#Rental Property Insurance Michigan

Text

Get Renters Insurance

Rental Property Insurance in Michigan can help protect against loss or damage to personal belongings when the insured is occupying a rental property. Buy Online!

0 notes

Text

Cranes Michigan

In Michigan, the use of cranes in construction and various industrial applications is pivotal for handling heavy loads and ensuring efficient project execution. While the need for cranes is evident, the decision between hiring a professional crane service provider and attempting to manage crane operations independently can significantly impact project outcomes. This article explores the reasons why hiring a professional for crane services in Michigan is not only beneficial but essential for safety, efficiency, and compliance with regulatory standards.

Why Choose Professional Crane Services?

1. Expertise and Experience

Professional crane operators and service providers in Michigan bring extensive expertise and experience to the table. Operating a crane requires specialized knowledge of load capacities, rigging techniques, and adherence to safety protocols. Professionals undergo rigorous training and certification processes to ensure they can handle complex lifting tasks safely and efficiently. Their experience allows them to navigate various job site challenges and ensure operations run smoothly without compromising safety or productivity.

2. Safety Standards and Compliance

Safety is paramount when it comes to crane operations. Professional crane service providers in Michigan adhere strictly to industry safety standards and regulations set by organizations such as OSHA (Occupational Safety and Health Administration). They conduct thorough safety inspections, maintain equipment regularly, and implement comprehensive safety protocols on-site. This commitment to safety minimizes the risk of accidents, injuries, and property damage, safeguarding both personnel and the project itself.

3. Equipment Reliability and Maintenance

Professional crane services in Michigan invest in state-of-the-art equipment and technology. They ensure their cranes are well-maintained, inspected regularly, and up to date with the latest safety features. Reliable equipment reduces downtime and enhances operational efficiency, allowing projects to stay on schedule and within budget. Additionally, professional crane operators are trained to identify potential equipment issues early, mitigating the risk of mechanical failures during critical lifting operations.

4. Efficiency and Project Management

Efficiency is crucial in construction and industrial projects where time equals money. Professional crane operators in Michigan are skilled in optimizing lifting operations to maximize efficiency and minimize downtime. They work closely with project managers and site supervisors to coordinate crane activities, anticipate logistical challenges, and streamline workflows. This proactive approach ensures that lifting tasks are executed promptly and that project timelines are met without compromising safety or quality.

5. Risk Management and Insurance Coverage

Hiring a professional crane service provider in Michigan includes the benefit of comprehensive insurance coverage. Professional operators carry liability insurance that protects against unforeseen accidents, damages, or injuries that may occur during crane operations. This coverage provides peace of mind to project stakeholders and ensures financial protection in the event of any mishaps or liabilities arising from crane-related activities.

6. Regulatory Compliance and Documentation

Navigating regulatory requirements can be complex, especially in the realm of crane operations. Professional crane service providers in Michigan are well-versed in local, state, and federal regulations governing crane usage, permitting, and safety standards. They handle all necessary permits and documentation required for crane operations, ensuring full compliance with regulatory bodies and avoiding potential legal issues or penalties.

Conclusion

In conclusion, the decision to hire a professional crane service provider in Michigan offers numerous advantages that extend beyond simple operational assistance. From ensuring safety and compliance to enhancing efficiency and risk management, professional crane operators play a crucial role in the successful execution of construction and industrial projects. By leveraging their expertise, experience, and specialized equipment, stakeholders can mitigate risks, optimize project timelines, and achieve superior outcomes. For anyone considering crane services in Michigan, opting for professional expertise is not just a choice but a strategic investment in project success and safety.

1 note

·

View note

Text

Cranes Near Me

In today's bustling construction and industrial landscape, the need for efficient and reliable equipment is paramount. Cranes play a pivotal role in numerous projects, from skyscraper construction to heavy equipment installation. However, the decision to hire a professional crane service provider versus attempting to manage crane operations independently is a critical one. This article delves into the reasons why opting for professional crane services near you is not just advantageous but essential for ensuring safety, efficiency, and project success.

Why Hire a Professional Crane Service?

1. Expertise and Experience

Professional crane operators and service providers bring years of experience and specialized knowledge to the table. Operating a crane requires more than basic machinery skills; it demands an intricate understanding of weight distribution, load capacities, site logistics, and safety protocols. Seasoned professionals undergo rigorous training and certifications, ensuring they can handle complex lifting scenarios with precision and safety.

2. Safety First

Safety is perhaps the most compelling reason to hire a professional crane service. Cranes are powerful machines capable of lifting immense weights to considerable heights. Mishandling can lead to catastrophic accidents, endangering lives and causing extensive property damage. Professional crane operators are trained in risk assessment, hazard mitigation, and emergency procedures, minimizing the likelihood of accidents and ensuring compliance with stringent safety standards.

3. Specialized Equipment and Maintenance

Professional crane service providers invest in state-of-the-art equipment designed for various lifting tasks. From tower cranes for high-rise construction to mobile cranes for versatile on-site maneuverability, these machines are meticulously maintained and regularly inspected for optimal performance and safety. Attempting to manage such equipment without the proper expertise and maintenance protocols can result in mechanical failures or operational inefficiencies, delaying project timelines and increasing costs.

4. Cost-Effectiveness

While it may seem cost-effective to handle crane operations internally, the long-term benefits of hiring professionals often outweigh initial savings. Professional crane services streamline operations, minimize downtime, and enhance productivity, ultimately translating into faster project completion and reduced overall costs. Moreover, reputable service providers offer transparent pricing structures and detailed project planning, eliminating unforeseen expenses and budget overruns associated with amateur crane management.

5. Regulatory Compliance

Operating cranes entails navigating a labyrinth of regulatory requirements and industry standards. Professional crane service providers are well-versed in local, state, and federal regulations governing crane operations, including licensing, permits, and insurance coverage. By partnering with a reputable provider, project managers ensure compliance with all legal obligations, mitigating potential fines, penalties, and project delays.

6. Enhanced Project Efficiency

Efficiency is the cornerstone of successful project management. Professional crane operators bring efficiency to the forefront by optimizing lifting strategies, minimizing idle time, and coordinating seamlessly with other construction activities. Their expertise in logistical planning and execution ensures that critical timelines are met, milestones are achieved, and project goals are realized without compromise.

