#SBI Health Insurance Customer Care Number

Text

#Best SBI Life Insurance Policy Plan In Hindi#SBI Health Insurance Plan In Hindi#SBI Health Insurance Plan#SBI Health Insurance Policy#SBI Health Insurance Hospital List#SBI Health Insurance Customer Care Number#SBI Health Insurance Plan For Family#SBI Health Insurance Premium Calculator#SBI Health Insurance Plan In India#sbi arogya plus policy in hindi#SBI Life Insurance Best Plan in Hindi#Best SBI Life Insurance Policy

0 notes

Text

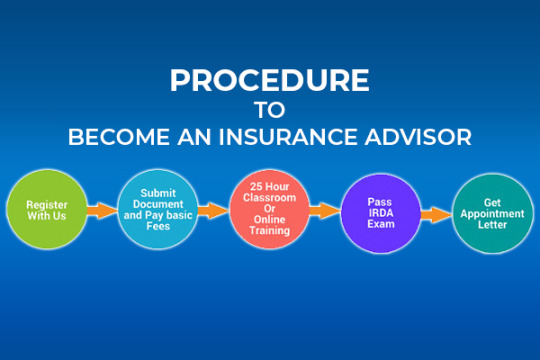

Become an Insurance Advisor with SBI Life

Become an Insurance Advisor with SBI Life

Searching for v Understanding the requirements for the job can assist you in the interview process. The experts at Join Insurance Career can assist you better in learning about the whole process of How to Become Policybazaar Agent.

Requirement: How to Become Policybazaar Agent

When looking for How to Become Policybazaar Agent, you must be 18 and have a 12th-grade education. You must also successfully complete the agent training and earn the certification. Apart from this, you must also drive your own efforts and have a flair for selling to join us as the insurance representative.

Procedure: How to Become Policybazaar Agent

When looking for How to Become Policybazaar Agent, visit the Policybazaar TV Partner website. This PB Partner website allows the registration of agents using Policybazaar.

Next, for How to Become Policybazaar Agent, the homepage will appear before you once you have accessed your official web page. On this page, you will find the option to register above. To register, click it.

Once you click on the button, a new page will appear before you.

You will need to fill in your cell phone number first. After this, you must select the”Send” OTP option to continue.

When you click Send OTP, a new page appears. On this page, you must submit the OTP you received from the mobile number provided by you.

Then, for How to Become Policybazaar Agent, you need to select the option to verify. If you believe that the OTP matches, a web page will display before you.

Enrolling in a professional program when looking at How to Become Policybazaar Agent is essential?

When looking How to Become Policybazaar Agent, enroll in an accredited professional program at Join Insurance Career to improve your selling skills as you work towards your professional license. You can take part in regular sales classes or take courses explicitly designed to help insurance professionals.

For How to Become Policybazaar Agent, our professionals assist you in developing the abilities you need to manage client relationships. We also help you understand the typical problems you may confront as an insurance professional. Through our expert guidance, you will learn about the efficient sales method you can use.

How Do Experts at Join Insurance Career Help?

We only work with trusted brands in the insurance industry. They are the market leaders, and they are known for their best products, customer focus, claim settlement ratios, affordable premium, and customer service. These companies offer the best agent commission, best-in-class recognition, and rewards. So, join your hands to become a protector in someone’s life!

Some Reputed Companies We Work Together With Include:

TATA AIA Life Insurance

TATA AIG Insurance

TATA Mutual Fund

Care Health Insurance

ICICI Lombard Insurance

0 notes

Text

India Travel Insurance Market Size More than Triple at a CAGR of 19.8%

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study estimated India Travel Insurance Market size at USD 85.6 million in 2021. And BlueWeave forecasts India Travel Insurance market to grow at a robust CAGR of 19.8% during the forecast period (2022–2028) to reach a value of USD 281.4 million by 2028, as deepening penetration of mobile internet enables travelers to choose convenient options for online travel bookings, and a comprehensive suite of packages for different types of travelers. However, a lack of understanding regarding insurance policies may hinder the market growth.

India Travel Insurance Market – Technology Advancements

Convenient choices for purchasing travel insurance through online comparison-shopping websites such as direct airline sites and online travel agents (OTAs) are driving the expansion of the travel insurance industry. Insurers are projected to strengthen existing travel insurance distribution networks with the help of innovative technologies, such as geolocation, application program interface (API), artificial intelligence (AI), data analytics, and global positioning system (GPS). Hence, the increasing use of innovative digital technologies could boost the growth of the travel insurance market in India.

