#How do I choose a liquid staking platform?

Explore tagged Tumblr posts

Text

Liquid Staking for Novices: A 2024 Introductory Guide

Unlock the full potential of your cryptocurrency investments with liquid staking, where liquidity meets profitability.

Liquid staking is transforming the cryptocurrency landscape by offering a solution to the liquidity problem associated with traditional staking. By issuing Liquid Staking Tokens (LSTs), this innovative approach allows users to stake their assets while retaining the ability to trade or use these tokens in various DeFi protocols. This dual benefit of earning staking rewards and maintaining liquidity makes liquid staking an appealing option for investors, particularly those involved with major cryptocurrencies like Ethereum and Solana.

Liquid staking is transforming the cryptocurrency landscape by offering a solution to the liquidity problem associated with traditional staking. By issuing Liquid Staking Tokens (LSTs), this innovative approach allows users to stake their assets while retaining the ability to trade or use these tokens in various DeFi protocols.

This dual benefit of earning staking rewards and maintaining liquidity makes liquid staking an appealing option for investors, particularly those involved with major cryptocurrencies like Ethereum and Solana.

The process of liquid staking involves depositing cryptocurrency into a staking contract, which then issues a liquid staking token representing the staked assets. These tokens can be utilized in decentralized exchanges, lending platforms, and yield farming protocols, providing users with the flexibility to optimize their investment strategies. This increased liquidity and flexibility allow users to respond quickly to market changes and new investment opportunities, making liquid staking a valuable tool in the crypto ecosystem.

Despite its benefits, liquid staking presents certain challenges, including the risk of validator penalties and smart contract vulnerabilities. Additionally, the regulatory environment for cryptocurrencies is continuously changing, which may impact staking practices. Nonetheless, liquid staking is poised to play a pivotal role in the future of blockchain finance, enhancing the value of crypto assets through improved accessibility and liquidity. Intelisync offers tailored blockchain solutions, including liquid staking, to help businesses Learn more.....

#Advantages of Liquid Staking Tokens#Can I lose my funds in liquid staking?#Challenges of Liquid Staking#How do I choose a liquid staking platform?#How Does Liquid Staking Work?#How Intelisync will help you to grow in the crypto world Liquid Staking#Understanding Staking and How Does Staking Work?#What cryptocurrencies support liquid staking?#What is Liquid Staking?#What is Restaking#What is the future of liquid staking?#Why Are LSTs Gaining Popularity?#intelisync blockchain development company intelisync bitcoin development services#intelisync web3 marketing services

0 notes

Text

Unlocking Crypto Farming: How to Make Your Crypto Work Smarter on STON.fi

Let’s be real—crypto farming can sound intimidating at first. When I first heard about it, my immediate thought was, "This sounds complicated!" But after diving in, I realized it’s simpler than it seems—and a powerful way to grow your crypto assets.

If you’re someone who wants to understand farming without all the fluff, let me break it down for you in a way that’s practical, relatable, and, most importantly, easy to apply.

What is Crypto Farming: Think of It Like Lending a Helping Hand

Imagine your friend is running a small business, and they need cash to buy inventory. You lend them some money, and they repay you with a little extra as a thank-you for helping out.

Crypto farming works similarly. Platforms like STON.fi need liquidity—basically, tokens available for people to trade easily. When you deposit your tokens into a farming pool, you’re providing that liquidity. In return, you earn rewards, usually in the form of additional tokens.

It’s a win-win situation: the platform gets the liquidity it needs, and you get rewarded for your contribution.

Why Does Farming Matter

Let’s put it this way: crypto platforms without liquidity are like stores without inventory. Nobody wants to shop where the shelves are empty! By farming, you’re ensuring there’s always “inventory” available for trading.

But beyond that, farming matters because it’s one of the simplest ways to grow your crypto without constantly trading or stressing about market volatility. Your tokens are working for you in the background, just like a well-oiled machine.

Why I Chose STON.fi for Farming

When I first dipped my toes into farming, I wanted a platform that was straightforward, reliable, and didn’t require me to be a tech wizard. That’s exactly what I found with STON.fi.

The platform is designed to be user-friendly. Whether you’re a complete beginner or someone with a bit of experience, STON.fi makes it easy to navigate, choose farming pools, and start earning rewards.

How STON.fi Farming Pools Work

Think of a farming pool as a community pot. Everyone contributes tokens, and the pot grows as more people join in. Over time, the pot is distributed back to contributors along with rewards, depending on how much they added.

Here’s a quick look at some of the farming pools available on STON.fi and what they offer:

1. JETTON/USDt V2 Extended

Rewards: 22,500 JETTON (~$6,000)

Lock-Up Period: 15 days

Explore now

This pool supports the blockchain gaming ecosystem, making it ideal for those who believe in the future of Web3 gaming.

2. hTON/TON V2

Rewards: 30,866 HPO (~$777)

Lock-Up Period: None

Explore now

A flexible option for those who want to start without locking their assets.

3. HPO/hTON V2

Rewards: 61,733 HPO (~$1,600)

Lock-Up Period: None

Explore now

Great for earning high rewards while keeping your assets accessible.

4. TON/uTON

Rewards: 411 STON + 345 uTON (~$3,700)

Lock-Up Period: None

Explore now

Perfect for those who support the TON ecosystem and want to earn tokens while doing so.

What I’ve Learned About Farming

When I started farming, I made a few rookie mistakes, but I also picked up some valuable lessons:

Start Small: If you’re new, start with an amount you’re comfortable with. It’s better to learn with less risk.

Research Is Key: Don’t just jump into any pool. Take the time to understand the project, its goals, and its reward structure.

Diversify: Don’t put all your tokens in one pool. Spreading your assets across multiple pools can reduce risk and increase your chances of steady returns.

How to Get Started with Farming on STON.fi

Getting started is simpler than you might think. Here’s a quick step-by-step guide:

1. Pick a Pool: Browse the available pools on STON.fi and choose one that aligns with your goals.

2. Provide Liquidity: Deposit the required token pairs for the pool. You’ll receive LP (liquidity provider) tokens in return.

3. Earn Rewards: Once your tokens are staked in the pool, sit back and watch your rewards grow over time.

It’s really that simple. The platform does all the heavy lifting while you earn passive income.

Why Crypto Farming Is Worth It

Farming has become one of my favorite ways to grow my crypto portfolio, and here’s why:

It’s predictable. Unlike trading, where market swings can wipe out gains, farming provides steady returns.

It’s passive. Once your tokens are staked, you don’t have to constantly monitor the market.

It’s rewarding. Knowing that my contributions help keep a decentralized platform running feels pretty good.

Farm tokens now

Final Thoughts: Make Your Crypto Work Smarter

Crypto farming on STON.fi isn’t just for tech-savvy experts—it’s for anyone who wants to make their assets work harder. Think of it as putting your money into a high-yield savings account, but with the added satisfaction of contributing to a growing ecosystem.

So, if you’ve been on the fence about farming, now’s the time to give it a shot. Start small, learn as you go, and watch your crypto portfolio grow steadily. Remember, the key is to take that first step—you’ll be surprised at how rewarding it can be.

Ready to get started? The world of farming is waiting for you!

2 notes

·

View notes

Text

How to Make Your Crypto Work Smarter with Farming on STON.fi

When I first heard about crypto farming, I’ll admit it sounded a bit intimidating. But once I dug deeper, I realized it’s one of the simplest ways to make your assets grow. Imagine putting your money into a savings account where you earn interest, but instead of just leaving it there, you play an active role in making the system better. That’s what farming on a decentralized exchange (DEX) like STON.fi feels like.

Let’s break this down together and make it as relatable and easy to understand as possible.

What Is Crypto Farming: Think of It Like Planting Seeds

Picture this: You own a small garden. Instead of letting it sit idle, you plant seeds. Over time, those seeds grow into fruits or vegetables, which you can harvest and enjoy. That’s farming, right?

Crypto farming works similarly. Instead of seeds, you provide your tokens as liquidity to a DEX. Instead of fruits, you earn rewards—additional tokens for supporting the ecosystem. It’s as straightforward as that.

By “planting” your tokens in a farm pool, you’re helping the platform maintain liquidity, ensuring trades can happen seamlessly. In return, you’re rewarded for your contribution.

