#Kingmind International

Text

Why Spending Bitcoin is a Good Idea (Especially if You Think They’ll Become Worth More in the Future)

Why Spending Bitcoin is a Good Idea (Especially if You Think They’ll Become Worth More in the Future)

Patrick van der Meijde is one of the founders of Arnhem Bitcoin City and BitKassa. In this guest post, Patrick outlines why spending bitcoin is actually a good idea.

“I don’t want to spend my bitcoins, because I believe they’ll become worth more in the future.” This may sound logical for a lot of bitcoin hodlers, but as one of the Arnhem Bitcoin City founders, I will show you that this is merely short-sighted and that you can actually gain from using bitcoins for your everyday expenses.

Let’s take two bitcoin hodlers who both believe bitcoin will gain value in the future. Let’s say they both own one bitcoin in cold storage, and they both have about 1,000 euros ($1,234.57) of expenses each month. They happen to live in Arnhem, a city where more than 100 merchants accept bitcoin.

Alice knows that she can pay half of her expenses in bitcoin at the shops that accept bitcoin. So each month after she receives her paycheck she buys 500 euros of bitcoins and loads it onto her mobile wallet, which she then spends at merchants. Bob just uses his euros for his payments.

Because of bitcoin’s volatility, Alice notices that at times when bitcoin drops in value, she has to refill her mobile wallet more often, but at times when bitcoin raises in value, she doesn’t have to refill her mobile wallet for a long time.

If bitcoin – just like they both believe – will become worth more in the long run, Alice has gained more from its raise than Bob because while Bob’s expenses cost him 1,000 euros each month, Alice – on average – actually saved euros on her everyday expenses, while she still has the same amount of bitcoins in her cold storage as Bob.

So yes, you can actually save money by using bitcoins for payments. In fact, a person who is able to get rid of all his fiat payments and only owns bitcoin (and thus pays for everything with the cryptocurrency) gains the most in case bitcoin raises in value. Of course, this person also runs the greatest risk in case the price of bitcoin collapses. But I’d say it is illogical to say you don’t want to use bitcoin because you believe it will raise in value. The more you believe in it, the smaller the amount of fiat money you should keep with you, so it would be better if you don’t have to keep fiat money for your everyday expenses.

And the best part is that with each bitcoin payment you give people a demonstration that it actually works and can be used for everyday payments. You would be surprised how often I get questions from other customers when I pay with bitcoin in a shop. They see it working and often are curious about it.

Unfortunately, I have to say that in December 2017, the situation changed temporarily and the extremely high fees even forced me to use fiat money, which felt bad. BitKassa, our own payment processor, which is being used by most merchants in Arnhem, was not prepared to support altcoins and Lightning Network was not available at that time. In fact, some people were still using bitcoin for paying for groceries while they had to pay about 15 euros fee. For each payment BitKassa processed, BitKassa also had to transfer the received bitcoins to either an exchange or to the merchant’s wallet which forced BitKassa to pay those high network fees as well. This led us to temporary halt BitKassa’s payment service.

In February the network fees went back to normal again. But as you can see on the statistics shown on the Arnhem Bitcoin City website, our turnover took quite a hit due to the high fees and are still recovering.

I also like to say that, of course, people have a very low incentive to use bitcoin for payments as paying with your debit card in the Netherlands goes exceptionally smooth – you mostly just swipe your card past an NFC device and you are done. At the moment bitcoin’s strength is in global payments, not local.

But let’s not forget what we are trying to accomplish here; getting people familiar with bitcoin and eventually educating them why bitcoin is superior to fiat money, although for now, fiat money is probably more convenient in most cases. But that will probably change and already for some tourists, paying with bitcoin is far more convenient than having to get cash in the local currency. Even credit cards are not very widely accepted in the Netherlands.

So yes, we will continue to use bitcoin around here, feel free to come on over and join us at one of our meetups

The post Why Spending Bitcoin is a Good Idea (Especially if You Think They’ll Become Worth More in the Future) appeared first on BTCMANAGER.

Source

The post Why Spending Bitcoin is a Good Idea (Especially if You Think They’ll Become Worth More in the Future) appeared first on Bitcoin Geek.

via Kingmind Why Spending Bitcoin is a Good Idea (Especially if You Think They’ll Become Worth More in the Future)

0 notes

Text

Bitcoin Exchange Bittrex Reopens Registrations and Unveils New Design

Bitcoin Exchange Bittrex Reopens Registrations and Unveils New Design

After four months of pausing new user registrations for a framework upgrade, Bittrex reopened registrations on April 10. However, the influx of new users caused a server overload ten minutes after the site went live, indicating a huge demand in the platform’s service and interest in bitcoin and altcoins.

Earlier in December 2017, the US-based crypto exchange paused all registrations for new users, citing their server’s saturated capacity and lack of staff for customer service. Potential new users had to fill out an application form and were added to a “waitlist,” with no clear date on when the exchange would relaunch its registrations.

Finally on April 10, 2018, without a prior statement, the exchange announced the relaunch of registrations on its revamped platform. In addition to this, the company introduced corporate accounts, which allow for multiple traders using a single account with a large asset holding.

CEO Bill Shihara said, “After diligently working to improve our infrastructure and upgrade our website, we’re pleased to announce registration for new users resumed today.”

The company also spoke of its recent team expansion, informing that they have brought on board former Amazon employees, as well as former members of the U.S. Departments of Justice and Homeland Security.

Server Failure

Ten minutes after its much-awaited launch, the company suffered an embarrassing server failure, which resulted in registrations to be suspended once again. The lapse was quickly attributed to unprecedented traffic from new users trying to sign up for the platform. Trading activities were suspended as well, but as of yet, there is no report of loss in funds.

Addressing the server failure, Bittrex said:

“Sorry for the inconvenience. Due to an overwhelming response from new users, registration is temporarily paused. We’re working to make the necessary tweaks and reopen signups again shortly.”

True to its word, the issue was solved in five hours, and registrations are now ongoing on the Bittrex website.

Early in 2017, U.S based Coinbase underwent similar issues. The cryptocurrency giant reported a mainframe shutdown, which it attributed to the large price increase of bitcoin, stimulating new investors to jump on the bandwagon.

A Handful of Users Express Disappointment

Despite the four-month improvement period, traders and investors quickly reported problems with the exchange.

Twitter user Adam Lasher, commented:

If I wanted a difficult shitty platform I would use binance. PLEASE give us an option to go back the old format. You guys don’t even have a LAST button on your buy and sells.

— Adam Lasher (@AdamLasher) April 10, 2018

Users also expressed their furor over the limited number of buy/sell entries the updated website allocated. An important aspect of trading, buy/sell entries are observed by traders to determine price action before placing trades. Thus, a limited order book is detrimental to a trader’s strategy.

Additionally, several users complained about the new layout itself, asking Bittrex to revert to its earlier interface.

People who clicked “like” just looked at the overall design. They haven’t even tried putting 5 trades in. The new @BittrexExchange interface will cost traders and the exchange itself money. UI gone wrong. #FAIL

Bring back the dual buy/sell panel like this… pic.twitter.com/EBTrVVyOcg

— Global Creators (@GlobCrea) April 11, 2018

The chart studies in the new design makes the site REALLY REALLY slow.

Did you actually test the new site?????

— cpt. kowalski (@datzeiiktoch) April 10, 2018

LOL You guys have had 4 months to hire new ppl, increase the system to handle heavy traffic, and implement new support AND do a dry test run of a re opening to see if u can handle it. Looks like another FAIL. Sorry Bittrex, but u will never catch up with @cz_binance.

— CryptoSoldier (@NoTimeToSearch) April 10, 2018

The post Bitcoin Exchange Bittrex Reopens Registrations and Unveils New Design appeared first on BTCMANAGER.

Source

The post Bitcoin Exchange Bittrex Reopens Registrations and Unveils New Design appeared first on Bitcoin Geek.

via Kingmind Bitcoin Exchange Bittrex Reopens Registrations and Unveils New Design

0 notes

Text

Roger Ver vs Samson Mow: Passionate Debates On Bitcoin Scaling At Deconomy 2018

Roger Ver vs Samson Mow: Passionate Debates On Bitcoin Scaling At Deconomy 2018

Roger Ver and Samson Mow’s discussion about Bitcoin scaling turned into a war of words at Deconomy 2018, annual Blockchain forum.

A panel discussion dedicated to Bitcoin (BTC) scaling between Bitcoin.com CEO Roger Ver and Blockstream Chief Strategy Officer Samson Mow turned into a battle of visions at the Distributed Economy’s (Deconomy 2018) first annual Blockchain forum in Seoul, South Korea, April 3rd.

The two-day event, which took place from April 3rd to 4th, brought together Blockchain enthusiasts, entrepreneurs, and leaders in the field aiming to cover the hottest topics in the industry.

