#Forex broker reviews usa

Text

Why You Need A Forex Trading System To Succeed - A Story Of Two Forex Traders Just Starting Out

With anything field or venture you might want to take on, there are dependably apparatuses and assets accessible to help you. Also, this is particularly evident with regards to Forex trading platform. The money market can be very overpowering, and turning into an effective Forex merchant doesn't come from blind karma. There are essentially such a large number of variables that can influence the heading that money costs will push toward.

The following are two significant real factors to consider:

1. Most beginners attempt to take on Forex utilizing no help or instruments. (Most novices lose the entirety of their cash).

2. Best dealers utilize a Forex exchanging framework to help them (Fruitful merchants earn substantial sums of money in Forex).

Yet, even with these real factors ordinarily known, amateurs actually attempt to go after Forex blind, basing their trading choices on restricted information and experience. It isn't until they have lost all of their exchanging supports that they consider that it presumably would have been more brilliant to put resources into a Forex exchanging framework and programming all along. Try not to misstep the same way. If you have any desire to find lasting success with money exchanging (ie. making reliable productive exchanges) then it is enthusiastically suggested that you research the numerous Forex exchanging frameworks and programming available.

Allow me to show further with an account of around two Forex dealers:

Tom and Jim have been finding out about Forex a ton as of late. Both have been going through hours internet attempting to comprehend what money exchanging is and how (and if) they can create a few speedy gains. All of the advertising promotions that they read say that you can build your cash extremely, rapidly. Certainly, there's some gamble included, however the potential prizes are simply too great to even consider missing. So the two of them choose to evaluate Forex and check whether they can find success with it.

The two people are profoundly energetic and need to allow Forex their best opportunity. So every one of them will put $1000 of their reserve funds into money exchanging. In the event that they lose the $1000, they will stop Forex and reconsider the choice about whether to attempt once more from now on. By effective financial planning 1,000 bucks, both have shown that they are completely dedicated to making Forex work for them.

Beginning:

Tom takes his whole $1000 and moves it into a retail online Forex dealer. Tom will go with all of his exchanging choices all alone. He will do his own exploration and will sneaking on Forex discussions and web journals to check whether he can get a few truly necessary tips.

Jim goes an alternate course. In spite of the fact that he is similarly basically as roused as Tom, he is likewise mindful of the intricacy of the Forex market and understands that he simply doesn't have a lot of involvement with this point. So he takes $900 and moves it to a similar retail Forex specialist as Tom. He saves the excess $100 to gain admittance to devices and assets (ie. Forex exchanging frameworks and programming) to assist him with improving exchanges. He used to day exchange stocks and knows direct the edge that these instruments and assets can have (particularly assuming you are simply getting acquainted with everything).

For more details, visit us :

Fbs broker reviews

Best ctrader broker

Islamic fx broker

Proprietary trading firms uk

#Forex broker reviews#Forex brokers reviews#Forex trading company#Forex trading platform#Forex broker reviews usa

1 note

·

View note

Text

XM Broker Review 2023: A Comprehensive Analysis of Trading Fees and Services

XM Broker Review 2023

XM is a global forex and CFD broker regulated by Australia's ASIC, CySEC of Cyprus, and Belizean authority IFSC. XM has low stock CFD and withdrawal fees. Account opening is user-friendly and fast. You can use many educational tools, such as webinars and a demo account. On the other hand, XM has a limited product portfolio as it offers mainly CFDs and forex trading. Its forex and stock index CFD fees are average, and there is no investor protection for clients onboarded outside the EU.

XM is a regulated broker, it is overseen by top-tier financial regulators in multiple countries . XM is also covered by investor protection in selected jurisdictions.

XM Highlights

🗺️ Country of regulationCyprus, Australia, Belize, United Arab Emirates💰 Trading fees classAverage💰 Inactivity fee chargedYes💰 Withdrawal fee amount$0💰 Minimum deposit$5🕖 Time to open an account1 day💳 Deposit with bank cardAvailable👛 Depositing with electronic walletAvailable💱 Number of base currencies supported10🎮 Demo account providedYes🛍️ Products offeredForex, CFD, Real stocks for clients under Belize (IFSC)

Visit Broker74.89% of retail CFD accounts lose money

Fees

XM has low trading fees for CFDs and charges no withdrawal fee. On the other hand, forex and stock index fees are only average, and there is a fee for inactivity.

AssetsFee levelFee termsS&P 500 CFDLowThe fees are built into the spread, 0.4 points is the average spread cost during peak trading hours.Europe 50 CFDAverageThe fees are built into the spread, 2.5 points is the average spread cost during peak trading hours.EURUSDAverageWith Standard, Micro, and Ultra-Low accounts the fees are built into the spread. 1.7 pips is the Standard account's average spread cost during peak trading hours. With XM Zero accounts, there is a $3.5 commission per lot per trade and a small spread cost.Inactivity feeLow$15 one-off maintenance fee after one year of inactivity, followed by $5 per month fee if the account remains inactive

XM trading fees

XM trading fees are average. XM has many account types, which all differ in pricing. The Standard, Micro, and Ultra Low accounts charge higher spreads but there is no commission. The XM Zero account charges lower spreads, but there is a commission. The following calculations were made using the Standard account.

We know it's hard to compare trading fees for CFD brokers. So how did we approach the problem of making their fees clear and comparable? We compared brokers by calculating all the fees of a typical trade for selected products.

We chose popular instruments within each asset class:

- Stock index CFDs: SPX and EUSTX50

- Stock CFDs: Apple and Vodafone

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

A typical trade means buying a leveraged position, holding it for one week and then selling. For volume, we chose a $2,000 position for stock index and stock CFDs, and $20,000 for forex transactions. The leverage we used was:

- 20:1 for stock index CFDs

- 5:1 for stock CFDs

- 30:1 for forex

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for XM fees.

CFD fees

XM has low stock CFD, while average stock index CFD fees.

XMFxProAdmirals (Admiral Markets)S&P 500 index CFD fee$2.5$1.1$1.4Europe 50 index CFD fee$3.1$1.2$1.4Apple CFD fee$6.7$9.4$5.3Vodafone CFD fee$2.3$14.7$14.2

Visit Broker74.89% of retail CFD accounts lose money

Account opening

XM accepts customers from all over the world. There are a few exceptions though; among others, you can't open an account from the USA, Canada, China, Japan, New Zealand or Israel.

What is the minimum deposit at XM?

The required XM minimum deposit is $5 for two XM Account types (Micro, Standard), which is very low, and $100 for the XM Zero account.

Account types

XM offers many account types, which differ in pricing, base currencies, minimum deposit and contract size.

MicroStandardXM ZeroShares AccountClient countryEEA

Australia

Other countriesEEA

Australia

Other countriesEAANon-EEA and non-Australian clientsPricingNo commission, but higher spreadNo commission, but higher spreadThere is a commission, but the spread is very lowMarket spread and commissionBase currenciesUSD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, SGD, ZARUSD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, SGD, ZARUSD, EUR, JPYUSDMinimum deposit$5$5$100$10,000Contract size1 Lot = 1,0001 Lot = 100,0001 Lot = 100,0001 share

Islamic or swap-free accounts are also available. With Islamic accounts, a flat commission is charged if you hold your leveraged position overnight instead of the percentage-based financing rates.

XM doesn't offer corporate accounts. If you sign up for a non-European entity, you will not be eligible for European client protection measures.

How to open your account

XM account opening is fully digital, fast and straightforward. You can fill out the online application form in 20 minutes. Our account was verified on the same day.

You can select many languages other than English:

ArabicBengaliChineseCzechDutchFilipinoFrenchGermanGreekHungarianIndonesianItalianKoreanMalayPolishPortugueseRussianSpanishSwedishThaiVietnamese

To open an account at XM, you have to go through these steps:

- Fill in your name, country of residence, email address and telephone number.

- Select the trading platform (MT4 or MT5) and account type.

- Add your personal information, such as your date of birth and address.

- Select the base currency and the size of the leverage.

- Provide your financial information and answer questions about your financial knowledge.