7. Risk Mitigation and Insurance Coverage

Construction projects inherently involve risks, and crane operations amplify these risks due to their complexity and inherent hazards. Professional crane service providers carry comprehensive insurance coverage tailored to crane operations, safeguarding against liabilities arising from accidents, property damage, or third-party claims. This proactive approach to risk management provides peace of mind to project stakeholders and protects against potential financial repercussions.

Conclusion In conclusion, the decision to hire a professional crane service near you transcends mere convenience; it is a strategic investment in safety, efficiency, and project success. By leveraging the expertise of certified operators, state-of-the-art equipment, and meticulous safety protocols, construction professionals can mitigate risks, optimize resources, and achieve superior outcomes. Whether tackling a high-rise construction project or facilitating equipment installation, entrusting crane operations to qualified professionals ensures compliance, enhances productivity, and fosters a culture of safety in the workplace. When it comes to cranes near you, choosing a professional service provider is not just prudent—it's essential for achieving unparalleled results in today's competitive construction industry.

1 note

·

View note

Text

Why Business Owners Need Business Auto Insurance: Protecting Assets on the Road

In today’s fast-paced business climate, transportation plays a crucial role in the operations of many businesses. For any business owner, whether they operate a small local delivery service or a large corporation with a fleet of vehicles spanning the nation, business insurance coverage is crucial. Let’s explore the importance of business auto insurance operations for businesses that depend on vehicles for transportation.

Understanding Business Auto Insurance

Understanding the details is crucial before exploring the reasons for obtaining business auto insurance in Carrollwood and Tampa, Florida. The purpose of business auto insurance coverage is to protect commercial vehicles. The business owns, hires, or leases company automobiles, trucks, vans, and other vehicles. Business auto insurance covers accidents, collisions, theft, vandalism, and other risks while operating commercial vehicles.

Legal Compliance and Financial Protection:

One of the primary reasons companies seek business auto insurance is to comply with legal obligations and protect their financial interests. Auto insurance is a requirement for all vehicles on public roadways in most states, including Michigan. If an accident occurs and there’s no insurance coverage, one can face penalties, a license suspension, and legal responsibility. Business auto insurance is essential for complying with state regulations and safeguarding assets from financial losses related to vehicles.

Coverage for Property Damage and Bodily Injury:

Accidents can occur anywhere and at any moment, even with conscientious drivers. Business auto insurance covers property damage and personal injuries caused by accidents. This policy also covers damage to other vehicles, structures, and personal belongings, as well as medical and legal fees for other accident victims. If businesses don’t have enough insurance coverage, their finances could be put at risk.

Protection for One’s Vehicles:

Business auto insurance provides coverage for both third-party liability and the vehicles owned by the business. Whether a business owns a single company car or operates a fleet of commercial trucks, these vehicles represent a significant investment for the company. Business auto insurance provides coverage for vehicle damage caused by collisions, accidents, theft, vandalism, and other covered risks. This ensures that vehicles are repaired or replaced rapidly, avoiding downtime and preserving company efficiency.

Comprehensive Coverage Options:

Business auto insurance offers a diverse selection of coverage options to meet the needs of different businesses. Liability coverage protects against property damage and bodily injury claims from third parties, whereas collision coverage covers damage to a vehicle caused by collisions with other vehicles or objects. Comprehensive coverage offers protection against theft, vandalism, fire, and natural disasters. Customize insurance policy to suit one’s needs by choosing the right coverage options for one’s business.

Coverage for Employees and Non-Owned Vehicles:

Business auto insurance may provide coverage for employees who use company vehicles as part of their jobs. This covers employee injuries in accidents and provides liability protection for damage resulting from company vehicles. Business auto insurance can provide coverage for vehicles that are not owned by the company, such as rental cars or vehicles owned by employees, when they are used for business-related activities. This ensures that the business is protected.

Risk Management and Peace of Mind:

Investing in business auto insurance can help mitigate the risks of using vehicles for work. Accidents and other road occurrences can significantly impact businesses, resulting in property damage, medical costs, legal fees, and reputational damage. Business auto insurance helps mitigate risks, allowing companies to operate without worries.

Business auto insurance plays a crucial role in managing risks for companies that depend on vehicles for their operations. Business auto insurance covers legal compliance, financial protection, property damage, bodily injury, and employee liability, ensuring the safety of one’s assets while on the road. Investing in comprehensive insurance coverage for business vehicles can help protect a company’s finances, investments, and reputation from unexpected road risks. One must also consider comprehensive commercial insurance in Carrollwood and Tampa, Florida, to protect their business against the odds.

0 notes

Text

Southern California Home Builders (Photo taken by Rachel Hughes in 2023 around Silver Lake in Los Angeles, CA)

They owned property in Los Angeles, El Cajon, San Diego, and Tulare County.

Apparently this legal understanding stems from the California appeals court case Southern California Home Builders v Young: "the right of the corporation to recover from those to whom corporate assets may have been unlawfully transferred does not affect the statutory liability of the directors who made the unlawful distribution, unless the corporation, in the exercise of the first right, causes the replacement, in whole or in part, of what was taken from the corporation. In that event the liability of the directors would be diminished proportionately or expunged, since the corporation would be entitled to what was taken and no more. "

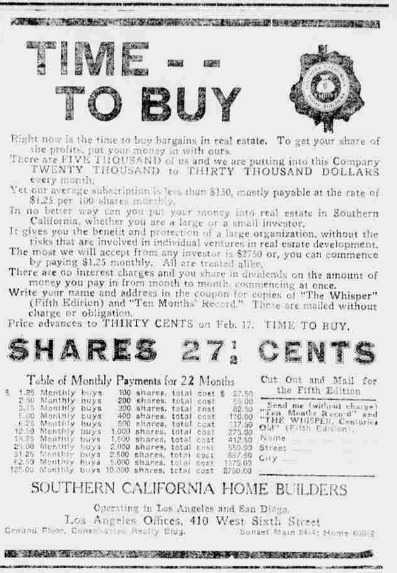

In 1913, they placed an advertisement selling shares of the business in the Santa Fe New Mexican (Santa Fe New Mexican, January 28, 1913, pg. 3, New Mexican Printing Company, accessed via the University of New Mexico UNM Digital Repository).

