#QuickBooksProAdvisor

Explore tagged Tumblr posts

Text

https://techcaddphagwara.com/best-QuickBooks-Course-in-Phagwara.php

#QuickBooksTraining#QuickBooksCourse#QuickBooksCertification#QuickBooksProAdvisor#QuickBooksOnlineTraining#QuickBooksDesktopTraining#QuickBooksHelp#QuickBooksTutorial#QuickBooksForBeginners#QuickBooksTips#QuickBooksEssentials#QuickBooksPremier#QuickBooksOnlineEssentials#QuickBooksOnlinePlus#QuickBooksEnterprise#QuickBooksDesktop#QuickBooksPro#QuickBooksConsultant#QuickBooksAccountant#QuickBooksOnlineAccountant#QuickBooksTrainingCourse#QuickBooksOnlineCourse#QuickBooksTutorials#QuickBooksLearning#QuickBooksForAccountants#QuickBooksForSmallBusiness#QuickBooksForFreelancers#QuickBooksForEntrepreneurs#QuickBooksForStartups#QuickBooksForNonprofits

0 notes

Text

youtube

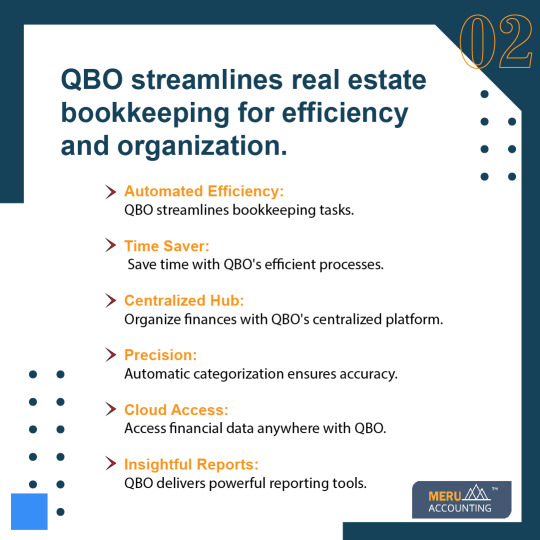

Outsource your accounting and bookkeeping works to Meru Accounting at $50 a Month in US.

Watch full video:- https://www.youtube.com/watch?v=63IViyx6BZs

#MeruAccounting#bookkeepingcompany#bookkeepingservices#bookkeepingtips#accountingservices#xeroaccounting#QuickBooks#quickbooksproadvisor#accounting#bookkeepers#india#uk#bookkeeping#Youtube

0 notes

Link

#accountingservices#bookkeepingservices#quickbooks#quickbooksonline#QuickbooksProAdvisor#smb#startup

1 note

·

View note

Link

How To Restore Company File In QuickBooks

4 notes

·

View notes

Text

#virtualassistant#virtualassistantservices#dataentryspecialist#bookkeepingservices#onlinebookkeeping#quickbooksproadvisor#xeroaccounting

1 note

·

View note

Photo

Affordable Accounting and Tax Services is a Tax Advisor in Cumming, GA

Affordable Accounting and Tax Services is the number one choice for financial services throughout Cumming, GA. We are here to provide you with the necessary assistance to ensure that you stay on top of your finances year round such as our clients yearly tax returns. Our team of tax advisors, grant writers, and bookkeeping consultants will make sure that everything is in order so that we can help you optimize your financial resources and reveal potential growth channels.

We offer the following:

Tax Preparation

Small Business Tax Services

Bookkeeping Services

Notary Services

Payroll Services

and more

At Affordable Accounting and Tax Services, our goal is your financial success, so if you would like more information about how our tax, bookkeeping, and accounting service can benefit you or your business, please contact us at Affordable Accounting and Tax Services today!

https://cummingtaxconsultant.com/

#TaxConsultant#TaxAdvisor#TaxPreparation#NotaryServices#BookkeepingServices#Accountant#PayrollServices#SmallBusinessTaxServices#IRSProblemSolution#GrantWriter#SalesTaxConsultant#QuickbooksProAdvisor#BookkeepingConsultant

1 note

·

View note

Text

Common mistakes with payroll made by small business owners.

