#Machine-to-machine (M2M) Connections Market

Explore tagged Tumblr posts

Text

Machine-to-machine (M2M) Connections Market by Technology (Wired, Wireless), End-user Industry (Automotive & Transportation, Utilities, Security & Surveillance, Healthcare, Retail, Consumer Electronics) and Region

0 notes

Text

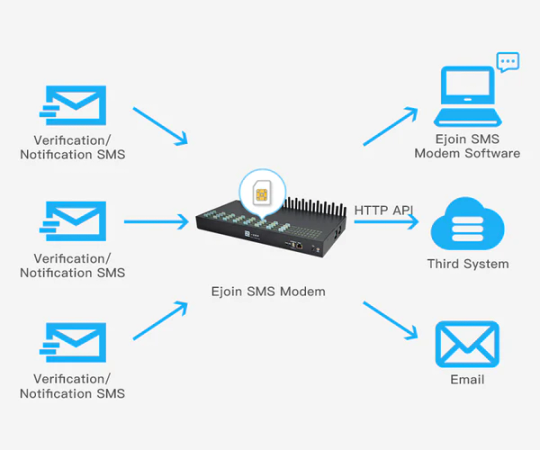

What is the use of SMS modem ?

An SMS modem is a device that enables computers and other electronic devices to send and receive SMS messages over a cellular network. It typically connects to a computer via a USB or serial port and utilizes a SIM card to establish a connection with the cellular network. SMS modems are frequently employed in applications where automated or bulk SMS message transmission and reception are required.

Here are some common applications of SMS modems:

Two-factor authentication: SMS modems can be used to send one-time passwords (OTPs) to users for two-factor authentication. This enhances security by requiring both a password and access to the user's phone for login.

Remote monitoring: SMS modems can transmit alerts and notifications from remote devices, such as sensors or alarms. This facilitates monitoring equipment in remote locations or receiving security breach alerts.

Bulk SMS messaging: SMS modems enable sending bulk SMS messages for marketing or notifications. This efficiently reaches a large audience compared to individual messages.

M2M (Machine-to-Machine) communication: SMS modems facilitate communication between machines, such as vending machines or ATMs. This enables status updates, command reception, or action triggering.

SMS voting and polling: SMS modems can collect votes or poll responses from a large population. This aids surveys, elections, or other feedback gathering methods.

SMS modems are versatile tools for SMS communication, with diverse applications in telecommunications, security, marketing, and automation.

2 notes

·

View notes

Text

Cellular IoT Module Chipset Market: Challenges in Standardization and Implementation, 2025-2032

MARKET INSIGHTS

The global Cellular IoT Module Chipset Market size was valued at US$ 4,670 million in 2024 and is projected to reach US$ 9,780 million by 2032, at a CAGR of 11.12% during the forecast period 2025-2032. The semiconductor industry backdrop shows robust growth, with global semiconductor revenues reaching USD 579 billion in 2022 and expected to expand to USD 790 billion by 2029 at 6% CAGR.

Cellular IoT Module Chipsets are specialized semiconductor components that enable wireless communication for IoT devices across cellular networks (4G LTE, 5G, NB-IoT). These chipsets integrate baseband processing, RF transceivers, power management, and security features into compact modules, facilitating machine-to-machine (M2M) connectivity in applications ranging from smart meters to industrial automation.

The market growth is driven by accelerating 5G deployments, with 5G chipset adoption projected to grow at 28% CAGR through 2030. While 4G LTE dominates current installations (72% market share in 2024), 5G chipsets are gaining traction in high-bandwidth applications. Key players like Qualcomm (holding 32% market share) and UNISOC are driving innovation through partnerships, such as Qualcomm’s recent collaboration with Bosch on industrial IoT modules featuring AI acceleration capabilities.

MARKET DYNAMICS

MARKET DRIVERS

Explosive Growth of IoT Applications to Accelerate Chipset Demand

The cellular IoT module chipset market is experiencing robust growth driven by the rapid expansion of IoT applications across industries. Global IoT connections are projected to surpass 29 billion by 2030, creating unprecedented demand for reliable connectivity solutions. Cellular IoT chipsets serve as the backbone for smart city infrastructure, industrial automation, and connected vehicles, enabling seamless machine-to-machine communication. The transition from legacy 2G/3G networks to advanced 4G LTE and 5G technologies is further fueling adoption, as these provide the necessary bandwidth and low latency for mission-critical applications.

5G Network Rollouts to Transform Industry Connectivity Standards

The global rollout of 5G networks represents a watershed moment for cellular IoT, with commercial 5G connections expected to reach 1.8 billion by 2025. 5G-enabled chipsets offer game-changing capabilities including ultra-reliable low latency communication (URLLC) and massive machine-type communication (mMTC) – essential for industrial IoT and autonomous systems. Major chipset manufacturers are introducing integrated 5G NR solutions that combine modem, RF transceiver, and power management, significantly reducing module footprint and power consumption while improving performance.

Moreover, the emergence of cellular vehicle-to-everything (C-V2X) technology is creating new revenue streams, with automakers increasingly embedding IoT modules for enhanced safety and navigation features. These technological advancements coincide with significant price reductions in 5G chipset manufacturing, making advanced connectivity accessible to mid-range IoT devices.

MARKET RESTRAINTS

Complex Certification Processes to Slow Market Penetration

Despite strong demand, the cellular IoT chipset market faces considerable barriers from stringent certification requirements. Each regional market maintains distinct regulatory frameworks for wireless devices, necessitating costly and time-consuming certification processes that can take 6-12 months per product. The situation is compounded for global IoT deployments requiring certifications across multiple jurisdictions, often representing 15-25% of total product development costs. This regulatory complexity particularly disadvantages smaller manufacturers lacking the resources for multi-market compliance.

Legacy System Integration Challenges to Constrain Adoption Rates

The integration of modern cellular IoT modules with legacy industrial systems presents significant technical hurdles. Many manufacturing facilities operate equipment with lifespans exceeding 20 years, designed before IoT connectivity became standard. Retrofitting these systems requires specialized gateways and protocol converters that add complexity and cost to deployments. Furthermore, the industrial sector’s conservative approach to technology upgrades means adoption cycles remain measured, despite the potential efficiency gains from cellular IoT implementation.

MARKET CHALLENGES

Power Consumption Optimization to Remain Critical Design Hurdle

While cellular connectivity offers superior range and reliability compared to alternatives like LPWAN, power efficiency remains an ongoing challenge for IoT module designers. Many industrial monitoring applications require 10+ year battery life from devices, pushing chipset manufacturers to develop increasingly sophisticated power management architectures. The introduction of advanced power saving modes like PSM and eDRX has helped, but achieving optimal battery life while maintaining responsive connectivity continues to require careful balancing of performance parameters.

Other Challenges

Supply Chain Volatility The semiconductor industry’s cyclical nature creates unpredictable component availability, with lead times for certain RF components occasionally exceeding 40 weeks. This volatility forces module manufacturers to maintain costly inventory buffers or redesign products based on component availability rather than optimal technical specifications.

Security Vulnerabilities As cellular IoT deployments scale, they become increasing targets for sophisticated cyber attacks. Chipset manufacturers must continuously update security architectures to address emerging threats while maintaining backward compatibility with deployed devices – a challenge that grows more complex with each product generation.

MARKET OPPORTUNITIES

AI-Enabled Edge Processing to Create Next-Generation Value Propositions

The convergence of cellular connectivity with artificial intelligence presents transformative opportunities for IoT module chipsets. Emerging architectures that combine cellular modems with neural processing units (NPUs) enable sophisticated edge analytics, reducing cloud dependency while improving response times. The edge AI chipset market is projected to grow at a CAGR of 18.8% through 2030, with cellular-equipped devices gaining particular traction in applications like predictive maintenance and autonomous surveillance systems.