What Are Farm Pools, and Why Do They Matter

Farm pools are like community gardens. Everyone brings their resources (tokens) and works together to keep the garden flourishing. On a platform like STON.fi, these pools are essential for ensuring there’s enough liquidity for traders to swap tokens.

Your contribution is more than just a deposit; it’s a way to keep the ecosystem alive and growing. And just like in a garden, the more you contribute, the more you stand to gain.

Farming on STON.fi: Why It’s a Game-Changer

STON.fi makes farming simple, even if you’re new to crypto. The platform is designed with users in mind, providing clear instructions and straightforward processes. It’s not about navigating complex systems but about empowering you to make your assets work smarter.

Here’s what sets STON.fi apart:

1. User-Friendly Interface: You don’t need to be a tech wizard. Everything is intuitive.

2. Flexible Options: Choose pools based on your goals—whether you’re in it for quick rewards or long-term growth.

3. Transparent Processes: No hidden terms or complicated jargon. You know exactly what you’re getting into.

Available Farming Pools on STON.fi

Here’s a breakdown of the farming opportunities currently available:

1. JETTON/USDt V2 Extended

Rewards: 22,500 JETTON (~$6,000)

Farming Period: Until December 30

Lock-Up Period: 15 days

JetTon Games is a blockchain gaming platform. By farming here, you’re not only earning rewards but also supporting the growth of blockchain-based gaming.

2. hTON/TON V2

Rewards: 30,866 HPO (~$777)

Farming Period: Until December 24

Lock-Up Period: None

This pool is perfect if you’re looking for flexibility. No lock-up means you can withdraw your tokens anytime while still earning rewards.

3. HPO/hTON V2

Rewards: 61,733 HPO (~$1,600)

Farming Period: Until December 24

Lock-Up Period: None

High rewards with no lock-up? It’s an opportunity to grow your assets without committing them long-term.

4. TON/uTON

Rewards: 411 STON + 345 uTON (~$3,700)

Farming Period: Until January 16

Lock-Up Period: None

This pool supports TON staking. If you believe in the TON ecosystem’s future, this is a great way to contribute while earning.

Farm tokens now

Lessons I’ve Learned from Farming

Farming isn’t just about earning tokens; it’s about building a strategy. Here are a few things I’ve picked up:

Start Small: When I first started, I didn’t dive in headfirst. I tested the waters with a small amount to understand how it works.

Stay Informed: Before joining any pool, I took the time to read about it—what tokens are involved, the rewards, and the lock-up period.

Diversify: Just like in traditional finance, I learned not to put all my eggs in one basket. Spreading my assets across different pools minimized my risks.

Why You Should Consider Farming

If you’ve been letting your tokens sit idle in your wallet, farming is a great way to put them to work. Think of it like opening a high-interest account at a bank. Your money doesn’t just sit there—it grows.

The best part? You’re contributing to the broader DeFi ecosystem. Every token you provide helps create a more robust and efficient platform for everyone involved.

How to Start Farming on STON.fi

Getting started is easier than you might think. Here’s how I approached it:

1. Choose a Pool: Look at the available options and pick one that aligns with your goals.

2. Provide Liquidity: Deposit the required token pairs. STON.fi automatically issues LP tokens for you.

3. Start Earning: Sit back and watch your rewards grow as the system does the heavy lifting.

Final Thoughts: Make Your Assets Work for You

Crypto farming isn’t as complicated as it sounds. Platforms like STON.fi have made it accessible for everyone, whether you’re a seasoned trader or just starting your journey.

What I love most about farming is that it aligns with a mindset of financial growth. It’s not about taking unnecessary risks but about making informed decisions and letting your assets do the work.

If you’ve been curious about farming but hesitant to start, I encourage you to take that first step. Begin small, learn as you go, and discover the rewards of being an active participant in the crypto space. Trust me, it’s worth it.

3 notes

·

View notes

Text

How Solana Developers Drive Growth for Blockchain Startups

Startups have been severely pressured by time to innovate, scaling efficiently, and promising reliable solutions for a broader user base in the highly volatile world of blockchain and Web3. Choosing a proper blockchain infrastructure can be the difference between a startup that thrives and one that will be left nowhere. Solana shines from this horizon with the great transaction speed and extremely low cost in a lively ecosystem that enables innovation across different sectors. With lightning speed and processing capabilities of more than 65,000 transactions per second, it is well suited for building consumer-grade dApps, financial instruments, NFT platforms, and much more. As competition heats up in the blockchain space, it becomes increasingly important to Hire professional Solana developers, those who work on closely related aspects through their hands-on experience on Solana core technologies. The team's backbone technically should be made with such resource people to drive the start-up into product development immediately, along with speedy market strategies-it gives the transformation of idea without delay into a scalable end-product.

Building Efficient and Scalable Applications

Solana has one of the strongest features in giving room for high throughput applications, while at the same time allowing decentralization and performance within it. Innovations such as Proof of History (PoH), which timestamps transactions before consensus; and Sea Level, Solana’s parallel smart contract runtime, allow the simultaneous execution of multiple smart contracts. Solana developers add huge value here. They write optimized code, structure smart contracts efficiently and do architecture that supports vertical and horizontal scaling. Whether you are building a DEX, a GameFi, or a high-volume NFT marketplace, they ensure stability of the application under high load. Startups will benefit a lot from this, as they can brazenly onboard users knowing that there will be no bottlenecks, downtimes, or performance lags. It gives a competitive edge to pitch to investors or partnerships as well.

Reducing Time-to-Market with Solana Tools

The potential for startups rests on their speed of execution; if you are first to market in the blockchain environment, you have a good chance of securing market share or user loyalty. A whole host of instruments with which developers can terminate building processes in hours and days is made available in Solana—Solana CLI, Anchor framework, Solana Web3.js, etc. These tools foster accelerated smart contract generation, local testing, and deployment onto the live network with practically no downtime. Developers especially love Anchor for its human-readable syntax and built-in security checks. Good Solana developers will go further to build CI/CD pipelines for deployment automation and version control, hence establishing a smooth rollout process. This entails, for any startup, launching a minimum viable product (MVP) in weeks rather than in months, allowing fast feedback, fast iteration, and jumpstart user acquisition. The faster you get your product to market, the faster you get traction; traction is everything when it comes to raising funds and growing the business.

Unlocking DeFi, NFTs, and Web3 Opportunities

The Solana ecosystem is so varied that it powers DeFi protocols, NFT platforms, decentralized social apps, and even real-time gaming projects. Solana developers are the ones doing the innovative work of integrating next-gen blockchain features such as yield farming, liquidity staking, on-chain governance, and cross-chain swaps into the startups. NFT developers create smart contracts enabling seamless minting, royalty management, metadata storage, and even dynamic NFTs creation. In DeFi, their efforts are channeled into developing order books, lending protocols, synthetic assets, and DEXs that deliver real-time performance. These developers also produce integration on the wider Web3 world -between wallets like Phantom, oracles such as Pyth, and even liquidity access through Serum- enabling startups' multi-channel revenue diversification and boosting engagement or new business models exclusive to blockchain.

Enhancing Security and User Trust

In blockchain, there is no option for security but it is embedded into the base. Just one overlooked vulnerability can destroy trust and cost millions in losses or possibly end a project entirely. As such, seasoned Solana developers weave security into every layer of the product: From writing audited and gas-optimized smart contracts to implementing stringent key management protocols, all defense is put up first, through unit tests, integration tests, and security audits for possible vulnerabilities such as reentrancy, integer overflow, and front-running opportunities. Additionally, they follow some best practices of the Solana ecosystem about the safe usage of Program Derive Addresses and assurance during token handling. Besides the technical security aspect, developers also make sure to take account of aspects like open-source licensing compliance, network up-time maintenance, and design for secure upgrade paths for smart contracts as another protective coverage that is legal and technical for the startup but also establishes credibility for the startup among users, partners, and even investors-in high-stakes sectors like DeFi and Web3 identity.

Community Integration and Ecosystem Growth

Solana is not a mere tech stack; it is a deep and wide ecosystem of developers, investors, creators, and users around the world. Startups that find conducive integration into this ecosystem tend to benefit in terms of faster growth along the lines of collaborations, funding, and visibility. The experienced Solana developers are likely to be plugged into this network and are therefore wielding it as a weapon. They contribute to open-source works, participate in Solana hackathons, and join forums and GitHub discussions that help them stay ahead of trends. They know how to apply for grants from the Solana Foundation, work with ecosystem projects like Metaplex, and take advantage of infrastructure services such as Helium or Switchboard. Developers strengthen aforementioned startups through community relationships, allowing them to gain organic traction, early adopters, and listings in ecosystem updates or showcase events. Community-connected developers do not just create apps; they create pathways for startups into the Solana universe.

