#ELSS vs ULIPs

Explore tagged Tumblr posts

Text

ULIP vs Mutual Fund: Which is the Better Investment Option?

What is a Mutual Fund?

A mutual fund is a professionally managed investment that pools money from investors to create a diversified portfolio of stocks, bonds, or other securities. When you invest in a mutual fund, you buy units that represent your share in the fund’s assets.

To understand the difference between ULIP vs Mutual Fund, consider this: ULIPs (Unit-Linked Insurance Plans) combine investment and insurance, while mutual funds focus purely on investments for wealth growth. Comparing their goals, costs, and benefits can help you choose the right option for your needs.

What is a Unit-Linked Insurance Plan (ULIP)? A Unit-Linked Insurance Plan (ULIP) is a financial product that combines investment and insurance in a single integrated plan. When you invest in a ULIP, a portion of your premium is allocated towards investment in various funds, such as equity funds, debt funds, or a combination of both. These funds are similar to mutual funds and are managed by professional fund managers. The performance of the funds directly impacts the value of your investment in the ULIP.

Difference Between ULIP And Mutual Fund - Which is Better? ULIP plan vs mutual funds are both investment options, but they have some key differences. Let us see how these two investment tools are different from one another and which is better for you:

Tax Benefit Premiums paid towards ULIPs are eligible for tax deductions under Section 80C of the Income Tax Act. Additionally, maturity proceeds are tax-free under Section 10(10D) if certain conditions are met. While Investments in Equity Linked Savings Schemes (ELSS) mutual funds are eligible for tax deductions under Section 80C.

Return On Investment Returns from ULIPs are subject to market risks as they are linked to the performance of underlying funds. The returns can vary depending on market conditions. Returns from mutual funds are also subject to market risks but are solely based on the performance of the fund’s portfolio.

Life Insurance Cover ULIPs offer a life insurance cover along with investment. A portion of the premium goes towards providing life cover, and the remainder is invested. On the other hand, mutual funds do not offer life insurance coverage. They are purely investment vehicles.

Lock-in Period ELSS mutual funds have a lock-in period of 3 years, which is the shortest among tax-saving investments under Section 80C. While ULIPs typically have a lock-in period of 5 years. This means you cannot withdraw funds from the ULIP during this period.

Rebalancing and Switching Investors can switch between different mutual funds within the same asset management company, but this might involve capital gains tax and exit loads. On the other hand, ULIPs offer the flexibility to switch between different funds (equity, debt, balanced) based on changing investment goals or market conditions.

0 notes

Text

Investing Smarter: A Guide to Step-Up SIPs, SIP vs PPF, FD vs Life Insurance, and Small vs Large Cap Funds

When it comes to building wealth, making informed decisions about where to put your money is essential. With the plethora of investment options available, it’s crucial to understand the pros and cons of each to maximize returns while mitigating risks. In this post, we’ll explore four critical financial instruments: Step-Up SIP, SIP vs PPF, FD vs Life Insurance, and Small vs Large Cap Funds. This guide will help you decide where your money will work best for you.

What is a Step-Up SIP?

Systematic Investment Plans (SIPs) have long been popular for investors looking to build a strong portfolio without lump-sum investments. A Step-Up SIP takes this a step further by allowing you to increase your investment periodically. This plan is ideal for those who expect their income to grow over time, allowing them to gradually raise their contribution without drastically affecting their budget.

A Step-Up SIP enables you to take advantage of rupee cost averaging, ensuring you buy more units when prices are low. Additionally, the increased contributions over time help to accelerate your wealth creation by capitalizing on the power of compounding. For instance, if you start with an SIP of ₹5,000 a month and increase it by 10% each year, your investments can grow significantly faster compared to a static SIP.

If you have a long-term investment horizon and anticipate income growth, a Step-Up SIP can be a more effective tool in building a substantial corpus for future goals, such as retirement, purchasing a home, or funding higher education.

SIP vs PPF: Which One Should You Choose?

When it comes to SIP vs PPF (Public Provident Fund), both have their strengths, but they serve different purposes. An SIP is primarily used for investing in mutual funds, which have the potential for higher returns based on market performance. A PPF, on the other hand, is a government-backed savings scheme that offers guaranteed returns with tax benefits.

Here are some considerations:

Risk and Return: SIPs returns depend on the market. In contrast, PPF offers a fixed rate of interest (currently around 7.1%) but without any risk to the principal.

Liquidity: SIPs generally offer more liquidity, allowing you to redeem your funds as needed (subject to exit load). PPF, however, has a 15-year lock-in period, though partial withdrawals are allowed after a set time.

Tax Benefits: Both SIPs (via ELSS funds) and PPF offer tax benefits under Section 80C, but PPF offers tax-free returns.

If you’re seeking long-term, safe investments with a guaranteed return, a PPF could be the better choice. But if you're comfortable with market risks and aiming for higher returns, SIPs would serve you better.

FD vs Life Insurance: Where Should You Park Your Money?

