#Single-use Bioprocessing Sensors

Explore tagged Tumblr posts

Text

India Single-use Bioprocessing Probes And Sensors Market To Reach $191.0 Million By 2030

The India single-use bioprocessing probes and sensors market is anticipated to reach USD 191.0 million by 2030 and is anticipated to grow at a CAGR of 12.61% during the forecast period from 2024 to 2030, according to a new report by Grand View Research, Inc. The increasing demand for biopharmaceuticals and the growing popularity of disposable systems in preclinical trials are key factors driving the growth of the single-use bioprocessing probes and sensors market in India. The need for faster and more efficient drug development processes and the rising demand for personalized medicines contribute to the increased implementation of single-use bioprocessing systems.

The implementation of single-use technology (SUT) in biomanufacturing processes offers advantages such as reduced risk of cross-contamination and ensuring product purity and integrity, which is crucial for the growing domestic biosimilars and biologics market. It enhances operational efficiency, leading to shorter turnaround times and increased productivity - a key benefit for Indian manufacturers to scale and meet the rising domestic and global demand for biopharmaceuticals.

Furthermore, the commercial advantages of single-use sensors, such as streamlined operations, enhanced flexibility, and improved regulatory compliance and product quality, make them an attractive option for Indian biomanufacturers. The adoption of these technologies can help Indian companies lower their capital expenditure and achieve faster turnaround times.

Request a free sample copy or view report summary: India Single-use Bioprocessing Probes And Sensors Market Report

India Single-use Bioprocessing Probes And Sensors Market Report Highlights

The pH sensors type segment held the largest revenue share of 20.24% in 2023 and is expected to grow at the fastest CAGR over the forecast period. The growing demand for precise process monitoring, driven by the expanding biopharmaceutical industry, drives the adoption of single-use pH sensors. The oxygen sensors segment is expected to register a significant CAGR over the forecast period.

The upstream segment dominated the segment with a market share of 73.49% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. It is driven by the increasing demand for biopharmaceuticals and the need for efficient and cost-effective manufacturing processes.

The biopharmaceutical & pharmaceutical companies dominated the segment with a market share of 41.69% in 2023. The consistent introduction of new and innovative single-use bioprocessing probes and sensors is a key driver behind the growth of this market segment.

India Single-use Bioprocessing Probes And Sensors Market Segmentation

Grand View Research has segmented the India single-use bioprocessing probes and sensors market based on type, workflow, and end use:

India Single-use Bioprocessing Probes And Sensors Type Outlook (Revenue, USD Million, 2018 - 2030)

pH Sensor

Oxygen Sensors

Pressure Sensors

Temperature Sensors

Conductivity Sensors

Flow Meter & Sensors

Other Sensors

India Single-use Bioprocessing Probes And Sensors Workflow Outlook (Revenue, USD Million, 2018 - 2030)

Upstream

pH Sensor

Oxygen Sensors

Pressure Sensors

Temperature Sensors

Conductivity Sensors

Flow Meter & Sensors

Other Sensors

Downstream

pH Sensor

Pressure Sensors

Temperature Sensors

Conductivity Sensors

Flow Meter & Sensors

Other Sensors

India Single-use Bioprocessing Probes And Sensors End-use Outlook (Revenue, USD Million, 2018 - 2030)

Biopharmaceutical & Pharmaceutical Companies

CROs & CMOs

Academic & Research Institutes

Others

List of Key Players in theIndia Single-use Bioprocessing Probes And Sensors Market

Thermo Fisher Scientific

Sartorius AG

PreSens Precision Sensing GmbH

Hamilton Company

Mettler-Toledo India Private Limited

PARKER HANNIFIN CORP

Danaher

Saint-Gobain

0 notes

Text

According to Nova One Advisor, the global single-use bioprocessing probes & sensors market size was valued at USD 3.85 billion in 2023 and is anticipated to reach around USD 11.27 billion by 2033, growing at a CAGR of 11.34% from 2024 to 2033.

0 notes

Text

Continuous Bioprocessing Market is driven by Process Intensification

Continuous bioprocessing integrates upstream and downstream operations in a seamless, uninterrupted workflow, replacing traditional batch methodologies with a steady-state production model. This approach enhances process efficiency by reducing cycle times, minimizing equipment footprint, and increasing overall product yield. Continuous bioprocessing systems leverage advanced sensors, real-time analytics, and automation to maintain optimal reaction conditions, ensuring higher consistency, improved quality attributes, and reduced risk of contamination. Key advantages include lower capital and operational expenditures, enhanced flexibility for multiproduct facilities, and accelerated time-to-market for biopharmaceuticals.

As the industry confronts growing demands for monoclonal antibodies, vaccines, and cell/gene therapies, Continuous Bioprocessing Market addresses capacity constraints while aligning with regulatory expectations for robust quality control. Increasing pressure to curb production costs and the need for sustainable manufacturing solutions further underscores the value proposition of continuous platforms. Adoption of this technology also opens new market opportunities for contract development and manufacturing organizations (CDMOs) and equipment suppliers. The integration of continuous upstream perfusion with continuous downstream capture and polishing steps fosters a modular, scalable paradigm that supports both clinical and commercial-scale production.

The continuous bioprocessing market is estimated to be valued at USD 429.0 Mn in 2025 and is expected to reach USD 764.3 Mn by 2032, growing at a compound annual growth rate (CAGR) of 8.6% from 2025 to 2032. Key Takeaways

Key players operating in the Continuous Bioprocessing Market are:

-AGC Biologics

-Biogen

-Bristol-Myers Squibb

-Sanofi Genzyme

-FUJIFILM Diosynth

Biotechnologies These market players leverage their extensive expertise in biologics manufacturing and robust R&D pipelines to develop integrated continuous workflows. AGC Biologics is expanding its global footprint through new facility investments that support perfusion and continuous capture. Biogen focuses on process optimization and digital twin technologies to enhance process insights and quality by design. Bristol-Myers Squibb invests in collaborative partnerships for next-generation chromatography and single-use technologies. Sanofi Genzyme pursues modular manufacturing units to enable rapid scale-up while maintaining stringent regulatory compliance. FUJIFILM Diosynth Biotechnologies drives market share growth by offering end-to-end continuous solutions, backed by advanced analytics and automation. Together, these market companies contribute to robust market analysis, shaping market trends and influencing market revenue streams across regions.

‣ Get More Insights On: Continuous Bioprocessing Market

‣ Get this Report in Japanese Language: 連続バイオプロセス市場

‣ Get this Report in Korean Language: 연속생물공정시장

1 note

·

View note

Text

Single-use Bioprocessing Systems Market Size, Share, Trends, Demand, Growth, Challenges and Competitive Outlook

Global Single-use Bioprocessing Systems Market - Size, Share, Demand, Industry Trends and Opportunities

Access Full 350-page PDF Report @

**Segments**

- **Product Type:** The single-use bioprocessing systems can be segmented into bags, bioreactors, mixing systems, tubing, filtration devices, sampling systems, connectors, sensors, and others. Bags are widely used for storage and transportation of biopharmaceutical products and are expected to witness significant growth due to their convenience and cost-effectiveness.

- **Application:** The market can be segmented based on applications such as monoclonal antibody production, vaccine production, cell therapy, gene therapy, and others. Monoclonal antibody production holds a major market share as it is extensively used in the treatment of various diseases.

- **End User:** End-user segmentation includes biopharmaceutical companies, contract development, and manufacturing organizations (CDMOs), research and academic institutes. Biopharmaceutical companies are the key end-users of single-use bioprocessing systems, driving market growth due to the increasing demand for innovative therapies and cost-effective manufacturing solutions in the industry.

