#DPDP ACT

Explore tagged Tumblr posts

Text

India’s DPDP Act Explained: What Every Startup Founder Must Know

Imagine you’ve built a fantastic app that collects users’ names, emails, and preferences to recommend local events. Suddenly, regulators knock on your door asking for your data-handling processes. Panic, right? The DPDP Act aims to prevent this scenario by setting clear rules and giving individuals control over their data. Let’s dive into the essentials so you’re prepared, not panicked. What Is…

#Cybersecurity Standards#data provacy#Digital Personal Data Protection#DPDP Act#DPDP Act 2023#legal#privacy

0 notes

Text

Analysis of Draft Digital Personal Data Protection Rules, 2025

By Manvee, Garima Bairagi and Pragati Chaurasiya Rule No.RuleAnalysisOur Viewpoint1Short Title and CommencementIt will be called the Digital Personal Data Protection Rules, 2025. These rules about data fiduciaries and consent managers will become effective on a specified date prescribed by the government. Whereas the rules pertaining to the establishment of the Data Protection Board and the…

0 notes

Text

MeitY releases draft rules of DPDP Act for Public Consultation

MeitY releases draft rules of DPDP Act for Public Consultation @neosciencehub #MeitY #DPDPAct #PublicConsultation #Sciencenews #neosciencehub #Technology

The Digital Personal Data Protection Act’s draft regulations were made public by the Ministry of Electronics and Information Technology. Since the Act was approved by Parliament in August 2023, the regulations have been eagerly anticipated. Through the MyGov portal, the government is accepting comments on the proposed regulations until February 18, 2025. The regulations are supposed to provide…

0 notes

Text

DPDPA Audit & Significant Data Fiduciaries

Imagine that a company in India, handling digital personal data, fails to comply with DPDPA rules due to its lack of transparent consent processes. So, unfortunately, they become exposed to legal consequences due to non-compliance and may even have to bear hefty fines of up to 250 Cr.

As an organisation, you want to steer clear of any non-compliance issue and an audit can be a lifesaver. It identifies and rectifies such vulnerabilities and protects the company's reputation and builds customer trust.

To put it simply, an audit is a proactive step to maintain data privacy, identify gaps, mitigate legal risks, and enhance your overall business integrity.

In this blog, we bring you everything you must know about DPDPA audits and significant data fiduciaries so you are on the safe side.

What Is The DPDPA Framework?

The DPDP Act 2023 brings us a comprehensive data protection law that's set to protect and safeguard personal data. It has far-reaching implications for businesses operating in the country.

DPDPA places various responsibilities on organisations that handle personal data to protect individuals' privacy and ensure responsible data management practices. This includes:

Getting free, specific, informed, unconditional, and unambiguous consent from individuals before collecting their personal data

Executing robust security safeguards to protect personal data from unauthorized access, accidental disclosure, acquisition, etc.

Granting individuals access to their data, as well as the right to correct, erase, or restrict its processing

In the unfortunate event of a data breach, organisations are obligated to notify the relevant authorities

It's also important to note that non-compliance with the DPDPA can result in penalties up to 250 cr.

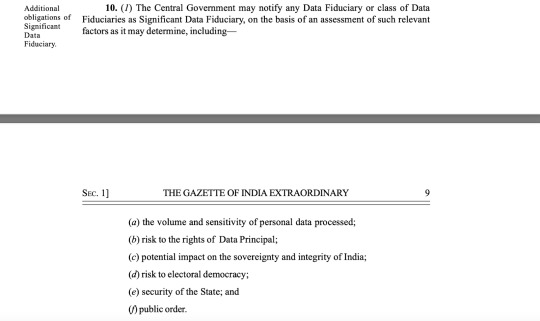

Who Are Significant Data Fiduciaries?

In simple terms, a 'data fiduciary' under the DPDP is someone who, either alone or with others, decides why and how personal data is processed. This can include individuals, companies, associations, the government, or any other entity that controls personal data.

If the Central government identifies a data fiduciary or a group of them, they are called a Significant Data Fiduciary.

Source: Meity

This decision is based on several factors, including:

The volume and sensitivity of personal data processed

Risk to the rights of the Data Principal

Potential impact on the sovereignty and integrity of India

Risk to electoral democracy

Security of the State

Public order.

Additional Duties of Significant Data Fiduciaries

A Significant Data Fiduciary has additional responsibilities on top of Data Fiduciary duties. This includes:

Appointing a Data Protection Officer (DPO) - The DPO will represent the Significant Data Fiduciary under the provisions of the DPDP Act. However, they must be based in India. The DPO must also report to the Board of Directors or a similar governing body and be the point of contact for grievance redressal

Appointing an independent data auditor - The auditor evaluates the entity's compliance with the law

Conducting periodic Data Protection Impact Assessment (DPIA), which evaluates how personal data is processed, risks to individuals' rights, and other relevant details

Undertaking periodic audits to ensure ongoing compliance

Adopting additional measures as prescribed by law

Why Periodic DPDPA Audits Are Necessary?

