#Initial Coin Offering Development Services

Explore tagged Tumblr posts

Text

ICO Development Services by BlockchainX offer expert solutions for creating and launching successful Initial Coin Offerings, ensuring secure, scalable, and innovative token offerings for your project.

#cryptocurrency#ico development#initial coin offering#ico development company#ico development service

0 notes

Text

What is an ICO on blockchain and how can it change the world?

In this blog about ICO on blockchain and how can it change the world, Read it out.

Introduction:

Transaction and storage ways have really been reorganized since blockchain technology came into existence. It’s set up as a decentralized as well as transparent technology that enables people to trade safely and without intermediaries. It is this pivotal aspect that has led to the rise of the Initial Coin Offering development (ICOs) as a new innovative form of fundraising for projects based on the blockchain.

ICO is an effort to fundraise for a project by issuing tokens or selling cryptocurrencies. These tokens are created based on blockchain technology and might represent a stake or utility in the project. When the project is expected to reach successful ends, initial investors will benefit a lot as they will get to buy these tokens at the startup period of the project, thereby maximizing profits eventually.

What is an ICO and how does it work?

An ICO is similar to an initial public offering (IPO) on the traditional stock market, but instead of stocks of company shares, but tokens of blockchain-based projects are sold. Investors can use such cryptocurrencies as Bitcoin or Ethereum to purchase these tokens.

ICO usually starts with the publishing of whitepapers, describing the project, vision, and business. General people interested in investing in the scheme can go through the whitepaper and decide on the same.

Once the ICO process starts, investors start purchasing these self-designed “tokens” by using the monies of cryptos. These tokens are accumulating in a digital wallet and one can use or exchange for the particular purpose under the project.

A long-standing difference between an IPO and an ICO is that through an IPO, shares in a company are sold, whereas with an ICO, it’s the case of selling tokens, some of which, depending on the project, may function as utilities.

A valid addition is that through an ICO, investors more easily come to retail, where there is no barrier to a minimum requirement of investment.

Why are ICOs important for blockchain technology?

ICOs are important for blockchain technology in a number of respects. Most importantly, ICOs provide funding to blockchain-based projects that would have otherwise faced complex difficulties with fundraising through traditional methods.

Truly, such a situation underwrites liberally the creation of ideas and projects-in and by themselves: it sweeps away dependency on traditional investors or financial institutions.

Lastly, an ICO democratizes investment and financial risk by extending an access to anyone to invest in blockchain-based projects. Until now, investment in startups and technology projects was limited to accredited investors or financial institutions in the world. With the introduction of ICOs, anyone can become an investor and have a slice of the cake if the project turns out to be successful.

Finally, ICOs speed up the development of blockchain technology by direct donors to projects that also eliminate the problem of financing for developers. Thus, it will allow them to move very swiftly without worrying about funding-and will propel at the same time the usage and development of blockchain technology across different industries.

How can ICOs change the world?

One of the ways that ICOs will be able to change the world is that they allow anyone to participate in blockchain-based projects and investments. In the current decentralized economy, the power of finance is not constrained to the ownership of a few, but studies show that finances have been distributed among investors across a vast expanse.

Secondly, they offer unique investment avenues for the individual. Before, an individual had very limited opportunities to invest in start-up and technology projects if he or she was not an accredited investor or company. Through ICOs, anyone can invest-and would gain a lot if project is successful. This democratizes investing and lets people take part in the growth of promising projects.

ICOs may well be the most important vehicle for reducing the financial divide of direct financing to projects in underdeveloped countries as well as to the billions of people who so far have not had access to traditional financial services. It can empower many developing economies and societies by connecting them to the global economy in a broader and more inclusive manner.

Successful examples of ICOs on blockchain

There have been a number of successful examples of blockchain ICOs so far that are proving to be game-changers in the industry. Among them, Ethereum is an outstanding one. The network has managed to amass something to the tune of $18m through its 2014 ICO. It is based around creating a blockchain platform through which smart contracts can be created by developers alongside decentralized applications.

Filecoin is another example with considerable success: it procured over $253 million in its ICO of 2017. It is a blockchain system that is going to create a decentralized cloud storage marketplace.

Another leading example is EOS that had raised over $4 billion in its ICO of 2018. It is a blockchain platform providing resources to developers for building high-performance decentralized applications.

These examples give an indication of how ICOs can help in raising capital for the birth of a blockchain application.

ICO regulations and legal framework

In the majority of countries, regulation of initial coin offerings are somewhat scant. This is because of the way blockchain technology works: it is decentralized and global, and is very resistant to the enforcement of particular regulations.

Developed countries are starting to establish rules that do provide the general outline of what constitutes an ICO. In the US, however, the Securities & Exchange Commission (SEC) provided informal guidelines that can help to define how tokens which were recently born (“issued during an ICO”) will be considered as securities and therefore subject to extant regulation.

For instance Europe, too, has promulgated a caution about ICO-related risks — European Securities Market Authority (ESMA) though it urges caution on the part of investors.

When blockchain technology becomes more widespread and more widely adopted, more regulations would likely be put in place, mainly focusing on initial coin offerings. This can range from the imposition of stricter disclosure norms on projects that want to carry out ICOs to protective measures intended towards investors.

Future of ICOs on blockchain

Promising are the instances of ICO done on blockchain which is ongoing and millions of dollars are being raised for blockchain-based projects.

One trend witnessed in the ICO domain is the happening of the decentralized funding platform which permits the project to be more efficient and secure on the way of carrying out ICO. These platforms are executed using smart contracts to run a fundraising process automatically, securing every transaction and is transparent from the standpoint of security and transparency.

More restrictive guidelines need to be implemented concerning ICOs, thereby boosting investor confidence and trying to mitigate the risks associated with investment in blockchain projects.

It is, therefore, established that ICOs will continue to play quite an important role in the development and adoption of blockchain technology in various industries.

What can we expect from ICOs in the future?

In simple terms, blockchain ICOs form a new means to finance blockchain projects where entrepreneurs and developers can get direct funds rather than involving traditional investors or financiers to realize their ideas and projects.

In fact, ICOs are capable of becoming transformative by propagating the fragmented, new economic order and offering new destinations of investment and integrating funding voids. However, ICOs also pose inherent risks to both investors as well as projects.

Regulations on ICOs are expected to be developed in the future that would put more confidence in investors and less risks associated with investment in blockchain-based projects.

Conclusion:

In conclusion, much is expected from ICOs in nurturing the development and utilization of blockchain development technology to the comes-out of industries such that they would continue to become some innovative way for funding projects-switching altogether in the future.

#cryptocurrency#blockchain#blockchainx#ico development#initial coin offering development#ico development service

0 notes

Text

Choosing the Right Bitcoin Wallet: A User's Manual

What is a Bitcoin Wallet?

It's not the most rocket science question, but you should still know that a Bitcoin wallet is either a physical device or an application that is utilized to transact Bitcoins back and forth. A physical wallet is used to hold physical currencies.

We all are familiar with the mechanisms of a physical wallet, in short, your Debit Card.

The Debit card in the folds of your wallet isn't paper money, but it's called plastic money, and it helps you access cash from your bank account. Bitcoin Wallet functions in a similar fashion.

The only obvious difference is that a centralized entity governs Debit cards, whereas no entity governs Bitcoin.

How do Bitcoin Wallets function?

Considering the example of a debit card, a Bitcoin account can hold at least one account, which is equivalent to a debit card. If you look closely, you'll see that a debit card has a lot of data linked to it, for example, the holder's account number along with a unique password that only he knows. Sames goes for Bitcoin. Every Bitcoin inside the Bitcoin wallet holds information linked to it, i.e., a Public Bitcoin address and a Private Key (password). A private key is basically a combination of 256-bit secret numbers.

