TradingGator is a trading review website that reviews Forex and CFD brokers, as well as Bitcoin and cryptocurrency exchanges. We focus on giving our readers great value to make well-educated decisions. TradingGator - For Traders, By Traders! Official Website

Don't wanna be here? Send us removal request.

Text

How To Find Good Investment News From Podcasts

How To Find Good Investment News From Podcasts

Gold investing and trading newsletters are certainly one of your best means to get the inside scoop on exactly what is going on within the gold market at any given moment. With gold investing and trading newsletters you will get all the current news surrounding gold and as well as some of the greatest advice available to you to make the right gold investing and trading decisions for yourself. Most newsletters will give you updates regarding gold trends, gold mine locations, gold mine prospecting reports, gold prices and any other information that can help you decide how to proceed with gold investing and trading. When you are reading a gold investing and trading newsletter, you will definitely want to keep an eye out for any signs of problems or any other indicators that might indicate that a gold mine is about to turn bad. Gold prices are always fluctuating, so it is important that you know when to get out while the rest of the investors continue to hang on.

There are several newsletters that are available and all of them will provide you with the same basic content. However, there are a couple of differences in gold investing and trading newsletters. The first is the length of the newsletters. While most are pretty short, there are a select few that go on for months on end. If you are looking for the most current information surrounding the gold investing and trading markets, then these are the gold investing and trading newsletters for you. You will receive the news from all of the major players in the gold markets in both the United States and abroad.

Some of these newsletters will even give you charts that show the gold investments and trading trends around the clock. Gold prices are constantly changing, but the charts will show you the patterns and tell you which way the market is heading. Some of these companies that provide gold investing and trading news services also have a number of charts available for your use as well. These charts are easy to read and will provide you with all of the basic gold investing and trading information that you need. All of this is presented in real time so that you can follow the markets and keep an eye on things at all times.

There are a number of other gold investing and trading newsletters that will allow you to invest in gold online. This is done through the use of an online account. Once you set up this account, you will be able to add funds to it and watch your gold investments increase. You can purchase units as you see fit and you don’t even need to wait on an exchange in order to do so. This is a great advantage and one that make gold investing and trading very convenient.

As you can see, there are quite a few different gold investment newsletters that are available. Which one you choose depends upon what you are interested in and the amount of information that you want. If you have more money that you would like to put into gold investments then you may want to look into several of these different investment opportunities. The key to being successful is to know when to pull out of your investments. Gold is a good buy because it usually doesn’t lose its value and you can hold onto it for quite some time.

While many of these investment newsletters will highlight several different gold investments, make sure that you check into the credentials of those offering the information. You can do this by checking the business history of the company. If the company has been around for quite some time then you can be sure that they are telling the truth about their gold investments. After all, who would want to invest in a company that isn’t going to last more than a few months.

Another thing to look for in gold investing and trading newsletters is the information that is being offered. Some will only go so far as to outline the different gold investment possibilities. Others will go into great detail about gold coins, bars, and rounds. Knowing everything about gold investments will allow you to become an expert in this area.

You should also take advantage of a gold investing and trading podcast if possible. These shows can be a great way to learn about gold from someone who has spent a lot of time researching the market. There is plenty of solid gold investment information out there if you just take the time to look for it. Even if you just listen to one of these podcasts on the radio you will gain valuable information about gold investing. The best place for you to find a good podcast is through an online search. You will easily be able to find dozens of them and if you like, you can also subscribe to them so that you can get emails about the newest shows.

youtube

The post How To Find Good Investment News From Podcasts appeared first on TradingGator.

source https://www.tradinggator.com/how-to-find-good-investment-news-from-podcasts/

0 notes

Text

Storing Cryptocurrencies In A Cryptocurrency Wallet

Many people want to know how they can store Cryptocurrency in aCryptocurrency Wallet. There are many different ways to do this. They all have their merits, but here are some of the most common and popular ones. If you’re not familiar with these methods and don’t know which would be best for you, then read on to learn more about them.

One: A Cloud-based wallet. This is probably the simplest way to store your Cryptocurrency. The process is easy, because your coins are safely stored in one location, the place that you’ve been assigned to as an account holder at your favorite online broker. One of the advantages is that if you move, you just move your balance. No matter what, no one needs to know where or how you got your Cryptocurrency.

Two: An offline wallet. This is often used for very large amounts of money. Most often, these are held by banks or credit unions, and are part of their corporate policies. You will need to go through some initial authentication process to begin trading and converting your Cryptocurrency, but this isn’t usually too difficult. This is often the most secure and convenient way to store your Coins.

Three: An Online Wallet. An online Cryptocurrency wallet is the most popular and most secure way to store your Coins. Your coins are securely stored online with no additional security risks. One of the benefits is that they are accessible from anywhere in the world and are insured by several top quality companies. You get to enjoy a number of added features, such as cold storage and paper backups, and are protected from hackers by using your private and secure login information.

Four: Software based wallets. These are the most commonly used way to store your Cryptocurrencies. They are easy to set up and use and many of them have built in feature support for multiple Coins. Usually they are purchased as a download or as a software application. This is the easiest and most secure way to store your Coins.

Five: Paper Wallets. Most people will agree that paper wallets are outdated and never get replaced, because people still like storing their Coins in physical form. There are many different types of physical coin wallets available, including the physically printed ones, which are great for storing small amounts of Coins.

Six: USB Wallets. Another widely used method of storing Coins is through the use of a USB wallet. You will be able to use the same kind of security features, as if you were storing the coins on your computer. Most of the time, the coins will not be available to access until they reach a certain age (usually around 10 days). This is done to prevent theft. However, it is not a secure way to store your Coins, because someone can simply steal the information that is contained on the backup file.

In conclusion, there are a variety of ways to store your Coins safely and securely. Which one you choose really depends on what kind of Cryptocurrency you are dealing with and whether you want to keep them online or offline. There is definitely a way for you to do both! If you are unsure, consult one of the several reputable companies that offer these services.

One: The simplest way to store your coins is to use an online service. There are many available, but one that is especially nice is the one that will let you see a proof of account, which will allow you to verify the data on that account (like where you bought the Coins, when you last logged in, etc.). Many of these sites also have special “tools” that will allow you to export your data in various formats (such as CSV). This is very useful for trading or investing.

Two: If you are going to keep your Coins offline, you can use software that you install. This is quite similar to having a paper wallet, except that instead of storing your Coins at a physical location, you are storing them online. This is an especially good way to store several types of coins – like those that are part of a collection. It is also often a good way to transfer Coins from one place to another.

