#HomeLoanRates

Photo

Interested in saving on your home loan? We've got smart strategies to help you secure the best rates. Let's make your dream home affordable and budget-friendly! Call us now! 🌐: vahomebuyersprogram.com/ 📧: [email protected]

0 notes

Text

5 Step how to Refinance in Australia

If you're looking to refinance your home loan, you're making a smart financial move that can help you save money on your monthly mortgage payments, reduce the overall interest you pay over the life of the loan, or consolidate debt. In this blog post, we'll explain the steps involved in refinancing your home loan so that you can make an informed decision.

Step 1: Assess your financial situation

Before you start the refinancing process for your home loan, you should take a good look at your finances to determine whether refinancing is the right option for you. You should consider the following questions:

How much equity do you have in your home that you can use to refinance your home loan?

What is your current interest rate on your home loan that you want to refinance?

What are the costs associated with refinancing your home loan, including application fees, appraisal fees, and closing costs?

What are your financial goals for refinancing your home loan?

Step 2: Shop around for the best refinance home loan deals

Once you have assessed your financial situation and decided that refinancing your home loan is the right option for you, it's time to shop around for the best refinance home loan deals. You can do this by:

Comparing interest rates and loan terms from different lenders for your refinance home loan.

Calculating the costs of refinancing your home loan, including application fees, appraisal fees, and closing costs.

Understanding the types of loans available for your refinance home loan, such as fixed-rate, adjustable-rate, or interest-only loans.

Step 3: Gather the necessary documentation for your refinance home loan

When you've found a lender and refinance home loan that you're happy with, you'll need to gather the necessary documentation to complete the refinancing process for your home loan. This documentation will typically include:

Proof of income (such as pay stubs or tax returns) for your refinance home loan.

Proof of assets (such as bank statements or investment account statements) for your refinance home loan.

Proof of debts (such as credit card statements or other loan documents) for your refinance home loan.

Information about your current mortgage (such as the loan balance and interest rate) that you want to refinance.

Step 4: Apply for the refinance home loan

Once you have gathered all the necessary documentation for your refinance home loan, it's time to apply for the loan. You'll need to fill out an application and provide the lender with all the necessary information about your finances and your current mortgage that you want to refinance. The lender will then evaluate your application and determine whether you qualify for the refinance home loan.

Step 5: Close the refinance home loan

If your application for the refinance home loan is approved, you'll need to close the loan. This involves signing the necessary paperwork, paying any closing costs for the refinance home loan, and transferring the funds from the new loan to pay off your existing mortgage. Once the refinance home loan is closed, you'll start making payments on the new loan according to the agreed-upon terms.

Refinancing your home loan can be a great way to save money and achieve your financial goals. By following these steps for your refinance home loan, you can make an informed decision about whether refinancing is right for you and ensure a smooth refinancing process for your home loan.

#homeloan, #refinance #homeloanrates #currentmortgagerates #mortgagerates, #australia #mortgagebroker.

0 notes

Photo

Home loans at attractive interest rates from HDFC Home loans. Best home loan for women and salaried individuals. Avail home loans at low processing fees.

1 note

·

View note

Video

undefined

tumblr

The biggest and most important financial decision of your life is buying a home of your own. Once you finalized the home that you want to buy, the next important step is to identify the bank Or financial institutions that will provide you loan for it's purchase. There are important factors that have to be taken into consideration while applying for home loan. Check out the video and learn about the factors to compare when you go for a home loan for any Bank and Financial Institution.

.

.