Conclusion

Solana is uniquely positioned as the perfect springboard for blockchain startups, possessing technical advantages, developer-friendliness, and an alive ecosystem. Fully exploiting this platform requires experience and strategic development; from building a scalable NFT marketplace to high-performance DeFi protocols and inventive Web3 apps, the success of any Solana startup is ultimately reliant on its developers. The Top remote Solana developers bring in best-class talent capable of building, securing, and scaling game-changing products. These developers write code that drives vision, accelerates timelines, and opens up new avenues for growth. In an industry where speed and innovation rule, the right Solana team becomes your strongest competitive differentiator.

0 notes

Text

The Future is Tokenized: How Do I Invest in Tokenization?

Hey there, future-forward investors! Welcome back to the new topic of the day, where we dive into the next big thing in finance—tokenization! Now, I know you’re asking, How do I invest in tokenization? Well, stick with me, because we’re about to break it down in a way that’s actionable, practical, and, most importantly, personal.

What is Tokenization?

Tokenization is transforming the way we invest. It’s the process of converting real-world assets—think real estate, art, stocks, even commodities—into digital tokens on the blockchain. These tokens represent ownership and can be bought, sold, or traded just like stocks. The best part? It opens the door to fractional ownership, meaning you don’t need millions to own a piece of high-value assets.

Why Should You Care?

Here’s the deal—tokenization is making investing more accessible, transparent, and liquid. No more waiting months to sell a property or dealing with endless paperwork. You can invest in a fraction of a Picasso, own a piece of a high-rise building, or even have a stake in rare collectibles—all with just a few clicks.

How Do I Invest in Tokenization?

Alright, let’s get to the action. If you’re ready to dip your toes into this digital revolution, here’s what you need to do:

Choose the Right Platform – Start by researching tokenization platforms like Securitize, tZERO, or RealT. Each offers different assets and investment opportunities.

Decide Your Asset Class – Are you into real estate? Art? Private equity? Decide what excites you and where you see potential growth.

Get Your Digital Wallet Ready – Since tokenized assets live on the blockchain, you’ll need a digital wallet to store and trade your investments securely.

Start Small & Learn – Like any investment, start with an amount you’re comfortable with. Observe how the market moves and educate yourself along the way.

Stay Updated – Tokenization is evolving fast. Follow industry news, join online communities, and keep an eye on new regulations and opportunities.

The Future is Now

This isn’t just some futuristic concept—it’s happening right now. More institutions are embracing tokenization, and we’re seeing massive growth in the industry. The question isn’t if tokenization will change investing, but how fast it will happen. And the best part? You can be part of this movement today.

So, what do you think? Are you ready to take that first step into the world of tokenization? Then I’ll show you one of the curated guide – How to invest in tokenization? Let’s build wealth together in the digital age!

0 notes

Text

From Passive Income to Profits: How STON.fi’s Yield Farming Can Grow Your Portfolio"

Are you interested in earning passive rewards through yield farming? Want to support liquidity and grow your crypto portfolio? Let’s dive into the basics of getting started with ongoing farming opportunities!

1. What is Yield farming?

Yield farming is a way to earn rewards by lending your crypto to a decentralized platform. You can contribute your tokens to liquidity pools, and in exchange, you earn rewards, usually gotten from the transaction fees generated by trades within the pool. The more liquidity you provide, the more you earn from these rewards. It’s an easy way to make your crypto work for you while supporting the platform.

2. How does ston.fi comes into the picture?

STON.fi is a decentralized exchange (DEX) on the TON blockchain which allows users to trade digital assets securely with low fees. It provides liquidity pools, yield farming, and cross-chain swaps, making it a flexible and efficient platform for decentralized finance (DeFi) activities. If you`re looking forward to maximizing your crypto earnings through yield farming then STON.fi is the best DEX for you. You will be enjoying sweet benefits such as:

i. low fees

ii. secure transactions

iii. high rewards

Their user-friendly interface and variety of liquidity pools makes it very easy to start earning. choose STON.fi for a smooth and profitable yield farming experience.

3. How Does It Work?

i. Choose a pool: Pick from different liquidity pools available on the platform, which might include pairs like TON-USDT or TON-ETH.

ii. Get LP tokens: After depositing, you’ll receive LP tokens representing your share in the liquidity pool.

iii. Start earning rewards: Once your tokens are in the pool, you’ll start earning from the trading fees and any additional farming rewards. You can also track your rewards and withdraw them anytime.

4. What Are the Best Pools to Farm?

Stone.fi has a variety of liquidity pools for different risk levels. You’ll want to check the APR (Annual Percentage Rate) to find the most rewarding farms. Typically, stablecoin pools like USDT-USDC are less risky, while token pairs like TON-ETH might offer higher returns but come with more risk. Make sure to pick pools that match your investment style.

5. How to Maximize Your Returns:

i. Reinvest your rewards: Some pools allow you to stake LP tokens for even higher rewards. This helps compound your earnings without much effort.

ii. Manage risk: Keep in mind that a loss can happen if the prices of the paired tokens change significantly, so always do your research before diving in.

6. Why Choose STON.fi for Farming?

STON.fi offers a user-friendly interface, low fees, and access to a growing ecosystem powered by the TON blockchain. The platform is built to scale and offers several farming options that fit different risk profiles.

Ready to start?

Head over to STON.fi and start farming!!!

0 notes

Text

How do I create a decentralized crypto exchange platform development?

Blockchain's rapid growth has opened the door to decentralized finance (DeFi) solutions, the most popular of which are decentralized cryptocurrency exchanges. These platforms provide users with better security, privacy and asset control.

You can create your own decentralized cryptocurrency exchange platform by following our instructions in this blog post.

Step 1: Define Your Objectives and Features

Before you start, it's important to establish the goals of your decentralized exchange platform. Determine the essential features you want to offer, including asset support, trade matching, user authentication, and order matching algorithms. To attract more users, consider adding advanced features like yield farming, staking and liquidity pools.

Step 2: Choose the Blockchain and Consensus Mechanism

Choosing the correct blockchain is essential to your decentralized exchange's success. Ethereum is a popular choice, due to its many smart contract features. However, depending on your needs, you may want to look into other solutions like Binance Smart Chain, Solana, or Polkadot. Furthermore, select a good consensus mechanism based on aspects like security, scalability, and energy efficiency, such as Proof-of-Work (PoW) or Proof-of-Stake (PoS).

Step 3: Design Smart Contracts

In decentralized exchanges, smart contracts are essential because they enable automated and trustless transactions. Create smart contracts to handle fund management, order placing, and order matching. Use industry standards for token deployment and compliance, such as ERC-20 and ERC-721.

Step 4: Implement a Secure User Authentication System

In the world of cryptocurrency, security is key. Establish a reliable mechanism for user authentication to protect personal data and guarantee user account security. Use multi-signature wallets, two-factor authentication, and secure key management to improve the overall security posture of your decentralized exchange.

Step 5: Develop an Simple User Interface (UI)

A simple user-friendly interface is essential to attract and retain users. Create a Simple UI that simplifies the trading experience. Include features like real-time price charts, order book displays, and a responsive dashboard. Consider mobile optimization for a seamless user experience across different devices.

Step 6: Integrate Liquidity Pools and Staking Mechanisms

Implementing liquidity pools will improve the liquidity of your decentralized exchange. Incorporate staking features that allow users to earn rewards by providing liquidity to the platform. This not only attracts users but also contributes to the overall stability of the exchange.

Step 7: Conduct Rigorous Testing

Thoroughly test your decentralized exchange platform to identify and address any vulnerabilities or bugs. Perform security audits to ensure the robustness of your smart contracts. Consider deploying a testnet version for public testing, gathering feedback, and making necessary improvements.

Step 8: Deploy and Market Your Platform

Once the test is completed, Deploy your decentralized exchange on the specified blockchain. Develop a comprehensive marketing strategy that includes partnerships, community engagement, and social media campaigns to promote your site. Highlight unique features and benefits that differentiate your transaction from the competition.

