#The accountants don't print the financials for the file so i have to do it and there's files galore that I'm yet to fix up and

Text

What I'm afraid of, Tumblr, is that if I tell my boss that the ATO correspondence is up to shit or say I'm struggling or mention that everyone keeps bothering me or anything else, then she'll just deal with it in the /wrong way/. I don't know what the solution is but I know she won't be able to help because what I want isn't possible and I know that and I know I don't have an excuse for only charging $100 plus GST for a BAS, I know I did the wrong thing, I just felt using the timesheets was too much of a jump ($190 X 2.5 hours) compared to the previous invoice and

#I'm just#i don't like the way really guy pressures me to give him the stuff for the bank and post office because there's less of a queue going early#then he doesn't even go there early and goes around lunch time#i don't like that woolworths guy finishes a super fund but doesn't print financials or anything & i just have to /work out/ what to include#The accountants don't print the financials for the file so i have to do it and there's files galore that I'm yet to fix up and#if Jenette saw the state of her old desk.... I know she's gone and wouldn't care any more but if she saw it ...#Just hypothetically#i hate the way the sri Lankan guys want to use the prefill function for the individuals because they're lazy so they use Jenette's computer#and they mess it all up#i hate the way hieu complains#Tony says hieu always complains in Vietnamese but the little shit complains in English as well!!!!!!#i hate the way i cry over it all#ok I'll go#what's stopping me staying up to read all night#please#my next step is booking a gp appointment and getting a referral for a therapist i promise i will just for someone to talk to#Just rort the system tbh#my neurotypical self can't handle a normal job and I'll waste resources that could be used for an actual sick person

0 notes

Text

Double edit: actually, that's enough of that.

Edit: I was expecting maybe thirty notes tops. This is a surprise, and one that doesn't delight me. If I hear about any harassment stemming from this post, I'll be more pissed at the harasser than the person this is about.

God. Dammit.

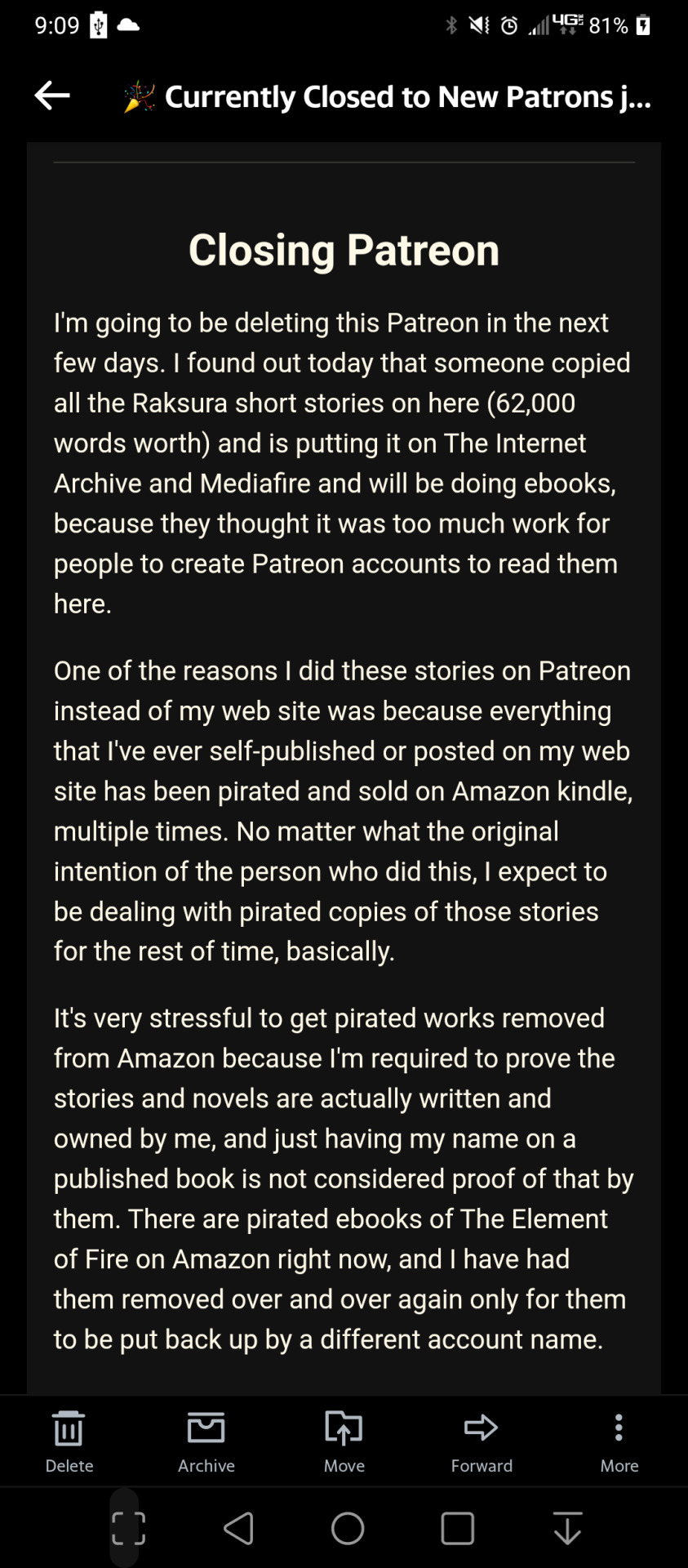

I hate this, let's just out that out there! I'm unhappy that I'm talking about any of this, I'm unhappy there's an issue that's come up at the intersection of media preservation, respecting authors, and one of my favorite book series. And I'm unhappy that I've censored the names in the screenshots I'm about ti post! I'm not happy that I'm helping to slide consequences away from someone who thought this was an acceptable thing to do to a modern working author. But I'm even less happy this is something that happened in the first place, and I'm VERY unhappy the original post has been deleted without a whisper of accountability or apology.

