#Digital payment solution

Text

WeGoFin: Revolutionizing Digital Payment Solutions

In an era where digital transformation is redefining how we conduct financial transactions, WeGoFin stands at the forefront, offering cutting-edge digital payment solutions that cater to the diverse needs of businesses and consumers alike. With a mission to simplify and secure transactions, WeGoFin is not just a service provider but a game-changer in the financial technology landscape.

#wegofin#digital payments#digital payment services#digital payment solution#best secure payment#best payment gateway#e wallet

0 notes

Text

Effortless Global Digital Payments: Integrate Hyperswitch in Minutes for 190+ Countries and 140+ Currencies

Accept payments globally within minutes by integrating Hyperswitch in four simple steps, enabling your business to receive digital payments from over 190 countries and in more than 140 currencies. Hyperswitch reduces 90% of the development effort related to payments, allowing you to collect payments through your preferred processor while maintaining full control over your payment operations. With a no-code integration, you can add payment processors to your payment stack without writing a single line of code. Hyperswitch supports integration with over 50 payment processors and 75 payment methods, ensuring you can accept payments through your customers' preferred methods. Optimize payment costs at scale by automatically routing transactions through the most cost-effective and reliable channels, reducing processing fees and enhancing reliability. The Hyperswitch control center offers detailed reporting, analytics, and customization, giving you comprehensive control over your payment operations.

1 note

·

View note

Text

Empowering Startups in High-Risk Sectors: How Epsilon Payments Leads the Way

Startups in high-risk sectors often face a myriad of challenges, from regulatory hurdles to complex payment processing needs. In such a competitive environment, having the right partner can make all the difference. Enter Epsilon Payments – a leading payment solutions provider that specializes in empowering startups in high-risk sectors. In this blog post, we'll explore the key ways in which Epsilon Payments is revolutionizing the payment landscape for startups, enabling them to thrive in even the most challenging industries.

Navigating Regulatory Complexity:

One of the biggest challenges for startups in high-risk sectors is navigating the complex regulatory landscape. From data privacy regulations like GDPR to industry-specific compliance requirements, startups must ensure they are operating within the bounds of the law. Epsilon Payments takes the guesswork out of regulatory compliance by staying abreast of the latest regulations and offering tailored solutions that ensure startups remain compliant at all times.

Streamlined Payment Processes:

Efficiency is paramount for startups looking to gain a competitive edge. Epsilon Payments understands this need and offers streamlined payment processes that minimize friction and maximize efficiency. Whether it's accepting payments online, in-store, or via mobile devices, our solutions are designed to make the payment experience seamless for both startups and their customers. By automating manual processes and integrating with existing systems, we help startups save time and resources while enhancing their overall operations.

Scalability and Flexibility:

As startups grow and evolve, their payment processing needs often change. Epsilon Payments provides scalable and flexible solutions that can grow with startups, ensuring they can easily adapt to changing demands. Whether it's processing a few transactions a day or handling high volumes of payments, our solutions are built to scale effortlessly. Additionally, our flexible pricing models allow startups to pay only for the services they need, making it easy to adjust as their business expands.

Fraud Prevention and Security:

Fraud is a constant threat for startups operating in high-risk sectors. Epsilon Payments offers advanced fraud prevention tools and robust security measures to protect startups and their customers from fraudulent activities. Our machine learning algorithms analyze transaction data in real-time to detect and prevent fraudulent transactions, while our encryption protocols ensure sensitive information remains secure at all times. With Epsilon Payments, startups can rest assured that their payment processes are fortified against cyber threats.

Dedicated Support:

At Epsilon Payments, we understand that startups need more than just a payment provider – they need a partner they can rely on. That's why we offer dedicated support to help startups every step of the way. Our team of experts is available 24/7 to provide assistance and guidance, whether it's setting up a new account, troubleshooting technical issues, or optimizing payment processes. With Epsilon Payments, startups can rest assured that they have a trusted partner by their side, ready to support their growth and success.

Startups in high-risk sectors face unique challenges, but with the right partner, these challenges can be overcome. Epsilon Payments is committed to empowering startups to succeed, providing them with the tools, support, and expertise they need to thrive in today's competitive landscape. From navigating regulatory complexity to streamlining payment processes and enhancing security, Epsilon Payments is leading the way in revolutionizing the payment landscape for startups.

Contact us today to learn more about how we can help your startup succeed.