The issue of Bitcoin scalability has always been a persistent and painful problem of the first cryptocurrency due to the constant increase in the number of transactions on the chain and the inability to validate them fast enough.

Giving the floor to Ver to express his opinion about Bitcoin scaling, the attendees witnessed his ardent conviction that the scaling of Bitcoin is a ‘natural’ part of the cryptocurrency’s Blockchain, and that there’s no reason to avoid block size increasing if the growing adoption requires it. Ver’s position is that Bitcoin has failed to become digital cash for everyday payments, such as paying for a coffee. That vision, according to Ver, now lives in the ideology of Bitcoin Cash (BCH).

Samson Mow, to the contrary, said that an over the edge increase of blocks is not an ultimate solution as it could lead to increasing the chain weight. Mow believes that there should be a second layer technology integrated, where everything is cryptographically bound to the main chain. According to Mow, this would enable keeping the Bitcoin Blockchain compact enough to synchronize transactions with nodes for a relatively small period of time. He also sees a solution in the usage of Bitcoin coupled with Lightning. Mow said:

“I think scaling Bitcoin, we have to take into consideration the computer science aspect of it. We can’t just make things up. We actually have to look at the code and we have to follow the consensus rule, so if you look at what Bitcoin Core has been doing, is they’ve been scaling all along so that everything is backwards compatible.”

Ver parried with an argument that the intention behind Bitcoin Core might be positive, however the empirical evidence shows that the “effects were negative and incredibly damaging to Bitcoin” and cause a “negative merchant adoption around the world.” Ver claimed that it’s easier for merchants to migrate to Altcoins rather than to add Lightning support to the existing Bitcoin payment option because it would be expensive and unreliable. Ver stated:

“Bitcoin Core is having negative merchant adoption around the world. Bitcoin Cash is having positive merchant adoption around the world. So even if Samson and Blockstream and Bitcoin Core supporters have the absolute best intentions in their heart, we have the empirical evidence to show that the effects were negative and incredibly damaging to Bitcoin. Let’s judge things by their effect and their results, not the intent of the people that were putting it together.”

Ver’s tone towards Mow’s Bitcoin Core team became accusatory, saying, “they’ve shattered the Bitcoin ecosystem into a thousand and one different altcoins and delayed the adoption of cryptocurrencies around the world by years.”

Mow stated that Bitcoin can be used by everybody, but technology takes time to mature, including Lightning. This will result, according to Mow, in the ability to make transactions with Bitcoin by anyone, even on low-grade devices. With a wider implementation of Lightning, transaction fees will inevitably change “like the weather, it can be hot one day, cooler the next day and windy and rainy.”

The passionate debates gave rise to a sarcastic reaction from the community, which has been absorbedly discussing the way Roger and Samson behaved on stage, rather than addressing the topic of Bitcoin scalability.

Youtube user Jonathan Mogg said:

“Does Bitcoin core have any spokesperson who can articulate the BTC value proposition anymore? You may not like Roger but he can speak to the commercial and economic aspects of Bitcoin far better than anyone I’ve seen from the Blockstream crew.”

Youtube user sssidhu7788 said:

“Samson didn’t answer anything, he didn’t clarify anything. Just sitting there like he’s some cool guy with an ace up his sleeve but nothing.”

Youtube user Slowly GoingBroke said:

“Roger Ver sounds like a BCH commercial. He is just embarrassing himself now…”

mango_drive said on Reddit:

“Roger appears so agitated and angry all the time. I don’t mind listening to differing opinions but he makes it rather unpleasant to do so.”

Bananananbread said on Reddit:

“Did you see Mow’s body language? The constant finger tapping and playing with the water bottle. He looked so nervous like he was about to visit the dentist for root canal surgery…”

The post Roger Ver vs Samson Mow: Passionate Debates On Bitcoin Scaling At Deconomy 2018 appeared first on Bitcoin Geek.

via Kingmind Roger Ver vs Samson Mow: Passionate Debates On Bitcoin Scaling At Deconomy 2018

0 notes

Text

Facebook And Trade Wars: What’s Happening With The Stock Market?

Facebook And Trade Wars: What’s Happening With The Stock Market?

Does the Recent Stock Market Decline Have Anything to Do With Bitcoin?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The US stock market recently posted its worst week since Jan. 2016, when weak economic data from Chain sparked a global selloff, an event that rekindled worries over global economic growth. Over the five days between March 19 and March 23, US stocks fell roughly 6 percent, European stocks were down roughly 4 percent, UK stocks were down 3.4 percent and Asian markets were down by up to 4 percent, with Japan faring worst by declining over 5 percent. The decline in the stock market came in a month in which Bitcoin declined by over 35 percent to bring the first quarter loss of the cryptocurrency to 47 percent.

On the first market day of the second quarter, the S&P 500 Index dropped by 2.2 percent, the poorest start to the month of April since the 1929 Great Depression, data from Bloomberg showed. By close of market on April 4, the stock market had recovered from the April 2 slump with the S&P 500 Index closing 1.3 percent higher and the Dow Jones Industrial Average closing 1.7 percent higher. By comparison, Bitcoin prices have been relatively flat since the start of the month.

For a number of reasons, one of which is the fact that stocks benefited from the surge in the cryptocurrency market last year, it’s possible to think that the recent struggles in the stock market has to do with the dismal performance of Bitcoin this year. Indeed, Bitcoin’s decline may have influenced stock prices, but such influence is marginal. The stock market decline was down to worries over global economies.

Fears over US vs. China trade wars

At the heart of the latest selloff are worries over potential trade wars that are likely to ensue from the Trump administration’s move to impose tariffs on up to $60 bln in Chinese imports. The US government had conducted an inquest, dubbed the “301 investigation,” into suspected unfair trade practices by China.

The US government will publish a list of targeted products in April. Robert Lighthizer, the US Trade Representative who led the inquest, told legislators on March 22 that aeronautics, modern rail, new energy vehicles and high-tech products would be subject to the new tariffs. Lighthizer admitted that China is likely to retaliate by targeting agricultural products from the US, which rely on the Chinese export market.

The Trump administration has been upfront about its intention to protect American goods and the latest tariff plan proves that the government is serious. Trump will reportedly consider taking further actions against China in coming weeks, depending on the response to the first phase of the tariffs.

The potentially negative effect that the tariffs and future actions that the Trump administration might take on international trade will have on the bottom line of US companies that rely on international trade is partly what sent stocks lower recently. This has been the consensus on Wall Street. As Brad McMillan, chief investment officer at Commonwealth Financial Network wrote in a note obtained by MarketWatch:

“For companies that sell to China, or indeed any country outside the US, the effects are likely to be negative—which is why markets are reacting again. Even the best-case results would still be worse, economically, than where we are now.”

Bruce Bittles from research firm Baird told CNBC “the market has been priced for perfection,” leaving the “market vulnerable to surprises” like the worries over potential trade wars. Ian Winer, the head of equities at Wedbush Securities added:

“A global trade war, whether it’s real or perceived, is what’s weighing on the market. There’s this huge uncertainty now. If China decides to get tough on agriculture or anything else, that will really spook people.”

“We’ve got a confluence of events: We’ve got some Facebook going on, some trade war going on, and higher interest rates going on,” Paul Nolte, portfolio manager at Kingsview Asset Management, Chicago told Bloomberg.

Social media privacy issues

Facebook has been under fire for how it handles user data following news that Cambridge Analytica mined data of 50 mln Facebook users without their permission. This sent shares of Facebook down roughly 13.8 percent in the week ended March 23 and the stock is down roughly one percent in the month-to-date. The revelation put pressure on tech stocks at large over heightened concerns that they might not be doing enough to protect user data. iShares U.S. Technology ETF, which tracks the performance of the Dow Jones US Technology Sector Index fell from $182.95 a share on March 12 to $165.68 a share on March 23. The ETF closed at roughly $168.18 a share on April 4. Typically, if tech stocks struggle the way they did, the overall stock market is definitely going to take a hit too.

Jaime Cox of Harris Financial Group, Richmond, Virginia declared the worries of entire tech:

“The entire technology complex is worried about what [Facebook founder] Mark Zuckerberg said last night [March 21], that maybe ‘we should be regulated’”. All of a sudden you have all of these technology companies that are going, ‘I can’t believe he said that,’ because that would basically hurt technology companies’ earnings potential.”

Simply put, the two events highlighted above — trades and data security — are at the heart of the recent struggles in the stock market. The global selloff of stocks in February triggered by worries over a potential interest rate hike by the US Federal Reserve also influenced market reactions to recent events as well.