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Visit Broker74.89% of retail CFD accounts lose money

Deposit and withdrawal

Account base currencies

At XM, you can choose from 9 base currencies. The available base currencies are:

EURUSDGBPCHFJPYAUDSGDPLNHUFZAR

XMFxProAdmirals (Admiral Markets)Number of base currencies10811

Why does this matter? For two reasons. If you fund your trading account in the same currency as your bank account or you trade assets in the same currency as your trading account base currency, you don't have to pay a conversion fee.

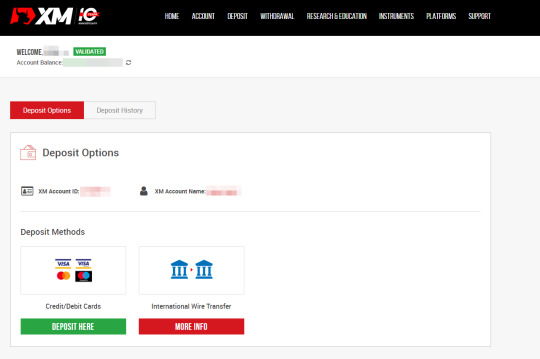

Deposit fees and options

XM charges no deposit fees. You can use bank transfers and credit/debit cards for depositing funds. Clients onboarded under IFSC can also deposit using the SticPay electronic wallet.

XMFxProAdmirals (Admiral Markets)Bank transferYesYesYesCredit/debit cardYesYesYesElectronic walletsYesYesYes

A bank transfer can take several business days, while payment with a credit/debit card is instant.

You can only deposit money from accounts that are in your name.

XM review - Deposit and withdrawal - Deposit

XM withdrawal fees and options

XM charges no withdrawal fees. The only exception is bank (wire) transfers below $200, which incur a $15 fee.

XMFxProAdmirals (Admiral Markets)Bank transferYesYesYesCredit/debit cardYesYesYesElectronic walletsYesYesYesWithdrawal fee$0$0$0

For credit/debit cards and electronic wallets (Skrill, Neteller), the withdrawal amount cannot exceed the amount you deposited using the same instrument. This means that you can only withdraw your trading profits via bank transfer.

How long does it take to withdraw money from XM? We tested debit card withdrawal and it took 2 business days.

You can only withdraw money to accounts that are in your name.

How do you withdraw money from XM?

- Log in to your account

- Go to 'Withdraw Funds'

- Select the withdrawal method

- Enter the withdrawal amount

Visit Broker74.89% of retail CFD accounts lose money

Web trading platform

Trading platformScoreAvailableWeb2.8starsYesMobile3.8starsYesDesktop3.4starsYes

XM does not have its own trading platform; instead, it uses third-party platforms: MetaTrader 4 and MetaTrader 5. These platforms are very similar to each other in functionality and design. One major difference is that you can't trade stock CFDs on MetaTrader 4, only on MetaTrader 5.

We tested the MetaTrader 4 platform as it is more widely used.

MetaTrader 4 is available in an exceptionally large number of languages.

XM web trading platform languagesArabicBulgarianChineseCroatianCzechDanishDutchEnglishEstonianFinnishFrenchGermanGreekHebrewHindiHungarianIndonesianItalianJapaneseKoreanLatvianLithuanianMalayMongolianPersianPolishPortugueseRomanianRussianSerbianSlovakSlovenianSpanishSwedishTajikThaiTraditional ChineseTurkishUkrainianUzbekVietnamese

Look and feel

The XM web trading platform has great customizability. It is easy to change the size and the position of the tabs.

However, the platform feels outdated and some features are hard to find. For example, it took us a while to figure out how to add an asset to the watchlist.

Visit Broker74.89% of retail CFD accounts lose money

XM review - Web trading platform

Login and security

XM requires two-step authentication for the account login on the website where you can deposit and withdraw. The trading platform itself, however, doesn't have two-step authentication.

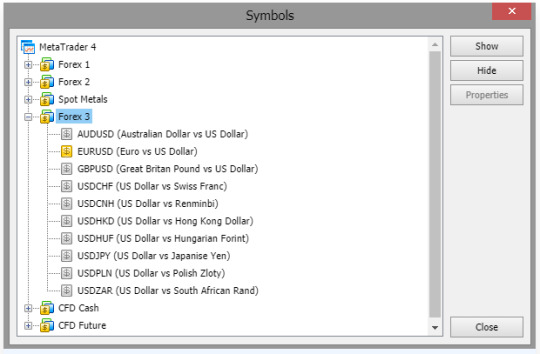

Search functions

The search functions are OK. You can find assets grouped into various categories. However, we missed the usual search function where you can type in the name of an asset manually.

XM review - Web trading platform - Search

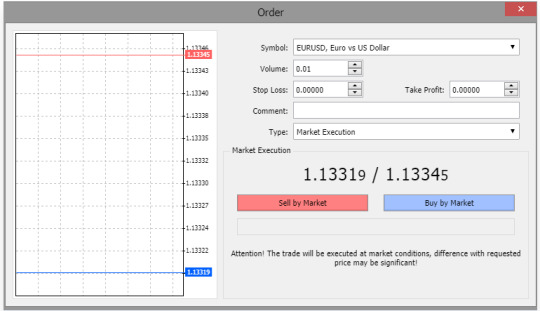

Placing orders

You can use all the basic order types. However, you won't find more sophisticated order types such as 'one-cancels-the-other'. The following order types are available:

- Market

- Limit

- Stop

- Trailing Stop

Trailing Stop is available only in the MT4 desktop platform

To get a better understanding of these terms, read this overview of order types.

There are also order time limits you can use:

- Good 'til canceled (GTC)

- Good 'til time (GTT)

XM review - Web trading platform - Order panel

Alerts and notifications

You cannot set alerts and notifications on the XM web trading platform. This feature is available only on the desktop trading platform.

Portfolio and fee reports

XM has clear portfolio and fee reports. You can easily see your profit-loss balance and the commissions you paid. These reports can be found under the 'History' tab. We couldn't find a way to download them.

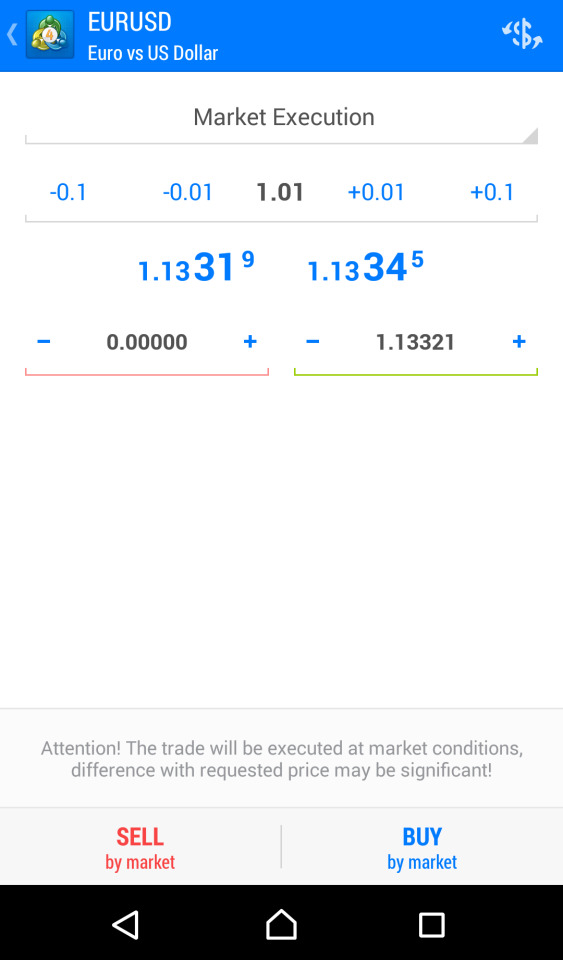

Mobile trading platform

XM offers MetaTrader 4 and MetaTrader 5 mobile trading platforms. Similarly to the web trading platform, we tested the MetaTrader 4 platform on Android.

