#Popular Apps and Tools Millennials Are Using to Save on Travel

Text

Popular Apps and Tools Millennials Are Using to Save on Travel

The holiday travel season is upon us, and many people, both young and old, want to get away. Millennials, in particular, are known for their love of travel. But how do they afford it when the average millennial budget does not contain a whole lot of wiggle room?

If you need ideas for getting away on the cheap, read on to learn about strategies and popular tools the millennial generation is using to prioritize travel without breaking the bank.

Follow Travel Bloggers

Why not get budget travel tips sent straight to your inbox? It is super easy! Search for your favorite travel bloggers on WordPress and beyond! Once you have found your faves, click the follow button and get updates and tips via email. Follow them on social media as well for even more tips.

Work It

Dying to dive deep into exploring a new city, but do not have the budget for a month-long getaway? Get a job! No, not a higher-paying one — just one in the locale you wish to explore.

In the new gig economy, employers eagerly seek workers willing to take on temporary and contract work. Some will even assist you in finding temporary lodging. If not, apps like Airbnb and VRBO are great places to find temporary wallet-friendly digs.

Use Reward Points

Do not overlook the beauty of reward points! Tons of credit cards offer travel rewards, even if your credit is less than perfect. Always jetting off somewhere new? Seek out cards with flight rewards. Many top airlines offer credit cards that help you build points quickly.

Have a favorite hotel chain? Join their rewards program! It is usually free, and you earn points with every stay. And a person’s gotta eat! Do not overlook loyalty programs many chains such as Starbucks offer to save toward free drinks and eats.

Money-Saving Apps

Free travel apps can be a boon for budget travelers! Apps such as TripAdvisor help travelers find local points of interest, read reviews by other travelers and find budget accommodations in seconds.

Other apps such as Trail Wallet help you set a travel budget and gently remind you when you are going overboard. Apps like Detour help you set up walking tours with audio guides in major cities worldwide, and for the truly cash-strapped, apps such as CouchSurfing allow you to find locals willing to open their doors — and couches — so you can crash after your explorations.

Many believe travel is well out of their budget, but that’s just not true. If the generation plagued with student loan debt and some of the highest costs of living we have seen yet can monetarily prioritize seeing this beautiful world, many others probably can too! By using a bit of ingenuity along with the latest technology, people young and old alike can afford to get away and enjoy a break from the norm this holiday season or any time of year!

Disclaimer: This post is sponsored by PSECU, a Pennsylvania-based credit union.

The post Popular Apps and Tools Millennials Are Using to Save on Travel appeared first on Travel to Blank.

from Popular Apps and Tools Millennials Are Using to Save on Travel

0 notes

Text

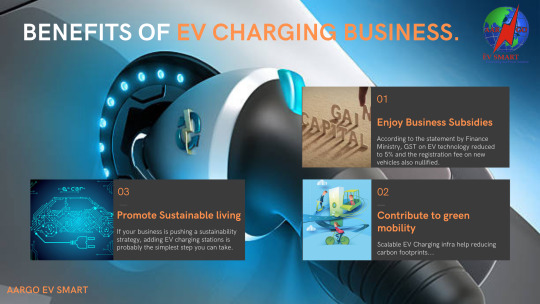

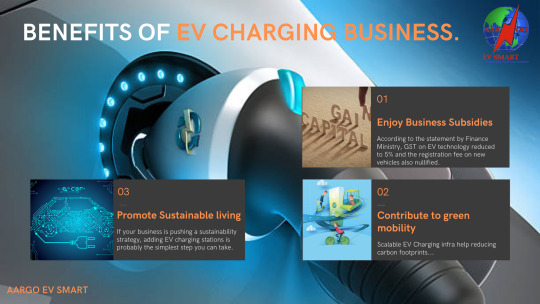

Benefits of EV Charging Business

EVs can also reduce the emissions that add to environmental change and smog, improving public health, and reducing ecological damage. Charging your EV on sustainable power, for example, solar or wind minimizes these emissions even more. See the difference in emissions between a conventional vehicle and an EV utilizing the calculator on the right.

Tax Advantages and subsidies-

According to a statement by the Finance Ministry, the GST rate on EVs will be reduced to 5% from 12%. The government will provide an additional income-tax deduction of ₹1.5 lakh on the interest paid on loans taken for the purchase of EVs. This amounts to a benefit of around 2.5 lakh over the loan period to the taxpayers who take loans to purchase electric vehicles. In order to make infrastructure for EV affordable, the Council also decided to lower the GST rate on the charger or charging stations for EV to 5% from 18%. Also, to make EV popular for public transportation, the hiring of electric buses (of carrying capacity of more than 12 passengers) by local authorities will be exempted from GST.

Attract and Retain High-quality employees-

Adding EV charging stations to company buildings is a huge advantage for employees— it encourages and facilitates their experience using EV vehicles. Think about the number of hours an employee parks in your lot. All of those hours could be utilized for charging their car, which is a significant advantage, particularly for employees who might not have a home charger.

This advantage can help decrease commute times in territories where EVs meet all requirements for carpool paths. All of this implies that the expansion of an EV charger can be a ground-breaking negotiating tool in retaining and holding talented workers. proprietors express strong interest in work environment charging, and numerous businesses already see the importance of introducing charging stations.) As an added bonus, if your organization’s premises service clients face to face, charging stations offer a special incentive for them to pay you a visit.

Promote Sustainability-

If your business is pushing a sustainability strategy, adding EV charging stations is probably the simplest step you can take. By adding charging stations, you demonstrate to both your employers and customers that you are taking action to promote sustainability and do your part in reducing emissions. In the event that you want to include EV charging as a feature of corporate sustainability strategy, it is easy to go with a smart EV charging infrastructure. Smart EV charging frequently incorporates a dashboard.

Entice Customers

Adding charging stations can help you entice customers in two key ways- Build Goodwill-Consumers, especially millennials, increasingly care about associating with corporations that promote sustainability. They are more motivated to work for a company that produces a product or service they believe in and also create it in a responsible way.

Attract customers with EVs- Charging stations can also attract new and loyal customers eager to patronize businesses that are supporting the transition to electric mobility. If you run a restaurant or a hotel, you might entice customers with your charging stations who might otherwise go somewhere else.

Increase your Footfall-

Using Apps, EV drivers can discover areas to charge their vehicles. If you introduce an EV charger on your business premises, it will feature on these applications and could increase the probability of visitors to your business. A significant number of these visitors could be local, yet some may be basically passing by and need to stop and charge. EV chargers could expand your brand awareness and these visitors could quit charging their vehicle and become one of your customers.

2. Generate revenue through selling electricity-

By installing an EV charging point outside your business, you could generate additional revenue by selling the electricity to the EV driver. Businesses can retain a profit on the price the driver pays to charge their vehicle, so the more EV charging points you have the more revenue you could generate.

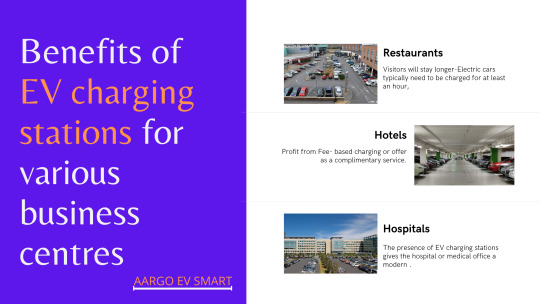

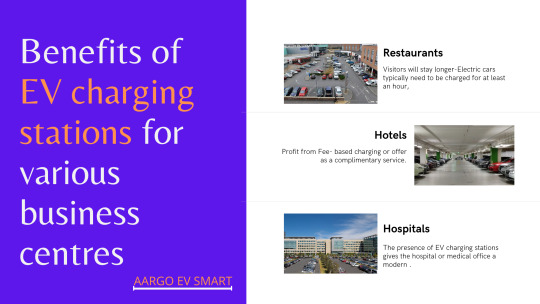

Benefits of EV charging stations at various business centers-

Restaurants

Visitors will stay longer-Electric cars typically need to be charged for at least an hour, which means that any visitors who are using your charging station will stay in your facility for at least that time. That means they’ll be more likely to opt for dessert, drinks, or coffee. Will attract repeat customers-A restaurant that offers EV charging stations is very likely to attract repeat customers. Electric car users will know that your facilities are able to accommodate their needs, and they’ll be more likely to choose you over competitors.

