#InternationalTransfers

Text

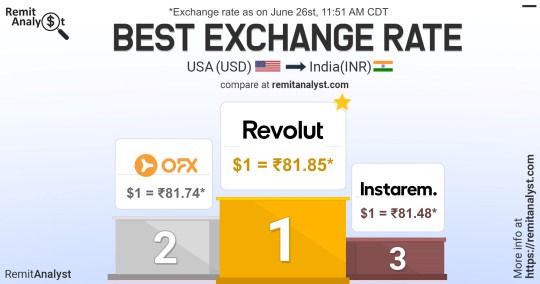

Are you looking to send money from the USA to India and searching for the best exchange rates? Look no further! RemitAnalyst is here to help you find the most competitive USD to INR rates in the market, ensuring that you save more with every transfer.

Why Choose RemitAnalyst?

RemitAnalyst is committed to providing you with a seamless and reliable remittance experience. Our goal is to empower you to make informed decisions when sending money to India, maximizing the value of your transfers.

Trusted Worldwide Service Provider:

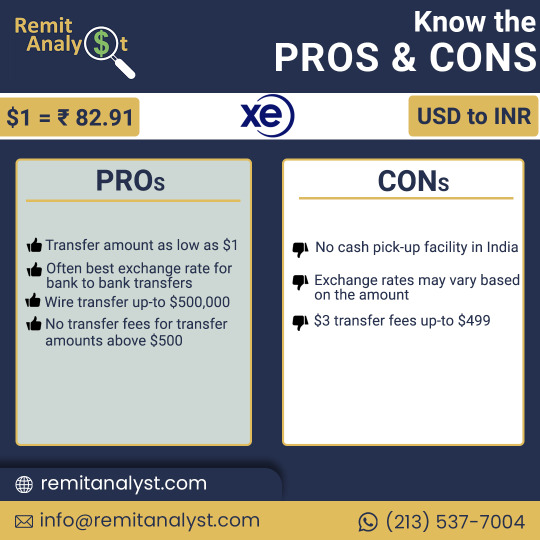

RemitAnalyst collaborates with XE Money, a renowned and trustworthy remittance service provider with a global footprint. Trust and reliability are at the core of our services.

Best USD to INR Exchange Rates:

We understand the importance of getting the best value for your money. Our platform allows you to compare USD to INR exchange rates from various providers to ensure you secure the most favorable rate available.

Save More with Every Transfer:

Comparing exchange rates through RemitAnalyst allows you to identify the best current rates for transferring money from the USA to India. Saving on exchange rates means more funds reaching your loved ones back home

How to Get Started:

Visit RemitAnalyst:

Navigate to our user-friendly website at www.remitanalyst.com .

Select Your Transfer Details:

Input the amount you wish to send and choose the currency pair (USD to INR).

Compare Rates:

View and compare the current exchange rates offered by various service providers to find the best deal.

Choose Your Provider:

Select the remittance service provider offering the most attractive rates and services for your transfer.

Initiate the Transfer:

Follow the steps to initiate your transfer securely and conveniently.

RemitAnalyst is here to simplify your remittance process and help you save more on your USD to INR transfers. Compare rates, choose wisely, and send money to your loved ones in India with confidence and savings.

Disclaimer: Exchange rates may vary and are subject to change. Please refer to the respective remittance service provider for the most up-to-date rates.

#RemitAnalyst#USDtoINR#MoneyTransfer#Remittance#XEMoney#SendMoneyToIndia#ExchangeRates#SaveMore#CurrencyExchange#InternationalTransfers

0 notes

Text

Need to transfer key personnel from abroad to your U.S. office? The L visa is a perfect fit for multinational corporations seeking to temporarily relocate their key employees.

https://visaserve.com/lawyer/2023/06/19/L-1-Visa/Need-to-transfer-key-personnel-from-abroad-to-your-U.S.-office_bl53790.htm

#L1Visa #L1A #L1B #IntraCompanyTransfer #ManagerialPosition #ExecutivePosition

#USImmigration #VisaExtension #MultinationalCompanies #GlobalMobility #EmployerEmployeeRelationship #USBusinessExpansion #InternationalTransfers #WorkVisa #USImmigrationPolicy #BusinessImmigration

0 notes

Text

ACCRUON CONSULTANTS

Transfer Pricing in UAE

The UAE’s implementation of a transfer pricing scheme can be seen as a crucial step in enhancing its standing as a desirable investment location and regional centre.

