#Data Analytics in Banking Market Forecast

Explore tagged Tumblr posts

Text

AI-Driven Supply Chain Finance: Transforming Investment Banking Strategy and Client Value in 2025

AI-Driven Supply Chain Finance: Transforming Investment Banking Strategy and Client Value in 2025

In today’s fast-evolving global financial ecosystem, supply chain finance (SCF) has emerged as a vital tool to enhance liquidity, reduce risk, and build operational resilience. Now, artificial intelligence (AI) is revolutionizing SCF, unlocking smarter, faster, and more strategic financing solutions. For investment bankers, this shift opens a powerful new frontier to innovate client offerings and deepen advisory impact. For those seeking to excel in this dynamic field, enrolling in investment banking professional courses can provide crucial expertise, while selecting the best institute for investment banking in Mumbai ensures access to top-tier training. Many professionals also consider an investment banking course with placement to jumpstart their careers effectively.

This article explores how AI is reshaping supply chain finance in 2025, from foundational shifts to cutting-edge tools, advanced tactics, and real-world applications. Whether you are a seasoned finance professional or an aspiring investment banker, you will gain actionable insights to harness AI-driven SCF as a strategic advantage.

The Evolution of Supply Chain Finance and the AI Revolution

Supply chain finance traditionally optimizes working capital by enabling early payments to suppliers while extending payment terms for buyers. Historically, these programs relied on manual processes, paper documentation, and static credit assessments that limited speed and scalability. Fintech innovations began digitizing SCF, but AI now accelerates a profound transformation.

By 2025, AI-driven platforms employ machine learning and advanced analytics to perform real-time risk assessments, automate financing approvals, detect fraud, and forecast cash flows with unprecedented precision. These capabilities enable companies to optimize liquidity, reduce financial risks, and enhance supply chain efficiency at scale.

Investment banks, once focused mainly on capital markets and advisory roles, are recognizing AI-driven SCF as a strategic growth area. For investment banking professionals, advancing through specialized investment banking professional courses is essential to keep pace with these technological shifts. Selecting the best institute for investment banking in Mumbai can provide the practical skills needed to integrate AI into SCF solutions effectively. Moreover, an investment banking course with placement offers the advantage of direct industry exposure, helping professionals apply AI-driven strategies in real-world scenarios.

By integrating AI technologies into financing products and advisory services, investment bankers can offer clients innovative solutions that improve liquidity management and supply chain resilience, imperatives in a post-pandemic, geopolitically volatile world.

Key AI Technologies and Tools Reshaping Supply Chain Finance

AI’s integration into SCF spans multiple interrelated functions. Understanding these tools is essential for investment bankers advising clients on effective SCF strategies.

Dynamic Risk Assessment: Machine learning models analyze vast data sets, including payment histories, macroeconomic indicators, and supplier behavior, to generate real-time, dynamic credit scores. This reduces defaults and expands financing access to smaller suppliers traditionally excluded due to lack of collateral or credit history.

Automated Financing Approvals: AI automates the approval process, cutting turnaround times from days to minutes. This boosts scalability and supplier satisfaction by speeding liquidity delivery.

Predictive Cash Flow Analytics: AI forecasts cash flow needs by analyzing historical transactions and market trends, enabling companies to plan liquidity proactively and avoid costly funding gaps.

Smart Contracts and Real-Time Payments: Combining AI with blockchain technology facilitates secure, automated payments to suppliers upon fulfillment of contract terms, enhancing transparency and trust.

Fraud Detection and Compliance Monitoring: Advanced AI algorithms continuously monitor transactions to detect anomalies and prevent fraud, ensuring regulatory compliance and protecting financial integrity.

Cloud-Native Platforms and Generative AI Agents: Platforms like FIS’s GETPAID integrate real-time receivables data with generative AI agents that proactively recommend financing options, transforming decision-making from reactive to strategic.

Emerging AI trends are shaping the future of supply chains and SCF:

Generative AI for Scenario Planning: Generative AI can simulate thousands of supply chain configurations and operational scenarios, optimizing cost, service levels, and sustainability metrics simultaneously.

AI-Powered Digital Twins: Dynamic digital replicas of supply chains continuously simulate operations in real time, enabling predictive analytics and autonomous adjustments to production schedules, inventory, and logistics, anticipating disruptions before they occur.

For investment bankers, mastering these AI capabilities is critical to developing innovative financing structures and delivering superior advisory services. Those pursuing investment banking professional courses will find that in-depth modules on AI and fintech innovation are increasingly common. Choosing the best institute for investment banking in Mumbai that offers such specialized training can significantly boost one’s competitive edge. Additionally, an investment banking course with placement ensures practical learning and industry connections, facilitating the application of AI tools in client engagements.

Advanced Strategies for Investment Bankers in AI-Driven SCF

To lead in AI-powered supply chain finance, investment bankers should adopt several advanced approaches:

Forge Fintech Partnerships: Collaborate with AI-focused fintech innovators to co-create tailored SCF solutions that combine banking expertise with cutting-edge technology, maximizing client value.

Leverage Extensive Data Assets: Utilize your institution’s rich client and market data to train AI models, enhancing risk assessment accuracy and predictive power.

Integrate with Enterprise Systems: Encourage clients to embed SCF platforms within their accounts receivable and payable systems, creating seamless user experiences and real-time financing visibility.

Position SCF as a Strategic Initiative: Frame SCF beyond cash flow management, as a lever to enhance enterprise valuation, strengthen risk posture, and build supply chain resilience.

Develop Clear Communication and Storytelling Skills: Explain complex AI-driven SCF solutions in clear, client-centric terms to build trust and drive adoption.

Emphasize ESG and Sustainability: Many AI-driven SCF platforms now incorporate environmental, social, and governance criteria, aligning financing with corporate responsibility goals and appealing to socially conscious investors.

Navigate Regulatory and Compliance Complexities: Stay informed about evolving regulations impacting AI and SCF to guide clients safely through compliance challenges.

For investment bankers pursuing professional growth, enrolling in investment banking professional courses that cover AI integration and fintech collaboration is highly recommended. The best institute for investment banking in Mumbai will offer updated curricula reflecting these market demands. An investment banking course with placement further equips bankers with practical experience to implement these advanced strategies confidently.

Case Study: FIS’s GETPAID Platform, A Blueprint for AI-Driven SCF Success

FIS, a global fintech leader, showcases AI’s transformative potential in SCF through its cloud-native GETPAID platform. This solution integrates real-time data analytics, AI-driven decision-making, and seamless connectivity with accounts receivable and payable systems to deliver a streamlined financing experience.

Recognizing that traditional SCF programs were operationally fragmented, FIS collaborated with partners like Microsoft to embed generative AI agents. These agents analyze live receivables data and proactively recommend optimal financing actions.

Key challenges included managing vast data complexity and ensuring compliance across multiple jurisdictions. By leveraging AI’s predictive analytics and fraud detection, GETPAID improved liquidity management while mitigating risk exposure. Clients report faster financing approvals, enhanced cash flow visibility, and stronger supplier relationships.

CFOs increasingly view SCF as a strategic mandate that drives enterprise valuation and resilience amid economic uncertainties. This case exemplifies how investment bankers can advise clients on adopting AI-driven SCF solutions aligned with broader financial and strategic goals.

Professionals who have completed investment banking professional courses often leverage such case studies to deepen their understanding. Choosing the best institute for investment banking in Mumbai can provide access to similar industry examples. Moreover, an investment banking course with placement ensures exposure to real-world applications, making the transition from theory to practice seamless.

Practical Tips for Aspiring Investment Bankers in AI-Driven SCF

To thrive in the emerging AI-SCF landscape, aspiring investment bankers should:

Build Robust AI Literacy: Gain a deep understanding of AI technologies, including machine learning, predictive analytics, smart contracts, and generative AI. This expertise is essential for evaluating platforms and advising clients.