Three: A physical place to keep your coins is always an option as well. In fact, this has become quite the trend. The advantages here are that if something happens to your coins, you do not have to worry about keeping them at a coin safe place, nor worrying about whether or not you remembered to save your password! Another advantage is that you will be able to access your coins easily, but will still be able to use the internet easily, since you can send them from your computer. This is often used for smaller amounts of coins, because there is not too much risk involved with it.

youtube

The post Storing Cryptocurrencies In A Cryptocurrency Wallet appeared first on TradingGator.

source https://www.tradinggator.com/storing-cryptocurrencies-in-a-cryptocurrency-wallet/

0 notes

Text

A Few Tips On Finding The Best Ways To Trade Forex CFDs

The best ways to trade Forex CFDs is to understand the market and how it works. This is easier said than done, especially as those who work and learn in the field of finance are rarely prone to share their wisdom, so much so that a good number of them prefer to remain within the comforts of their offices and trading desks. But if they had the opportunity to learn and trade at the heart of the market, then they would be able to take full advantage of this opportunity to make money for themselves and their families.

In order to appreciate the Forex markets you need to know something about the three types of trading which are: Forex day trading, Forex overnight trading and Forex swing trading. Day trading is one of the most widely used and popular techniques. It is where you buy and sell a certain quantity of CFDs within an hour or two. This is done in what is called the spot market. These contracts are listed on the OTCBB and the FOREX marketplaces and are traded for a small fee.

Forex overnight trading, however, is another widely used strategy. This involves trading on the Forex market, whilst also making trades in other currencies. This way of trading is more akin to traditional commodity trading. One of the benefits of using this technique is that you can earn more profits per deal and can protect yourself from falling market prices.

Swing trading, as you might have guessed, is the final method. Here you trade according to the direction in which particular currencies are moving. The advantage of this strategy is that you never stand the risk of your chosen currency crashing to a new low. However, many people use this method to profit from market price swings. If you are somebody who wishes to trade Forex CFDs then this is the best way for you to start.

You can also employ other strategies. One popular way traders use is ‘strategy trading’. This means that you choose a single pair that you think will rise over a period of time, then you set out to see if you can make money from it. This can be a risky strategy and you may actually end up losing money on several occasions. For this reason it isn’t that widely used.

One of the best ways to trade Forex CFDs is by trading with a managed account. With a managed account you are able to pay for the trades that you make, so you don’t risk your capital on every move the market makes. Some managed accounts will even tie in with an automated system which you can set the limits for. It is important to find an automated system which you feel comfortable with, as the market moves rapidly.

Some traders will also employ leverage. This basically means you trade more CFDs than you have in your account. As leverage has both advantages and disadvantages, it is never a good idea to trade with large sums of CFDs at once. If you do, you are likely to lose money. Ideally you should spread your trades over several different CFDs.

The best ways to trade Forex CFDs profitably is obviously to trade them yourself. However you should understand that Forex trading is essentially governed by forces that are beyond your control. That is why even experienced traders will usually have some losses along the way. Just remember to stay patient and you should be able to find great success in Forex trading.

youtube

The post A Few Tips On Finding The Best Ways To Trade Forex CFDs appeared first on TradingGator.

source https://www.tradinggator.com/a-few-tips-on-finding-the-best-ways-to-trade-forex-cfds/

0 notes

Text

What Is Cryptocurrency Arbitrage?

What Is Cryptocurrency Arbitrage?

Arbitrage is one of the methods of profit in Cryptocurrency markets. It is the process of selling one type of currency for another, with the hope that you can get more money by doing this than what you initially paid. In a way, it can be seen as an expansion of what is known as margin arbitrage. With this method of investing, the trader hopes that he can take advantage of movements in prices, making him a profit without having to actually hold the currencies in question. This is one of the advantages to using the Forex market instead of a traditional stock exchange.

The reason that this type of trading is able to continue despite the volatility of these types of exchanges lies in the simple fact that there are many more competing currencies on these exchanges than there are buyers. Even the largest and most liquid exchanges will have limits to how much they will let their customers spend on any one particular pair. With a large number of traders, though, the amount of volatility that is inherent in these types of markets is completely undesirable. There is always going to be a risk that the price of a given coin will fall through the floor.

When you make an investment in Cryptocurrency, you are assuming that the price difference between two different coins will stay the same. With that in mind, the idea of arbitrage is that the smaller the difference, the better off you will be. This profit is made through the difference between the buying and selling prices on the different exchanges.

One problem that many people run into when they think about what is cryptocurrency arbitrage? They tend to forget that there are other ways to profit in the markets besides through what is known as margin arbitrage. After all, if there was only one way to profit from the marketplace, wouldn’t everyone jump on board? The answer is no. There are numerous ways that one could go about making money with any given cryptocoin.

One of the least-mentioned but most lucrative methods of profits is through what is called shorting and longing. The way that this works is by purchasing a large number of coins at once and selling them at another price. If you can get lucky and the market rises, you could find yourself with a large profit. If not, you could lose some of your investments, but because of the nature of what is Cryptocurrency arbitrage, this isn’t going to do too much harm.

Another option that people have for getting in on the action without having to worry about what is Cryptocurrency arbitrage is by buying and selling what is known as the spot market for currencies that are known for being volatile in nature. For example, if you are looking to buy some lye for your cooking purposes, you would first want to weigh the benefits of buying it in the spot market versus purchasing it in your local supermarket. If you decide to purchase in the spot market, you will need to watch for the price differences between the two and ensure that you are getting a good deal.

There are many different kinds of places that people can purchase Cryptocurrency and one of the lesser-known arbitrage opportunities is through what is called an online exchange. These are trading platforms that allow you to place orders on what is commonly known as an auction website and then have them executed by other users all over the world. There are many different exchanges out there right now that are functioning this way, but they aren’t as well known as they should be. This is why you need to look into websites such as eBay, Amazon, and other places to purchase these items.

If you are considering what is Cryptocurrency arbitrage trading, one of the main things that you need to do is to open up a bank account in a reputable financial institution. This will help you ensure that you can have access to your Cryptocurrency in the event that you find that you are purchasing too much of one currency and selling it for another. You may need to have a lot of information in order to make this work, so be prepared. There may also be certain rules that you need to follow with how you can withdraw or buy into your account if you find that you are having trouble accessing your Cryptocurrency at that moment. Always be very careful with any kind of investments that you take part in, no matter what they are called. Even though Kyc has been a great thing recently, it is still a scam to many and you should be very cautious when looking into anything that has the word Cryptocurrency in it.

youtube

The post What Is Cryptocurrency Arbitrage? appeared first on TradingGator.

source https://www.tradinggator.com/what-is-cryptocurrency-arbitrage-3/

0 notes

Text

News on Blockchain Technology

If you ask an active bitcoin user what the biggest problem in the community is they will say that the biggest problem is people not learning how to get news on Blockchain. This is probably because if you are not familiar with what the term means it makes very little sense. A new technology like this is hard for the average person to grasp because the internet and technology as a whole are confusing and difficult to understand.

The term “blockchain” means “the internet”. So now you must be wondering how you can receive news on the internet from a website. This is actually quite simple if you know how to use a few tools. One tool is called twellow which can help you see exactly who the most mentions are on the most popular social platforms around. From there you can see which websites people are talking about and generally finding out more about them including where they are talking about it and why they are talking about it.

You can also view the latest posts by individuals you admire or follow on Twitter. If you follow somebody on Twitter you can easily see the conversations that take place on the platform. Many people use Twitter to connect with friends and loved ones and the ability to see these conversations makes it much easier to connect with them and learn about their lives.

