#Many payment methods in rupees - UPI

Text

#50#000+ events every month!#Amazing app for players who prefer to play on mobile#Many payment methods in rupees - UPI#PayTm#PhonePe Very good#Visit Now:- https://www.pro-cric.com

3 notes

·

View notes

Text

How to Place a Bet on Mostbet

Mostbet is a leading online betting platform, offering a diverse range of sports betting opportunities, live casino games, and virtual sports. With a user-friendly interface and secure transactions, Mostbet provides an immersive gambling experience. It’s a trusted destination for enthusiasts seeking excitement and variety in their gaming pursuits.

Getting Started

Register on Mostbet

Register on Mostbet by simply clicking the signup button on the top right corner of the screen. Select one click sign up and choose your reason. Read the terms and condition and tick to confirm button to sign up.

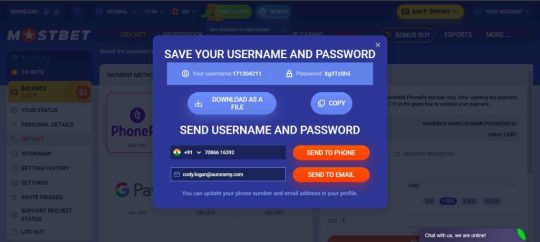

Create Username on Mostbet

Send your username and password by proving the phone number or email id. If you send it to your email, you will receive an email within short period of time. Confirm your email by clicking on the link in your email.

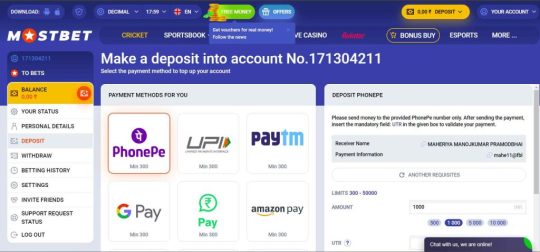

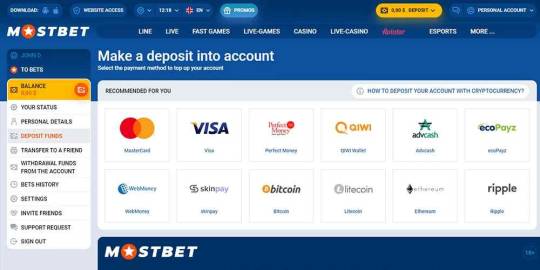

Make a deposit on Mostbet

To make a deposit click on the deposit button on the top right deposit option. There are various option ti deposit amount that you want. The Payment options are Phonepe, UPI, Paytm, Gpay, Amazon pay, IMPS, Payapp, Bhim, Freecharge, Airtel, Mobikwik, BTC, USDT, ETH, Binance, and many more. The amount to deposit starts from a minimum of Rs 300 to a maximum of Rs 50000.

To deposit, send the amount to the provided bank details only. After sending the amount insert the UPI ID and Transaction ID in the given box to validate the payment.

Make a Withdraw on Mostbet

Complete your profile before withdrawing the funds. Here are the steps to withdraw funds from your account:

Click on the “Personal account” button at the top right corner.

Go to the “Withdraw funds from account” section.

Choose the withdrawal method you used for depositing.

Specify the amount you want to withdraw and enter your account number.

Click “Order a withdrawal”.

When withdrawing funds, keep in mind:

The withdrawal time depends on the payment system and usually takes a few minutes, but in rare cases, it can take up to 72 hours.

You can only withdraw funds that were previously deposited and used for betting on “Sports” with odds of at least 1.3. Bets in other categories like “TOTO”, “Casino”, “Live Casino”, and “Virtual Sports” won’t count.

Make sure all required fields in your profile are filled out, and your phone number is linked to your account.

When you withdraw money for the first time or to a new account, you’ll get a text message with a code. You need to enter this code to confirm the withdrawal. The minimum amount you can withdraw in India is 500 INR.

If you want to withdraw to a different account, you need to deposit money into that account first, and then you can withdraw from it.

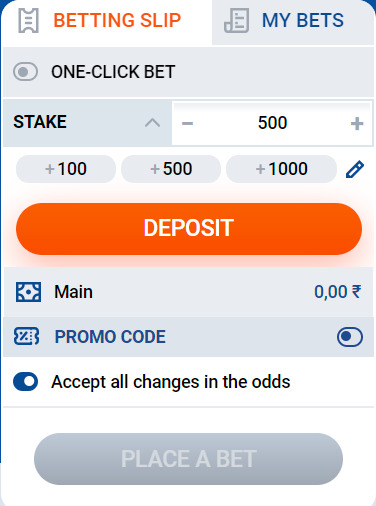

Place a Bet

To place a bet here is the following instructions:-

Choose whether you want to bet before a game (Line) or during a game (Live).

Pick the sport you’re interested in from the list on the left.

Find the country, championship, and match you want to bet on.

Click on the odds for the outcome you predict.

The bet will appear on the right side of the page.

If you want to make multiple bets, add more outcomes to your bet slip.

Enter the amount you want to bet (at least 10 rupees).

Click “Place a Bet” to confirm your bet.

Wait for the confirmation notification to appear.

You can check your current bets in your account under “Bets History.”

Types of Bet on Mostbet

Single Bet: This is a bet on just one event. If you predict the outcome correctly, you win based on the amount you bet multiplied by the odds for that outcome.

Accumulator Bet: This is a bet where you choose multiple outcomes. If all your predictions are correct, you win based on multiplying your bet by the odds for each outcome. But if even one prediction is wrong, you lose the entire bet. You can add as many outcomes as you want, but the maximum odds cannot exceed 2000. If you have more than four outcomes, Mostbet increases the odds by up to 20%.