A DPDPA audit falls under the additional responsibilities of a Significant Data Fiduciary.

It is mandatory for businesses in India to do a thorough DPDPA compliance audit. This audit can find any gaps in compliance and help take corrective measures to make sure they're following the law.

These audits can be incredibly beneficial, and here’s why you need them.

Regular DPDPA audits help you protect individuals' privacy in compliance with the law

It helps identify potential risks and vulnerabilities in data-handling processes

It lets you take proactive measures to mitigate risks before they become serious issues, such as hefty fines of up to 250 Cr

It helps you assess the effectiveness of existing security measures and identify areas for improvement to enhance overall data security. This, in turn, improves customer trust and brand image

It highlights any gaps or deficiencies in the organisation's data protection practices and offers insights into areas that may require additional attention or resources to prevent data breaches

DPDPA audits allow you to adapt to evolving threats and regulatory changes

Who Needs Regular DPDPA Audits?

It's quite simple. Audits are essential for all types of organisations and industries that handle personal data or have regulatory compliance requirements. However, as per the Digital Personal Data Protection Act, it's a mandate for Significant Data Fiduciaries, as discussed above.

This can include schools, colleges, and universities that handle student and staff information or healthcare providers who handle patients' medical records and sensitive health information. Regular audits ensure compliance, identify and address vulnerabilities, and maintain the security and integrity of the data they handle.

DPIAs and Audits: The Right Tool

Source: DPDP Consultants

Significant Data Fiduciaries are required to conduct DPIAs and regular audits. But this has to be done diligently. So, there is a need to automate the process to ensure all bases are covered while maximizing time and efficiency. These tools minimize human bias and produce a standardized report that streamlines the process.

That said, when it comes to DPIAs, you can switch to a Data Protection Impact Assessment Tool. It automates the entire DPIA process and lets you conduct the assessment almost effortlessly through a user-friendly platform.

With this tool, you can track risks that were identified during the assessment and make sure all concerned individuals are kept in the loop regarding the actions taken to mitigate these risks.

Let's make Compliance Easy

As per the DPDP Act, there are certain obligations you must adhere to when it comes to personal data. And, regular DPDPA audits and DPIAs are one of the duties of a Significant Data Fiduciary. DPIAs and audits help identify and rectify any potential breaches and ensure the lawful and secure processing of personal data.

They are almost indispensable for maintaining trust, avoiding penalties, and upholding a commitment to responsible data handling.

DPDP Consultants brings you a set of tools and services that makes compliance with the DPDP Act easy and streamlined:

Our Data Protection Consent Management tool streamlines the acquisition of valid consent and automates the entire process of managing, tracking, and handling consent requests

The Data Principal Grievance Redressal platform streamlines the process of exercising data rights through a user-friendly interface and improves response efficiency in accordance with the DPDP Act

Our Data Protection Impact Assessment tool aids in the easy assessment and tracking of risks and ensures transparent communication about risk mitigation efforts

Our Data Protection Awareness program allows management to oversee the ongoing and efficient execution of their personal data privacy initiatives

Our Contract Reviews and redrafting services ensure that your business's outsourcing agreements align with DPDPA compliance standards

Through our DPDP Data Protection Officer services, organisations can appoint a third party for process audits so it aligns seamlessly with DPDPA requirements

Our training program for employees caters to organisation-specific needs emphasizes the practical aspects of DPDPA compliance and covers personal data policies, processing activities, and more.

Compliance isn't just about following the law; it's also about building trust and keeping your brand's reputation strong. Treating personal data with care isn't just a legal requirement—it's key to making a digital society that's fair for everyone.

Simplify DPDPA Compliance And Optimise Your Operations!

DPDP Consultants offers comprehensive solutions for personal data privacy and privacy law guidance to ensure compliance.

#dpdp act#dpdp#dpdp act 2023#dpdpa tools#digital personal data protection#dpdpa#dpdp 2023#dpia#dpdp consultants#dpdp tool#DPDPA Audit

0 notes

Text

In the era of digital data explosion, the newly enacted DPDP Act endeavours to uphold individuals' authority over personal information.

0 notes

Text

DPDP Act Compliance Checklist 2025 by AiCyberWatch

AiCyberWatch provides a streamlined DPDP Act Compliance Checklist to help businesses align with India’s 2025 data protection law. Their solution combines advanced tools like IAM, DLP, and consent management to ensure secure and lawful data handling.