FD (Fixed Deposit) and Life Insurance are two different financial products with distinct objectives. Fixed deposits are intended for safe, low-risk investments with guaranteed returns, while life insurance is primarily for financial protection of your dependents in the event of your death.

FDs offer guaranteed returns (typically 5-7% per annum) and are insured up to ₹5 lakh in Indian banks. They are ideal for risk-averse investors or those looking for liquidity in the short to medium term.

Life Insurance, on the other hand, ensures financial security for your family in case of an unfortunate event. While some insurance plans offer returns (e.g., ULIPs or endowment plans), the primary goal should be protection, not investment. The returns on insurance policies are usually lower than those of FDs.

For most investors, FDs serve as a better investment vehicle when the focus is on returns, while life insurance should be treated purely as a tool for risk management and not as an investment option.

Small vs Large Cap Funds: Which One Fits Your Portfolio?

The debate between Small vs Large Cap Funds boils down to risk tolerance and investment goals. Both fund types have their place in a well-diversified portfolio, but they cater to different risk appetites and time horizons.

Small Cap Funds invest in smaller companies with high growth potential but come with increased volatility. They are better suited for aggressive investors willing to take on more risk for potentially higher returns over the long term.

Large Cap Funds, on the other hand, invest in well-established companies with stable earnings. While these funds may not offer the explosive growth potential of small caps, they provide more stability and are less volatile. Large-cap funds are better suited for conservative investors or those with shorter investment horizons.

Incorporating both small and large-cap funds can help balance risk and reward. Small caps can provide high growth, while large caps offer stability, which is critical in volatile market conditions.

Conclusion

Investing isn’t a one-size-fits-all approach. Your choice between a Step-Up SIP, SIP vs PPF, FD vs Life Insurance, or Small vs Large Cap Funds should be guided by your financial goals, risk appetite, and investment horizon. By understanding the nuances of each option, you can make informed decisions that will help you grow your wealth efficiently while managing risk.

0 notes

Text

Comparing Short-Term vs. Long-Term Investment Plans for 5 Years

Investing with a 5-year time frame in mind requires a strategy that balances growth potential with risk management. Whether you're saving for a down payment on a house, a child's education, or simply looking to grow your wealth, here are some of the best investment options to consider:

1. Mutual Funds

a. Equity Mutual Funds

Equity mutual funds invest primarily in stocks. They offer the potential for higher returns but come with higher risk. For a 5-year horizon, consider large-cap or diversified equity funds. These funds invest in well-established companies with a history of steady growth.

b. Hybrid Mutual Funds

Hybrid mutual funds, also known as balanced funds, invest in a mix of equity and debt instruments. This balance helps reduce risk while still providing decent returns. They are suitable for moderate risk-takers.

2. Fixed Deposits (FDs)

Bank fixed deposits are a popular choice for conservative investors. They offer guaranteed returns and capital protection. The interest rates on FDs vary across banks, so it’s wise to compare and choose the best rates. While the returns may be lower compared to equity, the safety and stability make FDs a good choice for risk-averse individuals.

3. Public Provident Fund (PPF)

The Public Provident Fund is a long-term investment option backed by the government. It has a lock-in period of 15 years, but partial withdrawals are allowed after 5 years, making it suitable for medium-term goals. PPF offers attractive interest rates and the returns are tax-free.

4. National Savings Certificate (NSC)

NSCs are government-backed savings bonds that come with a fixed interest rate and a 5-year maturity period. They are a safe investment option with the added benefit of tax deductions under Section 80C of the Income Tax Act. The interest earned is taxable, but the safety and guaranteed returns make NSCs a reliable choice.

5. Corporate Bonds

Corporate bonds are debt securities issued by companies to raise capital. They offer higher interest rates compared to government bonds. For a 5-year investment, look for high-quality corporate bonds (rated AAA) to ensure lower risk of default.

6. Real Estate

Investing in real estate can be a good option if you have a substantial amount of capital. Over a 5-year period, property values can appreciate significantly, especially in growing urban areas. However, real estate requires careful consideration of location, market trends, and liquidity needs.

7. Stock Market

Direct investment in the stock market can yield high returns if done wisely. For a 5-year period, consider investing in blue-chip stocks—shares of well-established companies with a strong track record of performance. Diversify your portfolio to mitigate risks.

8. Gold

Gold is considered a safe haven during market volatility. Investing in gold ETFs (Exchange-Traded Funds) or sovereign gold bonds can provide good returns. Gold tends to appreciate over time and offers a hedge against inflation and economic downturns.

9. Unit Linked Insurance Plans (ULIPs)

ULIPs provide the dual benefit of insurance and investment. Part of the premium goes towards life insurance, and the rest is invested in equity or debt funds. They have a lock-in period of 5 years and offer the potential for market-linked returns.

10. Recurring Deposits (RDs)

Recurring deposits are similar to fixed deposits but allow regular monthly investments. They offer fixed returns and are a good option for disciplined savers who want to accumulate a corpus over 5 years.

Key Considerations

Risk Appetite: Assess your risk tolerance before choosing an investment plan. Equity and mutual funds offer higher returns but come with higher risk, while FDs and PPFs offer lower returns with higher safety.

