#Ola IPO

Text

Phenomenal Ola Cabs Share Price Surge

Introduction

In the fast-paced world of ride-hailing services, one company's meteoric rise has captured the attention of investors and industry observers alike. Ola Cabs, with its innovative approach to transportation and unwavering commitment to customer satisfaction, has experienced a remarkable surge in Ola Cabs Share Price, marking a significant milestone in its journey towards becoming a dominant player in the market. ANI Technologies Private Limited, commonly known as "OLA," along with its subsidiaries (collectively referred to as the "Group"), emerges as a prominent technology-driven service provider in the burgeoning cab-hailing market of India. Established with a noble mission to extend mobility solutions to a billion Indians, ANI stands out as one of the frontrunners in offering internet and mobile technology platforms tailored for commuters seeking cab-hailing services.

Distinguished as one of the leading companies in its domain, ANI facilitates seamless cab-hailing experiences through its innovative internet and mobile technology platforms. OLA, a flagship entity of the Group, holds the distinction of being one of the world's largest ride-hailing companies, with a presence spanning over 250 cities across India, Australia, New Zealand, and the United Kingdom. Leveraging its expansive network, OLA provides a diverse array of ride-sharing options, encompassing taxis, bikes, and auto-rickshaws, thereby catering to the diverse commuting needs of millions of customers.

Central to OLA's success is its user-friendly mobile application, which connects clients to a myriad of vehicles, including motorcycles, auto-rickshaws, metered taxis, and cabs. This seamless connectivity empowers both customers and over 1.5 million driver-partners with unparalleled convenience and transparency in their commuting endeavors.

OLA predominantly generates revenue through commission income and convenience fees levied on drivers who enlist on its platform. In the fiscal year 2021, a substantial 86.5% of its revenue stemmed from these sources. Moreover, OLA boasts an extensive pool of over 1.5 million registered drivers on its platform, underscoring its significant market presence and operational scale.

Further bolstering its technological prowess, OLA maintains robust research and development centers, with a notable presence in the United Kingdom. These centers house technical and engineering teams equipped with specialized expertise in product application and development. Notably, OLA Electric, a subsidiary focused on electric vehicles (EVs), has announced plans to establish a dedicated R&D facility in the U.K. with an investment of $100 million over the next five years, underscoring the company's commitment to advancing sustainable mobility solutions.

In the ride-hailing and taxi segment, OLA has witnessed steady user penetration, with figures reaching 7.3% in fiscal year 2022 and projected to rise to 7.5% by fiscal year 2027. Founded in December 2010 by Bhavish Aggarwal and Ankit Bhati, OLA epitomizes a visionary initiative aimed at democratizing mobility for a billion people.

Operating under the brand name "OLA," the Group functions as a privately held entity incorporated and domiciled in India, with its registered office situated in Bengaluru, Karnataka. With its relentless focus on innovation, customer satisfaction, and market expansion, OLA continues to redefine the landscape of urban mobility, exemplifying excellence in the cab-hailing industry.

Ola Cabs: Redefining Urban Mobility

Ola Cabs, often referred to simply as Ola, stands as a pioneering force in the ride-hailing industry. Established with the mission of revolutionizing urban mobility, the company has leveraged cutting-edge technology and forward-thinking strategies to offer convenient, reliable, and affordable transportation solutions to millions of commuters across the globe.

Innovative Services and Solutions

At the heart of Ola's success lies its relentless pursuit of innovation and customer-centricity. Through its diverse range of services, including Ola Micro, Ola Mini, Ola Prime, and Ola Rentals, the company caters to the diverse needs and preferences of its customers. Moreover, Ola's commitment to sustainability is evident in its initiatives such as Ola Electric and Ola Bike, which aim to promote eco-friendly modes of transportation and reduce carbon emissions.

Market Expansion and Strategic Partnerships

Ola's share price surge can be attributed, in part, to its strategic expansion initiatives and partnerships. The company has successfully expanded its presence beyond its home market in India to international destinations such as Australia, New Zealand, and the United Kingdom. Additionally, collaborations with government agencies, automotive manufacturers, and technology firms have bolstered Ola's market position and facilitated its growth trajectory.

Technological Advancements and Customer Experience

Ola's relentless focus on technological advancements and enhancing the customer experience has been instrumental in driving its share price upwards. The company's intuitive mobile app, advanced algorithms, and seamless booking process have set new benchmarks in the industry, garnering praise from both users and industry experts alike. Furthermore, Ola's emphasis on safety measures, driver training programs, and responsive customer support further enhances its reputation as a trusted and reliable service provider.

Financial Performance and Investor Confidence

Ola's robust financial performance and promising growth prospects have instilled confidence among investors, contributing to its share price surge. With impressive revenue figures, expanding market share, and strategic investments in future technologies, the company continues to attract investment interest from both institutional and individual investors. Moreover, Ola's transparent communication and proactive investor relations efforts further reinforce investor trust and bolster its market valuation.

