#Startup Milwaukee Stories

Photo

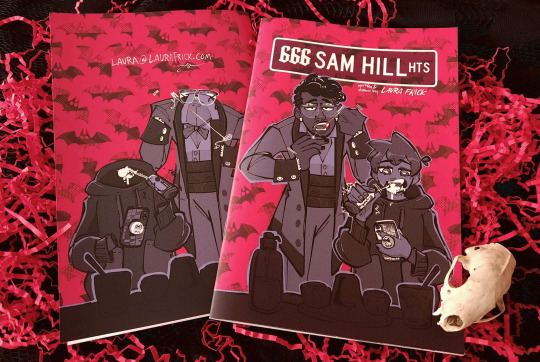

So there was a comics festival in my city this month, called MILK (Milwaukee Indie Local Komics). I debuted my first comic there, a 20 page comedy about vampires called 666 Sam Hill Heights. Available for purchase here at my Etsy: link

Meet Skip and Saffron, two ancient vampires trying to live semi-normal lives in midwest USA. After decades without supervision they've cooled off on the whole 'vampiric army conquest' vibe, and would rather play Fortnite or collect pogs than any of that nonsense. Still, normalcy isn't completely attainable when youre a bloodsucking hellspawn. If you're a fan of What We Do In The Shadows, this will be right up your alley!

20 pages with two short stories;

The Visitor:

Skip and Saffron try to evade getting written up by their supervisor by presenting their new startup venture.

The Child:

Skip's Halloween is ruined when his human neighbors enlist him to watch their 6 year old. Saffron licks blood off the kitchen floor.

59 notes

·

View notes

Text

What We Make for Ourselves

A story set soon after the events of Terminator: Dark Fate

Oakland, 2021

Sarah Connor’s knuckles were white as she maneuvered her jeep down the residential streets at highway speeds. She and Dani were cutting it close as is, having spent the last year preparing their plan to storm the no-name tech startup in Silicon Valley that would soon create Legion. She’d stopped Judgement Day once before, and she was sure she could do it again, but there was one last detour she needed to make in case their plan didn’t pan out. Someone she wanted to warn.

She’d never thought about visiting him before. She figured it would do no good, serve no purpose other than reopen old wounds. Until recently, she didn’t even know where he lived, but with Judgement Day drawing nearer she decided to take initiative. It didn’t take long to track him down; you’d be amazed how much you can find about a person on Google in a few minutes with just their full name. By sheer coincidence, he lived in the Bay Area, so she waited until they were already headed up for their mission to squeeze in time for her little visit. Might as well kill two birds with one stone.

Dani sat idly in the passenger seat, cradling a small manila envelope stuffed to the brim with building schematics. Grace hadn’t given them much to work with in terms of intel besides a company name and a short window for when the grid was supposed to go down, but somehow they’d managed to find the right data cache and download the floor plan for the server farm that would soon host the Legion software; Skynet by any other name still reeked of shit.

Dani would rather be at the motel finalizing their game plan than out in the open so Sarah could wax sentimental for no good reason. This outing was tactically dangerous, as they both had warrants for their arrest, Dani by ICE, Sarah by every intelligence community in the western world. A couple of fake driver’s licenses and Milwaukee accents would do little to hide their identities once the feds got back on their trail.

Sarah slowed the jeep to a crawl as she rounded the final corner onto a dead end street that butted right up against MacArthur Freeway. She parked on the curb between two houses, no doubt to the chagrin of their tenants, but immediately she knew she wouldn’t be there for long.

There he was

Right across the street, piling a small mountain of boxes into the back of an old pickup truck. Sarah didn’t dare take her eyes off him, even for a second, lest he disappear back into the void that was her memory. She hadn’t seen him in almost forty years, had almost forgotten his face, but all at once everything came flooding back. Good memories and bad, of the last normal day she ever lived. The day her best friend and mother were murdered by a machine, the day she went from an English major waiting tables to make ends meet to a soldier hellbent on stopping the end of the world. That was a lifetime ago, but here he was in front of her, younger now than ever before. She couldn’t help but stare, drinking in his face, memorizing every line, every curve. A man, probably his father, popped the truck’s hood and called to him as he checked the engine.

“Kyle, I’m topping her off with oil, but you need to remember to get gas before you hit the highway.”

“I’ll burn that bridge when I get to it, we’re not done loading my crap yet.”

Kyle Reese gingerly set down a duffel bag stuffed with unfolded clothes, and threw open the passenger side door. He was getting ready for his first semester at school, and packing his truck was proving to be the hardest part of the transition. “It’s like playing Tetris,” he quipped as he rearranged a few boxes, trying to will more space out of thin air.

He was taller than Sarah remembered. This Kyle had had an unremarkable childhood and never missed a meal, he was a far cry from the malnourished guerrilla she knew. Seeing him, this ghost from her past, living a normal life in a future she never thought she’d see, it was almost too much. She only turned away from him once she began to feel tears well up in her eyes. This encounter brought back too many painful memories, but pain, he once told her, can be controlled.

Just disconnect it.

His dad disappeared back into the house, and was soon replaced by three boys around Kyle’s age, carrying even more boxes.

“Why you got so much shit, Reese?” asked a short black kid with glasses.

“Because I’m trying to make things are hard as possible for you guys, that’s why.”

An tall Asian kid propped his box on the trucks roof so he could free his hands. “I’m really gonna miss you, man.” He walked over to Kyle and scooped him in for an awkward bear hug. Kyle tried not to laugh as he was lifted off his feet.

The kid with the glasses punched him playfully on the shoulder once the hugger finally put him down. “Hate to see you go, Reese. You know, it’s never too late to drop out and stay home.”

“Tempting, but I’m already balls deep in student loans. I might as well actually be a student for a while, otherwise they’d just be loans.”

“Things will never be the same without him,” cried a kid with a buzz cut, dramatically splaying himself out on the truck’s hood. “Poor kid, he was so young!”

“I’m not dying guys, I’ll see you in a few months, I’m coming home for Thanksgiving.”

“I can still hear his voice.”

Sarah didn’t bother stepping out of the jeep, but turned to face the small crowd of high schoolers, legs dangling out the missing driver’s side door. Dani followed her gaze across the street as she stowed the envelope in the glove compartment.

“That’s the friend you were talking about? He’s younger than I am.”

“I knew him, another him, from another time. Things have changed a lot since then.”

Kyle’s mom came bounding out the front door and embraced her son in an even more awkward hug than his friend’s.

“My little Kyle, heading out to college, paying bills. When’d you get so old? You’re not allowed to be an adult yet, you were still in preschool last week.”

“Mo-o-om,” Kyle complained with a smile. Only two of his friends laughed. “You didn’t act like this when Derek left for school.”

“Sure I did, every year, and I’ll do the same for you because I like embarrassing you in front of your friends. Now everyone come together. Marc, Andy, Sawyer, stand next to Kyle, I want to get a picture.”

“You already took a ton of pictures.”

“And I’m gonna take a ton more before you leave, now stand there and smile.”

They all huddled together against his truck, and she kept directing them like she was making Christmas cards at Sears. “Okay, now let’s have a funny one, everyone make a face. Great. Now let me get some with two of you at a time; Marc you’re first.”

Marc, the kid with the buzz cut, took this as an opportunity to force an exit. “Hey, Mrs. Reese, why don’t you go get his dad, and I’ll take a photo of all three of you. A family portrait, wouldn’t that be nice, Kyle?”

“Oh, I can’t think of anything better.”

She smirked, taking their hint. “I’ll be right back,” she said as she disappeared back into the house, calling her husband’s name.

“Quick, help me pack everything now and I’ll be gone before she gets back,” Kyle joked once she was out of earshot.

Three of the four boys began stuffing thing into the passenger side, well after it was full to capacity, but the bespectacled Sawyer stood back by himself for a few moments. Sarah’s eyes were still locked on Kyle, but Sawyer’s eyes were locked on her.

“Hey,” he called to his friends. “What’s wrong with this picture?”

“What’s up?”

“There’s an old lady staring at you, Reese. She’s been staring for like five minutes.”

