#SIP investment

Text

Secure Your Future with SIP Mutual Funds | Mahindra Manulife

Invest systematically and build wealth over time with SIP mutual funds at Mahindra Manulife. SIP, or Systematic Investment Plan, offers a disciplined approach to investing by allowing you to invest small amounts regularly. With Mahindra Manulife's SIP mutual funds, you can harness the power of compounding and achieve your long-term financial goals. Our expert advisors guide you through the process, helping you select the right SIP plans that align with your risk tolerance and investment objectives. Start your journey towards financial security and wealth accumulation today with SIP mutual funds from Mahindra Manulife

2 notes

·

View notes

Text

How Does SIP Work? When to Invest in SIP ? Types Of SIP?

SIP Scheme is an investment option where instead of putting a lump sum amount into mutual funds, the investors can invest a certain amount of money in mutual funds over a while. The investors can start SIPs at just INR 500 per month. SIP returns help them to accumulate wealth over a large period.

Once you apply for one or more SIP mutual fund plans, the amount is deducted from your registered bank account and invested in your mutual fund schemes. After making the first payment, you have the option to set the biller for auto-payments at the predetermined time intervals in the future. At the end of the day of the payments, the units of mutual funds are allocated to your account depending upon the NAV of the mutual funds.

When to invest in a SIP?

SIP Schemes can be started anytime the investing objectives of clients are matched with suitable schemes and associated risks. The plan must suit the long-term goals of the investors. So, there is no better day to start SIP than today, the sooner the better.

Types of Systematic Investment Plan (SIP)

There are 3 types of SIP Schemes you can start-

Perpetual SIP

This SIP scheme allows the investors to make investments without an end to the mandate date. Here the investor has the option to withdraw the amount invested as per his choice. Generally, a SIP carries an end date after 1 Year, 3Years or 5 years of investment.

Top-up SIP

As the name suggests, in this SIP scheme you have the option to increase the amount of investment periodically. Such increment could be due to an increase in income, promotion, or availability of additional corpus. Such funds are really helpful in making the best out of investment opportunities where the best and high-performing funds at regular intervals are available at lower prices.

Flexible SIP

Flexible SIP Schemes allow investors to increase or decrease the amount of investment as per/her choice. The investor can invest as per his own cash flow needs or preferences.

Benefits of investing in SIP

There are multiple SIP benefits over investing in Lumpsum. We have listed some of them as follows-

Disciplined investment: SIPs allow you to make periodic investments in a scheme that helps you to accumulate surplus or plan out for future events like retirement, foreign trips, children’s education & marriage. These plans help people who aren’t well-versed in the financial world and don’t have enough time to analyze the market movements from time to time. You can simply consult your financial planner and choose the right SIP scheme suitable for your financial needs. The sum would get auto deducted from your bank account so you don’t need to worry about on-time payments.

2 notes

·

View notes

Text

Mastering Mutual Fund SIP: Your Guide to Systematic Investment Plans and Dividend Mutual Funds

Introduction:

Investing in mutual funds has become an increasingly popular way to grow wealth over time. Among the various investment strategies available, the Systematic Investment Plan (SIP) stands out for its simplicity and effectiveness. This blog explores the benefits of mutual fund SIPs, how they work, and why dividend mutual funds might be a perfect fit for your portfolio.

What is a Mutual Fund SIP?

A Systematic Investment Plan (SIP) is a method of investing a fixed amount in mutual funds at regular intervals, typically monthly. This disciplined approach allows investors to accumulate units over time, regardless of market conditions. By investing systematically, you can benefit from the power of compounding and rupee cost averaging, which can potentially enhance your returns in the long run.

How Does a Mutual Fund SIP Work?