This photo, entitled "Building a new bungalow" is from the Herald Examiner Collection held by the Los Angeles Public Library. It shows the "construction of one of five new bungalows built in one week on Eighty-third Street, by the Southern California Home Builders."

As of 1917, the Southern California Home Builders had their headquarters at 321 Walter P. Story building, at the southwest corner of Broadway and Sixth streets (610 N. Broadway) in downtown Los Angeles. They only paid $50/month for rent, which also included the use of the telephone and the "valuable services from an experienced manager, Sydney B. Brown" (born in Carthage, Missouri on January 15, 1884). Pretty crazy that would be included, so I feel like I must not be understanding correctly. He collected rents, handled insurance, kept houses in good condition for rental or sale, and handled the "payment of taxes, assessments on properties, interest payments on mortgages, renewals of mortgages and collection of payments on trust deeds and other collections." Brown was also an agent for so many other companies in the Story building, including New Jersey Insurance Co of Newark, NJ; British & Federal Fire Underwriters of Norwich, England; Southwest Farming Co.; Repubilc Casualty Company of Pittsburg. It seems Brown ran all of these operations out of his own company, Sydney B Brown Co. with several employees: a telephone operator (Laura V Small, who lived on Laurel Canyon), a secretary (Mrs. Minnie T Leavitt, who lived on N Normandie Ave.), and someone else who worked in the insurance department (Lolah Boal of Alhambra). While the company's phone number was "Bway 24," his home phone number was 10783 (Los Angeles Director Co's Los Angeles City Directory, The Los Angeles Director Company, Los Angeles, CA, 1921, accessed via the Los Angeles Public Library).

They "closed a deal whereby a nine-room residence at 1527 Hayworth avenue, in Hollywood, was sold... to Margaret Robinson. Sydney B. Brown had charge of the deal." However, when they rented Burbank Hall to hold an annual meeting, they couldn't because the secretary had the flu and "there was not sufficient stock represented." At that time, the president of the company was named Charles A. Sessions, McCullough Graydon was VP, M. T. Leavitt was secretary, R. N. Earl was treasurer, and E. Fossler was director. Later that year, the company had an "assessment sale" and apparently it "showed the largest percentage that had ever been paid at any stock sale... The company is now considering the increasing of rentals" - I have no idea what that means. Nonetheless, I know the business wasn't doing too well in 1919. It was already "the second time that most of this corporation's assets were wiped out."

Quick interlude from some information about Sessions. He was born in 1843 in Michigan and died in 1933; he is buried at Forest Lawn Memorial Park in Glendale, CA (Findagrave.com). He was married to Mary Ellen Jay and had a son named Horace, who was a Private (though I don't know in what).

Another tangential person is Thomas Chalmers Vint. He was born in Salt Lake City, Utah in 1894 but had moved to Los Angeles, CA by the time he attended high school. He went to UC Berkeley and graduated with a BS in Landscape Architecture in 1920. He had also spent a semester at the Ecole des Beaux Arts at the University of Lyon, France and studied city planning at UCLA in 1921. He eventually had a four-decade career with the National Park Service! But, while in school, so I assume around the same time as the above folks where involved, he worked for A. S. Falconer, who designed bungalows for our company of focus! He had also worked as an assistant to Lloyd Wright.

The below are advertisements they took out, which show they both built homes but also underwrote insurance policies for fire and automobile. You'll also see their logo which is in their contractor stamp - rare to see a logo like this in a stamp!

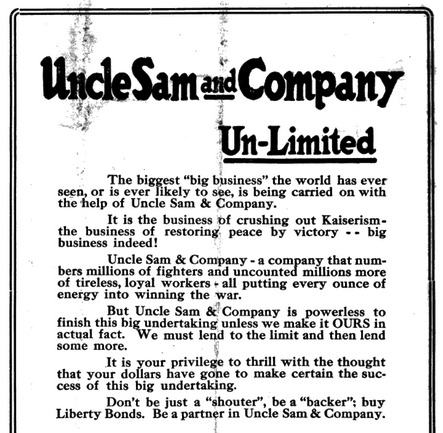

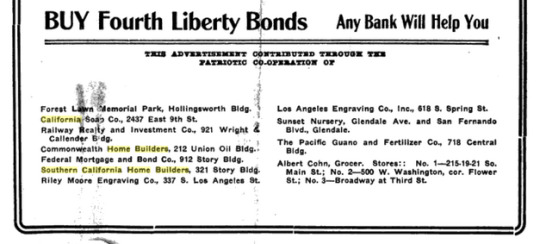

Another fun find is this war bonds advertisement, which was partially paid for by Southern California Home Builders.

I don't know what ended up happening to the company. But many decades later there was a (seemingly unrelated) Southern California Home Builders Association.

Sources not listed in-line:

Albuquerque Morning Journal, February 9, 1913, Journal Publishing Company (1913), accessed via University of New Mexico UNM Digital Repository.

American Globe: Investors Magazine, Volumes 15-16, 1917

The Codes of California: As Amended and in Force at the Close of the Forty-third - forty-fourth Session of the Legislature, 1919-1921, Bender-Moss Company, 1922.

The Credit Crunch and Reform of Financial Institutions: Hearings, Ninety-third Congress, First Session, United States Congress House Committee on Banking and Currency, U.S. Government Printing Office, 1973.

Pioneers of American Landscape Design II: An Annotated Bibliography. Bimbaum, Charles; Fix, Julie. National Park Service. 1995. Clemson University Libraries.

0 notes

Text

Explore Key Benefits of Motorcycle Insurance in Temperance and Monroe, Michigan

Riding a motorcycle is a fun activity. In many, it evokes a sense of liberty. The thrill of the open road is enticing, yet accidents and unforeseen events cannot be ruled out. Motorcycle insurance provides vital protection. Let's explore the benefits of motorcycle insurance and why riders need it.