Tax Implications: Consider the tax benefits and liabilities of each investment. Options like PPF and ELSS (Equity Linked Savings Scheme) offer tax deductions, while interest from FDs and NSCs is taxable.

Liquidity Needs: Ensure the investment aligns with your liquidity requirements. Some investments like real estate and PPF have longer lock-in periods, while others like mutual funds and stocks offer more liquidity.

Diversification: Diversify your investments across different asset classes to balance risk and return.

Conclusion

Choosing the right investment plan for a 5-year horizon depends on your financial goals, risk tolerance, and liquidity needs. A balanced portfolio with a mix of equity, debt, and fixed income instruments can help achieve optimal returns while managing risks. Always conduct thorough research or consult with a financial advisor before making investment decisions.

0 notes

Text

Last Minute Tax Saving Investments – Section 80C

Last Minute Tax Saving Investments – Section 80C

Detailed Analysis of Tax Saving Investment As the Financial Year 2021 is about to end and as we all know that 31st March is the last date for Tax-Saving Investments under section 80C, Investors rush for such investments which help them save taxes. For investors looking out for such last-minute Tax Saving Investments Option, let’s take a look at different investment options. Introduction From…

View On WordPress

#benefits of ELSS#ELSS#ELSS vs ULIPs#Employees Provident Fund#last minute tax saving investment#National Pension scheme#National Saving Certificates#NPS#PPF#Public Provident Fund#section 80c#Senior Citizen Saving Scheme#sukanya samriddhi yojana#tax#tax saving#tax saving investment fixed diposit#tax saving investmnet#ULIPs#voluntary provident fund#What are tax saving investment options#Where to invest to save taxes

0 notes

Photo

What is the distinction between a ULIP and an ELSS?

Understand the variations between ULIPs vs ELSS in order to make an informed investment decision.

0 notes

Text

6 Myths About Investing in ULIPs

What are ULIPs?

The ULIP full form is Unit Linked Insurance Plans. ULIPs are an investment product that combines the safety and security of an insurance policy with the wealth creation potential of equity investments, thereby offering investors the best of both worlds. ULIPs are similar to ELSS therefore it is natural for investors to think of a ULIP vs ELSS scenario when planning their investments. While ELSS (Equity Linked Savings Schemes) is a form of mutual fund that invests in equity. Both are tax-advantaged investments, but that's where the similarities end.

ULIPs vs ELSS

The mandatory lock-in period for ULIPs is five years, while the mandatory lock-in period for ELSS is three years. The amount invested is tax-deductible under Section 80C, but ULIP gains are taxable. However, long term capital gains tax (LTCG) exceeding Rs 1 lakh is taxed at 10% under the ELSS.

ULIP funds can be withdrawn after a 5-year lock-in period, subject to additional policy requirements. However, after the three-year lock-in period, ELSS funds will be released.

6 Myths About Investing in ULIPs

Financial myths can harm your finances, or you may be unable to gain from certain investments because of fear, a lack of awareness, or a mistaken perception. Here’s a look at common myths about investing in ULIPs.

Myth 1: A ULIP plan is ridiculously expensive.

Due to their high premium allocation and fees for fund administration services, many individuals consider ULIPs to be an expensive investment.

Fact: There was a period when ULIP providers charged up to 10% for the services they provided. Today, however, this is not the case. For the first ten years, the Insurance Regulatory and Development Authority of India (IRDAI) restricted these fees to 3%. The costs drop to 2.25 percent if you keep it longer. In reality, in India, you may get economical online ULIP plans with cheaper premiums to suit any budget.

Myth 2: Investing in ULIPs is risky.

Because of the substantial risk inherent in the equity markets, many people assume that ULIPs are not a realistic investment option.

Fact: While equity markets are volatile, ULIPs offer a wide range of fund options, including equity, debt, and balanced funds. Depending on your goals and risk appetite, you can select a fund option when acquiring ULIP coverage. If you are ready to take chances, you can invest in an aggressive equity fund, or if you want greater protection, you can choose a debt fund. In a ULIP programme, you can choose a mix of equity and debt funds.

Myth 3: ULIPs do not provide adequate returns.

Fact: The fund you choose determines your ULIP returns. As previously stated, these insurance provide a variety of investment possibilities based on your needs and objectives. You'll get the best results if you pick the correct funds and switch between them at the proper time. In this case, a ULIP plan calculator can be useful. A ULIP plan also allows you to use professional services to manage your investment and assure high returns.

Myth 4: Life insurance coverage is inadequate if the market collapses.

One of the most common misunderstandings about ULIP insurance is that the investment component will have an impact on life coverage.

Fact: The life insurance portion of the plan has nothing to do with market volatility. Whether the stock market reaches new highs or lows, your life insurance remains unchanged. In reality, in the tragic event of your death, a ULIP policy pays your loved ones the full-life cover or the fund value, whichever is larger. As a result, it's a wise investment decision.

Myth 5: In ULIPs, extra funds cannot be invested.

