#M2M Communication Market

Link

#market research future#m2m market#machine-to-machine connections#machine communication (m2m)#machine-to-machine (m2m)

0 notes

Text

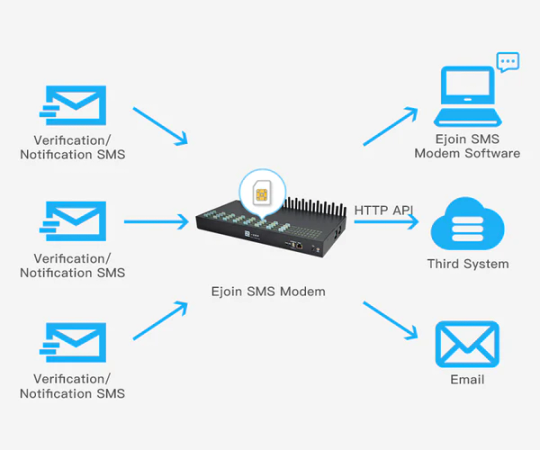

What is the use of SMS modem ?

An SMS modem is a device that enables computers and other electronic devices to send and receive SMS messages over a cellular network. It typically connects to a computer via a USB or serial port and utilizes a SIM card to establish a connection with the cellular network. SMS modems are frequently employed in applications where automated or bulk SMS message transmission and reception are required.

Here are some common applications of SMS modems:

Two-factor authentication: SMS modems can be used to send one-time passwords (OTPs) to users for two-factor authentication. This enhances security by requiring both a password and access to the user's phone for login.

Remote monitoring: SMS modems can transmit alerts and notifications from remote devices, such as sensors or alarms. This facilitates monitoring equipment in remote locations or receiving security breach alerts.

Bulk SMS messaging: SMS modems enable sending bulk SMS messages for marketing or notifications. This efficiently reaches a large audience compared to individual messages.

M2M (Machine-to-Machine) communication: SMS modems facilitate communication between machines, such as vending machines or ATMs. This enables status updates, command reception, or action triggering.

SMS voting and polling: SMS modems can collect votes or poll responses from a large population. This aids surveys, elections, or other feedback gathering methods.

SMS modems are versatile tools for SMS communication, with diverse applications in telecommunications, security, marketing, and automation.

2 notes

·

View notes

Text

5G Systems Integration Market Driven By Increase Investments In U.S., China, And Japan

The global 5G systems integration market size is estimated to reach USD 62.69 billion by 2030, registering a CAGR of 27.3% from 2022 to 2030, according to a new study by Grand View Research, Inc. Robust increase in the investments to deploy 5G network infrastructures across key countries, such as U.S., China, and Japan, has created the demand for integrating entire fifth generation infrastructure and applications across enterprises. This process will help enterprises to work as a centralized platform that will assist in reducing overall complexity. Thus, robust investments in building fifth-generation infrastructure, coupled with the growing need to set up a 5G-enabled ecosystem, are estimated to propel market growth.

Rapidly building smart cities have surged the adoption of numerous Internet of Things (IoT) devices across the globe. IoT devices require enhanced bandwidth to function appropriately. Thus, in order to provide high-speed broadband by supporting fifth-generation New Radio (NR), such as sub-6GHz and mmWave frequency bands, the entire infrastructure across these smart cities need to be upgraded in line with supporting fifth-generation radio network. Therefore, it is further estimated to boost the market growth from 2022 to 2030.

Gain deeper insights on the market and receive your free copy with TOC now @: 5G Systems Integration Market Report

Moreover, with the evolution of industry 4.0, the adoption of industrial sensors and collaborative robots is gaining popularity in the manufacturing sector across the globe. Therefore, to deliver seamless network connectivity to these above-mentioned devices, it is anticipated to raise the demand for 5G system integration services to make entire manufacturing facilities compatible with supporting next-generation 5G NR.

Rapidly rising digital transformation has disrupted the entire operation of the manufacturing industry. This has increased the trend of the machine-to-machine (M2M) communications to increase overall productivity as well as streamline the whole process. As a result, this has further expanded the need for high broadband to deliver uninterrupted connectivity to industrial sensors and robots. Therefore, the growing need for high broadband connectivity to establish seamless communication between machines is expected to elevate the demand for 5G system integration services in the next few years.

Furthermore, with the emergence of new technologies, such as network slicing and software-defined networking (SDN), the adoption of 5G system integration will witness a rapid surge to reduce overall enterprise infrastructure costs. Moreover, highly trained professionals must implement and manage the fifth-generation system integration services. This is anticipated to hinder market growth over the forecast period.

#5G System Integration Market Size & Share#Global 5G System Integration Market#5G System Integration Market Latest Trends#5G System Integration Market Growth Forecast#COVID-19 Impacts On 5G System Integration Market#5G System Integration Market Revenue Value

2 notes

·

View notes

Text

Small Satellite Market - Forecast (2022 - 2027)

The Small Satellite Market size is analyzed to grow at a CAGR of 18.2% during the forecast 2021-2026 to reach $8.2 billion. Small satellites, also termed as Smallsats are a class of flight-proven spacecraft, designed to meet high reliability mission requirements. The increasing popularity of these mini-satellites and nano-satellites is mostly due to their lightweight, versatile and inexpensive designs, integrated with the latest software and hardware improvements, which fuel the growth of the Small Satellite Industry. Hence, the affordable solution has broadened the diverse mission-specific standards across various industry verticals, including, asset tracking, security & defense, IoT, and other space programs. Furthermore, the rise in demands for satellite imagery, low-cost high-speed broadband, along with the investments in fundamental research in CubeSats are some of the factors that drive the growth of the Small Satellite Market.

Small Satellite Market Report Coverage

The report: “Small Satellite Industry Outlook – Forecast (2021-2026)”, by IndustryARC covers an in-depth analysis of the following segments of the Small Satellite Industry.

By Offering: Hardware (Satellite Antennas, Solar Panels, Terminals, Support Equipment and Others), Software and Service.

By Type: Mini-Satellite, Micro-Satellite, Nano-Satellite, Pico-Satellite, Femto-Satellite and Other.