When you invest in a mutual fund SIP, you commit to purchasing a certain amount of mutual fund units on a regular basis. This method ensures that you buy more units when prices are low and fewer units when prices are high. Over time, this strategy can reduce the average cost per unit, mitigating the impact of market volatility. Here's a step-by-step process of how a mutual fund SIP works:

1. Choose a Mutual Fund: Select a mutual fund that aligns with your financial goals and risk tolerance.

2. Decide the SIP Amount: Determine the amount you want to invest regularly. It could be as low as INR 500 per month.

3. Set Up the SIP: Register for the SIP with your chosen mutual fund house or through an online investment platform.

4. Automatic Deductions: The SIP amount will be automatically deducted from your bank account on the specified date each month.

5. Monitor and Adjust: Regularly review your investments and adjust the SIP amount if needed to stay on track with your goals.

Benefits of Investing in Mutual Fund SIPs

Mutual fund SIPs offer numerous benefits, making them an attractive option for both novice and seasoned investors:

- Disciplined Saving: SIPs encourage regular saving and investment, instilling financial discipline.

- Rupee Cost Averaging: By investing regularly, you spread your investment over time, reducing the impact of market volatility.

- Power of Compounding: Earnings from your investments are reinvested, leading to exponential growth over time.

- Flexibility: SIPs offer the flexibility to increase, decrease, or pause your investments based on your financial situation.

- Accessibility: With a low minimum investment requirement, SIPs make mutual funds accessible to a wide range of investors.

Exploring Dividend Mutual Funds

Dividend mutual funds are a type of mutual fund that focuses on providing regular income to investors through dividends. These funds invest in companies that are known for paying high dividends. Here’s why dividend mutual funds could be a valuable addition to your portfolio:

- Regular Income: These funds provide a steady stream of income through regular dividend payouts, which can be particularly beneficial for retirees or those seeking supplementary income.

- Capital Appreciation: While the primary focus is on income, dividend mutual funds also offer the potential for capital appreciation.

- Tax Efficiency: Dividends received from mutual funds are subject to dividend distribution tax, which can be more tax-efficient compared to interest income from fixed deposits.

- Stability: Companies that pay regular dividends are often financially stable, providing a level of security to investors.

Combining SIP with Dividend Mutual Funds

Investing in a mutual fund SIP that focuses on dividend-paying stocks can provide a balanced approach to wealth creation. This strategy offers the dual benefit of regular income and long-term capital growth. Here’s how you can make the most of this combination:

1. Select Dividend-Paying Funds: Choose mutual funds that have a track record of paying regular dividends.

2. Set Up a SIP: Start a systematic investment plan to invest in these dividend mutual funds regularly.

3. Reinvest Dividends: Consider reinvesting the dividends to purchase more units, leveraging the power of compounding.

4. Review Performance: Regularly monitor the performance of your funds and make adjustments as needed to align with your financial goals.

Conclusion

A mutual fund SIP is a powerful tool for building wealth systematically and achieving financial goals. By combining SIPs with dividend mutual funds, investors can enjoy the benefits of regular income and long-term capital growth. Whether you are a new investor or an experienced one, incorporating a systematic investment plan into your portfolio can help you navigate market volatility and achieve financial stability.

Start your journey with mutual fund SIPs today and take a step towards a secure financial future. Remember, the key to successful investing is consistency, patience, and regular monitoring of your investments.

#investment portfolio#portfolio managers#portfolio management#investment portfolio management#portfolio manager#portfolio management services#sharemarket#sip#sip investment#mutualfunds#mutual fund sip#diversified mutual funds

0 notes

Text

This blog explains SIP (Systematic Investment Plan) and SIP calculators. SIP calculators help you estimate your future returns by considering factors like monthly investment amount, investment duration, and expected return. They are beneficial for financial planning, goal setting, and understanding the power of compounding. The blog also details how to use a SIP calculator, the formula behind it, and additional features like inflation adjustment. Remember, the calculator provides estimates and actual returns may vary. Consider factors like realistic return expectations, market volatility, and investment horizon for successful SIP investing.

