#Crypto ATM Market Future Outlook

Explore tagged Tumblr posts

Text

Crypto ATM Market Future Outlook Analyzing Growth Trends, Technological Innovations, Consumer Adoption, and Global Cryptocurrency Expansion

The cryptocurrency market has witnessed exponential growth over the past decade, with crypto ATMs playing a critical role in bridging the gap between digital assets and mainstream financial systems. Crypto ATMs have become a vital tool for users seeking easy access to cryptocurrencies, enabling buying and selling of digital assets through convenient physical interfaces. As the market evolves, the future outlook for crypto ATMs is shaped by technological innovations, regulatory changes, and growing consumer adoption. This article delves into the factors influencing the future of the crypto ATM market and its anticipated trajectory.

1. Market Growth and Adoption Trends

The crypto ATM market is projected to grow at a robust pace, driven by the increasing adoption of cryptocurrencies worldwide. As of 2025, the number of installed crypto ATMs is expected to surpass 50,000 globally, with a compound annual growth rate (CAGR) of approximately 20%. The expansion of the cryptocurrency ecosystem, combined with a surge in retail and institutional interest, is fueling demand for accessible and user-friendly crypto transaction methods.

Countries such as the United States, Canada, and parts of Europe lead the market in crypto ATM installations, while emerging economies in Latin America, Asia, and Africa are becoming promising growth regions. These areas are experiencing higher cryptocurrency adoption rates due to factors such as financial instability, unbanked populations, and increasing smartphone penetration.

2. Technological Innovations Shaping the Market

Technological advancements are a significant driver of the crypto ATM market’s future outlook. Blockchain technology, which underpins the functionality of crypto ATMs, is continually improving in terms of speed, scalability, and security. These advancements ensure faster and more reliable transactions, addressing concerns about delays or inefficiencies.

Biometric authentication, such as facial recognition and fingerprint scanning, is expected to become standard in crypto ATMs, enhancing security and ensuring compliance with regulatory requirements. These features will likely boost consumer confidence and encourage broader adoption of crypto ATMs.

Additionally, future crypto ATMs may integrate multi-cryptocurrency support, allowing users to transact with a wider range of digital assets. With the rise of stablecoins and DeFi tokens, providing diverse cryptocurrency options will be essential for maintaining competitiveness in the market.

3. Impact of Regulatory Developments

Regulatory frameworks will play a pivotal role in determining the growth and expansion of the crypto ATM market. Governments around the world are increasingly focusing on regulating cryptocurrencies to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) standards. In the future, crypto ATM operators will need to implement robust compliance mechanisms to operate legally and sustainably.

Regions with crypto-friendly regulations, such as Switzerland and Singapore, are likely to see faster growth in crypto ATM installations. Conversely, markets with regulatory uncertainty or restrictive policies may experience slower adoption rates. Harmonizing international regulations could further accelerate the global expansion of the crypto ATM market.

4. Consumer Behavior and Preferences

Consumer behavior is central to the crypto ATM market’s growth trajectory. The demand for convenient and secure cryptocurrency transaction methods is rising, particularly among tech-savvy millennials and Gen Z users. These demographics value speed, accessibility, and the ability to conduct transactions without traditional banking intermediaries.

Crypto ATMs also appeal to individuals in regions with limited access to banking services. By providing a gateway to decentralized financial systems, crypto ATMs address the needs of the unbanked population, offering them a secure and efficient means of participating in the digital economy.

Moreover, the trend of crypto remittances, where users send money internationally using cryptocurrencies, is likely to boost demand for crypto ATMs. These machines provide a straightforward way for recipients to convert cryptocurrencies into local currencies.

5. Challenges and Opportunities

While the future of the crypto ATM market looks promising, there are challenges to address. Security concerns, including the risk of hacking or fraudulent activities, remain a key issue. Ensuring robust encryption and authentication protocols will be critical for maintaining consumer trust.

Another challenge is the high operating costs associated with crypto ATMs, including maintenance, compliance, and transaction fees. Operators will need to adopt innovative business models to ensure profitability while keeping costs manageable for users.

Despite these challenges, the market presents numerous opportunities. The integration of advanced technologies, such as artificial intelligence (AI) for transaction analytics and customer support, could enhance the functionality and user experience of crypto ATMs. Partnerships with financial institutions and retail businesses could also drive adoption by making crypto ATMs more accessible.

6. Future Outlook and Conclusion

The future of the crypto ATM market is bright, characterized by rapid technological innovation, growing consumer adoption, and expanding geographic reach. As the cryptocurrency ecosystem matures, crypto ATMs will remain a cornerstone of digital asset accessibility, bridging the gap between decentralized finance and everyday users.

To succeed, industry players must focus on improving security, ensuring regulatory compliance, and expanding their service offerings to meet evolving consumer needs. With the right strategies, crypto ATMs are poised to become an integral part of the global financial infrastructure, driving cryptocurrency adoption to new heights.

0 notes

Text

US Spot BTC ETFs Nears Overtaking Satoshi Nakamoto’s Bitcoin Holdings

Key Points

Bitcoin (BTC) is testing the $72K support level, with bullish sentiment influenced by increased demand from whale investors.

US spot Bitcoin ETFs have seen a net cash inflow of over $5.5 billion in the past month, potentially surpassing Satoshi Nakamoto’s holdings.

Bitcoin (BTC) has been hovering around the $72K support level over the last couple of days, following a rally that almost reached its previous all-time high.

The leading cryptocurrency, with a fully diluted market cap of approximately $1.51 trillion and a daily trading volume of around 42 billion, has experienced a surge in demand from large-scale investors.

Bullish Sentiment Returns

For the first time since March, Bitcoin’s daily Relative Strength Index (RSI) has exceeded the 70 percent mark, indicating a resurgence of bullish sentiment.

From a technical perspective, Bitcoin appears to be on the verge of entering the much-anticipated parabolic phase of the macro bull cycle.

After seven months of bearish sentiment, Bitcoin has gained significant bullish momentum.

In order to confirm the start of a parabolic trend, Bitcoin’s price must consistently close above the resistance range between $71K and $73K and convert it into a support level.

This bullish sentiment is expected to continue in the short term, driven by significant news from the United States.

The US 2024 elections will conclude next week, with pro-crypto candidates, including Donald Trump, showing higher approval ratings.

Additionally, the Federal Reserve is expected to announce another interest rate cut next week to bolster the country’s economic outlook.

Whale Investors Continue to Drive Demand

The demand for Bitcoin from whale investors has significantly increased over the past year compared to previous crypto bull cycles.