Example

108165236279178313660610114131826512483935470542150824153737659708197206310322

In the example above, you notice that the secret number is a weird number. The key functionalities of Bitcoin Wallet are to store and manage this private key. To be precise, these secret numbers are never given directly to the holder. There is a way to write it down in a human-readable format, also known as a backup -phrase, confidential passphrase or seed phrase. To understand this better, it's more like a password hint that helps you remember your password. The backup phrase is a list of words ranging from 12 to 24, which will enable you to gain access to your wallet and funds, even if your wallet is destroyed.

Let's see a quick example

Urge

Cricket

Scissors

Pretty

Arctic

Mango

Fence

Suggest

River

Install

Dog

Muffin

Since the backup phrase is very similar to a password you should never share it with anyone.

Anything being a secret is always a desire for someone, which means storing it on your computer isn't the best option as hackers are on the look or anyone you know can easily access it. A lot of people store their phrases by writing them down on paper. This brings up problems again because writing it on paper is also not a safe option.

Bitcoin Wallet comes to the rescue to cancel these unsafe methods. Bitcoin wallet integrates something called a Cloud Backup system. This can help you generate a single personalized passkey which can utilized to unlock your private keys. This will be stored in the form of a Google or iCloud account.

Kinds of Bitcoin Wallets

As mentioned earlier, there exist 2 forms of Bitcoin Wallet, i.e., Physical Wallet or Digital Wallet (Software)

Hardware Wallets

They are termed to be the most secure kind of Bitcoin wallet simply because they store private keys in a physical device which cannot be assessed via a PC or the internet. It's very much like a pen drive.

How to use this wallet?

Whenever a person wants to make a Bitcoin transaction, he/she will plug it into their PC. The hardware wallet will sign transactions without compromising the security of the private key. One sad part about these types of wallets is that despite being the most secure, they also are the most expensive.

Software Wallets

They are just the way they sound, like a PC, mobile phone or web browser. They exist on computing devices. This doesn't make it any less safe. Any hacking, malware or phishing activities cannot break the security of Bitcoin Software Wallet since it's built on Blockchain, making it safe for everyday use.

How to choose the best Bitcoin wallet for yourself?

It's really simple, but you still have to be vigilant.

Step 1

Make sure the Bitcoin Wallet has absolute security

(Facial and fingerprint recognition)

Step 2

The Bitcoin wallet should have a High Reputation

Step 3

You should have access to private keys (owning your Bitcoin)

Step 4

Cloud backup features

Step 5

An option to customize fee

Step 6

It should definitely have multi-signature functionalities

Want to create your own Bitcoin Wallet?

At Mobiloitte, we deliver services like Mobile Wallet Development, Web Wallet Development, Desktop Wallet Development, Bitcoin Blockchain Integration, Multi-currency Wallet Integration, Private Key Management, Two-Factor Authentication, Payment Integration services, and many more. Ready to get your own Bitcoin Wallet? Contact us today!!

Read More: https://bit.ly/41XxsvR

#Bitcoin Wallet Development Company#Bitcoin Wallet Development Solutions#Initial Coin Offering#Bitcoin Wallet Development Process#Bitcoin Wallet MobileApp#Bitcoin Wallet Development#wallet development services

0 notes

Text

6 Benefits of Initial Coin Offering Options Like Crowdfunding

Initial coin offerings (ICO) have emerged as a popular form of crowdfunding in the world of cryptocurrencies and blockchain technology

Although ICOs also have associated risks, they offer a number of benefits for both projects and investors. The following are six important benefits of ICOs as a crowdfunding method:

Access to Global Capital:

One of the most significant advantages of ICO software development service is their ability to reach investors around the world. Unlike traditional sources of financing, such as bank loans or local investors, ICOs can attract funds from anywhere on the planet via the Internet. This means that projects have the opportunity to access a much wider investor base, which can result in a greater amount of capital raised.

Financial Decentralization:

ICOs eliminate the need for financial intermediaries, such as banks or venture capital firms, that have traditionally controlled the flow of capital in the markets. By using blockchain technology and smart contracts, ICOs allow funds to flow directly from investor to project without the need for intermediaries. This can reduce the costs associated with fund-raising and provide investors with greater transparency on how funds will be used.

Enhanced Liquidity:

Once tokens are issued during an ICO, they can often be traded in cryptocurrency exchanges, providing investors with a way to settle their investments if they so wish. This contrasts with many traditional forms of financing, such as venture capital investments, which often have prolonged exit horizons and fewer liquidity options.

Active Community Participation:

ICOs encourage active community participation in the project from its early stages. Investors in an ICO become token holders, giving them an interest in the long-term success of the project. This can lead to greater community engagement, valuable feedback and continued support as the project develops and evolves.

Facilitating Technological Innovation:

ICOs are often used to finance projects that are developing innovative technologies or blockchain-based solutions. By providing a direct and global source of funding, ICO development solution can unlock the potential of projects that otherwise might have had difficulty obtaining funding through traditional methods.

Investment Return Potential (ROI) Significant:

For investors, ICOs offer the opportunity to earn a significant ROI if the project is successful. By investing in an early ICO, investors can benefit from the appreciation of the token value as the project develops and grows. However, it is important to highlight that there is also a higher level of risk associated with ICOs, and not all projects are successful.

In short, ICOs offer a number of significant benefits for both projects and investors. However, it is important to bear in mind that there are also risks associated with this method of financing, and it is crucial to carry out due diligence before participating in an ICO.

To Know more visit : ICO Development service

0 notes

Text

Why Connor is a Deviant Hunter Pt. 1

AO3 Link Next->

Hey, sudoku, didn't you post that story already? Why does this post say Part 1?

I made the post, set up an afternoon reblog that I forgot to delete, and then went to the grocery store. And then completely forgot about it until I returned etc. And again. And again. And then I forgot to add tags. Executive function is a bitch is what I'm saying. (This is updating tomorrow on AO3, but you guys actually interacted with what existed unlike them. So you're getting this a day early.)

WC: ~2,000

Summary:

Connor's description in the Extras gallery is as follows:

Connor is a prototype, named the RK800, created by CyberLife. Its initial goal is to assist human detectives in their investigations by offering them technological assistance. He is also equipped with a social module which is specially developed to create the "ideal partner", capable of integrating into any team

Why, then, is he a Deviant Hunter? This story is a partial attempt to answer that question, at least, in this universe.

As Hank is enjoying his time with Sumo, Connor realizes that if he thinks hard enough he can remember a dark classroom setting with a grainy video of Hank telling the story of how his wife died. A story where he (at the time) blamed the android. And in doing so, taught Connor to do the same.

Connor shuts the door behind Ainsel and lets out a sigh. Something inside of him shifted when that wall came down. He just isn't sure what.

A nearby door closes and Connor looks to Hank’s bedroom, the most likely place for Hank to be.

Hank is standing there, dressed in “real” clothing and not the pajamas from earlier.

“I just got off the phone with Ben, he's uh taking me to the emergency room. Make sure everything’s all right and all. You said you found me passed out on the floor yeah? That you broke into my house to check on me?”

Here Hank gestures vaguely towards the window with a garbage bag taped over it.

Connor flinches at his raised hand, even knowing Hank will not hit him. Wouldn't dare to with Ainsel in the same house.

And then flinches again at the memory of finding Hank on the floor, drunk and unconscious. And the fact that he did not do the smart thing and call for emergency services.

“I should have called for an ambulance,” Connor says. He begins adding up the numbers of the Fibonacci sequence in his head.

1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89.

1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89.