Satellite IoT Convergence to Expand Addressable Markets

The integration of satellite connectivity with cellular IoT chipsets is opening new possibilities for global asset tracking and remote monitoring. Major chipset vendors are developing hybrid cellular-satellite solutions that automatically switch between terrestrial and non-terrestrial networks, ensuring connectivity in areas without cellular coverage. This technology holds particular promise for maritime logistics, agriculture, and energy infrastructure monitoring in underserved regions, potentially adding millions of new connections to the cellular IoT ecosystem.

CELLULAR IOT MODULE CHIPSET MARKET TRENDS

5G Adoption Accelerates Growth in Cellular IoT Module Chipsets

The rapid deployment of 5G networks worldwide is fundamentally transforming the Cellular IoT Module Chipset market, with the 5G segment projected to grow at a CAGR of over 28% from 2024 to 2032. Unlike previous generations, 5G-NR technology enables ultra-low latency (under 10ms) and high bandwidth (up to 10Gbps), making it ideal for mission-critical applications like autonomous vehicles and industrial automation. Recent advancements in 5G RedCap (Reduced Capability) chipsets are bridging the gap between high-performance and cost-sensitive IoT applications, with power consumption reductions of up to 60% compared to standard 5G modules. Furthermore, the integration of AI-powered edge computing capabilities directly into cellular modules is enabling real-time data processing at the device level, significantly reducing cloud dependency.

Other Trends

LPWAN Convergence Driving Hybrid Solutions

While traditional cellular technologies dominate, the market is witnessing a surge in LPWAN-cellular hybrid chipsets that combine NB-IoT/LTE-M with LoRaWAN or Sigfox support. This convergence addresses the growing need for flexible connectivity in smart cities and industrial IoT, where deployment scenarios might demand both wide-area coverage and deep indoor penetration. Industry data indicates that hybrid modules now represent over 35% of new industrial IoT deployments, particularly in asset tracking and smart utility applications. The emergence of 3GPP Release 18 features is further optimizing power management in these solutions, extending battery life for remote devices to 10+ years in some configurations.

Vertical-Specific Customization Reshapes Product Offerings

Chipset manufacturers are increasingly developing application-specific optimized solutions, moving beyond one-size-fits-all approaches. For automotive applications, chipsets now integrate vehicle-to-everything (V2X) communication alongside traditional cellular connectivity, with processing capabilities enhanced for ADAS data throughput. In healthcare, modules are being designed with built-in HIPAA-compliant security chips and ultra-low power modes for wearable devices. The industrial sector is driving demand for ruggedized chipsets capable of operating in extreme temperatures (from -40°C to 85°C) with enhanced EMI shielding. This specialization trend has led to over 200 new SKUs being introduced by major vendors in the past 18 months alone, creating a more fragmented but application-optimized market landscape.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Chipset Manufacturers Drive Innovation in Cellular IoT

The global Cellular IoT Module Chipset market features a highly competitive landscape dominated by semiconductor giants and specialized IoT solution providers. Qualcomm Technologies Inc. leads the market with its comprehensive 4G and 5G solutions, capturing approximately 35% market share in 2024. The company’s strength lies in its Snapdragon X55 and X65 modems that power IoT applications across industrial, automotive, and smart city deployments.

While Qualcomm maintains leadership, MediaTek and UNISOC have been gaining significant traction in the mid-range IoT segment. MediaTek’s Helio series chipsets, known for their power efficiency, secured about 18% market share last year. Meanwhile, UNISOC’s focus on cost-effective LTE Cat-1 solutions has made it the preferred choice for mass-market IoT applications in emerging economies.

Chinese players Hisilicon and ASR Microelectronics have been expanding aggressively, particularly in the Asia-Pacific region. Hisilicon’s Balong series chips helped Huawei capture 12% of the global cellular IoT module market before facing supply chain challenges. ASR has since filled this gap with its competitive LTE solutions, growing at an estimated 25% year-over-year since 2022.

The market also sees strong competition from Intel and newer entrants like Eigencomm, with the latter making waves through its patented antenna technology that improves signal reliability in challenging IoT environments. Meanwhile, Sequans Communications continues to dominate the LTE-M/NB-IoT segment with its Monarch platform, preferred by utilities and smart meter manufacturers.

List of Key Cellular IoT Module Chipset Manufacturers

Qualcomm Technologies Inc. (U.S.)

MediaTek Inc. (Taiwan)

UNISOC (China)

Hisilicon (China)

ASR Microelectronics (China)

Intel Corporation (U.S.)

Eigencomm (U.S.)

Sequans Communications (France)

Segment Analysis:

By Type

5G Chipset Segment Drives Market Growth with Accelerated IoT Connectivity

The market is segmented based on type into:

4G Chipset

5G Chipset

By Application

Industrial Applications Segment Leads Owing to Widespread Adoption in Smart Manufacturing

The market is segmented based on application into:

PC

Router/CPE

POS

Smart Meters

Industrial Application

Other

By Technology

NB-IoT Technology Gains Traction for Low-Power Wide-Area Applications

The market is segmented based on technology into:

NB-IoT

LTE-M

5G RedCap

Others

By End User

Enterprise Sector Dominates with Growing Demand for Connected Solutions

The market is segmented based on end user into:

Enterprise

Consumer

Government

Industrial

Regional Analysis: Cellular IoT Module Chipset Market

North America The North American market is characterized by advanced IoT adoption, driven by strong technological infrastructure and high investments in 5G deployment. The U.S. leads with significant contributions from key players such as Qualcomm and Intel, focusing on scalable and low-power solutions for industrial and smart city applications. Government initiatives, including funding for connected infrastructure, fuel demand for cellular IoT chipsets. However, stringent regulatory frameworks around spectrum allocation and data security pose challenges. The region is shifting toward 5G-ready chipsets, with an estimated 45% of IoT modules expected to support 5G by 2026, particularly for enterprise and automotive applications.

Europe Europe exhibits steady growth, propelled by EU-wide IoT standardization policies and rising demand for energy-efficient connectivity in smart manufacturing and logistics. Germany and France dominate due to strong industrial IoT adoption, with a focus on LPWA technologies (NB-IoT and LTE-M). Regulatory emphasis on data privacy (GDPR compliance) influences chipset design to prioritize security features. The region faces challenges from fragmented telecom regulations and higher costs of deployment. However, increasing partnerships between semiconductor firms and telecom providers (e.g., Vodafone and Ericsson collaborations) are accelerating ecosystem development.

Asia-Pacific APAC is the fastest-growing market, accounting for over 50% of global cellular IoT module shipments, led by China’s aggressive 5G rollout and India’s digital infrastructure projects. China dominates with local giants like Hisilicon and UNISOC supplying cost-optimized chipsets for smart meters and wearables. Japan and South Korea prioritize automotive and robotics applications, leveraging high-speed connectivity. While affordability drives 4G adoption, 5G chipsets are gaining traction in urban hubs. Challenges include supply chain dependencies and intellectual property constraints, but government-backed IoT initiatives (e.g., India’s Smart Cities Mission) sustain long-term potential.

South America The region shows moderate growth, with Brazil and Argentina leading IoT deployments in agriculture and asset tracking. Economic volatility limits large-scale investments, but rising demand for connected logistics and renewable energy monitoring creates niche opportunities. Reliance on imported 4G modules prevails due to cost sensitivity, though local telecom operators are piloting NB-IoT networks to expand coverage. Regulatory hurdles and underdeveloped local semiconductor industries slow progress, but FDI in smart infrastructure projects could unlock future demand.