On the other hand, Bitcoin’s struggles have been down to its acceptance, or the lack thereof, on various levels including regulators and companies. The Wall Street Journal reported at the end of February that the US Securities and Exchange Commission (SEC) has “issued dozens of subpoenas and information requests to technology companies and advisers” involved in the cryptocurrency space. As more details of the SEC inquest became available at the beginning of March, in addition to a report in Bloomberg that suggested the Bitcoin regulation that the Chinese government imposed wasn’t temporary, the cryptocurrency market, led by Bitcoin began a downward spiral.

There is also the negative effect of the recent advertising bans imposed by companies including Facebook and Alphabet’s Google. Such ban sends a negative vibe to the public on cryptocurrencies and ICO projects.

Unexpected direction

What is clear is that the recent stock market performance has almost nothing to do with the performance of Bitcoin and cryptocurrencies at large. For the most part, the stock market struggles stem from investor panic over things that might be. As Julianne Niemann of research firm Smith Moore said “The market has a psychology right now of, ‘when in doubt, get out. We’ll figure out later what happened.’ “

If the downward trend of stocks continues especially because of the political uncertainties around the Trump administration, we might see investors look in the direction of Bitcoin to protect their wealth given that the government does not control it. This may inherently increase the demand for the number one cryptocurrency. Researchers at the Commonwealth Scientific and Industrial Research Organization found that political uncertainties in recent years, such as the economic crisis in Greece, uncertainties surrounding Brexit and the election of Donald Trump as U.S. president have brought about an increased demand for Bitcoin, pushing up prices in the end.

The post Facebook And Trade Wars: What’s Happening With The Stock Market? appeared first on Bitcoin Geek.

via Kingmind Facebook And Trade Wars: What’s Happening With The Stock Market?

0 notes

Text

Wall Street Bitcoin Bull Tom Lee Predicts “Massive Outflow” Of Crypto Before Tax Day

Wall Street Bitcoin Bull Tom Lee Predicts “Massive Outflow” Of Crypto Before Tax Day

Wall Street’s Tom Lee notes in a recent report that a need to convert crypto to fiat will rise exponentially in the lead up to tax day on April 17.

Fundstrat’s Tom Lee has predicted a “massive outflow” of cryptocurrency to fiat in the lead up to tax day in the US, CNBC reports today, April 5.

In a Thursday report Lee notes that, since US households owe an estimated $25 bln in capital gains taxes due to their crypto holdings, and crypto exchanges also will owe income taxes, both households and exchanges will be selling their crypto to pay the US government:

“We believe there is selling pressure by crypto exchanges who are subject to income tax in U.S. jurisdictions. Many exchanges have net income in 2017 [of more than] $1 bln and keep working capital in [Bitcoin]/[Ethereum], not USD — hence, to meet these tax liabilities, are selling BTC/ETH.”

According to Lee, “historical estimates are each $1 of USD outflow is $20-$25 impact on crypto market value.”

The crypto markets reported near 50 percent losses across the first quarter of 2018, marking BTCs and ETH’s worst first quarter performances in the history of the coins. However, anyone that capitalized on the crypto market spike in December 2017 that saw BTC’s price rise to $20,000 will need to pay capital gains tax on their earnings.

Lee’s Bitcoin Misery Index (BMI), created in mid-March to show how “miserable” BTC holders are based on the current price, shows that crypto holders are currently feeling the “misery:”

“Regulatory headline risk is still substantial. And sentiment remains awful, as measured by our Bitcoin misery index, which is still reading misery.”

Lee concludes that “[u]ltimately, we expect Bitcoin to find footing after April [17], tax day.”

Lee most recently predicted that Bitcoin will hit $91,000 by March 2020, based on BTC’s performance after past market dips. In January of this year, when BTC’s price was around $9,000, Lee told CNBC that BTC would hit $25,000 by the end of 2018, instead of by 2022 like he had previously predicted.

The post Wall Street Bitcoin Bull Tom Lee Predicts “Massive Outflow” Of Crypto Before Tax Day appeared first on Bitcoin Geek.

via Kingmind Wall Street Bitcoin Bull Tom Lee Predicts “Massive Outflow” Of Crypto Before Tax Day

0 notes

Text

Professionals To Be Paid For Their Data Through Blockchain Protocol

Professionals To Be Paid For Their Data Through Blockchain Protocol

sponsored

A Blockchain platform wants to cut out middlemen when businesses and professionals are forging new relationships, giving all parties greater control over data.

A new Blockchain platform wants to empower professionals by giving them full control of their data by cutting out the middlemen who make money out of their personal details.

Profede says its protocol is designed to make it easier and more cost effective for companies to contact individuals with job offers and business opportunities. Under this decentralized approach, professionals are paid every time their contact information and full profile is released to a business. Professionals set their own price in tokens depending on how accessible they want their profile to be.

The start-up is optimistic about becoming a mainstream player after signing an agreement with beBee, a collaborative platform for professionals which has already amassed 12 mln users in more than 100 countries. As part of the deal, beBee will be the first network to embrace Profede’s protocol – and the company says it is in talks with other apps to gain further market adoption.

“Making data valuable”

According to Profede, the current options for business networking are not working – with its whitepaper describing the professional recruitment market as “broken.”

The Estonia-based company claims professionals are currently being bombarded with low-quality offers, meaning businesses find it harder to entice them with genuinely exciting opportunities and struggle to get a return on their investment.

Profede also alleges that current recruitment platforms such as LinkedIn are charging businesses “outrageous fees” to get in touch with prospective candidates, and none of those fees are making their way to the professionals themselves.

How does it work?

Profede regards professionals as the type of workers who use LinkedIn profiles, as well as those who have registered with job portals and industry-specific social networks.

Through the Profede Professional Protocol, these users choose how much of their personal data is made public – and they decide how much other businesses and professionals must pay in order to access their full profile.

When their data is purchased, they will be compensated in Professional Activity Tokens – known as PATO for short. Profede takes a commission of 2 percent from these transactions, which is then reinvested into the platform.

The company believes this system will make professionals feel more valued, while also helping businesses to save time and money. Profede says businesses will only need to purchase data they are actually interested in – and, as every professional’s feedback rating will be on public display, there is less chance of a business wasting money in acquiring the data of professionals with poor track records.

Similar to its arrangement with beBee, Profede hopes its protocol will be embraced by other recruitment firms, job portals, headhunters and professional networks.

Profede says examples of where its Blockchain-based platform could make communication easier include when a business is looking to hire an experienced programmer, or when a professional is in the market for new job offers. It hopes its protocol will also help businesses boost their sales and start mutually beneficial partnerships with other entrepreneurs.

Looking to the future

By the middle of Oct. 2018, Profede hopes that an alpha version of its protocol will have been fully developed – paving the way for a beta version to be integrated into beBee by the end of the year.

Its final product is due to be launched on Ethereum’s mainnet in 2019. Once everything is up and running, one of Profede’s main priorities will be marketing its protocol to small and medium-sized apps, including job portals, professional networks, recruitment businesses, software vendors and professional service providers. The company hopes that attracting professional apps will incentivize professionals to create a profile and benefit from Profede’s protocol.

Profede is currently in the presale period of its initial coin offering, which ends on May 31, 2018, and the public crowdsale will begin on June 1.

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you all important information that we could obtain, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor this article can be considered as an investment advice.

The post Professionals To Be Paid For Their Data Through Blockchain Protocol appeared first on Bitcoin Geek.

via Kingmind Professionals To Be Paid For Their Data Through Blockchain Protocol

0 notes

Text

Big Tech Are Banning Crypto And ICO Ads – Is There A Reason to Panic?

Big Tech Are Banning Crypto And ICO Ads – Is There A Reason to Panic?

Major social media platforms have kicked out crypto and ICO related ads. Google will introduce similar actions in the nearest future. How does it actually affect the industry?

Major social media platforms, including Facebook, Instagram and Twitter have recently banned advertising for cryptocurrencies and initial coin offerings (ICOs), whilst Google will introduce similar regulations in June 2018. Facebook came first saying that such ads are related to ‘deceptive promotional practices’ and setting a precedent for other social media giants that have taken similar action towards crypto and ICO-related advertising.

The blanket bans have certainly done some damage to the market. Not only has it deprived industry players of certain promotional tools, but also contributed to the stigmatization of cryptocurrencies as a whole. However, there’s always a bright side: some experts argue that the crackdown might actually lead to legitimization of the industry.

Timeline of bans on crypto ads

On Jan. 30 Facebook issued a blog post announcing that it will prohibit ads that use “misleading or deceptive promotional practices,” referring specifically to ICOs and cryptocurrencies. Rob Leathern, Product Management Director at Facebook, explained:

“We want people to continue to discover and learn about new products and services through Facebook ads without fear of scams or deception. That said, there are many companies who are advertising binary options, ICOs and cryptocurrencies that are not currently operating in good faith.”

The ban was “intentionally broad”, meaning that the social media giant decided to ban all cryptocurrency ads on its platforms (Facebook, Instagram and Audience networks) first, and then find out how to pick out ones that are actually “deceptive”. Some sources in the industry suggest that Facebook will wait for US regulatory bodies to roll out definite policies, which might take months.