In conclusion, Building a decentralized crypto exchange platform requires careful planning, technical expertise, and a commitment to security. By following these steps, you can build a feature-rich, secure, and user-friendly decentralized crypto exchange that contributes to the growing landscape of decentralized finance. As the crypto space continues to evolve, your platform will play an important role in shaping the future of decentralized finance.

#decentralizedexchange#cryptoexchange#cryptocurrency#decentralization#crypto#nft#blockchain#decentralized

0 notes

Text

Why You Should join the $GHNY yield farming fever? (Tutorial included)

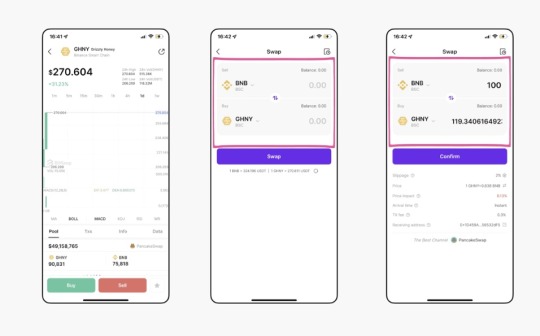

$GHNY is the native token of Grizzly.fi. Up till now, this yield farming platform has raised 26 million US dollars, with TVL skyrocketing. The APY of each pool is as high as 6,000%+. Will there be another DeFi Summer?

Recently, GHNY’s daily transaction volume exceeded $100 million! I think it’s time for me to do some digging. First of all, the purpose of the Grizzly.fi platform is well understood. It is to allow people to get income by staking in the bear market. Based on the BSC network, it currently provides investment opportunity in 7 trading pairs including USDT/USDC, USDT/BUSD, ETH/USDC. When users stake on Grizzly.fi, they get $GHNY. It is the fuel for the entire Grizzly.fi ecosystem. The longer the platform operates, the fewer tokens are minted.

If you want to get some GHNY outside the platform, you can always make a swap transaction in BitKeep Swap:

Preparation

If you’re using a cell phone, you’d need to download BitKeep app and create a wallet on BSC (or import an existing BSC wallet with your private key)

If you’d like to access BitKeep on your desktop, please get a BitKeep Chrome extension and connect wallet to the BSC network, or you can create a new wallet on BSC.

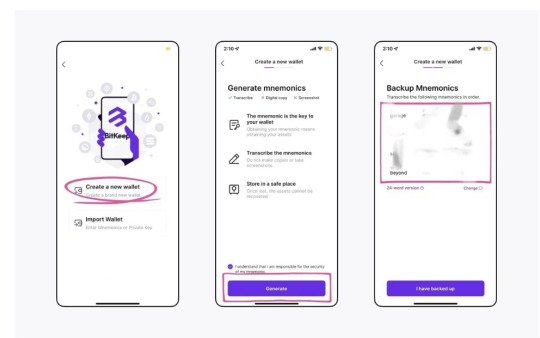

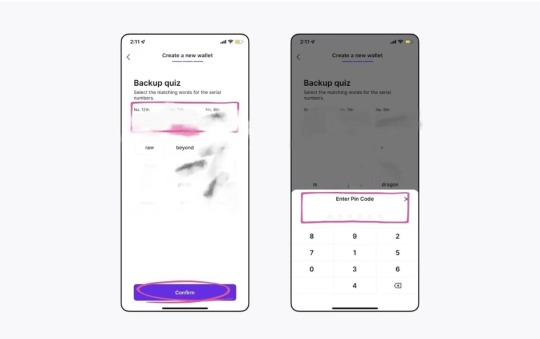

Here’s how to create a BSC Wallet in BitKeep:

Step 1: Download and install the BitKeep wallet.

Scan the QR code to download the latest version of BitKeep wallet

Create a wallet

Launch BitKeep wallet. Tap Create a new wallet. Read all the tips and check the prompt in the bottom, and tap “I have backed up”;

Verify your backup. Tap Confirm, then Enter Pin Code.

Please keep the mnemonics properly. It is recommended that you use a notebook to write down the mnemonics and put it away. Never take screenshots. BitKeep is a decentralized wallet, and it does not store your mnemonics on its server. Once the mnemonics get lost, you won’t be able to recover your assets, and BitKeep cannot help you recover your wallet.

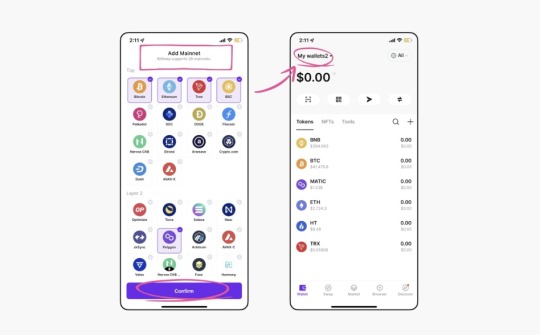

Add Mainnets and tap Confirm. Now you are ready to try out BitKeep.

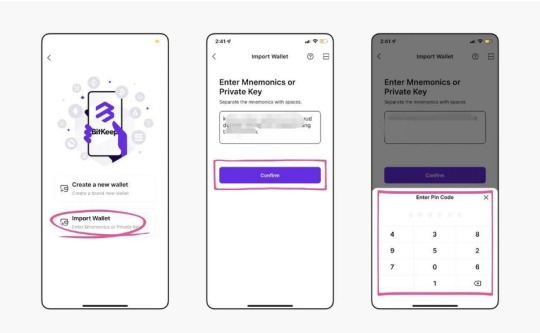

How to import a wallet;

You are going to need your private key or mnemonics to import a wallet. Do not copy it to the clipboard or there will be leaking risks. You’d better write the words down on a piece of paper and then input them manually.

Here’s a step-by-step instruction:

Launch BitKeep. Choose “Import an existing wallet”. Input your mnemonics or private key, then input your wallet password;

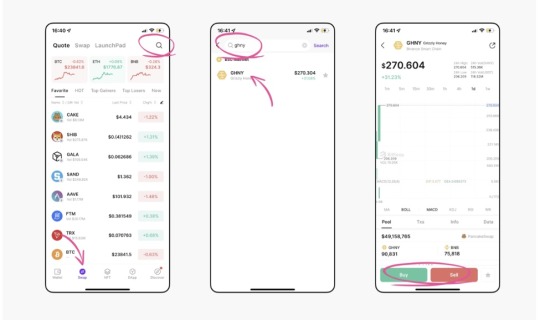

2. How to use BitKeep to get up-to-date info of Grizzly Honey (GHNY) 1) Launch BitKeep app, tap Swap, and tap Quote;

2) Tap the search bar, and enter GHNY or its token address 0xa045e37a0d1dd3a45fefb8803d22457abc0a728a, then tap the GHNY token you want to check out.

Here you can see its chart, liquidity pool, statistics, project information, etc.

3) Tap Buy or Sell to go to BitKeep Swap interface;

3. How to trade GHNY with BitKeep Swap:

1:

1) In the BitKeep Swap interface, choose the token pair;

2) In the search bar, enter GHNY or its smart contract address 0xa045e37a0d1dd3a45fefb8803d22457abc0a728a, then tap the token you want to swap;

3) Enter the amount, then tap Confirm and enter your password.

BitKeep Swap will automatically find the optimal cross-chain payment channel for you.

2:

1) On the GHNY page, tap Buy/Sell to jump to the Swap interface;

2) Select the token pair and enter an amount;

3) Now tap Confirm and enter your password.

If you want to check out the transaction record, just return to the Swap page, and tap the History icon.

Although the growth of GHNY is tempting. But a new crypto is not always reliable crypto, XD. For me, newly issued cryptos are just a fraction of my portfolio because I think we should always keep the risk — benefit ratio in mind. But if there’s a trading pair involving GHNY in the future, getting some of the token now may come in handy later. The information in this article is for reference only and shall not be construed as an investment advice.

3 notes

·

View notes

Text

Understanding the aftermath of r/wallstreetbets

A couple days back, I wrote up my best understanding of what happened with /r/wallstreetbets and meme stocks like Gamestop, trying to show how all the different, seemingly contradictory takes on the underlying financial stuff could all be true.

https://pluralistic.net/2021/01/28/payment-for-order-flow/#wallstreetbets

In the days since, a new series of contradictory takes has emerged, these ones disputing the meaning of this bizarre financial spectacle, and likewise what response, if any is warranted as it unfurls.