Employees perform tasks to help your product function to its optimum ability. What do they ask? To be treated and compensated fairly. Everyone deserves respect and being compensated for the work that they put in is only fair! When you're considering how much to reward your team for achievements or for exceeding expectations, it's important to reward them fairly in comparison to the work they're putting in. When it comes to compensation and benefits, clearly your employees should be compensated based on their workloads and talent level but they should also be rewarded when they go above and beyond. The best way to reduce these kinds of errors related to your payroll or invoices are having automated accounting software like QuickBooks premier hosting. Let’s discuss few common payroll mistakes that are made by the businesses:

QuickBooks Premier Cloud Hosting- Quick Cloud Hosting

Classification of employees It can be confusing but it's important for employers to understand that there are stark legal differences between contractors and employees. As an employer, you have a responsibility to both the contractor and your business. The biggest mistake that people make is not having this clearly outlined from the very beginning on paper otherwise you could be in jeopardy of incurring some hefty fines or penalties! On several occasions, employees and contractors alike have at times been marked incorrectly as workers of the other party. First up, this can lead to tax issues because one will be held responsible for both parties' taxes. As an employer, it is your responsibility to pay and file taxes on behalf of both your business and employees. You can use the best available solution QuickBooks premier cloud hosting for that. For one thing, you'll be able to use up less of your work time classifying your everyday employees and by default understating the total payroll tax amount. Additionally, you might even hire a contractor or freelancer who is willing to take on this role at a cheaper rate than what a more experienced full-time employee would expect to be paid for the same position.

Handling overtime payment The monthly paycheck your employees get is only for the time they've been allotted to work. Any services rendered beyond their job description must be compensated for. According to US Department of Labor's opinion, any employer should pay a premium for making employees work overtime. Overtime refers to work carried out in excess of a normal workweek. A normal workweek is the number of hours that a hardworking employee puts in per week but not more than 50 hours. Whether it is paid or unpaid, it should be decided and accurately communicated to employees at the time of hiring. It's important to remember that the monthly paycheck your employees even get for just showing up to work is only for their pre-defined working hours. Any services rendered beyond their job description need to be compensated. According to the US Department of Labor, some jobs may have requirements you might think are optional, but are actually fairly important to making conscious decisions while they're on the clock. Under the Department of Labor (DOL) statutes, it's not permitted to pay a lump sum amount for overtime without any regard for the number of hours worked. Skip out on paying overtime and you might end up with unenthused and unsatisfied employees who may start looking for new opportunities elsewhere.

Accurate record keeping Proper record keeping is important for accounting firms. The IRS is a ticking time bomb and the last thing you want is to have issues with them. Therefore, it’s imperative that your employees are paid accurately and that your business records in relation to payroll are meticulously collected into one place otherwise you could be facing fines or even a visit from the IRS itself. Misplaced records and documents are a problem that a company might have to deal with if they do not feel the need to invest in new technology. In addition, companies who work with spreadsheets and files as opposed to applications leave themselves vulnerable for attacks by computer viruses, malware, and so forth. When you're running a business, it's important to be able to locate the files you need in a flash. We take this for granted when using accounting software like QuickBooks premier hosting which has virtually unlimited storage space. This is why we recommend using QuickBooks hosting technology for storing and retrieving all your information, especially as you're likely to have many documents/records such as invoices, receipts, orders and more that need accounting in one way or another whether compiling reports or filing taxes! Another issue with manual record-keeping is that it's time consuming and can be tedious as well as stressful for a single accountant to have to input every transaction into their system on their own. Due to possible mistakes from being overworked and not having enough people who can help them out transacting all the necessary tasks, this leads to accounting errors. On the flip side, accounting software like QuickBooks premier hosting is great because of the features included and how they can help a business grow. They have built-in formulas that facilitate automatic calculations. However you can edit and rectify this information whenever you want to without disrupting the final results, as well.