Kyle looked over at Sarah, and she immediately turned away.

“Good for her,” he said without a second thought. He continued with the task at hand, trying to force an uncooperative shoe box into the space beneath the passenger seat.

“Isn’t that creepy?”

“Not really, she’s just some lady, she’s not hurting anyone.”

“You ever heard of stranger danger? She’s giving you the bedroom eyes, you’re gonna wind up in her windowless van.”

“Dude, shut up, she can probably hear you. Besides, that’s a jeep, it’s got nothing but windows, I’ll be fine.” Kyle turned back to Sarah who was trying to keep herself busy by reading the warranty sticker on the windshield. Dani nudged her to let her know Kyle was looking, and when she turned back to him, he smiled at her and waved.

Sawyer punched him on the shoulder again, less playfully this time. “Stranger. Danger. Windowless van. It’s your funeral, Reese.”

“Shut the fuck up, man. She’s probably a friend of my mom’s or something.”

With that, Sarah emerged from the jeep and walked over to the boys. Dani also stepped out so she could have a better look, but remained on the far side of the street. Sawyer tried to motion for his friends to head back towards the house, but none of them moved as Sarah stopped a few feet short of the curb.

“Kyle Reese?” She didn’t mean for it to come out as a question, but she couldn’t believe it was truly him.

“Never heard of him,” Sawyer said at the exact same moment Kyle responded “yes.” A third punch, not playful at all.

“It’s really good to see you, Kyle.”

“Um, yeah, it’s good to see you too. How, uh, how have you been?”

“You can stop pretending like you know me. You don’t.”

“Okay, cause I was gonna say… Can I help you? What’s up?” This woman was at least a decade older than his mom, and her face wasn’t familiar at all. He had thought that maybe she was an old babysitter of his, or he’d seen her at church or something, but he was now drawing a complete blank.

“I’m actually here to help you, Kyle. You see, there’s a storm coming. Something big, something bad, and I don’t know if I’m gonna be able to stop it.”

Kyle’s friends had backed into his yard, but he remained where he was on the curb. As she took a step closer to him, a gear in the back of his mind began turning, and he got the feeling that he had seen her before, but still couldn’t place where.

She told him a date and a list of cities to avoid, suggesting he head out into the desert and stay there. Andy inched his way towards Kyle and gingerly grabbed his shoulder. “C’mon man, I think your mom’s calling us, we should head back inside.”

Sarah stared into his soul with such intensity that he was a deer in the headlights, unable to move. She reached into a jacket pocket and pulled out another manila envelope, thinner than Dani’s, and handed it to him. His friends shook their heads, silently imploring him not to take it, but he did anyway.

Dani, seeing that the handoff was complete, beat the hood of the jeep to call Sarah back over. “We’re burning daylight, we should head out. Andale.”

“Just a second,” Sarah cried over her shoulder. She turned back to Kyle, who was holding the envelope out at arm’s length like it could explode at any moment. “I don’t have time to explain everything right now, but it’s really important that you trust me on this, Kyle. Your future is at stake. I don’t have a lot of people left I still care about, but you’re one of them. Have courage in the dark times to come. I’ll try to help you with what you must soon face, but just know that the future is not set. There is no fate but what we make for ourselves. You must be stronger than you imagine you can be. You must survive.”

She turned and walked away, climbing back into her jeep without another word. The engine roared to life, and she and Dani sped away, returning to the mission at hand, leaving the four cowering boys in their wake.

“The fuck was that?” Sawyer finally managed. “I mean, what the fuck was that about? What kind of shady ass drug dealer shit was that? Do not open that envelope, it could be a bomb or anthrax or something.”

“Dude, that was sketchy as hell,” Marc said, his voice wavering with adrenaline. “You need to tell your parents.”

“Who was she?” Andy asked, clutching his chest.

“I don’t know,” Kyle answered, tearing open the envelope before his friends had time to yell anything coherent. Inside was a long handwritten note which he’d accidentally torn in half. He had no time to read it before his parents came bounding back out of the house for their last family photo. The four friends broke apart and pretended like they had been loading the car this whole time; Kyle’s dad could tell they were hiding something, but didn’t want to ask what.

Kyle balled up the note in one hand and unceremoniously tossed it into the open window of his truck. He’d read it later and give his friends the full report, but he didn’t want his parents to know a thing, not yet at least. They took their photos, said their goodbyes, shared more hugs, and finally got all of his stuff wedged in such a way that nothing would fall out, and he hit the road just in time to get stuck in rush hour traffic.

He unwadded the note and barely made it through the first line before he froze.

“My name is Sarah Connor,” it read.

Sarah Connor. THE Sarah Connor.

He’d heard her name a few times over the years. She was a domestic terrorist wanted for blowing up a computer company back in the 90s. They called her the Cyberdyne Bomber, and her name was up there with the likes of Ted Kaczynski and Timothy McVeigh. She’d been in the news recently because she was finally caught at the US-Mexico border trying to sneak back across. She’d apparently killed a ton of guards and stolen a police helicopter, then crashed it into a dam or something like that. Kyle hadn’t kept up with the news with quite the same intensity as his parents.

He realized now that that’s where he knew her face from…

“Holy shit.”

He pulled off at the first exit he came to and parked at a gas station so he could read the whole thing in peace. He’d heard that she was a crazy person, the news said she was schizophrenic, that she believed there were evil aliens robots trying to take over the world. Her note was legible, to say the least, but no less fantastical than the news made her out to be.

The end of the world was coming, fire and fury would rain down from the heavens, machines would rise up against man to exterminate all life on Earth. And here he was, stuck in the middle of it all. She claimed she knew him in a past life, one of his past lives apparently, or a future life, it didn’t make a lot of sense. Something to do with time travel, with a rogue AI called Skynet, but it’s also called Legion, but then only recently? She was trying to stop the end of the world, but didn’t know if she’d be successful, and just wanted to give him a heads up so he didn’t die like four billion others.

He’d lived through several end-of-the-world prophecies since he was a kid, but he’d never given them much thought. June 6, 2006, 666, Biblical Revelations, nothing happened. May 21, 2011, the rapture, nothing happened. December 21, 2012, the Mayan calendar, nothing happened. And now Connor was convinced that the world was going to end later this month, but for real this time, and wanted him specifically to know about it.

Why had a domestic terrorist singled him out like this? Was he in danger? Was his family? He considered calling the police, the FBI, the crime stoppers hotline, anything, but he wasn’t sure what he’d even say. At the bottom of the note was a cellphone number with too many digits, obviously international, and he typed it into his phone almost without thinking. He couldn’t stop himself from doing it anymore than he could force himself to call the police. He was on autopilot, fight or flight mode, and he had apparently chosen fight.

It rang once, twice, then connected with no greeting. He could hear the wind whipping by on the other side, a car on the highway. With caution, he threw out a feeble “hello,” secretly hoping she wouldn’t be there and he could pretend none of this had happened.

“Talk to me, Reese.”

Fuck. “Is this really Sarah Connor?”

“Yes, Kyle. It is.”

“What’s going on?”

“Did you read my note or not?”

“None of that’s… it’s not… But that’s all BS… Isn’t it?” He sounded unconvinced, one way or the other.

So, Sarah had some convincing to do.

“Kyle, listen to me very carefully…”

#my stuff#my writing#long post#the terminator#terminator#terminator 2#judgement day#T2#terminator dark fate#terminator 6#dark fate#T6#fan fiction#sarah connor#dani ramos#kyle reese#I want to see something like this in the sequel#if it even gets a sequel#it will probably under perform and get rebooted again in a few years#terminator 7#no fate but what we make#no fate#terminator series#terminator franchise

18 notes

·

View notes

Text

Travel’s Fastest Growing U.S. Small Businesses Offer a Glimpse Into These Emerging Trends

A short-term rental apartment with hotel-style amenities bookable in Columbus, Ohio, from Frontdesk, a startup based in Milwaukee. It's the fastest-growing of more than a dozen U.S. private companies in travel, according to Inc. magazine. Frontdesk

Skift Take: The pandemic catapulted a few niche innovations into widespread use, benefiting a few fast-moving travel businesses. Lists come and go, but pay attention to the underlying trends that will last after the crisis passes.