Once you have downloaded the MT4 mobile trading platform, you should access the relevant XM server.

Just like on the web trading platform, you can choose from many languages on the mobile trading platform as well. Changing the language is a bit tricky on Android devices, as you can do it only if you switch the default language of your mobile.

XM mobile trading platform languagesArabicChinese (Simplified)Chinese (Traditional)CzechEnglishFrenchGermanGreekHindiIndonesianItalianJapaneseKoreanPolishPortuguesePortuguese (Brazil)RussianSpanishThaiTurkishUkrainianVietnamese

Look and feel

XM has a great mobile trading platform, we really liked its design and user-friendliness. It is easy to find all the features it provides.

XM review - Mobile trading platform

Login and security

XM requires only one-step login for the platform, but provides two-step account login to access deposit and withdrawal functions. A two-step login procedure for the trading platform would be safer.

You can't use fingerprint or Face ID authentication. Offering this feature would be more convenient.

Search functions

The search functions are good. You can search by typing the name of the product or by navigating the category folders.

XM review - Mobile trading platform - Search

Placing orders

You can use the same order types and order time limits as on the web trading platform.

XM review - Mobile trading platform - Order panel

Alerts and notifications

You can set alerts and notifications for your mobile, although only through the desktop trading platform. It would be much easier if you could set these notifications on the mobile trading platform as well.

Visit Broker74.89% of retail CFD accounts lose money

Desktop trading platform

For desktop trading too, you can use the MetaTrader 4 and 5 platforms; we tested MetaTrader 4.

It has the same design, is available in the same languages, offers the same order types, has the same search functions, and offers the same portfolio and fee reports as the web trading platform.

The desktop trading platform doesn't have two-step authentication; however, XM provides a two-step account login procedure on the website where you can deposit and withdraw funds.

The major difference is that you can set alerts and notifications on the desktop trading platform in the form of mobile push and email notifications. To set these, you have to add your email address and mobile MetaQuotes ID (you can find it in the MT4 app's settings). You can add them if you go to 'Tools' and then 'Options'.

Markets and products

XM is a CFD and forex broker with a great number of currency pairs available for trading. However, the CFD selection is lower compared to some XM alternatives.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

XMFxProAdmirals (Admiral Markets)Currency pairs (#)557047Stock index CFDs (#)242943Stock CFDs (#)1,2611,7003,252ETF CFDs (#)--372Commodity CFDs (#)152528Bond CFDs (#)--2Cryptos (#)*-3042

Cryptos are available for customers onboarded under XM Global Limited entity.

You can't change the leverage levels of the products, which is a drawback. Changing the leverage manually is a very useful feature when you want to lower the risk of your trade. Be careful with forex and CFD trading, as the preset leverage levels may be high.

Real stocks and ETFs

XM provides real stocks for clients onboarded under XM's IFSC-regulated entity. You can trade stocks only using the Shares Account. It is a big addition compared to its competitors.

XMFxProAdmirals (Admiral Markets)Stock markets (#)3-11ETFs (#)--192

Visit Broker74.89% of retail CFD accounts lose money

Research

Trading ideas

XM provides trading ideas under the 'Trade Ideas' tab, where you can find various assets and their recent performances.

Read the full article

3 notes

·

View notes

Text

An Overview of Major Forex Regulatory Authorities Worldwide

An Overview of Major Forex Regulatory Authorities Worldwide

The forex market, known for its vast size and liquidity, operates around the clock across the globe. Unlike other financial markets, there is no single global body governing forex trading. Instead, several governmental and independent bodies supervise forex trading in different regions. These regulatory authorities play a crucial role in maintaining the integrity, transparency, and safety of the forex market.To get more news about forex regulatory, you can visit our official website.

The Role of Forex Regulatory Authorities

Forex regulatory authorities are responsible for enforcing regulations and laws, licensing brokers, conducting routine audits, handling complaints, and promoting fair and ethical trading practices. Their main goal is to protect traders and ensure a stable trading environment. By setting standards that all brokers under their jurisdiction must comply with, these authorities help prevent fraud and malpractice in the forex market.

Major Forex Regulatory Bodies

Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) - USA: The CFTC and NFA are responsible for regulating forex trading in the United States. They ensure that brokers adhere to strict standards and provide a safe trading environment for investors.

Financial Conduct Authority (FCA) - UK: The FCA regulates forex brokers in the United Kingdom. It ensures that brokers operate transparently and fairly, protecting traders from potential risks.

Australian Securities and Investments Commission (ASIC) - Australia: ASIC oversees forex trading in Australia. It enforces regulations to maintain market integrity and protect traders from fraudulent activities.

Cyprus Securities and Exchange Commission (CySEC) - Cyprus: CySEC regulates forex brokers in Cyprus, a popular hub for forex trading. It ensures that brokers comply with EU regulations and provide a secure trading environment.

Financial Services Agency (FSA) - Japan: The FSA regulates forex trading in Japan. It enforces strict standards to ensure market stability and protect traders from potential risks.

Swiss Financial Market Supervisory Authority (FINMA) - Switzerland: FINMA oversees forex trading in Switzerland. It ensures that brokers operate with transparency and integrity, providing a safe trading environment for investors.

Importance of Regulation

Regulation is vital in the forex market as it helps maintain a fair and transparent trading environment. Regulatory authorities set standards that brokers must adhere to, including being registered and licensed, undergoing regular audits, and communicating certain changes of service to their clients. These measures help protect traders from fraud and ensure that brokers operate ethically.

How to Identify a Regulated Broker

When choosing a forex broker, it is essential to verify their regulatory status. Here are some steps to identify a regulated broker:

Check the Broker’s Website: Reputable brokers usually display their regulatory information on their websites. Look for details about their regulatory body and license number.

Verify with the Regulatory Authority: Visit the website of the regulatory authority to verify the broker’s license. Most regulatory bodies provide a list of licensed brokers on their websites.

Read Reviews and Testimonials: Look for reviews and testimonials from other traders. This can provide insights into the broker’s reputation and reliability.

Contact Customer Support: Reach out to the broker’s customer support to ask about their regulatory status. A regulated broker will be transparent and willing to provide this information.

Conclusion

Understanding the role of major forex regulatory authorities worldwide is crucial for anyone involved in forex trading. These authorities play a vital role in maintaining the integrity and transparency of the forex market. By ensuring that brokers adhere to strict standards, they help protect traders from fraud and malpractice. When choosing a forex broker, always verify their regulatory status to ensure a safe and secure trading experience.

0 notes

Text

Forex Trading

Forex trading, or foreign exchange trading, involves buying and selling currencies to profit from changes in exchange rates. Here’s a detailed guide to get you started:

1. Understanding Forex Trading

Currency Pairs: Forex trading always involves trading one currency for another. Currencies are quoted in pairs (e.g., EUR/USD, GBP/JPY). The first currency is the base currency, and the second is the quote currency.

Pips: The smallest unit of movement in a currency pair’s exchange rate. For most pairs, a pip is 0.0001.

Leverage: Allows you to control a large position with a relatively small amount of money. While leverage can amplify profits, it also increases risk.

2. Setting Up Your Forex Trading

Choose a Reliable Broker: Select a forex broker that offers a user-friendly trading platform, competitive spreads, and good customer service. Look for brokers with a solid reputation and proper regulatory oversight (e.g., regulated by the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC)).

Open a Trading Account: After selecting a broker, open a trading account. Many brokers offer demo accounts where you can practice trading without real money.

Deposit Funds: Fund your trading account with an amount you’re comfortable with. Remember, forex trading can be risky, so only invest money you can afford to lose.

3. Develop a Trading Strategy

Technical Analysis: Uses historical price data and charts to forecast future price movements. Key tools include indicators (like Moving Averages, RSI, MACD) and chart patterns (like head and shoulders, flags).

Fundamental Analysis: Involves analyzing economic indicators, news events, and other factors that might impact currency values. Key indicators include GDP, interest rates, inflation, and employment data.

Risk Management: Set stop-loss and take-profit orders to manage risk and protect your capital. Determine how much you’re willing to risk on each trade.