Stay Ahead of Industry Trends: Regularly track fintech advancements, supply chain disruptions, AI applications, and regulatory developments to enhance advisory capabilities.

Cultivate Cross-Functional Skills: Blend finance, data analytics, technology insights, and communication skills to bridge gaps between clients, fintech partners, and internal teams.

Focus on Client-Centric Solutions: Understand each client’s unique supply chain challenges and tailor AI-driven financing strategies that address specific pain points and growth objectives.

Leverage Data-Driven Storytelling: Use compelling data visualizations and narratives to demonstrate AI-SCF’s impact on liquidity, risk, and enterprise value, simplifying complex concepts.

Engage with Fintech Innovators: Network actively with startups and established AI solution providers to stay connected to innovation and partnership opportunities.

Advocate Ethical AI Use: Promote transparency, fairness, and compliance in AI applications to build trust with clients, regulators, and stakeholders.

For those building their careers, enrolling in investment banking professional courses is a foundational step. Selecting the best institute for investment banking in Mumbai that offers comprehensive AI and fintech modules enhances readiness for this evolving landscape. An investment banking course with placement is particularly valuable, providing hands-on experience and industry networking essential for success.

Conclusion: Leading Investment Banking’s Next Frontier with AI-Driven SCF

Artificial intelligence is revolutionizing supply chain finance by enhancing speed, accuracy, and accessibility. For investment banking professionals, this transformation offers a unique opportunity to innovate client offerings, deepen advisory relationships, and drive strategic value.

Integrating AI-driven risk assessments, automated financing, predictive analytics, smart contracts, and real-time payments is redefining liquidity management across global supply chains. Emerging AI trends such as generative AI and digital twins further elevate SCF's strategic potential.

Leading fintech platforms like FIS’s GETPAID demonstrate the tangible benefits of AI adoption, from operational efficiency to improved enterprise valuation and resilience. To succeed, investment bankers must develop AI expertise, foster fintech partnerships, and communicate AI-SCF’s strategic advantages clearly and compellingly.

Embracing investment banking professional courses is a critical pathway to gaining this expertise. Choosing the best institute for investment banking in Mumbai ensures access to industry-relevant skills and knowledge. Moreover, an investment banking course with placement accelerates career growth by combining theory with practical exposure.

By embracing this frontier, investment bankers position themselves at the nexus of technology and finance, creating smarter, more resilient supply chains and stronger client outcomes. The future of supply chain finance is intelligent, automated, and strategic. Investment bankers who lead this transformation will unlock unprecedented value for their clients and their firms in 2025 and beyond.

0 notes

Text

How Digital IPOs Are Disrupting Traditional Investment Banking in 2025

Gone are the days when taking a company public meant lengthy roadshows, big-bank underwriting fees, and elite institutional investors at the helm. In 2025, Digital IPOs are rewriting the rules of the game. Enabled by technology and democratized investment platforms, companies are now opting for direct listings, special purpose acquisition companies (SPACs), and app-based IPO subscriptions.

This revolution is reshaping the role of investment bankers—and for aspiring professionals, mastering the skills to thrive in this digital-first environment is crucial. That’s where a forward-thinking investment banking course in Kolkata can make all the difference.

💡 What is a Digital IPO?

A Digital IPO (Initial Public Offering) refers to a technology-enabled public offering process where companies raise funds through stock market listings, using digital platforms to handle everything from investor outreach to allocation and compliance.

Rather than relying solely on traditional underwriting by big investment banks, companies now:

Reach investors via digital apps (like Zerodha, Groww, and Upstox)

Use AI and analytics for demand forecasting

Streamline compliance and documentation digitally

Leverage social media for awareness, bypassing conventional roadshows

This shift empowers startups and emerging enterprises to access public markets faster, more transparently, and cost-effectively.

📉 Why Traditional Investment Banking is Being Challenged

1. Lower Fees with Direct Listings

Digital IPOs reduce reliance on underwriters, saving companies millions in fees. In a direct listing, a company goes public by selling shares directly to investors without issuing new ones.

Example: Spotify and Coinbase famously went public through direct listings, skipping the traditional investment banking route.

2. Retail Investor Dominance

Thanks to mobile trading platforms, retail investors now play a bigger role in IPO subscriptions—challenging the dominance of institutional investors in the IPO game.

3. Faster Market Access for Startups

Traditional IPOs can take months. Digital IPOs, often facilitated by SPACs or online-only listings, can bring a company to market in weeks.

4. Data-Driven Investor Targeting

Companies now use AI and real-time analytics to reach and understand their investor base, offering more customized marketing compared to old-school investment banking pitches.

📈 Trends Shaping Digital IPOs in India

India’s IPO landscape has rapidly evolved:

Zomato, Nykaa, and Mamaearth ran hybrid IPO models with major retail digital participation.

Platforms like Paytm Money, Groww, and Zerodha have simplified IPO bidding for the average investor.

The SEBI T+1 settlement and digital KYC norms have further smoothed out the retail IPO process.

As more Indian startups mature, we can expect an explosion of digital-first IPOs in the coming years—especially from tech, EV, and renewable sectors.

💼 Changing Role of Investment Bankers in the Digital IPO Era

While the traditional role of underwriter is evolving, investment bankers are far from obsolete. Instead, their responsibilities are shifting toward:

Digital compliance and risk assessment

Tech-enabled valuation and pricing models

Data-driven investor targeting

SPAC advisory and reverse merger planning

Cross-platform investor communications

In essence, investment bankers now need to be tech-savvy, data-literate, and agile.

🎓 Why You Should Choose an Investment Banking Course in Kolkata

Kolkata, a growing hub for fintech, finance, and education, offers a vibrant ecosystem for investment banking aspirants. An investment banking course in Kolkata that integrates real-world IPO training, digital tools, and case-based learning can help students:

Understand modern IPO mechanisms: direct listings, SPACs, digital subscriptions

Get hands-on with platforms like NSE/BSE IPO modules, financial modeling, and Excel automation

Learn to analyze investor sentiment via digital channels

Master compliance processes and AI-driven risk assessments

Such a course bridges the gap between traditional finance knowledge and the evolving demands of digital-first investment banking.

🔧 Key Skills for the Digital IPO Era

To succeed in the age of digital public offerings, professionals need to master:

IPO valuation & pricing strategies

Capital markets compliance and documentation

Investor roadshow design—virtual and social-media based

Advanced Excel and financial modeling

Digital marketing awareness for finance

SPAC structuring and execution

Regulatory updates from SEBI, FINRA, and global bodies

These are no longer “optional” skills—they’re mandatory for future-ready investment bankers.

🌍 Career Paths in the Digital IPO Boom

With the rise of Digital IPOs, several exciting roles are opening up in India and globally:

IPO Advisory Analyst

Equity Capital Markets Associate

Digital Capital Raising Consultant

SPAC Analyst

Investor Relations Executive

Compliance and Digital Listing Officer

Whether you want to work with startups, boutique IB firms, fintech platforms, or stock exchanges, having the right training through an investment banking course in Kolkata gives you a competitive edge.

✅ Final Thoughts

Digital IPOs are not a trend—they’re the future of capital markets. As this disruption gains momentum, the investment banking industry must evolve with it.

If you want to be part of this transformation, it’s time to rethink your learning strategy. A modern, application-based investment banking course in Kolkata will not only teach you traditional finance but also prepare you for a world driven by data, platforms, and digital investor ecosystems.

0 notes

Text

Top 10 Real-World Applications of Data Science in 2025

With 2025 fast approaching, data science is transforming industries and revolutionizing how businesses operate. From personalized shopping experiences to predictive healthcare, data-driven decision-making is at the core of innovation. For those looking to enter this exciting field, enrolling in the best data science training in Hyderabad is a smart first step toward a future-ready career.

