#RealEstateFinance

Explore tagged Tumblr posts

Text

Best Commercial Real Estate Finance UK

Enness brokers complex and substantial real estate finance deals for high-net-worth individuals, developers and investors. Enquire with Enness today. Our expert resources provide insights into property financing, investment strategies, and market trends. Enness has the lender access, experience, and credentials to deliver the best real estate finance solution for you.

2 notes

·

View notes

Text

Navigating Tariffs, Trade Tensions & Real Estate: What Homebuyers Need to Know

April 14, 2025

With today’s global economic shifts causing market fluctuations on a near-daily basis, it’s no wonder homebuyers and investors are asking: How do tariffs and trade uncertainty impact real estate and mortgages?

As a mortgage advisor working with clients from all walks of life, I’ve been closely tracking these developments to help guide informed, confident decision-making.

The reality is this: prolonged uncertainty—especially from drawn-out tariff discussions—tends to stall markets. It creates hesitation and a more cautious investment environment.

Let’s unpack what this means for you as a buyer or investor.

What’s Inside:

The Link Between Tariffs and Mortgage Rates

Consumer Confidence: A Key Driver in Real Estate

The True Cost of “Waiting It Out”

Focusing on What You Can Control

A Look Ahead: Real Estate Beyond Tariffs

Final Thoughts & How I Can Help

1. Tariffs & Mortgage Rates: What’s the Connection?

The influence of tariffs on mortgage rates isn’t always direct—but perception plays a big role.

When uncertainty clouds global markets, investors often pull back from equities in favor of safer bets like bonds. As bond prices rise, interest rates often drop—since rates and bond prices move inversely.

That said, market timing is unpredictable. For instance, when the U.S. eased tariffs for countries excluding China, we saw an unprecedented $4 trillion flood into the stock market in one day.

This kind of response shows just how quickly investor sentiment—and mortgage rates—can shift based on policy news.

2. Consumer Confidence: The Real Estate Accelerator

In real estate, consumer confidence is everything.

If people feel uneasy about their job, finances, or the broader economy, they’re less likely to make big decisions—like buying a home.

Ongoing trade disputes and shifting tariffs have a tendency to fuel this uncertainty, causing many to hit pause.

Still, it’s important to recognize: real estate continues to be one of the most effective paths to long-term wealth. Historically, homeowners consistently hold more wealth than renters—and that trend isn’t likely to change any time soon.

3. The Cost of Waiting: What Are You Really Losing?

I often talk with clients about the cost of waiting. This isn’t about pushing anyone into a rushed decision—it’s about understanding the financial trade-offs of postponing a purchase.

For example, during the hot market of 2020–2021, many first-time buyers opted to wait, expecting prices to drop. In reality, they missed out on 4% mortgage rates and now face homes that are roughly 40% more expensive.

Buying now might not be ideal for everyone—but for those who are financially ready, it could be a wise move. Here’s why:

You start building equity immediately

Real estate has a long history of appreciation

Loan balances decrease over time with each payment

Refinancing is an option if rates fall later

4. Focus on What You Can Control

It’s easy to feel overwhelmed by the macroeconomics of tariffs and global policy. But the truth is, most of it is out of our hands.

What you can control is your own financial strategy. That means:

Staying disciplined with saving and budgeting

Strengthening your credit profile

Educating yourself on the market

Preparing smartly for the purchase process

This approach isn’t about ignoring economic headlines—it’s about staying grounded in your own goals, regardless of the noise.

5. Looking Past the Politics: Real Estate Is Resilient

Trade disputes, inflation, and market corrections are part of the economic cycle. What history tells us, though, is that real estate tends to bounce back—often stronger—after periods of volatility.

From the 2008 recession to the early-pandemic market freeze, housing has proven itself to be a long-term winner. While no one can time the market perfectly, staying informed helps you make decisions that align with your financial well-being.

Final Thoughts: It’s About Options, Not Pressure

Everyone’s situation is different. For some, buying now—even with higher rates—makes sense. For others, waiting could be the smarter move.

Here’s what matters:

Buying now could mean locking in current prices and building equity sooner. If rates fall later, refinancing is an option.

Waiting might yield lower rates—but you risk rising prices or increased competition.

I’m here to help you weigh these options—not to push an agenda, but to offer clarity.

Ready to Talk?