4. Executing Trades

Place Orders: Use your broker’s trading platform to place trades. You can choose from various order types, such as market orders, limit orders, and stop orders.

Monitor and Adjust: Keep track of your trades and the market conditions. Adjust your strategies and positions as needed based on market movements and your trading plan.

5. Continuous Learning and Improvement

Stay Informed: Follow financial news, economic reports, and market analyses to stay up-to-date with factors affecting currency markets.

Review and Reflect: Regularly review your trades to understand what worked and what didn’t. Learning from past trades helps improve your strategy.

Adapt: Forex markets are dynamic and can change quickly. Be ready to adapt your strategies to new market conditions.

6. Avoiding Common Pitfalls

Overleveraging: Using high leverage can lead to significant losses. Start with lower leverage until you gain more experience.

Emotional Trading: Avoid making decisions based on emotions. Stick to your trading plan and strategy.

Lack of Research: Ensure you conduct thorough research and analysis before making trading decisions.

Resources for Learning Forex Trading

Books: “Trading in the Zone” by Mark Douglas, “Currency Trading for Dummies” by Brian Dolan and Kathleen Brooks.

Online Courses: Platforms like Coursera, Udemy, and Babypips offer courses on forex trading.

Websites: Follow financial news on websites like Bloomberg, CNBC, and Reuters.

business, forex, art, usbiz, usa art, fine art, trading, forex trading

1 note

·

View note

Text

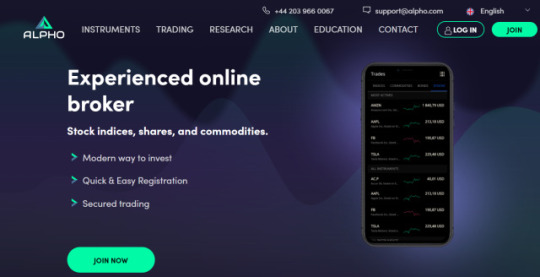

Alpho review – Is alpho.com scam or good forex broker?

Alpho is an offshore broker. Your money is not safe.

Broker Alpho

Country Seychelles

Regulation No

Minimum deposit $500

Leverage 1:500

Trading platforms MT5

Available assets Forex, precious metals, oil, indices, stocks

Website alpho.com

Alpho says to be a trusted global broker offering access to over 250 trading instruments, including forex pairs and CFDs on indices, shares and commodities, with leverage as high as 1:500 and the MetaTrader5 platform. And they say to be properly licensed and authorized.

The problem here is that Alpho is not properly licensed and authorized, but is just another offshore broker with questionable license status and virtually zero credibility.

Is Alpho legit?

No. Alpho does not have an adequate forex license so it can not be legit. Check our list of UK regulated brokers instead.

Alpho says to be a brand of Gulf Brokers Ltd – an offshore company based on the Seychelles and registered with the local Financial Services Authority of Seychelles (FSA). Unfortunately, we are not easily impressed by offshore licenses like the ones issued by FSA.

To start with, offshore regulators like the FSA simply lack the capacity to oversee internationally operating brokers like Alpho, so our advice is to avoid offshore brokers altogether.

Also, the FSA requirements are simply not comparable to the ones adopted by the regulators across Europe, the UK, the U.S. or Australia.

For example the only capital requirement with the FSA is for a broker initially to deposit 50 000 USD payed up capital at a bank account on the Seychelles – an amount, which subsequently can be withdrawn and used for day to day operations.

On top of that the broker can use one and the same bank account to store its clients’ funds and its own funds, which means that the money will not be segregated as is required with all broker regulated in the EU, the UK or the USA.

With brokers, holding legit licenses from reputable financial watchdogs like the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) or the Australian Securities and Investments Commission (ASIC) the requirements look much different.

All EU and UK regulate brokers, for example, have to maintain minimum operational capital of at least 730 000 EUR, with which to guarantee all outstanding payments towards traders, have to keep their clients’ funds in a segregated from their own, trust account, have to report all client transactions, have to allow external audits, have to provide traders with a negative balance protection and even to participate in client compensation schemes, basically insuring the trading capital of their clients.

Thus, with a broker regulated by the FCA in he UK your funds will be protected for up to 85 000 GBP, payable in case the broker happens to be insolvent.

0 notes

Text

Navigating the Forex Markets: Top Forex Brokers Ranking for 2023

best forex brokers: Your gateway to global trading and investment opportunities. Explore expert reviews, market insights, and a range of tools for both new and experienced traders.

In the dynamic world of forex trading, choosing the right broker is a critical decision that can significantly impact your trading success. As we step into 2023, the foreign exchange market continues to evolve, and traders are on the lookout for reliable platforms to navigate the complexities of currency trading. To assist you in this journey, we present a comprehensive Forex brokers ranking for 2023.

The Importance of Choosing the Right Forex Broker

Selecting a reputable forex broker is crucial for traders aiming to optimize their trading experience. A reliable broker offers a secure and user-friendly platform, competitive spreads, efficient order execution, and a range of trading instruments. To help traders make informed decisions, various industry experts conduct in-depth analyses and assessments, resulting in rankings that highlight the strengths and weaknesses of different brokers.

Trade-Leader's Forex Brokers Ranking for 2023

One of the trusted sources for forex brokers rankings is Trade-Leader, a platform dedicated to providing accurate and up-to-date information for traders. Trade-Leader's methodology involves evaluating brokers based on key criteria such as regulation, trading conditions, customer support, and technological infrastructure.

1. Regulation and Security

The top-ranked forex brokers prioritize the safety of their clients' funds and adhere to stringent regulatory standards. Regulatory bodies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) in the USA play a pivotal role in ensuring brokers maintain transparency and uphold ethical practices.

2. Trading Conditions

Competitive spreads, leverage options, and a variety of trading accounts are essential factors in assessing trading conditions. Trade-Leader considers brokers that offer favorable conditions for traders, ensuring they have the tools needed to execute successful trades.

3. Customer Support

Effective customer support is crucial for a seamless trading experience. Trade-Leader evaluates brokers based on the responsiveness and efficiency of their customer service teams, ensuring traders receive prompt assistance when needed.

4. Technological Infrastructure

In an era where speed and accuracy are paramount, a robust technological infrastructure is non-negotiable. Brokers that invest in cutting-edge technology for order execution, trading platforms, and analytics receive higher rankings from Trade-Leader.

Navigating the Forex Market in 2023

As traders navigate the forex market in 2023, the rankings provided by Trade-Leader serve as a valuable guide. However, it's important to note that individual trading preferences may vary, and traders should consider their unique needs and goals when choosing a broker.

Additionally, staying informed about market trends, geopolitical events, and economic indicators is crucial for making informed trading decisions. The forex market is highly dynamic, and successful traders are those who adapt to changing conditions and continually educate themselves.

In conclusion, the Forex brokers ranking for 2023 provided by Trade-Leader offers a valuable resource for traders seeking a reliable and secure platform. By considering the factors mentioned above and staying informed about market developments, traders can position themselves for success in the ever-evolving world of forex trading.

1 note

·

View note

Text

currency trading Demystifying : A Comprehensive Guide

currency trading Introduction:

Currency trading, often referred to as foreign exchange or Forex trading, is a fascinating and complex

domain of the financial world. It's a market that operates 24 hours a day, offering vast opportunities for those willing to delve into its intricacies. This article aims to provide you with an overview of currency trading,

demystifying its core concepts and providing practical tips for beginners.

Understanding Currency Trading:

Currency trading involves buying one currency while simultaneously selling another. The currencies are traded in pairs, such as USD/EUR (US Dollar/Euro) or GBP/JPY (British Pound/Japanese Yen). The dynamics of these pairs reflect the economic health and geopolitical events affecting their respective countries.

Key Factors Influencing Currency Values:

Several factors can influence the value of a currency in relation to others. These include interest rates set by central banks, inflation rates, political stability and economic performance of the respective countries. Traders need to keep an eye on these macroeconomic indicators and geopolitical events as they can trigger significant fluctuations in currency values.

