#High-performance Computing Server market segmentation

Explore tagged Tumblr posts

Text

Cheap VPS Hosting Services in India – SpectraCloud

SpectraCloud provides Cheap VPS Hosting Services in India for anyone looking to get simple and cost-effective compute power for their projects. VPS hosting is provided with Virtualized Servers, SpectraCloud virtual machines, and there are multiple with Virtualized Servers types for use cases ranging from personal websites to highly scalable applications such as video streaming and gaming applications. You can choose between shared CPU offerings and dedicated CPU offerings based on your anticipated usage.

VPS hosting provides an optimal balance between affordability and performance, making it perfect for small to medium-sized enterprises. If you're looking for a trustworthy and cost-effective VPS hosting option in India, SpectraCloud arise as a leading choice. Offering a range of VPS Server Plans designed to combine various business requirements, SpectraCloud guarantees excellent value for your investment.

What is VPS Hosting?

VPS hosting refers to a Web Hosting Solution where a single physical server is segmented into several virtual servers. Each virtual server functions independently, providing the advantages of a dedicated server but at a more affordable price. With VPS Hosting, you have the ability to tailor your environment, support you to modify server settings, install applications, and allocate resources based on your unique needs.

Why Choose VPS Hosting?

The main benefit of VPS hosting is its adaptability. Unlike shared hosting, which sees many websites utilizing the same server resources, VPS hosting allocates dedicated resources specifically for your site or application. This leads to improved performance, superior security, and increased control over server settings.

For companies in India, where budget considerations are typically crucial, VPS hosting presents an excellent choice. It provides a superior level of performance compared to shared hosting, all while avoiding the high expenses linked to dedicated servers.

SpectraCloud: Leading the Way in Low-Cost VPS Hosting in India

SpectraCloud has positioned itself as a leader in the VPS Hosting market in India by offering affordable, high-quality VPS Server Plans. Their services provide for businesses of all sizes, from startups to established enterprises, providing a range of options that fit different budgets and needs.

1. Variety of VPS Server Plans

SpectraCloud offers a wide range of VPS Server Plans, ensuring that there’s something for everyone. Whether you’re running a small website, an e-commerce platform, or a large-scale application, SpectraCloud has a plan that will suit your needs. Their VPS plans are customizable, allowing you to choose the amount of RAM, storage, and capability that fits your specific requirements. This flexibility ensures that you only pay for what you need, making it an economical choice for businesses looking to optimize their hosting expenses.

2. Best VPS for Windows Hosting

For businesses that require a Windows environment, SpectraCloud offers the Best VPS for Windows Hosting in India. Windows VPS hosting is essential for running applications that require Windows server, such as ASP.NET websites, Microsoft Exchange, and SharePoint. SpectraCloud Windows VPS Plans are designed for high performance and reliability, ensuring that your Windows-based applications run smoothly and efficiently.

Windows VPS Hosting comes pre-installed with the Windows operating system, and you can choose from different versions depending on your needs. Moreover, SpectraCloud provides full root access, so you can configure your server the way you want.

3. Affordable and Low-Cost VPS Hosting

SpectraCloud commitment to providing Affordable VPS Hosting is evident in their competitive pricing. They understand that businesses need cost-effective solutions without compromising on quality. By offering Low-Cost VPS Hosting Plans, SpectraCloud ensures that businesses can access top-tier hosting services without breaking the bank.

Their low-cost VPS hosting plans start at prices that are accessible to even the smallest businesses. Despite the affordability, these plans come with robust features such as SSD storage, high-speed network connectivity, and advanced security measures. This combination of affordability and quality makes SpectraCloud a preferred choice for businesses seeking budget-friendly VPS Hosting in India.

Key Features of SpectraCloud VPS Hosting

1. High Performance and Reliability

SpectraCloud VPS hosting is built on powerful hardware and cutting-edge technology. Their servers are equipped with SSD storage, which ensures faster data retrieval and improved website loading times. With SpectraCloud, you can expect minimal downtime and consistent performance, which is crucial for maintaining the smooth operation of your business.

2. Full Root Access

One of the significant advantages of using SpectraCloud VPS hosting is the full root access they provide. This means you have complete control over your server, allowing you to install software, configure settings, and manage your hosting environment according to your option. Full root access is particularly beneficial for businesses that need to customize their server to meet specific requirements.

3. Scalable Resources

As your business grows, your hosting needs will develop. SpectraCloud offers scalable VPS hosting plans that allow you to upgrade your resources as needed. Whether you need more RAM, storage, or Ability, SpectraCloud makes it easy to scale up your VPS plan without experiencing any downtime. This scalability ensures that your hosting solution can grow with your business.

4. Advanced Security

Security is a top priority for SpectraCloud. Their VPS Hosting Plans come with advanced security features to protect your data and applications. This includes regular security updates, firewalls, and DDoS protection. By choosing SpectraCloud, you can rest assured that your business data is safe from cyber threats.

5. 24/7 Customer Support

SpectraCloud customer support team is available 24/7 to assist you with any issues or questions you may have. Their knowledgeable and friendly support staff can help you with everything from server setup to troubleshooting technical problems. This 24/7 support ensures that you always have someone to turn to if you encounter any issues with your VPS hosting.

Conclusion:

In a competitive market like India, finding the right VPS Hosting Provider can be tough. However, SpectraCloud stands out with a perfect balance of affordability, performance, and reliability. The company's diverse offering of VPS Server Plans, coupled with its expertise in Windows VPS hosting and commitment to cost-effective solutions, make it the first choice for businesses of all sizes.

Whether you're a startup looking for budget-friendly hosting options or an established enterprise in need of a scalable and reliable VPS solution, SpectraCloud has a plan to meet your needs. With robust features, advanced security, and excellent customer support, SpectraCloud ensures you have the hosting foundation you need for your business to succeed. Choose SpectraCloud for your VPS Hosting needs in India and experience the benefits of top-notch hosting services without spending a fortune.

#spectracloud#vps hosting#vps hosting services#vps server plans#web hosting services#hosting services provider#cheap hosting services#affordable hosting services#cheap vps server

3 notes

·

View notes

Text

Advantages of PCIE produced by Chinese manufacturers

PCI Express (Peripheral Component Interconnect Express), commonly known as PCIe, is a high-speed interface standard for connecting various components in a computer system. It is widely used in modern desktops, laptops, servers, and other computing devices to enable high-speed data transfer between components such as graphics cards, network cards, storage devices, and more. PCIe technology has evolved over the years, offering increased bandwidth and improved performance compared to older interface standards like PCI and AGP.

Chinese manufacturers have been playing an increasingly important role in the production of PCIe components, offering a wide range of products that cater to the needs of different market segments. In this article, we will discuss the advantages of PCIe produced by Chinese manufacturers, highlighting the key features and benefits that make them a preferred choice for many customers.

Advantages of PCIe produced by Chinese manufacturers:

Cost-effective solutions: Chinese manufacturers are known for their ability to offer cost-effective solutions without compromising on quality. By leveraging their expertise in manufacturing and economies of scale, Chinese companies are able to produce PCIe components at competitive prices, making them an attractive option for customers looking to build high-performance computing systems on a budget.The chart compares one of AMP's products with that of Chinese manufacturer HOYATO.------AMP 649-18783-10100TLF vs.Hoyato PCIECP10-36GX. We can clearly find that there is little difference between the two products in the comparison of materials and various attributes of the products.What's more, most Chinese manufacturers have their own factories, so prices are more competitive.

Wide range of products: Chinese manufacturers offer a wide range of PCIe products to meet the diverse needs of customers. Whether you are looking for a basic PCIe x1 expansion card or a high-end PCIe x16 graphics card, Chinese manufacturers have you covered. They also offer specialized PCIe products for specific applications such as data storage, networking, and gaming, allowing customers to choose the right product for their requirements.