Booming Tourism Sector to Drive Demand for Travel Insurance

The main driver of the travel insurance business is the increase in tourism. When traveling to a foreign country, a majority of Indian travelers seek abroad travel insurance in India, implying that there is a huge market for travel insurance in India. Not just among international tourists, but also among domestic travelers, there has been a significant increase. According to recent estimates, 30 million Indians travel within India each year, and they also seek domestic travel insurance. Travel has become a part of academic, business, and personal life as people have become more mobile, exposing people to travel-related contingencies. Hence, an increasing number of travelers are expected to drive the demand travel insurance products and services in India.

Request for Sample Report @ https://www.blueweaveconsulting.com/report/india-travel-insurance-market/report-sample

Segmental Coverage

India Travel Insurance Market – By Insurance Coverage

Based on insurance coverage, the India travel insurance market is segmented into three categories: single trip, annual multi-trip, and long stay. Due to the development in business travel combined with rising disposable income, single trip travel insurance accounts for a substantial market share among them. However, more accessible and less expensive travel has made it easier for various families and fully autonomous travelers to take multiple trips in a year, resulting in a significant increase in annual multi-trip travel insurance.

Impact of Covid-19 on India Travel Insurance Market

Due to government-imposed severe lockdown measures, the COVID-19 pandemic slowed the growth of the travel insurance market in the first half of 2020. Due to the enormous worldwide health, social, and economic disaster created by the COVID-19 pandemic, travel and tourism are among the most affected businesses. After the gradual relaxation of the mandated lockdowns, the market gained traction in the second half of 2020. There will be an increase in the number of travelers in the coming years as a result of various industry participants providing coverage for COVID-19 related medical expenses.

Competitive Landscape

IFFCO Tokio Travel Insurance, TATA AIG, Apollo Munich (now, HDFC Ergo), Bharti AXA, Bajaj Allianz, SBI General Insurance, Future Generali, Royal Sundaram, HDFC Ergo, ICICI Lombard, Reliance, and Religare (now, Care Insurance) are the leading participants in India travel insurance market. Major travel insurance players in India are increasing their investments in developing new insurance plans to expand their customer base and geographic reach.

About Us

BlueWeave Consulting provides comprehensive Market Intelligence (MI) Solutions to businesses regarding various products and services online and offline. We offer all-inclusive market research reports by analyzing both qualitative and quantitative data to boost the performance of your business solutions. BWC has built its reputation from the scratch by delivering quality inputs and nourishing long-lasting relationships with its clients. We are one of the promising digital MI solutions companies providing agile assistance to make your business endeavors successful.

Contact Us:

BlueWeave Consulting & Research Pvt. Ltd

+1 866 658 6826 | +1 425 320 4776 | +44 1865 60 0662

0 notes

Text

Park Plus for Playstore

The Park+ App is a one-stop solution and 360-degree eco-system for all your needs as a vehicle owner. Our most popular services include:

Parking - Find, book, and reserve parking spots everywhere you drive.

FASTag buy and recharge - Buy FASTag, recharge, and view transaction history in one place

Daily car wash - Premium Doorstep Car Wash service for daily car washing

Car Insurance - Get holistic details and overviews on the best car insurance policies and buy or renew your car insurance.

Car Health Checks - Get a thorough and true evaluation of the fitness of your car, and your car’s true condition.

Car selling - Sell your car for the best price with our Car Listing service.

Updated Traffic Rules and Regulations - View and use updated real-time information on RTO rules for fines etc. from State wise RTOs

EMI Calculator - Our EMI calculator helps you calculate the EMI requirement when you want to buy a new car and have the car of your dreams.

RTO e-challan Check - Get your vehicle challan details using the Park+ app. The pending echallan status can be checked against a vehicle’s RC or your DL number and cleared instantly.

Vahan Registration Details - Helps you find complete RTO vehicle information such as vehicle details, owner name, and address, make, model, pollution, insurance, and much more by just entering the vehicle registration number.

Manage cars and automobiles using services and information on our app, a comprehensive care zone for your vehicles that make us a Super App for Cars.

Buy and recharge FASTag

Register and recharge FASTag on the go with the Park+ easy-to-use comprehensive FASTag app.

Register for FASTag and fastag app download.

Update your FASTag details and KYC information.

Open or close a FASTag account all in one place.

Do FASTag balance check. Access FASTag Recharge app. Keep track of your FASTag balance on the Park+ fastag balance check app instead of complicated banking apps and signing in. You can check your FASTag expenditure and history with the fastag download.

Reload FASTag through banking / UPI on Park+.

Park+ answers all FASTag-related queries. 24/7 assistance for FASTag emergencies and help for all customers.

How to use our Park+ FASTag service: Open the Park+ App > Click on Services > Enter your vehicle / vahan number plate details > Click enter and access FASTag balance. Recharge through Net Banking, Debit /Credit cards, UPI, and online wallets.