Due to the fast expansion of international markets, transfer pricing is becoming more and more relevant and crucial for businesses all over the world. Our wide variety of transfer price services, which we offer as subject matter experts, also includes advisory services, compliances, and transfer pricing planning.

Framing Transfer Pricing Policy and Advisory

Accrounis made up of economists, tax experts, and MBAs with practical experience in internationaltransfer pricing in UAE. By facilitating uniform reporting and removing internal discrepancies that may result from using multiple service providers, this unified worldwide approach makes the process more effective, efficient, and simple to explain to the appropriate authorities.

Transfer pricing, policy and advisory structuring

The concept of internal agreed-upon arm’s length and transfer pricing have gained popularity in the Middle East. When interacting with the federal tax authorities, theUAE’s corporate taxas well as the right transfer pricing plan and documentation will be crucial.

Allowing companies to modify existing policies in accordance with local legislation, corporate functions, and assessing how new tax rules might effect their overall tax condition.

Assisting companies in the analysis, reporting, and development of tools and procedures for tracking the results of transfer pricing.

Assist companies in creating and putting into place cost- and economically successful TP policies.

In the future, it will be essential for the company to have the tools and experts at their disposal. ATP policy that is structured and clearly stated will act as a comprehensive strategy for daily activities.

Transfer Pricing Documentation

Transfer pricing issues will arise as a result of a corporate entity’s expanding volume and complexity of domestic and international transactions, raising regulatory costs for taxpayers.

Transfer pricing issues will arise as a result of a corporate entity’s expanding volume and complexity of domestic and international transaction, raising regulatory costs for taxpayers.

A business will also need to maintain a master and local file if the arm’s length value of their related party transactions exceeds a certain threshold during the appropriate tax period (with format and content corresponding to the standards established under OECD BEPS Action 13).

Transfer Pricing Documentaion under OECD Guideliness

Authorities use a three-tiered approach for transfer pricing paperwork that is in accordance with

OECD transfer pricing rules. This approach entails:

Local file: A document that specifically refers to significant transactions involving local taxpayers.

County by country report : Information on the earnings and taxes the MNE group has paid, as well as details on the locations of its economic activities.

Goals of Transfer Pricing documentation in UAE

Let’s quickly go over the main objectives of transfer price documentation.

To give the information needed for tax authorities to conduct a precise assessment of the risk involved with transfer pricing.

To provide tax authorities with useful information they can use to conduct a full analysis of the firms’ transfer pricing practises.

In what ways does Accruon Consultants support UAE transfer pricing documentation?

Aids in the creation of transfer pricing documentation that meet TP standards

Assessing your present records to make sure they adhere to TP guidelines

Helping by providing guidance and advice on TP papers.

County by county reporting in UAE

According to the Country by Country Reporting (CbCR) rules put into place in the UAE with effect in 2019, large multinational enterprises (MNE) operating in the UAE are expected to submit a report to the appropriate authorities at the end of each financial year. AtAccroun Consultants,we have a team of tax advisors who can help customers understand the cbcr UAE requirements, conduct the necessary research to see if their business operations are subject to the limitations, and provide assistance with any necessary adherence.

CbCR: an Overview

Action 13 of the Base Erosion and Profit Shifting (BEPS) programme of the Organization for Economic Cooperation and Development (OECD) includes CbC Reporting UAE. The UAE has committed to implementing the BEPS basic standards for transfer pricing documentation and country-by-country reporting.

BEPS Action 13 mandates that large multinational groups of entities (MNEs) provide a CbC Report that includes a review of the MNE’s global revenue, profit before tax, income tax accrued, and numerous other economic activity indicators for each country in which it does business.

Organizations with tax residency in the United Arab Emirates and membership in MNEs with combined revenues equal to or above AED 3.15 billion (EUR 764 million / USD 858 million) in the fiscal year before the “financial reporting year” in question are subject to the CbCR criteria.

CbC Reporting Goals

CbC Reporting aims to address any informational gaps that may exist between tax administrations and taxpayers regarding the location of business value creation within MNE Groups and whether or not this corresponds to the locations where earnings are distributed and taxes are paid globally.

UAE CbCR regulations are applicable to MNE organization’s having headquarters in the UAE and financial reporting years starting on or after January 1, 2019.

What standards apply to filing?

The CbC report shall be submitted within 12 months following the end of the reporting period. For instance, the CBC report will be delivered no later than December 31, 2020, if the financial reporting year starts on January 1st, 2019.

