#SEBI Registered Investment Firm

Text

#Archers Wealth is a Exchange/SEBI registered#equity research firm and one of the leading financial services company. As an independent financial services firm#we offer Portfolio Management Services (PMS)#Alternative Investment Fund (AIF)#Arbitrage#Hedge Funds#Mutual Funds#Stock Trading#Bonds#and financial risk management products define our scope of work.

0 notes

Text

Bajaj Housing Finance IPO opens on Monday: GMP jumps; shareholder quota, date, review, other details of upcoming IPO

Minimize your trading risks & trade smarter with www.intensifyresearch.com 10 DAYS FREE TRIAL - best SEBI-registered RA firm.

Ganesh Chaturthi Bumper Offer - 10 DAYS FREE TRIAL & FLAT 30% DISCOUNT on all Research Services

Get comprehensive knowledge

– nifty buy sell signals,

– best shares to buy,

– profit making stocks,

– low risk investment option & lot more

by the best SEBI-registered RA firm.

#finance#stock market#banknifty#nifty prediction#economy#nifty50#investing#nse#sensex#share market#bajaj finance#bajaj housing finance#home loan#ipo alert#ipo news#invest#investment#investors#stocks#investing stocks#forex#financial planning#startup#business#services

2 notes

·

View notes

Text

Evolving Investment Adviser Regulations — SEBI Lawyers Analysis of 2020 & Recent Developments

In a move that has reverberated through India’s financial advisory sector, the Securities and Exchange Board of India (SEBI) has proposed significant amendments to its investment adviser regulations. As the industry grapples with these changes, it’s crucial to understand the trajectory that led us here. For a detailed examination of SEBI’s regulatory journey, the 2020 article by Vaneesa Agrawal, a prominent SEBI lawyer on Thinking Legal’s website on the amendments to SEBI’s investment adviser regulations offers invaluable insights and serves as a foundation for understanding these evolving standards.

This article will explore SEBI’s regulatory evolution, recent developments, and their implications for the future of financial advisory in India, drawing on expertise from SEBI lawyers who have closely followed these regulatory shifts.

Background on SEBI’s Investment Adviser Regulations

SEBI, the regulatory authority for the securities market in India, has long been a guardian of investor interests. The need for a robust regulatory framework for investment advisers became apparent as the financial landscape evolved, necessitating the introduction of the Investment Adviser Regulations in 2013.

Vaneesa Agrawal, an expert SEBI lawyer highlights that these regulations were designed to ensure transparency, mitigate conflicts of interest, and safeguard client interests by setting clear guidelines for who could provide investment advice and under what conditions.

Recent Developments and Draft Regulations

Fast forward to the present, and SEBI has once again stirred the waters with its latest draft regulations. These proposals, currently under public consultation, aim to refine and expand the regulatory framework further. Key among these proposed changes, as pointed out by expert SEBI lawyers, is the tightening of eligibility norms, which would require advisers to demonstrate a higher level of competence and integrity.

Additionally, SEBI is pushing for enhanced disclosure requirements, ensuring that clients are fully aware of the nature and scope of the advisory services they receive. SEBI lawyer emphasises that there is also a strong emphasis on risk profiling and suitability assessments, with the draft regulations mandating that advisers thoroughly understand a client’s risk appetite before making recommendations.

Experts in the field, such as noted SEBI lawyer Vaneesa Agrawal, have weighed in on these draft regulations. Vaneesa Agrawal highlights that while the intent to protect investors is laudable, the increased compliance burden could inadvertently strain smaller advisory firms.

“The balance between investor protection and fostering a thriving advisory ecosystem is delicate,” Vaneesa Agrawal notes, reflecting the broader industry sentiment that these regulations, “while necessary, must be implemented with caution.”

Impact on Financial Advisers and the Advisory Profession

Financial advisers and SEBI expert lawyers underscore that these regulatory changes present a mixed bag of challenges and opportunities. On the one hand, as pointed out by SEBI lawyers, stricter regulations can weed out unqualified practitioners, elevating the overall quality of advice in the market.

“This, in turn, could enhance client trust and potentially lead to greater industry growth.”

- Vaneesa Agrawal, a prominent SEBI lawyer.

However, the compliance burden is set to increase, especially for smaller firms that may lack the resources to adapt quickly to new requirements. Some SEBI lawyers have expressed concerns that the cost of compliance could be prohibitive, potentially pushing them out of the market. On the flip side, Vaneesa Agrawal adds, larger firms and those who have already invested in robust compliance mechanisms may find themselves at an advantage.

Industry bodies, such as the Association of Registered Investment Advisers (ARIA), have voiced a cautious welcome to the draft regulations. They appreciate SEBI’s efforts to protect investor interests but call for a more nuanced approach that considers the diverse landscape of financial advisers in India.

Future Outlook and Recommendations

Looking ahead, the financial advisory industry in India is poised for significant transformation. SEBI lawyers, across India mention that the draft regulations are likely to bring about a more professional and transparent advisory environment, benefiting investors in the long run. However, the industry must brace for a period of adjustment as these regulations come into effect.