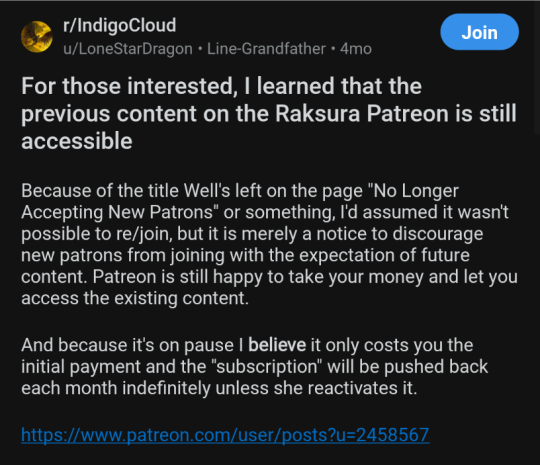

And here's a partial screenshot of the IA page, which has since been removed. I get the excitement to share something you love with a new audience. This isn't the right way to go about it.

First, if Martha Wells' patreon is still in place, I encourage everyone in the strongest possible terms to go sign up for it. It'll charge you one dollar. I've been a member since probably 2018, and I mistakenly believed it was locked to new members (it's labeled 'Currently Closed To New Patrons') until I had reason to look it up last night, when I tripped across this reddit post from earlier this year.

Now. I was looking it up because of this sudden patreon message:

Even if the patreon goes away, I still recommend that people sign up. Explore the stories! They're very fun! Even though the patreon has been dormant for years, I've loved having that repository in place.

In fact, in the interest of full disclosure, what kept me from immediately reblogging last night is that I've felt the same archival urges! I bound a hard copy of these stories earlier this year, and let me quote my own words from that post:

I live in a state of perpetual low key stress over the impermanence of digital media and that goes extra for sites that aren’t designed to work well as archives. I hope, desperately, that someday Martha Wells publishes more raksura, maybe even including these stories! I will buy it immediately. No thoughts, wallet empty. I own all her other raksura books in literally three formats, fingers crossed that by printing this, I can actualize a formal official printing of these stories by the author ��

So. Archiving, yes. But especially with a living, working author, I would never DREAM of posting a public free-for-all with IA and mediafire links. My most charitable interpretation is that OP thought it was fine since the stories were "free," even though the writeups acknowledge that access costs a dollar. Ao3 is also free. Reposting someone else's fic is still understood to be a dick move.

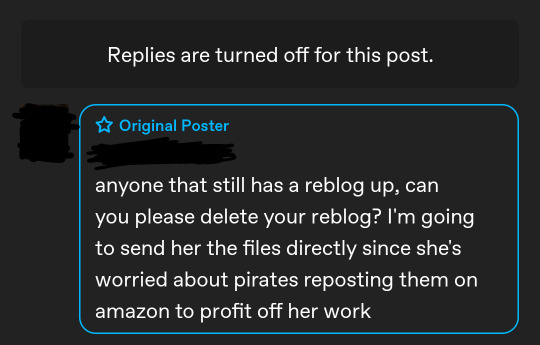

Last night i was left kind of stunned, and I was hoping to see some kind of response from op this morning taking responsibility, and was... disappointed to see that the post was just deleted. The IA listing was deleted too, and I hadn't actually looked up the mediafire post yet but I'm guessing it's also been nuked. Out of curiosity, I wanted to see if there was anything more in the comments, so I found a surviving reblog. And there was!

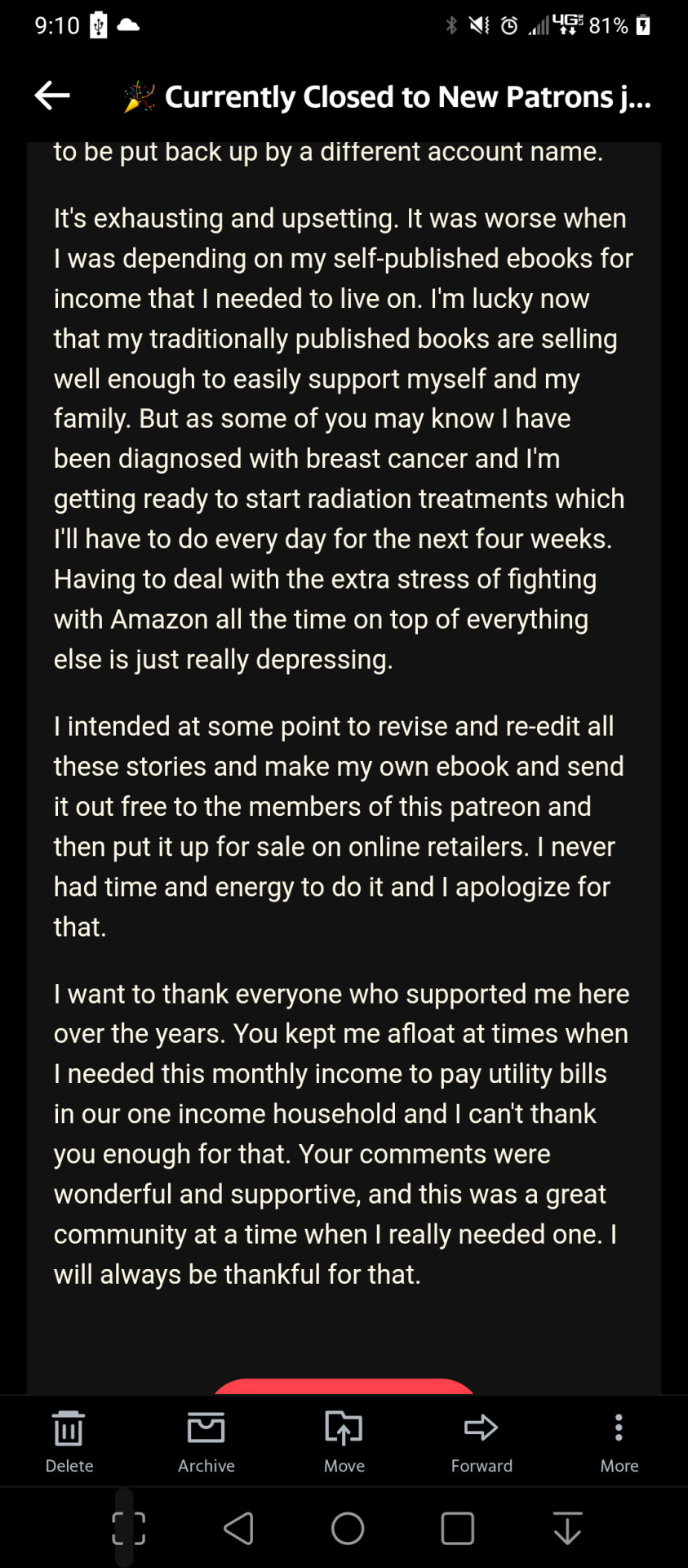

So I'm writing this post because I'm... frustrated. Taking down the files is a good step. Posting them publicly was a worse step, but hey. I still more than understand if Martha Wells still deletes her patreon. I don't understand what sending her files of her own stories is meant to accomplish, but whatever. Ascribing a profit-driven motive is driving me up a wall, though. She's financially stable. I read her email, and what i see is frustration that even though it only cost a dollar to access 62k of her work through her own chosen location, control of her writing is being forcibly removed from her. I'm sure that seeing copies sold by third parties wouldn't help, but I don't think that's the root issue.