High-quality components: Despite their competitive pricing, PCIe components produced by Chinese manufacturers are known for their high quality and reliability. Chinese companies adhere to strict quality control standards and use advanced manufacturing processes to ensure that their products meet the highest industry standards. This commitment to quality has earned Chinese manufacturers a reputation for producing reliable and durable PCIe components that perform well under demanding conditions.

Cutting-edge technology: Chinese manufacturers are at the forefront of PCIe technology, continuously innovating and developing new products that push the boundaries of performance and efficiency. They invest heavily in research and development to stay ahead of the competition, resulting in PCIe components that offer the latest features and capabilities. Whether you need support for the latest PCIe Gen 4 or PCIe Gen 5 standards, Chinese manufacturers have the technology and expertise to deliver cutting-edge solutions.

Customization options: Chinese manufacturers offer customization options for PCIe components, allowing customers to tailor their products to meet specific requirements. Whether you need a custom form factor, specialized features, or unique specifications, Chinese companies can work with you to develop a bespoke PCIe solution that fits your needs perfectly. This flexibility and willingness to collaborate with customers set Chinese manufacturers apart and make them a preferred choice for businesses and individuals seeking personalized PCIe solutions.

Strong supply chain: Chinese manufacturers benefit from a robust supply chain that enables them to source high-quality components and materials at competitive prices. This streamlined supply chain allows Chinese companies to reduce lead times, lower production costs, and improve overall efficiency, resulting in faster delivery times and better value for customers. By leveraging their supply chain capabilities, Chinese manufacturers can offer PCIe components that are not only cost-effective but also readily available when you need them.

Global presence: Chinese manufacturers have a strong global presence, with products distributed and sold in markets around the world. This widespread availability makes it easy for customers to access Chinese-made PCIe components regardless of their location, ensuring that they can benefit from the advantages of Chinese manufacturing no matter where they are. Chinese manufacturers also have a reputation for providing excellent customer support and after-sales service, further enhancing their appeal to customers worldwide.

In conclusion, PCIe components produced by Chinese manufacturers offer a compelling combination of cost-effectiveness, quality, technology, customization, supply chain efficiency, and global availability. Whether you are a business looking to upgrade your computing infrastructure or an individual building a high-performance gaming rig, Chinese manufacturers have the PCIe solutions you need. With their commitment to innovation, quality, and customer satisfaction, Chinese manufacturers are poised to continue leading the way in PCIe technology for years to come.

email:[email protected]

References:

"PCI Express" - Wikipedia, https://en.wikipedia.org/wiki/PCI_Express

"PCIe Interface Card" - Advantech, https://www.advantech.com/products/pcie-interface-card/sub_1-2jk2h5

"Chinese PCIe Manufacturers" - Alibaba, https://www.alibaba.com/showroom/chinese-pcie-manufacturers.html

https://www.dghoyato.com/

2 notes

·

View notes

Text

Data Center Market Forecast & Growth Trends

The global data center market was valued at USD 347.60 billion in 2024 and is expected to reach USD 652.01 billion by 2030, expanding at a robust compound annual growth rate (CAGR) of 11.2% from 2025 to 2030. This growth is primarily driven by the exponential surge in data generation across various sectors, fueled by widespread digital transformation initiatives and the increasing adoption of advanced technologies such as cloud computing, artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT).

As organizations generate and process vast volumes of data, the demand for scalable, secure, and energy-efficient data center infrastructure has intensified. Enterprises are seeking agile and resilient IT architectures to support evolving business needs and digital services. This has led to the rapid expansion of data center capacity worldwide, with a particular focus on hyperscale and colocation facilities.

Hyperscale data center operators—including major players such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud—are continuously scaling their infrastructure to meet global demands for cloud storage, computing power, and data processing. These tech giants are making substantial investments in constructing new data centers and upgrading existing ones to ensure seamless service delivery, latency reduction, and improved data security.

Simultaneously, the colocation segment is gaining momentum as businesses pursue cost-effective solutions to manage IT infrastructure. Colocation centers offer shared facilities equipped with high-speed connectivity, advanced cooling systems, and robust physical and cyber security. These benefits allow companies—especially small and medium enterprises—to scale their operations flexibly without the high capital expenditure required to build and maintain in-house data centers.

Another major trend accelerating market growth is the rise of edge computing. As the number of IoT devices and real-time applications grows, there is an increasing need for decentralized computing infrastructure. Edge data centers, located closer to end-users and data sources, provide reduced latency and faster response times—critical for applications in sectors such as autonomous vehicles, remote healthcare, industrial automation, and smart cities.

Key Market Trends & Insights

In 2024, North America dominated the global data center market with a share of over 40.0%, propelled by the widespread adoption of cloud services, AI-powered applications, and big data analytics across industries.

The United States data center market is anticipated to grow at a CAGR of 10.7% between 2025 and 2030, driven by continued digital innovation, enterprise cloud adoption, and the expansion of e-commerce and fintech platforms.

On the basis of components, the hardware segment accounted for the largest market share of more than 67.0% in 2024. The surge in online content consumption, social networking, digital transactions, and IoT connectivity has significantly boosted demand for high-capacity, high-performance hardware.

Within the hardware category, the server segment emerged as the market leader, contributing over 34.0% to revenue in 2024. Modern servers are being equipped with enhanced processing power, memory, and storage efficiency, all of which are crucial to supporting next-generation computing needs.

Among software solutions, the virtualization segment held a dominant share of nearly 18.0% in 2024. Virtualization allows data centers to maximize hardware utilization by enabling multiple virtual machines (VMs) to operate on a single physical server, reducing costs and increasing operational flexibility.

Order a free sample PDF of the Data Center Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2024 Market Size: USD 347.60 Billion

2030 Projected Market Size: USD 652.01 Billion

CAGR (2025-2030): 11.2%

North America: Largest market in 2024

Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Key players operating in the data center industry are Amazon Web Services (AWS), Inc. Microsoft, Google Cloud, Alibaba Cloud, and Equinix, Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

In February 2025, Alibaba Cloud, the digital technology arm of Alibaba Group, opened its second data center in Thailand to meet the growing demand for cloud computing services, particularly for generative AI applications. The new facility enhances local capacity and aligns with the Thai government's efforts to promote digital innovation and sustainable technology. Offering a range of services including elastic computing, storage, databases, security, networking, data analytics, and AI solutions, the data center aims to address industry-specific challenges.

In December 2024, Amazon Web Services (AWS) introduced redesigned data center infrastructure to accommodate the growing demands of artificial intelligence (AI) and sustainability. The updates features advancements in liquid cooling, power distribution, and rack design, enabling a sixfold increase in rack power density over the next two years. AWS stated that these enhancements aims to deliver a 12% boost in compute power per site, improve energy efficiency, and enhance system availability.

In May 2024, Equinix, Inc. launched its first two data centers in Malaysia, with the International Business Exchange (IBX) facilities now operational in Johor and Kuala Lumpur. The facilities are intended to cater to Equinix Inc.'s customers in Malaysia while enhancing regional connectivity.

Key Players

Alibaba Cloud

Amazon Web Services, Inc.

AT&T Intellectual Property

Lumen Technologies (CenturyLink)

China Telecom Americas, Inc.

CoreSite

CyrusOne

Digital Realty

Equinix, Inc.

Google Cloud

IBM Corporation

Microsoft

NTT Communications Corporation

Oracle

Tencent Cloud

Browse Horizon Databook on Global Data Center Market Size & Outlook

Conclusion

The global data center market is undergoing rapid expansion, driven by the growing digital economy, technological advancements, and the ever-increasing demand for data storage, computing power, and connectivity. Hyperscale and colocation facilities are at the forefront of this transformation, offering scalable and secure infrastructure that supports cloud computing, AI workloads, and real-time applications. Edge computing is further reshaping the landscape by bringing processing capabilities closer to data sources, enabling faster and more efficient services across various industries.

