#Henry Winkelmann

Text

Henry Winkelmann - Piercy Island off Cape Brett, 1911

101 notes

·

View notes

Text

Rephotography_'The 1990 Project'

Back in 1989 and 1990 the Auckland Public Library commissioned two projects to mark the national sesquicentenary a.k.a. 150 years since 1840 when Te Tiriti o Waitangi was signed and recognised as our founding document. This documentary initiative was named 'The 1990 Project', and aimed to record the look and feel of Auckland through oral history and documentary photography. (Jane Wild, Heritage Collections, Auckland Libraries)

The project involved five photographers: Stuart Page, Chris Matthews, Ans Westra, Miles Hargest and Paul McCredie. Photographed below on Queen St.

Image: Stuart Page. 1990 Project Photographers, Queen Street, 1989. Auckland Libraries Heritage Collections, 273-PAG057-22.

The series of over 6,000 images documented change in Auckland through the eyes of these five photographers and has since been a valuable comparison to see the kind of change occuring in our city.

The Auckland Central Library also holds collections of photographs, from the early to mid twentieth century, by photographers Henry Winkelmann and Rykenberg. Also with a more contemporary snapshot, the COVID collecting programme from 2020.

These photographs all document general change in Auckland but it is really interesting to see the snapshots that produce a timeline of change in the area I am interested in.

Though there are only a couple of the specific part of Roskill I have focused on, they show a change nonetheless. I would be really interested in getting re-shots of these scenes now.

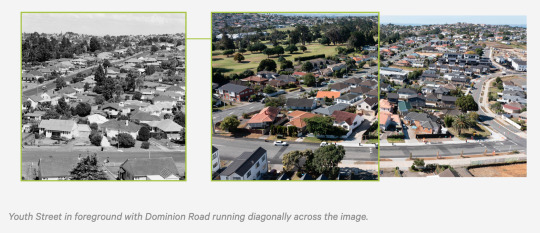

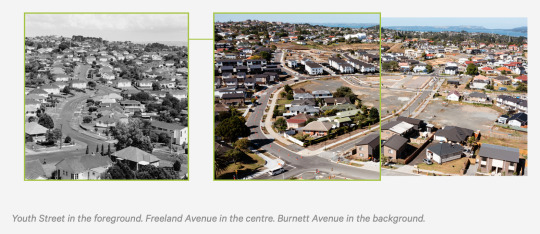

Image: Miles Hargest. 1990 Project, Houses in Mount Roskill, 1990-93. Auckland Libraries Heritage Collections, 273-HAR079-05-PAN.

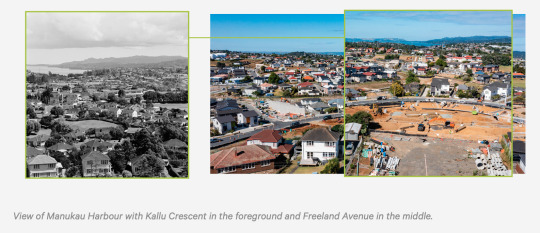

Image: Miles Hargest. 1990 Project, Manukau Harbour from Mount Roskill, 1990-93. Auckland Libraries Heritage Collections, 273-HAR079-12-PAN.

These are comparative images from the Roskill Development website (https://roskilldevelopment.co.nz)

0 notes

Photo

Looking south along Queen Street from corner of Customs Street. Henry Winkelmann, Auckland, 10 January 1925.

#Auckland#New Zealand#Queen Street#1920s#Henry Winkelmann#1925#Auckland Libraries#Sir George Grey Special Collections

