#MF Distributors software

Explore tagged Tumblr posts

Text

How Does The Document Vault Work In a Mutual Fund Software?

The document vault in mutual fund software is a feature that helps advisors store documents of their clients that are secured with a password. This helps them to perform instant transactions with the permission of clients. They don't need to wait for any documents. For More Information, Visit https://wealthelite.in/

#finance#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Best Mutual Fund Software for Ifa in India#Top Mutual Fund Software for Distributors in India#Top Mutual Fund Software for IFA in India#Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Distributor software#MF Distributors software#Best online platform for mutual fund distributor#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software

0 notes

Text

Is the Mutual Fund Software for Distributors in India Compatible With All Mutual Fund Schemes Offered in the Country?

Yes, the Mutual Fund Software for Distributors in India is designed to be compatible with a wide range of mutual fund schemes offered in the country, allowing MFDs to access and manage investments across various fund houses, categories, and schemes from a single platform. For more details, visit https://wealthelite.in/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Best Mutual Fund Software for Ifa in India#Top Mutual Fund Software for Distributors in India#Top Mutual Fund Software for IFA in India#Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Distributor software#MF Distributors software#Best online platform for mutual fund distributor#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software

0 notes

Text

Can Mutual Fund Software Help MFDs Stay SEBI Compliant and Competitive?

Mutual fund market is a place where trust and speed drive success, and yet compliance matters the most! Mutual Fund Distributors (MFDs) need to manage multiple portfolios, adhere to SEBI guidelines, and deliver timely services. That’s where digital transformation steps in.

Mutual Fund Software is designed to simplify everything from operations to compliance. It helps MFDs to manage investor data, track performance, and meet regulatory standards without the stress of manual processes.

Why SEBI Compliance Matters to Every MFD?

SEBI regulations aren’t optional, they’re extremely important for client protection and ethical investing. Falling short can lead to:

Heavy penalties

Loss of investor trust

Disruption in operations

Legal Hearings

That's why smart MutualFundSoftware simplifies the compliance process. It auto-generates reports, flags missing information, and sends reminders to fix gaps. So, instead of digging through paperwork, MFDs can stay focused on helping clients grow wealth.

Common Non-Compliance Issues That Can Be Avoided

Using traditional methods often results in outdated or missing client details. This not only disrupts transactions but can also trigger audit risks. With wealth management software, MFDs can track and update key fields such as:

✅ PAN & Aadhaar numbers – Required for all financial transactions.

✅ Mobile number & email – For communication and alerts.

✅ Nominee details – Essential for security and legal clarity.

✅ Bank account info – Crucial for withdrawals and dividends.

✅ KYC status – Mandatory for operational transparency.

✅ Tax status – For correct deductions and filings.

✅ Date of birth – Impacts product eligibility and profiling.

✅ Risk Profiling – SEBI mandates that investment professionals conduct risk profiling for their clients.

When these details are missing or incorrect, the software can easily flag them as missing, and then MFD can alert its clients and urge them to be compliant. This proactive system saves time and strengthens clients' trust in MFD.

How the Software Solves Compliance Hassles

One of the biggest advantages of modern mutual fund platforms is automation. Instead of manual tracking, the software takes over repetitive tasks like

Flagging incorrect or missing client data

Generating Non-compliance status reports

This means MFDs no longer have to second-guess if they’re SEBI-ready. Every compliance update is just a click away.

Delivering a Better Client Experience

When operations run smoothly, clients feel the difference. That’s why the best Mutual Fund Software for Distributors benefits investors too. MFDs can use these tools to:

Share real-time portfolio updates

Personalize strategies based on goals

Maintain accurate investor records

Resolve service requests faster

Client trust grows when MFDs deliver precision and speed. In turn, that loyalty fuels long-term growth.

Conclusion:

Being an MFD today means wearing many hats. From compliance to professional investment, from service to strategy. Software makes this multitasking easier, faster, and more accurate. By integrating it into daily operations, MFDs can build trust, deliver results, and grow their practice confidently. Now is the time to upgrade. Embrace technology that keeps your practice future ready.

#mutual fund software for distributors#mutual fund software for ifa#mutual fund software in india#top mutual fund software in india#best mutual fund software in india#best mutual fund software#mutual fund software for distributors in india#India's best Mutual Fund Software for Distributors#Best online platform for mutual fund distributor#CRM software for mutual fund distributor#Best CRM for financial advisors in india#wealth management software#software for Financial Advisors#online mutual Fund platform#mf distributors software in india

0 notes

Text

7 Must-Have Features in the Top Mutual Fund Software in India

Technology is getting increasingly popular among Mutual Fund Distributors (MFDs) in India. From online transactions to tracking client portfolios, software tools are becoming the backbone of business operations.