Challenges and Future Outlook

Despite its remarkable success, Ola faces a set of challenges including regulatory hurdles, competition from rivals, and operational complexities. However, with its agile business model, innovative spirit, and resilient leadership, the company is well-positioned to overcome these challenges and capitalize on emerging opportunities in the ever-evolving transportation landscape. As Ola continues to innovate, expand its market presence, and diversify its service offerings, its share price is poised to reflect its continued growth and leadership in the ride-hailing industry.

Conclusion

The phenomenal surge in Ola Cabs' share price underscores the company's unwavering commitment to innovation, customer satisfaction, and sustainable growth. As it continues to redefine urban mobility and expand its global footprint, Ola is poised to maintain its upward trajectory in the ride-hailing industry. With a solid foundation, robust financial performance, and a relentless drive for excellence, Ola Cabs' share price surge is a testament to its status as a trailblazer in the transportation sector.

0 notes

Text

OLA's IPO googly - for 2024 !?!?

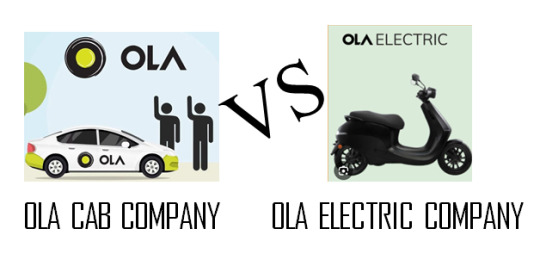

Please be check while applying for the OLA IPO… Check whether you are applying for the OLA CABS Company IPO or the OLA Electric Company IPO.

Both are DIFFERENT companies and both are as different as chalk & cheese.

Competition: Ola Cab Company has stiff competition from Uber and other regional cab companies. Such competition leads to a downwards price war. There are bans and protests conducted…

View On WordPress

#Ola Cabs IPO#Ola Electric Company IPO#ola electric ipo#ola ipo#Ola IPO Date#Ola scooter IPO#Ola Taxi IPO#When is Ola Electric IPO?#When is Ola IPO?

0 notes

Text

Unveiling the Dynamics of Ola Share Price: A Comprehensive Analysis

Introduction to Ola Stock Price:

Ola, a prominent player in the global ride-hailing industry, has not only revolutionized urban transportation but has also become a subject of interest for investors. This article aims to delve into the trends and factors influencing the Ola Share Price, providing readers with a thorough understanding of the company's financial performance and its future prospects.

Historical Performance Of Ola :

To comprehend the current state of Ola Share Price, let's take a step back and examine its historical performance. Founded in 2010 in India, Ola quickly expanded its operations to become one of the world's largest ride-hailing platforms. The company's journey from a startup to a market leader has been marked by strategic expansions, technological innovations, and evolving business models.

Ola Share Price has witnessed fluctuations since it went public, reflecting the inherent volatility of the stock market and the dynamic nature of the ride-hailing industry. The company's IPO garnered significant attention, and its subsequent listing saw both positive and negative movements in share prices, influenced by market sentiment and investor perceptions.

Factors Influencing Ola Share Price:

1. Ride-Hailing Industry Trends:

The ride-hailing industry is directly correlated with the overall mobility trends in society. Ola's share price is intricately linked to the demand for ride-hailing services, influenced by factors such as urbanization, changing commuting patterns, and economic conditions. Any shifts in these trends can impact Ola's business and, subsequently, its share price.

2. Market Competition:

Ola operates in a competitive landscape with other ride-hailing giants, both regionally and globally. Competition within the industry can affect Ola Market Share, pricing strategies, and profitability, all of which contribute to fluctuations in its share price.

3. Technological Innovations:

As technology continues to evolve, so does the ride-hailing sector. Ola's ability to embrace and implement technological innovations, such as autonomous vehicles, electric fleets, and improved user interfaces, can influence investor confidence and impact the company's valuation.

4. Regulatory Landscape:

Regulatory developments play a crucial role in shaping the operational environment for ride-hailing companies. Changes in regulations related to safety standards, pricing structures, or licensing requirements can impact Ola's operations and share price. Investors closely monitor the company's response to regulatory challenges.

5. Financial Performance:

The financial health of Ola is a critical factor influencing its share price. Key financial indicators, including revenue growth, profit margins, and cost management, are closely scrutinized by investors. Positive financial performance often translates to a higher valuation and, consequently, an increase in share price.

6. Global Economic Factors:

Economic conditions, both globally and regionally, can influence consumer spending patterns and business operations. Ola Share Price is not immune to broader economic trends, such as inflation, interest rates, and geopolitical events, which can impact investor sentiment and market dynamics.

Current Market Sentiment:

As of the latest available information, Ola Share Price has shown a mix of positive and negative movements. The market sentiment towards the company is influenced by a variety of factors, including recent financial results, strategic announcements, and broader industry trends.

