#Executor Grant of Probate

Text

Demystifying the Grant of Probate Certificate and Executor Grant of Probate in the UK

In the aftermath of losing a loved one, dealing with legal matters can be overwhelming. In the UK, the process of handling a deceased person's estate often involves obtaining a grant of probate certificate. Additionally, for those appointed as executors, understanding their role in securing this certificate is crucial. Let's delve into these concepts to shed light on what they entail.

How Does the Grant of Probate Certificate Work?

A grant of probate certificate is a legal document issued by the Probate Registry. It confirms the authority of the executor named in the deceased person's will to administer their estate. This certificate is necessary for accessing and distributing the deceased's assets, including property, money, and possessions.

How is a Grant of Probate Certificate Obtained?

To obtain a grant of probate certificate, the executor must apply to the Probate Registry. This involves completing an application form, providing details about the deceased's estate, and submitting the original will (if one exists). Additionally, the executor may need to swear an oath confirming their authority and undertaking to administer the estate according to the law.

How Does the Executor Grant of Probate Differ?

An executor grant of probate refers to the specific grant issued to the executor named in the deceased person's will. This grant authorizes the named executor to carry out their duties, such as collecting assets, paying debts and taxes, and distributing the estate to beneficiaries as per the will's instructions.

How Does an Executor Obtain Grant of Probate?

As the appointed executor, obtaining a grant of probate involves following a series of steps. Firstly, the executor must locate and review the deceased person's will to confirm their appointment. Next, they need to gather information about the deceased's assets and liabilities, including property, bank accounts, investments, and debts. With this information in hand, the executor can then apply for the grant of probate certificate as outlined earlier.

How Does Probate Support Executors?

Probate provides legal recognition and authority to executors, empowering them to fulfill their duties effectively. With a grant of probate certificate in hand, executors can access the deceased's assets, manage their affairs, and distribute the estate according to the terms of the will. This process ensures that the deceased's wishes are carried out and that beneficiaries receive their rightful inheritances.

How Does Probate Ensure Legality?

One of the primary purposes of probate is to ensure the legality of the estate administration process. By obtaining a grant of probate certificate, executors demonstrate to banks, financial institutions, and other relevant parties that they have the legal authority to act on behalf of the deceased. This helps prevent disputes and ensures that the estate is managed in accordance with the law.

How Does Probate Handle Disputes?

In some cases, disputes may arise during the probate process, particularly if there are disagreements among beneficiaries or challenges to the validity of the will. In such instances, probate provides a legal framework for resolving disputes and ensuring fair distribution of the estate. Courts may intervene to adjudicate disputes and uphold the deceased's wishes as expressed in their will.

How Does Probate Provide Closure?

Beyond its legal implications, probate plays a significant role in providing closure for the deceased's loved ones. By formalizing the estate administration process and facilitating the distribution of assets, probate allows families to settle the affairs of the deceased and move forward with their lives. It offers a sense of closure and finality, enabling grieving individuals to focus on healing and remembering their loved one.

In summary, the grant of probate certificate and executor grant of probate are essential components of the estate administration process in the UK. By providing legal authority and support to executors, probate ensures the efficient and lawful distribution of the deceased's assets, ultimately facilitating closure for their loved ones.

0 notes

Text

Probate Lawyers

At QLD Estate Lawyers, we have a team of experienced probate lawyers on hand and ready to answer all your questions. As a commonly used term during estate administration is it important you understand and what it means. Our expert and friendly Probate Lawyers are here to guide you through this difficult time and ensure you are well informed during the proceedings.

#Probate Lawyers Brisbane#Estate Administration Queensland#Will Dispute Lawyers QLD#Executor Services Brisbane#Grant of Probate Assistance Brisbane#Will Validation Legal Services#Estate Assets Management QLD#Probate Law Queensland#Brisbane Estate Planning Lawyers#Inheritance Law Firm Brisbane

3 notes

·

View notes

Text

not gonna lie i am keen to write about the Snicketverse’s solicitors or as y’all know attorneys. like estate administration is in huge demand there with everyone dying in fires or being killed in unfortunate events concerning three kids. and like what happens to their estates. where does the money and property they have themselves go if they don’t have kids? back to VFD? were the Baudelaire and Quagmire mansions sitting on land owned by VFD so when they went up there were no title transfers or transmissions out of their names? and have they all appointed whack executors like Mr Poe and Esmé? is every firm in town facing bane-of-their-existence executors, and how often do they face them? we only saw a year max of the Snicketverse - is it like this all the time? god not a single one of the solicitors is making it past 75 there either. imagine the stress. and oh my god imagine if the firms didn’t see the administration of the VFD rich’s estates. like they’re sitting on millions!! someone’s gotta fuckin organise grants of probate!! it needs to go to the court oh my god is it getting to the court

and even for other law matters, like, where are the court attorneys. like clearly Esmé Olaf and the Baudelaires were self acting because they were psychologically exhausted from their road trip it was more impactful narratively if they did but like are the attorneys all shady and sus af like Mr Poe and Esmé imply the Financial District is?

#esme’s own attorney bestie is one frances oswalda goldfinch (calls herself a solicitor bc she’s aus and difficult) faceclaim nicole kidman#please lmk if i’m getting stuff wrong americans i need it for my research#gray's posts#asoue#snicketverse

18 notes

·

View notes

Text

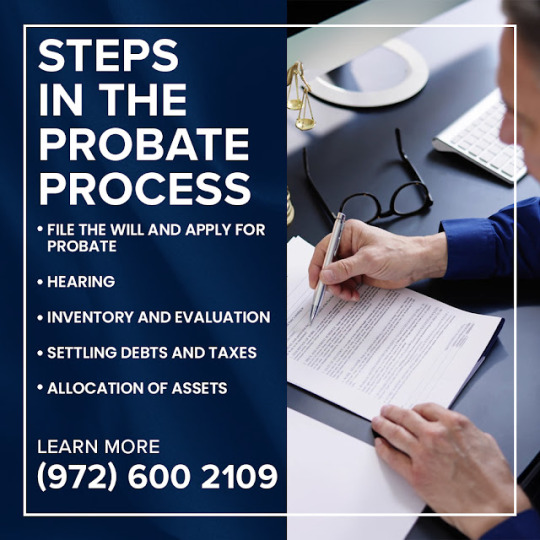

An Expert Overview Of Probate Proceedings in Texas

Ybarra Law Firm Introduces You To What Probate Lawyers Do During The Probate Process

Dealing with the probate process can be a daunting experience for many families dealing with the estate of a deceased loved one. Ybarra Law Firm, a premier legal practice in Irving, TX, is committed to demystifying the complexities of probate proceedings and offering expert guidance through each step of this intricate legal process.

