#James Koutoulas

Text

The lawyers that represented U.S. Representative Madison Cawthorn during a legal challenge to his candidacy in the 2022 North Carolina Primary are now suing the congressman themselves.

The Bopp Law Firm filed a lawsuit on December 1, alleging Cawthorn has failed to pay $193,296.85 in legal fees and costs.

The Indiana law firm has accused the congressman of breaching his contract.

The question over Cawthorn’s legal candidacy arose over his involvement in the “Stop the Steal” rally that occurred just before the U.S. Capitol riot on Jan. 6, 2021.

Voters challenged the congressman, citing Section 3 of the 14th Amendment which was designed to prevent congressmen who had fought in the Confederacy during the Civil War from returning to Congress.

The voters challenged that Cawthorn’s participation in the rally disqualified him from running for Congress.

In March, a U.S. District Judge ruled in Cawthorn’s favor and prevented the North Carolina State Board of Election from looking into whether he should be on the ballot for the 2022 Primary in May.

The voters appealed the ruling to the 4th U.S. Circuit Court of Appeals in Richmond, Virginia. The appeals court ultimately reversed the ruling and sent the case back to the district court.

According to the lawsuit, Cawthorn’s attorneys moved to have the district court case “dropped as moot” in order to avoid a possible ruling that could affect any of the congressman’s future campaigns.

The current representative of North Carolina’s 11th Congressional District is no stranger to legal woes in 2022.

In April, Cawthorn was cited for trying to bring a loaded gun through TSA at Charlotte Douglas International Airport, police said.

CMPD said Cawthorn admitted the firearm was his and he was cooperative with officers. He was issued a citation for possession of a dangerous weapon on city property, which is a City of Charlotte Ordinance.

Cawthorn has also been cited multiple times for various speeding violations. North Carolina Highway Patrol dashcam video released to QCN in April showed a traffic stop involving Cawthorn after he was pulled over in Cleveland County in March and was charged with driving with a revoked license.

Recently, the House Ethics Committee found he financially benefited while purchasing and promoting a cryptocurrency and had violated conflict of interest rules.

According to a report from the Washington Examiner, multiple watchdog groups said Cawthorn (R-NC) may have violated federal laws when he promoted a “pump-and-dump” cryptocurrency scheme.

Late last year, Cawthorn posed with the main investor behind the Let’s Go Brandon cryptocurrency, James Koutoulas.

In response to the photo, Cawthorn publicly said he owned LGBCoin cryptocurrency.

The following day, the cryptocurrency said it would sponsor NASCAR driver Brandon Brown, whose win at Talladega in 2021 kicked off the anti-Biden rallying cry “Let’s Go Brandon,” for the 2022 Xfinity Series season.

“If we do our job right, when you think of us, and you hear, ‘Let’s Go Brandon,’ you’ll think and feel, ‘Let’s Go America,’” Koutoulas said during the announcement.

LGBCoin’s value spiked by 75% following the sponsorship news, the Washington Examiner reported.

Watchdog groups reportedly told the Examiner that Cawthorn’s Instagram post suggested he may have had advanced knowledge of the deal with Brown and said that, combined with Cawthorn’s statement that he owns LGBCoin, “warrants an investigation from the Department of Justice and the Securities and Exchange Commission to see if the freshman congressman violated insider trading laws.”

By the end of January 2022, the value of LGBCoin had dropped from $570 million to $0.

After the committee’s findings in December, Cawthorn was ordered to pay $14,237.49 to charity. He was also told to pay $1,000 in late fees on reports filed for his cryptocurrency transactions.

#us politics#news#queen city news#2022#the hill#rep. madison cawthorn#north carolina#insider trading#ban insider trading#unpaid legal fees#Bopp Law Firm#stop the steal rally#14th amendment#4th U.S. Circuit Court of Appeals#House Ethics Committee#washington examiner#LGBCoin#cryptocurrency#Securities and Exchange Commission#department of justice

7 notes

·

View notes

Text

Edwards, 22-Year Haverhill License Commissioner, Former College Trustee to Receive Honors Tuesday

Longtime Haverhill License Commission Chairman Joseph C. Edwards will be honored Tuesday night before the Haverhill City Council as he steps down from the board.

