#LoanAmount

Text

Maximizing Your Financial Options: Decoding the Amount Loan for Your Borrowing Needs

I. Introduction

Welcome to this article on maximizing your financial options and decoding the concept of the "amount loan" for your borrowing needs. Whether you're looking to finance a new car, pay for education expenses, or cover unexpected medical bills, understanding how much you can borrow is crucial. In this article, we will explore the basics of borrowing money, and factors that influence loan amounts, provide a real-life example, and answer frequently asked questions to help you make informed decisions about your borrowing options.

II. What is an Amount Loan?

A. Understanding the Basics of Borrowing Money

When you need to borrow money from a financial institution like a bank or a credit union, you will often be applying for a loan. An amount loan simply refers to the specific sum of money you borrow from the lender. This amount can vary depending on several factors, which we will discuss in the following sections. It's important to note that when you borrow money, you are required to repay it over time, typically with interest, which is an additional cost for the privilege of borrowing the funds.

III. Factors Influencing Loan Amounts

A. Key Considerations for Determining Your Loan Amount

Creditworthiness: Your creditworthiness is a significant factor that lenders consider when determining the loan amount you can borrow. It refers to how reliable you are as a borrower based on your credit history, including your payment behavior and any outstanding debts. Lenders often assess your creditworthiness by looking at your credit score. A higher credit score indicates a better credit history and may increase your chances of obtaining a larger loan amount.

Income and Employment Stability: Lenders also evaluate your income and employment stability to assess your ability to repay the loan. They want to ensure that you have a steady source of income that can cover the loan payments. If you have a stable job and a regular income, it can positively impact the loan amount you can borrow.

Debt-to-Income Ratio: Another critical consideration is your debt-to-income ratio. This ratio compares your monthly debt payments to your monthly income. Lenders prefer borrowers with a lower debt-to-income ratio, as it indicates a better ability to manage additional loan payments. By keeping your debts low relative to your income, you can increase your chances of being approved for a larger loan amount.

IV. Real-Life Example

A. John's Loan Journey: A Practical Example

To help illustrate how the loan amount works in a real-life scenario, let's consider John's situation. John wants to purchase a car worth $20,000 and needs to secure an amount loan to finance it. Here's how the factors we discussed earlier come into play for John:

Creditworthiness: John has maintained a good credit history, always paying his bills on time and managing his debts responsibly. This has resulted in a high credit score, making him more attractive to lenders.

Income and Employment Stability: John has a stable job with a consistent monthly income of $4,000. He has been with the same company for several years, which demonstrates employment stability and assures lenders that he can repay the loan.

Debt-to-Income Ratio: John has minimal outstanding debts. His monthly debt payments, including credit card bills and student loans, amount to $500. With his monthly income of $4,000, his debt-to-income ratio is only 12.5%, which is considered low.

Based on these factors, John approaches a bank to apply for a car loan. Considering John's creditworthiness, income, and low debt-to-income ratio, the bank approves his loan application. They offer him an amount loan of $18,000, which covers most of the car's cost. John agrees to the loan terms and purchases the car.

V. Frequently Asked Questions

Clarifying Common Queries About Loan Amounts

Can I negotiate the loan amount with the lender?

Negotiating the loan amount with the lender is possible to some extent. However, it depends on various factors such as your creditworthiness, income, and the lender's policies. While you may not be able to negotiate the loan amount itself, you can focus on improving your creditworthiness and demonstrating your ability to repay the loan. This can potentially lead to a higher loan offer from the lender.

How can I increase my chances of obtaining a higher loan amount?

To increase your chances of obtaining a higher loan amount, you can take the following steps:

a. Improve your credit score: Pay your bills on time, reduce outstanding debts, and manage your credit responsibly. This can help raise your credit score and make you more attractive to lenders.

b. Increase your income: If possible, try to increase your income by taking on additional work or seeking a higher-paying job. A higher income can demonstrate your ability to handle larger loan payments.

c. Lower your debt-to-income ratio: Pay off existing debts or minimize your monthly debt payments. This will improve your debt-to-income ratio and show lenders that you can manage additional loan obligations.

Are there any limits to the loan amount I can borrow?

Yes, there are usually limits to the loan amount you can borrow. Lenders have their own policies and guidelines that dictate the maximum loan amounts they are willing to offer. These limits can vary based on factors such as the type of loan, your creditworthiness, and the purpose of the loan. It's important to discuss your borrowing needs with the lender to understand the specific limits that apply to your situation.