**Market Players**

- **Thermo Fisher Scientific Inc.:** Thermo Fisher is a leading player in the global single-use bioprocessing systems market, offering a wide range of products including bioreactors, mixers, and filtration devices. The company's focus on innovation and strategic partnerships has helped them maintain a strong market position.

- **Merck KGaA:** Merck KGaA is another prominent player in the market, providing single-use bioprocessing solutions for various applications such as vaccine production and cell therapy. The company's extensive product portfolio and global presence have contributed to its growth in the market.

- **Sartorius AG:** Sartorius is known for its high-quality single-use bioprocessing products including bags, filters, and sensors. The company's commitment to sustainability and technological advancement has earned them a loyal customer base in the industry.

- **Danaher Corporation:** Danaher Corporation offers a wide range of single-use bioprocessing systems through its subsidiary, PallThermo Fisher Scientific Inc., Merck KGaA, Sartorius AG, and Danaher Corporation are key players in the global single-use bioprocessing systems market, each contributing significantly to the industry's growth and innovation. Thermo Fisher Scientific Inc. stands out for its diverse product range, including bioreactors, mixers, and filtration devices. The company's commitment to innovation and strategic partnerships has solidified its position as a leading player in the market. By continuously introducing new technologies and products, Thermo Fisher Scientific Inc. has been able to meet the evolving demands of biopharmaceutical companies and research institutions.

Merck KGaA, another major market player, offers a wide range of single-use bioprocessing solutions tailored for applications such as vaccine production and cell therapy. With a strong global presence and an extensive product portfolio, Merck KGaA has been successful in addressing the specific needs of biopharmaceutical companies and research organizations. The company's focus on research and development, coupled with its strategic acquisitions, has been instrumental in its growth and market expansion.

Sartorius AG is renowned for its high-quality single-use bioprocessing products, including bags, filters, and sensors. The company's unwavering commitment to sustainability and technological advancement has earned it a loyal customer base within the industry. Sartorius AG's emphasis on product quality, reliability, and customer satisfaction has positioned it as a trusted provider of bioprocessing solutions worldwide.

Danaher Corporation, through its subsidiary Pall, offers a diverse range of single-use bioprocessing systems, catering to the needs of biopharmaceutical companies and research institutions. The company's innovative technologies and investment in research and development have enabled it to introduce cutting-edge solutions that enhance the efficiency and effectiveness of bioprocessing operations. Danaher Corporation's reputation for quality and customer service has contributed to its strong market presence and growth in the global bioprocessing systems market.

Overall, these market players**Global Single-use Bioprocessing Systems Market**

- **Product:** Media Bags and Containers, Filtration Assemblies, Disposable or Single-Use Bioreactors, Disposable Mixers, Bioreactors, Tangential-flow Filtration Devices, Depth Filters, Sampling Systems, Mixing Systems, Tubing Assemblies, Other Products - **Application:** Filtration, Storage, Cell Culture, Mixing, Purification - **End User:** Biopharmaceutical Manufacturers, Life Science Research and Development, Contract Research Organizations and Manufacturers - **Country:** U.S., Canada, Mexico, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, UAE, Egypt, Israel, Rest of Middle East and Africa

The global single-use bioprocessing systems market is witnessing significant growth driven by factors such as the increasing demand for biopharmaceutical products, advancements in bioprocessing technologies, and the benefits of single-use systems in terms of cost-effectiveness and efficiency. The market segments based on product type, application, and end-users provide insights into the diverse needs and preferences within the industry. Bags, bioreactors, and filtration devices are key products driving market expansion, with bags particularly favored for their convenience and affordability in

Core Objective of Single-use Bioprocessing Systems Market:

Every firm in the Single-use Bioprocessing Systems Market has objectives but this market research report focus on the crucial objectives, so you can analysis about competition, future market, new products, and informative data that can raise your sales volume exponentially.

Size of the Single-use Bioprocessing Systems Market and growth rate factors.

Important changes in the future Single-use Bioprocessing Systems Market.

Top worldwide competitors of the Market.

Scope and product outlook of Single-use Bioprocessing Systems Market.

Developing regions with potential growth in the future.

Tough Challenges and risk faced in Market.

Global Single-use Bioprocessing Systems top manufacturers profile and sales statistics.

Key takeaways from the Single-use Bioprocessing Systems Market report:

Detailed considerate of Single-use Bioprocessing Systems Market-particular drivers, Trends, constraints, Restraints, Opportunities and major micro markets.

Comprehensive valuation of all prospects and threat in the

In depth study of industry strategies for growth of the Single-use Bioprocessing Systems Market-leading players.

Single-use Bioprocessing Systems Market latest innovations and major procedures.

Favorable dip inside Vigorous high-tech and market latest trends remarkable the Market.

Conclusive study about the growth conspiracy of Single-use Bioprocessing Systems Market for forthcoming years.

Frequently Asked Questions

What is the Future Market Value for Single-use Bioprocessing Systems Market?

What is the Growth Rate of the Single-use Bioprocessing Systems Market?

What are the Major Companies Operating in the Single-use Bioprocessing Systems Market?

Which Countries Data is covered in the Single-use Bioprocessing Systems Market?

What are the Main Data Pointers Covered in Single-use Bioprocessing Systems Market Report?

Browse Trending Reports:

Over-the-top Services Market Coagulation Testing Market Single-use Bioprocessing Systems Market Digital Signage in Healthcare Market Tumor Transcriptomics Market Mucormycosis Market Guacamole Market Melanoma Market Human Milk Oligosaccharides (HMOs) in Infant Formula Market Single Loop Controller Market Swine Feed Phosphates Market Antibiotic-free Meat Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]

0 notes

Text

The Role of Biopharmaceutical Process Analytical Technology Market in Shaping Industry Growth by 2030

The biopharmaceutical process analytical technology market is projected to grow at a CAGR of ~16% over the forecast period. Major factors driving growth include increased demand for biopharmaceuticals, technological advancements in analytical technologies, growing transition to continuous manufacturing, growing emphasis on process optimization and regulatory compliance, growth in emerging markets, and increasing demand for advanced manufacturing solutions. However, the market faces several challenges, such as the high initial costs associated with establishing PAT systems, the technical complexities of integrating PAT into existing manufacturing processes, and variations in global regulatory expectations that may limit widespread adoption.

Biopharmaceutical process analytical technology (PAT) refers to a framework of tools, systems, and methodologies that helps to design, analyze, monitor, and control the manufacturing of biopharmaceutical processes in real time. It involves measuring critical process parameters (CPPs) and critical quality attributes (CQAs) to ensure the safety, efficacy, and quality of the final product.

To request a free sample copy of this report, please visit below

Enhancing efficiency and control in biopharmaceutical manufacturing through process analytical technology fuels its demand

As biopharma companies contend with rising demands for biologics and advanced therapies, the adoption of process analytical technology (PAT) systems has emerged as a vital factor in driving market expansion. PAT involves the integration of chromatographic, spectroscopic, and mass spectrometric sensors within both upstream and downstream operations. These technologies can be utilized in-line, online, or at-line, facilitating real-time monitoring and control of manufacturing processes. By offering immediate insights, these sensors allow for timely adjustments, process optimization, and interventions, which ultimately enhance understanding of the processes and improve product quality. Additionally, PAT systems gather extensive data throughout the manufacturing process, enabling the identification of bottlenecks and inefficiencies. This data-centric strategy aids in process optimization, thereby minimizing production timelines and resource consumption. Moreover, continuous manufacturing, bolstered by PAT, lowers operational costs, boosts throughput, and increases adaptability to fluctuating market demands. As these advantages drive its widespread implementation, the PAT market is positioned for significant growth, influencing the future landscape of the biopharma sector.

