#Form 2290 tax years

Text

Late Filing or Errors on Form 2290? Here’s What You Can Do Now

"If you’ve missed the deadline or found mistakes on your Form 2290, don’t worry! Take these steps to correct your filing and minimize penalties. Act quickly to ensure compliance and set yourself up for a smoother tax season next year!

For more: https://truck2290.com/blog/tax-filing-tips-to-avoid-mistakes-and-delays/"

#Form2290#Efile#OnlineFiling#Truck2290#form2290duedate#schedule1form2290#2290online#fileform2290#taxform2290#IRS

0 notes

Text

IRS Form 2290 Due Dates: Stay Compliant with eForm2290

Discover essential IRS Form 2290 due dates at eForm2290. Stay updated on deadlines for heavy vehicle owners to file their taxes and ensure compliance with federal regulations. Our comprehensive guide provides clear, concise information on when and how to submit Form 2290, avoiding penalties and ensuring timely tax payments. Whether you're a fleet manager or an owner-operator, our resources simplify the process, helping you stay on track with your tax obligations. Trust eForm2290 for accurate due date information and reliable filing support, ensuring your vehicles remain compliant with IRS requirements throughout the tax year

0 notes

Text

Empowering Logistics Companies | Form 2290

Welcome to the 2024 Key Tax Deadline and Strategies Season!

As we approach January 29th, the begin of the e-filing season, it’s time to center on proficient and stress-free assess filing.

We are committed to directing you through this prepare, guaranteeing a smooth involvement. Our group is here to oversee your monetary obligations with mastery and care, making assess recording direct and worry-free.

Forms to Anticipate by the Conclusion of January or the Starting of February Form W-2G: For detailing betting winnings. Form 1099-C: For announcing obligation of $600 or more canceled by certain monetary substances counting monetary teach, credit unions, and government government agencies. Form 1099-DIV: For announcing profits and selling distributions. Form 1099-G: For announcing certain government installments, counting unemployment recompense and state and nearby charge discounts of $10 or more.

Form 1099-INT: For detailing intrigued, counting intrigued on conveyor certificates of deposit. Form 1099-K: For announcing installments gotten from a third-party settlement entity. Form 1099-LS: For detailing reportable approach deals of life insurance. Form 1099-LTC: For announcing long-term care and quickened passing benefits. Form 1099-MISC: For detailing eminence installments of $10 or more, lease or other commerce installments of $600 or more, prizes and grants of $600 or more, edit protections continues of $600 or more, angling pontoon continues, restorative and wellbeing care installments of $600 or more.

Form 1099-NEC: For announcing nonemployee compensation. Form 1099-OID: For announcing unique issue discount. Form 1099-PATR: For announcing assessable disseminations gotten from cooperatives. Form 1099-Q: For detailing conveyances from 529 plans and Coverdell ESAs. Form 1099-QA: For detailing disseminations from ABLE accounts. Form 1099-R: For detailing conveyances from retirement or profit-sharing plans, IRAs, SEPs, or protections contracts. Form 1099-SA: For announcing conveyances from HSAs, Toxophilite MSAs, or Medicare Advantage MSAs. Form 1098: For announcing $600 or more of contract interest. Form 1098-E: For detailing $600 or more of understudy advance interest. Form 1098-MA: For announcing contract help payments. Form 1098-T: For announcing qualified educational cost and expenses. Form 8300: For announcing exchanges of more than $10,000 in cash (counting computerized resources such as virtual cash, cryptocurrency, or other advanced tokens speaking to value).

Form 8308: For detailing trades of a organization intrigued in 2023 that included unrealized receivables or significantly acknowledged stock items. Form 5498: For announcing IRA commitments, counting conventional, Roth, SEPs, and SIMPLEs, and giving the December 31, 2023, reasonable advertise esteem of the account and required least dispersion (RMD) if applicable. For proficient handling of your assess return, it is fundamental that we accumulate all essential data. It would be ideal if you fill out the brief Admissions Sheet.