#digital payment solution#payments#high risk merchant account#high risk payment gateway#fintech#transactions#business#merchant services

0 notes

Text

9 Benefits of Implementing Digital Payment Systems in Educational Institutions

Implementing digital payment systems in educational institutions offers numerous advantages, including:

Convenience: Digital payment systems enable students, parents, and faculty to make payments conveniently from anywhere, reducing the need to visit the institution in person.

Time-Saving: Transactions through digital payment systems are faster compared to traditional methods like cash or checks, saving time for both the institution and the payee.

Reduced Cash Handling: With digital payments, there's a decrease in the handling of physical cash, mitigating security risks and administrative burdens associated with cash management.

Enhanced Transparency: Digital transactions leave digital trails, enhancing transparency and accountability in financial transactions within the institution.

Improved Tracking and Reporting: Digital payment systems provide comprehensive reporting features, allowing educational institutions to track payments, generate financial reports, and streamline accounting processes.

Automatic Reminders and Notifications: These systems can be set up to send automatic reminders for pending payments, reducing the incidence of late payments and improving cash flow for the institution.

Integration with Other Systems: Digital payment systems can integrate with existing administrative and student management systems, providing a seamless experience for users and streamlining administrative tasks.

Accessibility: Digital payment systems can cater to diverse payment methods, including credit/debit cards, mobile wallets, and online banking, making it easier for users with different preferences to make payments.

Adaptability to Digital Trends: Embracing digital payment systems aligns educational institutions with the broader trend towards digitalization, preparing students for a digital-first world and enhancing the institution's reputation as technologically progressive.

OpenEduCat can significantly benefit educational institutions by facilitating the seamless integration and management of digital payment systems, enhancing the overall experience for students, parents, and faculty.

#digital payments#digital payment software#digital payment solution#online payment software#erp for school#erp for education#school erp#school software#opensource

0 notes

Text

#core banking solution providers#banking solutions#enterprise solutions services#digital payment solution#financial software companies#aeps software provider#banking as a service provider

0 notes

Text

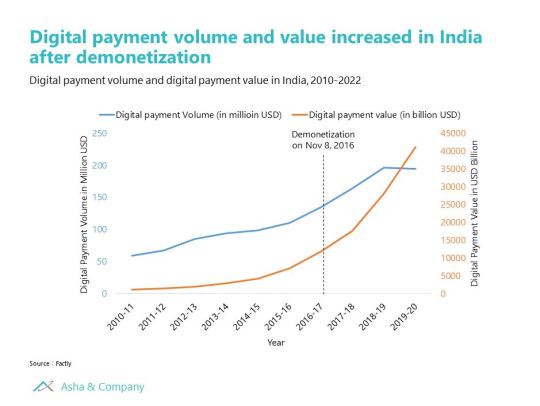

Rise of Digital Payment in India

Digital payments in India grew from 25B transactions in FY20 to 64B in FY22. This adoption of digital payment was fueled by the government's “Digital India” initiative, UPI payment, and lower mobile data costs. By 2026, India’s digital payment landscape is expected to grow to 411B transactions by FY27.

#market research#Digital Payment#digital payment solution#upi#Paytm#online payments#online paise kaise kamaye#onlinepaymentgateway#business intelligence#indian market

1 note

·

View note

Text

#it service provider#it consulting services#software devops service#digital customer experience services#digital payment solution#digital strategy consultant

0 notes

Text

Transaction Portals: A Strategic Asset for Modern Businesses

Transactional portals are synonymous for making profits with digital payments now! You can see lots of web portals offering huge discounts on every online payment, making things easier and more exciting for our customers!

Do you want to have a similar portal for your business?

You just simply need to know the need for and importance of having a transaction portal, its relevance to your existing trademark and brand value, and a foolproof plan for its execution!

Read this blog below and let us help you figure it out!

Read More: https://aixtor.com/blog/benefits-of-transaction-portals-for-businesses/

Contact us to know more!

#Transactional portals#digital payment solution#Digital Transformation#business technology#Streamlined Operations#Simplify Business#innovationdriven#digitalbusiness#modernbusiness#businessinnovation#payment processes

0 notes

Text

Explore the transformative impact of digital payment solutions on business growth in this insightful blog by BoTree Technologies. Discover how modern businesses are leveraging digital payment technologies to enhance customer experiences, streamline operations, and drive revenue. Uncover the key advantages of adopting digital payment solutions, from improved security and convenience to expanding market reach. With real-world examples and expert insights, this blog sheds light on the vital role of digital payments in today's dynamic business landscape. If you're looking to stay competitive and future-ready, understanding the power of digital payment solutions is essential. Dive into this blog to unlock the secrets of success in the digital payment era.