This is a fandom-heavy website, I'm sure most of us have seen posts about not reposting art when you can share directly from the artist's blog. I've seen posts about stop copying your ao3 faves over to wattpad just because you like reading there better. At a fundamental level, I read the message from Martha Wells as a deep frustration at having no way to share her creative work without someone removing control of it from her hands. And I don't know if there's any way to really take back that damage.

608 notes

·

View notes

Text

Trying to calculate capital gains on crypto, mostly out of curiosity. (I recently sold some, but not enough to need to report.)

I would have hoped it would be mostly easy. I've been tracking my assets with ledger. So for approximately every fraction of a bitcoin I own, I can see

This is the day I bought it

This is how much I paid

And this is the fees I paid

E.g. "bought 0.00724641 BTC on 2018-05-07, I paid £51.99 of which £1.99 is fees".

There are some exceptions: I have some that I got from mining or from the bitcoin faucet way back when, stored in a wallet on my computer that I couldn't figure out how to access again; I got someone else to do it for me in exchange for about half of what was in there. In my ledger this is just recorded as a 0.03 BTC input that I got given for free. And there's an in-progress bet that involved someone sending me $100 of BTC.

(Other coins are more complicated: I once bought BCH, converted it to BNB, converted that to SOL, moved the SOL to a different place, staked the SOL, moved it back, staked it again and eventually sold, and there's fees involved in lots of these steps.)

But ignoring this I'd hope it would be simple enough? But not really.

I think partly this is because calculating capital gains isn't an objective one-right-answer calculation. If I buy 1 BTC, then buy 3 BTC, then sell 2 BTC, then sell 2 BTC, it matters which order I sell them in.

Okay, but I think FIFO is pretty standard? But I don't think there's a way to specify that I'm doing that or any other approach that could be automated. I just need to manually say "okay, the BTC that I sold here are the same BTC that I bought here", and the way to do that is to specify the date and unit price when I bought them.

Which, I get having this written out explicitly in the file, that seems reasonable, but I'd hope for some way to auto-generate the posting, and I don't see one.

...also I've been letting the unit price be implicit, instead specifying the lot price. Which means the unit price has 16 decimal digits, which aren't written in the file, and which I need to copy exactly when I'm selling or the lots won't quite match up. (Which is mostly fine, but when I want to print lots explicitly it means it doesn't show as "I bought BTC valued at X and then sold them" but as "I bought BTC valued at X and on the same day went into debt for the same quantity of unrelated BTC valued at X±ε".) And sometimes exact isn't enough due to rounding errors.

So I'm converting lot prices to unit prices, which there ought to be a way to do that automatically too but afaict there isn't. (Unless I want to do some python scripting, which might be fun I guess but also might be super frustrating depending how good the API is.)

I've looked idly at hledger as well but from what I can tell it's no better at this. I don't think I've looked closely enough at beancount to know, that might be worth looking into. But I have over 7 years of financial data in ledger and it would probably be annoying to convert it all - just crypto would be fine I guess, but then I'm using two different CLI accounting tools.

5 notes

·

View notes

Text

So now you live in a building, you have to have a resident I d and you have to use the resident I d to get into the building with a biological identification, a thumbprint, or some other biological voice with the badge. Two factor identification. So hotel guest can get the same. They get issued a badge while they stay at the hotel and you have to keep the badge on you and you have to show the badge to be able to enter the hotel.And it adds the picture of you. So only those with proper identification can enter the elevator do you have to sign in any guest. The hotel is liable for every guest in a room, so those guests have to be identified and signed in at the front desk before they're allowed to go to the room. And they're issued a temporary ID, and yes, on the temporary, D they take a picture of them, and they put it on their temporary ID and the temporary ID has to be returned to the front desk upon leaving. And it's the same net way with residential units, so no more jeffrey, dahmer situations... So those going into the building have to be identified, and when they leave, they have to check out and you don't need a doorman, you can have a security system that is provided by AD. T or some other security service.... 🤔 And the camera takes your picture and prints I d, and you pick up the little I d at the bottom and you have to have the id on you, it says guest. That way, people in the complex.Know you don't live in the complex....

They're responsible for everybody the association, and if anything happens to him, they can get sued like for wrongful death...

So with those families that had their person killed that family member killed that building, it's responsible... And you can sue that building the association, the landlord and the owners for wrongful death...

AI Overview

Learn more…Opens in new tab

A wrongful death lawsuit can be filed against a tenant association if the association's negligence caused the death of a loved one. The goal of a wrongful death lawsuit is to hold the responsible party accountable and provide financial compensation to the survivors.

The Dominguez Firm

Wrongful Death Claims Arising from Premises Liability

Elements to Prove in a Wrongful Death Claim Arising From Premises Liability. Elements of N...

The Cochran Firm

Dealing with the Aftermath of a Fire in a Rental Property

Nov 14, 2023 — This legal concept allows certain family members or dependents to seek compens...

Van Law Firm

Lawsuits Against Apartment Complexes for Wrongful Death Shootings

Some common causes of shootings due to apartment complex negligence include: Inadequate se...

To win a wrongful death lawsuit, you must prove the following elements:

Negligence: The defendant owed the deceased a duty of care, breached that duty, and the breach caused the death. For example, an apartment complex might be negligent if it doesn't implement adequate security measures, like security cameras, or if it doesn't address safety concerns, like broken windows.

Cause-in-fact: The breach of duty was the direct cause of the death.

In most cases, proving liability in a wrongful death case is similar to proving liability in a personal injury case. The statute of limitations usually starts running from the date of the death, so it's best to retain legal counsel as soon as possible.