What Is Probate?

Probate is the legal process by which a deceased person's estate is managed and distributed according to their will or Texas intestacy laws if no will exists. This process involves several critical steps, including validating the will, appointing an executor, settling debts, and distributing assets to beneficiaries. Ybarra Law Firm, known for its expertise in probate law, emphasizes the importance of understanding each phase of probate to ensure a smooth resolution.

Probate Lawyers and Their Role

The role of probate lawyers is crucial in managing the probate process efficiently. Dallas probate lawyers at Ybarra Law Firm offer comprehensive services to guide executors and administrators through the complexities of probate. Their responsibilities include preparing and filing necessary documents, resolving disputes, and managing estate affairs. With their extensive knowledge of Texas probate law, Ybarra Law Firm’s team ensures that every legal requirement is met and that the process is handled with professionalism and care.

Disputes in Probate

Probate proceedings can often be complicated by disputes, which may arise over issues such as the validity of a will, disagreements among beneficiaries, or allegations of executor misconduct. Ybarra Law Firm is well-equipped to handle these challenges, providing mediation and litigation services to protect their clients' interests. By addressing conflicts promptly and effectively, their Dallas probate attorneys strive to resolve disputes amicably and ensure that the probate process proceeds smoothly.

Steps in the Probate Process

The probate process in Texas involves several key steps:

1. File the Will and Apply for Probate: The initial step is to file the will and an application for probate with the court. This filing starts the legal process of validating the will and appointing an executor to manage the estate.

2. Hearing: A probate court hearing is scheduled to review the will and the application for probate. If the court approves, it issues Letters Testamentary or Letters of Administration, granting the executor legal authority to handle the estate.

3. Inventory and Evaluation: The executor must compile an inventory of the deceased’s assets and have them appraised to determine their fair market value. This step is essential for managing estate taxes, settling debts, and distributing assets.

4. Settling Debts and Taxes: The executor is responsible for notifying creditors, paying valid debts, and handling any applicable taxes. Proper management of these financial aspects is crucial to protect the estate’s assets.

5. Allocation of Assets: Finally, the remaining assets are distributed to beneficiaries according to the will or, if no will exists, according to Texas intestacy laws.

Ybarra Law Firm’s probate lawyers provide expert guidance throughout these steps, ensuring that each phase is completed efficiently and in accordance with Texas laws.

Expert Probate Lawyers in Dallas To Handle Your Legal Needs During The Probate Process

Probate proceedings can be a complex and emotionally taxing experience. Having skilled probate lawyers by your side can make a significant difference in how smoothly the process unfolds. Ybarra Law Firm is dedicated to offering top-notch legal support to clients in Dallas, TX. You can be sure to have a probate lawyer in Dallas there who will ensure that the probate process is handled with expertise and compassion.

For more information about navigating probate proceedings or to schedule a consultation with experienced and bilingual Dallas probate lawyers, contact Ybarra Law Firm at (972) 600-2109 or [email protected] for expert legal assistance tailored to your needs.

Contact Information:

Ybarra Law Firm

511 E John Carpenter Fwy Ste 500

Irving, TX 75062

United States

Original Source: https://ybarrafirm.com/probate/what-happens-during-the-probate-proceedings-in-texas/

0 notes

Text

Unconventionally signed DIY will declared valid at great expense

Regrettably DIY wills almost invariably lead to the will-maker’s estate being put to unnecessary expense to overcome validity or interpretation issues and other legal problems.

Kevin Chambers died on 17 March 2023 at the age of 91. His wife and son died before him and he was survived by his daughter Cherie.

He made his will in October 2017 – after the death of his son – leaving everything to Cherie and appointing his friend Daniel to be the executor.

Kevin used a pre-printed will kit will, which he likely purchased at the local newsagent or post office.

Kevin filled in the DIY forms. The will was comprised by two pages, and on page 1 – after naming his grandson Daniel as executor – he specified in clause 3 that he gave Cherie “my entire estate”.

He then signed the will adjacent to clause 3 and at the bottom of page 1 but not in the usual place at the end of the will.

Despite there being further sections that could be completed on page 2, Kevin added nothing further on that page.

He failed to sign the attestation clause on that page, despite directions on the pre-printed form to do so.

Kevin’s will was witnessed by two friends. They did not sign on page 1 at either of the two places where Kevin had signed. They signed at the attestation clause at the bottom of page 2 where directed where Kevin had failed to do so.

Daniel did not take up his role as executor and instead Cherie applied for a Grant of Letters of Administration as the sole beneficiary, claiming that the will was validly made.

Whilst it was quite clear Kevin had intended to make a will, the fact he had signed it only on page 1 and not the attestation clause at it end where the witnesses had signed, caused the Probate Registrar to have concerns.

In her opinion the will was not validly executed in accordance with the requirements of s 10 of the Succession Act. She directed that the validity issue be heard and determined by a judge of the Supreme Court.

When the matter came before him, Justice Peter Davis declared the will to have been validly made despite the irregularities in how Kevin and the witnesses had signed it.

In his view, the irregularities did not mean the formal requirements of s 10 had not been met.

“Neither the positioning of Kevin’s signature on the first page, nor his failure to sign the second page, constitute a breach of the requirements,” he observed.

“There is nothing in s 10 which suggests that the witnesses must sign on the same page or place as the testator,” he ruled.