Middle East & Africa MEA is an emerging market, with the UAE, Saudi Arabia, and South Africa driving adoption in smart utilities and oil & gas. 5G-compatible chipsets are prioritized for smart city initiatives like NEOM in Saudi Arabia. Limited local manufacturing and reliance on imports constrain growth, but partnerships with global vendors (e.g., Qualcomm’s collaborations with Etisalat) aim to strengthen IoT ecosystems. Africa’s growth is uneven, with urban centers adopting IoT for payment systems while rural areas lag due to connectivity gaps. The region’s potential hinges on improving telecom infrastructure and reducing module costs.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Cellular IoT Module Chipset markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global Cellular IoT Module Chipset market was valued at USD 2.8 billion in 2024 and is projected to reach USD 5.9 billion by 2032, growing at a CAGR of 9.7%.

Segmentation Analysis: Detailed breakdown by product type (4G vs 5G chipsets), application (smart meters, industrial IoT, routers/CPE), and end-user industries to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with China accounting for 42% of global demand in 2024.

Competitive Landscape: Profiles of leading market participants including Qualcomm (35% market share), UNISOC, MediaTek, and Hisilicon, covering their product portfolios and strategic initiatives.

Technology Trends: Assessment of LPWA technologies (NB-IoT, LTE-M), 5G RedCap adoption, and AI integration in cellular IoT modules.

Market Drivers & Restraints: Evaluation of factors including smart city deployments, Industry 4.0 adoption, and spectrum availability challenges.

Stakeholder Analysis: Strategic insights for chipset manufacturers, module vendors, and enterprise IoT adopters.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/laser-diode-cover-glass-market-valued.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/q-switches-for-industrial-market-key.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ntc-smd-thermistor-market-emerging_19.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/lightning-rod-for-building-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/cpe-chip-market-analysis-cagr-of-121.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/line-array-detector-market-key-players.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/tape-heaters-market-industry-size-share.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/wavelength-division-multiplexing-module.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/electronic-spacer-market-report.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/5g-iot-chip-market-technology-trends.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/polarization-beam-combiner-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/amorphous-selenium-detector-market-key.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/output-mode-cleaners-market-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/digitally-controlled-attenuators-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/thin-double-sided-fpc-market-key.html

0 notes

Text

0 notes

Text

Europe Wearable Sensor Market Size, Revenue, End Users And Forecast Till 2028

The Europe wearable sensor market is expected to reach US$ 1,109.30 million by 2028 from US$ 411.09 million in 2021. The market is estimated to grow at a CAGR of 15.2% from 2021 to 2028.

Market Overview

Hands-free wearable technology helps deliver real-time information to device users. Mobile device original equipment manufacturers (OEMs) aggressively invest in wearable devices to offset declining margins in their traditional smartphone and tablet markets. As a result, the wearable sector has been flooded with various smart bands, smartwatches, and other wearable devices with machine-to-machine (M2M) offerings capable of collecting, sending, and processing data over mobile applications.Furthermore, the integration of M2M technology with wearable medical devices improves their flexibility and scalability. Due to the various benefits of IoT, AR, and M2M technologies, the demand from various applications such as healthcare and consumer electronics. Also, this increasing demand is projected to lead market players to invest and innovate more products related to these technologies, such as Xiaomi AR smart glasses. Thus, the increasing penetration of AR, IoT, and M2M technologies in smart wearables is creating future trends for the market. The Europe wearable sensor market is expected to grow at a good CAGR during the forecast period.

Grab PDF To Know More @ https://www.businessmarketinsights.com/sample/BMIRE00025224

Europe Wearable Sensor Strategic Insights

Strategic insights for the Europe Wearable Sensor provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

Market leaders and key company profiles

Texas Instruments Incorporated.

NXP Semiconductor.

Analog Devices Inc.

STMicroelectronics.

Infeneon Technology.

Sensirion AG.

Robert Bosch GmbH.

Panasonic Corporatin.

TE Connectivity Corporation.

TDK corporation.

Europe Wearable Sensor Regional Insights

The geographic scope of the Europe Wearable Sensor refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Wearable Sensor Market Segmentation

The Europe wearable sensor market is analyzed on the basis of sensor type, application, vertical, and country. Based on sensor type, the market is segmented into accelerometer, gyroscope, position sensor, motion sensor, image sensor, pressure and force sensor, touch sensor, and others. The accelerometer segment dominated the market in 2020.Based on application, the market is segmented into smart wristwear, smart glass, smart bodywear, and smart footwear. The smart wristwear segment led the market in 2020.Based on vertical, the market is segmented into consumer electronics, healthcare, and industrial and enterprise. The consumer electronics segment dominated the market in 2020.

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defence; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications.

0 notes

Text

RF Power Amplifiers Market Opportunities Driven by Emerging Technologies and Regional Infrastructure Growth

The RF (Radio Frequency) Power Amplifiers Market has witnessed substantial growth in recent years, propelled by the global expansion of wireless communication systems, rising demand for high-speed internet connectivity, and rapid technological advancements in RF components. These amplifiers are critical components in wireless transmitters, converting low-power RF signals into higher-power signals suitable for transmission across longer distances. They are widely used in telecommunications, military, aerospace, consumer electronics, and medical devices.

Market Dynamics

The primary driver of the RF power amplifiers market is the growing demand for smartphones and connected devices. The ongoing rollout of 5G technology has significantly boosted the need for efficient RF power amplifiers capable of supporting high-frequency bands and massive data throughput. Additionally, the rising adoption of Internet of Things (IoT) devices and machine-to-machine (M2M) communications in industrial and residential sectors further amplifies market demand.

Another key factor is the continuous modernization of military communication infrastructure. RF power amplifiers are vital in radar systems, satellite communications, and electronic warfare applications. Governments worldwide are investing in upgrading their defense technologies, which is contributing to the market's upward trajectory.

Moreover, increased demand for energy-efficient and miniaturized electronic components is driving innovations in amplifier designs. Advancements in semiconductor materials such as Gallium Nitride (GaN) and Gallium Arsenide (GaAs) have led to the development of amplifiers with higher efficiency, smaller size, and greater power density.

Segmentation Overview

The RF power amplifiers market can be segmented based on product type, frequency range, application, and region.

By Product Type:

Solid-State Power Amplifiers (SSPA)

Traveling Wave Tube Amplifiers (TWTA)

Linear Amplifiers

Wideband Power Amplifiers

Solid-state amplifiers are dominating the market due to their reliability, compact design, and energy efficiency. TWTAs, however, are preferred for high-power applications like satellite communication and broadcasting.

By Frequency Range:

Less than 10 GHz

10–20 GHz

20–30 GHz

Above 30 GHz

The “Above 30 GHz” segment is expected to grow rapidly, especially with the commercialization of mmWave 5G networks and advanced military radar systems.

By Application:

Consumer Electronics

Telecommunication

Automotive

Aerospace & Defense

Medical

Telecommunication remains the largest application segment, while aerospace & defense is expected to witness the fastest growth due to ongoing investments in security and surveillance technologies.

Regional Insights

North America currently leads the RF power amplifiers market, owing to the strong presence of key players, a well-established telecom infrastructure, and high military expenditure. However, Asia-Pacific is projected to grow at the highest CAGR due to rising smartphone penetration, expanding 5G deployment in countries like China, South Korea, and India, and increasing government investments in digital infrastructure.

Europe also plays a significant role in the market, with ongoing projects in space exploration, defense upgrades, and high-tech R&D activities in countries such as Germany, France, and the UK.

Competitive Landscape

The market is moderately consolidated with major players such as Qorvo Inc., NXP Semiconductors, Broadcom Inc., Skyworks Solutions Inc., and Analog Devices Inc. These companies are focused on strategic partnerships, new product launches, and technological innovation to gain a competitive edge.

Startups and smaller firms are also entering the market with specialized solutions, particularly in high-frequency and miniaturized amplifier technologies. The integration of AI and advanced signal processing into RF systems is becoming a key differentiator among competitors.

