Text

A PPF calculator helps estimate how much your contributions to a Public Provident Fund (PPF) account can grow over time. It considers factors like your annual contribution, investment tenure, and the prevailing interest rate. This helps with financial planning, comparing investment options, and making smart investment decisions. The calculator uses a formula to determine the maturity value based on investment amount, interest rate, and tenure. You can find PPF calculators online and enter your desired investment details to get an estimated maturity amount. Remember, interest rates are revised quarterly and the calculator provides an estimate.

#ppfcalculator#ppfcalculatoronline#publicprovidentfund#investkraft#investment#financialplanning#investmentplanning#taxbenefits#longterminvestment#growyoursavings#ppfinterestrate#ppf

1 note

·

View note

Text

This blog explains SIP (Systematic Investment Plan) and SIP calculators. SIP calculators help you estimate your future returns by considering factors like monthly investment amount, investment duration, and expected return. They are beneficial for financial planning, goal setting, and understanding the power of compounding. The blog also details how to use a SIP calculator, the formula behind it, and additional features like inflation adjustment. Remember, the calculator provides estimates and actual returns may vary. Consider factors like realistic return expectations, market volatility, and investment horizon for successful SIP investing.

#investkraft#finance#finance planning#financial calculators#sip calculator#sip return calculator#sip investment#Long Term Goals#investment

1 note

·

View note

Text

In India, EMI calculators help you estimate monthly loan payments for education and home loans. This free tool allows you to compare loan options, plan your finances, and manage expectations. By entering loan amount, interest rate, and tenure, you can see how changes impact your EMI. Remember, EMI calculators provide estimates and don't account for all loan fees. Consider your overall financial situation and explore tax benefits before applying for a loan.

#best emi calculator#emi calculator#online emi calculator#emi#loans#financial calculators#Loan Planning#Manage Your Budget#loan calculator#financial tools#Estimate Your EMI#Smart Borrowing

1 note

·

View note

Text

This blog explores PPF investment and how to maximize your returns. It explains PPF calculators and their benefits. With a provided formula, it showcases how to calculate maturity amount. Strategies like early and regular investment, maximizing contributions, and extending tenure are recommended. Remember, PPF interest rates are subject to change, and consult a financial advisor before making any decisions.

#ppfcalculator#ppfinterestrate#financialplanning#interestrate#financialsecurity#ppfcalculatoronline#taxbenefits#smartinvestment#ppf#publicprovidentfund

2 notes

·

View notes

Text

Fixed deposits (FDs) are a popular investment in India offered by banks and financial institutions. They allow you to deposit money for a fixed period and earn interest. FDs are considered low-risk with guaranteed returns, but interest rates vary depending on factors like bank, tenure, and deposit amount. You can choose to receive interest payouts regularly or reinvest them for higher returns (compounding). FDs are suitable for risk-averse investors or those seeking a safe way to grow savings with predictable returns.

#fixeddeposit#fd#InvestInFD#SafeInvestment#BeatInflation#FDInterestRates#financial planning#GrowMoney

2 notes

·

View notes

Text

An EMI calculator helps estimate your monthly loan payment before you borrow. It considers loan amount, interest rate and tenure to show you the financial commitment. This allows you to compare loans and plan your finances accordingly. There are EMI calculators for home, car, education and personal loans. You can easily find them online and enter loan details to calculate your EMI. Remember to consider processing fees, prepayment charges and other costs besides EMI before finalizing a loan.

#investkraft#loans#financial calculators#emi calculator#emi#online emi calculator#best emi calculator#emi calculator in india

2 notes

·

View notes

Text

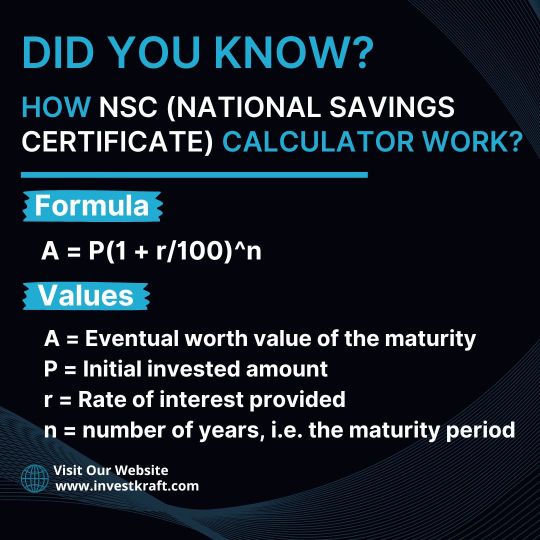

This blog post is about using an NSC calculator to estimate earnings on National Savings Certificates (NSCs) offered by the Post Office in India. NSCs are a safe investment with guaranteed returns but have a 5-year lock-in period. The calculator helps you input investment amount and see the estimated maturity amount and total interest earned. It is a good option for those seeking safe, long-term investment with tax benefits.