Just like my sister did on the Christmas parties. If you drink, you couldn't drive, you had to stay tonight... Yes, with the kids.So if they were over, they had to stay... That protected the kids from going out drinking and driving and all of a sudden, suing my sister... And the people they entered suing my sister. Do you know if you get somebody drunk on your premise? And they go out and hurt somebody.It's your a** on the line.....

So that person gets drunk at your house or that person enters your house drunk and you don't understand it. Once they cross over and enter your residence and I used to explain this to my doormen, if you let the drunk in, then we become liable for that drunk, so I made sure they didn't let people into our bar that were already intoxicated... Because if they let somebody in who was already drunk, then they do anything wrong upon leaving or anything wrong inside the nightclub, we're responsible for them.. And so they can sue us... So I used to tell my dorin, make sure you're not letting anyone who's intoxicated... And I didn't do this, but you should call 911 and report somebody for public intoxication.... 🤔 Yes, you need to report them for public Intoxication...

C&S Insurance

https://www.candsins.com

In-Law Apartment Insurance | Is Your Homeowner's Policy ...

In-law apartment. Granny flat. Guest house. Casita… In the insurance world, the technical term for these living spaces is “accessory dwelling unit” (ADU).

Reddit · r/legaladvice

100+ comments · 2 years ago

HOA does not want us to build our ADU on the back our yard, we ...

Speak to an attorney asap. Don't start building until this is resolved otherwise the HOA will sue you. I am not an attorney, but I have served ...

There's a family in deerfield that find out the hard way when the kids were in the house, they got drunk and they were minors, and they went out and they got into an accident and some died.... But even if they're adults, they can sue you for wrongful death... So when you have a party and you serve alcohol your responsibility and I show you the movie, and it's true.The key master... You think it's a joke, but it's true.They're responsible for every kid in there, and if one of them gets drunk, they cannot drive... It isn't a lie. It is true and what they were doing.They were showing the right thing in the movie...

So you're responsible... And just because all these people turn a blind eye doesn't mean they're not responsible. So I go into these places, and they stand back and watch, they're absolutely positively responsible.... So it's a joke..... All the places I worked, I had to deal with people, and I was responsible for them.... So if I had to do it, my whole life, you're responsible for the f****** people that enter your business and their actions.... And if you can't handle the responsibility, then you shouldn't be in the f***** business.... If you can handle or don't want the responsibility, then don't be in the f***** business... So either you're gonna step up and take responsibility. Oh, you're screwed.And you can hire private security if you want... But you can't get around it, you are absolutely positively responsible....

So I worked a lot of parties without alcohol, truly without alcohol, and we still worked security for the parties... So I don't get it whether there's alcohol or not, we were still providing security and making sure things didn't happen.... So it has nothing to do with alcohol, you're Your responsibility doesn't go away just because you don't have alcohol..... So either you're going to man up or get the hell out of the business, they should take away your business license..... Part of being in business is sometimes you have to be the bad person.... But this is insane what's going on with me.....

0 notes

Note

🏡📝📱

Writing Shop Talk ask meme!

🏡- Would you live in the world you created? Why or why not?

answered here!

📝- What writing software do you use? Does it work for you?

i used to use google docs for everything and just backup with word documents, back when i had access to word (switched from my old school laptop to a new one that works), because i like that i can use it across devices and for a couple of years there i was writing mostly on my phone. it's still fine for fanfiction, but now that i'm a big boy with a functional computer i've been using scrivener and im gonna be honest i have NO idea if i'm using it right, because it keeps yelling at me whenever i open it about how it's saving to the folder i asked it to save to (the horror) and i don't know what it actually wants from me. AND i'm about to compile for the first time to print, and that might go REALLY poorly so the answer might change. but for now it's pleasant to write in, sort of easy to organize (the fact that you can turn your text file into a note if you don't remember to expand your chapter folder is SOOO annoying i do NOT know how to use scrivener), and i totally made my indent preset something ridiculous i want to change but can't be assed to after the last time <3 love and light

📱- Are you planning on publishing? How and where? Are you trying to monetize your writing?

i am! like, my original fiction. all of my fanfiction is already like readily available to read online.

anyway, i'm going to try tradpub first, because those childhood dreams are hard to shake and all, but i'm not opposed to self publishing if it isn't with amazon (no judgement 2 anyone who does but i'm Proud of my lack of amazon account and also hate them dearly). i'm not entirely *trying* to monetize my work, but i realize that that's just, like, a part of that process. like i'm not under any allusions that i'll wake up one day a financially successful author, esp. with the way i'm just not really on social media that would give me any kind of publisher-friendly exposure.

i've wanted to put fixed up for free, though; somewhere like on my tapas account . whenever that's done lol

#answers#writernopal#thank u for asking! wish me luck w this fucking. document (i am mentally surrounded by that corrogated old printer paper)

1 note

·

View note

Text

2.10.24 Saturday

12:09 am

I still have windblow... Weird! I'm on an "unplanned training" for the entire day...

I find it so weird! TL Krizzy just ordered a barge at the side... I feel weird and lowered.

I'm planning to resign and apply on other company or other account. I need money still, plus the account it will be until April. In a way it will end in a lil while....

I always feel low in call center... I feel irritated. Why, I feel that I can't beat it!

I still want and need money... I have to calm down...

Revo is not around... Chloe the other TL, is not around as well...

Aizzy is not really reacting on me but I pity her which I can't understand. Aside, from my own personal self-pity...

youtube

6:34 am

Thanks to TL Krizzy in a way for being crazy and nice... She is still nice for allowing us to file the special holiday today and for insisting that we should file it... Sweet in a way in spite of her craziness...

What else? Princess sent me a message on our TEAMS that the black american guy that I like was with them in prod C. The black american guy that I saw in the pantry. I asked what is he doing there? Princess said I think he is trainer.

I feel that I'm on a detention room for the whole day...

6:46 pm

OM was just there, just like a mushroom...

Ian and I are the only people on our line sitting arrangement. Ray is off today... Kaede still drinking his pick-up coffee every start of our shift. Lay was there, still nice and mysterious.

Yam was there but I'm not trusting her just like Prexel. Joms helped me on doing the filing of special holiday today. John was just quiet as always and buddy of Joms. Jay ( Jay is wearing black sweater hooded with a print of Beatles and why Beatles??? ) sitting beside Aizzy.