Mayor James J. Fiorentini is expected to present Edwards, who has served on the Commission 22 years, with an official citation from the city. The mayor named retired Haverhill City Clerk Linda L. Koutoulas as Edwards’ successor on the…

View On WordPress

0 notes

Text

Mayor Fiorentini Promotes Haverhill Native Kaitlin Wright to City Clerk

Mayor Fiorentini Promotes Haverhill Native Kaitlin Wright to City Clerk

Mayor James J. Fiorentini has promoted Kaitlin M. Wright to City Clerk, succeeding Linda Koutoulas, who is retiring this month after leading the Clerk’s Office since January 2014.

Wright, Assistant City Clerk since October 2021 and before that Chief of Staff for a state representative, will take over Jan. 23 following Koutoulas’ last day Jan. 20.

A Haverhill native and Whittier Tech graduate,…

View On WordPress

0 notes

Text

Madison Cawthorn may have broken insider trading laws in alleged pump-and-dump crypto scheme: report

Madison Cawthorn may have broken insider trading laws in alleged pump-and-dump crypto scheme: report

On Tuesday, the Washington Examiner reported that experts suspect Rep. Madison Cawthorn, R-N.C., may have violated insider trading laws when he promoted a cryptocurrency named after a vulgar chant against President Joe Biden.

“On Dec. 29, the beleaguered North Carolina congressman posed at a party with James Koutoulas, a hedge fund manager and the ringleader of the Let’s Go Brandon…

View On WordPress

0 notes

Link

0 notes

Text

U.S. Presidential candidate served for alleged securities fraud at rally in NYC

U.S. Presidential candidate served for alleged securities fraud at rally in NYC

This campaign rally probably did not turn out quite as the candidate had envisioned it.

Presidential candidate Brock Pierce was served for his connection to alleged securities fraud during his campaign rally in New York City earlier today.

Source: Twitter.

James Koutoulas, the lawyer leading this case, told Cointelegraph that Pierce was served legal documents in connection with a class action…

View On WordPress

0 notes

Link

Per a May 18 complaint, more investors are looking to recoup funds invested in the record-breaking initial coin offering for EOS — which netted a total of $4 billion in cryptocurrency. Lawyers for the plaintiffs are calling over $200 million of that money illegally raised.

Conflict with U.S. securities law and investors

The complaint alleges that EOS was an unregistered security offering by block.one. Block.one is the development firm that spearheaded the ICO for EOS, which many saw as a form of investment in the company.

Language in the purchase agreements in EOS’s pre-sale told investors in the United States not to participate in the fundraising round. This was an effort to avoid conflict with the Securities and Exchange Commission (SEC). Block.one did not register the offering in the U.S., neither as a security nor under exemptions from securities registration, so they leaned on their measures to skip out on U.S. investors entirely as their means of compliance with the U.S. regulator.

However, some U.S. investors indeed participated in the ICO, and block.one ended up encountering the SEC anyway. In September, block.one settled with the commission for $24 million.

New allegations of actively courting investors

The new complaint alleges that the firm — which has offices in Hong Kong and Blacksburg, Virginia — knowingly and deliberately sought U.S. investors:

“From 2017 through the present, to drive demand for EOS Securities, Defendants have aggressively courted investors throughout the United States. Block.one first announced itself at a May 2017 conference in New York City, and punctuated its arrival with expensive ad space on a Times Square billboard.”

On the subject of how much investment actually came from the U.S., James Koutoulas, one of the lawyers for the plaintiffs, told Cointelegraph that they were “estimating bare minimum 200M in US losses.”

The complaint further dismisses block.one’s claims to be working towards decentralization as falsehoods.

However, that does not seem to be the end of the story. Early in April, law firm Roche Cyrulnik Freedman filed a rash of class-action suits against a number of crypto firms including block.one, based on similar allegations. The two cases will likely have to compete to be appointed lead counsel — effectively, leadership over the class.

