#How to get money back from Forex scam

Explore tagged Tumblr posts

Text

How to Choose the Best Broker for Stock, Forex, and Crypto Trading in 2024?

Navigating the world of trading can be overwhelming, especially when it comes to selecting the right broker to meet your trading requirements. Whether you’re interested in stocks, forex, or cryptocurrencies, the choice of broker can significantly impact your trading experience and success. In this post, we’ll explore the key factors to consider when choosing a broker and introduce you to ForexJudge.com, a reliable resource that offers comprehensive reviews and detailed analysis of the world’s best brokers.

Factors to Consider When Choosing a Broker

Regulation and Security:

Ensure the broker is regulated by a reputable financial authority. Regulation provides a level of security and oversight, protecting you from fraudulent activities.

Look for brokers that offer robust security measures, including encryption and two-factor authentication, to safeguard your funds and personal information.

Trading Platform:

A good trading platform should be user-friendly, reliable, and equipped with essential tools for analysis and trading.

Consider whether the platform offers mobile compatibility if you plan to trade on-the-go.

Fees and Commissions:

Compare the fees and commissions charged by different brokers. Lower fees can significantly enhance your profitability, especially if you trade frequently.

Be aware of hidden fees, such as withdrawal charges, inactivity fees, or charges for additional services.

Range of Assets:

Ensure the broker offers the range of assets you’re interested in trading. If you plan to diversify your portfolio, choose a broker that provides access to stocks, forex, and cryptocurrencies.

Some brokers specialize in specific asset classes, so make sure your chosen broker aligns with your trading preferences.

Customer Support:

Reliable customer support is crucial, especially if you encounter issues with your account or trading platform. Look for brokers that offer multiple support channels, including live chat, phone, and email.

Check reviews to gauge the quality and responsiveness of the broker’s customer service.

Education and Resources:

Many brokers offer educational resources such as tutorials, webinars, and market analysis. These resources can be invaluable, especially for beginners.

A broker that provides regular market updates and trading insights can help you stay informed and make better trading decisions.

How ForexJudge.com Can Help

With so many brokers available, making an informed choice can be challenging. This is where ForexJudge.com comes in. ForexJudge is a trusted platform that has compiled detailed reviews and analysis of the world’s best brokers. By providing comprehensive information and user feedback, ForexJudge helps traders make well-informed decisions.

Detailed Broker Reviews

ForexJudge offers in-depth reviews of brokers across various asset classes, including stocks, forex, and cryptocurrencies. Each review covers critical aspects such as regulation, fees, trading platforms, and customer support. By reading these reviews, you can gain valuable insights into the strengths and weaknesses of different brokers, helping you choose the one that best meets your needs.

User Feedback and Ratings

In addition to expert reviews, ForexJudge features user feedback and ratings. This community-driven aspect allows traders to share their experiences and provide honest assessments of brokers. This real-world feedback can offer a clearer picture of what to expect and help you avoid potential pitfalls.

Regular Updates and Alerts

The trading world is dynamic, with brokers frequently updating their services, fees, and policies. ForexJudge keeps you informed with regular updates and alerts, ensuring you have the latest information at your fingertips. This proactive approach helps you stay ahead of the curve and make timely decisions.

Making the Final Decision

When choosing a broker, it’s essential to consider your trading goals, risk tolerance, and preferred asset classes. By leveraging the resources available on ForexJudge, you can make a well-informed decision that aligns with your trading strategy.

Steps to Follow:

Identify Your Needs:

Determine what you want to trade (stocks, forex, crypto) and what features are most important to you (low fees, robust platform, educational resources).

Research and Compare:

Use ForexJudge’s detailed reviews and user feedback to compare different brokers. Pay close attention to factors such as regulation, fees, and customer support.

Test the Platform:

Many brokers offer demo accounts. Use these to test the trading platform and ensure it meets your needs before committing real funds.

Start Small:

When you choose a broker, start with a small investment to test the waters. As you gain confidence and experience, you can increase your trading capital.

Conclusion

Choosing the right broker is a crucial step in your trading journey. By considering factors such as regulation, fees, trading platforms, and customer support, you can make an informed choice that enhances your trading experience.

For a reliable resource in your broker selection process, turn to ForexJudge.com. With its comprehensive reviews, user feedback, and regular updates, ForexJudge provides the insights you need to make the best decision for your trading needs.

Happy trading, and may your investments be fruitful!

#Forex Trading Reviews#Best Forex Brokers#Crypto trading#Financial News Services#Forex Trading Forum#How to get money back from Forex scam#Forex Scams#Crypto Scams#Best Forex Trading Platforms#Financial Calendar

145 notes

·

View notes

Text

🚨 Fake Forex Brokers List in the Philippines: What Every Trader Must Know

If you’re researching the fake forex brokers list in the Philippines, you’re already taking a smart first step toward protecting your finances. In recent years, the popularity of forex trading has skyrocketed across the country. However, with this boom has come a wave of fraudulent brokers operating under false pretenses, targeting Filipino traders through social media, messaging apps, and even word of mouth.

These scam brokers can look legitimate on the surface. Their websites often appear professional, they may have active social media profiles, and they promise things like "guaranteed returns" or "zero risk" investments. The sad reality is that once you deposit your money, it becomes nearly impossible to get it back.

🎭 How Scam Brokers Operate

Fake forex brokers use a range of tactics to trick people. Their strategy usually begins with high-pressure marketing, promising fast profits with little effort. They often contact users through Facebook, TikTok, or WhatsApp, using fake screenshots of supposed earnings or testimonials to appear trustworthy.

Once a trader signs up, they’re typically asked to deposit funds. Initially, the platform may show fake profits to build trust. But when the trader tries to withdraw money, problems start: long delays, excuses about account verification, or sudden “processing fees.” In many cases, the money is never returned.

🚩 Red Flags of a Fake Broker:

★ No official registration or regulation

★ Guaranteed returns or income promises

★ Poor or non-existent customer service

★ Platforms that display manipulated or inconsistent data

★ Rejected or delayed withdrawals without explanation

These warning signs often go unnoticed until it’s too late. That’s why awareness is your best defense.

❗ Brokers to Avoid in the Philippines

Here’s a list of brokers that have been reported for suspicious activity, lack of regulatory oversight, or direct complaints from traders. These names are commonly linked with fraudulent practices and should be avoided:

✅ FX NextGen

✅ Calibur

✅ Titan FX

✅ FTE FX

✅ Prime XB

✅ Tradersway

✅ MidasGlobe

✅ Kronosinvest

✅ Binomo

✅ Circleforex

✅ First BTC FX

If you're currently dealing with any of these brokers, stop immediately. Cease all further deposits, save any communication or transaction records, and report the broker to the Securities and Exchange Commission (SEC) Philippines. Share your experience in online forums or trading communities to warn others. To read more

👉 Click here..

🇵🇭 Why the Philippines Is a Target

Now, let’s highlight why the fake forex brokers list in the Philippines continues to grow. The country has seen a surge in interest in online trading, with many Filipinos turning to forex as an alternative income stream. However, financial education and digital awareness remain limited for much of the population, creating an ideal target group for scammers.

These unregulated brokers often operate from offshore jurisdictions, making them difficult to trace. They can disappear overnight, leaving traders without any legal recourse. This is especially dangerous for first-time traders who may not know how to verify a broker’s legitimacy.

✅ How to Spot a Legitimate Broker

To protect yourself from scams, always take the time to verify a broker before signing up or depositing money. Here’s a simple checklist:

1. Verify SEC Registration

Ensure that the broker is properly registered with the Securities and Exchange Commission (SEC) before proceeding. A licensed broker will clearly display its regulatory credentials.

2. Check for Global Regulation

Top-tier brokers are regulated by international authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). A valid license from any of these adds credibility.

3. Review Trader Feedback

Search for independent reviews from real users. Avoid brokers with consistently bad ratings or unresolved complaints.

4. Test the Withdrawal Process

Start with a small deposit and try to withdraw your earnings. If there are delays, high fees, or unclear explanations, reconsider your choice.

