#ImporterExporterCode

Explore tagged Tumblr posts

Text

Everything You Need to Know About IEC Code Registration in India

If your business deals with international trade, obtaining an Importer Exporter Code (IEC) is a crucial step. The IEC is a unique 10-digit code issued by the Directorate General of Foreign Trade (DGFT), India, which is mandatory for any business involved in importing or exporting goods and services. In this guide, we’ll explain why IEC registration is essential, the benefits it offers, and how to complete the registration process.

What is IEC Code Registration?

An Importer Exporter Code (IEC) is a vital identification number required for businesses involved in international trade. Issued by the Directorate General of Foreign Trade (DGFT), the IEC is necessary to legally import or export goods or services across borders. Without this code, businesses cannot access customs or export promotion benefits, and it is essential for conducting cross-border transactions smoothly.

Key Benefits of IEC Code Registration

Registering for an IEC Code comes with several advantages:

Required for Import and Export: Without an IEC code, businesses cannot import or export goods and services in India.

No Compliance or Renewal: Once issued, the IEC code doesn’t require any further renewals or ongoing compliance, making it a simple one-time registration.

Expand to International Markets: An IEC code opens the doors for global business opportunities, enabling businesses to explore international markets.

Access to Government Export Incentives: Businesses with IEC registration can avail themselves of various government incentives designed to promote exports.

Remove Restrictions on Foreign Trade: An IEC registration eliminates restrictions on foreign trade, making it easier to deal with customs authorities and foreign traders.

Who Needs IEC Code Registration?

IEC Code registration is required by:

Businesses Involved in Import/Export Activities: Any business that imports or exports goods/services must register for an IEC code.

Sole Proprietors, Partnerships, LLPs, and Companies: Any legal business entity operating in India, including individuals and organizations, needs an IEC code.

E-commerce Sellers Engaged in International Trade: Online businesses selling internationally need an IEC to carry out cross-border transactions.

Businesses Seeking Export Incentives: Companies that wish to benefit from export incentives and subsidies offered by the government must have an IEC code.

Documents Required for IEC Code Registration

To apply for an IEC code, ensure you have the following documents ready:

PAN Card of the business owner or entity

Aadhaar Card or Passport (for identity verification)

Business Incorporation Certificate (for LLPs, Companies, and Partnerships)

GST Registration Certificate (if applicable)

Bank Account Details & Canceled Cheque

Digital Signature Certificate (DSC) for online filing

IEC Code Registration Process: Step-by-Step

Follow these simple steps to get your IEC code:

Visit the DGFT Portal Go to the DGFT IEC Registration Portal and create an account.

Enter Business Details Provide the required business details such as name, PAN, and bank details.

Upload the Required Documents Upload documents such as Aadhaar, PAN, GST registration (if applicable), and business incorporation papers.

Pay the IEC Registration Fees The government fee for IEC registration is ₹500.

Receive Your IEC Code Once your application is approved, you can download the IEC certificate directly from the portal.

How to Check Your IEC Code Registration Status?

You can easily track the status of your IEC registration on the DGFT Portal. Simply enter your PAN number and application reference ID to check the status.

Frequently Asked Questions (FAQs) on IEC Registration

What is the cost of IEC registration in India? The government fee for IEC registration is ₹500.

How long does it take to get an IEC Code? Typically, it takes 1-2 working days to process an IEC application after submission.

Can I apply for an IEC code online? Yes, the entire IEC registration process is conducted online via the DGFT Portal.

Is GST mandatory for IEC registration? No, GST registration is not mandatory for IEC registration unless the business is already registered under GST.

Get Expert Assistance for IEC Code Registration

At NG & Associates, we offer expert guidance to make your IEC registration process seamless. Whether you're an importer, exporter, or e-commerce business, we ensure your IEC code registration is done efficiently and hassle-free. Contact us today to get started!

0 notes

Text

What is the full form of ICEGATE?

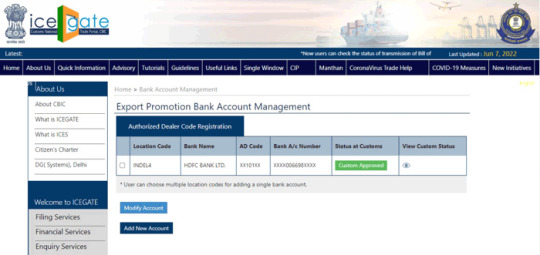

The full form of ICEGATE is "Indian Customs Electronic Commerce/Electronic Data Interchange (EC/EDI) Gateway." ICEGATE registration is mandatory for cargo carriers and Trading Partners and is required for filing documents online and generating shipping Bills and bills of Entry. The main purpose of ICEGATE is to accelerate the customs clearance process by reducing paperwork and allowing you to submit your documents electronically.

ICEGATE registration is a completely online process that benefits the user by reducing the processing time, lowering the overall cost due to reduced manpower requirements, and increasing visibility into your shipment's status at every step along the way. AD code registration on ICEGATE allows the exporter to receive payments in foreign currencies.

Types of ICEGATE Registration:

ICEGATE Partnership Registration

ICEGATE Simplified Registration

Who can apply for ICEGATE Registration:

F-card custom brokers or Custom house Agents(CHA)- Individuals, Firms or Employees

IEC Certificate holders

Console agents

Shipping Agents

Shipping Lines

Airlines

Air Cargo Agents

IEC Authorized persons

*If you want to know about EPR Registration, NGO Darpan Registration, GeM Registration, or APEDA Registration

#ICEGATERegistration#CustomsClearance#TradeFacilitation#ExportImport#CustomsRegistration#ImporterExporterCode#DigitalCustoms#CustomsCompliance#TradeSimplification#ElectronicCustoms#BorderTrade#CustomsModernization#GlobalTrade#EconomicGrowth#CrossBorderTrade#CustomsSolutions#InternationalBusiness#LogisticsManagement#TradeEfficiency#CustomsDocumentation

0 notes

Text

What Is an #ImporterExporterCode and Why Do You Need It? Know more its key features, benefits of #IEC, application process, eligibility, and documentation. Read More: https://www.globaljurix.com/blog/what-is-an-importer-exporter-code-and-why-do-you-need-it.php

0 notes

Photo

STEPS TO GET A DRUG LICENSE ONLINE

Drug license registration is location-specific. Apply for a drug license online in India and get at affordable prices, take assistance.

1. Drug licence registration in India 2. Basic requirements for getting drug licence online 3. Types of drug license in delhi you can apply for 4. Documents Required to get online drug licence

Read More

0 notes