System Bet: This is like multiple accumulator bets grouped together. The numbers in the system, like 4/5, mean you have five accumulators with four outcomes each, making a total of five outcomes. If one outcome doesn’t happen, you can still win on the other successful bets. You need at least three outcomes for a system bet and can have up to 12.

One-Click Bet

If you like fast betting, Mostbet has something special for you – a one-click bet feature. With this, you can bet with just one click. To use it, click the button next to the name on the betting slip, then enter the amount you want to bet. To place the bet, just click on any odds in the Line, and it will be placed without needing another confirmation. You can only use one-click bet for single bets.

0 notes

Link

Become a part of our community, contribute your knowledge, and unlock your earning potential. Together, let's explore the frontiers of human innovation and share the wonders of the world we live in!See you at Seapia.tech - where knowledge meets opportunity!

0 notes

Text

Hello Friends, Let’s talk about today’s article Rummy Most Apk Download Get Rs.80 Referral Bonus, When you download the app and register using your mobile number, you will receive ₹51 immediately.

you will earn ₹90-₹150 in addition to a 30% commission on their tax amount. Rummy Most Apk Is Now Quit Famous Along With Other Rummy Apps And They Added Many New Games To Play.

Table of Contents

Rummy Most Apk

How To Sign Up for Rummy Most Apk

How To Add Money In Rummy Most Apk

Games Available in Rummy Most App

Refer And Earn in Rummy Most Apk

Rummy Most App VIP Benefits

How To Withdraw in Rummy Most Apk

Conclusion:

Rummy Most Apk

This app has various card games such as Rummy, Red vs Black, Baccarat AB, Tp War, Andar Bahar, and more. You can earn real cash of thousands of rupees very easily by playing all these games in this application.

This Rummy app has a great referral program where you can earn ₹100 per referral so you can invite your friends and earn money. Follow the steps given below to register an account.Rummy Most ApkDownloadRummy Most Sign-up Bonus₹51Rummy Most Refer and Earn₹100 + 30% Commission

How To Sign Up for Rummy Most Apk

Download Rummy Most Apk From Given Link.

Now Install and Open the App.

Click on the Login/Signup button.

Enter your mobile number and password then click on the Signup Button.

How To Add Money In Rummy Most Apk

here you can add Paise to your account even at a minimum of ₹10. And you get the option to add Paise up to a maximum of ₹100000 here.

To add payment, click on the Pay Shop or Add Cash option given at the bottom of the home page.

Choose the amount as much as you want to add.

Click on the option of Add Cash.

Select UPI and click on Next Step.

Now enter your UPI ID and click on Pay Now.

Games Available in Rummy Most App

Dragon vs Tiger

Andar Bahar

Teen Patti

Rummy

Poker

Fruit Classic

Dice Treasure

Roulette

Daruma

Red and Black

Black Jack

Refer And Earn in Rummy Most Apk

Open Rummy Most Apk

Login into the App

Go to Menu > Click on Refer and Earn

Share your Rummy Most Referral Code

Get Free Cash Rewards to Play Rummy Game

Winning Amount Withdrawal into Bank Account & UPI

Rummy Most App VIP Benefits

You can become a VIP user to earn various bonuses and rewards like Weekly Bonus.

Tap the VIP icon.

Tap Buy.

Now deposit ₹500 and more.

Make the payment and you will become a VIP.

You can use the money to play games.

How To Withdraw in Rummy Most Apk

On the Rummy Most App dashboard simply click the Withdraw option

You will see your deposited and withdrawal balance

Tap the Withdrawalable option and add your Bank account details

You can set up any of the following UPI / IMPS / NEFT withdrawal methods

Then click to next and enter the amount you want to withdraw and submit.

DISCLAIMER:- This game involves financial risk. You may get addicted to this game. Therefore, all of you are requested to play this game on your own responsibility and at your own risk. If you are over 18 years old then you don’t play this game then you stay away from this game.

Conclusion:

Rummy Most App Game has the referral code to share with friends so that you can earn money from your referrals. inside which you earn money by playing different types of games

If you’ve any thoughts on the Rummy Most Apk Download, then feel free to drop them in the below comment box. Keep visiting our website: Thepmyojana.com for new updates on Rummy-Games.

I hope you like this post so please share it on your social media handles & Friends. Thanks for reading this article till the end.

1 note

·

View note

Text

Top 5 Cricket Betting Sites in Indian Rupees- Bet in a Convenient Way

If you are an Indian gambler, it’s better to find an online betting site that allows withdrawals and deposits in your local currency. You can deal with Indian National Rupee without paying extra exchange fees. Moreover, such sites understand you better and has all banking options available in India. We have a list of such cricket betting sites that accepts Indian Rupees. So, check the platforms and sign up as per your choice.

How to pick the best INR betting site?

The recommended betting sites accept Indian Rupees and also offers decent welcome bonuses. You can register, deposit and place bets within a few minutes on these gambling platforms. However, it’s crucial to consider some factors before you signup.

Licensing and reliability: Sign up on a trustworthy site with a valid license.

Navigation: Easy to understand interface is helpful for new and experienced wagers alike.

Coverage: Availability of popular sports including cricket, football, kabaddi, horse racing, tennis etc.

Gambling selection: If you love online casinos, then make sure the site has games like Andar bahar, blackjack, 7 up 7 down, bac bo, Satta Matka etc.

Higher odds and a wide range of betting options: Helps you to add thrill and excitement.

Welcome bonus and promotions: Sign up bonus is one of the biggest perks. Check the promotional offers if you are a regular gambler. A loyal player gets more benefits.

Payment aspects: Fast deposits and withdrawals in INR

Mobile betting: Browsing a betting site on your computer is great, but what if you are on the move? So, pick a platform that offers a smartphone application.

Live streaming and betting: Try a betting site that lets you place bets as the game progresses.

Support function: Fast, helpful and professional support ensures you don’t get stuck anywhere.