Indeed, Facebook’s move seemed to coincide with US Securities and Exchange Commission’s (SEC) public announcement regarding crypto-related investments and ICOs that was issued in Dec. 2017. In that statement, SEC chairman Jay Clayton suggested that there is a growing trend for “fraud and manipulation” in the cryptocurrency and ICO markets due to their rising popularity. Clayton also warned investors that there were no ICOs registered with SEC.

Essentially, Facebook has set a precedent for other big tech companies, as Google was next to follow. On March 14, soon after reports from crypto advertisers regarding suspensions and account terminations on Adwords (which Google denied at the time) emerged, the company announced that it will ban all cryptocurrency-related advertising of all types (ICOs, exchanges, wallets etc.) in June 2018. The policy will apply to Google search, Google-owned platforms including YouTube and display-advertising on third-party sites. The company also announced it is pulling cryptocurrency mining extensions from its Chrome Web Store this week.

Explaining the decision to ban cryptocurrency-related advertising, Scott Spencer, the Director of Sustainable Ads at Google, told CNBC:

“We don’t have a crystal ball to know where the future is going to go with cryptocurrencies, but we’ve seen enough consumer harm or potential for consumer harm that it’s an area that we want to approach with extreme caution.”

On March 26, Twitter confirmed rumors that the social media giant would follow Facebook and Google in clamping down on crypto-related advertising. The ban covered advertising for ICOs and token sales only. In addition, the policy also included bans on cryptocurrency exchanges and wallet services, unless they are public companies and are listed on major stock exchanges.

“We know that this type of content is often associated with deception and fraud, both organic and paid, and we are proactively implementing several signals to prevent these types of accounts from engaging with others in a deceptive manner,” the company explained to Bloomberg.

Recent reports also confirmed that Snap Inc., the company behind Snapchat, has been silently restricting ads for token sales since February, whilst its future plans on the rest of crypto ads types remain unclear.

At this point, all major social media platforms have announced (or have already implemented) restrictions on cryptocurrency and ICO advertising. It’s worth noting that Facebook and Twitter control about 60-70 percent of the online advertising market.

Cryptocurrency and ICO ads bans take toll on markets

Although soon after the Facebook’s announcement Jan. 30 Bitcoin took a hit and collapsed from roughly $10,166 to $6,914 by Feb. 5, it managed to come back even stronger: by Feb. 20 the price rallied to $11,228.

On March 14, after the news of Google plans to crackdown on crypto and ICO ads, Bitcoin rapidly fell below $8,000, losing about 9 percent of its value.

Closer to the end of March, soon after the Twitter ban announcement on March 26, Bitcoin took another hit. its value fell below $7500 on March 29, resulting in the steep sell-off and another depressing week for traders.

“Death cross”: mainstream media and public reaction

Some mainstream media including CNBC dubbed the price drops with the scary-sounding label “death cross”, implying that Bitcoin’s short-term movement average was about to cross below its long-term average. That contributed to obligatory public freakouts, although Reddit users kept their cool, even when the “death cross” actually happened on March 30. There was a number of sarcastic comments like “Yes, we crossed it. Now we’re all dead”, while others discussed the matter more seriously: many agreed that it was merely a lagging indicator. Some users noticed that Bitcoin had passed the so-called “death crosses” three times before the recent price drop.

Users also directly addressed Twitter’s CEO Jack Dorsey, who argued that Bitcoin will become world’s single currency within a decade just a week before introducing the ban on his social media platform: “I recently read an article that you believe in Bitcoin and fully support it. Then why you’re following Facebook’s steps and you’re now planning to ban cryptocurrencies and ICO-related ads?”

John Ratcliff, a game developer, software engineer and prominent cryptocurrency blogger, also claimed that the price drop has nothing to do “with Bitcoin’s network, which has literally never been stronger or more healthy”. Instead, he blamed “ICOs and alt bag-holders cashing out to fiat”, as well as panic-sellers.

Industry sources remain positive despite the looming potential for new lows, with various players anticipating the launch of the Lightning Network which might potentially strengthen Bitcoin’s position.

ICOs have been additionally stigmatized rather than actually affected

Rosemary O’Neill, CEO of Narrative, a Blockchain-based social network that has just finished its ICO, told Cointelegraph that token sale projects don’t actually rely on major social media platforms that much:

“Most ICO projects are already much more focused on the ICO directory sites, niche email newsletters, Telegram channels, and Discord rooms than big social. You always want to go where your audience is hanging out, and (sorry Facebook), the crypto crowd isn’t really focused there”.

However, according to O’Neill, the process of finding the right clientele has indeed been affected by the recent bans, although to a small degree:

“In the cryptocurrency/Blockchain project world, you typically have a two-phased audience…targeting crypto investors or alt coin enthusiasts for the token sale, and then shifting to the target audience for your actual platform or product post-token sale. The recent advertising bans really only make it a bit more difficult to cast a wide net in the first phase”

O’Neill claims that her company did not experience a significant loss in terms of token sale participants, although the recent bans seem to enforce the stigma of cryptocurrencies, which certainly doesn’t help: “It has a psychological impact on the way the average person views cryptocurrencies, and we’ve already heard people say, ‘well, Google’s not allowing it, it must be bad’ referring to all cryptocurrencies, which just isn’t true. It’s really unfortunate”.

Ben Noble, a founding partner of a marketing and PR company called MarketBlok, suggests that after the Google ban, the market will never be the same. “The mere suggestion of a Google ban shrank the market significantly. Much of the damage is already done. However, the ban will further create market attrition among companies that can’t fit into a new organic marketing paradigm. Good technology generally speaks for itself. But clever marketing will put a select few Blockchain companies on a pedestal”.

According to Noble, companies have shifted their resources from paid advertisements to direct marketing, public relations, brand journalism and search engine optimization (SEO). “With paid platforms dwindling, Blockchain companies need to make more calculated decisions with their marketing budget. Unfortunately, the sudden crackdowns have thrown the market off balance. Journalists are drowning in a cacophony of pitches, and bots and spam posting on social channels has accelerated”.

Noam Cohen, executive at Fusion, confirms the existence of growing stigma provoked by the big tech’s clampdown. “It is of course related to an increasing number of scams that have been surfacing in ICOs, and the increasing difficulty to ascertain to what degree is a new venture “scammy” – I think that public perception is becoming more negative of this space”.

The ever-growing number of various ICOs has even reached the point of becoming meme-worthy, Cohen adds:

“At face value, all ICOs now look the same – website design, countdown clocks, KYC [know your customer] and capping methodology – So similar that humorous memes have appeared mocking the template for a successful ICO. This ‘winning template’ has been so widely adopted that, for much of the public who is not tech-savvy enough to read white papers it becomes even more difficult to distinguish a good project from a scam; And the default attitude towards new projects is that of extreme skepticism”.

That, in turn, rushed the social media platforms to protect their customers. “In this atmosphere, one might imagine that any advertising of such new projects creates a liability for the media/channel, of being perceived as aiding and abetting fraud, and hence, the new policy.”, he says.

O’Neill confirms that assumption. She also adds that while it is not wrong to protect your consumers from bad actors, the action could have been more delicate to legitimate businesses:

“We feel the blanket ban is a knee-jerk response that ultimately dampens enthusiasm for what will be a world-changing technology of blockchain and cryptocurrency. The good news is that advertising bans are not going to stop that technology from happening; it’s like trying to stop the tide with a bucket”.

Noble warns that an investor shouldn’t evaluate a company solely on the platform used for promotion. “I’d be more concerned with the message of the advertisements. If an advertisement is pushing moon Lambos and unrealistic expectations for ROI, bail”.

A significant percentage of scams tend to stand out in comparison to legitimate ICOs. “The perpetrators of scams are looking for a quick buck and often rely on volume of outreach rather than quality of message. They tend to leave obvious holes in logic. Rule of thumb is: if you don’t understand what a company does, don’t invest.”, Noble adds.

The ICO team’s online presence should always be investigated, too. As Jonathan Hobbs, author of “The Crypto Portfolio: a Commonsense Approach to Cryptocurrency Investing”, puts it: “If you can’t find information about them on Google or Linkedin, they probably don’t exist”.

There are other factors besides social media marketing of ICOs, too: Hobbs highlights two particularly important ones: the strength of the ICO project team and the so-called ‘token economics’.

“Token economics encompass various metrics on how the ICO investment is structured to determine the potential value to the investor. A simple metric to consider here, for example, would be the price of the token at ICO relative the total supply of coins, and the traction the project team already has in achieving the goals set out in their roadmap”.