I think that all of these takes can also be true, and as with the trading itself, reconciling them requires that we widen the frame.

Let's start with Jimmy Carter.

In 1978, Carter's IRS created the 401(k), a tax-sheltered account for people who wanted to gamble on stocks to fund their retirement.

That was a fringe proposition at best.

The normal retirement system was a "defined benefits" pension where your employer guaranteed you a certain monthly percentage of your salary from retirement to death.

The vast majority of Americans wisely prefered a guaranteed payout to a tax-advantaged gambling account.

Obviously, right? On the one hand, you have the guarantee of a pension (maybe even inflation-indexed); on the other, you have a bunch of bets, that, if they go wrong, leave you literally homeless and starving.

When gamblers remortgage the family home and cash in the kids' college funds to play the tables, we consider them to have a mental illness, a pathological condition that harms them and the people around them.

Giving up a defined benefits pension in favor of a 401k is just the same kind of bet - staking all the money that will support you when you exit the workforce on the movement of stocks and bonds.

Who would do that voluntarily?

Pretty much no one. But the transition from defined benefits to 401k was not voluntary. Finance ghouls like Ethan Lipsig wrote memos to major employers like Hughes Aircraft showing them how they could ditch their pension obligations by moving workers to 401ks.

In the 80s, Reagan created a bunch of legal tools that allowed employers to coerce their workforces into giving up the security of a pension and force them into gambling their salaries on the prayer of a win in the markets.

This was insanely, amazingly great for the finance sector, in three ways:

1. It made companies more profitable. Guaranteeing that the workers whose labor made your company viable wouldn't spend their dotage starving and homeless is expensive.

Helping fund wagers on shares is much cheaper. The finance sector represented the major shareholders of the companies that transitioned to 401ks. The savings were transferred to these shareholders and the finance sector got commissions.

What's more, this temporary inflation of share prices disguised what was going on with the pension switcheroo: workers' defined benefits pensions were liquidated and turned into stocks, just as stocks were going up because their pensions had been liquidated!

Their legs had been amputated out from under them, but so subtly that they didn't yet feel the pain - and now their bosses cooked their legs and snuck them into their dinner, and everyone marveled at how full they felt after that hearty, meaty meal.

2. 401ks brought a lot of suckers to the table. The market was - and is - dominated by "sophisticated investors," AKA predators, who knew all the ways to fleece the rubes who had no idea how any of this worked.

The predatory nature of finance only increased over time. Hedge funds, for example, exist to find unethical practices that are legal (thanks to loopholes in the rules) and exploit them until they are illegal.

3. 401ks created a political force outside the finance sector that would lobby on its behalf. Transforming America into a nation of stockholders meant that workers had to choose between supporting rules that protected their jobs and rules that protected their retirement.

For your pension account to grow, you had to support policies that permitted finance ghouls to offshore your job, or misclassify you as a contractor, or eliminate the safety rules that prevented you from being maimed, or take away your right to sue for compensation.

Every time there's a particularly ghastly bankruptcy driven by PE or hedge funds - Toys R Us, Sears, etc - it emerges that at least some of that money is coming out of a union pension fund.

That's marketization - turning the once obscure, boring business of market-based capital allocation into a matter of import to everyday people.

Marketization begat financialization.

While marketization is primarily about capital allocation (who gets what money), financialization is about bets. Sometimes those bets are about things - businesses, houses, coal and timber - but things are limited. Mostly the financial market consists of bets on other bets.

Bets are infinite. Every time you make a bet, you create inventory for a market in a bet on the outcome of your bet. And that's inventory for a new market: bets on the outcomes of bets on the outcomes of bets.

It's called Wall Street Bets for a reason.

Bets need referees, someone who decides who the winner is. In sports, it's a major scandal if a referee is caught wagering on one of the teams in a match. In the financial markets, it's the norm - referees that lay wagers on the outcome of the contest they're overseeing.

Let's take stock:

Workers are forced to play the casino, and if their bets fail, they spend their old ages homeless and starving;

The vast majority of casino games are wholly abstract - bets on bets on bets - and require layers of refs;

the refs are all crooked.

Every couple of years, we have a massive, systemic financial crisis, and every time that happens, the finance sector lobbies for a no-strings-attached bailout, abetted by suckers who hate the finance sector but fear starving in their old age.

We're about to be engulfed in the second-largest crisis of our lifetime - the reckoning from trillions in capital market gains propped up by the Trump administration's policy of buying all corporate debt as a covid stimulus.

https://pluralistic.net/2020/09/28/cyberwar-tactics/#aligned-incentives

(the largest crisis of our lifetimes is a few years off, as the climate emergency piles losses on losses, stranding tens of trillions in assets, from fossil fuels to obsolete gas-stations to literally underwater coastal real-estate to whole towns incinerated by wildfires)

That's where we're at: a crooked casino that we've trusted our futures too, a crisis on the horizon, and a bunch meme-stock "players" who have thrown the normal weirdness of the market into stark relief through a spectacular stunt.

A lot of people are angry at Robinhood, the stock-trading platform at the center of all this. Robinhood froze trading on meme stocks, and has only allowed it to come back in a useless, performative trickle that is seemingly calculated to prevent more meme-stock gamesmanship.

Is Robinhood just another crooked ref? Yes…and no. The meme stock run upset the stable cheaters' equilibrium whereby cheating never escalated to the point where the game just collapsed.

For example, the total short position on Gamestop exceeds its total stock issuance.

Translation: there were more Gamestop shares promised between bettors than exist. When the game stops, all those promises come due, and they literally can't be paid off because there aren't enough tokens in circulation to settle all the debts.

Robinhood halted trading in part because the big fish upstream of Robinhood also halted trading, because they have even more at risk than Robinhood does if the game collapses - they the refs for MANY players, all the same size as Robinhood or larger.

https://www.bloomberg.com/opinion/articles/2021-01-29/reddit-traders-on-robinhood-are-on-both-sides-of-gamestop

But remember, the refs are cheating. And they are both downstream and upstream from other games in which the refs are also cheating.

And the games, as a whole, encompass our economy, including the solvency of the "real economy" (the people who make masks, deliver groceries and drive ambulances), and whether you spend your old age homeless and starving.

So the people who say, "Don't blame Robinhood, they didn't halt trading to help billionaires, they halted trading to prevent the game from collapsing are right."

But they're not the only ones who are right.

Also, there's the people who say that meme stocks aren't making money for little guys at the expense of the big guys. They're right too.

First, because these stocks will all need to be converted to cash, and that means selling them.

https://arstechnica.com/tech-policy/2021/01/the-gamestop-bubble-is-going-to-hurt-a-lot-of-ordinary-investors/

When the selloff starts, the price will plunge, because even if the stock was undervalued before, it's certainly overvalued now. Every bubble produces wealth for its early bettors who sell out to later players who lose everything when they can't find a sucker later on.

From Beanie Babies to subprime, bubbles burst and leave suckers holding the bag. If you just heard about meme stocks last week, you're too late to make money off of them.

There's another version of the "this isn't little guys, it's big whales" that's *also* true: the main beneficiary of the meme stock runs is giant funds who magnified and the bets from r/wallstreetbets and got out smart and fast.

https://twitter.com/zatapatique/status/1354904995901136896

So given all this, what can we make of calls (from parties as varied as AOC and Ted Cruz) to investigate Robinhood and other retail brokerages to see whether they're honest refs, or in the tank for billionaires?

At Naked Capitalism, Yves Smith calls this a "fatuous uproar," saying that the Senate has more important things to do during the racing-out-of-control pandemic than to investigate a literal penny-ante grift.

https://www.nakedcapitalism.com/2021/01/the-fatuous-uproar-about-robinhood-and-gamestop.html

Do we really care who the winner is in "a beauty contest between Cinderella’s ugly sisters" ("clueless new gen day traders versus clumsy shorts")?

Smith is right too.

A speculator-v-speculator contest that falls apart when the crooked ref halts play to prevent collapse - who cares who "wins?"

But here's how they can all be right - the "who cares" and the "goliath v goliath" and the "bubble" and the "Robinhood is a plutes' honeypot."

*If* there's hearings, and *if* those hearings expose the absurdity and corruption of the system, *then* there is a chance to build the political will to make real, systemic changes when the crisis comes.