Fact: To enhance the value of your investment portfolio and enhance savings, you can top-up your ULIP plan with an extra pool of reserves. This top-up insurance payment has the same tax advantages as your regular payment and can be paid at any time during the policy's term.

Myth 6: You can't terminate a ULIP policy.

Fact: Most ULIPs have a 5-year lock-in period during which you are unable to cancel the policy. The lock-in time allows you to save in a disciplined manner in order to achieve your objectives. Continuous investment in your ULIP pension plan, for example, ULIP will help you earn excellent returns and ensure your financial future after retirement. After the lock-in period, you can withdraw the investment plan at any time without paying any surrender charges.

To Sum Up

ULIPs have been around for a long time and have historically provided high returns. This modern and conventional investment mix provides the flexibility of switching funds as well as an easy withdrawal for your immediate needs, making it an essential investment instrument in your financial planning. If you don't want to deal with the inconveniences of individual planning, a ULIP with a small number of riders might be the way to go.

0 notes

Text

ULIP vs ELSS Mutual Fund: Key things that an investor must know

ULIP vs ELSS Mutual Fund: Key things that an investor must know

ULIP vs ELSS Mutual Fund: Unit Linked Insurance Plan or ULIP and Equity Linked Savings Scheme or ELSS Mutual Fund are one of the investment options that helps an investor get income tax benefit on investing and beat inflation by big margin in long-term. Both are market linked but ULIP is mix of both debt and equity while ELSS Mutual Fund is 100 per cent market linked. According to experts, both…

View On WordPress

0 notes

Text

Ulip vs mutual fund: Tax implications, charges and more

Ulip vs mutual fund: Tax implications, charges and more

1. Ulips are investment and protection products whereas a mutual fund is purely an investment product. 2. The premium paid for Ulips is covered under section 80C for tax deduction whereas the investment done in only ELSS mutual funds is covered under section 80C. 3. Ulips have a lockin period, typically of five years whereas openended mutual funds are totally liquid and can be withdrawn any…

View On WordPress

0 notes

Text

PPF vs ELSS vs ULIP: Where To Invest

Overview

You are not alone if you are planning to begin investing but are unsure about where to start from. Fortunately, in India, there are different types of investment opportunities available, but before you start, make sure that your investments and priorities are aligned, and you are in this for the long term.

Having said that, you might look at options such as ULIP vs ELSS vs PPF if your aim is to save tax. Additionally, if you want to plan for your retirement, which also comes with tax benefits, you should also look at ULIP. Keep in mind that your current income and your potential objectives rely on the right investment opportunity.

Here's what these opportunities for investment have to offer:

Equity Linked Savings Scheme (ELSS)

For those who want to invest in mutual funds and want to save taxes as well, ELSS is the go-to investment option. Investing in the stock market, this diversified equity mutual fund chooses individual companies with diverse market capitalizations. ELSS comes with a 3-year lock-in cycle. In contrast, the PPF has a minimum lock-in duration of 15 years. Investors should recognize that ELSS falls under the group of equity, where as many as 65% of the capital is invested in equity. The rate of return in ELSS is therefore volatile and totally depends on how well the stock market is doing over the period of time invested.

Under section 80C of the Income Tax Act, an investor can claim tax savings and earn tax deductions of up to Rs 1.5 Lakhs against investments made in the ELSS in a financial year. Furthermore, ELSS returns are taxed at 10%, without the benefit of indexation, if they surpass Rs 1 Lakhs in a financial year.

Public Provident Fund (PPF)

For decades, for many investors, PPF has remained a favored savings path, primarily because it provides tax savings and better returns. It is a secure investment choice with guaranteed returns that are good. Under Section 80C, PPF comes with EEE benefit, so the expenditure of up to Rs 1.5 Lakhs per year, the returns and the corpus after maturity are all exempted from taxation. It comes with a 15-year lock-in term, though.

There are provisions, however, where the investor can make partial withdrawals from the money invested, and after 7 years of investment, also take loans. One of the greatest advantages of investing in a PPF account is that the risk factor for PPF investment is relatively low, since it is backed by the government.

Unit Linked Insurance Plan (ULIP)

ULIP full form is Unit Linked Insurance Plans. These are investment plus insurance plans, as the name implies. With ULIPs, half of the investor's investment is used for insurance purposes, while the remainder is invested in the goods selected by the investor. A combination of equity, debt, and hybrid funds may also be the investment option. Bear in mind that the rate of return will differ according to the investment mix of equity, debt, and hybrid funds in ULIPs.

Under Section 80C, the premium paid under a ULIP product is liable for a tax deduction. Under Section 10(10D) of the Income Tax Act, the returns from the policy after maturity are excluded from income tax. Additionally, during the lifecycle of the investment, investors may also opt to turn from equity to debt or combination as per their investment requirement with ULIP.

Bottom Line - PPF vs ULIP vs ELSS

While investing in ULIP at first appears to be the best investment choice, investors should not combine investment and insurance with both investment and insurance in the same spot. It is said that by placing the same money in equity mutual funds by SIP and getting cover by opting for a term insurance plan, one could earn better returns. In addition, a lock-in duration of 5 years comes with ULIP.