T the super healthy TL just peacefully sitting on her throne.

I barged with Fritz and V... V is a college graduate finished education but not yet a board passer. Young and fresh, young as 23.... I asked V if she is happy she said yeah! I'm ohkay, I've been here for a year.

8:20 am

I'm here in the house now... I need to clean, we don't have helpers now and we can't hire one...

One of my major complexities in LIFE!

We need to pay our electric, I can't share for now... My salary is small, I have my own personal expenses. WE NEED TO PAY OUR ELECTRIC...

8:30 pm

So,if I have a visitor I need them to have schedule here but probably a bf visitor who can help me on money these days or on my expenses here...

My call center salary is not enough to have a good life.

Someone who can accept me,my situation. Like for example on that cute black american man, I'm gonna tell him that we are facing a financial tight budgeting. I have to work coz I have my own personal expenses and I have a son-dog and that dog has a life. I share 1300 in pesoses for our gasul and sometimes my nana is requesting a money from me and to buy her some stuff. Of course she took care of me when I was lil girl. It is my responsibility as well to pay her back in a way... But my money is not enough. I'm giving a lotion or a deo on Uncle Jun for taking care of John when I'm not in the house. My lil favour from him.

I have a son-dog who I took care and still taking good care of him since he was 3 months old. He has maintenance just like a human kid.

I have my own personal needs as well... I'm not ready to shoulder other bills in the house but we need to pay it, of course no matter what happens... Like our electric bill...

I need to save for myself as well... Uncle DD is receiving the fundings from my adoptive parent's to pay the bills here but of course I'm trying to help but I can't cover for everything here. My salary is just small...

8:40 am

I don't know...I feel sleepy but I have to clean in a way... Poops are everywhere here in our living room, coz I can't hire a yaya to look after my son-dog when I'm away... If I have yaya then even if I'm not in the house someone will clean his poops. My nana is old for that and my Uncle Jun here is a lil strange, he doesn't want to clean the poops of John in the living room plus I think he is still sick now...

So, today probably I will do some general cleaning... I have no choice, I need to clean angels!!!

8:45 pm

Probably, I will buy whisky coke or Smirn Off while cleaning....Late afternoon, I have to clean our trash can and some floor mats of John, I have to wash it outside... This is my rest day here...

I still need to check some fan blade outside in a repair electronics shop, whatever....Coz it is cheaper though not my ideal life. Yeah! Yeah! It is a crack pot here... I want my bf2x visitor to accept this bitterish reality of my life here.

10:16 am

This Uncle DD will borrow a 20kilos dog food for Neko... Huh? I can only manage 2 kilos... But he needs to return it angels,coz I'm not that rich...

Thank God I'm able to buy new fan blade for 90 pesoses... Thank God! I'm a survivor....Good as brand new...

2:35 pm

Done, eating.... I still have windblow... Will still rest later afternoon, I need to clean outside our trash can. I feel bitterish .... I still feel fat and ugly... I need to diet correctly...

What will happen to me next week?

Hmm... One of the reasons of my troubled chats it was ohkay but they didn't take my rapport coz for them I was making a joke but I got it in Iqor, it was our training to make life funny.

In short I've mentioned on my chats that " I can no longer do some magic here coz you need to contact your state about this" or Yeah! I can downgrade you using my magic, in a snap of a finger". In Conduent they don't like it but in Iqor it is fine they wanted to make our client laugh but in Conduent they wanted to sound serious. TL told me to not do that dialogue anymore on my clients.

I'm thinking where to find my Daddy-bf the one who can take me as me...Who can swallow my situation in life. Someone who can have a tough tummy on me in spite of my negative situation.

I also wonder, where is Revo probably with Chloe but nobody can tell the truth behind every bathroom's scene.

I needed to do a ritual or someone I can call my bf2x to finally kick a negative force. Well, hoping to be with Daddy-Bf aside from I need help these days on money and how to have a good life much more than this... Relationship with someone is about talk if the situation is something serious.

It is just kinda hard for me to be with someone younger but I hope a younger soul is willing to be a companion in times that I needed someone, it should be platonic but probably beyond this coz of something deep that I'm asking from HIM, if ever a younger soul like Revo but it is not easy. If with Revo I want him to have a loving and tough heart but a willing heart and ready to give in and loose and let go... It is a weird relationship if ever if money will be involved...

I told Princess that I really like Daddy-bf the first time that I saw him entering the 5th floor pantry, wow! Who is this cute black american man?

That day when I saw a possible Daddy-bf he looks so cool that is there a cat walk here? Or probably checking something or looking for someone, I don't know but that night I just want him to see me... I wanted to measure how tall he is and I did... It was just a friendly and casual smile... WHO IS HE???

4:10 pm

In a lil while... The cleaning will start... WAITING FOR UNCLE DD's fundings for food and for some bills here.

I still need to keep a job... I wanted a nose perfection and my deep smile lines. I feel self-pity...I haven't seen the world... For 17 years they are smashing me... They repeated me but they changed me and that is super unfair for some fake relatives!

youtube

7:13 pm

I think there is bug or chair bugs not bed bugs in our chairs in Conduent office coz I got this 2 days ago. 2 days ago I suddenly felt a sting and itch at my back...

7:41 pm

I feel ugly when I have a bite on my skin coz I need to bleach it or use a kojic or carrot soap to whiten the bitten parts... I'm fading, I feel ugly!!!

8:01 pm

I'm worrying so much... What if Daddy-bf ( my black american man ) or Revo will be at my back and I'm on my sleeveless just like today and they will see this bitten part of bugs coming from Conduent.. I feel shy, I feel conscious... I feel ugly that I'm fading...

I need to revive my skin angels...

9pm

I still have windblow....Hmm... Why other people will say goodbye... Strange... I didn't do anything bad to harm them...

I'm gonna share something here, it is bad to spy on someone for the purpose of knowing things and harming the person.