Given it was beyond dispute that Kevin signed the will with two witnesses who were present to see him do so and the witnesses each attested and signed the will in front of Kevin, all required formalities had been met.

That Kevin and the witnesses did not sign the will at all the required places unnecessarily complicated what otherwise was a straightforward probate application and added significant expense.

Attempts to save expense by completing a DIY will – rather than one prepared by an experienced solicitor – almost invariably add such expense to estate administration and regrettably, delay the process by many months.

ORIGINALLY FOUND ON-

Source: QLD Estate Lawyers(https://qldestatelawyers.com.au/unconventionally-signed-diy-will-declared-valid-at-considerable-expense/)

#contesting a will QLD#challenging a will QLD#disputing a will QLD#how to contest a will QLD#will contesting process QLD

1 note

·

View note

Text

Understanding Statutory Declarations and Wills and State Law in Ontario

Navigating legal processes can be complex, particularly when dealing with matters such as statutory declarations, wills, and estate law. In Ontario, understanding these legal concepts and their applications can help ensure that personal affairs are handled appropriately and in accordance with the law.

What is a Statutory Declaration?

A Statutory Declaration Ontario is a legal document affirming that certain facts are true to the best of the declarant's knowledge. It is a written statement that is signed before an authorized official, such as a notary public. In Ontario, statutory declarations are used for various purposes, including confirming identity, residency, or marital status. These declarations hold significant legal weight and are often required in legal, administrative, and commercial contexts.

The Importance of Statutory Declarations

Statutory declarations serve as vital tools for affirming facts when other forms of evidence are unavailable or unnecessary. They are used in situations where an affidavit may not be required but where a formal declaration is still necessary. In Ontario, statutory declarations are essential in processes such as property transactions, immigration applications, and certain legal proceedings.

Understanding Wills and Estate Law

Wills and estate law govern the management and distribution of a person's estate after their death. A will is a legal document that outlines how an individual's assets and belongings should be distributed among their heirs and beneficiaries. In Ontario, it is crucial to understand the legal requirements for creating a valid will to ensure that one's wishes are honored.

Creating a Valid Will

To create a valid will in Ontario, certain legal criteria must be met. The testator, or person creating the will, ought to be at least eighteen years old and in a good mental state. The will must be in writing, signed by the testator, and witnessed by two individuals who are not beneficiaries. Understanding these requirements is essential for ensuring that the will is legally binding and will be upheld in court.

The Role of an Executor

An executor is someone named in a will to handle the dead estate. The executor's responsibilities include gathering and managing the estate's assets, paying debts and taxes, and distributing the remaining assets to the beneficiaries. In Ontario, it is important to choose a trustworthy and capable executor, as they play a crucial role in executing the testator's wishes.

Probate and Estate Administration

Probate is the legal process of validating a will and granting the executor the authority to administer the estate. In Ontario, the probate process involves submitting the will to the court, proving its validity, and obtaining a grant of probate. The executor then carries out their duties, ensuring that the estate is settled according to the will and the law.

Challenges in Estate Administration

Distributing an estate can be a difficult and time-consuming chore. Executors may face various challenges, such as locating and valuing assets, dealing with creditors, and resolving beneficiary disputes. Understanding the intricacies of wills and estate law in Ontario can help executors navigate these challenges effectively.

The Importance of Professional Guidance

Given the complexities involved in statutory declarations and wills and estate law, seeking professional guidance is highly advisable. In Ontario, legal professionals can provide invaluable assistance in drafting statutory declarations, creating valid wills, and administering estates. Their expertise ensures that legal requirements are met and that potential issues are addressed proactively.

Conclusion

Understanding statutory declarations, wills, and estate law is essential for managing personal affairs and ensuring that legal matters are handled correctly. In Ontario, these legal tools play a critical role in affirming facts and managing estates. Seeking professional guidance can provide peace of mind and ensure that one's wishes are respected. For more information, visit northvistanotary.com.

0 notes

Text

Understanding the Key Responsibilities of Executors Holding a Letter of Testamentary

In the realm of estate planning and probate law, a Letter of Testamentary represents both a legal document and a significant responsibility. It is issued by the probate court to an appointed executor upon the validation of a deceased person's will. This document grants the executor the authority to oversee the administration of the deceased's estate, ensuring that their final wishes are carried out according to legal requirements. Here's a detailed exploration of the key responsibilities that executors hold when entrusted with a Letter of Testamentary. to know more visit us at : https://bizrocklegal.blogspot.com/2024/07/understanding-key-responsibilities-of.html

0 notes

Text

Professional Probate Lawyers in Melbourne | Eminent Lawyers

Qualified Melbourne Probate Lawyers Ready to Take Away Your Stress

Eminent Lawyers’ probate lawyers in Melbourne deliver expert guidance and support for all probate issues. We have an extensive understanding of the local legal landscape and are proud to provide comprehensive and personalised support to ensure the probate process runs smoothly.

Whether you are an executor managing an estate or a beneficiary seeking rightful inheritance, our experienced lawyers are committed to delivering expert counsel and ensuring a smooth resolution during this challenging time. We prioritise transparency and communication, striving to demystify probate proceedings for our clients. Our probate lawyers are well-versed in local regulations and possess the expertise to handle various probate matters efficiently. Get in touch with us to schedule an appointment with one of our team members.

Melbourne’s Probate Lawyers Always Acting on Your Best Interests

We are a premier Melbourne probate law firm where we blend legal expertise with exceptional client service. Our probate lawyers are devoted to guiding clients through the intricate probate process with a deep understanding of the legal nuances. From applying for a Grant of Probate to Letters of Administration, we are here to offer reliable legal support tailored to your unique circumstances. With a client-focused approach, you know you are in capable hands.

We aim to alleviate the challenges associated with probate by being your reliable partners and providing top-notch probate legal services to help you navigate legal procedures with confidence and peace of mind. Our seasoned team is passionate about what we do and always works diligently to deliver tailored solutions no matter the scale of your probate matters. Visit our website to learn more about our services.