And there's a real crisis coming: two, in fact. The covid junk bond financial crisis, which is due very soon, and the climate crisis stranded asset emergencies, which will unroll with increased tempo and intensity for decades to come.

The half-century cycle of "addressing" finance crises by increasing financialization MUST stop.

If the meme stock spectacle gets us to pay attention to hearings that reveal the irredeemable rot of the system, then it's a unique chance to spread *real* "financial literacy."

And that literacy is the necessary (but insufficient) precursor to taking action when the time comes - and the time is certainly coming soon.

133 notes

·

View notes

Text

How to Become a Crypto Artist?

Art is universal. It speaks to everyone but recognizes no authorities. It adapts to the times and these days it’s going digital. If you publish your work on the internet, not only will it stay there forever, but you will also get the chance to reach millions of people. Against the background of emerging and flourishing blockchain technology, crypto art has become a trending topic.

Blockchain and Art

Blockchain has revolutionized the way we perceive money, ushering in an era of digital ownership. Bitcoin, as storage of value and digital representation of money, was the first successful use case for blockchain, and some creative developers thought they could expand the concept of bitcoin into something new.

The introduction of smart contracts has brought the blockchain to many new applications, one of which is non-fungible tokens (NFTs). Non-fungible tokens are unique, and NFTs are digital assets with unique and non-interchangeable properties that are standardized, universal, liquid, and programmable. NFTs are applied into collectibles, in-game items, digital art, certificates, domain names, etc.

Digital artworks are transformed into crypto artworks by NFT, and the original model of copying artworks to USB disks and CDs is turned to transactions on the blockchain. The transaction process becomes open and transparent, and technological innovations such as AI are also adopted in digital art creation. It is only a matter of time before the art world is mesmerized by NFT and numerous artists tokenize and monetize their works one after another in a unique way.

What is crypto art?

Crypto art is rare digital art. More concretely, it is limited-edition collectible art that is cryptographically registered on the blockchain via tokens, which means the origin and provenance of digital artwork is transparent and auditable; and blockchain technology enables the tokens to be securely traded from one collector to another.

Once a token is created, the artwork begins its journey on a specific blockchain, where fans or collectors can purchase the artwork with cryptocurrency and it can be exchanged, traded or held by collectors just like any other rare artwork. Typically, crypto artwork can be sold through an auction: the creator lists the artwork they want to sell, after which bidders place their bids and the creator chooses to accept or not accept the bid. If the bid satisfies both two parties, then a transaction is made. Once the digital art asset is sold, the nun-fungible tokens are transferred directly to the buyer’s wallet, and the corresponding cryptocurrency is transferred to the seller’s wallet. Thanks to the blockchain, each transaction takes place on a peer-to-peer network and is protected by cryptography. This means that neither the capital nor the assets are held by the gallery or any other third party.

What does NFT mean for artists?

The decentralized and transparent nature of the blockchain is automatically expressed in the tokens stored on the platform, and these properties are shown in art in the following ways.

First, ownership is digitized into tradable tokens, thus increasing the liquidity of the artwork. Artists mint their works and issue them on the blockchain, and if they want to sell a piece, they can set a price based on its value and leave the rest to the market to work.

Second, NFT can also be used as a reliable method of verification and authentication. Thanks to its traceability, it becomes easier to track down the authentication and previous owners of an item and a certificate of authenticity is no longer needed. Everything is done on the chain and the integrity and value of the work is maintained.

Finally, it lowers the barrier of entry for independent artists who can use this medium to list and sell their artwork without having to pay for expensive gallery services. It also helps artists retain full ownership of their work, avoid paying fees to third-party intermediaries or agents, and enable artists get a better return on their artwork transactions.

How can I tokenize my artwork?

Several projects have emerged in the crypto artwork space, and these platforms spare artists all the technical work, as the artists simply need to provide the crypto artwork. Some of the most popular crypto art collecting and trading platforms are described below.

NFT Showroom is an art tokenization platform built on the HIVE blockchain. NFT Showroom allows artists to log in with their HIVE account and tokenize artwork with the help of its sidechain and smart contracts. The biggest benefit of the HIVE blockchain is that it requires no transaction fees, so there is no cost when an artist submits a piece of artwork to the chain and puts it up for sale. Those who purchase through HIVE will need a HIVE account. Users of HIVE accounts need to stake a small amount of HIVE coins to pay for transactions on the chain, and these HIVE coins remain in the possession of the users and can be sold at any time.

Rarible is built on the Ethereum blockchain and allows anyone with an Ethereum wallet to create accounts to tokenize their art. Since Rarible runs on Ethereum, users need to top up their accounts with Ether to pay for on-chain transactions. What’s interesting about Rarible is that it allows users to buy art with ETH, and hundreds of ERC-20-based tokens. Compared to the NFT Showroom on the HIVE chain, users of Rarible can open up the artwork to more buyers for better liquidity and a larger user base.

Makersplace also uses Ethereum to manage the tokenization of artwork, but also accepts other cryptocurrencies and fiats. Makersplace only charges 15% of the transaction when a crypto artist sells a work, and an additional 2.9% if the purchase is made via credit card. In addition, artists earn a 10% royalty whenever their work is re-sold.

Nifty Gateway, owned by cryptocurrency exchange Gemini, allows users to create tokenized versions of artwork using the NFT token standard Nifties. This platform is created in 2018 based on the Ethereum blockchain. Crypto artist Beeple’s artwork “THE COMPLETE MF COLLECTION” sold at auction on Nifty Gateway for $777,777, making it the most expensive crypto artwork to date.

The difference

As Jason Bailey stated in his introduction to the first Italian crypto art exhibition (Tolmezzo, from December, 2018 to February, 2019), “Unlike the traditional art world, crypto artists do not have to ask permission from gallery owners, agents, auction houses, or other intermediaries to share and sell their work. Instead, they use the blockchain to make their own decisions about displaying their work and making it available. Naturally, traditional artists often talk nonchalantly about crypto art, but that is certainly an important sign that crypto artists are on the right path.”

1 note

·

View note

Text

Online Presentation

Career Beyond Video Games

People view video games as a path with no end in sight. People view video games as nothing more than something to do in spare time or just a hobby. The truth is that it can be a career not in just making them but playing them for a living. Even with this, there are some parents that see a problem with their children playing video games. They see their children playing games such as Fortnite or League of Legends or etc. as a waste of time but do not know the reality (PV). My parents never saw video games as a waste of time and let me enjoy them during my childhood (F-Auto). I never thought that it would be possible to play video games as a career. I thought this type of job could only be a dream (FP). But nowadays there are those that have this dream job. Children are now able to look up to people who have this job and aspire to be like them. Besides creating the video games, the possible careers for playing video games is to become either a streamer or a professional video game player. These new careers were able to grow through streaming sites such as Twitch, a live streaming platform that focuses on video games. These sites were born from people who enjoy watching others play instead of themselves. Video games are not just for entertainment, they can be a career.

Video games today are not just a solo experience anymore, people are able to play with others from anywhere that has internet. People can make a career out of playing video games. One way to do this is to compete in Esports competitions, where people form teams and compete against each other. These competitions are organized by leagues such as the one known as Electronic Sports League, ESL, or any other league that is specific to a certain game. These competitions can be in two forms. One is being played online where the players play on servers over the internet. The other is playing offline where players play on a closed server in person and is streamed on platforms such as Twitch or YouTube. These platforms stream the competition live for everyone to watch and have a recording of the competition to watch in the future if someone chooses to do so. When teams eventually show results in competitions, they will be picked up by Esports organizations, the most notable being G2 Esports, Cloud 9, and Team Liquid. These organizations create contracts with players and the players can earn salaries so that they have a stable income. The professional Esports players will not have to do another job and can focus on Esports. Besides playing professionally, another path is streaming.

Professionals are not the only ones that stream, non-professional video game players also stream as well. A streamer is a person that uses a platform such as Twitch or YouTube to broadcast them playing video games live. The viewers can interact with the streamers through a live chat that is available to everyone. They can support the streamers through donations or subscriptions while the streamers can make money as well though sponsors and advertising. To become a streamer, all someone needs to do is record their voice and use Twitch or YouTube to stream their gameplay. Some streamers add a camera that faces them so the audience can view the streamer’s reactions. This creates the fantasy that the viewers are with the streamer when they are playing the game. This allows for a connection to be built between the streamer and viewer. If a strong connection is built, then the streamer is more likely to receive donations from the viewers. If they make enough money, then this can become there only job.

