#Instant Emergency Loan Ghaziabad

Text

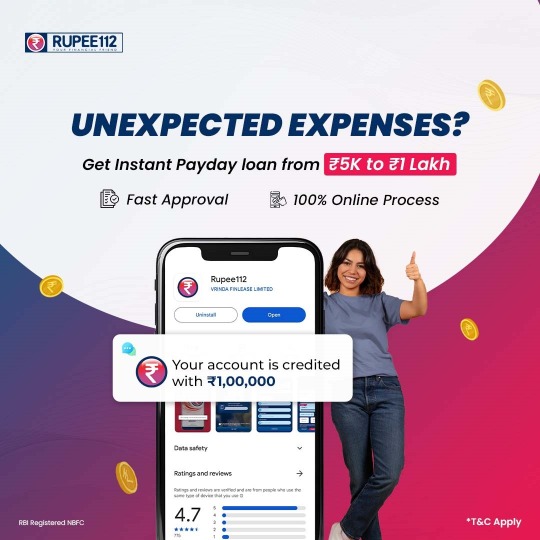

Apply for an instant personal loan

Rupee112 is an instant personal loan service provided by our customers. It is very reliable for instant loans. Those are quick service providers and easy ways. For more information visit our site.

#apply online for emergency loan Ghaziabad#Short Term Loans Online gurgaon#instant payday loan noida#Same Day Loan for Salaried Employees Bengaluru#Short term loan without CIBIL kolkata#short term loan for salaried employees Hyderabad#instant emergency loan Ghaziabad#Payday Loans for Salaried Employees faridabad#emergency loan online noida#Short Term Personal Loan in Gurgaon#instant personal loan for low cibil score noida#instant payday loan gurgaon

0 notes

Text

Delhi NCR, encompassing Delhi, Gurgaon, Noida, Faridabad, and Ghaziabad, is a bustling metropolitan region with a dynamic lifestyle. The demand for personal loans has surged, driven by various needs such as medical emergencies, education, travel, home renovation, or consolidating debt. This guide provides a detailed overview of applying for a personal loan in Delhi NCR, covering eligibility criteria, application process, necessary documentation, and tips to enhance approval chances.

Understanding Personal Loans

A personal loan is an unsecured loan provided by banks and non-banking financial companies (NBFCs) without requiring collateral. Borrowers can use the loan amount for any personal financial needs. Interest rates and repayment terms vary based on the lender and the borrower’s credit profile.

Why Apply for a Personal Loan in Delhi NCR?

1. Medical Emergencies:

Personal loans can cover unexpected medical expenses, ensuring timely treatment without financial strain.

2. Education:

Financing higher education or specialized courses can be challenging. A personal loan can bridge this gap.

3. Home Renovation:

Enhancing or renovating your home can be expensive. Personal loans offer a hassle-free way to manage these costs.

4. Debt Consolidation:

Consolidating multiple debts into a single loan simplifies repayment and can reduce the overall interest burden.

5. Travel and Wedding Expenses:

Personal loans can fund dream vacations or weddings, allowing you to create cherished memories without financial worry.

Eligibility Criteria for Personal Loans in Delhi NCR

Different lenders have varying criteria, but common eligibility requirements include:

1. Age:

Borrowers should typically be between 21 to 60 years old.

2. Employment Status:

Both salaried and self-employed individuals are eligible. Salaried employees need to be in their current job for a minimum period (usually six months to a year), while self-employed individuals should have a stable business with a proven track record.

3. Income:

A minimum monthly income requirement, usually starting from INR 20,000, is mandatory. Higher income levels can improve the chances of approval.

4. Credit Score:

A good credit score (typically above 750) is crucial. It reflects the borrower’s creditworthiness and impacts the interest rate and loan amount approved.

5. Existing Liabilities:

Lenders assess current EMIs and liabilities to gauge repayment capacity.

Steps to Apply for a Personal Loan in Delhi NCR

1. Research and Compare Lenders:

Compare interest rates, processing fees, repayment terms, and customer reviews of various banks and NBFCs.

