#LLDPEmarket

Explore tagged Tumblr posts

Text

Diving into Linear Low Density Polyethylene (LLDPE): Understanding Its Properties and Manufacturing (2023-2034)

In the world of plastics, LLDPE stands tall for its remarkable toughness, enabling the creation of thinner yet robust films. Not to be confused with its cousin LDPE, or Low Density Polyethylene, LLDPE boasts a unique structure with numerous short branches. This structural advantage allows its chains to glide smoothly during stretching, preventing entanglement—a common issue with LDPE due to its long branching chains. The result? LLDPE offers superior tensile strength, along with heightened impact and puncture resistance compared to LDPE. So, when it comes to durability and performance, LLDPE takes the lead, making it a top choice for various applications where strength and resilience are paramount.

Introduction

LLDPE or Low-Density Polyethylene is a lightweight, flexible plastic. LLDPE stands out among polyethylene variants due to its semi-crystalline nature, featuring linear molecular chains with short branches. Unlike LDPE and HDPE, these linear molecules exhibit slower tangling. LLDPE is synthesized using one of three alpha-olefin co-monomers, namely octene, hexene, or butene, each influencing its properties differently. Octene contributes long branch chains, offering superior performance. Hexene strikes a balance between octene and butene, providing a cost-effective way. Butene, the most commonly utilized co-monomer for commodity plastics due to its affordability, features the shortest branch chains. Moreover, LLDPE properties can be further tailored by blending it with other co-monomers, with combinations of butene and hexene being particularly prevalent in practice.

LLDPE’s properties include:

Puncture-resistant: making it highly resilient against sharp objects or external forces that could cause punctures or tears.

Good flexibility: its ability to adapt to different shapes or movements without losing its structural integrity.

Resistant to oxidation: LLDPE has the capability to withstand oxidation, which is a chemical reaction involving oxygen that can degrade or weaken materials over time. Resistance to oxidation ensures the material's durability and longevity.

Excellent barrier properties: LLDPE has the ability to prevent the passage of gases, liquids, or other substances through it. Materials with excellent barrier properties are effective in containing or isolating substances, protecting them from external factors.

High impact strength: LLDPE can withstand sudden or intense impacts without breaking or shattering, indicating its resilience to mechanical forces or collisions.

Good environmental stress cracking resistance: LLDPE is resistant to cracking or fracturing when subjected to stress from environmental factors such as temperature variations, chemical exposure, or mechanical loading. Low Water Absorption: With its low water absorption rate, LDPE remains unaffected by moisture, making it suitable for applications where exposure to water or humidity is common.

Low Cost: Perhaps one of its most appealing attributes is its affordability. LDPE offers a cost-effective solution without compromising on performance, making it a preferred choice for a wide range of applications across industries.

LLDPE exhibits distinctive melt flow characteristics, making it suitable for processes like blow molding, film extrusion, and injection molding. Film extrusion, particularly, dominates LLDPE processing. It's worth noting that LLDPE's semi-crystalline nature contributes to its high shrinkage rate, whereby the material occupies more volume in its molten state than when solid. Overall, LLDPE's versatile production methods and unique properties make it a go-to material for various applications in industries ranging from packaging to automotive and beyond.

Manufacturing Process

The manufacturing process consists of four primary phases:

(1) Polymerization

(2) Devolatilization

(3) Distillation

(4) Finishing

Polymerization:

Ethylene and 1-octene initially undergo treatment in fixed-bed adsorption systems to remove water, oxygen, and other polar impurities that could potentially hinder the catalyst. After purification, the monomers are mixed with a polymerization solvent comprising a blend of C8-C9 paraffins. This mixture then enters the first of two consecutive continuous stirred tank reactors (CSTR), where polymerization occurs.

The polymerization process happens adiabatically in the liquid phase, with hydrogen acting as a molecular weight regulator. These steps ensure impurity removal and create ideal conditions for controlled and efficient polymer production in the liquid-phase reactors.

Devolatilization & Pelletizing:

The polymer solution exiting the second reactor enters an adiabatic flash vessel, where pressure reduction causes volatile elements, mainly unreacted ethylene, to vaporize. The concentrated polymer solution then undergoes devolatilization to remove residual monomers. The separated volatile components are cooled and sent for distillation, while the polymer proceeds to finishing. The devolatilized polymer is fed into an extruder to incorporate additives and pelletize the polymer, resulting in the final product being transferred to blending and storage.