Whether you're trying to make sense of today’s market or you're thinking of starting an application, I’m here to help. Let's talk through your goals and find the path that fits you best.

Contact Me:

Adam Buice Loan Officer | NMLS #1619090 | MIG NMLS #34391 📞 404-416-6380 📧 [email protected] 🌐 www.AdamBuice.com

#RealEstateMarket#TariffsImpact#HousingMarketTrends#GlobalTradeAndRealEstate#PropertyInvestment#RealEstateEconomics#TradePolicy#TariffsAndHousing#MarketAnalysis#EconomicPolicy#RealEstateInsights#HomePrices#ConstructionCosts#TariffsAndPropertyValues#RealEstateFinance

1 note

·

View note

Text

𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐭𝐡��� 𝐑𝐨𝐥𝐞 𝐨𝐟 𝐁𝐫𝐨𝐤𝐞𝐫𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐒𝐞𝐜𝐨𝐧𝐝𝐚𝐫𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐟𝐨𝐫 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 𝐋𝐨𝐚𝐧𝐬!

The secondary market for commercial loans presents a wealth of opportunities but also a fair share of complexity. Whether you're an institutional investor or a lender seeking liquidity, navigating this space without expert guidance can be risky. That's where brokers come in. Far beyond simple middlemen, brokers act as connectors, analysts, and deal managers. Here’s how they add value at every step:

1. Connecting Buyers and Sellers

Brokers act as the primary bridge between those looking to sell loan portfolios and those aiming to invest in them. They leverage years of relationship building within the financial industry to identify off market deals and exclusive opportunities. This access allows both sides to save time and gain exposure to deals they might never have discovered on their own.

2. Providing Expert Market Insight

A seasoned broker brings with them an in-depth understanding of current market trends, pricing dynamics, and risk appetite. They interpret the market’s direction, offer clarity on the value of specific loan pools, and help investors position themselves for better returns. Their insights enable smarter decisions, especially in volatile or shifting economic environments.

3. Risk Mitigation and Due Diligence

Brokers go beyond matchmaking they take a deep dive into each loan’s profile. They analyze borrower performance history, repayment patterns, and collateral details. By conducting rigorous due diligence, they highlight potential red flags and provide a realistic picture of portfolio performance. This ensures that investors don’t just acquire assets they acquire the right assets.

4. Streamlining Transactions

Handling complex documentation, aligning with compliance protocols, managing timelines brokers do it all. They simplify each step of the process, from offer to closing, reducing the chances of delays or miscommunication. Their structured approach helps both buyers and sellers move forward with confidence and efficiency.

5. Navigating Regulatory and Legal Frameworks

Regulatory landscapes in commercial finance are constantly changing. Brokers stay informed about the latest compliance requirements, legal structures, and documentation standards. They guide parties through the legal maze, ensuring transactions are not only profitable but also fully compliant. This reduces exposure to post deal legal challenges.

Conclusion: More Than Middlemen

Brokers are essential players in the secondary commercial loan market. Their value lies in their ability to blend market intelligence with real world execution. Whether you're aiming to diversify your portfolio or offload performing or non performing assets, working with a knowledgeable broker can be the game changer you need.

Thinking of entering the secondary loan market? A good broker could be your greatest asset.

#CommercialLoans#SecondaryMarket#LoanBrokers#FinanceStrategy#InvestmentOpportunities#BusinessGrowth#RiskManagement#RealEstateFinance#PrivateLending#FinanceProfessionals

1 note

·

View note

Text

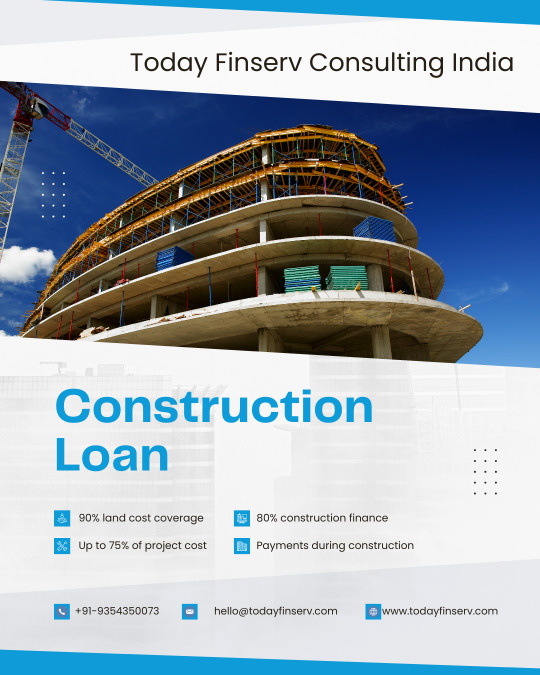

🏗️ Build Your Dream Project with Confidence!