By Industry: Satellite Services, Satellite Manufacturing, Launch Vehicles and Ground Equipment.

By Mission: Constellation Missions, Installation Missions and Replacement Missions.

By Application: IoT/M2M, Communication, Earth Observation & Meteorology, Military & Intelligence, Scientific Research & Exploration, Weather and Other

By Geography: North America (U.S, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Russia and Others), APAC(China, Japan India, South Korea, Australia and Others), South America(Brazil, Argentina and others)and RoW (Middle east and Africa).

Key Takeaways

North America is estimated to hold the largest market share of 45.7% in 2020, owing to the eminent requirement for responsive defense forces, massive investments for breakthrough custom-designed satellites, along with rigorous commercial services demand for satellite bandwidth and network solution.

The M2M Satellite Communication technologies are majorly driven by the potential launches of cloud-based solutions is estimated to drive the market.

The promising requirements to seek reliable connectivity between the land and sea operations, along with VSAT connectivity for on-board security, drive the market growth.

Request Sample

Small Satellite Market Segment Analysis – By Type

By Type, the Small Satellite Market is segmented into Mini-Satellite, Micro-Satellite, Nano-Satellite, Pico-Satellite, Femto-Satellite and Other. The Mini-Satellite is estimated to hold the highest share of 33.5% in 2020, owing to the advantageous features, including miniaturized design, travel at high speeds and remote sensing technology. In addition, affordable development solutions of Nano-Satellite technology makes them a suitable option to deliver superior solutions for communications. In February 2021, Fleet Space Technologies, an Australian nanosatellite company is set to launch its fifth nanosatellite, Centauri 3. The Centauri 3 is Fleet Space’s fifth and most advanced Commercial Nanosatellite, designed to power up a global network of connected devices deployed worldwide. Increasingly, these miniaturized spacecraft provide lucrative opportunities to most business enterprises to accelerate the growth of the Small Satellite Market.

Small Satellite Market Segment Analysis – By Application

By Application, Small Satellite Market is segmented into IoT/M2M, Communication, Earth Observation & Meteorology, Military & Intelligence, Scientific Research & Exploration, Weather and other. The communication segment held the major share of 22.2% in 2020 in the Small Satellite Market, due to the successful introduction of game-changing software for the satellite communication industry along with new business opportunities to expand remote location operation and real-time asset monitoring. In March 2020, a leading provider of next generation content connectivity solutions, NOVELSAT announced a comprehensive solution for mission critical satellite communications. The solution by Novelsat is designed to deliver highest levels of transmission security, resilience and robustness, with a comprehensive wide-ranging security suit, including, transmission security (TRANSEC), communication security (COMSEC), low probability of detection (LPD) and low probability of interception (LPI). Therefore, the growing demand for optimum levels of security and protection for business operations and other mission critical communications of across defense, security and government is estimated to drive the Small Satellite Market.

Inquiry Before Buying

Small Satellite Market Segment Analysis – By Geography

North America is estimated to hold the largest market share of 45.7% in 2020, along with Europe, owing to the eminent requirement for responsive defense forces, massive investments for breakthrough custom-designed satellites, along with rigorous commercial services demand for satellite bandwidth and network solution. The industry is poised to continue its rapid growth as SpaceX and others put up constellations of thousands of satellites intended to serve areas without access to broadband. In order to deliver beta testers download speeds, and robust internet coverage from space, worldwide, in May 2019, Elon Musk's SpaceX launched another 60 Starlink internet satellites into Earth’s orbit. The proposal of SpaceX's satellite internet was initiated in 2018, with the successful launch of the two Starlink test craft, known as TinTinA and TinTinB, designed to transfer huge amounts of information rapidly in comparison to fiber-optic cable. Thus, the Small Satellite industry is poised to grow as large scale space organizations are offering “space as a service” to enable business enterprises with accessibility to data, specific to business requirements. Simultaneously, the market of Small Satellite is witnessing potential growth in Asia Pacific region, owing to the digitalization across industries and vast majority of demonstrative space debris clearance service. In March 2021, Astroscale, a Japan-UK based company launched a mission aimed at removal of debris from Earth's orbit. With Elsa-d, a small satellite under the "End-of-Life Services" offerings by Astroscale, the mission was developed for a space debris removal system. Therefore, the significant intended areas to serve by the lower-cost satellite technologies and surging demand for Earth observation satellites in these regions are estimated to drive the Small Satellite Market.

Small Satellite Market Drivers

Popularity of M2M Satellite Communication

The M2M Satellite Communication technologies are majorly driven by the potential launches of cloud-based solutions, and growing demand from various end-users to expand their business reach globally, are estimated to drive the Small Satellite Market. In addition, rugged, superior and cost-effective Satellite Terminals and telematics devices are becoming a part of the present-day comprehensive fleet management solution, which also boost the market growth. In December 2020, the leading GPS Tracking Systems provider, Rewire Security launched GPS & Telematics software for fleets. The latest software by Rewire enables enterprise owners to generate the location of vehicles in real-time, monitor fleet driver behaviour, observe driver route history and other GPS & Telematics software features. Based on the increasing needs of visibility across the transportation sectors, in October 2020, ORBCOMM, a global provider of Internet of Things (IoT) solutions, launched ST 2100, a state-of-the-art satellite communications device that enables solution providers for seamless Satellite connectivity to IOT applications, and also several other targeted verticals, such as fleet management and utility. Thus, the latest versatile Communication device launches and power-efficient platforms, such as Satellite Antenna for maximum reliability and security drive the growth of the Small Satellite Market.

Schedule a Call

Potential demand for Maritime Satellite Communication solution

The promising requirements to seek enhanced and reliable connectivity between the land and sea operations, along with VSAT connectivity for on-board security and surveillance of shipping industry influence the demand of Maritime Satellite Communication platforms, thereby drive the growth of the Small Satellite Market. The technology innovations across maritime sectors are expanding due to the introduction of gyro-stabilized ground terminals, Minisatellite platforms and multi-frequency dish antennas to reduce the time lag during data transfer. In April 2019, a major international provider of telecommunications, enterprise and consumer technology solutions for the Mobile Internet, ZTE, announced the collaboration with Zhejiang Branch of China Mobile to launch “Heweitong”, a marine broadband satellite solution. The Heweitong offers seamless extension of the mobile network to the ocean, and mitigate other issues, such as high cost, poor coverage and slow data rate. Therefore, the growing emergence of new marine communication with ubiquitous connection for exceptional service is estimated to drive the Small Satellite Market.