It will be recognized as environment friendly-Many consumers are very concerned with the environmental impact of their choices, and if your restaurant has an EV charging station, it will enhance your company’s image. When consumers are looking for an environmentally friendly choice, they’ll choose your restaurant.

Hotels

Profit from Fee-based charging or offer as a complimentary service.

Attract new Ecotourism and electric car driving premium guests.

Increase revenue per available room.

Get higher ratings and positive reviews on popular travel sites.

Get your Hotel featured in map services and navigation systems.

Hospitals

The presence of EV charging stations gives the hospital or medical office a modern and sustainable appearance that fits the overall image that healthcare facilities typically portray: healthy living, scientific achievement, and cutting-edge patient care.

Why Should Healthcare facilities install EV charging stations-?

Providing valuable amenities for doctors, nurses, patients, and visitors who drive EVs.

Improving air quality and reducing emissions near sensitive communities.

Enhancing the visual appeal of the facility with high-tech charging stations.

Adding a “Green” dimension to the overall perception of the hospital.

Benefits of EV charging Station in Shopping Malls and Multiplex:

Shopping Malls and Multiplex

Attract EV Drivers-

Many individuals drive and park for their retail shopping trips—so many that the quantity of vehicles in lots is being utilized to anticipate the market performance for retail organizations. EV drivers clearly need to stop, as well, and they want to do it where they can charge. As the EV industry continues developing, EV charging will turn into a key investment for retailers that need to draw in EV drivers.

Increase Customer Spend-

Charging not only attracts customers and keeps them around longer, but can also increase the amount of time and money they spend in a store. One major retailer found that shoppers spent about a dollar for every minute they were in the store. By adding EV charging, the retailer tripled time in-store and, as a result, tripled customer spends. Now that’s a good deal.

Put your Store on Map-

EV charging also puts stores on the map—in a real sense. EV drivers depend on EV charging applications like Charge Point’s mobile application to rapidly discover places where they can charge. At the point when drivers search for spots to charge in our application, they can easily discover retail locations that offer to charge for their vehicles. Since EV drivers tend to charge their vehicles while they shop, having charging accessible can persuade drivers to pick a store over a competitor’s area.

Create Customer connections-

With smart EV charging that lets drivers interact with stations online or in a mobile app, retailers can create virtual “Connections” to drivers who use their stations. This just requires drivers to submit a simple connection request in the app and allows retail organizations to learn more about who��s using their stations and when giving them new insight into their customers.

Offer Special Deals to EV Drivers-

Retailers can build on these customer connections by developing loyalty programs that cater to EV drivers. Giving EV drivers special deals can bring them back to charge (and shop) even more often. Some sample offers that companies have created include free charging, free stays at hotels and even free wine tastings.

Corporate Parks

Customers stay for long-

Retail businesses benefit from EV charging stations. They motivate customers to remain and browse for more with straightforward parking facilities that can at the same time give charging benefits. Longer browsing increases the shopping basket.

2. Keeping employees happy-

Employees who feel valued by the business and whose needs are more engaged and productive. Providing essential electric charging for employees demonstrates a responsive and committed employer. Demonstrating environmental commitment and supporting brand value- Social responsibility is key for businesses today and enabling greener vehicles is a significant part of that. EV charging at the work environment sends a reasonable and clear message about where the business stands regarding reducing the ecological impact of its operations and personnel.

3. Improving efficiency and cutting costs-

Electric charging points at work may make life easier for employees; reducing time spent seeking out where to charge, for example. For companies where vehicle fleets are part of the business, there are opportunities to save on fuel and maintenance costs.

4. Providing convenience for clients-

Clients make decisions about which companies to partner with on the basis of a wide range of factors – and convenience is one of the most important. EV charging stations on the premises will be attractive as clients can simply fill up with charge while attending a meeting or site visit.

#EV charging stations#ev charging#EV charger installer#EV charging points#Electric vehicle charging station#DC fast charger#charging points#Charging station

1 note

·

View note

Text

Online services through the generations

New Post has been published on https://3veta.com/blog/articles/online-services-through-the-generations

Online services through the generations

People from every generation are working from home a lot more. They are also beginning to demand more of their everyday tasks to be quickly done from the comfort of their own sofa. Like a doctor’s consultation, your son’s tutoring or even your Zumba class. This is where online services provided by video chat are proving extremely convenient. It’s therefore no surprise that their popularity is growing vigorously.

As with most other technological advances, this phenomenon of online services from home fits differently into every person’s life. We adopt innovations in many different ways. But there is one factor that allows us to know pretty accurately how a certain person would react to a new technology. It’s the generational factor.

From Gen Z to Baby Boomers, everyone has their reasons to use video conferencing for online services. And when it comes to offering them, the motivators are even more diverse for each generation. We will examine the following generations:

Gen Z

Millennials

Gen X

Baby boomers

Generation Z

Born after 1996, some Gen Zers aren’t even old enough to vote yet. The oldest of them only entered the jobs market a few years ago and are still far from the corporate tops. With their limited buying potential, aren’t they the least interesting in terms of consumer economy? Well, we are talking about online services here. A video chat that ticks off an item from your to-do list. And this is where you hit a sweet spot with Gen Z.

Gen Z youngsters have grown up surrounded by technology. Тherefore they look for conveniences in every area of their lives. Online shopping is like second nature to them. Out of all generations they have benefitted the most from digital educational tools. This means that they will consider any queueing or travelling to offices an unnecessary waste of time.

Do you see how they will be the perfect customer of a home-based online service? As they gradually increase their disposable income, they will start needing various consultations more regularly. And they are certain to opt for the digital option.

What will they fancy?

One thing to consider though is that while Gen Z are digital natives, they are exclusively bound to their smartphones. Laptops are a device of last resort to them. According to a Snapchat survey 78% of Gen Z admit their mobile phone is their most important device to go online. At the same time 57% of them feel insecure without their smartphone. So providers who are after the Gen Z users should ensure their mobile app has all the bells and whistles of the desktop one.

And bells and whistles are a very Gen Z thing. You can attract them by offering a fully integrated experience in your platform. This means scheduling, in-app messaging function, file exchange, visual tools. Being extremely impatient too, they will definitely not tolerate online service apps that make them go through numerous unnecessary steps.

You might wonder what channels to use to promote your service to Gen Z.

Social media? Think again.

This young generation are the kings and queens of Snapchat and Instagram, but according to McKinsey, they’re more pragmatic and analytical about their decisions than the other generations. When deciding on products and services their most trusted source are family and friends. This is good news for providers of online consultations because they gain their customers through word of mouth anyway.

Gen Z is an exciting market and will be soon showing its full potential. But if there is one generation that you must never neglect when you talk about technology, it’s the Millennials.

Millennials

Everybody is interested in millennials and there are good reasons for this. People born roughly between 1980 and 1995 are currently the world’s largest living generation. They have finally recovered from the economic recessions and have a total spending power of $1.4 trillion in the US . They will be a significant consumer of online services but also have various reasons for entering this segment as providers.

Millennials are the most mobile generation with more than half planning to live in their homes 5 years or less. They are also known to dislike commuting which all contributes to their propensity to choose home-based professions. Millennials are currently accumulating valuable professional experience in the corporate world. Come a few years, and they will be looking to practice their knowledge exclusively to their own advantage.

