#FreeInvoice

Explore tagged Tumblr posts

Text

💼 Take Your Business to the Next Level with Zodot!

Whether it's creating invoices, managing clients, or tracking time and expenses—Zodot has it all! Streamline your workflow, close deals, and boost your productivity with our all-in-one platform.

🔗 www.zodot.co

#BusinessManagement#LaunchSoon#Zodot#Invoicing#FreeInvoicing#ProjectManagement#Freelancers#ClientManagement#TaskManagement#TimeTracking#IncomenandExpenseTracking#ProposalManagement#ContractManagement#BusinessReporting#ProductivityTools#BusinessAutomation#FreelancerTools

0 notes

Text

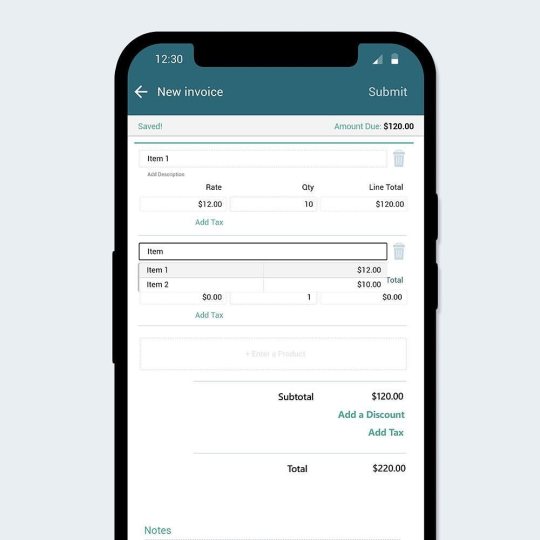

Do you want to make your billing process hectic to easier❓

Relax❕We've got your back.

Start your journey with BuildInvoices Software today and transform your billing headache into an Untroublesome Process. . 😍Try BuildInvoices Software . Visit https://buildinvoices.com/ for excellent invoices. . #invoice#online#finanical#onlinebilling#billing#invoicefinance #invoicedesign#invoicemaker#freeinvoice#onlinetools#tools #finances#money#finance#financetips#business#investing#investment#financegoals#budget#financialplanning#moneymanagement#financial#invest#investments#success

1 note

·

View note

Link

Thinking of hiring an invoice development company? Then your search ends here as Moon Technolabs brings you Moon Invoice, a free invoice generator tailored with all the necessary features for a proper hassle-free invoice generation.

1 note

·

View note

Link

When you use an online invoice generator, you can create invoices directly from your web browser in your preferred format. Free Invoicely is one of the most popular websites for free invoice generators, and it is most popular in India.

0 notes

Photo

Visit https://www.olabooks.co/ NOW and subscribe ASAP! Link in bio! #olabooks #freeinvoice #einvoice #digitalinvoice #shareinvoice #stopprinting #launchingsoon https://www.instagram.com/p/CXyegcOIMij/?utm_medium=tumblr

0 notes

Link

invoice template in word, invoice template in pdf, invoice template in excel, free invoice template, download free invoice templates, download invoice template, standard invoice template

0 notes

Text

All You Need To Know GST Invoice

When you are a GST registered dealer, you are required to provide GST invoice for the sales of your products and services, also known as GST bills to your customers. You can make free GST invoices for lifetime using Treflo.

The GST invoice mentions the parties involved in the transaction and a description of the products sold or services supplied.

It is known amongst the retailers that an incorrect invoice can obstruct the avail of GST credit.

And so, it is important to get the right GST invoice as a purchaser and issue a GST invoice as a supplier or seller.

Before we get into the know-how of the GST invoice, let us cover the basics of the GST and GST invoice.

What is GST?

Goods and Services Tax is one of the tax reforms in the history of India. Rolled out in July 2017, GST is one of the indirect taxes on the supply of products and services from the supplier to the consumer.

GST includes all taxes into one and subsumes all the indirect taxes. This is applicable for all the state-level and central-level taxes.[1]

What is a GST Invoice?

A seller issues a GST bill, or an invoice is issued for the recipient or the buyer of products and services.

The bill is issued by the seller or the supplier of the products and services.

This document includes the details of the parties involved in the transaction and details of all the products and services, along with the amount due for payment.

When you have to issue a GST invoice, make sure that you include the following is included in the GST invoice –

Product name and its description

Quantity of products and services supplied.

Details of the purchaser and the supplier

Terms and conditions of supply

Date of the supply

Discount provided by the seller

Price of each product sold or services rendered.

What are the Benefits of GST Invoice?

GST Invoice simplifies administration and expands the net tax.

Drives competitiveness

There is no hassle of multiple taxations; there’ll be seamless flow and remove distortions in the trade.