If you're planning to upgrade your system or choose a new platform, there are a few non-negotiable features that no top mutual fund software in India should miss. Let's walk through them together.

Features To Look For

1. Goal-Based Planning – Help Clients Plan Better

One of the strongest ways to retain clients? Help them achieve their life goals.

Top software should offer goal-based planning tools that allow you to:

● Create goal-specific investment plans (like retirement, education, marriage) ● Show clients how much they need to invest regularly ● Track progress against each goal ● Make it visual and easy to understand

Helping investors visualize their goals makes your advice more impactful and helps you build long-term relationships.

2. NSE/BSE + MFU Integration – Enable Insta Transactions

In 2025, speed matters. Investors don’t want delays, and neither should you.

Ensure the best mutual fund distributor platform, like that offered by REDVision Technologies, is integrated with:

● NSE NMF ● BSE STAR MF ● MFU (Mutual Fund Utility)

This makes real-time online transactions possible for your clients. That means:

● Instant SIP registration ● Quick switch/redemption ● Zero paperwork ● Faster onboarding process

3. SIP Calculators – Show Numbers, Make It Real

Most investors ask: How much should I invest?

That’s where SIP calculators help.

Look for a software that gives you:

● SIP return projections ● Step-up SIP calculations ● Goal-linked SIP illustrations ● Real-time output with simple inputs

This makes your discussions more insightful and data-backed, helping clients take action faster.

4. Fund Factsheets – Give Informed Suggestions

Your back office software must offer:

● Easy-to-read fund factsheets ● Performance comparison with benchmarks ● Expense ratios, ratings, and fund manager details ● Historical returns and portfolio insights

5. Multi-Asset Classes – Expand Your Offering

Today’s investors want more than just mutual funds. Your software should allow you to offer:

● Equity (stocks) ● Mutual Funds ● IPOs ● P2P Lending ● Loan Against Mutual Funds

This not only boosts your AUM but also positions you as a one-stop solution for all investment needs.

6. 24/7 Assistance – Because Business Never Sleeps

Your business doesn’t stop after 6 PM. And neither should support.

Choose software that offers:

● 24x7 customer support ● Quick query resolution ● Dedicated relationship managers ● Chat/email/call options for assistance

You should be able to get help when you need it, so your clients don’t face any delay.

7. Risk Profiling – Know Before You Recommend

Before suggesting a fund, you need to know your client’s risk appetite. That’s where digital risk profiling comes in.

Make sure the software includes:

● Risk questionnaires built into the system ● Auto-calculated risk score ● Suggested fund categories based on the score ● Easy sharing of profiling reports with clients

It protects you legally and helps you deliver the right investment advice.

Final Thoughts

Technology isn’t just about automation – it’s about enhancing trust, saving time, and delivering value. If you're an MFD looking to grow, scale, and stay relevant in today’s digital-first world, choosing software with the right features is a non-negotiable.

#mutual fund software#mutual fund software for distributors#mutual fund software for ifa#mutual fund software in india#top mutual fund software in india#best mutual fund software in india#mutual fund software for distributors in india#wealth management software in india#best mutual fund software for ifa in india#top mutual fund software for distributors in india

0 notes

Text

Imagine this:

You have a big-ticket client doing a monthly SIP of 1.5 lakhs. However, they require funds for their child's marriage.

Now, he wants to stop his monthly SIP and redeem investments that he has made over time. Or maybe he needs the money for a medical emergency and is adamant about redeeming his investment.

You are unable to stop this client from stopping this.

How will this impact you?

Loss of AUM

Loss of income

Stagnate growth

In fact, according to a report by Motilal Oswal, Mutual fund redemptions increased 39% year-on-year to Rs 332,300 crore in CY23.

It has led to a decline in net inflows to Rs 206,300 in 2023 from Rs 238,300 in CY22.

Why has this happened?

Liquidity is the culprit. Let me share an interesting fact with you to relate to this.

Did you know that LIC & PPF make more money than mutual funds?

But when we compare the returnsInvestment ProductAverage returns per annumMutual funds12-15%LIC4-5%PPF6-7%

Mutual funds offer better returns.

So, how is that possible that they make more money? The reason is that Mutual funds are very liquid when compared to other investment products.

The average holding period for LICs and PPFs is more than ten years. While over 50% of mutual funds units of regular plans were redeemed within a year, according to SEBI.