Are you interested learning?

- Forex

- Forex Bonus Offers

- Forex Trading Courses & Lessons

- Forex Video Tutorials

VI. Conclusion

In conclusion, understanding the concept of an amount loan and the factors that influence it is crucial for making informed borrowing decisions. Your creditworthiness, income, and employment stability, and debt-to-income ratio all play a significant role in determining the loan amount you can borrow. By responsibly managing your finances, improving your creditworthiness, and considering the lender's policies, you can maximize your chances of obtaining a higher loan amount. Remember to borrow responsibly and make timely repayments to maintain a healthy financial situation.

Read the full article

#borrowingmoney#creditworthiness#debt-to-incomeratio#financialoptions#incomestability#Loan#loanamount#loanlimits#loannegotiation#responsibleborrowing

0 notes

Text

Revolving Business Lines of Credit: Conquer Cash Flow Challenges

A revolving business line of credit can be a valuable tool for businesses seeking to improve cash flow management. Unlike a fixed-term loan, a revolving line of credit provides access to a pool of funds that can be drawn upon and repaid over time, offering greater control over your business finances.

Feeling overwhelmed by the complexities of business loans? We explain how revolving lines of credit offer a simpler and potentially faster application process compared to traditional options.

The Revolving Business Line of Credit Explained

Refinance

Definition and Key Characteristics

A revolving business line of credit is a type of financing that works similarly to a credit card.

You're approved for a maximum credit limit, which you can borrow from as needed.

Once you've repaid a portion of the borrowed amount, that credit becomes available for you to use again – hence the term "revolving."

Key characteristics of a revolving line of credit include:

- Flexible access to funds: Draw only what you need, when you need it.

- Repayment flexibility: Make payments on your own schedule, as long as you meet the minimum requirements.

- Interest charges: You'll pay interest only on the outstanding balance, not the entire credit limit.

- Renewable credit: As you repay the borrowed amount, that credit becomes available for you to use again.

Advantages Over Traditional Business Loans

While traditional term loans can provide a lump sum of capital, they often come with rigid repayment schedules and stricter qualification criteria.

Revolving lines of credit, on the other hand, offer several advantages:

- Increased financial agility: Access funds quickly to seize opportunities or address unexpected expenses.

- Customizable borrowing: Borrow only what you need, when you need it, reducing the overall interest paid.

- Streamlined approval process: Many lenders have a more straightforward application process for lines of credit compared to term loans.

Of course, like any financing option, revolving lines of credit may come with higher interest rates than some traditional loans.

For businesses that value flexibility and quick access to working capital, the benefits can outweigh the potential drawbacks.

Eligibility and Application Process

Loan Amounts

Creditworthiness and FICO Requirements

Lenders will evaluate your creditworthiness and FICO score to determine your eligibility for a revolving line of credit.

A strong credit history and a high FICO score (typically 680 or above) can increase your chances of approval and secure better terms.

According to FICO, factors that affect your business credit score include:

- Payment history: Your track record of making timely payments on existing debts.

- Credit utilization: The amount of credit you're using compared to your overall credit limits.

- Credit age: The length of your credit history and the age of your oldest account.

- Credit mix: The variety of credit types you have, such as loans, credit cards, and lines of credit.

Documents Required for Application

When applying for a revolving line of credit, be prepared to provide the following documentation:

- Business financial statements: Balance sheets, income statements, and cash flow statements for the past two years.

- Tax returns: Personal and business tax returns for the past two years.

- Bank statements: Recent bank statements showing your business's cash flow.

- Legal documents: Articles of incorporation, business licenses, and any relevant contracts or agreements.

Having these documents organized and up-to-date can help streamline the application process and increase your chances of approval.

Using Your Revolving Line of Credit Effectively

Credit Reporting

Common Business Uses (by Industry)

A revolving line of credit can be a versatile tool for businesses across various industries.

Here are some examples of how different sectors can leverage this financing option:

- Retail: Cover inventory costs, manage seasonal fluctuations, or finance marketing campaigns.

- Manufacturing: Purchase raw materials, cover payroll expenses, or invest in new equipment.

- Service-based businesses: Hire additional staff, fund expansion efforts, or cover operating costs during slow periods.

Over 40% of small businesses use lines of credit for working capital needs, making it one of the most popular financing options.