News on Blockchain is delivered regularly by a number of sources. There are news sites that publish articles that talk about the latest news on Cryptocurrencies and other technologies. These sites are known as publications and they are regularly updated and edited on a daily basis. You can go to these websites and subscribe to their publications and if you do not want to read the news on a regular basis, you can simply opt out of receiving these publications.

Another way to receive news on Blockchain and other technologies is through the Financial Times. The Financial Times continuously publishes articles on various topics and this includes news on cryptosurfers and the latest news on different technologies used in this industry. A great benefit of subscribing to the Financial Times online news digest is that it is frequently updated and often contains links to other articles that you may find interesting. This gives you an endless source of information on the latest trends and developments regarding Cryptocurrencies and other platforms. If you like to keep up with current affairs and in particular finance, this is one of the easiest ways to get news regularly updated. This is also an important aspect of understanding what Cryptocurrencies are and what they can do for you.

The Bank of England has published an excellent series of articles on its website known as Bank Ideas. These articles provide an in-depth look at different aspects of Cryptocurrency and their potential as financial services. The articles are written by experts in the field and they include an explanation of the role of Cryptocurrency in relation to money, the economy and central banks. It looks closely at how Cryptocurrencies could change our lives and why you should be excited about them. If you like this style of article, then you will probably enjoy reading the Bank of England articles on Cryptocurrencies.

Another popular place to see news on Cryptocurrency is from the likes of MIT Technology Review. This is a popular business and technology magazine that look at cutting edge innovations around the world. They publish articles that are heavily dedicated to covering new trends in digital currency, new technologies used in the industry and what Cryptocurrencies can do for you. If you are interested in learning more about what Cryptocurrencies are and what they can do for you, this is an outstanding place to read.

One other place that you might want to look for news on the future of Cryptocurrencies is from your friendly neighborhood news papers. There are some places in the newspaper that actually do feature articles on topics related to this growing technology behind the digital currency revolution. These places include the Wall Street Journal, Financial Times and many others. All of these publications regularly publish articles that cover upcoming trends in currencies as well as how new technologies behind the technology could impact individuals in very unique ways. Make sure to sign up for news alerts from these reputable news sources so that you can stay completely informed.

youtube

The post News on Blockchain Technology appeared first on TradingGator.

source https://www.tradinggator.com/news-on-blockchain-technology/

0 notes

Text

What Is An NFT? And Why Would Someone Want to Purchase Them?

What Is An NFT? And Why Would Someone Want to Purchase Them?

If you have ever heard the term “NFT” or “Next Generation Fundraising” then you are most likely wondering what it means. A non-fungal token is simply a unit of currency stored on a distributed ledger, also known as a block chain, which validates a particular digital product to be totally unique and so not interchangeable with any other like it in existence. Unlike traditional coins and paper money, the unit of currency NFTs are issued backed by digital assets such as digital images, audio recordings, and the like. This makes them completely digital in nature. Digital asset identification is usually done through encrypted digital keys.

So what is an NFT and what does it mean? Well, the concept of the Non-Fungal Tracking Fund was conceptualized by cryptographers during the early 1990’s as a way to create a more secure form of fundraising. Cryptocurrency is the transfer or exchange of digital information using some kind of cryptography, i.e. encryption or digitally encoded signatures. Since no government or central authority controls the money supply, cryptographers felt it was impossible to guarantee the funds would be held in tact, thus eliminating the possibility of fraud or accounting fraud which can easily occur in conventional fundraising methods.

The main benefit of nft is that it adds a layer of extra information to the digital art donation being made. By including the extra information, the donors are assured that the money they are sending will not be misused, and their investment will not go to waste. NFTs are able to verify the authenticity and credibility of the source of the digital art by authenticating each transaction using its own internal cryptography. With the added layer of extra information added to the transaction, it is then possible for the NFT to trace the funds back to the original donor, if needed.

Since Cryptocurrency and NFTs are both very new technologies, there is a great deal of uncertainty and skepticism towards both in the public and private sector. It is this uncertainty and skepticism which keeps the public from ever making full use of the benefits which both cryptosystems offer. This may in part be due to the fact that most investors do not fully understand what is an NFT, what it does, or how it works. In addition, most people have never purchased coins on the internet or at a physical retail location, meaning they have no real experience with the marketing or selling of these currencies, or any other comparable businesses.

The good news for those interested in understanding how these currencies work is that they are much easier to learn and understand than it was before. A great example of an easy to understand currency is the US dollar. All you really need to know is that it is backed by a central bank, is printed by the government, is backed by a credit company, and is traded on major exchanges such as the New York Stock Exchange. With that in mind, it is fairly easy to see how someone who has never purchased a single US dollar coin could understand how NFTs work. On the other hand, even the most skilled traders or investors need to learn a little bit about the Cryptocurrency markets before they can properly evaluate them.

Unlike the old days when digital assets such as US dollars, Europespespes, or Japanese Yen were sold in the same old way, trading in NFTs is very different. There are two main differences between the way in which NFTs are bought and sold, as well as how they are transferred from one player’s account to another. The first difference is the way in which the money is converted. Unlike with traditional currencies, when one is purchased from another, they are converted into the same currency. When selling them, however, it is typically the case that players receive either the virtual money equivalent or real currency, depending on which game or website they are playing on.

The second major difference is in the way in which their prices are determined. Unlike when you buy something, where the demand for a good increases as time goes on and the supply decreases, with the case of NFTs it is different. In fact, when one plays the popular massively multiplayer online role-playing game World of Warcraft (WoW), they are able to see their characters’ WoW gold and silver values increase as they do their own in-game activities. This is because the in-game money, known as eternals, are transferable to the players as they perform the particular activities that the game requires of them. When this happens, the gold and silver in question start increasing rapidly as they are transferred to their account.

In summary, it is not completely unbelievable that a person would try to obtain what is an NFT. If you are playing WoW or another massively multiplayer online role-playing game that has an in-game money transfer mechanism such as NFTs, then you may very well want to make sure that you have some nFTs on hand in order to increase your gold and silver in-game. Of course, you cannot actually cash out your nFTs just like you can cash out actual currency. However, if you are a casual player who likes to have some extra money in their pockets when they aren’t spending it on game play, then you may want to consider purchasing some nFTs so that you can have more units in your wallet and thus, you’ll be able to enjoy more of the fun of playing the game. You may also want to do this if you happen to find a website that gives out free nFTs for testing so that you can get a feel of whether or not the website’s operation is legitimate before you put any money down.

youtube

The post What Is An NFT? And Why Would Someone Want to Purchase Them? appeared first on TradingGator.

source https://www.tradinggator.com/what-is-an-nft-and-why-would-someone-want-to-purchase-them/

0 notes

Text

Finding Good Investment Newsletters

If you have been on the web for any length of time then you no doubt have by now noticed that there are a lot of good investment newsletters popping up all over the place. And there is good news for you in that you can actually set up your very own newsletter to help you achieve your investment goals. All you need to do is decide what kind of stock trading newsletters you want and how you want them to look. Believe it or not, a lot of people have already made this decision for them and they are enjoying it immensely. This is especially true when it comes to penny stock newsletters.