#quickbooksserverhosting#quickbookspremiercloudhosting#quickbookspremierhosting#smallbusinesses#accounting software#quickbooksproadvisor#remotedesktopservices#cloudhostingforquickbookdesktop

0 notes

Photo

Moving from Quickbooks Desktop to Quickbooks Online is a major step, but necessary if you're going to be a business operating in the future from the cloud. The efficiency that going online brings more than makes the change worthwhile. You'll only wish you made the change sooner! #quickbooks #bookkeeping #bookkeeper #quickbooksproadvisor #quickbookstraining #quickbooksconsultant #quickbookspro #quickbooksdesktop #quickbookscertified #quickbooksadvice #quickbooksaccountant #quickbookstraining #quickbookssupport #quickbookssetup #quickbooksselfemployed #quickbooksservices #quickbookssolutionproviders #quickbooksproadvisoronline #quickbooksexperts www.udemy.com/course/move-from-quickbooks-desktop-to-quickbooks-online https://www.instagram.com/p/CB2Xv5uAahc/?igshid=1o9937sufxd6k

#quickbooks#bookkeeping#bookkeeper#quickbooksproadvisor#quickbookstraining#quickbooksconsultant#quickbookspro#quickbooksdesktop#quickbookscertified#quickbooksadvice#quickbooksaccountant#quickbookssupport#quickbookssetup#quickbooksselfemployed#quickbooksservices#quickbookssolutionproviders#quickbooksproadvisoronline#quickbooksexperts

0 notes

Photo

How do you plan to end your year in terms of sales? How do you plan to increase your cash flow? https://myeverypenny.com/quick-tips-to-increase-your-business-cashflow/ #tuesday #myeverypenny #tuesdaythoughts #smallbusinessnetworking #smallbusiness #smallbusines #smallbusinessmatters #smallbusinessmatters #smallbusibessowner #quickbooksproadvisor #quickbooksconsultant #quickbooksambassador https://www.instagram.com/p/B3WMHXfgmOF/?igshid=16scoto5eiv3j

#tuesday#myeverypenny#tuesdaythoughts#smallbusinessnetworking#smallbusiness#smallbusines#smallbusinessmatters#smallbusibessowner#quickbooksproadvisor#quickbooksconsultant#quickbooksambassador

0 notes

Photo

#abroadwithacamera In another area of my life I am embracing the role of a #quickbooksproadvisor and had a wonderful time at #getconnectedvan #cloudaccounting (at AMS Events) https://www.instagram.com/p/Bx0yY-ShTVO/?igshid=76vjc255jt6c

0 notes

Text

Join our exclusive webinar on December 28 at 8:30 PM IST.

Unlock the secrets of Real Estate Accounting and Compliance!

Master rental & construction accounting with QuickBooks, Xero, Buildium, and Appfolio.

Don't miss out—reserve your spot now! https://forms.monday.com/forms/3b1b724b702bb107e9fc45852b4e1097?r=use1

#MeruAccounting#bookkeepingservices#bookkeeping#accounting#accountingservices#RealEstate#realestatetips#Xero#buildium#appfolio#accountingsoftware#QuickBooks#quickbooksproadvisor#Webinar#JoinUs#ahmedabad#ahmedabad_instagram

1 note

·

View note

Link

1 note

·

View note

Text

#virtualassistant#virtualassistantservices#dataentryspecialist#bookkeepingservices#onlinebookkeeping#quickbooksproadvisor#xeroaccounting

0 notes

Photo

Tax Consultant

Our tax consultants can help those who may need some assistance with understanding their taxes. We ensure that your financial records are completely accurate and filed in compliance with laws and regulations. When it comes to financial management, sometimes you miss things, which is why it’s always in your best interest to consult a professional accountant. Having a professional accountant look over your financial records can help improve your financial growth and the efficiency with which you manage your money. If you would like to learn more about our tax preparation services, please contact Affordable Accounting and Tax Services today.

https://cummingtaxconsultant.com/

#TaxConsultant#TaxAdvisor#TaxPreparation#NotaryServices#BookkeepingServices#Accountant#PayrollServices#SmallBusinessTaxServices#IRSProblemSolution#GrantWriter#SalesTaxConsultant#QuickbooksProAdvisor#BookkeepingConsultant

0 notes