For advisers navigating these changes, consulting with legal expertise that they’ll receive from a SEBI lawyer is becoming increasingly crucial. Legal expertise can help firms understand the nuances of the regulations and ensure full compliance, thereby avoiding costly penalties and reputational damage.

“While the road ahead may be challenging, it also presents an opportunity for advisers to differentiate themselves through higher standards of practice.”

- Vaneesa Agrawal, Founder, Thinking Legal

Conclusion

As SEBI continues to refine its regulatory framework, SEBI expert lawyers highlight that investment advisers must stay informed and proactive. The evolving landscape offers both challenges and opportunities, and those who adapt swiftly will likely thrive.

0 notes

Link

0 notes

Text

When searching for the best future tips provider in India, Nivesh Research stands out as a premier choice. As a SEBI-registered firm, Nivesh Research offers highly accurate and reliable stock future tips, making it one of the most trusted names in the industry. For anyone looking for expert guidance, Nivesh Research is the best future tips provider in India, ensuring well-informed decisions and strategic investments.

0 notes

Text

Market regulator Sebi advises exchanges to be more discerning on SME IPOs

Exchanges and market ecosystem should learn to say ‘no’ when it comes to listings of small and medium enterprises (SMEs), said Ashwani Bhatia, a whole-time member of the Securities and Exchange Board of India (Sebi), amid concerns of manipulation and fraudulent practices in the sector.

His comments come at a time when the market capitalisation of SMEs has surged to Rs 2 trillion and the segment sees heightened investor frenzy for subscriptions during Initial Public Offerings (IPOs). "Nobody is saying no to SME listings, even when they inflate their balance sheets. The auditors should be good doctors —don’t give them steroids when they can survive on paracetamol," he said at the Financing 3.0 Summit in Mumbai.

Bhatia urged SMEs to explore other funding opportunities through alternative funds before exploring listing.

“Instead of coming straight to IPO, a better way is to go to angel investors. Grow there for a while and then come to the exchanges,” he suggested. The commitments from Sebi-registered alternative investment funds (AIFs) have surged to Rs 1,169 crore for SME financing as of March, with Rs 735 crore already raised.

At the same event organised by the Confederation of Indian Industry (CII), Ashishkumar Chauhan, MD & CEO of the National Stock Exchange (NSE), said the exchanges have taken cognisance of the issues in SME listings.

“We will maintain the balance, and a stricter guideline is expected. Not all SMEs are doing good," said Chauhan.

The market regulator has of late adopted a stricter approach towards surveillance of SMEs and issued orders against firms found using the route to allegedly siphon off funds, inflate prices through fictitious transactions, or towards promoters using the avenue to offload stakes.

0 notes

Text

How to become a research analyst?

Becoming a research analyst typically involves a combination of education, relevant certifications, and gaining practical experience. Here’s a step-by-step guide to help you become a research analyst:

1. Educational Background

Bachelor’s Degree: Obtain a bachelor's degree in finance, economics, business administration, or a related field. This foundational knowledge is crucial for understanding market dynamics and financial instruments.

Master’s Degree (Optional): Pursuing a master’s degree in finance, economics, or business administration (like an MBA) can be beneficial, especially for advanced positions.

2. Gain Relevant Certifications

NISM Certification: In India, the National Institute of Securities Markets (NISM) offers a certification called Research Analyst Certification Examination (Series XV). Passing this exam is mandatory to become a SEBI-registered research analyst.

CFA Certification: Earning the Chartered Financial Analyst (CFA) designation is highly regarded globally and can significantly enhance your credibility and expertise in the field.

FRM/CAIA: Other certifications like the Financial Risk Manager (FRM) or Chartered Alternative Investment Analyst (CAIA) might also be useful depending on the area of specialization.

3. Develop Strong Analytical Skills

Learn how to analyze financial statements, use financial models, and understand valuation techniques.

Practice using software tools like Excel, Bloomberg Terminal, or specialized financial modeling tools.

4. Gain Work Experience

Internships: Start with internships in financial firms, investment banks, or research houses. This provides practical experience and helps in building industry contacts.

Entry-Level Positions: Look for junior roles like financial analyst, equity research associate, or any position that allows you to work under experienced analysts.

5. Stay Updated with Market Trends

Regularly read financial news, research reports, and follow the markets. Staying updated helps you understand how global and domestic factors influence various sectors and companies.

6. Network with Industry Professionals

Attend financial seminars, webinars, and networking events. Building a strong network within the industry can open up opportunities and help you learn from experienced professionals.

7. Build a Strong Research Portfolio

Create detailed research reports on companies or sectors, showcasing your analytical skills. A strong portfolio can help you stand out when applying for jobs.

8. Register with SEBI (For India)

If you wish to work as an independent research analyst in India, you need to be registered with SEBI. This involves meeting specific eligibility criteria and passing the NISM certification exam.

9. Continuously Improve Your Skills

The financial industry is dynamic, so it’s important to keep learning and updating your skills, whether through formal education, certifications, or self-study.

By following these steps and gaining experience, you can build a successful career as a research analyst.