Responsible Borrowing Practices and Tools

While a revolving line of credit offers flexibility, it's crucial to borrow responsibly and avoid overextending your credit.

Here are some best practices and tools to help you manage your line of credit effectively:

- Create a repayment plan: Develop a strategy for repaying the borrowed amount, factoring in your cash flow projections and upcoming expenses.

- Utilize online budgeting tools: Many lenders offer online platforms and mobile apps to help you track your credit utilization, payments, and remaining balance.

- Set up automatic payments: Avoid late fees and potential damage to your credit score by scheduling automatic payments from your business bank account.

- Monitor your credit utilization: Aim to keep your credit utilization below 30% of your total credit limit to maintain a healthy credit score.

By following these practices, you can enjoy the benefits of a revolving line of credit while minimizing the risks associated with over-borrowing.

Comparing Options and Choosing the Right Lender

Cash Back

Key Factors to Consider

With so many lenders offering revolving lines of credit, compare your options carefully. Here are some key factors to consider:

- Interest rates: Evaluate the annual percentage rate (APR) and any additional fees or charges.

- Credit limits: Ensure the credit limit offered aligns with your business's potential funding needs.

- Repayment terms: Understand the minimum payment requirements and any penalties for late or missed payments.

- Online platform functionality: Look for user-friendly online platforms that offer features like account management, bill pay, and credit monitoring.

By researching and comparing different lenders, you can find the revolving line of credit that best fits your business's unique needs and financial situation.

Consulting with Financial Experts

While a revolving line of credit can be a powerful tool, seek guidance from financial experts to ensure you're making an informed decision.

Consider consulting with a financial advisor or loan officer who can:

- Assess your business's financial health: Evaluate your cash flow, existing debts, and credit history to determine the most suitable financing options.

- Provide personalized recommendations: Offer tailored advice on the type of revolving line of credit, credit limit, and lender based on your specific needs and goals.

- Explain the fine print: Help you understand the terms and conditions, interest rates, and potential fees associated with different lenders and credit products.

By partnering with a trusted financial professional, you can navigate the world of business financing with confidence and make decisions that align with your long-term business objectives.

Alternatives to Revolving Business Lines of Credit

Cash Advance

Explore Other Financing Options

While revolving lines of credit offer unique benefits, they may not be the best fit for every business.

Depending on your specific needs and financial situation, you may want to explore alternative financing options, such as:

- Term loans: Traditional business loans that provide a lump sum of capital with fixed repayment schedules.

- Invoice financing: Borrow against outstanding invoices to improve cash flow while waiting for customer payments.

- Equipment financing: Secure funding specifically for purchasing new equipment or machinery.

- Crowdfunding: Raise capital through online platforms by pitching your business idea to a community of potential investors.

Each financing option comes with its own set of advantages and drawbacks, so it's important to carefully evaluate your business's needs and goals before making a decision.

Revolving Line of Credit vs. Personal Line of Credit

Key Differences and Distinctions

While revolving lines of credit can be used for both business and personal purposes, there are some key differences to be aware of:

- Application process: Business lines of credit typically require more extensive documentation and underwriting compared to personal lines of credit.

- Credit limits: Business lines of credit often have higher credit limits to accommodate larger funding needs.

- Purpose: Business lines of credit are intended for business-related expenses, while personal lines of credit are for personal or household expenses.

- Tax implications: Interest paid on a business line of credit may be tax-deductible, while interest on personal lines of credit is typically not.

According to the U.S. Small Business Administration (SBA), it's essential to keep business and personal finances separate to maintain proper accounting and avoid potential legal issues.

Beyond the Basics: Additional Considerations

business growth

Technological Integration

Many lenders have embraced technology to streamline the application and management process for revolving lines of credit.

Online platforms and mobile apps offer features like:

- Seamless application: Submit your application and required documents securely online.

- Account management: Monitor your credit utilization, make payments, and track your remaining balance.

- Security features: Enjoy enhanced security measures like two-factor authentication and fraud monitoring.

It's crucial to prioritize cybersecurity and follow best practices when utilizing online tools to manage your business finances.

Ethical Considerations and Sustainability

Consider the ethical implications and sustainability of your financing choices.

When evaluating lenders for a revolving line of credit, you may want to research:

- Lending practices: Ensure the lender adheres to fair and transparent lending practices, avoiding predatory or discriminatory behavior.