On-chain data analysis reveals that the supply of Bitcoin on centralized exchanges has dropped from over 2.7 million to less than 2.3 million in the last seven months, driven by the approval of spot BTC ETFs in the US.

In the last four weeks, US spot Bitcoin ETFs have seen a net cash inflow of more than $5.5 billion, led by BlackRock’s IBIT.

On October 30, US spot Bitcoin ETFs registered a net cash inflow of over $893 million.

BlackRock’s IBIT bought Bitcoins worth over $872 million, bringing its total assets to over $30 billion.

If BlackRock’s IBIT continues to acquire Bitcoin at the current rate, the US spot Bitcoin ETFs will surpass Satoshi Nakamoto’s holdings of about 1.1 million in the coming days.

Meanwhile, MicroStrategy Inc (NASDAQ: MSTR) plans to raise $42 billion through a $21 billion ATM equity offering and another $21 billion in fixed-income securities.

MicroStrategy, which currently holds over 252K BTCs, plans to reinforce its Bitcoin strategy in the near future.

0 notes

Text

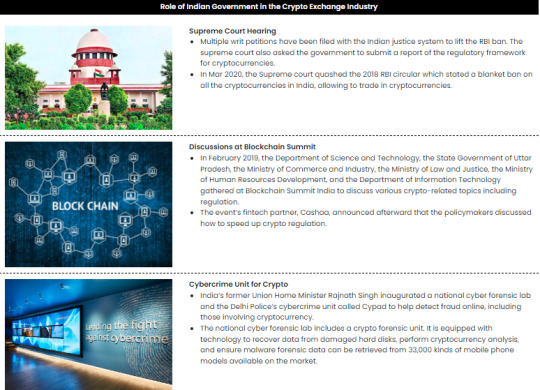

What lies ahead for India Crypto Exchange market? : Ken Research

Buy Now

This white paper delves into the promising potential of India's crypto exchange market, by presenting a comprehensive analysis based on extensive primary and secondary research. By examining growth drivers, government actions, and future prospects, this whitepaper aims to provide valuable insights into the evolving landscape of cryptocurrency trading in India. Our research is rooted in a rigorous methodology that combines in-depth interviews with key industry players, a thorough examination of market trends, and an analysis of government regulations. We present a holistic view of the Indian crypto exchange market, exploring its current state, growth trajectory, and the factors influencing its development. By delving into the dynamics of this market, we aim to equip stakeholders, investors, and policymakers with the knowledge required to navigate the opportunities and challenges that lie ahead. Read on to learn more on the potential of India's crypto exchange market, as we uncover its untapped possibilities.

1. The last decade saw an increase in awareness of virtual currencies, and a fast-growing tech-savvy population seeking alternative modes of investments created a buzzing crypto universe

Request a Call with Expert to know more about the business model

2. Young Investors Are Driving The Crypto Exchange Industry Growth In India Coupled With Cross-Border Remittances & Decentralized Finance (Defi) Which Are Major Traction For Investors

2.1 Moreover, factors such as strict foreign regulations made Rupee conversation complicated, therefore Indians are opting for digital currencies for conversion of INR to a more stable fiat currency

2.2 The introduction of Central Bank Digital Currency (CBDC) and the increasing popularity of NFTs among others has contributed to enhanced visibility of digital currencies in the market.

3. Though India is booming as a hub for Cryptos, there are several issues associated with it such as operational risks, cyber risks and governance risks.

4. To curb the issues, the Government of India played a major role to form a committee to draft regulatory frameworks on Cryptos, working with the Financial Action Task Force to update Crypto policies, and…

4.1. ... Pushed for the upliftment of the blanket ban on virtual currencies and set up Cybercrime unit for detection of the crypto-related frauds held online

5. Indian Crypto market shows good potential due to a surge in Crypto investments, Non-Fungible Tokens and entry of International Cryptocurrency Exchanges in India indicates a strong step forward

Some of the Intelligence Curated by Ken Research in Crypto Exchange Market Space:

MENA Remittance Market Outlook to 2027 segmented by mode of transfer (digital, traditional), type of channel (Banks, online platforms, money transfer operators), type of end use (migrant labour workforce, personal, small business & others) Geography (Latin America, Africa, Asia Pacific, Europe, Middle East)

Australia Cards and Payment Market Outlook to 2027F By Cards (Debit Cards, Credit Cards, Prepaid Cards), By Payment Terminals (POS and ATMs), By Payment Instruments (Credit Transfers, Direct Debit, Cheques, Cash and Payment Cards)

Brazil Cards and Payment Market Outlook to 2027F By Cards (Debit Cards, Credit Cards, Prepaid Cards), By Payment Terminals (POS and ATMs), By Payment Instruments (Credit Transfers, Direct Debit, Cheques, Cash and Payment Cards)

Global Remittance Market Outlook to 2027 segmented by mode of transfer (digital, traditional), type of channel (Banks, online platforms, money transfer operators), type of end use (migrant labour workforce, personal, small business & others) Geography (Latin America, Africa, Asia Pacific, Europe, Middle East)

India Payment Service Market Outlook to 2027F driven by government initiatives & rising need for faster payment modes

To Know more about this Whitepaper, Visit this link:-

Indian crypto exchange market

0 notes

Text

The Crypto ATM Market study with 65+ market data Tables, Pie charts & Figures is now released by HTF MI. The research assessment of the Market is designed to analyze futuristic trends, growth factors, industry opinions, and industry-validated market facts to forecast till 2029. The market Study is segmented by key a region that is accelerating the marketization. This section also provides the scope of different segments and applications that can potentially influence the market in the future.