It isn't enough. It just isn't enough. He needs more than that. Cyberlife would deactivate him for making a mistake that enormous. And he knows Hank will not harm him if Ainsel is nearby. That was why his strategy in the early days favored kindness towards Ainsel over kindness towards Hank.

Not only to repay Ainsel for their earlier kindness at the hostage situation where they first met. But because his analysis showed that someone like Hank would be much easier to build rapport with if he focused his efforts on Ainsel.

But this is a mistake so large that surely, surely Hank is going to report it. “Tell on him” to Cyberlife. End the life Connor is now beginning to hope he might deserve when the only thing that ought to hope for is Amanda's praise.

1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89.

Connor takes out his coin and begins doing Icarus over and over and over again. Making the coin sail into the air and catching it just before it can slip through his fingers.

1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89.

On and on and on it goes. The entire time, he keeps thinking like a mantra about how Hank will not hurt him. He is safe. Hank will not hurt him. He is safe. Hank will NOT hurt him. He is safe.

1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89.

Hank lowers his hand and slowly settles the hand on Connor's shoulder. Pats Connor a few times as if to assure that he isn't a threat.

“Hey Connor, I know you're used to working for a bunch of rich pricks and all but people lose their houses over not bein’ able to pay for the hospital bill. Shit sometimes the bills get so bad they start prayin’ to die.”

Connor knew this in theory but not in fact. He returns his coin to its rightful place then nods and gestures for Hank to continue.

—

Hank leans back against a nearby wall. “You know when I was going to college, one of the other kids had a dog chain around their neck sayin’ they were an epileptic and to please not call for an ambulance ‘cause they couldn't pay.”

Connor is unsurprised so far. College students are known to be a demographic that struggles financially.

He gestures that Hank can continue speaking. And he does.

“Don't get me wrong, I’m comfortable, I’ve got decent health insurance an’ shit but fuck…”

Hank runs a hand through his hair, likely trying to calculate how much the bill would have cost him.

Connor stays quiet. He’s interested in the math of it all, truly. But he doesn't want to take the risk that he'll end up intellectualizing the problem. Treating Hank and the very real problems of American life with less respect than they deserve.

It’s none of his business what kind of health insurance plan Hank is on. Or how much money Hank is saving for emergency expenses. Up until now it's been purely statistical for him that the leading cause of being unhoused is medical debt. It isn't anymore. Hank, at least, would have somewhere to go if driven into deep medical debt.

Connor lets Hank keep his thoughts to himself for a time as he makes sure Hank’s dining table is clean. That he hasn't missed anything. Tries thinking about the problem of the American medical industry on the level of simulated emotions rather than pure logic as Cyberlife has counseled him to do. It's the only way to give the problem the respect it deserves while Hank is speaking on it. He can do independent research later, after Hank is safely in the hospital.

—

Connor keeps thinking on the issue as Hank makes his way to the restroom.

With Ainsel living across the street, Hank's life would hardly need to change in any meaningful way. Especially since Ainsel's intelligent (and anxious) enough that he's sure they would call and insist on some sort of payment plan before adjusting their finances to help pay off the debt.

With Hank being middle aged he thinks Ainsel would have insisted on the house being in their name at some point within the past five years. So that even in the event of bankruptcy, Hank would always have somewhere to live.

In general, Hank could probably go and live with Ainsel, if he needed. It's highly likely he would see no other major changes in his lifestyle. Most people aren't so lucky. It's a sobering thought for him.

One of the realities he hadn't been exposed to while working for Cyberlife directly. It brings to mind all those times that a human has told him they consider themselves fortunate to work for Cyberlife. In fact, Connor doesn't think he, even once, saw a Cyberlife employee or contractor working with him worry about medical bills or expenses. At least not for long.

For instance, one of them mentioned how the price of insulin was costing them a fortune. They came to work the next day whistling cheerfully before expressing that Cyberlife had managed to get them a brand new vial of insulin. Two weeks later an executive order limited the price of insulin to $30. Somehow, looking back, Connor no longer thinks that was a coincidence or a mere stroke of good luck.

—

The flush of a bathroom toilet interrupts his thoughts.

“I had to take a piss.”

The programming takes exception to Hank's crude way of saying he was in need of using the restroom. Connor himself can only smile at how much better Hank seems to be feeling.

Hank looks around, confused, as if trying to remember what he was saying.

Connor tries not to laugh. “You were telling me you have decent health insurance?”

Hank nods appreciatively.

“Oh, yeah, thanks. Like I was sayin’, I’m comfortable and I’ve got decent health insurance. But if you'd called the ambulance on me there's a good chance I woulda been stuck with the whole bill.”

Connor nods, he'd discerned as much while Hank was in his bathroom. His every thought is, naturally, interrupted by what Hank says next.

“You saved me a fortune not calling the boo boo bus to come get me back up again.”

Connor blinks, “The what?”

He feels a brief moment of apprehension at interrupting Hank in the middle of his speech. He knows that Hank is not going to hurt him but that doesn't mean he “feels” that way.

Hank gives Connor a grin, stopping his self-blame before it starts.

“You know the fuckin’, it’s the boo boo bus. The wee woo wheels. The whambulance.”

Connor allows himself a slight smile at Hank's silly names for the ambulance. His apprehension slowly recedes like tides on a shore.

Hank, still grinning, nods at if he considers that a job well done.

The grin disappears from Hank's face. A focused, thoughtful look replaces it.

“Anyways, it's good you didn't call the ambulance, ‘cause I probably would have had to pay the fuckin’ bill. Not like they’d want to pay for me goin’ just because I got drunk off my ass.”

Nothing that Connor can think of seems as if it would be an appropriate thing to say. Nothing except, “I suppose.”

And even that seems rather lacking.

But it's the only thing that he could have said. Nothing else seems as if it would have “done the trick”.

Hank sighs, “You know, the only reason I’m even as ‘lucky’ as I am is ‘cause my wife died on the table. You know that whole thing with the doctor that danced during surgery? The new one I mean.”

Connor tilts his head, Cyberlife’s version of events did not involve a doctor. At all. He gestures for Hank to continue speaking.

Hank sighs again, this time exasperated. “Anyway, my wife's on the table for this big emergency surgery. There used to be this option at the hospital, they’d give you some kind of a discount if you let ‘em record the surgery for medical students to watch later. Good program, in theory.”

A cold feeling settles over Connor. He knows the particulars of this case inside and out. At least, he thought he did. He’s spent many nights considering that particular case. The one where an upstart android killed a wife and mother with its carelessness and arrogance. At least that was how he first learned about the case.

Connor nods in a way that he hopes is encouraging. Tries his best not to appear as if a fundamental belief about Deviancy is being shaken.

It must work because Hank continues speaking like a fact of Connor’s life isn't being called into question.

Hank scratches his cheek, “I’m saying ‘in theory’ here because it depends on the kind of doctor you get. If you get lucky, you get someone that actually does the damned surgery without playing it up for the camera. Nice, boring surgery. End of story. My wife? Got about the worst damned person you can get.”

Hank is silent for a long time. He reminds Connor, in that moment, of a wounded old soldier. Weary and tired of fighting the war that is his life but still willing to carry on for those he cares about.

But this is one battle that Connor can spare him from. At least temporarily. And carefully too. The memory seems to hurt Hank very much, yes. But given his stubborn personality, is quite likely to see the tough discussion through no matter how much pain it causes him. Simply to avoid the shame of a retreat.

Gently but firmly Connor says, “I think enough difficult subjects have been discussed or experienced for one night. Don’t you?”

Hank looks down, nods at Connor. “Yeah. Yeah. Uh… I’m gonna…go and hang out with Sumo now.”

Hank walks away from Connor and moves to sit on his couch only to be pounced on by an overjoyed St. Bernard.

