#Etoro Support phone Number

Text

Honest Forex Broker Review - Fx Pro

Fx Pro Trading Brokerage Fully Reviewed

In this summary we are going to make a fully reviewed explanation of Fx Pro trading brokerage in some detail.

About FxPro

Founded in 2006, FxPro has executed more than 500 million orders since its inception and has serviced more than 1.8 million clients in over 173 countries. As of 2021, FxPro lists over $100m in Tier 1 Capital and has more than 200 employees across its 4 offices.

The FxPro brand holds regulatory licenses in the United Kingdom (UK) under FxPro UK Limited, Cyprus under FxPro Financial Services Limited, South Africa, and the Bahamas. Making Fx Pro a highly trusted broker by many retail & institutional traders.

FxPro competes among the top MetaTrader brokers, offering the full suite of MT4 and MT5 platforms with multiple accounts and execution methods. The only drawback to an otherwise balanced forex broker is pricing that is slightly higher than the industry average.

In the below table please take your time to view some of Fx Pro's features & benefits:

Start Trading Like A Pro With Fx Pro

Is FxPro Safe?

FxPro is considered very low-risk, with an overall Trust Score of 93 out of 99. FxPro is not publicly traded and does not operate a bank. FxPro is authorized by one tier-1 regulator (high trust), two tier-2 regulators (average trust), and one tier-3 regulator (low trust). FxPro is fully authorized & regulated by the following tier-1 regulators: Financial Conduct Authority (FCA). Fx Pro is extremely unlikely to be a scam broker. and has been tried & tested by Fx Brokers Empire.

Commissions and Fees

FxPro's pricing is slightly higher than the industry average, putting it at a small disadvantage compared to its peers, such as Etoro or HF Markets, who both also offer the full MetaTrader and cTrader suites just like FxPro does. However what they lose in price is far outweighed with better options & service. Execution method: On FxPro MT4, you can choose either variable or fixed spreads. For the variable spread pricing, there are two types of execution-based pricing: instant and market. Instant execution is subject to requotes but no slippage, while market execution has the potential for slippage but without requotes. Commissions: FxPro offers its most competitive spreads on its cTrader platform, which uses commission-based pricing. FxPro's effective spread to trade EUR/USD is roughly 1.27 pips, based on 0.37 average spread + 0.9 pip commission equivalent on cTrader, using August 2020 data. Spreads: FxPro's floating rate model (variable spread) is available on both MT4 and MT5, with EUR/USD spreads of 1.57 pips for accounts on market execution (1.51 pips on MT5) and 1.71 for accounts with instant execution, as per August 2020 data from FxPro. Fixed pricing: On MT5, there is no fixed spread offering, and only market execution is available. Other platforms such as MT4 and web traders offer fixed pricing models. Active traders: FxPro offers an Active Trader program, & provides loyalty rewards for its longstanding traders. Executing large orders: Without question, FxPro's best feature is its ability to execute large trading orders, which can be placed with no minimum distance away from the current market price. A high liquidity broker which is important for high frequency & big money traders

Platforms and Tools

Thanks to offering MetaTrader, cTrader, and its own in built proprietary FxPro Edge web platform, traders at FxPro have a diverse selection of platform options depending on their trading style. Both beginners & experts can enjoy trading and perform with there respective platforms. MetaTrader suite: FxPro offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platform for web and desktop. A notable add-on is available for MT4 which is the suite of trading tools from Trading Central that can be rather helpful. cTrader: The FxPro cTrader platform is available for web and desktop. The cAlgo platform can also be used to enable algorithmic trading when using cTrader at FxPro. Proprietary platform: FxPro Edge is a light web-based platform that has robust charts and a responsive design. There are a few default layouts, and users can drag and drop the modules to rearrange them and add new widgets. Overall, there is a good foundation established for the future, especially for such a new in built platform. There will definitely be more updated features to this platform to enhance traders performance. Research

FxPro provides great daily market updates and analysis on its blog, along with content from third-party providers. Overall, we found the written articles from FxPro's in-house staff to be of a good quality. More Video content would help fill the gap in research, as FxPro's YouTube channel is mostly webinars, platform tutorials, and promotional videos. FxPro News blog: There are multiple articles per day available on FxPro's dedicated blog, including its 'Market Snapshots' series. These articles provide a daily outlook and are nicely organized, making it easy to consume, understand & apply in volatile market conditions. Traders dashboard: FxPro has a client portal where users can access sentiment data for various symbols and forex pairs, along with the trading session times and a summary of gainers and losers. There is also an integrated economic calendar. Adding trading capabilities to the client portal, or merging these features with the Edge platform, would help to centralize these resources in one place.Fx Pro Education

FxPro has a general education section where it provides written materials, along with some educational videos on its website. Overall, FxPro has a good foundation of educational content. Expanding its coverage and adding other videos on some more advanced trading elements would balance out the FxPro educational offering.Written content: FxPro's educational section features mini cards with key information and short paragraphs explaining things like "what is a stop out" in less than six sentences. There are 36 cards in the Psychology section and four other areas, each with a collection of learning cards. There is even progress tracking, so you know which modules or chapters you have finished, which is a nice touch.

Mobile Trading

Alongside providing its proprietary FxPro Direct app for trading, account management, and basic market news, FxPro's mobile lineup is powered by the same third-party providers as its desktop and web-based platforms: MetaTrader (Meta Quotes) and cTrader (Spotware).

cTrader: FxPro's white-labeled version of cTrader is consistent with the web-based platform, offering traders a really friendly & easy to use trading experience with a variety of trading tools. As far as third-party mobile apps go, cTrader is very versatile.

MetaTrader: The mobile versions of the MT4 and MT5 platforms are presented as standard from the developer with default features. In 2021, FxPro is a Best in Class MetaTrader Broker due to a range on smart trading indicators & strong liquidity.

FxPro Direct: The FxPro Direct app is the broker's proprietary mobile app which supports trading for users that have a CFD account, but is mainly optimized for account management. With just a quotes, trades, and history tab, we found that the FxPro Direct app was not very ideal for trading, compared to FxPro's other available mobile platforms. Meanwhile, the FxPro Edge platform is not yet available for mobile.

While FxPro does not stand out for its pricing, FxPro is a well-capitalized, trustworthy broker that offers multiple platform options, multiple execution methods, and, for professionals, can cleanly execute large orders. Fx Pro Trust

FxPro scores quite well when it comes to reputation and trustworthiness. Most importantly, they are regulated in the United Kingdom, which is reputedly safer than some regulators in the EU. FxPro also advertises that they have one of the highest counterparty credit ratings in the industry, scoring a whopping 95 on a hundred point scale, where a high score indicates a lower risk of default or bankruptcy. They also participate in the Financial Services Compensation Scheme (FSCS) that allows clients to claim compensation in the event FxPro were to become insolvent up to £80,000. They also offer clients negative balance protection under new EU guidelines that prevent clients from losing more money than they have deposited. So they are clearly not worried about liquidity issues as they have good insurances in place. One negative for FxPro is the absence of guaranteed stop‑loss orders. Some brokers offer this feature for a fee, but this is not offered by FxPro at all. Fx Pro Special Features

FxPro offers traders algorithmic trading through cTrader, which is an advanced algo and technical indicator coding application that allows traders to create and build algorithmic trading strategies and custom indicators. This is a smart technological feature that is not offered by many brokers and definitely worth checking out. FxPro also offers a Virtual Private Server (VPS) that enables clients to upload and run MT4 Expert Advisors and algo bots, 24 hours a day, without needing to keep the trading terminal running. These applications also allow for back testing of trading strategies.