0 notes

Text

On March 15, the Sheraton Hotel (Bishkek) hosted the PLAS-Forum "Digital Kyrgyzstan", from our organization there was an information booth with staff, and the most honorable and important thing for us: on stage with a report "Development of crypto industry in Kyrgyzstan" was made by Almaz Shabdanov (Chairman of the Board, Envoys Vision Digital Exchange)🚀

Topics that were covered and discussed at the forum: Development of Kyrgyzstan as a modern digital society. From analog society and economy to digital community and ecosystem of country scale The role and place of creative economy in the present and future of the country Electronic services in public administration and G2C. Digitalization of government services and systems of interaction with citizens Digital (remote) education and personnel development. Role of artificial intelligence and machine learning Fintech and Government Regulation Improvement of payment system Fintech as a banking industry culture Blockchain and smart contracts. Innovations that are becoming daily occurrences Problems of information technologies and artificial intelligence. Transformation of tasks and solutions necessary for the digital society NFT. Prospects for the use of non-interchangeable token technology in the near and medium term Cryptocurrency Industry 2023. Current state and main trends. Expected scenario of crypto market development ESG (Environment Social Governance). Principles of Responsible Banking (PRB). Green financing and Green Fintech. How and why to integrate ecological initiatives into fintech structures and banks. Islamic finance in Central Asian countries. Analysis of causes and development results. Promising Islamic banking for 21st century? Contactless and mobile payments. From improving technology and business to solutions supporting SMEs Instant (quick) payments systems. How they change banks, consumer demands and payment scenarios. Open Banking and Open APIs. How they impact the traditional banking market Big Data. Further transformations of the banking landscape The future of non-banks. Modern NeoBANK 4.0 = XaaS (Anything as a Service). Other scenarios for the development of non-banks SMB banking services against the changing banking landscape e-Commerce as an analogue of fintech for retail. Standalone product for national market Remote Identification is an integral part of digitalization of banking. From convenience for consumers to guarantee freedom of choice of products and services. Situation on the global ATM market. Main trends Digital currencies of central banks - CBDC. Goals and tasks to be solved with their help. International payment systems. Vector change and dynamics of MPS development Meta-universe as one of the interesting and breakthrough directions of payment business and retail. The mid-term outlook BNPL-model (Buy Now, Pay Later). A successful competitor to credit cards and consumer lending in the new environment? etc.

0 notes

Text

The CEO of Devere Group has predicted that the price of bitcoin will reach $50,000 by the end of this month. He explained that geopolitical tensions from the Russia-Ukraine war and institutional investment are key drivers boosting the price of bitcoin. He also said, “the dollar’s reserve status could, ultimately, be in jeopardy.” Devere’s CEO on the Future of Bitcoin The CEO of Devere Group, Nigel Green, has predicted that bitcoin’s price will reach $50,000 by the end of this month. Devere is an independent financial advisory and asset management firm headquartered in the UAE. The executive said on Tuesday after the price of bitcoin surged more than $6,000 in 24 hours: As it currently stands, I can see no reason why this price momentum should falter. I think we can expect to see bitcoin hit $50,000 by the end of this month. However, he noted that it is “too early to say” when the price of bitcoin will revisit last year’s all-time highs. Based on data from Bitcoin.com Markets, BTC peaked at $68,892 on Nov. 9. Green believes that “It’s not that big a leap from $50K to $68K.” He emphasized: “The world and the crypto market are moving at an accelerated rate in recent times. It’s certainly not out of the realms of possibility.” At the time of writing, bitcoin is trading at $39,007. Geopolitical Tensions and Dollar’s Reserve Status The Devere executive sees two key drivers boosting the price of bitcoin: geopolitical tensions and institutional investment. He explained that the war between Russia and Ukraine “has caused significant financial upheaval.” It has driven individuals, businesses and government agencies globally to look for “alternatives to traditional systems,” he detailed. “As banks close, ATMs run out of money, threats of personal savings being taken to pay for war, and the major international payments system SWIFT is weaponized, amongst other factors, the case for a viable, decentralized, borderless, tamper-proof, unconfiscatable monetary system has been laid bare,” the chief executive further opined, elaborating: And as alternatives, such as crypto, prove to be credible and workable, the dollar’s reserve status could, ultimately, be in jeopardy. “Savvy investors know this and will be further increasing their exposure to cryptocurrencies before prices rise further,” he predicted. Institutional Investors to Boost Demand for Bitcoin The Devere boss further predicted: “As more and more institutional investors take control of the sector, credibility increases, trading volumes go up and volatility goes down.” Emphasizing that the current Russia-Ukraine crisis has highlighted bitcoin’s key traits, Green concluded: This is why bitcoin is now the 14th most valuable currency in the world. I expect it to jump further still up the rankings in coming months. Green is not the only one who sees a positive outlook for bitcoin. Veteran investor and fund manager Bill Miller said this week that the situation in Russia is “very bullish for bitcoin.” What do you think about the prediction by Devere’s CEO? Let us know in the comments section below. Go to Source

0 notes

Photo

FED’s Powell Confirms Persisting Inflation, Could Tapering Stop Bitcoin’s Rally? https://bitcoinist.com/feds-powell-confirms-persisting-inflation-could-tapering-stop-bitcoins-rally/?utm_source=rss&utm_medium=rss&utm_campaign=feds-powell-confirms-persisting-inflation-could-tapering-stop-bitcoins-rally

Bitcoin has dropped 3.8% in the 24-hour chart as the Chairman of the U.S. Federal Reserve Jerome Powell gave a speech on the current economic outlook. As of press time, the crypto market has negatively reacted to Powell’s statements as the intuition finally hints at a possible start of tapering.

Related Reading | Can “Coin Days Destroyed” Indicator Predict Bitcoin Tops?

Per a report by Reuters, the FED Chair said the following on inflation, high expectations from investors on the metric have been driving the price of Bitcoin to new highs in 2021:

Supply constraints and elevated inflation are likely to last longer than previously expected and well into next year, and the same is true for pressure on wages.

Powell took a 180 degrees turn from previous statements. The phrase “inflation is transitory” has been associated with Powell and the Federal Reserve’s inability to take control of the economic situation.

The FED also faces a current scandal due to many of its members on national and state levels have allegedly profited from taking positions before big announcements made by the institution. This has yielded millions in gains to many of its high-ranking members.

As Bitcoinist reported, mathematical artist Nelson Saiers embodied the apparent general sentiment of mistrust towards the U.S. FED with its latest piece: an inflatable Bitcoin rat place on the institution’s building in New York. The work tries to convey the damage the FED’s reputation has taken over the years.

BTC trends downwards in the daily chart after FED hinted at tapering. Source: BTCUSD Tradingview

The FED Chair has tried to take on new measures to stop similar actions in the future, but the dame seems too great to fix in the short term. Ryan Selkis, founder at crypto research firm Messari, commented the following on Powell’s inflation statements and the institution’s overall performance:

Bitcoiners told you the truth. The Fed either lied or was so bad at their jobs the whole lot should be fired. Either way bitcoiners told you the truth.

Bitcoiners told you the truth.

The Fed either lied or was so bad at their jobs the whole lot should be fired. Either way bitcoiners told you the truth. https://t.co/iR5PJVFpCq

— Ryan Selkis (@twobitidiot) October 22, 2021

Bitcoin With More Downside Risk

The lack of trust, inflation expectations, and a possible start of tapering are creating a strong cocktail, as Bitcoin trends downwards in lower timeframes.