For more details, please visit us at link:

Website - https://eminentlawyers.com.au/probate-lawyers-melbourne/

1 note

·

View note

Text

How to Create an Estate Plan: A Beginner's Guide

Planning for the future is essential to ensure your assets are distributed according to your wishes and that your loved ones are cared for after you pass away. Creating an estate plan might seem daunting, but with a clear understanding of the basics, you can take the necessary steps to secure your legacy. Here's a beginner's guide to help you navigate the estate planning process.

Understanding the Basics of Estate Planning

Estate planning involves making arrangements for managing and distributing your assets upon your death or incapacitation. An estate plan typically includes a will, trusts, powers of attorney, and healthcare directives. The primary goal is to ensure that your wishes are respected and that your assets are distributed efficiently and with minimal legal complications.

It is crucial to start with an inventory of your assets. List all your properties, investments, bank accounts, insurance policies, and personal belongings. This comprehensive inventory will help you understand what you need to plan for and whom you want to benefit from your estate.

Creating a Will

A will is a legal document that specifies how your assets should be distributed after your death. It allows you to name an executor responsible for carrying out your wishes. Without a will, the state's intestacy laws will determine how your assets are distributed, which may not align with your desires.

To create a will, start by deciding who will inherit your assets. You can leave your belongings to family, friends, charities, or other entities. Additionally, if you have minor children, you can designate a guardian for them in your will. Consulting with an estate planning attorney can help ensure your will is legally sound and covers all necessary aspects.

Setting Up Trusts

Trusts are legal arrangements where one party (the trustee) holds and manages assets on behalf of another (the beneficiary). They can provide more control over how assets are distributed and help minimize estate taxes. There are different types of trusts, such as revocable living trusts and irrevocable trusts, each serving different purposes.

Revocable living trusts allow you to retain control over your assets during your lifetime and specify how they should be distributed upon your death. They can help avoid probate, the legal process of distributing a deceased person's estate. On the other hand, irrevocable trusts cannot be changed after they are established, but they offer benefits like asset protection and tax reduction.

Designating Powers of Attorney

A power of attorney (POA) is a legal document granting someone the authority to make decisions on your behalf if you cannot do so. There are different types of POAs, including financial and healthcare POAs. A financial POA allows someone to manage your financial affairs, while a healthcare POA permits someone to make medical decisions for you.

Choosing a trusted individual to act as your POA is crucial, as they will have significant control over your affairs. Discuss your wishes with the selected person and ensure they are willing to take on this responsibility. It's also wise to consult an attorney to draft a POA outlining the powers granted and any limitations.

Healthcare Directives

Healthcare directives, also known as living wills or advance directives, outline your preferences for medical treatment if you cannot communicate your wishes. These documents can specify the types of life-sustaining treatments you do or do not want, such as resuscitation, mechanical ventilation, and tube feeding.

Having a healthcare directive ensures that your medical care aligns with your values and desires, reducing the burden on your loved ones to make difficult decisions on your behalf. Discuss your wishes with your family and healthcare provider to ensure everyone understands your preferences.

Naming Beneficiaries

Naming beneficiaries on your financial accounts, insurance policies, and retirement plans is a simple yet important aspect of estate planning. Beneficiary designations allow these assets to bypass probate and be directly transferred to the named individuals upon your death.

Review your beneficiary designations regularly, especially after major events like marriage, divorce, or childbirth. Ensure that your designations are up-to-date and reflect your current wishes.

Reviewing and Updating Your Estate Plan

An estate plan is not a set-it-and-forget-it document. It should be reviewed and updated regularly to reflect changes in your life circumstances, financial situation, and legal requirements. Major life events such as marriage, divorce, the birth of a child, or the death of a beneficiary may necessitate updates to your estate plan.

Additionally, changes in laws and regulations can impact your estate plan. Regularly consulting with an estate planning attorney can help ensure that your plan remains valid and effective in achieving your goals.

Communicating Your Plan

Communicating your estate plan to your loved ones is essential to ensure your wishes are understood and respected. While it might be uncomfortable to discuss end-of-life matters, having these conversations can prevent misunderstandings and conflicts among your beneficiaries.

Share the location of important documents, such as your will, trusts, POAs, and healthcare directives, with trusted individuals. Consider providing a summary of your estate plan to your family members and discuss any specific wishes or instructions you have.

Seeking Professional Help

Estate planning can be complex, and seeking professional help can provide peace of mind that your plan is comprehensive and legally sound. Estate planning attorneys, financial advisors, and tax professionals can offer valuable guidance tailored to your situation.

An estate planning attorney can help draft and review legal documents to ensure they meet your state's requirements. Financial advisors can assist with asset management and beneficiary designations, while tax professionals can help you understand the tax implications of your estate plan and explore strategies to minimize taxes.

0 notes

Text

Steps to Take if an Executor Fails to Administer an Estate

If an executor is not administering an estate, there are several actions you can take:

Citation to Accept or Refuse a Grant: Forces the executor to act by applying for a grant of probate or renouncing their role.

Citation to Take Probate: Used if the executor is intermeddling but not progressing; requires them to apply for probate.

Citation to Propound a Will: Forcing the executor to prove the validity of a Will.

Removing an Executor: As a last resort, you can apply to the court to have the executor removed.

For detailed guidance, visit Grant Saw Solicitors LLP.

0 notes

Text

Affordable Protective Property Trust Will Costs with IWC Probate and Will Services

When dealing with the estate of a deceased loved one, probate can be a complex and emotionally taxing process. In the UK, many citizens turn to expert advice to navigate this legal procedure effectively. Probate is the legal process that confirms a deceased person’s will and grants the executor the authority to manage and distribute their estate. If there’s no will, the process can be even more complicated, often leading to disputes and delays. While some cases may be straightforward, others involve larger estates or disputes that require detailed knowledge of inheritance law.

Protective property trust will cost law can be intricate, with varying rules depending on the size of the estate and its assets. For example, different tax obligations might arise based on the value of the property, savings, or investments left behind. Professional advice helps citizens understand these nuances, ensuring that legal procedures are followed and that financial obligations are met.