— Sean O'Neill

Read the Complete Story On Skift

from Destinations – Skift https://ift.tt/3gbqOeA

Publish First on

0 notes

Photo

Proud and excited to announce our selection into the state funded WERCBENCH Labs Accelerator Program #accelerator #wisconsin #startup #milwaukee #teamultra #manthiniclub Check out the full story here! https://lnkd.in/d9yAz9s https://www.instagram.com/p/CHswpdUB55K/?igshid=vhsguywdkorp

0 notes

Text

Hotmerchpremium - Milwaukee Record Blog Boy 2020 T-Shirt

Hotmerchpremium – Milwaukee Record Blog Boy 2020 T-Shirt

Buy this shirt: https://hotmerchpremium.com/product/milwaukee-record-blog-boy-2020-t-shirt/

AZ Factory is a startup—one with the Milwaukee Record Blog Boy 2020 T-ShirtAdditionally,I will love this backing of a luxury group, but a startup nonetheless, and Elbaz likes that aspect. “For the first time I want to give birth to a new story and not to recreate or replace someone else. It’s a moment of…

View On WordPress

0 notes

Text

Big Deal Real Estate Investing Group - Online Webinar Milwaukee, Wisconsin Tickets, Multiple Dates

Points can range from 2% to 4% of the total loan amount. So, you’ll pay heftier fees in exchange for convenience, but that’s okay given the potential profit you’ll walk away with. Another obstacle is that they may not cover the full cost of buying the property. These lenders usually lend 65%-75% of the current value of the property. Some will lend based on the value of the property after it’s been improved, also known as the "after repair value" (ARV). That leaves you to fund the difference or find another source of funding to bridge the gap. Do a quick Google search for hard money lenders in your area and see what pops up. Also, go to local Real Estate Investors Association (REIA) meetings and network. Ask for recommendations from the members there. Once you’ve found a hard money lender, don’t forget to make sure that lender is reputable.

German proptech startup Thing-it raises €4.2 million to build the digital brain for smart buildings - EU-Startups

youtube

Kansas City Turnkey Real Estate Investments

https://buff.ly/37cBzqT

#RealEstateInvesting #PropTech #Dubai #London #Vancouver #Sydney #FinTech

— Aequius (@aequius) December 11, 2019

There are several ways to do this - from buying in an area with high rents, to putting a lot of money down so that your mortgage payment is low. One of our favorite ways to do this online is with Roofstock. You can buy single family rental properties (that already have tenants and cash flow) easily online. There are two downsides to owing a rental property directly. First, it typically requires a lot of cash up front - from the downpayment to the maintenance required. You really need to assess whether your return on investment will be worth it. The second major downside of real estate is dealing with tenants. You’ll need to screen renters before letting them move in. You’re also bound to hear sob stories at one point or another so you’ll have to learn to be firm with renters. If you’re the type to easily give in to people, you may be better off letting a property management service oversee your rental properties.

Other than the Libra news, some of you may have seen last week, maybe the week before, news that PayPal, via a 70% interest, purchased Chinese payments company GoPay. Now gives PayPal license to provide online payment services in China. 96.73 trillion. Listen, that's a big market opportunity. I don't know that necessarily all applies to PayPal. But ultimately, we're talking about money that flows through these networks. That's PayPal's opportunity. If you're talking about a country the size of China, you're talking about a lot of money flowing through a big network. PayPal getting entry into that market, that was the hardest part. Now it's going to be just about building out products and services for more people. You may wonder, why PayPal? Perhaps they're just seen as the best option in a tech-driven-payments world. I'm not sure. We obviously like it for a lot of reasons. It's a company that was built on the technology as opposed to one that's pivoting toward technology. And then, you can't forget about the big cross-border opportunity. Real Estate Investing 've seen MasterCard and Visa both investing heavily in that opportunity.

Commercial real estate (CRE) is used for business purposes, such as retail or office space. Industrial buildings, apartment complexes, mobile home parks, and assisted living facilities also fall into this category. Commercial real estate is costlier than residential real estate, often requiring a greater down payment. There's usually more property to manage, too. Investors in CRE need to dedicate ample time to learning how to properly invest in and manage the asset class before finding, buying, and managing an asset. With the larger upfront cost and significant time and effort required, many choose to invest in commercial real estate through alternative methods, such as REITs, ETFs, partnerships, or crowdfunding. 50,000 or more to their investments. Those who want cash flow or tax benefits from owning commercial real estate and are willing to dedicate time and effort to owning and managing the property. Real estate crowdfunding connects accredited investors with investment opportunities.

But if you can invest for at least three years, you might want to consider the MogulREIT II. It has more upside potential as investment properties appreciate in value and generate more income. The tradeoff is that you receive a smaller monthly dividend in the meantime. The MogulREIT I portfolio offers an annual dividend yield of 7.81% with monthly payments, as of July 1, 2019. This REIT holds commercial and retail properties across the U.S. There are also US Real Estate Equity Builder in the portfolio. You can view the current portfolio holdings on the RealtyMogul website. The MogulREIT II pays only a 4.50% annual dividend (since January 1, 2018) and holds multifamily apartment buildings. However, there’s more long-term upside potential because this REIT is more equity-focused. As equity projects appreciate in value, you can earn profits when they sell. This REIT launched in September 2017 and currently holds six properties located in Illinois, New York, and Texas.

0 notes

Text

Personalized wine? This Milwaukee company just raised $8.5 million to prove it’s the future

Wine buying is daunting for most people, whether it’s online or off a menu or in an aisle filled with so many brands that it’s hard not to buy the same products time after time, just to stay sane.

Therein lies the opportunity for Bright Cellars, a nearly four-year-old, 40-person Milwaukee, Wisconsin-based startup that sells wines directly to consumers on a subscription basis. Other monthly wine clubs have been at things longer, sending out award-winning wines, or hand-selected wines, or small-batch wines paired with craft meats and artisanal cheeses. But Bright Cellars is trying to educate members about what wine they might like so can figure out these decisions for themselves.

More interesting, to us: Bright Cellars is also quietly building a portfolio of its own wines based on member feedback, even while Brand Cellars doesn’t use its own label. In short, it’s going the way of wine giants like Gallo and Constellation and creating a number of different brands with the help of different suppliers. (Gallo, for example, owns Alamos and Barefoot Cellars, among roughly two dozen other brands. Constellation owns Cooper & Thief and Clos du Bois, among others.)

Taking a step back, the company starts to appear more ambitious than might seem based on its website, which immediately invites users to take a quiz aimed at discerning their particular taste profile. Think questions like: Do you like milk chocolate or dark or are you Reese’s type of person? Do you like you like your tea with lemonade and ice, or hot served with a lemon slice?

While the quiz is whimsical, Bright Cellars founders Richard Yau and Joe Laurendi insist the data they are collecting is a valuable asset, and not just potentially for winemakers. (Yau says Bright Cellars doesn’t sell that information but suggests the company might consider selling its aggregated insights at a later date.) It’s helping them figure out how tastes are changing, and, ostensibly, putting them in a better position to cater to those changing tastes than companies that are dictating to their customers, instead of listening to them.

It’s a good enough story, at least, that Revolution Ventures just led an $8.5 million Series A round for the company. Bright Cellars’s seed investor, the Milwaukee-based venture firm, CSA Partners, which has a range of consumer-facing companies in its portfolio, also joined the round.

It helps that the company is based in the Midwest, where Revolution is largely focused on helping startups compete with their East and West Coast peers. Yau, a native of San Francisco, says he never expected to live in Milwaukee, but after Bright Cellars was admitted in its earliest days to a local, three-month accelerator program called gener8tor, he and Laurendi decided to stay put. “I really like it, I really like the people,” says Yau. “It’s definitely a smaller entrepreneurial community, but the founders here are very passionate and very supportive and in a larger ecosystem, we might not be connected to all the pieces here that make it work.”