There are many streamers that make this a career and the most recent star to make it to the top of Twitch is called Ninja. According to a popular data collection website for streamers on Twitch, TwitchTracker, shows he has an average concurrent viewer count, the numbers of viewers currently watching a stream, of 38,000 people. He was also the first streamer on Twitch that was able to reach 10 million followers (TwitchTracker). With his personality, skills in Fortnite, and dedication he was able to build his fanbase from the ground up. Ninja was able to reach this height in streaming in just six years and continues to grow. A greater number of followers for a streamer correlates to an increase in income. Ninja focuses on a single game to make it easier for him to improve his skill. By improving his skills, he has a greater chance to get more followers. This is one of the types of viewers that someone can become if they want to choose to become a streamer for their career.

Besides a streamer like Ninja who focuses most of their time on a single game, there are also variety streamers who play a whole assortment of video games. Theses variety streamers can appeal to many viewers since different games attract different people or viewers can join to interact with the streamer. A popular variety streamer known as Shroud is on the same level as Ninja in terms of concurrent viewers but is different is that he plays a variety of different shooter games from virtual reality to popular First-Person Shooters (FPS). Another example is the more common variety streamers like one called Brownman who averages a thousand concurrent viewers per stream. Not everyone can succeed in streaming by increasing their skill, they can also be an entertainer. Brownman is an entertainer to his audience who focus on more than one genre when he streams. He plays a variety of games from farming simulators such as Stardew Valley to the classic Pokémon series. According to TwitchTracker, Brownman has played more than 300 games in just the span of three years. In this same amount of time, Shroud is shown to have played around 150 games in the same amount of time according to Twitchtracker (TwitchTracker). There can be streamers who focus on a single game or a single genre or any game they find enjoyable.

There are parents that see these career paths as nothing more than a waste of time. These parent that think this career path of video games is not viable for their child, need to look at how video games indirectly improve their child. Playing video games help improve a child’s development in visual imagery, problem solving, and visual processing. Researchers Sabrina Schenk, Robert K. Lech, and Boris Suchan study “the idea that video game playing is associated with many cognitive benefits” (Schenk). Many games having built in puzzles that challenge the player and makes them have to problem solve. The video game called The Witness focuses solely on the player completing puzzles. Even video games that seem to have nothing to do with puzzles still challenge the player by making them stay within certain parameters to find the solution of the game. Even if a child is not able to progress a career in video games, there is still a benefit to their cognitive abilities improving from years playing video games.

Contrary to the belief of some, professional Esports is not just a group of people who play videos games and call it a sport. The World Championships of some Esports can be compared to the Super Bowl in viewership numbers. The largest Esports, League of Legends, had total viewership of 99.6 million and a peak of 44 million concurrent viewers at the League of Legends World Championship 2018 (Goslin). Compared to the latest Super Bowl that had an average tv audience of 98.2 million people, this World Championship was able to draw in a larger crowd (Porter). Two other games that are rising within Esports are Tom Clancy’s Rainbow Six Siege and Rocket League. Tom Clancy’s Rainbow Six Siege’s highest competition called the Six Invitational had concurrent viewership of 113 thousand and total viewership of 8.8 million. Rocket League’s similar competition, Rocket League Championship Series, had concurrent viewership of 50 thousand and total viewership of 2.6 million (ESM. one). Rainbow Six is an Esports that can get to the level of League of Legends while Rocket League is still an up and coming Esports. Each of these are a different genre of video game and demonstrate how wide the range of people who are interested in Esports.

Traditional sport teams have also taken an in interest in the recent rise of Esports. These teams have gone so far as to create their own Esports teams while others have bought already established Esports teams. The European Rocket League Esports has two teams that are affiliated with professional soccer teams, F.C. Barcelona and Paris Saint-Germain F.C. The Esports organization Team Dignitas was created from the merger of two separate Esports organizations, Dignitas and Apex when bought by the NBA team, The Philadelphia 76ers (Dexerto). With more traditional sports team having a stake in Esports demonstrates how a career in Esports is becoming more common with bigger name organizations jumping in.

Some people may argue that Esports itself is not a sport since it is not “physical”, and they only sit in chairs and move their fingers. There is always going to be people who will not see the growth in Esports and not see the future where the big Esports competitions will be held in the same regard as the World Series of baseball or the Super Bowl of football. According to a report done by Limelight Networks that surveyed around 3,000 people aged eighteen and up from North America, Europe and Asia. People aged between 18 to 25 years old spend 3.42 hours a week watching others play video games which equates to about 3 hours and 25 minutes. The same aged group watches 2.27 hours of traditional sports and this is about 2 hours and 16 minutes (Limelight Networks) (FD). These people are spending more time watching streams than watching traditional sports shows how a shift how people view content will continue in the future. These numbers are realistic for myself since I watch almost all my entertainment streamed and almost no entertainment on tv.

Esports competitions can grow reliably not only with the help of the game’s popularity, but with help from the players themselves. This cooperation between these two aspects gives the competitions a chance to rival League of Legends. Professionals do not benefit from just the competitions they compete in growing, they help increase their own brand. An established brand makes it so that if their career professionally ends, they can still have a career in streaming. Some people can see a possibility that a game can become a top Esport and they take a chance on it by dedicating themselves to playing that game and increasing their skill. They see a game that could be their future career. Becoming a professional in an established game has different difficulties associated with it compared to a new game where someone can early on make a name for themselves.

One such Esports player is Pengu who plays for the G2 Esports Rainbow 6 team. When he decided to go into Esports he decided that he would take a chance on a new game at the time called Rainbow 6 Siege. He could have tried to go into another FPS, but he decided to go with Rainbow 6. His bet has paid off with him being one of the top players in the game while also being part of the team that has the best record in the game. They have most recently won the Six Invitational which the competition to decide who is the best in the world in Rainbow 6. Pengu is one of the many Esports players that can create a career from playing video games.

With the times changing, that means that the possible careers change as well. People, especially parents, that see no future with their children that play video games. Playing games like Fortnite or League of Legends leads to the possibility of becoming a professional since the Esports for these games has gone through exponential growth. This makes careers sustainable and viable for a future (SVC). This is the same for streaming but takes more work since they must work to gather an audience. This new career is here to stay and in no time soon will it die out and wither away into nothingness. People need to realize that these careers are possible and not a waste of time or just a simple dream that a kid has. Now it is possible for children to dream of playing video games for a living and not have to dismiss it.

Works Cited

“ESport Injuries - the Most Common Complaints.” ESportwissen.de, ESportwissen.de, 15 Oct. 2018, www.esportwissen.de/en/verletzungen-im-esport-die-haeufigsten-beschwerden/.

“Esports Teams & Tournaments Stats.” Esports Charts, ESM.one, 2019, escharts.com/.

“Full List of Professional Sports Teams In Esports.” Dexerto.com, Dexerto, 6 July 2016, www.dexerto.com/news/full-list-of-professional-sports-teams-in-esports/19056.

Goslin, Austen. “The 2018 League of Legends World Finals Had Nearly 100 Million Viewers.” The Rift Herald, Vox Media, 11 Dec. 2018, www.riftherald.com/2018/12/11/18136237/riot-2018-league-of-legends-world-finals-viewers-prize-pool.

Porter, Rick. “NFL Ratings Rise 5 Percent in 2018.” The Hollywood Reporter, The Hollywood Reporter, 10 May 2019, www.hollywoodreporter.com/live-feed/nfl-tv-ratings-rise-5-percent-2018-1172505.

Schenk, et al. “Games People Play: How Video Games Improve Probabilistic Learning.” Behavioural Brain Research, vol. 335, 2017, pp. 208–214.

“The State of Online Gaming – 2018.” Limelight Networks, Limelight Networks, 2018, www.limelight.com/resources/white-paper/state-of-online-gaming-2018/#overview.

“Twitch Channels, Games and Global Statistics.” TwitchTracker, TwitchTracker, 2019, twitchtracker.com/.