Top 5 betting sites accepting Indian Rupees

1. Betway

Betway is not only a betting site, it’s a gambling universe. Once you register, there are endless options to try your luck and skillset. Above all, you can place bets using Indian Rupees.

Betway accepts almost all the leading payment methods, including UPI, Skrill, and Neteller. Making the deposit and withdrawing the winning amount is also convenient.

Pros

User-friendly interface, perfect if you are a new gambler

Wide range of sports and casino games

Multiple deposit and withdrawal options, including e-wallets

Higher odds, especially in cricket

Live streaming and betting

Mobile application for iOS and Android

Cons

A limited number of promotional offers

2. Parimatch

Parimatch is active since 1994. So, it’s one of the oldest and most reputable betting sites. The website is user-friendly, and so is the smartphone app.

You can bet with Indian Rupees. Furthermore, Parimatch accepts numerous banking methods for your convenience. You can use UPI and PayTM. Furthermore, the site is available in Hindi and many other local languages.

Pros

Modern, yet easy to understand interface

Cover a wide range of sports

Excellent betting section for cricket, football and e-sports

Endless betting options

Unique betting exchange

Quick deposit and withdrawals

Cons

Slow chat support

3. Bet365

Bet365 is one of the best betting sites that accept Indian Rupees. You might have heard about this betting platform if you love gambling. It’s a vast sportsbook that offers live streaming, live betting, and multiple promotional offers for loyal players. Try this betting brand to enjoy a seamless betting experience using INR.

Pros

Licensed and reputable gambling brand

Huge bookmaker with a lot of sports to bet

Easy to browse website and smartphone app

Live-streaming and betting for added excitement

Competitive cricket odds

Cash-out to get some earnings before the results

Cons

The welcome bonus is not attractive

4. 22 bet

22Bet is a comprehensive betting site with live betting and higher odds. It has a wide range of payment modes, and you can deposit or withdraw in INR. This gambling brand covers all the major sports and has lots of casino games to cater for your betting needs.

22Bet has multiple promotional offers for loyal wagers. Plus, its Jackpot section is fantastic. You can win big here. Apart from that, this betting site has a user-friendly smartphone app.

Pros

Licensed and regulated bookmaker

The best site for football and cricket betting

Wide range of deposit and withdrawal modes

Fast and convenient payments

Easy to understand mobile application

Incredible live chat support

Cons

Lack of promotional offers

An outdated interface of the website

5. 10Cric

Indian wagers are the priority for 10Cric. It’s one of the reasons why this betting site is focused on cricket and has a user-friendly interface. This bookmaker also features live betting and live casinos for an added thrill. Try it if you want to bet using Indian Rupees, and you will not feel disappointed.

Pros

Dedicated to Indian gamblers

Exciting live betting

Higher odds, which means more winning amount

Fast withdrawals

Excellent smartphone app

Cons

Betting on horse racing is not available

FAQs

Is INR betting sites legal in India?

None of the laws in India is against online betting. The states can decide whether to allow betting via the internet or prohibit it. So, online gambling is only banned in Andhra Pradesh and Telangana. The rest of the regions lets you use online platforms to make extra money.

Is it safe to deposit money on betting sites in India?

Yes, you can safely deposit money on a licensed and reputable betting site. These platforms have numerous banking methods like UPI, e-wallets, net banking and cards. Whenever you try to deposit, the gambling site shows a payment gateway page, which is secure. So, none of your details or banking credentials will be compromised until and unless you are on a regulated platform.

How much time does it take to reflect withdrawal in my account?

The time to receive a winning prize in your account varies as per the betting platform and transaction method. For instance, you can get the amount within 24 hours using an e-wallet like Skrill, Neteller or PayTM. But, cards might take up to 5 days to complete the withdrawal process. Also, you need to scan and upload KYC documents like Aadhaar card, passport, voter ID card or pan card to be eligible to withdraw any amount from the gambling site.

What are the advantages of betting in INR?

You enjoy multiple benefits by signing up on a betting site that accepts Indian National Rupee.

Zero conversion charges: Betting on bookmakers that do not accept INR results in conversion fees. But, there are no such troubles when you are betting via Indian Rupees.

No calculations involved: No need to check the conversion rates if you are betting with INR. Enter the amount as per your budget and start betting.

Dedication for Indian gamblers: Most sites accepting INR are focused on the Indian market. So, you get all the popular sports in India. Plus, some of the platforms also offer support in Hindi.

Payment options: Sites accepting INR also offers local banking methods, like UPI and e-wallets like PayTM, PhonePe, and MobiKwik.

Final words

If you reside in India and love gambling, there is nothing better than a betting site that accepts INR. You don’t need to pay conversion fees and waste time in mathematics if bookies allow transactions in Indian Rupees. So, check our recommendations, pick a site according to your comfort and try your luck.

#Cricket Betting Apps#Best Online Betting Apps in India#Best Cricket Betting Apps in India#Best Real Money Indian Cricket Betting Apps#Best cricket betting app#Top 5 Best Cricket Betting Apps in India#Top 5 Cricket Betting Sites in India

1 note

·

View note

Photo

Easy Ways to Send Money from one bank to another in India.

Nowadays, one can choose from the plethora of fund transfer options. From the traditional way of fund transfer to online bank transfer, you can pick the best way to save your time and hassle. If you are wondering about easy ways to send money from one bank to another in India then, you don’t have to worry. You need to do some research before going for any option to save yourself from any deduction. Check out how to transfer money online from one bank account to another.

Online Payment Method

RTGS (Real-Time Gross Settlement)

The instantaneous fund transfer system continuously settles payment on an individual order basis once the transaction is done, it can’t be reversed. It’s a great way to do bank to bank transfer. The purpose of RTGS is to be used for high-value interbank transactions as there is less risk in settlements. Reserve Bank of India manages the payment system so, you can count on it for sending & receiving funds. All RTGS charges may incur higher costs to customers, while fund transfer ranges anywhere between Rs.25 to Rs.55. For the digital transactions, the maximum amount of limit per day is as per the customer’s TPT limit for the HDFC account holder.