0 notes

Link

Perhaps, you’re concerned about the security of your personal information or no longer want to share your data with Macy’s. If so, deactivating your Macy's online account is a valid option. #privacy concerns #online shopping

#deactivate#loyalty program benefits#clear cache#clear browser’s cookies#macys#Confirm Deactivation#order history#delete account#deactivate account#profile settings#account settings#account clean-up#privacy concerns#digital payment solution#online account#Macys Online Account#macys department store#macy online#online shopping platform

0 notes

Text

Digital Payment Platform Paypal launches its own Stablecoin PYUSD

#blockchain#cryptocurrency#crypto#technology#bitcoin#defi#paypal#digital currency#stablecoin#digital payment solution#blockchain technology#tech news

0 notes

Text

Adopting To Cashless Payment

Cashless payment is becoming increasingly popular due to its speed, ease of use, and contactless nature.

#digital transformation#technology#tech#it consulting#digital payment solution#cashless payment#it services#contactlesspayments#mobile app developers

0 notes

Text

Setting Up a System To Manage Customer Payments: A Quick Guide

Do you dread keeping track of payments from your customers? Are you tired of manually entering transactions into an Excel sheet? Fear not, because setting up a system to manage customer payments is easier than you think.

In this guide, we’ll walk you through six essential steps to set up a system to manage customer payments, so you can focus on what matters: growing your business. Let’s begin, shall we?

Steps to Set Up a System To Manage Customer Payments

1. Choose a Digital Payment Solution that Fits Your Needs

First things first, let’s pick a digital payment solution that you’re excited about. There are tons of options out there, so let’s choose one that fits your needs and makes your heart sing. Do some research and pick a payment solution like PayPal, Stripe, or Square that you feel good about. Then, set up your account and connect it to your bank. You got this!

2. Create a Payment Policy that Speaks Your Language

Don’t you hate it when you’re trying to communicate with someone who speaks a different language? The same goes for payment policies. Make sure to create a payment policy that speaks your language, and share it with your customers.

Your policy should cover everything from payment methods and terms to late fees and refunds. By communicating clearly, you’ll avoid misunderstandings and ensure that everyone’s on the same page.

3. Create and Send Invoices Promptly

Invoicing can be a time-consuming task, but it’s essential to manage customer payments. So, make sure to create and send invoices promptly, with all the necessary information, including the due date and payment methods accepted.

Using a digital payment solution can make the invoicing process more efficient, with features such as automatic invoicing and online payments. This will save you time and make it easier for your customers to make payments.

4. Track Payments and Follow Up on Overdue Invoices

Tracking payments is crucial to managing customer payments effectively. Keep a record of all payments received and follow up on any overdue invoices promptly. Most digital payment solutions have features that allow you to track payments and send reminders to customers.

Just remember: don’t be afraid to follow up on overdue invoices. After all, it’s your right as a business owner to be paid on time, right? So, use a friendly but firm tone in your communication with customers to ensure that payments are made promptly.

5. Automation for the Win

As your business grows, managing payments can become overwhelming. That’s where automation comes in. Use software tools to automate tasks like tracking payments, sending reminders, and generating reports. With more time on your hands, you can focus on the fun parts of running your business.

6. Keep Up-to-Date with Payment Regulations

Finally, it’s important to stay up-to-date with payment regulations to ensure that your payment process is compliant with any relevant laws and regulations. This includes data protection regulations such as GDPR, as well as payment processing regulations such as PSD2.

Also, make sure to do your research and stay informed about any changes in payment regulations that may affect your business. This will help you avoid any potential legal issues and maintain the trust of your customers.

Why Using a System To Manage Customer Payments is Important?

First off, let’s get real. No one likes to talk about money, but it’s a necessary part of running a business. And let’s be honest, keeping track of payments can be a real headache. That’s why setting up a payment system is crucial.

Just imagine a world where payments magically appear in your bank account without you having to lift a finger. That would be amazing, right? Well, unfortunately, we don’t live in a world of magic. That’s why you need to have a payment system in place to manage customer payments and keep track of who owes you what.

Not convinced yet? Let’s break it down even further. Here are some of the top reasons why setting up a system to manage customer payments is important:

Avoid late payments and unpaid invoices. Late payments and unpaid invoices can seriously hurt your business. It can create a domino effect of cash flow problems and affect your ability to pay your bills on time. By setting up a payment system, you can avoid these issues and ensure that you get paid on time.

Build trust with your customers. Communication is key when it comes to payment. By having a clear payment system in place, you can build trust with your customers and avoid misunderstandings. It shows that you’re organized, reliable, and committed to delivering on your promises.

