#Pluggable Optics for Data Center Market Size

Explore tagged Tumblr posts

Text

#Pluggable Optics for Data Center#Pluggable Optics for Data Center Market#Pluggable Optics for Data Center Market Size

0 notes

Text

Wavelength Division Multiplexing Module Market: Expected to Reach USD 5.92 Bn by 2032

MARKET INSIGHTS

The global Wavelength Division Multiplexing Module Market size was valued at US$ 2.84 billion in 2024 and is projected to reach US$ 5.92 billion by 2032, at a CAGR of 11.3% during the forecast period 2025-2032. The U.S. accounted for 32% of the global market share in 2024, while China is expected to witness the fastest growth with a projected CAGR of 13.5% through 2032.

Wavelength Division Multiplexing (WDM) modules are optical communication components that enable multiple data streams to be transmitted simultaneously over a single fiber by using different wavelengths of laser light. These modules play a critical role in expanding network capacity without requiring additional fiber infrastructure. The technology is categorized into Coarse WDM (CWDM) and Dense WDM (DWDM), with applications spanning telecommunications, data centers, and enterprise networks.

The market growth is primarily driven by escalating data traffic demands, with global IP traffic projected to reach 4.8 zettabytes annually by 2026. The 1270nm-1310nm wavelength segment currently dominates with over 45% market share due to its cost-effectiveness in short-haul applications. Recent technological advancements include the development of compact, pluggable modules that support 400G and 800G transmission rates, with companies like Cisco and Huawei introducing AI-powered WDM solutions for enhanced network optimization. The competitive landscape features established players such as Nokia, Corning, and Infinera, who collectively held 58% of the market share in 2024 through innovative product portfolios and strategic partnerships with telecom operators.

MARKET DYNAMICS

MARKET DRIVERS

Exploding Demand for High-Bandwidth Connectivity Accelerates WDM Module Adoption

The global surge in data consumption, driven by 5G deployment, cloud computing, and IoT expansion, is fundamentally transforming network infrastructure requirements. Wavelength Division Multiplexing (WDM) modules have emerged as critical enablers for meeting this unprecedented bandwidth demand. Industry data indicates that global IP traffic is projected to grow at a compound annual growth rate exceeding 25% through 2030, with video streaming and enterprise cloud migration accounting for over 75% of this traffic. WDM technology allows network operators to scale capacity without costly fiber trenching by transmitting multiple data streams simultaneously over a single optical fiber. Recent tests have demonstrated commercial WDM systems delivering 800Gbps per wavelength, with terabit-capacity modules entering field trials. This scalability makes WDM solutions indispensable for telecom providers facing capital expenditure constraints.

Data Center Interconnect Boom Fuels Market Expansion

The rapid proliferation of hyperscale data centers and edge computing facilities has created an insatiable need for high-density interconnects. WDM modules are becoming the preferred solution for data center interconnects (DCI), with adoption rates increasing by approximately 40% year-over-year in major cloud regions. The technology’s ability to reduce fiber count by up to 80% while maintaining low latency has proven particularly valuable for hyperscalers operating campus-style deployments. Market analysis shows that WDM-based DCI solutions now account for over 60% of new installations in North America and Asia-Pacific regions. Recent product innovations such as pluggable coherent DWDM modules have further accelerated adoption by simplifying deployment in space-constrained data center environments.

Government Broadband Initiatives Create Favorable Market Conditions

National digital infrastructure programs worldwide are driving substantial investments in optical network upgrades. Numerous countries have allocated billions in funding for fiber optic network expansion, with WDM technology specified as a core component in over 70% of these initiatives. The technology’s ability to future-proof networks while minimizing physical infrastructure requirements aligns perfectly with public sector connectivity goals. Regulatory mandates for universal broadband access are further stimulating demand, particularly in rural and underserved areas where WDM solutions enable efficient network extension. These coordinated public-private partnerships are expected to sustain market growth through the decade, with particular strength in emerging economies undergoing digital transformation.

MARKET RESTRAINTS

Component Shortages and Supply Chain Disruptions Impede Market Growth

The WDM module market continues to face significant supply-side challenges, with lead times for critical components extending beyond 40 weeks in some cases. The industry’s reliance on specialized optical components manufactured by a concentrated supplier base has created vulnerabilities in the value chain. Recent geopolitical tensions and trade restrictions have exacerbated these issues, particularly affecting the availability of indium phosphide chips and precision optical filters. Manufacturers report that component scarcity has constrained production capacity despite strong demand, with some vendors implementing allocation strategies for high-demand products. This supply-demand imbalance has led to price volatility and extended delivery timelines, potentially delaying network upgrade projects across multiple sectors.

High Deployment Complexity Limits SMB Adoption

While large enterprises and telecom operators have readily adopted WDM technology, small and medium businesses face significant barriers to entry. The technical complexity of designing and maintaining WDM networks requires specialized expertise that is often cost-prohibitive for smaller organizations. Industry surveys indicate that nearly 65% of SMBs cite lack of in-house optical networking skills as the primary obstacle to WDM adoption, followed by concerns about interoperability with existing infrastructure. The requirement for trained personnel to configure wavelength plans and perform optical power budgeting creates additional operational challenges. These factors have constrained market penetration in the SMB segment, despite the clear economic benefits of WDM solutions for bandwidth-constrained organizations.

Intense Price Competition Squeezes Manufacturer Margins

The WDM module market has become increasingly competitive, with average selling prices declining approximately 12% annually despite advancing technology capabilities. This price erosion stems from fierce competition among manufacturers and the growing influence of hyperscale buyers negotiating volume discounts. While unit shipments continue to grow, profitability pressures have forced some vendors to exit certain product segments or consolidate operations. The commoditization of basic CWDM products has been particularly pronounced, with gross margins falling below 30% for many suppliers. This competitive environment creates challenges for sustaining R&D investment in next-generation technologies, potentially slowing the pace of innovation in the mid-term.

MARKET OPPORTUNITIES

Open Optical Networking Creates New Ecosystem Opportunities

The shift toward disaggregated optical networks presents a transformative opportunity for WDM module vendors. Open line system architectures, which decouple hardware from software, are gaining traction with operators seeking to avoid vendor lock-in. This transition has created demand for standardized WDM modules compatible with multi-vendor environments. Early adopters report 40-50% reductions in capital expenditures through open optical networking approaches. Module manufacturers that can deliver carrier-grade products with robust interoperability testing stand to capture significant market share as this trend accelerates. The emergence of plug-and-play modules with built-in intelligence for automated wavelength provisioning is particularly promising, reducing deployment complexity while maintaining performance.

Coherent Technology Migration Opens New Application Areas

Advancements in coherent WDM technology are enabling expansion into previously untapped market segments. The development of low-power, compact coherent modules has made the technology viable for metro and access network applications, not just long-haul routes. Industry trials have demonstrated coherent WDM successfully deployed in last-mile scenarios, potentially revolutionizing fiber deep architectures. This migration is supported by silicon photonics integration that reduces power consumption by up to 60% compared to traditional coherent implementations. Manufacturers investing in these miniaturized coherent solutions can capitalize on the growing need for high-performance connectivity across diverse network environments, from 5G xHaul to enterprise backbones.

Emerging Markets Present Untapped Growth Potential

The ongoing digital transformation in developing economies represents a significant expansion opportunity for WDM technology providers. As these regions upgrade legacy infrastructure to support growing internet penetration, demand for cost-effective bandwidth scaling solutions has intensified. Market intelligence indicates that WDM adoption in Southeast Asia and Latin America is growing at nearly twice the global average rate, driven by mobile operator network modernization programs. Local manufacturing initiatives and government incentives for telecom equipment production are further stimulating market growth. Vendors that can deliver ruggedized, maintenance-friendly WDM solutions tailored to emerging market operating conditions stand to benefit from this long-term growth trajectory.