Increasing demand for biopharmaceuticals drives market growth

The demand for biopharmaceuticals has been growing rapidly, fuelled by various factors such as advancements in biotechnology, the rising prevalence of chronic diseases, and heightened awareness of personalized medicine. Key drivers of this trend include:

Increasing prevalence of chronic diseases: Chronic conditions such as cancer, diabetes, autoimmune disorders, and cardiovascular diseases are becoming more common worldwide. These illnesses often require advanced therapies like monoclonal antibodies, recombinant proteins, and gene therapies, all of which rely on biopharmaceutical technologies

Advancements in drug development: The development of highly targeted biologics, including monoclonal antibodies, fusion proteins, and CAR-T cell therapies, has expanded the range of treatable conditions. Additionally, innovations in bioprocessing, such as continuous manufacturing and single-use systems, have enhanced the efficiency and scalability of biopharmaceutical production

Personalized medicine: Biopharmaceuticals play a pivotal role in personalized medicine, offering treatments tailored to an individual's genetic makeup. For instance, gene therapies and advanced biologics are increasingly utilized in oncology and the treatment of rare diseases, addressing specific patient needs

Biosimilars as cost-effective solutions: Biosimilars are accelerating market growth by providing more affordable alternatives to expensive biologics, and improving patient access to life-saving treatments. Simplified regulatory pathways for biosimilars across various regions further support their adoption and market expansion

The surging demand for biopharmaceuticals is transforming global healthcare and manufacturing landscapes, driving innovation, regulatory evolution, and significant market growth.

Competitive Landscape Analysis

The global biopharmaceutical process analytical technology market is marked by the presence of established and emerging market players such as Thermo Fisher Scientific, Inc.; Merck KGaA; Danaher Corporation; Agilent Technologies, Inc.; Sartorius AG; Shimadzu Corporation; Waters Corporation; Bruker Corporation; Emerson Electric Co.; ABB Ltd.; PerkinElmer, Inc.; Yokogawa Electric Corporation; Applied Materials; and Mettler-Toledo International Inc.; among others. Some of the key strategies adopted by market players include new product development, strategic partnerships and collaborations, and investments.

🔗 Want deeper insights? Download the sample report here:

Global Biopharmaceutical Process Analytical Technology Market Segmentation

This report by Medi-Tech Insights provides the size of the global biopharmaceutical process analytical technology market at the regional- and country-level from 2023 to 2030. The report further segments the market based on product type, application, and end user.

Market Size & Forecast (2023-2030), By Product Type, USD Million

Liquid Chromatography/HPLC

Mass Spectrometry

NMR Spectroscopy

Infrared Spectroscopy

Gas Chromatography (GC)

Real-time PCR/qPCR

Others

Market Size & Forecast (2023-2030), By Application, USD Million

Bioanalytics

Biopharmaceuticals Processing

Drug Development

Vaccines

Drug Discovery

Biosimilars & Biologics

Other Applications

Market Size & Forecast (2023-2030), By End User, USD Million

Academic & Research Institutions

Biopharmaceutical Companies

Contract Manufacturing Organizations

Contract Research Organizations

Market Size & Forecast (2023-2030), By Region, USD Million

North America

US

Canada

Europe

UK

Germany

Italy

Spain

Rest of Europe

Asia Pacific

China

India

Japan

Rest of Asia Pacific

Latin America

Middle East & Africa

About Medi-Tech Insights

Medi-Tech Insights is a healthcare-focused business research & insights firm. Our clients include Fortune 500 companies, blue-chip investors & hyper-growth start-ups. We have completed 100+ projects in Digital Health, Healthcare IT, Medical Technology, Medical Devices & Pharma Services in the areas of market assessments, due diligence, competitive intelligence, market sizing and forecasting, pricing analysis & go-to-market strategy. Our methodology includes rigorous secondary research combined with deep-dive interviews with industry-leading CXO, VPs, and key demand/supply side decision-makers.

Contact:

Ruta Halde Associate, Medi-Tech Insights +32 498 86 80 79 [email protected]

0 notes

Text

Single-use Bioprocessing Market: Market Trends and Market Growth 2024-2032

The Single-use Bioprocessing Market Size was valued at USD 26.8 Billion in 2023 and is expected to reach USD 100.9 Billion by 2032, growing at a CAGR of 15.9% over the forecast period 2024-2032. This growth is driven by the increasing demand for biopharmaceuticals, advancements in single-use technology, and a shift toward cost-effective and flexible manufacturing solutions.

Get Free Sample Report @ https://www.snsinsider.com/sample-request/3661

Market Segmentation

By Product:

Simple & Peripheral Elements: Tubing, filters, connectors, transfer systems, bags, sampling systems, probes, sensors (pH, oxygen, pressure, temperature, conductivity, flow), and others.

Apparatus & Plants: Bioreactors (up to 1000L, 1000L-2000L, above 2000L), mixing, storage, filling systems, filtration systems, chromatography systems, pumps, and others.

Work Equipment: Cell culture systems, syringes, and others.

By Workflow:

Upstream bioprocessing

Fermentation

Downstream bioprocessing

By End-use:

Biopharmaceutical Manufacturers: CMOs & CROs, in-house manufacturers.

Academic & Clinical Research Institutes.

Regional Analysis

North America: Held the largest market share in 2023, driven by a strong biopharmaceutical sector, significant investments in research, and government support for biomanufacturing.

Asia-Pacific: Expected to witness the fastest growth due to rising healthcare investments, an expanding biopharmaceutical industry, and increased adoption of single-use technologies in manufacturing. Countries like China and India are playing a crucial role in market expansion.

Key Players

Service Providers / Manufacturers:

Thermo Fisher Scientific (HyPerforma Single-Use Bioreactors, BioProcess Containers)

Sartorius AG (Biostat STR Bioreactors, Flexsafe Bags)

Merck KGaA (Ultimus Film, Mobius Single-Use Systems)

Danaher Corporation (Xcellerex Bioreactors, Pall Allegro Systems)

GE Healthcare Life Sciences (Xcellerex XDR Bioreactors, WAVE Bioreactor Systems)

Eppendorf AG (BioBLU Single-Use Vessels, CelliGen BLU Bioreactors)

Corning Incorporated (HYPERStack Cell Culture Vessels, CellCube Modules)

Avantor, Inc. (J.T.Baker BPCs, Single-Use Mixer Systems)

Cellexus International (CellMaker Plus, CellMaker Regular)

Lonza Group AG (MODA-ES Bioprocess Software, Nunc Cell Factory Systems)

Key Market Trends

Growing demand for biologics, including vaccines and monoclonal antibodies.

Continuous technological advancements improving efficiency and scalability.

Increasing government support for biopharmaceutical manufacturing infrastructure.

Cost-effectiveness and flexibility of single-use systems compared to traditional stainless-steel setups.

Challenges include concerns over material leachables and extractables, as well as the need for standardization across single-use designs.

Future Scope

The single-use bioprocessing market is set for transformative growth, driven by the rising adoption of biologics and cell & gene therapies. Hybrid systems combining single-use and stainless-steel technologies are emerging to address scalability challenges. Moreover, the expansion into emerging markets presents substantial opportunities, as the demand for flexible and cost-efficient biomanufacturing solutions continues to rise.

Conclusion

The single-use bioprocessing market is undergoing rapid evolution, fueled by technological advancements and increasing global demand for biologics. While challenges related to standardization and material concerns remain, ongoing innovations and strategic investments will further strengthen the role of single-use technologies in the future of biopharmaceutical manufacturing.

