoan#LoanWithoutDelay#JanSamarth#SmartBanking#OnlineLoan

0 notes