#GordonGrowthModel

Explore tagged Tumblr posts

Text

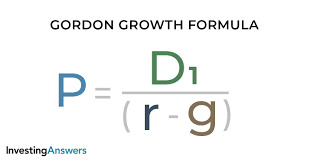

Understanding the Dividend Discount Model (DDM)

The dividend discount model works on the theory of calculating the net present value (NPV) of a company’s future cash flows using the time value of money concept (TVM). Basically, the DDM is based on estimating the present value of all potential dividends expected to be paid by the firm using a net interest rate factor or also called discount rate.

Estimating a company’s potential dividends can be a challenging job. To predict future dividends, analysts and investors may make certain assumptions or attempt to identify trends based on past dividend payment history. One can conclude that the company’s dividend growth rate will remain constant in perpetuity, which refers to an endless stream of similar cash flows with no end date.

Another thing is that shareholders who put their money into stocks run the risk of losing money because their investments can lose value. They anticipate a return/compensation in exchange for this risk. The market and investors expect reimbursement from a company’s cost of equity capital in return for owning the asset and bearing the burden of ownership. The Capital Asset Pricing Model (CAPM) or the Dividend Growth Model can be used to estimate this rate of return, which is expressed by (r). This rate of return, on the other hand, can only be realized when an investor sells his stock. Due to investor discretion, the appropriate rate of return can vary.

0 notes

Link

Gordon Growth Model (Formula, Examples) | Calculate Intrinsic Value

0 notes