#investkraft#finance planning#investment#financial calculators#nsc calculator#nsc#nsc interest rate#National Saving Certificate#NSC Return Calculator

1 note

·

View note

Text

Securing your financial future demands a solid plan, and Systematic Investment Plans (SIPs) emerge as an ideal choice. SIPs, a disciplined mutual fund investment method, offer long-term wealth accumulation through regular contributions. Benefits include financial discipline, rupee-cost averaging, compounding interest, and flexibility. SIPs suit investors of all levels, with calculators aiding in estimating returns. Starting early and staying consistent amplify SIP benefits, ensuring a brighter financial future.

#investkraft#finance planning#financial calculators#investment#sip return calculator#sip calculator#sip investment#SIP Interest Rate

1 note

·

View note

Text

In today’s financial landscape, securing your future is paramount. Post Office Fixed Deposits (FDs) in India offer safety and attractive returns. The blog details the 2024 interest rates, benefits, and types of Post Office FDs. It explains how to calculate interest, choose the right scheme, and factors to consider. Additionally, it compares Post Office FDs to bank FDs and outlines who can invest and how to open an account.

1 note

·

View note

Text

Discover the power of the Public Provident Fund (PPF) and its calculator for secure savings. Plan your future with ease, estimating potential returns and making informed investment decisions. The calculator simplifies complex calculations, empowering goal setting and understanding compound interest. Learn about tax benefits, guaranteed returns, and flexible investment options. Utilize the PPF calculator for different scenarios, finding the right strategy for your financial goals. Start your PPF journey today for a secure financial future.

#investkraft#financial calculators#finance planning#investment#PPF calculator#PPF Interest Rate Calculator#PPF Return Calculator#PPF Interest Rate

1 note

·

View note

Text

Discover the simplicity of Systematic Investment Plans (SIPs) with SIP Calculator. Estimate potential returns by inputting investment amount, duration, and expected return rate. The formula computes future value, aiding informed decisions. SIP Calculator fosters accuracy, planning, and easy comparison. Accessible online, it empowers investors to achieve financial goals confidently. Start planning with SIP Calculator today to witness your wealth flourish over time!

#investkraft#sip calculator#finance planning#financial calculators#investment#SIP Return Calculator#SIP Return Rate Calculator#SIP Interest Rate

1 note

·

View note

Text

The National Savings Certificate (NSC) is a fixed-deposit scheme in India offering safe investment with attractive interest rates. Calculating its maturity amount aids financial planning by setting goals, comparing investments, and estimating tax liability. Factors affecting maturity include principal, interest rate, and tenure. Two methods are available: using an NSC calculator online or manual calculation using a formula. Understanding these methods helps in informed investment decisions.

#investkraft#investment#Financial Planning#nsc calculator#financial calculators#NSC Interest Rate#National Saving Certificate

2 notes

·

View notes

Text

What Documentation Do I Need to Calculate House Rent Allowance?

To calculate your House Rent Allowance (HRA), you'll need specific documents handy. Typically, you'll require proof of your rent payments, such as rent receipts or rental agreement copies. These documents verify the amount you pay for housing. Additionally, you may need to provide your salary slips, which demonstrate your income. Some organizations might also ask for a letter from your landlord confirming your tenancy. Remember, accurate documentation is crucial for a smooth HRA calculation process. If you're unsure about the required documents or need assistance with your HRA calculation, you can visit the Investkraft website. Investkraft offers helpful resources and tools to simplify financial planning, including guidance on calculating HRA.

#investkraft#HRA Calculator#House Rent Allowance#financial calculators#financial services#calculator

2 notes

·

View notes

Text

What Are the Limitations of Using a Net Present Value Calculator?

While Net Present Value (NPV) calculators are valuable tools for assessing investment opportunities, they come with limitations. Firstly, they rely heavily on assumptions, such as future cash flows and discount rates, which may not always reflect reality accurately. Additionally, NPV calculations may overlook qualitative factors like market volatility or regulatory changes that could impact investment returns. Furthermore, NPV calculators typically require users to input precise data, yet uncertainties in forecasts can lead to unreliable results. Users must also consider the risk of using outdated or incorrect information, which could skew NPV calculations. For a more comprehensive understanding of NPV calculator limitations, consider exploring resources like Investkraft's website. They provide insightful articles and guides on investment analysis, offering practical advice on navigating the complexities of financial decision-making.