In addition to the legal hurdles, handling probate often coincides with grieving a loved one. Seeking advice from probate specialists or organisations like Citizens Advice can provide emotional relief, offering support during a difficult time.

These experts can assist with paperwork, legal terms, and negotiations, easing the burden on families. Probate errors can lead to significant financial loss. Getting advice ensures that executors don’t overlook any legal requirements, helping to settle estates more quickly and fairly.

For many, seeking probate advice is not just about following the law, but about achieving peace of mind during an emotional period. IWC Is a one-stop trusted name in the UK to get protective property trust will cost services.

0 notes

Text

Mother’s death bed regret falls short of a valid will

Many an attempt to make what appears to be a will unconventionally or informally falls short of a valid will because it does not meet minimum legal requirements.

Unfortunately this was the case in relation to the estate of Erika Kaegi-Fluri who – when she died – was survived by her only daughter, Juliana Wool.

In her first will made in December 2013, she left the whole of her estate to…

View On WordPress

#Estate Administration Queensland#Executor Services Brisbane#Grant of Probate Assistance Brisbane#Probate Lawyers Brisbane#Will Dispute Lawyers QLD

0 notes

Text

Estate Planning 101: What Is Estate Planning?

Estate planning is a crucial aspect of financial planning that involves preparing for the management and distribution of a person's assets and properties after their death or incapacitation. It encompasses various legal, financial, and personal decisions aimed at ensuring that your wishes are carried out regarding your estate, beneficiaries, and healthcare preferences. Estate planning is not reserved for the wealthy; it is a process that everyone should undertake to protect their assets, minimize taxes, and provide for their loved ones.

Here's a comprehensive overview of estate planning:

Asset Inventory and Assessment: Estate planning begins with taking stock of all your assets, including real estate, investments, retirement accounts, life insurance policies, business interests, and personal belongings. You should assess the value of each asset and consider how you would like them to be distributed among your beneficiaries.

Will Creation: A will is a legal document that specifies how your assets should be distributed upon your death. It allows you to designate beneficiaries for each asset, appoint guardians for minor children, and name an executor to oversee the probate process. Without a will, state laws (intestacy laws) will determine how your assets are distributed, which may not align with your wishes.

Trust Establishment: A trust is a legal arrangement that allows you to transfer assets to a trustee who will manage them on behalf of your beneficiaries. Trusts can help avoid probate, provide for minor children or beneficiaries with special needs, and offer privacy and control over asset distribution. There are various types of trusts, including revocable living trusts, irrevocable trusts, and special needs trusts, each serving different purposes.

Power of Attorney: A power of attorney is a legal document that grants someone the authority to make financial or healthcare decisions on your behalf if you become incapacitated. There are two types of powers of attorney: financial power of attorney, which authorizes someone to manage your financial affairs, and healthcare power of attorney (or healthcare proxy), which allows someone to make medical decisions for you.

Advance Healthcare Directives: Advance healthcare directives, also known as living wills, outline your preferences for medical treatment in case you are unable to communicate your wishes. This document specifies the medical interventions you do or do not want to receive, such as life support, organ donation, and palliative care.

Beneficiary Designations: Many assets, such as retirement accounts, life insurance policies, and payable-on-death (POD) accounts, allow you to designate beneficiaries directly. It's essential to review and update these beneficiary designations regularly to ensure they reflect your current wishes and avoid complications during estate distribution.

Tax Planning: Estate planning also involves strategies to minimize estate taxes and maximize the value of assets passed on to your beneficiaries. This may include gifting assets during your lifetime, setting up trusts to shelter assets from taxation, and taking advantage of applicable tax deductions and exemptions.

Review and Updates: Estate planning is not a one-time task; it requires regular review and updates to reflect changes in your life circumstances, such as marriage, divorce, the birth of children or grandchildren, significant asset acquisitions or disposals, and changes in tax laws. Regular reviews ensure that your estate plan remains relevant and effective in achieving your objectives.

In summary, estate planning is the process of arranging for the management and distribution of your assets and properties upon your death or incapacity. It involves creating legal documents such as wills, trusts, powers of attorney, and advance healthcare directives to ensure that your wishes are carried out and your loved ones are provided for according to your intentions. Proper estate planning with the experts offering estate planning services in Fort Worth TX offers peace of mind, protects your assets, and preserves your legacy for future generations.

0 notes

Text

Estate Planning: Protecting Your Wealth for Future Generations

Estate planning is a critical process for individuals seeking to manage and protect their assets during their lifetime and beyond. By carefully structuring an estate plan, you can ensure that your wealth is preserved, your wishes are honored, and your family is taken care of after your death. This article explores the essentials of estate planning, highlighting its importance and providing guidance on how to approach this vital task.

The Importance of Estate Planning

1. Asset Distribution

One of the primary goals of estate planning is to determine how your assets will be distributed upon your death. Without a clear plan, state laws will dictate the division of your estate, which may not align with your wishes. By creating a will or trust, you can specify exactly who will receive your property, financial assets, and personal belongings.

2. Minimizing Taxes

Estate planning can help minimize the tax burden on your heirs. Proper planning allows you to take advantage of tax-saving strategies, such as gifting assets during your lifetime or setting up trusts that can reduce estate and inheritance taxes. This ensures that more of your wealth is passed on to your beneficiaries rather than being consumed by taxes.

3. Avoiding Probate

Probate is the legal process through which a deceased person's estate is administered. It can be time-consuming, costly, and public. A well-structured estate plan can help your estate avoid probate, ensuring a smoother and more private transfer of assets to your heirs. This can be achieved through living trusts, joint ownership, and beneficiary designations.

4. Protecting Beneficiaries

Estate planning also involves making provisions for the care of minor children or dependents with special needs. By appointing guardians and establishing trusts, you can ensure that your loved ones are cared for according to your wishes and that their financial needs are met without delay or complication.