9 notes

·

View notes

Text

Baby Brezza, a $200 Formula Maker, May Pose Health Risks to Infants

Like many first-time parents, Jon Borgese, a tech executive in Manhattan, had heard the buzz around the Baby Brezza formula maker, a countertop device that automatically dispenses warm bottles of formula at the touch of a button.The $200 machine, widely available at retailers like Amazon, Target and Buy Buy Baby, markets itself as the “most advanced way” to mix powdered baby formula and water “to perfect consistency.”But after Mr. Borgese and his wife, Nicole, started giving the machine-mixed formula bottles last year to their 2-month-old daughter, Lily, she became fussy and began to look thin, he said. The couple rushed her to the pediatrician, who confirmed that Lily was losing weight and sent her for medical tests to determine the cause.The problem was the Baby Brezza gadget, which had dispensed watery formula with insufficient nutrients for the baby, said Dr. Julie Capiola, Lily’s pediatrician. Mr. Borgese said he had since filed two class-action lawsuits against the machine’s maker, claiming the device was defective.“You don’t want any baby or any parent to go through this,” he said, adding that Lily gained weight once the family stopped using the formula maker. “It was very, very upsetting.”Mr. Borgese was one of many parents who have reported issues with the Baby Brezza formula machine, which was the top-selling baby feeding accessory in the United States over the last two years, according to the NPD Group, a market research company. On Amazon, Facebook, Better Business Bureau and parenting forums, people have posted more than 100 complaints saying the machines dispensed incorrect or inconsistent amounts of water or baby formula.Separately, five pediatricians described to The New York Times how they had recently treated babies — whose parents had fed them Brezza-dispensed bottles — for failure to thrive, a condition caused by lack of nutrients. The doctors said the health risks could be even more severe because infants’ digestive systems aren’t developed enough to process formula that is too watery or too concentrated.“It’s fine if it’s your coffee machine and you get more caffeine,” said Dr. Ari Brown, a pediatrician in Austin, Texas. But when it comes to infant formula, she has warned parents against using automated devices like the Baby Brezza, saying it “could potentially be harmful.”David Contract, marketing team lead for the Betesh Group, a private company in Newark that makes the Baby Brezza devices, said the company had carefully calibrated the machines to work with more than 2,000 types of baby formulas and regularly tested the devices for precision. He said people must clean the machines frequently to prevent powder buildup, which could cause the systems to dispense watery formula — requirements he compared to installing infant car seats correctly.“We are confident our machine works properly and accurately when it’s used right,” he said. He later added, “I do think there are people who don’t use it properly, who get a bad outcome, who get a watery bottle because they’re not cleaning, they’re not using the right settings.”Mr. Contract said the Betesh Group believed that the lawsuits were an “attempt by a plaintiff’s lawyer to troll for additional plaintiffs by seeking media attention.” The Brezza machine had no other insurance claims or lawsuits against it, he said.The problems that families said they have had with the Brezza machines illustrate the risks of adopting novel health-related devices before they are on the radar of federal regulators.While the Food and Drug Administration regulates infant formula as a food and the Consumer Product Safety Commission oversees the safety of “durable” baby products like cribs, each agency initially said the other was responsible for vetting possible inaccuracies with automated baby formula-dispensing machines.Last year, the Consumer Product Safety Commission received two reports from health care professionals about how babies who had been fed formula mixed by the Brezza devices had “lost significant weight” or “had to be evaluated after drinking the formula.” Last month, the commission clarified that it was responsible for overseeing the devices and urged consumers to report any problems to saferproducts.gov.“Is anybody overseeing devices like this?” said Dr. Gayle S. Smith, a pediatrician in Richmond, Va., who said she had treated a Brezza-fed baby for failure to thrive. Or, she added, “is it babies who are supposed to fail to thrive in large enough numbers” before regulators intervene?Mr. Contract said the machines were safe and met F.D.A. requirements for materials that come into contact with food.Dr. Jacqueline Winkelmann, a pediatrician in Orange, Calif., said she had seen babies admitted to a hospital for weight loss because they were given bottles that had been mixed incorrectly by hand.“I believe the Baby Brezza Formula Pro is a great way to ensure baby gets the right amount of nutrients in every bottle,” said Dr. Winkelmann, who consults for the Betesh Group.The Betesh Group began selling automated formula-dispensing machines in 2013. The devices took off in 2018 when the company introduced a new model, the Baby Brezza Formula Pro Advanced. About half a million of the Brezza machines have been sold in the United States, the company said. Several similar machines are also available, with brand names like Baby EXO and Zomom.To use the Brezza machine, people fill compartments for water and infant formula powder. They also set the machine to their desired number of ounces and specific type of formula. Mr. Contract said the devices can save parents several minutes per formula bottle, a welcome convenience in the middle of the night.On BabyList, a popular site for expectant parents, more than 60,000 people — or about 6 percent of users — included the Brezza machines on their baby gift registries last year. Many parents swear by the devices.“Instead of stumbling around in the middle of the night, you go into the kitchen, press a button on the machine, go get the baby and, by the time you get back to the kitchen, the warm bottle is ready,” said Linda Murray, senior vice president of consumer experience at BabyCenter, a pregnancy information site where parents have debated the pros and cons of the devices.But Mr. Borgese and some other parents said that even when they carefully cleaned, set and filled the machines, the devices seemed erratic — sometimes producing opaque, milky-looking formula and other times dispensing watery-looking, translucent formula. In a federal class-action case he filed on Feb. 12, Mr. Borgese argued that the Betesh Group knew the devices did not mix the appropriate amount of formula and failed to warn parents and physicians. Some parents who said the device was inconsistent ran their own experiments to test it.“It was never giving you the right ratio,” said Paola Ortega, a brand strategist in Austin, who said the device dispensed too much formula powder and seemed to cause her son, Andrés, to vomit. She compared the machine-dispensed bottles with those she made by hand, she said, and found noticeable differences. Another parent, Ortal Gefen in Orange, Conn., said she stopped using a Brezza machine to make bottles for her son, Henry, in 2017 after she discovered it “wasn’t consistent from one bottle to the next.”She recently bought a newer model of the formula maker, which seemed more reliable. “When it works, it’s a lifesaver for parents,” Ms. Gefen said.Some parents who contacted the Betesh Group said they were frustrated with its customer service. In complaints posted on the Baby Brezza Facebook page or filed with the Better Business Bureau, consumers said the company was slow to answer emails, blamed them for user error or told them that their one-year warranties were expired.The Better Business Bureau has posted an F rating, a failing grade, for the Betesh Group, partly because of many complaints against the company and how long it took to respond.Mr. Contract said the company had resolved most of the complaints submitted to the Better Business Bureau and believed that they were generally not “an accurate reflection of our customers’ satisfaction with our products.”He added that the company’s customer service agents provide extensive troubleshooting, often helping people solve user errors like insufficient cleaning. As a precaution, he said, the machines are programmed to stop working and beep after every fourth bottle when they need to be cleaned. The Betesh Group is developing a third-generation “smart” version of the device, which will be introduced this summer. Mr. Contract said it would include an app that enabled parents to direct the Brezza machine to prepare formula bottles from their smartphones.