Small Satellite Market Challenges

Compatible Issue

The Small Satellites are designed to deliver advantageous services and indubitably, there are several successful launches around the globe and other possible space missions that eventually supported the mass production of platforms such as the CubeSat for upgraded communications role. However, small satellites are not compatible with every kind of operation due to being launched in lower orbits and also, tend to have a shorter lifespan. The design lasts for a year as it gets orbital decay due to the other orbital elements in space. Moreover, the available space is very limited, which is a major concern along with other mentioned design flaws, which hinder the growth of the Small Satellite Market.

Buy Now

Small Satellite Market Landscape

Partnerships and acquisitions along with product launches are the key strategies adopted by the players in the Small Satellite Market. The Small Satellite top 10 companies include Airbus SE, BAE Systems plc, Dauria Aerospace, L3Harris Technologies, Inc., Lockheed Martin, Magellan Aerospace, Maxar Technologies Inc., Northrop Grumman, ORBCOMM Inc., Rocket Lab, Park Aerospace Corp., Sierra Nevada Corporation, Aerospace Corporation, Space Flight Laboratory and many more.

Acquisitions/Technology Launches/Partnerships

In April 2021, the Norwegian Space Agency announced the successful launch of the NorSat-3 maritime tracking microsatellite built by Space Flight Laboratory (SFL), a premier microspace organization and provider of low-cost microsatellites and nanosatellites, in Toronto. The NorSat-3 maritime tracking is designed for space-based maritime traffic monitoring.

In April 2020, the Defense Advanced Research Projects Agency, DARPA awarded Lockheed Martin a $5.8 million contract for the Blackjack program, a satellite integration operation. The Blackjack is a project of DARPA to deploy a constellation of 20 satellites in low Earth orbit by the year 2022 to generate global high-speed communications.

In March 2020, Rocket Lab, a private American aerospace manufacturer and small satellite launch service provider signed an agreement to acquire Sinclair Interplanetary, a Toronto-based satellite hardware company. The acquisition is developed to deliver reliable and flexible satellite and launch solutions.

For more Aerospace and Defense Market reports, please click here

#Small Satellite Market price#Small Satellite Market#Micro-Satellite#Small Satellite Market size#Femto-Satellite#Small Satellite industry#Small Satellite Market share#Small Satellite Market report#Small Satellite industry outlook

2 notes

·

View notes

Text

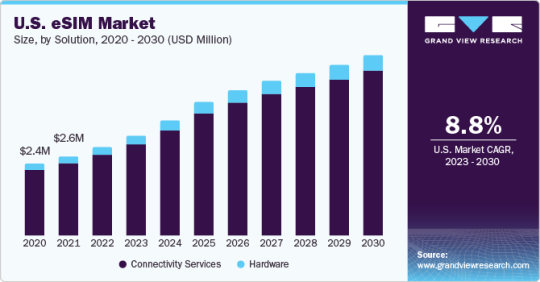

ESIM Imaging Market Size, Status and Forecast 2030

eSIM Industry Overview

The global eSIM market size was valued at USD 8.07 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. The market growth is driven by the rising adoption of IoT-connected devices in M2M applications and consumer electronics. There is an upsurge in the number of times eSIM profiles were downloaded across consumer devices. The eSIM market is propelling due to the rise in the adoption of eSIM-connected devices. According to Mobilise, in 2021, there were 1.2 billion eSIM-enabled devices, with the number expected to climb to 3.4 billion by 2025.

Gather more insights about the market drivers, restrains and growth of the eSIM Market

The introduction of eSIM in the automobile industry has provided tremendous flexibility in providing cellular connectivity to trucks and cars while unlocking new capabilities and features. It is expected that within the next several years, all cars will be cellular enabled, resulting in a better driving experience facilitated by novel linked services. Recently, the automotive industry took a giant step toward enabling the next generation of connected automobiles by implementing the GSMA-embedded SIM specification to strengthen vehicle connectivity. It is intended to improve security for various connected services.

The eSIM-enabled solutions offer automatic interoperability across numerous SIM operators, connection platforms, and remote SIM profile provisioning. With multiple network service providers involved in the operating chain, maintaining the security of these systems has grown complicated. Mobile Network Operators' (MNOs') credentials are collected and kept by the eSIM in the device's inbuilt software, making them vulnerable to security breaches. Furthermore, the operation of eSIM across numerous physical platforms and MNOs exposes it to several virtual environment concerns. As a result, the operational flexibility provided by eSIM may be rendered ineffective if security is breached, impeding market expansion.

Industry 4.0 is a technological breakthrough that has introduced smart machinery with automatic communication and control. Industry 4.0 refers to a networked environment in which actionable data and information are transferred between Machine to Machine (M2M) and Machine to Other (M2O) devices via the Internet of Things (IoT). Wi-Fi, sensors, RFID (radio frequency administrations), and autonomous computing software are all used in M2M systems to analyze data and send it over a network for further processing. M2M systems frequently rely on public and cellular networks for internet access. These factors enabled the integration of electronic manufacturers with eSIM (embedded SIM cards) into M2M systems, thereby contributing to market expansion. By enabling M2M communication, eSIM technology has enabled advancements in the connected ecosystem.

The increasing penetration of smartphones across countries such as China, India, Japan, and the U.S. is further anticipated to fuel market growth. Smartphone manufacturers such as Google, Samsung Electronics Co., Apple, Inc., and Motorola Mobility LLC, Ltd. have started implementing eSIM technology into their smartphones in alliance with several network service providers. For instance, Apple, Inc. has partnered with six service providers, Ubigi, MTX Connect, Soracom Mobile, GigSky, Redtea Mobile, and Truphone, to offer eSIM service. Smartphone and consumer electronics manufacturers' increasing adoption of eSIM to provide an enhanced and secure user experience is expected to bolster market growth.