Looking to fund a residential, commercial, or industrial construction? At Today Finserv Consulting India, our Construction Loan solutions are designed to help you turn blueprints into buildings—without the financial stress.

✨ Fast Approvals ✨ Structured Disbursements ✨ Competitive Interest Rates ✨ Expert Loan Advisory

Whether it’s your first project or your next big venture—we’re with you at every step.

📞 Contact us today to get started!

📞 Contact Us: +91-9354350073, +91-7827114145 🌐 Visit us at todayfinserv.com | [email protected]

#TodayFinserv#ConstructionLoan#RealEstateFinance#BuildWithConfidence#ProjectFunding#IndiaInfraFinance#ConstructionSupport#omwebdigital#offpagelinks

0 notes

Text

0 notes

Text

Common Home-Related Tax Deductions: Mortgage Interest (On loans up to $750,000) Property Taxes (Capped at $10,000 with state/local taxes) Home Equity Loan Interest (Only if used for home improvements) Energy-Efficient Upgrades (30% tax credit for solar panels, etc.) Home Office Deduction (If you use a dedicated workspace for business) Pro Tip: Keep good records of your mortgage payments, tax bills, and any home Improvements to maximize your savings at tax time! For a deeper look into home-related tax deductions, check out my latest article. This post is for general informational purposes only and should not be considered tax or financial advice. Always consult a licensed tax professional for personalized guidance.

Visit 321 Westlake Drive Website!

Visit 1034 Knoxbridge Road Website!

Visit 1015 Kimbro Drive Website!

Visit Our Blog Today!

Contact Us Today!

Ebby Halliday

The Shuler Group

Billy Shuler

Cell: 972.977.7311

Email: [email protected]

Website: https://www.ebby.com/bio/billyshuler

#forneyrealestate#forneyhomes#northtexasrealestate#northtexashomes#theshulergroup#sold#sellingforney#billyshuler#julieshuler#realestate#realestateagent#HomeBuying#TaxDeductions#HomeOwnership#RealEstateFinance#FirstTimeBuyer#TaxSeason

0 notes

Text

Mortgage Market Dynamics and the Performance of PennyMac Stock

Highlights

PennyMac stock is associated with mortgage production, servicing, and investment management.

The company has expanded its loan originations and servicing revenue.

Strategic operational efficiency supports its presence in the mortgage industry.

PennyMac Financial Services, Inc. operates in mortgage banking and investment management. It focuses on loan origination, servicing, and investment management, playing a significant role in the U.S. mortgage sector. PennyMac stock reflects the company’s standing in the industry as it continues to expand its mortgage portfolio and servicing capabilities.

Mortgage Production and Servicing

The mortgage production segment involves originating loans through correspondent lending, consumer direct lending, and broker channels. The mortgage servicing segment manages customer service, loan administration, and collections. With increased loan retention and portfolio expansion, the servicing segment has contributed to steady performance.

Financial Performance

PennyMac has reported consistent loan origination activity, supported by an increase in servicing revenue. The company’s mortgage servicing division continues to provide recurring revenue, strengthening its financial position. PennyMac stock has reflected the company’s strategic efforts in loan acquisitions and servicing operations.

Industry Dynamics

The mortgage industry is influenced by interest rates, housing demand, and refinancing activities. Companies in this sector navigate these dynamics by focusing on loan production, servicing efficiency, and technological advancements in mortgage lending. PennyMac stock is linked to the company’s ability to adapt to market trends and manage mortgage-backed assets effectively.

Operational Strategy

PennyMac emphasizes cost efficiency, digital mortgage services, and portfolio growth. The investment management segment aligns with broader industry developments, supporting its mortgage-backed securities and structured finance initiatives.

PennyMac stock represents the company’s mortgage banking and investment management operations. With a structured approach to loan origination and servicing, PennyMac continues to adapt to industry changes while focusing on operational efficiency and strategic expansion.