Raw Materials Recovery:

The volatile effluents from devolatilization, containing unreacted monomers and solvents, undergo purification through distillation columns to recover these components and eliminate impurities, refining the final product.

The manufacturing process of LLDPE (linear low-density polyethylene) by Dow Chemicals involves a combination of polymerization techniques. Here is the brief overview of the LLDPE production process:

Monomer Preparation:

The first step in LLDPE production is getting the building blocks ready, called monomers. Unlike LDPE which uses only ethylene, LLDPE is made by combining ethylene with another molecule called a comonomer. Common comonomers include 1-butene, 1-hexene, or 1-octene. Adding this comonomer creates branches in the LLDPE structure, which give it special properties different from LDPE.

Polymerization:

Dow uses various polymerization techniques to produce LLDPE.

Solution Polymerization

Monomers and a catalyst system dissolved in a solvent, it's all stirred together in a reactor under carefully controlled temperature, pressure, and mixing. This controlled environment triggers a chemical reaction called polymerization, with catalysts, which often are Ziegler-Natta or metallocene catalysts.

Gas-Phase Polymerization

For gas-phase production, the reaction happens in a special reactor with a constantly moving bed of particles. These particles may hold the catalyst system (like a supported catalyst or a metallocene one). The mixture of monomers and catalyst is fed into the reactor, along with precise controls on temperature, pressure, and how long the ingredients stay inside (residence time). The heat from the reaction itself helps keep the process going.

Product Finishing:

After the LLDPE is polymerized completely, it's time to collect it from the reactor. This raw material, called resin, might go through some finishing touches to get the exact properties needed. This involves removing any trapped gas (degassing), shaping it into pellets (pelletization), and additive incorporation.

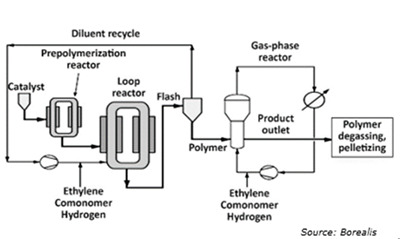

Borstar, a pioneering multi-modal patented technology employed by Borealis for PE and PP production, represents a significant advancement in process technology. Borealis is actively commercializing the latest iteration of Borstar, including Borstar PE 3G, and continues to innovate within the Borstar framework. These advancements enable flexible polymer design, ranging from bi-modal to multi-modal PE/PP resins, and contribute to the development of a diverse range of new plastics.

The Borstar polyethylene (PE) method enables the production of a wide range of bimodal and unimodal LLDPE, MDPE, and HDPE products. This method combines a loop reactor and a gas phase reactor to form Borstar PE. PE with densities ranging from 918 to 970 kg/m3 and melt flows from 0.1 to 100 can be manufactured using this process. While single-site catalysts will be utilized for PE processing in the future, Ziegler-Natta catalysts are currently employed.

A mixture of propane diluent and catalyst is injected into a small pre-polymerization reactor, where pre-polymerization takes place. The resulting slurry is then fed into the loop reactor, operating under supercritical conditions at temperatures of 75–100 °C and pressures of 55–65 bar, to produce higher density and lower molecular weight components of bimodal polymers. Afterward, diluent and unreacted materials are removed from the polymer in a flash tank.

The loop reactor and gas phase reactor operate independently, allowing for easy regulation of reactor conditions and flexibility in processing various products. In the fluidized bed gas phase reactor, polymerization continues, producing a homogeneous polymer on the same catalyst particles. Operating at temperatures between 75 and 100 °C and pressures of 20 bar, this reactor introduces fresh hydrogen, ethylene, and comonomer to form high molecular weight components and broaden the molecular weight distribution (MWD), enhancing the polymer's strength.

The production rate ratio between the reactors can be adjusted to achieve desired product qualities. Finally, hydrocarbon residues are removed, and the polymer powder is extruded to obtain the final product.

NOVA Chemicals use the SCLAIRTECH method on the other hand. The SCLAIRTECH technology method produces a wide spectrum of linear polyethylene (PE) products, including linear low, medium, and high-density grades with narrow to broad molecular weight distribution. The most effective PE swing method enables cost-effective production throughout the whole range of PE grades from a single train.

