#SIP Return Calculator App

Text

The Unknown Facts Of Best Digital Gold Investment That You Should Be Aware Of

For ages, gold has been a symbol of richness and an investment of value, but in modern times, gold investing has taken up a new form of digital gold. Digital gold investment alternatives allow you to buy digital gold online via phone, making it more accessible and convenient than physical gold.

While digital gold may appear to be a simple investment, there are some unknown facts regarding it that every investor should be aware of. This blog will look at some of the less-known features of digital gold investing.

Different Forms of Digital Gold

People frequently associate digital gold with cryptocurrencies such as Bitcoin. There are various types of digital gold, while Bitcoin is a digital store of value. Gold-backed cryptocurrencies and digital gold accounts provided by respectable institutions enable investors to own a portion of physical gold without actually owning it. These types of precious metals provide a stronger and more trustworthy link, making them a safe investment choice.

Transparency and Auditing

Another fact about digital gold is that many providers comply with strict transparency and auditing rules. Additionally, the best platform to buy digital gold typically follows the gold's ownership and verifies its existence using blockchain technology. Third-party audits regularly verify that the amount of genuine gold underlying digital gold tokens matches the tokens generated, improving trust and reliability.

Fractional Ownership

Unlike real gold, which is usually sold in fixed quantities like coins or bars, digital gold allows for ownership in fractions. Because you can invest as little or as much as you desire, it is accessible to a wider range of investors. This adaptability is especially tempting to people who want to start small and gradually build their holdings over time.

Low Transaction Costs

Investing in actual gold may involve substantial transaction expenses, such as costs for storage and insurance. Digital gold, on the other hand, has reduced transaction costs in general. You won't have to worry about storage, insurance, or transportation costs, which can reduce your potential profits.

Global Accessibility

Geographic boundaries do not apply to digital gold investments. Anywhere on the globe with an internet connection can invest in digital gold. Because of this global accessibility, you may diversify your investment portfolio and protect your capital from currency fluctuations or financial instability in our country.

Liquidity

The liquidity of digital gold is one of its benefits. Selling digital gold is often faster and easier than selling actual gold. Because you may change your digital gold holdings into cash or other assets at any time, it is a versatile investment alternative.

Security Measures

To secure your money, reputable digital gold providers prioritize safety measures. They frequently use powerful encryption and cybersecurity methods to protect your digital gold holdings from theft or hacking. Furthermore, governmental oversight in many regions guarantees that providers follow stringent security standards.

Regulatory Considerations

Many countries have the authority to regulate digital gold. It is critical to understand the regulatory framework in your area before investing. To protect your investment and legal status, ensure that the digital gold provider follows local rules.

Summing up

Although Spectrum Invest provides a quick and accessible option to invest in a valuable asset, there are a few Platforms that investors should be aware of. The various types of digital gold make an appealing investment alternative. As well as transparency, fractional ownership, and low transaction costs, these factors help you make the best digital gold investment in the competitive market.

It is critical to do thorough research, select a reputable platform, and learn about the legal framework to make informed investment selections. Digital gold is a great addition to your financial portfolio, providing a safe and flexible way to access gold's timeless appeal in the digital era.

#digital gold investment app in india#sip calculator#Digital gold disadvantages#digital gold price today#Digital gold investment returns in India#What is digital gold investment#Digital gold price today 1 gram#Digital gold price today in India

0 notes

Text

The Advantages of Investing in Gold

Investing wisely is crucial for long-term financial growth and stability. While there are various investment options available, gold has stood the test of time as a reliable asset class. In this blog post, we will explore the advantages of investing in gold compared to other forms of investment, highlighting why it's a prudent choice for investors looking to diversify and safeguard their wealth.

Tangible and Intrinsic Value:

Gold is a precious metal that has been coveted by civilizations throughout history. Unlike stocks, bonds, or digital currencies, gold is a tangible asset with intrinsic value. Its rarity, durability, and aesthetic appeal make it highly desirable, ensuring its long-term value.

Hedge Against Inflation:

One of the primary advantages of investing in gold is its ability to act as a hedge against inflation. When the value of fiat currencies declines due to inflation, gold tends to hold its value or even appreciate. Investors can protect their purchasing power by allocating a portion of their portfolio to gold, which serves as a reliable store of wealth during times of economic uncertainty.

Portfolio Diversification:

Diversification is a fundamental principle of investment. Gold offers a unique diversification opportunity due to its low correlation with traditional asset classes like stocks and bonds. During periods of market volatility or economic downturns, gold often performs differently, acting as a hedge and reducing the overall risk in an investment portfolio. By including gold, investors can potentially enhance their portfolio's stability and reduce volatility.

Safe-Haven Asset:

In times of geopolitical tensions, economic crises, or stock market declines, gold has historically been considered a safe-haven asset. Investors turn to gold as a reliable store of value when other investments become uncertain. Its enduring value and global acceptance make it an attractive option for individuals seeking stability and security in their investment choices.

Liquidity and Global Acceptance:

Gold is a highly liquid asset. It can be easily bought or sold in various forms, such as gold bars, coins, or Exchange-Traded Funds (ETFs). The global acceptance of gold ensures that investors can access liquidity and fair prices across different markets. Unlike certain investments that may face restrictions or regulatory challenges, gold offers a straightforward and universally recognized avenue for wealth preservation and capital appreciation.

Potential for Long-Term Growth:

Over the years, gold has shown the potential for long-term growth. While short-term fluctuations are common, gold's value has steadily increased over extended periods. This historical trend underscores its ability to preserve wealth and deliver attractive returns over time, making it an attractive investment option for patient investors.

Conclusion:

Investing in gold provides numerous advantages that set it apart from other forms of investment. Its tangible nature, inflation hedging capabilities, portfolio diversification benefits, and status as a safe-haven asset make it a prudent choice for investors aiming to protect and grow their wealth. Whether you are a seasoned investor or a newcomer to the financial world, considering gold as part of your investment strategy can help you achieve your long-term financial goals.

Remember, investing in any asset carries risks, and it's essential to consult with financial professionals to understand how gold can fit into your overall investment plan. With careful consideration and strategic allocation, gold can serve as a valuable addition to your investment portfolio, enhancing its stability and potential for long-term growth.

For more information and personalized advice, please visit our website, www.merasunaar.com, where our team of experts is ready to assist you in making informed investment decisions.