Investor Recommendations:

For investors considering Ola Shares, a comprehensive understanding of the ride-hailing industry, Ola's competitive positioning, and its growth strategies is essential. Thorough research and analysis, along with staying updated on market trends and regulatory developments, can assist investors in making informed decisions.

Diversification of investment portfolios is a prudent strategy to mitigate risks associated with individual stocks. Considering the dynamic nature of the ride-hailing industry, investors should carefully assess their risk tolerance and long-term investment goals before making decisions related to Ola Stocks.

Future Prospects:

Ola's future prospects are tied to its ability to navigate industry challenges, capitalize on emerging trends, and continue innovating. The company's foray into electric vehicles, expansion into new markets, and diversification of services, such as Ola Financial Services, contribute to its growth potential.

As the global transportation landscape evolves, Ola has the opportunity to position itself as a leader in sustainable and technologically advanced mobility solutions. Investors will closely monitor the company's execution of its strategic initiatives and its ability to adapt to changing market dynamics.

Conclusion:

Ola Share Price reflects not only the performance of the company but also the broader trends and challenges within the ride-hailing industry. Investors seeking to participate in the growth of Ola should approach their investment decisions with a well-informed perspective, considering historical performance, industry dynamics, and the company's future prospects.

As with any investment, diligence, and staying informed are crucial. The ride-hailing sector is dynamic, and Ola's trajectory in the stock market will be influenced by a myriad of factors. Investors, armed with a thorough understanding of these factors, can make informed decisions aligned with their financial objectives and risk tolerance in the ever-evolving landscape of the stock market.

0 notes

Text

Ola Electric's $700 million IPO: A Game-Changer in Sustainable Mobility

Ola Electric’s commitment to sustainable transportation takes a monumental step forward with its IPO plans. Engaging the expertise of investment banks Kotak Mahindra Capital and Goldman Sachs, the company aims to raise $700 million to propel its EV business to new heights.

The capital generated from the Initial Public Offering (IPO) will support the growth of Ola Electric’s electric vehicle…

View On WordPress

0 notes

Text

Ola Electric's Losses Put a Dent in India's Electric Scooter Dream

Ola Electric, India’s largest electric scooter manufacturer, recorded an operating loss of USD 136 million on revenue of USD 335 million in the previous fiscal year. SoftBank-backed business is planning for an IPO worth up to USD 700 million.

The loss exceeds the company’s publicly declared revenue target of USD 500 million. Ola Electric’s sales also fell short of projections, with the business…

View On WordPress

0 notes

Text

70+ Upcoming Latest IPO 2023 List!

Are you finding the Upcoming Latest IPO 2023 List? We provide all details and Many unicorn companies listed. Bajaj energy, byju's, ola, oyo rooms, swiggy, SAMHI Hotels, Fincare Small Finance Bank, Go Airlines, and Utkarsh Small Finance Bank is the latest upcoming IPO. If you want to know more about the IPO list for 2023, visit our blog!

#bajaj energy#byju's#fusion microfinance#gemini foods and fats#go airlines#hdb financial#ipo list#latest ipo#latest ipo 2023#muthoot microfin#ola#oyo rooms#snapdeal#swiggy#upcoming ipo list#upcoming ipo list for 2023#utkarsh small finance bank#vlcc health care

1 note

·

View note

Text

India’s Ola Cabs plans $500 mln IPO, to appoint banks soonon April 19, 2024 at 4:28 am

Reuters exclusively reported that Indian ride-hailing firm Ola Cabs is planning an initial public offering (IPO) to raise $500 million at a company valuation of about $5 billion.

The post India’s Ola Cabs plans $500 mln IPO, to appoint banks soon appeared first on Reuters News Agency.

View On WordPress

0 notes

Text

Ola Electric’s Dynamic Duo: Raahi Autorickshaw and Roadster E-Bike Set to Electrify Urban Mobility!

Ola Electric, renowned for pioneering sustainable mobility solutions, is set to diversify its product lineup with the introduction of electric auto-rickshaws and e-bikes. Named Raahi, the autorickshaw and the Roadster e-bike are poised to revolutionize urban transportation.

Strategic Vision and Product Launch

Ola Electric’s expansion into electric autorickshaws and e-bikes underscores its commitment to providing eco-friendly commuting options. The imminent launch of Raahi and Roadster aligns with the company’s goal of catering to evolving commuter needs while establishing itself as a leader in electric mobility.

Innovative Offerings and IPO Preparation

With successful electric scooter models like Ola S1 Pro, S1X, S1X+, and S1 Air, Ola Electric has solidified its position in the electric vehicle sector. As it prepares for an IPO, the company aims to set new milestones with its upcoming launches. The introduction of electric auto-rickshaws and e-bikes further strengthens Ola Electric’s market presence and enhances its appeal to investors.