That Yau and Laurendi were roommates at MIT is a nice twist, too. Though most MIT grads might be expected to work on AI-driven companies in cybersecurity, mental health, urbanization, or improving ed-tech, Yau isn’t shy about the fact that both he and Laurendi were aways more interested in starting a consumer company. Though they once worked on a parking app at a school hackathon, it was during a two-semester-long course in wine studies at neighboring Boston University to satisfy Yau’s burgeoning interest in wine that Bright Cellars was born. Says Yau, “We just realized that not a lot of people have time to take two semesters to learn enough about wine to feel like they understand it. We wanted to find an easier and more accessible way for people to get comfortable” with what they’re ordering.

It’s also the case that the market they’re looking to disrupt is a big one. According to data compiled by ShipCompliant/Sovos, which gathers data for the wine community each year, consumers spent roughly $3 billion on wine delivered to their doorsteps last year. Meanwhile, direct-to-consumer wine shipments jumped 9 percent between 2017 and 2018 to 6.3 million cases.

The same outfit says that one minor challenge to that growth are new, urban tasting rooms. A bigger change to which the industry is still adjusting is the growing number of customers who demand a more personalized experience. It seems unlikely that the broader industry has actual personalized wine in mind. If Bright Cellars takes off, that might change.

0 notes

Text

Rick Horrow’s 10 to Watch : Week of Februrary 18th

MAYORS EDITION

MLB in 2019 will "commemorate the 150th anniversary of professional organized baseball with a season-long series of uniform features and content integrations across its league-run media platforms." According to Sports Business Journal, the league's celebration will begin on Opening Day in late March with "special cap patches worn by every player." The cap application has "never been done to celebrate a major anniversary in baseball, but it will be similar to special postseason patches worn on the side of player caps." There also will be a "uniform patch worn all season on the right sleeve of player jerseys." Those sleeve patches "recall similar ones used to celebrate baseball's 100th anniversary" in 1969 and 125th in 1994. MLB also is planning an "extensive series of anniversary-driven multimedia content commemorations of great moments in baseball history that will run on MLB Network, MLB.com and the league's official social media channels.” It truly is a celebratory year, as the NFL is also celebrating its 100th anniversary and other key milestones of sport also unfold, which we will document throughout the year.

Overtime banks $23 million from Carmelo Anthony, Victor Oladipo, Spark Capital, and others. According to Hashtag Sports, the digital sports media startup focused on high-school athletes has raised $23 million in Series B funding. Venture-capital firm Spark Capital led the round, which brings the two-year-old company to $33.5 million raised to date. Others participating include MSG Networks and NBA players Victor Oladipo and Carmelo Anthony. With the latest funding, Overtime has a valuation of around $100 million. The company launched with short-form content centered on high-school basketball stars, and over the past year has expanded its coverage to include soccer, football, esports, and women’s basketball. Overtime also is looking to launch live in-person events and activations and is eyeing international expansion. People continue investing in Overtime because they’ve smartly monetized through branded-content deals and nascent ecommerce and merchandise business, and look to be a rising star in the youth sports digital media space.

U.S. Club Soccer and LaLiga North America have announced an expansion of their technical partnership first signed in August, 2015. The long-term extension continues a valuable relationship in youth soccer that has provided various coaching education resources to the American game, directly educating thousands of coaches and impacting even more players. It also points to LaLiga North America’s commitment to growing soccer in the U.S. LaLiga North America is a joint venture between LaLiga and Relevent Sports, which serves as the exclusive representation of LaLiga in the U.S. and Canada for all business and development activities. The operation supports the league’s growth in the U.S. and Canada through consumer-related activities including youth academies, development of youth soccer coaches, marketing agreements, consumer activations, exhibition matches, a coaching education series, and plans to have an official LaLiga Santander match played in the U.S. In 2019 and beyond, the two organizations plan to increase their Players First commitment by creating additional coaching development opportunities, extending LaLiga scouting to U.S. Club Soccer members, and offering exclusive benefits to Players First-licensed clubs and others.

The Sports Turf Managers Association (STMA), the non-profit association comprising 2,700 men and women professionals overseeing sports fields worldwide and critical to athletes’ safety, received outstanding participation at its 30th annual Conference and Exhibition in Phoenix. Visit Phoenix confirmed the community received over $3 million from total estimated direct expenditures from conference participants including event attendees, exhibitors, and organizers. The Phoenix Convention Center housed more than 2,300 participants including 1,400 sports turf leaders and 900 exhibitors from 14 countries for four days of industry education, networking events, and product demonstrations. The event was highlighted by a volunteer rebuild of Lindo Park baseball field, two “Seminar On-Wheels” tours of Phoenix area sports complexes, SAFE fundraisers, and the STMA Awards Reception and Banquet. SAFE, the association’s charitable foundation, raised nearly $41,000 through a bowling competition, live and silent auctions, raffles, and a golf tournament at Grand Canyon University Golf Course. Proceeds benefit educational programs, scholarships and grants enriching communities through safe, sustainable sports and recreation fields.

NASCAR goes all in on media advertising and teams up with Barstool Sports. With an aging fan base and no consistent uptick in ratings, NASCAR needs a serious revamp. To deal with this, NASCAR is launching an ad campaign for nearly 20 TV markets throughout the United States and has struck a digital partnership with Barstool Sports. According to Sports Business Daily, NASCAR is set to spend between $10 million-$20 million for this advertising campaign set to run throughout 2019 with a new technique of advertisements to be shown during non-NASCAR related programming. NASCAR is planning to launch locally themed ads on local Fox and NBC affiliates in NASCAR markets such as Atlanta, Charlotte, Kansas City, and Orlando/Daytona and such cities as Cleveland, Milwaukee, Raleigh, and Tampa where NASCAR doesn’t yet race. NASCARS’ overall marketing goal will be to tell the stories of its drivers and accompanying teams in hopes of bringing in new fans to the sports while retaining its core fan base.

The Alliance of American Football league is underway and the ratings show that it’s an early hit. The AAF debuted on February 9 on CBS. Surprisingly, according to Yahoo Sports, the new football league was able to pull off better television overnight ratings than a Houston Rockets vs. Oklahoma City Thunder NBA matchup and generally received positive reviews during its opening week. Although the early 2.1 overnight rating beat out the NBA numbers, there was certainly more curiosity about the AAF than a regular-season NBA game. In the past other startup football leagues such as the USFL and XFL performed well at the beginning before excitement quickly fizzled. The challenge for the AAF will be to keep the good times rolling as ratings will be harder to come by when the games are on CBS Sports Network and not CBS in primetime. Ultimately, compelling football will be what keeps fans engaged long term. The AAF will also be competing with the other new football league, the XFL, which is set to launch some time during 2020. The AAF will have to outperform other new football leagues in addition to well-established sports institutions such as the NBA and MLB during the spring and summer months.

Sports entities raise the bar on stylish celebrations of Black History Month. CBS Sports Network celebrates Black History Month with the premiere of “Althea & Arthur,” a documentary highlighting the legacies of Althea Gibson and Arthur Ashe on February 18. The documentary is narrated by Tony Award winning actress Phylicia Rashad and chronicles the impact Gibson and Ashe made to the world of tennis and in advancing civil rights in America during a time of racism and segregation. In Phoenix, The Arizona Republic notes the Suns’ Mikal Bridges, Josh Jackson, Kelly Oubre, and Richaun Holmes have "each worn themed sneakers in February" to celebrate Black History Month. The shoes will be made "available for purchase at the end of the month with the proceeds benefiting Elevate Phoenix, a local non-profit that works with youth." The Suns "commissioned designers to create the custom sneakers, but the players had a say in the theme.”

The PGA Tour continues to drive philanthropy. Last week, insurance firm Burns & Wilcox launched its signature philanthropic initiative Champions & Charities with brand ambassadors Webb Simpson and Jimmy Walker. The company will give a minimum of $50,000 to the charity of the golfers' choice. And the just-completed PGA Tour Genesis Open "will get a big upgrade" beginning in 2020, according to sources, in no small part because of its affiliation with Tiger Woods’ foundation. According to ESPN, the event held at Riviera Country Club and run by Woods' foundation will receive “elevated status,” which means it will have a significantly higher purse – growing to $9.3 million, as well as offer a three-year PGA Tour exemption to the winner (up from two years), and have an invitational field" of 120 players rather than 144. The best thing that Woods could do to boost its prominence? Win the event.

