#Maxxtokens

Explore tagged Tumblr posts

Text

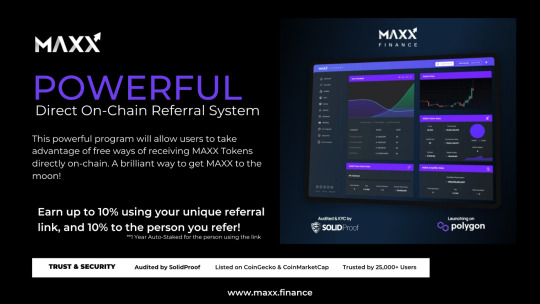

Direct On-Chain Referral System

MAXX implemented an on-chain referral system in the pre-launch phase that will allow users to invite people by sending them an invitation to the dashboard through their uniquely generated referral link.

This is a very powerful tool for both parties since it rewards both users who generate the link and the person receiving it. This referral system is widely used all over the world and will significantly reward users of the protocol.

In the early days of the World Wide Web, referral programs were used to generate website traffic. Today, referral programs are reborn to play a critical role in the Web3 ecosystem. It allows decentralized projects to bootstrap campaigns and grows without depending on VC or any other 3d party investment, giving all the power to the community from the very beginning. MAXX Referral is built with this idea in mind. Our built-in on-chain program rewards both the user who generates the link and the person receiving it, thus growing MAXX community with trust, transparency & sustainability.

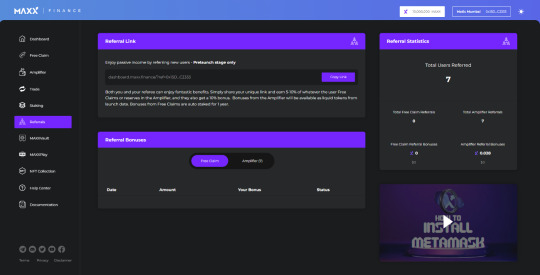

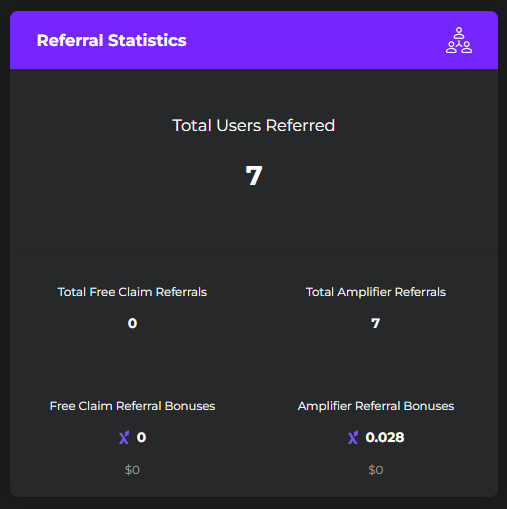

The referral page will be the place to generate your unique link, and once users claim the referral they will automatically generate the statistics in your dashboard to monitor.

Anyone who uses your link will receive a 10% bonus on their Freeclaim amount, or their Liquidity Amplifier deposits!

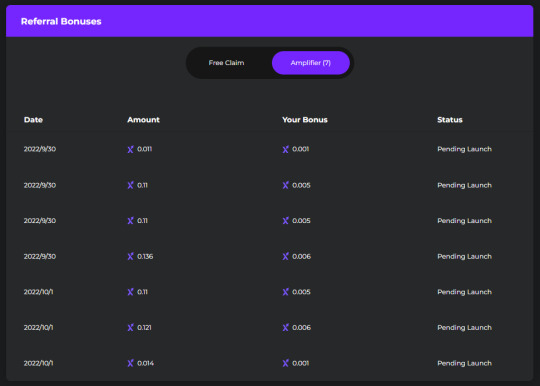

You will also receive an automatic commission, 10% for Freeclaims and 5% for Amplifier deposits.

Live statistics will give you the exact data of who uses the link and how many times it has been used as well as the amount of MAXX you receive for inviting others!

The Referral link can be used as many times and has no caps or limitations! So go on and use the heck out of it!