The process utilizes a reactor fed with a solution containing ethylene and a co-monomer, such as butene-1, octene-1, or even a combination of both. The short residence time (under 2 minutes) allows for a highly flexible system in the solution phase. This translates to quick transitions between producing different grades of the final product, making it adaptable to diverse market needs.

High conversion rates within the reactor maximize output and prevent uncontrolled reactions. A hydrocarbon solvent keeps the reaction mixture in solution while facilitating heat removal. This solvent is then efficiently recycled back into the reactor. Finally, the molten polymer exits the system and is shaped into pellets using a conventional extruder and pelletizer.

The Spherilene method, developed by LyondellBasell, employs a gas-phase reactor in its proprietary technology. The LyondellBasell Spherilene process encompasses a fluidized-bed, gas-phase approach for manufacturing polyethylene (PE) products across all densities, spanning from linear low density (LLDPE) to medium density (MDPE) and high density (HDPE). This technology's versatility, demonstrated by its extensive range of grades, empowers licensees to effectively navigate the continually evolving polyethylene markets well into the future.

The core of the Spherilene technology lies in its simple design with just one reactor and a recirculation system. This setup is surprisingly versatile, capable of producing a wide range of polyethylene (PE) products with melt indices between 0.01 and 100 g/10 min and densities spanning 0.918 to 0.965 g/cm3. This technology, using Avant Z Ziegler and Avant C Chromium catalysts, can create various single-modal (monomodal) products like LLDPE film, HDPE for injection molding, and MDPE for rotomolding and textiles.

Spherilene stands out for its operational stability, leading to high reliability when paired with the consistent performance of Avant catalysts. A unique reactor outlet mechanism efficiently extracts product with minimal gas contamination. Unlike competing technologies, Spherilene allows for start-up with Avant Z catalysts without needing a pre-existing polymer seed bed.

Applications of Linear Low Density Polyethylene (LLDPE)

Packaging

When storing multi-pack beverages for future use, the shrink wraps typically used to encase plastic bottles is often composed of LLDPE. Similarly, the durable plastic can rings utilized to hold together multi-pack canned beverages are also crafted from LLDPE material due to its robustness. It can be used in the form of stretch wraps.

Tubing

Beyond packaging, LLDPE finds use in tubes. LLDPE pipes for safe and reliable delivery of water to livestock.

Consumer Goods

Rigid LLDPE's affordability and ease of shaping make it a go-to material for everyday items like lids, buckets, bottles, and containers.

Market Outlook:

The global Linear Low Density Polyethylene (LLDPE) market stood at roughly 38 million tonnes in 2023 and is likely to grow at a CAGR of 4.80% by the year 2034. The rising need for low-density polyethylene (LLDPE) in packaging, fueled by its exceptional toughness and diverse applications in film production, especially in both food and non-food packaging sectors, is a significant factor driving market growth. The shift from rigid containers to flexible packaging further boosts this growth trend. Moreover, the growing demand for high-performance linear low-density polyethylene (LLDPE) with remarkable attributes such as superior strength and resistance to organic solvents significantly contributes to various applications. Importantly, the increasing utilization of LLDPE in injection molding, a crucial aspect of manufacturing technology, presents promising opportunities for market expansion.

Linear Low Density Polyethylene (LLDPE) Major Manufacturers

Significant companies in the Global Linear Low Density Polyethylene (LLDPE) market are ExxonMobil, ExxonMobil and SABIC JV, Nova Chemicals, Shell, DowDuPont, Chevron Phillips Chemical, Formosa Plastics, Lyondell Basell (Louisiana Integrated Polyethylene JV LLC), Sasol, Borealis GmbH, and Others.

Linear Low Density Polyethylene (LLDPE) Market Challenges

Linear Low Density Polyethylene (LLDPE) market has a few restraints as well that hinder its market growth trajectory. The emergence of cost-effective alternatives like linear low-density polyethylene (LLDPE), polyethylene terephthalate (PET), acrylonitrile butadiene styrene (ABS), and high-density polyethylene (HDPE) is hindering market growth. Additionally, the environmental impact of waste plastic bags, which pollute land and water, poses a significant threat to wildlife. As a result, many countries have implemented plastic bans, prohibiting the use of single-use plastic in various sectors, which could potentially impact the growth of the Low-Density Polyethylene Market.