Your precise reactions on the Admissions Sheet will empower us to give you with the best conceivable benefit and guarantee compliance with charge regulations. Convenient Arrangements and Custom fitted Assistance: Tax Deadline Understanding the complexities of assess season, G&S Bookkeeping offers helpful arrangements for record accommodation.

If you’re in the Rancho Cucamonga range, feel free to drop off your printed material at our office. Alternatively, secure online transfers are accessible. Our objective is to make your assess due date encounter as consistent as conceivable. For organizations with financial year plans, we give custom-made bolster to help in recognizing and assembly particular assess due date, guaranteeing prompt compliance. Conclusion: Set out on a Smooth Charge Journey: As the charge season unfurls, let us at G&S Bookkeeping ease your travel. With our mastery and personalized approach, we’re committed to guaranteeing a smooth and effective charge recording involvement for you.

Ready to begin? Provide us a call, and take the to begin with step towards a worry-free charge season.

0 notes

Text

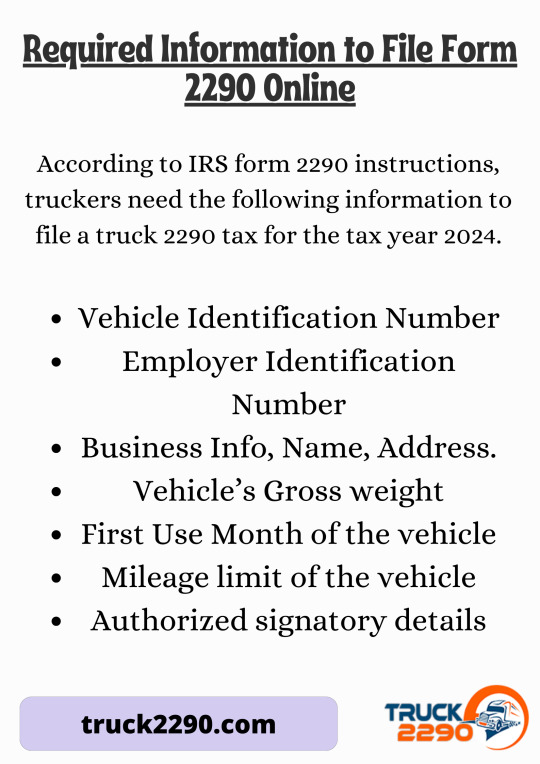

Required Information to File Form 2290 Online

Filing a 2290 tax form for the 2024 tax year is easy with Truck2290. Here, you will get assistance such as accurate tax calculations, free VIN correction, accessibility from anywhere, the ability to upload multiple VINs at once, and you will receive the instant schedule 1 proof in minutes.

0 notes

Text

What is Form 2290 Tax and How Does it Work?

Understanding Form 2290 Tax and its significance in the world of taxation, Form 2290 holds a significant place. This form, also known as the Heavy Highway Vehicle Use Tax Return, is an essential component of the United States tax system. It plays a crucial role in ensuring that heavy vehicles operating on public highways contribute their fair share to infrastructure development and maintenance.

Form 2290 tax serves as a means for the Internal Revenue Service (IRS) to collect taxes from owners of heavy vehicles with a gross weight of 55,000 pounds or more. These taxes are imposed on vehicles that are used primarily for transportation purposes and have an estimated annual mileage exceeding 5,000 miles.

The importance of Form 2290 tax lies in its contribution towards funding vital highway construction, repairs, and upgrades programs. The revenue generated from this tax is utilized to improve road safety measures, enhance transportation infrastructure, and support various initiatives aimed at maintaining efficient roadway systems throughout the country.

It is worth noting that compliance with Form 2290 tax requirements is not only an obligation but also beneficial for vehicle owners. By fulfilling their tax responsibilities through timely submission of this form and payment of applicable taxes, individuals and businesses can avoid penalties imposed by the IRS.

Who Needs to File Form 2290?

Form 2290 is a crucial document that needs to be filed by certain individuals and businesses. It is primarily used to report and pay the Heavy Highway Vehicle Use Tax (HVUT). The HVUT applies to vehicles with a gross weight of 55,000 pounds or more and is operated on public highways. So, who needs to file Form 2290?