2. Check Eligibility:

Use online eligibility calculators provided by lenders to check your eligibility.

3. Prepare Documentation:

Gather necessary documents, including identity proof, address proof, income proof, and bank statements.

4. Apply Online or Offline:

Online: Visit the lender’s website or download their mobile app. Fill out the application form, upload documents, and submit.

Offline: Visit the nearest branch of the bank or NBFC, fill out the application form, and submit the documents.

5. Verification and Approval:

The lender verifies the documents and may call for additional information. Approval is based on meeting eligibility criteria and verification results.

6. Disbursement:

Upon approval, the loan amount is disbursed to your bank account, usually within a few days.

Necessary Documentation

1. Identity Proof:

Aadhaar Card

Passport

Voter ID

PAN Card

2. Address Proof:

Utility bills (electricity, water, gas)

Rent agreement

Passport

Bank statement

3. Income Proof:

Salary slips for the last three to six months

Form 16

Income tax returns (for self-employed individuals)

4. Bank Statements:

Bank statements for the last three to six months

5. Photographs:

Recent passport-sized photographs

Tips to Enhance Loan Approval Chances

1. Maintain a Good Credit Score:

Regularly check your credit score and take steps to improve it by paying bills on time, reducing debt, and avoiding new credit inquiries.

2. Choose the Right Loan Amount:

Borrow only what you need and can comfortably repay. A lower loan amount increases approval chances.

3. Provide Accurate Information:

Ensure all information provided in the application is accurate and matches the documents submitted.

4. Reduce Existing Debt:

Pay off existing loans and credit card balances to improve your debt-to-income ratio.

5. Show Stable Income:

Provide evidence of a stable and sufficient income to demonstrate your repayment capacity.

6. Opt for a Longer Tenure:

A longer tenure reduces the EMI amount, making it easier to manage repayments, though it might increase the total interest paid.

Common Pitfalls to Avoid

1. Applying with Multiple Lenders Simultaneously:

Multiple loan applications within a short period can negatively impact your credit score.

2. Ignoring Fine Print:

Carefully read the terms and conditions, focusing on interest rates, processing fees, prepayment charges, and late payment penalties.

3. Over-borrowing:

Borrowing more than needed can lead to unnecessary financial strain.

4. Not Checking Credit Score:

A low credit score can lead to rejection or higher interest rates. Regularly monitor your credit score.

5. Delaying EMI Payments:

Timely repayment of EMIs is crucial to maintain a good credit score and avoid penalties.

Conclusion

Applying for a Personal Loan Providers in Delhi is a straightforward process if you understand the requirements and prepare accordingly. By choosing the right lender, providing accurate information, and maintaining a good credit profile, you can secure a personal loan to meet your financial needs. Always compare multiple offers, understand the terms, and borrow responsibly to ensure a smooth loan experience.

#personal loan in Delhi#personal loan in Delhi NCR#Personal Loan Providers in Delhi#instant personal loan in Delhi#apply for personal loan in delhi#online personal loan in delhi

0 notes

Link

Payday Loan in Delhi NCR | Cash Advance Loan: Payday loans are the best loan to overcome any emergency need of money for short period of time.

Adiloans understands the problem and provides instant Payday loan in Noida, Delhi, Faridabad, Ghaziabad, Gurugram/Gurgaon, and in other areas of Delhi NCR. To make loan process smooth and easy we introduce Online and complete technology driven loan process.

0 notes

Link

Instant Loan in Ghaziabad, Personal Loan in Ghaziabad | Phocket

Instant Loans in Ghaziabad

Ghaziabad is a city in the Indian state of Uttar Pradesh. It is sometimes referred to as the "Gateway of UP" because it is close to New Delhi, on the main route into Uttar Pradesh. It is a part of the National Capital Region of Delhi.