Contact Us: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Other Related Reports:

Fertility Services Market

Medical Power Supply Market

Post Traumatic Stress Disorder Treatment Market

MRI Guided Neurosurgical Ablation Market

#Single-use Bioprocessing Market#Single-use Bioprocessing Market Share#Single-use Bioprocessing Market Size#Single-use Bioprocessing Market Trends

0 notes

Text

Fermentation Vessels and Bioreactors: Driving Innovation in Bioprocessing

In the fields of pharmaceuticals, biotechnology, and food production, fermentation vessels and bioreactors play a crucial role in ensuring the growth of microorganisms, cells, and biologically active compounds under controlled conditions. These specialized systems are indispensable in producing vaccines, antibiotics, enzymes, and various biopharmaceutical products, making them the backbone of industrial bioprocessing.

Importance of Fermentation Vessels and Bioreactors

Fermentation vessels and bioreactors provide the ideal environment for cultivating microorganisms and cells essential for producing bio-based products. These vessels offer precise control over key parameters such as temperature, pH, oxygen levels, and agitation, ensuring optimal growth conditions and maximizing product yield.

The ability to maintain a sterile environment is paramount, as contamination can compromise entire production batches. Modern fermentation vessels and bioreactors are designed to minimize risks while enhancing productivity, making them indispensable for industries seeking consistency, scalability, and quality in their processes.

Compliance with Regulatory Standards

In pharmaceutical and biotech applications, adhering to strict regulatory standards is non-negotiable. Compliance with Good Manufacturing Practice (GMP) guidelines, the U.S. Food and Drug Administration (FDA), and other global regulatory bodies is essential to ensure product safety, quality, and efficacy.

Fermentation vessels and bioreactors must meet stringent standards for material selection, surface finish, and sterilization protocols. Regular validation and calibration processes are conducted to guarantee that every step of production aligns with regulatory requirements. Companies investing in compliant systems safeguard not only their products but also their reputations.

Innovation in Manufacturing Processes

Technological advancements have transformed fermentation vessels and bioreactors into highly sophisticated systems capable of automating complex bioprocesses. Innovations such as real-time monitoring, data-driven process control, and advanced sensors enable operators to fine-tune parameters, ensuring consistent performance and minimizing human error.

Additionally, the integration of single-use bioreactors has revolutionized the industry by reducing cross-contamination risks, accelerating production timelines, and lowering operational costs. These innovations empower manufacturers to remain agile in an increasingly competitive market.

Enhancing Productivity with Advanced Technologies

Modern fermentation vessels and bioreactors incorporate advanced technologies to enhance productivity and efficiency. Automation systems optimize processes, reducing downtime and ensuring uniform product quality. Real-time data collection and analysis enable predictive maintenance, minimizing disruptions and extending equipment lifespan.

Moreover, scalable designs allow for seamless transition from laboratory-scale to commercial production, accommodating the growing demands of pharmaceutical and biotech industries. By leveraging these technologies, companies can streamline their operations while maintaining the highest quality standards.

Ensuring Product Safety

Product safety is at the heart of every bioprocess. Fermentation vessels and bioreactors are meticulously designed to maintain sterile conditions throughout production. Features such as clean-in-place (CIP) and sterilize-in-place (SIP) systems ensure thorough cleaning and sterilization between production runs, preventing cross-contamination.

Material selection is equally important, with stainless steel and other non-reactive materials used to ensure product purity. Additionally, advanced filtration and monitoring systems help detect and eliminate potential contaminants, safeguarding both products and consumers.

Fermentation vessels and bioreactors are indispensable for the pharmaceutical, biotech, and food industries, ensuring consistent product quality, regulatory compliance, and enhanced productivity. Advanced technologies and rigorous manufacturing standards have made these systems more reliable and efficient than ever before.

Swjal Process Pvt. Ltd. stands at the forefront of delivering cutting-edge fermentation vessels and bioreactors. As a leading manufacturer in India, Swjal Process Pvt. Ltd. combines innovation, compliance, and expertise to provide robust solutions that empower industries to achieve excellence in bioprocessing.

#industrial vessles#mixing tanks#vessle with agiators#Fermentation vessels and bioreactors#swjal process

0 notes

Text

Downstream Processing Market: Key Trends and Growth Opportunities

The global downstream processing market size is expected to reach USD 94.79 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 14.84% from 2023 to 2030. The capacity requirements during the development of biologic drugs have changed over the past few years, wherein the demand for manufacturing high-volume products has shifted to developing small-volume, high-potency products. This creates new avenues for single-use technologies. A rise in the utilization of downstream processing techniques for the development of COVID-19 vaccines is a significant factor driving the market. The adoption of small-scale, single-use systems for process development and downstream processing is already high.

Thus, evolutionary changes are expected in the area of single-use technologies for manufacturing small-volume, highly-potent drugs. The development of novel film chemistries, closed systems, automation in clinical-scale single-use systems, and smart sensors are some noteworthy advancements in the field. A rise in applications of downstream processing for the production of biopharmaceuticals is expected to bring growth opportunities to the market. This has also led to an increase in strategic deals and development in the market. For instance, in February 2021, Evozyne, LLC collaborated with a leading rare disorders drug manufacturer for the production and marketing of novel biopharmaceuticals for immune modulation.

Key players are investing in the bioprocessing of vaccines and therapies for COVID-19 to increase their market share. For instance, in May 2022, Lonza and ALSA Ventures are partnering to provide biotech firms with development and manufacturing services. In May 2022, Lonza added Titanium Dioxide-free white hard gelatin capsules to its Capsugel Capsule Line. The new capsule includes an alternative opacifying technology that provides a good masking solution as well as enhanced light protection for the fill formulation. In December 2021, Repligen bought Newton, New Jersey-based BioFlex Solutions. The purchase adds to and enhances Repligen’s single-use fluid management product line, as well as simplifies its supply chain. The integration of BioFlex Solutions strengthens its system offering by further integrating components and assemblies.

Gather more insights about the market drivers, restrains and growth of the Downstream Processing Market

Downstream Processing Market Report Highlights

• The chromatography systems segment dominated the market for downstream processing and accounted for the largest revenue share of 41.29% in 2022

• The advent of single-use chromatography systems that bring an 80.0% reduction of the use of water and chemicals for buffer has further increased the adoption of chromatography for downstream processing of bio-therapeutics

• Filters are anticipated to grow at a lucrative rate over the forecast period. Efforts undertaken by the key players to develop intelligent membranes for purification & separation is fuelling the market growth

• Purification by chromatography accounted for the largest revenue share as it can be employed across all steps of a downstream process. The technique is also crucial in bioprocessing to obtain pure biologics

• The antibiotic production segment dominated the market for downstream processing and generated the largest revenue share of 32.48% in 2022 owing to the wide applications of antibiotics for the treatment of several disorders.

• A rise in occurrences of antibiotic resistance also propels the industrial-scale development of novel antibiotic candidates

• North America dominated the market for downstream processing with the largest revenue share of 34.57% in 2022 owing to government support for promoting bioprocess technologies, rising medical expenditure, and developed healthcare infrastructure.

• Asia Pacific expected to register the highest growth rate of 15.67% during 2023-2030 due to a rise in contract development services in emerging economies

Downstream Processing Market Segmentation

Grand View Research has segmented the global downstream processing market based on product, technique, application, and region:

Downstream Processing Product Outlook (Revenue, USD Billion, 2018 - 2030)

• Chromatography Systems

• Filters

• Evaporators

• Centrifuges

• Dryers

• Others

Downstream Processing Technique Outlook (Revenue, USD Billion, 2018 - 2030)

• Cell Disruption

• Solid-liquid separation

o Filtration

o Centrifugation

• Concentration

o Evaporation

o Membrane filtration

• Purification by Chromatography

• Formulation

Downstream Processing Application Outlook (Revenue, USD Billion, 2018 - 2030)

• Antibiotic Production

• Hormone Production

• Antibodies Production

• Enzyme Production

• Vaccine Production

Downstream Processing Regional Outlook (Revenue, USD Billion, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o Germany

o U.K.

o France

o Italy

o Spain

o Denmark

o Sweden

o Norway

• Asia Pacific

o Japan

o China

o India

o South Korea

o Thailand

o Australia

• Latin America

o Brazil

o Mexico

o Argentina

• Middle East and Africa (MEA)

o South Africa

o Saudi Arabia

o UAE

o Kuwait

List of Key Players of Downstream Processing Market

• Merck KGaA

• Sartorius Stedim Biotech S.A

• GE Healthcare

• Thermo Fisher Scientific Inc.