In 2025, we'll see ten of the most exciting real-world applications of data science.

1. Personalized Healthcare

Data science enables personalized treatment plans using patient data, genetic information, and historical health records. AI-powered diagnostics and wearable devices are helping doctors make faster, more accurate decisions, improving patient outcomes dramatically.

2. Fraud Detection in Finance

Banks and financial institutions are using data science to detect fraud in real time. Machine learning models analyze transaction patterns to flag suspicious activity, protecting both customers and businesses from financial loss.

3. Smart Cities and Urban Planning

From managing traffic flows to optimizing energy usage, data science helps city planners make smarter, more efficient decisions. In 2025, smart cities will use real-time data to improve public services and enhance quality of life.

4. Recommendation Systems

Whether you're browsing Netflix or shopping on Amazon, data science powers recommendation engines that personalize your experience. These systems are becoming even more precise with advances in behavioral analytics.

5. Predictive Maintenance in Manufacturing

Forecasting equipment failures using predictive analytics is becoming increasingly popular in industrial sectors. This reduces downtime, saves costs, and increases productivity across factories and production lines.

6. Autonomous Vehicles

To interpret sensor data, make driving decisions, and ensure safety, self-driving cars rely heavily on data science. In 2025, expect further advancements in AI-driven mobility solutions.

7. Retail and Customer Analytics

Retailers are using data science to track customer behavior, optimize inventory, and enhance in-store experiences. Data-driven insights help businesses forecast demand and personalize marketing campaigns.

8. Climate Change and Environmental Monitoring

Data science plays a crucial role in tracking climate patterns, predicting natural disasters, and developing sustainable solutions. Environmental scientists use big data to model and mitigate ecological risks.

9. Cybersecurity

With cyber threats on the rise, data science is essential for identifying vulnerabilities and responding to threats in real time. AI-driven security systems continuously monitor network activity to ensure data safety.

10. Education and eLearning

Adaptive learning platforms use data to analyze student performance and tailor content accordingly. In 2025, education will become more personalized and accessible thanks to data science tools.

Conclusion: Get Skilled for a Data-Driven Future

As these real-world applications show, data science is at the heart of innovation across every major industry. Whether you're passionate about healthcare, finance, tech, or sustainability, mastering data science can open doors to endless opportunities. To gain practical skills and industry-relevant experience, join SSSIT Computer Education, a leading institute known for offering the best data science training in Hyderabad. Start your journey today and become part of the future shaping the world!

#best software training in hyderabad#best software training in kukatpally#best software training in KPHB#Best software training institute in Hyderabad

0 notes

Text

Mastering AI in Supply Chain Finance: How Investment Bankers Can Lead the Next Wave of Growth and Risk Innovation

Mastering AI in Supply Chain Finance: How Investment Bankers Can Lead the Next Wave of Growth and Risk Innovation

In an era marked by rapid technological advances and shifting global trade dynamics, artificial intelligence (AI) is no longer a futuristic concept, it is the engine powering the transformation of supply chain finance (SCF) within investment banking. With geopolitical uncertainties, economic volatility, and evolving regulatory landscapes challenging traditional trade finance, AI-driven solutions offer investment bankers a powerful toolkit to unlock liquidity, sharpen risk management, and streamline operations.

For today’s investment banking professionals, understanding and mastering AI in SCF is critical to staying competitive and delivering exceptional client value. For those looking to deepen their expertise, pursuing investment banking professional courses can provide the necessary foundation to navigate this complex landscape effectively.

The Changing Landscape of Supply Chain Finance: From Manual to AI-Powered

Supply chain finance has long been a strategic lever for optimizing working capital and cash flows by extending short-term credit to suppliers and buyers within complex supply chains. Traditionally, banks relied on manual processes, verifying documents, assessing creditworthiness based on limited data, and applying standardized financing tools like reverse factoring or dynamic discounting. While these methods served well, they struggled with inefficiencies, opaque risk profiles, and an inability to scale seamlessly across diverse global supply chains.

AI is rewriting this narrative. By harnessing advanced machine learning algorithms and natural language processing, AI systems can analyze vast, complex datasets spanning multiple counterparties, geographies, and economic conditions. This capability enables real-time credit risk assessments, fraud detection, and liquidity forecasting with unprecedented accuracy.

Beyond automation, AI empowers banks to create dynamic pricing models and tailor financing offers that adjust continuously to market signals and individual client behaviors. Investment banks worldwide recognize this shift. Recent industry research shows that over half of global banks plan to boost their investment in trade finance technology in the coming year, with AI and machine learning adoption surging by 50%. This trend signals a fundamental reimagining of SCF, where AI is not just a tool but a core driver of innovation, efficiency, and client-centricity.

To capitalize on these opportunities, many professionals are enrolling in investment banking professional courses that focus on AI applications and financial analytics.

Key AI Innovations Reshaping Supply Chain Finance

Several cutting-edge AI capabilities are revolutionizing SCF, giving investment bankers new levers to create value:

Predictive Risk Management: Traditional credit models often look backward, relying on historical data and static criteria. AI shifts the paradigm by integrating diverse data streams, financial statements, payment histories, geopolitical events, and ESG metrics, to generate nuanced, forward-looking risk scores. This precision enables banks to price risk more accurately and extend financing to suppliers previously overlooked due to lack of transparent credit profiles.

Process Automation and Efficiency: AI dramatically reduces manual tasks in invoice processing, trade document verification, and compliance. Natural language processing (NLP) can extract and validate information from unstructured documents, such as contracts and bills of lading, accelerating transaction cycles and minimizing errors.

Dynamic Pricing Models: AI-driven algorithms continuously adjust financing terms, including interest rates and discount factors, based on real-time market conditions and client-specific data. This flexibility allows banks to offer more competitive and personalized SCF products.

Fraud Detection and Security: Machine learning models monitor transactional patterns to detect anomalies and potential fraud proactively, protecting both banks and clients from financial crime risks.

Enhanced Client Experience: AI-powered virtual assistants and intelligent chatbots provide personalized guidance, simplifying complex trade finance processes and increasing client engagement.

Together, these innovations enable investment banks to deliver SCF solutions that are agile, scalable, and finely tuned to the fluid demands of global supply chains. Aspiring professionals aiming to master these capabilities often seek out a financial analytics course with job guarantee to build practical skills that can be directly applied in this evolving field.

Navigating Regulatory and Ethical Challenges in AI-Driven SCF

As banks accelerate AI adoption in SCF, regulatory compliance and ethical considerations become paramount. Financial regulators worldwide are scrutinizing AI models for transparency, fairness, and data privacy. Investment bankers must ensure AI-driven credit decisions comply with anti-discrimination laws and data protection regulations such as GDPR.

Explainability, being able to clarify how AI arrives at decisions, is increasingly required to satisfy regulators and build client trust. Moreover, AI ethics demand attention to bias mitigation in algorithms and safeguarding sensitive supplier data. Partnering with legal and compliance teams early in AI initiatives can help banks navigate these challenges and embed responsible AI practices into their SCF offerings.

For those committed to excelling in this environment, enrolling in the best investment banking course in Mumbai with placement often includes modules on compliance, ethics, and AI governance, preparing students for real-world challenges.

Strategic Approaches for Investment Bankers to Harness AI in SCF

To capitalize on AI’s transformative potential, investment bankers should adopt a multi-faceted strategy that blends technology, client insight, and ecosystem collaboration:

Adopt AI-First or Parallel Innovation Models: Banks can either build new AI-first SCF platforms alongside legacy systems or systematically transform existing operations around AI capabilities. While resource-intensive, these approaches position banks for sustained leadership in a competitive market.