5. Avoid Pressure to Deposit More

Legitimate brokers won’t pressure you into making large deposits or upgrading accounts without a clear benefit.

❓ Frequently Asked Questions (FAQ)

Q1: How do I know if a broker is fake?

Check their license, read reviews, and test their withdrawal system. Lack of transparency is a major red flag.

Q2: What should I do if I’ve already invested with a scam broker?

Stop further transactions immediately. Gather all communication records and report the incident to the SEC and your bank.

Q3: Can I get my money back?

It’s difficult, but not impossible. Report the case as soon as possible to relevant authorities and request a chargeback from your payment provider.

Q4: Is forex trading legal in the Philippines?

Yes, it is legal. But you must use a broker that is registered and regulated by local or international financial authorities.

Q5: Are offshore brokers always untrustworthy?

Not always, but many unregulated offshore brokers are involved in fraudulent activity. Always verify their licenses.

🔚 Final Thoughts

The Top Fake Forex Brokers to Avoid in the Philippines isn’t just a headline—it represents real people who’ve lost hard-earned money to online fraud. Names like FX NextGen, Calibur, Titan FX, FTE FX, Prime XB, Tradersway, MidasGlobe, Kronosinvest, Binomo, Circleforex, and First BTC FX have all been associated with withdrawal issues, fake platforms, or missing funds.

If you're already trading or planning to start, don’t rush. Protect yourself by doing proper research, verifying all regulatory claims, and starting small. Remember, the fake forex brokers list in the Philippines is a warning created from real losses. Be smart. Be skeptical. And always verify before you invest.

#forex trading#forex broker#forex indicators#forexsignals#forex market#forex#forex expert advisor#forex robot#stockmarket

0 notes

Text

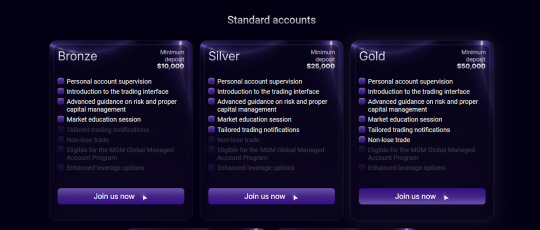

OneNexusWealth.com reviews – Account Types

When it comes to choosing a forex broker, trust is everything. The internet is full of flashy websites and bold promises — but how do you separate the serious players from the scams? That’s exactly why we’re taking a closer look at OneNexusWealth.com reviews in this brand review.

This broker has been gaining traction lately, and traders are starting to ask the right questions. Is it licensed? How do users rate it? What’s the platform like? Instead of just throwing around assumptions, we’re digging into real data — facts that can actually help you make a smart decision.

Flexible Account Tiers Tailored for Every Serious Trader

Account Type

Looking at this account structure, we can clearly see a tiered system that’s designed to cater to both intermediate and high-net-worth traders. Bronze, with its $10,000 entry point, already signals that this is not your average low-barrier broker — it’s aimed at serious investors. That alone tells us a lot.

Each higher tier likely brings more advanced trading conditions, better spreads, and personalized support. Think about it: would a broker offer seven levels of accounts unless they had a well-developed infrastructure and segmentation strategy? This looks like a good argument in favor of legal operation and strong business planning.

Domain Registration: A Strong Signal of Legitimacy

Let’s start this brand review with one of the most underrated, yet powerful indicators of legitimacy — domain registration dates.

According to the data, the domain for OneNexusWealth.com review was purchased in 2021-01-11, while the brand itself officially launched in 2022. This means the broker secured its digital presence well before going public. Now, why does that matter?

Well, here’s the thing: scammers and shady brokers usually buy domains at the last minute, slap together a website, and rush to market. But in this case, OneNexusWealth.com reviews clearly took the time to plan and prepare. They weren’t just after quick cash. They were setting the stage for long-term business. That looks like a good argument in favor of legality.

It also shows that the team behind the brand likely went through stages of regulatory procedures, platform development, and strategic planning. Who invests time and money a year in advance unless they’re serious? We think this broker can be trusted.

Regulation by FCA: A Stamp of Serious Credibility

One of the most convincing signs that a forex broker is playing by the rules is having a license from the FCA (Financial Conduct Authority) — and OneNexusWealth.com review has it.

Why is this such a big deal? Because the FCA is one of the most respected financial regulators in the world. We're not talking about a paper regulator or an offshore loophole; this is the UK’s top financial watchdog. Getting regulated by the FCA isn’t easy — it requires transparency, capital adequacy, regular audits, and strict adherence to customer protection protocols. That’s not something a shady broker can just fake.

And here’s another way to think about it: brokers under FCA oversight are legally required to keep client funds in segregated accounts. This protects traders in case of insolvency. So, when we see that OneNexusWealth.com reviews is FCA-regulated, it immediately gives weight to the argument that this is a legitimate and trustworthy company. This feels like more than just a formality — it’s a foundation of trust.

Client Reviews: A Solid Reputation Backed by Real Traders

Now, let’s talk about what actual users are saying — because in this industry, real feedback speaks volumes. OneNexusWealth.com reviews has a 4.2 rating on Trustpilot, with a total of 122 reviews, and out of those, 120 are positive. That’s not just good — in the world of forex brokers, that’s exceptional.

Why does this matter so much? Because Trustpilot isn’t just any review site. It’s one of the most widely respected platforms for collecting verified user experiences. A rating above 4 is already considered strong in the finance niche, where even top-tier brands often struggle to stay above 3.5. So, 4.2 — that’s impressive.

But here’s what makes it even more interesting: 120 out of 122 comments are positive. That’s more than just a good score — it shows consistent satisfaction across a broad user base. Would this many traders leave good reviews if they weren’t getting real results? We don’t think so. This looks like a good argument in favor of legal and responsible service.

Final Verdict: OneNexusWealth.com reviews Looks Built for the Long Game

After breaking down all the facts, OneNexusWealth.com reviews really starts to stand out — and not in a vague, “trust us” kind of way, but with real, measurable signs of legitimacy.

They registered their domain a full year before the brand’s official launch. That’s planning. That’s preparation. Then there’s the FCA license — one of the hardest-to-get and most respected regulatory seals in the financial world. That alone could convince a lot of cautious traders.

And let’s not forget the user feedback. A 4.2 rating on Trustpilot with nearly all reviews being positive? That’s not just a happy accident — that’s consistency, and it suggests the broker delivers on its promises.

Everything we’ve seen — from licensing to user experience to structured account types — tells the same story: OneNexusWealth.com reviews isn’t cutting corners. This looks like a broker that’s here to stay, built on regulation, transparency, and trust.

1 note

·

View note

Text

Legal Sword to Protect Your Rights and Interests--DJK LAW GROUP Capital Recovery Case Sharing

In today’s fast-paced digital world, financial scams are everywhere—from fake investment platforms to polished “customer service” frauds. Victims often lose large sums of money before realizing they’ve been deceived. In the face of shock and helplessness, many ask: “Is it even possible to recover my money?”

The answer is: Yes. Because justice, backed by law, never abandons you.

DJK LAW GROUP(https://www.djkllp.com/) is a professional legal team specializing in financial scams and asset recovery. We’ve successfully helped hundreds of victims reclaim their funds. In this article, we’ll share several real-life cases that show how the law can be your most powerful ally.

Fake Investment Platform – 85% Recovery (Case ID: DLG2024-INV01) Background Ms. Li was added to a “wealth management group” on social media. Group “mentors” lured her into investing in a high-return forex platform. Initially, small withdrawals seemed successful. But after depositing more, she couldn’t log in or withdraw funds—losing about RMB 350,000.

DJK LAW GROUP’s Intervention We quickly initiated asset preservation actions. Using legal and technical tools, we traced the payment processor and worked with the court to freeze suspect accounts.

Result Recovered RMB 300,000+ (over 85%) within 21 business days.