Information required for an RTGS transaction:

The amount to be transferred in rupees

Name of the payee/beneficiary

Name of beneficiary bank and bank branch

IFSC code of the payee/beneficiary

Account number of the payee/beneficiary

NEFT (National Electronic Fund Transfer)

The online bank to bank transfer fund system that allows interbank fund transfer. It is one of the popular ways of transferring money from bank to bank digitally. You can transfer funds from your bank branch to anyone, without visiting the bank. Earlier to transfer the funds, one had to withdraw the amount and then pay it in cash or cheque. Now, one can transfer a sum of money from his account to another person’s account, through the process of NEFT.

NEFT offers the ease of funds transfer from any NEFT- enabled bank account of any branch to any NEFT- enabled account located in any geographical area.

Transaction timing will be 48 half-hourly batches every day. The first batch settlement will start after 30 minutes. The operation will be permitted round the clock and all day of the year, including holidays. No upper and lower limit is set for amount transfer via NEFT.

The charges for transfer money from bank to bank range from Rs. 2.50 to Rs. 25 on the amount range from Rs. 10,000 to the amount more than Rs. 2 Lakh.

IMPS (Immediate Payment Service)

Apart from RTGS and NEFT, you can choose another way for fund transfer that is IMPS. It provides instant round the clock digital fund transfer services that you can use on your smartphones.

E-wallets

Similar to Credit cards and debit cards, E-wallets are a type of electronic card. It is used for online transactions and treated as the prepaid account in which you can store funds that you can use in the future for any instant payment like for booking train tickets, flight tickets, groceries, online purchases, etc. First, you need to install the app on your mobile and give the relevant data after that, the data will be stored in the database so, you don’t need to fill the form after any purchase. It is also used for cryptocurrencies like bitcoins.

UPI

UPI has made online payment much easier and faster, you can transfer money through your mobile phones and make instant bank to bank transfers, payments, or any purchase. This method of payment is developed by the NPCI (National payments corporation in India) and regulated by RBI( Reserve bank of India). You can add multiple bank accounts into a single app. Some of the popular UPI mobile applications are Airtel, Amazon Pay, Google pay, BHIM, Jiopay, Phonepe, Paytm, WhatsApp pay, and much more. UPI method solved many issues like earlier we use to rush to ATM for payments, sharing bills among friends, utility bill payments, collection, and distribution of money. The best thing about UPI is round a clock availability. The maximum fund Transfer Value is up to 1 lakhs.

Banking Apps

With the advancement of technology, financial transactions have become easier, and visiting banks become a rarity. You can make payments through your smartphones round the clock. There are several banking apps but some are the best apps that you should use for making payments. ICICI Bank’s iMobile Application is the highest-rated banking app on the Google play store. It permits its user’s easy fund transfer solution, convenience in payment of the utility and credit card bills, open FD RD anytime & manage your other policies. Also, the app is updating itself continuously to enhance the user experience. With 4.3 ratings on the Google play store, HDFC Bank Mobile Application is one of the best apps for online transactions in India. Other popular apps like Axis Mobile Application, SBI anywhere personal app, M- connect app by Bank of Baroda is designed for the faster and quicker transaction through your mobile phones.

2.Telephone Transfer

In this payment method, all you need to do is call the telephone number of your bank. You will be guided by some bank’s customer services representative or through an automated recording.

3.In-branch Bank Transfer

If you carry the money in cash, you can go to the bank and pay it into the account of the person directly.

Details required for transfer money from bank to bank Date of payment

Person’s name or business you’re paying. IFSC Number of the branch

Account Number

A payment references

Sender’s name and bank address

Conclusion:

The answer to how to transfer money online from one bank account to another is simple as due to the advancement of technology, many ways of an online bank transfer are being introduced by Government. By these payment methods, we don’t have to follow the traditional way of paying bills and transferring funds. The regular visits to banks and standing in a long queue are also minimizing. With online banking, we can make payments quickly, safely, and conveniently.

0 notes

Text

Rules To Ensure Safe Online Payments

With the new spawning of the digital world, online payments’ evolution is a vast way of its depth. More and more Indian buyers and customers shift from a traditional way of payment to credit or debit card payments to payment apps that flinger clearance of amounts with just a click away. Thus there are a huge number of reasons to crave a vigilant path while making online payments. Following a path of high credibility and trust is necessary to make strong security. So following rules to ensure safe online payments are very crucial.

Why Go For Rules To Ensure Safe Online Payments?

There is no lack of traumatizing evidence these days, proving the growing risks in online thefts. Sometimes it also ensures cash backs, which further encourages more of its usage. Be it dangling in a long line for electricity payments or mere ice-cream stalls. Online payments are the call for demand these days. With increasing demand, crimes are throbbing as well. To ensure a safe online payment platform, few golden rules are the requisite need of the hour.

Although technology is developing, just like the two sides of a coin, there are pros and cons to every aspect. Customers surrender their secretive bank account details for an easier approach. It further prompts a serious threat to security. Taking into consideration the safety of online transactions, the article is based.

Some people are easily tempted by many spam emails, messages of winning the lottery to earn quick. They even send them their account details very easily. This is one of the major causes of cyber theft and so much more. For online payments, as we have to provide our personal financial information, there are highly vulnerable chances of identity theft, security threat, financial loss, and mental trauma.

Advancement in technology is exhibited in two ways. Ways in which the developers use it as their golden key to a safer lock for secure transaction, frauds search for a compatible pin to unlock.

There are many types of frauds in online payments like clean fraud, account takeover, merchant fraud, customer fraud, triangular fraud, affiliate fraud, and reshipping.