Strategic Moves and Financial Objectives

The unveiling of Raahi symbolizes Ola Electric’s strategic direction preceding its IPO. Diversifying its product portfolio and attracting investor interest are key objectives for the company. With plans to raise significant capital through its IPO, Ola Electric aims to fuel growth and expansion in the electric vehicle market.

Leadership and Market Disruption

Under the leadership of Bhavish Aggarwal, Ola Electric is poised to disrupt the electric vehicle landscape once again. Aggarwal’s innovative strategies and focus on competitive pricing and execution in the electric 3W domain signal a game-changing shift in urban transportation. Following its success in the electric 2W market, Ola Electric aims to replicate this achievement in the 3W segment.

As Ola Electric ventures into electric auto-rickshaws and e-bikes, it marks a significant milestone in its journey toward providing sustainable mobility solutions. With a strong leadership team, innovative offerings, and strategic market moves, Ola Electric is poised to capture a significant share of the burgeoning electric vehicle segment, driving positive change in urban transportation.

Also Read

Ultraviolette Unveils Fast-Charging Revolution Sparks Up India’s EV Landscape

0 notes

Text

Why exit points in India are a difficult affair

For every aspiring entrepreneur in India dreaming of a grand exit – a unicorn IPO like Zomato's $1.3 billion debut or a blockbuster acquisition like Flipkart's $16 billion Walmart deal – the reality often paints a less vibrant picture. Navigating the exit landscape in this dynamic market can be akin to traversing a jungle, fraught with unexpected obstacles and demanding strategic agility. While the winds of change are undeniably shifting, the challenges remain significant, impacting diverse sectors and shaping the very trajectory of Indian entrepreneurship itself.

The current market conditions paint a complex canvas. While India boasts the third-largest startup ecosystem globally, with over 80,000 startups and a record $42 billion VC inflows in 2022, successful exits remain elusive. According to Bain & Co., only 0.5% of VC-backed companies achieve an IPO, compared to 10% in the US. This stark disparity speaks to a multitude of factors, including fragmented regulations like the complex SEBI guidelines for IPOs, limited liquidity in secondary markets, and a risk-averse investor landscape with a preference for established businesses over high-growth startups.

Kansaltancy Ventures is a Global Investment Management & IB firm into Venture Capital, Debt, M&A, Consulting & Virtual CFO with a network of 450+ VC Funds, Family Offices, Banks & Financial Institutions. Check https://www.Kansaltancy.com

The impact of these challenges ripples across diverse sectors. For tech startups, once touted as the golden geese of exits, the slowdown in global tech valuations has cast a shadow. Consider Swiggy, the food delivery giant, whose ambitious $4-5 billion IPO plans remain on hold amidst market volatility.

In contrast, infrastructure and social impact sectors, despite promising long-term potential, struggle to attract investors seeking quick returns, hindering their exit options. For instance, education startup BYJU's, despite boasting 100 million users and a $22 billion valuation, is actively exploring M&A options due to the complexities of IPOs in its sector.

However, amidst these complexities, whispers of change are stirring. The Indian government, acknowledging the need for a vibrant exit ecosystem, is implementing proactive measures like simplifying SEBI regulations for startups and encouraging M&A activity. Private equity firms like Blackstone and KKR are increasingly stepping in as secondary investors, providing much-needed liquidity for early-stage investors. This can be seen in Ola's recent $500 million secondary funding round, where existing investors exited partially, injecting liquidity into the company. These shifts, while still nascent, signal a growing understanding of the critical role exits play in fuelling the entrepreneurial engine.

Kansaltancy Ventures is a Global Investment Management & IB firm into Venture Capital, Debt, M&A, Consulting & Virtual CFO with a network of 450+ VC Funds, Family Offices, Banks & Financial Institutions. Check https://www.Kansaltancy.com

Looking ahead, the future of exits in India holds the promise of transformative advancements. The rise of blockchain technology, with its potential to automate compliance and track ownership, could revolutionize secondary trading, unlocking liquidity for early-stage investors. Embracing these innovations necessitates leaders with visionary foresight, capable of navigating the evolving technological landscape and utilizing its potential to create a more robust exit ecosystem.

The lessons learned from this evolving landscape extend far beyond the confines of boardrooms and pitch decks. Aspiring entrepreneurs must adopt a strategic approach to growth, prioritizing building sustainable businesses capable of attracting diverse exit options, not just chasing the elusive IPO dream. Investors, too, must adapt their decision-making strategies, understanding the long-term potential of ventures beyond short-term returns.

Educational institutions and industry bodies can play a crucial role by fostering entrepreneurial skillsets that encompass exit planning and financial literacy, preparing future generations for the complexities of the Indian market.

The entrepreneurial journey in India is an exhilarating yet arduous trek, a constant ascent towards unforeseen horizons. To truly conquer this journey, startups need to not only scale but also plan for strategic exits. Leaders who master the art of adapting to the changing landscape, building resilient businesses, and navigating the intricacies of the exit process will not only unlock sustainable success for themselves but also pave the way for a future where exits are not just occasional triumphs but become the norm, fuelling the growth of Indian businesses, and propelling the nation's entrepreneurial spirit onto the global stage.