Fx Pro Customer Support

FxPro prides itself on its "five‑star customer service," specifically its multilingual, 24‑hour Monday‑through‑Friday (24/5) customer service team. Their live phone support operates in several locations with a toll‑free number in the U.K., France, Germany, UAE, and Russia. Live chat is offered for both live trading clients and prospective clients. Unlike other brokers, they have a physical office in London with a reception desk that is open from 7:30 a.m. to 4:30 p.m. Some social media support is available on Twitter, but this is mainly news related rather than specifically for customer support.

Please Note: The FCA has a ban in place for the sale of crypto-derivatives to UK retail consumers as from 6th January 2021.

Fx Brokers Empire's Conclusion For Fx Pro

We recommend trading with this broker and find it to be a very trustworthy broker. Due to its popularity and multi tiered regulations, Fx Pro is extremely unlikely to be a scam. Fx Brokers Empire recommends using Fx Pro for its high liquidity & execution service. Along with outstanding customer support based on our own experiences & our client feedback. Using there run on line 'Trade Like A Pro' they definitely have weight in there words and offer some decent trading features. We further recommend not to start a investment account with Fx Pro in excess of £25,000 initially until you get used to the platform offered and all its features. Fx Pro is a highly popular trading choice & has a well branded name that delivers results for its traders, across Europe, Asia & most definitely in the UK as a trusted broker.

Fx Brokers Empire rates Fx Pro as a 4.5/5 star broker

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Start Trading Like A Pro With Fx Pro

#fx pro review#detailed fx pro review#fxpro#fxproreview#fxproreviewed#fx pro reviewed#fx pro best fca broker review

3 notes

·

View notes

Text

MyCelium Number 1833◀430▶︎6324™® MyCelium Phone NumBer ffdghf

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

Etoro Number

Etoro Phone number

Etoro Support Number

Etoro Support phone Number

1 note

·

View note

Text

How to Choose the Best Crypto Exchanges

It may be confusing to choose the best crypto exchange. You may be wondering which one will provide you with the highest number of digital assets, best security, and lower fees. These factors will determine which exchange will be the best for your needs. Here are some tips to choose the best cryptocurrency exchange. Keep in mind that there are many different options available on the market. However, you should choose the best exchange for your needs based on your own personal preferences.

First of all, look for regulatory status. You should make sure the exchange is regulated. There are some that are not, so check out the license. Check if they are registered with the SEC or FINRA. Other crypto exchanges that are registered with the SEC include eToro, Webull, and BTCC. Bybit is an unregulated exchange based in the British Virgin Islands. Regardless of the exchange you choose, make sure that it is regulated by the SEC.

If you are new to cryptocurrency investing, you may need some help. It's possible that you've never used a cryptic exchange before, so it's important to find one that offers free help and support. There are even websites dedicated to cryptocurrency investing that will answer all your questions. If you're new to this, you'll want to start with a platform that has a lot of experience with the process. You can find a good exchange by reading reviews but be aware that it may not be the best option for you.

Another thing to look for in a cryptic exchange is the fees they charge. The fees charged by each platform vary, but the best ones are those that charge the least. In some cases, you may not even need to trade much, so high fees don't matter. Also, some crypto exchanges don't accept US dollars, so you need to look for a site that doesn't charge you too much. The best exchanges also offer good customer support. A live chatbox is also a great feature.

To get started on crypto trading, you must deposit funds with a cryptocurrency exchange. Most exchanges accept fiat currency and USD. Some only allow certain currency pairs, so you may have to purchase Bitcoin first and then exchange it for another token. However, you can start small by putting $5 into your account. Once you've mastered the basics, you can then start investing in more expensive crypto currencies. This process may take some time, but it's worth the effort.

To start trading with cryptocurrency, you should sign up for an account. Most exchanges require an email address and verification of the address. Occasionally, they require a utility bill or copy of a utility bill. Some will also ask you to provide your phone number. Once you've completed the signup process, you should then deposit funds into your account. Once you have funds in your account, you can buy cryptocurrencies or other digital assets.

If you're looking for a cryptocurrency exchange in India, Kraken is probably the best choice for you. It offers tons of different coins to trade with and supports more than one hundred cryptos. However, this exchange does not allow residents of New York and Washington state. This is because it is a Japanese exchange, and thus, is restricted in what countries it will accept. However, its international status and high liquidity make it an excellent choice for traders in these states.

Gemini offers low trading fees and excellent security. It supports more than a hundred currencies, including more than twenty-crypto pairs, and offers educational resources. Unlike most of the other exchanges, Gemini is also regulated and can operate in all 50 states, so you won't have to worry about your safety and security. The best thing about this exchange is that it supports more than a hundred different crypto assets, including Bitcoin. It also offers competitive interest rates on assets, and a $10 BTC bonus for holding 100 dollars worth of crypto.

Coinbase is another great choice for those who are new to the crypto world. Although it is slightly expensive in some regions, it's the best choice for newbies. With a 70 million client base, Coinbase is also one of the best crypto exchanges for beginners. Coinbase allows instant purchases of cryptocurrency using a credit or debit card. They've been around since 2012, and their simple investment platform makes it a great choice for those just starting to trade crypto.

0 notes

Text

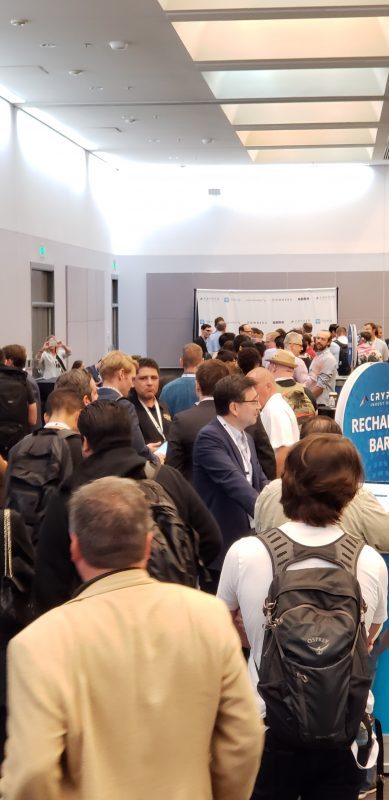

The 'Stache Invades Crypto Invest Summit; What I Saw & What You Missed!

All good conventions in LA begin about the same way, with sitting in traffic on the 110, 101, or the 405 at some point! This was, of course the case as I headed downtown Los Angeles to Crypto Invest Summit at the LA Convention Center. If you follow my journey here you know that I have been writing about all the things I was excited to see and do at this falls event and I was not disappointed. Check out all the trouble I got into at CIS and day-by-day review of the event and keynote speakers!

Crypto Invest Summit Double Top Pattern Emerges

As I wrote in previous articles, I was super excited about hearing both Steve Wozniak as well as Tim Draper speak at the event and I found both of them inspirational & motivating in very different ways. Each day of the summit kicked off with one of these major keynotes and it really set the pace. I JUST about missed the start of the Woz speaking, but managed to get my badge and get in there quicker than I anticipated. Here is how Day 1 at CIS went.

CIS Day 1

I got my media pass quickly thanks to the amazing staff at CIS and headed into the expanded main hall (it was much bigger this year than last year). I got there just in time to see Adam Draper finish his opening remarks with event co-founder Alon Goren. Adam has a style all his own compared his father Tim and I enjoyed hear the tail end of what he had to say about the future of crypto and predicting that in the next few years you will have 3 apps on your phone that use blockchain and you won't even know it.

Steve Wozniak came out next and was being interviewed by my buddy David Bleznak of Totle who always kills it on stage. When you talk about tech legends they don't get much bigger than Steve and hearing him recant the beginnings of his career and correlating them to current conditions with crypto as an emerging market was fun. Steve tends to go off on a few tangents from time to time which I actually enjoyed even if it didn't really answer the question presented. The spark that you see in other "crypto people" you can hear in Steve's voice as he talks broadly about the subject, claiming he sold all his Bitcoin and only retains 1 for testing purposes.