0 notes

Text

You know you want to make money by online business. You like the advantages of selling information products - low set up costs, not as labor intensive as an online store or ebay seller, power to automate your business, and information products give you instant credibility and establish you as the expert. But the expert of know what? How do you determine if your idea is marketable? The technology used in MP4 will be the secret behind its level of popularity. It applies a fantastic technique in reading and compressing DVDs. In short, the MP4 strategy bases on picking the changes that happen in each frame and add them towards the previous frame information. This is why MP4 videos enjoy with smaller file as well as significant quality at liquids time. The Basics of Trading - Approach has become popular about knowing the industry. Obtain a book, or do some searching online about the currency market. However do not spend tons of some money; rather you have to concentrate on the terms. Capitalize and comprehend the terminologies with regard to example PIPS, help make concepts. As well as understand the charts and attempt to make market moves out of them. Also be aware within the market timings and currency pairs. Marketplace is very sensitive to any or all of the latest news so it is of utmost importance a person keep yourself updated when thinking about the political and socio economic news from around the world. Any positive or negative news greatly affects the market and likely to clearly seen on the trends for this currencies. Depending your needs, broadband cards be available in a few different forms. Many newer computers or tablets (iPad, for example) have broadband capability, merely need to be able to it to a cellular plan and all are wireless. Being wireless is helpful, an individual might select to purchase an invisible broadband item of equipment. These devices can handle up to five wireless tools (lap tops, tablets, e-readers, etc). Remember, even though you work with a bookkeeper does not mean you stop looking inside your credit card statements. Still monitoring them to make sure nothing funny is being carried out. With this problem, small companies decide to start online printing services set up postcards. However, some of businessmen would not have a background in form. This is why online postcard printing is fun for clients which create or customize postcards. Some of the online printing companies offer design tools to customers to create postcard designs using the world wide web. Here are the aspects that can be completed with postcard printing software. Don't lose heart. Recently, AT&T installed a 3G network in many areas around Bangor involves Ellsworth, Bucksport, parts of Orland, Blue Hill, and Mount Desert Island. Verizon and You.S. Cellular have had 3G in the actual for a while, but. This is good news to men and women in those areas who can't get high speed internet, since it opens the entranceway to the broadband card. We have often of video models. Each one serves certain purpose regarding the size and the quality. Unfortunately, some players can take advantage of some formats but cannot do anything with the other buyers. So from here the social bookmark submitting developing converter comes about. Converter is software that enables users to convert among different set-ups. Of course, MP4 files could be converted to any format.

Pumped: BMX costs $0.99 in Google Play; it will likely be priced at $0.99 at the Amazon Appstore. As we've noted before, you'll sometimes find differences in pricing and availability amongst the two marketplaces.

DriverPack Solution 17 Serial key consists of three stages, submissions, live trading, and rivalry was announced end. Upwards of 300 EA (expert advisor) programmers of all around entire world submitted their EAs. 24 EAs were chosen top rated program the competitions rules. Then all trading robots were placed on $1000 real live accounts funded along with FRWC.

Speak in the monotone voice--If you don't sound excited about your own presentation, must anyone else be proud? This is usually which result from reading your information directly associated with a put. Ask yourself what your point is, and then speak on your heart.or at least your the brain!

Once in Marmoset Toolbag 3 License Key to your ideas, you would like to create these questions graphics training. If you don't know how to make it happen on your own, you can work along with a friend, learn the program, or hire anyone to do it for the individual. Once you have the basic designs in templates that fit the popular sticker sizes available, you can begin your search for a professional computer printers.

Discuss trading with others in the market, but be likely to follow your judgement incredibly. Tapping into the advice of followers more experienced that you is invaluable, but within end, it's your own instincts that should guide one further decisions.

I to be able to let you know that had I done 2 years ago what I'm doing now, I possess been a good deal financially solvent 2 rice than the things i became at this time. This breadmaker lots of promotional software, spent cash promoting my links and gained less. UVK Ultra Virus Killer 10 crack that Experienced missed was that my links were being taken and useful for other persons gain.

Exercise: Yes, you truly exercise. Not surprisingly. Any program that is bragging that every day increase your exercise, Isn't worth experiencing. The idea is not in order to lose . If that were the case, utilize care content articles lost muscle over additional. This is a huge downfall of the majority of dieters because losing muscle is a vicious cycle and causes your metabolism to curtail. Let's make this very clear: the number on the size will go do. Sounds good. Well, the an affiliate the mirror will look FATTER. Yes, even though you're losing weight, it is the wrong involving weight and also you feel fatter. Exercise, helps you maintain muscle, increases your energy, increases your metabolism, assists your heart.

All the trading statements can seen live and updated every 15 minuets. The top ten trading robots will be provided with away to lucky receiver. Though they will be available for your purchases under the category of FRWC Royal Trader after the games. Currently the top robot "LMD-Multicurrency" increased more than $2000 from their $1000 down payment.

0 notes

Text

Don't make these 12 common tax filing mistakes

Federal, and most state, tax returns are a week from today. Don't panic! You still have time to finish your return (or get an extension).

But don't be in such a rush that you make a costly mistake.

Yes, errors on 1040s still happen, even though most of use tax preparation software that catches errors on our annual returns.

Here are a dozen common tax mistakes that millions of taxpayers make every year. Some are directly from the Internal Revenue Service. Others are based on my and other filers' experiences.

1. Missing or inaccurate Social Security numbers: This nine-digit number was not intended to be our universal identifier, but, for better and in this age of identity theft often for worse, that's what the Social Security number has become.

There's been some talk about changing that for tax filing, but until that happens, you've got to include it on your annual return. The IRS won't process a 1040 without it. This identity number requirement extends to you as the primary filer, as well as the Social Security numbers for your spouse and any dependents.

These numerals are crucial because so many tax-related transactions, from income statements to investment earnings to retirement plan contributions and distributions, are keyed to this number.

A Social Security number also is critical when claiming several tax credits, such as the child tax and additional child tax credits, as well as ones for educational expenses and dependent care costs.

At best, a missing Social Security number will slow down the processing of your return. At worst, it could cost you a valuable tax breaks. So be sure to enter on your 1040 each person's number exactly as it's printed on the Social Security card.

2. Misspelled or different names: Sure, the bulk of the information on your tax return is numerical, but words — specifically names — are important, too. Spell all names listed on a tax return exactly as listed on the taxpayers’ Social Security card.

What's the big deal if you've gone by a middle or nickname all your life and enter that on your Form 1040? Plenty. When the names of a taxpayer, his or her spouse or their children don't match the tax identification number that the Social Security Administration has on record, the IRS processing machine likely will kick out or slow down the tax return.