Now that you are familiar with the dashboard and referral section you are ready! Follow the steps below to start using the referral link & earn MAXX rewards!

How it works!

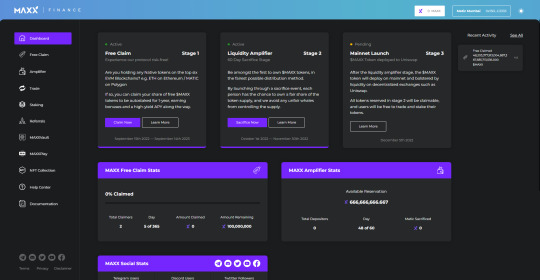

The MAXX website www.maxx.finance will have a web3 capable dashboard built into the site.

Once in the portal, you will need to connect your compatible wallet and make sure you are on the Polygon MATIC Network.

When you press Connect Wallet, it will automatically add the Polygon network if you are using MetaMask. If you are using another wallet, you may need to manually add the network.

To manually add the polygon RPC follow the instructions below:

Find the Network Settings in your wallet, and add a new entry for Polygon as follows: Network name: Polygon Mainnet RPC URL: https://polygon-rpc.com Chain ID: 137 Currency: MATIC Explorer: https://polygonscan.com/ Click Save.

Then connect your wallet.

Click the ‘referral’ section on the left-hand menu.

Finally copy your referral link and share it with the world!

💎 Join the best crypto community! https://t.me/MaxxFinance 🐦 Twitter: https://twitter.com/MaxxFinance 👾 Discord: https://discord.gg/XeQg8jt4WS 🔌 Linktree: https://linktr.ee/maxxfinance 📚 Gitbook: https://docs.maxx.finance/

Website www.MAXX.finance Join Our Team https://t.me/maxxcommunity

#maxxsystem#maxxtokens#maxxecosystem#maxxfinance#cryptocommunity#cryptocurrency#crypto#referral link#launchingsoon

0 notes

Text

MAXX Finance Staking Explained

The MAXX Staking Ecosystem is specifically designed to benefit the end user of the staking class. We estimate that only about 5–10% of the ecosystem will be part of this ‘staking’ class. This means if you become part of the 5–10% of users staking you will reap the rewards from the whole 100% supply inflation. Being part of this ecosystem will allow you to earn rewards from our whole blockchain project. There will be a few things you will have to know prior to staking.

Here are the simple steps you need to take to get into the staking ecosystem!

1 — You will want to join the liquidity amplifier & free claim airdrop to mint your own MAXX way before the project launched on a DEX. The benefit of being early is the fact that you will have the ability to choose what day and how much you want to sacrifice to become a MAXX holder.

2 — Once the staking contracts are rolled out you will have the ability to use your $MAXX tokens to send to a contract based on the parameters you set. Don’t forget no one ever holds on to your tokens and you are the one who chooses how much & how long you want to stake for. Once you set the time and length of the stake you will earn daily interest until the stake matures.

Supply & Demand The staking class receives rewards in the form of $MAXX tokens by staking, this gives the MAXX ecosystem the ability to fule the ‘utility’ and ‘revenue’ stream back into the MAXX Vault. By creating a MAXX stake you will be able to lock in and remove the supply from circulation thus sending the price pressure to the upside. Less supply = More Demand!

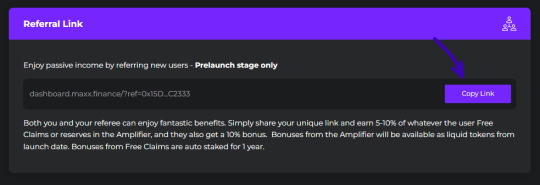

Easy To Use Web3 Dashboard MAXX team has developed a unique one-of-a-kind web3 dApp system where you can do all in one from joining the liquidity amplifier — to swapping tokens — to creating stakes or even using the many other cool features we have and plan on having on the website. Below is an interface preview of the unreleased dashboard. This is where you will spend most of your time interacting with the ‘MAXX Ecosystem’.