Feeling a fund crunch for your necessities? There's an easy solution to all your cash problems Ghaziabad, with Instant Cash Loans from Phocket. Phocket provides Instant Cash to Salaried Professionals between INR 5,000 and 1,00,000 with single EMI option for loans up to INR 10,000, flexible EMIs option (1/2/3) for loans greater than INR 10,000 in Ghaziabad. Our process is super fast and fully automated and instant cash is processed on the Same Day in Ghaziabad. The Instant cash loan can be taken for multiple purposes like Meeting EMIs, Credit card payment, Education loans, Travel loans, House renovation, Medical emergencies, Shopping and even for Festivals or Celebrations. Phocket's Instant cash helps you not to worry about the cash shortage problems and let Phocket take care of your financial requirement in a hassle-free manner. Take Phocket's Instant Cash Loans and feel the difference from other instant cash loan providers in Ghaziabad.

Follow the following steps to avail the Phocket's Instant Cash -

Visit our Website phocket.in or download our mobile app from Google Play Store

Fill Out a Quick Application Form, Upload the required documents and Submit your application to avail Instant Cash.

READ MORE-Get Instant Personal Loan, Advance Salary Online, Short term Loans | Phocket

0 notes

Text

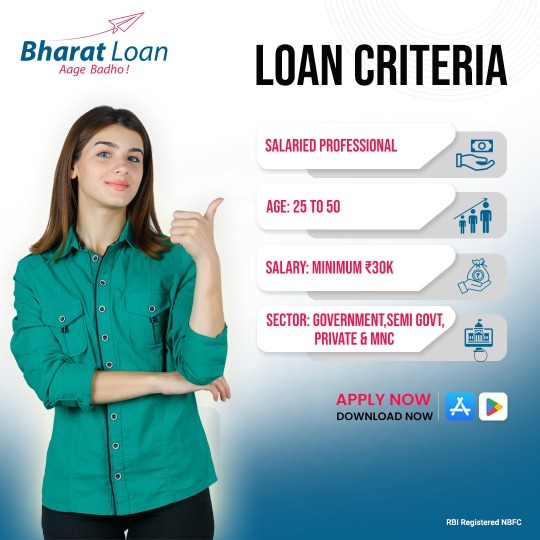

Redefining Financial Solution - Personal loan in Faridabad

Everyone is in the pursuit of achieving more; it can be getting a new car, a salary hike, a new job that pays more, starting a business, etc. While making sure every need and want is fulfilled, what if financial emergencies arise and you are left with nothing? When such situations arise, anyone, especially salaried employees, can access support from Bharat Loan, offering short-term loans ranging from ₹5k to ₹1Lakh. Visit the blog to read more.

Visit- Redefining Financial Solution - Personal loan in Faridabad

#Apply Online For Emergency Loan Ghaziabad#Salaried Loan Providers Ghaziabad#Best Instant Personal Loan App Ghaziabad#Instant Emergency Loan Ghaziabad#Best Instant Personal Loan App Ahmedabad#Payday Loans For Salaried Employees Faridabad#Urgent Personal Loans Ghaziabad#Emergency Personal Loans Delhi#Instant Personal Loan App Ahmedabad

0 notes

Text

What are the eligibility criteria for salaried professionals to access a personal loan?

The personal loan for salaried employees offered by Rupee112 can be of help at any time, for immediate need for funds to repair something at home, funds to travel to your dream vacation, or some funding for your business that requires an additional amount. Visit the blog to read more.

Visit- https://writeupcafe.com/what-are-the-eligibility-criteria-for-salaried-professionals-to-access-a-personal-loan/

#apply online for emergency loan Ghaziabad#Short Term Loans Online gurgaon#Same-Day Employee Loans Ghaziabad#instant payday loan noida#Same Day Loan for Salaried Employees Bengaluru#Short term loan without CIBIL kolkata#short term loan for salaried employees Hyderabad#instant emergency loan Ghaziabad#Payday Loans for Salaried Employees faridabad

0 notes

Text

Emergency Loan - Get Urgent Personal Loan Online

Get an Emergency personal loan of up to ₹ 1 lakh for any medical emergency. Instant approval, hassle-free process, and quick disbursement. 24*7 support! For more information visit the site.