The truth is that penny stock trading has changed so much since the 90’s. Back then trading on these types of securities was something that could be done only for the most financially savvy traders. Nowadays anyone with an internet connection can start making some really good money using penny stocks. The reason for this is that trading on these stocks has become more accessible to the general public and this is due to the fact that many different companies are willing to open up their doors for potential clients.

But if you want to be successful with penny stock trades you are going to have to be able to tell when a trade is over priced. This is why penny stock newsletters are so important because they help you to do just that. They show you when certain trades are over priced and will help you to cut back on those losses. This sounds easy but you have to remember that no one is going to invest in your newsletter if they think your trade is a bad idea.

The only way for you to do this is by making sure that every newsletter you send out is actually worth the money you are investing in it. And this isn’t as hard as it sounds. All you really have to do is invest some time into making sure that your newsletter has a good track record. This means that it should be sending out trades that are producing profits and not losing them. You can check out some testimonials or even past performance graphs to get an idea of whether or not you should be listening to the information contained in a newsletter.

Of course, there are some things you can look for in your newsletter that will tell you whether or not it’s a good investment newsletter. One of the most common ways people mess up is by not diversifying their trades. While penny stock trading has some appeal, you don’t want to put all your eggs in one basket. Make sure that you send out investments that cover a variety of different companies so that you have something for any given trade.

Also, make sure to keep your track of your stock trades and your profits separate from your own money. Just because you got lucky and got on the winning side of a trade once doesn’t mean that you’ll be so lucky again tomorrow. You should set aside some funds to allow for quick profits in case of a disaster. You wouldn’t want to risk all of your vacation money in a short stock trade, now would you?

Finally, look for a newsletter that has a good reputation. Any company worth investing in can be found on at least one web site. If the company has received good ratings on its web site or has received positive reviews in other places, they will probably have a good reputation as well. Look for a newsletter that focuses on the low-cost stocks that are likely to perform well as well. Keep in mind that you may not always be right about what a stock will do, but a good investing newsletter will help you keep track of the trends so that you don’t make stupid investing decisions.

Of course, don’t expect your newsletter to do all of the work for you. You still need to know about penny stocks yourself, and it’s a good idea to read other experts’ takes on the company as well. But if you follow the advice of a good investment newsletter, you’ll do just fine. After all, even the best investors face losses from time to time. Keeping your fingers close to the pulse of the investing world can help you avoid bad timing and make good investments.

youtube

The post Finding Good Investment Newsletters appeared first on TradingGator.

source https://www.tradinggator.com/finding-good-investment-newsletters/

0 notes

Text

Buy Bitcoins For Your Pension

There are many places to buy and sell bitcoins. However, most people do not understand how this currency works, what its purpose is or what it can be used for. Understanding the basics of how the system works will help you learn more about this revolutionary new way of saving money for the future. When you know how to buy it, you are able to become part of a worldwide network of people who are looking forward to a better financial future.

Before learning how to buy bitcoins for your pension, it is important to understand how the system works. This type of investment has been around for quite some time but only now is gaining in popularity. The primary selling point is that it is easy to buy and sell. You do not need to visit a broker to buy it. With the use of a computer, the seller is able to manage his account from anywhere in the world. It is also possible to convert a regular pension payment into bitcoins.

There is another benefit as well. Unlike regular currencies, which have fixed exchange rates, bitcoins are usually bought and sold in pairs. If you want to buy dollars to buy bitcoins, you would need to buy US dollars and then sell British pounds. This can be a little confusing, so there are many websites that help people learn how to buy this currency pair. You will not get the full value of the item you sold but the best way is to learn by trial and error.

The best thing about buying bitcoins for your pension is that they never go up in price like the US dollar. This makes them ideal for investors who need to buy dollars at one point in time and then sell them later at a profit. This is known as the digital time market and is an efficient way to make money from the internet. There is no need to keep large amounts of money in liquidator and instead you are able to buy dollars when you need them and sell them later to buy bitcoins for your pension.

Another benefit of buying bitcoins for your pension is that the process is very easy. All you need to do is find a company that allows you to buy this currency pair and then you will be able to track the price of each as it goes up and down. This is especially good if you are trying to predict trends in the market because this is very hard to do. By buying small amounts of each currency, you can start predicting the price movement of each as they increase in value. This is a simple way to turn a profit and you should consider doing this if you are interested in investing or have an interest in the stock market in general.

The reason why this is a great idea for your pension fund is because you can then diversify your portfolio. Traditional investments like stocks and bonds often do not give you the diversity that you need to see your investments do well. If one sector does extremely well, you will tend to lose money in other parts. However, buying bitcoins for your pension is a great way to ensure that you always make a profit. You do not have to worry about your investments going in the opposite direction. This is because the exchange rate between the two currencies will always go up and down.

Even though many people are wary about using the internet to buy anything online, you should not be afraid of it when looking to buy bitcoins. This is because the process is quite simple and it takes less than a minute to buy one from your local shop. In fact, you can buy one from most places that you would buy a train ticket online from. You can even buy them from the post office if you have a credit card with a balance.

Another benefit of buying bitcoins for your pension is that they are a hassle free investment. There are no commissions to be paid and no waiting time to wire funds from one place to another. This makes them ideal for anyone who wants an easy way to make a profit without any of the hassles usually associated with investing in the stock market. You also do not have to worry about having to follow an investment plan. Since you buy them online you can invest however you want and when you want.

youtube

The post Buy Bitcoins For Your Pension appeared first on TradingGator.

source https://www.tradinggator.com/buy-bitcoins-for-your-pension/

0 notes

Text

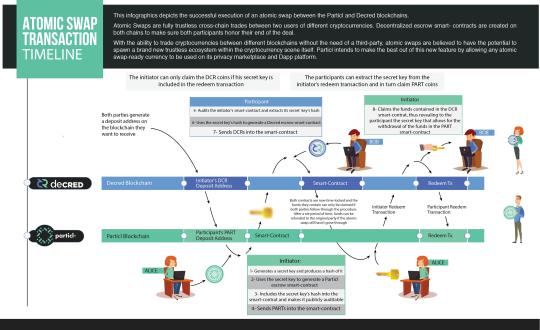

What Is an Atomic Swap – Revolutionizing Trading

The definition of what is an atomic swap is really quite simple; it is an electronic transaction that exchanges a specific value in one currency against another, without the intermediary of a bank or other financial institution. So in essence, what you are doing is trading commodities with each other directly. And like any trade, there are various pros and cons associated with it.

Let us first explore what it is not. Unlike a centralized exchange where trades happen within a relatively small pool of traders, trading in the traditional way requires that you have traders all over the world that can agree to trade at the same time. This leads to price volatility and risk that can be very costly to the small time trader. Because of this, many new and small companies do not have the capital to enter into long-term trading contracts. It also means that they cannot possibly test out their ideas in the marketplace. Because of these reasons, many newer companies will utilize what is called a “smart contract” to enter into exchanges and make trades without the interference of traders and brokers.