Browse through Grand View Research's Communication Services Industry Research Reports.

• The global speech analytics market was valued at USD 2.82 billion in 2023 and is projected to grow at a CAGR of 15.7% from 2024 to 2030. Advancements in omnichannel integration capabilities fuel the market's growth.

• The global commerce cloud market size was estimated at USD 17.78 billion in 2023 and is expected to grow at a CAGR of 22.8% from 2024 to 2030. The market is experiencing robust growth driven by several key factors.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030)

• Hardware

• Connectivity services

eSIMc Application Outlook (Revenue in USD Million, 2017 - 2030)

• Consumer Electronics

o Smartphones

o Tablets

o Smartwatches

o Laptop

o Others

• M2M

o Automotive

o Smart Meter

o Logistics

o Others

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030)

• North America

o U.S.

o Canada

• Europe

o UK

o Germany

o France

• Asia Pacific

o China

o Japan

o India

o Australia

o South Korea

• Latin America

o Brazil

o Mexico

• Middle East and Africa

o Saudi Arabia

o South Africa

o UAE

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

Key Companies profiled:

• Arm Limited

• Deutsche Telekom AG

• Giesecke+Devrient GmbH

• Thales

• Infineon Technologies AG

• KORE Wireless

• NXP Semiconductors

• Sierra Wireless

• STMicroelectronics

• Workz

Recent Developments

• In May 2023, Lonestar Cell MTN, a South African conglomerate, introduced eSIM technology in Liberia. This advancement allows subscribers to switch to eSIM-compatible devices without the hassle of removing physical SIM cards. Customers can scan a QR code provided at any Lonestar Cell MTN service center.

• In March 2023, Gcore, a public cloud and content delivery network company, launched its Zero-Trust 5G eSIM Cloud platform. This platform offers organizations across the globe a secure and dependable high-speed networking solution. By utilizing Gcore's software-defined eSIM, companies can establish secure connections to remote devices, corporate resources, or Gcore's cloud platform through regional 5G carriers.

• In February 2023, Amdocs, a software company, collaborated with Drei Austria to introduce a groundbreaking eSIM solution. This collaboration enables Drei Austria's customers to access the advantages of digital eSIM technology through a fully app-based experience. The innovative "up" app offers a seamless and entirely digital SIM journey powered by Amdocs' eSIM technology at Drei Austria.

• In December 2022, Grover, a subscription-based electronics rental platform, joined forces with Gigs, a telecom-as-a-service platform, to introduce Grover Connect, its very own mobile virtual network operator (MVNO), in the U.S. Through Grover Connect, customers in the U.S. can effortlessly activate any eSIM-enabled technology device, eliminating the complexities associated with carrier offers and contracts that may not align with their device rental duration.

• In October 2022, Bharti Airtel, a telecommunications service provider based in India, unveiled its "Always On" IoT connectivity solutions. This offering enables seamless connectivity for IoT devices across multiple Mobile Network Operators (MNOs) through an embedded SIM (eSIM) technology. Particularly beneficial for vehicle tracking providers, auto manufacturers, and scenarios where equipment operates in remote areas, requiring uninterrupted and widespread connectivity.

0 notes

Text

Industrial Internet of Things (IIoT) Market Growth and Business Opportunities in Coming Years | Allied Market Research

Allied Market Research, titled, Global Industrial Internet of Things (IIoT) Market by Component and Application: Opportunity Analysis and Industry Forecast, 2017-2023, the IIoT market size was valued at $115 billion in 2016, and is projected to reach at $197 billion by 2023, growing at a CAGR of 7.5% from 2017 to 2023.

IIoT is a network of multiple devices connected through communications technologies. The sub-systems are able to collect, monitor, analyze, and deliver insights for driving business decisions for the industrial companies. IIoT is an integration of advanced technologies such as Machine-to-Machine (M2M) communication

In 2016, the hardware components dominated the IIoT market in terms of revenue. Further, based on application, the manufacturing application led the market with 35% share in 2016.

Key Findings of the Industrial Internet of Things (IIoT) Market:

Hardware components are projected to continue to maintain their leading position during the forecast period.

Manufacturing application is projected to continue to maintain its leading position till 2023.

Asia-Pacific is expected to exhibit promising growth rate during the forecast period.

IIoT industry participants is anticipated to focus on introducing new products with innovations and partnerships to improve their market share.

The key players profiled in the report include Cisco Systems, Inc., General Electric, Intel Corporation, Rockwell Automation, Inc., ABB, Texas Instruments Inc., Dassault Systmes, Honeywell International Inc., Huawei Technology Co., Ltd., and International Business Machines Corporation (IBM). These market players focus on the development of new technology, launch of novel products with innovative variations, and adoption of partnership and collaboration as key strategies to establish their position in the market.

0 notes

Text

eSIM Market Size To Reach USD 15,464.0 Million By 2030

eSIM Market Growth & Trends

The global eSIM market is expected to reach USD 15,464.0 million by 2030 at a CAGR of 7.9% from 2023 to 2030, according to a study conducted by Grand View Research, Inc. Technological developments in consumer electronic devices such as smartphones, laptops, tablets, wearables fueling the eSIM market growth. Furthermore, due to the small size of the chipset, eSIMs are likely to be widely used in smartphones. For example, in 2018, Apple, Inc. released an iPhone featuring dual SIM capabilities, including a Nano-SIM and an eSIM. Furthermore, Apple, Inc. has included eSIM in their tablet and watch series.

SIM cards with eSIMs are considerably smaller than those with physical SIMs. Chipsets are therefore smaller when integrated into devices. Device manufacturers benefit from eSIM technology since they can save space by eliminating the physical SIM card tray and SIM card slot. Thus, factors such as compact design specification and multiple carrier support of the eSIM are propelling the market growth.