Although inflation is key, the injection of liquidity into global markets by the FED via its purchases of assets program has given the crypto and traditional market a great boost.

Related Reading | Walmart Hosts 200 Bitcoin ATMs: Easy-To-Use Options Diversify Users

Thus, any change into this dynamic by implementing tapering in 2022 could jeopardize Bitcoin’s run in the future.

In the short term, Bitcoin seems in danger of more downside, but with signs of strength on the bull’s corner. QCP Capital records an increase in leverage for the futures sector, as seen below.

Source: Skew via QCP Capital

The aggregated Open Interest (OI) for the Bitcoin Futures surpassed 400,000 BTC notional, the firm claimed. This metric stands very close to its previous all-time high and is accompanied by a spike in the funding rates for BTC perpetual contracts, but very far from its April levels, right before Bitcoin crashed.

QCP Capital added the following on the possibility of BTC’s price resuming its rally:

This means there is possibly still room for additional topside euphoria but we are at levels that are starting to stretch the market.

0 notes

Text

Crypto ATM Market Trends and Analysis segmented by Applications, Future Trends and Growth Prospects to 2026

Global Crypto ATM Market Research Report 2018-2026” This report researches the worldwide Crypto ATM Market size (value, capacity, production and consumption) in key regions like North America, Europe, Asia Pacific (China, Japan) and other regions. The report provides a unique tool for evaluating the Market, highlighting opportunities, and supporting strategies. This report recognizes that in this rapidly-evolving and competitive environment, up-to-date Marketing information is essential to monitor performance and make critical decisions for growth and profitability. It provides information on trends and developments, and focuses on Markets and materials, capacities and technologies, and on the changing dynamics of the Crypto ATM Market.

Allied Market Research published a new report, titled, " Crypto ATM Market” The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segment, Porter’s Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain thorough understanding of the industry and determine steps to be taken to gain competitive advantage.

Request Sample Report at: https://www.alliedmarketresearch.com/request-sample/6040

Cryptocurrency is the alternative form of payment to cash, credit cards, and check. In the cryptocurrency, the customer directly send money without interaction with the bank. Cryptocurrency is a currency with cryptographic protocol that allow customers transfer money securely, comfortably, and without any fraud.

Crypto ATM is the ATM from which individual can transfer cryptocurrency easily through ATM machine. For purchasing the crypto currency through the crypt ATM, first, the individual must go through the KYC, second, input the address of the crypto wallet to make deposit into, then insert the order money through crypto ATM, and finally confirm the transaction. For selling the crypto coin through the ATM, first individual must go through the KYC procedure, next send amount you want to sell through the address provided by QR code, next customer will get a redeem code on the registered technology, wait for the transaction to get confirm then collect the cash. The crypto ATM auto-generates receipts for every transaction. These receipts contain public and private keys in the form of QR code for the security purpose.

The report offers key drivers that propel the growth in the global Crypto ATM Market. These insights help market players in devising strategies to gain market presence. The research also outlined restraints of the market. Insights on opportunities are mentioned to assist market players in taking further steps by determining potential in untapped regions.

For Purchase Enquiry at: https://www.alliedmarketresearch.com/purchase-enquiry/6040

The research offers a detailed segmentation of the global Crypto ATM Market. Key segments analyzed in the research include type, coin and geography. Extensive analysis of sales, revenue, growth rate, and market share of each and for the historic period and the forecast period is offered with the help of tables.

The market is analyzed based on regions and competitive landscape in each region is mentioned. Regions discussed in the study include North America (United States, Canada and Mexico), Europe (Germany, France, UK, Russia and Italy), Asia-Pacific (China, Japan, Korea, India and Southeast Asia), South America (Brazil, Argentina, Colombia), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa). These insights help to devise strategies and create new opportunities to achieve exceptional results.

The research offers an extensive analysis of key players active in the global Crypto ATM industry. Detailed analysis on operating business segments, product portfolio, business performance, and key strategic developments is offered in the research. Leading market players analyzed in the report include General Bytes, Genesis Coin, Lamassu Inc, Covault. Bitaccess, Coinme, Coin Source, Bitxatm, Order bob, and RUSbit. These players have adopted various strategies including expansions, mergers & acquisitions, joint ventures, new product launches, and collaborations to gain a strong position in the industry.

Browse Complete Report For More Information @ https://www.alliedmarketresearch.com/crypto-atm-market

KEY BENEFITS FOR STAKEHOLDERS

This report provides a detailed quantitative analysis of the current market share and market forecast estimations from 2019 to 2026, which assists to identify the prevailing crypto ATM market opportunities.

An in-depth crypto ATM market analysis includes analysis of various regions and is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate region-specific plans.

A comprehensive analysis of the factors that drive and restrain the growth of the global crypto ATM market is provided.

Region-wise and country-wise market conditions are comprehensively analyzed in this report.

The projections in this report are made by analyzing the current crypto ATM market trends and future market potential from 2019 to 2026 in terms of value.

An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

The key market players within the crypto ATM market are profiled in this report and their strategies are analyzed thoroughly, which helps in understanding competitive outlook of global market.

Key offerings of the report:

Key drivers & Opportunities: Detailed analysis on driving factors and opportunities in different segments for strategizing.

Current trends & forecasts: Comprehensive analysis on latest trends, development, and forecasts for next few years to take next steps.

Segmental analysis: Each segment analysis and driving factors along with revenue forecasts and growth rate analysis.

Regional Analysis: Thorough analysis of each region help market players devise expansion strategies and take a leap.

Competitive Landscape: Extensive insights on each of the leading market players for outlining competitive scenario and take steps accordingly.

About Us

Allied Market Research (AMR) is a market research and business-consulting firm of Allied Analytics LLP, based in Portland, Oregon. AMR offers market research reports, business solutions, consulting services, and insights on markets across 11 industry verticals. Adopting extensive research methodologies, AMR is instrumental in helping its clients to make strategic business decisions and achieve sustainable growth in their market domains. We are equipped with skilled analysts and experts, and have a wide experience of working with many Fortune 500 companies and small & medium enterprises.

Contact:

David Correa

Portland, OR, United States

USA/Canada (Toll Free): +1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on LinkedIn: https://www.linkedin.com/company/allied-market-research

0 notes

Text

Blockchain Devices Market Shows Strong Growth with Leading Players | SAMSUNG, ShapeShift, CoolBitX Technology.