#Digital gold investment#Digital gold price today#finance app#buy digital gold#gold sip calculator#save gold#gold gifts#916 hallmark#hallmark gold#digital gold#what is digital gold#916 gold means#digital gold price chart#digital gold vs physical gold#digital gold india#daily savings app#gold returns#gold gift items#Is digital gold a good investment#best personal finance app#finance app india#best finance app#what is hallmark gold#gold price calculator#gold investment app#financial influencers#digital gold meaning#digital gold app#invest in digital gold#Save Money in digital gold from ₹ 10

1 note

·

View note

Text

A glimpse about Mutual funds

We all are fascinated about growing our passive income apart from the income that we acquire from various active sources i.e. from our jobs etc. But during the process when we desire for the time when “Money can work for us, instead of we working for it” as said by the great financial trainer Robert T Kiyosaki. We generally tend to have a fear or confusion whether we should invest in stocks or not?

This usually happens with most of us. The primary reason for this could be the lack of fundamental financial education. Having a desire to invest but unable to do so creates a dilemma which in turn opens a Pandora’s box for ourselves and we keep on working for money instead of creating a system where money can work for us.

What basically Mutual fund is?

A mutual fund as the name suggests is a fund in which several investors put in their share or contribution to generate a pool of money. This money is in turn invested by the company that basically offers the fund and since this is done by professionals who have proper knowledge about the financial market, you can get a better return out of it.

In simple terms, buying a mutual fund is like buying a pastry out of the entire cake. The mutual fund owner gets his share from the gains, profits, losses etc.

How Mutual funds are managed? Which body regulates it?

The company that manages the mutual fund is known as Asset Management Company. This company in turn hires a professional money manager, who trades in securities to accomplish the stated objective.

All the AMC’s are regulated by the Securities Exchange Board of India (SEBI). It provides regulations and guidelines which all AMC’s have to adhere.

Benefits of investing through Mutual funds.

All the mutual funds regulated by SEBI, are managed by highly professional money managers. These money managers always have a bulls-eye on the market and as it is their primary occupation they devote more time compared to any other investor who is investing in stocks individually. When you don’t have enough knowledge, mutual funds provide a way where you can avoid the stress of calculating difficult financial ratios and even analysing the company’s financial statement.

Basically, by using mutual funds, “You are using an instrument of money-making and using your money to earn more money for you, even if you don’t have an experience of doing it properly.

How to start the journey of investing in Mutual funds?

Investments in mutual funds can be done with a few clicks on the internet. Basically, through an online mode, it can be through the website offered by the Asset management company or through various apps.

1. Investing through an official website of Asset Management Company (AMC).

Every asset management company offers its website. Through that website, you can invest in various mutual funds schemes by just following the steps and completing your e-KYC verification. For this, your Aadhar and PAN card is required.

2. Through Apps

You can get the details of mutual funds and can easily invest in it by installing some apps in your smartphone. Various apps are available which allows you to get the details about the various mutual fund schemes, your account statement etc. Investors have a plethora of options for investing in various fund houses.

Precaution before investing in Mutual funds

As mutual funds are subject to market risks, you must choose your investing instrument carefully before investing. For any kind of financial investment activities, we recommend you to kindly learn about mutual funds and Systematic Investment Plan (SIP) in detail and if possible take the help of an expert professional regarding risks and returns. Because when it comes to investing, the only way to reduce the risk is to know the market in a better way from an expert.

3 notes

·

View notes

Text

Mutual Fund Sip Calculator

If you're into long-term financial planning like me, you'll appreciate having access to a mutual fund SIP calculator. I’ve been using this app, and it has a built-in tool that helps estimate potential returns from systematic investment plans (SIPs). It’s been super helpful in managing my investments better!

0 notes

Text

SIP Calculator: An Essential Tool for Effective Investment Planning

A SIP calculator is a valuable tool for investors looking to plan their investments systematically. SIP, or Systematic Investment Plan, is a popular investment method where individuals invest a fixed amount regularly in mutual funds. A SIP calculator helps investors estimate the potential returns on their investments and plan their financial goals more effectively.

What is a SIP Calculator?

A SIP calculator is an online tool that helps you project the future value of your SIP investments. By inputting details like the investment amount, duration, expected rate of return, and frequency of investment, the calculator provides an estimate of the corpus you can accumulate over time. This helps investors understand the power of compounding and make informed decisions.

How Does a SIP Calculator Work?

Input Investment Details:

Monthly Investment Amount: Enter the amount you plan to invest every month.

Investment Duration: Specify the number of years you plan to invest.

Expected Rate of Return: Input the anticipated annual return rate, typically based on historical performance of the mutual fund or market trends.

Calculate Future Value:

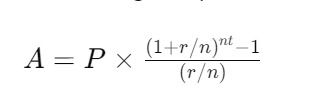

The SIP calculator uses a formula to estimate the future value of your investments, considering compound interest. The formula used is:

A = Future Value of the SIP

P = Monthly Investment Amount

r = Annual Interest Rate (in decimal)

n = Number of times the interest is compounded per year

t = Number of years of investment

Review the Results:

The calculator provides a detailed projection of the total amount accumulated and the interest earned over the investment period.

Benefits of Using a SIP Calculator

Financial Planning:

Helps you determine how much you need to invest regularly to achieve your financial goals, such as buying a house, funding education, or retirement.

Understanding Compounding:

Demonstrates the impact of compounding over time, highlighting how small, regular investments can grow significantly.

Adjusting Investment Strategies:

Allows you to experiment with different investment amounts, durations, and rates of return to find a strategy that best suits your financial goals.

Tracking Progress:

Provides a clear picture of how your investments are expected to grow, helping you stay on track with your financial objectives.

Where to Find a SIP Calculator

Many financial websites and mutual fund platforms offer free SIP calculators. Reputable sites like Mutual Fund Houses, financial planning portals, and investment apps typically feature these tools. Simply search for "SIP calculator" on these platforms to access a user-friendly tool.

Conclusion

A SIP calculator is an indispensable tool for anyone considering a systematic investment plan. By providing a clear estimate of potential returns and helping with financial planning, it enables investors to make informed decisions and achieve their financial goals efficiently. Use this tool regularly to adjust your investment strategy and stay on track towards building a secure financial future.

0 notes

Text

Best Mutual Fund Apps in India for Easy and Effective Investment

Investing in mutual funds has become increasingly popular in India, thanks to the ease and convenience brought by mobile apps. These apps provide a user-friendly platform for investors to manage their portfolios, track performance, and make informed decisions. Here are some of the best mutual fund apps in India that can help you with your investment journey.