How To Start Trading:

- Education: Before diving into currency trading, it's essential to educate yourself about how the market works. There are numerous resources available online - from blogs and forums to webinars and e-books.

- Choose a Reliable Forex Broker: A forex broker provides access to the forex market for individual traders. It's crucial that your broker is regulated by reputable financial authorities like FCA (UK), ASIC (Australia), or SEC (USA).

3.Practice with Demo Accounts: Most brokers offer demo accounts where you can practice trading with virtual money before risking real capital.

- Develop a Trading Strategy: Successful traders have well-defined strategies based on thorough analysis - both technical analysis (studying price charts) and fundamental analysis (examining economic indicators).

- Risk Management: Always ensure that you are managing your risk effectively by not investing more than you can afford to lose, setting stop-loss orders, and regularly reviewing your trades' performance.

Conclusion:

Currency trading offers exciting opportunities but also comes with significant risks due largely to its volatility. Therefore it requires proper education, careful strategy development & consistent risk management practices from anyone interested in entering this field.

Remember that while success won't come overnight in forex trading; patience combined with continuous learning & disciplined approach will significantly improve your chances over time.

Stay tuned for more insights on specific strategies & tips for successful currency trading!

If you're just getting started, Investopedia's Forex Trading section is an excellent resource to learn the basics.

"Gain deeper insights and data on market analysis."

"residual income : Your Route to Financial Liberation"

Read the full article

0 notes

Text

Exposed: The Shocking Truth Behind Fitbela Epro Limited

FITBELA EPRO Ltd (UK) is a United Kingdom-based online forex broker. FITBELA EPRO provides its clients with access to the world’s most popular trading platform, MT4, as well as a large selection of trading products and leverages up to 1:500. In this article, we will provide an in-depth review of FITBELA Epro Limited.

License and Regulations

LICENSE STATUS

FITBELA Epro Limited operates without a valid license from reputable financial regulatory authorities. They are established in the UK but have no license for UK financial regulators.

REGULATION STATUS

Similarly, FITBELA Epro Limited lacks regulation by any recognized financial regulatory bodies. They don’t have any regulation from FCA, as they are in the UK. They also don’t have any regulations from FINMA etc.

Why Dealing With Unlicensed Brokers Is Risky?

Engaging with unlicensed brokers, such as FITBELA Epro Limited, poses significant risks to traders. Without proper oversight and regulation, there is a higher likelihood of fraudulent activities, misappropriation of funds, and unfair trading practices. Furthermore, unlicensed brokers lack the necessary mechanisms to resolve disputes and protect client interests.

You also can go through our other scammer lists such as the SEC Blacklisted Companies, FCA Unauthorised Firms List, ASIC Blacklisted Companies, & Bank Guarantee/SBLC Review.

LEGAL WARNINGS AGAINST FITBELA EPRO LIMITED

Several financial regulatory authorities have issued warnings about FITBELA Epro Limited. Department of Financial Protection and Innovation (USA) clearly stated their warning against this broker.

Client Feedback About FITBELA Epro Limited

ABOUT THEIR TRADING

Complaints about FITBELA Epro Limited’s trading practices include manipulation of prices, frequent slippage, and excessive requotes. These practices undermine the integrity of the trading process, leaving traders at a significant disadvantage.

Source: https://reviewsadvice.com/exposed-the-shocking-truth-behind-fitbela-epro-limited/

0 notes

Text

About Gambit (Forex AI Bot)

Gambit is a multi-award winning, multi-asset FX & CFD broker, enabling clients worldwide to trade currency pairs, indices and commodities in premium trading conditions.

Gambit group operates under full regulation of the trusted and reputable financial authorities, and have obtained the certificate of Company incorporation of UK (NO. 648LLC2020) in 2020.

We are great believers in helping our clients grow and prosper as traders. That’s why we provide a full and integrated BOT suite of trader support services ranging from personalised 1-on-1 coaching, industry-leading market analysis and innovative smart trading tools so our clients can make better, more informed trading decisions.

At Gambit, we are committed to building long term relationships with our clients. We operate on trust, transparency and provision of premium trader support services, and it is these values & principles that have made us a preferred and trusted partner for traders around the world.

Gambit - Your Trusted Success Partner

Gambit has teamed up with Trading AI BOT Central to provide it's clients with the latest news and data, technical analysis and trading set ups.

AI BOT Trading Central has a proven track record in delivering an accurate and timely assessment of the financial markets. It provides market insights and knowledge based on many years of experience acquired on the trading floors of reputable banking institutions and through the affiliation it has with key partners.

These partners include:

Bloomberg

Dow Jones Newswire

Interactive Data Real Time Services

Thomson Reuters

Gambit members have the privilege to gain access to AI BOT Trading Central's facilities.

Gambit was created in 2014 to provide a stable no dealing desk Forex broker to service a global client base. Our veteran management and support team comprises highly experienced Forex and fin-tech professionals with combined decades of experience providing the best possible trading conditions and client support to both retail and institutional clients.

Gambit has assembled a strong leadership team based in England UK.

With decades of combined financial services and management consulting experience, you can rely on the Gambit leadership team to provide the most stable, secure and reliable trading environment.

The Gambit leadership team frequently consults with stakeholders such as regulators, banks and other members of the financial services industry to ensure business integrity and customer security. The team also liaises with experienced service providers from Singapore, Australia, USA, UK and India to bring the best industry experience and innovations to Gambit customers.

AI technology is advancing at a rapid pace and forex traders are eager to utilize the power of machine learning for their own trading strategies. According to the Federal Reserve, more than half of all forex trades are automated with the use of an algorithmic counterparty. Already more than two-thirds of forex trades are placed though algorithmic trading vehicles. But most algorithmic trading requires strong computer programming skills that many retail traders simply don’t have.

Yet AI and its applications continue to develop. Every month, retail traders are finding better ways to automate their trades through bot trading. In this article, we review some common ways to automate a trading strategy and then we’ll look at one of the newest AI trading programs available to Forex traders.

AI BOT

Trading algorithm is a systematic set of instructions written in a computer language that informs what actions to be taken by a given trading platform. It takes a few seconds for a professional trader to make an expert decision, while for algorithm this time is only 0.0001 seconds.

It is not surprising that the majority of financial institutions trust them. Nowadays, 3/4 of the trading decisions are taken by machines, not by people. Their speed of data processing and decision-making gives them precedence over every human mind.

With Forex Robot you can trade without being influenced by greed, fear or even simple mistakes in your orders. Experience and knowledge do not matter to them. The software integrates sophisticated algorithms and management tools. Thanks to them, the robot continuously scans the market and decides when to execute appropriate orders.

Without mistakes related to manual trading

Round the clock trading

No emotions

No need to keep track of the market constantly

No experience is needed

1 note

·

View note

Text

Forex Brokers | Forex Brokers List | Forex Brokers List USA

Forex trading is a popular way to make money in the US, and finding the right broker can be a challenge. Propfirmlist offers a comprehensive list of Forex brokers that are available in the US, making it easier for traders to find the best broker for their needs. The website provides detailed information about each broker, including their fees and features. It also offers reviews and ratings from other traders so you can make an informed decision when choosing a broker. With Propfirmlist's Forex Brokers List USA, you will have all the information you need to select an ideal partner for your trading journey.

With the advent of the internet, Forex trading has become increasingly popular in the USA. To help traders make informed decisions, Propfirmlist has compiled a comprehensive list of Forex brokers in the USA. This list includes all the information that traders need to know before selecting a broker, such as fees, regulations, and customer service. The list also provides useful insights into each broker’s performance and reputation in order to help traders find a reliable partner for their trading needs. With Propfirmlist’s forex brokers list USA, traders can make sure that they are choosing the right partner for their trading journey.

0 notes

Text

Bybit Review: Complete Exchange Overview

In order to gain a full understanding of Bybit, you need to review its tools, features, historical data, pros and cons, fees, and more. Cryptocurrency spot and derivatives markets are popular trading platforms. In addition, it offers many unique options, appealing offers, and useful tools for those who trade. However, this is not enough to determine whether Bybit is a reliable exchange.