Generally, anyone who owns a heavy vehicle that falls under the aforementioned weight criteria must file this form. This includes trucking companies, owner-operators, and even agricultural businesses that use heavy vehicles for farming purposes. It's important to note that there are specific deadlines for filing Form 2290.

For most vehicles, the deadline falls on August 31st of each year. However, if you purchase a new vehicle during the tax period, you will need to file within the month following the first use of the vehicle. Filing Form 2290 is not only a legal requirement but also ensures that you stay in compliance with IRS regulations.

Failure to file or pay the HVUT can result in penalties and interest charges. To simplify the process of filing Form 2290, many individuals and businesses choose to utilize online services or software programs specifically eform2290.com designed for this purpose. This tool streamlines the filing process and provide assistance in calculating taxes owed based on vehicle weight and usage.

In conclusion, if you own or operate a heavy vehicle meeting the weight criteria outlined by IRS regulations, it is essential to file Form 2290 in a timely manner. Doing so will keep you compliant with tax laws while avoiding any unnecessary penalties or fees.

0 notes

Photo

Hello truckers! IRS is shutdown for maintenance and they won’t process any tax returns or send acknowledgments or acceptance copies. But, you can e-file form 2290 truck taxes at Tax2290.com, we will transmit them to the IRS once they open for business. E-file form 2290 now! https://blog.tax2290.com/lets-plan-and-e-file-truck-taxes-before-irs-opens-for-this-year/

#Tax2290.com#form 2290#efile form 2290#IRS Shout Down#IRS Down Time#schedule 1 copy#form 2290 HVUT#form 2290 online e-filing services provider

0 notes

Photo

August 31 is the due date for reporting the Federal Vehicle Use Tax Form 2290 with the IRS. You just have less than a day to get it done. #2290eFiling is the best way to report and pay the dues on time. @tax2290 #efiling2290 is Easy and Fast, Schedule 1 proof in just minutes.

The Heavy Vehicle Use Tax Form 2290 for the new tax year 2022 – 2023 is due now & renew it online to receive IRS stamped Schedule-1 proof in minutes. Electronic filing is fast & easy only at @Tax2290.com. The best way to report & pay the 2290 #TruckTaxes. #Form2290 #HeavyTruckTax

#2290 tax online#2290 tax e file#2290 tax online for 2022#2290 tax e filing#2290 tax electronic filing#2290 tax for 2022#2290 tax for 2290 tax year#2290 tax online for 2290 tax year#2290 tax for july 2022#2290 tax e filing for 2022#2290 truck tax#2290 heavy truck tax#2290 tax form efile#2290 truck tax efile#2290 heavy truck tax e file

0 notes

Text

Best Lease Purchase Program in Trucking Industry

Lease purchase program, also known as a lease purchase agreement offers truckers the option to lease a truck with the option to purchase it eventually. When you opt for a lease purchase program, you need to make lease payments on the truck as well as take care of the fuel costs, insurance, and maintenance.

Lease purchase programs offer you a higher owner-operator pay rate for your work. Once you’ve completed the payment, your lease term draws to an end and you will be able to own the truck and begin your career as an owner-operator.

What are the benefits of a lease-purchase program?

Many aspiring truckers prefer the lease purchase program for the various perks that come with it. Here are some of them:

Lease purchase programs are affordable compared to purchasing a trucking as you can make the payment over the course of the lease period. You will be an owner-operator from the get-go all the while lessening your financial burden.

If you work with a good lease-purchase company, they will offer a greater degree of support by assigning consistent loads and helping you pre-plan and schedule your trips.

You don’t need to provide a line of credit as the lease purchase agreement is through a carrier.

You can garner a strong reputation and build reliability by working with a good lease-purchase company.

Some lease-purchase companies provide permits so you can save yourself from jumping through hoops to procure them.

