#FirstTimeDriverCanada

Explore tagged Tumblr posts

Text

How Insurance Rates Change After Getting Your First Canadian Driver’s License

Getting your first driver’s license in Canada is an exciting milestone—but it also comes with a new responsibility: auto insurance. Whether you’ve just passed your G1 or G2, you might be wondering: how much will insurance cost, and how will your rates change over time?

Here’s a guide to understanding how insurance rates work for new drivers in Canada, and how you can keep your premiums low as a beginner.

Why Are Insurance Rates Higher for New Drivers?

New drivers are considered higher risk because they have little to no driving history. Insurance companies typically base premiums on:

Age and experience

Driving history

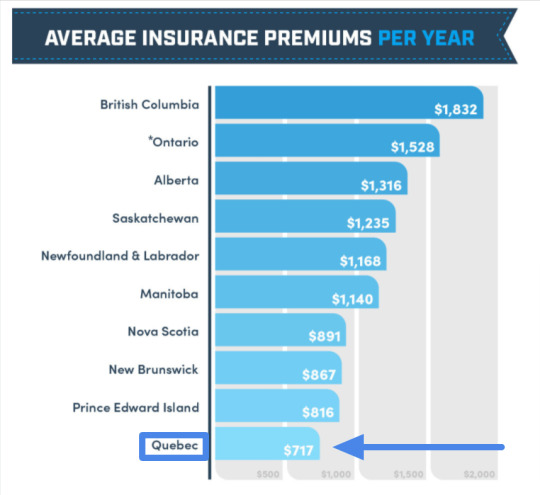

Type of vehicle

Where you live

Frequency of driving

Since new drivers haven’t yet proven themselves on the road, they usually face higher insurance rates—especially if they are under 25.

What Happens Right After You Get Your License?

Once you get your G1 or G2, you must either:

Be added to a parent or guardian’s policy, or

Purchase your own insurance policy if you own a vehicle.

G1 drivers often don’t need full coverage if they’re supervised while driving, but G2 drivers who can drive alone will need full liability coverage at minimum.

When Do Rates Start Going Down?

Your insurance rates can start to decrease after:

1–2 years of safe driving

Completing an accredited driver’s education course

Turning 25 (age matters in the insurance world)

No tickets or accidents on your record

You can speed up this timeline by preparing well and passing your tests the first time using resources like licenseprep.ca, which helps you understand road rules and safe driving practices.

What Can You Do to Lower Your Insurance?

Take an approved driver’s education course

Avoid accidents and traffic violations

Drive a car that’s cheaper to insure

Bundle your insurance if possible

Ask about student or good-driver discounts

Many insurers offer incentives for clean records and completed training—so it pays to learn smart from the start with tools like licenseprep.ca.

Final Thoughts

Your first car insurance quote might be a bit of a shock, but it gets better. With time, safe driving, and the right knowledge, you’ll see your rates drop steadily. Think of it as part of the journey—and a reason to build good habits from day one.

#FirstTimeDriverCanada#CanadianCarInsurance#NewDriverTips#InsuranceForBeginners#LicensePrep#SaveOnInsurance#G2DrivingCanada

0 notes