GST Invoice simplifies the tax structure and creates a common marketplace.

The GST bill reduces the hidden cost of doing business.

What is the format of the GST Invoice?

A GST invoice is issued to charge the tax and pass on the input tax credit.

As per the Section 31 of the CGST Act, 2017, a GST invoice must have the following mandatory fields –

Name of the customer

Date and invoice number

Shipping and Billing address of the consumer

GSTIN of the customer

Place of supply

HSN Code (Harmonized System of Nomenclature Codes)

The value of tax

GST rates and the total GST charged (this includes details of applicable SGST/CGST/IGST for the product)

Signature of the supplier

When should a GST Invoice be issued?

The GST Act defines a time limit to issue a GST tax invoice, revised GST bill, credit note, and debate note. The invoice should be given before or after providing products/services in terms of taxable products/services.

The due dates to issue a GST invoice are the following –

Goods (Normal Case) – The GST invoice must be issued before or on the delivery date.

Goods (Continuous Supply) – The invoice should be issued before or on the date of issue of payment/account statement

Services (Normal Case) – GST invoice must be issued within 30 days of the supply of services.

Services (Banks & NDFCs) – The invoice must be issued within 45 days of the supply of services.

What is the Importance of creating a GST Invoice?

Several variables make the GST invoice important for the smoother recording of profits.

A GST invoice is definite proof of a substantial transaction. A substantial exchange is required while recording GST returns because it contains details such as transacting parties, irrespective of whether the parties involved are enrolled under the GST structure, description of the product, dare of raising the receipt, administrations received, etc.

A GST invoice is used to compare with exchanges referenced by different parties to verify the details of the transactions. The retailers coordinate the receipt details effectively, and they can determine the output tax risk. This also helps to decide the measure of the input tax credit, which the taxpayer can claim.

You can claim the input tax break if the GST invoices meet all the requirements. The input tax break is the discount on the tax that you have paid on the transaction. If the taxpayer doesn’t confirm a transaction, the input tax credit will be added to the taxpayer’s output tax liability.

A GST invoice will guarantee that citizens won’t miss their deadlines for filing returns. The GST receipt contains the record of all exchanges that were made during a month. When a taxpayer files their monthly returns, the GST invoice will fill in as a record to determine the measures of GST a taxpayer should pay and the due date.

GST Invoice Under Special Circumstances

Invoice under Reverse Charge Basis

If the Reverse Charge Basis is applicable under the GST, the recipient must raise an invoice on self. Invoice must be raised on a consolidated basis for all the transactions done during the day on which GST is levied under Reverse Charge.

The registered party should issue a payment voucher for supplies when making the payment to the supplier.

Issuing of Invoice Provided there is a Continuous Supply of Goods.

When there is a continuous supply of goods, successive statements of accounts or payments are included; thus, the invoice should be issued before or at the time of each transaction.

Invoice in case of Continuous Supply of Services

When the due date of the transaction can be ascertained from the contract, the invoice should be issued before or on the due date of payment.

When the due date can’t be ascertained from the contract, the invoice should be before or when the supplier of services receives the payment.

If the payment is linked to the completion of the service, then the invoice shall be issued before or on the date of completion of the event.

Invoice in case of Export of Goods or Services

When exporting goods/services, then the invoice should carry one of the following endorsements as to the case maybe –

Supply meant for export under Letter of Undertaking or Bond without payment of Integrated GST.

Supply meant for export on the amount of Integrated GST.

Following are the details that shall be mentioned on an invoice –

Name of the recipient

Address of delivery

Name of the country (destination)

Transportation of Goods without Invoice

Under the following cases, it is allowed for the consignor to issue a delivery challan in place of the invoice at the time of removal of goods –

Transportation of products for job work.

Shipment of products for purposes other than by way of supply.

Supply of liquid gas where the quantity is not known.

The delivery challan should be made in triplicate for the consignee, the consignor, and the transporter.

GST Debit and Credit Note

Debit Note

A debit note is issued when the GST Invoice has been issued for a supply, and later on, it is found that the value or tax charged in that voice is less than what is actually chargeable.

A registered person who issues a debit note concerning the supply of goods/services can send the details of the debit note in return for the month during which the debit note has been issued.

Credit Note

A credit note is issued when the GST invoice is issued for a supply, and subsequently, it is found that the tax charged in the invoice is more than what is actually payable or when the recipient has returned the goods.

A registered retailer who issues a credit note is required to declare the details of the credit note in the GST return for the month during which the credit note has been issued. However, they have to ensure that they issue the note not later than September following the end of the financial year when the supply was made or the date of furnishing the relevant annual return, whichever of the two is earlier.

Can You Revise Invoices Issued before GST?