Control your FASTag registered at multiple banks with a single clink. These include:

SBI FASTag

NCPI FASTag

Airtel FASTag

Axis FAStag

Kotak FASTag

IDFC FASTag

Bank of Baroda FASTag

PNB FASTag

HDFC FASTag

IndusInd FASTag

ICICI FASTag

Airtel FASTag

Know your Vehicle and RTO

With the easy-to-use, RTO vehicle information app and mParivahan app stay updated with car info vehicle registration details. Use traffic fine checker RTO fine app and RTO information app to ensure previous fines and challans are paid. Avoid late fees/penalty payments. With a few clicks, license information, or car number plate information, Park+ makes it possible to find details you require from the RTO and get the best e parivahan sewa.

1: RC Status. Use number plate details to check all vehicle information like insurance, ownership, car age and model, engine model, petrol/diesel, and accident history.

2: Fines and Challans. Feed-in Driver’s Licence or Car Plate numbers and find pending challans.

3: Complete Car model and vehicle info and ownership info like vehicle owner details and Vahan registration details.

4: Insurance details, financier details.

6: Licence details like expiration and renewal and address.

Find parking near you

With Park+, you no longer have to worry about finding car parking. Our app lets you book parking spots anywhere in the country.

To offer suggestions on improving the app or feedback for the Park+ team, reach out to us at [email protected]. Disclaimer: All information related to Vehicles is retrieved from the website of Parivahan which is publicly available. The information is original and we are displaying the information in Public Interest. We do not have any connection with the RTO authority.

0 notes

Text

Is Choosing SBI General Health Insurance a Wise Step?

SBI General Insurance Company is undoubtedly a trusted name in the race of different health insurance providers in India. SBI Health Insurance plans are mainly designed keeping in mind the capacity to afford of the common people in our country. From affordable health insurance plans to 24x7 customer service and hassle-free claim settlement, SBI General offers everything that you can ask from a provider of a health insurance.

There are a number of reasons why people choose SBI General as their health insurer. Have look at the reasons why SBI Health Insurance is highly sought-after in our country.

You can avail hassle-free cashless health insurance facility through the network hospitals of SBI General.

SBI General health insurance policy offers free medical checkup for every 4 claim free years.

Imposes waiting of 1-3 years, depending upon the SBI health insurance plan you choose to buy.

Covers pre and post hospitalization costs for 60 days and 90 days respectively.

Depending on the type of SBI Health insurance plan you choose, you can avail coverage against alternative treatments such as Yoga, Ayurveda, Siddha, Unani and Homeopathy (AYUSH).

Daily cash allowance is available in exchange of SBI Health insurance policies.

Depending on the type of plan you choose, Sum Insured amount will be varied.

Provides coverage against ambulance expenses.

Assistance on claim settlement is offered under SBI health insurance policies

You can instantly buy or renew SBI health insurance policy through the official online portal of SBI General Insurance Company.

You can avail Tax Benefits under section 80D of the Income Tax Act.

Availability of 142 day care procedure that are covered under SBI health insurance policy.

Maternity covered under specific SBI health insurance plan after a waiting period of 9 months.

Enjoy assured renewal with SBI General health insurance policies.

After knowing about the wide range of benefits and features offered under SBI Health Insurance, it's crystal clear why choosing SBI General as your health insurer will not be a bad decision. However, in order to avail the best health insurance policy in India for the best price it is always advisable to compare different mediclaim policies from different insurers online. Comparison of health covers will ensure that you have the best health insurance plan for yourself or your family.

Know More Click Here

0 notes

Quote

How to choose the simplest insurance to health for Family?

When it comes to health insurance, there is no possibility to fits-all plan that you can accept. Medical Insurance is the contract based mostly policy with legal jargon thrown in.

Besides this, a Health Insurance policy has medical terminologies.

Of the numbers of medical insurance plans in the market, you may find that each one is unique in some way or the other, with the company has own benefits and limitations.

You have to do lot's of research before you find the right and good health insurance plan for you. You have to compare the health insurance plans offered by multiple companies.

Each family may have different-different health insurance requirements.

So, it's better and very helpful to visit ‘best health insurance plans comparison portals’ and do your own analysis.

However, before the buying, the family floater health insurance plan below are some of the important factors that you can keep in mind.

Premium: premium is usually the first thing that most people evaluate while buying insurance.

A family floater plan has provided health insurance to the whole family at a low cost compared to individual family member's Mediclaims.

Co-Pay clause: Co-payment means the policyholder will bear a specified percentage of the claim amount. For example, in a 75%-25% clause, the policyholder will bear 25% of the cost and the remaining amount (75%) can be claimed.

Sub-limits: all the Health insurance companies may specify limits for certain illnesses or treatments.

For ex: the policyholder can claim only Rs 20,000 for a cataract operation but the policy sum assured might be Rs3 Lakhs. The policies without sub-limits are better but may charge higher premiums.