0 notes

Text

Social media, telcos, lobby for 18-24 months to comply with DPDP Act

Social media companies, telecom operators, and Indian startups are set to lobby for a transition period of 18-24 months to fully comply with the Digital Personal Data Protection (DPDP) Act, 2023, citing technological complexities in two clauses, Business Standard has learnt. Major industry bodies representing local and global companies such as social media companies, big tech platforms, and…

View On WordPress

#Act#API#comply#Digital Personal Data Protection (DPDP) Act#DPDP#Indian startups#lobby#media#months#Social#Social media companies#telcos#telecom operators

0 notes

Text

Asia Pacific Data Privacy Software Market Growth Potential for the Period 2023 to 2030 | At a CAGR of 43.9%

Asia Pacific holds a prominent position in the global data privacy software market, supported by a growing emphasis on data protection, digitalization, and regulatory enforcement. Asia Pacific holds a significant data privacy software market share and is anticipated to expand at a robust CAGR of 43.9% during the forecast period. Globally, the data privacy software market share is projected to grow from USD 1.99 billion in 2022 to USD 30.31 billion by 2030. This rapid expansion in the Asia Pacific region is driven by increased cyber threats, regulatory reforms, and the digital transformation of both private and public enterprises.

Key Market Highlights:

2022 Global Market Size: USD 1.99 billion

2030 Global Market Size: USD 30.31 billion

Asia Pacific CAGR (2023–2030): 43.9%

Regional Strength: Rapid adoption across BFSI, healthcare, e-commerce, and IT sectors.

Leading Companies in the Data Privacy Software Ecosystem:

OneTrust, LLC

TrustArc Inc.

IBM Corporation

Securiti.ai

BigID, Inc.

Nymity Inc.

SAP SE

Exterro, Inc.

Informatica

Micro Focus (OpenText)

WireWheel

Privacy Tools

Request Free Sample Details: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/asia-pacific-data-privacy-software-market-107456

Growth Drivers:

The growth of the data privacy software market in Asia Pacific is largely fueled by the emergence and enforcement of comprehensive data protection regulations, such as China's Personal Information Protection Law (PIPL), India’s Digital Personal Data Protection (DPDP) Act, and Australia’s evolving Privacy Act. These regulatory frameworks compel organizations to invest in compliance technologies and privacy solutions.

Solution and Application Landscape:

Data privacy software solutions in Asia Pacific span a wide range of functions including consent management, data mapping, regulatory reporting, impact assessments, and incident response. These solutions are delivered through various deployment models such as cloud-based platforms, on-premise installations, and hybrid frameworks. Key industries leveraging these tools include financial services, healthcare, telecommunications, retail, and government bodies. The solutions are increasingly used to ensure compliance with global and local regulations such as GDPR, CCPA, PIPL, and HIPAA.

Segment Covered by:

Deployment

Application

Enterprise Type

Industry

Regional Market Trends:

The Asia Pacific region is seeing the rise of Privacy-as-a-Service (PaaS) models, particularly among startups and mid-sized organizations looking for scalable and cost-effective compliance tools. Governments across the region are implementing data localization requirements, further driving the need for region-specific privacy software solutions. In parallel, there is growing interest in using machine learning for privacy analytics, risk scoring, and automated data discovery. Sector-specific compliance standards are also emerging, particularly in regulated industries such as finance and education.

Speak To Analyst: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/asia-pacific-data-privacy-software-market-107456

Table of Content:

Introduction

Executive Summary

Market Dynamics

Competition Landscape

Segment

Company Profile covered with Key Players

#Asia Pacific Data Privacy Software Market Share#Asia Pacific Data Privacy Software Market Size#Asia Pacific Data Privacy Software Market Industry#Asia Pacific Data Privacy Software Market Analysis#Asia Pacific Data Privacy Software Market Driver#Asia Pacific Data Privacy Software Market Research#Asia Pacific Data Privacy Software Market Growth

0 notes

Text

Legal & HR Considerations for Employee-Generated Content

The enthusiasm around Employee-Generated Content (EGC) as a powerful marketing tool is undeniable. It offers authenticity, expands reach, and builds trust in ways traditional advertising simply can't. However, as companies increasingly encourage employees to become brand advocates, they must navigate a complex web of legal and HR considerations to harness EGC's benefits while mitigating significant risks.

Ignoring these crucial aspects can lead to intellectual property disputes, costly compliance violations, reputational damage, and strained employee relations. Proactive planning and clear policies are not just bureaucratic hurdles; they are essential safeguards for a successful and sustainable EGC program.

Here are five key legal and HR considerations for companies embracing Employee-Generated Content:

1. Intellectual Property (IP) Ownership and Usage Rights

One of the most fundamental questions to address is: who owns the content created by employees? While an employer generally owns work created by an employee within the scope of their employment (work-for-hire doctrine in many jurisdictions), EGC often blurs these lines. What if an employee creates a video on their personal phone, using their own time, but it promotes the company's product?

Clear IP Assignment: Companies need clear policies or agreements stating that any content created by employees that benefits the company (even if outside normal working hours or on personal devices) automatically becomes the company's property or that the company has perpetual, royalty-free rights to use, modify, and repurpose it across all channels.