It is evident that the longer you hold investments, the better the compounding. That is why LICs and PPFs make more money than MFs.

But the question remains the same. How to stop premature redemptions?

What could you have done to stop premature redemption?

Scenario 1

When the market falls, clients panic and want to redeem.

To stop your client from redeeming their investment, you should link a purpose to it. The purpose of the investment has a psychological impact. It emotionally attaches the person to their goal.

This ensures that your AUM remains stable even during market turbulence.

However, it may seem like a far-fetched exercise to make goals for every client. Worry not, we have got a solution! Goal GPS with tracker. With this, you can:

Make quick goals, whether planning for child education, retirement, house planning, etc., with a family photo and a goal photo.

Map funds, whether existing or new, and assess the shortfall.

Track goals by sharing proper reports with your clients.

Scenario 2

When clients want funds during an emergency.

At times when there is an emergency, and your client needs money immediately, there is no choice but to redeem their investment.

To solve this, we have got another solution. MFDs can offer loans against mutual funds.

Let us discuss how loans against mutual funds can serve as valuable insurance against client redemption in another blog

For now, As suggested by DP Singh, SBI Mutual fund

Don’t over-sell liquidity in mutual funds, promote longevity of investments. Liquidity is a comfort feature – only to be used in real emergencies. The more you promote liquidity, the more challenges you will face as you keep bringing in new business while redemptions leak out from your AUM. The longevity of investments is the only win-win for your clients and yourself.

Whenever you receive a new lump sum or SIP from your client, make sure to link it with a purpose and ensure longevity of investments. To learn more about how Goal GPS can help you, contact us today!

0 notes

Text

Why Mutual fund software for distributors manages diverse profiles?

The software is designed in such a way to deal with different great portfolios and means to provide increased profits on minor risk also the Mutual fund software for distributors efficiently give benefits to different investors without facing any issue. For more information, visit @- https://www.mutualfundsoftware.in/mutual-fund-software.php

#MutualFundSoftware#mutualfundsoftwareforifa#mutualfundsoftwarefordistributors#mutualfundsoftwareinindia#topmutualfundsoftwareinindia#bestmutualfundsoftware#mutual funds software#mf software#free mutual fund distributor software#mutual fund distributor software#mutual fund distributor back office software#software for financial advisors#top mutual fund software#online mutual fund platform for ifa#best mutual fund software for ifa#best ifa software#software for financial advisors in india#mutual fund software for investor

0 notes

Text

What are the Responsibilities of the Financial Advisors?

We need the financial advisors for streamlining our financial affairs for life. Although not all may be open towards the concept of having a financial advisor on board for various reasons, things can completely change when you have an advisor to help you make the right financial decisions. Things can certainly take a better turn when you have the financial advisor to guide you throughout the journey of your life. A financial advisor can be the guiding light that you need in making all the crucial decisions regarding your financial moves, the financial advisor truly has the best interest of the client at heart, and here are the responsibilities that a financial advisor must execute, with the help of his ifa back office system. So, let’s take a look.

The Responsibilities of the Financial Advisors:

The first and foremost responsibility of the financial advisor would be to streamline the financial affairs of the client. The financial affairs need to be sorted out accordingly with the help of the advisors. Usually when people get down to do financial planning they do not have much knowledge regarding the intricacies of the matter. The financial advisor on the other hand has the knowledge and experience regarding which way to make any move, and in a way that would actually benefit the client. He has access to financial tools like the mf distributor software as well. The first and the biggest responsibility of the advisor therefore, would be to take care of the financial planning needs of the client.

The next responsibility of the financial advisor would be to help their client take the right investment decision. The clients do not have the right ideas regarding the investment landscape, and they do not know how to make a move accordingly. They do not know which investment option would be right for them, which investment options will have lower risk factors, and most importantly how to build the ideal portfolio, with the help of the financial planning software in India the IFAs can help them. The financial advisors can help in this matter to a great extent as he has access to the best investment products. Furthermore, the advisor can also help the clients by assessing their risk factors, and helping them access the right products.

The next responsibility of the financial advisor would be to help the clients set the right financial goals, and an advanced ifa back office system can surely help him. More often than not, when it comes to setting up financial goals, we end up setting unrealistic goals. This can be harmful in the long run, because of the fact that the financial success depends on these goal setting to a degree. So, what the financial advisor should be doing instead is to help the clients find the right goals that are achievable. In fact, the financial advisors should also help the clients find the ideal investments which could be tied to a particular goal.