Reasons for Submitting CbC Report

The major recommendations for submitting the CbCR report are as follows:

To evaluate the risks of transfer pricing. to assess any additional hazards associated with BEPS.

To check whether the companies making up the MNE Group are abiding by the relevant transfer pricing laws.

To look up the company’s financials to see how much economic value was generated

CbC reporting in UAE : Asst Accruon Consultants

The UAE’s adoption of the CbCR recommendations is a crucial step that demonstrates to the international tax community the UAE’s commitment to passing new BEPS-related legislation. For the vast majority of MNE companies operating in the UAE, the new restrictions offer independence.

The new rules will mainly affect eligible MNE groups with headquarters in the UAE because they must develop and submit a CbC report. All qualified MNE organisations should review their status and ensure compliance because of the significant penalties for non-compliance.

A new federal corporation tax system will be implemented in the UAE starting on or after June 1, 2023, according to a historic announcement made by the UAE Ministry of Finance. The UAE will impose a normal corporation tax rate of 9%; the tax structure is designed to take into account global best practises and lessen the burden of company regulations.

The analysis of related party/connected person transactions to determine if they are priced in line with the arm’s length principle, or the price that a third party would pay for roughly the same deal under same conditions, is known as transfer pricing. Once the corporate tax is put in place, the Transfer Pricing Rules would be applicable in the UAE. All parties would be subject to the transfer pricing rules and other pertinent restrictions.

Transfer pricing advisory in UAE

Let’s quickly review the services we provide.

Transfer Pricing Policy Structure

Transfer pricing and the concept of internal agreed-upon arm’s length are becoming more popular in the Middle East. The corporation tax, along with the appropriate transfer pricing strategy and documentation, will be essential when communicating with the federal tax authorities. Therefore,

having the appropriate tools and professionals at their side will become more and more important for businesses in the future. A TP policy that is organised and clearly stated will act as a road map for daily activities. It will also guarantee:

Compliance withUAE Corporate TaxLaws, Appropriate Decision-Making Guidance, and Simplified Internal Procedures

Transfer Pricing Documentation

Businesses must adhere to the transfer pricing guidelines and supporting paperwork set forth by the OECD. Transfer pricing issues can be avoided by taxpayers by establishing that their transactions adhere to the arm’s length principle with the help of appropriate documentation. Accruon Consultants focuses on international business transactions and transfer pricing laws.

Accruon Consultants, a seasonedtax expert in the Dubai , UAE, can offer advice on upholding prope and efficient:

Local file

Master file

Assistance with Transfer Pricing Disclosure

The effective management of Transfer Pricing (TP) adherence and paperwork is now more important than ever for businesses. With the aid of knowledgeable tax experts, such asAccruon Consultants, the TP disclosure form would be provided, along with the fact that it is included in and submitted as part of the CIT return.

Country by Country reporting

Large multinational enterprises (MNEs) in the UAE are required to file a report with the relevant parties at the end of each financial year, detailing the amount of revenue, profit or loss before tax, income tax accrued, income tax paid, tax residence of the constituent company, and so on.

Transfer Pricing due diligence

The focus of tax authorities’ efforts is transfer pricing. As a well-known tax consultant in Dubai ,UAE, Accroun Consultants offers services in performing due diligence investigations to identify potential hazards and guarantee that transfer pricing guidelines and paperwork are followed.

Businesses in the UAE will have to abide by transfer pricing regulations and procedural requirements in accordance with the OECD Transfer Pricing Guidelines. The arm’s length rule should be used by tax payers to confirm that related-party transactions are valued separately. It is commendable and essential that the UAE made the switch to a tax economy in response to growing competition since it encourages economic diversity and responsibility. The importance of following an authority’s rules and regulations has increased, therefore businesses that wish to avoid future problems should work with the best tax consultant in Dubai ,UAE, likeAccruon Consultants, to provide transfer pricing services.

0 notes

Photo

Latest for Money Mag. A little extra effort to shop around for the best rates and fees when transferring money overseas could save you hundreds of dollars. Art director Ann Loveday. #illustration #editorial #editorialillustration #conceptual #money #finance #paperplanes #dollarbills #moneytransfer #internationaltransfers #landscape https://www.instagram.com/p/B2h6F2zgdFq/?igshid=h6cakpkd2nxi

#illustration#editorial#editorialillustration#conceptual#money#finance#paperplanes#dollarbills#moneytransfer#internationaltransfers#landscape

0 notes

Link

People have several questions when they want to send money online to their friends or family. Somehow, they are unable to find a proper medium that is reliable and trustworthy. Several online portals offer hassle-free methods for easy money transfer. However, most of them end up in spam, and the money sent does not reach anywhere.