—

As Hank is enjoying his time with Sumo, Connor realizes that if he thinks hard enough he can remember a dark classroom setting with a grainy video of Hank telling the story of how his wife died. A story where he (at the time) blamed the android. And in doing so, taught Connor to do the same.

7 notes

·

View notes

Text

The Sign of Four: The Strange Story of Jonathan Small (Part One of Two)

I will split this in two parts as I've got a lot to cover here.

CW for discussions of nasty prison conditions.

The depth of the Thames is about 6.5 metres at low tide in Woolwich, near to the Plumstead Marshes as they were then. However, the river has strong currents and very little visibility, so it would be a risky operation even with 2024 diving technology for some rather small objects.

The rupee originally was a silver coin dating back to ancient times in India, becoming something of a standard currency during the Mughal period. The East India Company introduced paper rupees and while there was an attempt by the British to move their territory to the pound sterling, they soon gave up, minting their own rupees with the British monarch's head on. The currency was also non-decimal. India retained the currency post-independence and went decimal as well.

Mangrove trees are very common in equatorial coastline regions - they can remove salt from the water, which would kill many other trees.

Prisoners set to the Andaman Islands penal colony were forced to work nine to ten hours a day to construct the new settlement, while in chains. Cuts from poisonous plants and friction ulcers from the chains would often get infected, resulting in death.

The convict huts on Ross Island were two-storey affairs, with the bottom as a kitchen and took area, the prisoners sleeping on the upper floor. Designed this way as an anti-malaria measure, they however leaked and the prisoners themselves were constantly damp from the rainfall, offering them little protection from the mosquitoes in any event.

Ague is an obsolete term for malaria; adults experience chills and fever in cycles.

The British would conduct experiments with quinine as a malaria treatment by force-feeding it to the prisoners. This caused severe side effects.

The British would make use of locals as warders, who wore sashes and carried canes. I'd imagine they could probably be quite brutal.

Pershoe is a small town on the River Avon near Worcester. It has a railway station with an hourly service to London, taking just under two hours today.

"Chapel-going" in this context means that the people attended a non-conformist church i.e. not one part of the Church of England.

"Taking the Queen's/King's shilling" was a historical term for joining the armed forces - for the army this was officially voluntary, but sailors could be forcibly recruited, being known as "press-ganged" until 1815. You would be given the shilling upon initial enlistment or tricked into taking it via it being slipped into your opaque beer. You would return the shilling on your formal attestation and then receive a bounty which could be pretty substantial in terms of the average wage, although a good amount of that would then be spent on your uniform. Some enlisted, deserted and then reenlisted multiple times to get multiple payments. The practice officially stopped in 1879, but the slang term remains.

The 3rd Buffs refers to the latter 3rd Battalion, Buffs (East Kent Regiment), a militia battalion that existed from 1760 to 1953, although it effectively was finished in 1919. However, in reality, they did not go to India to deal with the rebellion, instead staying in Great Britain to cover for the regular regiments who did.

The British never formally adopted the Prussian "goose step" instead going for the similar, but less high-kicking, slow march.

The musket would possibly have been the muzzle-loaded Enfield P53, a mass-produced weapon developed at the Royal Small Arms Factory in Enfield. It was itself was the trigger of the Indian Rebellion in 1857 due to the grease used in the cartridges. They would also be heavily used in the American Civil War on both sides, especially the Confederate one as they smuggled a lot of them, with only the Springfield Model 1861 being more widely used. As a result, they are highly sought after by re-enactors. The British used them until 1867, when they switched to the breech-loading Snider-Enfield, many of the P53s being converted.

The crocodile would likely have been a gharial, which mainly eat fish. Hunting and loss of habitat has reduced their numbers massively, with the species considered "Critically Endangered" by the IUCN.

"Coolie" is a term today considered offensive that was used to describe low-wage Indian or Chinese labourers who were sent around the world, basically to replace emancipated slaves. Indentured labourers, basically - something the US banned (except as a riminal punishment) along with slavery in 1865. In theory they were volunteers on a contract with rights and wages, however abuses were rife. Indentured labour would finally be banned in British colonies in 1917.

Indigo is a natural dark blue dye extracted from plants of the Indigofera genus; India produced a lot of it. Today, the dye (which makes blue jeans blue) is mostly produced synthetically.

I have covered the "Indian Mutiny" as the British called it here in my post on "The Crooked Man".

The Agra Fort dates back to 1530 and at 94 acres, it was pretty huge by any standards. Today, much of it is open to tourists (foreigners pay 650 rupees, Indians 50), although there are parts that remain in use by the Indian Army and are not for public access.

"Rajah" meaning king, referred to the many local Hindu monarchs in the Indian subcontinent; there were also Maharajahs or "great kings", who the British promoted loyal rajahs to the rank of. The Muslim equivalent was Nawab. However, a variety of other terms existed. The East India Company and the Raj that succeeded them used these local rulers to rule about a half their territory and a third of the population indirectly, albeit under quite a bit of influence from colonial officials. These rulers were vassals to the British monarch; they would collect taxes and enforce justice locally, although many of the states were pretty small (a handful of towns in some cases) and so they contracted this out to the British. As long as they remained loyal, they could get away with nearly anything.

562 of these rulers were present at the time of Indian independence in 1947. Effectively abandoned by the British (Louis Mountbatten, the last Viceroy, sending out contradictory messages), nearly all of them were persuaded to accede to the new India, where the nationalists were not keen on them, with promises they could keep their autonomy if they joined, but if not, India would not help them with any rebellions. Hyderabad, the wealthiest of the states, resisted and was annexed by force. The ruler of Jammu and Kashmir joined India in exchange for support against invading Pakistani forces, resulting in a war. A ceasefire agreement was reached at the beginning of 1949, with India controlling about two-thirds of the territory; the ceasefire line, with minor adjustments after two further wars in 1965 and 1971, would become known as the Line of Control, a dotted line on the map that is the de facto border and one of the tensest disputed frontiers on the planet.

India and Pakistan initially allowed the princely rulers to retain their autonomy, but this ended in 1956. In 1971 and 1972 respectively, their remaining powers and government funding were abolished.

Many of the former rulers ended up in a much humbler position, others retained strong local influence and a lot of wealth. The Nizam of Hyderbad, Mir Osman Ali Khan was allowed to keep his personal wealth and title after the annexation in 1948 - he had been the richest man in the world during his rule and used a 184-carat diamond as a paperweight, at least until he realised its actual value. The current "pretender", Azhmet Jah, has worked as a cameraman and filmmaker in Hollywood, including with Steven Spielberg.

16 notes

·

View notes

Text

[ inspo post ]

We all know Karlach as our happy-go-lucky, kind and caring friend / lover who we would destroy entire worlds for, but I think something that gets briefly looked over on occasion is the fact that she is used to being in danger. Constantly. It shows in her eyes, most of all, when we look past some of her body language. Everyone's eyes move because they are taking in their surroundings, and being able to assess the dangers / people around her based on what's in front of her and in her peripherals. This is something of second nature to her because she spent ten years being in constant peril.

This has given her a somewhat predatory nature when it comes to her environment, and how she can almost immediately assess what's where in a room from sight and sound alone. This goes hand-in-hand, also with the danger sense feature that is offered by barbarians as they level. She can quite literally pick out when something is a little off just from stepping into a room. Threat assessment is as natural as breathing and she doesn't need to specifically look around to know when something is fishy or where people / creatures are.

After all, despite how friendly and open she is, she was used as a weapon and old habits are treacherously hard to kick, especially when you've done all you can to survive.