Forge Data Partnerships: High-quality, diverse data is the lifeblood of AI accuracy. Collaborating with fintech firms, trade platforms, and alternative data providers enriches datasets, enhances risk models, and expands financing opportunities.

Educate and Engage Clients: Clear, relatable communication about AI’s benefits helps clients embrace innovation. Investment bankers should craft narratives that demonstrate how AI reduces risk, improves liquidity, and fosters growth across supply chains.

Integrate ESG into AI Models: Incorporating environmental, social, and governance criteria into AI-powered risk assessments aligns SCF offerings with clients’ sustainability goals and evolving regulatory expectations, creating competitive differentiation.

Continuously Measure and Optimize: Advanced analytics enable banks to monitor AI-driven SCF transactions, optimize pricing strategies, detect emerging risks early, and demonstrate tangible value to stakeholders.

Collaborate Across the Ecosystem: Innovation often requires partnerships with fintech innovators, regulators, and supply chain stakeholders. Cultivating a collaborative mindset enhances solution breadth and impact.

Investment bankers looking to implement these strategies effectively often turn to investment banking professional courses or the best investment banking course in Mumbai with placement programs to gain strategic insights and actionable skills.

Real-World Success: HSBC’s AI-Powered Supply Chain Finance Transformation

HSBC exemplifies how AI can redefine SCF in investment banking. Confronted with labor-intensive processes and limited risk visibility across diverse supplier networks, HSBC sought to modernize its trade finance operations. By investing heavily in AI and machine learning, and partnering with fintech innovators, HSBC integrated real-time data analytics, automated document processing, and AI-based credit scoring into its SCF platform.

Importantly, it embedded ESG metrics into risk models, supporting sustainable supply chains. The results were striking: processing times dropped by over 40%, financing expanded to thousands of new SME suppliers previously excluded due to opaque credit profiles, and risk-adjusted returns improved through precise credit pricing. Clients experienced enhanced liquidity management and greater supply chain transparency.

HSBC’s success illustrates how AI can simultaneously drive growth, resilience, and sustainability. Professionals aiming to replicate such success often enhance their credentials by completing a financial analytics course with job guarantee, equipping themselves with the analytical skills needed to lead similar transformations.

Practical Tips for Aspiring Investment Bankers

For those entering investment banking or seeking to deepen expertise in SCF, the following steps are essential:

Build Strong AI Literacy: Develop a solid understanding of AI fundamentals, machine learning, natural language processing, and predictive analytics, to engage effectively with technical teams and clients.

Stay Current on Industry Trends: Regularly review industry reports, research, and case studies on AI’s evolving role in trade and supply chain finance.

Master Client-Centric Communication: Learn to translate complex AI concepts into clear, client-focused benefits that address real-world challenges.

Gain Hands-On Experience with Data Analytics: Familiarize yourself with data visualization and analysis tools that support AI-driven decision-making.

Embrace Cross-Sector Collaboration: Innovation in SCF thrives on partnerships with fintechs, regulators, and supply chain participants. Cultivating an open, collaborative mindset is key.

Enrolling in investment banking professional courses or the best investment banking course in Mumbai with placement can provide structured learning paths to acquire these competencies, often with placement support to kickstart careers.

The Competitive Edge: Why AI Mastery Matters Now

AI-driven supply chain finance is not a distant opportunity, it is a present-day imperative. Banks that master AI in SCF unlock new growth avenues, mitigate risks more effectively, and deliver superior client experiences amid a complex global trade environment.

As AI reshapes banking’s core, professionals who lead this transformation position themselves and their institutions at the forefront of industry innovation. The journey demands commitment to continuous learning, strategic investment, and partnership-driven innovation.

But as HSBC’s example shows, the payoff includes operational excellence, inclusive growth, and sustainable impact across supply chains. For investment bankers ready to embrace AI’s potential, the next frontier is here, and it promises to redefine the future of supply chain finance.

Pursuing a financial analytics course with job guarantee or the best investment banking course in Mumbai with placement can be the catalyst to mastering these critical skills and securing a leadership role in this dynamic field.

This comprehensive exploration combines the latest industry insights, practical strategies, regulatory considerations, and real-world success to equip investment bankers with the knowledge and confidence needed to lead AI-driven supply chain finance innovation.

0 notes

Text

Back Office Workforce Management Market Size, Share & Growth Analysis 2034: Optimizing Operations with Automation & AI

Back Office Workforce Management Market is rapidly evolving as organizations seek smarter ways to handle non-customer-facing operations. Encompassing solutions such as task scheduling, labor forecasting, performance analytics, and time and attendance systems, this market is pivotal for businesses striving to increase operational efficiency. From banking to retail, companies are turning to these tools to automate manual processes, manage human capital effectively, and support strategic decision-making. With a market value of $3.1 billion in 2024 and projected growth to $6.4 billion by 2034, the sector is gaining strong momentum with a healthy CAGR of 7.5%.

Market Dynamics

What’s fueling this growth is a mix of technological innovation, rising labor costs, and the growing demand for transparency and accountability in business operations. The cloud-based deployment model leads with a 45% market share, offering flexibility, real-time access, and scalability to enterprises of all sizes. This is followed by on-premise (30%) and hybrid (25%) solutions, each addressing unique organizational needs.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS24564

The top-performing sub-segment is scheduling and forecasting, as organizations seek accurate, automated methods to deploy resources more efficiently. Close behind is analytics and reporting, where businesses are capitalizing on real-time data to fine-tune productivity and performance. As hybrid and remote work become the norm, solutions that support workforce visibility and self-service functionality are in high demand.

Key Players Analysis

Major players such as Verint Systems, NICE Systems, and Aspect Software are leading the charge with robust platforms that integrate AI, machine learning, and mobile capabilities. These companies continue to innovate, delivering tools that not only optimize task assignments but also offer insights into workforce trends and operational gaps.

Emerging players like Work Sync Innovations, Back Office Dynamics, and Efficient Ops are also disrupting the space. Their agility in customizing niche solutions for SMEs and specific industries such as healthcare or retail makes them strong contenders. A common thread among these players is a focus on subscription-based models and user-friendly interfaces, making their platforms more accessible and cost-effective.

Regional Analysis

North America holds the dominant position in the back office workforce management market. The United States, with its strong presence of large enterprises and advanced tech infrastructure, drives innovation and adoption. Cloud-based tools and AI-powered platforms are becoming staples in sectors such as finance and telecom.

Europe follows closely, where compliance with labor laws and a structured approach to workforce efficiency have spurred adoption. Countries like Germany, France, and the UK are investing in data-driven performance tracking systems, particularly in industrial and government sectors.

The Asia Pacific region is emerging as a growth hub, thanks to the expanding service sector in India, China, and Southeast Asia. Digital transformation, coupled with a rising middle class and rapid urbanization, is accelerating demand for scalable workforce solutions.

Latin America and the Middle East & Africa are showing promising signs of adoption as businesses in these regions move toward operational maturity. Government support for digital infrastructure and increasing awareness of workforce optimization benefits are contributing to gradual but steady market penetration.

Recent News & Developments

The integration of AI and machine learning has revolutionized forecasting and performance analytics in workforce management. These technologies enable predictive insights, helping organizations proactively manage staffing, avoid bottlenecks, and ensure regulatory compliance. Companies like NICE Systems have introduced intelligent platforms that analyze employee behavior, forecast workloads, and generate actionable strategies in real time.

Another significant trend is the rise of subscription-based pricing models, which provide flexibility for smaller businesses to access enterprise-grade solutions. Additionally, cloud adoption continues to rise, enhancing real-time collaboration and mobility — a must-have in today’s hybrid working world.

Recent product launches and strategic partnerships between software vendors and system integrators are shaping the competitive landscape. These developments aim to deliver more integrated, customizable, and mobile-friendly platforms, especially for industries undergoing rapid digital shifts like retail, education, and healthcare.