As users of online services from home millennials are already ahead of other generations. There is strong evidence that they require telemedicine services more than the generations before them. Currently only 15% of GPs in the US use telemedicine tools. Since millennials don’t have great healthcare needs yet, you can imagine the kind of revolution that will happen very soon.

How can you win a millennial customer for your online service?

Well, unlike Gen Z, millennials will not choose an online service just because it is online. Millennials are savvy customers who like to visit both physical and online shops for their purchases. To trust an online service they need to be certain about the quality of the service and the technological benefits. Providers have to make sure that their credentials are visible and that they have an informative website. Any extra options that your platform offers will be welcomed by the millennial user.

Enough said about millennials. The future of online services from home becomes even more exciting when you factor in the mature generation – Gen X.

Generation X

Gen X is sometimes forgotten by media and analysts and that is totally unfair. Known as “the slackers” and “the forgotten middle child”, they are in fact quite remarkable. People born between 1961 and 1979 are not as numerous as the Baby Boomers and Millennials. However, they are currently at the top of their careers and concentrate the largest spending power in the world.

However, Gen X seems to have a widely appreciated problem in the corporate workplace. According to data from the Harvard Business Review, Gen X is the most overlooked for promotions generation. They are however highly skilled, and actually have more direct reports than millennials on similar positions. They are also great communicators and know how to show empathy. This makes Gen Xers the perfect candidate for an online consultant – where your success really depends on your qualities.

In addition to that, many Gen X people are currently looking after their growing children. Аt the same time they are taking care of aging parents. That makes it quite difficult to fit a 40-hour office week and the leap to freelancing is more likely.

Gen Xers are also not afraid of adopting new technology. While Millennials top all charts in terms of technology use, Gen X is now adopting new technology much faster than 10 years ago. As providers of online services, they will appreciate the benefits of a robust video platform with well integrated features.

Gen X as users of online video services

As users, Gen Xers use both laptops and smartphones and will prefer consultants that allow them to have that choice. Their large disposable income makes all sorts of consultations very useful for them – financial investments, tax advice, even career coaching. Managing their heavy workloads takes up a significant amount of time. Therefore choosing an online video solution becomes a necessity for them.

Last but not least, let’s take a look at Baby Boomers. Online video consultations actually fit them really well. Read on to see why.

Baby boomers

Baby boomers are now going into their retirement age. You would expect them to have a decent disposable income, having finished raising their kids and paying their mortgages. It doesn’t seem to be quite so simple though. The financial crises of the 2000s have had an effect on savings and many baby boomers are delaying retirement. The problem is they are getting older and are generally less tech savvy than millennials and Gen X. This means they will not be the most competitive on the jobs market.

However they are highly skilled due to their long experience. Therefore they will be valuable providers of online consultations in the traditional professions – doctors, lawyers, business consultants.

On the other hand, many baby boomers who are more comfortable in their finances will choose to retire early. This could be either to look after grandkids or to pursue their long neglected hobbies. We often see them leaving their workplace only to start struggling with all their free time. Online consultations present a fantastic opportunity for them to maintain social contacts and attachment to their profession.

Of course, that means baby boomers will require the support of online consultation platforms. For their needs they are likely to choose simple, but reliable solutions that streamline the consultation process. That allows them to focus on what they love.

We shouldn’t underestimate the baby boomers as users of online consultations either. They already need regular access to healthcare and are the second largest living generation. So it’s only a matter of time until they become the largest users of telemedicine. For those of them who are with restricted mobility all other online video services will be particularly helpful.

Which generation to focus on?

There are many reasons to expect that online video services will impact greatly every generation’s life. The truth is there is still time until they reach their peak. However this only means that now is the right moment to start preparing for that. If you are an online service provider, think about how your customers want to connect with you and what you can do to meet their needs.

Here’s the full infographic “Meet Today’s Generations”.

#3veta #3vetaservices #onlineservices #videoservices #videoconferencing #meetclientsonline

0 notes

Text

16 Mind-Blowing B2B Video Marketing Tips to Increase Sales

Video marketing has become one of your most essential marketing tools to date, regardless of your B2B niche or industry. Cisco reported that by 2022, online videos would make up more than 82% of all consumer internet traffic — 15 times higher than it was in 2017.

Using video allows you to share more information about your products and services when compared to images or even gifs.

Instead of reading about it, people would rather watch instead. Maybe that's why 72% of customers would rather learn about a product or service by way of video.

If your mission is to sell successfully to other businesses, you can host a wide range of videos on YouTube, your website, and share it across your social media platforms.. To get started, here are sixteen mind-blowing B2B video marketing tips you can use to increase sales.

1. Create an Onboarding Video for New Employees & Customers

What does creating an onboarding video have to do with increasing sales. Great employee onboarding can improve employee retention by 82%, and keeping your staff informed and happy will allow them to contribute better to your company.

When new employees have a better understanding of your company mission and goals, they're more equipped to do tasks that will allow you to meet and maintain them.

Adobe New Employee Onboarding Video

youtube

A negative onboarding experience results in new hires being 2x more likely to look for other opportunities. But onboarding videos aren't just for new employees, and it's also great for new customers.

After new leads have successfully completed your sales funnel and have turned into paying customers to send them an onboarding video. Walk them through your product or service features, tools, updates, and help them with their first task/order.

A customer onboarding video helps to retain new customers and is a more effective method when compared to sending customers to a lengthy FAQ page to get started.

Wishpond Introduction Video

youtube

Remember your onboarding video should give an overview of what you have to offer. It should be more focused on what you can do to help them rather than why they should choose you. The fact that customers are watching this video means they've already considered you as their #1 choice.

2. Create a Product Demo Video for Sign Ups

A product demo video and an onboarding video are two of a kind. Your welcome video is sent to leads who have been successfully converted to a customer. However, a demo video is a sneak peek you send to potential leads to convert them into customers.

As a B2B company, especially when you're selling software or products, not all customers are willing to “buy to try” products or can be apprehensive about trying a free trial because it means taking time to overcome a learning curve.

Instead, send them a demo video with all the features that can help their business. Approximately 97% of marketers say video has helped users gain a better understanding of their products and services. Seeing your product in action gives customers proof that your features deliver what it promotes. Demo videos can also save your sales team time and effort when pitching to customers.

Asana Demo and Product Tour

youtube

3. Create Easy to Follow Tutorial Videos

It's well known that videos have the power to establish any brand or person as a thought leader. Youtube is a prime example of this statement. Tutorial videos allow you to educate your viewers (and potential customers) so that they see you as a credible source for all their industry needs.

There are two ways your B2B business can go about creating tutorial videos. You can either teach people how to use your product for their business or help them with various problems specific to their industries.

New Relic

youtube

New Relic is a software company that regularly posts videos on YouTube about how customers can effectively use their software, whether they're a beginner or an advanced user. They publish tutorials on every feature, including how to use detailed reports and manage integrations with other platforms.

Hubspot Academy

Hubspot decided to take it up a knot and created Hubspot Academy, teaching people how to be active social media marketers and sales reps in the digital marketing industry. They also offer certification and free resources with each video.

This video tutorial is one of the most powerful lead generation tools. You can use it to reach new customers and maintain your position as an expert in your industry.

4. Push and Promote Unboxing Videos

Long before influencers became a trend, YouTubers we're already working with and promoting brands with unboxing videos. An unboxing or a haul video is a video of a person discussing products they've purchased, typically on a bulk shopping spree, known as a "haul".

It's an online review done by an influencer that people trust, before customers. Around 89% say ROI from influencer marketing is comparable to or better than other marketing channels.

MuseFind shows 92% of consumers trust an influencer more than an advertisement or traditional celebrity endorsement. B2C companies aren't the only ones that can profit from this kind of video marketing.

Alibaba Express Shipment Unboxing

youtube

5. Share Your Brand Story

Sharing your brand story can help your B2B company connect with your ideal customer audience and push sales as you showcase the hard work that has built your company to what it is now.