So, as you embark on your entrepreneurial odyssey, remember that the ultimate victory lies not just in reaching the summit but also in crafting a clear path of descent. Embrace the challenges, hone your strategic agility, and become a pioneer in shaping a future where exits in India are not merely a dream but a well-charted route to achieving your entrepreneurial aspirations.

Let this not be the end, but the beginning of a conversation. Share your own experiences navigating the Indian exit landscape, the hurdles you faced, and the lessons you learned. Together, let us illuminate the path for future generations of entrepreneurs, ensuring that the Indian landscape becomes not just a fertile ground for startups but also a thriving ecosystem where ventures flourish and exits become a natural, celebrated milestone on the entrepreneurial journey.

About Tushar Kansal, Kansaltancy Ventures:

Tushar Kansal is the Founder and CEO of Kansaltancy Ventures, a distinguished professional recognized as a "Thought Leader" and "Thought Influencer." With a proven track record, Tushar has provided support to startups and growth-stage companies across various sectors. As a Venture Advisor with a Canadian VC Fund, he has contributed to over 350 investments spanning more than 60 countries.

Tushar's expertise is highly regarded in the business community, and his opinions are frequently sought by leading business news channels and publications, including CNN-News18, VCTV (Venture Capital Tv), Business World, Inc42, TechThirsty, and Digital Market Asia. He has delivered over 300 talks, available for viewing on YouTube and Google, showcasing his vast knowledge and insights.

Connected with 450+ investors globally, Tushar Kansal engages in sector-agnostic deal-making, with a typical ticket size ranging from USD 1-50 million.

Contact Information:

Email: [email protected]

LinkedIn: Tushar Kansal on LinkedIn

Personal Website: Tushar Kansal's Website

Blog: Indus Churning Blog

Company Profiles:

LinkedIn Company Profile

Kansaltancy Ventures Website

Facebook Page

Twitter Account

Instagram Page

0 notes

Text

#IPO2024#StockMarketNews#InvestingInsights#FinancialFuture#ShareBazaar#NewIPOs#MarketWatch#InvestmentOpportunities#StocksToWatch#CapitalMarkets2024#UpcomingIPOs

0 notes

Text

Ola Electric IPO Date, Price, GMP, Review, Company Profile, Risks & Financials 2023

New Post has been published on https://wealthview.co.in/ola-electric-ipo/

Ola Electric IPO Date, Price, GMP, Review, Company Profile, Risks & Financials 2023

Ola Electric IPO: Ola Electric is a young Indian electric vehicle (EV) company, aiming to disrupt the transportation landscape with its electric scooters and cars. They compete in the rapidly growing Indian EV market, fueled by government incentives and increasing environmental awareness.

Page Contents

Toggle

Ola Electric IPO Details:

Ola Electric Company Profile:

Ola Electric Financials:

Ola Electric IPO Objectives:

Ola Electric IPO Lead Managers & Registrar:

Ola Electric IPO Risks:

Ola Electric IPO Details:

IPO status: Not yet launched. DRHP filed with SEBI on December 22, 2023.

Expected timeline: Subscription likely in early 2024, listing soon after.

Offer size: Up to ₹5,500 crore fresh issue and offer for sale of 95,191,195 shares.

Price band: Not yet announced. Targeted valuation is $7-8 billion.

News and Developments:

Positive buzz: Filing the DRHP is a crucial step, generating excitement among investors and analysts.

Funding secured: Recent reports about Ola Electric securing $500 million in loan B financing demonstrate investor confidence.

Gigafactory progress: Progress on Ola’s ambitious Gigafactory project in Tamil Nadu adds weight to their production capabilities.

Market uncertainty: Global economic worries and potential inflation may dampen investor sentiment for risky ventures like IPOs.

Ola Electric Company Profile:

Ola Electric, a name synonymous with India’s electric vehicle revolution, is rapidly carving its niche in the burgeoning industry. Founded in 2017 by Bhavish Aggarwal, the mastermind behind Ola Cabs, Ola Electric has come a long way in its mission to disrupt the traditional transportation landscape. Let’s delve into the company’s history, operations, and market position.

A Brief History of Electrification:

2017: Ola Electric embarks on its electric journey, initially focusing on electric rickshaws.

2019: The company unveils its first electric scooter, the S1, followed by the S1 Pro in 2020.

2021: Ola Futurefactory, the world’s largest two-wheeler manufacturing facility, is inaugurated in Krishnagiri, Tamil Nadu.

2022: Ola launches its electric car, the Ola S1, marking its entry into the four-wheeler segment.

2023: The company files its Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) for its highly anticipated IPO.

Operations and Market Position:

Products: Ola Electric currently offers a range of electric scooters, including the S1, S1 Pro, and S1 Air, along with its flagship electric car, the Ola S1.