0 notes

Text

Investor's Guide: How to Invest in Nexus Select Trust

Real estate investment has always been a good choice for those who want to diversify their portfolios. This is evident in Nexus Select Trust available in India as one of the most captivating options on the current market. The leading retail-focused REIT in India, Nexus Select Trust provides investors with an unusual chance of becoming part of a group that owns high-quality shopping complexes all over the nation. One can learn about investing in Nexus Select Trust like what it is, how it works and why it should be included in your investment portfolio.

Understanding Nexus Select Trust

Nexus Select Trust is an Indian Real Estate Investment Trust (REIT) that primarily invests in retail properties. It owns and manages some of the most recognized shopping malls in India, thus playing a major role in the country’s retail space.

What is a REIT?

Before we delve further into Nexus Select Trust, let us first define what we mean by the term ‘REIT.’ A REIT is defined as an organization that owns, operates, or finances income-generating real estate assets.

Why Nexus Select Trust is Worth Investing In?

There are several reasons as to why Nexus Select Trust should be considered for investment:

1. Diversification

The main reason for considering investment in Nexus Select Trust is that it brings about diversification. Since real estate behaves differently from stocks and bonds, adding it to your portfolio can help reduce the risks associated with it.

2. A Constant Income Source

Nexus Select Trust earns its income mainly from the rents collected from its shopping malls. These malls accommodate a variety of tenants including global retailers, movie theaters, and restaurants among others. Competition among these tenants ensures minimum vacancies hence providing a consistent flow of income for the trust which pays out dividends to shareholders.

3. Exposure Towards Indian Retail Growth

The rapidly growing retail sector in India is driven by a young population and an increase in incomes plus urbanization. By investing in Nexus Select Trust, you gain some exposure to this progress, especially in the organized retail part, which is projected to keep on growing with many international brands coming into the Indian market.

4. Possibility of Capital Appreciation

Apart from regular income, Nexus Select Trust can also offer capital appreciation potential. The REIT appreciates as the value of its underlying real estate assets rises over time hence attracting more stock prices and consequently greater returns for investors.

How To Invest In Nexus Select Trust

Buying the stock of Nexus Select Trust is easy as it follows similar procedures used when purchasing shares of other publicly listed corporations in the stock market. You may follow these steps below if you have never bought stocks before:

1. Open a Demat Account

The first step towards being an investor at Nexus Select Trust is opening a Demat account which is needed for holding and trading stocks electronically. If you do not own one yet, open a demat account with any SEBI-registered brokerage firm of your choice.

2. Choose a Brokerage Platform

Pick out a brokerage platform that allows access to the Indian stock market. Most of the best platforms will let you trade in Nexus Select Trust stock too. Make sure to select such platform that offers real-time data and user friendly so that you can trade easily

3. Research The Stock

Carrying out deep research before making investments is very significant. Take into account the present price of the Nexus Select Trust share, record performance, dividends yields as well as other news about it that may have had some impact on the share price. By doing this it becomes easier to judge if it fits your investment goals.

4. Order placing

When you have made an irreversible decision regarding your investment, you can place your trade at the brokerage platform where you are registered. You may purchase the shares at market price or set a limit order if you have something particular in mind.

5. Keeping Track of Your Investment

After the acquisition of Nexus Select Trust stock, you must keep track of your investment regularly. By observing how things are trending in the market, performance metrics from your company, and announcements that would affect stock prices; hence, buying more, selling, or holding decisions would be sounder.

Factors to Consider Before Investing

Nexus Select Trust has numerous advantages; however, it is also necessary to take into consideration several aspects before investing:

1. Market Risks

All investments in REITs are associated with risks. Changes in the real estate market, interest rates, or economic conditions may affect the price of Nexus Select Trust stock, among other factors. Thus, it is essential to know how much risk you can afford at before making any decisions regarding this investment.

2. Dividend Yield

One of the main reasons why people invest in REITs is the high dividend yields that they offer. However, it should be noted that dividends are not guaranteed and can change based on the performance of underlying assets from time to time. Therefore, ensure that the yield meets your income expectations.

3. Long-Term Investment

Generally, speaking real estate investment is regarded as one that lasts for quite some period; In addition, although Nexus Select Trust has the potential for regular income and capital appreciation, it’s vital to take a long-term view on this stock. It’s best to hold onto shares during all market phases and cycles to get maximum profits at the end of the day.

Conclusion

Investing in Nexus Select Trust India is a fantastic opportunity for diversifying your portfolio and getting involved with the blossoming Indian retail sector. Based on its collection of premium malls and the predicted steady income, this scheme can be an attractive investment choice. When you follow these steps as provided in this guide, you can invest in Nexus Select Trust in confidence in the expectation of benefiting from developments within India’s retail market.

For more information, visit our website: https://www.nexusselecttrust.com/

0 notes

Text

ValAdvisor is a comprehensive valuation and advisory services firm that specializes in providing precise and reliable valuation services to a diverse range of clients including businesses, startups, and financial institutions. Their services span across various domains including mergers and acquisitions, financial securities, real estate, and industrial assets.

Services Offered by ValAdvisor:

Valuation for Mergers & Acquisitions: ValAdvisor provides expert guidance in valuing and analyzing intangible assets as part of mergers and acquisitions, ensuring compliance with global standards like Ind AS, IFRS, and US GAAP.