While Karlach spent a good portion of her young adult years in service of Enver as his bodyguard, she did not develop these skills as his bodyguard. While I personally headcanon that she excelled at that (he's alive, ain't he), there was actually very little outside of thugs and the occasional assassin (probably, this notion may change when I'm done researching), they were very easily disposed of in comparison to what Avernus threw at her. Avernus was an experience all on her own. While no stranger to the occasional scar, the most notable of which, before she was sold to Zariel, is seen in the gifset abouve.

Trivial, minor scars that come from the life she led before the hells. Hazards of the job, really.

Karlach's most notable scars are the burn marks over her shoulders and upper torso. While I like the idea of them being from the actual fighting, in actuality it was likely from the initial installation of the infernal engine that replaced her heart. Chances are, they did not quite realise that that much heat needed somewhere to go, and I mention this because that particular burn scar is localised around where they've littered the vents to let out steam.

Literal trial and error (maybe trial by fire huehuehue). The infernal engine scorching her like that is what led to her not only having vents installed, but the eventual inclusion of a similarly crafted slot where they would have given her soul coins to juice her up.

We can also see that the vents are on both shoulders, and the backs of them. This was likely their notion of protecting their "investment" with a little more of a careful hand. A dead champion is not a good champion.

This, she thought at the time, is all her life would be. A series of upgrades that would sculpt her into what Zariel wanted her to be as her hard-bought champion.

Now, if we look carefully at her arms and stomach, those are scars I think she got when she was actually fighting. The endlessness of the war does come with its price, and the fact that she has no fresh ones? Shows that not only did she do what she did to survive, but the fact that she was good at what she did.

2 notes

·

View notes

Text

The Rise of Blockchain: Changing Business, Politics, and Everyday Life

Blockchain generation has evolved considerably on account that its inception in 2008 as the inspiration for Bitcoin. Initially identified for its function in cryptocurrencies, blockchain has increased into a couple of industries, disrupting traditional commercial enterprise fashions and influencing society in profound ways. From improving transparency and security in transactions to allowing decentralized finance, blockchain is revolutionizing how businesses operate and how human beings interact with digital structures. This article explores the effect of blockchain on organizations and society, focusing on its advantages, demanding situations, and potential destiny developments.

Impact Of Blockchain On Society

Impact on Business

Blockchain generation gives organizations numerous advantages, which includes improved security, efficiency, and transparency. Many industries are leveraging blockchain to optimize operations, lessen costs, and construct agree with among stakeholders.

1. Enhanced Security and Transparency

One of blockchain’s maximum enormous benefits is its ability to offer steady and obvious transactions. The decentralized and immutable nature of blockchain manner that once facts is recorded, it cannot be altered or deleted. This gets rid of the chance of fraud, unauthorized get entry to, and information manipulation, that is specifically useful in industries like banking, healthcare, and deliver chain management.

For example, in economic services, blockchain ensures that transactions are steady and verifiable, lowering the risks of fraud and cyberattacks. Smart contracts—self-executing contracts with coded regulations—in addition decorate protection through making sure agreements are automatically enforced with out intermediaries.

2. Efficiency and Cost Reduction

Blockchain eliminates the want for intermediaries, decreasing transaction expenses and increasing operational efficiency. Traditional commercial enterprise processes regularly contain multiple parties, main to delays and further expenses. Blockchain simplifies transactions by permitting peer-to-peer interactions and real-time agreement.

For instance, in deliver chain management, blockchain allows actual-time monitoring of goods from production to transport. Companies like IBM and Walmart use blockchain to beautify supply chain transparency, decreasing inefficiencies and improving product authenticity.

3 Transforming Financial Services

The monetary sector has skilled substantial disruption because of blockchain. Decentralized finance (DeFi) platforms provide alternatives to standard banking, permitting customers to get right of entry to economic offerings without relying on centralized institutions.

Blockchain-based virtual currencies, including Bitcoin and Ethereum, have added new strategies of moving value globally with minimal fees. Cross-border payments, which formerly took days and involved excessive transaction prices, at the moment are processed instantly and value-efficiently using blockchain era.

Moreover, valuable banks worldwide are exploring Central Bank Digital Currencies (CBDCs) to improve financial rules and financial inclusion. Countries like China, Sweden, and the US are trying out CBDCs to streamline charge systems and decrease reliance on coins.

Four. Improved Data Management and Identity Verification

Businesses generate enormous quantities of information that require steady garage and efficient control. Blockchain gives a decentralized answer for statistics management, ensuring records is stored securely and accessed most effective by way of legal events.

One of the maximum promising applications is digital identity verification. Blockchain-primarily based identity answers permit people to manipulate their non-public records, lowering identification robbery and fraud. Companies like Microsoft and IBM are growing blockchain-primarily based virtual identification structures to improve safety and privacy.

Five. Revolutionizing Healthcare

Blockchain is remodeling the healthcare industry via improving records security, patient file management, and drug supply chain monitoring.

Patient information saved on blockchain can be securely accessed with the aid of authorized healthcare companies, ensuring correct and efficient clinical records monitoring. Additionally, blockchain prevents counterfeit drugs from entering the deliver chain by using verifying the authenticity of pharmaceutical products.

For instance, MediLedger, a blockchain-primarily based community, facilitates pharmaceutical organizations tune pills and prevent counterfeit drugs from achieving purchasers.

6. New Business Models and Innovation

Blockchain allows the improvement of new business fashions, inclusive of tokenization and non-fungible tokens (NFTs). Tokenization lets in agencies to transform bodily assets into digital tokens, allowing fractional possession and liquidity.

NFTs have revolutionized the artwork and amusement enterprise by means of supplying a decentralized way to authenticate and alternate digital assets. Artists and content material creators can promote their paintings directly to shoppers, eliminating the need for intermediaries and ensuring truthful compensation.

Impact on Society

Blockchain is not simply remodeling agencies; it's also reshaping society through selling decentralization, financial inclusion, and believe in virtual interactions.

1. Financial Inclusion

A huge part of the global population lacks get entry to to traditional banking offerings. Blockchain presents an opportunity for the unbanked to participate inside the global economy thru digital wallets and decentralized finance platforms.

Cryptocurrencies and blockchain-based totally financial offerings permit individuals in developing international locations to ship and receive bills without counting on banks. Mobile-based totally blockchain wallets provide an alternative to conventional banking, permitting users to shop and switch finances securely.

For example, structures like Stellar and Celo are centered on supplying less expensive financial offerings to underserved populations, supporting bridge the distance between the unbanked and financial systems.

2. Decentralization and Empowerment

Blockchain promotes decentralization by using getting rid of the need for intermediaries, giving individuals more manipulate over their assets and records. This is specially relevant in regions with risky governments and monetary systems, where human beings face demanding situations accessing banking offerings and securing their wealth.

Decentralized Autonomous Organizations (DAOs) are every other example of blockchain-pushed empowerment. DAOs permit communities to make collective selections without centralized leadership, fostering democratic and obvious governance.

3. Increased Trust and Accountability

In many sectors, lack of transparency and responsibility has led to corruption and inefficiencies. Blockchain enhances trust by using providing an immutable and transparent document of transactions.

Governments and organizations can use blockchain to improve public trust through ensuring transparency in elections, supply chains, and charity donations. For instance, blockchain-primarily based voting systems can save you election fraud and increase voter confidence. Estonia has implemented blockchain-based balloting to beautify electoral protection and integrity.

Four. Environmental and Ethical Concerns

While blockchain gives many benefits, it additionally raises worries, particularly concerning electricity intake. Proof-of-Work (PoW) blockchain networks, which include Bitcoin, require extensive energy to validate transactions, contributing to environmental issues.