The ULIPs available on Finserv MARKETS should be your top priority if you are thinking of availing one. These ULIPs come with the development of long-term equity, transparency and dual benefits guaranteed. They are investments that are tax-free and come with high returns.

0 notes

Text

ULIPs Vs Mutual Fund - Where Should I Invest?

A very common question among investors which instrument is better - Ulips or Mutual Funds (MF). Before you start thinking which instrument to invest, let's first understand these two financial instruments.

ULIPs - Unit Linked Insurance Plans

Popularly known as "ULIPs", it is an investment option provided by Insurance Companies. It is a single contract comprising of insurance cover with an investment benefit. The insurance company allots units to the ULIP investors and the net asset value (NAV) is calculated and declared on a daily basis. An investment in ULIP is divided into two parts - a) Life Cover Premium b) Investment. Premium paid in ULIP, certain portion goes for life cover and the remaining portion goes for investment.

Mutual Funds

Mutual Fund is an investment instrument which pools money from many investors and invest in (stocks, bonds, money market instruments). The company allots units to the MF investors and the current value of such investments is calculated on a daily basis and the same is declared through the Net Asset Value.

Difference between ULIPs and Mutual Funds

The basic difference between ULIP and MF is in terms of insurance cover. A ULIP provides a insurance component whereas a MF is a pure investment product. Generally speaking, ULIPs are mutual funds with an insurance cover.

ULIP = Mutual fund + Insurance cover

Now after understanding the difference between ULIP and MF, let's understand in detail which is better investment option - ULIP or MF.

Parameters for comparison

a) Expenses - Expenses incurred in a MF is lesser than the expenses of ULIPs. The reason is expenses in a mutual fund is capped, there is a pre-set upper limit, whereas for ULIPs no upper limit in terms of controlling the expenses is set by the insurance company.

b) Tax benefits - Any investment made in ULIP qualifies under 80 C of income tax act, where an investor can save tax on Rs 1,00, 000. In case of MF, only investment in ELSS (equity linked tax savings scheme) a specific type of mutual fund scheme qualifies for tax benefits under section 80 C.

d) Portfolio disclosure - MF houses are required to statutorily declare their portfolios on a quarterly basis, however there is no such statutory requirements for ULIPs.

e) Return on investment - As both the products are long term investment products, these products have given good returns to its investors. Many analysts' feels, from a long term view ULIP provides better return than MF. However this is not true in all cases, it all depends on the type of investment and the fund manager's skills in managing the funds.

Considering all the above factors, a mutual fund investment is better than ULIPs ulip insurance plan.

Insurance is meant for your future protection and it takes care of uncertainties in the future. However a MF is meant for only investment. As we investors do not have the expertise to invest in the stock market and other financial instruments, it is possible through MFs.

0 notes

Text

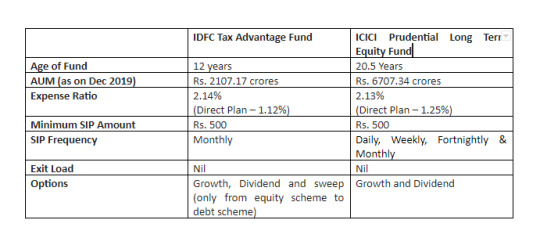

IDFC Tax Advantage ELSS Fund vs ICICI Prudential Long Term Equity Fund (Tax Saving)

Equity Linked Saving Schemes or ELSS are open-ended mutual funds that are eligible for tax deductions as per Section 80C of the Income Tax Act. They are emerging as the preferred choice for tax-saving instruments because of the shorter lock-in period (only three years) and potential for higher returns (compared to Provident Fund, NSC, ULIPs, etc.). These funds invest a significant chunk of the portfolio in equity and equity-related instruments. In this article, we will look at two tax-saving schemes – NAV of IDFC Tax Advantage Fund and ICICI Prudential Long Term Equity Fund to check their performance.

Fund Details:

Launched in December 2008, IDFC Tax Advantage ELSS Fund has a preference for large-cap stocks in terms of market capitalization. Half of the portfolio consists of these stocks while the balance is split between mid-cap (19.3%) and small-cap (29.83%) stocks. This fund is being managed by Mr Daylynn Pinto since October 2016. NAV of IDFC Tax Advantage Fund was Rs. 55.18 (Growth) and Rs. 16.10 (Dividend plan)

ICICI Prudential Long Term Equity Fund was launched in August 1999. The fund is managed jointly by Mr Harish Bihani and Sankaran Naren since November 2018. Ms Priyanka Khandelwal takes care of the overseas investment aspect. 2/3rd of the portfolio is invested in large-cap stocks while the balance is split (almost equally) between mid and small-cap stocks.

Portfolio Composition

In terms of sector allocation, financial services lead the chart for the funds. IDFC Tax Advantage Fund allocates 29% of the corpus in banks and finance while ICICI Prudential Long Term Equity Fund invests only about 22.9% of the funds in this sector.