As the market continues to evolve, investment in energy-efficient hardware, software virtualization, and regional data center development will be critical to meeting future demands. Companies that adopt flexible, sustainable, and innovation-driven data infrastructure strategies will be best positioned to capitalize on the tremendous growth opportunities in the data center space over the coming years.

0 notes

Text

Hybrid Cooling in Data Centers: Innovations & Market Forecast

Hybrid cooling market for data centersis gaining significant traction, propelled by the necessity to manage escalating computing demands while enhancing energy efficiency. By 2024, more and more colocation and hyperscale data centers will have implemented hybrid cooling systems, which combine liquid and air cooling techniques. In addition to satisfying the requirements of increased rack density, these systems use less water and adhere to more stringent environmental standards.

It is anticipated that developments in sensors, materials, and intelligent control systems would significantly improve the scalability and efficiency of hybrid cooling by 2034. High-performance and environmentally responsible data center operations are being made possible by hybrid cooling thanks to features like real-time thermal balancing and predictive maintenance.

Market Segmentation

By Application

1. Centralized Data Centers

Enterprise Data Centers: Individually owned and operated by organizations to support internal IT workloads, often requiring balanced and cost-effective cooling.

Hyperscale Data Centers: Operated by major cloud providers (e.g., Google, AWS), these massive server farms demand ultra-efficient hybrid cooling systems to manage extremely high power densities.

Colocation Data Centers: Multi-tenant facilities that lease out space, power, and cooling; they favor flexible hybrid cooling solutions to support varied client needs and equipment types.

2. Edge Data Centers

Smaller, decentralized facilities located closer to end users or data sources.

Require compact, modular, and efficient hybrid cooling systems capable of operating in constrained or remote environments to support latency-sensitive applications.

By Product

1. Liquid-to-Air Cooling Systems

Rear Door Heat Exchangers / Liquid-Assisted Air Cooling: Uses a liquid-cooled panel at the rear of the rack or integrates liquid circuits into air pathways to remove heat more efficiently than air cooling alone.

Closed Loop Liquid Cooling with Air Augmentation: Circulates liquid coolant within a closed system while supplementing with directed airflow to handle hotspots in high-density deployments.

2. Air-to-Liquid Cooling Systems

Direct-to-Chip / Cold Plate Cooling: Applies liquid coolant directly to heat-generating components (e.g., CPUs, GPUs) with residual air cooling used to manage ambient rack temperature.

Others (Chilled Beam, Immersion + Air Extraction): Encompasses innovative hybrid methods like chilled beams for overhead cooling or partial component immersion combined with air extraction to manage thermal loads.

Market Trend

The incorporation of AI-powered controls into hybrid cooling systems is a significant new trend. These clever technologies dynamically adjust cooling performance by using machine learning and real-time data. They can detect thermal inefficiencies, modify cooling ratios, and predict changes in workload, all of which greatly increase Power Usage Effectiveness (PUE). Data centers are becoming more intelligent, flexible, and energy-efficient as a result of the combination of AI and hybrid cooling.

Market Drivers

The worldwide drive for energy efficiency and sustainability is the main driver of the implementation of hybrid cooling. Data centers are being forced to lower their carbon emissions, electricity use, and water consumption due to regulatory pressure and corporate ESG requirements. By mixing air and liquid cooling methods, hybrid cooling provides a workable option that enhances thermal management without compromising performance, balancing environmental responsibility with operational objectives.

Market Restrain

High Initial Costs: The initial outlay required for hybrid cooling systems may be too costly for smaller facilities.

Complex Setup: Deployment calls for complex parts such as liquid pipes, heat exchangers, and cold plates.

Retrofitting Challenges: It might be technically challenging to integrate hybrid systems into older infrastructures.

Extended Payback Period: Adoption may be hampered by the delayed ROI, despite the fact that long-term savings are substantial.

Skilled Labor Requirement: The necessity for specialized knowledge of both liquid and air systems makes operations more complex.

Key Market Players

Schneider Electric SE

Vertiv Holdings Co.

STULZ GmbH

Rittal GmbH & Co. KG

Mitsubishi Electric Corporation

Trane Technologies

Airedale International Air Conditioning Ltd

Take Action: Gain Valuable Insights into the Rising Investments and Market Growth of Hybrid Cooling Market For Data Centers!

Learn more about Energy and Power Vertical. Click Here!

Conclusion

Data center hybrid cooling is becoming a vital component of contemporary IT infrastructure as compute demands rise and environmental laws become more stringent. Hybrid systems handle high-density workloads and provide improved energy efficiency and sustainability by fusing liquid and air-based techniques. Hybrid cooling is a critical element of next-generation data centers because of the potential for retrofitting, AI integration, and future scalability, even in the face of obstacles like expensive initial investment and complex infrastructure. With environmental effects coming under more and more scrutiny, hybrid cooling is set to become a key component of high-performance, sustainable digital infrastructure on a global scale.

0 notes

Text

Ferrite Core Choke Market Opportunities in Oil & Gas and Chemical Industries

MARKET INSIGHTS

The global Ferrite Core Choke Market was valued at US$ 674 million in 2024 and is projected to reach US$ 987 million by 2032, at a CAGR of 4.9% during the forecast period 2025-2032. The U.S. market accounted for 32% of global revenue in 2024, while China’s market is expected to grow at a faster 7.2% CAGR through 2032.

Ferrite core chokes are passive electronic components designed to suppress electromagnetic interference (EMI) and filter high-frequency noise in electronic circuits. These devices utilize ferrite materials – ceramic compounds of iron oxide with nickel, zinc or manganese oxides – which exhibit high magnetic permeability and electrical resistivity. Common types include surface-mount (SMD), through-hole, and toroidal chokes, with applications ranging from power supplies to automotive electronics.

Market growth is driven by increasing demand for EMI suppression in consumer electronics and electric vehicles, where ferrite chokes help meet stringent electromagnetic compatibility (EMC) regulations. The automotive grade segment, representing 28% of 2024 sales, is seeing particular growth due to rising EV adoption. Leading manufacturers like TDK and Murata continue to innovate with compact, high-temperature resistant designs, though supply chain disruptions for rare earth materials remain a challenge.

MARKET DYNAMICS

MARKET DRIVERS

Expanding Telecommunications Infrastructure to Accelerate Ferrite Core Choke Demand

The global telecommunications sector is undergoing massive expansion with 5G rollouts and datacenter proliferation, driving substantial demand for ferrite core chokes. These components are critical for electromagnetic interference (EMI) suppression in high-frequency circuits – a function becoming increasingly vital as 5G base stations multiply globally. Current projections indicate over 4 million 5G base stations will be deployed worldwide by 2030, each requiring multiple ferrite core components for signal integrity. Furthermore, hyperscale datacenters are adopting these chokes at a compound annual growth rate exceeding 15% to manage power quality in their server farms. This dual demand from telecom infrastructure and cloud computing is propelling the market forward at an unprecedented pace.

Electric Vehicle Revolution Creating New Application Frontiers

The automotive industry’s shift toward electrification represents a significant growth vector for ferrite core chokes. Modern electric vehicles incorporate between 50-100 ferrite components per vehicle for functions ranging from onboard charging to battery management systems. With electric vehicle production volumes projected to surpass 40 million units annually by 2030, the automotive segment is emerging as one of the fastest-growing application areas. Leading manufacturers are developing specialized automotive-grade ferrite chokes that meet stringent AEC-Q200 qualifications for temperature stability and vibration resistance. The parallel growth of charging infrastructure, which requires similar EMI suppression components, further amplifies this market opportunity.