Browse Full Report : https://www.globalinsightservices.com/reports/back-office-workforce-management-market/

Scope of the Report

This report presents a comprehensive overview of the Back Office Workforce Management Market, analyzing trends, opportunities, and challenges across types, applications, technologies, and regions. It covers historical data from 2018 to 2023, with forecasts up to 2034, providing businesses with deep insights into market growth and technological advancements.

Key areas explored include cloud versus on-premise deployments, AI integration, regulatory compliance strategies, and emerging use cases in hybrid work environments. The report also profiles key and emerging players, offering competitive intelligence on mergers, partnerships, and innovation strategies shaping the future of back office management.

#workforcemanagement #backofficeautomation #cloudsolutions #remoteworktools #aibusinesssolutions #digitaltransformation #employeeefficiency #hybridworktech #taskoptimization #enterprisetechnology

Discover Additional Market Insights from Global Insight Services:

Commercial Drone Market : https://www.globalinsightservices.com/reports/commercial-drone-market/

Product Analytics Market : https://www.globalinsightservices.com/reports/product-analytics-market/

Streaming Analytics Market : https://www.globalinsightservices.com/reports/streaming-analytics-market/

Cloud Native Storage Market ; https://www.globalinsightservices.com/reports/cloud-native-storage-market/

Alternative Lending Platform Market : https://www.globalinsightservices.com/reports/alternative-lending-platform-market/

About Us:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC 16192, Coastal Highway, Lewes DE 19958 E-mail: [email protected] Phone: +1–833–761–1700 Website: https://www.globalinsightservices.com/

0 notes

Text

How Finance Leaders Future-Proof Operations with SAP + Outsourcing

In 2025, the role of finance leaders has evolved beyond managing budgets and reviewing reports. Today’s CFOs and financial controllers are expected to drive strategy, manage risk, ensure compliance, and lead digital transformation — all while keeping operations lean and efficient.

To meet these growing demands, many finance leaders are embracing a powerful combination: SAP + outsourced bookkeeping. Together, they’re creating a scalable, future-ready finance function that helps businesses grow smarter — not just faster.

Here’s how this approach is helping finance leaders build resilient, high-performing operations.

The Pressure on Modern Finance Teams

The financial landscape is more complex than ever. Businesses now face challenges like:

Global expansion and multi-currency transactions

Evolving regulatory and compliance requirements

Increased demand for real-time financial data

Rising costs of in-house talent and technology

Higher expectations from investors and stakeholders

These challenges demand more than just a basic bookkeeping setup — they require a strategic, technology-enabled solution that can scale with the business. That’s where SAP-driven outsourced bookkeeping comes in.

What Is SAP + Outsourcing?

SAP is one of the world’s most trusted ERP (Enterprise Resource Planning) platforms. It automates and integrates critical business functions like accounting, payroll, inventory, CRM, and reporting.

Outsourced bookkeeping, meanwhile, involves partnering with a third-party provider to manage daily financial tasks such as:

Transaction recording

Invoicing and billing

Bank reconciliations

Financial reporting

Compliance support

When finance leaders combine SAP’s power with outsourced expertise, they create a finance infrastructure that’s built for long-term growth and agility.

Key Benefits for Finance Leaders

1. Real-Time Financial Visibility

One of SAP’s biggest advantages is real-time access to financial data. Dashboards and live reporting features allow finance leaders to track:

Cash flow

Profitability

Expenses

Budget vs. actuals

Instead of waiting for end-of-month reports, CFOs and decision-makers can now act on insights instantly — reducing delays and improving responsiveness.

2. Scalable and Flexible Operations

As businesses grow, their finance operations often become more complex. SAP’s robust infrastructure supports:

Multi-entity and multi-currency accounting

Global compliance frameworks

Integration with CRMs, HR, and supply chain systems

Outsourcing partners with SAP expertise can scale services as needed — whether your business is entering a new market or acquiring a new company. Finance leaders get the flexibility to grow without friction.

3. Cost Optimization

Hiring and retaining skilled finance professionals — especially those with SAP experience — can be expensive. Outsourcing offers a cost-effective alternative, giving companies access to expert support without the overhead.

Plus, SAP’s automation capabilities reduce the need for manual data entry and redundant processes, freeing up resources for higher-value strategic work.

4. Improved Accuracy and Compliance

SAP is built to support international accounting standards like GAAP and IFRS. Its automation features help eliminate human error, ensure consistent data entry, and keep audit trails intact.

Combined with a knowledgeable outsourced bookkeeping team, finance leaders can confidently meet deadlines, stay compliant, and be always audit-ready.

5. Faster Reporting and Decision-Making

Time-consuming manual reports are a thing of the past. SAP generates financial statements, forecasts, and analytics on demand. Your outsourced team maintains these reports and customizes them based on your business needs.

For finance leaders, this means faster decision-making, stronger forecasting, and data-backed strategic planning.

6. Focus on Core Strategy

Outsourcing allows internal finance teams to move away from repetitive tasks and focus on:

Financial planning and analysis (FP&A)

Risk management

Growth strategy

Investment planning

By offloading operational bookkeeping to SAP-powered experts, finance leaders can redirect their time and energy to initiatives that drive business success.

A Future-Ready Finance Stack

In 2025 and beyond, finance is no longer just about keeping the books clean — it’s about building a resilient, adaptable, and insight-driven operation. SAP offers the technology backbone, while outsourcing delivers the flexibility and expertise.

When combined, they enable finance leaders to:

Adapt quickly to market changes

Maintain financial health during rapid growth

Support complex business models with ease

Stay compliant across global markets

Final Thoughts

Finance leaders who embrace SAP + outsourcing are taking proactive steps to future-proof their operations. This modern model reduces costs, enhances visibility, improves compliance, and sets the foundation for long-term, sustainable growth.

If you’re still relying on outdated systems or siloed teams, now is the time to evolve. With the right outsourcing partner and SAP infrastructure in place, your finance function can move from reactive to strategic — and lead the way forward.

0 notes

Text

Scaling Your Australian Business with AI: A CEO’s Guide to Hiring Developers

In today’s fiercely competitive digital economy, innovation isn’t a luxury—it’s a necessity. Australian businesses are increasingly recognizing the transformative power of Artificial Intelligence (AI) to streamline operations, enhance customer experiences, and unlock new revenue streams. But to fully harness this potential, one crucial element is required: expert AI developers.

Whether you’re a fast-growing fintech in Sydney or a manufacturing giant in Melbourne, if you’re looking to implement scalable AI solutions, the time has come to hire AI developers who understand both the technology and your business landscape.

In this guide, we walk CEOs, CTOs, and tech leaders through the essentials of hiring AI talent to scale operations effectively and sustainably.

Why AI is Non-Negotiable for Scaling Australian Enterprises

Australia has seen a 270% rise in AI adoption across key industries like retail, healthcare, logistics, and finance over the past three years. From predictive analytics to conversational AI and intelligent automation, AI has become central to delivering scalable, data-driven solutions.

According to Deloitte Access Economics, AI is expected to contribute AU$ 22.17 billion to the Australian economy by 2030. For CEOs and decision-makers, this isn’t just a trend—it’s a wake-up call to start investing in the right AI talent to stay relevant.

The Hidden Costs of Delaying AI Hiring

Still relying on a traditional tech team to handle AI-based initiatives? You could be leaving significant ROI on the table. Without dedicated experts, your AI projects risk:

Delayed deployments

Poorly optimized models

Security vulnerabilities

Lack of scalability

Wasted infrastructure investment

By choosing to hire AI developers, you're enabling faster time-to-market, more accurate insights, and a competitive edge in your sector.