Blockchain Devices Market Blockchain devices market is expected to gain market growth in the forecast period of 2020 to 2027. Data bridge market research analyses that the market is expected to reach USD 3737.92 million by 2027 growing at a growth rate of 42.65% in the forecast period 2020 to 2027. The blockchain devices market is attaining a significant growth due to factors such as increasing trend of cryptocurrency and rising venture capital funding.

Rising adoption of blockchain technology in retail and supply chain network will accelerate the growth of the market. Increasing venture capital funding is expected to augment the blockchain devices market demand. Increasing market capping of cryptocurrency and availability of initial coin offering will uplift the market growth in the forecast period of 2020-2027. Rising technology leads to faster transaction is yet another factor that will drive the blockchain devices market. On the other hand, rising acceptance and adoption of cryptocurrency in various regions and industry will further create new opportunities for the growth of the market. Increasing government initiatives for the adoption of blockchain devices is another factor that will help in growth of the market in the forecast period of 2020-2027.

Get Exclusive Sample Report: @ https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-blockchain-devices-market

Some of the leading key players profiled in this study:

The major players covered in the blockchain devices market report are Ledger SAS, HTC Corporation, Pundi X Labs Private Limited., GENERAL BYTES S.R.O., RIDDLE&CODE GmbH, Sikur., SIRIN LABS, BLOCKCHAIN LUXEMBOURG S.A ., SatoshiLabs s.r.o., Genesis Coin Inc., Lamassu Industries AG, SAMSUNG, ShapeShift, CoolBitX Technology, Bitaccess, Covault, ELLIPAL, IBM Corporation, Microsoft, among other domestic and global players. Market share data is available for Global, North America, Europe, Asia-Pacific, Middle East and Africa, and South America separately. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Blockchain Devices Market Browse Related Report Here:

Energy Security Market

Cathode Ray Tube Display Market

Key Pointers Covered in the Blockchain Devices Market Trends and Forecast to 2027

Blockchain Devices Market New Sales Volumes

Blockchain Devices Market Replacement Sales Volumes

Blockchain Devices Market Installed Base

Blockchain Devices Market By Brands

Blockchain Devices Market Size

Blockchain Devices Market Procedure Volumes

Blockchain Devices Market Product Price Analysis

Blockchain Devices Market Healthcare Outcomes

Blockchain Devices Market Cost of Care Analysis

Blockchain Devices Market Regulatory Framework and Changes

Blockchain Devices Market Prices and Reimbursement Analysis

Blockchain Devices Market Shares in Different Regions

Recent Developments for Blockchain Devices Market Competitors

Blockchain Devices Market Upcoming Applications

Blockchain Devices Market Innovators Study

Get Detailed Toc and Charts & Tables @ https://www.databridgemarketresearch.com/toc/?dbmr=global-blockchain-devices-market

Scope of the Blockchain Devices Market

Current and future of Blockchain Devices Market outlook in the developed and emerging markets

The segment that is expected to dominate the market as well as the segment which holds highest CAGR in the forecast period

Regions/Countries that are expected to witness the fastest growth rates during the forecast period

The latest developments, market shares, and strategies that are employed by the major market players

Global Blockchain Devices Market By Type (Blockchain Smartphones, Crypto Hardware Wallets, Crypto ATMS, POS Devices, Others), Connectivity (Wired, Wireless), Application (Personal, Corporate), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa), Industry Trends and Forecast to 2027

Inquiry before Buying @ https://www.databridgemarketresearch.com/inquire-before-buying/?dbmr=global-blockchain-devices-market

About Us:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market

Contact:

Data Bridge Market Research

Tel: +1-888-387-2818

Email: [email protected]

0 notes

Text

Top 10 Active Ways to Make Money With Cryptocurrency

Scam Alert!

Now, this is critically important! Many scams are in the cryptocurrency industry! A great site to use to check if a cryptocurrency-related website might potentially be a scam is http://www.badbitcoin.org/, which has already vetted many websites, but it is not foolproof!

Due to always new investment opportunities popping up in the cryptocurrency industry, many sites might not prove to be valid, and you don’t want to fall prey as one of the initial victims! Therefore, you should always use your sound judgment! If the promised returns seem too good to be true — it probably is!

Diversifying Your Portfolio Is A Good Practice

A good practice is to diversify your portfolio — don’t put all your eggs in one basket! Practice an incremental approach, one step at a time, as you learn more and become aware of potential scams, you can invest more money. Always start with a tiny investment first! Please don’t get pressured by the hype and follow the herd because of the fear of missing out (FOMO) — go at your own pace!

Active Ways To Make Money With Cryptocurrency Requires Time And Energy

Active methods require you to devote your time and energy towards generating income with cryptocurrency, similar to a typical job or a business that you manage yourself. The good news is that there are many exciting ways to make active income with cryptocurrency. Using all my research, practical experience and the occasional run-in with scams, here are the top 10 active ways to make income with cryptocurrencies that I discovered:

1) Buy and Keep (HODL)

2) Trading

3) Cryptocurrency Payment Gateway

4) Invest in Initial Exchange Offerings (IEOs)

5) Invest in Security Token Offerings (STOs)

6) Cryptocurrency Education

7) Cryptocurrency News & Trends Subscriptions

8) Forming an Inner Circle

9) Bounty / Rewards Programs

10) Gaming

Active Method 1: Buy and Keep (HODL)

Figure 1: HODLing Cryptocurrency

The simplest, though not necessarily, the most lucrative strategy is to buy and hold your favorite cryptocurrencies, also known as HODL (“hold on for dear life”) in the community. HODLing is a long-term investing strategy that requires proper fundamental analysis. The topic of fundamental analysis is a huge one, but some basics to look out for are:

1) Company Analysis: Management has a history of success, right products, well-financed, good marketing, etc.

2) Industry Analysis: Not too much competition; government regulations are open; environmental factors are favorable, etc.

3) Economic Conditions: Are we in a bear or bull market? Are there any unforeseen economic conditions that can affect the product or service?

4) Future Profit Outlook: Will the products or services be in demand in the future? How large is the total addressable market? In what time frame might the product or service become obsolete?

After doing your fundamental analysis for a particular cryptocurrency-related product or service, and choosing your top picks, an excellent strategy to use is dollar-cost averaging. For example, if you get paid once or twice a month, you can allocate a small portion of your earnings to invest in your favorite cryptocurrency endeavor. In a few months after doing some more fundamental analysis, you might choose to rebalance your portfolio in favor of another cryptocurrency project, as well.