The waiting period for Pre-existing diseases:

you need to check if the existing diseases are covered by the policy.

In some policies, all the existing diseases may be covered and in some, the policyholder has to wait for a few years before making a claim.

Alternative Treatments: Some policies also cover non-allopathic or alternative treatments such as homeopathic, ayurvedic etc.,

The waiting period for specific diseases.Disease wise capping (if any).

Definition of family i.e., who and all can be included in a Family Floater plan with the insurance cover.

Check if any of the (or) all day-care procedures are covered?

Find out if any complimentary free-health check-ups are allowed?

Maximum Renewal age: This criterion states up to what age the policy can be renewed. Find out If life-long renewal is allowed or not?

No claim bonus: These are incentives provided by the company in case of a claim-free year.

It varies from company to company.

Check out the list of ‘exclusions’ provided in ‘Product brochure’ or consult the customer care of the concerned insurance company.

Claim Settlement Record: Given the nature of the product, claims settlement is important.However, the information that's available within the public domain isn't user-friendly, but it’s important to include them in your evaluation.

Top 10 Health Insurance Companies in India

1) Apollo Munich Health Insurance Company Limited : click here

Apollo Munich Health Insurance Company had an outstanding record of Incurred Claim Ratio of 63.03% for the fiscal year 2014-15, and it has brought additional benefits like portability and lifelong renewability options in its existing health insurance plans.

2) Star Health & Allied Insurance Company Limited: click here

Star Health & Allied Insurance Company recorded the Incurred Claim Ratio of 63.96% for the fiscal year 2014-15. The company has an in-house claim settlement procedure to deal with cashless hospitalization facility. Along with this, Star Health & Allied insurance company comes up with a range of exciting products that offer protection to Diabetes and HIV+ patients. Read more

3) Max Bupa Health Insurance Company Limited: click here

Max Bupa is one of the best-known insurance companies in India, which had an Incurred Claim Ratio of 55.16% for the fiscal year 2014-15. This company offers its health insurance policies to individuals from all age groups. Read more

4) SBI Health Insurance Company Limited: click here

SBI Health Insurance Co. Ltd is a joint venture between the State Bank of India (SBI) and Insurance Australia Group. SBI holds a 74% stake while 26% stake is held by Insurance Australia Group. It operates out in around 14,000 official branches across the globe. With an Incurred Claim Ratio of 75.01% for the fiscal year 2018-19, SBI Health Insurance Company has issued 198876 policies. Read more

Top Health Insurance Companies in India

5) Religare Health Insurance Company Limited: click here

Religare Health Insurance Company limited has shown tremendous growth in a short period of time, thereby setting a benchmark in the insurance market of India. It had an Incurred Claim Ratio of 61.13%. It is being regularly appreciated and promoted by the Fortis Hospitals. Read more

6) Cigna TTK Health Insurance Company Limited: click here

Cigna TTK Health Insurance Company is comparatively a new player in the Indian insurance market, as it was launched in 2014 only and immediately fell into the category of the best health insurance companies in India. Its Incurred Claim Ratio for the fiscal year 2014-15 is 64.32%. Read more

7) Bajaj Allianz General Insurance Company Limited: click here

Bajaj Allianz General Insurance Company has some health products that are very beneficial for customers from a particular age group. The 3 major health insurance products are Health Guard, Silver Health, and Star Package. Bajaj Allianz Insurance Company was the first to provide captive TPA services with certain additional benefits. Its Incurred Claim Ratio is 73.59% for the fiscal year 2014-15. Read more

8) New India Assurance Company Limited: click here

New India Assurance is a fully government-owned entity of India, which has been in operations since 1919. This company is well-known for its Mediclaim policy. The best feature offered under this health insurance policy is that it provides different ratings for major metros. It had an Incurred Claim Ratio of 98.78% for the fiscal year 2014-15. Read more

9) Oriental Insurance Company Limited: click here

Oriental general insurance is also a government-owned general insurance company that offers a wide range of health insurance products in India. The impressive part of Oriental health insurance is that it doesn’t require a pre-policy medical test up to the age of 60 years, whereas it is mandatory under other health insurance providers to get a medical examination done if you are below 45 years of age. Its Incurred Claim Ratio stood at 117.02% for the fiscal year 2014-15. Read more

10) National Insurance Company Limited: click here

National Insurance Company Ltd. is a full government entity, which has been serving its customers for more than a century and also provides health insurance coverage. It had an Incurred Claim Ratio of 110.02% for the fiscal year 2014-15. The best health product offered by National General Insurance Company is Varishtha Mediclaim that offers coverage to senior citizens.

http://www.smarttechdesk.com/2019/01/health-insurence.html

0 notes

Text

What Kind Of SBI Health Insurance Plans Are Best?