Best lease-purchase programs for you

Different lease-purchase companies have different rules and perks that give them the competitive edge over others in the market. The trick is to pick a company that helps you grow and flourish. We’ve put together a list of top lease-purchase programs that are most preferred in the industry:

Prompt support by the entire Swift network, including our 40 terminals and shops

Access to online business management tools, medical and legal protection plans, and more

Provides base plate licensing and permits

$35 for each additional drop/pick on multi-stop loads

100% of lumpers fees are paid

Contractors are insured while under dispatch by Swift Transportation

Tolls are reimbursed

No forced dispatch

You are eligible for voluntary health programs

Provides base plate licensing and permits

You get discounts on fuel, insurance rates, tires and maintenance cost

Weekly settlements are paid promptly- no waiting on bills and paperwork

Get access to new trailers and newest equipment in the industry

Benefits:

Get access to Pam corporate fuel rates

Maintenance and repairs at company rates

Provides base plate licensing and permits

You can file your own taxes as Pam does not deduct tax from your salary

Licensing and permitting fees are paid up front

IRS’s Heavy Highway Vehicle Use Tax is paid up front

Benefits:

Pay is based on percentage not mileage

Discounted prices on truck tires and parts

Provides base plate licensing and permits

Own your truck in just under 3 years

Flexible financing options

Riverside Transport

Riverside Transport has the most driver centric lease purchase program in the US. The company provides superior services along with technologies and equipment that helps you function efficiently and grow your business.

Benefits:

24/7 extended coverage support

Weekly payment and reimbursed lumper fees

Reimbursed scales

No payments on hometime

No credit checks, money down or trailer fees

No forced dispatch

Bumper-to-bumper full-service maintenance program

Loaner truck offered

Final Thoughts

If you aspire to grow professionally and become an owner-operator, lease-purchase programs are the best option for you. You must choose the best lease-purchase company to ensure that you reap the maximum benefits. Once you own your vehicle and fulfill your dream of becoming an owner-operator, don’t forget to stay compliant by filing your form 2290 on time over an IRS-approved partner like eForm2290.com so you can drive worry-free and grow your business.

2 notes

·

View notes

Text

IRS Now Accepting the Form 2290 for 2024-25 | Get Stamped Schedule-1 in Minutes!

Truck2290.com offers a quick and easy way to file Form 2290 for the 2024-25 tax year. Get your stamped Schedule-1 in minutes, ensuring your heavy vehicle is compliant with IRS regulations. Don't wait—file now to avoid penalties and keep your truck on the road!

#Form2290#HeavyVehicleTax#Truck2290#taxform2290#form2290online#whatis2290form#fileform2290#2290online#form2290duedate#2290forminstructions#schedule1form2290

0 notes

Text

Get Different Types of Transportation Permits - Global Multi Services

With 15 years in the truck permitting business, Global Multi Services know from practical experience how to help you set up your new trucking venture and the steps needed to keep you in business. We can assist you in forming your LLC or Corporation, securing your Federal Identification Number (also referred to as your EIN) SCAC number and of course take care of all of your truck permitting needs, including IRP Plates & Renewal, IFTA decals, MC Numbers, USDOT Numbers, 2290 filing and Fuel Tax Reporting. For more info, call us at (209) 982-9996 or visit the website.

#USDOT Number#mc authority#title transfer#corporation filling#2290 filing#IRP Plates & Renewal#ifta fuel tax returns

1 note

·

View note

Text

All You Need to Know About JST Truck Permits

JST Truck Permits is a US-based truck permits company that not only provides all the trucking permits and plates at a reasonable price but also delivers them very fast. Our main office is in Fresno, California, and also a branch in Indiana.

It is a complete house of all the trucking services and customer satisfaction is the prime goal of JST Truck Permits.

LIST OF ALL THE SERVICES

All Trucking Permits

To collect interstate taxes for fuel and miles operated in different states of the United States. It includes:

USDOT Number:

Trucking companies haul more than 10,000 pounds and involve interstate commerce need to have USDOT number.

MC Authority/ ICC:

It is required if the motor carrier operates as for-hire transport passengers across the interstate, or transport Federally regulated commodities.

Unified Carrier Registration (UCR):

UCR agreement is an accord between 49 states. The UCR fees are divided among the states.