Usage Scope: Define explicitly how the company intends to use the EGC (e.g., on its website, social media, in ads, internal communications). This transparency manages employee expectations.

Existing Agreements: Ensure that general employment agreements or IP policies cover EGC, or create a specific addendum for employee creator programs.

Without clarity, companies risk disputes over content ownership, usage, and even demands for compensation after the fact.

2. Confidentiality and Proprietary Information

Employees, by nature of their roles, have access to confidential and proprietary company information – unreleased products, internal strategies, financial data, client lists, and more. EGC poses a significant risk of inadvertent or intentional disclosure.

Explicit Guidelines: Social media policies must clearly define what constitutes confidential information and explicitly prohibit its sharing on public platforms.

Pre-Approval Processes: For highly sensitive industries or content, consider a light-touch pre-approval process for EGC, especially if it touches on product roadmaps, internal data, or competitive strategies.

Training and Reminders: Regularly educate employees on confidentiality obligations, emphasizing the long-term repercussions of breaches. Remind them that their general non-disclosure agreements (NDAs) extend to online content.

Industry-Specific Regulations: For sectors like healthcare or finance, strict data privacy laws (e.g., GDPR, HIPAA, India's DPDP Act) make accidental disclosures particularly risky, requiring extra vigilance.

A single leak can cause immense financial and reputational damage.

3. Compliance with Advertising Regulations & Disclosures

When EGC functions as marketing or an endorsement, it falls under advertising regulations. Regulators like the Federal Trade Commission (FTC) in the U.S. (and similar bodies globally) require transparent disclosure of material connections between endorsers and brands.

Mandatory Disclosure: Employees acting as brand advocates must clearly disclose their employment relationship in their posts. Simple hashtags like #Employee or #CompanyXYZEmployee or a clear statement in their bio are essential. This is crucial even if they are not directly compensated for the specific post.

Authenticity Requirement: Content must reflect the employee's honest opinions and experiences. The company cannot dictate what an employee must say, only provide guidelines for what they can share.

Consequences of Non-Compliance: Companies can face significant fines and reputational damage if their employee advocates fail to comply with disclosure requirements. Training and ongoing reminders are vital.

The blurred line between personal opinion and company endorsement necessitates strict adherence to these rules.

4. Employee Conduct, Brand Reputation, and Social Media Policies

EGC inherently links an employee's personal online presence to the company's brand image. This necessitates comprehensive social media policies that guide employee conduct both on and off company-owned channels.

Define Acceptable Behavior: Clearly outline expectations for professionalism, respect, and adherence to company values when posting online, even on personal accounts, if it could reasonably be associated with the employer.

Prohibit Harmful Content: Explicitly ban posts that are discriminatory, harassing, defamatory, or hateful. This protects colleagues, customers, and the brand.

Crisis Management: Have a clear protocol for addressing negative or controversial EGC, including how to engage with the employee privately, potential content removal, and crisis communication strategies.

Balance Freedom vs. Control: Policies should aim to empower employees while safeguarding the brand, avoiding overly restrictive language that stifles genuine expression. Employees often have legal protections (e.g., under labor laws for discussing working conditions) that broad policies cannot infringe upon.

A robust social media policy acts as a shield, protecting the company's reputation from unforeseen online missteps.

5. Compensation, Fair Labor Standards & Legal Agreements

If a company chooses to compensate employee creators (beyond their regular salary), it opens up additional legal and HR considerations.

Fair Labor Standards Act (FLSA) / Wage & Hour Laws: For non-exempt (hourly) employees, any time spent creating content for the company's benefit, even outside normal working hours, could be considered "hours worked" and be subject to minimum wage and overtime pay requirements. This is a significant risk if not managed properly.

Classification: Be cautious not to accidentally classify employees as independent contractors for EGC purposes if they are otherwise employees, as this can lead to misclassification penalties.

Creator Agreements: Formalize the compensation model (e.g., per post, performance bonus, non-monetary incentives) through a written agreement. This agreement should also cover IP, usage rights, and disclosure requirements, separate from or as an addendum to the main employment contract.

Tax Implications: Clearly outline the tax implications of any compensation provided to employee creators.

Careful structuring of compensation ensures compliance with labor laws and clear understanding of financial arrangements.

In conclusion, Employee-Generated Content offers unparalleled marketing advantages, but its successful integration requires a proactive, strategic approach to legal and HR considerations. By developing comprehensive social media policies, securing clear IP rights, ensuring regulatory compliance, educating employees, and carefully structuring any compensation, companies can build a robust employee advocacy program that leverages their most authentic voices while effectively mitigating the inherent risks. It's about empowering employees safely and strategically, ensuring that their valuable contributions benefit both the brand and themselves, without stepping into legal pitfalls.