The life changes after retirement, and when it comes to retirement planning the financial advisors must help the client come up with the right financial plan for making the retirement a peaceful and comfortable period. The advisors here can play the role of making the right calculations, and they can easily help you decide the amount of money that one requires to save and invest for the retirement phase with the help of the best mf distributor software.

The next responsibility of the financial advisor would be to guide the clients regarding the insurance strategies, and having access to a good financial planning software in India is a must. Just the way you should save, invest, you should also get insured to make your life absolutely safe. However, it is easy to skip on the insurance products as most of us like to think that these are not necessary at all, but the advisor can chip in and he can enable you to find the right balance here by guiding you towards the right investment products.

The financial advisors should also be the ideal guide when it comes to dealing with market volatility. The upheaval might make the clients really worried, and they might end up taking the wrong steps, with the help of the ifa back office system , the IFAs should come forward to help. The advisors should guide their clients and help them make sense of the volatility, and this will certainly help the clients calm down and not make any wrong decision.

These are the responsibilities of the financial advisors which they must be careful about. The clients need to be guided and they should guide them accordingly and help them reach a secure financial future.

1 note

·

View note

Text

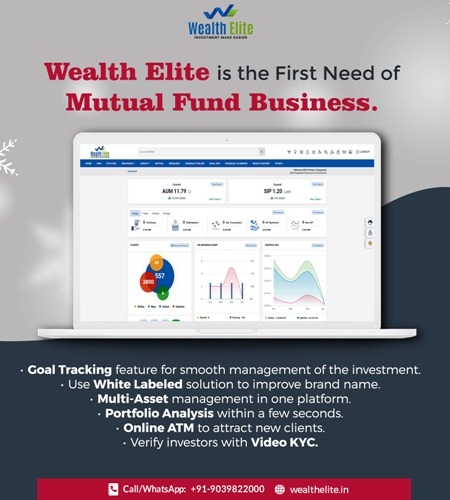

Which is the best Mutual Fund Software for Distributors that shows various features.

Redvision Global is a cutting-edge mutual fund software designed to help distributors streamline their operations and provide better service to their clients. Here are some of the key features that make Redvision Global stand out:

Portfolio Tracking: With online mutual fund platform, distributors can easily track the performance of their client's investments in mutual funds. The software provides real-time updates and alerts to ensure that the portfolio is on track.

Investment Recommendations: Redvision Global uses advanced algorithms to analyze market trends and provide personalized investment recommendations based on the risk profile of each client. This helps distributors make informed decisions and maximize returns.

Real-time Market Data: Wealth management software provides real-time updates on stock prices, NAVs, and other market data, allowing distributors to make informed investment decisions. This feature ensures that distributors are always up-to-date with the latest market trends.

Analytics: The software provides in-depth analytics on portfolio performance, asset allocation, and fund selection. This helps distributors identify areas of improvement and make informed decisions. With MF software, distributors can easily analyze their clients' portfolios and make data-driven decisions.

Customizable Reports: Financial Planning Software provides customizable reports that can be tailored to meet the specific needs of each client. Reports can be generated in multiple formats, including PDF, Excel, and HTML. This feature ensures that distributors can provide their clients with personalized reports that are easy to understand.

Risk Management: The software provides risk management tools that help distributors identify and mitigate potential risks in the portfolio. This feature ensures that distributors can manage risk effectively and protect their client's investments.

Mobile App: Wealth Elite mutual fund app has a mobile app that allows distributors to access their clients' portfolios on the go. The app provides real-time updates and alerts, making it easier to stay on top of portfolio performance. This feature ensures that distributors can provide their clients with timely updates and excellent service.

In conclusion, Redvision Global is a powerful mutual fund software that offers a range of features to help distributors manage their clients' portfolios effectively. To learn more https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

Everything about Mutual Fund software in India

What is a Mutual Fund?

A Mutual Fund is a trust enrolled with the Securities and Exchange Board of India (SEBI), which pools up the cash from individual/corporate financial backers and contributes something similar for the financial backers/unit holders, in value shares, Government protections, Bonds, Call currency markets and so forth, and disperses the benefits.

The Mutual Fund Software in India for Distributors is formulated to match each need of the monetary distributors serving in the investment organizations. The pay acquired through these ventures and the capital appreciation acknowledged are shared by its unit holders in relation to the quantity of units possessed by them. This pooled pay is expertly overseen for the unit-holders, and every financial backer holds an extent of the portfolio that is qualified not just for benefits when the protections are sold, yet additionally dependent upon any misfortunes in esteem also.