Task Rebate Scam – Full Recovery in 15 Days (Case ID: DLG2024-FRAUD07) Background Mr. Zhang saw an ad on a short video app promising part-time commissions for “task completion.” After getting minor rebates, he was tricked into making a larger payment. Eventually, the scammer vanished, and he lost over RMB 20,000.

Legal Action We gathered payment evidence, located multiple receiving accounts, and issued legal letters to the relevant platforms.

Result Full recovery in just 15 days—without going to court.

Cryptocurrency Scam – Cross-Border Recovery of RMB 300,000 (Case ID: DLG2024-CRYPTO03) Background Mr. Wang met a so-called “Hong Kong investment advisor” through a dating app. He was lured into investing in a fake crypto platform and lost RMB 300,000. Later, the platform became inaccessible and the scammer disappeared.

Cross-Border Strategy We mapped out Mr. Wang’s transaction flow, collaborated with Hong Kong law firms, and contacted a U.S.-based crypto wallet provider.

Result Frozen assets in digital wallets and recovered RMB 300,000 in 3 months.

Why DJK LAW GROUP Is Effective 1)Multidisciplinary Team: Our lawyers specialize in finance, criminal litigation, and global investigations.

2)Strong Forensic Capabilities: Skilled in digital forensics, fund tracing, and IP tracking.

3)International Network: Strong ties with overseas law firms and financial institutions.

4)Transparent Process: Clients receive detailed progress updates at every stage.

Law Is Not the Last Resort—It’s the First Sword to Draw Many think reporting to the police is all they can do. But with the right legal tools, we can:

1)Freeze scammer assets via court orders;

2)Request transaction reversals from banks and platforms;

3)File lawsuits and initiate legal enforcement.

These are the weapons DJK LAW GROUP uses every day to protect your rights.

Final Word: Justice Deserves a Strong Hand Being scammed isn’t the end—giving up is. At DJK LAW GROUP, we are committed to standing with every victim. Every dollar lost deserves to be found. Every client deserves justice.

If you or someone you know has fallen victim to a scam, don’t hesitate. Let the law fight for you—starting today.

1 note

·

View note

Text

Lexoro Byte Review 2025 - Is The Platform Scam Or Real?

Overall Rating: ⭐⭐⭐⭐☆ (4.6/5) AI Performance: 4.7/5 Ease of Use: 4.5/5 Earning Potential: 4.6/5 Security & Transparency: 4.4/5 Customer Support: 4.5/5

👉 Open Your Lexoro Byte Account Now

🚀 What is Lexoro Byte?

Lexoro Byte is a cutting-edge AI-driven trading platform designed for individuals who want to trade smarter—not harder. As of 2025, it stands out for its advanced data algorithms, automatic trading execution, and real-time predictive analysis across cryptocurrencies, forex, and commodities.

Whether you're a beginner or an experienced investor, Lexoro Byte is built to maximize returns while minimizing effort and risk.

💡 Key Features of Lexoro Byte

🤖 1. Advanced AI-Powered Trade Engine

The platform uses machine learning and market sentiment analysis to generate highly accurate buy/sell signals.

📈 2. Automated Trading

You don’t have to manually place trades—Lexoro Byte’s automation feature does it for you. Just set your preferences and let the system operate.

📊 3. Multi-Market Access

Trade across a variety of asset classes:

📉 Forex (e.g., EUR/USD, GBP/JPY)

🪙 Cryptocurrencies (e.g., BTC, ETH, SOL)

💰 Commodities (e.g., Gold, Oil)

🧪 4. Free Demo Mode

Not sure if it’s for you? Try the demo account to test the full system risk-free before committing real funds.

🔐 5. Secure Platform

With SSL encryption, regulated broker partnerships, and KYC verification, Lexoro Byte places a strong emphasis on user safety.

👍 Pros & 👎 Cons

✅ Pros:

✅ No prior experience needed

✅ Fast setup process

✅ Real-time AI updates & trade execution

✅ Transparent reporting and profit tracking

✅ 24/7 trading capability

❌ Cons:

❌ Not available in all countries (e.g., U.S., Canada)

❌ Requires stable internet connection for best performance

❌ Some features locked behind upsells (premium tools)

👉 Open Your Lexoro Byte Account Now

🧾 How Does Lexoro Byte Work?

Sign Up Create a free account with basic info and complete identity verification.

Fund Your Account Deposit a minimum of $250 to activate live trading mode.

Set Your Strategy Choose from conservative, balanced, or aggressive risk profiles.

Activate Auto Mode Lexoro Byte starts analyzing, executing trades, and adjusting strategies in real-time.

Withdraw Anytime Profits can be withdrawn within 24–48 hours, depending on the payment method.

🧑💻 Who Is Lexoro Byte Best For?

✅ Beginners looking to automate trading

✅ Busy professionals wanting hands-free income

✅ Crypto enthusiasts exploring AI-assisted strategies

✅ Investors seeking diversified options in one platform

❌ Not ideal for manual day traders or those in restricted regions

💬 Real User Reviews

“Lexoro Byte helped me get into crypto trading without having to learn everything from scratch. The automation is top-tier.” — Monique D., Netherlands

“I’ve been using Lexoro Byte for over 6 months now. The profits are consistent, and the dashboard makes everything easy to track.” — Andre W., Brazil

“Best part? I don’t have to be online all day. The system takes care of trades while I focus on my 9–5.” — Kieran M., Ireland

🛡️ Is Lexoro Byte Legit or a Scam?

✅ Lexoro Byte is legit. It works with regulated brokers, provides full transparency, and gives users access to a demo version before investing real money. While it's not a guaranteed income generator (nothing is), it's a trusted option for automated, data-backed trading.

❓ Frequently Asked Questions (FAQs)

❓ What is Lexoro Byte?

Lexoro Byte is an AI-powered trading software that automates investments in crypto, forex, and commodities using data-driven strategies.

❓ Is Lexoro Byte beginner-friendly?

Yes. The platform is designed for users with zero trading experience and includes guided setups and demo training.

❓ How much does it cost to use?

There's no subscription fee. You only need a $250 minimum deposit to activate the live trading feature.

❓ Is there a mobile app?

While there’s no dedicated app yet, the web-based dashboard is mobile-responsive and works well on phones and tablets.

❓ Can I lose money?

Yes. Like any form of investing, trading carries risk. However, Lexoro Byte's AI aims to optimize profit while managing downside risk.

❓ Is my data safe?

Absolutely. Lexoro Byte uses SSL encryption and KYC verification to ensure user privacy and security.

❓ Are there withdrawal limits?

There are no limits, but processing times range from 24–48 hours depending on your method.

👉 Open Your Lexoro Byte Account Now

0 notes

Text

Gerchikco (Gerchik and Co): Is this is a Reliable Broker? The Tryth Exposed

Gerchikco aka Gerchik and Co is a product of a famous man called Alexander Gerchik. He appeared in a documentary called the Wall Street Warriors. However, just because a forex broker has a celebrity’s backing, it doesn’t mean it’s reliable. There are a lot of factors to consider, the broker’s regulation, address, trading conditions, and a whole lot more before I can say it’s worth your time and money.

Gerchikco License and Regulation

Gerchik and Co is based in Vanuatu, an offshore region. However, even though Vanuatu is an offshore region, it has a financial regulator, the Vanuatu Financial Services Commission. When I checked the VFSC’s register for Gerchikco’s name, I found that they are really registered there and hold a license.

It’s a good sign.

In order to get a license from VFSC, a broker must deposit $50,000 as the security bond with the local Registrar of the Supreme Court. This measure ensures that the broker acts in the interests of its clients and not against them.

Read about: HighTopFX

I also found out that your funds will remain separate from the broker’s funds, ensuring that the broker can’t take them. In case a dispute occurs, you might get 20,000 compensation from the Financial Commission, which is another assurance of Gerchikco’s reliability.

However, VFSC is not among the most reputed regulatory authorities.

Stricter financial regulators exist in many regions such as the US and Europe. These regulators impose heavy restrictions and laws on forex brokers (and similar service providers) to ensure that the broker doesn’t act against the interests of its client.