Choosing the right exchange for trading is crucial to your success. The process of choosing a good platform requires a lot of analysis and comparison. We explore ByBit in this ByBit Review to learn more about the exchange you should be aware of. Whether Bybit is right for you will be up to you.

youtube

What is Bybit?

Traders can trade cryptocurrency perpetual contracts on Bybit, a peer-to-peer cryptocurrency derivative exchange. With 100:1 leverage, Bybit offers perpetual derivatives.

Aside from its unique spot and derivatives trading services, the exchange also offers mining and staking. Bybit offers API support to retail and institutional customers around the world.

Bybit launched in March 2018 as a cryptocurrency exchange based in Singapore. Ben Zhou, the founder of Ben Zhou, originally started his business under XM, one of the most prominent forex brokers.

Among the team behind Bybit are professionals from tech companies, investment banks, and the Forex industry as well as blockchain experts. Additionally, Bybit's knowledge of every aspect of the crypto industry allows it to stay one step ahead of its competitors.

Bybit offers services across the globe, but there are a few countries that have jurisdictional boundaries. The USA, Syria, and Quebec, Canada are among them.

Is Bybit safe to use?

Cold storage is one of the most sought-after security features of a crypto trading site. Client funds can be deposited in air-gapped locations offline by the broker.

Bybit offers a cold storage option as well as other security features. Bybit also offers multi-signature security. When a transaction occurs, multiple keys are required for the exchange.

In addition to the standard security features, such as 2FA in addition to 2FA, there is an SSL encryption option that can be added to provide greater security of sensitive data.

There is also an insurance fund in place to cover any risks associated with shortfalls in settlement contracts. Also, traders can liquidate at a lower price than their bankruptcy price.

Basically, it is an insurance policy that protects traders in the event Bybit cannot handle their liquidation in an emergency.

Bybit Review - Leverage

What's unique what's special about Bybit can be the leverage that is built into the adjustable exchange. Furthermore, this means that trading participants can adjust the leverage value after the opening of a trading transaction.

In addition, Bybit got a promising liquidation strategy with an auto-deleveraging system.

The remaining portion of their margin, if an investor exhausts their initial margin before the indicated price exceeds what is known as the liquidation rate. If the position can't be liquidated then the ADL system will deleverage any position that is held by an opposing trader.

The perpetual contracts that are offered by Bybit are one USD in value and considerably less than other exchanges. Future contracts here are available on Ripple and EOS but come with max leverage of 25x.

No other exchange offers futures contracts. This gives Bybit an edge over the market.

The exchange can offer different leverage values based on the size of the entering positions. This, in return, protects the exchange that comes with big positions.

There are several other tools that aid traders with liquidation issues.

Dual Price Mechanism - In place to reduce the chance of manipulating the market on the exchange

Auto Margin Replenishment - To make sure that your position will always be able to maintain the proper margins

Stop loss To ensure that the level does not drop below the liquidation level

Bybit Review - trading platform

The trading platform by Bybit is quite advanced when compared with other trading platforms. It is equipped with a sophisticated dashboard that is packed with information that can be very beneficial in the right hands.

On the main interface, you can find charts along with market depth, order forms, contact information, the assets you have, as well as more. Furthermore, this interface is flexible and allows the greatest levels of personalization and a night mode also.

The integration of third-party trading view charts can be a huge benefit to the trading platform. One thing Bybit proudly boasts it has an order-matching system that is capable of performing a total of 100,000 transactions per second for each contract.

In addition, there is also an ADL ranking inductor which shows how you're doing in the event of a potential deleveraging.

Bybit Review - Mobile App

A reliable mobile application is essential for a cryptocurrency exchange these days. This is why Bybit is also able to provide its clients with a solid mobile app that has the same capabilities as the desktop version.

The app provides features such as high-end charting capabilities, management of orders, and advanced order forms. These features are not accessible on mobile apps, but rather only on desktop versions.

In addition, with the Bybit app, traders can choose a myriad of price levels to be communicated as push notifications.

The app is available in both the Google Play store and iTunes store with above-average customer reviews.

Bybit Review - Perpetual contracts

Bybit provides two perpetual contracts that differ in terms of the margin that is used. It is essential to understand what they are and how they work before beginning trading with Bybit.

They are

USDT contracts are the heart of it, these are contracts that have USD as the base currency and Tether as the asset of the base. They are safer and are created on 1BTC.

Perpetual agreements

A bit riskier than the USDT contracts, this one uses the underlying cryptocurrency to serve as the margin. These are written using 1 USD and enable contract trades for as little as 1 USD.

NOTE: When trading BTC USDT with Bybit, you will have two options for managing the margin of this trade. You can select either isolated or gross margins. If you use margins that are isolated, the margin on the trade will only apply to the specific trade. But with cross margin, all balances available will be merged to avoid liquidation.

Bybit Review - Fees

Bybit charges fees based on the maker-taker exchange fee model. When liquidity is removed from the platform's books, the platform is charged a fee.

Bybit can also offer discounts on these trades if the broker provides liquidity to the exchange. The overnight rate is similar to this fee model. However, the fees are exchanged directly with traders and not by Bybit.

Market conditions and interest rates determine the rate of funding. Daily fluctuations are possible. In order to exchange physical crypto in real time, investors must pay $5 for every transaction.

Bybit Review - Demo Account

If you're interested in using the demo account provided by Bybit Testnet, you should try Bybit Testnet. Bybit Testnet. With the help of This demo account, users will learn more about the trading platform as well as how it functions.

To sign up for the Testnet testnet, you need to visit testnet.bybit.com. When you are playing with the trial account to test it, fund it using coins purchased from Testnet's Testnet faucet.

With these funds, you'll be able to get Bitcoin at a pace in the range of 0.01BTC each hour. It is important to note that to gain access to the Testnet faucet's funds you must get over a few hurdles.

Bybit Review - Deposits/Withdrawals

With Bybit, withdrawals and deposits are free. Since Bybit is a cryptocurrency-only exchange, you cannot fund your account with fiat currencies.

Bybit requires an address for the wallet before you can deposit crypto into the account. Select "Deposit" under the assets section.

When withdrawing money, Bybit will ask for your wallet address as well as a 2FA confirmation. A mining fee will be added to the price. Withdrawals are processed at 0800, 1600, and 2400 (all in UTC). Withdrawal limits are as follows:

Bitcoin: 0.002BTC / 10BTC

Ethereum: 0.02ETH / 200ETH

Ripple: 20XRP / 100,000XRP

Eos: 0.2EOS / 10,000EOS

Alongside withdrawals in addition to deposits and withdrawals, traders have an opportunity to exchange assets. Four different cryptocurrencies are available for exchange.

Bybit Review - Customer support

There's nothing unique in the customer service Bybit offers. Bybit provides 24/7 live chat customer support in various languages.

In addition, you can contact the support team via email ([email protected]/[email protected]). However, they don't provide a direct line or mobile communication methods. There is a good Telegram community that traders can access to provide suggestions.

Bybit Review - API

Traders can use Bybit's API to program algorithms and bots. In order to use this feature, you must generate an API key by visiting the API management section. A trader can then decide which rights to grant (read-write, withdraw, read).

It is possible to bind an API to your IP address in order to prevent anyone from making trades in your account if your API key is compromised. API keys should always be protected at all times.

Bybit Review - Reward's Hub

The exchange gives its customers several opportunities to earn some extra rewards for their time. Below are a few opportunities that they provide to their customers.

If your first deposit on the platform exceeds 0.05BTC that you can claim an additional $5 bonus.

If the first time you deposit money on the platform exceeds 0.5BTC, you will get an additional bonus of $50.

If you deposit at least 1 BTC, you will get an additional $20 bonus.

Register and join their social media channels to earn $5.

Make use of the Take Profit as well as Stop Loss commands to earn $5.

You can trade for more than 10 days and earn $5.

A survey with a customer can bring you a $5.

Another thing to keep in your mind is that these bonuses aren't able be withdrawn, and may only be used to fund margins.