Seth Godin once said, "Marketing is no longer about the stuff that you make, but about the stories that you tell." If you don't share your brand’s story, someone else might do it for you, and who knows your brand better than you do?

Harness the power of storytelling to boost your online presence and encourage customers to invest in what you have to offer them. Once you've completed your brand story, you can incorporate it in your sales pitch, marketing funnel, bio, mediums like your website and blog.

The We Company Story | WeWork

youtube

6. Post Customer Review Videos

Customer reviews play a vital role in your B2B business. Around 15% of online users don't trust businesses without reviews and who can blame them. Reviews are held in high regard, Bright Local found that 91% of millennials trust online reviews as much as friends and family.

If 72% of customers won't take action before they read some reviews, then you should make it a priority to have customer reviews and testimonials available on all your online platforms.

Amazon Web Services Customer Success Story

youtube

When you share your customer success stories and reviews, it shows viewers that your service and team are a reliable and worth investment for their own company. You show real first-hand people, real problems, and experience that your services can help.

7. Use VR or Augmented Reality to Promote Products

A Statista report shows that the global AR market is expected to rise significantly to about $90 billion by 2022.

Apruve defines VR (virtual reality) as a computer-generated environment or realities that are designed to simulate a person's physical presence in a specific environment that is designed to feel real. In contrast, AR (augmented reality) represents the integration of digital information with the user's environment in real-time.

Virtual and Augmented reality can help B2B companies to display their products, physical space (such as showrooms, shop floors, real estate, and more), giving business owners a real-life experience without having to travel or being limited by their geological location. This type of video marketing can also be an alternative to your demo or product video.

If you're a tech company, then VR and AR are something you should consider using to attract more customers.

AR App Idea: Interactive Realtor Resources for Open Houses

youtube

8. Share Highlights of Your Summit or Webinar

Approximately 73% of B2B marketers say a webinar is the best way to generate high-quality leads. But did you know that reposting or sharing your summit/webinar on your website or social media can create evergreen content that can keep attracting and generating leads for your B2B company?

Sharing snippets or the entire replay of your webinar allows people who might have missed or loved your webinar to review and share their favorite speaker's section.

Adweek Webinar- The Importance of Marketing Data Quality: Put a Stop to Wasted Media Spend

youtube

9. Share a Video Recap of Sponsored Events

In the B2B business community, it's popular for brands to sponsor events to fund a cause, gain notary, and brand awareness in their industry. Share your sponsored event with a video to promote it and show off how your brand impacts your industry.

This video marketing technique is better for networking than sales. It shows that your open to connecting with brands for future projects, collaborations, or events.

Intel is known to sponsor sporting and technological events to connect with their target audience and network with corresponding brands. Each year they cover the Olympic, supporting athletes and the hosting country.

Experience the Moment at the Olympic Winter Games | Intel

youtube

10. Create a “New Feature” Video or GIF

If your B2B company is launching a new feature or product, create a video to promote it! Graphics and words can only go so far instead, spice things up with an upbeat video showing customers how and where they can find and use your new feature.

Once you've created your video, you can share it across all your social media platforms and create an ad campaign to boost awareness and sales. Buffer regularly uploads new videos for every new feature, it's a cross between a demo and promotion video.

Buffer Analyze: Buffer’s Social Media Analytics and Reporting Tool

youtube

11. Promote Seasonal/Holiday Campaigns with Videos

During the holidays most B2C companies normally ramp up their marketing strategy to grab customers during the holiday rush, which doesn't leave much room for B2B brands like yourself. I say, don't let the holiday rush past you!

Create and promote a seasonal/holiday video campaign promoting how your services can help companies manage and maintain their business workflows before or during the holiday.

MultiVu is a media house that does media and creative strategies for B2B and B2C companies, during the holidays they post and promote holiday campaigns they've produced for clients to attract new prospects.

Bring Back the Holidays Campaign

youtube

12. Show Off Your Brand Collaborations with Videos

If you've partnered with a brand for a co-promotion or brand collaboration, give customers an idea of what they can expect from you too with a video.

For instance, when Tidio had announced their Shopify integration, they launched a video campaign not only to inform people but to show them how to integrate Tidio with their Shopify store successfully.

Tidio - Chat Bot Announcement! (Shopify)

youtube

13. Start a YouTube Channel for Your B2B Company

Google found that 65% of people use YouTube to help them solve a problem.

Want to build a house or remove weird parasites from your eye? YouTube might have the answer. Youtube is one of the best places to host and store all your video content for viewers and potential customers.

YouTube is the second most popular website after Google. Users view more than 1 billion hours of video each day on YouTube.

Youtube acts as an evergreen content base. Even if you don't see views significantly during the first few hours of uploading, it builds over time.

But if you're focused on making your reach, here are 18 powerful ways to grow your YouTube channel so you can see your subscriber count go up.

Kickstarter

14. Create Case Study Videos

According to the Content Marketing Institute, the top three most important marketing tactics for B2B businesses are in-person events, webinars, and case studies.

Case Studies allow you to go more in-depth, add statistics, and reports about how your products or services assisted a brand with a specific problem. Executing successfully on case studies requires not only telling a great story but also supporting it with great user experience.

This is done by organizing your content so users can search for what they need, developing headlines that capture the reader's attention and presenting the content in a way that's interesting and informative.

15. Add Video Content to Your Social Media Strategy Media Ads

Adding video to your social media strategy can help to boost your engagement and following. Social media posts with video have 48% more views when compared to static images. Not to mention social video gets shared 50% more than text and images combined.

Need another good reason to add video content to your social media marketing strategy?

Biteable found that 85% of consumers want to see more video content from brands.

Simply reposting your video content on your social media platforms can add more value to your customers. With platforms like IGTV and Facebook (live) videos, you can now add longer content and more views.

16. Follow these 3 B2B Video Marketing Gems for Success

Creating a video is the easy part. It's making sure that it's received well, has massive viewers, and helps to boost your online presence.

That's the real challenge. To help, here are three B2B video marketing gems that are easily overlooked but a critical factor in the success of your video.

Keep it short: and concise, Ad Age found that 33% of viewers will stop watching a video after 30 seconds, 45% by one minute, and 60% by two minutes. A lengthy video doesn't always mean good. Videos under two minutes long get the most engagement. Viewers now have shorter attention spans and would like to get to the point of your video sooner rather than later. If your video has to be very long, then it leads me to my next point!

Create eye-catching and engaging content: that will make your viewer stop dead in their tracks to watch your video. You're not the only B2B company using video marketing, and you won't be the last, so your video must stand out against competitors and the sea of online content competing for your customer's attention. Here are 6 types of video ideas to supercharge your social media.

Track your video ROI: to make sure your video is successful. Track what type of content gets the most engagement, your ad budget to promote, create, or boost your videos, and lastly, how each video brings revenue or leads to your website or sales team.

Summary

Video content is expected to make up 82% of internet traffic by 2021, and after that, it will only grow as more brands are incorporating video into their day to day marketing activities.

Around 73% of B2B marketers say video positively impacts their ROI. Proving it's worth the investment!

The next time you have a marketing campaign or ad campaign, think about adding video as your primary source of media and see what happens. Here's a quick recap at some of the B2B video marketing tips and ideas you can use to increase sales for your company:

Create an Onboarding Video for New Employees & Customers

Create a Product Demo Video for Sign Ups

Create Easy to Follow Tutorial Videos

Push and Promote Unboxing Videos

Share Your Brand Story

Post Customer Review Videos

Use VR or Augmented Reality to Promote Products

Share Highlights of Your Summit or Webinar

Share a Video Recap of Sponsored Events

Create a “New Feature” Video or GIF

Promote Seasonal/Holiday Campaigns with Videos

Show Off Your Brand Collaborations with Videos

Start a YouTube Channel for Your B2B Company

Create Case Study Videos

Add Video Content to Your Social Media Strategy Media Ads

Follow these 3 B2B Video Marketing Gems for Success

Related Articles

8 Best Business YouTube Channels to Sharpen Your Entrepreneur Skills

5 Ways to Attract More Customers with Ecommerce Video Marketing

[6 Tips for Branding on Instagram: How to Increase Your Brand's Value Using Instagram](https://blog.wish

from RSSMix.com Mix ID 8230801 https://ift.tt/3aXqDPx

via IFTTT

0 notes

Text

The Best of the Best Proven Side Hustles You Should Know About

Need to make a little (or a lot) of extra money this month?