• Danaher Corporation

• Repligen

• 3M Company

• Boehringer Ingelheim International GmbH

• Corning Corporation

• Lonza Group Ltd

• Dover Corporation

• Ashai Kasei

• Ferner PLC

• Eppendorf AG

Order a free sample PDF of the Downstream Processing Market Intelligence Study, published by Grand View Research.

#Downstream Processing Market#Downstream Processing Market Size#Downstream Processing Market Share#Downstream Processing Market Analysis#Downstream Processing Market Growth

0 notes

Text

Bioprocess containers Market Industry Forecast, 2024–2030

Bioprocess Containers Market Overview

Request Sample :

A major trend is the growing demand for single-use bioprocess containers. Single-use bioprocess containers eliminate cleaning requirements between batches and reduce the risk of batch failure due to cross-contamination. Additionally, single-use systems are also cost effective. Respondents identified lower-cost single use devices as the most important area of interest for new products and technologies in 2023. Another notable trend is the rise in upstream bioprocess products driven by increasing demand for biopharmaceuticals, including biologics and gene therapies. As the industry focuses on enhancing cell culture, fermentation, and early-stage production efficiencies, there is a heightened need for advanced upstream bioprocess products to support these developments. According to a February 2024 article in BioProcess International, the top areas in upstream production were cell-culture media, bioreactors, and information technology (IT), which encompasses automation, software, and networking. Interest in IT solutions among respondents grew from 21.1% in 2022 to 29% in 2023.

COVID-19 / Ukraine Crisis — Impact Analysis:

The COVID-19 pandemic significantly accelerated the growth of the bioprocess containers market, driven by the urgent demand for vaccine production and biologics manufacturing. As pharmaceutical companies ramped up production, flexible and scalable solutions like single-use bioprocess containers became critical for handling cell cultures, reagents, and drug formulations. Additionally, disruptions in global supply chains and a heightened focus on healthcare infrastructure underscored the importance of efficient bioprocessing technologies. Post-pandemic, the market continues to grow, with increased interest in biologics, gene therapies, and personalized medicine fueling demand for flexible manufacturing solutions.

The Ukraine-Russia war has disrupted global supply chains, impacting the bioprocess containers market. The conflict has led to shortages of raw materials, increased transportation costs, and delays in production for biopharma manufacturing. Europe, a key region for bioprocessing, has been particularly affected by rising energy prices and supply chain instability. Companies have been forced to seek alternative suppliers and adjust logistics strategies to mitigate these disruptions. Despite the challenges, the growing demand for biologics and vaccines continues to drive the market, with manufacturers prioritizing resilient, flexible bioprocess solutions to ensure production continuity.

Key Takeaways 2D Bioprocess Containers are the Largest Segment

2D bioprocess containers dominate the bioprocess containers markets due to their cost-effectiveness and operational efficiency. Offering benefits such as easier storage, reduced contamination risk, and simplified handling, 2D containers meet the industry’s growing demand for scalable and flexible solutions. Additionally, their structure minimizes contamination risks and allows for easier handling, streamlining workflows and reducing labor-intensive procedures. As the biopharmaceutical industry grows, there is an increasing demand for scalable and flexible solutions to meet diverse production needs. 2D containers cater to these requirements by enabling single-use options that simplify transitions between processes, making them ideal for adaptable production setups.

Inquiry Before Buying:

Bioprocess Containers Market Segment Analysis — By Application

Cell culture is a major application of bioprocess containers (BPCs), playing a crucial role in the biomanufacturing industry. BPCs are extensively used for growing and maintaining mammalian, microbial, and insect cells, offering flexibility and scalability in production. They are designed with features like ports for sampling and reagent addition, and integrated sensors for monitoring environmental conditions. The increasing demand for biologics, including therapeutic proteins and vaccines, has driven the widespread adoption of BPCs in cell culture, making it a key focus in the development and manufacturing of biopharmaceutical products. According to Merck 2024, Merck invested $24.84 million to expand cell culture media production in Kansas, USA.

North America Dominates the Market

North America leads the global bioprocess container (BPC) market due to its advanced biopharmaceutical industry and substantial investments in research and development. The United States and Canada are at the forefront, driving significant growth with a strong focus on innovative single-use technologies and sophisticated manufacturing processes. The region’s robust infrastructure, presence of major biopharma companies, and commitment to cutting-edge advancements make North America a key player in the BPC market, particularly in applications such as cell culture, media preparation, and downstream processing. The United States dominates the pharmaceutical industry, home to some of the world’s largest companies like Pfizer, Johnson & Johnson, Merck & Co. and AbbVie. In July 2024, Despite the expected decrease in COVID-related revenue, Pfizer’s revenue rose 3% operationally to $28.2 billion. In December 2023, Pfizer finalized the $43 billion acquisition of Seagen (a biotech company), doubling its oncology pipeline. Such developments are a major catalyst for growth in the bioprocess container market, as it leads to a significant increase in the production of biopharmaceuticals, particularly in the oncology space.

Bioprocess Containers Market Drivers

Single Use Systems

The cost-effectiveness of single-use systems is a major driver of the bioprocess containers market. Single-use bioprocess containers significantly reduce operational costs compared to traditional stainless-steel systems by eliminating the need for time-consuming cleaning, sterilization, and maintenance. This leads to lower capital and operational expenses, making single-use systems an attractive option for biopharmaceutical manufacturers looking to streamline their processes and improve efficiency. As a result, the adoption of single-use bioprocess containers is increasing, driven by their economic advantages and the growing demand for flexible and cost-efficient manufacturing solutions. BioPlan’s 19th Annual Report and Survey of Biopharmaceutical Manufacturing indicates a substantial rise in the use of commercial-scale single-use (SUS) bioreactors, which grew from 32.5% in 2019 to 43% in 2022. This 32% increase is primarily due to the heightened demand for flexibility and rapid deployment in bioproduction during the COVID-19 pandemic.

Schedule A Call :

Rising Demand for Biopharmaceuticals

The rising demand for biopharmaceuticals is a key driver of the bioprocess containers market, particularly due to the increasing prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders among the aging population. As the global population of individuals aged 60 and above continues to grow, with significant increases in regions like North America, Europe, and parts of Asia, the need for advanced biologic treatments, including monoclonal antibodies, vaccines, and cell therapies, is intensifying. Bioprocess containers play a critical role in the production, storage, and transportation of these biopharmaceutical products, making them essential to meeting the growing demand. This surge in biopharmaceutical production is, in turn, driving the expansion of the bioprocess containers market. According to IDF projections, the number of adults living with diabetes will increase by 46% to 783 million by 2045, representing one in eight adults. The American Cancer Society (ACS) estimates that by 2050, the number of cancer cases is expected to rise to 35 million.