Read the full article

#1technews#0financetechnology#0technologydrive#03technologysolutions#1technologycourtpullenvale#1technologydr#1technologydrive#1technologydrivemilpitasca95035#1technologydriveswedesboronj08085#1technologyplacerocklandma#1/0technologycorp#2technologydrivewarana#2technologydrivewarrennj#2technologydrivewestboroughma01581#2technologyfeaturestopreventcounterfeiting#2technologyplacemacquarie#2technologyplacemacquarieuniversity#2000stechnology#3technologybetsgenpact#3technologydrive#3technologydrivepeabodyma#3technologyplace#3technologywaynorwoodma#360technewshindi#3dprintingtechnews#3mtechnologynews#4technologycircuithallam#4technologydrive#4technologydrivelondonderrynh03053#4technologydrivepeabodyma01960

0 notes

Photo

Creator Winkelmann, Henry (7 Mar 1904)

Description

Showing part of the Auckland Railway Station, Beach Road, Railway Terminus Hotel (right), and Parnell School (centre distance), with homes in Parnell (distance)

0 notes

Photo

Fort St / Fort Lane then and now.

"Looking north from opposite Fort Street Lane, showing the premises of the New Zealand Express Company Limited in Fort Street, offices of F H Houghton, commission agent, J H Hopkins, produce broker, Commercial Union Assurance Company Limited, Thomas Cotter, solicitor, with horses and carts outside the building."

