#SatelliteDevelopment

Explore tagged Tumblr posts

Text

📢 FURTHER HIGH-GRADE INTERCEPTS AT KAMPERMAN – ASTRAL RESOURCES ADVANCES FEYSVILLE EXPLORATION ⚒️📈

Astral Resources NL (ASX: AAR) has reported further strong results from its latest diamond drilling program at the Kamperman Deposit, part of its 100%-owned Feysville Gold Project near Kalgoorlie, reinforcing the project’s potential contribution to the upcoming Mandilla Gold Project Pre-Feasibility Study.

🔍 Drilling Highlights:

• FRCD395: ▪ 20.5m @ 3.61g/t Au from 19.8m (incl. 0.6m @ 25.9g/t Au & 1m @ 17.8g/t Au) ▪ 18.8m @ 2.07g/t Au from 72.2m (incl. 1m @ 11.3g/t Au) ▪ Aggregate: 112.6 gram-metres

FRCD396: ▪ 4.2m @ 3.34g/t Au from 53.8m ▪ 10m @ 13.5g/t Au from 62.3m (incl. 2.5m @ 51.8g/t Au) ▪ Aggregate: 149.2 gram-metres

FRCD397A: ▪ 5.7m @ 1.83g/t Au from 109.5m ▪ 20.8m @ 2.15g/t Au from 120m (incl. 0.85m @ 12.7g/t Au) ▪ 3m @ 26.6g/t Au from 148.8m ▪ Aggregate: 138.2 gram-metres

📌 These results highlight multiple high-grade zones, structural continuity and the potential discovery of a new unmodelled high-grade lode.

🛠️ Exploration Momentum Builds: • 265-hole air-core program completed – assays pending

46-hole RC program now underway, targeting resource growth at Feysville

🗣️ “Kamperman continues to exceed expectations with every hole drilled. These results validate its potential as a high-grade satellite source for the Mandilla development,” said MD Marc Ducler.

Investor Outlook:

Astral Resources (ASX: AAR) is trading at $0.16 per share, offering exposure to a growing pipeline of high-grade gold assets in Western Australia. As metals markets remain robust, Astral’s continued exploration success at Feysville and Kamperman adds to its strategic advantage. With strong intercepts and resource updates on the horizon, investor sentiment may strengthen ahead of the Mandilla Pre-Feasibility Study.

📍Read More: https://www.investi.com.au/api/announcements/aar/4b2871f9-5db.pdf

⚠️ This update is based on official exploration results. Not investment advice — please do your own research before making investment decisions.

#AstralResources#ASXAAR#GoldExploration#KampermanDeposit#FeysvilleProject#MandillaGoldProject#HighGradeGold#DiamondDrilling#MetalsMarket#MiningStocks#GoldIntercepts#JuniorExplorers#ASXNews#ExplorationUpdate#MiningAustralia#GoldMining#GoldSectorUpdate#ResourceGrowth#InvestorOutlook#SatelliteDevelopment#PreFeasibilityStudy

0 notes

Text

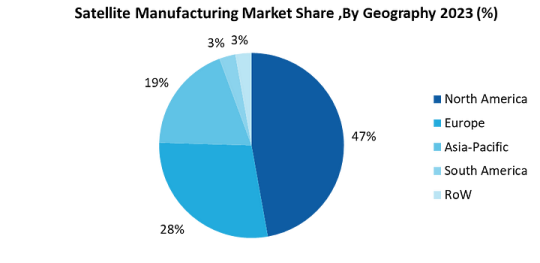

Satellite Manufacturing Market By Geography — Opportunity Analysis & Industry Forecast, 2024–2030

Satellite Manufacturing Market Overview:

Request sample:

Satellite manufacturing market is being reshaped by the Proliferation of Satellite Constellations and Miniaturisation of Satellite Technology. Next up is SpaceX’s Starlink project, which represents the rise of satellite constellations, with nearly 70 % of its 115 Falcon 9 launches in 2024 aimed at expanding its network. SpaceX launched 23 Starlink satellites on November 2024, 12 of which will have direct to smartphone connectivity and is pushing the boundaries of global connectivity to close the digital divide. On the other hand, the trend of miniaturisation is picking up, with Bengaluru based Pixxel achieving the milestone in July 2023. To develop compact satellites up to 150 kg in weight, with advanced technologies such as synthetic aperture radar and hyperspectral imaging, the company secured a multi-crore grant under the Ministry of Defence’s iDEX programme. These satellites, designed for the Indian Air Force, meet important defence and surveillance requirements and are part of the industry’s move toward smaller, cost-effective solutions with high impact capabilities.

Satellite Manufacturing Market- Report Coverage:

The “Satellite Manufacturing Market Report — Forecast (2024–2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Satellite Manufacturing Market.

AttributeSegment

By Solution

Hardware

Software

By Size

Small Satellites (up to 500kg)

Medium Satellites (500–1000kg)

Large Satellites (Above 1000kg)

By Range

Low Earth Orbit (LEO)

Medium Earth Orbit (MEO)

Sun Synchronous Orbit (SSO)

Geosynchronous Orbit (GEO)

By Application

Communication

Earth Observation & Remote Sensing

Research & Experiment

Reconnaissance

Mapping & Navigation

Others

By End User

Government

Defense

Commercial

Research Institutions

Maritime & Transportation

Academic

Others

By Geography

North America (U.S., Canada and Mexico)

Europe (Germany, UK, France, Italy, Spain, Netherlands and Rest of Europe)

Asia-Pacific (China, India, Japan, South Korea, Australia, New Zealand, and Rest of Asia-Pacific)

South America (Brazil, Argentina, Colombia, Chile and Rest of South America)

Rest of World (Middle East and Africa

Inquiry Before Buying:

COVID-19 / Ukraine Crisis — Impact Analysis:

The satellite manufacturing market was disrupted by the COVID-19 pandemic which led to delays in production and breaks in the supply chain. Labour shortages, delayed component deliveries, and deferred satellite launches were the result of lockdowns and restrictions. The pandemic saw communication and Earth observation satellite demand spike as remote connectivity and monitoring were relied on more, but manufacturers struggled to meet the demand in time.

The Russia Ukraine war had a significant impact on the satellite manufacturing market especially in terms of supply chain and geopolitical tensions. Russia is a major supplier of launch services and materials like titanium, propulsion systems, etc. At the outset of the war that disrupted access to the critical resources. sanctions on Russia added to difficulties, forcing manufacturers to look to alternative sources of supply. At the same time, the conflict drove up demand for military and reconnaissance satellites to track the situation in Ukraine and to maintain strategic communication.

Key Takeaways:

North America Dominates the Market

North America is the dominant region in the Satellite Manufacturing market largely due to the presence of players and substantial investments in the space sector. The United States, in particular, leads with companies such as SpaceX, RTX, Lockheed Martin and more which drive innovation in satellite manufacturing. Additionally, North America’s extensive launch infrastructure and high frequency of successful space missions support the demand for satellites. Additionally, the U.S government invests in satellites for surveillance, reconnaissance, and strategic defense applications which is driving the need for satellite manufacturing. In In November 2024, the Biden-Harris Administration announced CHIPS incentives awards to BAE Systems and Rocket Lab, underscoring North America’s leadership in the satellite manufacturing market. BAE Systems received $35.5 million to modernize its New Hampshire Microelectronics Center, significantly increasing production of critical MMIC chips for satellites and defense systems. Rocket Lab secured $23.9 million to expand its Albuquerque facility, boosting the production of space-grade solar cells essential for satellites and space programs like NASA’s Artemis. As the space economy continues to grow, including the need for satellite communications, Earth observation, and defense applications, North America’s robust framework positions it to retain its leading role in the global satellite manufacturing market.