Bioprocess Containers Market Challenges

Regulatory Requirements

Regulatory requirements in the bioprocess container market pose a significant challenge due to the need to comply with stringent standards across various regions and applications. Manufacturers must navigate complex regulations, such as those from the FDA, ISO, and USP, which require rigorous validation and documentation. Staying up-to-date with evolving guidelines and ensuring that containers meet these standards is crucial for maintaining product safety and efficacy, but it adds complexity and cost to the manufacturing process. According to Cytiva, single-use bioprocess technologies are advanced but lack specific regulations, creating uncertainty about their suitability for therapeutic production and leaving bio manufacturers concerned about their appropriateness.

Buy Now :

Bioprocess Containers Market Key Players

Product/Service launches, approvals, patents and events, acquisitions, partnerships and collaborations are key strategies adopted by players in the Bioprocess Containers Market. The top 10 players in the Bioprocess Containers Market are

Lonza Group AG

Corning Incorporated

Entegris, Inc.

Parker Hannifin Corporation

Meissner Filtration Products, Inc.

Merck KGaA

Avantor Inc.

Sartorius AG

Thermo Fisher Scientific Inc.

Cytiva,

For more Lifesciences and Healthcare Market reports, please click here

#Bioprocessing 🌱#PharmaceuticalManufacturing 💊#SingleUseTechnology 🧪#BiotechIndustry 🧬#BioprocessContainers 🏭#LabTechnology 🔬#BiopharmaInnovation 🚀#HealthcareManufacturing 🏥

0 notes

Text

According to Nova One Advisor, the global single-use bioprocessing probes & sensors market size was valued at USD 3.85 billion in 2023 and is anticipated to reach around USD 11.27 billion by 2033, growing at a CAGR of 11.34% from 2024 to 2033.

0 notes

Text

Global Single-Use Bioprocessing Market: Trends, Challenges, and Strategic Forecasts

The global single-use bioprocessing market size is projected to reach USD 80.13 billion by 2030, registering a compound annual growth rate (CAGR) of 16.24% over the forecast period, according to a new report by Grand View Research, Inc. The demand for single-use bioprocessing offerings is driven by the commercial advantages offered, including a reduction in costs and time required for bioprocessing operations. Originally used for monoclonal antibody production, single-use technologies are also gaining traction for cell and gene therapy manufacturing. As a result, broadening the scope of applications in biomanufacturing operations is likely to drive industry growth.

Furthermore, strategic initiatives from key players are expanding the industry's growth prospects. For instance, in July 2021, Cytiva and Pall Corp. announced investment plans for capacity expansion over two years. Among other key products, more than USD 300 million were invested in single-use technologies, such as bioreactor bags for cell expansion, used to make personalized therapies and syringe filters for scientific research. Similarly, the growing adoption of single-use equipment for in-house and contract manufacturing has opened new avenues for the flow of investments in this space. The industry is witnessing significant advancements in several product portfolios, including disposable probes and sensors, stirring systems, bioreactor designs, and filtration technologies, which are expected to contribute to strong revenue growth.

The benefits offered by single-use bioprocessing systems have enabled biopharmaceutical manufacturers to offer their products faster to the market by introducing multi-product facilities, entering into partnerships, or outsourcing pipeline products for contract development and manufacturing. For instance, in January 2021, Sartorius AG partnered with RoosterBio, a leading supplier of human Mesenchymal Stem/Stromal Cells (hMSC). This collaboration aimed at advancing cell & gene therapy manufacturing by leveraging the single-use manufacturing technologies from Sartorius AG. The COVID-19 pandemic has generated new growth opportunities for key stakeholders in the industry.

Key biopharmaceutical players can leverage the opportunity by expanding their COVID-19-related product offerings by scaling up their production facilities with the implementation of single-use bioprocessing equipment. A significant number of biopharmaceutical companies are actively involved in the development and production of COVID-19 vaccines. These programs are majorly based on single-use technologies as these systems are flexible, cost-effective, and reduce the risk of cross-contamination. Such an ongoing and continuous increase in the adoption of bioprocessing systems due to the COVID-19 pandemic is anticipated to drive industry growth.

Single-use Bioprocessing Market Report Highlights

The simple & peripheral elements segment held the largest share in 2023 due to the significant adoption of these products as a result of a variety of customizable options available for bioprocessing applications

The upstream bioprocessing workflow segment accounted for the largest share in 2023. Continuous developments and betterment in technologies for upstream bioprocessing are driving the segment growth

North America was the leading region in 2023 due to the high R&D spending and growth of the biopharmaceutical manufacturing sector in the region

Furthermore, the presence of key players, such as Thermo Fisher Scientific, Inc. and Danaher Corp., is driving the regional market

The biopharmaceutical manufacturers end-use segment dominated the industry in 2023 and accounted for the maximum revenue share. This was due to the high demand for biologics and heavy investments in cell & gene therapy manufacturing

Single-use Bioprocessing Market Segmentation

Grand View Research has segmented the global single-use bioprocessing market based on product, workflow, end-use, and region:

Single-use Bioprocessing By Product Outlook (Revenue, USD Million, 2018 - 2030)

Simple & Peripheral Elements

Tubing, Filters, Connectors, & Transfer Systems

Bags

Sampling Systems

Probes & Sensors

pH Sensor

Oxygen Sensor

Pressure Sensors

Temperature Sensors

Conductivity Sensors

Flow Sensors

Others

Others

Apparatus & Plants

Bioreactors

Upto 1000L

Above 1000L to 2000L

Above 2000L

Mixing, Storage, & Filling Systems

Filtration System

Chromatography Systems

Pumps

Others

Work Equipment

Cell Culture System

Syringes

Others

Single-use Bioprocessing By Workflow Outlook (Revenue, USD Million, 2018 - 2030)

Upstream Bioprocessing

Fermentation

Downstream Bioprocessing

Single-use Bioprocessing By End-use Outlook (Revenue, USD Million, 2018 - 2030)

Biopharmaceutical Manufacturers

CMOs & CROs

In-house Manufacturers

Academic & Clinical Research Institutes

Single-use Bioprocessing Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

Japan

China

India

South Korea

Australia

Thailand

Latin America

Brazil

Mexico

Argentina

Middle East and Africa (MEA)

South Africa

Saudi Arabia

UAE

Kuwait

List of key players

Sartorius AG

Danaher

Thermo Fisher Scientific, Inc.

Merck KGaA

Avantor, Inc.

Eppendorf SE

Corning Incorporated

Lonza

PBS Biotech, Inc.

Meissner Filtration Products, Inc.

Order a free sample PDF of the Single-use Bioprocessing Market Intelligence Study, published by Grand View Research.