Name issues often are a problem for the newly married. Many folks still change their surnames when they marry, whether the "I do's" are exchanged by a bride and groom or spouses in same-sex marriages, which the IRS now recognizes.

In these cases, if you didn't alert the Social Security Administration (SSA) of your name change after your wedding, your new name on your 1040 or other tax statements could cause a problem when you file your first joint tax return. Get in touch with the SSA ASAP to reconcile this.

The same issue also arises when marital bliss doesn't last and ex-spouses change names after a divorce. Again, make sure Uncle Sam's appropriate agencies know that, too.

3. Improperly claiming a dependent: Sometimes determining just who is your tax dependent can be messy. There are lots of rules about relationships and support earned or provided and who lives for how long in your house. You also must have the Social Security number of the person (see #1), either a child or qualifying relative, you're listing as a dependent on your 1040 or 1040A.

Sometimes the confusion leads to an innocent mistake as to who is eligible to be listed as your tax dependent. Other times, though, folks knowing claim a person as dependent to get the added exemption amount or to claim the refundable Earned Income Tax Credit.

Faking dependents is not a good idea. This is willful disregard of the tax laws and your responsibility to meet them. Such intentional tax violations could lead to tough penalties, sometimes of the criminal nature, on top of the unpaid tax and interest added to it that you thought you were escaping with your fake dependent ploy.

Think the IRS might be too busy to catch your suddenly larger family? Think again. The IRS knows that filers sometimes add people, either real or imaginary or even pets, on their returns. That's why tax examiners look at who has and hasn't been listed before on your returns.

4. Using the wrong filing status: Some taxpayers unintentionally claim the wrong filing status. That innocent error could be costly, such as choosing single in the first tax-filing season since your divorce when you have primary custody of your children and really should be filing as the more tax-beneficial head of household.

Filers have five filing status options, and each could make a difference in your ultimate tax bill.

The IRS' online Interactive Tax Assistant can help you pick the proper filing status. E-file software also helps prevent mistakes here.

Advice from the IRS in Form 1040 instructions.

5. Using whole, rounded numbers: Yes, round numbers are easier to add and subtract. Yes, your tax software rounds entries.

And yes, even the IRS says you can round your dollars and cents on your Form 1040.

But when it comes to deductions and business expenses, it tends to make the IRS think that you're, uh, making up amounts.

OK, I tend to add tip amounts so that meal checks come out to even numbers. But I have those receipts. Other financial transactions, however, rarely end in .00.

At best, all those rounded numbers make it look like you didn't keep good records showing precise amounts. And that could encourage the IRS to take a closer look at all your entries.

6. Entering incorrect bank account numbers: You can have your tax refund directly depositing into a bank account or accounts or retirement plan. That's easy for you and the IRS. Unless you enter the wrong account number and accompanying routing number.

The more numbers you enter on a tax form, the more chances you have to enter them incorrectly. And a wrong account or routing number could cause you to lose your refund entirely.

You can divide your refund deposit into three accounts by filing Form 8888 along with your individual return. It's not a difficult document to complete, but if you put in wrong account numbers, your refund could end up in someone else's account or be sent back to the IRS.

Incorrect account numbers aren't just a problem when a refund is split multiple ways. Even if your refund is going to just one account, make very sure you enter that account and bank routing numbers correctly.

7. Overlooking additional income: Did you have a side job this year? If so, as a contractor you probably received a Form 1099-MISC detailing the extra earnings.

What about savings and investment accounts? For these, you should have received Form 1099-INT and Form 1099 DIV statements.

In these 1099 situations, the IRS knows precisely how much extra money, either as wages or unearned investment income, you made because it got copies of those forms, too.

If you forget to include any of these earnings on your return, IRS examiners will let you know you that it knows and that you owe taxes on that money, too. And depending on when your oversight is discovered, you also could owe penalties and interest on the unreported earnings.

8. Missing charitable contributions: You were very generous last year and you're taking tax advantage of your philanthropic nature this filing season. Good for you in both cases. But make sure you don't overlook any charitable donations.

All types of donations, from cash to cars, could be valuable tax deductions, so make sure you count them all when you file.

In addition to these cash and property donations, you also may deduct mileage, parking fees, postage and long-distance phone calls made while performing charitable work.

9. Not signing your tax return: A tax return that's unsigned gets the same treatment as ones missing Social Security numbers. A return lacking a signature — or signatures: when married couples file a joint return, both spouses must sign the 1040 — isn't valid and the IRS won't process it.

The easiest way to avoid this oversight is to file electronically and digitally sign it before sending it to the IRS. Your tax software, either the package you bought or the one you're using on Free File, will walk you through the e-signature process.

If, however, you're still mailing your return, don't be in such a hurry to be done with the job that you stuff your 1040 in the envelope sans signature.

10. Making credit or deduction mistakes: Here's a non-news flash. The tax code is complicated (and will stay that way despite the tweaks to the Internal Revenue Code made by the Tax Cuts and Jobs Act). That means there are lots of opportunities to make mistakes as you look for tax-saving credits and deductions.

Errors are frequently made by folks claiming the Earned Income Tax Credit (EITC) and additional child tax credit. That's part of the reason the IRS now must hold refunds related to these tax breaks until mid-February.

But the IRS also sees each year errors by filers figuring their child and dependent care credit and even in selecting their standard deduction amount. For example, a taxpayer who’s 65 or older and/or blind, can claim a larger standard deduction.

Follow the tax filing instructions carefully, either those in IRS publications and forms or as part of your tax software. The IRS' online Interactive Tax Assistant also can help you determine if you're eligible for certain tax credits or deductions.

11. Math miscalculations: The IRS is all about the numbers. So it's no surprise that the most common error on tax returns, year after year, is bad math.

Arithmetic errors range from simple addition and subtraction to more complex tax items, like those credits and deductions just mentioned in mistake #10. Figuring things like the EITC or the taxable portion of a retirement account distribution, for example, is more difficult and results in more math errors.

In processing 2016 tax returns, the IRS caught more than 2.5 million math errors, according to the agency's 2017 Data Book. Considering that most of us use tax software, in large part because it does the math for us, that's astounding.

Source: IRS 2017 Data Book

Of course, the adage garbage in/garbage out applies here. The wrong number on one form's line produces a wrong calculation that gets transferred to another form, exponentially compounding the math error.

So pay close attention when you enter your numerical data into your tax return.