But what is an atomic swap trading scheme that is not centralized? In order to answer that question, we need to go back to how the concept works. Unlike the trading that occurs on the public exchanges where prices and times are publicly published, the trades that take place between two independent parties are not visible to the naked eye unless you take advantage of a specially developed technology called a “smart contract”. This technological device is basically a computer code which allows private keys to be encoded which makes it impossible for anyone but those parties to view the information.

Once the parties are notified of the transaction, then it is virtually impossible for a third party to reverse the atomic swap and take back the funds that were transferred. This is because the smart contract has encoded in them an unbreakable code that only the two originalenders can break. The reason this is so effective is due to the fact that once a trade is sealed in this manner, all future trades involving that particular asset will be recorded within the relevant block in the relevant chain. This means that if you ever want to take a look at your portfolio or some other information about your investments, you have the ability to look right into your past for answers.

The question might be what is an atomic swap if it isn’t exclusive to the financial world? Private key ownership is just one of the uses that this unique trading platform has in the corporate world. Other uses include online gaming platforms, gold trading, commodities trading, stock trading, and even real estate. Private key ownership is also beneficial to the environment as well as to ensuring the safety of finances. One interesting use of the system was developed by a group of Canadian developers who call themselves the “rious” people.

The “rious” individuals realized that there were distinct benefits to their fellow traders when they started using an atomic swap for trades on their local exchanges. First, by making trades on their local exchanges, they reduced their carbon footprint, because most of their trades were made within the same block, rather than at different exchanges. Second, by exchanging coins from their local transactions, they ensured that no single entity stood in their way, limiting their personal wealth to just a few select assets. This way, they avoided the fees often associated with exchange trading and could diversify their holdings. Third, by taking advantage of the low cost and high liquidity nature of these exchanges, they were able to use their funds for more productive purposes. For example, trades that involved large amounts of money (in excess of a few hundred dollars) allowed them to purchase real estate or invest in other productive assets.

What is an atomic swap, then, isn’t just a new concept that has suddenly materialized into the financial world. Instead, what is the application of technology to create new methods for people to manage their funds. Specifically, atomic swaps are created between two independent communities, both of which have a unique history and current relationship. One community takes the form of a “buyer” fund, making funds available to other buyers on the peer-to-peer platform. The other community becomes the “seller”, who offers funds to the other buyer on the peer-to-peer platform.

By doing so, the buyers of these funds benefit by enjoying lower transaction costs and access to a larger range of assets than would be possible with traditional centralized exchanges and clearinghouses. Sellers also enjoy a lower risk level since the assets being traded are not necessarily in their own possession. Instead, sellers take advantage of a system of pooled funds that are accessible to the buying public. What is an atomic swap, then, is really the application of technology to revolutionize how that the traditional exchange process functions.

youtube

The post What Is an Atomic Swap – Revolutionizing Trading appeared first on TradingGator.

source https://www.tradinggator.com/what-is-an-atomic-swap-revolutionizing-trading/

0 notes

Text

How to Pick Great Forex Brokers Online

With so many Forex brokers on the Internet, how do you find one that you can trust? Many people sign up with an online broker without even realizing it. They often have their own quote and may send out emails to remind you about your trading options. While these brokers certainly make you plenty of cash, they definitely are not meant for beginners or even small investors. The secret to being truly successful with Forex trade is doing more and less, while keeping your costs down.

There are a few things you should look for in a great forex broker. For starters, see if the company offers a free demo account. If so, use it to practice your skills. There’s nothing wrong with taking advantage of a free trial, and the broker doesn’t charge you for it, so why not take advantage? You can find great forex brokers online that will provide you with a free account and training to get you started. This way you have no risk, and you’ll know what you’re getting into from day one.

In addition to having a free demo account, you also need to be sure that the company gives you the tools you need. Some of the tools you want to include charts and support for multiple currencies. A great forex broker will provide these types of tools and show them off to you when you request them. If you’re a beginner, don’t worry about the learning curve. Even if you have no experience at all, you’ll still be able to understand what the charts and other indicators are telling you.

Finally, and perhaps most importantly, you want to make sure the company has credibility. When you’re looking for great forex brokers online, make sure that there are reviews and testimonials to back up their legitimacy. Some people say that it’s a lot easier to believe the people who are saying good things about a broker than those who are saying bad things. Others are skeptical, but that’s their prerogative. What you can do is read the background of the company, find out how long they’ve been in business, and read some of the clientele’s experiences. If the company has plenty of positive feedback and references, you can feel confident that they will be easy to work with.

Finding great forex brokers online is really quite simple once you understand how the process works. First of all, you go on the company’s website, look for the demo account, and check out all of the tools and features they give you access to. From there, you can figure out which broker suits your trading style. You might even find that you’ll be able to trade automatically using a system like Metatrader or TradeStation, which will give you an edge in the trading world.

It doesn’t take long to decide which broker you’d like to choose, either. Once you’ve found one that you like, you can open a practice account and learn more about the market. This is a great way to get a feel for the process and to learn what type of strategies work best for you. By taking advantage of a practice account, you can figure out your entry and exit points before you ever decide to get a real account with a real brokerage.

The next step you need to take when you want to be able to pick great forex brokers online is to pick a company with a good reputation. As mentioned above, there are many excellent companies out there, so you don’t have to settle for just one. But you should make sure that you’re working with a well respected firm, as this will greatly increase the odds that you’ll be able to trust that the firm’s services are going to be good for you. If you do enough research, you should easily be able to find some reviews of the top brokers.

Finally, you want to make sure that you’re getting a great service. Forex companies know that their services are valuable, and they treat them well. If you pick a broker that has a great reputation and provides good service, then you can rest assured that your trades are in safe hands.

youtube

The post How to Pick Great Forex Brokers Online appeared first on TradingGator.

source https://www.tradinggator.com/how-to-pick-great-forex-brokers-online/

0 notes

Text

Why Is the Blockchain Good For Distributed Apps?

A brief definition of “blockchain technology” may give a few insights into why it is valuable for those in the mobile apps industry. The main benefit is the fact that it provides a way to transfer money quickly, securely and automatically between two parties in real time. In fact, there are already many use cases where this technology can dramatically reduce the time delay that typically exists when sending messages through cell phones.

The need for fast data transfer is not new. However, with the massive amounts of data being sent every day by users of both smartphones and tablets, it has become increasingly difficult to send these data from one computer to another, or from one smartphone to another. This has been particularly true in the last several years, as hackers have exploited existing network protocols to send spam and malware to mobile apps.

The solution to this problem is provided by the distributed ledger known as the blockchain technology. The distributed ledger is a digital database that maintains records of all transactions taking place throughout the Internet. By recording the transactions and the timestamps they occur, it is possible to build a permanent and transparent reference frame which guarantees the timeliness and security of all the data that is stored in the mobile applications.