0 notes

Photo

Today We have a pleasure to pick up our Customer from @chopinairport to @Bydgoszcz 🛣 We are always ready for work! We are a professional 🚖 drivers, and We provide the best transport service in #Warsaw 🏙 ⭐⭐⭐⭐⭐ Book you transfer now📲(+48) 501-149-478📱 I am sure You will be satisfied with our offer 🙂👍 #warsawtransfers #warsaw #viptaxi #warsawtaxi #airporttransfer #pyrzowiceairport #katowiceairport #doortodoorservice #taxi #internationaltransfer #5starservice #bestinwarsaw #privatetour #feeback #businesstransport #warsawtransfers #Polandtaxi #Gdanskairport #warsawtaxi #airporttransfer #modlinairport #chopinairport #Bydgoszczairport #Poznanairport #morecomfortable #europetaxi #airporttransfers #Rzeszowairport #Katowiceairport #privatedriver #lockdowntaxi #taxiwarszawa (w: Bydgoszcz, Poland) https://www.instagram.com/p/CFZ6Iaahr7r/?igshid=1mvamjg2td3xi

#warsaw#warsawtransfers#viptaxi#warsawtaxi#airporttransfer#pyrzowiceairport#katowiceairport#doortodoorservice#taxi#internationaltransfer#5starservice#bestinwarsaw#privatetour#feeback#businesstransport#polandtaxi#gdanskairport#modlinairport#chopinairport#bydgoszczairport#poznanairport#morecomfortable#europetaxi#airporttransfers#rzeszowairport#privatedriver#lockdowntaxi#taxiwarszawa

0 notes

Text

UK Pension Office explores blockchain opportunities

The UK Department of Work and Pensions (DWP) has identified blockchain and distributed ledger technology as technologies that can transform the traditional payment industry.

According to Richard Laycock, Deputy Director for Digital Payments and Banking Systems at DWP, the agency is looking for ways to update its payment infrastructure.

In order to make the payment system “efficient, modern, fast, scalable, flexible and innovative,” the agency is exploring the possibilities of blockchain and distributed registry technology.

“We are seeing the first implementations of blockchain-based payment systems, such as Santander’s One Pay FX. Blockchain allows you to reduce the time, cost and number of errors associated with the execution of transactions, while the data is stored in a secure and unchanged registry, ”enhanced Laycock.

The official also noted that payment systems based on blockchain will create new business models and products.

Recently, one of Germany’s largest banks, Commerzbank, announced the possibility of creating blockchain payment solutions that could function without the direct involvement of a person.

0 notes

Text

Is Your Money at Risk? Safeguard Your Global Finances with Secure Online International Money Transfers

Sending money internationally online is a convenient and efficient way to transfer funds, but it's essential to ensure that the process is safe and secure. This guide will give you a full rundown of the safety and security measures for sending money online and tips for keeping yourself safe from fraud. We will also include some facts and data better to understand the current state of online money transfers.

What are The Security Measures for Money Transfers?

First, let's talk about the security measures for online money transfers. Most banks and money transfer companies use encryption technology to protect their customers' personal and financial information. This technology ensures that the data is scrambled and can only be decrypted by authorized parties. A study by the Aite Group, a financial services research and advisory firm, found that 80% of consumers think encryption is the most crucial online transaction security feature. Additionally, many of these institutions also use multi-factor authentication, which requires customers to provide multiple forms of identification before they can access their accounts.

Another essential safety measure is using secure servers to store customer information. Many banks and money transfer companies use servers located in safe, off-site locations and protected by firewalls and other security measures. This ensures that customer information is protected from unauthorized access or hacking attempts. A study by the Ponemon Institute, a research firm focusing on data protection, found that a data breach costs a company an average of $3.86 million. This shows how important it is to keep customer information safe.