However, newer blockchain models like Proof-of-Stake (PoS) consume notably less electricity and are being followed to deal with those worries. Ethereum’s transition from PoW to PoS in 2022 reduced its energy consumption through over ninety nine%, making blockchain extra sustainable.

Five. Privacy and Data Ownership

In the virtual age, private facts is frequently misused via agencies and governments. Blockchain-primarily based privateness solutions empower individuals to manipulate their records and limit unauthorized access.

Self-sovereign identification (SSI) is a concept in which people personal and manipulate their digital identities with out relying on 1/3 events. This prevents records breaches and identity theft at the same time as improving privacy protection.

6. Humanitarian Aid and Crisis Response

Blockchain technology is being used for humanitarian efforts, providing useful resource to refugees and disaster-stricken regions more efficaciously. Organizations like the World Food Programme (WFP) use blockchain to distribute aid without delay to beneficiaries, decreasing fraud and ensuring transparency.

For instance, WFP’s "Building Blocks" assignment uses blockchain to distribute meals assistance to Syrian refugees, ensuring finances attain those in want without intermediaries.

Challenges and Future Outlook

Despite its capacity, blockchain faces numerous challenges, together with:

Regulatory Uncertainty – Governments worldwide are still developing guidelines for blockchain and cryptocurrencies, developing uncertainty for agencies and customers.

Scalability Issues – Some blockchain networks conflict with gradual transaction processing speeds, restricting vast adoption.

Adoption Barriers – Many groups and people lack the technical know-how to put in force and use blockchain correctly.

Security Risks – While blockchain is steady, vulnerabilities in clever contracts and decentralized programs may be exploited via hackers.

2 notes

·

View notes

Text

Why Choose Malgo for Your Cryptocurrency Development Needs? A Comprehensive Guide

Cryptocurrency is rapidly changing the way businesses and individuals approach finance and technology. From its decentralized nature to its potential to disrupt traditional financial systems, the world of cryptocurrency is growing, and businesses are looking to adopt this innovative technology. But when it comes to cryptocurrency development, you need a reliable partner who can guide you through the process. That’s where Malgo comes in. This comprehensive guide explains why Malgo is the good choice for your cryptocurrency development needs.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. It operates independently of any central bank, meaning it is decentralized. Unlike traditional currencies issued by governments, cryptocurrencies are based on blockchain technology, a decentralized system that records all transactions made with a particular cryptocurrency.

Cryptocurrency offers numerous advantages over traditional currencies, including lower transaction fees, faster transaction times, and greater privacy. The most well-known cryptocurrency is Bitcoin, but there are thousands of other cryptocurrencies, each with its own unique features and use cases.

What is Cryptocurrency Development?

Cryptocurrency development refers to the creation and maintenance of digital currencies and blockchain-based solutions. It involves building the underlying technology that supports cryptocurrencies, including the development of wallets, exchanges, and security features.

For businesses looking to create their own cryptocurrency or blockchain-based solutions, cryptocurrency development is a critical step. It requires a deep understanding of blockchain technology, security measures, and the regulatory landscape. Cryptocurrency developers must be proficient in coding, cryptography, and distributed ledger technology to ensure that their digital currency is secure, scalable, and functional.

Why Should You Choose a Cryptocurrency Development Company? Key Considerations

Choosing a cryptocurrency development company is a significant decision. Several factors should be considered when making your choice, as the right company will play a key role in the success of your cryptocurrency project.

Expertise and Experience: A reputable cryptocurrency development company should have a team of experienced developers who are well-versed in blockchain technology, cryptocurrency protocols, and security measures. This expertise ensures that your cryptocurrency is built on a solid foundation.

Security: Security is one of the most critical aspects of cryptocurrency development. Your development partner should have a strong focus on building secure platforms that protect users' funds and data from cyber threats.

Regulatory Knowledge: The cryptocurrency industry is heavily regulated in many regions. A good development company will stay updated on the latest regulations and ensure that your cryptocurrency project complies with local laws.

Post-launch Support: Cryptocurrency development doesn't end once the product is launched. Ongoing support and maintenance are necessary to keep your cryptocurrency platform running smoothly and to address any emerging issues or updates.

Types of Cryptocurrencies:

There are various types of cryptocurrencies, each serving a different purpose and offering unique advantages for businesses. Understanding these types is essential when considering the development of your own cryptocurrency solution.

Coins: Coins like Bitcoin and Ethereum are the most commonly known cryptocurrencies. They have their own blockchain and are primarily used as a store of value or for transactions.

Tokens: Unlike coins, tokens are built on existing blockchains like Ethereum. These tokens can represent a variety of assets, from real-world assets to digital services. They are commonly used in Initial Coin Offerings (ICOs) and as a way to raise funds for new blockchain projects.

Stablecoins: Stablecoins are cryptocurrencies that are pegged to the value of a stable asset like a fiat currency (USD, EUR, etc.). They offer the benefits of cryptocurrency but without the volatility, making them ideal for businesses looking to integrate cryptocurrency into their operations without the risk.

Utility Tokens: These tokens are used to access specific features or services within a blockchain platform or ecosystem. For example, they might be used as payment for transactions or to access special services on a platform.

Security Tokens: Security tokens are digital representations of real-world assets like stocks or bonds. They are subject to regulation and provide businesses with an avenue to tokenize their assets for better liquidity and broader investor access.

Can Malgo Help with Regulatory Compliance for Cryptocurrency Projects?, A Clear Answer

Regulatory compliance is one of the most important aspects of cryptocurrency development. The regulatory landscape for cryptocurrency is complex and varies from country to country. Failure to comply with regulations can result in penalties, delays, or even project cancellation.

Malgo is well-versed in the regulatory requirements of the cryptocurrency industry. They have a team of legal and compliance experts who stay up-to-date with the latest laws and regulations.Their team can guide you through the regulatory process and help ensure that your cryptocurrency project adheres to all necessary legal requirements, such as Anti-Money Laundering (AML) and Know Your Customer (KYC) policies.

By choosing Malgo, you can be confident that your cryptocurrency project will comply with the laws of the countries in which you operate, ensuring a smooth and legal launch.

Does Malgo Provide Post-Launch Support for Cryptocurrency Projects?

Developing a cryptocurrency is just the beginning. The success of your cryptocurrency project largely depends on how well it is maintained and updated after its launch. This includes fixing bugs, adding new features, and ensuring the platform remains secure.

Malgo offers extensive post-launch support for cryptocurrency projects. Their team provide ongoing monitoring, troubleshooting, and updates to ensure that your cryptocurrency platform functions smoothly and securely. They also offers scalability solutions, meaning they can help your platform grow as your user base and transaction volume increase.

Having a partner like Malgo for post-launch support can make all the difference in maintaining a successful cryptocurrency platform.

Why Malgo is the Right Choice for Your Cryptocurrency Development Needs

Malgo stands out as a top choice for cryptocurrency development due to its expertise, commitment to security, and focus on customer satisfaction. With an experienced team of skilled developers and blockchain experts, Their team has successfully completed cryptocurrency projects and understands the industry's details. Security is a top priority at Malgo, implementing the latest protocols to safeguard your platform from vulnerabilities and attacks. Their regulatory experts ensure that your project remains compliant with shifting global laws, preventing potential legal issues. They also takes a customer-centric approach, building long-term relationships by offering best solutions aligned with your business goals, and providing post-launch support to ensure ongoing success. With a focus on scalability, Their team ensures your cryptocurrency platform can grow with your business. Ready to take your cryptocurrency project to the next level? Partner with Malgo for secure, scalable, and innovative solutions. Malgo’s deep understanding of the industry makes them the ideal choice for your cryptocurrency development needs.