Future Outlook

Looking ahead, the RF power amplifiers market is expected to continue its growth trajectory with expanding applications in 5G, satellite communications, autonomous vehicles, and smart infrastructure. The evolution toward 6G and the convergence of communication and computation at the edge will further fuel demand for advanced RF solutions.

However, challenges such as design complexity at high frequencies, thermal management issues, and regulatory compliance may hinder growth. Manufacturers must focus on innovation and reliability to meet the increasing expectations of modern communication systems.

0 notes

Text

0 notes

Text

Smart Manufacturing in India

There has been a rapid Advancement of technology in various fields, especially manufacturing, over the last few years. Technology-led changes are actually driving the next industrial revolution. Across the globe, factories are getting smarter with connected products and their systems operating as part of a larger, more responsive, and agile information infrastructure. The main aim is to take advantage and improvements in efficiency and profitability, increased innovation, and better management of safety, performance, and environmental impact.

The question is whether Indian infrastructure is ready for this and whether it is equipped with the knowledge and skills required to adapt to these evolving advanced technology concepts

Only 28% of the Indian manufacturing industry has an implemented smart factory and across geographies, it is 43%. The wave of a smart factory started with the adoption of Industry 4.0, and since then it has been essential for the survival of the manufacturing industry. The Government’s Make in India initiative will be a key enabler of connected factories in the country is believed by Probodh Chiplunkar.

The concept of connected factories has given rise to the altering landscape, where sensor-enabled machines effectively communicate with other machines, devices, and people, gathering the pool of data that can be used to make informed decisions. Industry 4.0 is a collection of 10 different technologies like

The Cloud

Big data and analytics

The industrial Internet of Things (IoT)

Co-bots

Sensors

Simulation

Horizontal and vertical system integration

Cyber-security

Augmented Reality

Virtual Reality

Industry 4.0, has procreated yet another formidable manufacturing force: machine-as-a-service (MaaS). Machine learning as a service market is expected to exceed more than $3,754 million by 2022. Whereas 3.3 billion M2M (Machine-to-machine) global connections are expected by 2021.

The future ofDigital Manufacturingwill bring all the operational efficiencies aspects of the manufacturing industry together – be it traditional industries (automotive, coal, electrical, etc.) or high-end industries (miniaturization, printed electronics, etc.). The Boston Consulting Group (BCG) research says that the tasks performed by robots across all manufacturing industries will increase to about 25% by 2025, from the current global average i.e. around 10%. More adoption of robotics will boost productivity by up to 30% which in return generates a performance improvement of 5% year-on-year and eventually brings down the average manufacturing labor costs also.

Yet manufacturers are working towards becoming digital enterprises to drive growth, profitability, innovation, and customer engagement.

Challenges Faced by Indian Manufacturing Industries

Integration

The Indian manufacturing industry is fast in grasping technology; it needs to confront the impediments that can impact the adoption of connected factories. It becomes difficult for the companies to have less human supervision and this acts as a barrier.

Connectivity

Pushing wireless connectivity can represent a change in the network infrastructure design. To bridge the gap of connectivity an integrated tool can be used to keep track of inbound and outbound shipments for location-related information, timely order fulfillment, and critical in-transit parameters such as temperature for example.

Financing

A key enabler of connected factories in India is the Government’s Make in India initiative, which aims to develop the country as the factory of the world and create highly skilled jobs in the sector. The governing committees and leadership people should have a firm-defined decision-making process.

Security

The most crucial is security, which companies can���t afford to ignore. The systems have to be strongly secure the data and communication as well as protect the intellectual property. Data security has been a concern due to the increase in integrating new systems and creating more access to those systems.

Skills

It is required to up-skill and re-skill workers while also giving them the required time to get accustomed to the new technology.

The main benefits of smart manufacturing in India are

Lower costs and enhanced revenue generation

Asset efficiency

Improvements in safety and sustainability

Mass Customization and reduced energy consumption

Knowledge transfer

Better analysis of inputs

Optimization of production flows

More efficient collection of production data

Improved usage of production resources, including raw materials and energy

Limit wastage

In the process of creating more agile and market-focused competencies, smart manufacturing is all about driving digital value chains. The Connected factories are going to be crucial for the ability to integrate global production and supply chains to enable the flow of information in real time and create opportunities to develop analytics frameworks for driving efficiency.

Investments in R&D and a skilled workforce along with a robust human-machine interface would be the key differentiators for manufacturers to commence on connected factories. A real breakthrough in smart manufacturing will come when the SMEs in India start partnering with IoT platform start-ups that enable higher efficiency.

The early adopters of smart manufacturing will have the early-mover advantage, while those who fear taking the risk will become irrelevant and be left behind.

For more details visit us : Exito

0 notes

Text

From Data to Strategy: Mapping the 5G Technology Market Potential

Introduction

The 5G revolution is no longer on the horizon — it’s here, and it’s reshaping industries, economies, and daily life across the globe. As the successor to 4G LTE, 5G (Fifth-Generation) wireless technology promises dramatically improved data speeds, ultra-low latency, massive device connectivity, and unparalleled network reliability. Beyond faster smartphones, 5G is the cornerstone for enabling advanced technologies like autonomous vehicles, smart factories, telemedicine, augmented reality (AR), and the broader Internet of Things (IoT) ecosystem.

The global 5G technology market has entered an accelerated growth phase, driven by soaring demand for high-speed data connectivity and the growing adoption of cloud-based applications and AI-powered services. From telecom providers and network hardware manufacturers to cloud service vendors and chipmakers, the 5G era is shaping new business models and competitive landscapes.

Market Overview

The 5G market encompasses a broad range of products and services — including network infrastructure (base stations, small cells, antennas), mobile devices (smartphones, tablets, routers), software (network slicing, SDN), and service providers offering 5G network access.

As of 2024, commercial 5G networks have been deployed across 80+ countries, with billions of connected devices expected to rely on 5G by 2032. The technology is being integrated into industries beyond telecom, including healthcare, automotive, smart cities, manufacturing, and media.

Download a Free Sample Report:-https://tinyurl.com/y6vrtts4

Key Market Drivers

Exploding Data Consumption

The proliferation of video streaming, cloud gaming, real-time collaboration tools, and immersive media has overwhelmed 4G LTE networks. 5G’s ability to deliver multi-gigabit per second speeds addresses this gap, making it indispensable for modern digital consumption.

Growth in IoT Devices

From smart homes and wearable health monitors to industrial automation, the number of IoT devices worldwide is projected to surpass 30 billion by 2032. 5G networks are uniquely designed to handle this surge, enabling seamless connectivity across millions of devices per square kilometer.

Industry 4.0 and Automation

In manufacturing and logistics, 5G enables real-time machine-to-machine (M2M) communication, predictive maintenance, remote operations, and digital twins — cornerstones of Industry 4.0. Private 5G networks are increasingly being adopted for operational control in factories, warehouses, and even oil rigs.

Support for Emerging Technologies

Augmented Reality (AR), Virtual Reality (VR), autonomous vehicles, and advanced telemedicine require low latency (often below 1 millisecond) and high bandwidth, both of which 5G provides. The growth of these cutting-edge technologies is tightly linked to the global rollout of 5G.

Market Challenges

While 5G adoption is accelerating, the market faces several challenges:

High Infrastructure Costs

Deploying 5G requires a dense network of small cells, fiber optic backhaul, and advanced antennas, representing substantial capital expenditure for telecom providers. The business case for 5G is still under pressure in low-ARPU (Average Revenue Per User) regions.

Spectrum Availability and Regulation

5G performance depends heavily on spectrum allocation — particularly in the millimeter-wave (mmWave) and mid-band frequencies. Regulatory delays in spectrum auctions and inconsistent allocation policies across countries can slow down market growth.