0 notes

Text

Stem Cell Manufacturing: An Emerging Industry Taking Shape

The past decade has seen tremendous progress in the field of regenerative medicine as scientists advance our understanding of stem cells and their potential to treat diseases. With this progress, the stem cell manufacturing industry has rapidly taken shape to bring these life-changing therapies to patients. After years of research in labs, we are now seeing stem cell therapies move from the experimental phase into commercialization as companies work to establish sustainable manufacturing capabilities. Optimizing the Manufacturing Process A major focus of the industry currently is optimizing stem cell manufacturing processes. Producing therapeutic-grade stem cells at scale brings unique challenges compared to traditional drug manufacturing. Stem cells are living cells that must be carefully expanded in bioreactors while maintaining their pluripotency and viability. Companies are developing novel bioprocessing techniques using automated closed systems to precisely control the cellular environment and growth factors added to reactors. This helps maximize yields while ensuring product quality and consistency between batches. Advances are also being made in purification methods to isolate stem cells from other cell types and debris. As the field progresses, we will likely see further standardization of manufacturing procedures. Ensuring Quality and Safety With any new therapeutic, ensuring patient safety is paramount. Stem cell manufacturers have rigorous quality control measures in place throughout the entire process from cell sourcing to final product. From donor screening and stem cell characterization to sterility and identity testing of final drug product - quality is monitored at every step. Companies are establishing facilities adhering to Good Manufacturing Practices to prevent contamination and retain batch traceability. Comprehensive testing is conducted to detect any genetic or other abnormalities in stem cells that could potentially cause harmful side effects. Regulatory agencies like the FDA are providing guidance to help establish manufacturing standards as therapies move into clinical trials and commercial applications. Adopting Automation and Single-Use Technologies To support commercial-scale production, there is increased adoption of automation and single-use equipment in stem cell manufacturing. Automating labor-intensive manual processes helps drive efficiencies and reduce costs. Single-use bioprocess containers, filters, tubing and sensors that come pre-sterilized eliminate the need for cleaning and validation of traditional stainless steel equipment. This offers flexibility for facilities to rapidly change processes. Combined with automation, single-use provides a cost-effective and scalable manufacturing approach for applications requiring small to intermediate production volumes. Further technological advancements will be key to producing the billions of doses of stem cells needed to address large patient populations. Developing Off-the-Shelf Stem Cell Therapies While initial stem cell therapies are focused on personalized autologous transplants, the longer-term vision is developing "off-the-shelf" allogenic therapies using donor stem cells that can be treated and banked for immediate use. This results in a simpler treatment model where patients receive standardized "pharmacy-ready" stem cell products rather than undergoing individualized cell harvest and preparation. Major challenges still exist in preventing immune rejection of foreign stem cells and ensuring consistency between donor batches. Companies are researching novel bioengineering techniques to induce stem cells into immunoprivileged states or render them "invisible" to a recipient's immune system. If successful, these strategies could unlock the potential of universal donor stem cell therapies at large commercial scales.

0 notes

Text

Bioreactors Market Dynamics: Global Growth and Trends (2023-2032)

The Bioreactors Market is projected to grow from USD 16,543 million in 2024 to USD 34,624.2 million by 2032, with a compound annual growth rate (CAGR) of 10.50%.

Bioreactors are integral to modern bioprocessing and biotechnology, serving as vessels that provide a controlled environment for the cultivation of microorganisms, cells, or biochemical reactions. These systems are crucial in the production of a wide range of products, including pharmaceuticals, vaccines, biofuels, and industrial enzymes. Bioreactors can vary in design, ranging from simple stirred-tank models to complex, automated systems with advanced monitoring and control capabilities. The primary function of a bioreactor is to maintain optimal conditions for biological activity, including temperature, pH, dissolved oxygen, and nutrient supply. This is achieved through precise engineering and the integration of sensors and actuators that allow for real-time adjustments to the culture conditions.

The pharmaceutical industry heavily relies on bioreactors for the production of monoclonal antibodies, recombinant proteins, and other therapeutic agents. These bioreactors must meet stringent regulatory standards to ensure product safety and efficacy. Single-use bioreactors, made from disposable materials, are becoming increasingly popular due to their flexibility, reduced risk of contamination, and lower capital investment compared to traditional stainless steel systems. This shift towards single-use technologies is particularly advantageous for small-scale production and clinical trials, where rapid changeovers and scalability are essential.

The bioreactors market is influenced by various dynamic factors that shape its growth, trends, and competitive landscape. Here are the key dynamics affecting the bioreactors market:

Market Drivers

Rising Demand for Biopharmaceuticals: The increasing prevalence of chronic diseases and the demand for personalized medicine are driving the growth of biopharmaceuticals, which in turn boosts the demand for bioreactors. Monoclonal antibodies, vaccines, and recombinant proteins are some of the key biopharmaceutical products that require bioreactors for production.

Advancements in Bioreactor Technology: Technological innovations, such as the development of single-use bioreactors, continuous bioprocessing, and improved control systems, are enhancing the efficiency and scalability of bioreactors. These advancements are making bioreactors more adaptable to various production needs, from small-scale research to large-scale manufacturing.

Expansion of the Biotechnology Industry: The growing biotechnology sector, supported by increased funding and research initiatives, is a significant driver for the bioreactors market. The rise in biotech startups and expansion of research and development activities are fueling the demand for bioreactors.

Increasing Adoption of Single-Use Bioreactors: Single-use bioreactors (SUBs) offer several advantages, including reduced contamination risk, lower capital investment, and greater flexibility. Their adoption is particularly high in biopharmaceutical manufacturing and small-scale production, driving market growth.

Growth in Cell and Gene Therapy: The rapid advancements in cell and gene therapy are creating a need for specialized bioreactors capable of supporting cell cultures and genetic modifications. This emerging field is contributing to the expansion of the bioreactors market.

Market Restraints

High Capital Investment: The initial investment required for setting up bioreactor systems, especially for large-scale production, can be substantial. This high capital cost can be a barrier for small and medium-sized enterprises (SMEs) and research institutions with limited budgets.

Operational Complexity: The operation and maintenance of bioreactors require skilled personnel and strict adherence to protocols to ensure optimal performance and sterility. The complexity of bioreactor systems can pose challenges, particularly for smaller organizations lacking technical expertise.

Regulatory Challenges: Bioreactors used in pharmaceutical and biopharmaceutical production must comply with stringent regulatory standards. Navigating these regulations can be challenging and time-consuming, potentially delaying product development and market entry.

Market Opportunities

Emerging Markets: Developing regions, such as Asia-Pacific, Latin America, and the Middle East, offer significant growth opportunities due to their expanding biopharmaceutical and biotechnology industries. Increasing healthcare expenditure, supportive government policies, and growing investments in research and development are driving market growth in these regions.

Customization and Personalization: The trend towards personalized medicine and customized therapies is creating a demand for flexible and scalable bioreactor solutions. Companies that can offer tailored bioreactor systems to meet specific production needs are likely to gain a competitive advantage.

Integration of Digital Technologies: The incorporation of digital technologies, such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT), is transforming bioreactor operations. These technologies enable real-time monitoring, predictive maintenance, and process optimization, enhancing overall efficiency and productivity.

Competitive Landscape

Key Players and Strategies: Major players in the bioreactors market include companies like Thermo Fisher Scientific, Sartorius AG, Merck KGaA, GE Healthcare, and Danaher Corporation. These companies are focusing on strategies such as mergers and acquisitions, partnerships, and product innovations to strengthen their market positions.

Innovation and Product Development: Continuous innovation and the development of new bioreactor models are critical for maintaining competitiveness. Companies are investing in research and development to introduce advanced bioreactors with improved performance, scalability, and user-friendliness.

Key Player Analysis

Sartorius AG (Germany)

Thermo Fisher Scientific, Inc. (U.S.)

Merck KGaA (Germany)

GE Healthcare (A subsidiary of General Electric Company) (U.S.)

Danaher Corporation (U.S)

Eppendorf AG (Germany)

Amec Foster Wheeler plc (U.K.)

Fluor Corporation (U.S.)

Jacobs Engineering Group Inc. (U.S.)

M+W Group (Germany)

More About Report- https://www.credenceresearch.com/report/bioreactors-market

The bioreactors market exhibits varying dynamics across different regions, driven by local demand, industrial applications, technological adoption, and regulatory environments. Here are the regional insights for the bioreactors market:

North America

Market Size and Growth: North America is one of the largest markets for bioreactors, driven by a robust biopharmaceutical industry, significant investments in biotechnology, and strong research and development activities. The United States, in particular, is a major contributor to market growth due to its advanced healthcare infrastructure and numerous biotech companies.

Key Drivers: High demand for biologics and biosimilars, substantial R&D funding, and a favorable regulatory environment.

Challenges: High capital investment and operational costs, stringent regulatory requirements.

Key Players: Thermo Fisher Scientific, GE Healthcare, and Danaher Corporation.