Save time and reduce errors. Manually tracking payments can be time-consuming and prone to errors. By automating the payment process with a digital payment solution, you can save time and reduce the risk of errors. Plus, you can spend more time on the fun parts of running your business.

Ensure compliance with regulations. Staying on top of payment regulations can be overwhelming, but it’s crucial to avoid legal issues. By setting up a payment system that’s compliant with regulations, you can protect your business and avoid any potential penalties.

Conclusion

As you could see, setting up a system to manage customer payments doesn’t have to be a snooze-fest. Using a digital payment solution can make the payment process more efficient and convenient for both you and your customers. It can also help you save time and reduce the risk of errors. So why not give it a try?

Remember, managing payments is an important part of running a successful business, but it doesn’t have to be stressful. With the right tools and mindset, you can make the payment process smooth and hassle-free.

Website : https://premierpaymentsonline.com/sb/setting-up-system-manage-customer-payments-quick-guide/

0 notes

Text

Navigating the Landscape: A Deep Dive into High-Risk Payment Processing

In the bustling world of e-commerce, where businesses dance on the digital tightrope, some face a steeper incline than others. Enter the realm of high-risk payment processing, a terrain where innovation battles complexity and opportunities tango with pitfalls.

For businesses operating in industries deemed “high-risk” by traditional payment processors, accepting payments can be an odyssey fraught with hurdles. From adult entertainment to travel agencies, nutraceuticals to credit repair, these businesses often find themselves ostracized by mainstream financial institutions. But fear not, intrepid entrepreneurs! This blog is your compass, guiding you through the intricate web of high-risk payment processing.

Unraveling the Enigma: What Makes a Business “High-Risk”?

Before we chart our course, let’s demystify the term itself. What qualifies a business as “high-risk”? The answer lies in a confluence of factors, including:

Chargeback rates: Businesses with a higher-than-average rate of chargebacks (disputed transactions) raise red flags for processors.

Industry perception: Certain industries, like online gambling or digital downloads, are inherently viewed as riskier due to potential fraud or regulatory issues.

Business model: Businesses with subscription models, pre-paid services, or intangible products face increased scrutiny.

Financial history: A checkered financial past, including bankruptcies or defaults, can cast a shadow on your payment processing prospects.

Charting Your Course: Essential Gear for High-Risk Voyagers

Now, equipped with our map, let’s pack our essential gear for this high-risk journey:

Merchant accounts: These specialized accounts act as gateways for high-risk businesses to accept payments. Finding a reliable provider who understands your industry and risk profile is crucial.

Payment gateways: These platforms handle the technical nitty-gritty of online transactions, ensuring secure and seamless payment experiences. Opt for a gateway with robust fraud prevention tools and global reach.

Risk management strategies: Proactive measures like thorough KYC/AML checks, advanced fraud detection systems, and chargeback mitigation plans are your shields against financial storms.

Transparency and compliance: Being open about your business practices and adhering to industry regulations builds trust with both processors and customers.

Navigating the Terrain: Common Challenges and How to Conquer Them

The high-risk landscape is teeming with challenges, but even the mightiest mountains can be scaled with the right approach:

Higher fees: Be prepared for steeper processing fees compared to traditional accounts. Negotiate with providers and prioritize value over mere cost.

Account termination: Unforeseen spikes in chargebacks or non-compliance can lead to account termination. Implement robust risk management and maintain open communication with your processor.

Limited payment options: Certain high-risk businesses may face restrictions on the types of payments they can accept. Explore alternative payment methods and focus on providing a smooth customer experience.

Reaching the Summit: The Rewards of High-Risk Payment Processing

While the climb might be steeper, the rewards for successfully navigating high-risk payment processing are substantial:

Access to a wider market: Accepting payments opens doors to a vast pool of potential customers who were previously inaccessible.

Increased revenue and growth: Streamlined payment options boost sales and pave the way for business expansion.

Competitive edge: Offering convenient and secure payment methods differentiates you from competitors who may struggle with traditional processing.

The Final Voyage: Bon Voyage, High-Risk Adventurers!

Navigating the landscape of high-risk payment processing demands resilience, resourcefulness, and a healthy dose of risk appetite. But for those who dare to venture forth, the rewards are plentiful. Remember, with the right map, the right gear, and the unwavering spirit of an explorer, you can not only conquer the high-risk terrain, but thrive in its fertile valleys. So, bon voyage, fellow adventurers! May your online transactions be smooth, your customers satisfied, and your business reach new heights!

#digital payment solution#payments#high risk merchant account#high risk payment gateway#fintech#transactions#business#merchant services

0 notes