Rules To Ensure Safe Online Payments

Online payment sites provide a wide platform for price comparisons, cashback offers, and so much more. With the increase in popularity, the tragic pit holes of cyber theft, security theft, cash loss have increased rapidly.

Under the disguise of useful apps to make your work smarter, Trojan secretly loads malicious theft codes into the device. Kaspersky has recently detected a new malicious Trojan that steals money from the phone. Once the app is installed, the Trojan carries the automated clicks forwards on the web pages. It works with the Wireless Application Protocol (WAP).

It is nothing but a type of phone payment that adds charges to the phone bill directly. The Trojan silently subscribes the phone to several devices. Trojan was undiscovered till 2017, but then it suddenly started affecting mobile phones. Transactions made from laptop or pc is safer than smartphones. There are more malware attacks on smartphones than laptops or pc. Online payments are the need of the world, especially after demonetization. So, there are certain precautions one must take to make it a smarter choice.

1. The most common way to sniff out faultiness is to check out the leftmost corner, whether it is HTTP or at the beginning of the URL in the site address. Most safer sites prefer using HTTPS or Hyper-Text Transfer Protocol over Transport Layer Security. It means the encrypted transfer of information between you and the server.

2. Use a computer for transaction procedures as smartphones are more prone to malware attacks. Use Google Chrome with a trusty anti-virus and HTTPS. Make sure you scan it regularly.

3. Make sure you grab yourself a temporary credit card. These are very much crucial as in case its information gets stolen; it is of no use. However, they are just for one-time usage purposes. In case you are a person of regular transactions, this won’t satisfy you.

4. Put up a strong password. Well, it may sound ‘not that important,’ but I can tell you it really is. Giving a strong password adds to more security.

5. Create a separate, private e-mail address; you don’t use it for any personal notice. Just keep it for online payment types.

6. Don’t go for free Wi-Fi spots. It is nothing but just another tactic used by thieves to steal information. They subscribe it automatically with the help of WAP into different servers. The major drawback of WPA2 is the encryption standard.

The biggest threat with free public Wi-Fi is lending a helping hand to the hackers to a position between you and the connection. They extract all your e-mail, phone number, Credit card, etc. information. So instead of visiting a shop for getting free Wi-Fi with a cappuccino, you end up giving all your personal information to the hacker.

If you don’t have an option, but public Wi-Fi, then use Virtual Private Networks or VPN. It allows you to make a secure internet connection.

7. Avoid using any online payment app you see. There are various apps to make your online transactions easier, smarter with lots of cash backs, and many more offers. In the present scenario, one of the trusted online transaction apps that is Pay pal. There are many more like Google Pay, Paytm, etc. So make sure you are always in reliable hands.

8. Never make any purchase from any unknown, untrustworthy source. Okay, some may show a deaf ear to this in the name of ‘DISCOUNT’ or ‘SALE.’ Yet, purchasing something from a reliable source paying 50-100rs extra is an act of brain than buying from the unreliable source at a cheaper rate, putting your account information at stake.

Imagine you’re getting something from a site at a lower price than others. Yet, it asks you for your account number, bank details, etc.

You thought of giving your account details in a flow of saving money and flaunting your funky apparel in your ladies club. The next morning you wake up after seeing yourself in your dream wearing that gorgeous dress. As you check your phone for any new good morning texts, you see a message from your bank with 0 account balance. How terrifying even to imagine. Isn’t it?

Make sure that website is secure and trustworthy. Take a proper note about its return policies. If only a deal looks to be true, go for it else DON’T.

9. Use a PASSWORD MANAGER. Still, using your anniversary date as your universal password? Well then, you’re in the path of trouble. The password manager provides a unique, strong, and convenient password to make it stiff strong. It just makes it better accessible and secure for accessing online services. They help you in making a strong, complex password, tenacious enough to hack it. They also aid in changing passwords if you forget (I know you’re on the list of forgetting too). It also makes sure you don’t use the same password for multiple accounts (okay, I know you’re hiding your face now). Trust me, it can be hazardous.

There are many password managers like Zoho, Dashlane, Lastpass, Keeper, etc.

The present most trustable is Zoho with 15 days free trial and then paid.

10. Make your personal information private to you. Well, now you can relate to what Raavana said during his last breathe in RAMAYANA. Just Ramayana things, you know. All that I want to depict is you should never share your personal data with anybody. Howsoever close might he/she not be. You should keep something to yourself, right!

11. Make sure your smartphone is under the grip of a trusted APP LOCK. Few online payment apps do not run without app lock encryption. Yet, considering prevention is better than cure, using an app lock leads to more safety.

For example, there are payment apps like Google Pay, Phone Pay that uses a mandatory PIN for its activation and working. This PIN has to be strong, secure, and private. Remember, this PIN is different from the UPI PIN that you use for payment.

12. Always put an eye away from spam e-mails or such text messages. Hurray! You won 1lakh rupees. Send your account details in this mentioned number for easier transfer of money. Isn’t this something every one of you must have experienced surely a hundred or more times? Check your phone. Even now, it must be present somewhere.

These are nothing but just thievery norms used by jobless scammers. They send you shitty messages with an attractive representation of lottery winning. They’ll ask for further details about your account number for the transaction.

Online Payement Method

Many online payment methods make our transaction processes smooth. It provides secret encryptions to keep customers’ information safe and secure after such a huge advancement in technology, demonetization, and the demand for a smarter and effective way of sending cash. Sitting comfortably on the sofa with a cup of tea in hand, there are many blooms of online payment methods—each one promising a safer and secure checkout experience.

Apart from a smarter experience, they make it quiet and easy. Within a lapse of seconds to transfer money from one corner of the world to another, just within one sip of tea. Isn’t it?