As the 2019 NASCAR season opens at Daytona, Dale Earnhardt Jr. volunteered on a chainsaw crew as they "cleaned up debris from Hurricane Michael" in Panama City, Florida. According to the Charlotte Observer, Earnhardt "joined a crew from Team Rubicon, the non-profit group of veterans that teams with first responders.” Likewise, NASCAR driver Kurt Busch will "pay for and give away 100 tickets" for each Monster Energy NASCAR Cup Series race this season to military members and veterans. The giveaway is in "partnership with the Veterans Tickets Foundation." NASCAR continues to be a team player and major contributor off the racetrack as well as working hard to keep sports fans’ focus on its racing circuit, state of the art facilities likeD, and high profile drivers.

USA BMX, Mongoose team up For STEM education initiative. USA BMX has signed a deal with the Mongoose bicycle brand to bring science, math, engineering and technology training to U.S. schools in a joint program that is projected to reach 225,000 students in 2019. Additionally, according to Sports Business Journal, Mongoose has hired nine-time USA BMX amateur national champion and USA BMX Foundation Marketing Coordinator Justin Posey as a sponsored rider and education ambassador. Interestingly, the Mongoose bicycle brand is owned by Pacific Cycle, a division of Montreal-based Dorel Industries.

0 notes

Text

Builders Bet Tiny Apartments Will Lure Renters

Bedrock micro lofts | Rock Ventures

Since Hannah Toth set out a few months ago to move out of her parents’ home in suburban Pittsburgh, she has seen plenty of airy apartments of up to 900 square feet.

What caught her eye is a 360-square-foot studio roughly the size of her childhood bedroom for just over $1,500 a month.

When Ms. Toth, 26 years old, tells family and friends about her decision, they ask, “You’re looking to live somewhere that’s how big exactly?”

Ms. Toth said she liked that the studio comes fully furnished, and that its smaller energy footprint is more environmentally sustainable.

A Pittsburgh developer is betting that more 20-somethings will pay more than $1,500 a month for the tiny studios in its new building, called Ollie at Baumhaus, even though space is so tight the beds double as couches.

It is a big risk in a city where the average apartment rents for a modest $979 a month, compared with nearly $3,400 in the New York metropolitan area and more than $2,800 in San Francisco, according to data provider Reis Inc.

A trend that started in pricey coastal cities as a response to rising rents is spreading to smaller cities that often have an abundance of relatively inexpensive housing options. In Milwaukee, Cleveland, Detroit, and Kansas City, Mo., developers are betting on demand from young people to live in tiny quarters even when cost isn’t the primary consideration.

Micro apartments generally come fully furnished with amenities such as wireless internet and in some cases maid service, at a price similar to those of larger traditional apartments. The cramped units encourage people to use the common spaces more, creating a greater sense of community, developers say.

The seven-story, 127-unit Ollie at Baumhaus building in Pittsburgh is set to open in June.

Justin Merriman for The Wall Street Journal

The developers are gambling that such amenities will help set the units apart in a crowded marketplace, where a rush of new building is coming online despite ample supply of affordable older housing stock.

“I think it will be an adjustment, for sure,” said Dan Mullen, president at Bedrock, the development arm of mortgage magnate Dan Gilbert’s family of companies. But the tall ceilings and windows help make it feel larger, he added. “When you get in one of these units, it feels very spacious.”

Bedrock’s new micro-unit building is set to open this summer, with 218 furnished units averaging 260 square feet each.

Mr. Mullen points to perks such as free high-speed internet, a flat-screen TV and a rooftop terrace where tenants can watch movies. The units will rent for less than $1,000 a month—roughly in line with larger studios in other new buildings, which typically don’t include utilities and internet.

The Pittsburgh building, which has 127 units in total and was developed by local firm Vitmore, will feature not just tiny apartments but also three-bedroom units designed to be shared by roommates—some of whom might never have met before.

Christopher Bledsoe, co-founder and chief executive of Ollie, a real estate startup that is managing the project, said the building, which is set to open in June, will feature a community garden where renters can grow their own fruits and vegetables, an on-site manager who is a fitness instructor and bartender, and cooking classes from local chefs.

“What would cause a 20-something graduate to leave Pittsburgh and come to New York City?” he said. “It’s the desire to not come home to an empty apartment.”

The buzz around the mini units could help distinguish the building. Nearly 2,300 new apartment units were completed in Pittsburgh in 2016 and an additional roughly 1,800 are expected this year, according to MPF Research, a division of RealPage . That compares with the historical average dating back to 2000 of 1,000 units a year.

In Kansas City, a developer is installing queen-sized beds in case would-be residents want to get even cozier and share their 300-square-foot flats with a roommate. The units will rent for $700 to $800 a month—about in line with the average rent for apartments of all sizes, according to Reis.

“Young people today seem to be able to group together,” said John Hoffman, a partner at UC-B Properties, which is developing the 50-unit building that is set to break ground in the coming months.

Mr. Hoffman said he modeled the design of the units on a cruise ship cabin. The sink doubles for both the kitchen and the bathroom, the microwave doubles as an oven and the fridge can handle “a 6-pack of long neck beer and a 12-inch pizza,” he said, which is all he figures young people these days need.

The post Builders Bet Tiny Apartments Will Lure Renters appeared first on Real Estate News & Advice | realtor.com®.

from http://www.realtor.com/news/trends/builders-bet-tiny-apartments-will-lure-renters/

0 notes

Text

Expanding Use Of Advanced Technologies Booming Demand In The Cylinder Tie Rod Market

The COVID-19 pandemic has caused supply and manufacturing disruptions in the automotive sector creating uncertainties in every aspect. The change in customer behavior in terms of mobility preferences during this crisis is changing the automotive landscape.

This pandemic situation has shut down many production lines owing to the trade restrictions and closed borders, creating a shortage in required parts and limiting the distribution of supplies. Different enforced measures including the closing of workspaces and dismissal of short-time workers have created a depression in the growth rate of the automotive industry.

The growing fear of recession is estimated to decrease overall sales and revenue. A limited supply of parts coupled with a reduced workforce has forced the leading OEMs to shut down their production. A significant drop in demand has restricted the cash inflow which is highly important in payment of salaries to the workforce. With growing uncertainties around the COVID-19 pandemic, the industry leaders are taking measures to adapt to the situation.

Global Cylinder Tie Rod Market: Introduction

Cylinder tie rods are the type of hydraulic or pneumatic systems utilized to produce linear motion by converting fluid pressure and flow to velocity and force. Cylinder tie rods are designed to withstand maximum rated pressure and used to mount the cylinder. When the cylinder tie rods extend at both ends of the cylinder, one end can be used for cylinder mounting and the opposite end can support the cylinder or be attached to the equipment or machine members. A strong advantage of the cylinder tie rod design is that it can be easily disassembled and examined for repair & maintenance. Furthermore, industry standards exist for cylinder tie rods, but the manufacturers often apply variations to make cylinder tie rods lighter and compact. Cylinder tie rods are utilized in a large majority of industrial and heavy duty manufacturing applications.

Subsequently, the study aims to analyze the most recent trends, dynamics, and potential strategies in the global Cylinder Tie Rod market.

Global Cylinder Tie Rod Market: Dynamics

At macro-level, the cylinder tie rod market is squarely dependent on the performance of the sales of industrial, mining, and construction equipment worldwide. With the infrastructure investment set to go up, demand for construction equipment will rise further. Also, the easy availability of financial schemes and increasing use of construction equipment in real estate construction activities, the demon for cylinder tie rods is foreseen to grow. In the global market, double-acting cylinder tie rods are anticipated to dominate the market over the coming years. Notwithstanding the existence of the current global macroeconomic headwinds, cylinder tie rods market is expected to outpace the growth of the general overall global economy. As global competitive dynamics force manufacturers to continue to optimize their manufacturing facilities, there is an increasing trend to adopt internet interconnected facilities and automation. Subsequently, attributing to the growth of cylinder tie rods market.