Cointelegraph reached out to block.one’s legal team but had received no response as of press time. This article will be updated if a response comes in.

0 notes

Text

Rep. Madison Cawthorn may have violated federal insider trading laws as he hyped up an alleged pump-and-dump cryptocurrency scheme, multiple watchdog groups told the Washington Examiner.

On Dec. 29, the beleaguered North Carolina congressman posed at a party with James Koutoulas, a hedge fund manager and the ringleader of the Let's Go Brandon cryptocurrency, a meme coin set up in the wake of the chant mocking President Joe Biden.

"LGB legends. ... Tomorrow we go to the moon!" Cawthorn, who has stated publicly he owns the cryptocurrency, posted on Instagram in response to the picture posted on Koutoulas's Instagram page.

The next day, LGBCoin did exactly as the lawmaker predicted.

NASCAR driver Brandon Brown announced on Dec. 30 that the meme coin would be the primary sponsor of his 2022 season, causing LGBCoin's value to spike by 75%. Brown's statement featured comments from Koutoulas, who was pictured with Cawthorn just a few hours prior.

Multiple watchdog groups told the Washington Examiner that Cawthorn's Dec. 29 Instagram post suggests the lawmaker may have had advanced nonpublic knowledge of LGBCoin's deal with Brown. The watchdogs said the post, combined with Cawthorn's statement that he owns LGBCoin, warrants an investigation from the Department of Justice and the Securities and Exchange Commission to determine whether the lawmaker violated federal insider trading laws.

"This looks really, really bad," said Dylan Hedtler-Gaudette, the government affairs manager for Project on Government Oversight, a federal watchdog group. "This does look like a classic case of you got some insider information and acting on that information. And that's illegal."

"I think there's probably a strong case here," Hedtler-Gaudette added. "I don't want to prejudge, but based on everything that's out there, I think there is a very strong possibility that if someone is going to investigate this, they're going to find something."

instagram

Craig Holman, a government affairs lobbyist for Public Citizen, said if Cawthorn purchased LGBCoin before Dec. 30 with nonpublic knowledge of the cryptocurrency's pending deal with Brown, that would constitute insider trading, a federal crime that can involve prison time.

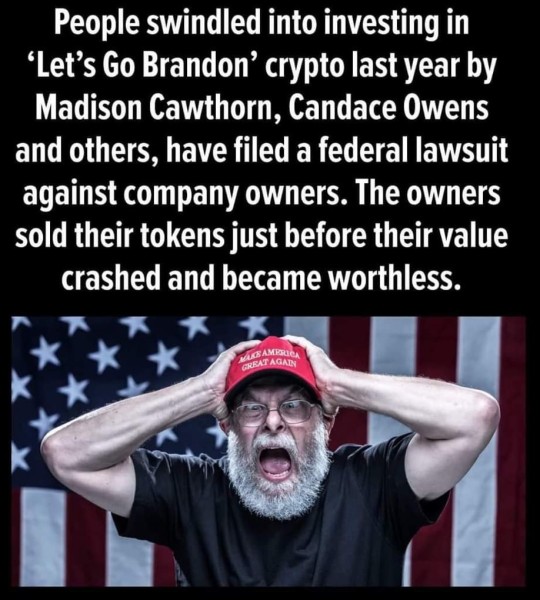

Immediately following Brown's Dec. 30 announcement, the value of all LGBCoin in circulation eclipsed $570 million. By the end of January, the market cap of the meme coin dropped to $0.

Koutoulas said in a Feb. 20 livestream that two factors led to LGBCoin's precipitous decline: First, NASCAR rejected LGBCoin's sponsorship deal with Brown on Jan. 4, and then later that month, unidentified insiders that owned an outsize share of the coin dumped all their holdings at once, causing the coin's market value to evaporate.

The swift rise and fall of the meme coin led one jilted investor to file a class-action lawsuit in April accusing Koutoulas and other LGBCoin insiders of using the digital currency to orchestrate a pump-and-dump scheme.