How the ban might actually legitimize the ICO industry

Hobbs believes that the regulatory crackdown is not necessarily harmful for the ICO market in the long term:

“The banning of ICO advertisements by companies like Google, Facebook and Twitter may not seem like the best thing to some, but it could help further legitimize the ICO industry in the coming years. By restricting their ability to advertise, it’s harder for scammers to find unsuspecting retail investors to buy into their projects.”

He also pinpoints that mainstream stock companies don’t promote their services to the public through paid advertising as it would be a “regulatory nightmare”. Hobbs believes that “If cryptocurrencies and ICOs are to be taken more seriously by large institutional investors (big banks, pension funds, asset managers and so on), then they should do the same”.

The post Big Tech Are Banning Crypto And ICO Ads – Is There A Reason to Panic? appeared first on Bitcoin Geek.

via Kingmind Big Tech Are Banning Crypto And ICO Ads – Is There A Reason to Panic?

0 notes

Text

Cryptocurrency Verge Responds To Hacking Claims By Launching ‘Accidental Hard Fork’

Cryptocurrency Verge Responds To Hacking Claims By Launching ‘Accidental Hard Fork’

Verge developers’ handling of a code bug has raised questions, particularly among miners, over management integrity.

Anonymity-focused cryptocurrency Verge (XVG) lost 25% of its value April 4 as news surfaced of an apparent hack which developers ‘resolved’ by accidentally initiating a hard fork.

According to various press and social media sources, including Verge developer known as Sunerok, a bug allowed manipulation of block mining timestamps. This created the potential for illegitimate coins to appear from nowhere.

“There’s currently a >51% attack going on on XVG which exploits a bug in retargeting in the XVG code,” Suprnova mining pool’s OCminer reported on Bitcointalk.

“Due to several bugs in the XVG code, you can exploit this feature by mining blocks with a spoofed timestamp. When you submit a mined block (as a malicious miner or pool) you simply set a false timestamp to this block one hour ago and XVG will then “think” the last block mined on that algo was one hour ago.”

The debacle comes just three weeks after John McAfee-endorsed Verge lost control of its Twitter account to hackers, with funds reportedly not being at risk.

Following the fresh bug reports, however, Sunerok appeared to adopt a laissez faire attitude to fixing them, pushing through an accidental hard fork.

“You guys are aware that the ‘fix’ you pushed actually IS a hardfork? So your blockchain snapshot is not valid anymore, the wallet’s won’t sync up from scratch anymore and the current chain is simply not usable anymore with that new ‘fix’?” OCminer continued.

Analysis by Suprnova suggested the hack stopped April 5. “I skimmed the logs and saw the attacker started the new attack at around block 2014060 and stopped just now at block 2026196,” OCminer wrote in a further post.

Verge’s last official Twitter update was published around 19 hours ago, claiming funds were only exploitable for three hours:

We had a small hash attack that lasted about 3 hours earlier this morning, it’s been cleared up now. We will be implementing even more redundancy checks for things of this nature in the future! $XVG #vergefam

— vergecurrency (@vergecurrency) April 4, 2018

The post Cryptocurrency Verge Responds To Hacking Claims By Launching ‘Accidental Hard Fork’ appeared first on Bitcoin Geek.

via Kingmind Cryptocurrency Verge Responds To Hacking Claims By Launching ‘Accidental Hard Fork’

0 notes

Text

India’s Central Bank To Stop Dealing With All Crypto-Related Accounts, ‘Not Ban On Crypto’ Commenters Say

India’s Central Bank To Stop Dealing With All Crypto-Related Accounts, ‘Not Ban On Crypto’ Commenters Say

India’s central bank will stop associations with all entities related to cryptocurrency, citing the “associated risks” like money laundering

The Reserve Bank of India (RBI) has announced that the bank will no longer provide services to any person or business that deals with cryptocurrencies, adding that it is also looking into releasing its own cryptocurrency in the future, according to a “Statement on Developmental and Regulatory Policies” released today, April 5.

India’s Finance Ministry had criticized Bitcoin (BTC) and cryptocurrencies for their “lack of intrinsic value” in January of this year, and the month saw several large Indian banks close or limit the functionality of crypto exchange accounts. In early February, false reports in the media of a country-wide crypto ban in early February led to a drop in the crypto markets.

RBI’s statement reads that although the technological innovations that support cryptocurrencies “have the potential to improve the efficiency and inclusiveness of the financial system […] Virtual Currencies (VCs] […] raise concerns of consumer protection, market integrity and money laundering, among others.”

RBI continues by noting that they have already warned those involved in the crypto industry several times of the “various risks” of dealing with cryptocurrencies before stating finally that:

“In view of the associated risks, it has been decided that, with immediate effect, entities regulated by RBI shall not deal with or provide services to any individual or business entities dealing with or settling VCs. Regulated entities which already provide such services shall exit the relationship within a specified time.”

According to local news outlet Quartz India, the period of time for businesses to extract themselves from the crypto sphere is three months.

At a press conference today, Bibhu Prasad Kanungo, the deputy governor of RBI, said in regards to the decision that cryptocurrencies have the potential to “endanger financial stability:”

“Internationally, while the regulatory response to these tokens are not uniform, it is universally felt that they can seriously undermine the AML (anti-money laundering) and FATF (Financial Action Task Force) framework, adversely impact market integrity and capital control. And if they grow beyond a critical size, they can endanger financial stability as well.”

Panjak Jain, who works in Blockchain and crypto communities in India as an investor and an advisor, posted a series of tweets today about the new RBI crypto regulations, underlining that the Indian government “hasn’t banned crypto:”

1/ Today the Reserve Bank of #India issued a circular telling “entities registered with the RBI” (essentially banks, financial firms) to stop working with crypto exchanges and businesses. The Indian government, hasn’t banned #crypto.

— Pankaj Jain (@pjain) April 5, 2018

Jain’s further tweets note that “the Indian government is obviously not coordinating amongst the various parts of the government,” citing that income tax is being collected on crypto traders, and adding that it is “interesting” that “RBI cut off fiat from crypto exchanges that have been following fairly good KYC/AML practices used by Indian institutions:”

8/ The Indian crypto market is still pretty small but offers a lot of future growth and opportunities, especially for the unbanked. I hope the RBI and the rest of the Indian government rethink this decision and take a more positive approach towards #crypto.

— Pankaj Jain (@pjain) April 5, 2018

Meanwhile, the same RBI statement on the end of its association with crypto dealings adds that the bank will be looking into creating its own state-backed cryptocurrency, “in addition to the paper currency that we have,” Kanungo notes, with a report to be submitted on its feasibility by the end of June 2018.

RBI’s interest in their own cryptocurrency is due to the “rapid changes in the landscape of the payments industry along with factors such as emergence of private digital tokens and the rising costs of managing fiat paper/metallic money,” which they cite as the impetus for central banks around the world to introduce “fiat digital currencies.”

Kanungo adds that a state-backed cryptocurrency could “hol[d] the promise of reducing the cost of printing of notes.”

Sathvik Vishwanath, the co-founder of India’s Unocoin, told Quartz India that he doesn’t believe this is the “right direction that the central bank has taken:”

“This will cause panic among a few million people in India who are already using cryptocurrrencies [sic]. If they want to launch their own digital currencies, they don’t need to ban existing ones.”

The post India’s Central Bank To Stop Dealing With All Crypto-Related Accounts, ‘Not Ban On Crypto’ Commenters Say appeared first on Bitcoin Geek.

via Kingmind India’s Central Bank To Stop Dealing With All Crypto-Related Accounts, ‘Not Ban On Crypto’ Commenters Say

0 notes

Text

Litecoin: Litecoin Market Cap Crosses $15 Billion and Still Rising

In a massive run up since the weekend the price of Litecoin has risen from under $100 on Friday to almost $300 at press time. Along with the price growth, the market cap of the altcoin has risen from $8 bln to over $16 bln in just two days.

The price spike has largely been attributed to a combination of increased awareness of Bitcoin, and the potential for Litecoin to become the payment method of choice, should Bitcoin price become so large that smaller payments are not viable.

The price jump led to an outcry of despair on Twitter under the hashtag #ShouldveBoughtMoreLitecoin, as investors regretted not buying more of the altcoin when prices were low.

Litecoin is now @ $250. I guess I #ShouldveBoughtMoreLitecoin.

— Loshan (@loshan1212) December 12, 2017

Massive rise

The huge rise in Litecoin’s market cap and price point reflects the overall growth in cryptocurrency adoption globally throughout 2017. The increase has been so substantial that the current market cap of Litecoin is more than the entire market cap of all cryptocurrencies combined at the start of the year.

Litecoin is now worth more than the entire cryptocurrency market just 15 months ago.

— Ari Paul (@AriDavidPaul) December 12, 2017

Part of the growth in cryptocurrency investment comes from investors shifting out of traditionally stable investment vehicles, like gold, to dip their toes in the crypto-waters.