For detailed insights on enhancing your product footprint, request for a Sample Report here https://www.persistencemarketresearch.com/samples/29728

Importantly, as the demand grows for finer functionality and control, predominantly in the heavy and oil & gas industry, system integrators and end-users rely more heavily on sensor –instrumented cylinder tie rods.

Global Cylinder Tie Rod Market: Segments

The global Cylinder Tie Rod market can be segmented based on product type, construction type, end use, function, and region.

Based on product type, the global Cylinder Tie Rod market can be segmented as:

Hydraulic Cylinder Tie Rod

Pneumatic Cylinder Tie Rod

Based on construction type, the global Cylinder Tie Rod market can be segmented as:

Aluminum

Steel

Based on end use, the global Cylinder Tie Rod market can be segmented as:

Industrial Equipment

Oil & Gas Industry

Automotive

Pharmaceutical

Foundries

Power Generation

Aerospace and Defense

Mobile Hydraulics

Construction Equipment

Agricultural & Forestry

Compaction

Mining Equipment

Material Handling

Based on function, the global Cylinder Tie Rod market can be segmented as:

Single Acting Cylinder Tie Rods

Double Acting Cylinder Tie Rods

Global Cylinder Tie Rod Market: Regional Outlook

Cylinder tie rod manufacturers in North America face competition from low-cost imports, but quality issues continue to impede broad acceptance by the U.S. OEMs. Nonetheless, U.S. imports of cylinders tie rods grew substantially in the past few years and look promising for the upcoming years as well. Moreover, China to remain at the forefront in terms of the sales of mobile equipment (mining and construction), translating the increased production of the hefty number of the equipment for industries and other end-use. Subsequently, the aforementioned regional parameters are likely to bolster the cylinder tie rid market in the foreseeable future. Adoption of mechanized agriculture and increased spending on infrastructure in developing countries of Latin America and the Middle East & Africa will likely benefit cylinder tie rod vendors.

Global Cylinder Tie Rod Market: Key Participants

List of some of the prominent market participants in the global Cylinder Tie Rod market discerned across the value chain include:

Festo Corporation

Parker Hannifin Corporation

Bosch Rexroth AG

Prince Manufacturing Corporation

Milwaukee Cylinder

Lynair, Inc.

Cross Manufacturing, Inc.

Sheffer Corporation

Cunningham Manufacturing Company

Eaton

For in-depth competitive analysis, Check Pre-Book here https://www.persistencemarketresearch.com/checkout/29728

The research report – Cylinder Tie Rod presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. The study on Cylinder Tie Rod market also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to Cylinder Tie Rod market segments such as geographies, application, and industry.

Our unmatched research methodologies set us apart from our competitors. Here’s why:

PMR’s set of research methodologies adhere to the latest industry standards and are based on sound surveys.

We are committed to preserving the objectivity of our research.

Our analysts customize the research methodology according to the market in question in order to take into account the unique dynamics that shape the industry.

Our proprietary research methodologies are designed to accurately predict the trajectory of a particular market based on past and present data.

PMR’s typical operational model comprises elements such as distribution model, forecast of market trends, contracting and expanding technology applications, pricing and transaction model, market segmentation, and vendor business and revenue model.

Persistence Market Research’s proactive approach identifies early innovation opportunities for clients in the global automotive sector. Our insights on next-generation automotive technologies such as connected cars, automotive emissions control, vehicle-to-vehicle (V2V), autonomous cars, electric and hybrid vehicles, and augmented reality dashboards ensure clients stay at the forefront of innovation.

Our competencies go beyond regular market research to deliver tailored solutions in an industry marked with increasing environment regulations, evolving consumer preferences, and a shifting landscape of emerging markets. We pride ourselves in helping our clients maximize their profits and minimize their risks. Actionable Insights & Transformational Strategies that Help you Make Informed Decisions.

Report Highlights:

Shifting Industry dynamics

In-depth market segmentation

Historical, current and projected industry size Recent industry trends

Key Competition landscape

Strategies of key players and product offerings

Potential and niche segments/regions exhibiting promising growth

A neutral perspective towards market performance

There has been a growing trend toward consolidation in the automotive sector, with the output of motor vehicles resting mainly in the hands of a few large companies and smaller independent manufacturers gradually.

Read all Automotive Market Insights here https://www.persistencemarketresearch.com/category/automotive-and-transportation.asp

Our client success stories feature a range of clients from Fortune 500 companies to fast-growing startups. PMR’s collaborative environment is committed to building industry-specific solutions by transforming data from multiple streams into a strategic asset.

0 notes

Text

Trump’s First Presidential Portfolio Lags Job, Stock Market Growth

In his first address to the U.S. Congress, President Donald Trump hailed General Motors Co, Harley-Davidson Inc, Intel Corp and seven other companies as innovators and job creators, predicting they would be among those producing “tens of thousands of new American jobs” and investing “billions and billions of dollars.”

Nearly three years later, with unemployment at the lowest in half a century, that first presidential portfolio has stumbled to fulfill that forecast. While Trump’s 10 companies have spent billions on new factories and upgrades, they failed to keep pace with new hires, according to a Reuters analysis of the group’s capital expenditures and headcount since 2017.

Collective employment at Fiat Chrysler Automobiles NV, Ford Motor Co, GM, Harley, Intel, Lockheed Martin Corp, Sprint Corp, Walmart Inc and small biotech Amicus Therapeutics has remained flat at about 2 million workers, the analysis shows. In the same period, total U.S. employment has risen by 4.5%.

Wall Street has not smiled extensively on Trump’s selected companies either.

Most of the companies’ total shareholder return has trailed the S&P 500’s 47% advance and sector benchmarks since Trump’s February 2017 speech. Only four of the 10 have outperformed the broad benchmark while five have lagged the wider market by 35 points or more, as of Jan. 28.

White House Deputy Press Secretary Judd Deere declined to comment about the individual companies, but noted more Americans are coming off the sidelines and finding work, and U.S. wages and consumer confidence are rising.

“Despite headwinds from severe monetary tightening and a global recession, President Trump’s agenda of fair and reciprocal trade, lower taxes and deregulation has created the strongest economy we’ve ever seen,” he added.

Still, struggles within the Trump portfolio underscore how the president’s economic and immigration policies have produced uneven results as he seeks another term in the White House.

Since he took office, only Fiat Chrysler and defense contractor Lockheed Martin have added a meaningful number of net new workers.

Lockheed’s U.S. headcount is up about 15%. Fiat’s employment is up about 11%, with some gains coming from broader North American operations. The net gain of jobs at the two companies is about 22,800 since the end of 2016, according to company disclosures.

“What a great brand Jeep is,” Trump said in a shoutout to Fiat Chrysler’s hot-selling vehicle, before signing a tariff agreement with China.

By contrast, the combined overall U.S. headcount at Ford and GM has declined by about 10,000, or 5%, to 184,000, despite investing billions of dollars in their automotive plants. (For a graphic click https://tmsnrt.rs/315LHzh )

For a broader picture, the U.S. economy has produced an average of 193,000 new jobs per month, over the past three years. But even with the benefit of Trump’s 2017 massive corporate tax rate cut, that is 14% less than the 224,000 jobs per month created during the last three years of Barack Obama’s administration, according to U.S. Department of Labor figures.

“Trump wins some, loses some when compared to Obama,” said Mark Zandi, chief economist at financial research firm Moody’s Analytics, referring to various economic indicators like stock market gains (more under Trump), federal budget deficit (less under Obama), fixed mortgage rates (lower under Obama) and household net worth (higher growth rate under Trump).

But Zandi and four other economists interviewed for this story said Trump sets himself apart with a restrictive immigration policy that is exacerbating labor shortages across jobs that pay low wages and top-end salaries.

“This is going to become a very severe impediment to growth,” Zandi said. “We’re used to seeing 200,000 new jobs created every month, but it will be one-fourth of that a few years from now.”

The U.S. labor force has grown at an annual rate of 0.5% in the 10 years since the Great Recession ended. But in the other four recent recoveries, annualized labor force growth was more than doubled, exceeding 1%, according to economists at the Federal Reserve Bank of Dallas.