MARKET RESTRAINTS

Raw Material Volatility Impacting Manufacturing Economics

Ferrite core choke production faces persistent challenges from raw material price fluctuations. The primary composition of nickel-zinc and manganese-zinc ferrites makes the market sensitive to nickel price swings, which have varied by over 40% in recent years. This volatility creates unpredictable manufacturing costs that strain profit margins, particularly for smaller producers. Additionally, rare earth element supply chain disruptions have periodically caused shortages of critical dopants like yttrium and lanthanum that enhance ferrite performance. These material constraints force manufacturers to either absorb cost increases or risk losing business to alternative EMI suppression technologies.

Miniaturization Trend Composing Technical Hurdles

The industry-wide push toward smaller electronic devices is testing the physical limits of ferrite core technology. While ferrite compositions can be optimized for higher frequency operation, core losses increase exponentially as dimensions shrink below critical thresholds. This creates an engineering dilemma – consumers demand increasingly compact devices, but physics dictates certain minimum sizes for effective EMI suppression at target frequencies. Many manufacturers report development cycles stretching 20-30% longer when designing chokes for space-constrained applications like wearable tech or ultra-thin notebooks. This technical barrier is particularly acute in the consumer electronics segment where product lifecycles continue to accelerate.

MARKET OPPORTUNITIES

Renewable Energy Integration Opening New Growth Channels

The global transition toward renewable energy systems presents compelling opportunities for ferrite core choke manufacturers. Solar inverters and wind turbine converters require specialized EMI filters to meet stringent electromagnetic compatibility standards. Each megawatt-scale solar installation typically incorporates between 50-200 ferrite components for harmonic filtering. With solar capacity additions projected to exceed 300 GW annually by 2025, this represents a substantial greenfield opportunity. Concurrently, vehicle-to-grid (V2G) systems emerging in smart grid applications will require new choke designs capable of bidirectional power flow management.

Advanced Material Formulations Enabling Market Expansion

Materials science breakthroughs in ferrite compositions are unlocking previously inaccessible application areas. Novel nickel-zinc ferrites now demonstrate stable performance up to 2GHz with core losses reduced by 40-60% compared to conventional formulations. This performance leap is enabling adoption in cutting-edge sectors like aerospace electronics and medical imaging equipment. Several manufacturers have recently introduced chokes with integrated heat dissipation features, solving long-standing thermal management challenges in power-dense applications. These material innovations allow ferrite technology to maintain relevance against emerging alternatives like nanocrystalline and thin-film solutions.

MARKET CHALLENGES

Intensifying Competition from Alternative Technologies

Ferrite core chokes face growing competition from emerging EMI suppression solutions. Thin-film inductors based on MEMS fabrication techniques offer superior miniaturization capabilities for portable electronics. Meanwhile, nanocrystalline cores achieve higher saturation flux densities that appeal to power electronics designers. These alternatives typically command 20-30% price premiums today, but their cost structures follow semiconductor-like learning curves. Many major OEMs are allocating R&D budgets to assess these technologies, particularly for next-generation products where space constraints or efficiency requirements exceed ferrite capabilities. This competitive pressure forces ferrite manufacturers to continuously enhance performance while maintaining cost advantages.

Supply Chain Complexities Causing Production Bottlenecks

The fragmented nature of ferrite core manufacturing creates vulnerabilities in the component supply chain. Core production, wire winding, and final assembly often occur across multiple specialized facilities spanning different regions. This distributed model proved problematic during recent global logistics disruptions, with average lead times ballooning from 8-10 weeks to over 20 weeks for some choke types. The situation is particularly challenging for automotive customers operating just-in-time manufacturing systems. Some tier-one suppliers report maintaining 30-50% higher inventory buffers to mitigate these risks, increasing working capital requirements across the value chain.

FERRITE CORE CHOKE MARKET TRENDS

Growing Demand for Miniaturized Electronic Components to Drive Market Growth

The ferrite core choke market is experiencing steady growth due to increasing demand for compact, high-performance electronic components across industries. With consumer electronics accounting for over 35% of total market demand, manufacturers are focusing on developing smaller yet more efficient ferrite-based inductors that can handle higher frequencies without saturation. The ongoing miniaturization trend in mobile devices, wearables, and IoT applications has led to optimized ferrite material compositions with improved permeability and lower core losses at frequencies exceeding 100 MHz. Furthermore, advancements in multilayer ceramic capacitor (MLCC) technology are creating complementary demand for matching choke components.

Other Trends

Automotive Electrification Spurs Application Growth

The automotive sector represents one of the fastest-growing segments for ferrite core chokes, with electric vehicle production increasing by 54% annually in key markets. Modern EVs require sophisticated EMI suppression in charging systems, battery management, and power conversion circuits where ferrite chokes provide critical noise filtering. Automakers increasingly specify high-temperature grade ferrites capable of stable operation under 150°C thermal conditions. This has led to material innovations like nickel-zinc (NiZn) ferrites gaining traction alongside traditional manganese-zinc (MnZn) compositions for specialized automotive applications.

Telecommunications Infrastructure Expansion Creates New Opportunities

Rollouts of 5G networks and fiber-optic infrastructure are generating substantial demand for broadband ferrite components. Telecom-grade chokes must maintain performance across wider frequency bands while resisting interference from adjacent components. Base station deployments increased by 28% year-over-year in major markets, creating steady demand for power line chokes and common mode filters. Manufacturers are responding with specialized ferrite formulations optimized for high-frequency operation above 1 GHz while maintaining compact form factors needed for dense equipment racks.

Supply Chain Diversification Becomes Strategic Priority

Recent geopolitical tensions and material shortages have prompted manufacturers to reevaluate supply chain strategies for ferrite core production. While China currently supplies approximately 60% of global ferrite powder, companies are establishing alternative sourcing relationships and regional production facilities. Several leading choke manufacturers have announced capacity expansions in Southeast Asia and North America, with projected increases of 15-20% in localized raw material processing capabilities by 2026. This geographic diversification aims to mitigate risks while maintaining quality standards through stringent process controls.

COMPETITIVE LANDSCAPE

Key Industry Players

Strategic Product Innovation Drives Competition in the Ferrite Core Choke Market

The global ferrite core choke market exhibits a moderately consolidated structure, with established electronics component manufacturers competing alongside specialized magnetic solution providers. TDK Corporation emerges as the market leader, commanding approximately 18% revenue share in 2024. Their dominance stems from extensive R&D capabilities and a vertically integrated supply chain that spans across Asia, Europe, and North America.

Competitors Murata Manufacturing and Yageo Corporation collectively hold roughly 25% market share, leveraging their strong foothold in consumer electronics and telecommunications sectors. These Japanese and Taiwanese firms benefit from precision manufacturing capabilities and strategic partnerships with OEMs in high-growth application areas.

Market dynamics show increasing competition in automotive-grade ferrite chokes, where players like Triad Magnetics and Coilcraft, Inc. are gaining traction. The shift toward electric vehicles and advanced driver-assistance systems (ADAS) has prompted these suppliers to expand their high-temperature resistant choke offerings, with several product launches anticipated through 2025.

North American manufacturers such as Magnetic Component Engineering, Inc. are adopting hybrid strategies – combining customized solutions for industrial applications with cost-competitive standard products. Meanwhile, emerging players in Southeast Asia are disrupting the market with competitively priced general-grade chokes, particularly for mid-range consumer electronics.

List of Key Ferrite Core Choke Manufacturers

TDK Corporation (Japan)

Murata Manufacturing Co., Ltd. (Japan)

Yageo Corporation (Taiwan)

Triad Magnetics (U.S.)

Magnetic Component Engineering, Inc. (U.S.)

Coilcraft, Inc. (U.S.)

C.A. Spalding Co. (U.S.)

Magnetic Circuit Elements Inc. (U.S.)

Able Coil & Electronics Co., Inc. (U.S.)

Manutech, Inc. (U.S.)