Accident and Injury Protection

Motorcycle insurance in Temperance and Monroe, Michigan, protects one's investment on the road. Motorcycle riders risk accidents and injuries so that insurance can bring stress relief and financial security. Motorcycle crashes cause more significant injuries. Luckily, the right insurance can cover medical bills, motorcycle repairs, and legal fees after a collision. Every rider who values safety and financial security should have comprehensive motorcycle insurance with protection against accidents and injuries. Proactively acquiring the correct coverage allows one to ride confidently and be ready for anything.

Financial Protection from Theft or Vandalism

Motorcycle insurance should cover theft and vandalism. Comprehensive coverage provides peace of mind and financial help for theft or vandalism. Theft or vandalism protection can cover repairs, replacements, or purchases. Professional riders realize they must insure their belongings to avoid losses.

Legality and Liability Protection

In many places, motorcycle insurance is mandatory. Riders without insurance face financial and legal penalties. Motorcycle insurance protects riders from legal fees and litigation if they cause damage or injury to others. Legality and financial stability are ensured.

Coverage for Accessories and Customization

Depending on circumstances and situations, riders may need to consider extras and customization. Fortunately, many insurance companies cover extras and customization since riders value them. This coverage includes saddlebags, custom paint, chrome, and more. Motorcycle accessories can be protected from theft, damage, and loss. Not all insurance covers accessories and specialty parts; so it's essential to verify policy. A knowledgeable insurance agent who understands motorcycle riders' needs can tailor coverage to protect bike and accessories in various situations.

Rider and Family Peace of Mind

Motorcycle insurance ensures riders and their families peace of mind in road emergencies. Comprehensive motorcycle insurance covers accidents, theft, and bike damage. Plus, it encompasses replacement, repairs, and liability for injuries or property damage. Given the risks associated with motorcycle riding, families feel safer with reliable insurance. With suitable insurance in place, families can ride confidently, knowing they are insured against all major and minor road risks.

Flexible Coverage

There are many motorcycle insurance coverage options to meet different demands and budgets. There are policies for casual riders who need basic coverage and seasoned enthusiasts who need complete coverage. Riders can choose liability, collision, or comprehensive insurance to suit their needs.

Access to Extra Services and Benefits

Beyond financial protection, motorcycle insurance usually offers features that enhance riding. Coverage may include roadside assistance, towing, rental reimbursement, and trip disruption. These advantages can aid motorcyclists with technical issues, breakdowns, or road accidents by providing fast support.

Discounts & Savings

To encourage safe riding and keep consumers, insurance firms give discounts. Riders who take safety classes, ride cleanly, or bundle numerous insurance with the same insurer may receive rate discounts. Anti-theft equipment and secure motorcycle storage can lower insurance costs, giving riders comprehensive coverage at lower rates.

Like renters insurance in Monroe and Temperance, Michigan, motorcycle insurance has several benefits beyond financial protection. Riders need insurance to protect against accidents and theft, comply with the law, and relax. Riders may ride confidently knowing they're covered from unexpected events by reviewing their coverage options and choosing a policy that meets their needs.

0 notes

Text

Pontiac Michigan Rental Home For Sale

Investors - LAND CONTRACT TERMS NOW Available: Land Contrtact Price: $125,000.00; LC Down Pmnt 20%, LC Interest Rate 7.75%; LC Terms 15 to 20 years, No Balloon. 3 bedroom, 2 full bathroom colonial home. Stucco exterior, Spacious living areas, Formal dining room, Fenced back yard. Located close to Perry Park and downtown Pontiac.

1 note

·

View note

Text

Dominion's Banks and Tokarz counsel the Michigan Manufacturing Association on the fundamentals and merits of a Sale-Leaseback transaction

Industrial real estate has been hitting record highs in the wake of COVID-19 as re-shoring manufacturing operations has become the trend. Impacted by changing economic times and increasing interest rates, many manufacturers have turned to sale-leasebacks, which occur when a property owner sells their building to an investor and simultaneously signs a lease with the investor. This selling option provides manufacturers who own a property an alternative to traditional financing and the ability to free up their capital tied up in real estate without having to make a costly move.

Here are 10 important aspects of sale-leasebacks manufacturers need to know:

1. Enterprise Value

A sale-leaseback can be very beneficial to owners who are considering selling their business and want to maximize their enterprise value. When it comes to selling a business, depending on your industry, it is expected to get two to eight times your EBIDTA (earnings before interest, taxes, depreciation and amortization) as a valuation of the business. However, given the business is creditworthy and willing to sign a strong lease, a manufacturer can expect to get the equivalent of a 10-20 multiple on each dollar of rent they are willing to pay. This will significantly increase the enterprise value as opposed to selling it in one packaged deal.

2. Generate Cash

A sale-leaseback allows a manufacturer to capture the value of the industrial real estate which has been at all-time highs over the last four years. Not only can they capture this value but they also do not need to make an expensive move. The cost of moving a business can easily soar into the six figures. This money is debt free on the balance sheet and monthly payments an operating expense can be very beneficial depending on the financial status of the business. It is not uncommon for owners to use the money from a sale-leaseback to fund expanding the business or acquire other businesses, while not having to take on new debt obligations.

3. Implications

Sale-leasebacks can have some other implications that need to be considered while deciding if it is the right choice for a business. First, it can lock the business into a long-term lease commitment. This can reduce the flexibility of the business. If the real estate market keeps appreciating, that appreciation will be lost as the asset has already been sold. Additionally, a sale-leaseback could open the company to increases in tax liabilities from the sale of their real estate. Anyone considering a sale-leaseback should consult their accountants and/or estate planners to help mitigate any potential tax liability.

4. Rental Rate

The rental rate that the tenant is willing to pay generally needs to be in line with the rest of the market. If the rental rate is high compared to the normal market rents in the area, it will over inflate the sale price which can deter investors or they may not be able to underwrite the transaction.

5. Lease Term

The terms of the lease also play a very important role. Investors want to see long-term leases so they know they have guaranteed income for an extended period of time. Anything less than a five-year lease tends to scare off investors who are willing to pay higher sale prices. Investors like to see the term in the 10-15+ year range, and this will help a seller get more money for their property.