#PennyMacStock#MortgageSector#NYSEStocks#LoanServicing#RealEstateFinance#MortgageBanking#HomeLoans#FinanceNews#StockMarketUpdates#HousingMarket

0 notes

Text

Navigating Buy-to-Let Tax Filing: A Landlord’s Guide to Staying Compliant and Profitable.

David had always dreamed of becoming a landlord. After purchasing his first rental property, he assumed that collecting rent and maintaining the house were the only responsibilities he needed to worry about. However, as tax season approached, he realized that buy to let tax filing was far more complex than he had anticipated.

His biggest concern? Avoiding penalties and ensuring he was making the most of his tax allowances. And just when he thought things couldn’t get more confusing, he learned about dormant accounts and how they applied to his buy-to-let company.

Understanding Buy-to-Let Tax Filing: What Every Landlord Needs to Know

Like David, many landlords fail to grasp the importance of filing their taxes correctly. If you own a rental property, whether personally or through a limited company, you must report your rental income to HMRC. Failing to do so can result in severe penalties and even an investigation.

Key Aspects of Buy-to-Let Tax Filing

Declaring Rental Income:

If you own property as an individual, rental income must be reported via a Self Assessment tax return.

If your property is under a limited company, rental income must be reported through corporation tax filing.

Allowable Expenses:

Mortgage interest (subject to tax relief limitations for individual landlords)

Property repairs and maintenance

Letting agent fees

Insurance costs

Council tax and utility bills (if paid by the landlord)

Tax Rates for Buy-to-Let Landlords:

Basic rate taxpayers (20%) pay tax on their rental profits at this rate.

Higher rate taxpayers (40%) and additional rate taxpayers (45%) pay more.

Limited companies pay corporation tax, currently between 19% and 25%.

Capital Gains Tax (CGT):

If you sell a rental property, you may be liable for Capital Gains Tax (CGT) at either 18% or 28%, depending on your income bracket.

Companies pay corporation tax on gains rather than CGT.

What Are Dormant Accounts, and Why Do They Matter?

After setting up a limited company for his buy-to-let investments, David assumed that he didn’t need to file anything until he actively started making income. However, he soon learned that even if a company has no transactions or income, it is still required to file dormant accounts with Companies House.

When Is a Buy-to-Let Company Considered Dormant?

If you registered a limited company but haven’t started buying or renting out properties yet.

If your company holds a property but has no financial transactions (e.g., no rental income, expenses, or mortgage activity).

If all company activities are paused for a financial year.

Even though dormant companies don’t have to file corporation tax returns, they must submit dormant accounts to Companies House every year. Failing to do so can result in fines or even the forced closure of your company.

How David Streamlined His Buy-to-Let Tax Filing

Feeling overwhelmed by the tax obligations, David decided to take a strategic approach to his buy-to-let tax filing to avoid mistakes and maximize his profits. Here’s what he did:

Used Property Accounting Software

Instead of tracking expenses manually, he started using property tax software to log rental income, expenses, and tax-deductible items.

Worked with an Accountant

A professional helped him ensure his filings were correct and optimized for tax efficiency.

Set Reminders for Filing Deadlines

David avoided penalties by keeping track of key deadlines for Self Assessment, corporation tax, and dormant accounts filing.

Leveraged Tax Reliefs

He ensured he was claiming all allowable deductions, including mortgage interest relief and repair costs, to reduce his taxable income.

Common Mistakes Landlords Make with Tax Filing

Even experienced landlords sometimes make errors that lead to penalties or lost profits. Here are some of the biggest mistakes:

Failing to report rental income: HMRC can investigate undeclared rental income, leading to heavy fines.

Missing tax deadlines: Late filings can result in penalties of up to £1,600.

Incorrectly classifying expenses: Not all property-related costs are tax-deductible.

Ignoring dormant accounts filing: Even if your buy-to-let company is inactive, you must file dormant accounts to stay compliant.

Final Thoughts: Stay Ahead of Your Buy-to-Let Tax Obligations

David’s journey highlights the importance of buy-to-let tax filing and staying on top of your financial responsibilities as a landlord. Whether you own property personally or through a company, proper tax planning ensures you remain compliant while maximizing your profits.

If you own a buy-to-let property under a limited company, don’t forget about dormant accounts if your business isn’t active yet. Ignoring these requirements can lead to unnecessary fines and legal trouble.