MARKET CHALLENGES

Technology Standardization Issues Complicate Interoperability

The WDM module market faces persistent challenges related to technology standardization and interoperability. While industry groups have made progress in defining interface specifications, practical implementation often reveals compatibility issues between different vendors’ equipment. Recent network operator surveys indicate that nearly 35% of multi-vendor WDM deployments experience interoperability problems requiring costly workarounds. These challenges are particularly acute in coherent optical systems, where proprietary implementations of key technologies like probabilistic constellation shaping create vendor-specific performance characteristics. The resulting integration complexities increase total cost of ownership and can delay service rollout timelines, potentially slowing overall market growth.

Thermal Management Becomes Critical Performance Limiter

As WDM modules increase in density and capability, thermal dissipation has emerged as a significant design challenge. Next-generation modules packing more than 40 wavelengths into single-slot form factors generate substantial heat loads that can impair performance and reliability. Industry testing reveals that temperature-related issues account for approximately 25% of field failures in high-density WDM systems. The problem is particularly acute in data center environments where air cooling may be insufficient for thermal management. Manufacturers must invest in advanced packaging technologies and materials to address these thermal constraints while maintaining competitive module footprints and power budgets.

Skilled Workforce Shortage Threatens Implementation Capacity

The rapid expansion of WDM networks has exposed a critical shortage of qualified optical engineering talent. Industry analysis suggests the global shortfall of trained optical network specialists exceeds 50,000 professionals, with the gap widening annually. This talent crunch affects all market segments, from module manufacturing to field deployment and maintenance. Network operators report that 60% of WDM-related service delays stem from workforce limitations rather than equipment availability. The specialized knowledge required for wavelength planning, optical performance optimization, and fault isolation creates a steep learning curve for new entrants. Without concerted industry efforts to expand training programs and knowledge transfer initiatives, this skills gap could constrain market growth potential in coming years.

WAVELENGTH DIVISION MULTIPLEXING MODULE MARKET TRENDS

5G Network Expansion Driving Demand for Higher Bandwidth Solutions

The rapid global rollout of 5G infrastructure is accelerating demand for wavelength division multiplexing (WDM) modules, as telecom operators require fiber optic solutions that can handle exponential increases in data traffic. With 5G networks generating up to 10 times more traffic per cell site than 4G, WDM technology has become essential for optimizing existing fiber infrastructure instead of deploying costly new cabling. The 1270nm-1310nm segment shows particularly strong growth potential due to its compatibility with current network architectures, with projections indicating this wavelength range could capture over 35% of the market by 2032. This trend is reinforced by increasing investments in 5G globally, particularly in Asia where China accounts for nearly 60% of current 5G base stations worldwide.

Other Trends

Data Center Interconnectivity

Hyperscale data centers are increasingly adopting DWDM (Dense Wavelength Division Multiplexing) solutions to manage the massive data flows between facilities. As cloud computing continues its expansion with a projected 20% annual growth rate, data center operators require high-capacity optical networks that can support 400G and 800G transmission speeds. The WDM module market benefits significantly from this shift, with fiber-based interconnects becoming the standard for latency-sensitive applications like AI processing and financial transactions. Recent innovations in pluggable optics have made WDM solutions more accessible for data center applications, reducing power consumption by up to 40% compared to traditional implementations.

Emergence of Next-Generation Optical Networking Standards

The adoption of flexible grid technology is transforming WDM module capabilities, allowing dynamic allocation of bandwidth across optical channels. This development enables more efficient spectrum utilization and supports the evolution toward software-defined optical networks. Market leaders are increasingly integrating coherent detection technology into WDM modules, enhancing performance for long-haul transmissions critical for undersea cables and continental backbone networks. While these advancements present significant opportunities, they also require manufacturers to invest heavily in R&D—currently estimated at 15-20% of revenue for leading players—to maintain technological competitiveness in this rapidly evolving sector.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Leaders Focus on Innovation and Strategic Expansion to Maintain Dominance

The global Wavelength Division Multiplexing (WDM) module market features a dynamic competitive landscape where established telecom giants and specialized optical solution providers coexist. Nokia and Cisco collectively accounted for over 25% of the global market share in 2024, leveraging their extensive telecommunications infrastructure and frequent product innovations. Both companies have recently expanded their WDM product lines to support 400G and beyond optical networks.

Meanwhile, Huawei continues to dominate the Asia-Pacific region with cost-effective solutions, while Fujitsu and ZTE have gained significant traction in emerging markets. These players differentiate themselves through customized wavelength solutions tailored for hyperscale data centers and 5G backhaul applications.

Specialized manufacturers such as Corning and CommScope maintain strong positions in the North American and European markets through continuous R&D investments. Corning’s recent development of compact, low-power consumption WDM modules has particularly strengthened its market position in energy-conscious data center applications.

The market has witnessed increased merger and acquisition activity, with larger players acquiring niche technology providers to expand their product portfolios. This trend is expected to intensify as demand grows for integrated optical networking solutions combining WDM with other technologies like coherent optics.

List of Key Wavelength Division Multiplexing Module Companies

Nokia (Finland)

Cisco Systems, Inc. (U.S.)

Huawei Technologies Co., Ltd. (China)

Fujitsu Limited (Japan)

ZTE Corporation (China)

Corning Incorporated (U.S.)

CommScope Holding Company, Inc. (U.S.)

ADVA Optical Networking (Germany)

Infinera Corporation (U.S.)

Fujikura Ltd. (Japan)

Lantronix, Inc. (U.S.)

Fiberdyne Labs (U.S.)

Segment Analysis:

By Type

1270nm-1310nm Segment Leads Due to Increasing Demand in Short-Range Optical Networks

The market is segmented based on wavelength range into:

1270nm-1310nm

1330nm-1450nm

1470nm-1610nm

By Application

Telecommunication & Networking Segment Dominates Owing to Rapid 5G Deployment

The market is segmented based on application into:

Telecommunication & Networking

Data Centers

Others

By End User

Enterprise Sector Leads Adoption for Efficient Bandwidth Management

The market is segmented based on end user into:

Telecom Service Providers

Data Center Operators

Enterprise Networks

Government & Defense

Others

By Technology

DWDM Technology Holds Major Share for Long-Haul Transmission

The market is segmented based on technology into:

Coarse WDM (CWDM)

Dense WDM (DWDM)

Wide WDM (WWDM)

Regional Analysis: Wavelength Division Multiplexing Module Market

North America The North American Wavelength Division Multiplexing (WDM) module market is driven by robust demand from hyperscale data centers and telecommunications networks upgrading to higher bandwidth capacities. The U.S. accounts for over 70% of regional market share, fueled by 5G deployments and cloud service expansions by major tech firms. While enterprise adoption is growing steadily, carrier networks remain the primary consumers. Regulatory pressures for energy-efficient networking solutions are accelerating the shift toward advanced WDM technologies, particularly dense wavelength division multiplexing (DWDM) systems. The market is characterized by strong R&D investments from established players like Cisco and Corning.

Europe Europe’s WDM module market benefits from extensive fiber optic deployments across EU member states and strict data sovereignty regulations driving localized data center growth. Germany and the U.K. lead adoption, with significant investments in metro and long-haul network upgrades. The region shows particular strength in coherent WDM solutions for high-speed backhaul applications. However, market growth faces temporary headwinds from economic uncertainties and supply chain realignments post-pandemic. European operators prioritize vendor diversification, creating opportunities for both western manufacturers and competitive Asian suppliers.