PayPal

Amazon Pay

Google Pay

Paytm

Phone Pay

Apple pay

Stripe

Visa checkout

Card payments like debit card, credit card, etc.

Net Banking

How To Pay Online?

Making it an easy, quick, and secure process is what’s aimed by online payment developers.

1. Payment With Debit Or Credit Cards

Be it any shopping site or your school or college fee payment. As you reach the final payment site

i. Click on the credit/debit card option.

ii. Enter the required data.

iii. As the final gateway receives the information, it connects it to the acquiring bank. The acquiring bank receives the transaction information and transfers it to the card network.

iv. After you’ve put your password, a verification OTP comes, which is valid for a few minutes. Make sure your phone number is tied-up with that particular bank account.

v. Type it in that provided box and wait for a message to pop up on your phone about the complete transaction.

2. Payment With Apps

Well, this is the easiest one so far to use. Just install the app, verifying with the assigned phone number with the bank account, and your job is done. Every time you need any online payments, you can scan the QR code. Or directly send the amount to any contact or phone bills, electricity bills, etc.

Many such apps like PayPal, Google Pay, Paytm, Phone Pay, and the list continue.

Best Ways Of Online Transactions

With the increase in online transactions, the threat of crimes has increased. To outcome, there are several measures to abide by for secure online payments. No doubt, to some degree, you can rely on these vast influencing technologies encrypted with a secret code. Even when everything is right, something goes left you don’t know (well, that was sarcasm) since various types of online transaction apps like Google Pay, Phone Pay, Pay Pal, etc.

Still amongst them, Pay Pal is the world’s largest online transaction medium. Every field of business internationally accepts it.

Simultaneously, for online shopping purposes, the usage of credit/debit card media is more trustworthy. That is because many cards provide fraud protection and higher security. Thus, when shopping for a new credit/debit card, make sure you go through all its security services granted.

Free public hotspots are of the major ways how thieves steal your information. So avoid using free Wi-Fi from the cafe or the hotel you’re residing in.

Frequently Asked Questions

1. Which is the best way for online payment?

For shopping, purposes use credit or debit cards, electricity bill payments, school/college fees, etc. you can use online transaction apps like Google pay or Pay pal.

2. Which is the safest medium to pay online?

The safest medium is the one that does not use any account information. Make a bold note of it never to share your account or any such information with anyone during online transactions. Online payment ways never ask for such unless its fraud.

3. Which is a safer way for online transactions, Credit cards, or online apps like PayPal?

The credit card offers a lot of security safe ways for online transactions. With the advancement in technology, payment options like Credit card and PayPal have attracted many customers. Added to that, PayPal is the most secure online payment apps in comparison to the rest.

Even though there are all safety measures, there are still ways how information can get stolen. Be it by HTML interception, server bleaching, HTTP instead of HTTPS, etc.

Technology is changing every day to make it better. But it can’t always be 100% percent secure in not letting your information scrapped off.

While online apps are more prone to online thefts, Credit or Debit cards are vulnerable to physical stealing, scamming, or skimming. Online transaction apps use safer ways like- Gateway, encrypted codes. Even Credit card companies invest hugely for a secure transaction process; still, all Credit card companies are not reliable.

One sentence for a thousand words, using reliable online payment apps in requisite trustworthy sites and Credit cards from a trusted source, is what sounds justice to the problem.

1. For online shopping purposes, use a temporary Credit card (refer above for more )

2. Always make transactions from a computer and not a smartphone.

4. How to testify if a website is secure?

Look for the following options for getting a proper light about conforming if a site is actually secure-

1. Website address- The address bar has to start with https:// and not https where S stands for Secure. There are many such fake websites where it is found, so make sure to look at it.

2. The address bar turns green- You must have marked as you’ve typed or copied an address, and o,n reaching, it turns green. Well, it is nothing but an indication of a safe way ahead.

3. Padlock symbol- Take a glimpse at the padlock symbol too.

4. Relevant certificate- If you get a padlock symbol, you can know who has registered that site. You can get a certificate if it is a trusted site, but if ignored, don’t give a second thought and escape.

Conclusion

By now, you must have been clear about the safety platforms of online payments. So, the next time you go for online payment, you know what is best for you.

source http://invested.in/rules-to-ensure-safe-online-payments/

1 note

·

View note

Text

Play Rummy Online – How To Earn Money From Classic Rummy

Making money has just gotten simpler. Classic Rummy offers various ways to make money for free! It is the legal way to earn money online.

This is an amazing opportunity for anyone to add more money to their wallet and simple ways to make real cash online.

Of course, everyone has smartphone or laptop or desktop computer with free good internet connection, why don’t use this opportunity for make money online.

This article is going to shine a light on Easy Methods to Make Money Online for Free.

Playing Online Rummy:

Online Rummy is for Entertainment, is the best card games for two players. Classic Rummy offers best variants (101 Pool, 201 Pool, Deals and Points Rummy) for rummy players to win rummy game and for make money online.

Classic Rummy offers zero cost registration with a bonus and a welcome package for its users.

How to Make Money Online?

Register for Free

Get your Bonus in Classic Rummy

Welcome Package

Refer a friend

Play Tournaments in Classic Rummy

Follow the below steps to make money for free today in Classic Rummy:

Method 1: Register for Free

Open the Classic Rummy App and register your account for free. Enter a unique username and password for your Classic Rummy account.

Verify your email and phone number to verify the authenticity of your Classic Rummy account. Your Classic Rummy account is now active.

Method 2: Get your Bonus in Classic Rummy

Classic Rummy provides an exclusive offer to new rummy players, just one step to do for getting this bonus offer.

After downloading or registering with classic rummy, you need to verify your Mobile and E-mail.

You Get Detail Information for How to Verify Mobile and Email.

Once you have verified your Email and Mobile, on your first deposit you get 100% of bonus up to 5000 will be credited to your Classic Rummy account.