Segment Analysis:

By Type

General Grade Segment Holds Significant Market Share Due to Widespread Electronics Applications

The market is segmented based on type into:

General Grade

Automotive Grade

Others

By Application

Consumer Electronics Segment Dominates with Increasing Demand for Power Management Solutions

The market is segmented based on application into:

Consumer Electronics

Automotive

Telecom/Datacom

Others

By End User

Original Equipment Manufacturers (OEMs) Lead Market Adoption for Integrated Circuit Designs

The market is segmented based on end user into:

Original Equipment Manufacturers (OEMs)

Aftermarket

System Integrators

By Core Material

Nickel-Zinc Ferrite Cores Gain Traction for High-Frequency Applications

The market is segmented based on core material into:

Manganese-Zinc Ferrite

Nickel-Zinc Ferrite

Others

Regional Analysis: Ferrite Core Choke Market

North America The North American ferrite core choke market demonstrates steady growth, largely driven by robust demand from the telecommunications and automotive sectors. The U.S. remains the largest contributor, supported by 5G infrastructure deployment and rising EV adoption, both of which require high-performance EMI suppression components like ferrite chokes. Recent investments in semiconductor manufacturing under the CHIPS Act ($52.7 billion allocated) are expected to further boost demand for electronic components, reinforcing market expansion. However, supply chain disruptions and reliance on imported raw materials remain key challenges for manufacturers in the region.

Europe Europe maintains a strong position in the ferrite core choke market due to stringent EMC compliance standards, particularly in Germany and France where industrial automation and automotive sectors dominate. The EU’s push for energy-efficient electronics under eco-design regulations has spurred innovation in high-temperature-resistant ferrite materials. Sustainability initiatives have also led to increased R&D in recyclable chokes. However, market growth faces constraints from rising energy costs and competition from Asian manufacturers offering cost-competitive alternatives. Tier-1 suppliers like TDK and Murata continue to lead through technological differentiation.

Asia-Pacific Accounting for over 45% of global consumption, the Asia-Pacific region dominates the ferrite core choke market, with China, Japan, and South Korea as production hubs. Massive electronics manufacturing output—particularly consumer devices and telecom equipment—fuels ongoing demand. China’s local component sourcing mandates have stimulated domestic ferrite choke production, though quality inconsistencies persist in mid-tier suppliers. Meanwhile, India emerges as a high-growth market due to expanding smartphone penetration and EV infrastructure development. Price sensitivity remains a key market characteristic, favoring general-grade chokes over premium automotive-grade variants.

South America The South American market shows moderate but uneven growth, with Brazil leading regional demand primarily for consumer electronics applications. Economic volatility limits widespread adoption of advanced ferrite core solutions, keeping the market reliant on imported standard-grade chokes. Infrastructure gaps in testing and certification hinder local manufacturing development. However, gradual modernization of industrial facilities and telecom networks in Argentina and Colombia presents niche opportunities for suppliers specializing in cost-optimized solutions tailored to emerging market needs.

Middle East & Africa This region represents an emerging market with growth concentrated in GCC countries and South Africa, where telecom tower deployments and datacenter construction drive choke demand. The lack of local production facilities results in complete import dependency, creating logistical challenges. While adoption rates lag behind global averages, increasing digitalization projects—such as Saudi Arabia’s NEOM smart city initiative—suggest long-term potential. Market development is constrained by limited technical expertise in high-frequency applications and preference for lower-cost alternatives to ferrite-based solutions.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Ferrite Core Choke markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global Ferrite Core Choke market was valued at USD million in 2024 and is projected to reach USD million by 2032.

Segmentation Analysis: Detailed breakdown by product type (General Grade, Automotive Grade, Others), application (Consumer Electronics, Automotive, Telecom/Datacom), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The U.S. market size is estimated at USD million in 2024, while China is projected to reach USD million by 2032.

Competitive Landscape: Profiles of leading market participants including TDK, Murata, Yageo, Triad Magnetics, and Coilcraft, Inc., covering their product offerings, R&D focus, and recent developments.

Technology Trends & Innovation: Assessment of emerging materials, miniaturization trends, and evolving industry standards in ferrite core technology.

Market Drivers & Restraints: Evaluation of factors driving market growth such as increasing demand for EMI suppression in electronics, along with challenges like raw material price volatility.

Stakeholder Analysis: Insights for component suppliers, OEMs, system integrators, and investors regarding strategic opportunities in the evolving ferrite components ecosystem.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/global-gaas-power-amplifier-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ambient-light-sensor-for-display-system.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/solar-obstruction-light-market-to-reach.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ac-dc-power-supply-converter-market-to.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/boost-charge-pump-ics-market-to-reach.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-motion-detector-sensor-market-to.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/x-ray-inspection-for-security-market-to.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-spatial-filters-market-to-reach.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-e-beam-liner-market-advancements.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-active-quartz-crystal-oscillator.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-ultrasonic-radar-market-share.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-ammeter-shunt-resistors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-wifi-and-bluetooth-rf-antenna.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-industrial-control-printed.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-scanning-transmission-electron.html

0 notes

Photo

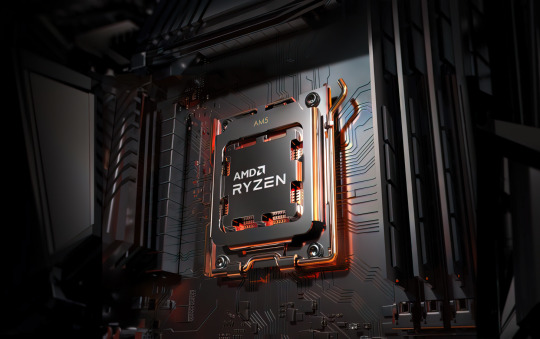

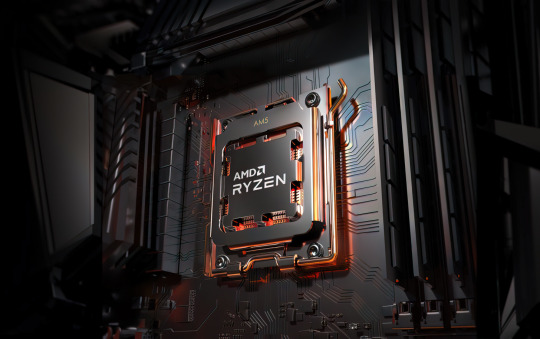

Did AMD just reveal its next-generation Zen 6 “EPYC Venice” CPUs? New Linux kernel patches list fresh CPU IDs, hinting at a major update for data centers and HPC 🖥️. These processors, built with TSMC's 2nm tech, promise up to 256 cores and 512 threads, pushing AMD's performance limits further. The focus on workstation and server segments indicates a strategic move toward AI and high-performance computing markets. If you're interested in custom computing solutions with top-tier specs, GroovyComputers.ca offers specialized builds that can keep you ahead of the curve. Whether for gaming, professional workstations, or data centers, their custom computers are designed to meet the latest tech trends and demands. Ready to upgrade to a next-gen PC? Check out GroovyComputers.ca for your custom build needs today! Have you been awaiting AMD's new epic processors? Share your thoughts below! 🚀 #AMD #Zen6 #EPYC #CustomPC #HighPerformance #DataCenter #HPC #LinuxKernel #TechNews #NextGen #Gaming #Workstation #GroovyComputers #FutureReady

0 notes

Photo

Did AMD just reveal its next-generation Zen 6 “EPYC Venice” CPUs? New Linux kernel patches list fresh CPU IDs, hinting at a major update for data centers and HPC 🖥️. These processors, built with TSMC's 2nm tech, promise up to 256 cores and 512 threads, pushing AMD's performance limits further. The focus on workstation and server segments indicates a strategic move toward AI and high-performance computing markets. If you're interested in custom computing solutions with top-tier specs, GroovyComputers.ca offers specialized builds that can keep you ahead of the curve. Whether for gaming, professional workstations, or data centers, their custom computers are designed to meet the latest tech trends and demands. Ready to upgrade to a next-gen PC? Check out GroovyComputers.ca for your custom build needs today! Have you been awaiting AMD's new epic processors? Share your thoughts below! 🚀 #AMD #Zen6 #EPYC #CustomPC #HighPerformance #DataCenter #HPC #LinuxKernel #TechNews #NextGen #Gaming #Workstation #GroovyComputers #FutureReady

0 notes

Text

Data Center Liquid Cooling Market Size, Forecast & Growth Opportunities

In 2025 and beyond, the data center liquid cooling market size is poised for significant growth, reshaping the cooling landscape of hyperscale and enterprise data centers. As data volumes surge due to cloud computing, AI workloads, and edge deployments, traditional air-cooling systems are struggling to keep up. Enter liquid cooling—a next-gen solution gaining traction among CTOs, infrastructure heads, and facility engineers globally.