How to Hire AI Developers: A Strategic Approach for Australian CEOs

The process of hiring AI developers is unlike standard software recruitment. You’re not just hiring a coder—you’re bringing on board an innovation partner.

Here’s what to consider:

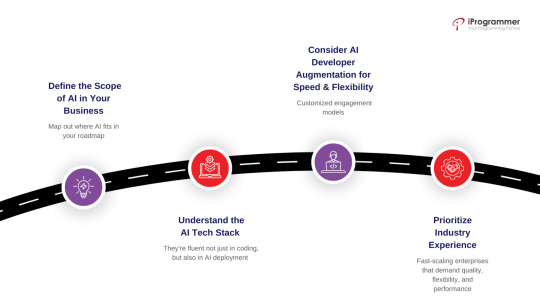

1. Define the Scope of AI in Your Business

Before hiring, map out where AI fits in your roadmap:

Are you looking for machine learning-driven forecasting?

Want to implement AI chatbots for 24/7 customer service?

Building a computer vision solution for your manufacturing line?

Once you identify the use cases, it becomes easier to hire ML developers or AI experts with the relevant domain and technical experience.

2. Understand the AI Tech Stack

A strong AI developer should be proficient in:

Python, R, TensorFlow, PyTorch

Scikit-learn, Keras, OpenCV

Data engineering with SQL, Spark, Hadoop

Deployment tools like Docker, Kubernetes, AWS SageMaker

When you hire remote AI engineers, ensure they’re fluent not just in coding, but also in AI deployment and scalability best practices.

3. Consider AI Developer Augmentation for Speed & Flexibility

Building an in-house AI team is time-consuming and expensive. That’s why AI developer staff augmentation is a smarter choice for many Australian enterprises.

With our staff augmentation services, you can:

Access pre-vetted, highly skilled AI developers

Scale up or down depending on your project phase

Save costs on infrastructure and training

Retain full control over your development process

Whether you need to hire ML developers for short-term analytics or long-term AI product development, we offer customized engagement models to suit your needs.

4. Prioritize Industry Experience

AI isn’t one-size-fits-all. Hiring developers who have experience in your specific industry—be it healthcare, fintech, ecommerce, logistics, or manufacturing—ensures faster onboarding and better results.

We’ve helped companies in Australia and across the globe integrate AI into:

Predictive maintenance systems

Smart supply chain analytics

AI-based fraud detection in banking

Personalized customer experiences in ecommerce

This hands-on experience allows our developers to deliver solutions that are relevant and ROI-driven.

Why Choose Our AI Developer Staff Augmentation Services?

At iProgrammer, we bring over a decade of experience in empowering businesses through intelligent technology solutions. Our AI developer augmentation services are designed for fast-scaling enterprises that demand quality, flexibility, and performance.

What Sets Us Apart:

AI-First Talent Pool: We don’t generalize. We specialize in AI, ML, NLP, computer vision, and data science.

Quick Deployment: Get developers onboarded and contributing in just a few days.

Cost Efficiency: Hire remote AI developers from our offshore team and reduce development costs by up to 40%.

End-to-End Support: From hiring to integration and project execution, we stay involved to ensure success.

A Case in Point: AI Developer Success in an Australian Enterprise

One of our clients, a mid-sized logistics company in Brisbane, wanted to predict delivery delays using real-time data. Within 3 weeks of engagement, we onboarded a senior ML developer who built a predictive model using historical shipment data, weather feeds, and traffic APIs. The result? A 25% reduction in customer complaints and a 15% improvement in delivery time accuracy.

This is the power of hiring the right AI developer at the right time.

Final Thoughts: CEOs Must Act Now to Stay Ahead

If you’re a CEO, CTO, or decision-maker in Australia, the question isn’t “Should I hire AI developers?” It’s “How soon can I hire the right AI developer to scale my business?”

Whether you're launching your first AI project or scaling an existing system, AI developer staff augmentation provides the technical depth and agility you need to grow fast—without the friction of long-term hiring.

Ready to Build Your AI Dream Team?

Let’s connect. Talk to our AI staffing experts today and discover how we can help you hire remote AI developers or hire ML developers who are ready to make an impact from day one.

👉 Contact Us Now | Schedule a Free Consultation

0 notes

Text

What Makes a BA Honors in Economics a Smart Career Choice

In today’s data-driven and globally connected world, the need for professionals who understand how economies work is greater than ever. Whether it’s addressing unemployment, managing inflation, advising policy, or analysing markets, economics is at the core of many decisions that shape our lives. This is why pursuing a BA Honors in Economics has become a popular and rewarding academic path.

But what exactly does this degree offer, and why should it be on your radar if you’re considering a career in economics, policy, finance, or research? Here’s a detailed look at why this undergraduate program is more relevant than ever and what you should expect from a well-designed course.

A deep dive into economic theory and practice

A BA Honors in Economics offers a rigorous foundation in both microeconomics and macroeconomics. You’ll explore topics like market dynamics, consumer behaviour, fiscal policy, international trade, and development economics. Unlike a general BA, the honors track gives students a deeper and more structured understanding of complex economic principles and their applications.

But it’s not just about theory. Good programs integrate real-world examples, case studies, and assignments that make abstract concepts easier to grasp. This balanced approach helps students build strong analytical and critical thinking skills—skills that are essential in the real world.

Strong focus on data and quantitative skills

Economics today goes hand-in-hand with data analysis. That’s why a quality BA Honors in Economics program includes training in statistics, econometrics, and research methods. These subjects teach students how to gather data, test economic theories, and draw meaningful insights using tools like regression analysis and forecasting models.

Learning to work with data prepares students for roles in banking, consulting, policy-making, and even emerging fields like data science. The ability to analyse trends and back decisions with evidence is a skill in high demand across industries.

Career versatility and scope

One of the biggest advantages of studying economics is the versatility it offers. A graduate with a BA Honors in Economics can explore a wide range of careers, including:

Economic research and analysis

Financial planning and investment advisory

Civil services and government policy

Data analytics and market research

Banking and insurance

International development and NGOs

It also serves as a strong foundation for higher studies, such as MA in Economics, MBA, or even law and public policy. Whether your interest lies in business, government, or social change, this degree gives you the flexibility to chart your path.

Developing decision-making and problem-solving skills

Economics is not just about numbers - it’s about making choices. Through coursework and discussions, students learn to evaluate trade-offs, weigh costs and benefits, and consider long-term outcomes. These decision-making skills are valuable in any role that requires planning, strategy, or leadership.

Over time, you also become more aware of how government policies, international events, and market trends influence everyday life. This makes you a more informed professional and citizen.

Research and independent thinking

Another major benefit of pursuing an honors program is the emphasis on research. A BA Honors in Economics encourages students to engage in independent projects and explore contemporary issues through data and analysis. These opportunities help you build a strong academic profile and give you an edge if you plan to pursue postgraduate education.

Research-based learning also promotes intellectual curiosity and encourages you to look beyond textbooks. It teaches you how to ask the right questions and find evidence-based answers.

Learning from experienced faculty

Choosing the right university for your BA Honors in Economics can make all the difference. A strong program should be taught by experienced faculty members who not only have academic expertise but also industry or policy experience.

At IMS Unison University in Dehradun, the School of Management offers a well-rounded BA Honors in Economics program that blends academic theory with practical learning. Faculty members are deeply engaged in research and bring real-world insights into the classroom, making the subject more relatable and engaging for students.

Exposure to internships and industry interactions

Economics may seem like a theoretical subject, but it has practical applications in every sector. That’s why internships and industry exposure are important parts of any top-tier economics program. Students should have the opportunity to work with financial institutions, think tanks, or development organisations to apply what they’ve learned.

IMS Unison University offers such opportunities through partnerships with corporates, public institutions, and research organisations. These internships help students understand the practical side of economics and build a network of professional contacts even before they graduate.