Visit- https://www.bharatloan.com/apply-now

#Apply Online For Emergency Loan Ghaziabad#Salaried Loan Providers Ghaziabad#Best Instant Personal Loan App Ghaziabad#Instant Emergency Loan Ghaziabad#Best Instant Personal Loan App Ahmedabad#Payday Loans For Salaried Employees Faridabad#Urgent Personal Loans Ghaziabad#Instant Payday Loan Mumbai#Emergency Personal Loans Delhi#Instant Personal Loan App Ahmedabad#Instant Personal Loan For Salaried Employee Hyderabad#Urgent Payday Loans Hyderabad#Top Personal Loan Providers Ahmedabad#Instant Short Term Loan Online Chennai#Short Term Personal Loan In Gurgaon#Instant Emergency Loan Ahmedabad#Best Instant Personal Loan Hyderabad#Immediate Personal Loans Faridabad

0 notes

Text

Emergency Loan - Get Urgent Personal Loan Online

Digital, paperless online method. You can apply for an emergency loan without moving out of your house. Upload your papers on the bank's website and wait. Get instant online support on medical alternative loans of up to ₹1 Lakhs. Get the loan amount distributed within 10 minutes of signing the agreement, without a credit score received loan. For more information visit our site.

Visit- https://www.bharatloan.com

#Apply Online For Emergency Loan Ghaziabad#Salaried Loan Providers Ghaziabad#Best Instant Personal Loan App Ghaziabad#Instant Emergency Loan Ghaziabad#Payday Loans For Salaried Employees Faridabad#Emergency Personal Loans Delhi

0 notes

Text

Apply Instant Emergency Loan

Get Instant Online Loans in Minutes with Bharatloan Personal Loan App Online. Clients canister now download the instant loan app online such as Bharatloan. Read More.. https://www.ted.com/profiles/46583025

#instant personal loan app#personal loan apply#Apply instant emergency loan#loan apply online#Salaried Loan Providers Ghaziabad#Best Instant Personal Loan App Ghaziabad#Instant Emergency Loan Ghaziabad#Best Instant Personal Loan App Ahmedabad#Payday Loans For Salaried Employees Faridabad#Urgent Personal Loans Ghaziabad#Instant Payday Loan Mumbai#Emergency Personal Loans Delhi#Instant Personal Loan App Ahmedabad#Instant Personal Loan For Salaried Employee Hyderabad#Urgent Payday Loans Hyderabad#Top Personal Loan Providers Ahmedabad#Instant Short Term Loan Online Chennai#Short Term Personal Loan In Gurgaon#Instant Payday Loan Gurgaon

0 notes

Text

Apply for Instant Personal Loan Online Of Up To Rs. 1 Lakh

Apply for instant personal loans online with Rupee112. Get a Personal Loan up to 1 lakh immediately at small interest rates, and supple repayment options. Rupee112 is the best and most reliable service provided by our client. For more information Visit our site.

Read More.. https://www.makedo.fr/profile/rupee112/profile

#apply online for emergency loan Ghaziabad#Short Term Loans Online gurgaon#Same-Day Employee Loans Ghaziabad#instant payday loan noida#Same Day Loan for Salaried Employees Bengaluru#Short term loan without CIBIL kolkata#short term loan for salaried employees Hyderabad#instant emergency loan Ghaziabad#Payday Loans for Salaried Employees faridabad#Short Term Personal Loan in Gurgao#instant personal loan for low cibil score noida#Personal Loan for Salaried Employee Faridabad#urgent payday loans Kolkata#emergency personal loan app Ahmedabad#Urgent Personal Loans Ghaziabad

0 notes

Text

Instant Loan For Salaried Employee Hyderabad

Rupee112 is offering instant loans to salaried employees of Hyderabad, which can be your one-stop solution for managing financial emergencies effortlessly. Download the app now and apply. For more information visit our site.