Market Size Overview: A Surge in Demand

The global data center liquid cooling market size was valued at USD 21.14 billion in 2030, and it is projected to grow at a CAGR of over 33.2% between 2025 and 2030. By 2030, fueled by escalating energy costs, density of server racks, and the drive for energy-efficient and sustainable operations.

This growth is also spurred by tech giants like Google, Microsoft, and Meta aggressively investing in high-density AI data centers, where air cooling simply cannot meet the thermal requirements.

What’s Driving the Market Growth?

AI & HPC Workloads The rise of artificial intelligence (AI), deep learning, and high-performance computing (HPC) applications demand massive processing power, generating heat loads that exceed air cooling thresholds.

Edge Computing Expansion With 5G and IoT adoption, edge data centers are becoming mainstream. These compact centers often lack space for elaborate air-cooling systems, making liquid cooling ideal.

Sustainability Mandates Governments and corporations are pushing toward net-zero carbon goals. Liquid cooling can reduce power usage effectiveness (PUE) and water usage, aligning with green data center goals.

Space and Energy Efficiency Liquid cooling systems allow for greater rack density, reducing the physical footprint and optimizing cooling efficiency, which directly translates to lower operational costs.

Key Technology Trends Reshaping the Market

Direct-to-Chip (D2C) Cooling: Coolant circulates directly to the heat source, offering precise thermal management.

Immersion Cooling: Servers are submerged in thermally conductive dielectric fluid, offering superior heat dissipation.

Rear Door Heat Exchangers: These allow retrofitting of existing setups with minimal disruption.

Modular Cooling Systems: Plug-and-play liquid cooling solutions that reduce deployment complexity in edge and micro-data centers.

Regional Insights: Where the Growth Is Concentrated

North America leads the market, driven by early technology adoption and hyperscale investments.

Asia-Pacific is witnessing exponential growth, especially in India, China, and Singapore, where government-backed digitalization and smart city projects are expanding rapidly.

Europe is catching up fast, with sustainability regulations pushing enterprises to adopt liquid cooling for energy-efficient operations.

Download PDF Brochure - Get in-depth insights, market segmentation, and technology trends

Key Players in the Liquid Cooling Space

Some of the major players influencing the data center liquid cooling market size include:

Vertiv Holdings

Schneider Electric

LiquidStack

Submer

Iceotope Technologies

Asetek

Midas Green Technologies

These innovators are offering scalable and energy-optimized solutions tailored for the evolving data center architecture.

Forecast Outlook: What CTOs Need to Know

CTOs must now factor in thermal design power (TDP) thresholds, AI-driven workloads, and sustainability mandates in their IT roadmap. Liquid cooling is no longer experimental—it is a strategic infrastructure choice.

By 2027, more than 40% of new data center builds are expected to integrate liquid cooling systems, according to recent industry forecasts. This shift will dramatically influence procurement strategies, energy models, and facility designs.

Request sample report - Dive into market size, trends, and future

Conclusion:

The data center liquid cooling market size is set to witness a paradigm shift in the coming years. With its ability to handle intense compute loads, reduce energy consumption, and offer environmental benefits, liquid cooling is becoming a must-have for forward-thinking organizations. It is time to evaluate and invest in liquid cooling infrastructure now—not just to stay competitive, but to future-proof their data center operations for the AI era.

#data center cooling#liquid cooling market#data center liquid cooling#market forecast#cooling technology trends#data center infrastructure#thermal management#liquid cooling solutions#data center growth#edge computing#HPC cooling#cooling systems market#future of data centers#liquid immersion cooling#server cooling technologies

0 notes

Text

Server Market becoming the core of U.S. tech acceleration by 2032

Server Market was valued at USD 111.60 billion in 2023 and is expected to reach USD 224.90 billion by 2032, growing at a CAGR of 8.14% from 2024-2032.

Server Market is witnessing robust growth as businesses across industries increasingly adopt digital infrastructure, cloud computing, and edge technologies. Enterprises are scaling up data capacity and performance to meet the demands of real-time processing, AI integration, and massive data flow. This trend is particularly strong in sectors such as BFSI, healthcare, IT, and manufacturing.

U.S. Market Accelerates Enterprise Server Deployments with Hybrid Infrastructure Push

Server Market continues to evolve with demand shifting toward high-performance, energy-efficient, and scalable server solutions. Vendors are focusing on innovation in server architecture, including modular designs, hybrid cloud support, and enhanced security protocols. This transformation is driven by rapid enterprise digitalization and the global shift toward data-centric decision-making.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6580

Market Keyplayers:

ASUSTeK Computer Inc. (ESC8000 G4, RS720A-E11-RS24U)

Cisco Systems, Inc. (UCS C220 M6 Rack Server, UCS X210c M6 Compute Node)

Dell Inc. (PowerEdge R760, PowerEdge T550)

FUJITSU (PRIMERGY RX2540 M7, PRIMERGY TX1330 M5)

Hewlett Packard Enterprise Development LP (ProLiant DL380 Gen11, Apollo 6500 Gen10 Plus)

Huawei Technologies Co., Ltd. (FusionServer Pro 2298 V5, TaiShan 2280)

Inspur (NF5280M6, NF5468A5)

Intel Corporation (Server System M50CYP, Server Board S2600WF)

International Business Machines Corporation (Power S1022, z15 T02)

Lenovo (ThinkSystem SR650 V3, ThinkSystem ST650 V2)

NEC Corporation (Express5800 R120f-2E, Express5800 T120h)

Oracle Corporation (Server X9-2, SPARC T8-1)

Quanta Computer Inc. (QuantaGrid D52BQ-2U, QuantaPlex T42SP-2U)

SMART Global Holdings, Inc. (Altus XE2112, Tundra AP)

Super Micro Computer, Inc. (SuperServer 620P-TRT, BigTwin SYS-220BT-HNTR)

Nvidia Corporation (DGX H100, HGX H100)

Hitachi Vantara, LLC (Advanced Server DS220, Compute Blade 2500)

Market Analysis

The Server Market is undergoing a pivotal shift due to growing enterprise reliance on high-availability systems and virtualized environments. In the U.S., large-scale investments in data centers and government digital initiatives are fueling server demand, while Europe’s adoption is guided by sustainability mandates and edge deployment needs. The surge in AI applications and real-time analytics is increasing the need for powerful and resilient server architectures globally.

Market Trends

Rising adoption of edge servers for real-time data processing

Shift toward hybrid and multi-cloud infrastructure

Increased demand for GPU-accelerated servers supporting AI workloads

Energy-efficient server solutions gaining preference

Growth of white-box servers among hyperscale data centers

Demand for enhanced server security and zero-trust architecture

Modular and scalable server designs enabling flexible deployment

Market Scope

The Server Market is expanding as organizations embrace automation, IoT, and big data platforms. Servers are now expected to deliver higher performance with lower power consumption and stronger cyber protection.