Tip: Coinmarketcap.com does some fundamental analysis for you already that is accessible if you view the rating tab for a particular cryptocurrency. Another good site to use is coinpaprika.com.

Recommendations:

If you are a long-term investor, you might also want to consider storing your crypto assets in high yielding mobile wallets as a form of savings. Using the Celsius App, long-term investors can get an annual interest rate of up to 10% with some stable coins such as USD, PAX, DAI, TUSD, GUSD, and others.

Active Method 2: Trading

Figure 2: Trading View

If you are technically minded and like to look at visual charts, you might also consider becoming a cryptocurrency trader. Figure 2 shows a popular trading platform used by many cryptocurrency traders known as Trading View. Cryptocurrency exchanges are open 24 hours 7 days a week so you can perform trades anytime, unlike traditional markets such as equities. Many types of traders require different levels of both involvement and risks. Here are some of the different types of traders:

1) Trend Traders: follow the trend to buy low and then sell high

2) Swing Traders: take advantage of market volatility

3) Margin Traders: bet prices will fall so short the market instead of going long

4) Futures Traders: They hedge against volatility with fixed asking & selling prices

5) Options Traders: bet it’s going to be a buyers’ or sellers’ market

6) Day Traders: open and close multiple positions within 24 hours

Tip: Good YouTube channels to use to learn about cryptocurrency trading are Data Dash and Ready Set Crypto. They offer many free videos to learn about using technical analysis for trading.

Tip: For a listing of top cryptocurrency exchanges by volume visit https://coinmarketcap.com/rankings/exchanges/

Recommendations:

Here are some cryptocurrency exchanges that I recommend:

1) Binance: The largest cryptocurrency exchange in the world! Now supports margin trading!

2) Coinbase: This is a prevalent cryptocurrency exchange, especially in the US, that supports fiat to crypto conversions.

3) KuCoin: This exchange allows you to invest in new coins and coins you won’t find on the larger exchanges!

4) LocalBitcoins: This exchange has a vast number of ways to buy Bitcoins and other cryptocurrencies that are sometimes even discounted from the market rate!

Active Method 3: Cryptocurrency Payment Gateway

Many retailers and online sellers now accept cryptocurrencies for payments. You can set up a cryptocurrency payment gateway yourself in your retail or online store. The model is similar to how PayPal, Mastercard, and Visa are accepted. Sellers make money with transaction fees and some margin in price. Some retailers also maintain cryptocurrency-based ATMs. You can buy real estate, cars, gold, and many other items with Bitcoin and other cryptocurrencies.

Figure 3: Some subway franchises accept Bitcoin.

Figure 4: Some retail outlets also maintain cryptocurrency ATMs.

Tip: For buying gold and silver with cryptocurrencies, I recommend goldsilver.com.

Active Method 4: Invest in Initial Exchange Offerings (IEOs)

Initial Exchange Offerings (IEOs) were invented to build more trust with investors after many shady Initial Coin Offerings (ICOs) failed. I worked on a few ICO projects as a consultant, and I can say that the vast majority of them, >95%, turned out to be scams or just had wrong business models or tokenomics. ICOs did, however, open up suitable investments to small investors. Traditionally, only affluent investors were able to partake in top tier investments. For example, say you wanted to buy some Apple or Amazon stock, this would cost you thousands of dollars to buy one share. Using ICOs allowed small-time investors to invest even a few dollars into top tier investments. IEOs differ from ICOs because they occur on an officially trusted exchange itself, so the investment offer is better vetted. Again proper fundamental analysis aids when deciding to invest in an IEO.

Tip: Binance Launchpad is a good example of a platform used by IEOs.

Active Method 5: Invest in Security Token Offerings (STOs)

Security Token Offerings (STOs) are the most regulated cryptocurrency token offerings. The security is backed by actual collateral: assets, equity, commodities, land, real estate, etc. Therefore, STOs are subjected, protected, and regulated by some national-based authority. However, due to the different definitions of securities and varying classification of cryptocurrencies as a financial asset class concerning each country, the definition of what exactly constitutes a “Security Token” is still debatable.

Tip: For a listing of upcoming STOs, visit https://tokenmarket.net/security-token-calendar/.

Active Method 6: Cryptocurrency Education

Figure 5: Many online and offline courses now offered about cryptocurrency.

Many websites now offer cryptocurrency education for a fee. There are courses on Udemy.com and Lynda.com on investing and trading cryptocurrencies. Once you gain knowledge and experience, you can teach people about cryptocurrencies yourself by using books, e-books, webinars, seminars, etc. However, there are still many free ways to learn about cryptocurrencies, especially on YouTube.

Tip: I recommend the YouTube channels, Data Dash and Ready Set Crypto for free learning and the AMTV Bitcoin academy, a paid service.

Active Method 7: Cryptocurrency News & Trends Subscriptions

Figure 6: Trends in the cryptocurrency industry are popular subscriptions.

Professional crypto traders and investors are interested in the latest news & trends to make informed decisions. Many online venues offer up to date news and trends, usually for a monthly based subscription. In return, you get daily or weekly newsletters and membership to some online community with live training and chat available. If you like to do market research, like social media and are a talented technical writer, then this might be a sufficient income option for you.

Tip: For subscription-based services, I recommend Ready Set Crypto and The Dollar Vigilante.

Active Method 8: Forming an Inner Circle / Joining a Signals Group

Figure 7: Buy the rumor and sell the news.

Another good strategy that you can employ is to form an inner circle or join a signals group. You can join a private WeChat, WhatsApp, Telegram Group, etc. Some of these groups are free, and some require payment. Usually, in these types of groups, you get what you pay for in terms of price. In joining these types of groups, your goal is to hear rumors before the rest of the retail traders do. In this way, you can buy the rumor when the prices are still very low and then sell the news when the prices are at a peak. You can start your private chat group with your most informed and connected contacts that can give you buy and sell signals.

Tip: A strategy that I like to use is following different channels on Twitter, Facebook, YouTube, and Telegram on investments and topics that I’m most interested in learning. I then view the posts that generate the most buzz.

Active Method 9: Bounty / Rewards Programs

Figure 8: Coinbase Earn allows you to earn crypto while watching educational videos.

You can also earn crypto by performing specific tasks. For example, you might write a positive review, create a cool logo, answer trivia questions, etc. You might also be able to receive free crypto by participating in token airdrop campaigns.

Tip: My favorite cryptocurrency reward program now is on Coinbase Earn. You watch videos on various cryptocurrency projects, answer questions, and then receive free coins in return.