Yes, it is possible to revise invoices that were issued before GST. Under the GST regime, all dealers should apply for provisional registration before acquiring the permanent registration certificate.

Refer to the following image to understand the protocol of issuing a revised invoice.

This process applies to all the invoices between the date of issue of the registration certificate and the date of implementation of GST. As a dealer, the revised invoices must be issued against the invoices that are already issued. The dealer has to ensure that the revised invoice is issued within one month of the issue of the registration certificate.

How Many Copies of Invoices Should be Issued?

For Goods – 3 copies; original for the recipient, duplicate for the transporter, and triplicate for the supplier.

For Services – 2 copies; original for the recipient and duplicate for the supplier.

Conclusion

There are several benefits to business that are likely to come on GST Invoice are different in every other respect.

There are no controversies as there is only one rate which makes the invoicing simpler.

There will be no such entry taxes that cause the movement of products by road transport.

Under the GST regime, exemption across the state and the center will be the same, making the duty rates the same all over the country.

GST merges most of the existing taxes into the single system of taxes, and it replaces the taxes that the Central and State governments previously levied.

The GST tax invoice has proven to be a better tax system because it is more efficient, effective, transparent, and increases competitiveness in the global market.

1 note

·

View note

Text

KEY BENEFITS OF E-INVOICING FROM SUPPLIERS PERSPECTIVE

1- Accelerating the payment cycle:

As we know, email or paper-based invoicing takes a longer time to appear on the AP system, and also the overall functionality level is low. Also, there is a risk surrounding that data might get lost during the process. Whereas the electronically derived invoices are much safer, and the data is stored on the workflow system. It reduces all kinds of delays and days of sales outstanding which would undoubtedly accelerate the payment cycle.

2- Elimination of refused invoices:

As e-invoicing reduces the risks of human errors to zero, therefore the buyer does not have to re-key any data. Thereby, the rate of rejected invoices decreases.

3- Reconciling Accounts effectively:

Sometimes it happens that the buyer demands deductions against an invoice due to shipment issues. Suppliers have to reconcile the payments they receive from buyers. E-invoicing has simplified the process as customers send electronically derived payments with all the details and adjustments.

4- Customer Satisfaction:

There are no lengthy procedures to be undertaken while processing invoices which would ultimately lead to customer contentment. E-invoicing has played its part well when it comes to customer satisfaction.

Not only buyers but suppliers can also get remarkable advantages from e-invoicing. Head over to the website of Ola Books and subscribe to get more information.

0 notes

Link

Create professional invoices using our invoice generator for free!

Billing your clients is no more a nightmare for you! Use professional invoice templates our invoice maker has to offer!

0 notes

Text

online invoice

This Privacy Policy document contains types of information that is collected and recorded by invoicy.io and how we use it. If you have additional questions do not hesitate to contact us. online invoice

#invoicecreator #invoicebuilder #invoicegenerator #whatisaninvoice #proformainvoice #createinvoice #invoicemaker #freeinvoice #invoiceexample #receiptmaker #howtomakeaninvoice #freeinvoicegenerator

0 notes

Link

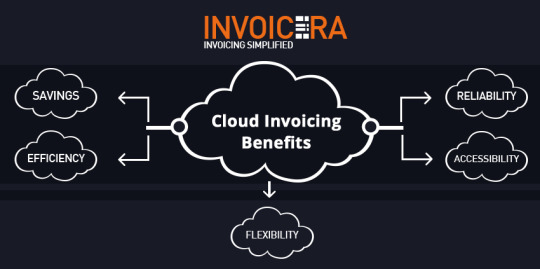

Invoicing in the entire business process holds the utmost importance. Selecting the best online invoicing tool to stay on the top of your business holds the key. According to your business needs, decide on the online invoicing software that will suit the best for your business.

#BestInvoicingSoftware#InvoicingSoftware#OnlineInvoicingSoftware#InvoicingOnline#FreeInvoicing#FreeOnlineInvoicing#InvoicingSoftwareFree

0 notes

Link

#BestInvoicingSoftware#InvoicingSoftware#OnlineInvoicingSoftware#InvoicingOnline#FreeInvoicing#FreeOnlineInvoicing

0 notes

Photo

Send #invoices straight from #FastPayee invoice software and say goodbye to manual paperbased Invoices.https://goo.gl/PTvjmT #FreeInvoice

0 notes

Link

Regardless of whether you need you to have a solopreneur business where you’re doing basically everything or plan to scale to an out and out organization additional time, there are five hints you ought to pursue to rapidly scale your outsourcing freelancing work into an effective business.

0 notes

Link

Buyers often avoid availing services from providers that do not have a billing system in order. It raises doubts regarding the quality of the products and services being provided. But, free billing software for small businesses can give you a more polished framework that helps customers trust you.

0 notes