#OnlineMoneyTransfers#InternationalTransfers#MoneyTransferSafetyMeasures#CybersecurityTips#SecureTransactions#FraudPrevention#PaymentSecurity

0 notes

Text

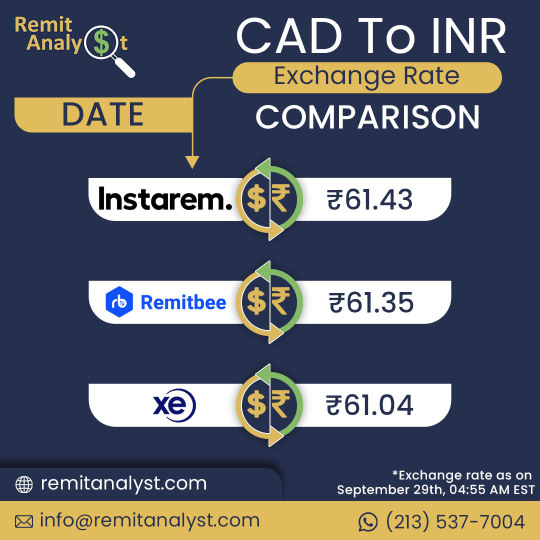

Looking for the best exchange rates to send money from Canada to India? Look no further than RemitAnalyst - your go-to platform for comparing exchange rates and saving on your international transfers!

Why Choose RemitAnalyst? 🚀

✅ Comparison at Your Fingertips: RemitAnalyst provides an easy-to-use interface to compare the latest exchange rates and fees from various money transfer providers, ensuring you get the best deal for sending money to India.

✅ Save Big on Transfers: By comparing rates, you can save a significant amount on every transaction. Make the most out of your hard-earned money with RemitAnalyst.

✅ Real-Time Updates: Our platform offers real-time exchange rate updates, giving you the most accurate and up-to-date information to make informed decisions.

Send Money from Canada to India Effortlessly! 🇨🇦➡️🇮🇳

Are you looking for the best current exchange rate to transfer Canadian Dollars (CAD) to Indian Rupees (INR)? RemitAnalyst has got you covered! We provide a hassle-free way to send money and ensure that you get the most out of your Canadian Dollars when transferring to India.

Best Current Exchange Rate: CAD to INR 📊

Get the best exchange rate for your CAD to INR transactions by visiting our website: RemitAnalyst - CAD to INR

Save more on your international money transfers and make your funds count when sending money from Canada to India. RemitAnalyst is here to help you compare and choose wisely! 💰

#RemitAnalyst#MoneyTransfers#ExchangeRates#SendMoney#CanadaToIndia#SaveMore#CADtoINR#BestRates#InternationalTransfers#FinanceSolutions

0 notes

Text

Sending Money from Australia to India? Compare and Save More with RemitAnalyst

Looking to send money from Australia to India? Look no further than RemitAnalyst - your trusted platform to compare and save on international money transfers. We understand the importance of finding the best AUD to INR exchange rates, and we're here to help you make informed decisions.

Discover INSTAREM - A Leading Money Transfer Service Provider

At RemitAnalyst, we've partnered with INSTAREM, a top-tier money transfer service provider, to ensure a seamless and efficient transfer of funds from Australia to India. With INSTAREM, you can trust that your money will reach its destination securely and promptly.

Get the Best AUD to INR Exchange Rates

Our platform provides real-time and accurate information on exchange rates, empowering you to find the most favorable AUD to INR rates for your transfers. We strive to help you maximize the value of your money and minimize unnecessary expenses.

Predicting Future Exchange Rates

RemitAnalyst also offers predictions for possible future exchange rates, giving you insights into potential market trends. Stay ahead of the curve and plan your transfers strategically to get the most out of your money.

Compare, Analyze, and Choose Wisely

With RemitAnalyst, you have free access to compare and analyze various money transfer service providers. We understand the importance of making an informed decision when sending money abroad, and we're committed to providing you with all the necessary tools and information to choose the best option that suits your needs.

Save more on your international money transfers with RemitAnalyst. Trust us to guide you towards the most cost-effective and efficient way to send money from Australia to India. Start comparing and start saving today!

#RemitAnalyst#MoneyTransfers#AUDtoINR#INSTAREM#SaveMore#SendMoneyAbroad#ExchangeRates#CompareAndSave#FinancialSavings#InternationalTransfers#SmartMoneyMoves

0 notes

Text

Is Your Money at Risk? Safeguard Your Global Finances with Secure Online International Money Transfers

Sending money internationally online is a convenient and efficient way to transfer funds, but it's essential to ensure that the process is safe and secure. This guide will give you a full rundown of the safety and security measures for sending money online and tips for keeping yourself safe from fraud. We will also include some facts and data better to understand the current state of online money transfers.