Gamified Ecosystem To Reward Users

NFT & Bonuses The MAXX team has added tons of fun perks & features into the protocol to encourage users to try the $MAXX ecosystem absolutely free with the ‘Freeclaim Airdrop’. To having awesome bonuses & rewards through the Genesis NFT & MAXXBoost.

There is also gamified features in the staking contract which will encourage users to stake for longer & bigger as well as penalties to make the protocol self sufficient.

Longer Pays Better & Bigger Pays Better Bonus The longer & bigger the stake the more rewards you receive so when creating a stake pay attention to how long and how much you stake to receive the MAXX rewards!

Early Withdrawl If a user decides to withdraw their stake early, they will be penalized an amount of their principal+interest earned so far.

The penalty amount is proportionate to the time remaining / original duration of the stake.

For example, if the stake is 100 days long, but the user has only served 80 days and unstakes early with 20 days remaining, they will lose 20% of their Principal+Interest.

Late Withdrawal Once a stake reaches maturity, the user has a 14-day grace period to withdraw their stake without any penalty. If for some reason, they do not withdraw it until a later date, they will be penalized depending on how late it is withdrawn.

The penalties start on day 15 after maturity, at a rate of 100/365 (0.273972602739726)% per day.

Stake Transfer MAXX has innovated a system that will allow users to avoid early-end staking penalties by transferring the stake. We will be rolling out a timeline for a marketplace very shortly but the stakes will be available to transfer from the start of the launch. Transferring a stake is a very powerful tool and can create a whole new ecosystem for our users who will want to trade the stakes.

These are just to name a few of the most innovative staking systems which will blow the competition out of the ecosystem! Join our whitelist and telegram group today to be a part of our project.

💎 Join the best crypto community! https://t.me/MaxxFinance 🐦 Twitter: https://twitter.com/MaxxFinance 👾 Discord: https://discord.gg/XeQg8jt4WS 🔌 Linktree: https://linktr.ee/maxxfinance 📚 Gitbook: https://docs.maxx.finance/

Website www.MAXX.finance Join Our Team https://t.me/maxxcommunity

#maxxsystem#maxxfinance#maxxtokens#stakingexplained#cryptocommunity#cryptocurrency#defi#crypto#maxxecosystem#stakingsystem

0 notes

Text

The State Of DeFi — Rapidly Advancing 💡

Cryptocurrency is advancing at an extremely fast rate, especially when it comes to decentralized finance (DeFi). It was only a few years ago that Uniswap launched its decentralized exchange (DEX), quickly becoming the most popular protocol with over $1.1+ trillion in trading volume to date.

Not only did this give a trusted method of liquidity pools and token exchange, allowing users to rely less on centralized exchanges, but it also welcomed a rapidly expanding ecosystem of new projects, dApps, and integrations all built on the Uniswap Protocol. Blockchain technology has been created to remove the middleman & protect users from counterparty risks.

Every day we are less reliant on these third parties and continue innovation to further disconnect ourselves from centralization. In our eyes, a perfect DeFi space is a place where users can manage their accounts safely, and without having unnecessary counterparties posing a risk to funds or trades. DeFi dApps are built on Web3, allowing for full traceability and proof of ownership thanks to the blockchain.

MAXX Finance has created an ecosystem that allows users to safely store their own tokens on cold storage wallets and interact with the protocol only when needed, never having any counterparty risk. A transparent ecosystem that is backed by an actual tangible utility, with well-thought-out tokenomics designed to create sustainability and longevity.

MAXX Finance is paving the way for innovation in DeFi & adding to the space to make it better as a whole for many years to come. Visit https://maxx.finance to learn more and get involved!