Meanwhile, a key plank in Trump’s agenda – rebuilding the country’s manufacturing base – recently took a hit when the sector fell into its deepest slump in more than a decade.

But there are plenty of bright spots, big and small.

U.S. headcount at defense contractor Lockheed Martin, for example, has surged 15% to about 102,300 employees since the end of 2016 as it seeks full-rate production of its F-35 fighter jet, according to company.

Lockheed shares have climbed, too, producing a total return of 76% since Trump’s 2017 speech, easily outpacing the S&P 500’s total return of 47% during that time.

Amicus Therapeutics Inc, which Trump hailed for treating rare metabolic disorders, has nearly doubled its U.S. headcount to more than 500 people, according to U.S. Department of Labor disclosures. Its shares are up 39% since Trump’s speech, boosting its market value to more than $2 billion. The Nasdaq US Small Cap Biotech Index is up 61% during that time.

SPENDING BILLIONS

In 2018, the Trump portfolio of companies collectively used about $60 billion from their cash flows on capital expenditures to make new products and to remain competitive, according to their financial statements. Intel, for example, plowed $29.6 billion into research and development and capital investments during 2019, up 33% from 2016 levels. It plans to invest more than $7 billion to complete a chip plant in Arizona, one of the largest construction projects in the country.

“We anticipate it will create 3,000 Intel jobs,” company spokeswoman Chelsea Hughes said. Intel’s total return is 99% since Trump highlighted the company in his first address to congress.

After a recent surge in its stock price, Intel is beating the 91% total return of the S&P 500 Semiconductor Index. The benchmark includes high-flying rivals like Nvidia Corp, whose shares are up 147% since Trump’s address.

Japan’s SoftBank Corp is also investing billions of dollars in U.S. startups, and has created thousands of jobs, with help from American venture capital firms and mutual funds.

But as seen by the WeWork saga, and other troubled investments like the dog walking company, Wag Labs Inc, a lot of those jobs could disappear overnight.

Other companies Trump touted that have kept payrolls inline are getting mixed reviews from investors.

Shares of Harley-Davidson have dropped 34% since the president hailed the “magnificent motorcycles” in his first address to congress. Trump’s trade tensions, however, have hurt the Milwaukee, Wisconsin-based company, which last year struck a deal to build a smaller motorcycle in a venture with a Chinese company. Harley-Davidson’s latest available headcount of 5,900 is down slightly from 6,000 at the end of 2016, according to company disclosures.

Trump has criticized the company for moving some of its production offshore. Harley Davidson did not return messages seeking comment.

The economists Reuters spoke with applaud the investments, but they say big chunks of capital go toward upgrades and automation, not necessarily net gains in workers.

“There’s not a lot of trickle down to the local economy,” said Sarah Low, a University of Missouri-Columbia economics professor who focuses on employment in rural areas.

(Reporting By Tim McLaughlin; editing by Dan Burns and Edward Tobin)

from IJR https://ift.tt/3aOW3rH

via IFTTT

0 notes

Text

These 26 predictions from finance execs reveal how much Wall Street jobs will transform over the next decade

These 26 predictions from finance execs reveal how much Wall Street jobs will transform over the next decade

http://bit.ly/2EQ6igy

With 2020 quickly approaching, Business Insider has been polling experts to learn what finance, investing, payments, and real estate will look like in 2030.

The past 10 years have seen cost pressures and technological change sweeping across the financial-services industry, and we saw that come to a head in several key ways in 2019.

Tech and big data will inevitably continue to drive some key shifts. And the types of skills and jobs needed are generally expected to look very different in 10 years as more basic functions continue to be automated away.

Here are 26 predictions about what's in store for the next decade.

Click here for more BI Prime stories.

With 2020 quickly approaching, Business Insider has been polling experts to learn what finance, investing, and real estate will look like in 2030.

The past 10 years have seen cost pressures and technological change sweeping across financial services, and we saw that come to a head in several key ways in 2019.

This year may be remembered as the year that the broker wars reached a fever pitch and discount brokers slashed stock-trading commissions to zero (setting up a compelling argument for industry consolidation in the process.) We also wrote about how the rise of portfolio trading for credit — the latest in a string of innovations to come to the credit market in recent years — was pushing that space toward electronification and away from high-touch practices that dominated for so long.

All the while, historically low interest rates over the past decade-plus have sent investors on a frantic search for yield, resulting in huge piles of yet-to-be-spent private-equity dollars.

We've also written about how new tech could leave some industries scrambling to address ethical issues and get out in front of regulatory changes. In the insurance-tech world, for example, some are voicing worries that the use of tech to write increasingly customized insurance policies could leave the riskiest customers without coverage.

Given the whirlwind year we had in 2019, we were interested to learn from experts what the future could hold.

If there's one takeaway, it's that technology and big data will inevitably continue to drive some key shifts. And the type of skills and jobs needed in and around finance are generally expected to look very different in 10 years.

New tech will likely change the way we move around in the world, which could translate to changes in real-estate markets. Virtual and augmented reality could give us new ways to picture investments and risk. Human jobs giving financial advice will change as more basic functions are automated away.

And algorithmic trading and the rise of passive investments will likely continue to reshape public markets — changing what it means to be a stock picker.

Here are the 26 must-know predictions for the next decade.

Alex Nicoll, Casey Sullivan, Bradley Saacks, Meghan Morris, and Shannen Balogh contributed reporting.

1) Voice-enabled tech will be commonplace in wealth management

Wealth execs who we surveyed overwhelmingly see artificial intelligence and machine learning as heavily aiding advisers by 2030. Artificial intelligence has already showed up at TD Ameritrade, which its rival Charles Schwab is set to acquire in a $26 billion deal expected to close during the second half of next year.

Business Insider reported earlier this year that the firm was building out a Netflix-like recommendation system powered by AI, in which clients are served news and information based on their trade data and holdings.

Danielle Fava, the director of innovation at TD Ameritrade Institutional, is now thinking about other use cases. By 2030, the industry should expect AI to aid advisers in providing their clients with "extreme personalization" in how and when they communicate and making investment decisions, Fava said.

She also sees voice-enabled search functions, paired with machine-learning technology, becoming commonplace at advisory firms.

"A decade from now, one of the hottest trends in technology should be commonplace among advisory firms: voice-enabled search combined with machine learning," she said.

"Adoption of smart speakers such as Amazon Alexa and Google Home is expected to be faster than for any other consumer device, including the smartphone, as consumers grow more comfortable making trades and checking their account information without clicks and taps."

Read more wealth-manager predictions.

2) The Amazon effect will reshape mortgage lending

Experts expect the mortgage-lending industry, which is still bogged down in Byzantine paper-heavy steps, to rapidly evolve in the coming years as the Amazon effect — meaning the buy-it-now expectation among consumers — finally hits mortgage providers.

"While owning a home has long been the cornerstone of the American dream, it's head-scratching that in today's on-demand Amazon and Venmo digital world, the mortgage industry — with $15 trillion in assets — has remained painfully analog and plagued with inefficiencies," said Vishal Garg, the cofounder and CEO of the mortgage-tech startup Better.com, a rapidly growing digital-lending startup that has attracted more than $200 million in funding from backers.

Garg said he expected the "Amazon effect" to hit the mortgage industry, eventually allowing customers to deal with different parts of the process in one place — realtor, financing, title insurance, homeowners insurance, and appraisals.

Read more about how upstart lenders and incumbents like Bank of America are thinking about mortgage tech.

3) Private-equity firms will staff more tech specialists

New technology affecting many industries in which private-equity portfolio companies operate is expected to shape the private-equity workforce as firms continue to morph into giant asset managers, launching and expanding new products for investors, experts said.

By 2030, private-equity firms will likely have whole teams of specialists who dedicate themselves to implementing and maintaining new technologies at a wide variety of portfolio companies across sectors, recruiters told Business Insider.

"The sectors themselves may also be categorized differently" within the private-equity firm, Noah Schwarz, a recruiter at Korn Ferry, said. "For example, old-line industrial manufacturing will likely be called industrial technology."