To learn more, visit HR Tech Pub.

0 notes

Text

How To Build Privacy Compliance For India's New DPDP Act?

As soon as the Digital Personal Data Protection Act 2023 was enacted, many companies started efforts to get compliant - from updating privacy policies to tweaking contracts.

But is this enough?

While that's a good start, true compliance involves a deeper commitment. What's needed here is a comprehensive understanding of the law's nuances and implications, along with proactive measures to ensure ongoing adherence. Ahead, we tell you how to build privacy compliance for India's new DPDP Act. Let's dive in!

What Is The Privacy Compliance?

Privacy compliance makes sure that businesses handle an individual's personal data according to the legal regulations of the DPDP Act. This protects the data from any breaches and unauthorized access.

Now, adhering to the regulations is mandatory. It not only protects individuals' privacy but helps businesses avoid heavy legal penalties.

By implementing privacy measures, you build trust with customers, manage risks, and demonstrate commitment to ethical data handling practices.

What Is the Digital Personal Data Protection Act (DPDPA)?

Source: Meity

The Digital Personal Data Protection Act 2023 is India's first privacy law and is defined as an Act to provide for the processing of digital personal data in a manner that recognizes both the right of individuals to protect their personal data and the need to process such personal data for lawful purposes and for matters connected therewith or incidental thereto.

The Digital Personal Data Protection Act 2023 addresses privacy concerns by outlining rules for handling personal data. Similar to the EU's GDPR, it emphasizes consent and data subject rights.

That said, it has distinct features, including specific language, and requirements. The DPDPA mandates that businesses inform users about data processing through a privacy policy. Consent must be informed, meaning users understand what they're agreeing to. Failure to provide proper notice invalidates consent and data processing.

To put it simply, the Digital Personal Data Protection Act 2023 protects personal data by ensuring transparency and enforcing stringent consent standards.

Challenges In Privacy Compliance

Privacy compliance faces various challenges. They include:

Understanding and adhering to diverse regulations of the Digital Personal Data Protection Act(DPDPA) may need a nuanced outlook.

Businesses may struggle with data governance, determining who accesses data and how it's used, while ensuring compliance with laws.

The lack of clear guidelines can make implementation feel complicated and lead to uncertainty and potential legal risks.

Balancing security measures with user accessibility poses a challenge, as overly restrictive policies can hamper user experience.

New technology introduces new privacy concerns, requiring constant adaptation to protect data effectively.

Education and awareness gaps among employees and customers further compound these challenges, stressing the need for comprehensive privacy training programs.

What Must Companies Do To Build Privacy Compliance?

Here are a few things companies can do to build privacy compliance:

Create clear guidelines for all employees and update them regularly to adapt to changing circumstances.

Ensure adherence to policies from top management to down and integrate them into company culture through open communication.

Make policies easily understandable and encourage staff to follow them. Also, address any implementation challenges immediately.

Utilise checklists to help everyone follow procedural requirements and track progress efficiently.

Facilitate easy and clear methodology for responding to Data principal rights and grievance redressal.

Conduct regular training sessions for all staff levels to reinforce understanding of policies and maintain compliance.

Stay up-to-date on evolving laws and regulations and ensure policies remain relevant and compliant with current standards.

Enforce policies consistently across all team members and departments and showcase the importance of compliance in daily operations.

Perform audits periodically to evaluate policy effectiveness, identify areas for improvement, and manage any security gaps.

Use automation tools to streamline compliance processes and maintain consistency.

Privacy Compliance Solutions & Automated Tools

As you can see, building privacy compliance for India's new DPDP Act requires a comprehensive approach. You must understand the law’s intricacies and develop a robust action plan. From conducting Data Protection impact assessments to clear data handling policies, it needs continuous efforts.

DPDPA Consultants bring you all the necessary tools and solutions, which makes privacy compliance with the Digital Personal Data Protection Act 2023 easier. Here's how:

Our Data Protection Consent Management tool enables obtaining valid consent easily and automates consent request handling, ensuring compliance throughout the process.

With Data Principal Grievance Redressal, individuals can effortlessly exercise their data rights through a user-friendly platform, enhancing response efficiency in line with the Digital Personal Data Protection Act 2023.

Simplify the Data Protection Impact Assessments (DPIAs) process with our tool and allow easy risk assessment and tracking, ensuring everyone stays informed about the efforts.

Our Data Protection Awareness program enables management to oversee the continuous execution of their personal data privacy initiatives efficiently.

Ensure outsourcing agreements comply with the DPDP Act through our Contract Reviews and redrafting services.

Our custom training programs address organization-specific needs, emphasising practical aspects of DPDP compliance such as personal data policies and processing activities.

Build Privacy Compliance For DPDPA Today!

Boost your compliance journey with DPDP Consultants. Our comprehensive suite of automation tools and expert services simplifies DPDPA adherence every step of the way.