Network Hokey Pokey At CIS

After Steve speaking I headed over to the booth floor and started mingling with people and projects. I first ran into my friends over at Blockchain Beach who had a media booth and were on fire with the number of interviews they were pushing through. They even roped me into doing an interview for them with a project that was overbooked and I had a lot of fun helping out!

Shortly after that I finally got to meet CryptoBeadles of my youtube buddies who also produces great crypto content as well as co-founding the Monarch wallet (which I will be reviewing very soon). He had the whole crew out there with him doing interviews on site as well and I had a blast hanging with them at the booth throughout the day. I headed inside to check out the booths, but I could hardly make it a few feet without running into someone I knew! One of the things I love about going to these cons is talking with everyone. I got to do an interview with my buddy Gaston for Blockchain Beach as well with a quick appearance by Ernesto from Crypto Space San Pedro.

I ran into the infamous Kenn Bosak and of course we had to get a pic of the epic meeting! This guy is a crypto warrior, spreading adoption everywhere he goes. Talking with him, he said he is on pace to hit 50 conferences this year! wow!

When you go to these things a few times you do start to see a lot of the same people which makes it fun and what conference would be complete with out a little Brekkie Von Bitcoin? We had multiple Satoshi Droppers in the house including Andy & Daniel from the Coinboys, BitcoinBella and CryptoWendyO on Day 2. I certainly made a lot of new friends on the day and saw a ton of other people like Crypto Rick here below.

Favorite Booths

I make a point to talk to just about every booth at the conference since there are 2 days and you can easily do so with the amount of booths there depending on how many speakers you catch.

My overall favorite has to go to the Abra booth as they had a great looking setup, but they best thing? They were giving you $25 in Bitcoin for downloading their mobile crypto wallet right there on the spot! Epic! They had this screen counting down to how much of the free Bitcoin was left. I would have loved to see it counting down in Satoshis, but still really cool.

I had fun at the Sense chat booth too as well as got to do a quick interview for them (Brekkie did one too!). Sense is a decentralized messaging app. They had one of those fun wheels and my first spin landed on a CryptoKitty, but they were out, so I ended up getting an invite to Taco Tuesday at their office sometime soon along with a sweet hat.

I talked to Matthew at Kingsland School of Blockchain and I really liked what they are trying to do with training blockchain engineers and helping make the end connection. Since this is right up my alley I wanted to let them know I supported their cause and would love to help out if I could in any way.

The IDEX / Aurora crew was also at the summit and I got to talk to them a bit about the recent decision to stop allowing New York customers use their platform. They have a solid team and I think with a hybrid solution this makes a lot of sense legal wise to be cautious of where you operate.

Of course Totle is always on the top of my list and the Title sponsor of the event did not disappoint with David, Jordan, and the rest of the team help many learn how to improve their DEX experience by using the Totle software.

Rounding out the list is the Autonomy chain project that had a cool autonomous car prototype there showing you how the scanner works. The folks over at Crypto Poker Exchange have a very clean and fun looking blockchain poker, and I HAD to include ODB coin (named after the late, great Old Dirty Bastard of Wu Tang) who are making coins for individual music artist.

Day 2 At CIS

As I walked into day two at Crypto Invest Summit bright and early, there was CryptoWendyO already doing interviews at the Blockchain Beach booth, so I said hi real quick and headed over to the main hall to hear legendary investor Tim Draper speak.

When it comes to crypto Tim knows his stuff a little better than The Woz does and I really love how excited he gets over how it can change our future. This is a guy who lost his BTC in the Mt. Gox crash and then doubled down and went in again because he believes in it that much. We kicked the morning off with some jumping jacks at Tim's request and then Alon settled in and they dove in. I think when we see well known and respected men like Tim & Steve giving crypto their seal of approval it really means we are headed in the right direction of mass adoption in my opinion.

Directly after the great keynote by Tim, Ran Neu-Ner the host of CNBC's "Crypto Trader" show did a live taping and had Tim on as the first guest along with a few other great guests. It was cool to see them hustle to pull this off completely unscripted! I will say one of the highlights was this really funny eToro commercial featuring a Game of Thrones kinda theme!

https://youtu.be/Ihd0moB0ehM

I cut out a bit early before the taping ended to get in the VERY long time to get a free copy of Tim Draper's new book "How To Be The Startup Hero" signed by the man himself.

They had a huge pile of books to give away to everyone at the summit, but damn was that line long! I waited about an hour and thirty minutes but it was worth it to get a personalized copy of the book and this great selfie with Tim!

I hung out for a little while longer at the convention talking with people and projects and I was even surprised by my buddy Arnold with these amazing mustache shaped cuff links that he gave me! How amazing are the people I continue to meet in this crazy crypto world?!?

After such a great conference I am really looking forward to the next one, but until then...

'Stache That Crypto Friends!

Read the full article

1 note

·

View note

Text

How to Start Investing in Crypto? (Beginners Guide)

Cryptocurrency investing is the new financial trend that promises a lot, but will it actually deliver? Well, to find out we have to dig a bit deeper and find out more about the concept of investing in crypto.

What are Cryptocurrencies?

Cryptocurrency is a new technology built on the blockchain. Even though they are addressed as crypto-currencies, they are considered digital assets that have some kind of value. They work independently of the banks as a record of digital transactions.

The main thing you should know is that cryptocurrencies allow us to transact business directly with each other as buyers or sellers, without the need of a middleman, such as a bank. Without the middleman, you can eliminate the transaction fees.

Things to Consider before Investing in Crypto

The number one cryptocurrency is Bitcoin. Bitcoin first came out in the market in 2009. Since then a lot more cryptocurrencies have flooded the market. Some see cryptocurrencies as a new worldwide global currency that will replace fiat money.

If you are not familiar with cryptocurrencies and you have just started to learn about them the first thing you should have in mind is that crypto investing can be pretty hard. Although, if you play smart and make thorough research before investing it can be really rewarding.

Here are something you must consider before getting into action:

Don’t put money that you can afford to lose

Establish thorough research of the crypto market before you start investing

Know the reason why you are investing

Always double-check everything, because there are a lot of scammers in this business

There is no need to buy a whole coin – you can buy only small pieces of the coins

Bonus tip: Make sure to check out the best ways to invest in yourself.

How does crypto go up in value?

Source: Getty Images

These are the most important factors that influence the value of cryptocurrencies.

Supply and demand – The value of cryptocurrencies comes from the people. People who buy a cryptocurrency for a certain amount of money. The larger the amount of transactions is, the higher will be the value of the cryptocurrencies. There must be high demand for people who want to buy them in order to increase the value.

Cost of production and power usage – Mining and developing cryptocurrencies is not easy. It requires a lot of money and a lot of power consumption.

Usability – For crypto to go up in value people must trade with them every day. It is not enough just to buy them.

Investors – Investors have a key role in the value of cryptocurrencies. They spend a lot of money and buy a large number of cryptocurrencies. Automatically the value goes up.

Community – Cryptocurrencies must be attractive and interesting for people to buy them. They should support the cryptocurrency and promote them on regular basis.

Steps-by-Step Investing in Crypto

If you want to go to a local bank or some kind of financial institution, or brokerage firm to buy cryptocurrencies the answer is – you can’t. Because the process of buying crypto is doesn’t have any regulations and is not understood in financial institutions they choose to not work with them.

Find an Exchange

You should choose wisely before choosing a platform for buying cryptocurrencies. Because you can’t go to your local bank to buy them the choice for buying them is limited. These are the best places where you can buy and exchange cryptocurrencies.

eToro – Probably the most advanced and sophisticated platform of all. It is safe and offers one-of-a-kind investment options (Copy Trader technology).