Conclusion:

The rising need for Linear Low Density Polyethylene (LLDPE) to produce thin films for flexible packaging across diverse industries is projected to fuel the growth of the global LLDPE market. The unique properties of LLDPE like puncture resistance, resistance to corrosion, low water absorption, and tough nature makes it useful for packaging applications. Rising technological developments and product development is likely to aid the LLDPE market expansion. With increasing emphasis on cleanliness and long-lasting products, LLDPE is poised to become even more popular. Its reliability makes it a go-to material for a wide range of consumer products like buckets and bottles.

1 note

·

View note

Text

Linear Guideway Middle East and Africa Market Research Report 2021-2028.

At the beginning of 2021, COVID-19 disease began to spread around the world, millions of people worldwide were infected with COVID-19 disease, and major countries around the world have implemented foot prohibitions and work stoppage orders. Except for the medical supplies and life support products industries, most industries have been greatly impacted, and Linear Guideway industries have also been greatly affected. This Report covers the manufacturers’ data, including: shipment, price, revenue, gross profit, interview record, business distribution etc., these data help the consumer know about the competitors better. This report also covers all the regions and countries of the world, which shows a regional development status, including market size, volume and value, as well as price data. Also read :http://www.marketwatch.com/story/linear-guideway-linear-low-density-polyethylene-lldpemarket-research-report-with-size-share-value-cagr-outlook-analysis-latest-updates-data-and-2021-2021-07-12 Besides, the report also covers segment data, including: type segment, industry segment, channel segment etc. cover different segment market size, both volume and value. Also cover different industries clients information, which is very important for the manufacturers. If you need more information, please contact BisReport Section 1: Free——Definition Section (2 3): 1200 USD——Manufacturer Detail THK (JP) HIWIN (TW) NSK (JP) Bosch Rexroth (DE) IKO (JP) Schaeffler (DE) PMI (TW) PBC Linear (US) Schneeberger (CH) SBC (KR) TBI MOTION (TW) Also read :http://www.marketwatch.com/story/antiemetics-market-research-report-with-size-share-value-cagr-outlook-analysis-latest-updates-data-and-news-2020-2027-2021-07-17 Rollon (IT) CPC (TW) Thomson (US) HTPM (CN) Best Precision (CN) Yigong China (CN) HJMT (CN) Golden CNC Group (CN) Shandong Sair (CN) Right Machinery (CN) ZNT (CN) Section 4: 900 USD——Region Segmentation North America Country (United States, Canada) South America Asia Country (China, Japan, India, Korea) Europe Country (Germany, UK, France, Italy) Other Country (Middle East, Africa, GCC) Section (5 6 7): 500 USD—— Product Type Segmentation Ball Guide Roller Guide Needle Guide Industry Segmentation Satellite and Other Equipments Auto Parts Production Line CNC Machine Railway Traffic Equipments Industrial Robots Channel (Direct Sales, Distributor) Segmentation Section 8: 400 USD——Trend (2020-2025) Section 9: 300 USD——Product Type Detail Section 10: 700 USD——Downstream Consumer Section 11: 200 USD——Cost Structure Section 12: 500 USD——Conclusion Also read :http://www.marketwatch.com/story/sic-anode-material-market-research-report-with-size-share-value-cagr-outlook-analysis-latest-updates-data-and-news-2020-2026-2021-07-16 TABLE OF CONTENTS: Section 1 Linear Guideway Product Definition Section 2 Global Linear Guideway Market Manufacturer Share and Market Overview 2.1 Global Manufacturer Linear Guideway Shipments 2.2 Global Manufacturer Linear Guideway Business Revenue 2.3 Global Linear Guideway Market Overview 2.4 COVID-19 Impact on Linear Guideway Industry Section 3 Manufacturer Linear Guideway Business Introduction 3.1 THK (JP) Linear Guideway Business Introduction 3.1.1 THK (JP) Linear Guideway Shipments, Price, Revenue and Gross profit 2015-2020 3.1.2 THK (JP) Linear Guideway Business Distribution by Region 3.1.3 THK (JP) Interview Record 3.1.4 THK (JP) Linear Guideway Business Profile 3.1.5 THK (JP) Linear Guideway Product Specification 3.2 HIWIN (TW) Linear Guideway Business Introduction 3.2.1 HIWIN (TW) Linear Guideway Shipments, Price, Revenue and Gross profit 2015-2020 3.2.2 HIWIN (TW) Linear Guideway Business