Read more about the five key themes that will shape private equity in the coming decade.

4) Wall Street will play catch-up with tech when it comes to office design

Todd Burns, JLL's head of project and development services, said he was seeing ratios increase to as many as four employees per desk in some financial institutions' divisions, up from one desk for every one employee.

And those desks look different: Burns said finance was increasingly adopting the sit-stand desks common at tech companies. He expects financial firms to keep tracking tech firms in terms of workplace design — albeit will a several-year lag.

"My belief is the financial institutions are generally 5 to 7 years behind everybody else," he said. In a decade, "offices will look more like tech firms but have the security of the bank."

Read more about the office of the future.

5) Different ways to finance homeownership could attract bank copycats

The housing-affordability crisis will continue through the beginning of the decade and potentially longer, according to most of the experts we spoke with. Within real estate, a few startups are trying to offer different kinds of ownership options.

One large category of startups focused on affordability straddles the borders of proptech and fintech by using technology to update financial products like rent to own, fractional ownership of homes, and home-equity loans.

Brad Greiwe, the cofounder of the proptech-focused venture-capital firm Fifth Wall, said these models may be able to attract consumers, but once they do, the larger banks will copy them and put these proptech companies out of business.

"It is being driven from the proptech technology side, and unless the banks are going to adopt them, it's not going to be that impactful," Greiwe said.

Read more about what experts think it will take to solve the affordability crisis.

6) Financial firms will keep moving offices out of big cities

Both to keep costs low and to tap new labor pools, financial institutions have already signaled plans to expand into cheaper markets well outside New York and San Francisco: PIMCO is hiring for a 200-person office in Austin, Texas; BlackRock is building a 1,000-person office in Atlanta; AllianceBernstein is moving much of its New York office to Nashville, Tennessee.

Similarly, JLL's Burns said he talked to a client this month with space in Washington, DC, that's thinking about a move.

"They're a financial institution saying, 'We could do that in Milwaukee just as easily.' I think you'll see more of this move from city centers," he said. Hot markets for JLL's financial clients include Charlotte, North Carolina, and Houston.

Julie Whelan, CBRE's head of occupier research for the Americas, said CBRE has seen a lot of interest from finance in what real estate calls secondary markets — like Phoenix, Nashville, and Tampa, Florida — and she expects that interest to accelerate.

"There will be some tertiary markets that start to pop up. We looked at markets we'd consider next-generation where you'd need to be a pioneer from a financial services perspective, like Utah — not Salt Lake City, but going out to Provo; Boise, Idaho; Raleigh-Durham; Indianapolis," Whelan said.

"Those are markets we'll start to hear more about from a financial-services perspective that are more overshadowed by the secondary markets now."

Read more about how Bank of America is chasing smaller deals and already expanding its investment bank to far-flung American locations that it had previously ignored, adding San Diego, Nashville, and Salt Lake City.

7) Investment research, asset allocation, and portfolio rebalancing will be fully automated, thanks to AI and ML

Wealth execs we talked to largely see the industry being dominated by fewer large players than today, wealth managers (who still exist) regularly harnessing artificial intelligence, and advisers taking on a more conciergelike role.

"With the proliferation of artificial intelligence and cloud computing, many investment-management processes currently implemented by advisers will likely be fully automated using algorithms and machine learning to offer implementation with limited adviser intervention, e.g., investment research, asset allocation, portfolio rebalancing," Ben McGloin, the head of advice, planning, and fiduciary services at BNY Mellon Wealth Management, said.

"These adviser tools will not only ensure improved and more consistent outcomes for clients but will also allow advisers to manage more clients and spend more time with them."

Read the full text of our wealth-manager survey here.

8) The Internet of Things will play more of a role in payments — and smart cars are up first

The card-network giant Visa has been investing in Internet of Things payments for the past couple of years, Bisi Boyle, the vice president of Internet of Things at Visa, told Business Insider. Smart devices making their own payments is likely to start with smart cars, with other applications in appliances and other devices to come after that.

Boyle heads up efforts around connected payments and is leading Visa's charge to make sure the card network's rails are connected on the Internet of Things. And for 2020, she's focused on rolling out invisible payments in cars.

"We saw the opportunity because of this explosion of connected devices that make up the Internet of Things that people use every day now," Boyle said.

The four use cases Visa is exploring with cars are fuel, parking, food, and tolls. Cars, Boyle said, will likely be the first place consumers will see Internet of Things payments — and she predicted that capability could arrive as soon as next year.

"The idea is you're just living your life, and all these payment experiences happen," Boyle said.

Visa is betting that fuel and parking use cases will surface in the 12 to 18 month range, Boyle said. And the card company has already partnered with car companies like Honda to start rolling out the tech.

Paying for parking and gas are just the beginning, though. Boyle sees drive-thru and curbside food pickup as the next step for the tech within three years.

Read more about how Citi Ventures is betting on cars that pay their own bills and why its cohead of investing envisions a future where your devices make payments without you.

9) Closing on a house will take days, not weeks

The average time it takes to close on home is still upward of 45 days — a month and a half.

But that figure has been falling as the influence of startups proliferates. A 2018 study by the Federal Reserve Bank of New York found fintech mortgage challengers processed applications 20% quicker than traditional lenders without engaging in riskier underwriting.

Home closings for digital customers at places like Better and Bank of America happen in about 20 days — half the industry average. Redfin offers a 25-day closing guarantee, and the average will continue to drive lower as more parts of the process are streamlined.

"We'll see the time from application to closing shrink considerably as we're able to automate more of the preapproval, underwriting, appraisal, and the close," Jason Bateman, head of Redfin Mortgage, said. "We're within striking distance of being able to consistently close a sale within 12 days of an accepted offer."

By 2030, closing on a home in under a week will become the norm, Better.com's Garg said.

"The continued advancement in technological innovation around the mortgage process will soon allow us to see five-day closings in the coming years," Garg said.

Read more about what Bank of America is already doing on the tech front for mortgages.

10) Financial advisers will need to prove the value of the human touch

Financial planning was a topic that cropped up again and again with wealth execs.

"Successful advisers will need to demonstrate that they can add value beyond the computing capability of algorithms," BNY Mellon Wealth Management's McGloin said.

"In order to navigate the short- and long-term wealth-management challenges that certainly lay ahead, advisers will need to ensure that their clients have a comprehensive wealth plan that goes beyond just managing their investments."

He said that financial advisers would need to use advisory tools to work closely with their clients to make sure that the advice they provide and the practical strategies they recommend are in tune with their clients' preferences. They also need to help realistically provide for the future that clients want for themselves and their families.

"This is not a formula likely solved by algorithms; it's a personalized plan for growing and sustaining real-life wealth," McGloin said.

Read more wealth manager predictions here.

11) The lines between private equity and hedge funds will blur

Private equity, once an obscure part of the alternatives space, will have more assets than the better-known hedge-fund industry by 2023, according to Preqin. Institutional investors, meanwhile, are shifting more of their portfolios to the private markets, according to EY, in part because of underperformance of active managers on the public markets.

"The demand for less-liquid securities will grow over time as more and more view it as an area that investment firms have an edge and where high returns can be generated relative to liquid markets," Don Steinbrugge, the founder of the consultancy AgeCroft Partners, said.

"The lines are blurring between hedge funds and private equity, and I expect the industries over time to converge."

Already, top stock-picking hedge funds — managers who made their names and their billions with concentrated bets on well-known public companies — are seeing the light.

Viking is growing its private-markets team after putting more than a half a billion dollars to work in the private companies during the first half of this year, while Tiger Global and Coatue have become some of the biggest early-stage investors. Point72 and Two Sigma have built out venture-capital arms, and Lone Pine is opening up another one of its funds to private investments.

Read more about big investors' plans to drop hedge funds in favor of private equity.

12) The brokerage and wealth industry will continue to consolidate

Charles Schwab in November announced plans to buy rival TD Ameritrade.

Leading up to that, analysts considered what discount brokers' rapid-fire decisions to eliminate online-stock-trading commissions would mean for the brokerage industry's future — and how those firms fit into the broader wealth-management space.