While Cawthorn isn't named as a defendant in the class-action lawsuit, he is identified as one of the coin's celebrity endorsers that helped Koutoulas inflate LGBCoin's market value before the rug was pulled.

Koutoulas relaunched LGBCoin in February, claiming the second iteration of the meme coin came with restrictions preventing "whales," or people with significant holdings in the coin, from offloading all their coins at once.

Since its relaunch in February, LGBCoin has traded around 95% below the peak price set in late December.

Despite the poor performance of the meme coin, Cawthorn has continued to tour the nation with Koutoulas, promote his ownership of the coin, and urge his followers to purchase the asset.

"I got Let's Go Brandon coin," Cawthorn said at the Conservative Political Action Conference, according to a video Koutoulas posted to his Instagram page in late February. "It's working out well, very well."

Cawthorn promoted the coin again with Koutoulas in March during the American Freedom Tour in Fort Lauderdale, Florida.

"This is going to the moon, baby! To the moon!" Cawthorn said while pointing to an LGBCoin logo pinned to Koutoulas's suit jacket. "Letsgobrandon.com — get on the train. Get on the train. Take the power of currency away from the government."

Also in March, Cawthorn appeared with Koutolulas at Freedom Fight Night in Miami. The two were pictured inside a UFC-like arena pointing at the LGBCoin logo.

"The blood on the logo is from the guys that sold the dip," Koutoulas said on Instagram.

instagram

Cawthorn appeared at multiple events with Koutoulas before the meme coin spiked in late December.

"Incredible spending back to back nights with the affable Patriot @CawthornforNC," Koutoulas wrote in a Dec. 5 tweet with a picture of him posing with Cawthorn, who was holding a pin with the LGBCoin logo.

Koutoulas has also signaled that Cawthorn owns LGBCoin.

Both Koutoulas and the LGBCoin Twitter account retweeted a photo in early April that identified Cawthorn as a holder of the meme coin. Koutoulas also retweeted a message claiming the North Carolina lawmaker had "endorsed" the coin.

And in his Feb. 20 livestream, Koutoulas claimed that unidentified members of Congress had purchased LGBCoin.

"We've had several people who are on the America First platform, who are actually congressional candidates and/or current members of Congress that have bought with their own money, and I believe members have donated to [charities] with LGB," Koutoulas said.

Lawmakers are required to disclose if they purchase over $1,000 worth of any cryptocurrencies, but Cawthorn has not filed any disclosures indicating he owns LGBCoin.

Koutoulas said in his Feb. 20 livestream that both iterations of LGBCoin were designed so that the meme coin was not classified as security for regulatory purposes.

"It is not technically or legally possible for a decentralized meme coin that exists to promote free speech and charitable giving to be classified or treated as a security," Koutoulas told the Washington Examiner.

But Hedtler-Gaudette, the government affairs manager for POGO, said that even if LGBCoin isn't considered a security, that won't render Cawthorn immune from insider trading laws.

"No matter what, though, having advance and nonpublic information that is then used to gain advantage in a financial market (including straight up commodities) is illegal, making my call for DOJ or SEC investigation still operative in this case," Hedtler-Gaudette said.

Holman, the Public Citizen government affairs lobbyist, added that Cawthorn would need to disclose if he purchased over $1,000 of the coin — even if it isn't considered a security for regulatory purposes.

Amid his public promotion of LGBCoin, Cawthorn used his authority as a lawmaker to introduce a resolution in the House in February that would "deregulate cryptocurrencies and incentivize blockchain innovation."

While Cawthorn's proposed resolution lacked any specifics, Holman said Cawthorn could have run afoul of the STOCK Act if he introduced the measure for his own financial benefit.

"Owning cryptocurrency would be an asset subject to disclosure of a lawmaker’s annual financial disclosure form," Holman said. "It also could constitute a 'personal benefit' under the STOCK Act, making any official actions taken by Cawthorn to specifically and substantially benefit its value a violation of the STOCK Act."

Cawthorn's office did not return requests for comment.