Creator

Winkelmann, Henry

Date

22 Jan 1914

Sir George Grey Special Collections, Auckland Libraries, 1-W1394

0 notes

Photo

Date: 15 of June 1907

Source: Sir George Grey Special Collections, Auckland Libraries, 1-W977A

Photo: Henry Winkelmann

“Looking south showing the old Queen Street Wharf and the new Queens Wharf (foreground), ferries ' Kestrel' and 'Condor' at Devonport Steam Ferry Company's jetty, part of Quay Street jetties (left), also showing premises in Quay Street of the Colonial Sugar Refinery, S Rawnsley, New Zealand Laundry Company, A and G Price, W A Ryan and Company, United Repairing Company, Northern Steamship Company, A J Parker, New Zealand Shipping Company, Northern Roller Mills (during construction of extensions) and Endeans Buildings."

This image to me is beautiful. With the smoke rising up into the sky, you can imagine everyone working hard, with the hassle and bassle of the city life. Looking at this photo and knowing that the reclaiming on the fore-shore had happened, I find this so interesting and profound.

0 notes

Text

One of American, Delta, and United's most feared rivals just suffered a major blow

Etihad Aviation Group holds equity stakes in seven airlines around the world.

Two of them, Air Berlin and Alitalia, are now bankrupt.

The CEO behind the strategy has left Etihad.

However, some investments have paid off.

Etihad's grand plan for global domination looks to be in deep trouble.

In July, the Abu Dhabi, United Arab Emirates-based aviation giant announced a staggering $1.87 billion loss for 2016. This, after posting a $103 million profit the previous year.

Etihad blames $808 million of losses on financial exposure to partner airlines such as Air Berlin and Alitalia.

Now, things have gone from bad to worse.

On Tuesday, Air Berlin entered into administration, declaring itself insolvent and initiating a major restructuring. Air Berlin's financial implosion happened just three months after Alitalia's bankruptcy in May.

Together, Etihad's total financial exposure to the two troubled European carriers edges north of $4.5 billion.

"Etihad had a very ambitious and creative, but very risky strategy which was to invest in airlines in different countries to gain a proxy presence as an airline group, and two of its riskiest investments was Air Berlin and Alitalia," Henry Harteveldt, a travel analyst for Atmosphere Research Group, told Business Insider.

In July, the chief architect of the plan, former Etihad CEO James Hogan, exited the company he helped build.

Going global

Over the past few years, Etihad embarked on an equity-acquisition spree that has seen the carrier take substantial ownership stakes in a series of "partner airlines." This includes 49% of Alitalia, 29.2% of Air Berlin, 49% of Air Serbia, 24% of Jet Airways, 21.8% of Virgin Australia, 40% of Air Seychelles, 49.8% of Niki, and 33% of Swiss-based Etihad Regional. However, Etihad sold its stake in Etihad Regional in July.

Last September, these partner airlines along with Etihad Airways and its accompanying subsidiaries were reconfigured to form Etihad Aviation Group.

In theory, Hogan's partnership concept makes a tremendous amount of sense. Investing in or taking over struggling airlines in advantageous markets for pennies on the dollar while simultaneously growing Etihad's global reach is strategically sound. This approach also allows Etihad to enter potentially hostile markets free of political opposition and without the need to launch an operation from scratch.

In practice, the partnership strategy is much more complex. Some have worked out well for Etihad. For instance, Air Serbia has relaunched and become a solid feeder into the Etihad network. The investment in Jet Airways has helped Etihad unlock the potentially lucrative Indian market. While Virgin Australia has become a viable competitor for Qantas.

At the same time, Germany's Air Berlin and Italy's national carrier, Alitalia, have not fared so well. Both airlines were acquired to help Etihad increase its reach into the prized European and transatlantic markets, and to a certain extent, they have done exactly that. Operationally, however, Air Berlin and Alitalia have continued to bleed money.

On the face of it, the $2.35 billion Alitalia investment seemed like a solid deal. For the cost of a few Airbus A380 superjumbos, the company acquired a major airline with a fleet of 100 planes, Hogan told Business Insider in 2015.