IRP Plates:

Most efficiently and quick delivery of IRP plates. We take care of everything that is required during this process.

New Mexico WDT:

All vehicles over 26,000 pounds have to register with the New Mexico weight-distance tax permit.

New York HUT:

JST Truck Permits will get you enrolled for New York HUT permit and will provide the quarterly filing too. The average time to get the decals is 6-7 business days.

Oregon (PUC):

The state of Oregon requires trucking companies to get Oregon Permits separately. Our experienced team will get it ready for you.

SCAC Code:

A carrier that needs PAPS stickers will have to get a SCAC Code first. Let JST help ease things for you.

Kentucky Permit (KYU):

According to the state of Kentucky, it is necessary for all the operators with a licensed weight of 60,000 lbs or more to report mileage tax.

IFTA Fuel Tax Permit:

It is an agreement between states of the United States and the Canadian province. It includes:

IFTA Account Setup

IFTA Quarterly Filing

IFTA Compliance

Additional Decals

2290 Filing (HVUT)

Supervisor Training:

JST truck Permits providing 60min training on drug abuse and 60min training on alcohol abuse. The supervisors must ensure drug and alcohol-free workplace. They must be trained for this and certified from a valid service provider. JST Truck Permit is a valid service provider. After passing supervisors training will understand how to induct reasonable suspicion testing.

DOT Drug & Alcohol Testing:

According to FMCSA, it is necessary to ensure a drug and alcohol-free workplace for the employees. An addicted employee can cause harm to property as well as other employees too.

JST Truck Permits providing drug and alcohol testing all over the nation.

DOT Audit Support:

FMCSA conducts thousands of audits throughout the year and can ask any document related to safety and employee. It is better to be ready with your documents. Don't wait for the letter from FMCSA.

Let our experienced staff handle your all document work and get you ready for anytime DOT audit.

DOT Compliance Management:

It's better to meet the standards of the Department of Transportation to stay in compliance otherwise motor carriers can face serious consequences.

Let JST Truck Permit ease things for you.

Driver Qualification Files:

According to FMCSA record-keeping of drivers is necessary for every motor carrier. This process is very hectic and time-consuming.

Let JST Truck Permits handle all your hassles.

MCS 150:

MCS 150 form must be updated every 2 years according to FMCSA even if there are no changes in your company otherwise you will get fined. We don't want you will get fined. Let JST Truck Permit take care of your MCS 150 update.

Open New Trucking Company:

Want to open a new trucking company? It is a very difficult and complicated process to process all the documents work according to the different needs.

Let our experienced staff help you with this. They will guide you step-by-step until your documentation gets completed.

#trucking#truck#truckdriversusa#truckdriverlife#MCS150#irp#drug and alcohol testing#FMCSA#California#truckpermits#ICCpermits

1 note

·

View note

Text

Truck2290 is an IRS-approved & leading form 2290 e-file provider. Also, it has won millions of truckers’ trust in the most recent years. Choose us to file truck 2290 Returns & pay Heavy vehicle use taxes securely to the IRS.

#irs2290#trucktax#taxfiling#2290duedate#irsform2290#hvut#form2290#heavyvehicletax#taxseason#truck2290

0 notes

Text

Steps to Select the Best Heavy Highway Use Tax

The Transportation industry includes a remarkable development in the past few years. Each and every year several completely new companies are stepping into in this subject. But they will need to learn about the particular taxes they need to pay once these people start working. The Transport Company working together with heavy vehicles ought to realize inside details about HVUT or perhaps heavy highway use tax. Heavy Highway Use Tax can be a central duty attained upon large automobiles at a licensed gross bodyweight equal to as well as exceeding 55,Thousand pounds along with operates about open public highways.

The maximum HVUT pertaining to the vehicles exceeding beyond 75,000 pounds is $550 annually. Annually Agency associated with Motor Autos (BMV) requires the repayment receipt or HVUT. The tax duration of Heavy Highway Use Tax begins on July one along with ends on June 30 next year. The gross taxable weight with the vehicle may be the summation. The real unloaded weight associated with the actual automobile fully equipped pertaining to service. The actual unloaded weight of any trailers or semitrailers fully equipped for services typically utilized together with all the car, truck dispatcher.