IDFC Tax Advantage Fund is a diversified fund and spreads the overall portfolio over 22 sectors. After banks, the next highest allocation is in the Software industry. (8%). Petroleum products, Consumer Products and Construction projects cumulatively constitute 18% of the portfolio, with equal distribution amongst themselves.

ICICI Prudential Long Term Equity Fund invests its corpus selectively in 13 sectors. The major contributors (after financial services) are Energy (14.6%), Consumer Goods (10.9%) and Metals (8.6%)

Performance

IDFC’s tax-saving fund was launched in 2008. Since its inception, it has generated 16.74% returns. In absolute terms, Rs. 10,000 invested in Dec 2008 would become Rs. 55,020 (compared to Rs. 52,918 if invested in benchmark funds) and the same can be confirmed from the NAV of IDFC Tax Advantage Fund. Performance metrics for this fund across multiple time-frames are:

ICICI Prudential Long Term Equity Fund has generated 19.8% returns since its inception in 1999. In money terms, investment of Rs. 10,000 in the fund (at the time of launch) would have grown to Rs. 392,330. This is more than 2.5 times the growth offered by the benchmark. Performance metrics for this fund across multiple time-frames are:

Final Words

These schemes are suitable for investors who seek capital appreciation in the long run and have an investment horizon of a minimum of five years. Both of them have outperformed their respective benchmarks (since inception metric) and are a good choice for someone looking for a higher return yielding tax saving instrument and readiness to absorb some risk. An investor’s choice for a particular fund should depend on their own financial goals and investment objective.

0 notes

Text

Top ULIP Myths To Know Before Investing

ULIPs have been around for a while, and people have understood the benefits they have to offer in comparison to other products. However, there is still a lot that is misunderstood, and as a result, a lot of people are still not tapping into the unique potential that ULIPs have to offer. Moreover, when looking for a product to channel your savings into, if you land on pages that pitch ULIPs vs ELSS, and against pure insurance products, they get much more confused than before.

That’s why, in this article, we will cover some of the myths that ULIPs are surrounded by. And if you are not really sure what the ULIP full form is, or what they do, then we have the answers for that too. So let’s begin with a primer on ULIPs. After that, we look into some of the myths that surround ULIPs in the market.

What does ULIP stand for?

The full form of ULIPs is Unit Linked Insurance Policies. These are basically investment vehicles which have an insurance component built into them. So, when you pay a premium towards your ULIP, a part of it is paid towards the insurance component while the rest of it is contributed towards a common pool of funds that work to generate wealth. So ULIPs serve a double purpose, of insurance and wealth generation.

Now, let's look at some of the myths that surround ULIPs in the market today.

Myth #1: ULIPs are risky, you should choose safer options like fixed deposits.

Fact: First, ULIPs have an insurance component built within them, which is not the case with fixed deposits - which is why the two products are not comparable at all. The right comparison would be to consider fixed deposit + life insurance vs ULIPs. When you consider that debate, neither is the interest earned through fixed deposits exempt from tax, nor do they perform as well as ULIPs, on an average.

Funds received on maturity of a ULIP, on the other hand, are exempt from tax under certain conditions. Moreover, ULIPs allow you to customise your policy according to your risk appetite. This allows you to play within your comfort zone while insuring yourself and generating wealth through a single product.

Myth #2: ULIPs vs ELSS - pick ELSS

Fact: The entire ULIPs vs ELSS debate doesn’t make sense because, once again, the two products are not comparable at all. ELSS or Equity linked saving schemes work to generate wealth over a medium-term. While these are a good way to serve the dual purpose of investing and tax saving, ULIPs come with an insurance component as well.

Moreover, ULIPs tend to have a higher return on investment as compared to ELSS, which provide a dynamic return averaging around 12-14%. Moreover, the ability to customise your risk and achieve higher returns is what really makes ULIPs attractive to buyers. For the cherry on top, you get a sizable amount of life cover too.

Myth #3: ULIPs are rigid and there is no way out from them. Pick a pure investment product instead.

Fact: This was the case in the early years. ULIPs do have a lock-in period of 5 years, and that is because they intend to generate wealth over a longer period of time. ULIPs are usually offered over a much longer period too. However, modern ULIPs have rebalancing tools built into them, which allows you to pick from a wide variety of funds to invest in. These can be debt based or equity based.

The ability to customise your funds over a period of time not only helps you play by your dynamic risk appetite over years, but also helps you take your funds to their highest potential. All the while, you get a life cover too, which is something that pure investment products lack. Some ULIPs also allow you to pick your life cover, which also helps them stay strong when compared to pure insurance products too.

Add to this a partial withdrawal option - the rigidity argument no longer holds. ULIPs are in fact, so flexible, that they can help you take care of major expenses like your child’s education, vehicle purchase, and so on. All you have to ensure is that you plan for them beforehand, so that they are timed after your partial withdrawal becomes valid. And if you are looking for the “ground exit”, then you can even discontinue your ULIP after the lock in period.