Asia-Pacific Asia-Pacific dominates global WDM module consumption, with China alone representing approximately 40% of worldwide demand. Explosive growth in mobile data traffic, government digital infrastructure programs, and thriving hyperscaler ecosystems propel market expansion. While Japan and South Korea focus on cutting-edge DWDM implementations, emerging markets are driving volume demand for cost-effective coarse WDM (CWDM) solutions. India’s market is growing at nearly 15% CAGR as it rapidly modernizes its national broadband network. The region benefits from concentrated manufacturing hubs but faces margin pressures from intense price competition among domestic suppliers.

South America South America’s WDM module adoption remains concentrated in Brazil, Argentina and Chile, primarily serving international connectivity hubs and financial sector requirements. Market growth is constrained by limited domestic fiber manufacturing capabilities and foreign currency volatility affecting capital expenditures. However, submarine cable landing stations and mobile operator network upgrades provide stable demand drivers. The region shows particular interest in modular, scalable WDM solutions that allow gradual capacity expansion – an approach that suits the cautious investment climate and phased infrastructure rollout strategies.

Middle East & Africa The Middle East demonstrates strong WDM module uptake focused on smart city initiatives and regional connectivity projects like the Gulf Cooperation Council’s fiber backbone. UAE and Saudi Arabia lead deployment, with significant investments in carrier-neutral data centers adopting wavelength-level interconnection services. In contrast, African adoption remains largely limited to undersea cable termination points and mobile fronthaul applications. While the market shows long-term potential, adoption barriers include limited technical expertise and reliance on international vendors for both equipment and maintenance support across most countries.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Wavelength Division Multiplexing Module markets, covering the forecast period 2024–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.8 billion by 2032, growing at a CAGR of 11.3%.

Segmentation Analysis: Detailed breakdown by product type (1270nm-1310nm, 1330nm-1450nm, 1470nm-1610nm), application (Telecommunication & Networking, Data Centers, Others), and end-user industry to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Asia-Pacific accounted for 42% market share in 2024.

Competitive Landscape: Profiles of 18 leading market participants including Cisco, Nokia, Huawei, and Infinera, covering their market share (top 5 players held 55% share in 2024), product portfolios, and strategic developments.

Technology Trends: Analysis of emerging innovations in DWDM, CWDM, and optical networking technologies, including integration with 5G infrastructure.

Market Drivers: Evaluation of key growth factors such as increasing bandwidth demand, data center expansion, and 5G deployment, along with challenges like supply chain constraints.

Stakeholder Analysis: Strategic insights for optical component manufacturers, network operators, system integrators, and investors.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/fieldbus-distributors-market-size-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/consumer-electronics-printed-circuit.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/metal-alloy-current-sensing-resistor.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/modular-hall-effect-sensors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/integrated-optic-chip-for-gyroscope.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/industrial-pulsed-fiber-laser-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/unipolar-transistor-market-strategic.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/zener-barrier-market-industry-growth.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/led-shunt-surge-protection-device.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/type-tested-assembly-tta-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/traffic-automatic-identification.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/one-time-fuse-market-how-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pbga-substrate-market-size-share-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/nfc-tag-chip-market-growth-potential-of.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/silver-nanosheets-market-objectives-and.html

0 notes

Text

Active Optical Cable & Extender Industry worth $6.2 billion by 2028

The report "Active Optical Cable & Extender Market by Product, Protocol (InfiniBand, Ethernet, Serial-Attached SCSI (SAS), DisplayPort, HDMI, Thunderbolt, USB), Form Factor (QSFP, QSFP-DD, SFP, SFP+, PCIE, CXP), Application and Region - Global Forecast to 2028" The active optical cable & extender market size is valued at USD 3.3 billion in 2023 and is anticipated to be USD 6.2 billion by 2028, growing at a CAGR of 13.1% from 2023 to 2028.

The key factors contributing to the growth of the active optical cable & extender market include the requirement for fiber optic modules in data centers and the large-scale adoption of cloud-based services. The acceptance of big data and analytics software is also a key factor driving the active optical cable & extender market. AOCs are deployed within data centers to optimize the existing infrastructure by providing higher data rates among servers, switches, and storage facilities. Cloud computing services require high bandwidth, processor speed, and I/O. Active optical cables are used for various cloud computing applications to meet these demands.

The extenders segment holds the second highest market share of the product segment.

Extender plays a crucial role in modern data transmission and telecommunications networks. As data rates and bandwidth demands continue to escalate, the need for reliable and high-speed connectivity over longer distances has become paramount. Extender addresses this requirement by utilizing optical fibers to transmit data signals over much greater distances than traditional copper cables. The extenders enable seamless communication between data centers, buildings, campuses, and across geographical locations, making them an essential component in an interconnected world.

InfiniBand to hold the largest share of the market in 2022.

InfiniBand is an industry-standard specification with a roadmap defining increasing speeds. It interconnects servers, communications infrastructure equipment, storage, and embedded systems. It provides switched, point-to-point channels with data transfers of up to 600 gigabits per second. Established and governed by the InfiniBand Trade Alliance (IBTA), InfiniBand technology is a prominent networking solution in supercomputer clusters. This technology has also become the preferred network interconnection method for GPU servers, particularly with the growing influence of AI applications.

QSFP-DD segment to exhibit second-highest CAGR between 2023 and 2028.

QSFP-DD (quad small form-factor pluggable double density) is a transceiver module designed to meet the escalating demand for high-speed data transmission in modern networking and data communication environments. The QSFP-DD module incorporates more electrical lanes and higher data rates than QSFP28. This module leverages eight lanes capable of supporting data rates of 25 Gbps or 50 Gbps, resulting in an aggregate data rate of up to 400 Gbps. This significant enhancement in data capacity positions QSFP-DD as an ideal solution for bandwidth-intensive applications, such as cloud computing, data centers, and emerging technologies, including 5G networks and artificial intelligence.

North America to hold the second-largest share of the active optical cable & extender market during the forecast period.

In North America, AOCs and extender cables are widely used for various applications, including data centers, energy, and telecommunications, to provide advanced connectivity solutions. AOCs are vital conduits for high-speed data transmission, enabling fast communication and efficient networking in sectors such as telecommunications and data centers. They support the growing demand for fast and reliable internet connectivity, facilitating seamless video streaming, online gaming, and business operations.

On the other hand, extender cables are crucial in sectors such as manufacturing and energy, where they bridge communication gaps between remote equipment and control centers. They facilitate efficient data transmission from renewable energy sources and bolster security and surveillance systems in critical infrastructure protection and defense. As North America continues to drive technological innovation, AOCs and extender cables are pivotal in enhancing connectivity and data transmission, contributing to the region’s economic growth and technological advancement. Moreover, top active optical cable companies, such as Broadcom (US), 3M (US), Coherent Corp (US), and Corning Incorporated (US), are headquartered in North America.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=138597811

Coherent Corp.(US), Broadcom (US), Amphenol Communications Solutions (US), Corning Incorporated (US), TE Connectivity (Switzerland), 3M (US), Molex (US), Sumitomo Electric Industries Ltd.(Japan), Dell Inc.(US), Eaton (Ireland), EverPro Technology Co., Ltd. (China), Alysium-Tech GmbH (US), Mobix Labs Inc. (US), Unixtar Technology, Inc. (Taiwan), IOI Technology Corporation (Taiwan), GIGALIGHT (China), Siemon(US), Koincable (China), Black Box (US), ATEN INTERNATIONAL Co., Ltd. (Taiwan), T&S Communication Co, Ltd. (China), ACT(Netherlands), APAC Opto Electronics Inc. (Taiwan), Shenzhen Sopto Technology Co., Ltd., (China), Anfkom Telecom (China), Extron (US), and Roctest (Canada) are the major players in active optical cable & extender market. These players have implemented various strategies to extend their global reach and enhance their market share.