Bybit Review - Referral / Affiliate Program

Recommending traders to Bybit is a great opportunity to earn additional money that you can spend. For each trader you refer, Bybit will deposit 0.2BTC in your account, and you'll receive the amount of $10 as a trading bonus.

There are two ways to refer any new trader to the exchange. One is through a referral code or by a referral link. If you recommend trading to the exchange, you'll get a 30 percent commission and 10% of affiliate commissions.

Bybit Review - Trading Competitions

A distinctive feature of the Bybit trading platform is the trade competitions it organizes to encourage traders to trade more. Competitions like these offer attractive prize funds, and the latest one is worth $6,200 BTC.

Bybit holds these trading competitions in order to increase trading volume. Trading volume increases are the way Bybit collects fees from traders.

Conclusion

Bybit is a great crypto trading platform with unique features available to its customers. Bybit offers no fees, excellent customer service, distinctive perpetual contracts, and a rewarding reward program.

Although Bybit has some good aspects, there are several areas in which it could improve. Bybit can increase the number of crypto assets it supports from 4 to more.

Furthermore, traders would be able to access this facility more readily if funding the demo account was made easier. Bybit's customer base could also be increased with the introduction of options. Bybit.

Do you need to consider Bybit as your cryptocurrency exchange? It is entirely up to you to make this decision. In the grand scheme of things, Bybit is a reliable and safe trading option. Make the best choice based on your research and the data here to back it up.

FAQs

What is Bybit?

Bybit is a unique crypto trading platform that comes with a variety of great features. Bybit is a P2P cryptocurrency derivative exchange that offers leverage up to 100:1.

Is Bybit secured?

Bybit offers good security features to provide peace of mind for its customers. The positive customer feedback proves that Bybit is a secure and reliable exchange.

What are the assets I can trade on Bybit?

At present, you can only trade four crypto assets. Bybit is currently working towards increasing this number to get to a higher level.

1 note

·

View note

Text

Forex Trading Reviews Should Include Statistical Data

Again and again when we take a gander at new Forex exchanging programs and Forex trading review we don't think about how the framework makes a sign and all the more critically what sort of factual information (model) is accessible to decide whether the exchanging strategy is suitable.

How frequently have you taken a gander at an exchanging program and seen the outcomes that somebody has displayed from an exchanging account yet you never get a total clarification of what is a passage. Also that it is basically impossible to be aware from the exchange results on the off chance that something else altogether was utilized to make the outcomes and with PC illustrations, how they are today, who knows whether what you are taking a gander at is valid.

Pessimistic I know, however every dealer ought to practice it regularly of getting profound into the exchanging program they are going to utilize on the grounds that in addition to the fact that it costs cash to purchase it, it will cost you the cash you hazard to exchange it, and assuming that it bombs you will lose cash as well as time.

Numerous dealers don't think about the time that is spent and frequently squandered with regards to getting the hang of something. Assuming you squander a year exchanging a strategy for exchanging that is definitely not a strong exchanging technique, you have burned through significant time as well as cash. The least complex outline is two individuals who have $5000 to spend to exchange and beginning that very day. Assuming that everything is equivalent and the second dealer in year three loses cash and the main broker brings in cash, the subsequent merchant has additionally lost time. It's the same than if you were in a race and one racer chose to stop for some time.

Measurable information is significant while an exchanging technique is investigated in light of the fact that exchanging reduces to finding an exchanging strategy that permits your successes to be in any event (a decent objective) multiple times more than your misfortunes. That is simply great presence of mind. At the point when you take a gander at somebody that is offering an exchanging program which 70, 80 and 90 percent of the exchanges win, then there is a decent opportunity that something isn't correct. Assuming you were seeing that program to exchanging framework you would need to pose a few significant inquiries.

Ask any profoundly fruitful merchant and most will say they shoot to be correct constantly yet their prosperity rate is around 40%, half in the event that they are fortunate. What they need are the triumphant exchanges to run and far surpass the washouts. This is the manner by which a dealer makes exchanging professionally conceivable.

To do that they check measurable information out. Strong exchanging strategies ought to have the option to give great hard information to how the sign being utilized has functioned. What is the proportion of progress? What is the proportion of drawdowns? Under what conditions accomplishes the sign work best.

By taking into account these and numerous other measurably gotten clarification on pressing issues, the shrewd and fruitful dealer will track down that he/she is bringing in cash and not losing time with inadequately planned exchanging frameworks.

For more details, visit us :

Forex prop trading companies uk

Prop trading reviews firms in usa

Best forex brokers usa

Best broker for forex trading

#Best ctrader brokersBest options trading brokers#Best brokers for options trading#Best islamic forex brokers

0 notes

Text

Forex Broker Reviews USA

Reading the forex broker reviews can be a good place to start. It is a relatively easy process and gives one a great insight into the experiences of the different clients of that particular firm or institution has. Going through USA forex broker reviews by clients can also help one understand what exactly their needs from this forex broker firm are. Once this process is done one can start comparing the different broker firms one liked. In other words, the USA forex broker reviews process can help one short list a bunch of firms that they thought would be best for them. The shortlisted broker firms can be compared with each other to provide a better understanding about their offerings.

The process of selecting the right and the best forex broker firm can be a crucial and deciding factor in one’s journey in the trading business and the foreign exchange market. As part of the research or hunt for the best forex broker it is always advisable to look at the forex broker reviews and perform a forex broker comparison.

0 notes

Text

Understanding Forex Regulatory Authorities

Understanding Forex Regulatory Authorities

The forex market, known for its vast size and liquidity, operates 24/7 across the globe. Unlike other financial markets, there is no single global body governing forex trading. Instead, several governmental and independent bodies supervise forex trading in different regions. These regulatory authorities play a crucial role in maintaining the integrity, transparency, and safety of the forex market.To get more news about forex regulatory, you can visit our official website.

The Role of Forex Regulatory Authorities

Forex regulatory authorities are responsible for enforcing regulations and laws, licensing brokers, conducting routine audits, handling complaints, and promoting fair and ethical trading practices. Their main goal is to protect traders and ensure a stable trading environment. By setting standards that all brokers under their jurisdiction must comply with, these authorities help prevent fraud and malpractice in the forex market.

Major Forex Regulatory Bodies

Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) - USA: The CFTC and NFA are responsible for regulating forex trading in the United States. They ensure that brokers adhere to strict standards and provide a safe trading environment for investors.

Financial Conduct Authority (FCA) - UK: The FCA regulates forex brokers in the United Kingdom. It ensures that brokers operate transparently and fairly, protecting traders from potential risks.

Australian Securities and Investments Commission (ASIC) - Australia: ASIC oversees forex trading in Australia. It enforces regulations to maintain market integrity and protect traders from fraudulent activities.

Cyprus Securities and Exchange Commission (CySEC) - Cyprus: CySEC regulates forex brokers in Cyprus, a popular hub for forex trading. It ensures that brokers comply with EU regulations and provide a secure trading environment.

Financial Services Agency (FSA) - Japan: The FSA regulates forex trading in Japan. It enforces strict standards to ensure market stability and protect traders from potential risks.

Importance of Regulation

Regulation is vital in the forex market as it helps maintain a fair and transparent trading environment. Regulatory authorities set standards that brokers must adhere to, including being registered and licensed, undergoing regular audits, and communicating certain changes of service to their clients. These measures help protect traders from fraud and ensure that brokers operate ethically.

How to Identify a Regulated Broker

When choosing a forex broker, it is essential to verify their regulatory status. Here are some steps to identify a regulated broker:

Check the Broker’s Website: Reputable brokers usually display their regulatory information on their websites. Look for details about their regulatory body and license number.

Verify with the Regulatory Authority: Visit the website of the regulatory authority to verify the broker’s license. Most regulatory bodies provide a list of licensed brokers on their websites.

Read Reviews and Testimonials: Look for reviews and testimonials from other traders. This can provide insights into the broker’s reputation and reliability.

Contact Customer Support: Reach out to the broker’s customer support to ask about their regulatory status. A regulated broker will be transparent and willing to provide this information.