The 5G technology is intended to deliver faster internet speeds and more network capacity. 5G is expected to provide download speeds of 1 gigabit per second while lowering latency to less than a millisecond. This is expected to have a beneficial impact on the eSIM market, expanding its acceptance across a range of cellular-enabled devices. As a result, network service providers and OEMs are overhauling their infrastructure in order to efficiently manage the connectivity and speed provided by 5G. eSIM technology, which can be easily integrated into smaller devices like fitness bands, wearables, and smartwatches, is the future of 5G.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/esim-market

Industry 4.0 is a technological breakthrough that has introduced smart machinery with automatic communication and control. Industry 4.0 refers to a networked environment in which actionable data and information are transferred between Machine to Machine (M2M) and Machine to Other (M2O) devices via the Internet of Things (IoT). Wi-Fi, sensors, RFID (radio frequency administrations), and autonomous computing software are all used in M2M systems to analyze data and send it over a network for further processing. M2M systems frequently rely on public and cellular networks for internet access. These factors enabled the integration of electronic manufacturers with eSIM (embedded SIM cards) into M2M systems, thereby contributing to market expansion. By enabling M2M communication, eSIM technology has enabled advancements in the connected ecosystem.

eSIM Market Report Highlights

Due to connectivity subscriptions from M2M devices, the connectivity services segment held the greatest market share in 2022

The hardware segment is expected to attain a substantial CAGR throughout the forecasted period due to smartphone manufacturers' use of eSIM technology

Due to technological improvements and IoT connectivity among devices, the consumer electronics segment is expected to expand at a considerable CAGR of more than 9.2% throughout the forecast period

Regional Insights

North America dominated the market and accounted for the largest revenue share of 39.1% in 2022. and is expected to grow at the fastest CAGR of 8.7% over the forecast period. The growth is due to the network providers' high presence and the region's fastest technological advancements. The growth is due to the network providers' high presence and the region's fastest technological advancements.

Europe is expected to grow significantly during the forecast period. European companies are the early adopters of the latest technologies. At the same time, the regions are headquarters to several prominent market players, such as Giesecke+Devrient Mobile Security GmbH, NXP Semiconductors N.V., STMicroelectronics, and others. These areas also witness the rising adoption of smart connected devices and cars. Due to all these factors, these two regions are expected to maintain their lead during the forecast period.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030)

Hardware

Connectivity services

eSIMc Application Outlook (Revenue in USD Million, 2017 - 2030)

Consumer Electronics

M2M

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030)

North America

Europe

Asia Pacific

Latin America

Middle East and Africa

List of Key Players in eSIM Market

Arm Limited

Deutsche Telekom AG

Giesecke+Devrient GmbH

Thales

Infineon Technologies AG

KORE Wireless

NXP Semiconductors

Sierra Wireless

STMicroelectronics

Workz

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/esim-market

0 notes

Text

5G Chipsets Market: Trends, Drivers, Challenges & Opportunities

The global 5G chipsets market size is estimated to be USD 36.29 billion in 2023 and is projected to reach USD 81.03 billion by 2028 at a CAGR of 17.4%.

The growing demand for high-speed internet, the need for better network coverage, increased cellular and M2M IoT connections, growing adoption of 5G in automobiles, increase in mobile data traffic, rising demand for high-speed and low-latency 5G infrastructure, and widespread use of chipsets in consumer electronics is driving the market.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=150390562

Market Dynamics:

Driver: High use of M2M communication technology

The speed and reliability of 5G are expected to have a massive impact on machine-to-machine (M2M) and IoT. Key reasons for the increased adoption of new M2M technologies are better connectivity for smooth communication and low power requirements. The existing capacity of mobile networks must handle billions of nodes that are anticipated to ascend in the next couple of years to achieve effective M2M communication. Currently, the network capacity cannot manage M2M and human-based communications and their different communication patterns, such as latency time. For this reason, a next-level cellular network for mobile communication featuring hyper-connectivity and larger bandwidth is required (e.g., a 5G network). M2M communication technology will be widely used in heavy manufacturing and process industries (e.g., food industries) to increase the efficiency of different processes and reduce human interference with machines. M2M communication is thus expected to drive the 5G chipsets market.

Restraints: High cost of 5G chips for mobile devices

The high price of 5G chips contributes to increased initial deployment expenses for manufacturers and mobile device producers. This cost is incurred when integrating 5G capabilities into smartphones, tablets, and other mobile devices. The cost of 5G chipsets is a substantial component of the overall manufacturing cost of 5G-enabled devices. This, in turn, affects the retail price of these devices, potentially limiting their affordability for a significant portion of the consumer market. High chipset costs may restrict research, development, and innovation resources in the 5G chipset market. This can potentially slow down technological advancements, limiting the pace of improvements and optimizations.

Opportunities: The emergence of private 5G networks to address wireless communication requirements in industrial IoT

Private 5G networks offer low-latency communication and high reliability, which are crucial for industrial applications. 5G chipsets play a pivotal role in delivering these capabilities, ensuring that the communication infrastructure meets the stringent requirements of industrial environments. Industrial IoT applications generate large volumes of data that require high bandwidth and capacity for efficient and real-time communication. 5G chipsets enable the transmission of massive amounts of data at faster speeds, facilitating the seamless operation of IloT devices and systems. Private 5G networks cater to industrial use cases, including smart manufacturing, predictive maintenance, remote monitoring, and augmented reality applications. The versatility of 5G chips makes them suitable for addressing the diverse communication requirements of these use cases. As industries worldwide recognize the benefits of private 5G networks for their lloT needs, the demand for 5G chips is expected to grow globally.

Challenges: Design challenges for RF devices operating at higher frequency

5G technology operates at higher frequency bands than previous generations, utilizing millimeter-wave (mmWave) frequencies. The design challenge arises because higher frequencies present unique characteristics and technical obstacles that demand careful consideration in RF device design. Higher frequency signals, such as those in the mmWave spectrum, have shorter wavelengths. This results in challenges related to signal propagation and range. Signals at higher frequencies are more prone to absorption by atmospheric gases and are susceptible to obstacles like buildings and foliage, requiring sophisticated design techniques to overcome these limitations. As the 5G landscape evolves, ensuring standardization and compatibility across different devices and manufacturers becomes crucial. Design challenges include meeting industry standards and ensuring interoperability within the diverse ecosystem of 5G-enabled devices.