Recommendations:

The Brave browser lets you effortlessly earn cryptocurrency just by surfing the net and joining reward programs too!

Crowd Holding, which is currently in Beta as of this writing, is an open innovation platform empowering anyone to earn rewards, and entrepreneurs to get insights from key stakeholders, employees, and consumers.

PublishOx is a great way to get paid in crypto for reading and writing blog articles!

Active Method 10: Playing Games!

Figure 9: Minecraft was one of the first games to use BTC as an in-game currency.

Last but certainly not least, you can earn cryptocurrency by playing games! Now here is a real story; I once met a guy who became a Bitcoin millionaire by playing Minecraft. The story goes is that he was playing the game a lot during his college days and accumulated a lot of Bitcoin as the in-game currency. Then he got a serious girlfriend, so he didn’t play the game for a long time. Many years later, he logged in and found out that he still had all those Bitcoins, but they were worth tremendously much more, so he was now a Bitcoin millionaire!

There are many games now that use cryptocurrency as the in-game currency. For example, in Ether Quest, you compete with other players for Ethereum. As of this writing, on the Apple store, good games for earning crypto are Alien Run, Storm Play, Free Bitcoin, Bitcoin Aliens, and Blockchain.

Tip: Have your little cousins or kids use your game account to earn you crypto! It’s the best of both worlds; they are kept busy and enjoy while you make some crypto on the side!

Holiday Sale: 50% Off on all our digital products! https://www.moneywisealpha.com/product-category/digital/?orderby=price

Join our mailing list to get a 1-Page Quick Guide on “How To Earn Crypto For Free!”

https://moneywisealpha.com/mailinglist

Follow Us On Social Media:

Website: http://www.moneywisealpha.com/

Book Site: http://btcmoneytop20.com

Facebook Book Page: https://fb.me/BTCMoneyTop20Ways

Blog Site 1: https://medium.com/money-wise-alpha

Blog Site 2: https://www.publish0x.com/money-wise-alpha/

Blog Site 3: https://steemit.com/@moneywisealpha

Blog Site 4: https://moneywisealpha.tumblr.com/

Blog Site 5: https://moneywisealpha.blogspot.com/

Facebook Book Page: https://fb.me/BTCMoneyTop20Ways

YouTube: https://youtube.com/c/MoneyWiseAlpha

DailyMotion: https://www.moneywisealpha.com/dailymotion

DTube: https://www.moneywisealpha.com/dtube

Bitchute: https://www.moneywisealpha.com/bitchute

Book Promotion: https://www.youtube.com/watch?v=EQnmcY_VfME

Twitter: https://twitter.com/my_csales23

LinkedIn: https://www.linkedin.com/in/christian-john-sales-92375ab/

Book Group: https://www.linkedin.com/groups/10472552/

Telegram: https://t.me/MoneyWiseAlpha

0 notes

Link

Global Crypto ATM Market Report provides complete industry analysis, market outlook, size, growth, opportunities and forecast 2024. This report will assist in analyzing the current and future business trends, sales and revenue forecast. It provides top manufacturers information along with manufacturing cost analysis, industrial chain, sourcing strategy and growth.

0 notes

Text

Mayor of Chicago: Facing Financial Crisis, Crypto Adoption is Inevitable

According to a report in Forbes, Rahm Emanuel, the Mayor of the City of Chicago, has stated that he sees crypto adoption as inevitable. He bases his outlook on the growing appeal of Bitcoin and other digital assets in an increasingly unstable geopolitical world.

Emanuel posited that financial crises, like that currently being experienced in Venezuela, would eventually force people to opt out of fiat currency just to survive.

He’s “Gotta Learn About It” But Emanuel is Refreshingly Grounded When it Comes to Crypto

The Mayor of Chicago gave his outlook on crypto during a meeting held to debate the city’s growing fintech industry on March 18. In response to a question from the audience, he stated that he felt cryptocurrency adoption was an inevitability, however, a timeline for such a great shift from current monetary norms would be anybody’s guess.

After admitting that he really was not an expert on the field, the mayor stated:

“Nation states are falling apart or receding. City states are emerging, so the political structures we all grew up under are changing. One day, somebody’s going to figure out – whether that’s Argentina, ten years from now, five years from now – how to use cryptocurrencies to stay alive when their facing a financial crisis, and then you’re going to find out that this moment has arrived.”

Although lacking explicitness in his response, Emanuel appears to be alluding to Bitcoin and other cryptocurrencies giving populations a means to “opt-out” of a national economy. Those living in nations where governments mismanage finance to such a degree that inflation spirals out of control – Zimbabwe, Venezuela, and Turkey, in recent years – can elect to store their wealth in digital assets, the value of which is not correlated to any entity, government or otherwise. Although wildly volatile, Bitcoin has proved more stable over short periods than numerous national currencies numerous times over its ten year existence.

In economies suffering hyperinflation, huge stacks of cash are worth next to nothing.

Another audience member later asked Emanuel about his overall thoughts about the crypto asset and blockchain space. Again, the mayor reiterated that the industry was not his forte but added:

“The trend lines are affirmative for its future. I don’t know if that’s ten years, and I don’t know if that’s 20 years, but it’s affirmative. I don’t know what it is. I know it’s an alternative way to trade, and therefore, I gotta learn about it, and I gotta be honest, as mayor, it’s not the top 100 things I would have to learn about.”

Chicago the Crypto Hub?

With its history steeped in finance, a crypto-curious mayor, and a hive of high profile companies, including Coinbase offices, setting up shop there, Chicago is fast becoming a cryptocurrency hot spot in the US. Recently, the city also received an additional 30 Bitcoin ATMs taking the total number of units in the city centre up to a relatively impressive 184 according to CoinATMRadar.

Until recently, the city also hosted two of the most over-hyped but high-profile Bitcoin trading products – BTC futures contracts were offered by both the Chicago Board Options Exchange and the CME Group. However, following the recent announcement that the CBOE was halting Bitcoin futures for an undisclosed period of time, that number has fallen to one.

Related Reading: Why Bitcoin Market May Be Better Without CBOE Futures Contracts

Featured Image from Shutterstock.

The post Mayor of Chicago: Facing Financial Crisis, Crypto Adoption is Inevitable appeared first on NewsBTC.

from CryptoCracken SMFeed https://ift.tt/2OhCZHq via IFTTT

0 notes

Text

Mayor of Chicago: Facing Financial Crisis, Crypto Adoption is Inevitable

According to a report in Forbes, Rahm Emanuel, the Mayor of the City of Chicago, has stated that he sees crypto adoption as inevitable. He bases his outlook on the growing appeal of Bitcoin and other digital assets in an increasingly unstable geopolitical world.