About MarketsandMarkets™

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem.Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research.The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook.

0 notes

Text

400G CFP8 in the Data Center: Options For Your Optical Transceiver Module

The worldwide network traffic is expanding due to the rapid expansion of mobile Internet, cloud computing, big data, and other technologies. Major providers in the market have started to launch 400G and even 800G optical transceiver modules. So, do you know the 400G CFP8 optical transceiver module? This article will take you through what CFP8 optical transceiver module is, the types available in the market, its features and benefits, and where it is applicable to use this product.

What is a 400G CFP8 Optical Transceiver Module?

400G CFP8 (Eight Channel Form Factor Pluggable) optical transceiver module is designed for use in 400 Gigabit Ethernet interfaces over single-mode fiber (SMF). It is defined by CFP MSA CFP8 and supports eight channels (8x50G) with data rates of 400Gbps. It has a small size of 40 x 102 x 9.5 mm.

Types of 400G CFP8 Optical Transceiver Module

Generally speaking, there are four types of 400G CFP8 optical transceiver modules on the market— CFP8 FR8, CFP8 LR8, CFP SR16, and CFP DR4. The interfaces of the four CFP8 transceivers are generally specified to allow for 8 x 50Gb/s, 16 x 25Gb/s, and 4x100Gb/s modes, respectively.

Features and Benefits

16x25G electrical interface

Electrical and optical signaling is available using 50Gb/s or 25Gb/s components

Good thermal and cooling management due to a larger footprint

Low port density due to the large size of the CFP8 form factor

Requires a larger enclosure, around the size of a CFP2

Applications

400G CFP8 optical transceiver module is used in 400G Ethernet, data centers, telecommunications networks, cloud networks, enterprise networking, etc.

Conclusion

400G CFP8 optical transceiver module provides Ethernet users with a dense port and high-throughput solution. It has a compact size and low power consumption.

Sun Telecom specializes in providing one-stop total fiber optic solutions for all fiber optic application industries worldwide. We are devoted to not only meeting the need of customers but; also providing our customers with basic and in-depth knowledge about fiber optic products and solutions through articles. Contact us if you have any needs.

1 note

·

View note

Text

Coherent Optical Equipment : By Top Leading Key Players, Ciena Corporation,Cisco Systems Inc, Eci Telecom

Coherent optical Equipment refers to a typically hot-pluggable coherent optical transceiver that uses coherent modulation and is typically used in high-bandwidth data communications applications. Optical modules typically have an electrical interface on the side that connects to the inside of the system and an optical interface on the side that connects to the outside world through a fiber optic cable. The technical details of coherent optical modules were proprietary for many years, but have recently attracted efforts by multi-source agreement (MSA) groups and a standards development organizations such as the Optical Internetworking Forum. Coherent optical modules can either plug into a front panel socket or an on-board socket. Coherent optical modules form a smaller piece of a much larger optical module industry.

Coherent Optical Equipment Market Reports provide a high-level overview of market segments by product type, applications, leading key players, and regions, as well as market statistics. The research insights focuses on the impact of the Covid-19 epidemic on performance and offers a thorough examination of the current market and market dynamics. This crucial understanding of the report's objective can help you make better strategic decisions about investment markets by assessing elements that may affect current and future market circumstances. The leading key players in the Global and Regional market are summarized in a research to understand their future strategies for growth in the market.

Key Players Covered In Coherent Optical Equipment Market Are :

· Ciena Corporation

· Cisco Systems Inc

· Eci Telecom

· Fujitsu Limited

· Huawei Technologies Ltd

· Infinera Corporation

· Nec Corporation

· Nokia Corporation

· Telefonaktiebolaget Lm Ericsson (Ericsson)

· Zte Corporation

· Adva Optical Networking

· Carl Zeiss Meditec

· Zygo Corporation

· Vision Engineering Ltd.

Market has segmented the global Coherent Optical Equipment market on the basis of type, application, and region:

By Type:

· Modules/ /Chips

· Optical Amplifiers

· Optical Switches

· Wavelength-division Multiplexer (WDM)

· Others

By Application:

· OEM’s

· Data Centers

· Networking

· Others

By Regional Outlook (Revenue, USD Billion, 2017 – 2028)

· North America (U.S., Canada, Mexico)

· Europe (Germany, U.K., France, Italy, Russia, Spain, Rest of Europe)

· Asia-Pacific (China, India, Japan, Southeast Asia, Rest of APAC)

· Middle East & Africa (GCC Countries, South Africa, Rest of MEA)

· South America (Brazil, Argentina, Rest of South America)Covid-19 Impact and Recovery Analysis on Industry:

The COVID-19 pandemic has had devastating effects on several industry verticals globally. To constrain the number of cases and slow the coronavirus spread, various public health guidelines were implemented in different countries across the globe. COVID-19 protocols ranging from declaring national emergency states, enforcing stay-at-home orders, closing nonessential business operations and schools, banning public gatherings, imposing curfews, distributing digital passes, and allowing police to restrict citizen movements within a country, as well as closing international borders. With the growing vaccination rate, governments are uplifting the protocols to give a boost to the stagnant economy. Like other industries, Coherent Optical Equipment Market have experienced slowdown the growth, however market is expected bounce back as restrictions are being lifted up by governments across the globe.

IMR presents a detailed study, and summation of data from multiple sources by an analysis of key parameters. Our report on solvent distillation device market covers the following areas:

• Coherent Optical Equipment Industry Sizing Analysis

• Coherent Optical Equipment Industry Forecast Analysis

• Coherent Optical Equipment Market Industry Analysis

Also, the Coherent Optical Equipment market analysis report includes information on upcoming technology trends, restraints, threats, challenges and opportunities that will influence market growth. This is to help companies strategize and leverage all forthcoming growth opportunities. The report contains a comprehensive market and competitive landscape in addition to an analysis of the key vendors.

Key Benefits For Stakeholders

· The study provides an in-depth analysis of the coherent optical equipment market trends to elucidate the imminent investment pockets.

· Information about key drivers, restraints, and opportunities and their impact analyses on the global coherent optical equipment market size is provided.

· Porter's five forces analysis illustrates the potency of the buyers and suppliers operating in the global coherent optical equipment industry.

· The quantitative analysis of the market from 2022 to 2028 is provided to determine the global coherent optical equipment market potential.

0 notes

Text

Wireless Interconnect

https://www.primus-it.com/products/wireless-interconnect/

Wireless interconnect

Wireless Interconnect is at the heart of most modern technology, and the need for strong, secure wireless performance is only growing with IoT and the popularity of smart devices. Module systems must offer reliable performance and support the latest protocols to provide easy internet access for end consumers. These modules can offer a variety of inputs, including SD and USB capability, and new designs are expected to improve efficiency and system sensitivity in small sizes.

Our broad product portfolio includes 25G SFP28 and 50G QSFP28 to support 5G development. Together they compose a comprehensive suite of solutions capable of delivering highly efficient power in small package sizes. Our innovative, cost-effective solutions help simplify design and provide high levels of integration so wireless access is simple and secure, and customers can stay connected.

Primus IT's innovative, efficient optical transceivers offerings help enable the best wireless Interconnect.

SFP interconnect cable overview

The GBIC module is divided into two categories: one is the ordinary cascade GBIC module, which realizes the common connection with other switches; the other is the stack special GBIC module, which realizes the redundant connection with other switches.