Coinbase – It started almost ten years ago as a platform where you can trade with Bitcoin. Since then you can use Coinbase to safely trade with multiple cryptocurrencies.

Gemini – With Gemini, you can trade with cryptocurrencies but also can store them in your own digital wallet.

Unifimoney – Unifimoney is a great app to use. You can trade and store more than 30 cryptocurrencies. They also provide you with banking services.

Binance US – This is the parent company of Biance. It has the cheapest trading fees from all of the other exchange platforms. The only disadvantage is that there aren’t many trading pairs between different cryptocurrencies.

Robinhood: A broker to consider – Robinhood doesn’t charge you any commissions. With Robinhood, you can buy cryptocurrencies (Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, and Dogecoin) with no commission.

Wealthfront – With wealthfront you can expose (with Grayscale Bitcoin Trust and Grayscale Ethereum Trust) cryptocurrencies without actually buying them.

Create an account

To create an account for cryptocurrencies is fairly easy. To set up your account you just need to have time and patience. These are the required information you need to set up your account on the crypto platforms:

Your full, legal name

Your date of birth

Your email address

Your phone number

Your home address

At least one copy of some utility bill to the address you will write

Your social security number

Your ID, passport, or your driver license

A picture of you together with your ID

To write down why do you want to invest in crypto

Deposit money

Before start investing in crypto, you must first decide how much money you want to spend. Have in mind a couple of things before you deposit money:

Investing in cryptocurrencies is different than investing in stocks

Investing in cryptocurrencies doesn’t pay you interest rate or dividends

They are meant to be an alternative currency and not investments

Bear in mind that some crypto exchanges have fees for depositing and withdrawing money, so make sure you read the Terms and Conditions before investing.

Choose a crypto storage

There are several types of crypto storage wallets that you can choose from. The choice is yours.

Desktop wallets – They are installed on your personal computer and because of that they are safer than online wallets because. The best one for desktop users is Exodus.

Online wallets – They are easier to use but less safe than desktop wallets. The information is saved on the cloud and can be opened from any computer. The best one for online users is Trezor Model T.

Mobile wallets – This type of wallet is an app that you can install on your smart device. The best one for mobile users is Mycelium.

Hardware wallets – With hardware wallets, you can keep your private key in a hardware device, like a USB drive for example. They are safer than online wallets because the key is not stored online and only you have access to it. The best one for hardware users is Ledger Nano X.

We hope that by reading this article you will have more insight into cryptocurrencies and how do they work.

So, don’t waste any more time and go out and make your first purchase, but before you do make sure that you made enough research and remember that patience is the key in these kinds of investments.

The post How to Start Investing in Crypto? (Beginners Guide) appeared first on Business Border.

from WordPress https://ift.tt/3DgHxar

via IFTTT

0 notes

Text

How to Buy Bitcoin in New Zealand Now (Ultimate NZ Guide)

Best Sites to Buy Bitcoin in NZ

eToro

Easy account opening

Market-leading social trading

Free stock trading

Buy Bitcoin Now –>

67% of retail CFD accounts lose money

Coinbase

Easy account opening

Secure

Very popular exchange

Buy Bitcoin Now –>

Your capital might be at risk!

eToro

Demo Account: Yes

Min. deposit: $100

Trading Platforms: Desktop, Web & Mobile

Assets: Forex, Crypto, Stocks & Commodities

Market-leading social trading

Available for US citizens

Free stock and ETF trading

Easy account opening

Visit eToro

67% of retail CFD accounts lose money

Read Review

Coinbase

Easy account opening

Secure

Great pricing

Easy to use phone app

Well-known brand

Great customer service

Offers advanced trading through Coinbase Pro

Visit Coinbase

Like any other country across the world, New Zealand has experienced a rise in interest in cryptocurrency. With more people jumping onto the cryptocurrency bandwagon, it’s essential to know which channels to follow to buy Bitcoin safely.

This article is the ultimate guide on how to buy Bitcoin in New Zealand in 2021 and explains facts you should know before buying Bitcoin.

Is Bitcoin (BTC) Trading Legal in New Zealand?

There’s currently no specific law regulating Bitcoin trading in New Zealand. Therefore, it’s safe to say that Bitcoin trading is legal in New Zealand. However, due to the sparse regulations in this sector, it’s difficult to get legal help if something goes wrong.

The Financial Market Authority (FMA) in New Zealand warns New Zealanders of the potentially significant losses that come with trading Bitcoin and other cryptocurrencies and the frauds associated with the cryptocurrency investments.

Bitcoin & Crypto Trading in New Zealand

With the free Bitcoin trading environment in New Zealand, investors have a chance to buy, sell, hold, and use their Bitcoin as they please. More people are choosing to invest in Bitcoin and cryptocurrencies.

As the demand for Bitcoin increases among New Zealanders, there has been a rise in the number of crypto exchanges and marketplaces for trading Bitcoin.

Investors can buy and sell Bitcoin in multiple places like exchanges, P2P marketplaces, over-the-counter brokers, and other private trades.

19 Ways to Make Money with Bitcoin

(Ultimate Guide)

Most of these platforms are local and offer services locally to NZ investors. The boundaries are open to international Bitcoin trading platforms, and many people are embracing their services.

Further, in this article, we’ll mention some places we think are the best platforms for you to buy Bitcoin in New Zealand.

How to Buy Bitcoin in NZ (Step-by-step)

This guide highlights eToro as a leading cryptocurrency exchange globally, with excellent features and top-tier security systems for safe trading. Even though it offers other services like CFD trading, eToro New Zealand allows investors to trade cryptocurrencies only.

Upon signing up, eToro will provide you with a secure cryptocurrency wallet where you can safely store your Bitcoin as you hold or trade them. It has a simple, user-friendly interface that makes trading easy for both experienced and new traders.

Here’s a step-by-step guide when buying Bitcoin on eToro.

Step 1 – Sign up with eToro.

The sign-up process is seamless. On eToro’s official website, find the “Get Started” button and click on it. Fill in the application form with your correct details and agree to the policies and conditions. You can also choose to sign up through your Facebook or Google Account.

Sign Up Here –>

As you sign up, you’ll be required to verify your identity as part of KYC requirements and in compliance with the government’s financial regulations.

The verification process is easy and will need you to upload a picture of a government-issued ID card or driver’s license and a copy of a utility bill document or financial statement showing your address.

How to Open an eToro Account

Step 2 – Deposit funds

eToro supports several payment methods which you can use to deposit funds into your eToro account. It accepts traditional methods like bank transfers and cards and online wallets like WebMoney, Neteller, Skrill, and PayPal.

To deposit funds, find the “Fund Your Account” section on your account and click on it. Select the amount, currency, and your preferred payment method and proceed. Most of the deposit methods process the funds immediately, and they appear on your account instantly.

eToro accepts $200 as the minimum deposit for all accounts.

Step 3 – Buy BTC Safely & Easily

eToro hosts up to 15 top cryptocurrencies, with Bitcoin leading the list. To buy Bitcoin, click on “Trade Markets” on your dashboard and choose Bitcoin. Click on “Trade” and specify the amount of BTC you want to buy in NZD.

You can customize other settings like ‘Stop Loss’ and ‘Take Profit’ for the trade, even though this step is not compulsory. After everything is set, click on “Open Trade,” and you’ll have initiated a transaction to buy your first Bitcoin.

youtube

Regulation of Bitcoin in New Zealand

According to a report published in September 2018 on the cryptocurrency regulations, New Zealand has not passed any laws regulating cryptocurrencies. However, some existing laws regulate cryptocurrencies to counter-terrorism and money laundering activities, impose taxes, and protect investors.

In October 2017, the FMA announced and published a guide for Initial Coin Offerings (ICOs) and cryptocurrencies to facilitate responsible innovation and ensure flexibility in the financial market.