- Environmental impact: Look for lenders that prioritize sustainability and support environmentally responsible businesses.

- Community involvement: Consider lenders with a strong commitment to community development and small business growth.

By aligning your financing decisions with your ethical values and sustainability goals, you can contribute to a more responsible and equitable business landscape.

Future Trends and Emerging Options

Underwriting Criteria

Anticipating the Future of Business Financing

The world of business financing is constantly evolving, so stay informed about emerging trends and innovations. In the coming years, we may see:

- Increased integration of artificial intelligence (AI) and machine learning: Streamlining the application and underwriting processes, enabling faster and more personalized financing solutions.

- Rise of alternative lending platforms: Online platforms leveraging peer-to-peer lending models or crowdfunding to provide access to capital for businesses.

- Blockchain-based financing solutions: Exploring the potential of blockchain technology to facilitate secure, transparent, and decentralized financing options.

By staying ahead of these trends, you can position your business to take advantage of new and innovative financing solutions as they become available.

Exploring Emerging Alternatives

While revolving lines of credit are a well-established financing option, it's always worth exploring emerging alternatives that may better suit your business's needs. Some potential alternatives to keep an eye on include:

- Revenue-based financing: Accessing capital by sharing a percentage of your business's future revenue with investors.

- Online lending platforms: Leveraging technology to connect businesses with a network of lenders, streamlining the application and funding process.

- Crypto-backed loans: Using cryptocurrencies or other digital assets as collateral for securing business loans.

As with any financing option, conduct thorough research, assess the risks and benefits, and seek guidance from financial experts before pursuing these emerging alternatives.

By leveraging the power of a revolving business line of credit and implementing responsible financial practices, you can position your business for success, seize opportunities, and navigate challenges with confidence.

Real-World Example: How a Revolving Line of Credit Saved a Retail Business

Nadine owns a small boutique clothing store in a trendy urban neighborhood.

During the holiday season, her sales typically skyrocket, but she often struggles to keep up with the increased demand for inventory.

In previous years, she had to turn down potential sales due to stock shortages, missing out on valuable revenue.

This year, however, Nadine took a proactive approach and secured a $50,000 revolving line of credit from her local bank.

As the holiday rush began, she was able to tap into her credit line and purchase additional inventory to meet the surge in customer demand.

Thanks to her revolving line of credit, Nadine not only avoided stock-outs but also capitalized on the seasonal sales spike.

By January, she had repaid a significant portion of her borrowed amount and was able to restock her store with new merchandise for the upcoming spring season.

Nadine's experience highlights the power of a revolving line of credit in providing businesses with the financial agility to seize opportunities and navigate periods of high demand or cash flow constraints.

Good, Better, Best: Tailoring Your Revolving Line of Credit Strategy

Restaurant Industry

Good: Securing a Basic Revolving Line of Credit

Even a basic revolving line of credit can provide valuable financial flexibility for your business.

By meeting the minimum creditworthiness requirements and securing a modest credit limit, you'll have access to working capital when needed, allowing you to:

- Cover unexpected expenses or cash flow gaps.

- Take advantage of supplier discounts or bulk purchasing opportunities.

- Smooth out seasonal fluctuations in your business's cash flow.

Better: Optimizing Your Revolving Line of Credit

To unlock the full potential of a revolving line of credit, consider optimizing your strategy by:

- Negotiating better terms: Leverage your strong creditworthiness and financial history to secure lower interest rates and higher credit limits.

- Integrating online tools: Utilize lender-provided online platforms and mobile apps for seamless account management and credit monitoring.

- Developing a comprehensive repayment plan: Create a detailed plan for repaying borrowed funds, factoring in your business's cash flow projections and upcoming expenses.

By optimizing your revolving line of credit, you can enjoy greater financial flexibility while minimizing the associated costs and risks.

Read the full article

#annualpercentagerate#bankloans#BusinessLoan#Cashadvance#cashback#CreditCard#creditreporting#creditworthiness#factoring#fico#ficoscore#interest#InvoiceFinancing#lenders#linesofcredit#loanamounts#monthlypercentagerate#personallinesofcredit#refinance#revolvingbusinesslineofcredit#underwritingcriteria

0 notes

Text

The Mortgage Calculator offered by carlistmalaysia is a user-friendly tool designed to assist potential homeowners in Malaysia in estimating their monthly mortgage payments.