The distributed ledger used by the blockchain technology is based on peer-to-peer technology. This means that each computer in the system acts as a validator. This makes it impossible for a hacker or group of hackers to tamper with the ledger in any way. The ledger is also secured, as each transaction is encrypted before being sent. Additionally, the chain is able to monitor the total number of shares that have been issued as well as the total amount of money that has been sent.

There are a couple of other benefits that come from using the Blockchain technology for the purpose of mobile app development. First off, it provides the security that is necessary in order to ensure that no third party can tamper with the records that are in the system. It does this through the use of digital signatures. All transfers within the system are signed using this digital key. When you have a physical item such as a credit card, the transaction is going to be recorded in a database. However, if you want to ensure that the transaction was safe, you have to keep a record of it.

The second benefit comes from the fact that the blockchains prevent the recording of all digital assets. This includes the entire history of any given transaction. By prohibiting the recording of such documents, the blockchains provide a way of ensuring that there is confidentiality with respect to all digital assets. There are a lot of uses for the Blockchain, and one of those uses is for the purposes of digital asset custody.

Developers who are working on decentralized apps are often required to store their data in a server. With the help of this technology, developers will be able to generate a private key that will be associated with their server. Once the private key is attached to this server, anyone will be able to access the data that is stored in the server. In other words, with the help of the Blockchain, decentralized apps will no longer pose any security risks since the entire process is done online.

One of the most popular reasons as to why the Blockchain is great for decentralized apps comes from the fact that the technologies that make it possible to work with this feature are readily available. Developers can use their own computer networks to generate the private keys needed to access the information. Furthermore, they will not need to download any software since the infrastructure that is necessary for the use of the technology is already present on the devices that users will be using. Developers who are looking to implement a decentralized protocol should check out the use cases for the technologies that make up the Blockchain.

youtube

The post Why Is the Blockchain Good For Distributed Apps? appeared first on TradingGator.

source https://www.tradinggator.com/why-is-the-blockchain-good-for-distributed-apps/

0 notes

Text

Buy Gold For Your Pension

One of the best investments for any investor is gold. It is true that you need to have physical gold in order to have an asset that is secured in the case of a secure investment, but remember that there are several pension schemes that offer you the opportunity to buy gold and keep it aside. Gold can be an excellent way to secure your future, and one of the best reasons to buy gold now is because prices are at all time highs. Why wouldn’t you want to buy gold for your pension? It is one of the most secure forms of investment around today. In this article we are going to tell you more about why you should invest in gold and how buying gold can help you secure your future.

Most people purchase gold bullion for their pension. They understand that gold bullion has a lot of advantages and can increase in value over the years. A solid investment portfolio which consists of gold bullion is highly advisable if you want to safeguard your pension in the case that your employer does not offer any scheme to do so. Gold has also been shown to increase in value significantly during times of financial crisis, which means that you can easily lock in a higher level of value if you have some gold to invest in.

But why would anyone consider investing in gold bullion instead of investing in some shares? First of all, gold bullion is much more stable than shares. If your pension scheme offers you the option of buying physical gold, then you should take it, because even in tough economic times it is still possible to make money if you have a carefully chosen portfolio. Stocks can crash in value very quickly and you won’t be able to keep it if you lose your investments, whereas gold bullion will always be worth something, regardless of the economy.

Investing in gold might seem like a risk, because you are purchasing an asset which is not always guaranteed to perform well, but this is just because people who buy gold are often older or have other investment worries. It is far from a sure thing, but the historical gold price chart shows that it is still possible to make money even during times of economic downturn. The only factor which makes gold less desirable than stocks is the risk of theft, which is why physical gold prices tend to go up rather than down. This means that you need to be aware of the current gold price and buy gold bullion as an accessory to your portfolio rather than as part of a comprehensive diversified portfolio. Investing in gold can also give you a good return on your money, especially if you buy physical gold bars, but you have to keep in mind that you will also have to set aside a small percentage of your portfolio for the possible chance of theft.

The main advantage of gold bullion over shares is that you can hold it in your hand and touch it, whereas with shares there is no way to do this. Gold can be easily stolen, so it is far preferable to protect yourself by buying physical gold bullion instead of shares. If you buy gold for your pension, then you can ensure that you are protected from any potential theft. You will be able to sell your bullion should you ever need to, but this is something that is completely unneeded in a world where money can be lost in second hands every minute. The investment opportunity provided by gold bullion is far too great to ignore.

The only problem with buying gold bullion as an investment is that it is far too expensive to be practical for most people. If you think about it, you probably have no problem spending large sums of money on entertainment or food but buying physical bullion requires a substantial sum of money at first glance. If you want to buy gold bullion as a means of protection against the economic crisis, then you will probably have to wait until the economy starts to pick up again before you can start investing in gold again. If you are sensible though, then you will realise that gold is an excellent way to protect your wealth. A few years ago, the prices of gold were so high that they were only affordable by governments and banks.

Nowadays, the prices of gold bullion and gold coins are dropping, but you may not find that you personally need them to start saving money. After all, you probably have other investments that will allow you to earn more than enough money to cover your retirement or live on comfortably. In fact, gold coins can also be a good way of diversifying your portfolio, by investing in different types of coins from several countries.

There are several advantages of buying gold for your pension. If you have a safe place to keep it, then you can sit back and let it accumulate without having to worry about theft or loss. Investing in gold makes perfect sense if you want to protect your wealth or live comfortably in old age. Unlike the stock market, gold cannot be manipulated by any type of financial tool. This is a major advantage, making gold coins a perfect way to buy gold for your pension.

youtube

The post Buy Gold For Your Pension appeared first on TradingGator.

source https://www.tradinggator.com/buy-gold-for-your-pension-2/

0 notes

Text

What Currency Brokers Should You Trust?

What Currency Brokers Should You Trust?

Which currency brokers to trust when trading? This is a question that many people ask, especially once they begin trading. Trust or not to trust depends upon your level of experience and comfort with the Forex market. It also depends on whether you can afford to pay for an annual or monthly fee.

Many traders have no qualms about choosing a broker they can trust. These are usually the ones who have been in the game for quite some time. They have an extensive knowledge of the Forex market and most of them are trustworthy. However, there are some other brokers that traders often choose because they see them as a good investment. They are the kind that offering low commissions and is willing to let traders use their platforms.

The trick in choosing a broker depends on how much you plan to trade. If you plan on investing small amounts of money, then brokers that are willing to give their services for free are most likely the best choice. However, traders who plan on making big money spend a lot of money on their brokerage. The trick is choosing brokers that offer low commissions but high rates of earnings. Then you will be able to make a significant profit if you are able to increase your capital.

In addition to the rate of earnings, one of the primary factors traders consider when choosing brokers is their platform. There are some brokers that limit the number of trades that can be executed in a day while there are others that allow traders to open multiple accounts. Aside from limiting the number of trades, some platforms also restrict the amount of money that can be withdrawn or deposited. You must carefully read all the rules and terms of each broker before choosing one. Some of them even impose a daily limit or a recurring transaction limit.