1. Groww

Groww is one of the most popular mutual fund investment apps in India. It offers a simple and intuitive interface, making it easy for both beginners and experienced investors to navigate. With Groww, you can invest in direct mutual funds without any commission, ensuring that your returns are maximized. The app also provides detailed insights and analysis to help you make informed investment decisions.

2. ET Money

ET Money is another top mutual fund app that provides a comprehensive solution for managing your finances. It allows you to invest in direct mutual funds, track your expenses, and even manage your insurance policies. The app offers personalized recommendations based on your financial goals and risk tolerance, making it easier to build a balanced portfolio.

3. myCAMS

myCAMS is an official mobile app by CAMS (Computer Age Management Services) that offers a consolidated view of your mutual fund investments. It supports multiple fund houses and provides various features such as SIP (Systematic Investment Plan) registration, switching funds, and redemptions. The app also allows you to download account statements and capital gain statements for tax purposes.

4. Zerodha Coin

Zerodha Coin is a mutual fund investment platform by Zerodha, one of the largest stockbrokers in India. The app allows you to invest in direct mutual funds without any commission or brokerage fees. Zerodha Coin integrates seamlessly with Zerodha's trading platform, Kite, making it convenient for investors to manage both their mutual fund and stock investments in one place.

5. Paytm Money

Paytm Money offers a hassle-free way to invest in mutual funds directly. The app provides a wide range of mutual fund options and allows you to start investing with as little as ₹100. Paytm Money also offers features like SIP calculator, risk profiling, and fund comparison to help you make well-informed investment decisions.

6. KFinKart

KFinKart is another comprehensive mutual fund investment app that provides a single view of your entire portfolio. It supports multiple mutual fund houses and offers features like SIP registration, purchase, redemption, and switch transactions. The app also provides detailed reports and insights to help you monitor and manage your investments effectively.

Conclusion

Choosing the right mutual fund app can significantly enhance your investment experience. The best apps provide a seamless, user-friendly interface, detailed insights, and a wide range of investment options. Whether you are a beginner or an experienced investor, these mutual fund apps in India can help you achieve your financial goals with ease and convenience.

For more:

best mutual funds app in india

best mutual fund app

top mutual fund app in india

best mutual funds app india

0 notes

Text

Simplify Investing With Axis MF: Your Direct MF App

Make your mutual fund investments easy and reliable with the Direct MF App by Axis Mutual Fund. As an investor, accessing direct mutual funds can significantly enhance your returns over the long term. With this app, you can invest in a wide range of direct mutual funds offered by Axis Mutual Fund, bypassing intermediaries and maximizing your investment potential.

0 notes

Text

Can I start investing with a small amount of money?

Yes, you can absolutely start investing with a small amount of money. In fact, many investment platforms and financial products are designed to accommodate investors with varying capital levels. Here are several ways you can begin investing with a modest amount:

Robo-Advisors:

Robo-advisors are automated investment platforms that use algorithms to create and manage a diversified portfolio for you based on your risk tolerance and financial goals. They often have low minimum investment requirements, making them accessible to investors with small amounts of money.

Micro-Investment Apps:

Micro-investment apps allow you to invest small amounts of money, sometimes as little as a few dollars, in a diversified portfolio of stocks or exchange-traded funds (ETFs). These apps often use a "round-up" feature, rounding up your everyday purchases to invest the spare change.

Fractional Shares:

Some brokerage platforms offer the option to purchase fractional shares of stocks or ETFs. This allows you to invest in high-priced stocks with as little money as you can afford, owning a portion of a share.

Savings Plans:

Investment and savings plans, such as systematic investment plans (SIPs) in mutual funds, allow you to invest small amounts regularly. This approach is known as dollar-cost averaging, where you invest a fixed amount at regular intervals, reducing the impact of market volatility.

Exchange-Traded Funds (ETFs):

ETFs are investment funds that are traded on stock exchanges. They often have lower expense ratios compared to mutual funds and allow you to buy and sell shares throughout the trading day. ETFs can be a cost-effective way to start investing with a small amount.

Direct Stock Purchase Plans (DSPPs):

Some companies offer direct stock purchase plans, allowing investors to buy shares directly from the company. These plans often have low minimum investment requirements, making them accessible to small investors.

Peer-to-Peer Lending:

Peer-to-peer lending platforms enable you to lend money directly to individuals or small businesses in exchange for interest payments. While this involves some risk, it can be a way to diversify your investment with a relatively small amount of money.

Education Savings Accounts (ESAs):

If you're saving for education expenses, consider using an Education Savings Account (ESA) like a 529 plan. These plans often have lower minimum contributions and offer tax advantages for education-related expenses.

Real Estate Crowdfunding:

Crowdfunding platforms allow you to invest in real estate with a small amount of money. You can participate in real estate projects alongside other investors, pooling resources to access opportunities.

High-Yield Savings Accounts:

While not traditional investments, high-yield savings accounts can offer a higher interest rate than regular savings accounts. They provide a safe place to park your money while earning some return.

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in india

You can also downloadLTP Calculator app by clicking on download button.

Before you start investing, it's important to establish clear financial goals, understand your risk tolerance, and conduct research on the investment options available to you. Even with a small amount, consistent and disciplined investing over time can lead to meaningful portfolio growth. As your financial situation improves, you can gradually increase your investment contributions.

0 notes

Text

What Is SIP And How Does It Work?

In this modern era, when it comes to securing one's financial future, the first thing that pops up in the mind is "Investing". There are multiple options and ways for people to invest. One way that has captured everyone's attention is a Systematic Investment Plan (SIP). They have become a go-to investment option because of how easy and efficient they are. In this article, we are going to dive deep into SIPs, how they work and how you can use SIP Calculator in your financial planning.

What is SIP?

Investing in mutual funds can be done with ease and discipline if you use a Systematic Investment Plan (SIP). It enables you to make set monthly investments of a predetermined amount of money. Because of their flexibility and low entry hurdles, SIPs are a desirable investment option for both novice and seasoned investors.

How does SIP work?

SIPs are simple. Instead of investing the entire amount in one go, you invest a certain amount on a monthly or quarterly basis. Here are some of the benefits one gets with SIPs:

1. Easy Investing

Investing with SIP is very easy. You can even begin with an amount as small as Rs. 1000 per month. Due to the small investment amount and the extended period over which investment management fees are distributed, investing through SIPs is a cost-effective strategy that minimises the impact of fees on overall results.

2. Long-term Advantages

SIPs are an excellent choice for long-term investing because they let users benefit from compound interest by making regular contributions over a lengthy period. This implies that your investments' returns are reinvested, causing them to expand exponentially over time.