Contact Us For DPDP Compliance Tools

FAQ

How do you ensure data privacy compliance?

Ensuring data privacy compliance involves several steps such as implementing robust security measures, conducting regular audits, staff training, etc. The right set of strategies is imperative to uphold regulatory standards.

Why is data privacy and compliance important?

Data privacy and protection are important to protect individuals' sensitive information, maintain trust with customers, and avoid legal penalties associated with data breaches or mishandling.

What are the 5 pillars of compliance with the Data Privacy Act?

The five pillars of compliance with the Data Privacy Act include appointing a consent manager, data protection officer, conducting risk assessments, implementing data protection measures, creating a privacy management program, and reporting breaches immediately.

#dpdpa tools#dpia#dpdp act 2023#digital personal data protection#dpdp#dpdp act#dpdp 2023#dpdpa#dpdp consultants#dpdp tool

0 notes

Text

Corporate Compliance Services in India: Streamlining Success in 2025

India’s regulatory landscape in 2025 is more dynamic than ever, with evolving laws, digital mandates, and sector-specific requirements shaping the corporate environment. The introduction of the four Labour Codes, the Digital Personal Data Protection (DPDP) Act, 2023, and updates to tax and environmental regulations have heightened the need for robust compliance frameworks. For corporates, navigating this complex web of regulations is critical to avoid penalties, enhance operational efficiency, and maintain stakeholder trust. Corporate compliance services have emerged as a vital solution, offering expertise and tailored strategies to ensure adherence. This blog delves into the role of these services, their key offerings, and their importance for businesses in India.

The Growing Need for Compliance Services

India’s regulatory framework spans labour laws, taxation, environmental standards, data protection, and corporate governance, with frequent updates adding layers of complexity. The Labour Codes, set for nationwide implementation in 2025, consolidate 29 central labour laws, requiring businesses to overhaul HR and payroll systems. The DPDP Act imposes strict data privacy obligations, while GST compliance and environmental regulations demand precision. Non-compliance risks fines, legal disputes, and reputational damage. Compliance services provide corporates with the tools and expertise to stay aligned with these evolving requirements, ensuring seamless operations across industries like manufacturing, IT, healthcare, and retail.

Core Offerings of Corporate Compliance Services

Compliance service providers offer comprehensive solutions to address India’s multifaceted regulatory landscape. Key services include:

1. Labour Law Compliance

The four Labour Codes—Code on Wages, Industrial Relations Code, Code on Social Security, and Occupational Safety, Health, and Working Conditions Code—introduce uniform wage definitions, social security for gig workers, and safety mandates. Compliance services assist with payroll alignment to minimum wage standards (Rs. 783–1,035 per day in 2025), EPFO and ESI contributions, and adherence to the 12-hour daily work cap. They also support the transition to new rules, ensuring compliance for large enterprises (500+ employees) and smaller firms with extended timelines.

2. Data Protection and Privacy Compliance

The DPDP Act, effective in 2025, regulates personal data processing, requiring consent-based frameworks for employee and customer data. Compliance services help corporates implement secure data handling practices, conduct audits, and ensure cross-border data transfers align with regulations. This is critical for IT, e-commerce, and BPO sectors handling sensitive information.

3. Taxation and Financial Compliance

GST compliance remains a cornerstone, with services ensuring accurate filing, input tax credit reconciliation, and adherence to e-invoicing mandates. Corporate tax compliance, including transfer pricing and advance tax payments, is streamlined to meet deadlines. Providers also assist with audits under the Companies Act, 2013, ensuring financial transparency for listed and unlisted entities.

4. Environmental and Sustainability Compliance

With stricter environmental norms under the Environment Protection Act, 1986, and extended producer responsibility (EPR) rules for waste management, corporates face increased scrutiny. Compliance services guide businesses in obtaining environmental clearances, implementing sustainable practices, and filing mandatory reports, particularly for manufacturing and energy sectors.

5. Corporate Governance and Secretarial Services

The Companies Act, 2013, and SEBI regulations mandate robust governance practices, including board compliance, shareholder reporting, and annual filings. Compliance services manage statutory registers, ensure timely AGM/EGM filings, and align with CSR obligations, reducing risks for directors and promoters.

6. POSH and Workplace Compliance

The Prevention of Sexual Harassment (POSH) Act requires Internal Complaints Committees (ICCs) for workplaces with 10+ employees. Compliance services facilitate ICC setup, employee training, and policy drafting to foster safe and inclusive workplaces, critical for employee retention and legal protection.

7. Industry-Specific Compliance

Sectors like pharmaceuticals, banking, and IT/ITES face unique regulations. Compliance services tailor solutions, such as RBI compliance for NBFCs, FSSAI adherence for food businesses, or IT-specific exemptions in states like Karnataka, ensuring sector-specific alignment.