GBIC is basically replaced by SFP for the following reasons:

SFP (Small Form-factor Pluggables) can be simply understood as an upgraded version of GBIC. SFP module (half the size of the GBIC module, you can configure more than twice the number of ports on the same panel. Because the function of SFP module is basically the same as that of GBIC, it is also called miniaturized GBIC (Mini-GBIC) by some switch manufacturers.

SFP supports SONET, Gigabit Ethernet, fibre Channel (Fiber Channel), and other communication standards. This standard extends to SFP+, to support 10.0 Gbit/s transmission rates, including 8 gigabit fibre Channel and 10GbE. The optical fiber and copper core version of the SFP+ module is introduced. Compared with the Xenpak, X2 or XFP version of the module, the SFP+ module leaves part of the circuit implemented on the motherboard rather than in the module.

Applications of sfp interconnect

Sfp interconnect cable is the main type of high-speed IO interface interconnection system that has long been used to connect servers, storage, switches, video and communication systems. The main market segment implementations include cloud data centers, enterprise data centers, HPC (High performance Computing) labs, camera surveillance systems, and so on. FP interconnection system is developed from HSSDC (High Speed Serial data Connector). HSSDC-1 and HSSDC-2 break with the traditional use of two-piece metal connector contact systems because plug connectors use PCB with gold-plated pads to match the metal contacts of edge socket connectors. Compared with the previous very large, heavy and wide parallel IO interface connectors and cables, modern sfp interconnect cable is more convenient and efficient. SFP is also used for 2.5, 5, and 8 Gbps data rate applications, including InfiniBand standard single-channel links.

FAQs of Wireless Interconnect

What is Wireless Interconnect?

The so-called wireless network refers to a network that can realize the interconnection of various communication devices without wiring.

What wireless technology includes?

Wireless network technology covers a wide range, including global voice and data networks that allow users to establish long-distance wireless connections, as well as infrared and radio frequency technologies optimized for short-distance wireless connections.

0 notes

Text

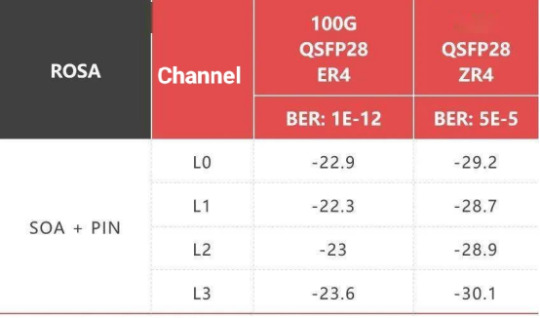

Super Long Haul Transmission: 100G QSFP28 ER4 vs. 100G QSFP28 ZR4

With the continuous development of big data, cloud computing and 5G services, the global network data traffic is increasing, which requires the upgrading of network bandwidth. In order to meet the demand of 100G optical modules for long-distance metropolitan area transmission and data communication network, 100G QSFP28 4WDM-40, ER4 Lite, ER4 and ZR4 optical modules have been launched in the market in recent two years. In this article, we mainly compare and introduce two types of optical modules, QSFP28 ER4 and QSFP28 ZR4.

100G QSFP28 ER4 optical transceiver

The 100G QSFP28 ER4 optical fiber module adopts WDM multiplexing wavelength division technology, the wavelength is 1295.56~1309.14, the packaging form is QSFP28, the LC duplex connector is used, the maximum transmission distance with single-mode optical fiber can reach 40km, with DDM, and has the advantages of small volume and low power consumption.

The transmitter of 100G QSFP28 ER4 optical module adopts DML laser supporting dual rate, and the power consumption is less than 3.8W under the condition of full temperature of 0 ~ 70 ℃, which meets the requirements of green energy saving in data center.

Product Features

v Hot pluggable QSFP28 MSA form factor

v Compliant to Ethernet 100GBASE-ER4 Lite

v Supports 103.1Gb/s aggregate bit rate

v Up to 30km reach for G.652 SMF without FEC

v Up to 40km reach for G.652 SMF with FEC

v Single +3.3V power supply

v Operating case temperature: 0~70oC

v Transmitter: cooled 4x25Gb/s LAN WDM EML TOSA (1295.56, 1300.05, 1304.58, 1309.14nm)

v Receiver: 4x25Gb/s APD ROSA

v 4x25G electrical interface (OIF CEI-28G-VSR)

v Maximum power consumption 4.5W

v Duplex LC receptacle

v RoHS-6 compliant

Applications

v 100GBASE-ER4 Ethernet Links

v Infiniband QDR and DDR interconnects

v Client-side 100G Telecom connections

100G ER4 optical module is connected with 100G switch and the transmission distance can up to 40km. The QSFP28 100G ER4 optical module has high receiving sensitivity and low power consumption, providing an economical and applicable solution for the long-distance application of 100G port between computer rooms.

100G QSFP28 ER4 optical transceiver

The transmission distance of 100G QSFP28 ZR4 optical module can reach 80km through access to single-mode fiber, built-in 4-channel refrigeration EML laser and pin detector, and adopts 4-channel 25G NRZ wavelength division multiplexing technology (lwdm4), with a transmission rate of 100Gpbs. It is mainly used in 100G Ethernet, data center, telecommunications and other scenarios.

Product Features

v QSFP28 MSA compliant

v Hot pluggable 38 pin electrical interface

v 4 LAN-WDM lanes MUX/DEMUX design

v 4x25G electrical interface

v Maximum power consumption 6.5W

v LC duplex connector

v Supports 103.125Gb/s aggregate bit rate

v Up to 80km transmission on single mode fiber

v Operating case temperature: 0℃ to 70℃

v Single 3.3V power supply

Applications

v 100GBASE-ZR4 100G Ethernet

v Telecom networking

The 100G QSFP28 ZR4 optical module overcomes the drawbacks of large size and power consumption with cost-optimized, small size and low power consumption to provide point-to-point solutions in data centers without deploying legacy CFP/CFP2 interfaces and the ability to operate over point-to-point links up to 80km long without optical amplification and dispersion compensation. In general, 100G QSFP28 ZR4 optical module is suitable for long-distance connection and has the advantage of low power consumption. It provides an economical and applicable solution for DCI optical interconnection between distributed data centers.

0 notes

Text

Direct Attach Cable Market Forecast Report By Type, Demand, Technology & Scope, 2025

The global Direct Attach Cable Market research report provides complete insights on industry scope, trends, regional estimates, key application, competitive landscape and financial performance of prominent players. It also offers ready data-driven answers to several industry-level questions. This study enables numerous opportunities for the market players to invest in research and development.

Market Overview:

The global direct attach cable market size is projected to touch USD 13.3 billion by the end of 2025, as per the report released by Million Insights. It is projected to ascend with a CAGR of 36.4% from 2018 to 2025.The rising preference for direct attach cables for the purpose of data storage is predicted to fuel the product demand over the estimated period.

Key Players:

Arista Networks, Inc.

Cisco Systems, Inc.

Cleveland Cable Company

Hitachi

Juniper Networks

Methode Electronics

Molex, LLC

Nexans

Panduit

ProLabs Ltd

The Siemon Company

3M

Request free sample to get a complete analysis of top-performing companies @ https://www.millioninsights.com/industry-reports/global-direct-attach-cable-market/request-sample

Growth Drivers:

Growing spending by producers in highly efficient pluggable products is anticipated to propel the demand for DAC and fiber optics. Moreover, optical fibers act as a crucial transmission medium between HPC and data centers to enable stability and flexibility in data transmission. The cables preferred for interconnect applications and short-range data transmission. The growing penetration of internet is encouraging manufacturers to spend in R&D in order to introduce advanced products for data transmission. The manufacturing of optical fibers is an expensive and cumbersome process, researchers are emphasizing on the development of reliable products, while keeping the overall cost product low.