An company will profile any risk based on it's previous experience. Factors such as those below are those factored in when pricing that risk, also in order to as

calculatingthe premium and terms. Pardon me of appears like basic stuff! Bear with me as it's all regulated leading somewhere in finding out how the insurance

businessworks and how by understanding it you will get the best type of cover at the best price for your Lambretta. Assume 'cheapest' think best affordable!

Think of it utilising this way - For anyone who is choosing an accessory to customise your scooter supply it those special finishing touches you don't go for that cheapest.Precisely should request for your bike insurance.

What kind of health strategy should you buy when you are self made use of? Take your choose up. You can buy a personal plan, group plan, short term insurance plans, and 100 % possible even self-insure with any adverse health savings decide. To get a ball park figure of the items you can afford, use the internet to obtain a health insurance quote. SBI health insurance Recommended plug in information the calculator asks for, an individual also will receive an associated with insurance companies with includes. You will see very affordable prices on some insurance packages, while the numbers of very expensive on persons. What's the variation? The difference will be the deductible that you just will be careful for.

Do you have a secret fishing hole," I asked. Jerry had told me most fishermen, who knew the river, had favourite places they fished and rarely shared these

secret places. Pat just chuckled. The twilight was ending and darkness coming around. The premium can be paid site your speed. You can enroll for monthly, quarterly, half yearly or annual payments depending upon your cash. The insurers usually prefer annual payment prepare a person who is using the insurance, that the lowest price for them. This is that most belonging to the companies produce a reduction inside your agree to pay annually.

It could be very easy to look for short term insurance online especially that the world wide web is trusted. Many insurance companies have their websites. Money-making niches also some websites provide quotes many companies. Utilised choose them if you need not have adequate time or patience to fill up

several acquire quotes designs. Such kind of websites also provides assistance by providing tips, advice and links to reliable insurance company websites. Try to be able to a want you to cosign your motorcycle financial loan. This will help in the case the lender will not let an individual a loan in your name alone. Consider save up as much money as possible for a bharti AXA general insurance deposit. Try to look for a couple of dealers focusing on working with bad credit loans. This will give merely few options if critical. Remember that most lenders and dealers will demand that you have your motorcycle guaranteed. Credit can play an element here, a person's rates. This is particularly true a person's need sport bike insurance plans, by which rates are notoriously significant.

If include custom paintwork or handlebars, extended forks or some other personal inclusions in your beautiful machine you'll want to ensure the insurer

understandsthis and covers you upon their. This is where talking with a broker, and one with specialist knowledge of insuring bikes, scooters and mopeds

comes into it's personally own.Visit Insurance plan online and uncover the best insurance quote that suits your travelling needs. Check out their webpage and click on the button for precise product that you prefer. You is required to fill up a quote engine which will process facts in just a few additional minutes. Then, an extensive involving quotes in order to be presented you. You choose the quote which fits your needs, and we suggest that you take the long-term travel insurance plan. Long-term coverage end up being the a bit expensive than short-term ones, but it can do help it can save a larger amount of cash in your immediate future. Being wise in your travel insurances hopping may give you a venture to within the most involving your coverage plan.

0 notes

Text

Become an Insurance Advisor with SBI Life

Searching for How to Become Policybazaar Agent? Understanding the requirements for the job can assist you in the interview process. The experts at Join Insurance Career can assist you better in learning about the whole process of How to Become Policybazaar Agent.

Requirement: How to Become Policybazaar Agent

When looking for How to Become Policybazaar Agent, you must be 18 and have a 12th-grade education. You must also successfully complete the agent training and earn the certification. Apart from this, you must also drive your own efforts and have a flair for selling to join us as the insurance representative.

Procedure: How to Become Policybazaar Agent

When looking for How to Become Policybazaar Agent, visit the Policybazaar TV Partner website. This PB Partner website allows the registration of agents using Policybazaar.

Next, for How to Become Policybazaar Agent, the homepage will appear before you once you have accessed your official web page. On this page, you will find the option to register above. To register, click it.

Once you click on the button, a new page will appear before you.

You will need to fill in your cell phone number first. After this, you must select the”Send” OTP option to continue.

When you click Send OTP, a new page appears. On this page, you must submit the OTP you received from the mobile number provided by you.

Then, for How to Become Policybazaar Agent, you need to select the option to verify. If you believe that the OTP matches, a web page will display before you.

Enrolling in a professional program when looking at How to Become Policybazaar Agent is essential?