💎 Join the best crypto community! https://t.me/MaxxFinance 🐦 Twitter: https://twitter.com/MaxxFinance 👾 Discord: https://discord.gg/XeQg8jt4WS 🔌 Linktree: https://linktr.ee/maxxfinance 📚 Gitbook: https://docs.maxx.finance/

Website www.MAXX.finance

0 notes

Text

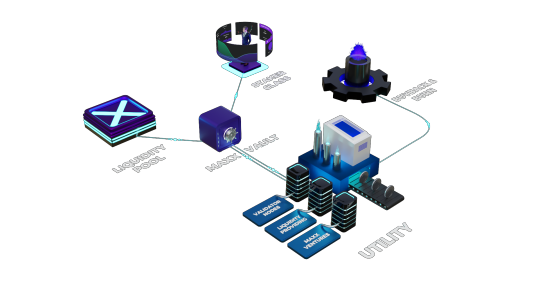

MAXX 360 Utility Explained

A protocol without utility is a recipe for disaster. With that being said, every protocol that is extremely successful essentially offers some form of a revenue-generating system for its ecosystem. Besides well-balanced tokenomics, massive launches, and of course the community, the system needs to properly function and be able to last well into the future.

Tangible utility is exactly what makes MAXX different.

MAXX 360° Utility

MAXX ecosystem is self-reliant this means that the participants in the protocol whether 100 people or 100,000 people at launch will be set up to work and function without question well into the future.

The point of MAXX Finance is to have 360-degree coverage in the DeFi space and solidify our place in the DeFi world by taking over the whole space. How? Well, Walmart really sounds like a good example here, we plan on doing DeFi just in a mainstream type of way. I’ll explain.

MAXXVault presents BoostLiquidity Strategy MAXXVault is a community DAO governed Vault that distributes & allocates the MAXXLiquidity between multiple diversified risk portfolios.

MAXXValidator Nodes — across multiple different EVM chains MAXX Finance will own validator nodes that will constantly produce yield. Even when markets are low MAXX will have a voting system that will allocate the Vault liquidity to this strategy. With the safest and most robust strategy, MAXX Validators will generate between 10–15% APY and will essentially fuel the protocol’s future for many years to come. They sometimes call Validator Nodes to be the “Real Estate of Crypto”. Users typically can’t afford validators, but now with MAXX they can.

Risk management — The specific strategy is a no-risk no trading strategy that will be a long-only validator holding system. Depending on the market conditions the MAXXVault DAO will vote on whether to remove risk or add risk to these nodes.

EX: MAXX adds $50M to validators across multiple different EVM chains in a period of over 1-year in a DCA strategy (dollar cost average) where we buy a small portion over a 1 year period to DCA into the position. During this time the market went up 1,000% and the community voted on the MAXXValidator nodes to go liquid and tether up. Once the vote passes we can DCA (Dollar cost average) out of the positions to minimise the risk. This allows the protocol to capture the $450M in profit. The next step would be to use the tether to provide LP in stablecoins to the ecosystem allowing us to further capture yield while rebalancing the holdings.

MAXX LP Providing/Yield Farming — a complete risk-averse tactic to allow us to provide stablecoin LP to yieldfarm. This is a system that will allow us to switch strategies during market blowoffs when sitting in stables.

Risk Management — The primary concern is to make sure that we have only the most risk-averse tactics during LP providing. The strategies will be voted on through the DAO and only implement community-voted decisions.

MAXX Ventures — MAXX will have an incubator — Think Shark Tank in DeFi where users will be able to submit proposals to get their ideas or projects funded. MAXX will have a voting system that will allow us to take on projects and allocate resources that are viable for the success of the project. This can essentially create some future 💎 in the ecosystem. You have heard of these projects that have lots of success, imagine how many people brilliant developers or people with amazing ideas have no correct vehicle to actually create the next big thing. With the MAXX Venture program, we will be allocated to projects all across the scope, from small to large. All the voting will be done through our DAO system and the community gets to vote on what projects MAXX takes on. MAXX has a development and marketing team in-house that can expand and build out pods to take on other projects as ventures as well as allow the MAXX protocol to benefit from holding these projects in our portfolio.

Token BURN 🔥

All of these systems will generate revenue which in return will be burned. The yield that we generate or profits that we capture will essentially go back into the deflation of MAXX finance. What does that mean? $MAXX price will forever be forced up and the liquidity will constantly be bought up through the DEXs.