Side hustles are an incredible way to boost your monthly income. Whether you want to stay home and make money from home, get out of the house to make money, or try something unique and fun – I have you covered.

This list is updated weekly and if there is anything you think I need to take out or add to the list, please let me know in the comments below the post.

Also, if you do find something and you’re having a lot of success with it, you’d be helping everyone out by sharing your win in the comments below. Thanks so much and enjoy the guide to making more money each month.

Table of Contents

My First Picks...

1. Share Your Opinion

2. Door Dash

3. VIPKID

4. Airbnb

5. Share Your Blog with the World

6. Become a Virtual Assistant

Online Hustles

7. Start a Social Media Marketing Business

8. Ebates (Now Rakuten)

9. Honey Browser Extension

10. Inbox Dollars

11. Fiverr

12. Make Money with PayPal

13. Amazon

14. Amazon Affiliate Links

15. eBook Publishing

16. Etsy

17. Craigslist

18. User Testing

19. Become a Freelance Writer

20. Zazzle

21. eBay

22. Do Transcription Work or Data Entry Work

23. Sell Your Photos Online

24. Start a Web Design Business

Driving Hustles

25. Uber/Lyft Driver-Partner

26. Uber Eats

27. Be a Paid Designated Driver

28. Drive People to the Airport

Extremely Passive Hustles

29. Rent Out Your Garage or Driveway

30. Become a Voiceover Artist

31. Rent out your Car

32. Rent out a Room full-time

Some Skill Required Hustles

33. Become an Online Coach

34. Create an Online Course

35. Spray Tanning

36. Become a Cover Letter/Resume’ Writer

37. Develop an App

38. Catering

39. Computer Repair

40. Computer Training

41. Guitar Gigs

42. Guitar Lessons

43. Handyman Work

44. Lifeguard

45. Mobile Oil Change

46. Network Marketing

47. Personal Training

48. Tutoring

49. Teach Music Lessons

50. Start a Baking Business

51. Become a Sports Umpire

Physical Labor Hustles

52. Clean Pools

53. House Cleaning

54. Mowing Lawns

55. Painting Gates

56. Painting Services

57. Shoveling Snow

58. Wash Cars

59. Wash Windows

Unique Hustles

60. Rent out Your Baby Gear

61. Sell Your Hair Online

62. Paint Street Numbers

63. Sell Drinks

64. TaskRabbit

65. Start a Home Staging Business

66. Be a Work-From-Home Customer Service Rep

67. Start an Estate Sale Service Business

68. Start a Vending Machine Business

69. Pick Up Trash in Parking Lots

You’ve Got to be Kidding Me Hustles

70. Be a Sperm Donor

71. Be a Plasma Donor

72. Become a Cuddler

73. Pick up Dog Poop

74. Rent-a-Friend

Easy Peasy Hustles

75. Babysitting

76. Dog Walking

77. Gig Walking

78. Golf Course

79. House-sitting

80. Mystery Shopper

81. Pet Grooming

82. Pet Sitting

83. RedBox

84. Sell ScrapMetal

85. Tax Prep

86. Sign Spinner

87. Sign Holder

Final Takeaway

My First Picks…

These first five are favorites because they are quick ways to get started making extra money and they have long-term potential as well! All five of them do require an internet connection, but sine you’re reading this from the internet, I think you’re covered there ?

1. Share Your Opinion

and get money sent to your PayPal

Yup, you can actually generate side income by simply giving your opinion via online surveys. It’s not going to make you rich tomorrow, but it’s still a great way to generate extra income during your down time.

If you think surveys may be the way to go, check out our full list of the top survey companies for both online and offline opinions here.

Survey Junkie

2. Door Dash

Door Dash is our favorite pick for food delivery because it’s been reported back to us that DoorDashers make slightly more than UberEats drivers. While we don’t have any factual statistics to prove this right or wrong, we still pick DoorDash over UberEats as our top side hustle for food delivery. If you have a car, bike, or scooter, get started with Door Dash today and start making money for your next vacation, your upcoming wedding, or whatever expense you’re saving for!

Maybe you just don’t feel like driving people around in your car or maybe you don’t even have a car. Depending on the city you live in, Uber Eats allows you to deliver food to people via your car, bike, or scooter. Turn on the app in the morning before work, when you get home, or whenever you have some extra time to make money on your terms.

Door Dash

3. VIPKID

VIPKID will pay you up to $22/hour to teach English from the comfort of your home to children in China. Currently VIPKID has over 70,000 teachers teaching English as a second language to over 600,000 children in China.

They do require you to have a Bachelor’s degree from either the USA or Canada and they ask for “some teaching experience”. However, from the teachers we have spoke with from VIPKID, they said “teaching” doesn’t have to mean teaching in a traditional educational setting.

The lessons are 30 minutes long and you will be paid up to $11 for each 30-minute lesson. One thing to note is since you are teaching across the globe in a live setting, you will be teaching at odd hours (late at night or first thing in the morning). However, the teachers we spoke to said it was fun, rewarding, and it paid well for being able to stay at home and teach from their laptops.

VIPKID

4. Airbnb

Did you know you can rent your room or house out at Airbnb? They have been around since 2008 and millions of people have been renting out their rooms or entire homes to travelers from all over the world. If you do this right, you may be able to cover your entire mortgage! If you’re going to be gone for a month or two, you may as well allow your space to make money while you’re gone.

Airbnb

5. Share Your Blog with the World

I started this blog in 2015 from my laptop at my kitchen table and today it generates over $10,000 per month 🙂 However, in the beginning it was just a side hustle project that turned into full-time income much quicker than I would have ever dreamed.

If you love writing, then starting a blog is exactly the right side hustle for you. There are many ways to generate income from blogging, with one of the most popular being through affiliate income.

How does it work?

You know how you can share a referral link from companies you love and they will send you $5 for referring them a customer? Affiliate partners work the exact same way.

Is blogging complicated?

Absolutely not! But just in case, I did create a step-by-step guide to help you get started in about 15 minutes.

Start a Blog

6. Become a Virtual Assistant

If you enjoy working from your laptop, then becoming a virtual assistant may be exactly what you need. We use a few virtual assistants for Money Peach and one of them earns over $10,000 per month as a VA. Other places where you can become a virtual assistant for an agency where they find work for your is Upwork. They take a 10% fee, but 90% is still a great side hustle.

You can also listen to Episode 80 on the Money Peach Podcast (below) where my own Virtual Assistant shares how she got started as a VA and within a few years was able to quit her full-time job and start earning over $10k per month doing what she loved.

Virtual Assistant Course (Use Promo Code Peach 10 for $50 Off)

Online Hustles

I love online hustles because they give you the freedom to do these anywhere. If you’re constantly traveling for work or out of town a lot you’re going to absolutely love these online side hustles.

7. Start a Social Media Marketing Business

Our very own social media manager was actually someone who was enrolled inside Awesome Money Course. We noticed how great she was inside our private students-only Facebook group and we offered her a job with us. Now she manages all of our social media for Money Peach and she has also been offered social media jobs from other bloggers!

A great place to get started is visiting the Facebook Side Hustle Course by Bobby of Millennial Money Man. You can read how many of the students from the course are landing social media jobs for $1,000 – $2,000 month! Not a bad little side hustle, right?