6. Lease Type

The type of lease also needs to be considered. Investors like to see a minimum of a triple net lease in which you the seller or future tenant would be responsible for property expenses including maintenance (generally excluding the structure and parking lot), lawn/snow care, real estate taxes, building insurance and the utilities. If a manufacturer is only interested in a gross, single or double net lease, this will drive down the amount a buyer would be willing to pay. Conversely, absolute net leases will help to drive up a potential sale price. In an absolute net lease, the tenant would be responsible for maintaining and replacing the entire property including the roof, parking lot and structure.

7. Tenant’s Credit

The status of the future tenant’s credit is important to investors as it determines how likely their new tenant is able to fulfill their lease commitment. This creditworthiness is a major driving factor in the cap rate an investor can pay for the building. A lower cap rate garnered by a strong tenant credit rating will increase the price the investor can pay for the building.

8. Location, Location, Location

Investors prefer buildings in dense population centers with strong labor pools. They are also going to prefer to be in a dense industrial market. In the event that a manufacturer, as the tenant, were to go out of business or move, it will be easier to backfill the property. However, there are buyers out there that specialize in rural properties but generally the cap rate will be lower and they will be looking for a longer lease term usually in the 15-20+ year range.

9. Building Condition

Building conditions are very important for owner operators to consider. If a manufacturer is considering selling on a sale-leaseback and the roof, parking lot or HVAC needs to be replaced, it will be a detriment to the potential sale price. Any investor is going to look at what it is going to cost to make those repairs/replacements, and tag on a contingency margin plus a little extra for having to do the work themselves. If a building has been built for a very special purpose or is functionally obsolete, that will also drive up the cap rate an investor would be willing to pay. This is because specialty buildings are much more difficult to re-tenant and give added risk to prospective investors. This aspect can play a major role for manufacturers who are looking to build a custom building. It is very important to consult a real estate professional to ensure that your design will serve not only your own manufacturing purposes but also not be so unique that it has no marketability when it comes time to sell or re-tenant that asset.

10. Buy Back Option

An additional option that can be worked into a sale-leaseback is an option for the owner to purchase the property back. This is used by owners who are looking for debt-free financing but do not want to lose long-term control of their real estate asset. These options are generally set with a predetermined buy-back price at certain time periods throughout the lease.

Leveraging industrial real estate with a sale-leaseback can be the perfect solution for some manufacturing businesses. Sale-leasebacks afford more control with favorable terms not available in other financial transactions. Reasonable and customary terms maximize the marketability of a property and attracts more investors. It is important to consult real estate professionals, accountants, attorneys and estate planners as they can help to negate any avoidable tax implications and make sure your new lease does not have any hidden surprises. Working with a trusted commercial real estate professional with experience in industrial sale-leasebacks will help a business owner to properly execute and time the transaction.

To read this original article posted by the Michigan Manufacturers Association: https://mimfg.org/Articles/top-10-things-to-know-about-sale-leasebacks

0 notes

Text

Mastering Commercial Apartment Financing with BoathouseCFG in Michigan's Dynamic Market

Introduction:

The real estate market in Michigan is thriving, with commercial apartments emerging as a lucrative investment opportunity. Understanding the intricacies of financing these investments, however, can be challenging. BoathouseCFG, a leader in financial solutions based in Michigan, specializes in providing commercial apartment loans tailored to meet the needs of investors. This blog explores the world of commercial apartment loans and how BoathouseCFG can help you navigate this complex landscape.

Understanding Commercial Apartment Loans:

Commercial apartment loans are designed for the purchase, renovation, or refinancing of multi-family rental properties. Unlike residential mortgages, these loans are typically granted to corporations, LLCs, or other types of business entities and are secured by the property itself.

Why Michigan is Ideal for Commercial Apartment Investments:

Michigan's diverse economy and growing population make it an attractive market for commercial apartment investments. Cities like Detroit, Grand Rapids, and Ann Arbor offer substantial opportunities due to their economic growth, student populations, and rising demand for rental housing.

BoathouseCFG’s Role in Your Investment:

Tailored Financial Solutions: BoathouseCFG understands that each investment is unique. We offer customized loan options to fit your specific project needs and investment goals.

Expert Guidance: With years of experience in the Michigan market, our team provides invaluable insights and advice, helping you make informed decisions.

Streamlined Loan Process: We simplify the loan application process, making it more efficient and less daunting for investors.

Types of Commercial Apartment Loans Offered:

Conventional Mortgages: Ideal for stabilized and high-quality properties with good occupancy rates.

Government-Backed Loans: Such as those insured by the FHA, which can offer lower down payments and competitive rates.

Bridge Loans: For investors looking to renovate or reposition a property before obtaining long-term financing.

The Application Process:

BoathouseCFG’s application process is designed to be transparent and straightforward. It involves an initial consultation, financial assessment, property appraisal, and a structured closing process, ensuring clarity and efficiency at each step.

Success Stories:

Featuring testimonials from satisfied clients who have successfully secured commercial apartment loans through BoathouseCFG, showcasing our commitment to client success and financial partnership.

Market Insights:

Stay updated with the latest trends, market analyses, and forecasts in Michigan’s commercial real estate sector, positioning BoathouseCFG as your knowledgeable partner in this dynamic market.

Conclusion:

Whether you’re a seasoned investor or new to commercial real estate, BoathouseCFG in Michigan is your trusted ally in securing the right financing for your commercial apartment investments. Our expertise, personalized services, and commitment to your success make us the ideal partner for your real estate endeavors.

Call to Action:

Ready to dive into the world of commercial apartment investments in Michigan? Contact BoathouseCFG today for expert guidance and tailored loan solutions. Visit our website https://boathousecfg.com/ to learn more or to start your loan application process.

Tagged - Commercial Apartment Loans, Multi Family Loan Michigan, Apartment Loans Michigan, Multi Family Financing, Apartment Building Loans, Multi Family Rehab Loan.