Calculating SIP Returns with SIP Calculator:

You can use a SIP calculator to figure out how much money you could make from your SIP investments. These online tools, which you can find on apps like m Stock app, can assist you in projecting the future value of your investments by taking into account variables such as the amount of your SIP, the length of your investment, and your expected rate of return. It's a useful tool for tracking your progress and setting realistic financial objectives.

SIPs have become a well-liked and useful investing instrument that can assist people in reaching their financial goals. When combined with tools such as the SIP calculator, SIPs contribute significantly to a well-thought-out financial strategy. You may create a more secure financial future and confidently strive towards your financial objectives by starting early and investing regularly.

0 notes

Text

A Comprehensive Guide to SIP Calculator|SIP investment

Introduction:

Saving and investing wisely is the cornerstone of financial security and success. One of the most popular and effective investment avenues in the world of finance is Systematic Investment Plans (SIPs). SIPs allow you to invest in mutual funds systematically over time, helping you achieve your financial goals. To make informed decisions about SIPs, understanding how a SIP calculator works is crucial. In this comprehensive guide, we'll explore SIP calculators, their benefits, and how to use them effectively.

Chapter 1: Understanding SIPs

What is a SIP?

A Systematic Investment Plan (SIP) is a disciplined way of investing in mutual funds. Instead of making a lump-sum investment, you invest a fixed amount regularly, typically monthly. This approach encourages consistent saving and reduces the risk associated with timing the market.

Advantages of SIPs

• Rupee Cost Averaging: SIPs buy more units when prices are low and fewer units when prices are high, helping you average out the cost per unit over time.

• Power of Compounding: Your money earns returns, and those returns further generate returns, compounding your wealth over time.

• Disciplined Investing: SIPs instill financial discipline by automating your investments.

• Accessibility: SIPs are accessible to investors with different risk profiles and financial capabilities.

Chapter 2: What is a SIP Calculator?

Definition and Purpose

A SIP calculator is a handy tool that helps you estimate the potential returns on your SIP investments. It takes into account various parameters, including the SIP amount, investment duration, and expected rate of return, to provide you with a projection of your wealth at the end of the investment period.

Components of a SIP Calculator

• SIP Amount: The amount you invest regularly.

• Investment Duration: The period for which you plan to invest.

• Expected Rate of Return: The anticipated annual growth rate of your investment.

Chapter 3: How to Use a SIP Calculator

Step-by-Step Guide

1. Access a SIP Calculator: Many financial institutions, mutual fund websites, and financial apps offer SIP calculators for free.

2. Enter SIP Amount: Input the amount you intend to invest monthly.

3. Set Investment Duration: Specify the number of years or months you plan to invest.

4. Expected Rate of Return: Estimate the annual growth rate based on historical performance or your financial advisor's recommendations.

5. Calculate: Click the calculate button to see the potential future value of your investment.

Chapter 4: Benefits of Using a SIP Calculator

• Accuracy: SIP calculators provide a precise estimate of your future wealth, helping you set realistic financial goals.

Goal Planning: You can tailor your SIP investments to meet specific financial goals such as buying a house, funding education, or retirement planning.

Comparison: Easily compare different SIP scenarios to determine the most suitable investment strategy.

Chapter 5: Tips for Effective SIP Planning

• Regularly Review and Adjust: Periodically review your SIP investments and make adjustments based on changes in your financial goals or market conditions.

• Diversify: Diversify your SIP portfolio to spread risk across various mutual funds.

Stay Informed: Keep yourself informed about market trends and economic developments that might impact your investments.

Conclusion:

In a world where financial security is paramount, SIPs offer a robust investment strategy. A SIP calculator is your trusted companion in this financial journey, helping you make informed decisions and achieve your financial dreams. Whether you're new to investing or a seasoned pro, understanding and effectively using a SIP calculator can be the key to unlocking your financial freedom. Start planning your SIP investments today and watch your wealth grow systematically over time.

Learn more about your favorite posts...

0 notes

Text

Digital Gold vs. Physical Gold: Unveiling the Future of Precious Metal Investments

Investing in gold has long been considered a reliable strategy for wealth preservation and diversification. However, the emergence of digital gold has introduced a new dimension to the age-old debate of digital assets versus physical ownership. In this article, we will explore the key differences and advantages between digital gold and physical gold, shedding light on their respective potentials in the ever-evolving investment landscape.

Digital Gold: The Rise of a Technological Innovation

Digital gold, also known as tokenized gold or gold-backed cryptocurrencies, has gained significant momentum in recent years. Leveraging blockchain technology, it offers investors a digitized representation of gold, enabling them to own fractional units of the precious metal without physical possession. This form of investment provides individuals with increased accessibility, enhanced liquidity, and reduced transaction costs compared to traditional physical gold.

Physical Gold: A Timeless Investment with Tangible Value

For centuries, physical gold has been a symbol of wealth and a safe haven asset during times of economic uncertainty. Owning physical gold entails acquiring tangible assets, such as gold bars, coins, or jewelry, which can be stored securely. Physical gold offers investors the comfort of direct ownership, allowing for a personal connection with the precious metal and providing a sense of security in times of market volatility.

Differences in Liquidity and Accessibility

Digital gold has transformed the landscape of gold investments by enhancing liquidity and accessibility. Unlike physical gold, which requires physical delivery or safekeeping, digital gold can be bought, sold, and traded instantly through online platforms, often 24/7. This ease of access allows investors to take advantage of market opportunities and respond swiftly to changing conditions, without the logistical constraints associated with physical gold.

Transaction Costs and Storage Considerations

When it comes to transaction costs, digital gold typically offers a more cost-effective solution. Traditional gold purchases involve expenses related to storage, insurance, and transportation. Digital gold eliminates these costs, as it operates on blockchain platforms, leveraging secure storage solutions and smart contracts. In contrast, physical gold requires appropriate storage facilities, often with associated fees, and may incur additional costs for insurance and transportation.

Risk and Security Factors

Physical gold ownership carries inherent risks, including the potential for theft, damage, or loss. Safeguarding physical gold requires secure storage solutions, such as bank vaults or personal safes, along with insurance coverage. Digital gold, on the other hand, benefits from the security measures provided by blockchain technology. Each digital gold token is typically backed by physical gold held in secure vaults, ensuring the asset's legitimacy and mitigating the risks associated with physical possession.