The guidance requires all entities that offer cryptocurrency-related financial services to comply with the FMC Act (2013) ‘fair dealing’ requirements.

For the entity to provide services to New Zealanders, it must be compliant with the Financial Service Providers Act of 2008 and be present in the Financial Service Providers Register.

On ICOs, the guidance indicates that ICOs are considered a financial service that operates value transfer service, and tokens can be acquired using legal tenders like the NZ Dollar and thus subject to the FMC Act.

On anti-money laundering requirements, there’s neither guidance nor legislation from the government of FMA that refers specifically to cryptocurrencies.

However, some of the crypto exchanges are registered as reporting entities to the Department of Internal Affairs (DIA) on anti-money laundering (AML) and Counter-financing terrorism (CFT).

Cryptocurrencies are subject to taxation in New Zealand in different scenarios. Even though there are no cryptocurrency-specific laws on taxation, existing ordinary taxation laws apply. For example:

Suppose a business accepts payment in the form of cryptocurrency. In that case, it is liable to pay an income tax as per the law, and the amount depends on the value of the cryptocurrency in NZD at the time of transaction.

If a person buys cryptocurrency for disposal, any realized profits or losses from selling it will attract a tax and must be recorded.

Any cryptocurrency gained from mining is also taxed as mining is considered a profit-making activity.

Best Bitcoin Exchanges in New Zealand

As promised earlier, we consider two Bitcoin exchanges as the best places to buy Bitcoin in New Zealand. They are eToro.com and Coinbase.com.

eToro

As a leading cryptocurrency exchange globally, this Israeli-based company has established itself in New Zealand and gained a large client base. In New Zealand, eToro is limited to trading cryptocurrencies only because of country restrictions.

Visit eToro

Here are some of the reasons why many investors love it:

It supports up to 15 world top cryptocurrencies.

It supports cryptoNZD pairs—for example, BTCNZD.

It offers low trading costs and fixed spreads.

There are hundreds of in-built technical charts for analysis and market study.

Investors enjoy social trading features that are not available on other brokers.

You can conveniently trade using a fast and user-friendly mobile trading app.

Coinbase

Coinbase is the best choice for first-time cryptocurrency investors because of its simple interface and the easy Bitcoin-buying process. Having extended its reach to New Zealand, the USA-based broker stands as one of the most preferred Bitcoin exchanges by many investors.

Visit Coinbase

Here are some of the reasons why:

It’s an excellent platform for new cryptocurrency buyers.

It hosts up to 40 popular cryptocurrencies worldwide.

It offers excellent customer service.

It has employed tight security features like 2-factor authentication to protect client’s funds.

The Price of Bitcoin in New Zealand

BTCNZD Chart by TradingView

new TradingView.widget( { "width": 700, "height": 436, "symbol": "CAPITALCOM:BTCNZD", "interval": "D", "timezone": "Etc/UTC", "theme": "light", "style": "1", "locale": "en", "toolbar_bg": "#f1f3f6", "enable_publishing": false, "allow_symbol_change": true, "container_id": "tradingview_3c703" } );

At the time of this writing, the price of Bitcoin in New Zealand Dollars (NZD) is as follows.

1 Bitcoin equals 89,518.12 New Zealand Dollar.

Due to the high volatility associated with the cryptocurrency market, the price of Bitcoin keeps changing. Please check for the current price.

Cryptocurrency Scams in New Zealand

The unregulated nature of Bitcoin trading and exchanges in New Zealand predisposes investors to cryptocurrency scams. Recent reports have shown a rise in the number of people getting scammed every day.

Earlier, most scams were orchestrated in the form of Ponzi schemes, but now people are alert when they encounter such. Therefore, scammers are now coming up with new tactics and tricks to lure unsuspecting investors and get away with their money.

One of such incidences is Bruce Harding’s experience, an enthusiastic Bitcoin investor in New Zealand. According to his narrative, the scammer contacted him on Instagram and talked about investments on ExpresscoinFX.com, where they can make huge profits fast.

The scammer showed him proof of potential earnings and profits skyrocketing to $5000 within few days. Another one had made $1500 in two days from a deposit of $200. Enticed and happy, Harding signed up to the account and deposited $1500.

As expected, his profits began to grow. But when he sent a withdrawal request, he was asked to pay $2500 before the payment is made. The money was never released, and they cut off communication with him.

Many other people have fallen prey to such tricks from cunning scammers, so the FMA warns cryptocurrency investors to be careful as they are hacking and fraud targets.

As an investor, you can protect yourself by:

Keeping your private key safe and uncompromised.

Investigating any platform offering cryptocurrency services before committing your money to it.

Avoiding any suspicious emails and sign-ins which can give scammers access to your wallets.

Bitcoin Mining in New Zealand

Bitcoin mining is an innovative way to earn Bitcoin. However, it may be an impractical exercise in New Zealand because of the high electricity costs and the low-profit margins.

As time goes by and the value of Bitcoin increases, even the difficulty in mining the Bitcoin and the expenses that accompany the process also continues to rise.

Investors interested in mining Bitcoin invest heavily in acquiring and maintaining Bitcoin mining machinery and incur electricity costs during mining. When total investment is weighed against the expected returns, profit margins are too low or negative.

Since many coins are choosing the proof-of-stake mining method, many investors now prefer to mine other coins and convert them to Bitcoin. It’s a time-saving method, and the profits earned are higher compared to mining Bitcoin directly.

Bitcoin Popularity in New Zealand

Even with its ‘buyers beware’ state in New Zealand because of no regulations, it’s evident that Bitcoin has taken center stage and gone into the mainstream as more people invest in it.

The ease of transacting business using Bitcoin has encouraged more people to adopt it as a payment method for goods and services. In 2019, a report published in the Financial Times indicated that New Zealand had allowed companies to pay their employees using their preferred cryptocurrencies.

In this way, Pay-As-You-Earn tax is easily imposed on the salaries paid through cryptocurrencies as long as it is pegged to the fiat currency. These payments are subject to employer agreement and other terms, but it’s a great move to promote the mainstream adoption of cryptocurrencies in the country.

A surge in the number of new investors is expected as renowned institutions invest in Bitcoin.

A recent development highlights the New Zealand Fund Management, which publicly announced its investment in Bitcoin. At the end of 2020, the institution had assets worth $350 million, of which 5% is invested in Bitcoin.

New Zealanders have access to the best Bitcoin exchanges from across the world so they can trade Bitcoin safely and on the best platforms. The FMA constantly reminds Bitcoin buyers to be careful in their investments as the cryptocurrency market is prone to scams and online fraud.

Before buying Bitcoin from any exchange, ensure that the exchange:

Is in the Financial Service Providers Register.

Is part of the dispute resolution scheme

Segregates your funds and stores them safely in a trust account.

Where Can I Use Bitcoin in New Zealand?

There are several places you can use Bitcoin in New Zealand. Most of these businesses are online, but there are also physical businesses that are accepting Bitcoin. The list is long and continues to grow daily.

In this article, we’ll mention some of these places, and you can check them out.

They include CoinCompass, XT88, Mangawhai Osteopathy, Hyperion Wines, Jmafi, MyGold, Aurum, Oyster & Chop, Mega, WebSope, GoWeb NZ, 3D Hub, Electroluxvacuums, Cerebral Palsy Society NZ, TreeFellas, MrPipes, The Battery Clinic, Bookabach, Beach Surf School, Chris Meek, Ipurangi Limited, Matrix Typography, Mane Salon, KUSKE, INSTYLING, Abalone Thai, Pyramid Valley Vineyards, and many others.

Even with many places to spend Bitcoin, many investors prefer to buy and hold like they’d do other securities and then sell later when the price has gone higher. If the history is anything to go by, the price of Bitcoin today is over 1000 times its price in its early days, and it’s expected to continue going high.