#investkraft#finance#finance planning#financial calculators#sip calculator#sip return calculator#sip investment#Long Term Goals#investment

1 note

·

View note

Text

Invest in SIP !!!

Learn everything about SIP. Know how it works & why its is important as an investment. Calculate all your returns using SIP calculator.

0 notes

Text

Maximising Your Mutual Fund Investments with SIP Return Calculators

Mutual funds offer a way for individuals to pool their money together and invest in a diversified portfolio of stocks, bonds, or other securities. Managed by professional fund managers, mutual funds can help reduce the risk of investing and provide an easier path to the financial markets for individual investors. This collective investment scheme allows participants to benefit from the inherent advantages of large-scale investing, including reduced transaction costs and enhanced portfolio management. Understanding what is mutual fund and how it operates is crucial for anyone looking to start their investment journey.

To further enhance the benefits of mutual fund investments, many investors turn to Systematic Investment Plans (SIPs). SIPs allow investors to contribute a fixed amount of money into a mutual fund at regular intervals, taking advantage of dollar-cost averaging and the potential for compound interest over time. However, projecting the future value of these investments can be complex due to the variables involved, such as the amount invested, the frequency of investment, the expected rate of return, and the investment period. This is where a sip return calculator becomes an indispensable tool for investors.

This return calculator is an online tool designed to help investors estimate the returns on their SIP investments in mutual funds over a specific period. By inputting details such as the monthly SIP amount, the duration of the SIP, and the expected annual return rate, investors can get a forecast of their investment growth. This calculator simplifies the complex calculations involved in determining compound interest over varying periods, providing investors with a clear picture of how their money could grow. It enables investors to plan their investments more effectively, aligning their investment strategy with their financial goals.

The power of compounding plays a significant role in the growth of SIP investments. With each investment period, the returns earned are reinvested to generate more returns, leading to exponential growth over the long term. This effect is magnified in SIPs due to the regular intervals of investment, which ensure that the investor benefits from both the highs and lows of the market, averaging out the cost of investment.

Using this return calculator allows investors to experiment with different scenarios, adjusting the monthly SIP amount, investment period, and expected rate of return to see how these changes affect the potential outcome of their investment. This can be particularly useful for setting realistic savings goals and timelines, ensuring that investors are on the right track to achieving their financial objectives, whether it’s building a retirement nest egg, saving for a child’s education, or planning for a major purchase.

Individual investors can access the financial markets through mutual funds, which offer diversification and professional management. SIPs help investors improve their investment strategy through regular investing and compounding. This return calculator is essential for investors seeking clarity and confidence in their investments. Understanding investment returns allows investors to make informed decisions that align with their long-term financial goals, maximising mutual fund returns.

#mutual fund investment#sip calculator#sip calculator online#mutual fund sip calculator#sip investment

0 notes

Text

The SIP calculator is a crucial companion for investors seeking clarity and foresight in their financial journey. This online tool takes into account variables such as the investment amount, tenure, and expected rate of return to generate projections of potential returns. It transforms complex financial calculations into a user-friendly interface, allowing investors to visualize and plan their investment growth. The SIP calculator demystifies the intricacies of systematic investment planning, making it an indispensable resource for anyone keen on making informed financial decisions.

#stock trading#stock market#investing stocks#investment#stock#sip calculator#sip investment#arihant capital

1 note

·

View note

Text

SIP Investment Building Wealth through Smart Investment Strategies

Discover the power of SIP Investment a reliable and disciplined approach to grow your wealth steadily over time.