0 notes

Photo

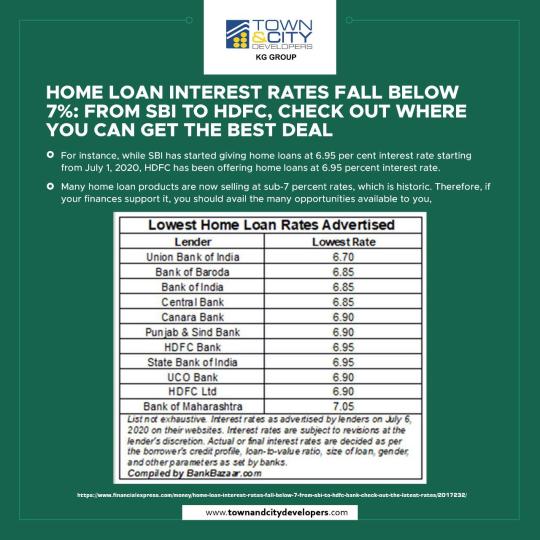

Check out where you can get the best deal on Home Loan Interest 👇🏦

#HomeLoan#LoanInterest#NewHome#BankLoan#Home#HomeLoanRate#Coimbatore#Apartments#1BHKFlats#2BHKFlats#TownandCityDevelopers#KGGroup

0 notes

Text

Tips for Choosing a Lending Institute for a Home loan

Summary: This article evaluates the factors one should consider when selecting a lending institute for a home loan by assessing factors such as security, interest rates, and accessibility.

Today, a number of lending institutions – both banking and non-banking institutions – offering home loans at competitive interest rates. Hence, loan seekers are confused between the wide choices of home loans to avail the one that suits their individual needs.

Selecting a home loan depends on an individual’s preferences and financial capacity. However, researching the providers of home loan is vital to ensure they are getting the best deal to ensure highest profitability and convenience.

Moreover, a home loan is a loan term loan, hence to have the right financing partner is vital to ensure peace of mind and flexibility. Let us evaluate the factors to consider when selecting a lending Institute for a home loan.

Home Loan Interest Rates

Home loan interest rates are usually very similar across most banks in a particular state or country. Moreover, even non-banking institutions offer loans that are close to bank home loan rates. However, there are lending institutions that charge higher home loan interest rates than regular banks, offering extra features in its place. Others offer lower interest rates but may charge high fees and penalties. Thus, loan seekers must evaluate, the lending institute by researching their home loan interest rates, fees and surges, loan tenure, and the benefits offered, depending on an individual’s preferences and situations.

Accessibility and Quick Approval

Banks often offer the advantage of having one or more branches right in the individual's locality. Hence, the individual can visit banks directly and get all their queries regarding home loans and home loan interest rates answered directly by an expert bank representative. Whereas, a lending institution that is not a bank might not have a local branch one can visit, hence limiting the approachability to the home loan provider.

However, both banking and non-banking lending institutions today have the option of applying for a home loan online. The advantage of applying for a home loan online is that online applications are generally quickly processed, convenient and offer better home loan interest rates.

Moreover. When applying for a home loan online, applicants with savings accounts with the bank may be offered discounted home loan interest rates, have a reduced need for paper work and almost instant pre-approval. After which a loan bank representative can call the applicant regarding their chosen home loan offer and request the documentation and answer any pertaining queries.

Security and Reputation

Banking institutes are often old institutions that have been established for a long time. And hence, their reputation and experience is well-established. Plus, in order for a bank to function, they must abide by the rules, regulations, and security measures that regulate every banking institute in the country – both online and offline. Hence, home loans from banks offer highly secure and insured.

Non-banking lending institutes are regulated by laws and standards that they must maintain. However, a lot of non-banking lending institutions are new and may not have a reputation that precedes them. Furthermore, a non-banking lending institution is subject to the economy. A financial crisis or downward shift in the economy can affect a non-banking lending institute more than a banking institute. Making banks a saner choice for a long-term home loan.

Either way, whether an individual chooses to apply for a home loan online, or offline, it is crucial that he or she researches the lending institution in detail and evaluate the home loan features, processing time, accessibility, convenience, home loan interest rate and benefits offered by the lending institution to make the final choice.

0 notes

Text

Homebuyers should watch out for rising interest rates.