Bitcoin ATMs in New Zealand

According to coinatmradar.com, there is presently no Bitcoin ATM in New Zealand. In 2014, Bitcoin Central launched a Bitcoin ATM in New Zealand at the Ironbar Café in Auckland to serve New Zealand investors.

It would operate in two ways as investors could buy and sell Bitcoin for NZD safely as Robocoin made the machine with multi-layer security to keep the transactions safe. However, these services did not last long as the company had to shut down its operations in 2018.

In an announcement made on the company’s official website, the CEO lamented the negativity facing Bitcoin in the area, which made it difficult to access proper banking facilities to keep the ATM running.

Must-Know Facts to Know Before Buying Bitcoin

There are a lot of speculations about Bitcoin, with good reason. Some think it’s a well-orchestrated Ponzi scheme waiting to crash in an instant, while others think it’s the digital form of gold, and so they go for it.

Far from the speculations, here are some facts about Bitcoin.

Bitcoin is one of the most volatile assets in the financial space. Its price can skyrocket within hours and drop just as fast. If you’re planning to invest in Bitcoin, you should be aware of this and work on your timing because whether you make a profit or a loss will depend on your timing.

Bitcoin is not anonymous, as many people tend to believe. The buyer and seller’s identity is not public, but the details of the transaction are stored in a public ledger called the blockchain.

Bitcoin is usable as a payment method, and some governments impose a tax on profits generated from Bitcoin used within the country. This depends on the set regulations in the country. Before buying Bitcoin, it’s important to familiarize yourself with such requirements depending on the country you live in.

Bitcoin is for everyone because, as a digital currency, it’s not controlled by anyone or limited to a specific group of people. As much as you can buy Bitcoin from anywhere in the world, you can also participate in the mining process.

youtube

How to Buy Bitcoin New Zealand – Best New Zealand Bitcoin Exchange 2020 Guide

FAQ

Where to buy Bitcoin in New Zealand?

eToro and Coinbase.

How do I buy Bitcoin in New Zealand?

On these two providers (eToro and Coinbase), you can purchase your Bitcoin through bank wire, debit/credit card, PayPal, Neteller, Skrill, RapidTransfer, Klarna, and several others.

How do I store my private key?

If you purchase Bitcoin or Cryptocurrency through the providers discussed in this article, they’ll store the private key for you safely.

Summary - Where to Buy Bitcoin in the New Zealand Instantly

eToro

Great platform for trading

Easy to use

Buy Bitcoin Here –>

67% of retail CFD accounts lose money

Coinbase

Best crypto wallet

Quick sign up process

Buy Bitcoin Here –>

Your capital might be at risk!

Other Bitcoin buying guides:

How to Buy Bitcoin in the UK Instantly

(in 2021)

How to Buy Bitcoin in South Africa Instantly (in 2021)

How to Buy Bitcoin and Other Cryptocurrencies (Safely and Easily)

The post How to Buy Bitcoin in New Zealand Now (Ultimate NZ Guide) appeared first on TradingGator.

source https://www.tradinggator.com/how-to-buy-bitcoin-in-new-zealand/

0 notes

Text

eToro Launches GoodDollar and Leverages Yield Farming and Staking to Deliver a Sustainable Global Basic Income

September 8, 2020 — Multi-asset investment platform, eToro, is excited to announce that it has launched GoodDollar: a non-profit initiative that leverages decentralized finance to offer a protocol for distributed basic income. First proposed at Web Summit 2018, the concept has since advanced into a working economic model, wallet, and digital basic income coin that was launched this week.

The launch of GoodDollar means that anyone with an internet connection and phone number can receive its native crypto asset, G$, store it in the GoodDollar wallet, and transact. A pool of G$ is given away daily to users, who can use the digital asset to facilitate barter and trade locally and globally.

GoodDollar presents a sustainable, financially inclusive use case that uses new products such as staking and yield-farming, which have driven the $15 billion market cap boom across decentralized finance in recent weeks. Through staking in protocols such as Compound, AAVE, DMM, and others, GoodDollar supporters earn a yield-payout while also funding GoodDollar’s G$ basic income coin. GoodDollar G$ is backed by a monetary reserve of crypto assets: its value is derived from the interest generated by third-party permissionless protocols. Through the amassed reserve interest, G$ coins are minted: individual and corporate supporters receive market-rate yield-payouts in G$, and a daily amount is set aside to be distributed as basic income. At launch, DAI is the first supported crypto asset in GoodDollar’s monetary reserve, and Compound is the first integrated protocol.

“For years we have heard the hype about blockchain’s ability to deliver on financial inclusion, yet most of the gains in the crypto market continue to benefit a small set of savvy and connected users. GoodDollar wants to close this gap by offering every person easy access to basic digital assets,” says GoodDollar founder, Yoni Assia. “Now anyone with an internet connection can have their own digital wallet to hold and use crypto assets. We hope GoodDollar will serve the next 100 million crypto users, through freely distributing a new form of internet money that can be used to generate economic activity. And just as importantly, GoodDollar offers crypto holders an opportunity to do good with their crypto: yield-farming via GoodDollar means that you can do well for yourself while doing good for others, and unites the interests of capital holders and basic income recipients.”

In the wake of the coronavirus outbreak, based on a recent study, 71% of Europeans now support some form of basic income and more than 20 nations are exploring UBI as a key policy proposal. By utilizing the tools of blockchain and decentralized finance, GoodDollar turns the UBI concept into reality, launching a ‘trickle-up’ value structure that delivers purchasing power directly to the hands of people, and is transparent and fair.

GoodDollar’s launch includes the release of the G$ token and wallet, a simple application where users ‘claim’ their G$ daily. With social log-in features and a non-KYC verification process, the wallet is designed to place money in the hands of those who need it most. In the days since release, thousands of GoodDollar wallets have already been created by users from over 40 countries, including South Africa, Nigeria, Ghana, Kenya, Senegal, Argentina, and Venezuela.

The next phase of GoodDollar’s development will introduce referral bonuses for users who share and promote the network, features to enable individual and corporate staking, integrations with new protocols, and expanded tools to facilitate trade, barter, and merchant partnerships.

About GoodDollar

GoodDollar is a people-powered framework to generate, finance, and distribute global basic income via the GoodDollar token (G$). Its goal is to provide a baseline standard of living and reduce wealth inequality through the creation of a universal basic income. The project was founded by Yoni Assia, the Co-founder, and CEO of eToro, the global investment platform with over 14 million registered users, and based on his theory of social money first presented in 2008. eToro has financed the GoodDollar project as part of its corporate social responsibility initiatives.

About eToro

eToro was founded in 2007 with the vision of opening up global markets so that everyone can invest in a simple and transparent way. The eToro platform enables people to invest in the assets they want, from stocks and commodities to crypto assets. Its global community of more than 14 million registered users can share their investment strategies and anyone can emulate the most successful traders. Due to the simplicity of the platform, users can easily buy, hold and sell assets, monitor their portfolio in real-time, and transact whenever they want.

Media contact

Anna Stone

Marketing & Partnerships

from Cryptocracken Tumblr https://ift.tt/2GZ4xSA

via IFTTT

0 notes

Text

eToro Launches GoodDollar and Leverages Yield Farming and Staking to Begin Delivering a Sustainable Global Basic Income

Multi-asset investment platform, eToro, is excited to announce that it has launched GoodDollar: a non-profit initiative that leverages decentralized finance to offer a protocol for distributed basic income. First proposed at Web Summit 2018, the concept has since advanced into a working economic model, wallet, and digital basic income coin that was launched this week.

The launch of GoodDollar means that anyone with an internet connection and phone number can receive its native cryptoasset, G$, store it in the GoodDollar wallet, and transact. A pool of G$ is given away daily to users, who can use the digital asset to facilitate barter and trade locally and globally.