0 notes

Text

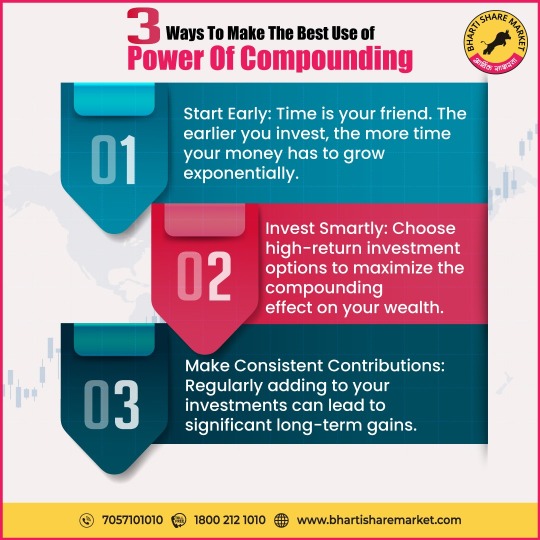

Power of Compounding in Stock Market.

0 notes

Text

The SIP Calculator, a beginner's ally, simplifies wealth planning. By inputting investment details, it demystifies Systematic Investment Plans, enabling newcomers to grasp and strategically plan for financial goals with ease and confidence.

0 notes

Text

Should You Invest In SIP?

Over the past five years, the stock market has witnessed an unprecedented surge in investor participation, with the majority favoring mutual funds as their investment vehicle of choice. Within this realm, the Systematic Investment Plan (SIP) has emerged as a game-changing strategy, captivating investors with its disciplined approach and promising returns. Let’s unravel the secrets behind SIP and understand why it stands out as the most effective way to navigate the dynamic landscape of mutual fund investing.

Why SIP? A Gateway to Financial Discipline:

One of the most significant challenges individuals face is saving money consistently. SIP tackles this issue head-on by instilling financial discipline through regular, automated investments. By committing to investing at regular intervals each month, SIP ensures that saving becomes a priority before discretionary spending.

Start Small, Dream Big:

One of the remarkable features of SIP is its accessibility. With an entry point as low as INR 500 per month, even individuals with modest earnings or limited savings can participate in the growth of the Indian stock market. SIP plans across various mutual funds open doors to wealth creation for a diverse range of investors.

Timing Stress? Not with SIP:

Unlike attempting to time the market, a daunting task even for seasoned investors, SIP alleviates the stress associated with market timing. Through the power of averaging, investors benefit whether the market is at its peak or in a downturn. The consistent investment intervals ensure a balanced portfolio over time.

Compounding Magic:

SIP harnesses the magic of compounding by reinvesting monthly returns until maturity. This compounding effect leads to exponential growth in your investment over time. The longer you stay invested, the greater the impact of compounding on your wealth.

Flexibility and Freedom:

SIP offers unparalleled flexibility, allowing investors to stop their plans at any point without incurring penalties. This freedom contrasts sharply with traditional investments like Fixed Deposits or Recurring Deposits, providing investors with control over their financial decisions.

Skip a Month, No Worries:

Life is unpredictable, and financial constraints may arise. SIP understands this reality, allowing investors to skip a month without penalties. This feature distinguishes SIP from rigid investment options, offering breathing room during challenging times.

Scaling Up with Extra Income:

As your financial situation evolves, SIP provides a seamless way to scale up your investments. If you find yourself with additional disposable income, starting another SIP plan in different mutual funds diversifies your portfolio and maximizes returns.

Emotion-Free Investing:

Emotions have no place in successful investing. SIP introduces discipline, steering investors away from impulsive decisions driven by market fluctuations. By sticking to a systematic approach, investors shield themselves from short-term volatility and emotional reactions.

Past Performance: A Glimpse into the Future:

The success stories of SIP investors speak volumes. Consider a SIP of ₹3000 per month in HDFC Top 200 initiated in 1999. Over 15 years, a total investment of ₹5.4 lakh burgeoned into almost ₹35 lakh. Similarly, Franklin India Prima Plus, with the same SIP amount, turned ₹5.4 lakh into nearly ₹31 lakh in 15 years. These examples underscore the long-term wealth-building potential of SIP.