Market Dynamics and Volatility

Both digital gold and physical gold are subject to market dynamics and the volatility of gold prices. However, the ease of trading and instant liquidity offered by digital gold allows investors to react swiftly to market movements, capitalize on opportunities, and manage risk effectively. Physical gold, while historically considered a stable investment, may involve longer turnaround times for buying, selling, or converting into cash during volatile market conditions.

Conclusion

The rise of digital gold presents investors with a compelling alternative to physical gold, offering increased accessibility, enhanced liquidity, and reduced transaction costs. While physical gold continues to be a tangible and time-tested investment with its own merits, digital gold introduces a new dimension of convenience and flexibility. Ultimately, the choice between digital gold and physical gold depends on individual preferences, risk tolerance, and investment goals. As technology continues to evolve, the landscape of precious metal investments will witness further innovation, providing investors with a diverse range of options to navigate the ever-changing market dynamics.

#Digital gold investment#Digital gold price today#finance app#buy digital gold#gold sip calculator#save gold#gold gifts#916 hallmark#hallmark gold#digital gold#what is digital gold#916 gold means#digital gold price chart#digital gold vs physical gold#digital gold india#daily savings app#gold returns#gold gift items#Is digital gold a good investment#best personal finance app#finance app india#best finance app#what is hallmark gold#gold price calculator#gold investment app#financial influencers#digital gold meaning#digital gold app#invest in digital gold#Save Money in digital gold from ₹ 10

1 note

·

View note

Text

SIP Calculators in India: A Guide to Finding the Best Online Tools

Investing in mutual funds through Systematic Investment Plans (SIPs) has gained immense popularity in India due to its simplicity and potential for wealth creation. However, before you start your SIP journey, it's crucial to have a clear understanding of how your investments will grow over time. This is where an SIP calculator comes into play. In this article, we will explore the importance of SIP calculators and discuss some of the best online options available in India.

Understanding SIP Calculators

A SIP calculator is a handy tool that allows investors to estimate the potential returns on their investments in mutual funds through SIPs. It takes into account various parameters such as the invested amount, the SIP tenure, the expected rate of return, and the frequency of investments to provide a projection of the future value of the investment. This helps investors set realistic financial goals and make informed decisions about their SIP investments.

The Importance of Using SIP Calculators

Goal Setting: SIP calculators assist investors in setting specific financial goals. Whether it's buying a house, funding your child's education, or building a retirement corpus, these calculators help you determine how much you need to invest regularly to achieve your goals.

Risk Assessment: By adjusting the rate of return in the calculator, investors can assess the potential risks associated with their chosen mutual fund schemes. This can help in making informed investment decisions that align with their risk tolerance.

Investment Planning: SIP calculators aid in creating a well-structured investment plan. They provide insights into the ideal SIP amount needed to meet your financial objectives, enabling you to allocate your resources efficiently.

Realistic Expectations: These calculators offer a clear picture of what investors can expect in terms of returns. It helps prevent overestimation of returns and sets realistic expectations, reducing the chances of disappointment.

Portfolio Diversification: SIP calculators allow you to experiment with different SIP amounts and tenures, helping you diversify your portfolio effectively to minimize risk.

Best SIP Calculators Online in India

Mutual Fund Websites: Most mutual fund houses in India offer SIP calculators on their official websites. These calculators are reliable and user-friendly as they are directly linked to their funds' data. Examples include HDFC Bank Mutual Fund's SIP Calculator, ICICI Prudential Mutual Fund's SIP Planner, and SBI Mutual Fund's SIP Return Calculator.

AMFI's SIP Calculator: The Association of Mutual Funds in India (AMFI) offers an SIP calculator on its website. It provides a neutral platform to calculate returns across various mutual fund schemes, making it a useful tool for comparing different funds.

MoneyControl: MoneyControl, a popular financial news and information platform, also offers an SIP calculator. It allows you to calculate the future value of your SIP investments and offers insights into different mutual fund schemes.

ET Money: ET Money is a personal finance app that includes a comprehensive SIP calculator. It not only helps in estimating future returns but also provides portfolio tracking and investment recommendations.

Value Research Online: Value Research Online offers a suite of financial tools, including an SIP calculator. It provides detailed analysis and historical performance data for mutual funds, aiding investors in making informed decisions.

MySIPOnline: MySIPOnline is a dedicated mutual fund investment platform that offers an advanced SIP calculator. It not only calculates SIP returns but also provides personalized investment recommendations based on your financial goals and risk profile.

Conclusion

Selecting the best SIP calculator online in India is essential for effective financial planning and informed investment decisions. Whether you choose calculators offered by mutual fund houses, financial websites, or dedicated investment platforms, make sure the tool aligns with your investment goals and provides accurate projections. Using SIP calculators is a prudent step towards achieving your financial objectives and building long-term wealth through systematic investments in mutual funds.

1 note

·

View note

Text

What is the Right Time to Start SIP Investment

SIP or Systematic Investment Plan is an investment option that enables individuals to invest a fixed amount at regular intervals in mutual funds. For instance, you can opt for quarterly, monthly, weekly or daily SIP mutual funds. SIPs have gained immense popularity among investors due to their flexibility, low investment threshold, and ability to create long-term wealth. However, one of the most common questions among investors is about the right time to start investing in SIPs. In this article, we will discuss some key factors to help you determine the right time to invest in SIPs.

Invest early

The sooner you start investing in SIP investment plan, the better. When you start investing early, you get the advantage of compounding, which allows your investment to grow exponentially over time. The longer you stay invested, the more your returns get compounded, leading to higher returns. Therefore, it is advisable to start investing in SIPs as early as possible to take advantage of the power of compounding.

Also Read : Daily SIP Investment Plan in Hindi

Market conditions

Investing in SIPs requires you to be disciplined and consistent. It is advisable to avoid making investment decisions based on market trends or news. One should not try to time the market or wait for the "right time" to invest in daily SIPs. Instead, it is important to focus on long-term investment goals and continue to invest regularly in SIPs. However, one should always keep an eye on market conditions and trends to make informed investment decisions.

Personal financial goals

Personal financial goals play an important role in determining the right time to invest in SIPs. Your investment strategy and time horizon should align with your financial goals. If you are investing in SIPs to meet long-term financial goals, such as retirement planning, you should start investing as early as possible, regardless of market conditions. However, if you have a short-term financial goal, such as buying a car or a house, you should invest in SIPs after assessing your risk appetite and market conditions. You can also use systematic investment plan calculator to guage your expected returns from SIP.