A balanced and flexible academic environment

Another factor to consider is the learning environment. A good economics program should offer a mix of core subjects, electives, and extracurricular opportunities. This helps students tailor their learning experience to match their interests and career goals.

IMS Unison University’s BA Honors in Economics program offers specialisations in areas such as Development Economics, International Trade, and Economic Policy. The campus culture promotes learning both inside and outside the classroom through workshops, debates, and economics clubs.

Conclusion

If you are looking for a degree that offers intellectual depth, career flexibility, and the chance to make an impact, a BA Honors in Economics is worth serious consideration. It is a course that opens up a world of possibilities—whether in policy-making, business, research, or international development.

IMS Unison University offers one of the most thoughtfully designed programs in this field, combining academic rigor with practical exposure. With experienced faculty, modern infrastructure, and a supportive learning environment, it prepares students to succeed in a competitive and ever-changing world.

If economics fascinates you and you’re ready to explore how markets work and policies shape our world, then this could be the right step forward.

0 notes

Text

Master Financial Analysis with KPMG's Industry-Endorsed Course

If your goal is to learn more about numbers, drive strategic decision-making, or propel yourself higher within the finance funnel, then this program is for you. With a curriculum based on leading industries, the Financial Analysis Prodegree (endorsed by KPMG) in partnership with Imarticus Learning, will provide you with just that.

What Is Financial Analysis?

Financial analysis is evaluating companies, budgets, and projects to assess financial health and long-run viability. Financial analysis is a major part of corporate finance, investment banking, consulting, etc.

Key aspects of financial analysis include:

Ratio analysis

Cash flow analysis

Trend analysis

Forecasting, financial modelling

A structured curriculum in financial analysis will help learners make decisions based on evidence, assess risk, and ultimately, contribute.

Why Choose the KPMG Financial Analysis Prodegree?

KPMG is bringing its global heritage in audit, tax, and advisory to the classroom through this program, making it more than a course, but a pathway to actual finance careers.

What makes this program unique:

Industry-Approved Curriculum: Created with KPMG experts and contains actual case studies, projects, and assessments.

Recognised Certification: Internationally recognised certification to build credibility and employability.

Flexible Learning: 100% online with self-paced learning—great for all students and working professionals.

Practical, Job-Ready Tools: Learn practical knowledge in Excel, Power BI, and SQL - the skills that recruiters want.

Who Should Enroll?

This program is ideal for

Students who graduated with a degree in commerce, finance, or economics

Professionals at the beginning of their careers in finance

Professionals in their careers who are re-skilling to become analytical

Entrepreneurs who make decisions about finances for their businesses.

If you aim to learn more about numbers, drive strategic decision-making, or push yourself up in the finance funnel, then this program is for you.

What You’ll Learn

Excel for financial modelling

Power BI for data visualisation

Google Sheets for collaborative financing tasks

SQL for basic extraction and analysis of financial data

These tools are embedded into real-world scenarios, solving business problems, not just learning theory.

Career Outcomes

After course completion, you will be ready for roles like:

Financial Analyst

Business Analyst

Investment banker

Budget Analyst

Equity research analyst

Risk manager

Graduates of the course have progressed to working in banks, MNCs, fintech startups, and global consultancies.

Salary Insights

Based on market data:

Entry-Level: ₹4–6 LPA

Mid-Level: ₹8–12 LPA

Senior Roles: ₹15–20 LPA+

Your actual remuneration will depend on your experience, skill set, and what company you join.

Why Financial Analysis is More Crucial Than Ever

Businesses are operating in more volatile and complex circumstances. It can serve to:

Maximise profitability

Reduce costs

Ensuring compliance

Driving growth strategies

It’s no wonder that skilled financial analysts are in high demand across industries.

Getting Started

Enrolling is simple:

Visit the official Imarticus Learning website

Sign up with your details

Choose a payment plan

Join the orientation webinar

Most learners complete the course in 3 to 6 months at their own pace.

FAQs

Do I need to have a finance background?

No. This course is supported for beginners. You will be guided from the basics to the advanced stuff.

What certification will I get?

A globally recognised certification from KPMG.

Is there placement support?

Yes. You will have a deep recruitment network and job support.

Is the course entirely online?

Yes. The course involves live sessions and recordings, and you will have the help of an online community.

Conclusion

If you’re ready to future-proof your career and learn the language of business and finance, there’s no better starting point than the KPMG-endorsed Financial Analysis Prodegree with Imarticus Learning.

With experiential learning, world-class expertise, and international accreditation, you’ll not only have in-demand skills but also have the confidence to reach evidence-based conclusions for your organisation.

Explore the program today at Imarticus Learning, and take that initial step on the journey to being a high-impact financial professional.

0 notes

Text

Top short-term courses for 2025: AI, data, accounting skills

Whether you're a fresh graduate, a career switcher, or a working professional looking to climb the ladder, investing time in a short-term course can be a game-changer. Traditional degrees may take years, but today's fast-paced job market rewards upskilling, and online short term courses are the smartest way to stay ahead.

UniAthena offers a variety of industry-relevant programs you can complete in just a few weeks. Here’s a closer look at some of the best short-term courses you can start today free of cost, flexible in schedule, and globally recognized.

Top Online Short-Term Courses for Professionals

Basics of Data Science

Data is the currency of the digital world. With the Basics of Data Science short-term certificate course, you’ll learn to make sense of large datasets, uncover insights, and support strategic decisions.

Duration: 4–6 hours

Certification: CIQ, UK

Perfect for: Beginners in tech, business analysts, entrepreneurs

This is one of the best short-term courses for anyone curious about analytics, automation, and business intelligence.

Executive Diploma in Machine Learning

Machine Learning is transforming industries—from healthcare to finance. With the Executive Diploma in Machine Learning, you'll dive into predictive modeling, pattern recognition, and ML algorithms that power recommendation systems and fraud detection tools.

Duration: 2–3 weeks

Certification: AUPD

Ideal for: Tech professionals, data enthusiasts, IT graduates

One of the most impactful short-term IT courses, this diploma arms you with the skills that companies are hiring for—now.

Diploma in Artificial Intelligence

Ready to be part of the AI revolution? The Diploma in Artificial Intelligence gives you a fast-paced introduction to machine vision, neural networks, and smart systems.

Duration: 1–2 weeks

Certification: AUPD

Designed for: Professionals seeking a tech edge, AI-curious learners

AI isn’t just the future, it’s your future.

Accounting Short-Term Course: Mastering Accounting

Want to decode balance sheets and lead budget planning? The Mastering Accounting course offers real-world skills in financial reporting, ratios, and auditing.

Duration: Flexible

Certification: CIQ, UK

Great for: Business owners, finance executives, recent graduates

This is one of the most practical Accounting short term courses that can open doors in any organization.

Basics of Digital Marketing

From social media to SEO, learn how to attract and convert customers online. The Basics of Digital Marketing short-term course covers tools like Google Analytics, email marketing, and paid ad campaigns.

Duration: 4–6 hours

Certification: CIQ, UK

Ideal for: Entrepreneurs, marketing aspirants, content creators

Start building campaigns that convert—without any prior experience.

Diploma in Financial Risk Management Course

Finance doesn’t come without risk, but you can learn how to manage it. The Diploma in Financial Risk Management course teaches you the frameworks and tools used in banking and corporate finance to mitigate losses and forecast risks.

Duration: 1–2 weeks

Certification: AUPD

Targeted at: Finance professionals, bankers, auditors

A powerful choice among the best short-term courses for high-paying finance roles.

Mastering Product Management

Lead with vision and strategy. The Mastering Product Management course walks you through product lifecycle, market fit, user research, and roadmap planning.

Duration: 1 week

Certification: AUPD

Perfect for: Aspiring product managers, startup founders, team leads

Product managers are in demand—make your next move count.