Market Share: In the Indian electric two-wheeler market, Ola Electric holds a dominant position, capturing over 50% share in FY23. However, it faces stiff competition from established players like Hero Electric and Ather Energy.

Global Ambitions: Ola Electric aspires to become a global leader in the EV space, with plans to enter international markets like the UK and Australia.

Key Facts and Figures:

Funding: Ola Electric has raised over $1 billion in funding from prominent investors like SoftBank, Temasek, and Tiger Global.

Valuation: The company is currently valued at around $5.4 billion, potentially reaching $7-8 billion after its IPO.

Employees: Ola Electric employs over 10,000 people across its various operations.

Prominent Brands and Partnerships:

Ola Futurefactory: This state-of-the-art facility boasts a production capacity of 20 million electric two-wheelers per year.

Ola Electric Mobility Institute (OEMI): This dedicated institute focuses on research and development in electric vehicle technology.

Partnerships: Ola Electric has partnered with key players like Flipkart, Axis Bank, and Bharat Petroleum to facilitate e-commerce sales, financing options, and charging infrastructure development.

Milestones and Achievements:

Building the world’s largest two-wheeler factory.

Becoming the leading electric two-wheeler manufacturer in India.

Developing and launching its own electric car within a short timeframe.

Competitive Advantages and USP:

First-mover advantage in the Indian electric scooter market.

Vertically integrated operations, including battery production.

Focus on cutting-edge technology and innovation.

Building a robust charging infrastructure network.

Ola brand recognition and established customer base.

Ola Electric’s journey is a testament to its ambition and agility in the dynamic EV landscape. With its aggressive expansion plans, focus on innovation, and strategic partnerships, the company is poised to play a pivotal role in shaping the future of mobility in India and beyond.

Ola Electric Financials:

Revenue: Ola Electric has demonstrated explosive revenue growth in FY23, with total revenue reaching Rs. 2,782 crore, a rise of over 500% compared to FY22. This growth is primarily driven by increased sales of its electric two-wheelers.

Profitability: Despite the remarkable revenue increase, the company continues to incur losses. Net loss in FY23 stood at Rs. 1,472 crore, widening from Rs. 784 crore in FY22. This is mainly due to high operating expenses associated with factory setup, research & development, and marketing initiatives.

Ola Electric IPO Objectives:

Ola Electric’s decision to go public through an IPO is driven by several key objectives, all of which align with its ambitious future growth strategy:

1. Capital Raising: The primary objective is to raise funds, estimated to be around Rs. 7,250 crore, through a combination of fresh issue and offer for sale (OFS). This capital injection is crucial for:

Funding Growth: Ola Electric aims to expand its product portfolio beyond electric scooters, introducing new models and venturing into four-wheeler segments like electric cars and commercial vehicles.

Building Manufacturing Capacity: Scaling up production capacity for existing and future models requires significant investments in infrastructure and technology. Ola’s Futurefactory, while impressive, needs additional resources to meet its long-term goals.

R&D and Innovation: Continued investment in research and development is essential for staying ahead in the rapidly evolving EV landscape. This includes battery technology advancements, autonomous driving features, and other cutting-edge innovations.

Debt Reduction and Financial Flexibility: A portion of the raised funds might be used to repay or pre-pay existing debt, enhancing the company’s financial stability and flexibility for future investments.

2. Enhanced Brand Recognition and Market Credibility: Going public brings Ola Electric under the public spotlight, increasing brand recognition and attracting a wider investor base. This can solidify its position as a leading player in the Indian EV market and strengthen its credibility among potential partners and customers.

3. Access to Talent and Partnerships: A successful IPO can attract and retain top talent, crucial for executing the company’s growth strategy. Public listing also opens doors for potential partnerships with established players in the automotive, technology, and financial sectors.

Ola Electric IPO Lead Managers & Registrar:

Ola Electric has entrusted a consortium of renowned investment banks to act as lead managers for its highly anticipated IPO:

Lead Managers:

Kotak Mahindra Capital Company Limited: A leading financial institution in India with extensive experience in managing large-scale IPOs, including SBI Cards, HDFC Life, and LIC.

Citigroup Global Markets India Private Limited: Renowned global investment bank with a strong track record in IPOs across various sectors, including Zomato, Nykaa, and Paytm.

BofA Securities India Limited: Global leader in investment banking with extensive experience in managing major Indian IPOs like IRCTC, Indian Railway Finance Corporation, and Coal India.

Goldman Sachs (India) Securities Private Limited: Reputable investment bank with deep expertise in handling tech-oriented and high-growth IPOs, including Delhivery, Macrotech Developers, and Policybazaar.

Axis Capital Limited: Leading domestic investment bank with successful involvement in IPOs like Adani Wilmar, Glenmark Life Sciences, and Dixon Technologies.

ICICI Securities Limited: Established Indian financial institution with significant experience in managing IPOs like Sona BLW Precision Forgings, Indigo Paints, and Astral Poly Technik.