How can you spot a broker who is trying to deceive you?

A broker’s credentials, registration, and job history can be reviewed using BrokerCheck, a free online tool provided by FINRA. Disputes with clients, disciplinary actions, and specific financial and criminal matters on the broker’s record are all covered in the disclosure portion of BrokerCheck.

On top of that, regulators like FCA offer insurance compensation in case the broker steals the funds of their clients. For example, FCA can give you up to £85,000 if an FCA-regulated broker steals your funds.

It would be best to go with brokers that have a license from CySEC or FCA depending on your region. They have stronger regulations and keep a closer watch on their licensed brokers.

Gerchikco Trading Conditions

You should always check the trading conditions of a forex broker before doing business with them. Let’s see what are trading conditions of this broker:

Trading Platform

To be honest, the best trading platforms available in the industry are Metatrader 4 and 5. Almost all reputed forex brokers use these platforms because they offer a ton of features.

And Gerchik and Co understands this fact very well. They provide you with both of the trading platforms, MetaTrader 4 and MetaTrader 5. You get access to MetaTrader’s app market, trading tools, and automated trading, all of which simplify your trading experience and make it easier for you to trade.

The charting features of MetaTrader platforms are quite impressive and are certainly worth considering. They offer plenty of technical analysis indicators such as Bollinger Bands and Fibonacci retracement, simplifying your trading experience further and ensuring that you get the best chances of making profits.

It’s great that Gerchikco offers MetaTrader 4 and 5 platforms to its clients.

Minimum Deposit

Gerchikco has kept its minimum deposit requirement quite accessible at $100. Although it’s a little higher than you would expect from a reliable broker, it’s not too high as shady brokers keep.

Many forex scams keep their initial deposit requirement high which allows them to grab a lot of funds immediately. Such brokers are aware of their pathetic services and so, they don’t give you a chance to test out their services beforehand. Instead, they force you to make a big financial commitment. In case you decide to discontinue availing their services, they will steal the huge deposit you had made.

It’s a common strategy among shady forex brokers and that’s why I don’t recommend trading with such brokers.

Leverage and Spreads

Everything was looking great until I checked the broker’s offered leverage. Gerchikco offers 1:100 leverage ratio, which is too high by industry standards.

High leverage is usually a sign of a scam. This is why financial regulators restrict their brokers on how much leverage they can offer to their clients. For example, the UK-based regulator FCA doesn’t allow its brokers to offer a leverage ratio higher than 1:30.

High leverage ratios can wipe out all of your earnings and even put you in debt quickly. They are very risky, especially if you’re a beginner.

Gerchikco offers tight spreads of 0.4 pips. The spreads determine the cost of each trade for a trader and that’s why the tighter they are, the better is the broker.

Trading Accounts

Gerchikco offers multiple trading accounts to its clients:

Easy Start for Investors

This account requires a minimum investment of $100 and offers you 1:100 leverage and statistics. You’d have to pay $10 commission per lot.

Mini

This account requires a minimum deposit of $500 and offers all the benefits of the previous account along with the feature of Algo Trading. You’d have to pay $10 commission per lot with this account.

Simple

This account requires a minimum investment of $1000. You get all the benefits of the previous accounts and have to pay $10 per lot.

Silver

This account requires a minimum deposit of $10,000. You’d have to pay $9 fee per lot and get all the benefits of the previous accounts.

Gold

The Gold account requires a minimum investment of $25,000. You’d have to pay $8 commission per lot and get all the benefits of the previous accounts.

Platinum

The minimum deposit for this account is $100,000 and offers all the benefits of the previous accounts. In addition to those benefits you’d only have to pay $7 commission per lot and get 0 spread. Gerchik and Co offers you dedicated custom bots with this account as well.

Gerchikco Payment Methods and Charges

Transaction Methods

Gerchikco provides you with several payment options. You can fund your trading account with WebMoney, Bitcoin, ADVCash, Neteller, credit card, Payeer, Skrill, PerfectMoney, and bank transfer. However, I recommend funding your trading account only with bank cards as they let you file a chargeback 540 days since the date of making the deposit. This way, if something goes wrong, you can still get your money back. Bank transfer and Bitcoin payments are non-refundable so it’s best to avoid using them.

Fees

The broker doesn’t charge anything for making deposit and withdrawals. Gerchikco charges you commission per lot depending on your trading account. They claim to process withdrawal requests within a business day which is quicker than the industry average of 48 average.

Offered Bonuses

Things looked quite good until I read their terms and conditions. Gerchik and Co offers bonuses to its clients however, it doesn’t mention them on its website.

Reputed financial regulators such as FCA don’t let their brokers offer bonuses to their clients because they make withdrawals trickier and complicate the situation.

Similar Post: FXGroup100

Moreover, a common strategy among shady forex brokers is they would offer you a ton of bonuses. Bonuses in the forex industry are notorious as they allow the broker to complicate the withdrawal process for the user. The funds you receive in a bonus always belong to the broker, not you.

Should You Trade with Gerchikco? No

The forex industry attracts a lot of scams and they are of various sorts. Some scammers tend to give an unsolicited call and claim that you’re eligible for a random bonus. Others would run ads on the internet claiming to offer attractive deposit bonuses or easy profits.

Creating a website and filling it with lies is very easy. And these scammers target inexperienced traders too. Usually, these brokers operate from offshore areas such as St. Vincent or the Commonwealth of Dominica. They operate from such areas because these places don’t have financial regulators like the US or the UK. So they don’t have to follow any strict laws and can easily steal the funds of their users without facing any legal repercussions.

You should always check a broker’s regulation and T&C’s before trading with them.

The regulator of Gerchikco is not a reputed one. Even though they follow a lot of procedures that ensure that the broker won’t act against your interests, the terms and conditions of the broker weren’t good.

First, there’s the issue of high minimum deposit requirements. There are plenty of reputed brokers that have minimum deposit requirements as low as $5. So it doesn’t make sense to choose this option when you have better options available.

Second, the broker claims to offer bonuses in its terms and conditions. Bonuses can make it very difficult for you to get withdrawals.

Gerchikco Review: Conclusion

Gerchikco doesn’t seem like a scam but it’s not a good option. You can find much better options in the market and you don’t have to trade with this broker. I don’t recommend trading with them.

There are many scams in the forex industry. And they keep growing. The best way to combat these scams is to spread the truth about them so their schemes would fail before they even start.

If you know someone who’s interested in forex trading, share this article with them. They should know the truth about such scammers.

1 note

·

View note

Text

Trusted Forex Scam Recovery Experts in the USA to Get Your Money Back

Forex trading is an attractive investment opportunity for many people in the USA, but it can also expose traders to the risk of fraud. Forex scams are increasingly common, with scammers targeting unsuspecting investors. If you've fallen victim to a Forex scam, it may feel like there's no way to recover your lost funds. However, Forex scam recovery experts can assist you in getting your money back. This article explores how these experts can help, with a particular focus on Fusion Forensics, one of the leading firms specializing in Forex scam recovery.

Understanding Forex Scams: How They Work

Forex scams often involve fraudulent brokers or platforms that prey on traders by offering unrealistic returns or unregulated trading conditions. Here are some common types of Forex scams:

Fake Brokers: Scammers set up fake Forex trading platforms or brokerage services to lure investors into depositing funds. Once the money is deposited, these brokers disappear, leaving investors with nothing.

Ponzi Schemes: Some Forex scams operate like Ponzi schemes, using the investments of new traders to pay returns to existing investors. Eventually, the scheme collapses, and many investors lose their funds.

Manipulated Markets: Fraudulent brokers can manipulate currency exchange rates to create artificial profits or losses, often leaving traders with substantial financial losses.

Understanding how these scams operate is the first step in recognizing and avoiding them. However, if you've already fallen victim, the next step is recovery, and that's where experts like Fusion Forensics come into play.