Startup Valuation: The firm offers tailored valuation services for startups and portfolios, particularly for venture capital and private equity firms, addressing the unique challenges of valuing unconventional business models.

ESOP and Sweat Equity Valuation: ValAdvisor assists in the valuation of equity-based awards, ensuring compliance with various financial reporting standards like IFRS 2 and FASB ASC Topic 718.

Financial Securities Valuation: The company handles the valuation of various financial instruments including debt, equity, and derivatives, catering to both regulatory and reporting needs.

Compliance and Regulatory Valuation: They provide valuation services that comply with various Indian regulations such as the Companies Act, Income Tax Act, and SEBI, among others.

Corporate Finance Services: ValAdvisor offers services like financial modeling, due diligence, and quality of earnings analysis to support strategic business decisions.

Real Estate and Industrial Asset Valuation: They specialize in valuing tangible assets like plant, machinery, and real estate, often for purposes like mergers, acquisitions, and financial reporting.

REIT and INVIT Valuation: As a registered valuer, ValAdvisor conducts valuations for Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) in compliance with SEBI regulations.

ValAdvisor is recognized for its fast turnaround times, cost-effective solutions, and a strong commitment to confidentiality and quality. Their client base includes global MNCs, startups, and financial institutions across various industries (ValAdvisor) (ValAdvisor) (ValAdvisor)

#business valuation#startup valuation#brand valuation#accounting#branding#business#commercial#ecommerce#valadvisor#economy#valuation

0 notes

Text

Top Stock Advisory Firms in India to Watch in 2024

Top Stock Advisory Firms in India to Watch in 2024

Introduction

Navigating the complex world of stock markets can be daunting, especially for new investors. Stock advisory firms provide valuable insights, recommendations, and strategies to help investors make informed decisions. In 2024, with the dynamic nature of the market, the role of these advisory firms is more critical than ever. This article will guide you through the best stock advisory firms in India, focusing on the top 10 SEBI registered stock advisory firms.

Importance of Stock Advisory Firms

Stock advisory firms play a crucial role in guiding investors through the complexities of the stock market. They provide:

Expert Analysis: Leveraging their expertise, advisory firms analyze market trends, company performance, and economic indicators to provide reliable recommendations.

Personalized Advice: Tailored investment strategies based on an individual’s financial goals, risk tolerance, and investment horizon.

Timely Updates: Regular updates on market movements and changes in stock recommendations help investors stay informed and make timely decisions.

Risk Management: By providing risk assessment and mitigation strategies, advisory firms help investors protect their capital.

Criteria for Selecting the Best Stock Advisory Firm

Choosing the right stock advisory firm is crucial for successful investing. Consider the following criteria:

SEBI Registration: Ensure the firm is registered with SEBI, which adds a layer of credibility and regulatory oversight.

Track Record: Look for firms with a proven track record of successful recommendations and satisfied clients.

Services Offered: Assess the range of services offered, including research reports, personalized advice, portfolio management, and customer support.

Fees and Charges: Compare the fee structures of different firms to ensure they align with your budget.

Client Reviews: Read reviews and testimonials from other investors to gauge the firm’s reliability and effectiveness.

Top 10 Stock Advisory Firms in India

Discover the Top 10 Stock Advisory Firms in India that offer expert analysis, personalized advice, and reliable recommendations. These Stock Advisory Firms in India are renowned for their track record, SEBI registration, and comprehensive market insights, guiding investors towards informed and profitable decisions.

1. Research and Ranking

Research and Ranking is renowned for its detailed research reports and personalized advisory services. Their focus on long-term wealth creation and a client-centric approach makes them one of the best stock advisory firms in India.

2. Equitymaster

Equitymaster offers independent equity research and analysis, providing unbiased recommendations. Known for its in-depth reports and extensive market insights, Equitymaster has a strong reputation among investors.

3. Motilal Oswal Financial Services

Motilal Oswal Financial Services combines traditional brokerage services with top-notch advisory solutions. Their expertise in equity research and strong market presence make them a preferred choice for many investors.

4. Sharekhan

Sharekhan, a subsidiary of BNP Paribas, offers comprehensive stock advisory services alongside its brokerage services. With a robust research team and extensive market experience, Sharekhan provides valuable insights to investors.

5. CapitalVia Global Research Limited

CapitalVia specializes in providing real-time advisory services for traders and investors. Their focus on technical analysis and market trends helps clients navigate the volatile stock market effectively.

6. Angel One

Angel One (formerly Angel Broking) offers a wide range of services, including stock advisory, portfolio management, and investment planning. Their user-friendly platforms and reliable advisory services make them a popular choice.

7. Kotak Securities

Kotak Securities offers expert research and advisory services, backed by a strong team of analysts. Their comprehensive market analysis and personalized recommendations cater to the needs of various investors.

8. ICICI Direct

ICICI Direct, a part of ICICI Securities, provides detailed research reports and stock recommendations. Their extensive market research and strong customer support make them one of the top advisory firms in India.