0 notes

Text

R. A. Monk Insurance Agency provides car insurance to clients across mid-Michigan, including Flint, Midland, Bay City, Saginaw, Frankenmuth, and surrounding areas. Our highly qualified professional staff has offered automobile insurance with reasonable coverage, including bodily and personal injury, rental car coverage, property damage, and so much more!

0 notes

Text

Michigan Supreme Court’s Clarifying Decision on the State’s No-Fault Auto Insurance Policy

By Taylor Trenta, Calvin University Class of 2025

August 16, 2023

As of last month, the Michigan Supreme Court clarified that Michigan’s no-fault insurance law does not apply to injuries before the 2019 Act. [1] This 5-2 decision specified that the 2019 amendment is not applicable to earlier and already established policies. [1] The no-fault act was amended in 2019, limiting family-provided attendant care reimbursement, possible medical services, and other alterations. [1] In context, driving in Michigan as a resident requires a no-fault automobile insurance policy. Without it, the punishment is a fine of up to $500 and a year in jail, as well as a 30-day license suspension. [2]

According to the Michigan Department of Insurance and Financial Services, “If you are injured in an auto accident, PIP will pay all reasonable and necessary medical expenses for your lifetime up to the maximum coverage amount selected in the affected policy. PIP will pay wage loss and replacement services for up to three years after the date of the accident.” [2] Personal Injury Protection options include Unlimited Coverage, $500,000 per person per accident, $250,000 per person per accident, $250,000 per person per accident with exclusions, no PIP medical insurance, etc. [2] For property protection, no-fault will pay up to $1 million for cases of damage to another person’s home, fence, or parked vehicles. [2] For Residual Liability Insurance, “Michigan’s no-fault insurance protects insured persons from being sued as the result of an automobile accident, except in certain situations. This includes when the injured party does not have enough coverage to pay for treatment or payment must be made to compensate someone that was killed or seriously injured.” [2] Additional options include Collision and Comprehensive Insurance, Limited Property Damage Liability Insurance, and Towing and Rental Car Coverage. [2]

Michiganders brought attention to the change in policy when Ellen M. Andary and Phillip Krueger experienced challenges to their coverage. After injuries from automotive accidents, the two received uncapped lifetime medical care, but faced challenges following 2019. [1] The case states, “It has long been the rule in Michigan that for insurance purposes the rights and obligations of the parties vest at the time of the accident. For purposes of a no-fault policy of insurance, this means that neither the insured nor the insurer can unilaterally change the terms of a policy after a covered accident occurs.” [1] This emphasized concerns from prior injuries. These people, along with others throughout the state, worried about being able to cover medical expenses if the policy was altered retroactively. The case syllabus says, “Andary’s and Krueger’s rights to [personal protection insurance] benefits under the applicable no-fault insurance policies vested, at the latest, when their injuries occurred and they first became eligible for [personal protection insurance] benefits.” [1] With the majority opinion, Justice Elizabeth Welch wrote: "The 2019 no-fault amendments do not clearly convey an intent to retroactively modify these vested contractual rights.” [3]

In contrast, Viviano wrote the dissent, saying the decision: “thwarts the will of the Legislature” and “As a result, the efforts of the Legislature and the Governor to reduce costs and make insurance more affordable for all the residents of our state will not come to fruition for many decades.” [4] While the updated decision only applies to crash survivors from before June 11, 2019, future dissent may come. [4] When the new cost controls were implemented, lawmakers did not specify if it impacted pre-2019 or post-2019 accidents. With the new decision, 15,000 Michiganders who experienced catastrophic accidents on the road are to be paid at full rates without cost controls. [5] With the overhaul law, healthcare providers were required to cut their prices by approximately 45%; this resulted in some patients being dropped. [5] The alteration also exempts survivors from the 56-hour cap placed on home attendant care. [5]

For the American Civil Liberties Union of Michigan and health organizations, this ruling was a positive decision. Dan Korobkin, legal director for the ACLU of Michigan, stated: “Applying the [2019] law retroactively has resulted in the withdrawal of critical care from people who are living with severe disabilities as a result of catastrophic injuries suffered in car accidents — care that allows them to continue living their lives and participate in society... Because of this ruling, it is our hope that thousands of Michiganders seriously injured in auto accidents, and receiving crucial care and resources through insurance coverage, won’t have their lives dangerously upended.” [1]

However, not all are happy with the results from the turmoil. Kris Curtis, director of CBI Rehabilitation Services in East Lansing, stated, "From what I understand, 30 programs like ours closed... Other health care providers stopped providing services to auto no-fault clientele, and they closed their doors. So, from the statistics I've heard, there were over 6,000 workers in this area that lost their jobs." [3]

While this decision helps clarify the policy, questions remain about the 2019 no-fault decision in Michigan. Even before the new cost controls were implemented, Michigan was the only state in the United States to require drivers to pay for full personal injury protection; consequently, Michigan was consistently the state with the highest auto insurance rate. [5] Now, Insure.com says Michigan ranks fourth. [4] However, many victims of car accidents before 2019 are relieved to receive coverage again.

______________________________________________________________

Taylor Trenta is a pre-law student at Calvin University, located in Grand Rapids, Michigan. She is currently studying history and economics as an Honors Scholars student.

______________________________________________________________

[1] Davidson, Kyle. (July 31, 2023). “Michigan Supreme Court: No-fault auto insurance changes don’t impact prior services.” Michigan Advance. Michigan AdvanceMichigan Supreme Court: No-fault auto insurance changes don’t impact prior servicesChanges to Michigan's no-fault auto insurance law do not apply to individuals injured before the changes were issued, the Michigan Supreme....1 week ago.

[2] Michigan Gov. “Brief Explanation of Michigan No-Fault Insurance.” Michigan Gov. https://www.michigan.gov/-/media/Project/Websites/autoinsurance/PDFs/FIS-PUB_0202a.pdf.

[3] Meyers, Elle. (July 31, 2023). “Michigan Supreme Court upholds no-fault auto insurance ruling.’ CBS Detroit. CBS NewsMichigan Supreme Court upholds no-fault auto insurance ruling(CBS DETROIT) - Early Monday morning, the Michigan Supreme Court upheld a previous lower court ruling, saying those who were injured in car....1 week ago.