Key Takeaways: Mastering the Art of SIP Investing:

1. Discipline is the Key:

- SIP embodies disciplined investing, promoting consistency over time.

2. Diversification through Multiple SIPs:

- Investors can diversify their portfolio by initiating SIPs in two or more funds.

3. Tax Benefits with SIPs:

- Certain SIP investments are eligible for tax deductions under Section 80C of the Income Tax Act, providing an additional financial incentive.

4. Harness the Power of Compounding:

- To fully benefit from compounding, it’s crucial to hold onto investments for an extended period.

5. Start Early, Stay Committed:

- Beginning your SIP journey early is akin to planting the seeds of wealth. Patience is key, and the earlier you start, the more significant your financial harvest.

Conclusion:

In the ever-evolving landscape of financial markets, SIP emerges as a beacon of financial prudence and growth. Its ability to instill discipline, coupled with the flexibility it offers, makes SIP a powerful tool for investors of all levels. As we navigate the complexities of wealth creation, SIP stands as a testament to the idea that consistent, disciplined investing is the cornerstone of financial success. So, embark on your SIP journey, stay committed, and let the power of compounding pave the way for a prosperous financial future.

For more information or To open Trading / Demat Account — Visit our Website 👩💻

𝐰𝐰𝐰.𝐢𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭𝐨𝐫𝐨𝐧𝐥𝐢𝐧𝐞.𝐜𝐨𝐦

To talk to our expert team — Call us ☎️

+𝟗𝟏 𝟕𝟗𝟔𝟗𝟏 𝟓𝟑𝟔𝟎𝟎

#stock market#investing#sip investment#systematic investment plan#finance#systematic review#investmentor#stocks news#savings#wealth management#share market#investing stocks#bse#nse#indian stock market#tradinginsights#smart investing#financial planning#passive income#financial strategy#personal finance#investmentor securities#forex trading#forex education#forexmarket

0 notes

Text

Secure Your Future with SIP Mutual Funds | Mahindra Manulife

Invest systematically and build wealth over time with SIP mutual funds at Mahindra Manulife. SIP, or Systematic Investment Plan, offers a disciplined approach to investing by allowing you to invest small amounts regularly. With Mahindra Manulife's SIP mutual funds, you can harness the power of compounding and achieve your long-term financial goals. Our expert advisors guide you through the process, helping you select the right SIP plans that align with your risk tolerance and investment objectives. Start your journey towards financial security and wealth accumulation today with SIP mutual funds from Mahindra Manulife

0 notes

Text

Differences Between Mutual Funds and SIP: Which is the Best Investment Strategy?

Mutual funds and Systematic Investment Plans (SIP) are two popular investment options for retail investors in India. Deciding which one is better for your financial goals can be confusing at first. This article aims to demystify mutual funds and SIP to help you make an informed decision. While mutual funds allow you to invest a lump sum into a variety of assets managed by a fund manager, SIP lets you invest smaller fixed amounts periodically into a mutual fund scheme. Mutual Funds vs SIP - understanding the differences between these two can help you choose the right option aligned with your investment objectives and risk appetite.

A sip investment in mutual funds simply means investing a fixed amount regularly in a mutual fund scheme. SIPs allow you to invest small amounts periodically, say monthly or quarterly, to build a large corpus over time. The key benefit of SIP is rupee cost averaging, which helps reduce market timing risk. By investing a fixed amount regardless of market fluctuations, you end up buying more units when the market price is low and fewer units when the price is high. This averages out the purchase cost over time.

Mutual funds are professionally managed investment vehicles that pool money from numerous investors to invest in various asset classes like equity, debt, gold etc. Based on the composition, they are categorised as equity funds, debt funds, hybrid funds, solution-oriented funds, index funds etc. The funds are managed by expert fund managers who aim to generate inflation-beating returns over time.