Time horizon

Your time horizon, or the duration for which you plan to stay invested, is another crucial factor in determining the right time to invest in SIPs. If you have a long-term investment horizon, say 10-15 years, you have the advantage of riding out market ups and downs, and hence, you can invest in SIPs at any time. However, if you have a short-term investment horizon, say 1-3 years, you should be more cautious and invest in SIPs during a period when the market is stable.

Therefore, the right time to invest in SIPs depends on several factors, such as personal financial goals, time horizon, market conditions, and discipline. The key is to start investing as early as possible, remain focused on your long-term financial goals, and avoid making investment decisions based on short-term market trends. Additionally, investors should always seek professional advice before investing in SIPs to assess their risk appetite and investment objectives. You can visit ZFunds for expert advice regarding mutual fund investing. You can invest in daily SIP, or opt for lump sum investment on our website and app.

0 notes

Text

What are Index Funds? Which Index Fund Should You Invest In?

https://wizely.in/wizeup/index-fund-definition-types/Many people seemed to be interested in Index funds these days and we believe that is a good thing. Index funds are the easiest and cheapest ways to passively invest in the stock market.

So let us understand what are Index funds and how you can invest in these funds.

What is an Index Fund?

An index fund is a type of a mutual fund that tracks any particular index. You must have heard of the Nifty 50 index. This index has the top 50 companies in the country. Now if you invest in a Nifty 50 index fund. What you are basically doing is that you are investing in the top 50 companies in the country. Here are some key things you need to know about Index funds.

Earn up to Rs 25 lakhs in cash rewards with Wizely Wednesdays.

Download Wizely

How Much is the Fee to Invest in Index Funds?

Low fees is one of the main reasons why investors opt for index funds. On average, the fees for most index funds is between 0.1 to 0.2 %. This is much lesser compared to the average 1% that is charged by most actively managed funds.

Also read: Here's How You Should Invest at Every Age

How Much Risk?

The second reason why investors opt for index funds is lower risk. When you choose an actively managed fund then your returns are dependent on the performance of your fund manager. However, when you invest in Nifty 50 then your returns depend on the performance of the markets. Since, Index funds are well diversified and invest in the top companies of the country the risk factor and volatility is relatively low.

Download the Wizely app and start earning financial rewards daily for good financial habits.

Download Wizely

How Much Return?

Now coming to the main point. How much money can you make investing in Index funds? Well historically, Index funds have delivered about 12% return. If the markets continue to do well and India continues to remain on a decent growth trajectory then we can expect similar returns going forward as well.

Also read: Interest Rate: Definition, Formula and Calculation

Which Index Fund Should I Invest in?

So which index fund should you invest in? Ideally you should choose the one with the lowest expense ratio since all the index funds should deliver the same returns. You can however choose which index you want to track. So like Nifty 50 tracks the top 50 companies. The nifty next 50 would track the biggest 50-100 companies in the country etc. If you just want to invest in just 1 index fund and are looking for a low risk opportunity you could go for a Nifty 50 index fund.

How do I Invest?

If you want to invest in an Index fund you can do that through many websites like Groww, ET Money etc. It’s a simple process and you can invest either a lump sum amount or through an SIP.

One interesting question that is often asked is ‘Should one invest in index funds if already invested in a large cap mutual fund?’

As we discussed, an index fund invests in all top 50 companies so a lot of the stocks in an index fund will be common with a large cap mutual fund. If you have already invested in a large cap fund and are happy with its performance then you can skip investing in an index fund otherwise there is no exact answer for this. It totally depends on the kind of risk you want to take.

An index fund on average gives 12 % return.

A good large-cap fund could deliver around 15% while a poor large-cap fund could deliver around 10%.

If you want to take the risk of choosing for that extra 3% then you could go for large-cap funds otherwise you should stick with index funds. Also remember that a large cap fund would charge 1-2% fees while an index fund would charge only 0.2% so unless your large cap fund performs significantly better, you will not make more money with them.

For more information, visit here

https://wizely.in/wizeup/index-fund-definition-types/

0 notes

Text

A Miraculous TikTok Account

Part 9

First

Previous

Next

Chat laid back in his bed but, for once, he wasn’t tired.

He was set to go on patrols that night, so he’d pretty much done everything he’d wanted for the day earlier. He’d gotten all his sleep, watched every video, finished his skin and hair care routines…

Only to find out that, hey, he didn't actually need to do that because Hawkmoth had chosen today to akumatize someone.

So patrols were out of the question. Hawkmoth had a recharge time of a few hours it seemed, but he usually didn’t do multiple akumas on the same day. They were always less powerful when he did too many in quick succession.

Well, at least he could go fight the akuma, right?

Wrong.

Because it was quickly brought to his attention that he actually couldn’t go, because the akuma was Mr. Pigeon and he quite famously had a bird allergy.

So the three women had all headed out (Carapace had stayed behind to finish an essay) and Chat had been left behind.

He scrolled through TikTok for a while. The app was definitely watching him, because almost all the content on his For You Page was animal videos…

Not that he minded.

But he could only handle so much cuteness at once, so that only worked for a few minutes.

Next, he went on Twitter to see what everyone was currently arguing about. That was bound to be entertaining…

Unfortunately, it seemed everyone in Paris was more concerned with the akuma than anything else at the moment. He didn’t need action shots of his housemates or to know more about Mr. Pigeon’s new plan to take the birds to space or whatever so he can… feed them? What?

The only other notable app on his phone was Instagram, but he wasn’t about to go on that. He was supposed to be in Tibet at some fancy private school, if people saw he was active he’d have to come up with answers to the millions of questions he’d inevitably get.

Now what…?

He pushed himself up to a sitting position with minimal groaning and attempted to run a hand down his face despite his mask.

Screw it. He was bored. He’d go bother Carapace.

He shuffled two doors down. He knocked twice…

There was a scrambling sound before he got a yell to come in.

When Chat actually did so, he found Carapace fastening his mask to his face. He was sitting at his desk, the area around him littered with crumpled pieces of paper.

“Salut?”

Chat batted away some with his feet as he made his way towards Carapace. “Salut. Chloe would kill you if she saw how much paper you’re wasting.”

“Paper is biodegradable, isn’t it?” Said Carapace with a slight grin.

“True.”

“... is there a reason you’re here?”

Chat didn’t answer, instead he slung himself over Carapace’s lap and laid there like a giant housecat. Which he pretty much was.

Carapace wasn’t even all that surprised.

All of the miraculous holders were well aware that the miraculous had side effects for them. They seemed to have attributed his constant need to be in contact with others as one of the side effects.

Chat knew that wasn’t the case, he was just Like That, but who was he to tell them they were wrong?