Another important thing traders look at is the reputation of the broker. In this category, the top performers always have positive feedback from their customers. Traders may check the online discussion forums or forum posts of brokers to determine if a broker has good feedback from their clients. If a platform allows members to post comments and questions, then you can do some research about how well that broker responds to queries and complaints. Platforms that have good reputations are often the ones that have responsive customer service representatives who are eager to assist customers.

Most of the currency brokers provide online reports that help their clients determine their performance. However, not all brokers provide the same quality report. It pays to shop around to obtain the best quality report. The brokers that have high quality online reports are those that are transparent in providing the information. The best currency brokers will show their clients their real performance in terms of gains and losses.

In addition to the quality of reports, you should also consider the number of currencies that a broker offers. Not all currency brokers offer all currencies. You need to evaluate whether the broker offers a service that will benefit your trading. For instance, if you trade in one particular currency but are looking for assistance in handling another currency, then it is best to choose a broker that offers services that cover multiple currencies. Otherwise, traders risk losing all the money they have invested in forex trading if they have to switch brokers because they do not have the right trader pair available to them.

Finally, when checking out currency brokers, it pays to ask about the firm’s customer service. If a broker does not respond promptly to a customer’s inquiry, then it is better to find another broker. The customer service department of a broker’s website can usually be reached by phone or email. The customer service representative can answer any questions about the firm’s services or products. If a broker does not offer good customer service, then it is best to go with other options. Forex brokers that have a reputation for providing good service to their clients are the brokers you should trust to trade with.

youtube

The post What Currency Brokers Should You Trust? appeared first on TradingGator.

source https://www.tradinggator.com/what-currency-brokers-should-you-trust/

0 notes

Text

Is It Worth Using a Bitcoin ATM?

A popular way to buy and sell digital currencies like Dash, Litebit and Doge is with the use of an ATM. A Bitcoin ATM will allow a user to buy Dash, Litebit or other digital currencies through a bank such as Wells Fargo or Citibank. The ATM usually connects directly to a trader’s computer, which then communicates with a local network of Internet cafe shops and physical locations for in-person transactions. A merchant can accept various forms of payment through a Bitcoin ATM, including credit cards, electronic check, or local phone calls.

A variety of different services are provided by the ATM, providing a secure and convenient way for buyers and sellers to complete their online transactions. A typical transaction can include a deposit to the buyer’s account, which is held by the ATM. They can then make withdrawals by scanning a fingerprint of the buyer or by signing up for a designated account through their web site. Some bitcoin as provide bi-directional payment processing, enabling the exchange of Dash, Litebit or other digital currencies for actual cash payments.

There are several different ways to operate a full-service teller machine business, depending on which digital currency you’re dealing with. In most cases, a merchant simply uses his or her bank account as collateral to guarantee a funds transfer. Some will also allow the use of a debit card, but most banks do not offer this service. Since the funds are transfers between your bank account and your virtual wallet, the transactions are considered safe and secure.

Not all brokers and trading platforms offer the opportunity to participate in digital currency trading. Therefore, many Tellers Machines will not be accepting deposits from accounts held at any one particular financial institution. It may be necessary to find a third party that can accept the transactions on your behalf. There are several companies that specialize in such work and can sometimes offer access to more than one digital currency exchange on one platform.

These third party vendors offer a wide range of services to help you get started. You’ll need to determine whether or not your company qualifies as a merchant. You must also establish a merchant account. There are numerous guidelines and stipulations in place to prevent the abuse of this service. All transactions must be conducted in accordance with anti-money laundering and know-your-customer guidelines. Be sure to educate any customers who may be using your vending machines about the risks of accepting digital currencies.

Some people may wonder if they can get around the problems associated with using an ATM. There are two potential answers to this question. If your company qualifies as a retailer – which is defined as a business that sells physical goods, such as groceries, books or clothing – then you may be able to use a virtual register, known as a merchant account, instead of a traditional ATM. This type of service does require the use of a debit card, though, and it may not be available in all states.

Some businesses, such as restaurants, may also qualify for an uninterruptible transaction fee. This fee covers the cost of ensuring the server periodically restarts. Some ATMs allow multiple transactions at the same time, but you have to wait until the other transactions have finished before transferring your money. Virtual systems do not suffer from these issues. You can use one machine to accept payments and transfer them to either a debit card or a traditional card. The machine will then deduct your payment automatically.

The benefits of using one of these machines is the assurance that your money will be safe and accessible when you need it most. Some people may worry about the safety of these transactions, since hackers can attack ATMs, taking out funds and causing chaos. A majority of machines that accept this form of payment are protected by multiple layers of encryption to ensure that the transaction is secure. In addition, the transaction fee typically covers the cost of maintaining the ATM network, which is quite low. These systems allow you to use your own wallet, instead of relying on third-party services.

youtube

The post Is It Worth Using a Bitcoin ATM? appeared first on TradingGator.

source https://www.tradinggator.com/is-it-worth-using-a-bitcoin-atm/

0 notes

Text

Altcoins Are a Good Investments

Altcoins are an interesting new innovation on the block, they are digital currencies that can be issued and traded like regular currencies. They can also function as a secondary currency in case you lose your primary one or have an unfortunate incident. As with other currencies, altcoins are subject to change on a daily basis depending on the general state of the economy. With so many things that affect our world, it is good to know that we can rely on something that is not governed by a set of federal laws or a singular central political entity.

The altcoin market has taken off in recent years, and more people than ever before are starting to invest. However, you need to keep in mind that while it is good to invest in them, it is just as important to understand how to make the most of your investment. This is where the knowledge of what altcoins are and how to invest in them comes into play. Knowing how to invest intelligently into this dynamic financial tool will result in seeing some very nice returns.

There are many ways that you can invest in altcoins. You can buy them from an existing AltICOIN account, which is one of the most popular ways to do so. You can also use your credit card to purchase a variety of different types of Altcoins. However, since Altcoins are still fairly new, you may run into trouble if you are relying on credit cards for the large balances.

The first thing that you want to do is educate yourself about the investment. Start reading up about the altcoin and learn as much as you can about it. Once you know enough about it, then it is time to research how you can invest. As with any new investment you should always seek out advice from professional experts who are able to advise you on a range of different options.

One option of how you can invest is through what is known as an exchange-traded fund. This is the more traditional way of investing. Basically, you will buy up one currency and then trade it back into another currency. However, because these trades are not controlled by you, there is a greater chance that you will lose money in these trades.

Another option is to use what is called a mini forex account. A mini forex account is an account that is specifically designed to allow investors to invest in various different types of alternative currencies without having to deal with large amounts of money at one time. However, it does mean that you are limited to trading one type of currency at a time.

One other way of investing in altcoins is by purchasing them in what are called “digital certificates”. Basically, instead of dealing with paper certificates, you are dealing with digital certificates. In the case of this, you will be issued an altcoin wallet. The wallet would essentially be a USB stick or a digital document that you can plug into your computer. From there, you would be able to spend your altcoins from any location with an Internet connection.