Emanuel posited that financial crises, like that currently being experienced in Venezuela, would eventually force people to opt out of fiat currency just to survive.

He’s “Gotta Learn About It” But Emanuel is Refreshingly Grounded When it Comes to Crypto

The Mayor of Chicago gave his outlook on crypto during a meeting held to debate the city’s growing fintech industry on March 18. In response to a question from the audience, he stated that he felt cryptocurrency adoption was an inevitability, however, a timeline for such a great shift from current monetary norms would be anybody’s guess.

After admitting that he really was not an expert on the field, the mayor stated:

“Nation states are falling apart or receding. City states are emerging, so the political structures we all grew up under are changing. One day, somebody’s going to figure out – whether that’s Argentina, ten years from now, five years from now – how to use cryptocurrencies to stay alive when their facing a financial crisis, and then you’re going to find out that this moment has arrived.”

Although lacking explicitness in his response, Emanuel appears to be alluding to Bitcoin and other cryptocurrencies giving populations a means to “opt-out” of a national economy. Those living in nations where governments mismanage finance to such a degree that inflation spirals out of control – Zimbabwe, Venezuela, and Turkey, in recent years – can elect to store their wealth in digital assets, the value of which is not correlated to any entity, government or otherwise. Although wildly volatile, Bitcoin has proved more stable over short periods than numerous national currencies numerous times over its ten year existence.

In economies suffering hyperinflation, huge stacks of cash are worth next to nothing.

Another audience member later asked Emanuel about his overall thoughts about the crypto asset and blockchain space. Again, the mayor reiterated that the industry was not his forte but added:

“The trend lines are affirmative for its future. I don’t know if that’s ten years, and I don’t know if that’s 20 years, but it’s affirmative. I don’t know what it is. I know it’s an alternative way to trade, and therefore, I gotta learn about it, and I gotta be honest, as mayor, it’s not the top 100 things I would have to learn about.”

Chicago the Crypto Hub?

With its history steeped in finance, a crypto-curious mayor, and a hive of high profile companies, including Coinbase offices, setting up shop there, Chicago is fast becoming a cryptocurrency hot spot in the US. Recently, the city also received an additional 30 Bitcoin ATMs taking the total number of units in the city centre up to a relatively impressive 184 according to CoinATMRadar.

Until recently, the city also hosted two of the most over-hyped but high-profile Bitcoin trading products – BTC futures contracts were offered by both the Chicago Board Options Exchange and the CME Group. However, following the recent announcement that the CBOE was halting Bitcoin futures for an undisclosed period of time, that number has fallen to one.

Related Reading: Why Bitcoin Market May Be Better Without CBOE Futures Contracts

Featured Image from Shutterstock.

The post Mayor of Chicago: Facing Financial Crisis, Crypto Adoption is Inevitable appeared first on NewsBTC.

from Cryptocracken WP https://ift.tt/2OhCZHq via IFTTT

0 notes

Text

Crypto Bull Run: The Next One Will be Remembered

Crypto Bull Run: The Next One Will be Remembered

A little over a year ago we saw the height of the biggest crypto bull run in history. Nowadays, prices have fallen by roughly 90% and the outlook on crypto is mostly negative.

One Chinese crypto mining pool founder however, says that the next crypto bull run will be even stronger. This points to a Bitcoin price above the all-time high, which is something a lot of experts have trouble seeing right now.

Zhu Fa is a co-founder of the crypto mining pool Poolin. His claim that Bitcoin would surge to about 5 million Chinese yuan is taken by most experts as a joke. After all, every crypto enthusiast would love to have a Bitcoin worth $740 000. The chances of such a development remain slim to say the least, but Fa seems to remain positive.

After all, this turbulence is now lasting well over a year. Crypto bulls like Fa remain positive but in the current market situation, predictions like Fa’s don’t score you a lot of respect. He openly stated:

“In the next crypto bull run, the price of Bitcoin will be between $74K to $740K.”

Such a dramatic rise would result in a market cap of roughly $12 trillion. Currently, Bitcoin’s price record is $20 089 and at the time, the market cap was a little over $326 billion.

Zhu Fa also did not comment on a specific time window. Even if his prediction for the next crypto bull run turns out to be true, it doesn’t seem like it will be in the near future.

There is more than one crypto bull hyped for the next crypto bull run

The Winklevoss twins have also made astronomical price predictions. They have quite frequently compared Bitcoin to gold and predicted that the currency could potentially appreciate against the USD by nearly 4000%. This will lead to a market value of roughly $4 trillion.

Tyler and Cameron Winklevoss have also stated multiple times that Bitcoin will eventually disrupt gold. Despite the currently harsh market conditions, the brothers have remained very optimistic about Bitcoin’s future. After all, the brothers invested massively into Bitcoin when the price was around $120.

Tim Draper, American tech billionaire and venture capitalist made an even bolder prediction last year. He stated that Bitcoin will reach $250K by 2022 and the overall market cap by 2033 will be more than $80 trillion.

Whether or not these predictions are made because the investors want immense profit from the next crypto bull run or they simply believe in the technology is irrelevant.

The key factor to consider here is if an eventual price increase of this magnitude actually occurs, will the newly rich crypto bulls use their gains to help the industry and the ordinary people or will we simply replace one group of wealthy, always-hungry businessmen for another?

You can also check out:

Crypto ATM is a clear sign of Crypto Adoption in the Philippines

BitTorrent: Can the Purchase by TRON be Considered a Mistake

Global Recession: Experts Say Odds are Going Increasingly Up

Crypto Bandwagon: This is Only the Beginning of the Beginning

The post Crypto Bull Run: The Next One Will be Remembered appeared first on CoinStaker | Bitcoin News.

http://bit.ly/2Sa3bEf

0 notes

Link

The “Blockchain Devices Market by Type (Blockchain smartphones, Crypto hardware wallets, Crypto ATMs, POS terminals, and Others), Connectivity (Wired and Wireless), Application (Personal and Corporate), End-User (BFSI, Government, Retail, Travel and hospitality, Transportation and logistics, and Others), and Region, Global Forecast, 2018 to 2028” study provides an elaborative view of historic, present and forecasted market estimates.

#adroit market research#blockchain devices market#blockchain devices market 2020#blockchain devices market size#blockchain device market trend

0 notes