Below are the Mutual Fund Insights that everyone should know that will helps the mutual fund advisor and distributor .The accompanying assets can assist you with tracking down the best adviser for you. It's ideal to draw up a waitlist of somewhere around three financial advisers and ring them all prior to settling on one. Confined advisers will either zero in on only one branch of knowledge, similar to pensions, yet take a gander at the entire of the market, or could suggest investments from all suppliers, yet only for one kind of products, for example, just suggesting unit trusts.

A can scour the market to observe investments and products that are custom-made to your conditions, and assist you with expressly anticipating the things you need to do with your cash from here on out. You can in any case purchase complex Mutual Fund App without an adviser, despite the fact that you could be putting your money at risk. It's truly vital to search around while searching for an Mutual Fund Software for IFA. An examination site is a decent spot to begin; Unbiased and Vouched For are the greatest.

You can utilize their channels to limit a waitlist in light of specialized topics and client surveys. Nivesh Life suggests setting up gatherings with somewhere around three IFAs so you can conclude which can give you the best support of your requirements, and the best incentive for cash. On the off chance that you don't have to meet your adviser face to face, you could set aside cash by looking outside of your neighbourhood.

Mf distributor software helps customers to optimize their analytical capacity and endorse the right product mix based on a precise client’s unique goals, requirements, and risk appetite.

The platform is giving distributors to get possibilities from any area without experiencing any limits which are further developing the organization experience alongside an augmentation in the assets of the firm. The thriving of the country likewise gets a force as far as expansion and headway which affirms the spot at the worldwide level of Mutual Fund Software for Distributor

For what reason would it be a good idea for me I decide to Invest in Mutual Fund ?

• For retail financial backer who doesn't have the opportunity and skill to break down and put resources into stocks and securities, shared reserves offer a suitable speculation elective. This is on the grounds that:

• Mutual Fund Software give the advantage of modest admittance to costly stocks.

• Common assets differentiate the gamble of the financial backer by putting resources into a bin of resources.

• A group of expert asset chiefs oversees them with inside and out research inputs from speculation examiners.

• Being organizations with great haggling power in business sectors, common assets approach significant corporate data which individual financial backers can't get to.

Advantages

Affordability

Professional management

Diversification

Variety of investment options according to the financial status of the investor

Return potential

Flexibility

Transparency

Tax benefits

0 notes

Text

Does your Mutual Fund Software offer integration with exchanges like BSE and NSE?

Yes, our Mutual Fund Software offers integration with exchanges like BSE and NSE, enabling MFDs to seamlessly access and trade mutual fund investments, ensuring efficient management and monitoring. It also helps in keeping track of all the investments in one place. For More Information, Visit: https://wealthelite.in/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Best Mutual Fund Software for Ifa in India#Top Mutual Fund Software for Distributors in India#Top Mutual Fund Software for IFA in India#Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Distributor software#MF Distributors software#Best online platform for mutual fund distributor#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software

1 note

·

View note

Text

How can MFDs Grow With MFU Integration in Mutual Fund Software in India?

Hello, MFDs! Have you been hustling to grow your business? Ever wished there was a way to streamline operations, impress clients, and conquer those ambitious AUM goals? Well, worry no more! Here's why MFU integration in mutual fund software in India is the game-changer you've been waiting for.

Imagine this: You're dealing with a busy HNI (High Net-worth Individual) who wants to invest across multiple AMCs. Manually handling all that paperwork would be a nightmare, right? But with MFU, it's a breeze. You can map their existing investments with just a one-time password (OTP). No more endless form filling, just happy clients!

But wait, there's more! MFU goes beyond HNIs. Think about the time you save placing bulk orders. No more repetitive entries – just a single email, and you're good to go. This frees up your precious time to focus on what truly matters: building relationships and providing top-notch financial advice.

Here's the magic MFU brings to your MFD life:

Seamless Onboarding: Onboard new clients faster and easier than ever before.

Effortless Mandate Creation: Set up investment mandates for your clients in a flash.

Client Consolidation: Map existing client investments across different ARNs with a simple OTP.

Transaction Powerhouse: Purchase, redeem, switch – you name it, MFU handles it with ease.

Bulk Order Hero: Place bulk orders for multiple clients through a single email. Convenience at its finest!

Think of MFU as your efficient tool. It simplifies complex tasks, saves you time, and lets you focus on what you do best – being an extraordinary financial advisor. Plus, with Wealth Elite's user-friendly interface and top-notch customer service, using MFU is as smooth as butter.