Key Components of an Estate Plan

1. Wills and Trusts

A will is a legal document that outlines your wishes for the distribution of your assets. It also allows you to appoint an executor to manage your estate and a guardian for minor children. Trusts, on the other hand, can provide more control over asset distribution and can help avoid probate. There are various types of trusts, including revocable living trusts and irrevocable trusts, each serving different purposes and offering unique benefits.

2. Power of Attorney

A power of attorney is a document that grants someone you trust the authority to make financial and legal decisions on your behalf if you become incapacitated. This ensures that your affairs are managed according to your wishes, even if you are unable to communicate them.

3. Health Care Directives

Health care directives, such as a living will and a durable power of attorney for health care, allow you to specify your medical care preferences and appoint someone to make health care decisions on your behalf. These documents ensure that your medical treatment aligns with your values and desires, providing peace of mind for you and your loved ones.

4. Beneficiary Designations

Many assets, such as life insurance policies, retirement accounts, and bank accounts, allow you to name beneficiaries directly. These designations supersede the instructions in your will, making it crucial to keep them up to date and consistent with your overall estate plan.

Conclusion

Estate planning is an essential step in securing your legacy and protecting your wealth for future generations. By taking the time to create a comprehensive estate plan, you can ensure that your assets are distributed according to your wishes, reduce the tax burden on your heirs, and provide for your loved ones' future needs. With careful planning and professional guidance, you can leave a lasting impact and peace of mind for those you care about most.

Estate planning can be complex, and laws vary by state. Consulting with an estate planning attorney, financial advisor, and tax professional can help you navigate the process and ensure your plan is legally sound and tax-efficient.

Empowering your financial future with expert guidance, one FREE consultation at a time.💯

🔗 To know more, visit - www.fintlivest.com

📞 Contact us – 8951741819 / 9637778041

👉 Follow for daily financial tips and strategies: Fintlivest

https://www.fintlivest.com

https://www.instagram.com/fintlivest

https://www.youtube.com/@Fintlivest

https://in.pinterest.com/fintlivestservices/

#EstatePlanning #WealthProtection #FutureGenerations #FinancialPlanning #LegacyPlanning #AssetManagement #TrustsAndWills #TaxPlanning #FamilyWealth #InheritancePlanning

#investment#budgeting#insurance#wealthmanagement#personalfinance#financialplanning#investmentstrategy#smartinvesting#finance#financialfreedom#realestate#estateplanning

0 notes

Text

Sell My House In Columbus: Probate Tips for Easy Sale

You’re thinking, “I want to sell my house in Columbus, but it’s in probate”. Probate can be a complex and lengthy process, especially when selling a house. In this article, we will explore what probate is, why it is necessary for selling a house, and the steps involved in selling a house in probate. We will cover everything from obtaining court confirmation of the sale to distributing proceeds. We will also discuss the benefits and challenges of selling a house in probate, including avoiding hefty maintenance expenses and potential family conflicts. If you want to sell your house in Columbus through probate, this article will provide valuable tips for a smooth sale process.

Key Takeaways:

Probate is the legal process of transferring property ownership after someone’s death.

Selling a house in probate is necessary to ensure a legal transfer of ownership.

To sell a house in probate, you must obtain legal documents, appraise the property, notify heirs, list the house for sale, negotiate terms, obtain court confirmation, and distribute proceeds.

What is Probate?

Sell My House in Columbus

Probate is the legal process through which a deceased person’s assets are distributed, debts are paid off, and titles are transferred to heirs or beneficiaries. In Ohio, probate involves the court overseeing the estate’s administration, ensuring the deceased’s wishes are fulfilled.

In real estate, probate facilitates property sales by providing a framework for transferring ownership rights. The executor, appointed by the court, is responsible for managing the decedent’s property, ensuring it is appropriately valued and distributed according to the will or state laws if no will exists. The probate process also addresses any outstanding debts and taxes owed by the estate, safeguarding the interests of creditors and beneficiaries.

Why is Probate Necessary for Selling a House?

Probate is essential for selling a house because it validates the transfer of property ownership from the deceased to their heirs or beneficiaries. In Ohio, the probate process ensures that all legal requirements are met before the property sale can proceed.

By going through probate, the court oversees the distribution of assets, including real estate, in compliance with the deceased’s will or state laws. This process not only protects the interests of the beneficiaries but also clarifies property ownership, making the house sale legally binding. Without probate, the transfer of ownership may face challenges or disputes, hindering the smooth completion of real estate transactions. Thus, understanding the intricacies of probate is crucial for anyone involved in estate planning or property sales in Ohio.

What are the Steps to Sell a House in Probate?

Selling a house in probate involves several vital steps to ensure a smooth transaction. From obtaining court approvals to notifying heirs and beneficiaries, each step is crucial.

Once the court approves the sale, the next step is to conduct an appraisal to determine the property’s fair market value. This valuation is essential for setting the listing price and attracting potential buyers.

After the appraisal, you must notify all interested parties, including heirs, beneficiaries, and creditors, about the pending sale. A real estate agent experienced in probate sales can help showcase the property effectively and manage negotiations.

Once offers start coming in, carefully evaluate each before accepting the most suitable offer.

Obtain Letters Testamentary or Letters of Administration

The initial step in selling a house in probate is obtaining Letters Testamentary or Letters of Administration from the court, granting the executor the legal authority to manage the estate and proceed with the sale.

Letters Testamentary or Letters of Administration are crucial documents that establish the executor’s right to act on behalf of the deceased. These letters grant the executor the power to gather and distribute assets, pay debts, and sell the property. These letters are necessary for the executor to proceed with the sale of the property or make important decisions regarding the estate. Typically, the court will issue these letters once the executor has filed the necessary paperwork and met any legal requirements.

Get Appraisal of the Property

Appraising the property is crucial in determining its market value before listing it for sale during the probate process. An accurate appraisal helps in setting the right price and attracting potential buyers.

Through property appraisal, an impartial third party assesses the real estate’s worth, considering its size, condition, location, and recent sales of comparable properties. This comprehensive valuation process ensures that the property is priced competitively in the market and increases the likelihood of a successful sale.