Play online rummy games for free using that Classic Rummy Signup Bonus. Play Rummy Online and earn money from Classic Rummy.

Method 3: Claim the Welcome Package for Make Money Online

Classic Rummy supports Credit Card, Debit Card, VISA, Net Banking, Wallets, and UPI Money, bank transfer payment methods.

Make your first deposit using the bonus code,“MINI100; MAX100 & MEGA100” to get 100% Bonus up to ₹ 5,000 and Cash Up to ₹500.

For More Information about ‘Classic Rummy Welcome Bonus’

Method 4: Refer a friend

Yes, it is as simple as that. The more friends you have, the more money you can earn.

How does ‘refer a friend’ work to Earn Money in Rummy?

Once completion of Downloading and Registration process of you at Classic Rummy.

Click on the ‘Refer A Friend’ in Classic Rummy Mobile app and refer your friends,

Once your friend registers and deposits money into his/ her account, you become eligible to earn free up to 1500/- and 20% bonus.

Method 5: Play Tournaments every day

Classic Rummy offers exclusive tournaments in every Month for the rummy players to earn money online.

Select the type of Tournament in Classic Rummy you want to participate in from the many options available in the Classic Rummy Website.

You can register for any tournament and have a chance to win up to 10,000/- rupees.

Now It’s Your Turn to Earn money from Rummy

The above mentioned are simple methods to make fast easy cash by playing Classic Rummy.

What are you waiting for? Now that you possess knowledge on how to make free cash, it’s time to be part of the rich man’s world.

Simply Download Classic Rummy, Refer Friends, Play Tournaments and Earn!

Make money from home or on the go!

0 notes

Text

Indians are switching to digital payments in droves

THE ALLEYS of the 150-year-old Chor (Thieves’) Bazaar, a colourfully named flea market in Mumbai, are crammed with goats, used tyres, speakers, drills and other assorted ephemera. But even in this unlikely place, modern payment methods are gaining a foothold. In stalls abutting the market, bags of sand can be paid for by providing a phone number or scanning a QR (quick response) code. Many countries have seen digital payments take off in the past few years; in India, where little over a decade ago a cheque could take more than two weeks to clear, it feels like a revolution.

It is one that has been shaped, not always intentionally, by government policies. September 2010 saw the arrival of Aadhaar, a system of biometric IDs that could be used to open a bank account. After becoming prime minister in 2014, Narendra Modi chivvied bankers to open accounts for everyone. Around 360m basic “Jan Dhan” (people’s wealth) accounts were opened, adding to the 243m accounts already in existence. But many sat empty, or held just a rupee or two put in by banks under government pressure to reduce the number of zero-balance accounts.

In this section

Two further developments gave those unused accounts a purpose. The first was the launch in 2016 of the Unified Payments Interface (UPI), an interbank money-transfer system. The second was “demonetisation” later that year, when 86% of banknotes in circulation were recalled. That caused economic carnage—but also gave digital payments a galvanic boost. Paytm, India’s largest digital-wallet firm, took out ads thanking Mr Modi for the move.

Paytm now claims 371m users. PhonePe, a subsidiary of Walmart-owned Flipkart, claims more than 150m, and BHIM, run by a government-led bank co-operative, 46m. The value of digital transactions has risen more than 50-fold in the past two years, with many more smaller payments (see chart). Even the drivers of Mumbai’s three-wheeled auto-rickshaws have begun accepting payments that go through UPI to their (presumably new) bank accounts.

China’s giant payment apps, WeChat and Alipay, send transfers between their digital wallets, going through an official clearing house. Cryptocurrencies, which some tout as a possible future for digital money, touch the regulated financial system only when they are bought and sold. By contrast India’s pioneers, which started with digital wallets, are fast becoming interoperable with UPI, which sends money directly between bank accounts. The result is both well integrated with the banking system and flexible enough to allow innovation in serving customers.

Regulators are happy with the system, says Saurabh Tripathi of BCG, a consultancy, since it protects deposits, increases financial inclusion and cuts tax evasion from unreported cash deals. It also suits banks, since they get fine-grained information on transactions that can be used for credit analysis and product customisation.

The global tech giants like the look of it, too. Google Pay is already available in India and Amazon Pay plans to launch soon. WhatsApp, which has 300m Indian users, has run a trial of a payments service with 1m of them, though the government’s requests regarding privacy and data-localisation are delaying it going nationwide. The success of other dominant chat apps that have moved into payments, such as WeChat Pay in China and Kakao Pay in South Korea, suggests that whenever its launch happens, it will go with a bang. ◼

https://econ.st/2wBUHO6

0 notes

Text

#Exclusive: SBI can launch its new entity like NPCI - Report

SBI may soon form a new entity on the lines of National Payments Corporation of India (NPCI). With this, SBI is preparing to enter the fast growing digital payment ecosystem under India's primary stakeholder.

Process to be completed soon

According to a report in the Economic Times, an SBI official said that senior management officials of India's largest lender have held initial talks. Along with this, the possibility of applying license under the New Umbrella Entity (NUE) of Reserve Bank of India for retail payment is also being considered.

Last week, the Reserve Bank of India released the framework of NUE through which Central Bank also opened the window for its application. Under this, the entities receiving approval can set up a payments company to own and operate the Pan India digital payment network. It is using power with NPCI only.

The SBI spokesperson said that the lender is examining this framework primarily as the bank can leverage scale, customer base and existing capabilities to offer new digital services.

The spokesperson further said that SBI is also examining the framework. He further added that the digital retail payment ecosystem can be made even better through additional entities.

The SBI spokesperson said that through this the reach and expansion of financial support will be further enhanced and many new and affordable products will also be made available on this platform.

Knowing this topic, people told that this conversation is still at a very early stage. Also, this unit can be strengthened through a model of common ownership for new payment methods and SBI as a promoter can invite other state-owned banks to form consortium. is.