The weight of the maximum load often continued the vehicle along with any kind of trailers or semitrailers often utilized together with the car. Who's required to pay HVUT as well as Heavy Highway Use Tax? You're expected to pay Heavy Highway Use Tax in case your company satisfies these criteria's. The highway motor vehicle is authorized in your own name. The gross weight of the vehicle is usually 55,000 pounds or surpasses. It really is expected for you to exceed the actual mileage above 5000 miles (7500 miles for Agricultural & Logging vehicles).

If your company offers plans to not exceed the 5000 miles (7500 miles for Agricultural & Logging vehicles). Then a car can be designated as Tax hanging vehicle. You do not have to cover the income taxes but need to file this anyhow. Several teams which tend to be excused the particular HVUT comprise The Federal Government. State or perhaps local governments, including the District of Columbia. State or local authorities, such as the District of Columbia. Mass transportation authorities. Indian tribal governments (for vehicles used in tribal government functions).

Indian tribal governments (for vehicles used in tribal government functions). You may have the subsequent information to document your own HVUT Vehicle Identification Number (VIN) of each vehicle over 55,000 pounds. Employer Identification Number (EIN). The taxable gross weight of each vehicle. Penalties due to filing significant Highway Use Tax. If you miss to be able to document HVUT earnings or perhaps pay taxes within the given deadline, the IRS may possibly impose penalties or charges you. HVUT charges may also be billed on you in case there's any fake in declaring tax returns.

These kinds of penalties will be incorporated on the interest billed on the late payment. If you've got a legitimate reason behind late transaction, then fines regarding past due declaring of Heavy Highway Use Tax might not be levied you. For filling following the actual deadline, you need to attach the proof of postpone to be able to get reduction. Thus, it is compulsory for Every transport business to help document Heavy Highway Use Tax form 2290 timely. Not merely it helps you save from charges but also assists One to be authenticated within the company. To perform Your company with no obstacles, document the taxes promptly and adhere To every legislation.

1 note

·

View note

Text

What is IRS 2290 E File?

IRS 2290 E File - It is a process of filing 2290 in an online breaking news tax to the IRS online process. In Previous years, truck holders have only one option to file 2290 online. Only with the paper filing option, truck holders used to pay their heavy Highway vehicle use tax. But now, there is a new option introduced by the IRS to file 2290 in an online. It is very easy to file IRS 2290 form online and do 2290 highway tax payment. When truckers used to file their form 2290 with paper then it became very difficult to handle all the tax payments by the IRS. But when the IRS introduced tax online payment, it became easy to collect all the 2290 Taxes by the IRS. Also, it is really easy to file and make 2290 payment by the filers.

The concept of from 2290 electronic filing raised for the purpose of making highways better and safe. Because of the heavy vehicles which are running on public highways are causing damage to the roads. Repairing and reconstruction of public highways are tied with a huge amount. The IRS alone can't bare the amount for reconstruction. Therefore, the IRS decided to impose a tax on truck owners. But the thing that truckers need to consider here is every trucker need not to file and 2290 tax with the IRS. Truck owners whose vehicle gross weight is higher than 55, 000 pounds or more only need to File IRS Form 2290 Online.

File IRS 2290 Online with Simple Steps

Also, the truck holders whose vehicle mileage limits are increased than 5,000 miles are also needed to Pay 2290 Highway Use Tax in an online. Furthermore, it is necessary to Pay Highway Tax 2290 with the IRS for the agricultural vehicles which are running with the mileage limit of 7,500 miles or more. Truck owners need to consider all of these things and then only they need to Pay their 2290 Taxes with the IRS. With the IRS 2290 E File, truckers can easily grab their 2290 Schedule 1 Proof in minutes from the IRS.