Small Satellites Represent the Largest Segmen

In the Satellite Manufacturing market, small satellites are the dominant segment. Small satellites have revolutionized the satellite manufacturing landscape driven by their affordability, versatility and rapid development cycles. These satellites including nanosatellites and microsatellites are significantly cheaper to design, build and launch compared to traditional large satellites. Their compact size allows multiple small satellites to be launched on a single rocket reducing per-unit launch costs. Moreover, advances in miniaturized electronics and high-performance materials have enabled small satellites to perform complex tasks, from Earth observation and scientific research to navigation and defense. The rise of commercial constellations heavily relies on small satellite technology due to its scalability and ease of replacement. In May 2024, Revolv Space secured $27.33 million to enhance small satellite capabilities, highlighting growing demand in the segment.

Schedule A Call :

The funding will support the launch of its autonomous Solar Array Drive Assembly (SARA), designed to boost small satellite performance and meet the increasing needs of constellation operators. Additionally, research institutions leverage small satellites for educational purposes and low-cost experimentation further driving demand. All these factors combined with shorter production timelines and increasing innovation in modular designs position small satellites as a major segment in the satellite manufacturing industry.

LEO is the Largest Segment

In the Satellite Manufacturing market, Low Earth Orbit (LEO) has become the dominant segment due to its unique advantages and expanding applications. Satellites in LEO operate at altitudes between 500 and 2,000 km, allowing for lower latency in communications and higher-resolution imaging compared to higher orbits. This makes LEO ideal for Earth observation, remote sensing and real-time data transfer. Additionally, the reduced launch energy required to reach LEO contributes to lower overall mission costs makes it more viable for commercial ventures and smaller organizations. The growing trend of mega-constellations such as SpaceX’s Starlink and Amazon’s Kuiper relies on LEO for its ability to support large networks of interconnected satellites that provide global coverage. Furthermore, advancements in satellite design and propulsion systems enable efficient orbital deployment and maintenance within LEO. The World Economic Forum reckons that Earth observation data could add up to $700 billion in value by 2030, contributing $3.8 trillion to global GDP over that period. In addition, Earth observation can help to support policies and practices that could reduce over 2 billion tons of CO₂ emissions per year, making it an invaluable resource in the global sustainability field. With such a large economic and environmental influence, Low Earth Orbit observation is the largest application segment in the Satellite Manufacturing market. Additionally, the increasing private sector investments and evolving market demands ensure LEO’s continued dominance in satellite manufacturing.

Expansion of Satellite Constellations Boosts the Market

Expansion of satellite constellations is one of the major factors driving the Satellite Manufacturing Market, as can be seen from the recent growth of the European Galileo navigation system. Two more satellites were launched in September 2024, bringing the number of operational satellites to 32 in total. The placement of these satellites in medium Earth orbit at 23,222 km improves the constellation’s robustness and reliability. This expansion is crucial to guarantee the uninterrupted provision of high precision global navigation services, which Galileo intends to provide to more than two billion users around the globe. The demand for satellite manufacturing is still growing as more satellites are set to be deployed by 2026, and second-generation satellites are being developed. With countries and private companies investing in expanding their satellite networks for enhanced communication, navigation and data services, the opportunities to innovate and manufacture satellites more efficiently have never been higher. The growing need for satellite constellations is fueling the growth of the satellite manufacturing industry, which is accelerating advancements.

Buy Now:

High Cost of Materials to Hamper the Market

For more details on this report — Request for Sample

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships, and collaborations are key strategies adopted by players in the Satellite Manufacturing Market. The top 10 companies in this industry are listed below:

L3Harris Technologies Inc.

SpaceX

Lockheed Martin Corporation

RTX

Airbus

Boeing

Thales

AAC Clyde Space, Inc.

Ariane Group

Sierra Nevada Corporation

#SatelliteManufacturing#AerospaceIndustry#SatelliteTechnology#SpaceInnovation#NewSpaceEconomy#SatelliteDevelopment#AerospaceEngineering#SpaceTech

0 notes