0 notes

Text

M2M Satellite Communication Market Recent Development, Size, Share, Top Key Players, Industry Analysis, Advance Technology, Future Development & Forecast – 2028

http://dlvr.it/TBNV4J

0 notes

Text

M2M Satellite Communication Market Recent Development, Size, Share, Top Key Players, Industry Analysis, Advance Technology, Future Development & Forecast – 2028

http://dlvr.it/TBNJhh

0 notes

Text

M2M Satellite Communication Market Recent Development, Size, Share, Top Key Players, Industry Analysis, Advance Technology, Future Development & Forecast – 2028

http://dlvr.it/TBNHhZ

0 notes

Text

Over the last few years, the use of SMS for personal communication has considerably reduced, with most users preferring OTT messaging platforms like WhatsApp and Telegram. In fact, the consumer SMS market is a decelerating market.

But this does not mean SMS is dead. On the contrary, enterprise SMS, or A2P in particular (Application to Person), has a stellar story and will grow almost in double digits in the next few years.

All the notifications you receive, like OTP, bank statements etc., are examples of A2P SMS. This market had a shot in the arm during the pandemic. There was a surge in digital transactions; many government alerts were being sent and other app notifications.

But the key driver for this sector going forward will be IoT. When we speak about IoT, there are various ways devices can communicate. To put things in context, we can consider IoT bifurcated into cellular and non-cellular IoT. For cellular-based IoT, all notifications run through SMS, making it a huge opportunity, considering the M2M SIM market is growing reasonably rapidly (in its mid 20’s).

Emerging verticals such as healthcare would also help propel the growth story of A2P SMS, with automation being the critical business lever.

Also, for a country like ours, where mobile penetration is very high and for a segment which still relies on feature phones, A2P SMS remains one of the most cost-effective and yet secure ways to reach out to a large cross-section which resides not only in urban metros but also in the hinterland. know more....

0 notes

Text

Bluetooth Low Energy Module Market - Forecast(2024 - 2030)

Bluetooth Low Energy Module Market Overview

Bluetooth Low Energy Modules Market is estimated to surpass $6.7 billion by 2026 at a CAGR of 15.2% majorly driven by surge in adoption of Internet of Things (IoT) for interconnecting networks using wireless sensor networks such as machine-to-machine (M2M), people-to-people (P2P) and machine-to-people (M2P). The demand for Bluetooth enable devices owing to rapid industrialization along with high adoption of consumer electronics devices in the developing countries such as China, India, Malaysia and others have driven the growth of the market. Data transfer and exchange of data within a short range is possible due to low power consumption owing to which Bluetooth low energy modules are widely deployed. In the recent years, the development of beacon technology digital marketing, indoor positioning, electronic payment and other such applications are gaining traction. Beacons use proximity technology to detect human presence nearby and trigger preset actions to deliver informational, contextual, and personalized experience and it is a part of IoT.

Bluetooth Low Energy Module Market Report Coverage

The report: “Bluetooth Low Energy Module Market Report– Forecast (2021-2026)”, by IndustryARC covers an in-depth analysis of the following segments of the Bluetooth Low Energy Module market

By Mode: Single Mode, Dual Mode

By Application: Gaming, Wearable Electronics, Industrial and Building Automation, Consumer Electronics, Asset Tracking and Proximity Marketing, Automotive, Telecom, Electronic Devices, Sports and Fitness, Healthcare and Others

By Geography: North America (U.S, Canada, Mexico), Europe(Germany, UK, France, Italy, Spain, Russia and Others), APAC(China, Japan India, SK, Australia and Others), South America(Brazil, Argentina and others), and RoW (Middle East and Africa)

Request Sample

Key Takeaways

Japan is in a strong position in terms of pioneering diabetes care due to the excellent healthcare expertise.

Rapid advancements towards consumer electronic devices such as wireless headsets, audio devices, wireless speakers and many others with smart connectivity are expected to further boost the market demands towards advanced technologies such as Bluetooth low energy modules to meet growing customer demands.

The Korean government along with an automobile manufacturer Hyundai Motor Group had announced of investing about $41 Million won in 2019 to boost the developments towards making the auto industry more competitive by implementing advanced digital navigation technology in autonomous vehicles and connected cars.

Bluetooth Low Energy Module Market Segment Analysis - By Mode

Single-mode gadgets only accept Bluetooth low energy as a mode of communication and is projected to grow at 21.8% CAGR through 2026. These devices cannot connect directly with Bluetooth classic devices, however they are highly designed for Bluetooth low energy and therefore reap the full benefits of this technology. Single mode BLE's existence is so inextricably linked to the phenomenal rise of smartphones, laptops, and mobile computing, it has progressed far more quickly. Single mode BLE's early and successful acceptance by smartphone industry heavyweights like Apple and Samsung paved the way for its widespread adoption. As the smartphone and tablet markets mature and prices and margins shrink, the need for connectivity with the outside world on these platforms continues to increase, providing peripheral vendors with a rare opportunity to deliver creative solutions to issues that people might not even be aware of today. Several advantages have converged around single mode BLE, and the floodgates have opened for tiny, nimble product designers to obtain access to a potentially large market for task-specific, imaginative, and revolutionary products on a comparatively small design budget. Today, users can get all-in-one radio-plus-microcontroller (system-on-chip) systems for just under $2 per chip and in small quantities, which is far less than the total cost of equivalent wireless technologies such as WiFi, GSM, Zigbee, and so on. BLE enables to create feasible devices that can communicate with any new smartphone platform using simple chips, software, and standards.

Inquiry Before Buying

Bluetooth Low Energy Module Market Segment Analysis - By Application

Asset Tracking segment is projected to grow at the fastest rate of 43.2% through 2026. With the use of smartphones the BLE signals are detected. The server checks the data sent by the smartphone providing personalized campaigns such as greeting the customers at entry, notifying special offers, product discounts, or getting feedback. This in turn attracts more and more customers increasing the sales. BLE modules installed on every item enable fast tracking and tracing. In addition, it acts as a digital and IoT infrastructure. The retail vendors are able to establish a whole new level of direct and indirect communication between themselves and the customers and a position-related information can be displayed directly on the shopping cart through the BLE mesh.