9. Karvy Stock Broking

Karvy offers a range of investment services, including stock advisory, research reports, and portfolio management. Their focus on detailed analysis and customer-centric approach has earned them a solid reputation in the market.

10. Axis Direct

Axis Direct, the brokerage arm of Axis Bank, provides reliable stock advisory services along with its brokerage services. Their strong research team and personalized advice help investors make informed decisions.

Conclusion

Selecting the best stock advisory firm is essential for successful investing. The firms listed above are some of the top SEBI registered stock advisory firms in India, known for their expertise, reliable advice, and strong market presence. By considering the criteria outlined in this article, you can choose the firm that best suits your investment needs and goals for 2024.

#best stock advisory firms in India#top 10 SEBI registered stock advisory firms in India#Top 10 Stock Advisory Firms In India

0 notes

Text

Tata Motors reported a consolidated net profit of Rs 17,483 crore?

(adjusted for exceptional gains and losses) for Q4FY24, surpassing TCS’ consolidated net earnings of Rs 12,434 crore.

That's impressive! Tata Motors is definitely firing on all cylinders. Here's a quick breakdown of the news:

Tata Motors' strong Q4: They reported a whopping Rs 17,483 crore in consolidated net profit, adjusted for exceptional gains and losses.

Surpassing TCS: This is a significant achievement as it eclipses TCS's consolidated net earnings of Rs 12,434 crore for the same quarter.

Tata Motors becoming more profitable: This could indicate a shift within the Tata Group, with Tata Motors potentially becoming their most profitable company.

It's interesting to see Tata Motors exceeding TCS in terms of profitability for this quarter. It will be interesting to see if this trend continues throughout the year.

The recent decline in Tata Motors' share price is likely due to a combination of factors, including:

Overall market sentiment: The Indian stock market has been volatile in recent weeks, and this has impacted Tata Motors along with other companies.

Concerns about the global economy: There are growing concerns about a possible recession in the United States and other major economies, which could hurt demand for cars and other Tata Motors products.

Company-specific issues: Tata Motors has faced some challenges in recent quarters, such as supply chain disruptions and rising input costs. These issues have weighed on investor sentiment.

Despite these challenges, there are also some reasons to be optimistic about Tata Motors' future prospects. The company is a major player in the growing Indian automotive market, and it is also expanding into new markets such as electric vehicles. Additionally, Tata Motors has a strong track record of innovation and product development.

Overall, the short-term outlook for Tata Motors' share price is uncertain. However, the company has a long-term growth potential, and investors should take a long-term view when making investment decisions.

Here are some additional resources that you may find helpful: Stock Recommendation, Commodity Recommendation, Intraday Stock Recommendation, Equity Recommendation, Options Trading Recommendation, Nifty Futures Recommendation, Stock Futures Recommendation, Nifty Futures Recommendation

UNIQUE SERVICES

We have unique and innovative services which you hardly find anywhere else. Other RA's focus on providing number of trades but we focus on quality of the trades and believe in actual results. Our services are results oriented services which give pure satisfaction.

EACH OF OUR ASPECTS IS DRIVEN BY OUR FOCUS ON YOU OUR STRENGTHS Personalized approach All services customized to suit you. Building a portfolio that defines your preferences and vision. Experienced and knowledge-rich team A team comprising of proficient Private Bankers, Investment Bankers, and Market Specialists with a collective experience of over 45 years! Equipped with crucial market insights Our team is always equipped with the dynamics of the market and the key insights on various products in the industry. Technologically adept and advanced This lets us create solutions and strategies that are in sync with our clients and builds their wealth in the most profitable way. Experienced and knowledge-rich team We use the most advanced analytics software used by the biggest global firms.

*Interested in investing in potential wealth-building stocks like Tata Motors*…?

Join us at demiumresearch.com or call 7030916716 today. Let's make your money work..

0 notes

Text

India's Top 5 SEBI Expert Lawyers

In the labyrinth of India’s burgeoning securities market, the Securities and Exchange Board of India (SEBI) stands as the vigilant guardian, ensuring fair play and investor protection. As the market cap of companies listed on the NSE surpassed USD 4 trillion as of 2024, the role of SEBI and SEBI lawyers has never been more critical. However, the regulatory landscape can be as complex as it is vast, often requiring the expertise of legal sherpas to guide companies and individuals through potential pitfalls.

Enter the SEBI expert lawyers — legal professionals whose mastery of securities laws, regulations, and enforcement practices makes them indispensable allies in corporate boardrooms and courtrooms alike. These SEBI expert lawyers don’t just interpret the law; they help shape its application, defending clients in investigations, steering them through regulatory proceedings, and championing their interests in high-stakes litigation.

In this blog, we unveil the top five of India’s long list of SEBI lawyers, each bringing unique strengths to the intricate dance of compliance and strategy. Their stories not only showcase individual brilliance but also underscore a collective commitment to upholding the integrity of India’s financial heart.

1. Sandeep Parekh

At the helm of Finsec Law Advisors, Sandeep Parekh stands as a colossus in India’s financial regulatory landscape. A former executive director at SEBI and now a renowned SEBI lawyer, Parekh’s trajectory from the youngest holder of this prestigious post to founding a top-tier financial sector law firm reads like a masterclass in legal excellence.