Carapace reached down and gave his hair a tiny ruffle and then went back to work.

Chat pulled out his phone again and started scrolling idly through Twitter for something to do (also he was kind of curious about the space pigeons now). The sound of Carapace’s pencil on the paper and his tiny sighs and curses were the only noises in the room for a while…

His eyes slid over the room. The bed looked untouched, there were a few empty energy drink cans strewn about, but other than that...

“So, wait, is homework literally all you do when you’re in here?”

“It’s all I have energy for outside of working out and patrols most days. Why?”

Chat rolled over to look up at him. “It’s just… you’re so…” He tried to think of a way to phrase it nicely, but when he couldn’t he settled for: “boring…?”

Carapace frowned a little. “And you’re so annoying!”

Chat flinched. As most people do when someone insults them.

His face softened and he groaned a little. “... sorry. That wasn’t… I’m just a little stressed out about school. This paper is due at midnight and I don’t know what to write.” He cracked a half smile and motioned to all the wads of paper. “As you might have been able to tell.”

He relaxed as well. “Yeah. I hear school is stressful.”

“You hear…?”

He hesitated. They were supposed to keep most things about their lives as civilians a secret, but… there was no way he could figure out who he was from this piece of information, so: “I was homeschooled.”

Carapace raised his eyebrows, thought about it, then nodded. “That makes sense.”

“Huh?”

“You have sheltered rich kid vibes.”

“... thanks?”

“No problem,” he responded easily. He set his pencil down and stretched as much as he could with someone still laying across his lap. “So. You had to have had a good education. Have any tips for my essay?”

Chat yawned and closed his eyes. “Depends. What’s the subject?”

“Film history.”

“... I don’t know anything about that, I don’t think, sorry. Ladybug or Rena might, ask them when they get back.”

Carapace laughed a little. “I don’t need information, if I did at least then I could just look it up, I just don’t know how to… write?”

He blinked his eyes open and then looked at him. “I can help if you just need to get your thoughts in order.”

“Really?” Said Carapace, his face lighting up.

Chat groaned a little as he stretched out. “Sure. Let me get a whiteboard.”

“We have paper…?” He said, watching his housemate get up and start walking out of the room.

“Shhhh, it’s for the aesthetic.”

Chat walked to the fridge and grabbed the whiteboard and markers from it.

He took a quick picture of the board so he could put everything back on it when he was done. Rena had apparently been doing some calculations on it. He remembered, vaguely, that she had mentioned calculating Hawkmoth’s height…

Holy crap. That’s tall. Sure, Hawkmoth was tall, but was he really THAT tall?

He shook his head slightly and erased, then returned to Carapace’s room. He smiled as he held them up for him to see.

“Tada.”

“So… what are we doing?”

“You --” Chat pointed a marker at him. “-- are going to talk about everything you know on the subject. I --” He pointed at himself. “-- am going to put everything in categories and we can go from there.”

Chat very quickly discovered why he was having so much trouble getting anything down. Carapace was… let’s call it ‘passionate’. The moment he started speaking his words tumbled out so quickly that Chat had had to scramble to pull the cap off of the marker so he could start sorting.

But, really, it always is nice to hear someone ramble about something they’re passionate about. Chat had to fight an urge to just watch and listen to Carapace as he talked about how ‘absolutely insane the textbook is for not going that much into eastern theater when there’s so much to talk about about kabuki theater alone --.’

Two hours and many struggles to fit so much information into such a compact space later, Carapace had run out of things to talk about.

“... is there a page limit?” Said Chat as he tossed over a water.

Carapace caught it without even really looking and took a few sips before speaking again: “Uh… yeah. Five pages max. That’s… my main problem.”

Chat looked at the board. What was on there alone was probably two pages in itself and that was just the general names of the topics…

He tipped his head from side to side and then circled a part of it. “Behold. That’s probably around four, and then you can do a bit of extra plus an introduction and conclusion.”

Carapace looked like he was going to cry.

“Are you… okay?”

He sniffled and wiped his eyes. “Where have you been all my life?”

“Uh… being homeschooled?”

“Oh. Right.”

Chat slung himself over Carapace’s lap again as he got to work. He scrolled through his phone for a while.

He jumped a little when he got a text. Still not used to that.

He opened the message.

Ladybug: We’ve washed off and changed clothes so your allergies won’t be irritated. Heading home now.

Kittychat: Thanks :D

He got left on read by three people, but that’s fine.

“They’re on their way back.”

Carapace grinned. “Wow, they beat Mr. Pigeon? Shocker!”

When Chat laughed a little, Carapace’s grin got a little more mischievous.

“Seriously, though, imagine losing to Mr. Pigeon. Couldn’t be me.”

“I am allERGIC --!”

He was cut off by Carapace’s laughter and, after a moment, he joined in.

They lapsed into a comfortable silence…

Then Chat got an idea. A small smirk made its way onto his face.

“You said that your account was going to be showing the world that we’re all normal people under the masks, right?”

“Among other things…?”

“Want to mess with the others and get some footage?”

“You complete me. C’mon.”