Hybrid cloud deployment across enterprise segments

Servers tailored for AI, ML, and high-performance computing

Real-time analytics driving edge server demand

Surge in SMB and remote server solutions post-pandemic

Integration with AI-driven data center management tools

Adoption of liquid cooling and green server infrastructure

Forecast Outlook

The Server Market is set to experience sustained growth, fueled by technological advancement, increased cloud-native workloads, and rapid digital infrastructure expansion. With demand rising for faster processing, flexible configurations, and real-time responsiveness, both North America and Europe are positioned as innovation leaders. Strategic investments in R&D, chip optimization, and green server technology will be key to driving next-phase competitiveness and performance benchmarks.

Access Complete Report: https://www.snsinsider.com/reports/server-market-6580

Conclusion

The future of the Server Market lies in its adaptability to digital transformation and evolving workload requirements. As enterprises across the U.S. and Europe continue to reimagine data strategy, servers will serve as the backbone of intelligent, agile, and secure operations. In a world increasingly defined by data, smart server infrastructure is not just a utility—it’s a critical advantage.

Related reports:

U.S.A Web Hosting Services Market thrives on digital innovation and rising online presence

U.S.A embraces innovation as Serverless Architecture Market gains robust momentum

U.S.A High Availability Server Market Booms with Demand for Uninterrupted Business Operations

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Mail us: [email protected]

0 notes

Text

Server Liquid Cold Plate Market 2025-2032

The global Server Liquid Cold Plate market was valued at US$ 28.10 million in 2023 and is anticipated to reach US$ 2,793.61 million by 2030, witnessing a CAGR of 62.31% during the forecast period 2024-2030.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/320/server-liquid-cold-plate

A Server Liquid Cold Plate is a type of heat sink that utilizes liquid coolant to dissipate heat from high-power electronic components, such as CPUs and GPUs. It typically consists of a plate with a network of micro-channels or micro-fins for efficient heat transfer, and is connected to a liquid cooling system that circulates coolant through the channels to remove heat from the device. Liquid Cold Plates are commonly used in servers, data centers, and high-performance computing applications where reliable and effective cooling is critical to maintaining system performance.

Report Scope

This report aims to provide a comprehensive presentation of the global market for Server Liquid Cold Plate, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding Server Liquid Cold Plate.

The Server Liquid Cold Plate market size, estimations, and forecasts are provided in terms of output/shipments (K Units) and revenue ($ millions), considering 2023 as the base year, with history and forecast data for the period from 2019 to 2030. This report segments the global Server Liquid Cold Plate market comprehensively. Regional market sizes, concerning products by Type, by Application, and by players, are also provided.

For a more in-depth understanding of the market, the report provides profiles of the competitive landscape, key competitors, and their respective market ranks. The report also discusses technological trends and new product developments.

The report will help the Server Liquid Cold Plate manufacturers, new entrants, and industry chain related companies in this market with information on the revenues, production, and average price for the overall market and the sub-segments across the different segments, by company, by Type, by Application, and by regions.

Market Segmentation By Company

AVC

Auras

Shenzhen Cotran New Material

Shenzhen FRD

Cooler Master

CoolIT Systems

Nidec

Forcecon

Boyd

KENMEC

By Type

Copper Type

Copper+Aluminum Type

By Application

Internet

BFSI

Telecom

Energy

Healthcare

Others

By Region

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe)

Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of APAC)

The Middle East and Africa (Middle East, Africa)

South and Central America (Brazil, Argentina, Rest of SCA)

FAQs on the Server Liquid Cold Plate Market 1. What is the Server Liquid Cold Plate Market size in 2023?

➤ The global Server Liquid Cold Plate market was valued at US$ 28.10 million in 2023.

2. What is the projected market size of the Server Liquid Cold Plate Market by 2030?

➤ The market is anticipated to reach US$ 2,793.61 million by 2030.

3. What is the Compound Annual Growth Rate (CAGR) of the Server Liquid Cold Plate Market during 2024-2030?

➤ The market is expected to grow at a CAGR of 62.31% during the forecast period.

4. What drives the growth of the Server Liquid Cold Plate Market?

➤ The growth is driven by:

Increasing demand for efficient cooling systems in high-performance servers.

Rising adoption of advanced cooling solutions in data centers to reduce energy consumption.

Growing investments in data center infrastructure globally.

5. Which industries benefit the most from Server Liquid Cold Plate technology?Industries benefiting from this technology include:

Data Centers: To manage high-density server cooling.

Telecommunications: For cooling equipment in high-capacity networks.

Cloud Computing Providers: To optimize performance in large-scale server operations.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/320/server-liquid-cold-plate

Drivers

1. Increased Demand for High-Performance Computing (HPC)

The demand for high-performance computing (HPC) solutions, driven by industries such as artificial intelligence (AI), machine learning (ML), big data analytics, and cloud computing, has led to an increased need for effective cooling solutions. HPC systems generate significant amounts of heat, and server liquid cold plates offer an efficient method of maintaining optimal operating temperatures.

2. Growth in Data Center Infrastructure

With the rapid growth of cloud services, data centers, and edge computing installations, the need for advanced thermal management solutions, including liquid cooling, has become more pronounced. Server liquid cold plates provide superior thermal efficiency compared to air-cooling systems, supporting the high-density computing requirements of modern data centers.

3. Increasing Power Density in Servers

As servers become more powerful, the power density of computing systems has increased, creating more heat. Traditional air cooling systems struggle to handle the rising thermal demands. Server liquid cold plates are designed to effectively dissipate this heat, offering an essential solution for managing the increasing heat load in modern servers.

4. Environmental and Energy Efficiency Concerns

Governments and industries are placing more emphasis on reducing the carbon footprint and improving the energy efficiency of their operations. Liquid cooling solutions, including server liquid cold plates, are more energy-efficient than traditional air cooling, as they use less power to manage higher heat loads, contributing to lower energy consumption and operational costs.

5. Adoption of Liquid Cooling in High-Density Applications

As industries continue to scale their operations and deploy high-density servers for applications like gaming, scientific simulations, and financial modeling, liquid cooling solutions like cold plates are gaining favor due to their ability to effectively manage the heat produced in these high-density setups.

Restraints

1. High Initial Investment

Although server liquid cold plates offer long-term operational efficiency, the initial investment cost for liquid cooling systems is often higher compared to traditional air cooling methods. This can act as a barrier for small to medium-sized companies or data centers with limited budgets.

2. Complexity of Installation and Maintenance

Implementing a liquid cooling system requires careful planning and specialized expertise. The installation and maintenance of server liquid cold plates can be more complex and require trained personnel. This complexity might deter companies from adopting these solutions, especially in environments where quick deployment is essential.

3. Risk of Leaks and Maintenance Challenges

While server liquid cold plates are highly effective at cooling, there is always the potential for leaks in the liquid cooling system, which could lead to equipment damage. Ensuring the reliability and longevity of liquid cooling systems requires regular maintenance, and the possibility of a failure can be a deterrent for some organizations.

4. Compatibility Issues

Integrating server liquid cold plates into existing infrastructures, particularly in older systems or those not designed with liquid cooling in mind, can present compatibility issues. Retrofitting existing systems for liquid cooling may involve additional costs and potential downtime.

Opportunities

1. Advancements in Cooling Technology

The development of more advanced cooling technologies, such as two-phase liquid cooling and loop heat pipes (LHP), presents significant opportunities for improving the efficiency and performance of server liquid cold plates. Companies investing in R&D to advance liquid cooling technology will be able to offer more efficient, compact, and reliable solutions.

2. Growing Demand for Green Data Centers

As data centers strive to meet sustainability goals, there is a rising demand for green data centers. Server liquid cold plates, with their energy efficiency and reduced carbon footprint, align with the industry’s shift towards environmentally responsible cooling methods, opening up opportunities in this growing sector.

3. Expansion in Emerging Markets

The server liquid cold plate market is seeing significant growth in emerging markets where data center infrastructure is expanding rapidly. As companies in regions such as Asia-Pacific, Latin America, and the Middle East invest in building more data centers, the demand for efficient cooling solutions like server liquid cold plates is expected to rise.