Bajaj Allianz Goal Assure on Finserv MARKETS is an excellent ULIP that helps you fulfil your life goals with all the cutting-edge features that an investment and/or an insurance product should offer today. With 8 different funds and 4 different investment strategies to choose from, you can now take full control of your financial journey. What’s more, you even get rewarded for paying your funds regularly, in the form of fund boosters. So what are you waiting for? Visit Finserv MARKETS today to buy the Bajaj Allianz Goal Assure plan, and kickstart your financial journey!

0 notes

Text

INVESTMENT IN REAL ESTATE VS STOCK MARKET

Investment in real estate comes always comes with its own pros and cons. Unlike yesteryears, there are diversified investment opportunities available for today’s investors. Most common forms of investment options available are bank deposits, postal deposits, mutual funds & ULIPS, stocks, real estate & gold.

However for people looking at genuine investment options, real estate is a safe bet considering the fact that it is regarded as a long term investment option. Compared to bank deposits or mutual funds which have a normal lock-in period of generally upto five years, investment in property stays for a period of 15 to 20 years.

In mutual funds or stocks, one needs to continuously keep a track of how the fund is performing. At the same time, these funds are critically sensitive to the performance of the stock market. So is the scenario with ULIPs or ELSS.

However real estate investments do not come with these downsides. Investment in real estate works in an uncomplicated way. Let us get to the process of how a real estate investment works; An investor can either pay a lump-sum or make stage-wise payments and once the property is ready for occupation, it is handed over to the customer. He can fund the property through a loan or through his own liquidity. He can utilize this property either as his own dwelling or put it up for rent or sell it when the markets are doing exceptionally well.

Unlike mutual funds or ULIPS, one need not keep a track of the amount that is invested. Renting out the property means that the owner gets return on investment on a monthly basis.

The best time to invest in real estate is when there is more supply and less demand. That’s when you can bargain a great deal. These are testing times for the Indian economy with reduced consumption due to recession. India’s current GDP will grow at the rate of 6-6.5 per cent in the next fiscal year 2020-2021 which is an encouraging sign for the economy.

One need to follow an optimistic approach when it comes to investment in property and also need to patiently wait if he is looking to multiply his investment. Thus it can be justified that real estate is a far better investment option than stocks.

0 notes

Photo

Which is better ELSS or ULIP?

ELSSs and ULIPs are two particular things that fill different necessities. While a ULIP is a mix of life inclusion and hypothesis offered by additional security companies, ELSS is a worth fund. Both are charge saving hypotheses, anyway the likeness closes there. Examine in knowledge with respect to ulip vs elss at finserv MARKETS now.

0 notes

Text

Looking for Investment Options? Here 7 Reasons Why You should invest in ULIPs

Overview

There was a period when stocks were manually traded in Mumbai under a banyan tree. Since then, we've come a long way. Hundreds of thousands of financial products are available today to assist you in investing your hard-earned money. You can choose from each of these options to either protect or increase your capital, depending on your needs, limits, and financial goals.

Mutual funds are currently one of the most common investment options. Simply put, it is a type of investment fund that collects capital from investors and then invests it on their behalf in various assets in order to generate a profit. It's similar to riding the train, where the driver transports all of the passengers to the same place. The fund manager is the driver, the train is the mutual fund system, and the passengers are the investors in this situation.

ULIPs vs Mutual Fund

Mutual funds are often confused with another financial product known as ULIPs, or Unit-Linked Insurance Plans. There are insurance plans that serve the dual purpose of offering coverage as well as earning you a profit from investment. The insurance firm, like the mutual fund house, creates a fund to raise funds from investors. It then invests the funds in a variety of securities, including stocks and bonds. Isn't this similar to mutual funds? They are not, however, the same.

The differences

The most significant distinction is that mutual funds do not have life insurance; only ULIPs do. This is the amount of money that the insurance firm guarantees to your relatives in the event of your untimely death.

ULIPs have additional protection.

Certain ULIP products on the market have riders or built-in benefits that include extra security. These ULIP products are best for consumers who are saving for a particular need and are concerned that their needs will not be fulfilled if they are no longer available in the future. Saving for a child's education is one example. To meet these needs, some ULIP products have a lump sum guaranteed upon the death of the parent. In addition, the firm agrees to pay the fund's premiums on behalf of the parent. It also provides the family with a steady income for the remainder of the policy's term.

Savings on taxes

ULIPs qualify for tax deductions under Section 80C. Your net taxable income is reduced by the amount you spend in a ULIP. As a result, the amount of money you owe the government in income tax is reduced. Mutual funds, on the other hand, do not always assist you in lowering your tax burden. Only ELSS, or Equity-Linked Savings Schemes, have these tax benefits.

When to use ULIPs vs Mutual Fund?

So when do you buy a ULIP and when should you buy a mutual fund? This is a difficult question to address. It is entirely dependent on your personal requirements.

To begin with, if you require your investment to be liquid—that is, easily convertible into cash at a moment's notice—you should consider a mutual fund. A five-year lock-in period is required for ULIPs. You won't be able to get your money back during this period. Naturally, not every mutual fund is liquid. The lock-in duration for ELSS funds is also three years.