Security Concerns

The complex, software-defined nature of 5G networks introduces new vulnerabilities. Network slicing, virtualization, and multi-vendor environments create a broader attack surface, making cybersecurity a critical priority.

Industry Trends

Rise of Private 5G Networks

Large enterprises, particularly in the manufacturing, logistics, and healthcare sectors, are deploying private 5G networks to ensure high security, dedicated performance, and total control over network architecture. This trend is expected to become mainstream by 2027.

Network Slicing

5G enables network slicing — the ability to partition a single physical network into multiple virtual networks optimized for different use cases (e.g., autonomous vehicles, telehealth, streaming). This dynamic allocation of network resources will play a significant role in service delivery over the next decade.

Open RAN (Radio Access Network)

Traditional telecom networks have long been locked into proprietary hardware ecosystems. Open RAN is reshaping the 5G landscape by promoting hardware-agnostic, interoperable solutions that reduce costs and foster vendor diversity.

Edge Computing Integration

As 5G’s low-latency potential becomes fully realized, edge computing is evolving in parallel. By moving data processing closer to the user or device, edge computing enhances response times and reduces data load on core networks — a critical enabler for autonomous systems and immersive applications.

Regional Insights

North America

The U.S. and Canada are global leaders in 5G commercialization, backed by heavy investments from operators like Verizon, AT&T, T-Mobile, and Rogers. 5G is driving adoption in connected cars, remote surgeries, smart cities, and military communications.

Europe

European Union countries are focusing on pan-European 5G corridors for cross-border autonomous vehicle operations and industrial IoT applications. Operators like Vodafone, Deutsche Telekom, and Orange are at the forefront of 5G rollout, supported by government-backed initiatives.

Asia-Pacific

China, South Korea, and Japan are trailblazers in the 5G race. China, with over 3 million base stations as of 2024, leads in scale, while South Korea boasts some of the world’s fastest average 5G speeds. The Asia-Pacific region is also witnessing strong 5G growth in India, Singapore, and Australia.

Competitive Landscape

The 5G market is intensely competitive, involving global telecom giants, semiconductor companies, network equipment vendors, and cloud providers.

Key players include:

Telecom Operators: Verizon, AT&T, China Mobile, Vodafone, SK Telecom

Equipment Providers: Huawei, Ericsson, Nokia, Samsung Networks

Chip Manufacturers: Qualcomm, Intel, MediaTek

Cloud Providers: Amazon Web Services (AWS), Microsoft Azure, Google Cloud

Strategic partnerships, spectrum acquisitions, and R&D investments are driving differentiation in an increasingly commoditized market.

Market Forecast to 2032

According to industry forecasts, the global 5G technology market is expected to grow at a compound annual growth rate (CAGR) of approximately 28% from 2024 to 2032, reaching a market valuation of over USD 1.8 trillion by the end of the forecast period.

Key growth segments include:

Consumer Applications: Smartphones, smart homes, immersive media

Enterprise Applications: Private 5G networks, industrial IoT, remote collaboration

Public Infrastructure: Smart cities, autonomous transportation, telehealth

With each successive year, network capabilities, device compatibility, and use-case diversity will expand, unlocking new economic opportunities and technological breakthroughs.

Conclusion

5G technology represents a seismic shift in how the world connects, communicates, and computes. Far more than a simple speed upgrade, 5G enables a new digital ecosystem — one that fuels real-time, intelligent, and immersive experiences across every sector.

As the global rollout continues, industries will need to address challenges related to infrastructure, regulation, and security. However, the long-term impact of 5G is clear: it will be a foundation for future innovations ranging from self-driving cars and AI-powered robotics to remote surgery and fully connected smart cities.

Stakeholders that invest early in 5G ecosystem development — from chip design and network planning to application-layer solutions — will be best positioned to lead in the data-driven economy of 2032 and beyond.

Read Full Report:-https://www.uniprismmarketresearch.com/verticals/information-communication-technology/5g-technology

0 notes

Text

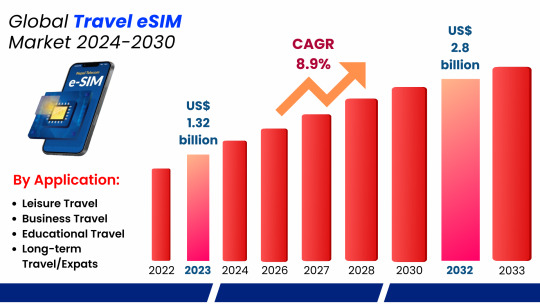

Travel eSIM Market Global Outlook and Forecast 2024-2030

Travel eSIM Market Size, Share 2025

Industry Overview:

A travel eSIM is an electronic SIM card designed for use during international travel. It allows you to connect to local mobile networks without the need for a physical SIM card.

The global Travel eSIM market has shown significant growth over the past few years, with the market valued at approximately US$ 1.32 billion in 2024. This growth is set to continue, with projections indicating that the market will reach a value of US$ 2.8 billion by 2032, reflecting a Compound Annual Growth Rate (CAGR) of 8.9% from 2024 to 2032. The expanding market is driven by several factors, including the rising demand for seamless connectivity, increasing adoption of IoT devices, and the growing number of eSIM-enabled devices.

The eSIM (Embedded Subscriber Identity Module) market is revolutionising mobile connectivity by substituting a more adaptable and digital SIM card for conventional physical SIM cards. This technology is especially helpful for travellers, IoT devices, and organisations that need multi-network connectivity because it enables users to swap carriers remotely without having to change SIM cards. The business is anticipated to grow quickly as eSIM adoption rises, propelled by smartphone manufacturers, IoT applications, and linked autos. Telecom companies, device producers, and software vendors are important participants in ensuring a safe and smooth digital experience. Although there are still issues with international standardisation and compatibility, the eSIM business has a lot of room to development.

Industry Analysis by Segments

Consumer eSim to hold the highest market share: by type

In terms of type the global travel eSim industry has been segmented as Consumer eSim and Machine to Machine eSim.

The consumer eSIM category holds a dominant market share of 60-65% due to its incorporation into popular consumer devices such as wearables, tablets, and smartphones. The integration of eSIM technology into flagship products by major tech companies including as Apple, Samsung, and Google has greatly increased customer adoption.

The flexibility and ease of use that eSIMs provide have contributed significantly to this expansion. For those who travel frequently or require access to different networks, eSIMs are perfect as they enable carrier switching without the need to physically replace the card, in contrast to standard SIM cards. Users no longer need to visit a physical store to complete the activation process because they can connect to a network digitally instantaneously. To further improve the user experience, eSIMs also support dual-SIM capabilities, which enables users to manage their personal and work numbers on the same device. Demand is anticipated to be driven by the increasing number of eSIM-compatible handsets on the market as well as rising consumer knowledge of its benefits. The use of eSIM technology will probably pick up speed as 5G networks spread and consumers demand more dependable, quicker connectivity, thereby consolidating its dominance in the consumer electronics industry.

Further, the Machine-to-Machine (M2M) eSIMs hold a 35-40% share of the market. These eSIMs are critical in the growing IoT sector, where they enable devices to communicate with each other without human intervention. Their use is expanding in industries such as automotive, logistics, and smart cities.

Smart phone to hold the highest market share: by Application

With 50–55% of the market share, smartphones are the most popular application category in the eSIM industry. The increasing number of smartphones with eSIM support as a result of big manufacturers like Apple, Google, and Samsung including the technology into their most recent models is what is driving this domination. The ease that eSIMs provide—especially for travelers—is a major factor propelling this market's expansion. Since eSIMs eliminate the need to swap out traditional SIM cards, they are the perfect option for frequent travellers who need to access various networks in different areas. Customers find it more appealing when they can handle various profiles or providers on a single device rather than having to carry around multiple SIM cards.