Choosing the right cryptocurrency development partner is crucial for the success of your project. Malgo stands out as a top choice for businesses looking to develop a secure, scalable, and regulatory-compliant cryptocurrency platform. With a team of experienced developers, a strong focus on security, and a commitment to customer satisfaction, Malgo is the ideal partner for your cryptocurrency development needs.

2 notes

·

View notes

Text

Navigating the Maze of Crypto Scams: Effective Strategies for Prevention and Recovery

Introduction: The Rising Threat of Cryptocurrency Scams

As cryptocurrencies gain widespread acceptance, the lure of quick profits has not only attracted investors but also cybercriminals, leading to a surge in crypto-related scams. Protecting your digital assets against these threats requires a proactive approach, encompassing awareness, prevention, and recovery strategies.

Understanding Crypto Scams: The Basics

Identifying Common Types of Cryptocurrency Scams

Cryptocurrency scams can take various forms, each designed to part unsuspecting victims from their digital assets. Some prevalent types include:

Investment Scams: These scams promise extraordinary returns through crypto investments and are often structured like traditional Ponzi schemes.

Exchange Scams: Victims are tricked into using fake cryptocurrency exchanges, which may disappear overnight.

Wallet Scams: Scammers create fake wallets to steal user credentials and drain their holdings.

ICO Scams: Initial Coin Offerings (ICO) that are fraudulent, where the crypto token is either non-existent or the ICO itself is based on false promises.

Red Flags and Warning Signs

The key to avoiding cryptocurrency scams is recognizing warning signs, such as:

Promises of guaranteed high returns with little risk.

Anonymous teams or unverifiable developer identities.

Pressure to invest quickly or offers that seem too good to be true.

Techniques for Investigating Crypto Scams

Unraveling crypto scams requires a blend of technical expertise and investigative rigor. Effective techniques include:

Blockchain Analysis: Tools and software are used to analyze transactions and track the flow of stolen funds across the blockchain.

IP Address Tracking: Identifying the IP addresses associated with fraudulent activities can help pinpoint the scammer’s location.

Collaboration with Regulatory Bodies: Working with cryptocurrency exchanges and regulatory authorities can help in freezing fraudulent accounts.

Strategies for Recovering Lost Cryptocurrencies

Losing cryptocurrency to a scam can be devastating, but there are ways to attempt recovery:

Act Quickly: Immediate action can increase the chances of recovering stolen assets.

Crypto Recovery Services: Specialized services can assist in tracing lost or stolen cryptocurrencies and negotiating their return.

Legal Recourse: In some cases, legal intervention might be required to recover large sums.

Preventative Measures to Secure Your Assets

Implementing robust security measures is crucial in safeguarding your cryptocurrencies:

Utilize two-factor authentication (2FA) for all transactions.

Store large amounts of cryptocurrency in cold storage solutions.

Educate yourself continually about new types of scams in the crypto space.

Conclusion: Staying One Step Ahead of Crypto Scammers

As the crypto market continues to evolve, so too do the tactics of scammers. Staying informed, vigilant, and proactive is your best defense against these digital threats. For victims of crypto fraud, recovery may be challenging but not impossible, with the right guidance and support. For comprehensive support in crypto fraud investigation and recovery, visit www.einvestigators.net, your trusted partner in protecting and recovering your digital wealth.

3 notes

·

View notes

Text

The really fun thing about being friends with @spiderwarden is that the things we spoke about before, can be used for meta. Thank you, Melody, for being gracious enough to allow me to use the tags of this post.

Now, we all know Karlach as our happy-go-lucky, kind and caring friend / lover who we would destroy entire worlds for, but I think something that gets briefly looked over on occasion is the fact that she is used to being in danger. Constantly. It shows in her eyes, most of all, when we look past some of her body language. Everyone's eyes move because they are taking in their surroundings, and being able to assess the dangers / people around her based on what's in front of her and in her peripherals. This is something of second nature to her because she spent ten years being in constant peril.

This has given her a somewhat predatory nature when it comes to her environment, and how she can almost immediately assess what's where in a room from sight and sound alone. This goes hand-in-hand, also with the danger sense feature that is offered by barbarians as they level. She can quite literally pick out when something is a little off just from stepping into a room. Threat assessment is as natural as breathing and she doesn't need to specifically look around to know when something is fishy or where people / creatures are.

After all, despite how friendly and open she is, she was used as a weapon and old habits are trecherously hard to kick, especially when you've done all you can to survive.

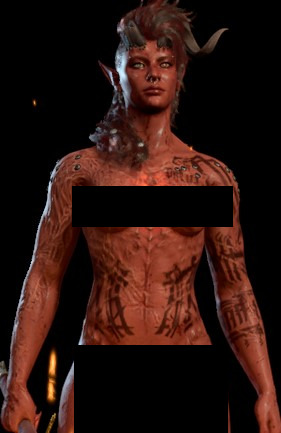

While Karlach spent a good portion of her young adult years in service of Enver as his bodyguard, she did not develop these skills as his bodyguard. While I personally headcanon that she excelled at that (he's alive, ain't he), there was actually very little outside of thugs and the occasional assassin (probably, this notion may change when I'm done researching), they were very easily disposed of in comparison to what Avernus threw at her. Avernus was an experience all on her own. While no stranger to the occasional scar, the most notable of which, before she was sold to Zariel, is seen in the gifset about.

Trivial, minor scars that come from the life she led before the hells. Hazards of the job, really.

Karlach's most notable scars are the burn marks over her shoulders and upper torso. While I like the idea of them being from the actual fighting, in actuality it was likely from the initial installation of the infernal engine that replaced her heart. Chances are, they did not quite realise that that much heat needed somewhere to go, and I mention this because that particular burn scar is localised around where they've littered the vents to let out steam.

Literal trial and error (maybe trial by fire huehuehue). The infernal engine scorching her like that is what led to her not only having vents installed, but the eventual inclusion of a similarly crafted slot where they would have given her soul coins to juice her up.

We can also see that the vents are on both shoulders, and the backs of them. This was likely their notion of protecting their "investment" with a little more of a careful hand. A dead champion is not a good champion.

This, she thought at the time, is all her life would be. A series of upgrades that would sculpt her into what Zariel wanted her to be as her hard-bought champion.

Now, if we look carefully at her arms and stomach, those are scars I think she got when she was actually fighting. The endlessness of the war does come with its price, and the fact that she has no fresh ones? Shows that not only did she do what she did to survive, but the fact that she was good at what she did.

#nsft /#it's censored but she is in fact nekkie#I will write up a separate post about the tattoos and how they are zariel showing off Karlach as her property later :)#i also think that in a double edged sword sort of way the one thing that kept her safe during the blood wars was the same thing-#that hindered her too in a way.#gnutty for gnomes. — [ out of character. ]#our hero? karlach. a knock-kneed delinquent from the outer city with everything to give & nothing to lose. — [ headcanons. ]

18 notes

·

View notes

Text

How to Select the Best Cryptocurrency Development Services Provider Near You?

Choosing the right cryptocurrency development services provider is crucial for the success of your blockchain project. Whether you're launching a new cryptocurrency, developing a decentralized application (dApp), or planning an Initial Coin Offering (ICO), finding a reliable and competent development team can make all the difference. Here’s a comprehensive guide to help you navigate this important decision.

1. Define Your Project Requirements

Before you start looking for a cryptocurrency development services provider, it’s essential to clearly define your project requirements. Outline the scope of your project, including technical specifications, desired features, security considerations, and any regulatory compliance requirements. Understanding your project needs will help you evaluate potential providers more effectively.

2. Evaluate Technical Expertise

One of the most critical factors in selecting a cryptocurrency development services provider is their technical expertise. Look for a team that has a proven track record in blockchain development, particularly in the specific technologies and platforms you intend to use (e.g., Ethereum, Hyperledger, Stellar). Verify their experience through case studies, client testimonials, and their portfolio of completed projects.