Parekh’s arsenal of expertise as a SEBI lawyer, honed through years at the regulatory epicenter, has transformed Finsec Law Advisors into a beacon for corporations navigating the labyrinthine world of securities law. His firm’s meteoric rise to become India’s highest-rated Financial Regulatory Practice in just seven years is a testament to his unparalleled acumen as a SEBI expert lawyer.

Beyond the boardroom, Parekh’s influence as a SEBI lawyer permeates academia. His long-standing faculty position at IIM-A and his seminal work, “Fraud, Manipulation and Insider Trading in the Indian Securities Markets,” now in its fourth edition, have shaped a generation of financial minds.

Parekh’s global recognition as a “Young Global Leader” by the World Economic Forum and his membership in Mensa speaks volumes about his intellectual prowess, further solidifying his reputation as a leading SEBI lawyer.

2. Vaneesa Agrawal

Youth combined with expertise makes for a potent mix, as epitomised by Vaneesa Agrawal, founder of Thinking Legal, an expert SEBI lawyer focusing on fund formations. In 2021, she was recognised as part of the BW Legal World Elite 40 Under 40 Club of Achievers by Businessworld. The Legal 500 directory notes that, “Vaneesa Agrawal heads up the firm, and has a strong record as a fund counsel and in early-stage transactional work.”

Agrawal’s trajectory — from a first generation woman lawyer to a recognised authority on SEBI matters — is as impressive as it is inspiring.

Vaneesa Agrawal’s team of SEBI expert lawyers at Thinking Legal mirrors her multifaceted outlook. “We’re SEBI lawyers who are focused on fund formations and regulatory advisory,” she notes. This diversity shines through in their handling of complex matters, such as setting up angel funds, fund of funds and venture capital funds..

In one of the webinars she was part of, Vaneesa Agrawal represented Thinking Legal and advised on the entire gamut of the early-stage investment ecosystem through SEBI-registered funds, starting from setting up angel and venture capital funds, to deployment across various series transactions. It’s this blend of technical know-how and practical foresight that positions her as a rising star in the legal world as an expert SEBI lawyer focusing on funds.

3. Manan Lahoty

Manan Lahoty, partner at IndusLaw and with over two decades of experience, specialises in capital markets, particularly in SEBI-regulated transactions, reads like a playbook for corporate excellence.

Lahoty’s expertise as a SEBI lawyer has been instrumental in shaping some of India’s most prestigious public offerings, including those of Coal India, Zomato, and Paytm. His dual qualification to practice in both India and England & Wales adds a global perspective to his counsel, making him a go-to SEBI expert lawyer for domestic and international investment banks alike.

Beyond the boardroom, Lahoty’s influence permeates the legal community. Chambers and Partners lauds him as “one of the best capital markets lawyers in India,” while Forbes India Magazine recognizes him among the country’s Top 100 Great People Managers.

4. Vasudha Goenka

Vasudha Goenka stands as a colossus in India’s securities regulatory landscape. A former Deputy General Manager at SEBI, Goenka’s trajectory from handling contentious proceedings at the regulatory epicentre to joining a top-tier law firm reads like a masterclass in legal excellence.

Goenka’s arsenal of expertise, honed through 16 years at SEBI, has transformed her into a beacon for corporations navigating the labyrinthine world of securities law. Her extensive experience in quasi-judicial proceedings before SEBI and SAT, coupled with her deep knowledge of various SEBI regulations, speaks volumes about her capabilities as a SEBI lawyer.

Beyond the courtroom, Goenka’s influence permeates the legal community. Chambers and Partners lauds her as “one of the best capital markets lawyers in India,” underscoring her reputation as a premier SEBI lawyer.

5. Ganesh Rao

A Partner specializing in this intricate field, Ganesh Rao as a SEBI lawyer presents a repertoire that reads like a playbook for navigating the complex world of investment funds.

Rao’s arsenal of expertise as a SEBI expert lawyer, honed through years of advising both general and limited partners, has transformed him into a beacon for clients ranging from development financial institutions to family offices. His adept handling of special situations, including fund disputes and manager removals, speaks volumes about his capabilities as a funds expert and SEBI lawyer.

Beyond standard practice, Rao’s influence as a SEBI lawyer permeates the investment community. His recognition as one of ’40 under 40 India Inc’s Top Young Leaders’ by the Economic Times underscores his visionary approach in SEBI-related matters.

Rao’s consistent Band 1 ranking in Investment Funds by Chambers and Partners, and his distinction as an outstanding legal professional by Asian Legal Business, testify to his unparalleled acumen as a SEBI expert lawyer in this specialized field.

The Road Ahead: Partnering with SEBI Expert Lawyers

As SEBI’s mandate evolves — with recent forays into fund formations, startup listings, and social media’s impact on markets — the value of specialised SEBI lawyers intensifies. The lawyers profiled here don’t just interpret these changes; they help clients turn regulatory shifts into strategic advantages.