Regional Analysis:

In terms of region the global travel eSim has been segmented as North America, Europe, Asia Pacific, Middle East and Africa and South America.

Leading the global Travel eSIM market, Europe holds a 35-40% market share. The region's advanced mobile infrastructure, high adoption of eSIM-enabled devices, and favourable regulatory environment contribute to its dominance. The travel eSIM market in Europe is quickly becoming one of the most competitive and dynamic areas in the world. Europe is a centre for the adoption of cutting-edge digital solutions like eSIMs because of its high volume of international travel, advancements in technology, and supportive regulatory environments. More and more European travellers are searching for flexible, affordable mobile connectivity options that let them stay connected without having to deal with the inconveniences of traditional SIM cards or exorbitant roaming fees. The growing consumer demand for digital-first solutions and the wide availability of eSIM-compatible products, such as wearables and smartphones, are further factors driving the need for the eSIM era.

The increasing international travel across Europe further accelerating the travel eSim market in the region, In comparison with the previous year, there were more foreign visitors arriving in Europe in 2024. In 2024, the number of inbound arrivals was approximately 708 million, which was less than in 2019. This was despite a notable annual growth.

The European Travel Commission (ETC) has published its most recent "European Tourism Trends & Prospects," which states that as of 2024, the sector is stronger than ever. Overnight stays have climbed by 7%, while the number of foreign visitors has increased by 6% from 2019.

End Use Industry Impact Analysis:

The rapid expansion of the global tour eSIM market is being driven by the rise in global tour, the development of the mobile technology, and the increasing demand for digital solutions that provide seamless connectivity.

A primary factor propelling the growth of the Asia tour eSIM market is the substantial growth of both international and intraregional travels. It is anticipated that the number of international visitor arrivals (IVAs) to Asia Pacific will rise from 619 million in 2024 to 762 million in 2026, representing a recovery rate of 111.6% in comparison to the level of 2019. By 2026, visitor arrivals in Asia are expected to reach 564.0 million, followed by those in the Americas (167.7 million) and the Pacific (30.4 million).

Saudi Arabia alone welcomed over 100 million tourists, marking a 56% increase from 2019 and a 12% rise from 2022. Furthermore more the World Travel & Tourism Council (WTTC) reported that in 2024, tourism contributed AED 220 billion to the UAE’s GDP, a figure expected to increase to AED 236 billion in 2024

According to the World Travel & Tourism Council’s (WTTC) latest Economic Impact Report (EIR), reveals the North America Travel & Tourism sector is projected to grow at an average annual rate of 3.9% over the next decade, outstripping the 2% growth rate for the regional economy and reaching an impressive $3.1 trillion in 2032.

According to the international Trade Association, International travel plays a critical role in the US economy. Prior to the COVID-19 pandemic, in 2019, international visitors spent $233.5 billion experiencing the United States; injecting nearly $640 million a day into the U.S. economy

Competitive Analysis:

Some of the key Players operating within the industry includes:

Airalo

Holafly

MAYAMOBILE

BNESIM

Dent Wirelss

Keepgo

Nomad

Sim Options

Surfroam

Airhub

TravelSim

ETravelSIM

Ubigi

Numero eSIM

Total Market By Segment:

By Type:

Consumer eSIM

M2M eSIM (Machine to Machine)

By Application:

Leisure Travel

Business Travel

Educational Travel

Short-term/Temporary Stay

Long-term Travel/Expats

By Connectivity Type:

Standalone eSIM

eSIM with Roaming

Regional eSIM

Global eSIM

By End User:

Individuals

Enterprises

Telecom Operators

Travel Agencies

By Service Offerings

Data Services

Voice Services

SMS Services

Region Covered:

North America

EuropeAsia Pacific

Middle East and Africa

South Africa

Report Coverage:

Industry Trends

SWOT Analysis

PESTEL Analysis

Porter’s Five Forces Analysis

Market Competition by Manufacturers

Production by Region

Consumption by Region

Key Companies Profiled

Marketing Channel, Distributors and Customers

Market Dynamics

Production and Supply Forecast

Consumption and Demand Forecast

Research Findings and Conclusion

Combined Plans:

There are several distinct players in the highly competitive travel eSIM market, including tech companies, eSIM providers, and mobile network carriers. Important rivals are well-known telecom giants, which use their extensive international networks and strong brand names to sell travel eSIM plans directly to customers. Specialised eSIM providers like Airalo, GigSky, and Ubigi, on the other hand, are becoming more and more popular by providing flexible data packages and multi-country plans as well as affordable, customised travel eSIM solutions that are specifically designed for travellers from outside.

Tech companies like Apple and Google also influence the competitive landscape by integrating eSIM technology into their smartphones, enabling direct access to eSIM services through their app ecosystems. This has created opportunities for third-party eSIM service providers to partner with these tech firms, enhancing their global reach.

Key industry Trends:

Integration with IoT and Connected Device:

The Internet of Things (IoT) and linked devices are integrating eSIM generation, which is greatly expanding its use cases and marketability. As the Internet of Things continues to expand, eSIMs are finding their way into a wider range of electronics than just smartphones, such as wearable’s, connected motors, and smart home appliances. There are various benefits to this integration:

Wearables: Wearables, such as fitness trackers and smart watches, can maintain independent connectivity without relying on a paired phone because of eSIMs. Customers can now benefit from instantaneous message delivery, phone calls, and mobile data access via their wearable device, enhancing functionality and user experience.

Connected Cars: eSIMs in the automotive industry enable smooth connectivity for linked automobiles, providing features like real-time navigation, remote diagnostics, and infotainment services. The incorporation of eSIMs into cars facilitates updates via the air, enhances safety features, and offers improved connectivity for telematics and navigation applications.

Smart Home products: Home automation controllers, security systems, and thermostats are examples of smart home products that are incorporating the eSIM era. Through this connection, devices can communicate with one other and with customers anywhere in the world with consistent and dependable connectivity.

The expansion of eSIM technology into these diverse applications enhances its utility and opens up new market opportunities. For device manufacturers, integrating eSIMs simplifies design and manufacturing processes by eliminating the need for physical SIM card slots, leading to more compact and robust devices. Additionally, eSIMs support global connectivity, allowing devices to operate seamlessly across different regions without the need for multiple SIM cards.

Industry Driving Factor:

Rising Demand for Flexible and Convenient Connectivity Solutions:

Due to the increasing demand for seamless communication and connectivity when on the go, consumers are placing an increasing emphasis on the flexibility and convenience of their connectivity solutions. This trend is particularly noticeable among travellers, who are searching for solutions to make staying connected in unusual locales easier. These demands are met by ESIM technology, which gives traditional SIM cards a more adaptable and user-friendly option. eSIMs, as opposed to physical SIM cards, eliminate the need for physical swaps and let users activate and manage their mobile subscriptions online. With this method, travellers will no longer need to buy and insert several SIM cards or put up with the hassle of switching SIM cards when travelling to different countries. Alternatively, they could easily switch between plans or businesses right from their device, usually through a mobile app. One further factor driving the growing demand for eSIMs is their capacity to support many profiles on a single eSIM. This feature enables users to manage private plans for personal and business use or seamlessly transition between local and international plans. This flexibility now ensures continuous connectivity and helps users avoid paying exorbitant roaming fees in addition to improving comfort. The popularity of eSIM technology is continuing to rise as more customers look for solutions that fit their busy lifestyles and travel habits. This indicates a larger trend towards more flexible, virtual, and hassle-free connectivity options.