#abhousingrealtypvtltd

#HomeBuyers #Homes #HomeForSale #HomeLoan #HomeLoanRate #IntrestRate #Pune #PCMC #RiceInPrice

0 notes

Link

One of the most important aspects of going to auction is ensuring you have your finance in order and in place https://auctionfinance.ding.financial/ #homeloanratecomparison #homeloancalculators #homeloansaustralia #investmentloan #homeloancomparison #homeloans #firsthomeloan #lendingtools #homeloanrates

0 notes

Link

One of the most important aspects of going to auction is ensuring you have your finance in order and in place https://auctionfinance.ding.financial/ #homeloanratecomparison #homeloancalculators #homeloansaustralia #investmentloan #homeloancomparison #homeloans #firsthomeloan #lendingtools #homeloanrates

0 notes

Text

How A Healthy Credit Score Can Reduce Your Home Loan Rate…

If you have a dependable track record of loan repayment and an independent credit information bureaus rating that's high, you have something to cheer for.

Now, based on your credit score you can avail of cheaper home loans. Bank of Baroda (BOB), a state-run bank, recently announced that anyone with a Credit Information Bureau (India) Limited (CIBIL) score of 760 and above would be eligible for a home loan at 8.35%. This is the lowest offering so far, beating even SBI's 8.65%.

The Marginal Cost Lending Rate (MCLR) of BOB stands at 8.35%. In other words, the bank doesn't charge a premium to those with high credit scores. Without a doubt, mortgages provide additional safety but it seems post demonetisation, there is now a competition among banks to promote the credit growth.

There's a caveat though. Those who have a sub-724 credit score would get a rate of 9.35%. While those in the mid-range (725 to 759) will be charged 8.85% interest rate. Amongst the existing borrowers of BOB, clients who are still following the base rate mechanism may also be delighted. The bank has been offering a migration from the base rate system to MCLR system free of cost.

Let's see what affects your credit score...

Independent credit information agencies such as CIBIL collect information about your running loan repayments from a financial institution. And provides you with a score based on factors such as:

Your timeliness of repayment;

Usage of credit limits;

Duration of credit;

Types of loans—secured, unsecured, etc.; and

The number of credit inquiries you made in the past

Can you improve your credit score?

Of course, you can. But it's not possible overnight. For that, you need to change your credit behaviour and maintain consistency thereafter. Here are some tips for improving your credit score:

You should pay all your EMIs on time

Use credit limits rather conservatively

Avoid opting for multiple credit cards

And as far as possible, maintain a healthy balance between secured and unsecured loans

When you opt for long-duration secured loans, rating agencies consider this as a positive, provided you pay all your EMIs in time.

Now it remains to be seen if other banks also follow suit. However, having a high credit score may not be just enough for other lenders. Many banks and financial institutions consider a whole host of other factors before they offer you loans at cheaper rates. Those factors include:

You income

Nature of your job/work

Your age

Your residual working span

Your average monthly bank balance

The list above is not exhaustive, and financial institutions may consider other factors too.

A note for those who are still on a base-rate regime

Unless you switch to MCLR regime, you won't experience lowered borrowing cost as much as new borrowers for now. However, keep in mind the MCLR regime will transfer any increase in interest rates equally efficiently. We are not far away from seeing a bottom on borrowing rates, especially for retail borrowers. Under such a scenario, you should do a thorough assessment of options available to you. Depending on the remaining duration of your loan, the quantum of EMI and type of loan, you could decide whether it makes sense to migrate from base rate regime to MCLR regime at this juncture.

This post on " How A Healthy Credit Score Can Reduce Your Home Loan Rate… " appeared first on "PersonalFN"

0 notes

Photo

A joint home loan gives numerous benefits. To know more, visit https://goo.gl/BJbYyN or reach us at 0120-4545956

0 notes

Text

Six things about home loans tax incentives you didn't know

2016 is looking to be one of the best years for home buyers. More tax benefits, rate cuts on loans, stagnant property prices, and new launches in the 'affordable' segment with freebies and attractive payment schemes. Many of you will be looking to take advantage of these benefits and buy a house. While hunting for a house at the right price, you'll be haggling with the bank to cut a loan deal too. Even if you get a discount on both, your tax bill can burn a hole unless you know the rules well. Here goes a list of six lesser known and often-missed tax benefits on home loans.