Europe

Market Size and Growth: Europe is a significant market for bioreactors, with countries like Germany, France, and the UK leading the way. The region benefits from a strong focus on biopharmaceutical production, innovative research, and supportive government policies.

Key Drivers: Growing biopharmaceutical industry, increasing adoption of single-use technologies, and strong focus on sustainability and innovation.

Challenges: Regulatory complexity and high production costs.

Key Players: Sartorius AG, Merck KGaA, and Eppendorf AG.

Asia-Pacific

Market Size and Growth: The Asia-Pacific region is experiencing the fastest growth in the bioreactors market, driven by expanding biopharmaceutical manufacturing capabilities, rising healthcare expenditures, and growing investments in biotechnology. Countries such as China, India, Japan, and South Korea are at the forefront of this growth.

Key Drivers: Large population base, increasing demand for biologics and vaccines, supportive government initiatives, and cost-effective manufacturing.

Challenges: Variability in regulatory standards and need for skilled workforce.

Key Players: Thermo Fisher Scientific, Sartorius AG, and local manufacturers such as Esco Aster.

Latin America

Market Size and Growth: The bioreactors market in Latin America is growing steadily, with Brazil and Mexico being key contributors. The market is supported by increasing investments in biotechnology and healthcare infrastructure improvements.

Key Drivers: Growing biopharmaceutical sector, increasing healthcare access, and favorable government policies.

Challenges: Economic instability, supply chain issues, and regulatory compliance.

Key Players: GE Healthcare, Sartorius AG, and local companies.

Middle East and Africa

Market Size and Growth: The Middle East and Africa region is developing as a potential market for bioreactors, driven by improving economic conditions, increasing healthcare investments, and a growing focus on biotechnology.

Key Drivers: Expanding healthcare infrastructure, rising demand for biopharmaceuticals, and government initiatives to boost local production.

Challenges: Political instability, limited local production capacity, and regulatory challenges.

Key Players: International companies like Thermo Fisher Scientific and Sartorius AG, with emerging local manufacturers.

Regional Highlights

North America and Europe: These regions are characterized by mature markets with a focus on innovation, high regulatory standards, and significant investments in research and development.

Asia-Pacific: This region is marked by rapid industrialization, increasing investments in biotechnology, and a large consumer base driving market growth.

Latin America and Middle East & Africa: Emerging markets with significant growth potential, driven by economic development, urbanization, and increasing demand for biopharmaceuticals.

Future Outlook

Technological Advancements: Ongoing innovations in bioreactor technology, such as the development of single-use systems and continuous bioprocessing, are expected to drive market growth across all regions.

Sustainability Focus: Increasing emphasis on sustainable production practices and the use of environmentally friendly materials is influencing market dynamics, particularly in developed regions.

Market Expansion: Emerging markets in Asia-Pacific, Latin America, and the Middle East & Africa offer significant opportunities for market expansion, driven by economic growth and industrial development.

Segments:

Based on End-Users

R&D Departments

R&D Institutes

CROs (Contract Research Organizations)

Biopharmaceutical Companies

Biopharmaceutical Manufacturers

CMOs (Contract Manufacturing Organizations)

Biopharmaceutical Companies

Based on Usage

Lab-Scale Production

Pilot-Scale Production

Full-Scale Production

Based on Scale (In Liters)

5L-20L

20L-200L

200L-1500L

Above 1500L

Browse the full report – https://www.credenceresearch.com/report/bioreactors-market

Browse Our Blog: https://www.linkedin.com/pulse/bioreactors-market-analysis-global-industry-trends-a8l4f

Contact Us:

Phone: +91 6232 49 3207

Email: [email protected]

Website: https://www.credenceresearch.com

0 notes

Text

Streamlining Biomanufacturing: Advantages of Single-Use Bioreactors

Single-use bioreactors are revolutionizing the field of biotechnology, offering a flexible and cost-effective alternative to traditional stainless-steel bioreactors. These disposable systems, made from flexible plastic materials, are designed for the cultivation of cells and microorganisms in biopharmaceutical production, vaccine development, and academic research. With the increasing demand for biologics and personalized medicines, single-use bioreactors provide scalability and rapid turnaround times, accelerating the production of critical therapies while minimizing contamination risks. Advancements in technology, such as sensor integration and automation, further enhance process control and reproducibility, making single-use bioreactors an attractive option for biomanufacturing facilities worldwide. As the biopharmaceutical industry continues to evolve, single-use bioreactors are poised to play a pivotal role in meeting the growing demand for safe, efficient, and sustainable bioprocessing solutions.

#SingleUseBioreactors #Biopharmaceuticals #Bioprocessing #Biomanufacturing #Biotech #Innovation #Sustainability #ProcessControl #BiomedicalEngineering #TechTrends #PharmaTech #HealthTech #Automation #FlexibleManufacturing #FutureOfBiotech

0 notes

Text

0 notes

Text

Global Top 5 Companies Accounted for 73% of total SUS (Single Use System) for Biopharma Process market (QYResearch, 2022)

Single-use systems (SUS) refers to biopharmaceutical manufacturing (bioprocessing) equipment designed to be used once (or for a single manufacturing campaign) and then discarded.

This report focuses on devices and consumables, mainly including single-use bioreactors, disposable sterile bags, and disposable filtration systems.

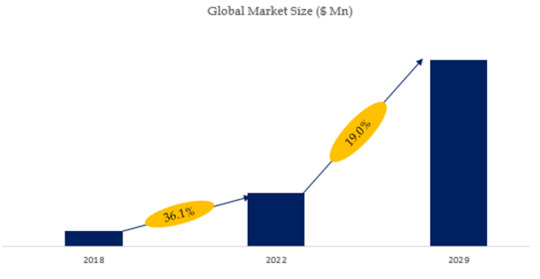

According to the new market research report “Global SUS (Single Use System) for Biopharma Process Market Report 2023-2029”, published by QYResearch, the global SUS (Single Use System) for Biopharma Process market size is projected to reach USD 15.47 billion by 2029, at a CAGR of 19.0% during the forecast period.

Figure. Global SUS (Single Use System) for Biopharma Process Market Size (US$ Million), 2018-2029

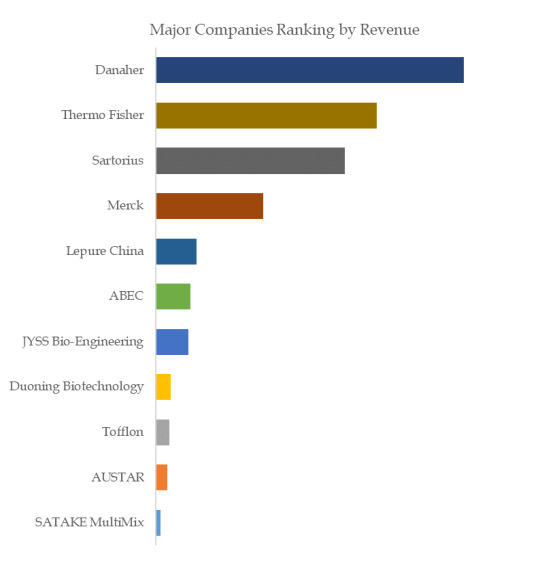

Figure. Global SUS (Single Use System) for Biopharma Process Top 11 Players Ranking and Market Share (Ranking is based on the revenue of 2022, continually updated)

The global key manufacturers of SUS (Single Use System) for Biopharma Process include Danaher, Thermo Fisher, Sartorius, Merck, Lepure China, ABEC, JYSS Bio-Engineering, Duoning Biotechnology, Tofflon, AUSTAR, etc. In 2022, the global top five players had a share approximately 73.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

For more information, please contact the following e-mail address:

Email: [email protected]

Website: https://www.qyresearch.com

0 notes