GoodDollar presents a sustainable, financially inclusive use case that uses new products such as staking and yield-farming, which have driven the $15 billion market cap boom across decentralized finance in recent weeks. Through staking in protocols such as Compound, AAVE, DMM, and others, GoodDollar supporters earn a yield-payout while also funding GoodDollar’s G$ basic income coin. GoodDollar G$ is backed by a monetary reserve of cryptoassets: its value is derived from the interest generated by third-party permissionless protocols. Through the amassed reserve interest, G$ coins are minted: individual and corporate supporters receive market-rate yield-payouts in G$, and a daily amount is set aside to be distributed as basic income. At launch, DAI is the first supported cryptoasset in GoodDollar’s monetary reserve, and Compound is the first integrated protocol.

“For years we have heard the hype about blockchain’s ability to deliver on financial inclusion, yet most of the gains in the crypto market continue to benefit a small set of savvy and connected users. GoodDollar wants to close this gap by offering every person easy access to basic digital assets,” says GoodDollar founder, Yoni Assia. “Now anyone with an internet connection can have their own digital wallet to hold and use crypto assets. We hope GoodDollar will serve the next 100 million crypto users, through freely distributing a new form of internet money that can be used to generate economic activity. And just as importantly, GoodDollar offers crypto holders an opportunity to do good with their crypto: yield-farming via GoodDollar means that you can do well for yourself while doing good for others, and unites the interests of capital holders and basic income recipients.”

In the wake of the coronavirus outbreak, based on recent study, 71% of Europeans now support some form of basic income and more than 20 nations are exploring UBI as a key policy proposal. By utilizing the tools of blockchain and decentralized finance, GoodDollar turns the UBI concept into reality, launching a ‘trickle-up’ value structure that delivers purchasing power directly to the hands of people, and is transparent and fair.

GoodDollar’s launch includes the release of the G$ token and wallet, a simple application where users ‘claim’ their G$ daily. With social log-in features and a non-KYC verification process, the wallet is designed to place money in the hands of those who need it most. In the days since release, thousands of GoodDollar wallets have already been created by users from over 40 countries, including: South Africa, Nigeria, Ghana, Kenya, Senegal, Argentina, and Venezuela.

The next phase of GoodDollar’s development will introduce referral bonuses for users who share and promote the network, features to enable individual and corporate staking, integrations with new protocols, and expanded tools to facilitate trade, barter, and merchant partnerships.

About GoodDollar

GoodDollar is a people-powered framework to generate, finance, and distribute global basic income via the GoodDollar token (G$). Its goal is to provide a baseline standard of living and reduce wealth inequality through the creation of a universal basic income. The project was founded by Yoni Assia, the Co-founder and CEO of eToro, the global investment platform with over 14 million registered users, and based on his theory of social money first presented in 2008. eToro has financed the GoodDollar project as part of its corporate social responsibility initiatives.

About eToro

eToro was founded in 2007 with the vision of opening up global markets so that everyone can invest in a simple and transparent way. The eToro platform enables people to invest in the assets they want, from stocks and commodities to cryptoassets. Its global community of more than 14 million registered users can share their investment strategies and anyone can emulate the most successful traders. Due to the simplicity of the platform, users can easily buy, hold and sell assets, monitor their portfolio in real time, and transact whenever they want.

Media contact

Anna Stone

Marketing & Partnerships

[email protected]

from Cryptocracken WP https://ift.tt/2E03u3G

via IFTTT

0 notes

Text

eToro Launches GoodDollar and Leverages Yield Farming and Staking to Begin Delivering a Sustainable Global Basic Income

Multi-asset investment platform, eToro, is excited to announce that it has launched GoodDollar: a non-profit initiative that leverages decentralized finance to offer a protocol for distributed basic income. First proposed at Web Summit 2018, the concept has since advanced into a working economic model, wallet, and digital basic income coin that was launched this week.

The launch of GoodDollar means that anyone with an internet connection and phone number can receive its native cryptoasset, G$, store it in the GoodDollar wallet, and transact. A pool of G$ is given away daily to users, who can use the digital asset to facilitate barter and trade locally and globally.

GoodDollar presents a sustainable, financially inclusive use case that uses new products such as staking and yield-farming, which have driven the $15 billion market cap boom across decentralized finance in recent weeks. Through staking in protocols such as Compound, AAVE, DMM, and others, GoodDollar supporters earn a yield-payout while also funding GoodDollar’s G$ basic income coin. GoodDollar G$ is backed by a monetary reserve of cryptoassets: its value is derived from the interest generated by third-party permissionless protocols. Through the amassed reserve interest, G$ coins are minted: individual and corporate supporters receive market-rate yield-payouts in G$, and a daily amount is set aside to be distributed as basic income. At launch, DAI is the first supported cryptoasset in GoodDollar’s monetary reserve, and Compound is the first integrated protocol.

“For years we have heard the hype about blockchain’s ability to deliver on financial inclusion, yet most of the gains in the crypto market continue to benefit a small set of savvy and connected users. GoodDollar wants to close this gap by offering every person easy access to basic digital assets,” says GoodDollar founder, Yoni Assia. “Now anyone with an internet connection can have their own digital wallet to hold and use crypto assets. We hope GoodDollar will serve the next 100 million crypto users, through freely distributing a new form of internet money that can be used to generate economic activity. And just as importantly, GoodDollar offers crypto holders an opportunity to do good with their crypto: yield-farming via GoodDollar means that you can do well for yourself while doing good for others, and unites the interests of capital holders and basic income recipients.”

In the wake of the coronavirus outbreak, based on recent study, 71% of Europeans now support some form of basic income and more than 20 nations are exploring UBI as a key policy proposal. By utilizing the tools of blockchain and decentralized finance, GoodDollar turns the UBI concept into reality, launching a ‘trickle-up’ value structure that delivers purchasing power directly to the hands of people, and is transparent and fair.

GoodDollar’s launch includes the release of the G$ token and wallet, a simple application where users ‘claim’ their G$ daily. With social log-in features and a non-KYC verification process, the wallet is designed to place money in the hands of those who need it most. In the days since release, thousands of GoodDollar wallets have already been created by users from over 40 countries, including: South Africa, Nigeria, Ghana, Kenya, Senegal, Argentina, and Venezuela.

The next phase of GoodDollar’s development will introduce referral bonuses for users who share and promote the network, features to enable individual and corporate staking, integrations with new protocols, and expanded tools to facilitate trade, barter, and merchant partnerships.

About GoodDollar

GoodDollar is a people-powered framework to generate, finance, and distribute global basic income via the GoodDollar token (G$). Its goal is to provide a baseline standard of living and reduce wealth inequality through the creation of a universal basic income. The project was founded by Yoni Assia, the Co-founder and CEO of eToro, the global investment platform with over 14 million registered users, and based on his theory of social money first presented in 2008. eToro has financed the GoodDollar project as part of its corporate social responsibility initiatives.

About eToro

eToro was founded in 2007 with the vision of opening up global markets so that everyone can invest in a simple and transparent way. The eToro platform enables people to invest in the assets they want, from stocks and commodities to cryptoassets. Its global community of more than 14 million registered users can share their investment strategies and anyone can emulate the most successful traders. Due to the simplicity of the platform, users can easily buy, hold and sell assets, monitor their portfolio in real time, and transact whenever they want.

Media contact

Anna Stone

Marketing & Partnerships

[email protected]

from CryptoCracken SMFeed https://ift.tt/2E03u3G

via IFTTT

0 notes

Photo

New Post has been published on http://cryptonewsuniverse.com/five-years-of-ethereum-from-a-teenage-dream-to-a-38b-blockchain/

Five Years of Ethereum: From a Teenage Dream to a 38B Blockchain

Five Years of Ethereum: From a Teenage Dream to a $38B Blockchain

How far has the Ethereum blockchain come in the five years since its inception? We explore key developments, changes and challenges.