So, what are you waiting for? Unleash the power of MFU integration in your fund management software and watch your business soar! We are here to help you every step of the way. Let's take your MFD game to the next level!

For more details, visit https://wealthelite.in/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Best Mutual Fund Software for Ifa in India#Top Mutual Fund Software for Distributors in India#Top Mutual Fund Software for IFA in India#Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Distributor software#MF Distributors software#Best online platform for mutual fund distributor#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software

0 notes

Text

Why is Integration With BSE StAR MF Important in Mutual Fund Software for Distributors?

Distributing mutual funds can be tough. With clients demanding more and more, and so many things to keep track of, doing everything manually can slow you down. REDVision makes efficient mutual fund software for distributors that can make your life easier. It can automate regular tasks and reduce mistakes. This way, you can focus on growing your business. Let’s discuss one such web-based platform, BSE Star MF, and how integration with this platform can aid MFDs.

What is BSE StAR MF?

BSE Star MF is an online platform created by the Bombay Stock Exchange (BSE) that allows distributors to buy and sell mutual funds easily. It's like an online marketplace. Where MFD can browse different funds, place orders, and make payments, all from your computer or smartphone.

It offers a range of benefits, including:

Single Platform: A single platform to manage multiple fund houses and schemes. Real-time Updates: Access to real-time market data and fund NAVs. Automated Order Placement: Smoothly places orders directly from the software to BSE Star MF. Reporting: Generate comprehensive reports with detailed analytics. Compliance Adherence: Ensure compliance with SEBI regulations through automated processes.

Why integration with BSE Star MF is a great thing for an MFD?

The integration of mutual fund software with platforms like BSE Star MF is a game-changer. It helps with seamless transactions and order execution. Distributors can access a centralized system to handle many processes. Making sure smoother operations and better client experiences. It eliminates manual paperwork and reduces the chances of errors. Which allows distributors to focus on building relationships rather than managing data.

Conclusion

Integrating technology can significantly improve how MFDs do business. By integrating BSE Star MF with strong software, MFDs can unlock significant benefits. This strategic move can help them stay ahead of the competition. So they can deliver exceptional client service and drive business growth.

#mutual fund software#mutual fund software for ifa#mutual fund software in india#mutual fund software for distributors#top mutual fund software in india#wealth management software in india#top mutual fund software for distributors in india

0 notes

Text

What is Mutual Fund Expense Ratio

What fees do you pay to Mutual Fund Company for managing your Funds?

Total Expense Ratio (TER) is the terminology used for fees or charges you as an investor pay to the Mutual Fund company for managing your money. Most investors are not aware of the charges they pay to a Mutual Fund company. In this article let us understand how a Mutual Fund company charges you for managing your money.

Why one need to Pay a Mutual Fund Company?

Any business, needs to charge their end users for supplying a product or service. These charges are taken to pay the expenses that the business mandatorily incurs on various things such as salary of their employees, raw material, transportation, electricity and above all the profit that the business needs to earn. All this money is paid by the end user for any product or service.

Let’s take an example for this. Say, you are buying a Jeans Pant. For manufacturing Jeans, the manufacturer needs to have machinery, labour, factory premises, electricity, and raw material. He also does marketing of the product for which certain budget is required. Above all, manufacturer needs to earn a profit by selling each product. Not only the manufacturer, the shopkeeper who sells the product also earns profit. All the money is added to the price of the product. So, even if the manufacturing price of the Jeans is say, Rs 500, you may have to buy it at, say Rs 1500. This is because the price involves, money spent for marketing and profits of manufacturer and shopkeeper.

Mutual Fund works in a similar manner. When you buy a Mutual Fund scheme, it is an equivalent to product such as Jeans Pant in above example. Any Mutual Fund company needs to incur expenses to run Mutual Fund scheme. These expenses can be salary of the Fund Managers, money required for research software, office premises, electricity, and marketing. Above all the Mutual Fund companies also earns profit. Not only the Mutual Fund company, the Distributors of Mutual Fund also needs to earn their profit (as in case of a shopkeeper). All these expenses are then added to the Mutual Fund scheme and finally charge to the end user (an investor in this case).

How does a Mutual Fund Company charge you?

The methodology of charging a to an investor of a mutual fund scheme is different than in case of Jeans Pant. In the case of Jeans Pant the amount is added to the final cost of the pant and is charged to the buyer.

Here the charge which is also called as TER (Total Expense Ratio) is added to the NAV (Net Asset Value) of a scheme.

Read:

What is NAV in Mutual Funds? How to interpret it?