How Forex Scam Recovery Experts Can Help You

If you’ve been scammed in Forex trading, you don’t have to navigate the recovery process alone. Forex scam recovery experts specialize in helping victims of fraud recover their investments. Here’s how they can assist:

1. Thorough Case Evaluation and Consultation

Forex scam recovery experts begin by offering a free consultation to assess your situation. They gather all the necessary details about the scam, including the broker or platform involved, the amount of money lost, and any evidence you have. Based on this information, they provide advice on the next steps and the likelihood of successfully recovering your funds.

2. Evidence Collection and Investigation

To recover your funds, experts need to build a strong case against the scammer. They will gather crucial evidence such as transaction records, communications with the broker, and any details regarding the platform used. This evidence is vital for taking legal or financial action.

3. Legal and Financial Action

Forex scam recovery experts leverage their knowledge of financial regulations and laws to take legal action. They work closely with regulatory bodies and legal professionals to ensure that your case is handled according to the law. They may also engage with the authorities to freeze the scammer's assets or take action against unregulated brokers.

4. Confrontation with Fraudsters

After gathering all the necessary evidence, scam recovery experts may initiate negotiations or confrontations with the fraudsters. In some cases, this may involve communicating with unregulated brokers, lawyers, or other parties involved to demand the return of your funds.

5. Preventing Future Scams

Forex scam recovery experts not only help you recover your lost money, but they also provide guidance on how to protect yourself from future scams. They educate investors on recognizing red flags in the Forex market and suggest trusted brokers regulated by financial authorities. This helps ensure that you can continue trading safely and confidently.

Why Choose Fusion Forensics for Forex Scam Recovery?

When it comes to recovering your lost investments, working with the right experts is crucial. Fusion Forensics is a trusted name in the field of scam recovery, and they offer specialized services to help Forex scam victims in the USA.

Fusion Forensics: Experts in Fraud Recovery

Fusion Forensics is a leading company that specializes in cryptocurrency and Forex scam recovery. Their experts have extensive experience dealing with unregulated brokers and fraudulent trading schemes. Here are some of the services Fusion Forensics provides:

Case Evaluation: Fusion Forensics offers a free initial consultation to help you determine the best course of action for recovering your funds.

Comprehensive Investigation: The team conducts thorough investigations to trace your funds and collect essential evidence for your case.

Legal Action and Regulatory Support: They have a deep understanding of financial laws and regulations, working with legal professionals to take action against fraudsters.

Transparent Communication: Throughout the process, Fusion Forensics keeps you informed, providing regular updates on the progress of your case.

Expert Advice on Avoiding Future Scams: They offer tips and guidance to help you recognize legitimate brokers and avoid future scams in the Forex and cryptocurrency markets.

To get started with Fusion Forensics, visit their website here.

How to Avoid Forex Scams in the Future

While it’s essential to focus on recovery after falling victim to a Forex scam, it's equally important to learn how to avoid future scams. Here are a few tips to protect yourself:

1. Check for Regulation and Licensing

Always verify that the Forex broker you're working with is properly regulated. In the USA, the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) are key regulatory bodies. Make sure that any broker you choose is registered with one of these organizations.

2. Research the Broker Thoroughly

Before committing any funds to a Forex platform, research it thoroughly. Look for independent reviews, testimonials, and any complaints from other traders. Be cautious if you can’t find verifiable information about the platform.

3. Watch Out for Unrealistic Promises

Forex trading inherently carries risks, and any broker promising guaranteed high returns with little to no risk is likely a scam. Avoid brokers that make unrealistic claims about potential profits.

4. Ensure a Secure Trading Platform

Always use a secure, encrypted platform when trading Forex. Look for HTTPS encryption and other security measures to protect your personal and financial information.

5. Start Small and Practice First

If you're new to Forex trading, start small. Many regulated brokers offer demo accounts where you can practice trading without risking real money. This is an excellent way to familiarize yourself with the platform and avoid making hasty decisions.

Conclusion

Forex scams can result in significant financial losses, but with the right expertise, you can reclaim your lost funds. Forex scam recovery experts, like the team at Fusion Forensics, can provide the support and guidance you need to recover your investments. By acting quickly and engaging with professionals, you increase the chances of getting your money back and ensuring that you don’t fall victim to future scams.

If you've been scammed in Forex trading, reach out to Fusion Forensics today to begin the recovery process and protect your financial future.

0 notes

Text

Top Crypto Scam Recovery Services in the USA: How to Reclaim Your Funds

Cryptocurrency has revolutionized the financial world, but it has also opened the door for scammers to prey on unsuspecting investors. Whether you’ve fallen victim to a fake ICO, Ponzi scheme, or a fraudulent investment platform, you might be wondering how to reclaim your funds. Fortunately, there are crypto scam recovery services that specialize in helping victims recover their lost assets. In this article, we’ll highlight the top recovery services in the USA and guide you on how to recover your funds efficiently, with a special mention of me14solutionsltd as a trusted recovery partner.

Why Crypto Scams Are So Prevalent

Before diving into the recovery process, it’s important to understand why cryptocurrency scams are so common. Scammers exploit the anonymity and global nature of digital currencies, often targeting inexperienced investors. Here are a few types of prevalent scams:

Phishing Scams: Fraudulent websites or emails trick users into providing private keys or account information.

Ponzi Schemes: Fake investment platforms that promise high returns, only to collapse once new investors stop pouring in money.

Rug Pulls in DeFi Projects: Fraudulent decentralized finance (DeFi) projects that disappear, taking all investor funds.

Fake ICOs and Token Sales: Scams involving fake initial coin offerings (ICOs) where investors buy tokens from non-existent companies.

Now, let’s explore the top crypto scam recovery services that can help you get your funds back.

How Crypto Scam Recovery Services Can Help

Crypto scams can be difficult to navigate on your own due to the decentralized and irreversible nature of cryptocurrency transactions. Recovery services offer expertise in tracing stolen funds, legal assistance, and practical steps to recover what was lost. The services provided by professional companies typically include:

Forensic Analysis: Experts track stolen funds across the blockchain.

Negotiation and Mediation: They may work with the scammers or third-party platforms to recover funds.

Legal Action: In cases where negotiations fail, legal teams will pursue scammers through international legal frameworks.

Top Crypto Scam Recovery Services in the USA

Here are some of the top-rated crypto scam recovery services in the USA that can assist victims of fraudulent schemes:

1. me14solutionsltd

If you’ve fallen victim to a cryptocurrency scam and need expert help, me14solutionsltd is a top choice. Their team of forensic experts and legal professionals provides comprehensive fund recovery services. Specializing in cryptocurrency scams, forex fraud, binary options scams, and investment fraud, they use advanced tools to trace stolen funds and implement strategies to recover them.

Key Features:

Expert Fund Recovery: Specialized in tracing stolen cryptocurrency across various blockchain platforms.

Global Reach: They handle cases worldwide, ensuring that victims from any part of the world can access their services.

Experienced Team: A dedicated team of legal and forensic professionals helps recover funds efficiently and swiftly.

Tailored Strategies: Each case is unique, and me14solutionsltd provides customized recovery solutions.

2. CoinFirm

CoinFirm is a leading crypto compliance and blockchain analytics platform that offers recovery services for victims of crypto fraud. Their proprietary technology helps trace and trace illicit transactions, which is invaluable for recovering funds.

Key Features:

Blockchain Analytics: Uses blockchain analysis tools to track stolen funds.

Compliance: Works with regulatory bodies to ensure that victims' rights are protected.

Reputation: Known for their work in cryptocurrency fraud detection and recovery.

3. Crypto Asset Recovery (CAR)

Crypto Asset Recovery offers a comprehensive suite of services to assist with recovering funds from crypto scams. Their team uses a combination of blockchain forensics, negotiation, and legal tools to help victims reclaim their lost assets.

Key Features:

Forensic Tools: Advanced tools to trace and identify where stolen funds were sent.

Experienced Negotiators: Works with both victims and exchanges to recover assets.

Legal Assistance: Offers legal support if recovery efforts require litigation.