$MAXX Inflation

With MAXX inflation is a feature, not a bug

The MAXX ecosystem is built to allow users to capture higher than normal yield to the staking class for removing supply from the market and contributing to the protocol. However, the inflation is minimal, and when it comes to global inflation comparing it to even Bitcoin during its days when it would pay out over $50 to $25 per block rewards. Inflation in the blockchain supports the ecosystem to continue its function. Our inflation supports MAXX’s protocol and is fixed based on the number of users who stake it. The more users who stake the higher the global inflation. Based on our research we estimate approximately 10–15% of users that will be using our staking system which means that the global inflation for the MAXX protocol will be between 2–5% yearly.

How do we calculate this? If there is only 10% of the community staking, and the staking rewards they will earn per fiscal year is 30% then the global inflation will be 3% in order to pay them this interest. MAXX has a well-balanced tokenomic system that offsets this inflation easily and here’s how.

$MAXX Gamified Deflationary features

By gamifying the system MAXX will have multiple levels of deflationary measures pre-programmed into the smart contracts:

Trade Taxes — Users will have a small fee paid to the MAXXVault for any transactions created on the chain, buy, sell, or staking taxes.

Early End Stake Penalties — Users will be able to create stakes at any point & stop them at any point. Sometimes the price of the token will be very volatile and give people reason to exit their stakes early, although users will have to take penalties to end stakes early. These penalties will help deflate and be a countermeasure to inflation. These are just basic integrated deflationary features that will help regulate and create MAXX a deflationary protocol.

The described above is not even the tip of the iceberg; the growth of MAXX is unstoppable. Join the movement now. Like & Share this story.

💎 Join the best crypto community! https://t.me/MaxxFinance 🐦 Twitter: https://twitter.com/MaxxFinance 👾 Discord: https://discord.gg/XeQg8jt4WS 🔌 Linktree: https://linktr.ee/maxxfinance 📚 Gitbook: https://docs.maxx.finance/

Website www.MAXX.finance Join Our Team https://t.me/maxxcommunity

0 notes

Text

Smart contract security audit schedule

Security in a smart contract and protocol is probably the most important thing that you should focus on. MAXX is no exception when it comes to focusing on security we take it very seriously, to say the least. In order to ensure that the community of MAXX finance is safe from any exploits or hacks we are running the security audits in 3 stages.

1 — Third Party Auditor — We hired a third party auditor group Solid Proof that did the smart contract testing for MAXX Finance and created an audited report. We have successfully completed this step.

2 — Public Bug Bounty Hackathon — A public offering to test and hack the smart contract with rewards up to $25,000

3 — Community Testing — A community available portal to run the protocol in testnet and find issues or problems with the platform

4 — Final Third Party Audit by Certik

MAXX Finance has 2 primary contracts, 12 initial contracts that were created and has about 200,000 lines of code.

The first primary contract is distribution of $MAXX to the community; this is called the liquidity amplifier phase. This smart contract is fairly straightforward and will not require a security audit as the sole purpose of it is to collect $MATIC & Distribute free $MAXX tokens to the users. Below is an explanation of how this process works.

Liquidity Amplifier Phase Smart Contract — This contract specifically handles the distribution of $MAXX utility tokens which will allow you to enter a lobby over a period of 60 days to forfeit your $MATIC (POLYGON) Coin for your FREE $MAXX utility token. This contract will be responsible for the whole event of this exchange.

During this 60-day process, the second smart primary contract which is the MAXXStaking contract is going to be tested through a public bug bounty program that will give rewards to users in the form of payments USDT / USDC.

MAXX Staking Smart Contract — The staking contracts function is to allow users to remove the tokens from the supply and choose a duration in which they lock up their tokens in a smart contract & earn rewards in the form of $MAXX tokens. This is the primary function & the utility of MAXX tokens.

We are offering as much as $25,000 bounty programs to find flaws in these smart contracts. This will allow us to thoroughly test the smart contract prior to the ‘minting’ day of the liquidity amplifier phase.

Once we are done with this testing process, both internal & community testing is complete, the smart contract will then be sent to Certik for their third party audit. MAXX believes this is the best way to launch the protocol and ensure MAXX security to the community.

For more updates follow our twitter.com/maxxfinance

www.maxx.finance

0 notes