Source Cointelegraph

The post Litecoin: Litecoin Market Cap Crosses $15 Billion and Still Rising appeared first on Bitcoin Geek.

via Kingmind Litecoin: Litecoin Market Cap Crosses $15 Billion and Still Rising

0 notes

Text

Cryptopay.me: Provide Bitcoin Debit Card Service

Cryptopay Review: Provide Bitcoin Debit Card Service

There are many people in world concerned about how they can spend their bitcoin or cash out to fiat currency. If you face this situation. You can try Cryptopay Bitcoin Debit Card Service

Cryptopay was founded in October of 2013 and has since been based out of UK. It is a wallet and payment platform where merchants and consumers can transact with each other while leveraging best of both worlds i.e. crypto & traditional banking.

They also offer other useful services in tandem with their bitcoin debit card which has made it different from its peers.

Let us see explore its exclusive features one by one.

Everything You need to know

1. Cryptopay’s Bitcoin Wallet

Cryptopay Bitcoin wallet provides an easy way to buy, store and send bitcoins all over the world. It allows convenient deposit methods in major fiat currencies such as USD, EUR, GBP where you can hedge against BTC price fluctuations using Cryptopay Flex Accounts. (I will cover flex accounts in the next section).

But this wallet is a kind of co-hosted wallet where your funds are protected by multisig wallet technology powered by BitGo. It also has a two-factor authentication in place for the extra security of your funds.

Getting started with Cryptopay’s Bitcoin Wallet is quite easy and straightforward after which you are eligible to enjoy all their services.

Cryptopay.me Wallet

Sign up and create your account with your name and email ID.

Submit your ID proofs and get verified.

Add funds GBP, EUR or USD.

Get your Bitcoins.

2. Cryptopay’s FLEX Account

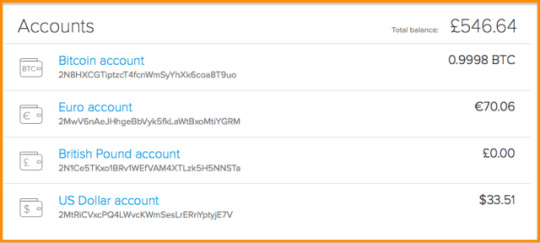

Flex Account

When you sign up and become a verified customer of Cryptopay, you get access to their FLEX account.

A FLEX account is more than a standard BTC account or wallet which you generally get after signing up a wallet service. This FLEX account gives access to your BTC account in 4 currencies instead of just one or two.

Here you have the liberty of accessing/keeping your funds spread across 4 differently currencies namely in Euro (EUR), Pound Sterling (GBP), US Dollar (USD) and Bitcoin (BTC).

You might question the need of so many types of currencies? But wait! Having these many types has an advantage.

The advantage is you can spread your funds across four different currencies and hence protect yourself from the price volatility of Bitcoin.

And as they add more fiat currency support, it will become more useful to hedge your position against the market.

3. Cryptopay’s Bitcoin Debit Card

Cryptopay’s Bitcoin Debit Card

Cryptopay issues Bitcoin debit cards which are low commission cards. They are delivered free of cost within 2-3 weeks within Europe with standard delivery but if you are in a hurry and want your card early, you can spend some bucks to get it within 10 days.

Cryptopay Bitcoin Debit Card Supported Currency USD, EUR, GBP Has An App Yes Anonymous No Physical Card Yes Virtual Card Yes Card Type VISA

These cards are issued in both physical and virtual forms. To get these cards, an ID verification is required to order your Cryptopay Bitcoin debit card. Also, it is not anonymous, as your name and email ID are required for registration.

But these cards are accepted at all places that accepts Visa debit cards. Below is their fee schedule. Also, they don’t ship their cards to all countries, so check here if your country is supported by them.

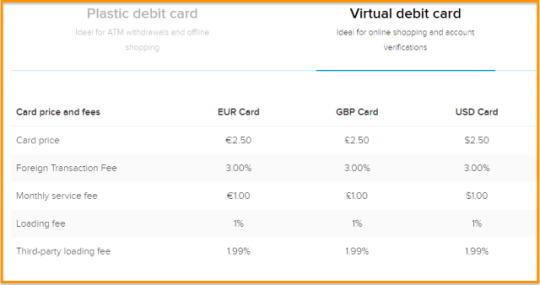

Plastic Card Fees:

Cryptopay Plastic Card

Virtual Card Fees:

Cryptopay Virtual Card

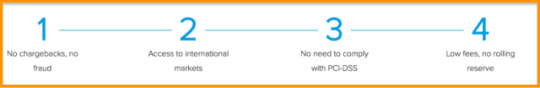

4. Accept Bitcoin With Cryptopay

If you are a merchant or are running a business online, you should also start accepting Bitcoins as payments. Accepting Bitcoins over traditional payments has several advantages, some of these are shown the graphic below.

Cryptopay.me Merchant app

With Cryptopay.me you also get the benefit of a service where you get a developer’s kit and access to Cryptopay.me API to integrate Bitcoin payment��into your business.

More Than A Bitcoin Debit Card Service

It is, without a doubt, more than just a bitcoin debit card company.

With its flagship services and a well-funded team after the ICO, they are continuously improving and developing innovative services to its customers.

Their ICO raised 15 million Euros without an MVP! That is because they already had a fully functional product and a concrete business plan.

Now with the raised funds and their upcoming products like Bitcoin brokerage service, Bitcoin Bank account, and P2P exchange, they look even more roadmap.

Their ICO is now over and that is why it makes more sense in using their services. That is because the team would be working working hard to deliver on their promises which will bring in better products, services and support for the company’s customers. So it makes absolute sense in using their services at this point in time.

Also, only if you are interested, you can get HODL of some of the CPAY tokens that were distributed during their ICO once they get listed on exchanges. I am saying this because according to their whitepaper, CPAY HODLers will be earning some share of the company’s referral commissions starting from January 2018, which is good smart passive income opportunity. (I will update this section when CPAY tokens are live on exchanges)

What are you waiting for? Join Cryptopay.me now and enjoy your financial freedom.

The post Cryptopay.me: Provide Bitcoin Debit Card Service appeared first on Bitcoin Geek.

via Kingmind Cryptopay.me: Provide Bitcoin Debit Card Service

0 notes

Text

In Consolidation Mode, Bitcoin Awaits Decisive Move

Bitcoin has been restricted to a narrow price range of $10,000 to $11,000 for almost 72 hours.

CoinDesk’s Bitcoin Price Index (BPI) moved above the $10,000 mark on Monday, but the rally from last Sunday’s low of $9,304.68 ceased at a seven-day high of $11,044.16 yesterday. At the time of writing, the BPI is at $11,583.

The cryptocurrency has depreciated by 1.4 percent in the last 24 hours, according to data from CoinMarketCap. Further, it ended last month on a flat note, and is reporting a 1 percent gain on a weekly basis.

Notably, average daily trading volume dropped 38 percent in February, adding credence to bitcoin developer Meni Rosenfeld’s view that the craze for buying cryptocurrencies, in general, has calmed down.

That said, trading activity could pick up if the pace of bitcoin (BTC) sees an inverse head-and-shoulders breakout. However, technical charts also indicate scope for a big sell-off if BTC dips below the lows seen over the weekend.

Bullish scenario: inverse head-and-shoulders breakout

The descending trendline resistance and the inverse head-and-shoulders neckline are shown to converge at $11,640 by Saturday.

A high volume break (UTC lose) above $11,640 would signal long-term bull market revival and could open up towards $17,000-$17,400.

Bearish scenario I: BTC drops below $9,280

BTC could drop to point D ($6,659), as indicated by the bat pattern (harmonic pattern), if yesterday’s inverted bearish hammer candle on the downward sloping 50-day moving average is followed by a break below $9,324.75 (Feb. 25 low), today or in the next few days.

As per rules, the leg BC could go as high as $11,502 – 88.6 percent Fibonacci retracement of leg AB. Only a move above $11,502 would invalidate the bat pattern.

Note that point D is a “bullish reversal” according to bat pattern rules, meaning BTC will likely witness a sharp rebound from $6,659.

Bearish scenario II

Another possibility is that BTC moves above $11,502, but faces rejection at the confluence of inverse head-and-shoulders neckline resistance and descending trendline resistance

Failure to take out the confluence of resistance at $11,640, followed by a quick drop below $9280.4, could yield a sell-off to $6,000 (February low).