Mortgage Calculator

.calculator

max-width: 500px;

margin: 0 auto;

padding: 20px;

background-color: #E9E9E9;

border-radius: 5px;

input[type="number"]

width: 100%;

padding: 10px;

margin-bottom: 10px;

border: 1px solid #ccc;

border-radius: 5px;

button

width: 100%;

padding: 10px;

background-color: #4caf50;

color: #fff;

border: none;

border-radius: 5px;

cursor: pointer;

#result

font-size: 24px;

font-weight: bold;

text-align: center;

margin-top: 20px;

Mortgage Calculator

Loan Amount (RM):

Interest Rate (%):

Loan Term (years):

Calculate

function calculate()

var loanAmount = document.getElementById("loanAmount").value;

var interestRate = document.getElementById("interestRate").value;

var loanTerm = document.getElementById("loanTerm").value;

var monthlyInterestRate = (interestRate / 100) / 12;

var numberOfPayments = loanTerm * 12;

var monthlyPayment = (loanAmount * monthlyInterestRate) / (1 - Math.pow(1 + monthlyInterestRate, -numberOfPayments));

monthlyPayment = monthlyPayment.toFixed(2);

document.getElementById("result").innerHTML = "Monthly Instalment: RM " + monthlyPayment + "";

Are you considering purchasing a property in Malaysia and navigating the complexities of mortgages? Understanding the financial implications of a home loan is crucial before making any significant decisions. Fortunately, tools like the Mortgage Calculator provided by carlistmalaysia make this process more manageable and transparent. In this guide, we'll delve into the features and benefits of this tool, empowering you to make informed decisions about your home loan.

How To Use Mortgage Calculator?

Begin by inputting your loan amount, interest rate, and loan tenure into the designated fields. If applicable, include any additional expenses such as insurance and taxes to refine your calculation further. Once you've entered all necessary information, click on the calculate button to generate your results. The Mortgage Calculator will provide you with a breakdown of your monthly payment, total interest payable, and the overall cost of your loan. Use this information to assess the affordability and feasibility of your mortgage.

Benefits of Using the Home Loan Calculator?

Gain clarity on your monthly financial commitments, enabling better budgeting and financial planning. Easily compare different loan scenarios by adjusting variables such as loan amount and tenure to find the most suitable option. Understand the true cost of homeownership by viewing comprehensive breakdowns of your mortgage payments and total interest payable. Make informed decisions about your mortgage, armed with accurate insights into your financial obligations. Access the Mortgage Calculator anytime, anywhere, empowering you to explore your home loan options at your convenience.

The Mortgage Calculator provided by carlistmalaysia is a valuable tool for anyone considering purchasing property in Malaysia. By utilizing this tool, you can gain invaluable insights into your mortgage obligations, enabling you to make informed decisions about your financial future.

Your question Home Loan Calculator in Malaysia?

Which question will you have about this Calculator? Let’s justify these. There we are including the major questions and answers about this Calculator. So, let’s start now.

How Accurate are the Calculations Provided by the Mortgage Calculator? The home loan Calculator provided by carlistmalaysia utilizes industry-standard formulas to generate accurate estimations of your monthly mortgage payments. While the results are based on the information provided, they offer a reliable indication of your potential financial commitments. Can I Use the Mortgage Calculator for Different Types of Loans? Yes, the Mortgage Calculator in malaysia is versatile and can be used for various types of loans, including home loans, refinancing, and property investment loans. Simply input the relevant details to obtain tailored insights into your specific loan scenario. Is the Calculator Free to Use? Absolutely, the Calculator is a complimentary tool provided by carlistmalaysia to assist individuals in their financial planning endeavors. There are no hidden fees or charges associated with its usage. How Often Should I Use the Home Loan Calculator In Malaysia? It's advisable to use the Home Loan Calculator whenever you're exploring home loan options or considering significant financial decisions related to property purchase. Regularly reassessing your financial situation ensures that you stay informed and prepared.

0 notes

Text

List Of All Public And Private Sector Banks In India 2022

List Of All Public And Private Sector Banks In India 2022

In India, banks are the most traditional type of financial intermediary. They are crucial in directing family funds toward both structured and unorganized industries. Indian Commercial Banks, Industrial Banks, Exchange Banks, Agricultural Banks, Cooperative Banks, and Indigenous Bankers comprise the Indian Banking System. The Reserve Bank of India serves as the system’s central bank.Types of Banks

Indian banks are categorized into four major types:

Commercial Banks: These are further classified into

Public Sector Banks – The government owns most of the stock. Punjab National Bank, State Bank of India, Central Bank of India, and other institutions are examples of public sector banks.