Facebook Side Hustle

8. Ebates (Now Rakuten)

Ebates is a company that has partnered with over 2,000 online companies to form an affiliate relationship with each of them. An affiliate relationship simply means Ebates and each online company have created a partnership where Ebates will refer you or I to buy something from them, and that company then sends Ebates a thank-you referral.

The good news: Ebates then splits the thank-you referral with you, and you earn Cash Back.

The Better News: You can Make Money by referring friends, family, or anyone else to join Ebates!

Ebates extends their referral program to any Ebates member who would like to share how to earn Cash Back while shopping online. Once you create an account with Ebates, you can invite your friends and family to join in on the Cash Back savings, and YOU will also receive a thank-you referral, aka make money.

BONUS $10 with Ebates Right Now

9. Honey Browser Extension

Honey is a free tool that will search for online coupons and apply them to your online shopping cart to make sure you are saving the most money. Instead of searching for coupons one at-a-time and applying them individually, Honey does all of this for you in the matter of seconds. Not only will you save money, but you will also MAKE MONEY with their refer-a-friend program. For anyone you refer to the app, Honey will send you $5 as soon as they purchase something via the app up to $1,000.

Honey Browser Extension

10. Inbox Dollars

Inbox Dollars is a rewards club that pays you in cash for completing a variety of online activities. This can include searching the internet, filling out surveys, printing off coupons, and shopping online. If you are already doing these things, you may as well get paid for it, right?

Inbox Dollars

11. Fiverr

Fiverr is a platform where you can sell your products and services starting at $5 per gig. After you have a few $5 gigs under your belt, you can start increasing how much you charge. Here at Money Peach, we hire people from Fiverr all the time. Just recently, we found someone for a quick logo design and another to transcribe some videos we created.

Also, the Fiverr platform does take 20% from each gig. Therefore, if you do a $5 gig, you will take home $4 per gig. However, if you can complete 3-4 gigs in an hour, your hourly rate could start at $16 – $20 per hour!

Fiverr

12. Make Money with PayPal

Already have a PayPal account?

We have put together a list of the side hustles that will pay you in PayPal gift cards which can then be deposited into your PayPal account – just like cash!

Where to make money with PayPal

13. Amazon

Selling on Amazon is almost identical as selling on eBay in terms of fees and ease of use. However, sometimes items that don’t sell as well on eBay do better on Amazon and vice versa. Either way, it is a side hustle worth looking at if you can buy for cheap and resell for a higher price.

14. Amazon Affiliate Links

I know of a guy who started out as a handyman. He then took that idea as a handyman and started his own blog to teach people how to fix things themselves through blogging and video tutorial. At the end of every post or video, he would tell you what tool he used to get the job done and would provide a link directly to Amazon for you to purchase that product.

However, he also signed up for a free Amazon Affiliate Account. Every time someone clicks on his link and buys ANYTHING on Amazon, he gets a commission! Think about this: Amazon pays him for the tool he recommended and also for anything else they Add To Cart. This is why I love blogging and why I have a free tutorial to help you get started.

15. eBook Publishing

Make money by writing your own book and self publishing it on Amazon for free. There are different options available for how your can price your book and earn income from the sale of your book in the Amazon store. Questions about self publishing your own book? Check this out.

16. Etsy

Instead of having to open up your brick and mortar store, sell your creations on Etsy. Whether you make clothing, crafts, baby toys, or jewelry, you can open up your own store at Etsy. I have a friend selling her awesome clothing line on Etsy and it brings in a very nice income for the family. This is another great side hustle, but don’t expect instant results. You may need to be patient for this one.

17. Craigslist

We all know you can buy and sell stuff on Craigslist, but have you ever thought about offering a service you can provide. If providing a service isn’t your thing, you can scan Craigslist for great deals and then later resell items for a profit. This takes persistence and patience, but I have a friend who went from a $4k truck to a $24k in truck in 18 months by flipping cars from Craigslist.

There are also many other sites competing with Craigslist and you may have better exposure by posting on these sites like Craigslist.

18. User Testing

Don’t want to do an online survey, but still like to surf the web and earn some cash? Companies will pay you to try out their apps or visit their websites and give them feedback. Usertesting and UserFeel uses your feedback on apps and websites that aren’t as user-friendly and then pays your for it.

19. Become a Freelance Writer

If you are a good writer, consider searching online sites such as freelancer.com for writing jobs. Individuals or companies might need freelance writers for a number of reasons.

Individuals or companies might need a writer for their blog or website, or a company might need a writer for its instruction manuals, for instance.

Pro Tip: The best way to learn how to get freelance writing jobs is from someone who has been doing it for years. Holly Johnson generates over $100k per year freelance writing and she has a program to show you how to do it.

**Money Peach Readers: Use Coupon Code PEACH10 to Receive 10% Off at Checkout**

Become Freelance Writer

An even better option is to learn from those who are already making 6-figures as freelance writers. Check out Episode 13 on the Money Peach Podcast where Holly and Greg Johnson share how they got started as freelance writers and soon turned their side hustle into a 6-figure income.

20. Zazzle

Make money on Zazzle as a designer by selling your artwork on different products or you can actually make and manufacture the products for sale. I have a friend who takes old dry wood and paints slogans on them. She needs to sell them on Zazzle; she could create a very quick and profitable side hustle.

21. eBay

You can have your own store up in only a few minutes at eBay. To start, you must have a seller account, must be verified through PayPal. You are even able to give a detailed description of your store with a catchy design to attract customers. I have a friend who will buy all of the unused bras at a last chance type of store and resell them for a profit at her eBay store. Last I heard, she was doing $1,000/month in her first couple of months.

22. Do Transcription Work or Data Entry Work

Companies hire transcriptionists for a number of reasons. A doctor’s office might need a medical transcriptionist to record information about a patient’s appointment, or law enforcement agencies might need transcription services for court cases or suspect interviews.

Data entry work, which is a bit easier than transcription work, is also available from companies who hire people to work from home. Simply google “transcription work” or “data entry jobs” for a list of companies currently hiring work-from-home reps.

23. Sell Your Photos Online

Do you take amazing photos? You can actually sell your photos online at places like iStockPhoto, Shutterstock, Fotolia, and Bigstockphoto. Photos can be sold over and over again, allowing you to earn a residual income!

24. Start a Web Design Business

If you’re knowledgeable about web design, you could make money creating or improving on websites for individuals or businesses.

Advertise on Craigslist or approach businesses directly if they have a website that needs improvement.

There really is no shortage of ways to make extra money if you’re willing to get creative and do some research. Which financial goals will you use the extra cash you earn to accomplish?

TWEET THIS 'When you're broke, the best place to go to get more money is work'Click To Tweet

Driving Hustles

If you have a car, you may as well use it to help you side hustle, right? Here’s our favorite driving side hustles.

25. Uber/Lyft Driver-Partner

If you are unfamiliar with Uber or Lyft, then make sure you still have a pulse and you are breathing air.

To get started, some minimum requirements you need are a car, a smartphone, and the Uber or Lyft app. You become available to drive as soon as you complete the activation process and then you are ready to start earning money. Fares are paid out weekly or up to 5X a day when you register for Instant Pay with your debit card!

Today, there are more riders on the road than ever! This is one of my absolute favorite ways to start generating money quickly.

Drive with Uber

Drive with Lyft

26. Uber Eats

Maybe you just don’t feel like driving people around in your car or maybe you don’t even have a car. Depending on the city you live in, Uber Eats allows you to deliver food to people via your car, bike, or scooter. Turn on the app in the morning before work, when you get home, or whenever you have some extra time to make money on your terms.

Uber Eats

27. Be a Paid Designated Driver

Pretty self-explanatory.

28. Drive People to the Airport

Some airports don’t allow Uber or Lyft to drop people off or pick them up, but that doesn’t mean you shouldn’t still offer up airport rides on your own. Post an ad to all of your friends on social media that you are now their preferred method of getting to the airport. I used to do this when I first got my license and it paid very well 🙂

OR JUST DRIVE WITH UBER OR LYFT (See Number 24 Above)

Extremely Passive Hustles

If you like passive income, then you may want to review the top 40 passive income ideas . But to get you started, here are our favorite side hustles that are also extremely passive.