4. Increasing Use of Immersion Cooling

Immersion cooling is an emerging trend in which electronic components are submerged in a dielectric liquid. This technology is closely linked to server liquid cold plates, and as immersion cooling gains popularity, there is potential for integration and further development, creating new growth opportunities for cold plate manufacturers.

5. Rising Adoption in AI and Machine Learning

With AI and ML models becoming increasingly data- and compute-intensive, the need for efficient cooling in server systems has never been greater. As these technologies grow, the demand for liquid cooling solutions in server applications is set to rise, providing a significant growth opportunity for the market.

Challenges

1. Limited Awareness of Liquid Cooling Benefits

Despite the growing demand for server liquid cold plates, many organizations, particularly those with traditional data centers, are not fully aware of the benefits that liquid cooling can bring. Overcoming this knowledge gap and educating potential customers will be a challenge for market players.

2. Competitive Pricing Pressures

As the market for server liquid cold plates grows, companies are likely to face pricing pressures from competitors offering lower-cost solutions. Maintaining the balance between performance, energy efficiency, and cost will be a key challenge for players in the market.

3. Technological Integration and Standardization

The lack of standardization across various server liquid cold plate technologies can lead to integration challenges and compatibility issues. Ensuring interoperability between different cooling solutions and server architectures will be essential for the long-term growth and adoption of these systems.

4. Regulatory and Safety Standards

Compliance with various regulatory and safety standards related to liquid cooling systems, especially in highly regulated industries like healthcare and finance, can create hurdles for manufacturers and operators. Ensuring that products meet all safety standards will be critical to gaining widespread acceptance.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/320/server-liquid-cold-plate

0 notes

Text

Silicone Fluids Market Size, Share, Demand & Growth by 2035

The Silicone Fluid Market is widely recognized for its applications in personal care, lubricants, and industrial coatings. However, one niche segment is rapidly gaining strategic importance but remains underexplored in conventional market reports—the use of silicone fluids in thermal interface materials (TIMs) for electric vehicles (EVs) and advanced computing systems. As global industries push the boundaries of energy efficiency and miniaturization, the heat generated by tightly packed electronics demands materials with superior thermal control. In this context, silicone fluids—especially high-purity polydimethylsiloxane (PDMS) fluids—are stepping into the spotlight as enablers of thermal innovation. This article dives deep into this overlooked domain, uncovering how silicone fluids are poised to shape the future of heat transfer technology.

𝐌𝐚𝐤𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐞𝐝 𝐃𝐞𝐜𝐢𝐬𝐢𝐨𝐧𝐬 – 𝐀𝐜𝐜𝐞𝐬𝐬 𝐘𝐨𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐈𝐧𝐬𝐭𝐚𝐧𝐭𝐥𝐲! https://www.futuremarketinsights.com/reports/sample/rep-gb-928

The Role of Silicone Fluids in EV Thermal Management Systems

Thermal stability is mission-critical in electric vehicles. Power electronics, battery packs, and electric drivetrains all operate under high thermal stress, which directly affects performance and safety. Traditionally, phase-change materials and thermal pastes have played a central role in dissipating heat, but these solutions often degrade under cyclic loading and prolonged operation. Silicone fluids, particularly volatile silicone oils, are increasingly being formulated into next-generation TIMs due to their superior thermal conductivity, low volatility, and excellent dielectric properties.

Recent innovations in the EV sector—such as the use of direct-contact liquid cooling systems—have triggered demand for silicone-based heat transfer fluids. Tesla, for instance, has filed patents discussing the use of silicone-enhanced thermal pastes to improve the heat dissipation of battery modules. These silicone fluids not only offer a broader operating temperature range but also maintain their properties after repeated thermal cycling, reducing maintenance needs. Their non-reactive chemical profile further ensures compatibility with sensitive electronic components, making them ideal for automotive electronics that demand both durability and safety.

Polydimethylsiloxane Fluids in High-Performance Computing Systems

In the realm of high-performance computing (HPC), including artificial intelligence servers and advanced gaming consoles, managing thermal output is a formidable challenge. The transition from air-cooling to liquid cooling is already underway, and silicone-based coolants are becoming integral to this shift. Polydimethylsiloxane fluids are preferred due to their precise viscosity control, long-term chemical stability, and resistance to thermal oxidation.

For example, researchers at Stanford University recently conducted experiments involving silicone-based TIMs integrated into microprocessor packaging. The results demonstrated a 30% improvement in thermal dissipation compared to conventional materials. Similarly, tech companies like IBM and Google are exploring immersion cooling solutions using specialty silicone fluids to manage the heat generated by AI and cloud infrastructure. These use cases underscore the rising relevance of silicone fluids not just in managing heat, but in enabling the performance of data-driven technologies.

𝐔𝐧𝐥𝐨𝐜𝐤 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 – 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰: https://www.futuremarketinsights.com/reports/silicone-fluid-market

The Rise of High-Purity and Specialty Grade Silicone Fluids

While silicone fluids are generally produced in bulk for commodity uses, a small but growing segment of the market is centered on high-purity and specialty-grade variants. These fluids are engineered with extremely tight tolerances for impurity content and molecular weight distribution, making them suitable for cutting-edge applications such as chip manufacturing, nano-engineered cooling solutions, and aerospace electronics.

The market for these high-purity silicone fluids is still developing but commands a high value per kilogram due to the complexity of production and the stringent performance requirements. Companies such as Shin-Etsu Chemical and Elkem Silicones have recently expanded their product portfolios to include such high-end offerings. This emerging trend is driving growth in what could be termed the “ultra-premium” segment of the polydimethylsiloxane fluids market, which remains largely absent from most mainstream market analyses.

Asia-Pacific’s Quiet Leadership in Thermal-Grade Silicone Production

Despite China’s dominance in overall silicone production, the production of thermal-grade silicone fluids is seeing specialized leadership from countries like Japan and South Korea. These nations benefit from tightly integrated supply chains, high R&D spending, and close collaborations between academic institutions and manufacturers. Japan’s Shin-Etsu and South Korea’s KCC Corporation have made significant investments in scaling up the production of thermally optimized silicone fluids, particularly for electronics and automotive sectors.

South Korea’s Ministry of Trade, Industry and Energy has also supported initiatives aimed at domestic innovation in thermal materials, recognizing their role in boosting the competitiveness of the nation’s EV and semiconductor industries. These efforts have translated into export growth for thermal-grade silicone oils, even amid broader geopolitical and trade tensions.

Polymers & Plastics: https://www.futuremarketinsights.com/industry-analysis/polymers-and-plastics

Current Challenges and the Road Ahead

Despite their potential, silicone fluids for thermal applications face some challenges. One major concern is the thermal degradation of silicone oils over extended use, particularly at extremely high temperatures. Additionally, recycling and disposal of used silicone-based TIMs remain complex due to their chemical stability. High-purity grades also incur high manufacturing costs and require advanced handling and processing infrastructure.

However, the industry is responding with innovation. Research is underway into hybrid TIMs that encapsulate silicone fluids within solid-state matrices to improve thermal efficiency and prevent leakage. Startups and academic labs are exploring surface-modified PDMS fluids that offer enhanced heat transfer without sacrificing stability. These breakthroughs could address existing limitations and broaden the applications of silicone fluids across new verticals.

Key Segments Profiled in the Silicone Fluids Industry Survey

Type:

Straight Silicone Fluid

Dimethyl Silicone Fluid

Methylphenyl Silicone Fluid

Methylhydrogen Silicone Fluid

Modified

Reactive Silicone Fluid

Non-Reactive Silicone Fluid

End Use Industry:

Agriculture

Energy

Homecare

Personal Care

Textiles

Pharmaceuticals

Other End Use Industries

Region:

North America

Latin America

Western Europe

Eastern Europe

APEJ

Japan

Middle East & Africa

About Future Market Insights (FMI)