Increasing application of active optical fibers in consumer electronics and digital signage is anticipated to accelerate the growth of direct attach cable market over the estimated duration. Active HDMI fiber optics are widely preferred over copper cables in various consumer electronics such as 4K TVs owing to their higher bandwidth than copper cables.

The high risk of replacement of optical and copper cables is poised by wireless broadband, which is predicted to restrain the market growth in the upcoming years. Wireless networking provides internet facilities to the rural population. Moreover, a less cost of investment and technological enhancement resulting in excellent internet speed are few other factors promoting wireless broadband demand.

Product Type Outlook:

Direct Attach Copper CablesPassive Direct Attach Copper Cables Active Direct Attach Copper Cables

Active Optical Fibers

End User Outlook:

Networking

Telecommunications

Data Storage

Control Room

High Performance Computing (HPC) Centers (HPCs)

Regional Outlook:

On the basis of region, the market is segregated into Europe, North America, Middle East & Africa, Asia Pacific, and South America. North America is projected to lead the market in the coming years, owing to surging demand for high-speed internet in high-performing computing centers along with steady growth of data centers.

Asia Pacific regional market is predicted to foresee considerable growth from 2018 to 2025, owing to increasing demand for improvements and growing expansion of data centers in nations such as Japan, China, and India. Europe is anticipated to ascend with a steady rate over the estimated period due to rising need for bandwidth in economies such as Germany and the U.K.

Browse Related Category Research Reports @ https://industryanalysisandnews.wordpress.com/

0 notes

Text

Cisco Twinax Cables: Do You Choose The Right One?

Telecom networking key products like patch cord and Twinax cable are the most conventional and mandatory components that support the reliability and hassle-free technical performance of a transceiver. However, there is a variety of Cisco Twinax cables available in the market with many common features but still having some differences in many ways. Understanding the detailed insight features of the Cisco cables helps you make the best decision for your application.

Here we have mentioned everything that you should know about the Cisco Twinax cables, including their technical features and specifications for your convenience.

SFP+ Twinax Cable Basics

Twinax cables are broadly identified as SFP+ direct attach cables in the telecom industry and are used to interconnect switches and other key devices at SFP compatible or Dell transceivers for long running performance. By directly connecting the two end side SFP+ slots, the Cisco cable eliminates the integration of the cost-consuming optical module transceiver required in the equipment. Moreover, it will effectively reduce energy consumption, latency, and installation duration. Therefore, Cisco cables have become an ideal choice that should be integrated into transceivers for modern, high speed 10 Gigabit Ethernet applications.

Working Principle & Features of Cisco Twinax Cables

It is a fixed length of fiber cable with a connector at both ends. The main features of Cisco cables are mentioned below:

· Smallest 10G form factor

· Supports 10G Base Ethernet

· Hot swappable input and output application that plugs into an Ethernet SFP+ port

· Provide flexibility of interface choice

· Supports pay-as you-populate model

· Support digital optical monitoring

· Simple installation & easy maintenance

· Guaranteed performance for sensitive applications & transceivers

· Reliable, robust, and secure cable type

With the development of copper technology, both the Cisco cable and dell transceiver are interchangeable and hot swappable. If you manage to find strong interchangeability comprise a cable, then this is the identity of choosing the right cable for your application. These portable cables are designed specifically for small/medium sized businesses like data centers, hotels, and organizations that need to expand wired connectivity as per the requirement.

There are many versions of Cisco cables that have built-in optical transceivers with slots right into the adapter’s SFP+ ports so you can save buying on expensive pluggable transceiver ports. So, another factor that you need to look after is a cable with a built-in reliable transceiver for keeping the operational cost low.

There are many Cisco Twinax cables and dell transceiver suppliers that offer the standard telecom industry products, meeting the parameters to assure you get the right component at the best price. All you need is to do understand your requirement first and then know what features, qualities, and specifications you need to keep on priority before purchasing. Hopefully, this guide about the Cisco cable will help you get a thorough understanding of how to choose the right cable for your application.

0 notes

Text

Direct Attach Cable Market 2025 Share | Latest Regions, Revenue, Drivers, Trends and Influence Factors

The global Direct Attach Cable Market size is projected to touch USD 13.3 billion by the end of 2025, as per the report released by Million Insights. It is projected to ascend with a CAGR of 36.4% from 2018 to 2025.The rising preference for direct attach cables for the purpose of data storage is predicted to fuel the product demand over the estimated period. Growing spending by producers in highly efficient pluggable products is anticipated to propel the demand for DAC and fiber optics. Moreover, optical fibers act as a crucial transmission medium between HPC and data centers to enable stability and flexibility in data transmission. The cables preferred for interconnect applications and short-range data transmission.

Request a Sample PDF Copy of This Report @ https://www.millioninsights.com/industry-reports/global-direct-attach-cable-market/request-sample

Market Synopsis of Direct Attach Cable Market:

The growing penetration of internet is encouraging manufacturers to spend in R&D in order to introduce advanced products for data transmission. The manufacturing of optical fibers is an expensive and cumbersome process, researchers are emphasizing on the development of reliable products, while keeping the overall cost product low.

Increasing application of active optical fibers in consumer electronics and digital signage is anticipated to accelerate the growth of direct attach cable market over the estimated duration. Active HDMI fiber optics are widely preferred over copper cables in various consumer electronics such as 4K TVs owing to their higher bandwidth than copper cables.

The high risk of replacement of optical and copper cables is poised by wireless broadband, which is predicted to restrain the market growth in the upcoming years. Wireless networking provides internet facilities to the rural population. Moreover, a less cost of investment and technological enhancement resulting in excellent internet speed are few other factors promoting wireless broadband demand. Wireless broadband satisfies the need of businesses more efficiently than copper or optical owing to low installation charges, higher stability, and enhanced reliability.

The key players are focusing on expanding their product array through innovative offers. For example, Nexans in 2018, introduced the addition of direct attach cables and active fiber optics to its data center product offering. These cables can improve the product portfolio of the data center and can offer reliable, cost-effective, and effective performance solutions.

View Full Table of Contents of This Report @ https://www.millioninsights.com/industry-reports/global-direct-attach-cable-market

Table of Contents:-

Chapter 1 Methodology and Scope

Chapter 2 Executive Summary

Chapter 3 Direct Attach Cable: Market Variables, Trends & Scope

Chapter 4 Direct Attach Cable: Product Estimates & Trend Analysis

Chapter 5 Direct Attach Cable: Application Estimates & Trend Analysis

Chapter 6 Direct Attach Cable: End-use Estimates & Trend Analysis

Chapter 7 Direct Attach Cable: Industrial End-use Estimates & Trend Analysis

Chapter 8 Direct Attach Cable: Regional Estimates & Trend Analysis

Chapter 9 Competitive Landscape

Chapter 10 Direct Attach Cable: Manufacturers Company Profiles

Get in touch

At Million Insights, we work with the aim to reach the highest levels of customer satisfaction. Our representatives strive to understand diverse client requirements and cater to the same with the most innovative and functional solutions.

0 notes

Text

#Pluggable Optics for Data Center#Pluggable Optics for Data Center Market#Pluggable Optics for Data Center Market Size

0 notes

Text

The Ultimate Guide To Win The Active optical Cables Market 2022 - Market 4.0 ($3.43 Billion Market)

“Active Optical Cable Market, by Protocol (InfiniBand, Ethernet, Serial-Attached SCSI (SAS), and Others) Form Factor (QSFP, CXP, and Others), End-user Application (Data center, Consumer Electronics, and Others), and Geography - Global Trends & Forecast to 2022"

is expected to reach USD 3.43 Billion by 2022, at a CAGR of 27.1 % during the forecast period. Increasing need of bandwidth requirements and huge deployments of data center are factors that drive the active optical cable market.