The same goes for the Air Berlin deal.

"Air Berlin, on paper, looked like it would be very beneficial for Etihad," Harteveldt said. "It gave Etihad access to a major European market that's arguably the strongest in terms of economic strength and demand for air travel."

So what happened?

"These two investments have turned out to be sort of Etihad biting off more than it can chew," Airways senior business analyst Vinay Bhaskara told Business Insider.

What went wrong

According to Bhaskara, there are two types of reclamation projects that tend to succeed in the airline industry. The first is an airline that is underperforming simply because it is "making boneheaded strategic errors" to the point at which the airline is essentially its own worst enemy. These are easier to fix because they tend to be in good markets with good fundamentals. Thus, a management change should do the trick, Bhaskara said. Jet Airways falls into this category.

The second is an underperforming airline that is government owned or struggling with an incredible amount of internal dysfunction. These turnarounds can be successful if an outside force such as Etihad is "handed the keys to the kingdom" to tear down and rebuild the airline after making wholesale changes. This is exactly what Etihad was able to do at Air Serbia, Bhaskara added.

Technically, Air Berlin and Alitalia should have gone into this second category. But Etihad was never given the chance to implement the same type of full rebuild as Air Serbia.

With Alitalia, Etihad brought in new management, revamped its product, and improved its service. Many of the old problems that plagued the "Old Alitalia," however, still plague the "New Alitalia" today. Bhaskara said one of the major issues the airline ran into was the powerful labor unions that prevented Etihad from making drastic changes that could have made the airline profitable.

In April, Alitalia entered into administration after workers rejected a management restructuring plan that would have cut salaries and jobs at the airline.

According to the Financial Times, the last time Alitalia generated an annual profit was in 2002 — one year before the founding of Etihad Airways.

The Air Berlin situation is slightly different than Alitalia, but equally dysfunctional.

Air Berlin's downfall

According to Harteveldt, Air Berlin faced a myriad of issues ranging from a delayed airport to a disjointed product strategy.

First, the airport. Even though Berlin is one of the largest and most important cities in Europe, it doesn't actually have a world class airport.

The state-of-the-art Berlin Brandenburg Airport was scheduled to open in 2010. However, persistent delays have now pushed that day to as late as 2020.

As a result, Air Berlin hasn't been able to develop the mega hub it had hoped for in its home town. Instead, it has to settle for a smaller hub in Dusseldorf. However, that pales in comparison to the hubs Lufthansa has in larger markets like Frankfurt and Munich, Harteveldt told us.

At the same time, Air Berlin has been facing stiff competition from low-cost carriers like RyanAir, EasyJet, WizzAir, and other carriers.

And then there was the airlines own "basket case" business strategy.

"Air Berlin just didn't have a clear strategy," Harteveldt said. "It was a low cost, bare bones airline for its short haul European flights, but it tried to be a traditional full-service airline on its long-haul flights."

"It didn't accomplish either objective very well," the analyst added.

Even though the labor situation at Air Berlin was less contentious than Alitalia, it was still an issue that plagued the airline.

"In Europe, airlines are high profile industries that are highly unionized and the unions work very hard to protect their workers' jobs," Harteveldt said. "Compared to the United States, for example, it very difficult for an airline in Europe to gain the labor efficiency that it needs whether that be wages or productivity or anything else."

So where does that leave Air Berlin?

What's next for Etihad's partners

While Etihad is willing to explore commercial opportunities with the airline, it has made it clear that after $2.3 billion in investment its coffers are now off limits to Air Berlin.

"You can hear the sound of Etihad wiping its hands of Air Berlin all the way from Abu Dhabi to California," Harteveldt said.

Although Harteveldt believes the Alitalia will likely fly on, the analyst thinks Air Berlin is effectively done as an airline. However, Bhaskara believes it's still too early to say whether Air Berlin's fate is sealed.

Air Berlin CEO Thomas Winkelmann has spoken out publicly to ensure his customers that the airline's flights will operate as usual with the help of a bridging loan worth $176 million.