#investkraft#finance#Net Present Value#NPV Calculator#calculators#financial calculators#financial services

0 notes

Text

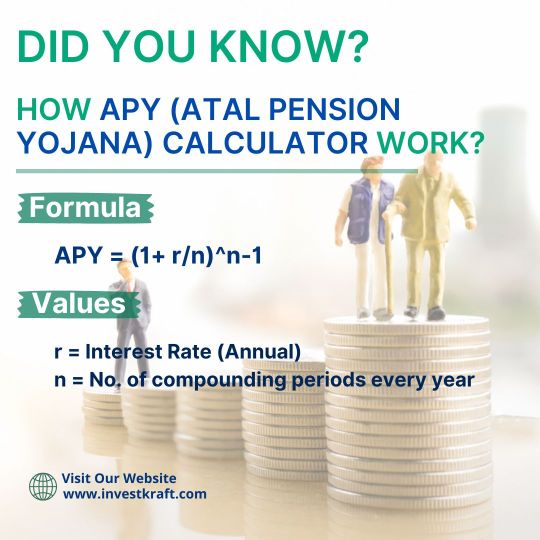

How Accurate Is the Atal Pension Yojana Calculator?

The accuracy of the Atal Pension Yojana (APY) Calculator, particularly on the Investkraft website, is generally reliable. This online tool estimates the pension amount one can receive under the APY scheme based on inputs like age, contribution amount, and the chosen pension plan. While it provides a useful estimate, it's essential to understand that the final pension amount may vary slightly due to factors such as changes in government regulations or economic conditions. However, Investkraft strives to keep its calculator updated to reflect any such changes, ensuring users get as accurate a prediction as possible. Overall, while the APY Calculator offers valuable insights into potential pension benefits, it's advisable to consult with financial experts for a comprehensive retirement planning strategy.

2 notes

·

View notes

Text

Can I Calculate NSC Returns Online?

Yes, you can easily calculate NSC (National Savings Certificate) returns online. Platforms like Investkraft offer user-friendly NSC calculators that help you estimate the returns on your investment. These calculators typically require you to input basic details such as the investment amount, the NSC's maturity period, and the prevailing interest rate. Investkraft's website provides a convenient tool where you can quickly input these details and get an instant estimate of your NSC returns. It's a hassle-free way to plan your investments and understand the potential gains from NSC investments. By using the NSC calculator on Investkraft's website, you can make informed decisions about your financial future without needing to perform complex calculations manually. It's a valuable resource for anyone considering NSC investments.

2 notes

·

View notes

Text

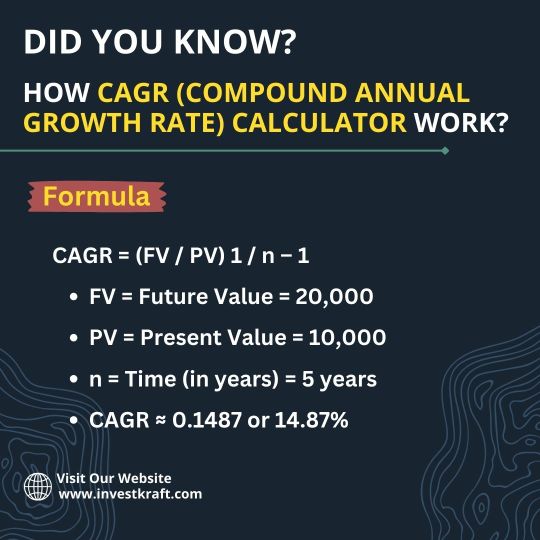

Looking for an Accurate Online CAGR Calculator?

If you're seeking an accurate online CAGR (Compound Annual Growth Rate) calculator, Investkraft website is your solution. With Investkraft, you can effortlessly determine the growth rate of your investments over multiple periods. This user-friendly tool simplifies complex calculations, making it accessible for everyone, from seasoned investors to beginners. Simply input your initial and final investment values, along with the time period, and let Investkraft do the rest. Accuracy is paramount when analyzing investment growth, and Investkraft ensures precise results every time. Whether you're planning your financial future or evaluating past performance, Investkraft's online CAGR calculator provides the reliable insights you need. Take control of your investments today with Investkraft and make informed decisions for a prosperous tomorrow.

#investkraft#finance#financial calculators#Compound Annual Growth Rate#CAGR Calculator#calculators#financial services

2 notes

·

View notes