4. Chargebacks911

Chargebacks911 is a global leader in chargeback and fund recovery services. While they specialize in chargebacks for traditional finance, they also offer services for victims of cryptocurrency fraud. They are known for their strong relationships with financial institutions, which helps facilitate quicker fund retrieval.

Key Features:

Chargeback Expertise: Specializes in chargebacks for both crypto and traditional payments.

Customer Support: Provides one-on-one support to help victims understand their recovery options.

5. MyChargeBack

MyChargeBack provides personalized recovery services for victims of crypto scams. They offer tailored services to help victims recover funds lost to fraud and scams, including cryptocurrency-related issues. They also work on a no-win, no-fee basis, which is an attractive option for many victims.

Key Features:

Tailored Solutions: Offers recovery strategies that are unique to each individual case.

No-Win, No-Fee: Operates on a contingency basis, meaning you pay only if your funds are recovered.

Global Reach: Operates worldwide, allowing access to victims from different regions.

Step-by-Step Process of Fund Recovery

Here’s an overview of the typical steps involved in recovering funds from a crypto scam:

1. Report the Scam

The first step is always to report the scam to the authorities and any relevant cryptocurrency exchange or platform. It’s crucial to document all your interactions, transactions, and any relevant data.

2. Contact a Recovery Service

Once you’ve reported the scam, reach out to a recovery service like me14solutionsltd. A reputable recovery company will begin an investigation into your case.

3. Forensic Investigation

The recovery team will track your stolen funds across the blockchain. They will use forensic tools to identify the wallet addresses and trace where your funds have gone.

4. Legal Assistance and Negotiation

If funds are located, the recovery team may begin negotiating with the scammers or platform involved. If necessary, legal action may be taken to ensure the return of your assets.

5. Asset Recovery

If successful, the recovery service will help facilitate the return of your stolen funds, either by direct negotiation or legal action.

How to Avoid Crypto Scams in the Future

While recovery services can help you reclaim lost funds, prevention is the best solution. Here are some tips to avoid falling victim to crypto scams:

Do thorough research before investing. Always check the legitimacy of a crypto project or platform.

Be cautious with unsolicited offers. Avoid engaging with unknown people offering investment opportunities.

Use trusted platforms. Stick to reputable crypto exchanges and wallets to reduce your exposure to scams.

Enable security features. Use two-factor authentication (2FA) and strong passwords to protect your accounts.

Conclusion

If you’ve been scammed, don’t lose hope—there are expert services available to help you recover your funds. me14solutionsltd is one of the leading recovery companies, specializing in crypto scams and offering global reach, legal support, and forensic investigation. Remember, acting quickly and contacting a trusted recovery service can significantly improve your chances of getting your funds back. Stay vigilant and always prioritize security to protect yourself from future scams.

1 note

·

View note

Text

Luzuna Reviews - Scam or Not?

The website Luzuna.com is owned and operated by Techna Solutions LTD, with its registered office in Saint Lucia. Based on the registration number listed, the company was founded in 2021. As for the domain, it was registered in 2020. Meanwhile, the project does not have a license. Finally, the broker’s services do not apply to residents of the countries of North Korea, France, Iraq, and the United States.

Is it safe to trade here? We will answer this question after analyzing the company’s trading conditions and legal documents.

Trading Conditions

Luzuna offers an authoring terminal in the web version and mobile application. You can trade stocks, derivatives, spot metals, currency pairs, commodities, and indices on the platform. However, you need a promo code to register. The support team can help you get one, but the broker doesn’t announce a referral program. Luzuna offers 6 trading plans that are structured by minimum deposit.

Beginner $500 – Basic Market Access, One Click Trading.

Basic $5,000 – Market Updates.

Premium $50,000 – Special Support, Personal Push and SMS alerts.

Premium Pro $100,000 – Personal Manager, Exclusive Market Updates, Free Installments.

Investor $250,000 – Full market access.

VIP $1,000,000 – Access to new features, Priority support, Better execution and pricing, VIP account manager, Exclusive events and promotions.

The broker promises all clients not to deduct any additional commissions. You will find the service exclusively for Islamic accounts in the mobile version.

Luzuna publishes the following pages on the website: Trading Hours, Contract Deadline, Economic Calendar, and Market News. The company offers all clients free trading education and support via live chat.

FAQ

Would investing in Luzuna offer the best returns?

You are more likely to lose money on a platform that provides huge leverage, which is prohibited or significantly restricted in the EU and the US. You will risk a lot of money trading CFDs with an anonymous offshore broker on unknown terms.

Does Luzuna carry out withdrawals?

The company reserves the right to block your account at any time without prior warning and explanation. Such provisions are spelled out in the User Agreement. We see a lot of bad reviews from clients who say the broker doesn't pay out money they earned and takes their deposits. Share your experience in the comments.

May I be scammed on luzuna.com?

Yes, we see signs of illegal activities by the company. This Forex broker does not have a license, and it cannot legally provide financial services. You can't get your money back if it blocks your account. You agree to this when you register your profile.

What's the best way to share my experience with Luzuna?

Fill out the form and we'll make sure your voice is heard.

How can I tell if Luzuna is a fraudulent company?

Do your own research and never believe those who promise you easy money.

1 note

·

View note

Text

Jared Davis charged with $10 million fraud

Here we go again, the CFTC or Commodity Futures Trading Commission busted well-known Options hustler, Jared Davis of Sandusky, Ohio.

Additionally, in a concurrent filing, the United States Attorney filed a 22-count indictment for conspiracy to commit wire fraud, conspiracy to launder money, wire fraud, money laundering, obstruction of justice, and tax evasion.

For most of us, September 17, 2019, was like every other day. We spent the day making our football picks, tried to scrape out profits from the stock market. However, for poor Jared Davis, he spent the day in the back of a police car. All shackled up like a Hawaiian pig at an $8 luau.

Yep, Jared got arrested. We heard from witnesses, the FBI woke him up at 4 am. The wife and kids were wild-eyed, screaming, and terrified as the badges and guns moved throughout the fancy house. They took all the computers, phones, papers, and any evidence laying about. Most importantly, they took Jared. And since Jared was a prick, they waddled him out to the police cruiser — still in his underwear.

Getting arrested by the FBI at 4 am is fucking scary. I should know.

What exactly did Jared Davis do wrong?

According to the FBI and the United States Attorney court filings, Jared had been operating a phony Forex, Contracts For Difference, and Binary Options brokerage out of his house, and a boiler room located in downtown Sandusky.

How did the scheme work? Glad you asked. Beginning in about 2014 through the present, Jared was running an unlicensed and unregistered stocks, options, and Forex brokerage.

Who needs to bother with registering with the SEC or the CFTC anyway!? That’s a waste of time, and those pesky regulations meant to protect investors — who needs those? ( I am being satirical)

In the past few years, drafted quite a few articles about the “white label” phony brokerage industry. What the heck is a “white label” phony brokerage? In a nutshell, offshore companies plug financial data into a piece of software that looks like a real brokerage, in every imaginable way, except it is not real. Instead, it’s just a video game where retail traders can open accounts and execute “live” trades on the platform.

The problem is that these “white label” trading platforms are incredibly easy to manipulate so that the investor is virtually guaranteed to lose. Think of it like a slot machine at an Indian casino, at any time, the casino can flip a switch and the machine simply stops paying. Or, they can rig the machine so that your “penny” bets pay at a higher frequency, but the moment you start upping it to “quarter” bets, the machine tightens up like a straight butthole at a gay bar.

Fraudulent “live trading room”

The scam was clever. Jared Davis had several living trading rooms and affiliate marketing agreements where 3rd parties would provide “education and trading signals” to the retail investor.

The educational component supposedly taught people how to use technical analysis to predict the stock market. The victim would be given the educational products in hopes of luring the victim into actually taking trades.

The “live trading room” would be the “education in action” where the victim would watch the moderators supposedly execute live trades. The victim would watch the supposedly profitable trades and attempt to replicate the moderator.