Private Sector Banks – Private individuals own the majority of the stake. Private banks include institutions like HDFC Bank, ICICI Bank, AXIS Bank, etc.

Regional rural banks,

Foreign banks – Foreign banks are those with their corporate headquarters located outside of India. Standard Chartered, American Express, Citibank, and other institutions are examples of foreign sector banks.

Small Finance Banks

Payments Banks

Cooperative Banks

List of All Public and Private Sector Banks in India 2023

List of Public Sector Banks

- Bank Name-Establishment-Headquarter

- Bank of Baroda-1908-Vadodara, Gujrat

- Bank of India-1906-Mumbai, Maharashtra

- Bank of Maharashtra-1935-Pune, Maharashtra

- Canara Bank-1906-Bengaluru, Karnataka

- Central Bank of India-1911-Mumbai, Maharashtra

- Indian Overseas Bank-1937-Chennai, Tamil Nadu

- Punjab and Sind Bank-1908-New Delhi, Delhi

- State Bank of India-1955-Mumbai, Maharashtra

- UCO Bank-1943-Kolkata, West Bengal

- Union Bank of India-1919-Mumbai, Maharashtra

- Punjab National Bank-1894-New Delhi, Delhi

- Indian Bank-1907-Chennai, Tamil Nadu

- List of Private Sector Banks

- Bank Name-Establishment-Headquarter

- Axis Bank-1993-Mumbai, Maharashtra

- Bandhan Bank0-2015-Kolkata, West Bengal

- CSB Bank-1920-Thrissur, Kerala

- City Union Bank-1904-Thanjavur, Tamil Nadu

- DCB Bank-1930-Mumbai, Maharashtra

- Dhanlaxmi Bank-1927-Thrissur, Kerala

- Federal Bank-1931-Aluva, Kerala

- HDFC Bank-1994-Mumbai, Maharashtra

- ICICI Bank-1994-Mumbai, Maharashtra

- Induslnd Bank-1964-Mumbai, Maharashtra

- IDFC First Bank-2015-Mumbai, Maharashtra

- Jammu and Kashmir Bank-1938-Srinagar, Jammu and Kashmir

- Karnataka Bank-1924-Mangaluru, Karnatka

- Karur Vysya Bank-1916-Karur, Tamil Nadu

- Kotak Mahindra Bank-2003-Mumbai, Maharashtra

- IDBI Bank-1964-Mumbai, Maharashtra

- Nainital Bank-1922-Nainital, Uttrakhand

- RBL Bank-1943-Mumbai, Maharashtra

- South Indian Bank-1929-Thrissur, Kerala

- Tamilnad Mercantile Bank-1921-Toothukudi, Tamil Nadu

- YES Bank-2004-Mumbai, Maharashtra

Apply for LoanHow Can We Help YouApply for Loan

cibil issue

Want to discuss

want to know ROI

Personal Loan

Business Loan

Loan against property

Home Loan

education loan

auto loanAmount Looking in Lac

Selected Value: 10

Comment or Message

Submit

Read the full article

1 note

·

View note

Link

0 notes

Photo

Know about 6-Major Factors that Influence your Home Loan's interest rate here

#BankLoan#Bank#HousingLoan#HomeLoan#Loan#Interest#LoanInterest#CreditScore.#LoanAmount#EMI#JobProfile#LTVRatio#InterestRate#Employee#TownandCityDevelopers#KGGroup#FlatSaleCoimbatore#ApartmentSaleCoimbatore#AffordableFlats#Township#Construction

0 notes

Link

0 notes

Photo

Check whether you can Afford a Home Right Now with our EMI Calculator.