SBI Capital Markets Limited: Investment arm of India’s largest bank, SBI, with significant involvement in IPOs like Glenmark Pharmaceuticals, Larsen & Toubro Infotech, and Indiabulls Real Estate.

BOB Capital Markets Limited: Investment banking arm of Bank of Baroda, with experience in managing IPOs like Aavas Financiers, RBL Bank, and Sundaram Asset Management.

Track Record:

These lead managers collectively boast a proven track record of successfully managing complex IPOs in diverse sectors, highlighting their experience, expertise, and network of investors. This expertise provides investors with confidence in the execution and overall success of the Ola Electric IPO.

Registrar:

Link Intime India Private Limited is appointed as the registrar for the Ola Electric IPO. The registrar’s role involves handling shareholder records, managing share transfers, dividend payments, and other administrative tasks related to the issue and trading of shares. This ensures a smooth and transparent process for investors throughout the IPO and beyond.

Ola Electric IPO Risks:

While Ola Electric’s IPO holds immense potential, it’s crucial to acknowledge and understand the inherent risks associated with investing in this high-growth, high-risk venture. Here are some key points for potential investors to consider:

Industry Headwinds: The EV market, despite its promising prospects, faces challenges like rising battery costs, dependence on government subsidies, and the potential for policy changes. These factors could impact Ola Electric’s profitability and growth trajectory.

Company-Specific Challenges:

Profitability Concerns: Ola Electric continues to incur significant losses, raising concerns about its ability to achieve long-term profitability. The company’s ambitious growth plans might further strain its finances in the short term.

Intense Competition: Established players like Hero Electric and Ather Energy, along with potential new entrants, will intensify competition in the Indian EV market. Ola Electric needs to differentiate itself and maintain its market share to achieve sustained success.

Manufacturing and Supply Chain Risks: Reliance on imported components and potential supply chain disruptions can impact production timelines and delivery schedules, affecting the company’s ability to meet demand.

Execution Risks: Implementing Ola’s ambitious expansion plans and future ventures like car production requires strong execution capabilities. Any missteps or delays could hinder the company’s progress.

Financial Health:

While Ola Electric’s revenue growth is impressive, its current financial position raises some red flags for investors:

High Losses: The company’s net loss nearly doubled in FY23, highlighting the need for significant improvement in cost management and profitability.

Limited Operating History: Ola Electric is a relatively young company with limited operating history, making it difficult to assess its long-term viability and ability to overcome challenges.

Debt Levels: While currently low, the company might need to take on debt to finance its expansion plans, potentially increasing its financial risks.

Ola Electric Mobility Limited – DRHP

Also Read: How to Check IPO allotment status?

0 notes

Text

OLA Electric IPO - No. 1 Indian eScooter maker coming to IPO - to Apply or Not? Risky? Monopoly Multibagger?

End of Ice Age?… This could be the start of the end for Internal Combustion Engine (ICE) Petrol/Diesel cars & scooters/motorcycles … for… Stone age did not end due to the lack of stones.

Ola Electric, the e-scooter manufacturer submitted its initial draft papers to SEBI to initiate an initial public offering (IPO) aimed at raising ₹5,500 crore.

New equity share issuance amounting to…

Read…

View On WordPress

#ola electric#ola electric ipo#ola electric ipo analysis#ola electric ipo date#ola electric ipo dates#Ola Electric IPO details#ola electric ipo gmp#ola electric ipo gmp review#ola electric ipo latest gmp#ola electric ipo latest news#ola electric ipo price#ola electric ipo price band#ola electric ipo review#ola electric ipo size#ola electric news#ola electric scooter#ola electric scooter ipo#ola ipo#ola ipo news#ola ipo review

0 notes

Text

Analyzing Ola Share Price: Factors Affecting Its Performance

Introduction to Ola Share Price

Ola, the Indian ride-hailing giant, has been a topic of great interest and scrutiny among investors and analysts alike. The company's share price has witnessed its fair share of ups and downs, influenced by various factors ranging from market sentiment to industry dynamics. In this article, we will delve into the Ola share price, its historical performance, and the factors that affect its valuation.

Understanding Ola: A Brief Overview

Ola, founded in 2010 by Bhavish Aggarwal and Ankit Bhati, emerged as a major player in the Indian ride-sharing industry. The company provides a wide range of transportation services, including cabs, auto-rickshaws, and two-wheeler taxis. Ola quickly expanded its services across India, challenging its American counterpart, Uber, and becoming a dominant force in the Indian market.

Historical Share Price Performance

To analyze Ola share price, we must consider its historical performance. Unfortunately, as of my last knowledge update in September 2021, Ola was a privately held company and had not yet gone public. Since then, the company's status may have changed, but I do not have access to real-time data beyond that date. Therefore, any analysis of Ola's share price performance beyond September 2021 is not possible without access to more recent data.