When looking How to Become Policybazaar Agent, enroll in an accredited professional program at Join Insurance Career to improve your selling skills as you work towards your professional license. You can take part in regular sales classes or take courses explicitly designed to help insurance professionals. For How to Become Policybazaar Agent, our professionals assist you in developing the abilities you need to manage client relationships. We also help you understand the typical problems you may confront as an insurance professional. Through our expert guidance, you will learn about the efficient sales method you can use.How Do Experts at Join Insurance Career Help?We only work with trusted brands in the insurance industry. They are the market leaders, and they are known for their best products, customer focus, claim settlement ratios, affordable premium, and customer service. These companies offer the best agent commission, best-in-class recognition, and rewards. So, join your hands to become a protector in someone’s life!

Some Reputed Companies We Work Together With Include:

TATA AIA Life Insurance

TATA AIG Insurance

TATA Mutual Fund

Care Health Insurance

ICICI Lombard Insurance

0 notes

Text

Become an Insurance Advisor with SBI Life

Searching for How to Become Policybazaar Agent? Understanding the requirements for the job can assist you in the interview process. The experts at Join Insurance Career can assist you better in learning about the whole process of How to Become Policybazaar Agent.

Requirement: How to Become Policybazaar Agent

When looking for How to Become Policybazaar Agent, you must be 18 and have a 12th-grade education. You must also successfully complete the agent training and earn the certification. Apart from this, you must also drive your own efforts and have a flair for selling to join us as the insurance representative.

Procedure: How to Become Policybazaar Agent

When looking for How to Become Policybazaar Agent, visit the Policybazaar TV Partner website. This PB Partner website allows the registration of agents using Policybazaar.

Next, for How to Become Policybazaar Agent, the homepage will appear before you once you have accessed your official web page. On this page, you will find the option to register above. To register, click it.

Once you click on the button, a new page will appear before you.

You will need to fill in your cell phone number first. After this, you must select the”Send” OTP option to continue.

When you click Send OTP, a new page appears. On this page, you must submit the OTP you received from the mobile number provided by you.

Then, for How to Become Policybazaar Agent, you need to select the option to verify. If you believe that the OTP matches, a web page will display before you.

Enrolling in a professional program when looking at How to Become Policybazaar Agent is essential?

When looking How to Become Policybazaar Agent, enroll in an accredited professional program at Join Insurance Career to improve your selling skills as you work towards your professional license. You can take part in regular sales classes or take courses explicitly designed to help insurance professionals. For How to Become Policybazaar Agent, our professionals assist you in developing the abilities you need to manage client relationships. We also help you understand the typical problems you may confront as an insurance professional. Through our expert guidance, you will learn about the efficient sales method you can use.How Do Experts at Join Insurance Career Help?We only work with trusted brands in the insurance industry. They are the market leaders, and they are known for their best products, customer focus, claim settlement ratios, affordable premium, and customer service. These companies offer the best agent commission, best-in-class recognition, and rewards. So, join your hands to become a protector in someone’s life!Some Reputed Companies We Work Together With Include:

TATA AIA Life Insurance

TATA AIG Insurance

TATA Mutual Fund

Care Health Insurance

ICICI Lombard Insurance

0 notes

Text

Become an Insurance Advisor with SBI Life

Become an Insurance Advisor with SBI Life

Searching for How to Become Policybazaar Agent? Understanding the requirements for the job can assist you in the interview process. The experts at Join Insurance Career can assist you better in learning about the whole process of How to Become Policybazaar Agent.

Requirement: How to Become Policybazaar Agent

When looking for How to Become Policybazaar Agent, you must be 18 and have a 12th-grade education. You must also successfully complete the agent training and earn the certification. Apart from this, you must also drive your own efforts and have a flair for selling to join us as the insurance representative.

Procedure: How to Become Policybazaar Agent

When looking for How to Become Policybazaar Agent, visit the Policybazaar TV Partner website. This PB Partner website allows the registration of agents using Policybazaar.

Next, for How to Become Policybazaar Agent, the homepage will appear before you once you have accessed your official web page. On this page, you will find the option to register above. To register, click it.

Once you click on the button, a new page will appear before you.

You will need to fill in your cell phone number first. After this, you must select the”Send” OTP option to continue.

When you click Send OTP, a new page appears. On this page, you must submit the OTP you received from the mobile number provided by you.

Then, for How to Become Policybazaar Agent, you need to select the option to verify. If you believe that the OTP matches, a web page will display before you.

Enrolling in a professional program when looking at How to Become Policybazaar Agent is essential?

When looking How to Become Policybazaar Agent, enroll in an accredited professional program at Join Insurance Career to improve your selling skills as you work towards your professional license. You can take part in regular sales classes or take courses explicitly designed to help insurance professionals. For How to Become Policybazaar Agent, our professionals assist you in developing the abilities you need to manage client relationships. We also help you understand the typical problems you may confront as an insurance professional. Through our expert guidance, you will learn about the efficient sales method you can use.How Do Experts at Join Insurance Career Help?We only work with trusted brands in the insurance industry. They are the market leaders, and they are known for their best products, customer focus, claim settlement ratios, affordable premium, and customer service. These companies offer the best agent commission, best-in-class recognition, and rewards. So, join your hands to become a protector in someone’s life!