Benefits of Engaging Compliance Services

Outsourcing compliance offers strategic advantages:

Expert Guidance: Providers stay updated on regulatory changes, ensuring accurate and timely compliance.

Cost Efficiency: In-house compliance teams are resource-intensive; outsourcing optimizes costs.

Risk Mitigation: Regular audits and proactive measures reduce legal and financial exposure.

Technology Integration: Automated tools for payroll, tax filing, and data management enhance efficiency.

Scalability: Services cater to startups, SMEs, and large corporates, adapting to business growth.

Selecting the Right Compliance Partner

Choosing a reliable compliance service provider is critical. Corporates should look for:

Expertise in Indian regulations and sector-specific laws.

Technology-driven solutions, including cloud-based compliance platforms.

Proven track record with client testimonials and case studies.

Customized offerings to address unique business needs.

Strong communication and support for ongoing compliance needs.

Preparing for 2025’s Regulatory Landscape

As India’s regulatory environment evolves, corporates must prioritize compliance to thrive. The Labour Codes’ phased rollout, DPDP Act enforcement, and sector-specific mandates demand proactive preparation. Compliance services enable businesses to update policies, train staff, and leverage technology for seamless adherence. Regular audits and employee awareness programs further strengthen compliance frameworks.

By partnering with expert compliance services, corporates can navigate India’s regulatory maze with confidence, ensuring legal adherence, operational excellence, and stakeholder trust in 2025 and beyond.

1 note

·

View note

Text

DPDP Breach: One Weak Vendor Can Break Your Chain?

In the age of digital transformation, data is currency, and with it comes the responsibility of safeguarding personal information. The Digital Personal Data Protection Act (DPDP) has redefined the rules of engagement for Indian businesses, especially brands, OEMs, and dealerships that handle large volumes of customer data.

No longer is data privacy just a technical issue — it’s a boardroom priority.

Under DPDP, accountability lies with the Data Fiduciary, regardless of who actually processes the data. This means even if your marketing, lead generation, or CRM efforts are outsourced, you bear the ultimate liability. A single vendor’s oversight — be it storing leads in an unprotected spreadsheet or mishandling consent — can unleash a storm of legal penalties, financial losses, and reputational damage.

The message is clear: You can outsource execution, but not responsibility.

When your logo is on the page, your name — and your liability — are on the line. The DPDP Act makes it clear: no matter how many vendors or partners you engage, ultimate responsibility for data privacy and compliance remains with you. Even one weak link in your vendor chain can expose your brand to massive penalties and lasting reputational damage.

That’s why it’s critical to assess your entire vendor ecosystem and ensure every partner is up to the mark. By choosing Sekel Tech, you gain more than just a platform — you secure a comprehensive, automated, and privacy-first solution that keeps you ahead of regulatory requirements. Sekel Tech empowers you to manage consent, monitor vendors, and respond to incidents swiftly, so you can focus on growing your business with confidence.

Don’t leave your compliance to chance. Make Sekel Tech your trusted partner in DPDP compliance and brand safety — because in today’s digital world, airtight data governance is your strongest competitive advantage.

0 notes

Text

OnGrid Unveils Instant BGV to Supercharge Hiring Workflows

The Need for Speed in Hiring

In a hyper-competitive job market, companies can’t afford slow background checks. Traditional background verification processes often take days—sometimes even weeks—causing onboarding delays and candidate drop-offs. That’s where instant BGV comes in as a game-changer.

What Is Instant BGV?

Instant BGV refers to a digital-first, technology-driven approach to background verification that delivers results in minutes instead of days. With OnGrid’s newly launched instant BGV solution, companies can now verify a candidate’s identity, address, criminal record, employment history, and even face match—all within a few clicks.

Key Features of OnGrid’s Instant BGV

AI-Powered OCR: Automatically extracts and validates candidate data from uploaded documents.

Real-Time Checks: Enables instant identity, address, employment, and criminal verifications.

Bulk Upload & API Integration: Designed to handle high-volume hiring needs.

Data Privacy & Compliance: Built with enterprise-grade encryption and adherence to India’s DPDP Act.

Benefits for Employers and Candidates

With OnGrid’s instant BGV, hiring teams save up to 60% of their time. Candidates enjoy a seamless onboarding experience with less waiting and more transparency. The system also minimizes manual errors, ensures better compliance, and supports scalable growth for enterprises and startups alike.

The Future of Hiring Is Instant

As hiring accelerates across sectors like tech, gig work, logistics, and BFSI, solutions like OnGrid’s instant BGV are not just helpful—they’re essential. Fast, reliable, and compliant background checks are now just a few clicks away.