Bluetooth Low Energy Module Market Segment Analysis - By Geography

Bluetooth Low Energy Module market in Asia-Pacific region held significant market share of 35.9% in 2020. The Bluetooth Low Energy (BLE) Market is witnessing a significant growth in North America due to upsurge in consumer electronics sector owing to the growth of laptops, tablets and other electronic gadgets largely for business needs, work from home scenario for the COVID-19 pandemic, online classes, gaming sectors along with the adoption of smart technologies in industries such as Automotive and Industrial Automation. According to Intelligence Node, the number of smartphone users in United States crossed 260 million in April 2020, and smartphone shipments reached 161 million units in 2019. This indicates the growth of the market as the BLE modules are deployed in the smartphones interfacing smart devices such as smart watches, smart locks and others and the information is displayed in the smart phone. Increasing penetration of IoT in Canadian markets have surged the adoption of BLE technology for tracking and monitoring of vital assets, which has become much simpler through the use of this technology. Moreover, connected sensors that transmit the location of vehicles are used to track the status of machines and containers fuelling the market growth.

Schedule a Call

Bluetooth Low Energy Module Market Drivers

Increasing Adoption of IoT

The Internet of Things (IoT) refers to a device that operates in the physical world using embedded wireless sensors that can link to the Internet through wired or wireless connections. RFID, NFC, Bluetooth, Bluetooth Low Energy (BLE), and Zigbee are indeed a few of the wireless connectivity solutions available to these sensors. Big Data and the Internet of Things (IoT) are thriving at a rapid pace as a result of technical advances in a diverse array of market verticals. These developments are often included in high-end Bluetooth Low Energy (BLE) modules, which is propelling the demand for Bluetooth Low Energy (BLE) modules forward at a rapid pace. Natural Language Processing (NLP), facial recognition, and Artificial Intelligence are all supported by analytics in Bluetooth Low Energy (BLE) modules. The application platform for Bluetooth Low Energy (BLE) modules are growing, with instances including baby tracking, traffic monitoring, and automated number plate recognition. According to EnOcean GmbH, approximately 400 TWh (terawatt-hour) of energy has been wasted by 14 billion wireless sensor networks (WSNs) users in low power mode around the world. However, with 50 million smartphones, demand will rise by 3.5 times to over 1,400 TWh by 2022. As a result of its low power consumption, Bluetooth Low Energy (BLE) has the best chance of entering the market deeply, resulting in good growth opportunities in the near future, especially in the remote healthcare and automotive industries.

Low Power Consumption Capability

Bluetooth Low Energy is a smarter, more energy-efficient variant of the Bluetooth wireless technology. It is now contributing to turn mobile devices into intelligent devices by making them more portable, and simple. Anything, from the physical architecture to the usage models, is geared toward reducing power consumption. A BLE system is kept in sleep mode for the majority of the time to save power. The device wakes up when an incident happens, and a brief message is sent to a gateway, PC, or mobile. The average power usage is around 1 A and the maximum/peak power consumption is less than 15 mA. The active power consumption is a tenth of that of traditional Bluetooth. A button cell battery could last 5-10 years in low-duty-cycle applications. The Bluetooth low energy (BLE) modules are built in such a way that they can operate for four to five years on a single charge. The BLE technology is expensive, but it has a wide variety of applications. Unlike standard Bluetooth, the Bluetooth low energy (BLE) module does not generate heat. Furthermore, data transfer can be accomplished at a higher rate. The Bluetooth low energy (BLE) module has a higher throughput and a longer range than the standard Bluetooth module.

Bluetooth Low Energy Module Market Challenges

Issues with One to One Pairing

Security researchers say vulnerabilities during pairing constitute a severe security risk. Unlike its predecessor Bluetooth Classic, which could accommodate multiple user links, Bluetooth Low Energy has been designed for one-to-one connections, owing to its low power consumption functionality. Bluetooth Classic is built on a mesh network, while Bluetooth Low Energy was created to be mobile in a mesh topology for fast connectivity and disconnection. While a Bluetooth Low Energy powered hub/master computer will connect to several Bluetooth Smart devices, the reverse is not valid. As a result, the user's ability to send data from a single Bluetooth Smart powered sensing device to multiple hub devices is restricted. This is a source of worry for top players who must scan various output metrics on multiple tracking systems on a regular basis. In April 2020, researchers at The Ohio State University recently developed an automated app analysis tool and used it to identify 1,757 vulnerable free BLE apps in Google Play store. They also performed a field test in which 7.4% of 5,822 BLE devices were vulnerable to unauthorized access.

Buy Now

Bluetooth Low Energy Module Market Outlook

Product launches, acquisitions, Partnerships and R&D activities are key strategies adopted by players in the Bluetooth Low Energy Module market. Bluetooth Low Energy Module top companies include STMicroelectronics, Cypress Semiconductor, Murata, Panasonic and Texas Instruments among others.

Acquisitions/Product Launches

In March 2021, U-blox launched professional grade MAYA-W1 Wi-Fi 4 and Bluetooth 5 multiradio module based on NXP’s IW416 chip for fast-growing, future-oriented professional applications. It has Bluetooth low energy and Bluetooth classic in a single hardware component.

In March 2019, Murata Manufacturing has partnered with Cypress Semiconductor to develop a low power, small form factor Wi-Fi and Bluetooth module. The new Type 1LV CYW43012 improves battery life in wearabls, smart home products and portable audio applications.