Property appraisals also play a vital role in safeguarding the interests of all parties involved in probate sales by objectively assessing the property’s value which can help mitigate disputes among heirs or beneficiaries.

Notify Heirs and Beneficiaries

Informing heirs and beneficiaries about the property sale is essential to keeping them updated on the probate process, involving them in decisions, and ensuring transparency in the sale proceedings.

Clear and consistent communication with heirs and beneficiaries during probate property sales is crucial in maintaining trust and understanding among all parties involved. Providing regular updates about the sale progress, discussing any potential challenges or decisions that may arise, and seeking their input fosters collaboration and respect for their stake in the estate distribution.

By keeping heirs and beneficiaries informed and engaged throughout the process, it not only helps manage their expectations but also allows them to voice any concerns or preferences they may have regarding the sale of the property. This openness and involvement can help prevent misunderstandings and conflicts, ensuring a smoother and more harmonious probate property sale.

List the House for Sale

Listing the house for sale involves showcasing the property to potential buyers, leveraging real estate platforms, and marketing strategies to attract interested parties during the probate sale.

One crucial aspect of listing a house for probate sale is to ensure the property is presented in its best possible light. This may involve decluttering, staging, and highlighting unique selling points to make it stand out in a competitive market.

Effective marketing tactics such as professional photography, virtual tours, and targeted advertising can significantly enhance the property’s visibility. Utilizing reputable real estate platforms like MLS, Zillow, and Realtor.com is essential to reaching a wide audience of potential buyers seeking probate properties.

Accept an Offer and Negotiate Terms

Accepting an offer and negotiating terms are critical steps in finalizing the sale of a house in probate. Ensuring mutually beneficial terms for both parties is essential for a successful transaction.

Once an offer is made on a probate property, the next phase involves looking into negotiations to reach an agreement that satisfies both the buyer and seller. This often includes detailed discussions on price, closing timelines, and potential contingencies.

Price negotiations are central in this process, as both parties aim to secure a deal that aligns with market value and the property’s condition.

Legal considerations, such as ensuring all documentation is accurate and meeting the necessary probate laws, are fundamental aspects that cannot be overlooked. Attention to detail is key to preventing any legal hitches down the road. Each step in the negotiation process must be carefully navigated to ensure a fair and lawful agreement is reached.

Obtain Court Confirmation of Sale

Obtaining court confirmation of the sale is a crucial step in the probate process, ensuring that the transaction is legally binding and compliant with the court’s requirements for property sales.

When a property is sold as part of a probate estate, the court approval serves as a safeguard to protect the interests of all parties’ interests. The validation process involves a thorough review by the court to ensure transparency and fairness in the sale. Through this oversight, the court verifies that the sale price is reasonable and that all legal obligations are met. Court approval assures that the sale will not be subject to challenges or disputes after completion, offering a sense of finality and security to the transaction.

Pay Off Debts and Distribute Proceeds

After the sale is confirmed, the next steps involve paying off outstanding debts from the estate proceeds and distributing the remaining funds to the rightful heirs and beneficiaries per the probate court’s directives.

Once the debts are settled, the executor or personal representative must ensure that all financial obligations of the deceased are met before allocating the remaining assets. This includes meticulously reviewing all creditor claims, negotiating settlements where possible, and obtaining court approval for distribution. It is crucial to carefully document all transactions and maintain accurate records to provide a transparent account of the estate’s financial activities.

What are the Benefits of Selling a House in Probate?

Selling a house in probate offers several advantages, including avoiding hefty property maintenance costs, expediting the sale process, and potentially fetching a higher selling price.

By selling a house in probate, the sellers can save a significant amount on upkeep expenses, as there is often less need for extensive renovations or repairs before putting the property on the market. This streamlines the selling process and accelerates the transaction, allowing sellers and potential buyers to reach a mutually beneficial agreement quickly. Selling the property in probate may lead to a more competitive asking price, attracting a more comprehensive range of interested buyers and ultimately enhancing the chances of securing a favorable deal.

Avoids Hefty Expenses of Maintaining the Property

One significant benefit of selling a house in probate is avoiding the substantial expenses associated with property maintenance, repairs, and upkeep, which can be financially burdensome for the estate.

By eliminating the need for ongoing property upkeep, the estate can save significant money that would have otherwise been allocated toward maintaining the property.

These cost savings are particularly advantageous in probate sales, as they provide much-needed financial relief for the heirs and beneficiaries, enabling them to settle the estate efficiently and without incurring additional financial strain.

Faster Sale Process

Selling a house in probate typically results in a quicker sale process than traditional market sales, allowing for a more efficient resolution of the estate’s assets and distributions.

In probate transactions, the streamlined procedures often lead to a faster turnaround time from listing to closing. This accelerated pace can significantly benefit beneficiaries by expediting the estate closure process, enabling them to access their inheritance sooner. Efficient sale timelines in probate sales mean the property can be sold and the proceeds distributed more promptly, reducing the time and complexities typically associated with asset liquidation in standard market sales.

Potential for Higher Selling Price

Selling a house in probate can yield a higher selling price due to market demand, property condition, and competitive bidding, resulting in increased returns for the estate.

One crucial element that can significantly impact the selling price is the strategic timing of listing the property. By carefully studying the current market trends and understanding peak selling seasons, sellers can capitalize on favorable conditions to attract buyers willing to pay a premium.

Showcasing the property’s unique features and investing in minor renovations or improvements can enhance its perceived value, attracting more potential buyers and driving up the final sale price.

Actively engaging with multiple interested buyers and creating a competitive bidding environment can lead to offers that exceed the initial valuation, ultimately maximizing the estate returns.

What are the Challenges of Selling a House in Probate?

While selling a house in probate offers benefits, it also presents challenges, such as a lengthy and complex process, potential family conflicts, and the requirement for court approval at various stages.