#instant BGV#background verification#OnGrid#hiring workflows#HR technology#digital onboarding#candidate verification#employee background check#real-time BGV#AI in hiring#bulk verification#onboarding automation#remote hiring#BGV API#tech-driven recruitment

0 notes

Text

Got it! Here's the revised version of the blog with the keyword “digital marketing agency” used consistently (not in plural form) and naturally throughout:

The Role of Blockchain in the Future of Digital Marketing Agency

Blockchain technology is no longer just a buzzword in the world of cryptocurrencies—it’s fast becoming a strategic tool for the future of digital marketing. As privacy concerns, ad fraud, and data transparency challenges continue to grow, blockchain is offering solutions that could transform how a digital marketing agency operates, builds trust, and delivers results.

Let’s explore how blockchain is reshaping the future of marketing—and why every forward-thinking digital marketing agency should start paying attention.

1. Transparency in Advertising and Media Buying

A major problem faced by any digital marketing agency is the lack of transparency in ad spending. With multiple intermediaries in programmatic advertising, clients often don’t know where their money goes—or if their ads were actually seen by humans.

Blockchain introduces a distributed ledger system where every transaction is recorded and verifiable. This helps a digital marketing agency:

Verify ad impressions and eliminate bot traffic

Track campaign spending with full visibility

Build client trust through tamper-proof reporting

2. Better Data Privacy and Consent Control

As global regulations like GDPR, CCPA, and India’s DPDP Act continue to evolve, privacy compliance is no longer optional. Blockchain allows for decentralised identity systems where users control how their data is shared.

For a digital marketing agency, this means:

More ethical and transparent data collection

Permission-based campaigns driven by smart contracts

Reduced reliance on third-party cookies

This aligns perfectly with the cookieless future already transforming the industry.

3. Enhanced Loyalty and Rewards Programs

Blockchain enables token-based loyalty systems that are secure, scalable, and easy to track. A digital marketing agency can design and deploy custom blockchain-based loyalty programs to:

Reward repeat customers or brand advocates with tokens

Create digital assets (like NFTs) that boost engagement

Drive long-term customer retention in a gamified ecosystem

This introduces a new layer of value-driven marketing.

4. Authenticating Influencer Marketing

Influencer fraud is a real challenge. Fake followers and engagement can mislead brands and waste marketing budgets. Blockchain can bring trust to the influencer space by creating verifiable records of:

Follower authenticity

Campaign results

Pre-agreed milestones via smart contracts

A digital marketing agency can use this tech to guarantee real performance and ROI from influencer partnerships.

5. Secure Content Attribution and Ownership

In content-heavy campaigns, ownership and licensing can be murky. Blockchain timestamps and stores digital assets securely, providing proof of authorship and usage rights.

This allows a digital marketing agency to:

Protect intellectual property (blogs, images, videos)

Ensure original creators receive credit and payment

Automate licensing terms with smart contracts

It’s a safer, smarter way to manage digital content in a fast-moving environment.

6. Decentralised Programmatic Advertising

Traditional ad buying involves numerous middlemen. Blockchain can streamline this through smart contracts—automating ad delivery, payment, and validation.

Benefits for a digital marketing agency include:

Faster campaign launches with reduced operational friction

Verified real-time ad placements

Lower fraud risk with end-to-end traceability

This creates a more efficient, performance-driven advertising model.

7. Crypto-Enabled Micro-Payments

Blockchain allows frictionless micro-transactions, enabling entirely new advertising models:

Pay-per-view campaigns where users earn tokens for watching content

Tip systems for high-value content or creators

User opt-in models where consumers control ad experiences

A digital marketing agency can leverage these to offer value exchanges between brands and audiences, creating more engaging experiences.

8. Immutable Brand Reputation Records

Trust is currency in marketing. With blockchain, reviews, testimonials, and customer feedback can be stored immutably—offering a transparent record of a brand’s reputation.

This helps a digital marketing agency:

Combat fake reviews and disinformation

Validate ESG or sustainability claims

Build trust-driven marketing strategies

Brands can prove—not just claim—their values and track record.

Final Thoughts

Blockchain isn’t replacing traditional marketing—it’s redefining it. From ad transparency to content security and loyalty innovations, the technology gives a digital marketing agency new tools to create value, build trust, and stay ahead of the competition.

In the years ahead, agencies that embrace blockchain won’t just be tech-savvy—they’ll be future-ready. Because in tomorrow’s digital landscape, transparency, privacy, and decentralisation won’t just be features—they’ll be expectations.

0 notes

Text

Why Did India Need the DPDP Act? Let’s be honest. We’ve all faced annoying spam calls, fake loan messages, and sudden “lucky winner” emails. Most of these happen because someone sold or leaked your personal data. There were court cases, RTIs, even PILs in the Supreme Court. In 2017, the Court finally said that privacy is a fundamental right under Article 21. That was the turning point. The Government then started working on a full-fledged law to protect our digital personal data. After a few drafts and changes, the Digital Personal Data Protection Act, 2023 was passed. It officially became law on 11th August 2023.

0 notes