#us politics#news#washington examiner#2022#rep. madison cawthorn#nc#north carolina#James Koutoulas#let's go brandon#lgbcoin#Brandon Brown#nascar#cryptocurrency#insider trading#ban insider trading#department of justice#Securities and Exchange Commission#Dylan Hedtler-Gaudette#project on government oversight#instagram#twitter#Craig Holman#public citizen#stock act#federal stock act

46 notes

·

View notes

Text

Haverhill Lauds Retiring City Clerk Koutoulas, Welcomes Wright

Haverhill Lauds Retiring City Clerk Koutoulas, Welcomes Wright

Haverhill this week offered well wishes to retiring City Clerk Linda L. Koutoulas, while welcoming her successor, Kaitlin M. Wright.

Mayor James J. Fiorentini this week promoted Wright, who has served as assistant city clerk since October 2021 and previously served as chief of staff for Republican state Rep. Steven Xiarhos. As assistant city clerk, Wright worked closely with Koutoulas in…

View On WordPress

0 notes

Text

US Presidential candidate served for alleged securities fraud at rally in NYC

This campaign rally probably did not turn out quite as the candidate had envisioned it. Presidential candidate Brock Pierce was served for his connection to alleged securities fraud during his campaign rally in New York City earlier today. Source: Twitter. James Koutoulas, the lawyer leading this case, told Cointelegraph that Pierce was served legal documents in connection with a class action case against Block.one — a company that Pierce co-founded. Block.one was the company behind EOS’ $4 billion initial coin offering. The project’s ICO was the largest such offering to date.…

The post US Presidential candidate served for alleged securities fraud at rally in NYC appeared first on CryptoNewsTrending.

source https://cryptonewstrending.com/us-presidential-candidate-served-for-alleged-securities-fraud-at-rally-in-nyc/

0 notes

Text

Another Class Action Against Block.One Alleges Dirty Dealings During EOS ICO

Another Class Action Against Block.One Alleges Dirty Dealings During EOS ICO:

Per a May 18 complaint, more investors are looking to recoup funds invested in the record-breaking initial coin offering for EOS — which netted a total of $4 billion in cryptocurrency. Lawyers for the plaintiffs are calling over $200 million of that money illegally raised.

Conflict with U.S. securities law and investors

The complaint alleges that EOS was an unregistered security offering by block.one. Block.one is the development firm that spearheaded the ICO for EOS, which many saw as a form of investment in the company.

Language in the purchase agreements in EOS’s pre-sale told investors in the United States not to participate in the fundraising round. This was an effort to avoid conflict with the Securities and Exchange Commission (SEC). Block.one did not register the offering in the U.S., neither as a security nor under exemptions from securities registration, so they leaned on their measures to skip out on U.S. investors entirely as their means of compliance with the U.S. regulator.

However, some U.S. investors indeed participated in the ICO, and block.one ended up encountering the SEC anyway. In September, block.one settled with the commission for $24 million.

New allegations of actively courting investors

The new complaint alleges that the firm — which has offices in Hong Kong and Blacksburg, Virginia — knowingly and deliberately sought U.S. investors:

“From 2017 through the present, to drive demand for EOS Securities, Defendants have aggressively courted investors throughout the United States. Block.one first announced itself at a May 2017 conference in New York City, and punctuated its arrival with expensive ad space on a Times Square billboard.”

On the subject of how much investment actually came from the U.S., James Koutoulas, one of the lawyers for the plaintiffs, told Cointelegraph that they were “estimating bare minimum 200M in US losses.”

The complaint further dismisses block.one’s claims to be working towards decentralization as falsehoods.

However, that does not seem to be the end of the story. Early in April, law firm Roche Cyrulnik Freedman filed a rash of class-action suits against a number of crypto firms including block.one, based on similar allegations. The two cases will likely have to compete to be appointed lead counsel — effectively, leadership over the class.

Cointelegraph reached out to block.one’s legal team but had received no response as of press time. This article will be updated if a response comes in.