Some Reputed Companies We Work Together With Include:

TATA AIA Life Insurance

TATA AIG Insurance

TATA Mutual Fund

Care Health Insurance

ICICI Lombard Insurance

0 notes

Text

Become an Insurance Advisor with SBI Life

Searching for How to Become Policybazaar Agent? Understanding the requirements for the job can assist you in the interview process. The experts at Join Insurance Career can assist you better in learning about the whole process of How to Become Policybazaar Agent.

Requirement: How to Become Policybazaar Agent

When looking for How to Become Policybazaar Agent, you must be 18 and have a 12th-grade education. You must also successfully complete the agent training and earn the certification. Apart from this, you must also drive your own efforts and have a flair for selling to join us as the insurance representative.

Procedure: How to Become Policybazaar Agent

When looking for How to Become Policybazaar Agent, visit the Policybazaar TV Partner website. This PB Partner website allows the registration of agents using Policybazaar.

Next, for How to Become Policybazaar Agent, the homepage will appear before you once you have accessed your official web page. On this page, you will find the option to register above. To register, click it.

Once you click on the button, a new page will appear before you.

You will need to fill in your cell phone number first. After this, you must select the”Send” OTP option to continue.

When you click Send OTP, a new page appears. On this page, you must submit the OTP you received from the mobile number provided by you.

Then, for How to Become Policybazaar Agent, you need to select the option to verify. If you believe that the OTP matches, a web page will display before you.

Enrolling in a professional program when looking at How to Become Policybazaar Agent is essential?

When looking How to Become Policybazaar Agent, enroll in an accredited professional program at Join Insurance Career to improve your selling skills as you work towards your professional license. You can take part in regular sales classes or take courses explicitly designed to help insurance professionals. For How to Become Policybazaar Agent, our professionals assist you in developing the abilities you need to manage client relationships. We also help you understand the typical problems you may confront as an insurance professional. Through our expert guidance, you will learn about the efficient sales method you can use.How Do Experts at Join Insurance Career Help?We only work with trusted brands in the insurance industry. They are the market leaders, and they are known for their best products, customer focus, claim settlement ratios, affordable premium, and customer service. These companies offer the best agent commission, best-in-class recognition, and rewards. So, join your hands to become a protector in someone’s life!

Some Reputed Companies We Work Together With Include:

TATA AIA Life Insurance

TATA AIG Insurance

TATA Mutual Fund

Care Health Insurance

ICICI Lombard Insurance

0 notes

Text

Become an Insurance Advisor with SBI Life

Searching for How to Become Policybazaar Agent? Understanding the requirements for the job can assist you in the interview process. The experts at Join Insurance Career can assist you better in learning about the whole process of How to Become Policybazaar Agent.

Requirement: How to Become Policybazaar Agent

When looking for How to Become Policybazaar Agent, you must be 18 and have a 12th-grade education. You must also successfully complete the agent training and earn the certification. Apart from this, you must also drive your own efforts and have a flair for selling to join us as the insurance representative.

Procedure: How to Become Policybazaar Agent

When looking for How to Become Policybazaar Agent, visit the Policybazaar TV Partner website. This PB Partner website allows the registration of agents using Policybazaar.

Next, for How to Become Policybazaar Agent, the homepage will appear before you once you have accessed your official web page. On this page, you will find the option to register above. To register, click it.

Once you click on the button, a new page will appear before you.

You will need to fill in your cell phone number first. After this, you must select the”Send” OTP option to continue.

When you click Send OTP, a new page appears. On this page, you must submit the OTP you received from the mobile number provided by you.

Then, for How to Become Policybazaar Agent, you need to select the option to verify. If you believe that the OTP matches, a web page will display before you.

Enrolling in a professional program when looking at How to Become Policybazaar Agent is essential?

When looking How to Become Policybazaar Agent, enroll in an accredited professional program at Join Insurance Career to improve your selling skills as you work towards your professional license. You can take part in regular sales classes or take courses explicitly designed to help insurance professionals. For How to Become Policybazaar Agent, our professionals assist you in developing the abilities you need to manage client relationships. We also help you understand the typical problems you may confront as an insurance professional. Through our expert guidance, you will learn about the efficient sales method you can use.How Do Experts at Join Insurance Career Help?We only work with trusted brands in the insurance industry. They are the market leaders, and they are known for their best products, customer focus, claim settlement ratios, affordable premium, and customer service. These companies offer the best agent commission, best-in-class recognition, and rewards. So, join your hands to become a protector in someone’s life!Some Reputed Companies We Work Together With Include:

TATA AIA Life Insurance

TATA AIG Insurance

TATA Mutual Fund

Care Health Insurance

ICICI Lombard Insurance

0 notes

Text

Become an Insurance Advisor with SBI Life

Searching for How to Become Policybazaar Agent? Understanding the requirements for the job can assist you in the interview process. The experts at Join Insurance Career can assist you better in learning about the whole process of How to Become Policybazaar Agent.