Wrapping Up - ULIPs vs Mutual Fund

Be clear on what you want to do with your money before investing in any of the financial products. Individuals with a long-term financial strategy for asset formation and insurance should consider ULIPs. A ULIP that is kept until maturity can be beneficial for retirement, children's education, and other financial objectives. It combines the advantages of savings and security into a single plan. Furthermore, ULIPs are for people who are unfamiliar with the stock market or the various fund options available through a mutual fund but want to benefit from long-term capital appreciation through investing in equities.

It's difficult to choose between ULIPs vs mutual funds. However, if you know where to look for the right information, it can be made simpler. The simplest method is to go straight to Finserv MARKETS, where you can conveniently search a variety of ULIPs vs mutual funds that meet your requirements. You may also request that they contact you and that an experienced advisor assist you in making your decision.

0 notes

Text

Which Funding Plan Gives Most Positive aspects? – Aegon Life

When creating an funding portfolio, people discover a number of funding choices together with ULIPs and ELSS. Each ULIPs and ELSS contain investing in equities and embody tax saving options as part of their plan. On this dialogue, we checklist out the advantages of ULIPs vs ELSS.

What’s a Unit Linked Funding Plan?

Unit Linked Insurance coverage Plans supply policyholders the twin good thing about funding and life insurance coverage. In ULIPs, part of your premium is allotted for investments in fairness funds or debt funds, and the opposite half is reserved for all times cowl.

Traders additionally get life insurance coverage profit once they go for a ULIP. Upon the loss of life of the investor, the nominee will get the pre-decided sum assured or the full fund worth, whichever sum is larger on the time of payout.

For instance, Mr. Naidu has purchased a ULIP for 10 years for which he pays an annual premium of INR 50,000. The insurance coverage firm has provided a sum assured of INR 500,000 which is 10 instances the annual premium.

Mr. Naidu’s premiums are allotted for investments in market equities and life cowl. If Mr. Naidu suffers an accident or dies after paying four premiums, the nominee will get the whole sum assured, i.e. INR 500,000, since the returns on fairness funding at this stage is decrease than the sum assured.

In one other circumstance, Mr. Naidu dies after paying 9 premiums whose complete value is INR 450,000. The nominee receives a payout of a sum equal to the fund worth for the reason that quantity is larger than the sum assured at this level.

One should notice that returns on fairness funding depend upon market volatility. Due to this fact, ULIPs don’t all the time assure worthwhile returns upon funding.

To counter market volatility, you’ll be able to select choices corresponding to Fairness Fund, Debt Fund, Hybrid Fund. This lets you alter your funding technique in keeping with the shifting panorama of the market.

With ULIPs, your investments as much as INR 150,000, in addition to returns are exempted from taxation underneath part 80C and 10 (10D) respectively.

Since ULIPs include a minimal lock-in interval of 5 years, it’s perfect for traders who need returns in the long term, say 10-15 years. Due to this fact, ULIPs are top-of-the-line long-term funding devices.

What’s an Fairness Linked Saving Scheme?

Fairness Linked Saving Scheme or ELSS is a sort of funding technique the place your whole corpus is invested in fairness markets. Since equities and equity-related merchandise are affected by market fluctuations, the returns on capital funding can’t be assured. This makes investing in ELSS appropriate for traders who’re extra tolerant of market dangers.

Nonetheless, via ELSS Systematic Funding Plan (SIP), you’ll be able to counter the results of market fluctuations. With ELSS SIP, you’ll be able to put money into market equities at common time intervals. This negates the danger of investing a lump sum quantity and incurring potential losses upon modifications out there scenario. ELSS SIP dilutes your danger by supplying you with a various funding choice.

Like ULIPs, ELSS investments are exempted from taxation as much as a most of INR 150,000 underneath part 80 C of the Indian Tax Act. Furthermore, the returns on funding are additionally tax-free.

ELSS supply two choices for funding:

1. Progress Possibility: The returns, income and bonuses obtained from investments are re-invested for future beneficial properties. Traders obtain returns solely after the completion of lock-in interval of three years.

2. Dividend Possibility: Traders obtain interim funds of returns within the type of dividends underneath this selection. They will both go for an everyday money payout or proceed shopping for equities with the dividends.

In abstract, ELSS is right for traders in search of short-term beneficial properties. It is best to do not forget that though ELSS could doubtlessly reward you with larger returns, the dangers are additionally larger. You’ll be able to all the time go for ELSS SIP to create a various funding portfolio and reduce danger.

ULIPs are nice funding devices if you’d like most returns over an extended tenure. ULIPs are useful in securing your future and supplies monetary help to your little one’s training, marriage and different necessary life phases. Additionally, you’ve gotten the added benefit of a life cowl.

Discover out extra about ULIPs and Aegon Life’s merchandise like time period insurance coverage and different merchandise, go to our house web page.

Calculate premium to your Time period Plan

from insurancepolicypro http://insurancepolicypro.com/?p=1221

0 notes