Source www.coindesk.com

The post In Consolidation Mode, Bitcoin Awaits Decisive Move appeared first on Bitcoin Geek.

via Kingmind In Consolidation Mode, Bitcoin Awaits Decisive Move

0 notes

Text

មិននឹកស្មានថា ណូម័រ លះបង់រឿងមួយដើម្បីទិញផ្ទះតម្លៃជិតដប់មឺុនដុល្លារជូនម្តាយ ក្នុងថ្ងៃនៃក្តីស្រលាញ៉

ពិធីការនី និងជាតារាសម្តែង កញ្ញា អន រ៉ាសុីសុមេត្តា ដែលមហាជនភាគច្រើនស្គាល់ថាឈ្មោះ ណូម័រ បានធ្វើឲ្យមហាជនកោតសរសើរជាខ្លាំងក្រោយពីបានទិញផ្ទះជូនអ្នកមានគុណ នៅក្នុងបុរីមួយដែលមានតម្លៃប្រមាណជាជិត១០មឺុនដុល្លារ នាឪកាសទិវាបុណ្យនៃក្តីស្រលាញ់។ កញ្ញាថែមទាំងបានបញ្ចាក់ថានាងសុខចិត្តមិនកែច្រមុះ ដើម្បីទុកលុយទិញផ្ទះឲ្យម្តាយទុកជាការដឹងគុណ ដោយកញ្ញាបានសរសេររៀបរាប់នៅក្នុងគណនីហ្វេសប៊ុករបស់ខ្លួនថា៖

“អូនសុខចិត្តលះបង់ការធ្វើច្រមុះ ដើម្បីយកលុយមកបង្កប់ទិញផ្ទះមួយល្វែងទៀតជាកាដូថ្ងៃបុណ្យនៃសេចក្តីស្រលាញ់ជូនអ្នកម្តាយ គ្រាន់អោយអ្នកម្តាយដាក់ជួលបានកំរៃ 400$ ទៅ 500$ក្នុងមួយខែនៅដៃគាត់ដែរ។ សូមអ្នកម្តាយចាំថា ទោះគ្មានថ្ងៃបុណ្យនៃសេចក្តីស្រលាញ់ក៏សេចក្តីគោរពអាណិតស្រលាញ់របស់កូនតែងមានចំពោះអ្នកម្តាយគ្រប់វិនាទី។ surprised gift Valentine’s Day for my everything Mak Keo I LOVE YOU ( ភ្នំពេញថ្ងៃទី13/14 ខែកុម្ភះ ឆ្នាំ2018 ទឹកចិត្តកូនស្រីចំពោះអ្នកម្តាយ )”៕

Source komsan.khmernotes.com

via Kingmind មិននឹកស្មានថា ណូម័រ លះបង់រឿងមួយដើម្បីទិញផ្ទះតម្លៃជិតដប់មឺុនដុល្លារជូនម្តាយ ក្នុងថ្ងៃនៃក្តីស្រលាញ៉

0 notes

Text

ខ្លោចចិត្ត! អគ្គិភ័យឆេះតូបលក់ឥវ៉ាន់ចាបហួយ១កន្លែង នៅស្រុកត្រពាំងប្រាសាទ បណ្តាលឲ្យស្លាប់មនុស្សស្លាប់៣នាក់ រួមទាំងទ្រព្យសម្បត្តិទាំងស្រុង

(ឧត្តរមានជ័យ)៖ ហេតុការណ៍អគ្គិភ័យមួយ បានឆាបឆេះតូបលក់អីវ៉ាន់ទាំងស្រុង និងបណ្តាលឲ្យស្លាប់មនុស្ស៣នាក់ (ម្តាយ និងកូនស្រី២នាក់) នៅយប់រំលងអាធ្រាត្រចូលថ្ងៃទី៩ ខែកុម្ភៈ ឆ្នាំ២០១៨ ស្ថិតនៅភូមិសែនសំ ឃុំអូរស្វាយ ស្រុកត្រពាំងប្រាសាទ។

មន្រ្តីនគរបាលខេត្តឧត្តរមានជ័យ បានឲ្យដឹងថា ករណីខាងលើនេះបណ្តាលឱ្យស្លាប់មនុស្ស៣នាក់ ខណៈជនរងគ្រោះទាំងអស់ កំពុងសម្រាកស្ងប់សុខស្រួល នៅក្នងតូបលក់ទំនិញខាងលើនេះ។

ជនរងគ្រោះទាំង៣នាក់រួមមាន៖ ទី១-ឈ្មោះ ថង់ ហូវ អាយុ៤២ឆ្នាំ មានជម្ងឺជាប់សរសៃចង្កេះ (ត្រូវជាម្តាយ), ទី២-ឈ្មោះ ចាន់ លីហ្សា អាយុ១៣ឆ្នាំ (ត្រូវជាកូនបង្កើត) និង៣-ឈ្មោះ ចាន់ លីតា អាយុ ០៧ឆ្នាំ (ត្រូវជាកូនបង្កើត) ជនរងគ្រោះទាំងបីនាក់រស់នៅភូមិ-កើតហេតុ។

លោកឧត្តមសេនីយ៍ទោ ម៉ែន លី ស្នងការនគរបាលខេត្ត បានឲ្យដឹងថា ករណីខាងលើនេះការខូចខាតរួម តូបលក់ឥវ៉ាន់ចាបហួយទំហំ ០៥x ០៧ម៉ែត្រ និងសម្ភារទ្រព្យសម្បត្តិនៅក្នុងតូប ត្រូវឆេះខូចខាតទាំងស្រុង ដែលបណ្តាលមកពីផ្ទុះឆ្លងចរន្តភ្លើង។

លោកស្នងការបន្តថា ករណីនេះ ក្រោយទទួលបានព័ត៌មានភ្លាម លោកអធិការនគរបាលស្រុក បានដឹកនាំកម្លាំងចុះអន្តរាគមន៍ ពន្លត់ដោយប្រើប្រាស់ទឹកអស់៣ឡាន ទើបរលត់ទាំងស្រុង តែអ្វីដែលខ្លោចចិត្តនោះ គឺគ្រោះថ្នាក់សង្គមនេះបានបណ្តាលឲ្យម្តាយកូនស្រីតូចៗ២នាក់ ស្លាប់ក្នុងហេតុការណ៍គួរឲ្យអាសូរយ៉ាងពន់ពេក៕

ខ្លោចចិត្ត! អគ្គិភ័យឆេះតូបលក់ឥវ៉ាន់ចាបហួយ១កន្លែង នៅស្រុកត្រពាំងប្រាសាទ

ខ្លោចចិត្ត! អគ្គិភ័យឆេះតូបលក់ឥវ៉ាន់ចាបហួយ១កន្លែង នៅស្រុកត្រពាំងប្រាសាទ

ខ្លោចចិត្ត! អគ្គិភ័យឆេះតូបលក់ឥវ៉ាន់ចាបហួយ១កន្លែង នៅស្រុកត្រពាំងប្រាសាទ

ខ្លោចចិត្ត! អគ្គិភ័យឆេះតូបលក់ឥវ៉ាន់ចាបហួយ១កន្លែង នៅស្រុកត្រពាំងប្រាសាទ

ខ្លោចចិត្ត! អគ្គិភ័យឆេះតូបលក់ឥវ៉ាន់ចាបហួយ១កន្លែង នៅស្រុកត្រពាំងប្រាសាទ

Source www.khmerload.com

via Kingmind ខ្លោចចិត្ត! អគ្គិភ័យឆេះតូបលក់ឥវ៉ាន់ចាបហួយ១កន្លែង នៅស្រុកត្រពាំងប្រាសាទ បណ្តាលឲ្យស្លាប់មនុស្សស្លាប់៣នាក់ រួមទាំងទ្រព្យសម្បត្តិទាំងស្រុង

0 notes

Text

អបអរសាទរ កូនស្រី យុគ ចិន្តា លើកបានពាន Asia Pacific Arts Festival ហើយ!