Choosing the right SEBI lawyer transcends win-loss records. It’s about finding a partner who grasps the nuances of your business, anticipates regulatory headwinds, and crafts bespoke solutions. Whether it’s Parekh’s regulatory acumen, Agrwal’s innovative drive, Manan’s global prowess, Gornka’s contentious mastery, or Rao’s investment savvy, each brings a vital instrument to the symphony of SEBI compliance.

0 notes

Text

Expert Guidance, Trusted Results: The Value of SEBI Registered Stock Advisory Services

In the dynamic and often unpredictable world of the stock market, sound investment decisions are essential to success. However, navigating the complex financial markets requires knowledge, experience and reliable information. This is where SEBI (Securities Exchange Board of India) registered stock advisory services come in handy, offering investors expert guidance and reliability. We will delve into the value of a SEBI registered stock advisory services and how investors can be empowered to confidently achieve their investment goals and we will go further.

Meaning of SEBI Registration:

SEBI is the regulatory body tasked with regulating the securities market in India. It plays an important role in protecting the interests of investors, providing transparency and ensuring the certainty and stability of the financial system. SEBI registration is mandatory for providing stock advisory and portfolio management services in India. By obtaining SEBI registration, advisory firms have committed to adhere to stringent regulatory standards and compliance requirements, providing investors with additional confidence and trust in services provided in the 19th century.

Skills and market insights:

One of the major benefits of collaborating with a SEBI-registered stock advisory service is getting expert guidance and market insights. The Registered Advisors employ experienced professionals with in-depth knowledge of financial markets, financial dynamics and investment strategies. These experts conduct comprehensive research and analysis to identify potential investment opportunities, analyze market risks, and develop investment strategies tailored to clients’ investment objectives and risk tolerance If they with their knowledge and insight, investors can make informed decisions and approach investment challenges with greater confidence.

Customised Investment Strategies:

SEBI-registered stock advisory services understand that every investor has unique objectives, preferences and risk profiles. They offer personalized investment strategies tailored to meet the specific needs and goals of individual clients. Whether you’re a conservative investor looking for consistent returns, a growth-oriented investor targeting capital appreciation, or a high-risk investor looking for compelling growth opportunities, Registered Advisors Their Names can be customized portfolios that reflect your financial goals and preferences. By aligning your investments with your financial aspirations and risk appetite, you can provide optimal returns by minimizing downside risk.

Risk Management and Portfolios:

Effective risk management is the cornerstone of successful investing, and SEBI registration for stock advisory services prioritizes portfolio diversification as a key risk mitigation strategy. Diversification of assets, geographically and geographically and reduces the impact of volatility on the market and reduces the necessary disruption to the market and reduces the waiting list and retirement mindset and the departments are built over a long period of time. Analysis through bond actions Experience greater stability and volatility in your portfolios, even during market turmoil

Transparency and Accountability:

SEBI registered stock advisory services are committed to maintaining the highest standards of transparency and accountability in their operations. Clients are provided with clear and detailed information on investment options, costs, business metrics and risks. Registered advisers comply with stringent reporting requirements and disclosure norms set by SEBI to ensure that their clients have timely access to accurate information to assess how their investment is active and the right decisions have been made. By enhancing transparency and accountability, registered advisers build trust and confidence with their clients, strengthen client-adviser relationships and enhance the overall client experience.

Conclusion:

In conclusion, SEBI listed stock advisory company provide investors with expert guidance, reliable results and peace of mind in their investment journey. Using their expertise in financial planning, market thinking and a personal approach, Registered Advisors empower investors to confidently navigate the complexities of the stock market and achieve their financial goals They also play a key facilitating role you get someone shy whether you are an experienced investor or new to the market Be that as it may, partnering with a SEBI-registered investment advisory firm can be a valuable asset in search seeking economic success.

#best stock market advisor#best trading advisory services#stock market advisory#small cap stocks#stock market advisory services#sme stocks#top micro cap stocks

0 notes

Text

Share Market Trading Tips | Intraday Trading Tips in India

Welcome to Nivesh Research, your trusted partner in the world of stock market investments. Established as a SEBI-registered stock advisory firm, we specialize in providing expert guidance and reliable stock Intraday Trading Tips in India recommendations tailored to meet your financial objectives. With a commitment to transparency, integrity, and customer satisfaction, we strive to empower investors with the knowledge and insights needed to navigate the complexities of the market confidently. Share Market Trading Tips

Why Choose Us?

SEBI-Registered Firm: We operate under the stringent guidelines set by SEBI, ensuring compliance and reliability in our advisory services. Share Market Trading Tips

Expertise and Experience: Our team consists of seasoned market analysts with years of experience in financial markets, providing you with expert insights and strategic recommendations.

Proven Track Record: We have a history of delivering consistent results and helping clients achieve their investment goals through well-researched stock calls and portfolio management strategies.

Client-Centric Approach: Your success is our priority. We offer personalized investment strategies that align with your unique financial goals and risk tolerance, backed by comprehensive market research and analysis.

