#ElectronicsExport

Explore tagged Tumblr posts

Text

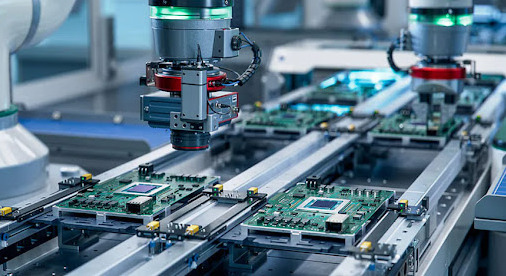

India’s Electronics Leap: How PLI Schemes and Infrastructure Are Redefining Manufacturing

India is fast-tracking its ambition to become a global electronics manufacturing powerhouse. With a mix of well-structured Production Linked Incentive (PLI) schemes and robust infrastructure development, the country is actively reducing its dependence on imports, boosting exports, creating jobs, and attracting international investments.

Building an Electronics Ecosystem: ECMS Initiative

Recognizing the need to strengthen the components ecosystem, the government introduced the Electronics Components Manufacturing Scheme (ECMS) with an outlay of ₹23,000 crore. This scheme aims to drive domestic production of passive electronic components, sub-assemblies, and capital equipment essential for electronic manufacturing.

Strategic Push Through PLI Schemes

The Indian government’s push for domestic electronics manufacturing revolves around targeted financial support for value chain expansion. The PLI initiatives reward companies for incremental manufacturing and sales in India.

1. PLI for Large-Scale Electronics Manufacturing

Introduced in April 2020, this scheme was designed to attract substantial investments in mobile and electronic components manufacturing. It provides 3% to 6% incentives on incremental sales over a five-year period.

Its success is evident—mobile phone production in India jumped from 5.8 crore units in 2014–15 to a massive 33 crore units in 2023–24, reducing import reliance and turning India into a net exporter of mobile phones.

2. PLI 2.0 for IT Hardware

This version extends support to the IT hardware segment—covering laptops, tablets, servers, and ultra-compact PCs. Companies receive about 5% incentive on incremental sales over six years.

The scheme emphasizes component localization, including semiconductor design and integrated circuit packaging, making India more self-reliant in high-tech electronics.

ECMS: Multi-Tiered Manufacturing Support

The ECMS offers flexible incentive models—turnover-linked, capital-expenditure linked, and hybrid. It targets key sectors such as telecom, power electronics, automobiles, and medical devices. With a projected ₹59,350 crore in investment and ₹4.56 lakh crore in production output, the scheme is expected to create over 91,000 direct jobs.

As of late 2024, PLI schemes across 14 sectors had brought in ₹1.61 lakh crore in investment, created over 11.5 lakh jobs, and generated about ₹14 lakh crore in production—transforming the manufacturing landscape.

Infrastructure as the Backbone

Beyond incentives, India is also investing heavily in industrial infrastructure to support electronics production.

Electronics Manufacturing Clusters (EMCs)

The EMC scheme supports the creation of state-of-the-art infrastructure for the Electronics System Design and Manufacturing (ESDM) ecosystem. Greenfield projects can receive up to 50% of project costs (up to ₹50 crore per 100 acres), while brownfield projects may receive 75% support.

So far, 19 greenfield EMCs and 3 Common Facility Centres (CFCs) have been approved, spanning 3,464 acres and backed by ₹1,470 crore in government grants. States such as Tamil Nadu, Uttar Pradesh, and Karnataka are rapidly emerging as new electronics hubs.

Improved Connectivity: Bharatmala, Sagarmala & PM Gati Shakti

Modern infrastructure is key to seamless manufacturing. Initiatives like Bharatmala and Sagarmala, along with the PM Gati Shakti National Master Plan, are transforming India’s logistics network. The development of dedicated freight corridors, automated cargo handling, and real-time tracking systems is helping cut costs and reduce transit delays.

Expected Impact: A New Era for Indian Electronics

Boosting Local Value Chains

By incentivizing domestic production of core components, these schemes reduce India's dependency on foreign imports—especially from China, Taiwan, and South Korea. Localization of even 50% of key components can lead to billions in foreign exchange savings.

Massive Employment Generation

With direct and indirect job creation at the core of every scheme, the electronics sector is expected to employ hundreds of thousands of skilled and semi-skilled workers across the country.

Rising Electronics Exports

India has set an ambitious goal of producing $300 billion worth of electronics by 2026, of which $120–140 billion is aimed at exports. The PLI schemes have already helped expand India's export base by attracting tech giants like Apple and Samsung to deepen their operations.

Innovation and Technological Capability

R&D and semiconductor design are integral to India’s future strategy. Initiatives like SPECS and the semiconductor-specific incentives under PLI aim to enhance indigenous design and manufacturing capabilities.

Road Ahead: Addressing Key Challenges

Despite rapid progress, certain challenges must be resolved:

Supply Chain Gaps: Continued import of certain high-tech components requires a stronger local supply network.

Infrastructure Bottlenecks: EMCs need consistent upgrades in power, water, and transport to match global standards.

Skilled Workforce Shortage: Scaling up training programs is essential to support high-volume manufacturing.

Ease of Doing Business: Simplifying regulations and approvals will accelerate investment flows and industrial growth.

Conclusion

India’s aggressive push through PLI schemes and infrastructure investment is redefining its electronics sector. From import substitution to export-led growth, the country is positioning itself as a global electronics manufacturing hub. With the right policy continuity, focus on skill development, and strategic global partnerships, India is well on its way to becoming a dominant player in the international electronics value chain.