1. You can claim tax benefit on interest paid even if you missed an EMI.

Unlike the deduction on property taxes or principal repayment of home loans, which are available on 'paid' basis, the deduction on interest is available on accrual basis. Meaning, even if you have missed a few EMIs during a financial year, you would still be eligible to claim deduction on the interest part of the EMI for the entire year."Section 24 clearly mentions the words "paid or payable" in respect of interest payment on housing loan. Hence, it can be claimed as a deduction so long as the interest liability is there," says Kuldip Kumar, partner-tax, PwC India. However, retain the documents showing the deduction so that you can substantiate if questioned by tax authorities. The principal repayment deduction under Section 80C, however, is available only on actual repayments.

2. Processing fee is tax deductible.

Most taxpayers are unaware that charges related to their loan qualify for tax deduction. As per law, these charges are considered as interest and therefore deduction on the same can be claimed."Under the Income Tax Act, Section 2(28a) defines the term interest as 'interest payable in any manner in respect of any money borrowed or debt incurred (including a deposit, claim or other similar right or obligation)'. This includes any service fee or other charge in respect of the loan amount," says Kumar. Moreover, there is a tribunal judgment which held that processing fee is linked to services rendered by the bank in relation to loan granted and is thus covered under service fee. Therefore, it is eligible for deduction under Section 24 against income from house property .Other charges also come under this category but penal charges do not.

3. Principal repayment tax benefit is reversed if you sell before 5 years.

You score negative tax points if you sell a house within five years from the date of purchase, or, five years from the date of taking the home loans. “As per rules, any deduction claimed under Section 80C in respect to principal repayment of housing loan, would get reversed and added to your annual taxable income in the year in which the property is sold and you will be taxed at current rates," says Archit Gupta, CEO, and ClearTax.in. Thankfully, the loan amortization tables are such that the repayment schedule is interest heavy and the tax-reversal rule only apply to Section 80C.

4. Loans from relatives and friends are eligible for tax deduction.

You can claim a deduction under Section 24 for interest repayment on loans taken from anyone provided the purpose of the loan is purchase or construction of a property. You can also claim deduction for money borrowed from individuals for reconstruction and repairs of property. It does not have to be from a bank. ""For tax purposes, the loan is not relevant, the usage is. The taxpayer should be able to satisfy the assessing officer how the loan has been utilized for constructing or purchasing a house property and completion of construction was within five years and other conditions are met," says Gupta. Remember, the lender must also file an income-tax return reporting the interest income and paying tax on it. "The interest charged should be reasonable and a legal certificate of interest should be provided by the lender along with name, address and PAN," says Gupta.This rule, however, is only applicable for interest repayment. You will lose all tax benefits for principal repayment if you do not borrow from a scheduled bank or employer. The additional benefit of Rs 50,000 under Section 80EE is also not available.

5. You may not be eligible for tax break even if you are just a co-borrower.

You cannot claim a tax break on a home loans even if you may be the one who is paying the EMI. For one, if your parents own a property for which you are paying the EMIs, you can't claim breaks unless you co-own the property. "You have to be both an owner and a borrower to claim benefits. If either of the titles is missing you are not eligible," says Gupta. Even if you own a property with your spouse, you can't claim deductions if your name's not on the loan book as a co-borrower.

6. You can claim pre-construction period interest for up to 5 years.

You know you can start claiming your home loans benefits once the construction is complete and you receive possession. So, what happens to the installments you made during the construction or before you got the keys to the house? As per rules, you cannot claim principal repayment but interest paid during the period can be accrued and claimed post-possession."The law provides a deferred deduction on the interest payable during pre-construction period. The deduction on such interest is available equally over a period of 5 years starting from the year of possession," says Vaibhav Sankla, director, H&R Block.