#Bluetooth Low Energy Module Market#Bluetooth Low Energy Module Market Share#Bluetooth Low Energy Module Market Size#Bluetooth Low Energy Module Market Forecast#Bluetooth Low Energy Module Market Report#Bluetooth Low Energy Module Market Growth

0 notes

Text

The global demand for Telecom API was valued at USD 325.1 Million in 2023 and is expected to reach USD 1960.92 Million in 2032, growing at a CAGR of 22.10% between 2024 and 2032.The telecommunications industry is undergoing a significant transformation, driven by the proliferation of digital technologies and the increasing demand for seamless connectivity. One of the key catalysts of this transformation is the Telecom API (Application Programming Interface) market. Telecom APIs enable developers to integrate telecom services such as voice, messaging, and data into applications, driving innovation and enhancing user experiences. This article explores the current state of the Telecom API market, its growth drivers, key trends, and future prospects.

Browse the full report at https://www.credenceresearch.com/report/telecom-api-market

Market Overview

The global Telecom API market has witnessed robust growth over the past decade. As of 2023, the market is valued at approximately $250 billion and is projected to reach $450 billion by 2028, growing at a compound annual growth rate (CAGR) of 12.5%. This growth is attributed to the increasing adoption of cloud-based services, the proliferation of smartphones, and the rising demand for IoT (Internet of Things) applications.

Key Growth Drivers

1. Proliferation of Smartphones and Mobile Applications: The widespread use of smartphones and the surge in mobile applications have created a substantial demand for telecom APIs. These APIs allow developers to integrate telecom services into their apps, enhancing functionality and user engagement. Services like SMS, voice calls, and mobile payments are seamlessly integrated using telecom APIs, driving their adoption.

2. Rising Demand for IoT and M2M Communication: The Internet of Things (IoT) revolution has led to an explosion of connected devices, ranging from smart home appliances to industrial machinery. Telecom APIs play a crucial role in enabling machine-to-machine (M2M) communication, facilitating data exchange between devices and networks. This has opened new revenue streams for telecom operators and API providers.

3. Shift Towards Cloud-based Services: Cloud computing has become the backbone of modern digital infrastructure. Telecom APIs enable seamless integration of telecom services with cloud platforms, allowing businesses to scale their operations and enhance service delivery. Cloud-based telecom APIs also offer cost advantages and flexibility, further driving their adoption.

4. Digital Transformation Initiatives: Enterprises across various industries are embarking on digital transformation journeys to improve efficiency and customer experiences. Telecom APIs are instrumental in these initiatives, enabling businesses to leverage telecom capabilities in their digital solutions. For instance, APIs for SMS notifications, voice recognition, and video conferencing are increasingly used in customer service applications.

Key Trends

1. 5G Integration: The rollout of 5G networks is set to revolutionize the telecom industry. Telecom APIs are evolving to leverage the capabilities of 5G, such as low latency, high-speed data transfer, and enhanced connectivity. This will open up new opportunities for developers to create innovative applications and services that were previously not possible with 4G technology.

2. Expansion of CPaaS (Communication Platform as a Service): CPaaS platforms are gaining traction as they provide developers with a comprehensive suite of communication APIs, including voice, messaging, and video. These platforms simplify the integration of telecom services into applications, reducing development time and costs. The CPaaS market is expected to grow significantly, driven by the increasing demand for real-time communication solutions.

3. API Security and Compliance: As the use of telecom APIs expands, so do concerns about security and compliance. Ensuring the security of data transmitted through APIs and adhering to regulatory requirements are critical challenges. Telecom API providers are investing in advanced security measures and compliance frameworks to address these concerns, enhancing trust among users and businesses.

4. Artificial Intelligence and Machine Learning Integration: The integration of AI and ML technologies with telecom APIs is opening new avenues for innovation. AI-powered APIs for voice recognition, chatbots, and predictive analytics are being developed to enhance user experiences and automate processes. This trend is expected to drive further growth in the Telecom API market.

Future Prospects

The future of the Telecom API market looks promising, with several factors poised to drive its growth. The continued expansion of 5G networks, the rise of IoT applications, and the increasing adoption of cloud-based services will create new opportunities for telecom API providers. Additionally, the integration of emerging technologies such as AI, ML, and blockchain will further enhance the capabilities and security of telecom APIs.

Moreover, as businesses continue to prioritize digital transformation, the demand for telecom APIs will remain strong. Enterprises will increasingly rely on these APIs to deliver innovative services, improve customer engagement, and streamline operations.

Key Players

AT&T Intellectual Property

Telefonica S.A.

Google

Verizon

TWILIO INC.

Others

Segmentation

By Type of API

SMS API (Short Message Service API)

Voice API

Payment API

Location API

WebRTC API

Authentication API

Subscriber Identity Module (SIM) Card API

By Deployment Model

Cloud-based APIs

On-Premises APIs

By End-User Industry

Telecom Operators/Service Providers

Enterprises

Developers/Startups

By Service Type

Payment Services

Content Delivery

Location-Based Services

Identity Management

Voice Calling Services

Data and Messaging Services

By User Type

Internal Telecom API Users (within the telecom operator)

External Telecom API Users (third-party developers, enterprises)

By Revenue Model

Subscription-Based

Pay-as-You-Go

Freemium Models

By Security Type

OAuth (Open Authorization)

Token-Based Security

Other Authentication Mechanisms

By Region

North America

The U.S.

Canada

Mexico

Europe

Germany

France

The U.K.

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Rest of Middle East and Africa

Browse the full report at https://www.credenceresearch.com/report/telecom-api-market

About Us:

Credence Research is committed to employee well-being and productivity. Following the COVID-19 pandemic, we have implemented a permanent work-from-home policy for all employees.

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

Website: www.credenceresearch.com

0 notes

Text

Industrial WLAN Market - Forecast(2024 - 2030)

Industrial WLAN Market size is estimated to reach $1.8 billion by 2030, growing at a CAGR of 13.4% over the forecast period 2024-2030. Increasing demand for connected factories, smart cities, and smart utilities to provide seamless networking among associated machines and systems is set to drive the market. Increasing adoption of high-speed Machine-to-Machine (M2M) communication to transmit data between connected devices for real-time monitoring and controlling has stimulated market growth.

0 notes

Text

The M2M Satellite Communication Market is expected to be 11.9% during the forecast period and the market size is expected to reach nearly 16.24 billion by 2029

0 notes