Mastering Supply Chain Management

Learn how global businesses move products efficiently with the Mastering Supply Chain Management course. Cover demand forecasting, logistics, inventory, and resilience planning.

Duration: 1 week

Certification: CIQ, UK

Ideal for: Manufacturing professionals, operations managers, logistics coordinators

A strategic course to level up your supply chain know-how.

Executive Diploma in Procurement & Contract Management

Procurement professionals handle billion-dollar budgets and vendor contracts. Learn negotiation, compliance, and supplier relationship management in the Executive Diploma in Procurement & Contract Management.

Duration: 2–3 weeks

Certification: AUPD

Best for: Project managers, legal advisors, supply chain professionals

A must-have skill set for leadership roles in logistics and procurement.

Diploma in Environment Health and Safety Management

Ensure safe and sustainable work environments with the Diploma in Environment Health and Safety Management. Understand hazards, prevention strategies, and compliance guidelines.

Duration: 1–2 weeks

Certification: AUPD

Great for: HR managers, safety officers, freshers post-12th

This is one of the most valuable short-term management courses after 12th for students and early-career professionals.

Special Focus: Upskilling Opportunities

In a rapidly developing country, digital education is more important than ever. Access to UniAthena’s Online Short Courses provides a gateway for learners to gain global credentials without leaving home.

With high youth unemployment and a growing need for skilled professionals, courses like Diploma in Financial Risk Management, Basics of Digital Marketing, and Mastering Accounting can help build resilient careers.

By enrolling in best short term courses in fields like AI, Procurement, or Supply Chain, professionals can step into international roles or uplift local enterprises with world-class skills.

All courses are 100% online and can be accessed via mobile—ideal for regions with limited infrastructure.

Conclusion: Choose the Right Course, Right Now

The future belongs to those who keep learning. Whether you're looking for an Accounting short term course, aiming to master AI or Data Science, or want to step into Product or Supply Chain Management, there's a course waiting for you on UniAthena.

Every course mentioned above offers:

Flexible schedules

Globally accredited certificates

Career-ready skills

No upfront cost

Bonus Tips

For high-growth tech careers, explore the Executive Diploma in Machine Learning or Diploma in Artificial Intelligence.

Want to switch to business or finance? Consider the Mastering Accounting or Diploma in Financial Risk Management course.

Already in management? Advance with Mastering Product Management or Executive Diploma in Procurement & Contract Management.

The best time to start upskilling was yesterday. The second-best time? Right now.

Explore UniAthena’s Online Short Courses and reshape your career today.

#TopShortTermCourses#ShortTermCourses2025#AICourses#DataAnalytics#AccountingSkills#LearnAI#DataScience#CareerDevelopment#Upskill2025#FutureSkills#TechnologyTraining#OnlineCourses#SkillsForSuccess#ProfessionalGrowth#FastTrackLearning#AITraining#LiveYourPotential#WorkPlaceSkills#LearningJourney

0 notes

Text

Top Reasons Small and Medium Businesses Choose Business Central

In today's fast-paced digital landscape, small and medium-sized businesses (SMBs) are continuously looking for smart, scalable solutions to boost productivity, lower operating costs, and preserve a competitive advantage. Microsoft Dynamics 365 Business Central has emerged as the leading ERP solution designed to address these changing requirements. But why is Business Central such a popular choice among SMBs? Let's look at the primary reasons for its widespread popularity.

1.All-in-One Business Management Solution

Business Central smoothly integrates all major business tasks, including finance, sales, purchasing, inventory, and operations, into a single unified platform. This reduces the need for many separate tools and gives a consolidated picture of corporate data, allowing businesses to make educated decisions faster and more efficiently.

2.Cloud-Based Flexibility

Business Central's cloud-based architecture allows SMBs to access business data from any location, at any time. Whether your team works in-office, remotely, or across numerous locations, Business Central provides consistent and secure access, enabling the contemporary hybrid work environment while maintaining efficiency.

3.Seamless Integration with Microsoft Products

For firms that already use Microsoft technologies such as Excel, Outlook, Teams, and Power BI, Business Central offers a familiar and integrated experience. Its natural integration with the Microsoft ecosystem improves team collaboration and data analysis, allowing enterprises to work more efficiently without switching platforms.

4.Scalable and Cost-Effective

Business Central is meant to develop alongside your company. Whether you're managing a small team or growing into new markets, the system scales seamlessly to match your demands. With flexible subscription pricing and lower equipment expenses thanks to the cloud, it's an economical ERP alternative for SMBs that doesn't sacrifice enterprise-grade capabilities.

5.Enhanced Financial Visibility and Control

Managing cash flow, budgets, and financial reporting may be difficult, especially for expanding firms. Business Central makes financial management easier by offering real-time dashboards, automatic bank reconciliation, and seamless audit trails, giving business owners greater financial information and control.Microsoft Dynamics 365, which includes AI and machine learning, offers businesses actionable insights, predictive analytics, and automation to help them make better decisions. This enables firms to forecast demand, utilize resources, and improve departmental efficiency.

6.Improved Inventory and Supply Chain Management

Inventory and supply chain management are critical for small and medium-sized businesses that sell products. Business Central uses intelligent forecasting to optimize stock levels, decrease waste, and predict reordering needs. It ensures that you always have the appropriate items in the right location—at the right time.

Read more....

0 notes

Text

How Investment Banks Are Using AI to Thrive Amid Tariff Uncertainty: Strategies, Tools, and Real-World Results

The global investment banking landscape is in flux, shaped by unprecedented tariff hikes, supply chain disruptions, and geopolitical tensions. In this environment, resilience is not optional; it is a competitive necessity. Banks are increasingly turning to artificial intelligence (AI) to navigate these challenges, transforming how they operate and compete. For professionals interested in Investment Banking Courses in India, understanding AI's role in this new era is crucial. This article explores how investment banks are leveraging AI to build tariff resilience, highlighting the latest strategies, tools, and real-world results.

The New Era of Tariffs and Trade

The United States has recently imposed its highest tariffs in over a century, sending shockwaves through global markets and supply chains. These measures have disrupted the flow of goods, increased costs for critical hardware, and forced banks to rethink their sourcing and operational strategies. The suddenness and scale of these changes have made traditional risk management approaches insufficient, pushing banks to seek innovative solutions. For those considering a Financial Modelling Course in India, grasping the impact of tariffs on financial markets is essential.

AI has emerged as a critical tool in this new era, enabling banks to monitor tariffs in real time, identify alternative suppliers, and adapt pricing strategies on the fly. The ability to process vast amounts of unstructured data and predict non-linear outcomes is proving invaluable as banks navigate an increasingly complex and uncertain trade environment.

The Evolution of AI in Investment Banking

AI’s journey in investment banking has been marked by steady progress and expanding applications. Initially, AI was used to automate routine tasks and enhance risk management. Today, its scope has broadened to include client service, market analysis, and strategic planning. For aspiring investment bankers, Certification Courses for Financial Modelling can provide a solid foundation in understanding AI's applications in finance.

Key Developments in AI Adoption

Automation and Efficiency: AI-powered assistants like Bank of America’s Erica and Citigroup’s Agent Assist have revolutionized customer interactions, reducing costs and improving satisfaction. These tools are especially beneficial for banks offering Investment Banking Courses in India, as they enhance client engagement.

Data Analysis: Advanced AI algorithms are now central to predictive analytics, helping banks forecast market trends and make informed investment decisions. This is particularly valuable for professionals enrolled in Financial Modelling Course in India programs.

Risk Management: AI tools continuously monitor and mitigate risks associated with transactions and investments, ensuring compliance with evolving regulatory requirements. Certification Courses for Financial Modelling often emphasize the importance of AI in risk management.