The adoption of emerging technologies such as Software-defined networking (SDN) and network-function virtualization (NFV) among others would impact the growth of the active optical cable market. The report covers the major segments of the market which are protocol (InfiniBand, Ethernet, Serial-Attached SCSI (SAS) DisplayPort, PCI Express(PCIe), HDMI, Thunderbolt, USB, and Others ), form factor (QSFP,CXP,CX4, SFP, CFP, CDFP, and others), and end users (data centre, consumer electronics, high performance computing (HPC), telecommunication, personal computing, and others ), and geography. The market size estimations for these segments are provided in this report; the key trends and market dynamics related to these segments are also covered under separate chapters for these segments.

Data center is expected to lead the end user application of the active optical cable market. The growing demand for active optical cable in data center, worldwide is one of the key drivers of the market. The data center market also needs a broad portfolio of fiber optic modules to connect servers, switches, and storage, which is accomplished by active optical cable. Therefore, increase in the deployment of data center is a key driver of market.

Download PDF Here: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=138597811

InfiniBand protocol is highly used protocols among others. It is scalable and supports quality of service (QOS) as well as it is highly efficient among other protocols. The interface of this protocol in commercial applications such as server and supercomputers are playing a key role in the market growth.

Quad Small Form-factor Pluggable (QSFP) form factor are highly used in the active optical cable due to increasing usage in the data center market. QSFP active optical cables are designed to have high performance, low power consumption, and long reach. These type of cables are perfect for high density signal transmission in data centers and high performance computing applications among others.

High implementation cost of the active optical cable is one of the major restraints for the growth of this market. The major players in the market are Finisar Corporation. (U.S.), TE Connectivity Ltd. (Switzerland), Avago Technologies Ltd (U.S.), FCI Electronics (Singapore), Molex Incorporated (U.S.). These players adopted various strategies such as new product developments, acquisition, collaborations, and business expansions to enhance their presence in the active optical cable market.

For more information visit: https://www.marketsandmarkets.com/Market-Reports/active-optical-cable-market-138597811.html

Contact: Mr. Shelly Singh MarketsandMarkets™ INC. 630 Dundee Road Suite 430 Northbrook, IL 60062 USA : 1-888-600-6441.

0 notes

Text

Active Optical Cable & Extender Industry worth $6.2 billion by 2028

The report "Active Optical Cable & Extender Market by Product, Protocol (InfiniBand, Ethernet, Serial-Attached SCSI (SAS), DisplayPort, HDMI, Thunderbolt, USB), Form Factor (QSFP, QSFP-DD, SFP, SFP+, PCIE, CXP), Application and Region - Global Forecast to 2028" The active optical cable & extender market size is valued at USD 3.3 billion in 2023 and is anticipated to be USD 6.2 billion by 2028, growing at a CAGR of 13.1% from 2023 to 2028.

The key factors contributing to the growth of the active optical cable & extender market include the requirement for fiber optic modules in data centers and the large-scale adoption of cloud-based services. The acceptance of big data and analytics software is also a key factor driving the active optical cable & extender market. AOCs are deployed within data centers to optimize the existing infrastructure by providing higher data rates among servers, switches, and storage facilities. Cloud computing services require high bandwidth, processor speed, and I/O. Active optical cables are used for various cloud computing applications to meet these demands.

The extenders segment holds the second highest market share of the product segment.

Extender plays a crucial role in modern data transmission and telecommunications networks. As data rates and bandwidth demands continue to escalate, the need for reliable and high-speed connectivity over longer distances has become paramount. Extender addresses this requirement by utilizing optical fibers to transmit data signals over much greater distances than traditional copper cables. The extenders enable seamless communication between data centers, buildings, campuses, and across geographical locations, making them an essential component in an interconnected world.

InfiniBand to hold the largest share of the market in 2022.

InfiniBand is an industry-standard specification with a roadmap defining increasing speeds. It interconnects servers, communications infrastructure equipment, storage, and embedded systems. It provides switched, point-to-point channels with data transfers of up to 600 gigabits per second. Established and governed by the InfiniBand Trade Alliance (IBTA), InfiniBand technology is a prominent networking solution in supercomputer clusters. This technology has also become the preferred network interconnection method for GPU servers, particularly with the growing influence of AI applications.

QSFP-DD segment to exhibit second-highest CAGR between 2023 and 2028.

QSFP-DD (quad small form-factor pluggable double density) is a transceiver module designed to meet the escalating demand for high-speed data transmission in modern networking and data communication environments. The QSFP-DD module incorporates more electrical lanes and higher data rates than QSFP28. This module leverages eight lanes capable of supporting data rates of 25 Gbps or 50 Gbps, resulting in an aggregate data rate of up to 400 Gbps. This significant enhancement in data capacity positions QSFP-DD as an ideal solution for bandwidth-intensive applications, such as cloud computing, data centers, and emerging technologies, including 5G networks and artificial intelligence.

North America to hold the second-largest share of the active optical cable & extender market during the forecast period.

In North America, AOCs and extender cables are widely used for various applications, including data centers, energy, and telecommunications, to provide advanced connectivity solutions. AOCs are vital conduits for high-speed data transmission, enabling fast communication and efficient networking in sectors such as telecommunications and data centers. They support the growing demand for fast and reliable internet connectivity, facilitating seamless video streaming, online gaming, and business operations.

On the other hand, extender cables are crucial in sectors such as manufacturing and energy, where they bridge communication gaps between remote equipment and control centers. They facilitate efficient data transmission from renewable energy sources and bolster security and surveillance systems in critical infrastructure protection and defense. As North America continues to drive technological innovation, AOCs and extender cables are pivotal in enhancing connectivity and data transmission, contributing to the region’s economic growth and technological advancement. Moreover, top active optical cable companies, such as Broadcom (US), 3M (US), Coherent Corp (US), and Corning Incorporated (US), are headquartered in North America.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=138597811

Coherent Corp.(US), Broadcom (US), Amphenol Communications Solutions (US), Corning Incorporated (US), TE Connectivity (Switzerland), 3M (US), Molex (US), Sumitomo Electric Industries Ltd.(Japan), Dell Inc.(US), Eaton (Ireland), EverPro Technology Co., Ltd. (China), Alysium-Tech GmbH (US), Mobix Labs Inc. (US), Unixtar Technology, Inc. (Taiwan), IOI Technology Corporation (Taiwan), GIGALIGHT (China), Siemon(US), Koincable (China), Black Box (US), ATEN INTERNATIONAL Co., Ltd. (Taiwan), T&S Communication Co, Ltd. (China), ACT(Netherlands), APAC Opto Electronics Inc. (Taiwan), Shenzhen Sopto Technology Co., Ltd., (China), Anfkom Telecom (China), Extron (US), and Roctest (Canada) are the major players in active optical cable & extender market. These players have implemented various strategies to extend their global reach and enhance their market share.

About MarketsandMarkets™

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem.Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research.The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook.

0 notes

Text

A Quick Guide toUnderstanding QSFP28 LR4 Optical Transceiver

There is no denying that the 100G data center optics market is accelerating, which leads to the great demand for 100G optical transceivers. Among all the 100G optical transceiver modules, the QSFP28 LR4 optical transceiver is the most preferred type. It is small in size, has low power consumption, high density, and high speed. This paper will provide you quick guide to understanding QSFP optical transceivers.