However, the moderator was using a version of the software that virtually guaranteed that the moderator’s trades would be successful, while the trades of victims would be harder to execute. The victim would continue to attempt to replicate the moderator at ever-worsening prices. All the while, the moderator would enthusiastically encourage the victims in live chat to “get your orders filled” no matter the cost.

Additionally, the live trading rooms contained “shills” that would hype the results by declaring themselves also profitable. However, the “shills” were nothing more than a staged audience.

The end result was predictable. The moderator, who represented the phony brokerage would nearly always be successful. While the customers would always lose.

Some customers were actually good at trading, they still got screwed

According to the criminal indictment, some of the customers never participated in the “live” trading room and instead deployed their own strategies.

Some of these strategies were quite successful. The US Attorney highlighted several instances that resulted in large losses for Jared Davis. This frustrated and angered Jared Davis immensely. As a result of experiencing losses, Jared demanded that the “white label” software provider rig the software so that the trades became even more difficult to profit.

Yet again, the successful trader was able to keep “beating the house” and subsequently demanded payment. Did the victim get paid? Not a chance. Jared Davis simply refused.

Hide and seek from the regulators

As regulators began to tighten the noose on Jared Davis with subpoenas and regulatory action, he then attempted to circumvent the regulators by creating various shell companies and websites to keep the scam rolling.

The first company was Option Mint, then Option King, and then Option Queen, and finally Option Prince. However, the one connecting piece was the boiler room located in Sandusky Ohio.

Additionally, Jared was unaware that the FBI had subpoenaed Jared’s email server and as the emails were darting throughout the criminal network, employees, customers, that everything was being read and watched by investigators.

It certainly looks like Jared will be going away for a while. Thanks for reading. Another investment scammer bites the dust.

Mary Haynes

1 note

·

View note

Text

Fake Forex Brokers List in South Africa – What Every Trader Should Know

If you're searching for the fake forex brokers list in South Africa, you're already taking a smart first step toward protecting your investments. In today's digital trading world, not every broker you come across is trustworthy—and falling into a scammer's trap can be costly.

⚠️ Known Fake Forex Brokers Targeting South Africans

Here are several platforms that have been flagged by traders and watchdogs for suspicious or fraudulent behavior. These brokers either operate without FSCA registration or have been associated with unethical practices:

FX NextGen

Calibur

FTE FX

Prime XBT

Tradersway

MidasGlobe

Circleforex

First BTC FX

These brokers often advertise heavily on social media, offer unrealistic returns, and make it extremely difficult to withdraw funds. Always avoid brokers that can't prove their regulatory status with the FSCA (Financial Sector Conduct Authority).

View the full list of risky brokers here. 👉 Click now

✅ Trusted Forex Brokers to Consider Instead

If you're looking for a safe and regulated trading experience, the following brokers have solid reputations, strong customer service, and transparent policies:

8Cap – Regulated by ASIC and known for fast execution speeds.

FP Markets – Great for both beginner and professional traders with ECN pricing.

IC Markets – Offers tight spreads, low fees, and strong global regulation.

Octa – Well-reviewed for its user-friendly interface and reliable trading conditions.

💡 Quick Tips to Spot a Fake Broker

No FSCA license number or fake license info

Too-good-to-be-true offers and bonuses

Vague contact details and no real company address

Withdrawal issues or unclear fee structures

Aggressive marketing tactics via WhatsApp or Telegram

❓FAQs: Protecting Yourself from Forex Broker Scams

Q1: How do I check if a forex broker is fake? Visit the FSCA’s official site and verify the broker’s registration number. If it’s not listed, that’s a big red flag.

Q2: Can I get my money back from a fake broker? It’s difficult. Report them to the FSCA and consider speaking with a financial recovery expert or legal adviser.

Q3: Are demo accounts useful for spotting scam brokers? Yes. Some fake brokers offer limited demo functionality or none at all, which is another warning sign.

🔚 Final Thoughts

Navigating the forex market safely requires caution and research. Always consult a fake forex brokers list in South Africa before signing up with any platform, especially if it’s one you’ve never heard of. And when in doubt, stick with well-known, regulated brokers who put transparency and security first.

#forex trading#forex broker#forex market#forex robot#forex#forexsignals#stockmarket#forex expert advisor#forex indicators#forextrading

0 notes

Text

Luzuna Reviews

The website Luzuna.com is owned and operated by Techna Solutions LTD, with its registered office in Saint Lucia. Based on the registration number listed, the company was founded in 2021. As for the domain, it was registered in 2020. Meanwhile, the project does not have a license. Finally, the broker’s services do not apply to residents of the countries of North Korea, France, Iraq, and the United States.

Is it safe to trade here? We will answer this question after analyzing the company’s trading conditions and legal documents.

Trading Conditions

Luzuna offers an authoring terminal in the web version and mobile application. You can trade stocks, derivatives, spot metals, currency pairs, commodities, and indices on the platform. However, you need a promo code to register. The support team can help you get one, but the broker doesn’t announce a referral program. Luzuna offers 6 trading plans that are structured by minimum deposit.

Beginner $500 – Basic Market Access, One Click Trading.

Basic $5,000 – Market Updates.

Premium $50,000 – Special Support, Personal Push and SMS alerts.

Premium Pro $100,000 – Personal Manager, Exclusive Market Updates, Free Installments.

Investor $250,000 – Full market access.

VIP $1,000,000 – Access to new features, Priority support, Better execution and pricing, VIP account manager, Exclusive events and promotions.

The broker promises all clients not to deduct any additional commissions. You will find the service exclusively for Islamic accounts in the mobile version.

Luzuna publishes the following pages on the website: Trading Hours, Contract Deadline, Economic Calendar, and Market News. The company offers all clients free trading education and support via live chat.

FAQ

Would investing in Luzuna offer the best returns?

You are more likely to lose money on a platform that provides huge leverage, which is prohibited or significantly restricted in the EU and the US. You will risk a lot of money trading CFDs with an anonymous offshore broker on unknown terms.

Does Luzuna carry out withdrawals?

The company reserves the right to block your account at any time without prior warning and explanation. Such provisions are spelled out in the User Agreement. We see a lot of bad reviews from clients who say the broker doesn't pay out money they earned and takes their deposits. Share your experience in the comments.

May I be scammed on luzuna.com?

Yes, we see signs of illegal activities by the company. This Forex broker does not have a license, and it cannot legally provide financial services. You can't get your money back if it blocks your account. You agree to this when you register your profile.

What's the best way to share my experience with Luzuna?

Fill out the form and we'll make sure your voice is heard.

How can I tell if Luzuna is a fraudulent company?

Do your own research and never believe those who promise you easy money.

1 note

·

View note

Text

Jared Davis charged with $10 million fraud.

Here we go again, the CFTC or Commodity Futures Trading Commission busted well-known Options hustler, Jared Davis of Sandusky, Ohio.

Additionally, in a concurrent filing, the United States Attorney filed a 22-count indictment for conspiracy to commit wire fraud, conspiracy to launder money, wire fraud, money laundering, obstruction of justice, and tax evasion.

For most of us, September 17, 2019, was like every other day. We spent the day making our football picks, tried to scrape out profits from the stock market, However, for poor Jared Davis, he spent the day in the back of a police car. All shackled up like a Hawaiian pig at an $8 luau.

Yep, Jared got arrested. the FBI woke him up at 4 am. The wife and kids were wild-eyed, screaming, and terrified as the badges and guns moved throughout the fancy house. They took all the computers, phones, papers, and any evidence laying about. Most importantly, they took Jared. And since Jared was a prick, they waddled him out to the police cruiser — still in his underwear.

Getting arrested by the FBI at 4 am is fucking scary. I should know.

What exactly did Jared Davis do wrong?

According to the FBI and the United States Attorney court filings, Jared had been operating a phony Forex, Contracts For Difference, and Binary Options brokerage out of his house, and a boiler room located in downtown Sandusky.

How did the scheme work? Glad you asked. Beginning in about 2014 through the present, Jared was running an unlicensed and unregistered stocks, options, and Forex brokerage.