Industry Restraining Factor:

Device compatibility is one of the major challenges facing the eSIM business. Although the eSIM technology is increasingly being included into more modern wearable, and smartphones, many older or even less advanced devices do not support eSIM functionality. Due to the fact that a significant section of the customer base still uses devices that require physical SIM cards, this issue limits the market penetration of travel eSIMs. The switch to eSIMs isn't always possible for clients with mismatched equipment, which is likely to cause annoyance and reduce the potential customer base for travel eSIM providers. The challenge of device compatibility is made more difficult by the slow rate of update or modification of older devices. The adoption of eSIM generation may be slow in many places, especially where clients are more price-sensitive or where older devices are still in widespread use. Travel eSIM providers face a challenge as a result of this delayed adoption rate because they must serve a wide range of target customers with different levels of technological proficiency.

Report Scope:

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides break down details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by types, applications, Connectivity type, end use and Service Offerings. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.Report AttributesReport DetailsReport TitleTravel eSIM Market Global Outlook and Forecast 2024-2030Historical Year2018 to 2022 (Data from 2010 can be provided as per availability)Base Year2024Forecast Year2032Number of Pages107 PagesCustomization AvailableYes, the report can be customized as per your need.

1 note

·

View note

Text

Recent Developments in the Global Machine-to-Machine (M2M) Connections Market Ecosystem: Trends and Analysis

The Machine-to-Machine (M2M) connections market is evolving rapidly, driven by advancements in connectivity technologies, increasing adoption of IoT, and the expansion of 5G networks. M2M communication facilitates seamless data exchange between devices, enabling industries to enhance automation, improve efficiency, and optimize decision-making processes. This article explores recent developments…

0 notes

Text

0 notes

Text

Cellular IoT Module Chipset Market: Challenges in Standardization and Implementation, 2025-2032

MARKET INSIGHTS

The global Cellular IoT Module Chipset Market size was valued at US$ 4,670 million in 2024 and is projected to reach US$ 9,780 million by 2032, at a CAGR of 11.12% during the forecast period 2025-2032. The semiconductor industry backdrop shows robust growth, with global semiconductor revenues reaching USD 579 billion in 2022 and expected to expand to USD 790 billion by 2029 at 6% CAGR.

Cellular IoT Module Chipsets are specialized semiconductor components that enable wireless communication for IoT devices across cellular networks (4G LTE, 5G, NB-IoT). These chipsets integrate baseband processing, RF transceivers, power management, and security features into compact modules, facilitating machine-to-machine (M2M) connectivity in applications ranging from smart meters to industrial automation.

The market growth is driven by accelerating 5G deployments, with 5G chipset adoption projected to grow at 28% CAGR through 2030. While 4G LTE dominates current installations (72% market share in 2024), 5G chipsets are gaining traction in high-bandwidth applications. Key players like Qualcomm (holding 32% market share) and UNISOC are driving innovation through partnerships, such as Qualcomm’s recent collaboration with Bosch on industrial IoT modules featuring AI acceleration capabilities.

MARKET DYNAMICS

MARKET DRIVERS

Explosive Growth of IoT Applications to Accelerate Chipset Demand

The cellular IoT module chipset market is experiencing robust growth driven by the rapid expansion of IoT applications across industries. Global IoT connections are projected to surpass 29 billion by 2030, creating unprecedented demand for reliable connectivity solutions. Cellular IoT chipsets serve as the backbone for smart city infrastructure, industrial automation, and connected vehicles, enabling seamless machine-to-machine communication. The transition from legacy 2G/3G networks to advanced 4G LTE and 5G technologies is further fueling adoption, as these provide the necessary bandwidth and low latency for mission-critical applications.

5G Network Rollouts to Transform Industry Connectivity Standards

The global rollout of 5G networks represents a watershed moment for cellular IoT, with commercial 5G connections expected to reach 1.8 billion by 2025. 5G-enabled chipsets offer game-changing capabilities including ultra-reliable low latency communication (URLLC) and massive machine-type communication (mMTC) – essential for industrial IoT and autonomous systems. Major chipset manufacturers are introducing integrated 5G NR solutions that combine modem, RF transceiver, and power management, significantly reducing module footprint and power consumption while improving performance.

Moreover, the emergence of cellular vehicle-to-everything (C-V2X) technology is creating new revenue streams, with automakers increasingly embedding IoT modules for enhanced safety and navigation features. These technological advancements coincide with significant price reductions in 5G chipset manufacturing, making advanced connectivity accessible to mid-range IoT devices.

MARKET RESTRAINTS

Complex Certification Processes to Slow Market Penetration

Despite strong demand, the cellular IoT chipset market faces considerable barriers from stringent certification requirements. Each regional market maintains distinct regulatory frameworks for wireless devices, necessitating costly and time-consuming certification processes that can take 6-12 months per product. The situation is compounded for global IoT deployments requiring certifications across multiple jurisdictions, often representing 15-25% of total product development costs. This regulatory complexity particularly disadvantages smaller manufacturers lacking the resources for multi-market compliance.

Legacy System Integration Challenges to Constrain Adoption Rates

The integration of modern cellular IoT modules with legacy industrial systems presents significant technical hurdles. Many manufacturing facilities operate equipment with lifespans exceeding 20 years, designed before IoT connectivity became standard. Retrofitting these systems requires specialized gateways and protocol converters that add complexity and cost to deployments. Furthermore, the industrial sector’s conservative approach to technology upgrades means adoption cycles remain measured, despite the potential efficiency gains from cellular IoT implementation.

MARKET CHALLENGES

Power Consumption Optimization to Remain Critical Design Hurdle

While cellular connectivity offers superior range and reliability compared to alternatives like LPWAN, power efficiency remains an ongoing challenge for IoT module designers. Many industrial monitoring applications require 10+ year battery life from devices, pushing chipset manufacturers to develop increasingly sophisticated power management architectures. The introduction of advanced power saving modes like PSM and eDRX has helped, but achieving optimal battery life while maintaining responsive connectivity continues to require careful balancing of performance parameters.

Other Challenges

Supply Chain Volatility The semiconductor industry’s cyclical nature creates unpredictable component availability, with lead times for certain RF components occasionally exceeding 40 weeks. This volatility forces module manufacturers to maintain costly inventory buffers or redesign products based on component availability rather than optimal technical specifications.

Security Vulnerabilities As cellular IoT deployments scale, they become increasing targets for sophisticated cyber attacks. Chipset manufacturers must continuously update security architectures to address emerging threats while maintaining backward compatibility with deployed devices – a challenge that grows more complex with each product generation.

MARKET OPPORTUNITIES

AI-Enabled Edge Processing to Create Next-Generation Value Propositions

The convergence of cellular connectivity with artificial intelligence presents transformative opportunities for IoT module chipsets. Emerging architectures that combine cellular modems with neural processing units (NPUs) enable sophisticated edge analytics, reducing cloud dependency while improving response times. The edge AI chipset market is projected to grow at a CAGR of 18.8% through 2030, with cellular-equipped devices gaining particular traction in applications like predictive maintenance and autonomous surveillance systems.

Satellite IoT Convergence to Expand Addressable Markets

The integration of satellite connectivity with cellular IoT chipsets is opening new possibilities for global asset tracking and remote monitoring. Major chipset vendors are developing hybrid cellular-satellite solutions that automatically switch between terrestrial and non-terrestrial networks, ensuring connectivity in areas without cellular coverage. This technology holds particular promise for maritime logistics, agriculture, and energy infrastructure monitoring in underserved regions, potentially adding millions of new connections to the cellular IoT ecosystem.

CELLULAR IOT MODULE CHIPSET MARKET TRENDS

5G Adoption Accelerates Growth in Cellular IoT Module Chipsets

The rapid deployment of 5G networks worldwide is fundamentally transforming the Cellular IoT Module Chipset market, with the 5G segment projected to grow at a CAGR of over 28% from 2024 to 2032. Unlike previous generations, 5G-NR technology enables ultra-low latency (under 10ms) and high bandwidth (up to 10Gbps), making it ideal for mission-critical applications like autonomous vehicles and industrial automation. Recent advancements in 5G RedCap (Reduced Capability) chipsets are bridging the gap between high-performance and cost-sensitive IoT applications, with power consumption reductions of up to 60% compared to standard 5G modules. Furthermore, the integration of AI-powered edge computing capabilities directly into cellular modules is enabling real-time data processing at the device level, significantly reducing cloud dependency.