Let's say, a scheme charges you 2% for managing your money for one year. However, here the AMC (Asset Management Company or simply Mutual Fund Company) does not deduct all this 2% of your money at one go. Had they done it that way, your investment would have been 2% lesser than the invested amount. Suppose when you invest Rs 1 Lac then your investment would have been Rs 98000 only. However, this not how AMC charges you as an investor.

These 2% are divided on daily basis. So, 2% will be divided by 365 and will be deducted from NAV on daily basis.

Let’s take an example. Suppose you invest Rs 100000 in a MF Scheme. NAV of this scheme is say, Rs. 120. You should get 100000/120 = 833.33 Units

But this scheme charges TER of 2% per year and this 2% will be divided on daily basis and will be deducted from the NAV. Now, every day (2%*120/365=0.00658) will be deducted from the NAV and actual NAV declared is 120-0.00658=119.9934.

The amount of investment becomes 119.9934*833.33 = 99994.521. So, you have indirectly paid Rs 5.5 per day as expenses ratio to the mutual fund company. Which is 2% of your investment when looked upon for one year.

Can Mutual Fund Company charge me any amount at their will?

Unlike any other industry the Mutual Fund Industry is highly regulated and the expenses that any scheme can charge is defined by the SEBI. SEBI is a government body which regulates mutual fund industry in India.

SEBI has defined how much a scheme can charge to its investor. You can check the details of the charges on this link.

https://www.amfiindia.com/investor-corner/knowledge-center/Expense-Ratio.html

Do all the schemes have same Expense Ratio?

No, different schemes will have different expense ratios. The TER depends on the type of scheme, the amount the scheme is managing and whether the scheme is a Direct Plan or a Regular Plan.

Generally, the Equity type of schemes have larger expense ratio as compared to Debt type of Mutual Fund schemes.

Larger the size of a scheme, lower is its expense ratio.

Direct Plans have lesser expense as compared to Regular Plans as the direct plan is supposed to be directly bought by the investor himself and there is not Distributor involved. In case of a Regular Plan the Distributor helps investor in buying the Mutual Fund scheme and hence he earns a commission by selling the regular plans. Therefore, commission paid is charged to the investor as a part of expense ratio.

Conclusion:

As in case of any product, mutual funds also charge investors for managing their money. Only that the expenses charged by the Mutual Fund company are not upfront and hence are not paid directly by the investor to the mutual fund company. Instead, the charges are deducted from NAV on daily basis. If you are an aware investor and understand how to invest in Mutual Funds you can opt for Direct Plan wherein you will pay lesser expense. However, if you do not know much about investing in mutual fund, better to avail services of MF Distributor even if you have to pay somewhat higher expenses as compared to Direct Plan, these expenses are very minor though.

0 notes

Text

How can the liquidity of Mutual funds become a problem for MFDs?

Imagine this:

You have a big-ticket client doing a monthly SIP of 1.5 lakhs. However, they require funds for their child's marriage.

Now, he wants to stop his monthly SIP and redeem investments that he has made over time. Or maybe he needs the money for a medical emergency and is adamant about redeeming his investment.

You are unable to stop this client from stopping this.

How will this impact you?

Loss of AUM

Loss of income

Stagnate growth

In fact, according to a report by Motilal Oswal, Mutual fund redemptions increased 39% year-on-year to Rs 332,300 crore in CY23.

It has led to a decline in net inflows to Rs 206,300 in 2023 from Rs 238,300 in CY22.

Why has this happened?

Liquidity is the culprit. Let me share an interesting fact with you to relate to this.

Did you know that LIC & PPF make more money than mutual funds?

But when we compare the returnsInvestment ProductAverage returns per annumMutual funds12-15%LIC4-5%PPF6-7%

Mutual funds offer better returns.

So, how is that possible that they make more money? The reason is that Mutual funds are very liquid when compared to other investment products.

The average holding period for LICs and PPFs is more than ten years. While over 50% of mutual funds units of regular plans were redeemed within a year, according to SEBI.

It is evident that the longer you hold investments, the better the compounding. That is why LICs and PPFs make more money than MFs.

But the question remains the same. How to stop premature redemptions?

What could you have done to stop premature redemption?

Scenario 1

When the market falls, clients panic and want to redeem.

To stop your client from redeeming their investment, you should link a purpose to it. The purpose of the investment has a psychological impact. It emotionally attaches the person to their goal.

This ensures that your AUM remains stable even during market turbulence.

However, it may seem like a far-fetched exercise to make goals for every client. Worry not, we have got a solution! Goal GPS with tracker. With this, you can:

Make quick goals, whether planning for child education, retirement, house planning, etc., with a family photo and a goal photo.