Truck holders can Pay their Heavy Highway Tax Form 2290 with the IRS in minutes with the 2290 Online Filing Process. The very comfortable method to File 2290 IRS Form and 2290 Heavy Use Tax Payment is an IRS 2290 E File. IRS 2290 E File, the Heavy Vehicle Use Tax Payment also help you to claim a credit from the IRS. Therefore, truck holders can easily file 2290 online also claim their credit from the IRS. When the truck holders heavy vehicles stolen, sold, or destroyed then they can claim a credit from the IRS. Also, if any vehicle gross weight will not increase than 55,000 pounds or more than also truck holders can claim a credit from the IRS.

What do you need to File 2290 online?

To File Form 2290 electronically, All you need is:

An EIN, Business Details such as company name and address.

An email address.

The VIN number of your truck or trucks. 17 digits VIN number, The IRS also accepts a short VIN. Therefore, you can also include short VIN Number.

A Check to pay IRS 2290 Taxes.

A Credit Card or Debit Card to pay the nominal e-filing service fee.

File IRS Form 2290 Online and Pay Heavy Highway Vehicle Use Tax

Visit our site Form 2290 Filing for more info about 2290 Online Filing. Contact us at +1-316-869-0948 and start IRS Form 2290 Online Filing.

1 note

·

View note

Photo

There're quite a few ways you can benefit from #prefiling #Form2290 for TY2020-21 with www.Tax2290.com:

>10% discount on the service fee.

>Be the first one to receive your #Stamped #Schedule1 copy, so you need not stop delivering the essentials during this pandemic.

>Pre-filing gives you almost 3 months preparation time for Tax Due payment before deadline,

>Avoiding risk of late filing penalties and IRS surprises.

>Ample time for infinite corrections before IRS accepts your return.

We’re open for business during the COVID-19 (coronavirus), pre-file 2020-21 Form 2290 today!

#Form2290#Prefile form 2290#pre-file for 2020-2021#HVUT form 2290#Form 2290 for tax year 2020-2021#10% discount to efile 2290#Form 2290 discounts#Form 2290 offers#Form 2290 tax years#Form 2290 due Date

0 notes

Text

How Heavy Highway Use Tax Is Important?

Knowing the fact about is heavy highway vehicle tax is quite crucial. A better understanding will help you to find out its importance. It also encourages you to submit a heavy highway tax. You get to enjoy the benefits of paying this tax when you know where it goes. This is an essential fee that they need to pay. This tax is collected from all of the truckers. This is important for companies to transport their products. This is a essential fee for the truckers. This tax is used for the keeping highways and roads in a fantastic condition. What else if the businesses forget to pay the tax on time? It will cost a huge penalty in their side. Weight distance tax should be calculated on the basis of different states laws, rates of fuel on various states, etc.. Heavy vehicle use taxes are calculated based on its own load.

The Heavy Vehicle Use Tax is filed to the IRS by using Form 2290. The burden of the taxable freight should be calculated here. Truckers need to pay the sum annually. They operate before they have to take collection based on various actions. The initial bill for tax due amount based on the return plus any interest and penalties. At the least, an additional bill ought to be sent by the IRS as a reminder. Interest and penalties will continue to add on until the complete due amount is paid. Ranging from applying for last tax year’s refund to tax because of seizing assets and property, the IRS takes steps. IRS usually takes measures based on the previous year’s tax return because of property seizing or strength seizing. One ought to cover the heavy highway use tax prior than the due date of tax payment without balance keeping. If a trucker failed to pay the complete tax at one time, they need to contact the IRS.

If you don’t admit that maintain a copy of the bill and any tax returns, cancelled checks, other records. It will help the IRS to understand why your bill is wrong. IRS may understand the problem with your tax with such documents. You can visit the local IRS office for a solution. Should you describe or admit your problem previously, IRS will take action on the matter. If you’re facing bankruptcy or other financial problems, notify it previously to the IRS. You can call them or can visit their offices for discussion. You can discuss them to keep it to stop. Making tax report and paying tax on right time is troublesome of lots of the trucking companies. They use the Weight distance tax software to make the job simple. This software can calculate and send the tax report punctually to IRS. With the help of this software, you can save time, money efforts and mistakes as taxes are paid properly and on time.

2 notes

·

View notes