Selling a property in probate can be challenging due to the extended duration of the legal procedures involved. From filing the initial petition to the final distribution of assets, each step can be time-consuming and demanding. This lengthy process can test all parties’ patience, adding to the stress of an already emotional situation.

Family dynamics can further complicate the sale. Disagreements over the property’s value, the distribution of proceeds, or the decision-making process can lead to conflicts that hinder progress. In such cases, communication breakdowns and differing opinions can escalate tensions and prolong the selling process.

Court mandates introduce another layer of complexities, as all decisions regarding the sale must comply with legal requirements. This means that every transaction concerning the property needs judicial approval, making the entire process subject to the court’s timeline and regulations.

Lengthy and Complex Process

One significant challenge of selling a house in probate is the lengthy and intricate process, which involves legal requirements, court proceedings, and estate administration tasks that can extend the sale timeline.

Probate sales involve legal compliance and navigating through various court procedures, such as obtaining court approval for the sale and dealing with estate regulations. These proceedings can introduce significant delays, as each step must adhere to the court’s strict protocols and timelines. Executors or administrators are tasked with fulfilling administrative duties meticulously, from filing necessary documents to managing assets and debts within the estate. The complexity of the probate process necessitates patience and attention to detail to ensure all required legal steps are correctly followed.

Potential for Family Conflicts

Selling a house in probate can lead to potential family conflicts arising from disagreements over property distribution, sale terms, or inheritance issues, complicating the selling process.

Family dynamics are crucial in these situations, with varying opinions and emotions often at play. Inheritance conflicts may stem from differing perceptions of fairness or entitlement. Property disagreements can intensify if there are multiple heirs with differing priorities regarding the sale or preservation of the property.

Resolving these disputes requires effective communication and negotiation among family members. Mediation can be a valuable tool for facilitating discussions and reaching consensus on sale terms and property distribution. Seeking legal guidance to establish clear guidelines for the probate sale can help prevent disagreements from escalating.

Court Approval Required

One of the challenges of selling a house in probate is the necessity for court approvals at various stages, adding legal formalities and potential delays to the sale process that require compliance with court regulations.

These court approvals are pivotal in ensuring that the sale of a property within a probate process goes smoothly and adheres to the regulatory requirements set forth by the judicial system.

Obtaining court approval verifies the legitimacy and validity of the property transaction, offering protection to all parties involved in the estate settlement.

The court-mandated procedures provide oversight and accountability and safeguard the rights of heirs and creditors, preventing any potential disputes or legal challenges down the line.

Frequently Asked Questions

What is probate, and how does it affect selling my house in Columbus?

Probate is the legal process of handling the estate of a deceased person. If the property is part of the estate and requires court approval before it can be sold, it can affect selling your house in Columbus.

Who handles the probate process for a property in Columbus?

The executor in the deceased person’s will typically handles the probate process. The court will appoint an administrator to handle it if there is no will.

Should I wait until the probate process is complete before selling my house in Columbus?

In most cases, no. You can still sell the property during the probate process, but you must obtain court approval and follow specific guidelines.

What if there are multiple heirs to the property in Columbus?

If there are multiple heirs to the property, they will need to agree on the sale before it can proceed. If they cannot reach an agreement, the court may need to step in and make a decision.

Can I sell my house in Columbus if the property has outstanding debts or taxes?

Yes, but the sale proceeds may need to pay off those debts or taxes before being distributed to the heirs.

How can a professional home buying company help with selling my house in Columbus during probate?

A professional home-buying company, like Rapid Fire Home Buyers, can help expedite the sale of your house during probate by handling all the necessary paperwork and obtaining court approval. This can save you time and make the process much smoother.

1 note

·

View note

Text

Securing Your Legacy: The Importance of Wills and Estate Planning

In the hustle and bustle of daily life, contemplating one's mortality might not be the most comfortable topic. Yet, planning for the distribution of your assets and the well-being of your loved ones after you're gone is not only responsible but crucial. Welcome to our guide on wills and estate planning, where we delve into why it's essential and how to get started.

Understanding Wills and Estate Planning

What is a Will? A will is a legal document that outlines your wishes regarding the distribution of your assets and the care of any minor children. It allows you to designate beneficiaries for your property and specify guardianship for your dependents.

Why is Estate Planning Important? Estate planning is about more than just distributing assets. It's about ensuring that your loved ones are provided for, minimizing taxes, and potentially avoiding family disputes. Without a clear plan in place, your assets may be distributed according to state laws, which might not align with your intentions.

The Components of Estate Planning

Will: As mentioned, a will is a cornerstone of estate planning. It allows you to specify who will inherit your assets and who will be responsible for carrying out your wishes as the executor.

Trusts: Trusts are legal arrangements that hold assets on behalf of a beneficiary. They can be used to manage assets during your lifetime and distribute them according to your wishes upon your death. Trusts can also offer benefits such as avoiding probate and providing for minor children or individuals with special needs.

Power of Attorney: A power of attorney grants someone the authority to make financial or medical decisions on your behalf if you become incapacitated. Having a trusted individual designated can ensure that your affairs are handled according to your wishes even if you're unable to express them yourself.

Healthcare Directives: Healthcare directives, including a living will and healthcare proxy, outline your preferences for medical treatment if you're unable to communicate them yourself. They ensure that your wishes regarding life-sustaining treatment and end-of-life care are honored.

Getting Started with Estate Planning

Take Inventory: Start by making a list of all your assets, including bank accounts, investments, real estate, and personal property. Also, consider any debts you may have.

Determine Your Goals: Think about what you want to accomplish with your estate plan. Who do you want to inherit your assets? Do you have specific charitable intentions? Are there any family dynamics or potential conflicts to consider?

Consult Professionals: Estate planning can be complex, so it's essential to seek advice from professionals such as estate planning attorneys, financial advisors, and tax experts. They can help you navigate the legal and financial aspects of creating a comprehensive plan.

Review and Update Regularly: Life changes, and so should your estate plan. Review your documents regularly and make updates as needed, especially after significant life events such as marriage, divorce, births, or deaths in the family.

0 notes