Map funds, whether existing or new, and assess the shortfall.

Track goals by sharing proper reports with your clients.

Scenario 2

When clients want funds during an emergency.

At times when there is an emergency, and your client needs money immediately, there is no choice but to redeem their investment.

To solve this, we have got another solution. MFDs can offer loans against mutual funds.

Let us discuss how loans against mutual funds can serve as valuable insurance against client redemption in another blog

For now, As suggested by DP Singh, SBI Mutual fund

Don’t over-sell liquidity in mutual funds, promote longevity of investments. Liquidity is a comfort feature – only to be used in real emergencies. The more you promote liquidity, the more challenges you will face as you keep bringing in new business while redemptions leak out from your AUM. The longevity of investments is the only win-win for your clients and yourself.

Whenever you receive a new lump sum or SIP from your client, make sure to link it with a purpose and ensure longevity of investments. To learn more about how Goal GPS can help you, contact us today!

Visit Us

1 note

·

View note

Text

Why does Top Mutual fund software in India assist research?

Assessing the implementation of a particular scheme manually is a time-consuming method and the outcomes are also modified but the Top Mutual fund software in India gives the proper research of funds with a trend chart. For more information, visit@ https://www.mutualfundsoftware.in/mutual-fund-software.php

#MutualFundSoftware#mutualfundsoftwareforifa#mutualfundsoftwarefordistributors#mutualfundsoftwareinindia#topmutualfundsoftwareinindia#bestmutualfundsoftware#mutual funds software#mf software#free mutual fund distributor software#mutual fund distributor software#mutual fund distributor back office software#software for financial advisors#top mutual fund software#online mutual fund platform for ifa#best mutual fund software for ifa#best ifa software#software for financial advisors in india#mutual fund software for investor

0 notes

Text

Mutual Fund Industry in India - An Overview of 2022

Asset growth in 2022 was aided by solid inflows into equities and hybrid schemes and steady inflows via systematic investment plans (SIP). As a result, financial institutions have improved their mutual fund software for distributors to meet the increased demand. The domestic mutual fund (MF) industry's average assets under management (AAUM) increased by 19.5%, from Rs 32.1 trillion in the March 2021 quarter to Rs 38.4 trillion in the March 2022 quarter.

SBI MF maintained its leadership position, with an AAUM of Rs 6.47 trillion, up from Rs 5 trillion in Jan-March 2021, a 28.27 percent increase. For April 2022, the average Assets Under Management (AAUM) of the Indian Mutual Fund Industry was 38,88,960 crore.

As of April 30, 2022, the Indian mutual fund industry has 38,03,683 crore in assets under management (AUM). In May 2014, the industry's AUM passed the 10 Trillion (10 Lakh Crore) mark for the first time, and in less than three years, the AUM size had more than doubled, crossing the 20 Trillion (20 Lakh Crore) mark for the first time in August 2017. In November 2020, the AUM amount will surpass 30 trillion (30 lakh crore).

The industry AUM was 38.04 Trillion (38.04 Lakh Crore) and overall number of accounts (or folios) was at 13.13 crore, while the number of folios under Equity, Hybrid, and Solution Oriented Schemes, where the most significant investment comes from the retail segment through a mutual fund software, stood at around 10.47 crore.

The number of SIPs and monthly collections has grown due to the high number of new first-time investors joining the market and the ease of registering SIPs through online fintech portals. Still, the average ticket value per SIP has declined. The average SIP ticket size in December 2021 was Rs 2303 per SIP, down from Rs 3313 in December 2017.

On the other hand, monthly SIP receipts climbed by 77% in the same time to Rs 11,005 crore, up from Rs 6222 crore in December 2017. According to distributors, SIPs surged by 41% in the previous year, to 4.91 crore operating accounts from 3.47 crore accounts, as many new investors entered the market.

According to a Consumer spending forecast survey, 31 percent of Indians would invest in mutual funds and 10 percent in shares in 2022. Mutual funds have grown at an exponential rate in the last year. Its growing popularity has given it an advantage in the Indian individual finance business.

Banks and other financial organisations require dependable software to manage the growing demand for mutual funds. Such programmes that reduce transactional load and effort are always in demand.

Companies such as Winsoft can provide Smart Mutual, a mutual fund distribution system that can manage end-to-end transactions. Such companies can also offer expert services like offshore software development.

#mutual fund software for distributors#mutual fund software#offshore software development#Winsoftech

0 notes