The True Meaning

The term <fake news> has recently become overused by people on both sides of the political spectrum. This term began with Donald Trump, the 45th President of the United States. It started with his response to a reporter’s question by tweeting “FAKE NEWS – A TOTAL POLITICAL WITCH HUNT!” (Rosen). Now he has completely taken off with this term. He answers any question or information that does not fit his portrayal to the American people by responding with the label <fake news>. President Trump gave the false label <fake news> when he said “Any negative polls are fake news, just like the CNN, ABC, NBC polls in the election. Sorry, people want border security and extreme vetting” (Rosen). He gave this label to information that he could not prove was fake but to information that he did not agree with. The purpose of doing this was to convince people to disregard the polls that show people do not approve of his presidency. This virus of misuse has spread beyond the President to his close supporters. People now use the label <fake news> by attaching it to any information that they disagree with. The misuse of <fake news> needs to stop or important information that demonstrates the true personality of an important figure and they cannot easily stop it by saying the two words, <fake news>. This will put the American people in a situation where they can not disregard the truth from the false with no way to label false information.

This term has been around in some form throughout history. The origin of <fake news> has its origin in recent history. The word fake is young when compared to its synonyms false and untrue. The word fake was “used as an adjective prior to the late 18th century” (Fallon) when compared to false that has been around a larger amount of time. People before the 18th century would use words such as false or untrue when writing or speaking about <fake news>. The earliest use of false news goes “as far back as the 16th century” when <fake news> was needed (Merriam-Webster). <Fake news> means that the information presented to the public is false and untrue. A warning sign is needed so people can see the distorted truth that plagues the internet. This label is one of those warnings. The first recorded use is at the end of the 19th century in a newspaper article. It has only been around a 100 hundred since the first use of this word. The definition of <fake news> as described by the Cambridge Dictionary states it as “false stories that appear to be news, spread on the internet or using other media, usually created to influence political views or as a joke” (Cambridge Dictionary). This definition shows how misinformation can be used to influence people during a political time. According to this definition, Donald Trump would be false in his use of the term since the polls cannot be proven as false information. The top ranked definition from the website Urban Dictionary describes <fake news> as “Normally typed in ALL CAPS, It is the only type of news that Mr. Trump loves” shows how the top ranked definition given by a community that connects the term to the President (Urban Dictionary). This website is a crowdsourced website that takes in new definitions and allows the community to create the definitions themselves. This definition would make Donald Trump’s use of the term correct if not that for the fact that it mentions him in the definition. His use of the term influenced the community of Urban Dictionary. This correlation shows how a single misuse of a term can lead to others misusing it in the same way. With more people connecting this false definition to <fake news>, the misuses will continue to spread. This false definition spreads while stays the same on Urban Dictionary and will not stop with the origin not stopping as well.

The term <fake news> is used whenever politics is brought up. Politics has become a battle where each candidate tries to make the other one look worse than themselves. Through this struggle to defame each other, information with some truth is twisted and contorted beyond recognition. This situation creates information that needs to be labeled as <fake news>. This information now has become false even though it began as truth, but it is now bundled with false so the entirety of it is false. The false definition that someone disagrees with information instead of it being false information. The increase in use started with the conservative side of American politics because the one who began the misuse is affiliated with the corresponding political views. After 2016, the last Presidential Election, the use has dramatically increased in the last two years. President Trump used <fake news> in quick succession to label all information that he felt is the opposite of his image. This information was anything from information concerning his private life, to events of his past. The correct use of this term is to label information that is classified as lies. For example the statement “Donald Trump is not an American citizen.” This statement can easily be proved false with evidence such as his birth certificate. This correct use demonstrates the correct definition that <fake news> needs to be used so that untrue information does not spread around. If the false information can spread, then it could influence a person’s vote during an election such as the Presidential Election. Instead of Donald Trump using <fake news>, a better term for him would be alternative fact. This term demonstrates the type of definition that he is searching for. It tells that what you believe is different than the posted information. It does not state that the information is wrong, but that he simply disagrees with it. The information that is true becomes clouded within all the misinformation with the incorrect use of <fake news>. The use of <fake news> instead of alternative fact allows for information that is true to be disregarded when it is needed. There would be no way to know if the information given is <fake news> or not. If there is no label, then this will lead to the public not trusting any source on the internet simply because there is no way to know what is true and what is not. It is necessary to have a label to show false information when it is layered in with true information. The previous scenario will eventually come to fruition if this label is not preserved.

President Trump’s use of <fake news> has created a situation where the meaning is contorted to a definition that the information is something that one disagrees with. He is creating a narrative of labeling anything and everything that he does not agree with. The impact of this change creates a place where information about shady politicians is disregarded because the label <fake news> would have lost its meaning and purpose. The general public is beginning to change their connotation of the term to the new false definition. This new connotation that is overtaking the old one is the same as the fable called The Boy Who Cried Wolf. This fable is about a boy who looks after the sheep. He informs that town if a wolf comes after the town’s sheep. But instead he plays pranks on the townsfolk by falsely yelling that a wolf is coming. Evenly the townsfolk ignore the boy’s cries until he sees a wolf, but the townsfolk now ignore his cries. Then the wolf kills all the sheep. This fable demonstrates that even when a liar tells the truth, they are not believed. When this is applied to <fake news>, the incorrect use creates a place where no politician or political figure can be brought to light with the term ruined. This outcome is the future if the term usage continues its path. The recent events with the term show how it is important to realize that misusing a word makes the true meaning clouded by the new false meaning. Whenever using <fake news>, the only proper use is false information that is purposely spread about someone and should not be used because the information does not agree with a given narrative.

References

“Fake News.” Cambridge English Dictionary, Cambridge University Press, 2019, dictionary.cambridge.org/us/dictionary/english/fake-news.

“Fake News.” Urban Dictionary, Urban Dictionary, 2019, https://www.urbandictionary.com/define.php?term=fake%20news.

Fallon, Claire. “Where Does the Term 'Fake News' Come From? The 1890s, Apparently.” The Huffington Post, TheHuffingtonPost.com, 24 Mar. 2017, www.huffingtonpost.com/entry/where-does-the-term-fake-news-come-from_us_58d53c89e4b03692bea518ad.

“How Is 'Fake News' Defined, and When Will It Be Added to the Dictionary?” Merriam-Webster, Merriam-Webster, 2018, www.merriam-webster.com/words-at-play/the-real-story-of-fake-news.

Rosen, Christopher. “All the Times Donald Trump Has Called Something 'Fake News'.” EW.com, Entertainment Weekly, July 2017, ew.com/tv/2017/06/27/donald-trump-fake-news-twitter/.

Wendling, Mike. “The (Almost) Complete History of 'Fake News'.” BBC News, BBC, 22 Jan. 2018, www.bbc.com/news/blogs-trending-42724320.

Quote:

“Instead of following the rules without regard for whether they’re making our writing effective or not, we often need to question the rules. To write with style, we need at times to break the rules.” -Donna Gorrell

Response:

I agree with the first part of the quote about questioning the rules. This is because learning why the rules are there in the first place helps strengthen the effectiveness of the writing. The rules can be broken but only in specific situations and should not be abused. The situation depends on the audience of the piece and the purpose of the writing. When breaking a rule in the wrong way can ruin the writing as a whole.

Quote:

“Journalism is printing what someone else does not want printed. Everything else is public relations.” -George Orwell

Response:

I would agree with it because you want to write in a way so people cannot misinterpret what you are trying to convey to the reader. People will always try to contort anything they see to match their own views on people or a certain topic

https://docs.google.com/presentation/d/1pX73TnsJzYhG0DBbkIYIPh7rHZ3z_2VHlAQUzqNLAJ8/edit?usp=sharing

1 note

·

View note

Text

PMXX

Digital PMXX is a startup founded by two industry veterans

youtube

What is MetalBacked.Money?

MetalBacked.Money is a decentralized digital asset backed by physical gold and platinum reserves, which means that MBMX is not only an investment, but also a savings account. The goal is to safely improve financial well-being — to be and have a positive impact on the lives of others, helping millions of people shape their financial futures — People's Money.

DuDe coin is a new cryptocurrency that has several unique features that make it stand out from the rest. It is based on blockchain technology and uses a proof of stake algorithm, which makes it more secure and efficient than other cryptocurrencies. In addition, DuDe coin has very low transaction fees, making it ideal for use in everyday transactions. If you are interested in learning more about the DuDe coin or want to start using it yourself,

Why Choose People's Money?