29. Rent Out Your Garage or Driveway

You’ve likely heard of AirBnB, where you can rent out rooms in your house – or your whole house – to travelers wanting to avoid the impersonal feel and high cost of hotel rooms.

Maybe you can’t or don’t want to rent out rooms in your house, but you might have space in your garage to rent out. Sites such as Air Garage help people rent out their garage spaces and driveway spaces.

People might want to rent out your garage or driveway space because they work close to where you live and want cheaper and safer parking options.

Or they might want to rent out your parking space because there’s an event near you, such as a state fair or sporting event.

Depending on where you live you could easily earn $50 or more a month for parking spots in your garage or driveway.

Check out this Money Peach podcast with AirGarage CEO Jonathan Barkl for more info.

30. Become a Voiceover Artist

You know those people who talk on radio and TV commercials but you never see their faces? They’re called voiceover artists, and they get paid good money to do what they do.

Sites like Backstage list available voiceover jobs, and Carrie Olsen, professional voiceover artist, has a great web site that can help you learn how to become a voiceover artist.

Check out this Money Peach Podcast with Voice Over Star Carrie Olsen for more info.

31. Rent out your Car

Did you know your car sits idle 93% of the time? If you’re not going to need your car for the next couple of days/weeks/months, you may as well let it earn you some cash. You can list your car through RelayRides and have your personal car rented out tomorrow.

32. Rent out a Room full-time

Own a home and need extra cash each month? Rent out a room in your house to help cover the mortgage and free up some of your cash. I have a single friend who has a $1,200 mortgage and he consistently earns $2,000+ every month by renting out room(s) in his house via Airbnb. Fun fact – he applies the extra cash towards his mortgage each month!

Airbnb

Some Skill Required Hustles

So, not all side hustles are for everyone. In fact, these ones below do require some skill to make money. But, the more skill you have, the more money you will make!

33. Become an Online Coach

If you have an idea and can help people, pay attention. Whether it is motivating someone, helping them pass a class, or teaching them how to build a website, this can all be done online. Setup you’re pricing, terms, and accept payment through something as simple as PayPal and you are on your way. I recommend using Skype or Google Hangouts since it is 100% free. Help someone and get paid – genius.

34. Create an Online Course

Is there something you are good at and can teach to others? I have a friend who will teach you how to clean pools over his site, Swim University. Check out Udemy for ideas on your next online course and see how much people are paying for someone like you to teach them.

One of the greatest accomplishments I have had in my business is helping others reach financial freedom. We have had over 500 students graduate Awesome Money Course and completely turn their money situation around!

If you are tired of living the paycheck-to-paycheck lifestyle and would like to save more, pay off debt, and reach true financial freedom, then Awesome Money Course was made for you.

I am so confident you will absolutely love the program that I have 100% money-back guarantee…meaning you could download the entire course, keep it, and ask for a refund.

I hope no one would do that, but I will also take that risk if it results in you learning how to manage money, pay off debt, save, and build a wealthy future.

However, if you would like to try a little bit of our program out, we do have a 100% free mini-course called the Cash Flow Formula which will show you the step-by-step to building a monthly cash-flow plan with many of our favorite money-hacks to save more and pay off debt quicker!

Start Cash Flow Formula (FREE)

35. Spray Tanning

A good friend of mine (Jessica) has become the queen of spray tanning in our area. In fact, she is making $900 per week cash spray tanning both the ladies and the men and it’s all through word-of-mouth! You can check her out at JC Glows on Facebook to see how she set up her side hustle.

I asked her how she got started and she said this:

She started with this exact tanning kit

She uses this tanning tent

She taught herself how watching YouTube

36. Become a Cover Letter/Resume’ Writer

Professionals of all kinds pay ridiculous amounts of money for professionally written resumes. I know one guy who paid a professional resume’ writer $5,000.

If you have a knack for writing compelling and attention-grabbing resumes, consider offering your services on sites such as freelancer.com or Craigslist.

37. Develop an App

If you’ve got a great idea for an app that will make people’s lives easier or more exciting, this could be a great side hustle for you.

Check out this post on learnappmaking.com for more information on how to develop and market an app for some extra income.

38. Catering

If you love cooking, serving food, and entertaining at your own home, then get paid to do it for someone else. This can be fun and can often go from side hustle to full-time if you’re really good at it!

39. Computer Repair

If you love “playing” computers, then help someone repair theirs and get paid for it. Note: You must know a little bit about computers 🙂

40. Computer Training

How many Baby Boomers (or anyone for that matter) do you know who are still having trouble checking their email. If you were able to navigate to this web page, then you probably have the skills to teach extremely basic computer skills to an extreme beginner.

41. Guitar Gigs

A friend of mine finds guitar gigs online, on Facebook, and in the paper all the time. He shows up, plays for a few hours, and leaves with cash in hand. Note: you must be good at playing the guitar.

42. Guitar Lessons

If you are handy on the 6 string and can show someone else, teach them. Better yet, teach the world online how to play guitar.

43. Handyman Work

Some people are handy and others are not. Let your neighbors know that you are available to hang a ceiling fan, patch a hole in the drywall, fix an irrigation leak, or paint a fence. All can be done for them ASAP for a small fee 🙂

I love TaskRabbit. Whether I need a doggy door installed, someone to clean my house this weekend, or even mount a TV, I can go on TaskRabbit to find someone in an instant. YOU could be that person I find next on TaskRabbit for hire!

44. Lifeguard

Become a lifeguard and earn $16/hr – $20/hr part-time. Not only do you make some extra cash, but you are guaranteed to get a little tan as well.

45. Mobile Oil Change

If you don’t mind getting underneath the car and pulling the drain plug for people, then this could be your next side hustle. People are busy, and may want to pay you to change their oil while they are at work. Note: Wal-Mart always has the cheapest oil.

46. Network Marketing

Network marketing (sometimes referred to as multi-level-marketing) can sometimes have a bad connotation if you have ever been scammed in the past. However, there are very reputable companies out there that you can start working for today with very little buy-in or overhead. A member of our family started off her network marketing business as a side hustle and has turned it into a part-time gig with full-time income. Warning: if you are told it doesn’t require any actual work – run away!

47. Personal Training

Someone out there wants to get into better shape, and they are willing to pay you to help them. If you love fitness, this would be a perfect side hustle for you.

48. Tutoring

Take your education and use it to make money on the side. Tutor students and get paid handsomely.

Live in the U.S. or U.K. and hold a bachelor’s degree? You can earn up to $20/hr plus bonuses to teach kids English online from the comfort of home. Learn more here.

49. Teach Music Lessons

From singing to playing piano or any other number of instruments, parents everywhere are seeking music lessons for their kids.

If you have a gift for a musical skills, consider teaching that skill to local kids. You might be able to find jobs by looking on Craigslist or by seeking out local public school or homeschooling groups to connect with parents who have school-aged children.

50. Start a Baking Business

Do you have a gift for baking goodies such as cake, muffins or cookies? Why not use that gift to make yourself some extra cash?

Events such as birthday parties, weddings, office parties and meetings, retirement parties and more often have baked treats as a part of their celebration.

Advertise your culinary skills on Craigslist and with local event booking venues for your bakery services.

Be sure to check with state officials on what the rules are for serving and selling food in your area first.

51. Become a Sports Umpire

Are you knowledgeable about the rules and regulations of certain sports? Do you like working with kids? Recreation associations often pay good money for organized sports umpires for football, baseball, and more.

In our area, umpires earn about $30 an hour. Check with local sporting organizations for job opening details.

Physical Labor Hustles

If you don’t putting in a little sweat equity, you can do very well side hustling with some physical labor attached to it. I did #50 when I was getting out of debt and generated over $1,000 each month.