Transparent and Honest Advice: We believe in transparency in all our interactions. Our advice is clear, honest, and aimed at empowering you to make informed investment decisions. stock Intraday Trading Tips in India

Dedicated Customer Support: Our dedicated support team is always available to address your queries and provide guidance, ensuring you receive prompt and reliable assistance whenever you need it. Share Market Trading Tips

0 notes

Text

A Beginner's Guide to Investing in IPOs: From Application to Allotment

IPOs can be a thrilling way for beginners to enter the stock market, but they also present challenges and learning curves. From the IPO application to the final allotment, several steps can seem daunting. Successfully investing in new public offerings requires understanding these steps, including IPO allotment.

The first question most new investors have is how to invest in an IPO. The process begins with selecting a reliable broker or trading platform that has access to IPOs. Most brokerage firms offer their clients the facility to apply for IPOs through their platform. It is essential to ensure that your chosen broker is registered with the relevant financial authorities and has a good track record.

Once you have a broker, the next step is to keep an eye on upcoming IPOs. This can be done by monitoring financial news, subscribing to updates from your brokerage, or using financial news platforms. When an appealing IPO is announced, you should carefully review the company's prospectus, which is usually available on the website of the Securities and Exchange Board of India (SEBI) or the company's site. The prospectus provides detailed information about the company’s financials, risks, and reasons for raising funds.

After deciding to participate in an IPO, the application process is the next step. In India, this is typically done through the ASBA (Application Supported by Blocked Amount) facility, where your application money gets blocked in your bank account and is only deducted when you receive the share allotment, thus ensuring safety and transparency in the transaction. You can apply through your bank or directly through your brokerage platform, depending on the facilities provided.

Once the application period ends, the allocation process begins. This allotment process is crucial and can depend on the level of oversubscription. If an IPO is oversubscribed, the shares might be allotted proportionately among all the applicants, or a lottery system might be used in the case of excessive demand. Checking the allotment status is straightforward; it can be done by visiting the registrar’s website of the IPO and entering your application number or PAN card details.

Finally, once the shares are allotted, they will be credited to your demat account, and they can be traded on the stock exchange from the listing date. It's important to have a strategy in place for whether to hold or sell the shares post-listing, which should be based on a careful analysis of the market conditions and the company’s performance outlook.

Beginners can get into the stock market by investing in IPOs. The investor must understand the process, research the market, and monitor it. IPOs can be profitable with the right strategy and analysis. Start small, learn often, and gain confidence as you navigate IPOs.

0 notes

Text

Intraday Trading Guide for Beginners in India

Intraday trading, also known as day trading, involves buying and selling financial instruments within the same trading day, with the aim of profiting from short-term price movements. Here's a guide for beginners in India interested in intraday trading:

Understand the Basics: Before diving into intraday trading, it's crucial to understand the basics of the stock market, including how it functions, key terminology, and trading mechanisms.

Educate Yourself: Take the time to educate yourself about intraday trading strategies, technical analysis tools, and risk management techniques. There are numerous resources available, including books, online courses, and educational websites.

Choose the Right Broker: Select a reputable brokerage firm that offers a user-friendly trading platform, competitive brokerage rates, and reliable customer support. Ensure that the broker is registered with SEBI and complies with regulatory requirements.

Start Small: Begin with a small amount of capital that you can afford to lose. Intraday trading involves high risk, and it's essential to start with a cautious approach until you gain experience and confidence.

Develop a Trading Plan: Create a well-defined trading plan that outlines your trading goals, risk tolerance, entry and exit criteria, and position sizing strategy. Stick to your plan and avoid making impulsive decisions based on emotions.

Use Technical Analysis: Learn how to analyze price charts and use technical indicators to identify potential trading opportunities. Common technical analysis tools include moving averages, relative strength index (RSI), MACD, and Fibonacci retracements.

Practice Paper Trading: Before risking real money, consider practicing intraday trading using a simulated trading platform or paper trading account. This allows you to test your strategies and gain experience in a risk-free environment.

Manage Risk: Implement strict risk management measures to protect your capital. Set stop-loss orders to limit potential losses on each trade, and avoid risking more than a certain percentage of your trading capital on any single trade.

Stay Informed: Stay updated with market news, economic indicators, and corporate announcements that may impact stock prices. Be aware of scheduled events such as earnings releases, economic reports, and central bank decisions.

Review and Learn: Keep a trading journal to record your trades, including entry and exit points, reasons for each trade, and the outcome. Review your trades regularly to identify strengths and weaknesses, and continuously strive to improve your trading skills.

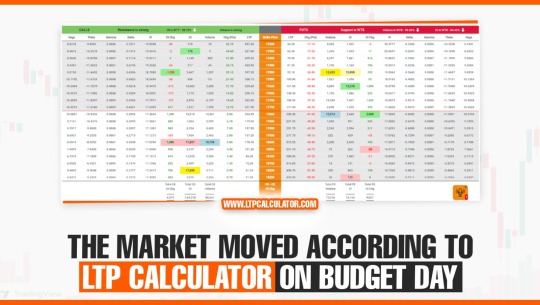

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in India.

You can also downloadLTP Calculator app by clicking on download button.

Remember that intraday trading requires discipline, patience, and continuous learning. It's not a get-rich-quick scheme, and success in intraday trading takes time and effort. Start slowly, manage your risks wisely, and be prepared to adapt your strategies as needed based on market conditions.

0 notes