[4] Gibbens, Lauren. (July 31, 2023). “Michigan court limits scope of no-fault reform. Will insurance rates rise?” Bridge Michigan.

Bridge MichiganMichigan court limits scope of no-fault reform. Will insurance rates rise?Car crash survivors injured before 2019 no-fault law aren't subject to its restrictions on medical fees, Michigan Supreme Court rules....1 week ago.

[5] Reindl, JC. (July 31, 2023). “Michigan Supreme Court: No-fault overhaul doesn't apply to 15,000 catastrophic survivors.”

Detroit Free Press. Detroit Free PressMichigan Supreme Court: No-fault overhaul doesn't apply to 15000 catastrophic survivorsThe Michigan Supreme Court on Monday ruled that new medical cost controls in Michigan's recent overhaul of its no-fault auto insurance....1 week ago.

0 notes

Text

Cardinal Insurance Company, a renowned Michigan insurance provider, is dedicated to giving you the best business insurance, life insurance, vehicle insurance, and professional liability insurance available.

0 notes

Text

My dad’s really pushing me to buy a condo; he’s a boomer so he’s very big on the idea that all his children should own homes, because for boomers buying in early adulthood in the 1980s, they basically made a killing in real estate over the course of their lives, just by the luck of having been born at the right time.

So I made a calculator that calculates monthly payments of buying vs renting. It’s not so sophisticated as to take into account using the down payment money on the condo/house vs investing in an index fund or something--I’m just not worrying about that. But it’s got mortgage payments, HOA fees, property taxes, and insurance estimates. And the fact that HOA fees, property taxes, and rent all go up over time. (And property taxes in CA increase in a predictable way after a purchase, divorced from the real estate market.) Anyway, the calculator does not take into account that home prices increase over time so resale value might be higher than your purchase price. There’s only so much I’m willing to speculate on. It also doesn’t take into account that you get a tax credit for mortgage payments, because at a certain point I just have to consider this spreadsheet done and stop adding to it.

What I’ve learned is that around where I live, where rent is extremely high, the break-even point averaged over 5 years is a (30-year) mortgage of about $250k, not counting equity built up by paying off your mortgage, or $300k counting equity. Less than that, and it’s cheaper to buy, more than that and it’s cheaper to rent (assuming--as I do--that you live in a one-bedroom apartment). That’s taking into account condo fees, although they can vary a lot--I used some of the real numbers I was looking at with my parents today, but admittedly some of the higher numbers. My calculation also assumes the sort of mortgage interest rate you can get with really good credit--obviously if you have bad credit, that could change things somewhat.

If, instead, you’re buying a house and paying your own external home maintenance, it’s a bit harder to guess. But by my estimates, not counting equity the break-even is a mortgage of about $280k, and counting equity, about $320k. (There’s a lot less point to living in a condo in a place like CA where you don’t have to worry about shoveling snow. Back in Michigan, the HOA fees felt very worth it, because among everything else including building maintenance, they paid for all the snow removal, which--especially as a Californian--I simply did not even want to get into dealing with.)

Comparing to a two-bedroom apartment--i.e. higher rent--so generalizing a little past my personal needs: break-even for a condo, not counting equity, is a mortgage of about $330k, and counting equity, about $380k. For a house, $350k and $410k respectively.

If you’re sure you’re going to be living in a place longer-term, that’s when things become more worthwhile, because you’re building up more equity. Also because HOA fees and/or maintenance prices don’t go up nearly as fast as rent. So for 10 years, I’m finding that for a condo, with and without equity, the break-even mortgages compared to a 1-bedroom rental are $350k and $420k, respectively (you can see the equity starting to be a bigger effect). For a house, $380k and $460k respectively.

So, ok, what’s the upshot? The upshot is that you need to be able to put down a down-payment of more than the normal 20% for buying a home to be worthwhile around here. I can do that, because I lived in my previous condo for 17 years and paid off the whole thing after about 14 years (...and successfully cashed my sales check finally lol). Basically I can leverage the equity from my previous home purchase--in a much cheaper region of the country--toward the down payment in a more expensive place, many, many years later.

A first-time home buyer, and/or someone significantly younger than me with less savings, would lose money buying, though, because the minimum price for a condo around here is about $450k and the minimum price for a house is about $750k. (So for a house you’d have to be able to pay like half of it upfront for it to be worthwhile. Hardly anyone can do that. That right there is the argument for picking a condo, even if HOA fees are more than house maintenance: buying a house is simply going to be out of range for most people in the first place.)

The other upshot is basically the old advice that you need to be sure you’re going to be living in the same place for at least five years to even think about buying a home. Otherwise, there’s basically no way to make it work out in your favor, unless you can somehow just buy the whole thing in cash from the start.

Of course, that’s not everything--sometimes with what you can buy vs rent at that break-even point, the place you can buy is bigger and/or nicer than the place you can rent. Sometimes it’s worth paying more for that quality of life, if you can afford it. Sometimes your family needs are such that finding a suitable rental at all is very hard, so buying is the most plausible option.

But if you’re just looking at the numbers, that’s how it comes out.

#I made the calculator in libreoffice's fake version of excel#so I can pass it around to anyone in my family who might want to play with it

1 note

·

View note

Text

life insurance

Encore Insurance is an independent insurance agency in Michigan that offers the coverage you need at a price you can afford, along with excellent service. Our clients choose us time and time again because we save them the hassle of finding the right policy and eliminate unnecessary stress during the claims process.

No one wants to be in a car accident, but no matter how carefully you drive or park, something can still go wrong. That's why you need car insurance. With the right car insurance, you can get compensation for repairing your damaged car, treating your accident injuries and more. If you need help choosing the best car insurance in Michigan, look no further than Encore Insurance.

Before taking out car insurance, you need to be clear about what cover you need and what you can afford. Once you have this information, you can start shopping for auto insurers that fit your budget and needs. If you find multiple insurers that offer your preferred coverage, choose the one with the best customer ratings and the lowest price.

Going through this whole process takes a lot of time and energy, and still, you might end up choosing the wrong product. At Encore Insurance, we've already shopped around for the best auto insurance deals so you don't have to. Let our experts guide you to the best value car insurance that will protect your interests and save you money.