0 notes

Photo

Super Flexible Podcast Episode 30b: Trade Wars With James “The Brain” Koutoulas in the basement for the week, Travis and John set out on a discussion about Twitter trade polls and rookie pick trade values.

0 notes

Text

A cryptocurrency hedge fund has delivered a 24,000% return over the past 3 years

Pantera Capital has delivered a 24,004% returns for investors since its founding in 2013.

The cryptocurrency-focused hedge fund was among the first to specialize in the nascent digital coin market.

Bitcoin's more than 13,000% return since its inception can't hold a candle to Pantera Capital.

The blockchain-focused California-based hedge fund has delivered a 24,004% return for investors since its founding in 2013, according to a report by Nathaniel Popper at The New York Times.

"A significant portion of the gains have come this year, thanks to the skyrocketing price of an individual bitcoin, which hit $19,000 on Monday," Popper reported Tuesday.

Hedge funds focused on cryptocurrencies have opened up at an eye-popping rate this year. Pantera Capital was among the first to dive into the nascent market for digital coins and the underpinning blockchain technology.

An estimated $2 billion has been invested with specialist hedge funds focusing on cryptocurrencies in 2017, according to estimates from Morgan Stanley. Over 100 such funds exist, according to the bank.

Even some traditional hedge funds are turning to the crypto-space to find outsized returns for clients.

Typhon Capital Management, a Florida hedge fund that specializes in commodities, is launching a cryptocurrency fund at the beginning of 2018 that will invest in digital currencies and initial coin offerings.

Typhon's CEO, James Koutoulas, told Business Insider he expects to raise $5 million to $20 million for the new fund.

"We now feel comfortable taking investors money and putting it into this space," Koutoulas said.

The cryptocurrency market has soared to incredible heights in 2017, providing myriad opportunities for investment firms. Bitcoin, for instance, has soared 1,700% this year to more than $18,000 a coin, according to data from Markets Insider. The entire market for digital coins, of which there are now more than 1,300, now stands above $600 billion.

Read the full report at The New York Times>>

SEE ALSO: Cyberattack brings a cryptocurrency exchange to its knees

Join the conversation about this story »

NOW WATCH: Cryptocurrency is the next step in the digitization of everything — 'It’s sort of inevitable'

0 notes

Text

A new class-action lawsuit filed by an investor in Trumpworld’s favorite “Let’s Go Brandon” meme coin claims that some of the token’s key players orchestrated a pump-and-dump scheme.

The news marks the latest bit of drama that has plagued the coin since its inception last year and which has persisted since the cryptocurrency relaunched in February. A number of former President Donald Trump’s most loyal fans bought into the crypto hype, only to see the value of their investments plummet.

Attorneys for the plaintiff, an investor in the coin named Eric De Ford, claimed that the token’s executives and insiders “made false or misleading statements” and “disguised their control over the [c]ompany.” Ultimately, the 79-page suit filed in Florida alleges, those insiders “cynically marketed the LGB Tokens to investors so that they could sell off their portion…for a profit,” even as the selloff caused the value of the coin to drop precipitously for the remaining crypto holders.

The defendants included the Trumpy hedge funder James Koutoulas, NASCAR, and conservative media personalities Candace Owens and David Harris Jr., among others.

Koutoulas fired back at the allegations in text messages to The Daily Beast. “The plaintiff’s behavior frankly, is disturbing—almost like a stalker,” he wrote.

Koutoulas sent a document that showed apparent email exchanges between De Ford and other individuals affiliated with the coin in February, in which De Ford said he was “inspired by what this token can do for our nation” and offered to help market the coin for free. Evidently his perspective on the coin’s management quickly changed.

“One moment he’s praising our vision and offering to promote the coin, now suddenly, he’s filed a bizarre conspiracy claim,” Koutoulas said.

In a statement, a lawyer representing the plaintiff, Aaron Zigler, sought to rebut Koutoulas’ version of events. “We are disappointed to learn that Mr. Koutoulas would resort to such a misleading characterization of the facts in this case in what appears to be a desperate attempt to continue to prop-up the value of the token and to scare away other defrauded investors from seeking their day in court,” he wrote.