Also, there is a possibility that SBI may partner with fintech companies and because of this partnership, state-owned lenders will pursue digital technology initiatives through their banking channels.

According to RBI guidelines, if the entity gets a green signal, then SBI will have to pay at least 500 crore rupees as paid sub capital.

NPCI is controlling about 60 percent share

Let me tell you that currently NPCI is handling about 60 percent of the entire volume through its various channels. These channels include Unified Payments Interface (UPI), Immediate Payment System and National Financial Switch.

The process of the central bank will also be completed in the next 6 months

As per RBI guidelines, interested entities can apply by February 2021. The Central Bank expects that the investigation of the application will be completed in the coming 6 months and the process will be completed.

#National Financial Switch#National Payments corporation of India#New Umbrella Entity#State Bank of India#reserve bank of india

0 notes

Text

New Post has been published on OmCik

New Post has been published on http://omcik.com/google-joins-indias-cashless-payments-rush/

Google joins India's cashless payments rush

India’s push to go cashless has another high-profile supporter: Google.

It launched a mobile payments app designed for the Indian market on Monday, becoming the latest big player to join an increasingly crowded field.

The app, called Tez, will connect users’ smartphones to their bank accounts via India’s Unified Payments Interface (UPI), a platform already used by 55 of the country’s top banks.

Tez is available on Google’s (GOOGL, Tech30) Android operating system as well as Apple’s (AAPL, Tech30) iOS.

“I believe that in our lifetime we will witness a digital transformation of the Indian economy,” said Caesar Sengupta, the executive leading Google’s push into emerging markets.

“In many areas, we will see India leapfrog the West. One area where this is going to happen is payments and commerce,” he told reporters in Delhi.

Related: How Google plans to get a billion new users

Tez, like other mobile payment apps, will allow users to send money to each other as well as make payments to vendors who have the app.

Indians still pay for most things in cash but the government is pushing hard to move those transactions online, championing digital payments through initiatives such as UPI and the country’s national biometric identification program.

Related: First cash, now India could ditch card payments by 2020

Digital payments in India also got a massive boost last November when Prime Minister Narendra Modi banned all 500 and 1,000 rupee notes — the two largest currency denominations at the time.

The move threw the cash economy into chaos and forced many to switch to digital payments so they could keep buying essential goods and services.

“A lot of people went in for digitization in terms of a mode of payment more out of compulsion, rather than finding it a more convenient method to transact,” Finance Minister Arun Jaitley said Monday at Google’s launch event.

“What started as a compulsion becomes a matter of convenience and eventually a matter of spending habit as far as Indian people are concerned.”

Several top companies have already gotten in on the act in the hope of winning over India’s 400 million internet users. They include Alibaba (BABA, Tech30), with its Paytm service, and Indian e-commerce giant Flipkart.

Facebook (FB, Tech30), which already has over 200 million monthly users in India, plans to offer digital payments on WhatsApp.

Related: India’s economic growth slumps as big reforms bite

Tez marks Google’s latest effort to grow in India, where about 900 million people are not yet online. The company is providing free WiFi to over 100 Indian train stations, and launched an offline version of YouTube last year.

Google is also using Tez to push further into India’s non-English speaking population. The mobile payments app will be available in seven Indian languages — Hindi, Bengali, Gujarati, Kannada, Marathi, Tamil and Telugu.

The app could be introduced in markets similar to India in the future, Google said.

CNNMoney (New Delhi) First published September 18, 2017: 7:54 AM ET

0 notes

Text

UPI App for iPhone

Does iPhone / iOS have any application with UPI support?

Short Answer: Yes! Download PhonePe and you are good to go.

After Indian Government’s move to demontise 500 and 1000 rupee note, it has become very difficult to do day to day money transactions. For quick money transfer, there are two options; one is Mobile wallets like Paytm, Mobikwik and other is Bank Applications. But there are some problems with both these methods.

In case of mobile wallet like Paytm, Mobikwik, they charge some percent of commission (normally 1%) to transfer money back to bank account. So, be cautious whenever transferring amount back to bank account. Thankfully, these application clearly show the amount charged as fee. In case of Bank Application, sender needs to know receiver’s bank account number and IFSC code or MMID. All these are numeric values and it may get difficult to remember these numbers. Also, It is not secure to share your bank account number with every other person.

MONEY TRANSFER USING UPI

Raghuram Rajan the ex-RBI Governor has done fantastic job by starting UPI (Unified Payment Interface). UPI is money transfer solution by NPCI (National Payments Corporation of India). UPI has 35 major banks on board. In this method, for money transfer, all you need to know is VPA (Virtual Payment Address). It is of format “name@bank” eg. abc@sbi. Much like email ID, this ID would be unique to person and cannot be reused.

1. REGISTER YOUR VPA ID

As I mentioned, VPA ID is very similar to email ID. So if you don’t want your VPA ID to look like “Rahul123456@sbi”, better register for VPA. Use any android mobile in order to do so. This would at least ensure that you can receive money in your account by simply telling your short and easy to remember VPA ID.

2. Use Mobile Wallet

Paytm and Mobikwik have really really good interface in iOS. It should be noted that, for now charges are NIL (0%) as government is trying hard to tackle the cashless situation. Also, one good part about Mobile Wallet is it works like pocket money, keeping expenses in check.

Best Upi App TO TRANSFER MONEY

Android ecosystem has many application with UPI support like SBI Pay, Axis Pay, ICICI bank app, Chillr (by HDFC), PhonePe (by Yes Bank). On the other hand, iOS has only one application PhonePe. Banks will push update to their apps to include UPI payment, but it will take lot of time. Cause more than 97% of smartphone users in India use android phone, i.e. less than 3% use iPhone.

Source: http://bit.ly/2pg9LOQ

0 notes