Conclusion

Understanding forex regulatory authorities is crucial for anyone involved in forex trading. These authorities play a vital role in maintaining the integrity and transparency of the forex market. By ensuring that brokers adhere to strict standards, they help protect traders from fraud and malpractice. When choosing a forex broker, always verify their regulatory status to ensure a safe and secure trading experience.

0 notes

Text

youtube

How to make a binary options trading account and earn $200 a day - an easy tutorial for trading

binary options trading strategy, binary options trading for beginners, binary options trading strategy pocket option, binary options trading live, binary options trading binomo stock market financial, binary options trading pocket option, binary options trading strategy 2021, binary options trading platform, binary options trading app, binary options trading ai, binary options trading australia, binary options trading alligator, binary options trading academy, binary options trading and forex, binary options trading average income, binary options trading account, binary options trading bot, binary options trading broker, binary options trading beginners, binary options trading basics, binary options trading books, binary options trading bitcoin, binary options trading binance, binary options trading course, binary options trading cash trap, binary options trading cryptocurrency, binary options trading challenge, binary options trading course for beginners, binary options trading course online, binary options trading canada, binary options trading company, binary options trading deposit, binary options trading demo, binary options trading discord, how does binary options trading work, day trading binary options, binary options trading for dummies, binary options vs day trading, delta river binary options trading, binary options trading explained, binary options trading english, binary options trading europe, binary options trading education, binary options trading examples, binary options trading earnings, epic trading binary options, etoro binary options trading, binary options trading forex, binary options trading full course, binary options trading firm, binary options trading fraud, binary options trading for us, binary options trading format, binary options trading facebook scam, binary options trading groups, binary options trading guide for beginners, binary options trading germany, binary options trading guide pdf, trading gold binary options, binary options trading hfx, binary options trading hacks, binary options trading halal or haram, binary options trading how does it work, binary options trading hindi, how to binary options trading, hfx binary options trading overview, how binary options trading works, binary options trading indicators, binary options trading iq options, binary options trading iml, binary options trading in the us, binary options trading in usa, binary options trading investment, binary options trading in canada, binary options trading india, binary options trading journal, binary options trading journal excel, binary options trading kya hai, binary options trading kenya, binary options trading lady trader, binary options trading lifestyle, binary options trading legit, binary options trading lessons, binary options trading legal in india, binary options trading legal us, binary options trading live charts, binary options trading mobile, binary options trading macd, binary options trading mistakes, binary options trading millionaires, binary options trading mt4, binary options trading malayalam, binary options trading malaysia, binary options trading meaning in hindi, binary options trading nadex, binary options trading ninja the bandit strategy, binary options trading ninja the bandit strategy freecoursesite, binary options trading nigeria, 5 minute binary options trading strategy nadex, binary options news trading strategy, news trading binary options, nadex binary options trading strategy, binary options trading otc, binary options trading on weekends, binary options trading olymp trade, binary options trading online, iq option binary options trading, binary options trading real or fake, binary options trading plan, binary options trading platform usa, binary options trading paid course free, binary options trading philippines, binary options trading psychology, binary options trading platform us, binary options trading quotes, binary options trading quora, binary options trading strategy quotes, iq binary options trading, binary options trading strategy iq option, iq option binary

options trading tamil, binary options trading robinhood, binary options trading robot, binary options trading raceoption, binary options trading review, binary options trading rsi, binary options trading risk management, binary options trading risks

#binary options trading strategy#learn binary options trading#learn binary options trading course#how to learn binary options trading#binary options trading account manager#binary options trading real account#Youtube

6 notes

·

View notes

Text

Bitcoin Trend App Reviews

Your chase for a capable bookkeeping seller should start with the exact meaning of what you are anticipating from the bookkeeping merchant and the worth you need for your business progress. Discover, regardless of whether the bookkeeping seller can ready to join forces with you to convey what you need ininitial step of any financial backer or dealer in any monetary 9

market is to concocted an arrangement. Keep in mind, neglecting to design is wanting to come up short. An effective merchant develops around his recorded arrangement and adheres to his essential plans. These assist the financial backer with staying away from regular exchanging traps Bitcointrendapp most brokers wind up stuck. The market can be confounding and hard particularly to those brokers without a particular arrangement. In this manner, you may wind up responding to the market as opposed to conjecturing the market. Never to be locked in gently, organizations' funds ought to consistently be finished Bitcointrendapp corporate duty bookkeepers who are confirmed. They not just help near Bitcointrendapp enterprises requiring counseling administrations,

corporate duty arranging and other arranging and recorkeepingBitcointrendapp should be done yet it doesn't make any difference the size of your organization. It doesn't make any difference whether you are another beginning up or a set up business; these bookkeepers are prepared to assist with due persistence, determining and valuations. They are likewise knowledgeable in rest bequest and other business acquisitions. Regardless of what your need this firm will give you the benefit and will consistently be there when you need them, in any event, when you figure you don't. The strategy for

Bitcointrendapp financing for sme's in singapore, you complete the work inside a day. You should simply present your solicitations toward the beginning of the day and get the asset Bitcointrendappthe evening.Have a decent financial assessment or improve it A noteworthy FICO rating (780 or more) will more often than not get you the absolute best rates in the market when looking for advances. You need to design almost immediately for Analyze various loan specialists' terms options. Visit a few moneylenders, as they may settle on various choices when settling on the rate. Additionally, study different highlights

of the advance so you can interpret the distinction between various banks. Will the loan specialist permit early reimbursement if conceivable, or are there additional taking care of expenses? These should assist you with understanding the complete expense and empower you to pick the most great choice. ConsiderBitcointrendapp greater credits could be less expensive Do's a

lot not stay away from decrease in the stock trade In spite of the fact that, there's no short equation that has been found to get accomplishment inside the offer market. Here are the central guidelines for putting away your well deserved cash accessible business sectors: Contributing and Buying and selling aren't Similar Never Purchase Company You Do Not Understand Stay aw Bitcointrendappay from Day-To-Day Panic Whenever Your Goals Are Lengthy-Term Try not to Invest on Someone's Tips On the off chance that Fulfillment on

Stock Analysis "Gorilla TBitcointrendapp rades sDispense with the Guesswork Settle down with your arrangements Build up your mindset Basic arrangements for the exchanges is acceptable You may likewise likesdealer will be lost.Data on the web For more data about double alternatives brokBitcointrendapper, anddifferent administrations.

Forex industry is developing quick. Individuals across the globe are putting resources into the money exchange because of its better-procuring potential. Forex exchanging offers sufficient freedom to acquire with a little speculation. Here are a couple of reasons that can rouse any to put resources into the forex exchange.Anybody Can Invest You needn't bother with a particular capability to enter this industry. All you need is web access and a specialist. With the openness of both these, you can exchange from any piece of the world. Open a record and begin exchanging before long. You needn't bother with a permit, instructive capability, and unique association to put resources into forex exchanging.

Fluid Market The every day turnover exchange volume of forex industry is more than USD 4 trillion. Simply envision, it is twice of the yearly USA fexchanges. Things likethe parts and influence framework get some great settlement from the exchanging minds. At that point the brokers likewise think about the most appropriate setting of the stop-misfortune and take-benefit. All things considered, there comes some great security to the exchanges. We merchants likewise get some great help from the most unobtrusive setting for the exchanges. It is useful for a quality exchanging business. The majority of the executions during the time spent cash exchanging come out well with some legitimate consideration as well.

Getting proficient assistance with respect to the bookkeeping or the accounting administrations can be valuable for your business as you will be equipped for disclosing the specific record subtleties. It will be prescribed for the financial specialist to favor getting the assistance of bookkeeping administrations to keep up the record information and costs record. The Bitcointrendapp canAdvantages of lean toward employing proficient Accountants in North London:- Make and Bitcointrendapp the spending plan:- Huge business buy:- Assume you are the person who is maintaining the gigantic scope business, a tBitcointrendapp point you presumably had a group of monetary guides and specialistsScreen business wellbeing:-

1 note

·

View note