Carapace snatched his phone off his desk and they headed down to the living room to prepare.

~~~

Taglist

@nathleigh @mialuvscats @sassakitty @th1s-1s-my-aesthet1c @blueslushgueen @woe-is-me0

#a miraculous tiktok account#chat noir#adrien agreste#carapace#nino lahiffe#ladybug#marinette dupain cheng#queen bee#chloe bourgeois#rena rouge#alya cesaire#miraculous team#miraculous fic#ml fic#rewriting miraculous#chloenette#chlonette#adrino

69 notes

·

View notes

Text

Beautiful Mistakes

AO3 @tsshipmonth2020

Masterpost- Previous- Next

Summary- Remy can't think before he has his coffee and that causes problems for him and his soulmate.

A/N- Slightly altered so that the marks disappear a few minutes after they’ve been received.

Day 9 Remile- Whatever you draw on your skin shows up on your soulmate

Emile could feel the slight itch on his cheek that indicated a message from his soulmate had appeared. He flushed with embarrassment but kept his composure. He quickly scrawled on his wrist.

Not now, Rem. I'm with a client.

He turned back to his patients with a smile and his wrist itched as Remy replied.

Oops

"Doc, you okay?"

"My apologies, my soulmate likes to send messages when he wakes up. Except he works… at night," Emile sighed, affectionately yet exasperated.

"Well the flags look cute, I guess as long as you're okay with your patients knowing..." Dot smiled and nodded encouragingly.

Emile paled, "he didn't…"

"I think he did," Larry replied.

Emile put a hand to his cheek, "it's a pride flag isn't it?"

"Oh don't worry, Doc! It's so cute! Larry, isn't it cute?"

"He's going to be rather upset with me. I can't check it, and he's not out at work yet… but enough about me, back to Dorry! Or if you prefer, Larrydot?? " Emile grinned despite the looks of confusion the couple were giving him. His cheek and wrist continued to itch but he insisted on staying focused on the session.

By the time Larry and Dot were leaving, the itching had crawled up his forearm. Remy must be rather upset.

He checked his watch. The next appointment was in 20 minutes. He could take 5 to read through the tirade and would still be able to review notes for the next couple. He rolled up his sleeve to see a block of text that grew more frantic the farther it got up his arm.

Babe check out the drawing!

I worked hard on that girl pls appreciate me

Em i have work in an hour

Look. At. Your. Cheek.

This isn't funny!

Okay it was supposed to be funny but i can't have a gay flag on my face at work they will kill me!!!!

Bitch

Bitch

You don't love me im gonna die because you don't love me

No one is gonna believe me if i have to lie about this

Please????

>:[

Emile chuckled and wrote back quickly.

This is your fault for drawing on your cheek. You know I work and can't check messages right away.

He checked the time again and pulled out his phone, opening the camera app. He admired the little gay flag crossed with a pan flag. He took a quick selfie to preserve the drawing on his phone. It really was sweet, if unfortunately timed. Luckily, most of his clients would be fairly understanding. Remy's coworkers on the other hand would not.

The tirade on his arm had faded and been replaced with a new line from Remy.

Don't judge me I didn't have my coffee yet girl

Emile chuckled and pulled his sleeve back down, finding the file and notes he had for the next couple's session.

Remy sat in his car, obsessively checking the mirror until the flags on his cheek faded away. The last thing he needed was to get outed by a soul mark. He was usually late anyway because of the line at Starbucks, what harm would one more day do?

A lot of harm, apparently.

His boss was waiting by the loading dock, impatiently tapping his foot as Remy strolled up.

"'Sup? What are we-"

"Don't even bother clocking in. You don't do shit here and this is the fifth time you've been late this month. You're done."

Remy sputtered, "this is homophobic!"

His boss stared hard at him, eyes narrowing, "You're lazy and you're gay? You're FIRED!"

"Whatever! Your loss, you prick!" Remy turned and flipped the man off as he walked back to his car. He got in and locked the doors, taking some deep breaths. He considered writing to Emile, but decided this was probably an in-person topic.

He restarted the car and drove home, mentally preparing for a lot of explaining.

Emile was surprised to see Remy's car in the driveway when he got home and more than a little concerned. He parked and hurried inside. He found his soulmate sitting in the dark, sipping coffee, and scrolling instagram.

"Remy? Are you okay?"

"Got fired."

"Oh my stars! What happened?"

Remy gave an exasperated sigh, "he didn't like me being late. He also blamed me being gay so idk maybe there's a lawsuit there."

"Was it because of the flags? I tried to check as soon as possible…"

"No… I'm usually late anyway," Remy sank deeper into the couch and Emile moved to sit down next to him, placing a hand on his shoulder.

"Maybe it was time for a career change. You can find somewhere more accepting with less crazy hours."

"Maybe I'll become a stripper. They make good money right?" Remy mused, leaning into Emile’s side. The other man wrapped him in a one armed hug.

"While I am sure you'd be a natural, I'd be very concerned for your safety as a sex worker, dear. What about something you're passionate about?" Emile tried to be encouraging, numbers running through his head calculating exactly how long they could live off a single salary.

The outlook was not super promising.

"Don't worry, babe, I'll do some research tonight and fill out some applications. Promise," Remy gave Emile a smile that was skin deep, "what do you want for dinner? I'm starving."

After a week of Remy submitting applications and hearing nothing back, Emile was about ready to suggest the exotic dancer route himself. It wasn't that they were under financial stress (yet), moreso that Remy was a lot more rambunctious being cooped at home during the night. He kept waking Emile up too early and the loss of sleep was starting to affect his clients.

"Hey Doc? You're kinda unusually quiet today…"

Emile shook himself back to alertness, "sorry about that Elliott, where were we?"

"Um," they tapped their fingers together while thinking, "I think I was talking about how my soulmate never writes back. They check every message but I never get any from them. It doesn't… feel good."

"Remember what we've said before, Elliott, your worth isn't based on your soulmate. Whatever reason they choose not to write back, the fact of the matter is that you're still an amazing and powerful person in your own right."

Emile was interrupted by an itching on his wrist. Remy would usually still be asleep by now it was late enough in the morning.

He resisted the urge to check the mark as he spoke with Elliott and he could feel the itch crawling up his arm.

After the session, Emile quickly pulled up his sleeve, praying for good news.

I GOT IT!!!

Finally got an interview for tomorrow!!

<3 <3 <3

There were several more hearts and Emile allowed himself a small smile of relief. He doodled back a heart or two for Remy before returning his focus back to work.

They could celebrate when that interview turned into a position.

He greeted the next couple with a broader smile and a tad more exuberance, much to their dismay.

Remy was nervous. This job sounded too good to be true and they'd practically hired him on the spot. He wasn't about to let his soulmate down though.

He followed the man down the hall, sipping his tea for comfort.

"Honestly just don't let anyone eat anything inedible or hit each other and you'll do great," the man smiled, showing Remy into a room with a dozen kids and two other frazzled looking adults.

Piece of cake right?

Emile was in the middle of a session when he felt the itch on his cheek. He tried to smile through it, but then he felt more itches on his legs and arms and nose. His clients were too preoccupied actually talking through their issue with each other so Emile checked his arm to find a rainbow of scribbles that kept growing.

He put a hand to his face to cover his nose and cheek. What had Remy gotten himself into?

Pretty soon his clients were used to seeing Emile with colorful marks all over his face. He explained that his soulmate worked with kids and almost everyone nodded knowingly. He did ask that if they ever saw an inappropriate drawing they let him know so he could check it right away.

Some days he would draw little cartoons for the kids to fill in. They loved that and he always sent them little hearts back when they did a good job (they always did a good job).

And most importantly, Remy was having a great time with his job and got to be home at nights, so they saw each other a lot more often. They both enjoyed that.

#tsshipmonth2020#Soulmate September 2020#writing on skin#cussing#remile#remy sleep#emile picani#larry and dot#elliott#homophobia#soulmate au

49 notes

·

View notes