Other Trends

LPWAN Convergence Driving Hybrid Solutions

While traditional cellular technologies dominate, the market is witnessing a surge in LPWAN-cellular hybrid chipsets that combine NB-IoT/LTE-M with LoRaWAN or Sigfox support. This convergence addresses the growing need for flexible connectivity in smart cities and industrial IoT, where deployment scenarios might demand both wide-area coverage and deep indoor penetration. Industry data indicates that hybrid modules now represent over 35% of new industrial IoT deployments, particularly in asset tracking and smart utility applications. The emergence of 3GPP Release 18 features is further optimizing power management in these solutions, extending battery life for remote devices to 10+ years in some configurations.

Vertical-Specific Customization Reshapes Product Offerings

Chipset manufacturers are increasingly developing application-specific optimized solutions, moving beyond one-size-fits-all approaches. For automotive applications, chipsets now integrate vehicle-to-everything (V2X) communication alongside traditional cellular connectivity, with processing capabilities enhanced for ADAS data throughput. In healthcare, modules are being designed with built-in HIPAA-compliant security chips and ultra-low power modes for wearable devices. The industrial sector is driving demand for ruggedized chipsets capable of operating in extreme temperatures (from -40°C to 85°C) with enhanced EMI shielding. This specialization trend has led to over 200 new SKUs being introduced by major vendors in the past 18 months alone, creating a more fragmented but application-optimized market landscape.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Chipset Manufacturers Drive Innovation in Cellular IoT

The global Cellular IoT Module Chipset market features a highly competitive landscape dominated by semiconductor giants and specialized IoT solution providers. Qualcomm Technologies Inc. leads the market with its comprehensive 4G and 5G solutions, capturing approximately 35% market share in 2024. The company’s strength lies in its Snapdragon X55 and X65 modems that power IoT applications across industrial, automotive, and smart city deployments.

While Qualcomm maintains leadership, MediaTek and UNISOC have been gaining significant traction in the mid-range IoT segment. MediaTek’s Helio series chipsets, known for their power efficiency, secured about 18% market share last year. Meanwhile, UNISOC’s focus on cost-effective LTE Cat-1 solutions has made it the preferred choice for mass-market IoT applications in emerging economies.

Chinese players Hisilicon and ASR Microelectronics have been expanding aggressively, particularly in the Asia-Pacific region. Hisilicon’s Balong series chips helped Huawei capture 12% of the global cellular IoT module market before facing supply chain challenges. ASR has since filled this gap with its competitive LTE solutions, growing at an estimated 25% year-over-year since 2022.

The market also sees strong competition from Intel and newer entrants like Eigencomm, with the latter making waves through its patented antenna technology that improves signal reliability in challenging IoT environments. Meanwhile, Sequans Communications continues to dominate the LTE-M/NB-IoT segment with its Monarch platform, preferred by utilities and smart meter manufacturers.

List of Key Cellular IoT Module Chipset Manufacturers

Qualcomm Technologies Inc. (U.S.)

MediaTek Inc. (Taiwan)

UNISOC (China)

Hisilicon (China)

ASR Microelectronics (China)

Intel Corporation (U.S.)

Eigencomm (U.S.)

Sequans Communications (France)

Segment Analysis:

By Type

5G Chipset Segment Drives Market Growth with Accelerated IoT Connectivity

The market is segmented based on type into:

4G Chipset

5G Chipset

By Application

Industrial Applications Segment Leads Owing to Widespread Adoption in Smart Manufacturing

The market is segmented based on application into:

PC

Router/CPE

POS

Smart Meters

Industrial Application

Other

By Technology

NB-IoT Technology Gains Traction for Low-Power Wide-Area Applications

The market is segmented based on technology into:

NB-IoT

LTE-M

5G RedCap

Others

By End User

Enterprise Sector Dominates with Growing Demand for Connected Solutions

The market is segmented based on end user into:

Enterprise

Consumer

Government

Industrial

Regional Analysis: Cellular IoT Module Chipset Market

North America The North American market is characterized by advanced IoT adoption, driven by strong technological infrastructure and high investments in 5G deployment. The U.S. leads with significant contributions from key players such as Qualcomm and Intel, focusing on scalable and low-power solutions for industrial and smart city applications. Government initiatives, including funding for connected infrastructure, fuel demand for cellular IoT chipsets. However, stringent regulatory frameworks around spectrum allocation and data security pose challenges. The region is shifting toward 5G-ready chipsets, with an estimated 45% of IoT modules expected to support 5G by 2026, particularly for enterprise and automotive applications.

Europe Europe exhibits steady growth, propelled by EU-wide IoT standardization policies and rising demand for energy-efficient connectivity in smart manufacturing and logistics. Germany and France dominate due to strong industrial IoT adoption, with a focus on LPWA technologies (NB-IoT and LTE-M). Regulatory emphasis on data privacy (GDPR compliance) influences chipset design to prioritize security features. The region faces challenges from fragmented telecom regulations and higher costs of deployment. However, increasing partnerships between semiconductor firms and telecom providers (e.g., Vodafone and Ericsson collaborations) are accelerating ecosystem development.

Asia-Pacific APAC is the fastest-growing market, accounting for over 50% of global cellular IoT module shipments, led by China’s aggressive 5G rollout and India’s digital infrastructure projects. China dominates with local giants like Hisilicon and UNISOC supplying cost-optimized chipsets for smart meters and wearables. Japan and South Korea prioritize automotive and robotics applications, leveraging high-speed connectivity. While affordability drives 4G adoption, 5G chipsets are gaining traction in urban hubs. Challenges include supply chain dependencies and intellectual property constraints, but government-backed IoT initiatives (e.g., India’s Smart Cities Mission) sustain long-term potential.

South America The region shows moderate growth, with Brazil and Argentina leading IoT deployments in agriculture and asset tracking. Economic volatility limits large-scale investments, but rising demand for connected logistics and renewable energy monitoring creates niche opportunities. Reliance on imported 4G modules prevails due to cost sensitivity, though local telecom operators are piloting NB-IoT networks to expand coverage. Regulatory hurdles and underdeveloped local semiconductor industries slow progress, but FDI in smart infrastructure projects could unlock future demand.

Middle East & Africa MEA is an emerging market, with the UAE, Saudi Arabia, and South Africa driving adoption in smart utilities and oil & gas. 5G-compatible chipsets are prioritized for smart city initiatives like NEOM in Saudi Arabia. Limited local manufacturing and reliance on imports constrain growth, but partnerships with global vendors (e.g., Qualcomm’s collaborations with Etisalat) aim to strengthen IoT ecosystems. Africa’s growth is uneven, with urban centers adopting IoT for payment systems while rural areas lag due to connectivity gaps. The region’s potential hinges on improving telecom infrastructure and reducing module costs.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Cellular IoT Module Chipset markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global Cellular IoT Module Chipset market was valued at USD 2.8 billion in 2024 and is projected to reach USD 5.9 billion by 2032, growing at a CAGR of 9.7%.

Segmentation Analysis: Detailed breakdown by product type (4G vs 5G chipsets), application (smart meters, industrial IoT, routers/CPE), and end-user industries to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with China accounting for 42% of global demand in 2024.

Competitive Landscape: Profiles of leading market participants including Qualcomm (35% market share), UNISOC, MediaTek, and Hisilicon, covering their product portfolios and strategic initiatives.

Technology Trends: Assessment of LPWA technologies (NB-IoT, LTE-M), 5G RedCap adoption, and AI integration in cellular IoT modules.