If a fire, windstorm, or other accident damages your home, the cost of restoring your property may be more than you can afford out of pocket. However, if you have home insurance, your insurer will cover the damage, allowing you to rebuild your home quickly.

Need help getting home insurance in Michigan? Encore Insurance Group has you covered. For over a decade, we have been serving Wolverine State residents in finding the insurance coverage that works for them. You can count on us to get you reliable home insurance that will give you peace of mind and save you money.

Admitting your physical limitations and taking out life insurance requires a high level of maturity. The required vision and humility will benefit your loved ones for the rest of their lives. At Encore Insurance Group, we pride ourselves on providing our customers with clear and easy to understand Michigan life insurance information.

Most people take vacations to clear their minds and relax. However, getting peace of mind is elusive if you find yourself without insurance around.

At Encore Insurance Group, we offer a variety of RV coverage options to suit your intended use. Read on to discover the different types of RV insurance plans we provide to our fellow Michigan residents.

Protect your financial future with RV rental insurance. If you plan to rent an RV and go on a family vacation, you'll need RV rental insurance. Recreational vehicles cost a lot of money and repairs are exorbitant if you need rare spare parts. Avoid headaches when negotiating with a rental company and let our agents do the talking.

1 note

·

View note

Text

Payroll Companies in Michigan Can Make Your Life Easier

Payroll companies in Michigan offer a variety of services. They can process payroll, pay employees, and even complete tax forms. They can also help you stay compliant with state and federal laws. They can help you avoid costly mistakes, including missing paychecks. Whether you are a small business or a large corporation, payroll services can make your life easier.

Some payroll companies specialize in specific industries. Some have specialized software that makes it easy to onboard film crews or rental property owners. Others provide general liability insurance, hired & non-owned auto policies, and rental property coverage. Some of these services may be free, while others charge. The cost of payroll services varies depending on the number of employees and the service provider. Choosing the right provider can ensure you are getting the most for your money.

In addition to payroll services, some companies offer time and attendance solutions to help boost employee productivity. Other services include bookkeeping and human resource management. These solutions can save your business time and effort and eliminate back office tasks.

A payroll companies michigan can handle all of your payroll needs, but you can also choose a company that provides customized HR solutions. These companies often provide a variety of benefits to your business, including customizable employee benefits, time and attendance, and human resources.

If you are a small business with limited resources, a PEO can provide you with all the tools and expertise you need to effectively run your company. You will pay less for worker's compensation and unemployment taxes and get savings on employee benefits. You can choose from hundreds of PEOs. A one-time quote is often available to you through the PEO Exchange.

When you have hired a payroll company, you can be sure they will adhere to your business's rules and regulations. Some of the most common rules for paying employees in Michigan include ensuring that they have a Michigan address, paying time and a half for overtime, and filing tax forms. It is illegal for an employer to fail to pay an employee.

Other regulations require employers to follow a certain timeline when they hire new employees. They must report new hires within twenty days of hiring. They also have to keep records of terminated employees. This information can be kept for three years. The Michigan Bureau of Employment Relations has a website where employers can find forms and regulations.

During the onboarding process, a business should collect and prepare all the necessary payroll forms. These can include W-4s, I-9s, and direct deposit information. Some of these forms should be provided to each employee upon hiring. In order to pay your employees correctly, you will need to know all of the details of your employees' tax withholding.

You will need to keep up with changes in the law. You can always find information on the State of Michigan business website. You can also contact the Michigan Bureau of Employment Relations. The bureau has detailed information about payroll rules, minimum wages, and other regulations.

1 note

·

View note

Text

Complete Guide on Carpet Steam Cleaning Plymouth Michigan

Super Steamers Carpet Cleaners is a full-service cleaning company for homes and businesses. In Plymouth, Michigan, we are the go-to business for complete carpet steam cleaning Plymouth Michigan, upholstery cleaning, and tile and grout cleaning. Serving Southeast Michigan's citizens and business owners with pride.

It has been demonstrated that cleaning your carpet can assist persons with allergies and asthma breathe better indoors. Not only will our expert carpet cleaning services eliminate allergens in your carpet, but also in the air of the cleansed regions. The Bee Clean procedure uses far less moisture than standard steam cleaning because it uses a green seal-certified solution. Our truck-mounted steam extraction technique strikes the ideal mix between thorough cleaning without sopping the carpet or pad at the back. This technique produces speedy drying periods and stops bacteria and mould from growing under your carpet.

Your carpet cleaning requirements can be met by Super Steamers Carpet Cleaners, which has over thirty years of experience in carpet cleaning. A tried-and-true method for keeping your home clean is to clean your carpet and upholstery at least twice a year. Your carpets will inevitably seem old and unclean as a result of pets, kids, and everyday activities wearing down the carpet fibers. Soiled, unclean carpeting is a result of outdoor factors such dirt from shoes, dust, pollen, and allergens in the air. To ensure that all soil, allergens, and stains are removed from your carpeting, we offer a truck mounted deep extraction steam cleaning.

When it comes to carpet steam cleaning Plymouth Michigan, Super Steamers Carpet Cleaners is one of the most reputable companies. The owners of our businesses have been residents of Canton for more than 20 years. We take pride in serving the neighborhood and have progressed with Canton. Both business properties have been in our care for more than three decades.

Truck Mount Steam Extraction

To clean carpets and upholstery, we employ the well regarded truck-mounted hot water steam extraction technique. We bring the hoses from our own truck mounts inside, spray hot steam, and rinse to remove both filth and detergents at once. Your carpet is left fresh and clean while all soil and leftovers are returned to the truck. Any other carpet cleaning rental equipment, rotary scrubbing, or dry cleaning techniques fall short in comparison to the truck mount method. It is acknowledged as the industry's best technique for cleaning carpets.

We can offer you great service, top-notch goods, and restored outcomes because we are fully licenced and insured. Super Steamers Carpet Cleaner can handle all of your cleaning needs, including steam extraction if your oriental rug needs a deep clean. For details about Carpet Steam Cleaning Plymouth Michigan, take a look at our website.

0 notes