What is a QSFP28 LR4 Optical Transceiver?

QSFP28 LR4 is a hot-pluggable, 4-channel, and full-duplex optical transceiver designed for optical communication applications. It is compliant with 100GBASE-LR4 of the IEEEP802.3ba standard.

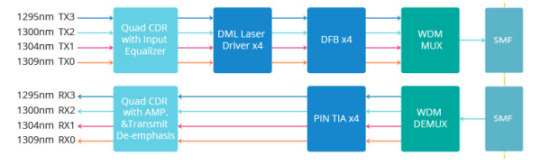

How Does QSFP28 LR4 Optical Transceiver Work?

QSFP28 LR4 optical transceiver converts 4 input channels of 25Gbps electrical data to 4 channels of LAN-WDM optical signals and then multiplexes them into a single channel for 100Gbps optical transmission. At the receiver side, the module de-multiplexers a 100Gbps optical input into 4 channels of LAN-WDM optical signals and then converts them to 4 output channels of electrical data.

The central wavelengths of the 4 LAN-WDM channels are 1295.56,1300.05, 1304.58, and 1309.14nm as members of the LAN-WDM wavelength grid defined in IEEE802.3ba.The high-performance cooled LAN-WDM EA-DFB transmitters and high sensitivity PIN receivers provide superior performance for 100Gigabit Ethernet applications up to 10km links and are compliant with optical interface with IEEE802.3ba Clause88 100GBASE-LR4 requirements.

Features and Benefits

QSFP28 LR4 optical transceiver provides the following features and benefits:

Hot pluggable QSFP28 MSA form factor

Compliant with IEEE 802.3ba 100GBASE-LR4

Up to 10km reach for G.652 SMF

Operating case temperature: 0~70C

Transmitter: cooled 4x25Gb/s LAN WDM TOSA (1295.56, 1300.05, 1304.58, 1309.14nm)

Receiver: 4x25Gb/s PIN ROSA

4x28G Electrical Serial Interface (CEI-28G-VSR)

Single 3.3V power supply

Maximum power consumption 4.0W

Duplex LC receptacle

RoHS-6 compliant

Applications

QSFP28 LR4 optical transceiver is used in 100GBASE-LR4 ethernet links, Infiniband QDR and DDR interconnect, client-side 100G telecom connections, data centers, high-performance computing networks, enterprise core and distribution layers, campus networks, etc.

Conclusion

QSFP28 LR4 optical transceiver is used with single-mode fiber optic cables and duplex LC connectors and can reach a maximum transmission distance of 10km. It has low power consumption, small in size, and is easy to install and deploy. Sun Telecom specializes in providing one-stop total fiber optic solutions for all fiber optic application industries worldwide. Contact us if any needs.

1 note

·

View note

Text

Direct Attach Cable Market Worth $13.3 Billion by 2025

The global direct attach cable market size is expected to reach USD 13.3 billion by 2025 at a 36.4% CAGR during the forecast period, according to a new study by Grand View Research, Inc.Rising adoption of direct attach cables for data storage is likely to boost market growth through 2025. The data center landscape is changing rapidly due to increasing utilization of direct attach cables for data storage. Increasing investments by manufacturers in high-speed pluggable products have been driving demand for active optical cables and direct attach cables. This is in order to meet the requirements of high-density and high-bandwidth applications, whilst keeping power consumption low. Additionally, active optical cables act as the main transmission medium in data centers and High-Performance Computing (HPC) to ensure flexibility and stability of data transmission. The cables are used for short-range data communication and interconnect applications.

Expanding Internet penetration across the world is urging manufacturers and suppliers to invest in research and development activities with a view to develop better products for data transmission. As the production of active optical cables is a complex and expensive process, researchers are increasingly focusing on innovating reliable high-speed pluggable products, whilst keeping the cost of the final product low.

Direct attach cables primarily find application in telecommunication, data centers, networking, consumer electronics, and high-performance computing centers. The telecom sector is one of the most prominent application sectors and is regulated by government and other related regulatory authorities.

Growing use of active optical cables in digital signage and in consumer electronics such as 4K TVs is anticipated to boost the growth of the direct attach cable market. Active HDMI optic cables are increasingly preferred over traditional copper cables in consumer electronics such as 4K TVs on account of their significantly tighter bender radius compared to traditional copper cables.

Furthermore, the high threat of replacement of copper and fiber cables with wireless broadband is hindering the growth of this market. Wireless networking offers internet accessibility and connectivity to people residing in rural areas. Additionally, a low initial cost of investment and technological advancements resulting in higher frequency rates are some of the factors that are contributing to the demand for wireless broadband. Wireless broadband meets the requirements of businesses more effectively than fiber and copper due to lower latency, lesser installation time, and higher reliability and stability.

Next-generation data centers demand high-speed cables, without compromising quality and flexibility of the pluggable product. For instance, Molex, LLC introduced Quad Small Form-Factor pluggable plus products such as the QSFP28 and QSFP56-DD interconnect solutions for high-density applications with a speed of up to 400 Gbps. QSPF28 and QSFP56-DD can be combined with servers, switches, routers, and SAN cards. These pluggable products can perform in extreme high temperature environment, which includes hot data centers.

Market participants have been diversifying their product portfolio through innovative offerings. For instance, in January 2018, Nexans announced the addition of active optical cables and direct attach cables to its data center solutions product portfolio. These cables were added to enhance the product offerings of the data center business segment and were designed to offer cost-effective, high-performance, and reliable solutions.

To request a sample copy or view summary of this report, click the link below: https://www.grandviewresearch.com/industry-analysis/direct-attach-cable-market

Further key findings from the report suggest:

Technological advancements have led to the evolution of high-speed pluggable products to improve high-density applications such as data centers

By form factor, the CFP segment is expected to exhibit the highest CAGR of 38.5% over the forecast period

Market participants are diversifying their product portfolio through innovative offerings, which is slated to give the market a significant boost

Arista Networks, Inc.; Cisco Systems, Inc.; Cleveland Cable Company; Hitachi, Ltd.; Juniper Networks; Methode Electronics; Molex, LLC; Nexans; Panduit; ProLabs Ltd; Solid Optics; The Siemon Company; 3M; Avago Technologies Ltd; Emcore Corporation; FCI Electronics; Finisar Corporation; Shenzhen Gigalight Technology Co., Ltd; Sumitomo Electric Industries, Ltd; and TE Connectivity Ltd are some of the key players in the market.

See More Reports of This Category: https://www.grandviewresearch.com/industry/semiconductors

About Grand View Research:

Grand View Research, Inc. is a U.S. based market research and consulting company, registered in the State of California and headquartered in San Francisco. The company provides syndicated research reports, customized research reports, and consulting services. To help clients make informed business decisions, we offer market intelligence studies ensuring relevant and fact-based research across a range of industries, from technology to chemicals, materials and healthcare.

0 notes

Text

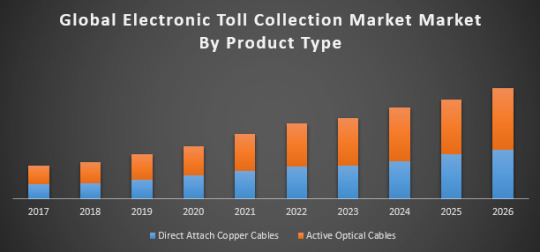

Global Electronic Toll Collection Market

The Global Electronic Toll Collection market size was valued at US$ 1.18 Bn in 2017 and is expected to reach US$ 14.4 Bn by 2026 to exhibit a CAGR of 36.71% during the forecast period.