“That a litigant and lawyer like Mr. Koutoulas would expose himself to potential defamation claims and bar discipline in response to being named in a thoroughly researched and well-founded federal lawsuit is consistent with the same poor judgment alleged in the Complaint,” he added.

Some of Trumpland’s most vocal influencers got behind the coin and subsequently were named in the class action suit, including Owens and Harris. Donald Trump Jr.—who has hawked the coin publicly—wasn’t named, however.

“This #ad has one purpose and it’s to let you know that free speech is about to make a major comeback. Stay tuned @letsgo,” Trump. Jr. wrote in an April 7 tweet that garnered over 30,000 likes.

A source close to Trump Jr. with direct knowledge told The Daily Beast that Trump Jr. hasn’t entered into any agreement with the Let’s Go Brandon coin.

Owens billed the lawsuit as a frivolous filing that “borders on hilarity.”

“For starters, I was not paid a single red cent ‘to promote’ the LGB coin,” she told The Daily Beast. “Beyond that, I myself lost money on the coin which removes me unequivocally from any notion of an inside ‘pump and dump’ scheme.”

Harris did not immediately respond to The Daily Beast’s request for comment.

The original Let’s Go Brandon coin was inspired by a televised mishap at a NASCAR race last year. After driver Brandon Brown won the event, the crowd loudly chanted “F*ck Joe Biden,” which an NBC reporter inaccurately relayed as “Let’s Go Brandon.” The slogan soon caught on as a pro-Trump rallying cry and a critique of what his fans perceived as media bias.

For a time, it looked like the cryptocurrency would become an official sponsor of Brown’s NASCAR team, but the deal was ultimately kaboshed. That caused the token’s price to fall, and the class action lawsuit claims that insiders made things worse by selling their stakes. (The suit further alleges that NASCAR didn’t adequately distance itself from the crypto token; the company did not respond to a request for comment as of publication time.)

By February, the coin’s market value had fallen more than 99 percent from its peak—leading a number of its key players to hash out a plan to rebrand and relaunch.

The aggressive marketing strategy hasn’t slowed. Last month, when former President Trump appeared on Harris’ podcast, he was presented with 500 billion of the new Let’s Go tokens by Koutoulas. The value of those coins t hen stood at a measly $45,000; prices have stayed roughly flat over the past 30 days.

“Sounds good to me!” Trump replied. “I don’t know exactly what it means, but it sounds good to me.” It is unclear whether the former president ultimately accepted the tokens.

#us politics#2022#cryptocurrency#crypto#let's go brandon#rep. madison cawthorn#candace owens#donald trump#republicans#conservatives#donald trump jr#yahoo#the daily beast#James Koutoulas#David Harris Jr#Eric De Ford#trump supporters

53 notes

·

View notes

Text

Cooper Pulls Nomination Papers for Haverhill Mayoral Run; Others Also Seek City Elected Offices

Cooper Pulls Nomination Papers for Haverhill Mayoral Run; Others Also Seek City Elected Offices

Haverhill Patrolman Guy Cooper recently took out nomination papers to seek the corner office in City Hall.

Cooper took out papers during the first week they were available from City Clerk Linda L. Koutoulas. As WHAV reported in February, Cooper had already established the “Cooper Committee” in a filing with the state Office of Campaign and Political Finance. While incumbent Mayor James J.…

View On WordPress

0 notes

Text

Haverhill Formally Swears in 11 Patrolmen at City Hall Ceremony

Haverhill Formally Swears in 11 Patrolmen at City Hall Ceremony

Ten recent Police Academy graduates and an officer who transferred to Haverhill last fall were recognized at a formal swearing in ceremony Friday in City Hall.

Haverhill City Clerk Linda L. Koutoulas administered the oath of office to the 11 patrolmen Friday morning at City Hall auditorium in the presence of families, Mayor James J. Fiorentini, Police Chief Alan R. DeNaro and Capts. Robert P.…

View On WordPress

0 notes