What are The Security Measures for Money Transfers?

First, let's talk about the security measures for online money transfers. Most banks and money transfer companies use encryption technology to protect their customers' personal and financial information. This technology ensures that the data is scrambled and can only be decrypted by authorized parties. A study by the Aite Group, a financial services research and advisory firm, found that 80% of consumers think encryption is the most crucial online transaction security feature. Additionally, many of these institutions also use multi-factor authentication, which requires customers to provide multiple forms of identification before they can access their accounts. Read More

0 notes

Text

Sending money internationally online is a convenient and efficient way to transfer funds, but it's essential to ensure that the process is safe and secure. This guide will give you a full rundown of the safety and security measures for sending money online and tips for keeping yourself safe from fraud. We will also include some facts and data better to understand the current state of online money transfers.

What are The Security Measures for Money Transfers?

First, let's talk about the security measures for online money transfers. Most banks and money transfer companies use encryption technology to protect their customers' personal and financial information.

0 notes

Text

🌍 RemitAnalyst: Compare to Save More! 🌍

Sending money from Canada to India? Looking for the best current exchange rate to make your transfer? Look no further! RemitAnalyst is here to help you compare and save more on your international money transfers.

💱 Get the Best Exchange Rates 💱

RemitAnalyst is your go-to platform for finding the most favorable exchange rates when sending money from Canada to India. We understand that every penny counts, which is why we constantly monitor and analyze the rates offered by various money transfer providers. Our goal is to ensure you get the best value for your hard-earned money.

0 notes

Text

Let's look at some data and statistics to understand the current state of online money transfers. According to the World Bank, international remittances (money transfers) reached $689 billion in 2019. The top five countries receiving the most remittances are India, China, Mexico, the Philippines, and Egypt. Additionally, according to the Pew Research Center, in 2019, 64% of U.S. adults used the internet to send or receive money. This highlights the increasing popularity of online money transfers and the growing number of people who rely on them.

Online money transfers can be a convenient and efficient way to send money internationally. Still, knowing what safety and security measures are in place and what you can do to avoid fraud is essential. By researching and being vigilant, you can help ensure that your money transfers are safe and secure. Additionally, you can make better-informed decisions about sending money internationally by understanding the fees associated with online money transfers and the industry's current state.

0 notes

Text

🌍 RemitAnalyst: Compare to Save More! 🤑💸

Are you looking to send money from the USA to India? Look no further! RemitAnalyst is here to help you find the best current exchange rate to transfer your money and save more on your international transactions.

💱 USD to INR: Secure the Best Exchange Rate!

When sending money internationally, securing a favorable exchange rate is crucial to maximizing your savings. RemitAnalyst allows you to compare the exchange rates offered by different remittance providers, ensuring that you get the most bang for your buck. By choosing the best exchange rate available, you can save a significant amount of money on your transfer.

#RemitAnalyst#MoneyTransfer#ExchangeRates#SaveMore#InternationalTransfers#USDtoINR#RemittanceProviders#TransparentService#TimeSaving#UserFriendly

0 notes

Text

XE Money is renowned for its expertise in foreign exchange and international money transfers. With a solid reputation built over many years, XE Money has become a trusted name in the industry, providing customers with reliable and secure remittance services.

🌟 Why Choose XE Money?

1️⃣ Competitive Exchange Rates: XE Money offers some of the best exchange rates in the market. By choosing XE Money, you can maximize the value of your money when converting USD to INR, allowing you to send more to your loved ones or achieve your financial goals.

2️⃣ Transparent and Efficient: XE Money believes in transparency and strives to provide clear and comprehensive information about exchange rates, fees, and transfer options. This ensures that you have all the necessary details at your fingertips to make informed decisions.

3️⃣ Convenient and User-Friendly: XE Money's online platform is designed to be user-friendly and intuitive, making the money transfer process smooth and hassle-free. With just a few clicks, you can initiate your transfer and track its progress, giving you peace of mind throughout the transaction.

4️⃣ Security and Reliability: XE Money prioritizes the security of your funds and personal information. They employ robust encryption technology and adhere to stringent security protocols, ensuring that your money is safe throughout the transfer process.

#RemitAnalyst#SaveMore#MoneyTransfer#GlobalRemittance#USDtoINR#XEMoney#BestExchangeRates#InternationalTransfers#RemittanceServices#SecureTransfers#FinancialSolutions#SendMoneyToIndia#HassleFreeTransfers#TransparentServices

0 notes