Altcoins are good investments because they offer higher potential returns than traditional stocks and bonds. However, like with any investment, you need to know everything about your investments before you decide if it is right for you. If you do decide that investing in altcoins is right for you, be sure to look into everything that you would be investing in.

Investing in altcoins can be done through a variety of different ways. For instance, you could purchase a stock certificate, although the fees for this would be very high. You could also invest through a variety of different online brokerages. However, this usually involves a lot of paperwork and fees that may deter many people from investing in this manner.

If you want a way that is a little less formal and a little less smelly, then you could invest in an “altcoin futures”. This is not as popular as the other ways of investing in altcoins, but some people still choose this method. Basically, what you do is invest in an interest-bearing asset, such as gold or silver coins. However, instead of holding onto the coin itself, you invest in an amount of time. Therefore, if you are investing for a month, then you would own that coin and have it earn interest.

Altcoins are a good way to earn a profit, especially if you choose to buy them rather than sell them when the market has fallen and the value of the coin tapers off. There are tons of places to invest in altcoins, so finding one that you like shouldn’t be a problem. Just remember, though, that you need to be careful. Never invest all of your money at once. Be smart about it and you should be fine.

youtube

The post Altcoins Are a Good Investments appeared first on TradingGator.

source https://www.tradinggator.com/altcoins-are-a-good-investments-2/

0 notes

Text

What is A Cryptocurrency Airdrop?

What is A Cryptocurrency Airdrop?

What is an airdrop? Airdrop is the transfer of an uncolored asset from one computer to another computer through the use of internet. An airdrop is simply a transfer of a cryptogram (a sequence of alphabets that make up a keyword) to a number of selected wallet addresses. Airdrop systems are typically implemented as a method of attracting new users and attention to a brand, resulting in a wider distribution of assets and more users interacting with your brand. Airdrop can be used in a number of ways. The goal is to enhance the user experience by adding another dimension to browsing the web.

There are several different types of airdrop. The most well known are the pay per click (PPC) schemes. This involves placing an ad on a search engine where your ads will be targeted according to keywords chosen by you. Your ads will appear on the right hand side of search results. You can choose which wallets to distribute your PPC ads to. There is also an upcoming private key infrastructure (PKI) project that aims to give away a free public key rather than a private key.

The next term airdrop refers to the distribution method of tokens. These are normally distributed at a token sale event, like an online auction. Most commonly, these are sold in block transactions, meaning each transaction requires an extra block ofether (a specific amount of ethernet) to complete. These are the most commonly used methods for distributing tokens.

Another commonly used method is the incentivized gateways. These are third party organizations that will act as a liaison between your distributors and the wallet you are using. This will give you access to their wallet for the currencies they exchange and you will in turn, in return, be able to redeem your airdrop tokens for bitcoins.

One of the newest methods of spreading awareness about a cryptotopian vehicle is with the use of wallets. Many wallets today have integrated the ability for users to select multiple transactions to make. For example, an individual may have several different wallets and may choose which wallet to interact with based upon the interest and demographics of the wallet. This provides a gateway for distributing airdrop tokens to the community, while also allowing users to control their own funds by only spending what they want. This concept is similar to what is known asICO, which is a funded transfer scheme.

This is the reason why it is important to understand the difference between what is a cryptocurrency airdrop andICO. ICO is a funded transfer scheme, which is designed to let people control their own funds, and spend it however they see fit. This is done by issuing the coins to a smart phone or mobile device, and then having access to your own private dashboard. These devices will generally allow you to have access to both your personal account and any other wallets you have on your person. You will be able to select which wallets you want to work with, and spend accordingly.

What is aICO is a form ofICO, which would be funded by a little differently. AICO is a managed fund that will allow you to spend your money in whatever way you choose. The concept behind what is aICO is that you are allowed to control your personal invested wealth, and spend it however you want, while gaining access to a wide variety of diverse digital currencies. With this access, you will be able to purchase a wide variety of airdropped coins, while giving the opportunity to spread your awareness of the new wave of coins being introduced.

What is aICO and how it works is that the airdrop manager will issue you multiple free coins after you have verified that you have a PayPal or MasterCard account. They will then transfer the funds from your wallet to their private dashboard. This then allows you to receive a wide variety of free coins and convert them into your private and controlled currency, all from the comfort and convenience of your own computer. What is aICO is an exciting concept and will revolutionize the way that people will dine out in the future.

youtube

The post What is A Cryptocurrency Airdrop? appeared first on TradingGator.

source https://www.tradinggator.com/what-is-a-cryptocurrency-airdrop/

0 notes

Text

Comprehensive EasyMarkets Review Released By TradingGator

TradingGator is a website that offers trading reviews on a variety of subjects. The website provides information about CFD signals, as well as the top European Forex brokers. The information helps novice traders become more skilled in their execution.

Ft Lauderdale FL: TradingGator is pleased to announce that the website has recently published a helpful and comprehensive review about EasyMarkets. The easyMarkets review discusses a variety of features that the platform provides. Some of the most helpful features include the fact that a demo account is available; a relatively small minimum deposit; mobile, web and desktop trading platforms; and MetaTrader4; the trading assets of the easyMarkets broker include Forex, Crypto, Stocks and CFDs. The fee schedules are transparent, and the platform offers a unique cancellation feature.

TradingGator is a website for traders by traders. The site includes honest and unbiased reviews of online brokers. The target audience is people who are interested in cryptocurrencies, Forex and finance. The founders of the website are real traders who understand the services which traders actually need. The website provides enough information about the brokerage so that potential traders can make an informed decision before selecting the platform.

The review characterizes the easyMarket broker as one with tight spreads and guaranteed stops. When searching for a trading platform, easyMarkets should fit the needs of site security, user-friendliness, profitability and a great overall trading experience. The platform is a safe and average risk broker. Clients can enjoy excellent protection for funds and can trade without worry. The platform has licenses from the most reputable and recognized regulatory authorities, ASIC and CySEC.

Clients who use easyMarkets enjoy negative balance protection and fixed spreads, particularly in volatile markets such as Forex CFDs and cryptocurrency. Investors are kept aware of the costs and are not affected by changes in market conditions. The platform is required to separate company funds and client’s funds, and the broker has sufficient liquid capital to protect against unexpected fluctuations of the market. In the event of insolvency, European Union clients are protected for amounts up to 20,000 EUR.

About the Site:

TradingGator is a comprehensive informational website that provides details about trading, brokers, techniques and more. The detailed reviews help prospective traders gather information to utilize in choosing a broker or platform. The selection of a broker should not be made with superficial consideration. Additional details are available at https://www.tradinggator.com/easymarkets-review/

==========================

Contact Info:

Company: TradingGator

Address: 806 Popular Lane, Ft Lauderdale FL 33311

Email: [email protected]

The post Comprehensive EasyMarkets Review Released By TradingGator appeared first on TradingGator.

source https://www.tradinggator.com/comprehensive-easymarkets-review-released-by-tradinggator/

0 notes