3. Assess Security Measures

Security is paramount in the cryptocurrency and blockchain space due to the high value of digital assets and the prevalence of cyber threats. Ensure that the development services provider has robust security protocols in place, including adherence to best practices such as code audits, multi-layered encryption, secure smart contract development, and regular security updates.

4. Check Regulatory Compliance

Regulatory compliance is another critical consideration, especially if your project involves tokens or involves financial transactions. Ensure that the development team is well-versed in relevant regulatory frameworks (e.g., KYC/AML regulations) and can implement compliance measures effectively. A reputable provider should prioritize legal compliance to mitigate regulatory risks.

5. Evaluate Development Methodologies

Understand the development methodologies and processes employed by the cryptocurrency development services provider. Agile methodologies are often preferred in blockchain development for their flexibility and iterative approach. Ensure that the provider emphasizes transparency, regular communication, and milestone-based deliverables to keep your project on track.

6. Review Client Support and Maintenance

Post-launch support and maintenance are crucial for the long-term success of your blockchain project. Inquire about the provider’s support services, including troubleshooting, bug fixes, and updates. A reliable provider should offer ongoing maintenance to address evolving technological and security needs, ensuring the continued functionality and security of your platform.

7. Consider Industry Reputation and Reviews

Research the reputation of potential cryptocurrency development services providers within the industry. Seek reviews from past clients and industry experts to gauge their reliability, professionalism, and overall satisfaction with the services provided. Online platforms, forums, and social media can provide valuable insights into the provider’s reputation and client relationships.

8. Evaluate Cost and Budget

While cost shouldn’t be the sole determining factor, it’s important to consider your budget and compare pricing among different providers. Beware of overly low-cost offers that may compromise quality or lack transparency in pricing structure. Look for a provider that offers competitive pricing aligned with the scope and complexity of your project, with a clear breakdown of costs.

9. Assess Communication and Collaboration

Effective communication and collaboration are essential when working with a cryptocurrency development services provider. Evaluate their responsiveness, clarity in communication, and willingness to understand your project vision. A provider who values collaboration and offers proactive suggestions can contribute significantly to the success of your blockchain venture.

10. Seek Customization and Scalability

Every blockchain project is unique, requiring tailored solutions to meet specific objectives. Ensure that the development services provider offers customization options and scalability to accommodate future growth and evolving market demands. Whether you’re launching a startup or expanding an existing platform, scalability should be a key consideration in your provider selection.

Conclusion

Selecting the best cryptocurrency development services provider near you involves careful evaluation of technical expertise, security measures, regulatory compliance, support services, reputation, cost, and collaboration capabilities. By thoroughly assessing these factors and aligning them with your project requirements, you can make an informed decision that sets the foundation for a successful blockchain venture.

Choosing the right partner is not just about finding a development team but selecting a strategic ally committed to your project’s success from inception through implementation and beyond.

#Cryptocurrency Development Services#Cryptocurrency Development#Cryptocurrency#Crypto#Cryptocurrency Development Solutions#Cryptocurrency Development Company#Cryptocurrency Development Agency

2 notes

·

View notes

Text

How to launch an ICO? the ultimate guide (step by step )

An ICO is the initial public offering of an asset, in this case a cryptocurrency asset, in the world of cryptocurrencies.

Beginning cryptocurrency lovers have a wonderful opportunity to become involved with an ICO by making a small initial investment because it frequently starts with a cryptocurrency at a cheap price.

Despite this, taking part in an ico software development carries both risk and reward. Investors may lose more money than they initially invested if there is minimal demand for the token. On the other hand, ICOs are intriguing, and it’s critical to balance the risk and return.

Step 1 : Form an idea

Although it may seem relatively obvious that you need an idea in order to launch an ICO, this is a chance to share ideas with others. Additionally, you can choose the specifics of your coin’s operation and general objective. For instance, some coins concentrate on certain niche markets, developing blockchain solutions in front of Web 3.0, while others merely want to be a coin that people can invest in and trade with.

Step 2: Put together a project team

Putting together a team enables you to contact individuals who are probably authorities in many of the fields in which you require information. This covers matters of law and regulation as well as potential applications for the coin’s functionality. Before the coin is made available to the general public, this team can offer a lot of information and address any project issues.

Step 3 : Write a whitepaper

Many cryptocurrencies start with a whitepaper that describes the tokenomics, goal, and business strategy of the coin, among other things. The paper, in theory, gives investors all the information they require to decide whether to purchase the coin.

If the coin is solving an issue, the whitepaper should explain what it is solving and how it will solve it. For maximum effect, host this on your website to attract new followers. You should also include a product roadmap in this document that outlines your goals for the coin’s future.

Step 4 : Smart contracts

The creation of a smart contract is one of the last steps in the ICO creation process. There are several choices besides the industry standard and most popular ERC-20. Furthermore, OpenZeppelin offers a tool (and template) to generate a smart contract with little to no input from you if you are unsure how to accomplish it. Once this is finished, run it and give it a close inspection.

Step 5: Deciding on a Coin Sales Model

The following step is to pick a sales model from among the several that are available. Your decision may be influenced by a number of variables, including where your headquarters are located (because many nations have varied regulations regarding ICOs).

There are eight different token sale models that you can use for an ICO.

1.Fixed rate offer (Uncapped)

According to this approach, a token would be offered for sale at a set price, enabling early adopters to buy a small number of tokens without the price volatility typically associated with the cryptocurrency market. Instead, it will only do so for a set amount of time before buyers of the token must pay the going market price.

2.Softcap

In a soft cap sales model, the creator of the token chooses the minimum ICO fundraising amount and sets the price in accordance. As a result, he demands the sale of a specific quantity of tokens for a specific sum, following which the ICO will run until the predetermined end date and time. This increases the likelihood that the fundraising will be a success.

3.Hardcap

With a hard cap, as opposed to a soft cap, the maximum amount of capital required is decided by the token developer. Depending on which occurs first, the ICO expires at this cap or at the conclusion of the ICO duration. It’s possible that as a result, prospective investors won’t have the chance to invest in the ICO, making it unlikely that some will think about doing so in the future.

4. Hidden cap

Investors won’t be aware of the amount of funding until the ICO because of concealed caps. They won’t be aware of any further targets until the ICO launches. This would keep important data under wraps until the public needs to know them, which can be helpful if there is a lot of speculation about the ICO.

5. Dutch auction

According to the Dutch auction process, the value of a cryptocurrency coin starts at the highest selling price. The price then decreases to a point where all of the bids received will cover the tokens being offered.

This is not the best way to launch an ICO for someone, especially if it’s their first time, because it’s very complicated. It may not be the best if the token developer desires a straightforward process because it operates counter to how an auction would typically operate.

6. Reverse Dutch Auction

The reverse Dutch auction should theoretically be the opposite of the aforementioned, although this is not exactly accurate. It is simpler, which is good news. There are only a certain amount of tokens available, and throughout the ICO’s lifetime, an equal number of tokens will be sold each day. So, for instance, 20% of the total token supply would be sold each day if the ICO lasted for five days.

If there is a lot of interest in the ICO, this relatively straightforward mechanism regulates the allocation of tokens.

7. Collect and return

Buyers can place bids above the predetermined price in this approach, but there is one. A portion of the capital may be returned to investors when the price exceeds a predetermined threshold. Investors will have to conduct numerous smaller transactions in order to obtain larger sums.

This increases the number of persons who can take part in the ICO development service . The drawback is that it results in increased transaction fees for users.

8. Dynamic roof