52. Clean Pools

This requires very little overhead and is simple to do. Go to Google Earth and look up which homes in your neighborhood have a pool, and offer to start today. I actually did this to get out of debt and it worked out great!

53. House Cleaning

People are busy and don’t have time to clean their homes. This is where you come in 🙂 Search your area in Craigslist to get an idea for pricing your own services.

54. Mowing Lawns

If you don’t have the funds to purchase all the equipment, then offer to your mow lawns with their equipment. I actually did this in grade school because I wasn’t old enough to drive. I just showed up, grabbed their lawnmower, and was paid.

55. Painting Gates

Gates fade and someone needs to repaint them. A kid in the neighborhood took pics of faded gates and pretty gates and posted them on the mailbox with his number and price. (I think one of the faded gate pics he took was my gate also).

56. Painting Services

Remember that movie American Pie 2 where they spend the summer in a lake house and do some side painting. No one likes painting their houses or walls, so why not help them out for a little side cash? Start out small by offering to paint a bedroom or two, and work your way up from there. Pricing rule: $1 per square ft of painting.

57. Shoveling Snow

No one likes shoveling snow and this is why you will be paid for it.

58. Wash Cars

If you can wash a car, then you can make money. People are busy and don’t have time to even take their cars to the wash anymore…this is where you come in.

59. Wash Windows

I recently paid a guy to wash my windows because he advertised $4/window. He spent about 1 hour washing a total of 20 windows and walked away with $80 cash. His entire setup was a bucket and a squeegee. Maybe I should wash my own windows and my neighbor’s windows for an affordable price of only $4 a window.

Unique Hustles

If you are unique, then you deserve some unique side hustles. Some of these are extremely cool, but a few of them…well I am still waiting for you to try.

60. Rent out Your Baby Gear

Think of it as the Airbnb of Baby Gear.

Have you ever traveled with kids and realized what a pain-in-the-butt it is to take the stroller, hi-chair, pack-n-play, and everything else that babies need? Think about dragging all of that through the airport, onto the train, or inside the Uber?

BabyQuip offers a simple solution. They provide families with a wide assortment of clean, quality baby equipment—everything they need to keep their little ones sleeping well at night and happily engaged during the day.

And guess who makes 80% commission (plus tips) renting their baby gear out?

You, the side hustler!

BabyQuip

61. Sell Your Hair Online

Thinking about a new hair style? You may want to. People are paying up to $1,000 for quality hair if you can remember to wash it more than once a month J Check out what your hair is worth at Hairsellon.

Hairsellon

62. Paint Street Numbers

A father and son rang my doorbell and pointed out to me my street numbers were faded. “For only $10, they would repaint my street numbers so my house would look better”. I paid it and it took them 37 seconds. They did 6 houses on my street alone. This is a great little side hustle.

63. Sell Drinks

where it’s hot (and where it’s cold)

I live in Phoenix where it will hover at 116°F during the summer. During the hottest weeks, there is a guy who sells snow cones and water for a premium.

I asked him how business was recently – he smiled and said “Business is gooooooood”. Buy a case of water at Costco for $0.12 a bottle and resell them for $2 wherever it is HOT. Who wouldn’t pay $2 for ice-cold water during the dog days of summer?

64. TaskRabbit

Become a task rabbit and get paid. People in your neighborhood are looking to pay you to put together furniture from Ikea, do their grocery shopping, install a ceiling fan, be a bartender at their party, or mount their TV to the wall.

65. Start a Home Staging Business

Somebody is always selling a home, and homes sell faster and for more money when they are “staged”.

As a home stager you can tailor your business to meet a variety of client needs. Creating relationships with local realtors is one way to help you find home staging clients.

66. Be a Work-From-Home Customer Service Rep

There are many legit companies that offer to hire customer service representatives who can from home. One of the more popular work-from-home companies is U-Haul, the well-known moving company.

67. Start an Estate Sale Service Business

An estate sale business buys a large majority of a client’s belongings, including furniture, vehicles and more, at a group rate and sells the stuff individually for profit.

This is a business that will take some work as you get to know the ropes but can be very lucrative in the long run.

68. Start a Vending Machine Business

Many companies want vending machines installed at their businesses for the convenience of employees and clients alike.

Although this type of side hustle would involve some costly initial cash, you may be able to make it up quickly if you install the machines in thriving businesses that service large numbers of people.

69. Pick Up Trash in Parking Lots

Brian Winch came on the podcast to share how he picks up trash around parking lots and now earns a 6-figure income by doing so. Although it may not be glorious work, it does pay well and it’s extremely affordable to get started. Before you get started, check out the Clean Lots tutorial here.

You’ve Got to be Kidding Me Hustles

Before you read on, just remember the name of these side hustles are you’ve-go-to-be-kidding-me side hustles. Some of them will actually shock you ?.

70. Be a Sperm Donor

This is straight out of the movie Road Trip when they need gas money. However, you can make substantial money donating sperm, with some places offering up $1,000/month to healthy men. Be aware, if you’re not a true thoroughbred, you won’t be paid as much!

71. Be a Plasma Donor

Since there is no way to synthetically make plasma, you will be compensated for your donation. Rates vary from state to state, but you can make on average $200/month for only a few hours of your time….and blood.

We have a full list of where you can earn $400 per month donating plasma here.

72. Become a Cuddler

Ah yes, cuddling. This is an actual real job and I recently saw it featured in a news segment. People are paying for up to 3 hours of platonic hugging (and they pay a lot). Job requirements: enjoy hugging strangers.

73. Pick up Dog Poop

Who likes picking up dog poop? Nobody. This is why you can get paid for it.

youtube

74. Rent-a-Friend

You can sign up for free at Rentafriend to be someone else friend both part-time and full-time with pay between $20/hr – $50/hr. Yes, this sounds very strange from the outside looking in, but a lot of times you are helping someone get acquainted in a new town, meet a new group of friends, or simply have a cup of coffee with. Most importantly – friendship is always platonic (no touching).

Easy Peasy Hustles

These are some of the classic side hustles that we call the easy peasy ones. If you are looking for simple, but yet effective, these are the side hustles for you.

75. Babysitting

If you like kids and don’t go out on the weekends, become a babysitter. Advertise to all of your friends (and Facebook Friends) that you will watch their kids so they can have a date night. New to the area? Then get connected with Care.com to become a certified/recommended babysitter in your area.

76. Dog Walking

Create this ad: “Love your dog but simply don’t have time to walk them? Let me help you!” There will always be someone willing to pay to keep their doggy happy, and this person is you.

77. Gig Walking

Download the free App and then find “gigs” in your neighborhood that companies are willing to pay you for. Can you check out the price of milk in a certain store for $6 or snap a pic of a storefront for $5 on the way to work? Note: You will start off with the crappier jobs in the beginning, but prove yourself and you will start getting offered the higher-paying jobs soon enough.

78. Golf Course

If you love being around the golf course (or don’t mind a few drunk old men) you can make pretty good money part-time by collecting balls off the range, cleaning golf carts, or serving cold beers at the tee box.

79. House-sitting

Who doesn’t want to get paid for simply living in someone else’s house for a few day days? This is simple and people will pay you for it. You can think of it as a mini staycation too!

80. Mystery Shopper

Get paid $10 – $30 on average to be a mystery shopper. However, beware because there are a lot of scams out there. I recommend checking out Marketforce, Best Mark, and Intelli-101 before you head anywhere else.

81. Pet Grooming

There are people out there that simply will not shave their dog and will pay you for it. Create a Facebook Page called “iShaveDogs” and let all your friends know! Someone will hire you.

82. Pet Sitting

If you truly love animals, then why not get paid to hang out with someone else’s dog or cat for the weekend? You can become a pet sitter at Care.com or specialize in only watching over someone’s pooch at Rover.

83. RedBox