Requirement: How to Become Policybazaar Agent

When looking for How to Become Policybazaar Agent, you must be 18 and have a 12th-grade education. You must also successfully complete the agent training and earn the certification. Apart from this, you must also drive your own efforts and have a flair for selling to join us as the insurance representative.

Procedure: How to Become Policybazaar Agent

When looking for How to Become Policybazaar Agent, visit the Policybazaar TV Partner website. This PB Partner website allows the registration of agents using Policybazaar.

Next, for How to Become Policybazaar Agent, the homepage will appear before you once you have accessed your official web page. On this page, you will find the option to register above. To register, click it.

Once you click on the button, a new page will appear before you.

You will need to fill in your cell phone number first. After this, you must select the”Send” OTP option to continue.

When you click Send OTP, a new page appears. On this page, you must submit the OTP you received from the mobile number provided by you.

Then, for How to Become Policybazaar Agent, you need to select the option to verify. If you believe that the OTP matches, a web page will display before you.

Enrolling in a professional program when looking at How to Become Policybazaar Agent is essential?

When looking How to Become Policybazaar Agent, enroll in an accredited professional program at Join Insurance Career to improve your selling skills as you work towards your professional license. You can take part in regular sales classes or take courses explicitly designed to help insurance professionals. For How to Become Policybazaar Agent, our professionals assist you in developing the abilities you need to manage client relationships. We also help you understand the typical problems you may confront as an insurance professional. Through our expert guidance, you will learn about the efficient sales method you can use.How Do Experts at Join Insurance Career Help?We only work with trusted brands in the insurance industry. They are the market leaders, and they are known for their best products, customer focus, claim settlement ratios, affordable premium, and customer service. These companies offer the best agent commission, best-in-class recognition, and rewards. So, join your hands to become a protector in someone’s life!Some Reputed Companies We Work Together With Include:

TATA AIA Life Insurance

TATA AIG Insurance

TATA Mutual Fund

Care Health Insurance

ICICI Lombard Insurance

0 notes

Text

Become an Insurance Advisor with SBI Life

Searching for How to Become Policybazaar Agent? Understanding the requirements for the job can assist you in the interview process. The experts at Join Insurance Career can assist you better in learning about the whole process of How to Become Policybazaar Agent.

Requirement: How to Become Policybazaar Agent

When looking for How to Become Policybazaar Agent, you must be 18 and have a 12th-grade education. You must also successfully complete the agent training and earn the certification. Apart from this, you must also drive your own efforts and have a flair for selling to join us as the insurance representative.

Procedure: How to Become Policybazaar Agent

When looking for How to Become Policybazaar Agent, visit the Policybazaar TV Partner website. This PB Partner website allows the registration of agents using Policybazaar.

Next, for How to Become Policybazaar Agent, the homepage will appear before you once you have accessed your official web page. On this page, you will find the option to register above. To register, click it.

Once you click on the button, a new page will appear before you.

You will need to fill in your cell phone number first. After this, you must select the”Send” OTP option to continue.

When you click Send OTP, a new page appears. On this page, you must submit the OTP you received from the mobile number provided by you.

Then, for How to Become Policybazaar Agent, you need to select the option to verify. If you believe that the OTP matches, a web page will display before you.

Enrolling in a professional program when looking at How to Become Policybazaar Agent is essential?

When looking How to Become Policybazaar Agent, enroll in an accredited professional program at Join Insurance Career to improve your selling skills as you work towards your professional license. You can take part in regular sales classes or take courses explicitly designed to help insurance professionals. For How to Become Policybazaar Agent, our professionals assist you in developing the abilities you need to manage client relationships. We also help you understand the typical problems you may confront as an insurance professional. Through our expert guidance, you will learn about the efficient sales method you can use.How Do Experts at Join Insurance Career Help?We only work with trusted brands in the insurance industry. They are the market leaders, and they are known for their best products, customer focus, claim settlement ratios, affordable premium, and customer service. These companies offer the best agent commission, best-in-class recognition, and rewards. So, join your hands to become a protector in someone’s life! Some Reputed Companies We Work Together With Include:

TATA AIA Life Insurance

TATA AIG Insurance

TATA Mutual Fund

Care Health Insurance

ICICI Lombard Insurance

0 notes