Distribution by Region 3.2.3 Interview Record 3.2.4 HIWIN (TW) Linear Guideway Business Overview 3.2.5 HIWIN (TW) Linear Guideway Product Specification 3.3 NSK (JP) Linear Guideway Business Introduction 3.3.1 NSK (JP) Linear Guideway Shipments, Price, Revenue and Gross profit 2015-2020 3.3.2 NSK (JP) Linear Guideway Business Distribution by Region 3.3.3 Interview Record 3.3.4 NSK (JP) Linear Guideway Business Overview 3.3.5 NSK (JP) Linear Guideway Product Specification 3.4 Bosch Rexroth (DE) Linear Guideway Business Introduction 3.5 IKO (JP) Linear Guideway Business Introduction 3.6 Schaeffler (DE) Linear Guideway Business Introduction … Section 4 Global Linear Guideway Market Segmentation (Region Level) 4.1 North America Country 4.1.1 United States Linear Guideway Market Size and Price Analysis 2015-2020 4.1.2 Canada Linear Guideway Market Size and Price Analysis 2015-2020 4.2 South America Country 4.2.1 South America Linear Guideway Market Size and Price Analysis 2015-2020 4.3 Asia Country 4.3.1 China Linear Guideway Market Size and Price Analysis 2015-2020 4.3.2 Japan Linear Guideway Market Size and Price Analysis 2015-2020 4.3.3 India Linear Guideway Market Size and Price Analysis 2015-2020 4.3.4 Korea Linear Guideway Market Size and Price Analysis 2015-2020 4.4 Europe Country 4.4.1 Germany Linear Guideway Market Size and Price Analysis 2015-2020 4.4.2 UK Linear Guideway Market Size and Price Analysis 2015-2020 4.4.3 France Linear Guideway Market Size and Price Analysis 2015-2020 4.4.4 Italy Linear Guideway Market Size and Price Analysis 2015-2020 4.4.5 Europe Linear Guideway Market Size and Price Analysis 2015-2020 4.5 Other Country and Region 4.5.1 Middle East Linear Guideway Market Size and Price Analysis 2015-2020 4.5.2 Africa Linear Guideway Market Size and Price Analysis 2015-2020 4.5.3 GCC Linear Guideway Market Size and Price Analysis 2015-2020 4.6 Global Linear Guideway Market Segmentation (Region Level) Analysis 2015-2020 4.7 Global Linear Guideway Market Segmentation (Region Level) Analysis Section 5 Global Linear Guideway Market Segmentation (Product Type Level) 5.1 Global Linear Guideway Market Segmentation (Product Type Level) Market Size 2015-2020 5.2 Different Linear Guideway Product Type Price 2015-2020 5.3 Global Linear Guideway Market Segmentation (Product Type Level) Analysis Section 6 Global Linear Guideway Market Segmentation (Industry Level) 6.1 Global Linear Guideway Market Segmentation (Industry Level) Market Size 2015-2020 6.2 Different Industry Price 2015-2020 6.3 Global Linear Guideway Market Segmentation (Industry Level) Analysis Section 7 Global Linear Guideway Market Segmentation (Channel Level) 7.1 Global Linear Guideway Market Segmentation (Channel Level) Sales Volume and Share 2015-2020 7.2 Global Linear Guideway Market Segmentation (Channel Level) Analysis Section 8 Linear Guideway Market Forecast 2020-2025 8.1 Linear Guideway Segmentation Market Forecast (Region Level) 8.2 Linear Guideway Segmentation Market Forecast (Product Type Level) 8.3 Linear Guideway Segmentation Market Forecast (Industry Level) 8.4 Linear Guideway Segmentation Market Forecast (Channel Level) Section 9 Linear Guideway Segmentation Product Type 9.1 Ball Guide Product Introduction 9.2 Roller Guide Product Introduction 9.3 Needle Guide Product Introduction Section 10 Linear Guideway Segmentation Industry 10.1 Satellite and Other Equipments Clients 10.2 Auto Parts Production Line Clients 10.3 CNC Machine Clients 10.4 Railway Traffic Equipments Clients 10.5 Industrial Robots Clients Section 11 Linear Guideway Cost of Production Analysis ….continued Contact Details: NORAH TRENT [email protected] Ph: +162-825-80070 (US) Ph: +44 2035002763 (UK) 971 0503084105

0 notes

Text

LLDPE Market is Expected to Grow at CAGR of 4.79% during the forecast period until 2032

The Linear Low-Density Polyethylene (LLDPE) market has experienced substantial growth and transformation in recent years, propelled by a multitude of factors shaping the global landscape. LLDPE, a type of polyethylene characterized by its linear molecular structure and low density, finds extensive applications across various industries, including packaging, agriculture, construction, automotive, and healthcare. Its unique combination of properties, such as high tensile strength, flexibility, toughness, chemical resistance, and puncture resistance, has made LLDPE a preferred choice for a wide range of applications.