{Source: http://economictimes.indiatimes.com/wealth/tax/six-things-about-home-loan-tax-incentives-you-didnt-know/articleshow/52395495.cms}

1 note

·

View note

Link

0 notes

Photo

Rate rises, US interest rates may hit Australian home loan rates

0 notes

Text

Home Loan for Women

It's a women's world - as the saying goes. The spirit of this saying extends to financial world too. If you are woman looking to purchase a house using home loan for women, then you have reason to cheer.

There is a general perception that women pay their dues on time and are less likely to default, when compared to their male counterparts. This is the reason that lenders are willing to offer certain financial benefits to women.

One of the biggest benefits for woman borrowers is that they need to pay lower interest rates as compared to men. As of now, this differential is around 0.05%. This might seem small at first but it can have a significant impact on the total repayment made to the lender. Mathematically speaking too, when the amount involved is in lacs, any concession that is available on interest rates is a welcome one. However, women can get loans on lower rates only when they become primary applicants or co-applicants for home loan for women.

The benefits don't end there. Many Indian states have lower stamp duty for house registration if the house is registered in the name of a woman. Although banks do not mention these schemes in their advertisement, they usually show interest in accepting home loan for women applicants and co-applicants.

Similarly, stamp duty for house registration is also lower in some states if the house is registered in the name of a woman. This in itself can result in a lot of savings as registration costs run into several lacs.

But it should always be remembered that lenders are there to earn profits and are not doing any social service. So they will lend, only if they are reasonably sure that the borrower will pay back his or her dues on time. Hence irrespective of whether the borrower is a male or a female, having a good credit history is absolutely necessary for getting the home loan approved.

{Source: http://www.tatacapital.com/blog/home-loan/home-loan-for-women.htm}

0 notes

Text

Home Loan Rates - Tips on Finding the Best Rate

The home loan rates applied to your home mortgage is the cost of the money that you have borrowed. The money itself is called the principal, while the price you pay to borrow the money is considered the interest. In addition, you can expect to pay at least a few of the closing costs on your home loan. Usually, it is the seller who pays closing costs, but that is traditional, rather than a requirement. Each and every factor that is associated with the acquisition of the loan itself should be explored. A few dollars for a loan cost item, or a half percentage point on the loan rate can add up to thousands of dollars.

Know your broker

Choosing a loan broker that you trust or have done business with in the past can help you to find the best home loan rates on a mortgage. If you have not worked with a broker previously, do the due diligence required to get to know his or her reputation. Check the Better Business Bureau for complaints. Ask friends, family and neighbors who they used when they obtained a mortgage loan on their property. Ask why they selected the broker--it may be their brother-in-law. Your real estate buyer's agent may be able to help you with the names of brokers they have dealt with in the past.

Clean up your credit file

Another way to improve your home loan rates is to clean up any inaccuracies that may have accrued on your credit file. There are three major credit reporting agencies that many lenders use to access information about how you have managed your financial obligations in the past. If you obtain a copy of these credit reports for yourself--which can be done each year at no cost--and remove any inaccurate or misleading information, you are much more likely to have a lower interest rate on your home loan.

Closing costs

Closing costs are those which typically are paid during the completion, explanation and signing of the loan documents. While they do not usually have a direct bearing on the home loan rates, they may require you to come up with cash in order to complete the loan. Many of the closing costs can be rolled into the cost of the mortgage, but this action means that you will be paying more interest dollars out during the course of the mortgage term.

Interest and term

The interest rate and the term are the two most critical factors when it comes to determining the home loan rates. The interest rate may be fixed or adjustable. The loan type may be an option adjustable rate mortgage, contain a balloon payment or sometimes an interest only loan. Only your personal financial circumstances will help you determine which is the best rate for you. Take time to review the factors in building the cost of the money for your mortgage and decide which will be the best option for your household.

{Source: http://ezinearticles.com/?Home-Loan-Rate---Tips-on-Finding-the-Best-Rate&id=1330103}

0 notes