The key takeaway? Stay informed, use the right tools, and work with experts to handle your tax obligations efficiently. By doing so, you can focus on growing your property investments without worrying about tax surprises.

Frequently Asked Questions (FAQs)

1. Do I need to file a tax return for my buy-to-let property?

Yes, if you earn rental income, you must report it to HMRC. Individuals file through Self Assessment, while buy-to-let companies must file corporation tax returns.

2. What expenses can I deduct when filing my buy-to-let tax return?

You can deduct expenses like mortgage interest (subject to relief rules), property maintenance, letting agent fees, insurance, and council tax (if paid by the landlord) to reduce taxable rental income.

3. What happens if my buy-to-let company is dormant?

If your company is inactive, you must still file dormant accounts with Companies House each year. However, you do not need to file a corporation tax return unless the company starts trading.

4. How can I reduce my buy-to-let tax liability?

Tax-efficient strategies include buying property through a limited company, claiming allowable expenses, utilizing mortgage interest relief, and strategically selling properties to minimize capital gains tax.

5. What are the penalties for late buy-to-let tax filing?

Late tax returns can result in penalties starting at £100 for a missed deadline, increasing to £1,600 or more if left unpaid. HMRC may also charge interest on unpaid tax.

#CorporateTax#BuyToLet#TaxPlanning#PropertyInvestment#LandlordTax#TaxFiling#RealEstateFinance#RentalIncome#BusinessTax#InvestmentTax

0 notes

Text

Refinancing your home loans can lower your interest rates and monthly payments. Let’s explore the best options to help you achieve financial freedom

Learn More: https://www.loansandmortgages.com.au/should-you-refinance-your-home-loan/

#RefinanceHomeLoan#MortgageRefinance#LowerInterestRates#FinancialFreedom#SaveMoney#HomeLoans#MortgageBroker#FinanceTips#DebtReduction#RealEstateFinance#RefinanceOptions#SmartFinances#MortgageSavings#BetterRates#HomeFinance

0 notes

Text

Understanding the differences between government loans and conventional loans is crucial for borrowers looking to make informed decisions about their mortgage options. Government loans are typically backed by a federal agency, such as the FHA (Federal Housing Administration), VA (Veterans Affairs), or USDA (United States Department of Agriculture). These loans often have lower down payment requirements and more flexible eligibility criteria, making them an attractive option for first-time homebuyers and those with lower credit scores.

Conventional loans, on the other hand, are not backed by any government agency and are instead underwritten by private lenders or institutions. These loans usually have stricter credit score and down payment requirements but offer more variety in terms and conditions. They can be preferable for borrowers with higher credit scores who can afford larger down payments, as they often come with lower interest rates and fewer upfront fees.

Both types of loans have their advantages and considerations, and the best choice depends on the borrower’s financial situation, long-term goals, and the specific requirements of each loan type.

#GovernmentLoans#ConventionalLoans#HomeBuying#MortgageOptions#FirstTimeHomeBuyer#RealEstateFinance#FHALoans#VALoans#USDALoans#MortgageTips#FinanceEducation

0 notes

Text

Why Choose a Bridging Loan for Auction Purchases? ✅Speed: Get the funds you need quickly to meet auction deadlines. ✅Flexibility: Tailored repayment options to suit your financial situation. ✅Expertise: Our experienced team guides you through every step of the process.

Ready to make your next property purchase a reality?

Reach out to Kinetic Finance today and discover how our bridging loans can be the perfect solution for your auction needs.

📞 0333 335 5756 📧 [email protected] 🌐 https://kineticfinance.co.uk/

#Bridgingloan#auctionpurchase#realestatefinance#propertyinvestment#auctionproperty#shorttermfinance#bridgeloans

0 notes

Text

#marketing#HomePurchaseLoan#FloridaRealEstate#MortgageLending#HomeBuyingTips#RealEstateFinance#FloridaHousingMarket#PropertyInvestment#HomeOwnershipJourney

0 notes

Text

𝐁𝐮𝐢𝐥𝐝𝐢𝐧𝐠 𝐚𝐧 𝐄𝐟𝐟𝐞𝐜𝐭𝐢𝐯𝐞 𝐓𝐞𝐚𝐦: 𝐇𝐢𝐫𝐢𝐧𝐠 𝐟𝐨𝐫 𝐒𝐮𝐜𝐜𝐞𝐬𝐬 𝐢𝐧 𝐋𝐨𝐚𝐧 𝐁𝐫𝐨𝐤𝐞𝐫𝐢𝐧𝐠!