Author Details: S. Ravi (Sethurathnam Ravi) Promoter and Managing Partner of Ravi Rajan & Co. LLP Former Chairman of the Bombay Stock Exchange

0 notes

Text

Malaysia Exports Report 2024-25

📦 Top 10 Exports of Malaysia in 2024-25 – Complete Report 📊 Malaysia’s export economy is booming in 2024! With a total export value of $329.45 billion, the country ranks as the 26th largest exporter in the world.

Here's what you’ll find in our detailed analysis:

✅ Top Export Products:

Electronic Integrated Circuits

Palm Oil

Refined Petroleum

Rubber, Plastics & more

✅ Major Export Destinations:

Singapore 🇸🇬

USA 🇺🇸

China 🇨🇳

Japan, Hong Kong, Vietnam

✅ Insights by HS Code & Country ✅ Export Trends, Historical Data, and Growth %

📍 Whether you're a trader, analyst, or business owner — this report gives you the edge you need.

📲 Read the full blog here 👉 https://www.tradeimex.in/blogs/top-10-exports-of-malaysia-2024-25

#MalaysiaExports#GlobalTrade#ExportReport#Malaysia2024#ExportData#TradeImeX#AsiaTrade#PalmOilExports#ElectronicsExport#HSCodeAnalysis

0 notes

Text

India’s Growing Presence in the Global Electronics Market: Key Insights and Future Projections

India has increasingly established itself as a major player in the global electronics market. With electronics exports to the United States surpassing $20 billion in the fiscal year 2023–2024, the country is demonstrating significant competitiveness and growth in this sector. This article delves into the key highlights of electronics exports from India, examining current trends, future projections, and the driving factors behind its expansion.

Current State of India’s Electronics Export Industry

India's electronics export industry has shown impressive growth over recent years. In the fiscal year 2023–2024, the country’s electronics exports reached $20 billion, marking a substantial increase from previous years. The primary electronic goods exported from India include mobile phones, laptops, consumer electronics, and medical and telecom equipment. Notably, Tamil Nadu has emerged as the leading electronics exporter, contributing $9.56 billion to the sector.

The Indian electronics market is poised for continued expansion, with export values projected to nearly triple from $431 billion in 2023 to $835 billion by 2030. This robust growth is underpinned by a compound annual growth rate (CAGR) of 24% anticipated over this period. This growth trajectory reflects India's increasing dominance in the global electronics landscape.

Growth Trends and Sector-Specific Insights

India’s electronics industry has experienced a dramatic growth rate in recent years. For instance, domestic production surged from $43 billion in FY17 to $87 billion in FY22. The export of electronic goods also witnessed a significant increase, with a CAGR of 22%, climbing from $5 billion in FY17 to $15 billion in FY22. The government’s Production-Linked Incentive (PLI) scheme and efforts to enhance semiconductor availability have played a crucial role in this growth.

Specific segments of the electronics industry are expected to maintain strong growth. Mobile phone production in India has grown at a CAGR of 5%, from 58 million units in FY15 to 310 million units in FY23. The consumer electronics market is projected to grow at a CAGR of 6.5% from 2022 to 2030, while the semiconductor market is expected to expand at a CAGR of 20% from 2022 to 2026.

Key Drivers of Growth

Several factors are fueling the growth of India's electronics exports:

Competitive Labor Costs: India benefits from a large pool of skilled and semi-skilled workers available at relatively low wages, making it an attractive destination for electronics manufacturing.

Rising Domestic Demand: Increasing affluence and the government’s focus on digitization, through initiatives such as Digital India and Startup India, have boosted domestic demand for electronic products.

Technological Advancements: Investments in research and development, coupled with the adoption of advanced technologies like Artificial Intelligence (AI), the Internet of Things (IoT), and 5G, are positioning India as a key player in next-generation electronics.

Geographical Advantage: India's strategic location in Asia, with robust connections to major markets like China, Japan, and South Korea, enhances its attractiveness for electronics manufacturers looking to export products across the region.

Major Export Destinations

India's electronics exports reach various global destinations. The top export markets include:

United States

United Arab Emirates

China

Germany

Vietnam

Bangladesh

Sri Lanka

Nepal

Indonesia

These countries are significant consumers of electronics, offering favorable trade terms and contributing to India’s growing export figures.

Future Vision and Goals

India has set ambitious short-term and long-term goals for its electronics sector. By 2025–2026, the government aims to make electronics one of the top three export commodities, with a projected demand of $180 billion. Long-term goals include establishing India as the world's leading producer and exporter of electronics and creating a $1 trillion ecosystem for mobile devices, consumer electronics, and IT gear within the next decade.

Conclusion

India’s electronics export sector is on an upward trajectory, driven by competitive labor costs, rising domestic demand, technological innovation, and strategic geographic positioning. With a strong growth outlook and supportive government policies, India is well-positioned to expand its role in the global electronics market. For the latest data and insights on India's electronics exports, including market trends and product specifics, visit ExportImportData.in and explore comprehensive trade data and analytics.

0 notes

Text

Electronics Trading & Export Company - Trustworthy Trader

Epitomme is a significant exporter of electronic products and equipment from India. We're a global Electronics export company. We provide our clients with a full range of services. We have a huge inventory of parts and products, and we can ship to any destination within the world.

0 notes

Text

How to Export Electronics Products from India to Philippines?

"🌏 Exploring Global Markets: Learn How to Export Electronics Products from India to the Philippines! 💡💻📲 Don't miss out on this golden opportunity! 🌟 🌐📦 Read full Blog - https://tinyurl.com/2p9chjf7

0 notes