សៀមរាប៖ ជារឿងគួរឲ្យសរសើរ និងមានមោទនភាពខ្លាំងណាស់ ក្នុងនាមជាម្ដាយ នៅពេលដែល ឃើញកូនស្រីជាទីស្រលាញ់ បានបំពេញមុខជូនគ្រួសារ តាមការខិតខំរៀនសូត្រ ក៏ដូចជាស្ដាប់ដំបូន្មាន ។

ដោយឡែក អ្នកនាង យុគ ចិន្តា ក៏មានអារម្មណ៍ មិនខុសពីអ្នកម្ដាយដទៃដែរ ខណៈកូនស្រីបណ្ដូលចិត្ត ដែលទើបផ្ដើមធំពេញវ័យ នឹងត្រូវបានគេស្គាល់ឈ្មោះថា អម បាន កសាងកេរ្តិ៍ឈ្មោះជាច្រើន ជូននាង និងគ្រូសារមួយនេះ។

ជាក់ស្ដែងមុននេះបន្តិច ពិធីការនីចាស់វស្សា រូបនេះ ក៏បានបង្ហោះសារសម្ដែង ពីក្ដីរំភើបជាខ្លាំង ក្រោយពីកូនស្រី តែម្នាក់របស់អ្នកនាង ទទួលបានពានរង្វាន់ កម្មវិធី Asia Pacific Arts Festival ដែលប្រារព្ធឡើងក្នុងទឹកដី ខេត្តសៀមរាប។

ដោយក្នុងនោះ អ្នកនាង បានសរសេរថា៖ « អរគុណសម្រាប់ រាល់ការលើកទឹកចិត្តរបស់អ្នកគាំទ្រទាំងអស់គ្នា !ឥឡូវនេះក្តីរំពឹងទុក គឺទទួលបានដូចអ្វីដែលចង់បានពិតប្រាកដមែន ! អរគុណដល់ការខិតខំប្រឹងប្រែងរបស់ថៅកែ អម ដែលមិនធ្វើឲ្យនាងខ្ញុំខកចិត្ត! អរគុណថៅកែអម សំរាប់ការលើក ពានមាសនៅក្នុងពេលវេលានេះម្តងទៀត សំរាប់កិត្តិយសរបស់ក្រុមគ្រួសារ ផ្ញើរភាពរីករាយនិងស្នាមញញឹមពីខេត្តសៀមរាប ជាមួយនិងពានមាសពី កម្មវិធី Asia Pacific Arts Festival របស់ថៅកែអម» ។

គ្រាន់តែអានសារនេះហើយភ្លាម ទើបដឹងថា យុគ ចិន្តា ពិតជាស្រលាញ់កូនស្រីខ្លាំង ព្រោះតែ ក្មេងស្រីវ័យជំទង់ រូបនេះមិនដែលធ្វើឲ្យ អ្នកម្ដាយ ជាទីគោរពនាង ខកចិត្តម្ដងណាឡើយ ពិតជាគួរឲ្យសរសើរខ្លាំងមែនទែន៕

កូនស្រីអ្នកនាង យុគ ចិន្តា ទទួលបានពានរង្វាន់ កម្មវិធី Asia Pacific Arts Festival

កូនស្រីអ្នកនាង យុគ ចិន្តា ទទួលបានពានរង្វាន់ កម្មវិធី Asia Pacific Arts Festival

កូនស្រីអ្នកនាង យុគ ចិន្តា ទទួលបានពានរង្វាន់ កម្មវិធី Asia Pacific Arts Festival

កូនស្រីអ្នកនាង យុគ ចិន្តា ទទួលបានពានរង្វាន់ កម្មវិធី Asia Pacific Arts Festival

កូនស្រីអ្នកនាង យុគ ចិន្តា ទទួលបានពានរង្វាន់ កម្មវិធី Asia Pacific Arts Festival

កូនស្រីអ្នកនាង យុគ ចិន្តា ទទួលបានពានរង្វាន់ កម្មវិធី Asia Pacific Arts Festival

កូនស្រីអ្នកនាង យុគ ចិន្តា ទទួលបានពានរង្វាន់ កម្មវិធី Asia Pacific Arts Festival

កូនស្រីអ្នកនាង យុគ ចិន្តា ទទួលបានពានរង្វាន់ កម្មវិធី Asia Pacific Arts Festival

Source www.khmerload.com

via Kingmind អបអរសាទរ កូនស្រី យុគ ចិន្តា លើកបានពាន Asia Pacific Arts Festival ហើយ!

0 notes

Text

យ៉ែម សំអូន បើកកកាយ ទំនាក់ទំនងខ្លួនជាមួយ សារ៉ាយ សក្ខណា ស្ដាប់ឡើងព្រឺសម្បុរ!

ភ្នំពេញ៖ ជារឿង មួយដែលមិននឹកស្មានដល់សោះថា ទំនាក់ទំនងរបស់តារាសម្ដែងចាស់ឆ្នាំលោក យ៉ែម សំអូន និងអ្នកនាង សារ៉ាយ សក្ខណា តាមពិតមានភាពស៊ីជម្រៅជាង អ្វីដែលអ្នកគ្រប់គ្នា បានដឹងកន្លងមក។

នេះបើសម្ដីដែល លោក យ៉ែម សំអូន បានបង្ហោះ លាតត្រដាងពីចំណងមិត្តភាពអ្នកទាំងពីរ លើគណនីផ្លូវការរបស់ខ្លូន ដោយនិយាយចំៗថា លោក ពិតជាស្រលាញ់ អ្នកនាង ដូចជាកូនស្រីខ្លួន ខណៈដែល សារ៉ាយ សក្ខណា តែងហៅលោក ថា ឪ អស់ពេលជិត១០ឆ្នាំមកហើយ។

ដោយក្នុងនោះលោក បានរៀនរាប់យ៉ាងលម្អិតថា៖ « ពិតមែនហើយពេលវេលាពិតជាដើរលឿនហួសពីការស្មាន កាលវេលារំលងមក ១0ឆ្នាំជាងហើយ ខ្ញុំតែតែងឮពាក្យមួយម៉ាត់ របស់ក្មេងស្រីម្នាក់ថា (ឪ)ដែលមិនប្រែប្រួលជាមួយដំណើជីវិតសិល្បៈដ៏ចាក់ស្រេះ បន្ទាប់ពីកូនស្រីបង្កើត តែមួយរបស់ខ្ញុំដែលប្រើពាក្យថា(ប៉ាប៉ា) ឃើញគាត់ឭសម្ដី របស់គាត់និយាយជាមួយ ពេលខ្លះខ្ញុំព្យាយាមទប់ ដោយអារម្មណ៍ខ្សិបខ្សួល ប៉ុន្តែនៅពីក្រោយខ្នងមនុស្សផងទាំងពួង ទឹកភ្នែកខ្ញុំក៏ហូចុះមកដោយការនឹករលឹកកូនបង្កើតខ្លួនឯង ហើយតែងតែដំណាល់រហូតតាំងជួបដំបូងថាគាត់ និងកូនស្រីខ្ញុំមានចរិតនិងនិស្ស័យចេះគោរពនិងស្រលាញ់ឪពុកម្ដាយចេះជួយមនុស្សជុំវិញខ្លួនដូចគ្នាណាស់ មែនហើយវាសនាជីវិតយើង មើលមិនឃើញថាមិនត្រូវ

បានហើយគ្រប់គ្រាន់ហើយសម្រាប់ (ឪ) មិនបំបាច់លើសនិងក៍បានព្រោះតាំងពីដំបូងគឺមិនដែលសុំឲ្យ មានកាស្រលាញ់លើសហ្នឹងទេ ឯងពិតជាធ្វើឲ្យ(ឪ)និងមនុស្សគ្រប់គ្នារំភើប ដែលយើងមានថ្ងៃនេះ តាំងពីបាតដៃទទេ កម្សត់កម្រ វេទនាមហាសែនកម្សត់ ប៉ុន្តែទាំងនេះហើយគឺជាភាពជោគជយ័លាក់មុខ ដែលប្រឈមនឹងរឿងរ៉ាវជីវិត។ ចំណងមិត្តភាព ការាប់អាន វាគុណធម៌មួយ ដែលមិនមានសម្រាប់ តែពេលផឹកសុី ជុំគ្នា រឺមានតម្លៃត្រឹមតែស្រាមួយដប់៥0$ នោះដែរ (នេះជាតំលៃមនុស្ស)។(ឪ)អគុណគ្រប់យ៉ាងដែលឯងនៅតែរក្សាលំនឹង កាស្រលាញ់មិនប្រួលប្រែ តែប៉ុណ្ណឹងគឺគ្រប់គ្រាន់ហើយសំរាប់ (ឪ) សូមឲមានជោគជ័យ និងមានសុភមង្គលនៅក្នុងជីវិតណាកូនណា (ស្រលាញ់កូន)»។

សារនេះ បានឲ្យទស្សនិកជន មិត្តអ្នកអាន កាន់តែដឹងច្បាស់ថា ទំនាក់ទំនងនៃតារាល្បីឈ្មោះទាំង២ ដួងនេះ ពិតជា ពិសេសលើសការគិត និងមិនមែនត្រឹមតែជាមិត្តរួមអាជីពធម្មតាៗឡើយ៕

លោក យ៉ែម សំអូន

អ្នកនាង សារ៉ាយ សក្កណា

សារ៉ាយ សក្កណា និង យ៉ែម សំអូន មានទំនាក់ទំនងល្អដូចឪពុក និងកូន

សារ៉ាយ សក្កណា និង យ៉ែម សំអូន មានទំនាក់ទំនងល្អដូចឪពុក និងកូន

សារ៉ាយ សក្កណា និង យ៉ែម សំអូន មានទំនាក់ទំនង ល្អដូចឪពុក និងកូន

Source www.khmerload.com

via Kingmind យ៉ែម សំអូន បើកកកាយ ទំនាក់ទំនងខ្លួនជាមួយ សារ៉ាយ សក្ខណា ស្ដាប់ឡើងព្រឺសម្បុរ!

0 notes