One of the primary drivers of the LLDPE market is the increasing demand for flexible packaging solutions. LLDPE films, sheets, and bags are widely used in the packaging industry for applications such as food packaging, industrial packaging, consumer goods packaging, and agricultural packaging. With the rapid expansion of the retail sector, e-commerce platforms, and convenience stores, the demand for lightweight, durable, and cost-effective packaging materials has surged, thereby driving the growth of the LLDPE market.

Read Full Report: https://www.chemanalyst.com/industry-report/lldpe-market-497

Moreover, the agriculture sector represents another significant market for LLDPE, particularly in the manufacturing of agricultural films, greenhouse films, mulch films, and silage bags. LLDPE films offer excellent properties for crop protection, soil moisture retention, weed suppression, and temperature regulation, thereby enhancing crop yields and agricultural productivity. As farmers increasingly adopt modern farming practices, precision agriculture techniques, and greenhouse cultivation methods, the demand for LLDPE films is expected to grow substantially.

Furthermore, the construction industry presents lucrative opportunities for the LLDPE market, particularly in the manufacturing of geomembranes, waterproofing membranes, construction films, and insulation materials. LLDPE's excellent mechanical properties, durability, and resistance to environmental factors make it an ideal choice for construction applications such as roofing, flooring, insulation, and vapor barriers. With urbanization, infrastructure development, and construction activities on the rise, the demand for LLDPE-based construction materials is projected to increase significantly.

Additionally, the automotive sector represents a growing market for LLDPE, driven by the increasing demand for lightweight, fuel-efficient vehicles and automotive components. LLDPE-based materials are used in automotive applications such as interior trim, door panels, seat covers, dashboard components, and underbody coatings. As automotive manufacturers focus on reducing vehicle weight, improving fuel efficiency, and enhancing passenger safety and comfort, the demand for LLDPE-based automotive materials is expected to rise.

Despite the promising outlook, the LLDPE market faces challenges and constraints, including volatile raw material prices, environmental concerns, and regulatory compliance issues. However, industry stakeholders are actively addressing these challenges through initiatives focused on product innovation, sustainability, and circular economy principles. Moreover, strategic partnerships, mergers, and acquisitions are driving consolidation and market expansion in the LLDPE industry.

In conclusion, the LLDPE market is poised for continued growth and innovation, driven by its versatile applications, inherent properties, and compatibility with evolving market trends. By leveraging its strengths in packaging, agriculture, construction, automotive, and other sectors, the LLDPE market can navigate towards a more sustainable and prosperous future, ensuring its relevance and competitiveness in the global marketplace.

About Us:

ChemAnalyst is an online platform offering a comprehensive range of market analysis and pricing services, as well as up-to-date news and deals from the chemical and petrochemical industry, globally.

Being awarded ‘The Product Innovator of the Year, 2023’, ChemAnalyst is an indispensable tool for navigating the risks of today's ever-changing chemicals market.

The platform helps companies strategize and formulate their chemical procurement by tracking real time prices of more than 400 chemicals in more than 25 countries.

ChemAnalyst also provides market analysis for more than 1000 chemical commodities covering multifaceted parameters including Production, Demand, Supply, Plant Operating Rate, Imports, Exports, and much more. The users will not only be able to analyse historical data but will also get to inspect detailed forecasts for upto 10 years. With access to local field teams, the company provides high-quality, reliable market analysis data for more than 40 countries.

Contact US:

420 Lexington Avenue, Suite 300

New York, NY

United States, 10170

Emai-id: [email protected]

Mobile no: +1- 3322586602

#LLDPE#LLDPEmarket#LLDPEnews#LLDPEdemand#LLDPEmarketsize#LLDPEmarketshare#LLDPEmarketforecast#LLDPEmarketanalysis

1 note

·

View note