At the end of the day, all is not lost for the Etihad partner airline strategy.

"In some cases, it looks like Etihad bet on some winning horses," Harteveldt said. "Alitalia is still on the track and so we can't call that race yet."

While it seems like the Etihad partnership strategy will probably live on to fight another day, Air Berlin and Alitalia have proven to be two very painful and expensive speed bumps along the way.

SEE ALSO: Delta has a new secret weapon against American and Southwest

FOLLOW US: on Facebook for more car and transportation content!

Join the conversation about this story »

NOW WATCH: This $41K plane ticket comes with a shower, bed, and butler service

0 notes

Text

Er is veel gebeurd de afgelopen maand en daarom ook dat wij helemaal niks gepost hebben.

Wij hadden niet durven dromen dat wij zoveel opdrachten binnen zulke korte tijd binnen zouden krijgen.

Dankzij dat Pia en ik hebben mee gedaan aan een pitch evenement van school werden wij aangesproken door de communicatie afdeling van WDKA.

Zij hebben ons mid Maart gevraagd om de vormgeving van de Henri Winkelmann award te ontwerpen.

Dit hield in dat wij 4 weken de tijd hadden om voor 19 april:

-zuilposters te maken die voor de school komen te hangen

(een voor de winnaar en een voor de genomineerden)

- 6 videos te maken van de genomineerden

- een award te maken

- een teaser te maken

- programma boekjes

- cheque

- tafelnummers

- slideshow stills

Wij gingen de uitdaging aan ondanks de hoeveelheid van werk in zn korte periode. Nu is het vandaag 24 april en hebben wij 5 dagen geleden al ons werk afgeleverd en zijn ontzettend trots op het resultaat.

Wij hebben ontzettend veel geleerd van deze opdracht:

- werken met een (korte) deadline

- communicatie met de opdrachtgever

Wij hebben in ook fouten gemaakt en hier hebben wij ook veel van geleerd.

Het eind resultaat zou ik in een andere blogpost posten.

0 notes

Photo

View of the Harbour Board building on corner of Little Queen Street and Quay Street West. Henry Winkelmann, Auckland, January 1927.

#Auckland#New Zealand#Queen Street#1920s#Henry Winkelmann#1927#Auckland Libraries#Sir George Grey Special Collections

5 notes

·

View notes

Photo

Looking east from Pitt Street along Karangahape Road. Henry Winkelmann, Auckland, November 1919.

#Auckland#K Road#1910s#Henry Winkelmann#New Zealand#1919#Auckland Libraries#Sir George Grey Special Collections

6 notes

·

View notes

Photo

Team of senior soccer players at Swanson. Henry Winkelmann, Auckland, November 1905.

#sport#football#soccer#group portrait#1900s#Auckland#Henry Winkelmann#1905#Auckland Libraries#Sir George Grey Special Collections

2 notes

·

View notes

Photo

The Grand Hotel in Princes Street. Henry Winkelmann, Auckland, 22 September 1902.

#Auckland#New Zealand#Princes Street#Grand Hotel#1900s#Henry Winkelmann#Auckland Libraries#Sir George Grey Special Collections

6 notes

·

View notes

Photo

Looking north along Grafton Gully towards the harbour, North Shore and Rangitoto. Henry Winkelmann, Auckland, August 1910.

#Auckland#New Zealand#landscape#Rangitoto#1910s#Henry Winkelmann#Auckland Libraries#Sir George Grey Special Collections

8 notes

·

View notes

Photo

View of McKays Bay (now Campbells Bay). Henry Winkelmann, Auckland, 19 June 1915.

#landscape#beach#Auckland#New Zealand#1910s#1915#Henry Winkelmann#Auckland Libraries#Sir George Grey Special Collections

21 notes

·

View notes

Photo

Cases of kauri gum being loaded onto a dray at Andreae and Company's warehouse. Henry Winkelmann, Auckland, July 1905.

#Auckland#kauri#Henry Winkelmann#1900s#New Zealand#1905#Auckland Libraries#Sir George Grey Special Collections

1 note

·

View note