Factors Influencing Ola Share Price

When assessing the share price of a company, multiple factors come into play. In the case of Ola, should it go public, several factors may impact its valuation and share price. These factors are crucial for investors and analysts to consider:

1. Market Sentiment: The overall sentiment in the stock market can significantly impact a company's share price. Positive news about the company, the ride-sharing industry, or the economy as a whole can boost investor confidence and lead to an increase in Ola's share price.

2. Competitive Landscape: Ola's performance is closely tied to the competition it faces, primarily from Uber. The ride-sharing industry is highly competitive, and any strategic moves made by Ola or its competitors can sway investor sentiment and share prices.

3. Regulatory Environment: Government regulations and policies can play a pivotal role in the ride-sharing industry. Ola Share Price could be affected by changes in rules governing the sector, such as licensing requirements, safety standards, or pricing restrictions.

4. Financial Health: The financial stability and performance of Ola are key determinants of its share price. Investors often look at metrics like revenue growth, profitability, and debt levels to gauge the company's financial health.

5. User Base and Growth: The number of users and the rate at which Ola acquires new customers can significantly affect its valuation. A growing user base often translates to higher revenues and increased share prices.

6. Technological Innovations: Ola's ability to adopt and leverage new technologies, such as autonomous vehicles, can be a game-changer for the company. Investors may react positively to innovations that enhance the company's competitive advantage.

7. Partnerships and Mergers: Collaborations and mergers with other companies in the transportation sector can impact Ola share price. Successful partnerships can lead to increased market share and growth potential.

8. Global Economic Conditions: Macroeconomic factors, such as inflation, interest rates, and economic growth, can influence Ola Share Price. An economic downturn can lead to reduced consumer spending and, subsequently, lower demand for ride-sharing services.

9. IPO Performance: If Ola goes public, the success of its initial public offering (IPO) will directly impact its share price. A highly successful IPO can result in a surge in share price, while a lackluster IPO can have the opposite effect.

10. Public Perception and Brand Reputation: How Ola is perceived by the public can play a role in share price performance. Negative publicity or controversies can negatively affect the company's reputation and, in turn, its share price.

Investor Considerations

For investors interested in Ola or any other company's shares, it's essential to conduct thorough research and due diligence. Here are some considerations:

1. Risk Tolerance: Assess your risk tolerance and financial goals. The stock market can be volatile, and investing in individual stocks like Ola can be riskier than investing in diversified funds.

2. Diversification: Diversifying your investment portfolio can help spread risk. Consider investing in a variety of assets to reduce exposure to the performance of a single company.

3. Long-Term vs. Short-Term: Determine your investment horizon. Short-term trading and long-term investing require different strategies. Consider your financial goals when deciding on your investment approach.

4. Financial Analysis: Study Ola's financial reports, including revenue, profit margins, and balance sheets. These provide insights into the company's financial health.

5. Industry Analysis: Understand the dynamics of the ride-sharing industry and how Ola compares to its competitors. Look at trends, growth potential, and potential disruptors in the sector.

6. Regulatory Environment: Stay informed about government regulations that may impact Ola and the ride-sharing industry. Changes in regulations can have significant repercussions.

7. Management Team: Evaluate the management team's experience, vision, and strategic decisions. Strong leadership can drive a company's success.

8. Market Research: Stay updated on market sentiment, trends, and news related to Ola and the ride-sharing industry. Market sentiment can be a powerful influencer of share prices.

Conclusion

Ola, as a prominent player in the Indian ride-sharing industry, holds significant potential for investors. Ola Share Price, should it go public, will be influenced by various factors, including market sentiment, competitive landscape, regulatory changes, and the company's financial performance. Investors should conduct thorough research and consider their risk tolerance, financial goals, and investment horizon before deciding to invest in Ola or any other company's shares.

Please note that the information provided in this article is based on my last knowledge update in September 2021, and the status and performance of Ola may have changed since then. Therefore, it is crucial to access up-to-date information and consult financial experts before making investment decisions.

0 notes

Text

Ola Electric files DRHP with SEBI, to raise Rs 5,500 Cr via fresh issue

Indian electric vehicle company Ola Electric has submitted its draft red herring prospectus (DRHP) for an IPO, aiming to raise Rs 5,500 crore through fresh equity shares and an offer for sale of over 95 million shares. Promoters Bhavish Aggarwal and Indus Trust will sell a portion in the offering, joined by investors like SoftBank and Tiger Global. The funds will be used for capacity expansion, debt repayment, research, and corporate purposes. SoftBank holds the largest stake at 21.98%, with Ola Electric reporting a seven-fold increase in revenue to Rs 2,631 crore in FY23 but an 87.76% rise in losses to Rs 1,472 crore.

If you want to get complete information related to this topic click HERE.

0 notes

Text

Ola Electric Files For IPO: Check Face Value, Opening And Closing Date, Issue Size & More

View On WordPress

0 notes