Visit- https://www.rupee112.com/apply-now

#Short Term Loans Online gurgaon#Same-Day Employee Loans Ghaziabad#instant payday loan noida#Same Day Loan for Salaried Employees Bengaluru#Short term loan without CIBIL kolkata#short term loan for salaried employees Hyderabad#instant emergency loan Ghaziabad#instant personal loan low cibil chennai#Personal Loan for Salaried Employee Faridabad

0 notes

Text

Emergency Loan - Get Urgent Personal Loan Online

Need Immediate financial support? Apply now for an emergency loan from Rupee112 and get the support you need. Rupee112 personal loan is the best Service provided to our customers. For more information visit our site.

Visit- https://www.rupee112.com/apply-now

#Short Term Loans Online gurgaon#Same-Day Employee Loans Ghaziabad#instant payday loan noida#Same Day Loan for Salaried Employees Bengaluru#Short term loan without CIBIL kolkata#short term loan for salaried employees Hyderabad#instant emergency loan Ghaziabad#Payday Loans for Salaried Employees faridabad#emergency loan online noida

0 notes

Text

Experience the power of Rupee112's Instant Personal Loan, providing immediate financial relief when you need it the most. Say goodbye to long waits and financial stress. With Rupee112, you can easily access funds to address your urgent needs. Apply now for a seamless process, quick approvals, and instant disbursals. Rupee112 is here to empower you with financial freedom and flexibility!

#apply online for emergency loan Ghaziabad#instant emergency loan Ghaziabad#Short term loan without CIBIL kolkata#short term loan for salaried employees Hyderabad#Short Term Loans Online gurgaon#instant payday loan gurgaon#Personal Loan for Salaried Employee Faridabad#emergency personal loan app Ahmedabad#Urgent Personal Loans Ghaziabad#emergency personal loan approval gurgaon#best instant personal loan app Ahmedabad#Short Term Loan Services faridabad#instant personal loan low cibil chennai#Online personal loans faridabad#instant payday loans Bengaluru

0 notes

Text

Apply Online for Emergency Loan Ghaziabad

Ghaziabad residents, apply for instant personal loan from Rupee112 online for emergency and get the funds you need within minutes. Quick approvals and efficient online processes ensure you handle unforeseen expenses with ease. Your financial safety net is here. Apply now! Visit the read more.

Visit- https://www.rupee112.com/

#instant personal loan online gurgaon#instant emergency loan Ghaziabad#Apply instant emergency loan Ahmedabad#Top Personal Loan Providers Ahmedabad#best instant personal loan app Ahmedabad#best personal loan provider app

0 notes

Text

Rupee112 is a leading financial institution committed to empowering individuals in their financial journey. As a trusted lender, Rupee112 specializes in providing Instant Personal Loans to individuals facing various financial needs and challenges.

Reference Link:-https://in.pinterest.com/pin/1118089044977730177/

#Payday Loans for Salaried Employees faridabad#emergency personal loan app Ahmedabad#Urgent Personal Loans Ghaziabad#emergency personal loan approval gurgaon#urgent payday loans Kolkata#best instant personal loan app Ahmedabad#Short Term Loan Services faridabad#instant personal loan low cibil chennai#Immediate personal loans faridabad#Online personal loans faridabad#Salary-Based Loans Mumbai#instant payday loans Bengaluru#instant personal loan for salaried gurgaon#best instant loan app kolkata#instant loan for salaried employee Hyderabad

2 notes

·

View notes

Text

Instant Personal Loan Online

Bhartloan is very reliable and provides better loan service. It is a speedy and flexible service provided. Apply for a loan minute disbursal within 10 minutes. For more information visit our site.

Visit- https://www.bharatloan.com/apply-now

#Apply Online For Emergency Loan Ghaziabad#Payday Loans For Salaried Employees Faridabad#Instant Payday Loan Ghaziabad

0 notes