In the competitive world of loan brokering, your team is the backbone of your business. Whether you're launching a new brokerage or expanding your current operations, surrounding yourself with the right people can be the key to sustained growth and success.

Here are six strategic tips to help you build and develop a high-performing brokerage team:

1. Hire for Experience and Flexibility

While industry experience is valuable, adaptability is just as important. The financial landscape is constantly evolving, so look for team members who are eager to learn, embrace change, and stay ahead of industry trends.

2. Prioritize Communication Skills

Strong communication is critical in loan brokering. Your team should be able to simplify complex financial concepts, actively listen to client needs, and build lasting relationships through trust and clarity.

3. Encourage a Collaborative Culture

Individual performance matters, but success is truly driven by collaboration. Foster a team environment built on mutual respect, where skills complement one another and goals are achieved together.

4. Invest in Ongoing Training

Top-performing teams never stop learning. Provide access to continued education, professional development, and mentorship programs to keep your team informed and competitive in a dynamic industry.

5. Use Technology to Drive Efficiency

Technology can make or break your operational efficiency. Equip your team with tools that streamline lead management, track performance, and enhance productivity throughout the sales cycle.

6. Look for Passion and Drive

Motivated individuals with a genuine passion for helping clients are invaluable. Seek out candidates who are goal-oriented, customer-focused, and committed to making a positive impact.

Final Thoughts Building a winning team in loan brokering isn't just about filling roles—it's about cultivating a culture of growth, accountability, and shared success. With the right hires and support systems in place, your team can become your strongest competitive advantage.

#LoanBrokering#TeamBuilding#HiringForSuccess#BusinessGrowth#Leadership#FinancialServices#SmallBusiness#RecruitmentTips#Entrepreneurship#Sales#CustomerSuccess#TeamDevelopment#RealEstateFinance

1 note

·

View note

Text

🏠 Unlock the Power of Your Property with a Loan Against Property! 💼✨

Need funds for your next big dream or emergency needs? With Today Finserv Consulting India, you can turn your property into the financial support you need!

🔑 Benefits of Loan Against Property: ✔️ Lower interest rates compared to personal loans ✔️ Longer repayment tenure ✔️ Use funds for business expansion, education, or personal needs ✔️ Keep your property, unlock its value!

📈 Why Choose Today Finserv Consulting India? 🏦 Quick & hassle-free loan approval 📝 Transparent terms, no hidden charges 💸 Flexible repayment options tailored to your needs

Your property holds the key to financial freedom. Don’t wait—unlock its potential today!

📞 Call us at +91-9354350073, +91-7827114145 or visit todayfinserv.com to get started!

#TodayFinserv#todayfinservconsultingindia#LoanAgainstProperty#FinancialFreedom#RealEstateFinance#PropertyLoans#UnlockYourProperty

0 notes

Text

0 notes

Text

Thinking about buying a home? One of the biggest tax benefits of homeownership is the mortgage interest deduction—but how much can it actually save you? Let’s break it down with a real-world example. Example: Mortgage Interest Deduction for Year 3– Home Price: $500,000– Loan Amount: $400,000 (Assuming 20% down payment)– Interest Rate: 6% (Fixed)– Year in Loan: 3rd Year– Total Interest Paid (Year 3): ~$22,000 If you itemize your deductions, you can deduct that $22,000 from your taxable income! Thinking about buying a home? Understanding tax benefits can help you plan ahead! Send me a DM or reach out if you have questions. This is for informational purposes only and is not tax or financial advice. Always consult a tax professional for personalized guidance.

Visit 1034 Knoxbridge Road Website!

Visit 1015 Kimbro Drive Website!

Visit Our Blog Today!

Contact Us Today!

Ebby Halliday

The Shuler Group

Billy Shuler

Cell: 972.977.7311

Email: [email protected]

Website: https://www.ebby.com/bio/billyshuler

#forneyrealestate#forneyhomes#northtexasrealestate#northtexashomes#theshulergroup#sold#sellingforney#billyshuler#julieshuler#realestate#realestateagent#HomeBuying#MortgageTips#TaxDeductions#HomeOwnership#FinancialPlanning#RealEstateFinance

0 notes