It would seem that five years is a relatively short time for an information technology company,

but Ethereum has made colossal progress during this time, growing from its own initial coin offering project to the largest blockchain platform, running about 2,000 decentralized applications. Today, the market capitalization of its native cryptocurrency, Ether (ETH), is worth $38 billion — larger than Ford Motor Company and the popular app Snapchat. Not only that, but the value of Ether has seen a 121-fold increase over the period of the network’s existence. While the whole team is preparing for the transition to the proof-of-stake consensus algorithm ahead of the upcoming Berlin upgrade, Cointelegraph recalls the striking changes that have occurred to the platform over the five years since its launch, and the failures that have only toughened its resolve.

2013/2014: An idea to an $18 million crowdsale

Ethereum was invented by Vitalik Buterin, a Canadian programmer of Russian descent. It was 2013, and Buterin was just an 18-year-old teenager, but his idea found a lively response in the global blockchain community. Later, Gavin Wood, a British computer programmer, proved the possibility of creating the system invented by Buterin and described the basic principles of its operation in the Ethereum “Yellow Paper.” Together with the first members of the Ethereum team, they launched a crowdsale and raised $18 million for the project’s development.

2015: Network launch and exchange listing

The first version of the Ethereum cryptocurrency protocol, called Frontier, was launched on July 30, 2015. But the security level the system boasted back then was far from what Ethereum is today. The launch of Frontier marked an important milestone in the history of the network, after which the developers immediately started working with smart contracts and creating DApps on the real blockchain. The first existing historical record of Ether’s price is from Aug. 7, 2015, when ETH was added to the Kraken crypto exchange at $2.77 per coin. Over its first three days of trading, its price dropped to a demeaning $0.68, most likely under the influence of rapid sales by early investors. In the second half of the year, droves of crypto enthusiasts rushed to learn what they could about Ethereum. A particularly significant contribution to its popularization was made by the DEVCON-1 developer conference, which was held from Nov. 9 to 13. The event sparked intense discussions on the development of Ethereum, with the participation of representatives from IBM, Microsoft and UBS.

2016: The DAO, hackers and Ethereum split

At the beginning of 2016, the price of Ether rose rapidly, fueled by news of the upcoming launch of a network protocol with a more stable version: Homestead. As a result, ETH reached its first serious high of $15 per coin on March 13, with the platform’s market cap exceeding the boastful $1 billion mark. On March 14, Homestead went live, which made its blockchain officially secure through new protocols and network changes (EIP-2, EIP-7 and EIP-8), making future updates possible. More specifically, the network protection became based on mining, which was planned only for the initial stage of development with subsequent transition to PoS with a hybrid model at an intermediate stage. At the same time, exuberant requirements for video memory acted as protection against the use of ASIC miners.

The next event, which brought the price of Ether to its highest value that year — $21 — was the widespread media coverage of the dizzying success of The DAO project, which raised more than 12 million ETH ($150 million at the time ) in May. The DAO — an acronym for decentralized autonomous organization — was one of the pioneers of the upcoming ICO era and chose Ethereum as its launchpad to raise investments. However, on June 16, using a vulnerability in The DAO’s code, unknown hackers stole about $60 million in ETH from the project. News of the attack sliced the price of ETH in half to $11. Buterin offered to return the stolen funds by conducting a hard fork to restore the network to its pre-attack state. Following a controversial hard fork held on July 20, the network split into two: Ethereum and Ethereum Classic. On Sept. 22, Ethereum suffered another blow: The network was subjected to a distributed denial-of-service attack, significantly slowing its operations. The news became an impetus for the beginning of a local downtrend in the curbed price, which began consolidating in the $7–$9 range by the end of the year. Two unplanned hard forks were then carried out to improve the resilience of the network and rectify the consequences of the DDoS attack.

2017: ICO boom

Ether’s price experienced a meteoric rise at the start of 2017 as the cryptocurrency was added to the eToro platform on Feb. 23. Around the same time, the number of unconfirmed transactions on the Bitcoin network had reached 200,000, causing an increasing number of crypto investors and miners to opt for Ether as an alternative investment. On May 6, the price of ETH set a new bar of $95 per coin. The popularity of Ethereum grew rapidly in the crypto community and among DApp developers. The initial coin offering hype also contributed to the increased demand for Ether, as thousands of projects opted to fundraise in ETH. By Sept. 1, the price of Ethereum had almost reached a whopping $400, but news of China banning ICOs and crypto trading quickly slashed it to nearly $220. The price gradually recovered by mid-October after the release of the Byzantium network upgrade, which took place on Sept. 18. Along with the growth of the ICO bubble, in which Ether was still the main means of payment, ETH reached nearly $800 by the end of the year.

2018: Ethereum at $1,400 and a bearish trend

The beginning of 2018 turned out to be even more successful for Ethereum than the previous one. On Jan. 13, the price of Ether reached its all-time high of around $1,400. But the ICO rush, which had triggered the rapid growth of Ethereum’s price in 2017, came to an end. Throughout 2018, its echoes played a cruel joke on Ether as thousands of ICO projects sold their savings, meaning that ETH dropped even faster than the rest of the market. In early September, news of the Constantinople hard fork — expected in November — slowed the drop in the price and injected positive sentiment into the community. However, the network upgrade was delayed. Influenced by inter-bearish sentiments on the crypto market and pending updates, the price fell to $85, dropping from the second-largest to the third-largest cryptocurrency by market capitalization behind XRP.

2019: Technical works, update delays and popularity of DAOs

Many aspects spiraled out of the control of developers over the year as they were actively engaged in conducting technical work on the network. Meanwhile, the community lost count of the number of upgrades carried out. In January, the technical roadmap gained clarity as difficult engineering problems were solved and the Ethereum development community continued to grow. DeFi became the largest sector within Ethereum, and the market saw early signs of growth in gaming and decentralized autonomous organizations. At the beginning of 2019, the only DeFi protocol with significant funds was MakerDAO, which had a total of 1.86 million ETH ($260.4 million at the time). The playing field became much more diverse by the end of the year when new participants rushed into the industry.

On Feb. 28, the Constantinople hard fork took place on the Ethereum network, which prepared it for the transition to the Casper PoS protocol and the abolition of the previous mining model. However, the eighth upgrade, called Istanbul — which initially had been scheduled for Dec. 4 — was delayed and activated on the Ethereum mainnet on Dec. 8. Among the main objectives of Istanbul were ensuring the compatibility of the Ethereum blockchain with the anonymous Zcash (ZEC) cryptocurrency and increasing the scalability of the network through SNARKs and STARKs zero-knowledge-proof protocols. In addition, the update made it difficult to carry out denial-of-service attacks on the network due to the change in the cost of gas needed for launching operating codes.

The progress of Ethereum 2.0 laid the foundation for the world’s largest corporations to start using the Ethereum blockchain. In July, Samsung released a software kit for Ethereum developers, six months after it was revealed that the development of its new phone included a built-in Ethereum wallet. Another large partnership involved internet browser Opera, which had launched an Ethereum-supported Android wallet at the end of 2018 and announced a built-in Ethereum wallet for iOS users in early 2019. Meanwhile, Microsoft continued its involvement with the Ethereum ecosystem. In May, the company released the Azure Blockchain Development Kit to support Ethereum development. In October, it backed a tokenized incentive system from the Enterprise Ethereum Alliance for use within enterprise consortiums. And in November, it launched Azure Blockchain Tokens, a service that lets enterprises issue their own tokens on Ethereum.

2020: The DeFi boom and PoS