Check your eligibility now: https://www.shraddaassociates.com/loan-calculator

0 notes

Text

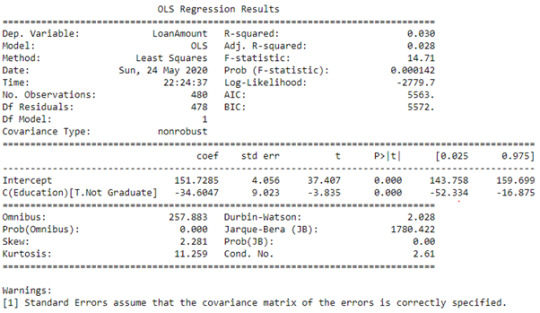

ANOVA Test in Python

Importing required libraries

import os as os

import pandas as pd

import numpy as np

import statsmodels.formula.api as smf

import statsmodels.stats.multicomp as multi

Importing Data

df = pd.read_csv('Housing_Data.csv')

The dataset is on loan prediction having customer attributes and the loan outcome

ANOVA problem statement - Checking if Loan Amount is related to Education Qualification

So here Loan Amount is the continuous variable and Education Qualification is Categorical Variable. Education Qualification has only two levels

df_anova_test = df_anova[['Education', 'LoanAmount']]

using ols function for calculating the F-statistic and associated p value

model1 = smf.ols(formula='LoanAmount ~ C(Education)', data=df_anova_test)

results1 = model1.fit()

print (results1.summary())

So here the p value is 0.000142 and it is < 0.05 (Significance Level). So we can say that Loan Amount does vary with Education Qualification and there is some association between Education Qualification and Loan Amount. So we reject Null Hypothesis

Comparing Means

df_anova_test.groupby('Education').mean()

So we can the difference of 34 in the means of the two Education levels

ANOVA POST Hoc Testing

Here we will consider categorical variable that has more than two levels. So here the categorical variable would be Property_Area which has three levels and Loan Amount would be the continuous variable

Let us run the ANOVA test first

df_anova_test1 = df_anova[['Property_Area', 'LoanAmount']]

Using ols function for calculating the F-statistic and associated p value

model1 = smf.ols(formula='LoanAmount ~ C(Property_Area)', data=df_anova_test1)

results1 = model1.fit()

print (results1.summary())

So here p-value < 0.05 and we can say that there is some association between Property Area and Loan Amount. So we reject NULL Hypothesis

Let us perform Post Hoc Test and check on Type I error. So let us perform this by using Tukey HSD test

mc1 = multi.MultiComparison(df_anova_test1['LoanAmount'], df_anova_test1['Property_Area'])

res1 = mc1.tukeyhsd()

print(res1.summary())

Here the last column indicates which categories of the variables are significant. So True means we can reject NULL Hypothesis and can say that Loan Amount for Rural is very different from Urban. But there is no association between the Loan Amounts of Rural & Semi Urban and Semiurban & Urban

1 note

·

View note

Text

Write an SQL command, which deletes all information on ended loans, which is to say loans where the total repaid amount equals the lend amount

Write an SQL command, which deletes all information on ended loans, which is to say loans where the total repaid amount equals the lend amount

11 This problem is about writing SQL for the relation Repayment from the above proablem. problement(borrower id, name, address, loanamoun id, name, address, loanamount, requestdatoe, nt, requestdate, repayment date, request amount) a) (4 Rrl points) Write an SQL request that returns all the tuples with information on repayments from the aith id equal to 42, and where the lent amount exceeds 1000…

View On WordPress

0 notes

Photo

Paskola Value Is a Attractive interest rates. Rs 1 crore for debt oriented mutual fund schemes. Pay interest only on the loanamount utilized. Overdraft facility.

0 notes

Link

0 notes

Text

Question SOLVED: "SquareRootTest"

Question SOLVED: “SquareRootTest”

Question SOLVED: “SquareRootTest”

[kkstarratings]

In C# add to code to prior code down below instructions. Read code “SquareRootTest”.

1. class Program

{

public static double loanAmount;

public static double years;

public static double interest;

static void Main(string[] args)

{

…..

//for loanAmount

do {

}while ( continueLoop );

…..

//for years

do {

}while ( continueLoop );

…..

//for interest

do {

View On WordPress

0 notes

Text

Question SOLVED: "SquareRootTest".

Question SOLVED: “SquareRootTest”.

In C# add to code to prior code down below instructions. Read code “SquareRootTest”.

1. class Program

{

public static double loanAmount;

public static double years;

public static double interest;

static void Main(string[] args)

{

…..

//for loanAmount

do {

}while ( continueLoop );

…..

//for years

do {

}while ( continueLoop );

…..

//for interest

do {

}while ( continueLoop );

}

…..

}

2. Create a…

View On WordPress

0 notes

Link

0 notes