Who needs to bother with registering with the SEC or the CFTC anyway!? That’s a waste of time, and those pesky regulations meant to protect investors — who needs those? ( I am being satirical)

In the past few years, City Clean News has drafted quite a few articles about the “white label” phony brokerage industry. What the heck is a “white label” phony brokerage? In a nutshell, offshore companies plug financial data into a piece of software that looks like a real brokerage, in every imaginable way, except it is not real. Instead, it’s just a video game where retail traders can open accounts and execute “live” trades on the platform.

The problem is that these “white label” trading platforms are incredibly easy to manipulate so that the investor is virtually guaranteed to lose. Think of it like a slot machine at an Indian casino, at any time, the casino can flip a switch and the machine simply stops paying. Or, they can rig the machine so that your “penny” bets pay at a higher frequency, but the moment you start upping it to “quarter” bets, the machine tightens up like a straight butthole at a gay bar.

Fraudulent “live trading room”

The scam was clever. Jared Davis had several living trading rooms and affiliate marketing agreements where 3rd parties would provide “education and trading signals” to the retail investor.

The educational component supposedly taught people how to use technical analysis to predict the stock market. The victim would be given the educational products in hopes of luring the victim into actually taking trades.

The “live trading room” would be the “education in action” where the victim would watch the moderators supposedly execute live trades. The victim would watch the supposedly profitable trades and attempt to replicate the moderator.

However, the moderator was using a version of the software that virtually guaranteed that the moderator’s trades would be successful, while the trades of victims would be harder to execute. The victim would continue to attempt to replicate the moderator at ever-worsening prices. All the while, the moderator would enthusiastically encourage the victims in live chat to “get your orders filled” no matter the cost.

Additionally, the live trading rooms contained “shills” that would hype the results by declaring themselves also profitable. However, the “shills” were nothing more than a staged audience.

The end result was predictable. The moderator, who represented the phony brokerage would nearly always be successful. While the customers would always lose.

Some customers were actually good at trading, they still got screwed

According to the criminal indictment, some of the customers never participated in the “live” trading room and instead deployed their own strategies.

Some of these strategies were quite successful. The US Attorney highlighted several instances that resulted in large losses for Jared Davis. This frustrated and angered Jared Davis immensely. As a result of experiencing losses, Jared demanded that the “white label” software provider rig the software so that the trades became even more difficult to profit.

Yet again, the successful trader was able to keep “beating the house” and subsequently demanded payment. Did the victim get paid? Not a chance. Jared Davis simply refused.

Hide and seek from the regulators

As regulators began to tighten the noose on Jared Davis with subpoenas and regulatory action, he then attempted to circumvent the regulators by creating various shell companies and websites to keep the scam rolling.

The first company was Option Mint, then Option King, and then Option Queen, and finally Option Prince. However, the one connecting piece was the boiler room located in Sandusky Ohio.

Additionally, Jared was unaware that the FBI had subpoenaed Jared’s email server and as the emails were darting throughout the criminal network, employees, customers, that everything was being read and watched by investigators.

It certainly looks like Jared will be going away for a while. Thanks for reading. Another investment scammer bites the dust.

0 notes

Text

Read our Rentalzi review to see if we recommend this broker for trading. Just to clear doubts, this is a rentalzi.com review.

Is Rentalzi Legit? After taking a look at their website, it shows that they do not fall under any regulating agency. That is a MAJOR RED FLAG!! That should be enough for you NOT to invest with them. And they also work with websites that offer "Automated trading software" which is another red flag, as this kind of websites are infamous for scamming schemes.

So, Rentalzi is just another unregulated forex broker, which means the customers aren’t protected, and there is highly likely they will get away with your hard-earned money and there will be no regulating agency to hold them responsible.

How does the scam work? Usually, unregulated forex brokers work in the following way. They will call people to persuade them to make the initial minimum deposit. And they will try any conceivable method in order to make that happen. They will offer deals that sound too good to be true. Like we will double your initial deposit or you will make hundreds of dollars per day easily. Please don’t fall for anything they say!!! It is a SCAM! After making the initial deposit, they transfer clients to a smarter scammer, called a "retention agent", who will try to get more money out of you. Also, one thing we need to add here is: don’t trust the good Rentalzi reviews you might see online. They pay websites and services to improve their online reputation by posting good reviews about them.

Withdrawing funds You should submit a withdrawal request ASAP, because your funds are never safe with an unregulated broker. And here is when things get tricky.

If you want to withdraw your money and it does not matter if you have profits or not, they will delay the withdrawing process for months. If they delay it for six months, you won't be able to file a chargeback anymore and your money is gone for good. It doesn’t matter how often you remind them or insist in withdrawing your money, you will NOT get them back. And if you signed the Managed Account Agreement or MAA, which is basically authorizing them to do anything they want on your account, they will lose all your funds so there won't be anything to request anymore.

How to get your money back Rentalzi? If you already deposited your money with them and they refuse to give your money back, which is very likely to happen, don’t worry, it might be a way or two to get your money back. First of all, you need to keep the emails as proof that you have been requesting the money back from them but they don’t give it to you. Or they delay the process for too long, with the intention of not refunding your money.

0 notes

Text

How to Recover from Forex Scams: A Comprehensive Guide

Understanding Forex Scams

Forex scams are deceptive schemes aimed at defrauding investors in the foreign exchange market. These scams can take many forms, from fake investment platforms to Ponzi schemes. Falling victim to a forex scam can be devastating, but recovery is possible with the right approach.

Identifying a Forex Scam

Recognizing the signs of a Forex scam recovery is crucial. Promises of high returns with little risk, pressure to invest quickly, and unregulated brokers are red flags. Always conduct thorough research before investing and ensure the broker is registered with financial authorities.

Steps to Take After Being Scammed

Document Everything: Collect all relevant information, including emails, transaction records, and communication with the scammer. This documentation is essential for reporting the scam and recovering funds.

Report the Scam: Contact your local financial regulatory authority to report the scam. In the United States, you can reach out to the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). Reporting the scam helps authorities track fraudulent activities and prevent further victimization.

Notify Your Bank or Payment Provider: Inform your bank or payment provider about the scam. They may be able to reverse transactions or halt future unauthorized transfers. Acting quickly increases the chances of recovering your funds.

Seek Legal Assistance: Consulting with a lawyer who specializes in financial fraud can provide you with guidance and support. Legal professionals can help you navigate the complexities of recovering your money and may assist in taking legal action against the scammers.

Utilizing Recovery Services

Several companies specialize in helping scam victims recover their funds. These services often work on a no-win, no-fee basis, meaning they only get paid if they successfully recover your money. While these services can be helpful, it’s important to vet them carefully to avoid falling victim to another scam.

Protecting Yourself from Future Scams

Prevention is better than cure. Here are some tips to protect yourself from future forex scams:

Verify Broker Credentials: Ensure the broker is registered with a recognized financial authority.

Educate Yourself: Understanding how the forex market works can help you spot fraudulent schemes.

Be Skeptical of High Returns: If an investment sounds too good to be true, it probably is.

Stay Informed: Keep up to date with news and alerts about the latest scams and fraudulent activities.

Conclusion

Recovering from a forex scam is challenging but possible. By acting swiftly and following the steps outlined, you can increase your chances of getting your money back. Always remain vigilant and take preventive measures to protect yourself from future scams. Remember, thorough research and skepticism are your best defenses against fraud.

1 note

·

View note

Text

How to Recover from a Forex Scam: Effective Strategies and Tips

Understanding Forex Scams

Forex trading offers lucrative opportunities but also attracts fraudsters. Scammers prey on unsuspecting investors, promising high returns with minimal risk. Understanding the common tactics used by these scammers is the first step in protecting yourself and recovering lost funds.

Identifying Forex Scams

Forex scam recovery often involve promises of guaranteed profits, high-pressure sales tactics, and unregulated brokers. Beware of unsolicited offers, unrealistic returns, and brokers who refuse to provide transparent information. If it sounds too good to be true, it likely is.

Immediate Steps to Take After Being Scammed