The main difference between mutual funds and SIP is that mutual funds are the investment product while SIP is a disciplined method of investing in them. You can invest in mutual funds through SIP or via lumpsum investments. SIP helps make the process more disciplined, and automated and reduces risks significantly.

Now which one is better depends on your financial situation and goals. If you have a large lump sum amount to invest, going for mutual funds directly can help deploy the capital immediately into the market. But SIP is a better approach if you want to invest smaller fixed amounts regularly. It enforces discipline and provides flexibility to invest according to your capacity.

SIP works very well for goals that are 5-10 years away as it allows your corpus to grow steadily over time. By investing regularly, you benefit from rupee cost averaging and compounding. For young investors starting their investment journey, SIP is often the better approach compared to direct mutual funds.

However, both mutual funds and SIPs have their advantages. SIP helps you start with small amounts and invests automatically. Direct mutual funds allow quick capital deployment. Based on your specific needs, you can use either or both in tandem to build long-term wealth. SIP can help build the core portfolio which you can supplement with lumpsum investments.

1 note

·

View note

Text

Maximize Your Wealth: Unveiling the Best SIP Plans and Returns

Introduction

Welcome to our comprehensive guide on Systematic Investment Plan (SIP) returns and the pursuit of the best SIP plans to accelerate your wealth accumulation journey. At The Gainers, we're dedicated to helping you make informed investment decisions that align with your financial aspirations.

Understanding SIP and Its Benefits

A Systematic Investment Plan (SIP) is a disciplined approach to investing in mutual funds, where you contribute a fixed amount regularly over time. SIPs offer several advantages, including:

- Rupee Cost Averaging: SIPs enable you to buy more units when prices are low and fewer units when prices are high, averaging out the cost per unit over time.

- Compounding Returns: By consistently investing over the long term, you benefit from the power of compounding, where your investments generate returns on returns.

Exploring the Best SIP Plans for Optimal Returns

When selecting the best SIP plans, the focus is on identifying funds with a proven track record of generating superior returns over time. At The Gainers, we analyze various SIP options to recommend plans that align with your risk tolerance and investment goals. Our approach includes:

- Performance Analysis: We evaluate best SIP plans and returns based on historical returns, consistency, and fund manager expertise.

- Risk Assessment: Understanding the risk profile of each SIP is crucial. We help you select plans that match your risk appetite while aiming for optimal returns.

Why Choose The Gainers for SIP Investments?

1. Expert Guidance: Our experienced advisors provide personalized guidance tailored to your financial objectives.

2. Transparent Approach: We believe in transparent communication, ensuring you understand the rationale behind our SIP recommendations.

3. Diversified Portfolio: Access a range of SIP options across asset classes to diversify your investment portfolio effectively.

Start Your SIP Journey with Confidence

Ready to embark on your SIP journey? Contact The Gainers today to explore the best Systematic Investment Plan (SIP) for optimal returns. Whether you're saving for a specific goal or building wealth for the future, our team is committed to helping you achieve financial success through disciplined and strategic investments.

Invest smart. Invest with The Gainers.

0 notes

Text

Securing your financial future demands a solid plan, and Systematic Investment Plans (SIPs) emerge as an ideal choice. SIPs, a disciplined mutual fund investment method, offer long-term wealth accumulation through regular contributions. Benefits include financial discipline, rupee-cost averaging, compounding interest, and flexibility. SIPs suit investors of all levels, with calculators aiding in estimating returns. Starting early and staying consistent amplify SIP benefits, ensuring a brighter financial future.

#investkraft#finance planning#financial calculators#investment#sip return calculator#sip calculator#sip investment#SIP Interest Rate

1 note

·

View note

Text

SIP Tax Saving: Maximizing Benefits through SIP | Bajaj Finserv Mutual fund

Discover the potential of SIP tax saving to optimize your investments. Learn how Systematic Investment Plans offer tax benefits and secure your future at Bajaj Finserv Mutual Fund.

0 notes