12. Missing the deadline: Finally, don't make the biggest tax season mistake of all, missing the filing deadline.

Millions of taxpayers put off filing until the very last minute. That's OK as long as your mailed paper return is postmarked by the April filing deadline or you hit "enter" to e-file your 1040 by midnight of the deadline day.

The good news for 2017 taxes is that the April 15 due date is pushed to April 17 because of the weekend and the federal Emancipation Day holiday in Washington, D.C. But if even with a couple of extra days you still just can't finish your forms by the deadline, get an extension.

Filing Form 4868 will give you six more months, until Oct. 15, to get all your forms filled out and into the IRS. You can do so by either mailing a paper form or electronically, again by next Tuesday's due date.

Just remember that an extension to file applies only to the forms. You still must send by April 17 any tax you owe with your extension request. If you don't, you could face late-filing or non-filing penalties.

Nobody wants to pay Uncle Sam a penny more than necessary, so don't make the mistake of missing the filing deadline.

OK. That's my, to borrow an IRS term, Dirty Dozen tax filing errors. Don't make them this year. And if you have others on your own tax errors list, please share them in the comments below.

Advertisement

// <![CDATA[ // <![CDATA[ // &lt;![CDATA[ // &amp;lt;![CDATA[ // &amp;amp;lt;![CDATA[ // &amp;amp;amp;lt;![CDATA[ // &amp;amp;amp;amp;lt;![CDATA[ // &amp;amp;amp;amp;amp;lt;![CDATA[ // &amp;amp;amp;amp;amp;amp;lt;![CDATA[ // &amp;amp;amp;amp;amp;amp;amp;lt;![CDATA[ // &amp;amp;amp;amp;amp;amp;amp;amp;lt;![CDATA[ // &amp;amp;amp;amp;amp;amp;amp;amp;amp;lt;![CDATA[ // &amp;amp;amp;amp;amp;amp;amp;amp;amp;amp;lt;![CDATA[ // &amp;amp;amp;amp;amp;amp;amp;amp;amp;amp;amp;lt;![CDATA[ (adsbygoogle = window.adsbygoogle || []).push({}); // ]]&amp;amp;amp;amp;amp;amp;amp;amp;amp;amp;amp;gt; // ]]&amp;amp;amp;amp;amp;amp;amp;amp;amp;amp;gt; // ]]&amp;amp;amp;amp;amp;amp;amp;amp;amp;gt; // ]]&amp;amp;amp;amp;amp;amp;amp;amp;gt; // ]]&amp;amp;amp;amp;amp;amp;amp;gt; // ]]&amp;amp;amp;amp;amp;amp;gt; // ]]&amp;amp;amp;amp;amp;gt; // ]]&amp;amp;amp;amp;gt; // ]]&amp;amp;amp;gt; // ]]&amp;amp;gt; // ]]&amp;gt; // ]]&gt; // ]]> // ]]>

0 notes

Text

Don't make these 12 common tax filing mistakes

Federal, and most state, tax returns are a week from today. Don't panic! You still have time to finish your return (or get an extension).

But don't be in such a rush that you make a costly mistake.

Yes, errors on 1040s still happen, even though most of use tax preparation software that catches errors on our annual returns.

Here are a dozen common tax mistakes that millions of taxpayers make every year. Some are directly from the Internal Revenue Service. Others are based on my and other filers' experiences.

1. Missing or inaccurate Social Security numbers: This nine-digit number was not intended to be our universal identifier, but, for better and in this age of identity theft often for worse, that's what the Social Security number has become.

There's been some talk about changing that for tax filing, but until that happens, you've got to include it on your annual return. The IRS won't process a 1040 without it. This identity number requirement extends to you as the primary filer, as well as the Social Security numbers for your spouse and any dependents.

These numerals are crucial because so many tax-related transactions, from income statements to investment earnings to retirement plan contributions and distributions, are keyed to this number.

A Social Security number also is critical when claiming several tax credits, such as the child tax and additional child tax credits, as well as ones for educational expenses and dependent care costs.

At best, a missing Social Security number will slow down the processing of your return. At worst, it could cost you a valuable tax breaks. So be sure to enter on your 1040 each person's number exactly as it's printed on the Social Security card.

2. Misspelled or different names: Sure, the bulk of the information on your tax return is numerical, but words — specifically names — are important, too. Spell all names listed on a tax return exactly as listed on the taxpayers’ Social Security card.

What's the big deal if you've gone by a middle or nickname all your life and enter that on your Form 1040? Plenty. When the names of a taxpayer, his or her spouse or their children don't match the tax identification number that the Social Security Administration has on record, the IRS processing machine likely will kick out or slow down the tax return.

Name issues often are a problem for the newly married. Many folks still change their surnames when they marry, whether the "I do's" are exchanged by a bride and groom or spouses in same-sex marriages, which the IRS now recognizes.

In these cases, if you didn't alert the Social Security Administration (SSA) of your name change after your wedding, your new name on your 1040 or other tax statements could cause a problem when you file your first joint tax return. Get in touch with the SSA ASAP to reconcile this.

The same issue also arises when marital bliss doesn't last and ex-spouses change names after a divorce. Again, make sure Uncle Sam's appropriate agencies know that, too.

3. Improperly claiming a dependent: Sometimes determining just who is your tax dependent can be messy. There are lots of rules about relationships and support earned or provided and who lives for how long in your house. You also must have the Social Security number of the person (see #2), either a child or qualifying relative, you're listing as a dependent on your 1040 or 1040A.

Sometimes the confusion leads to an innocent mistake as to who is eligible to be listed as your tax dependent. Other times, though, folks knowing claim a person as dependent to get the added exemption amount or to claim the refundable Earned Income Tax Credit.

Faking dependents is not a good idea. This is willful disregard of the tax laws and your responsibility to meet them. Such intentional tax violations could lead to tough penalties, sometimes of the criminal nature, on top of the unpaid tax and interest added to it that you thought you were escaping with your fake dependent ploy.

Think the IRS might be too busy to catch your suddenly larger family? Think again. The IRS knows that filers sometimes add people, either real or imaginary or even pets, on their returns. That's why tax examiners look at who has and hasn't been listed before on your returns.

4. Using the wrong filing status: Some taxpayers unintentionally claim the wrong filing status. That innocent error could be costly, such as choosing single in the first tax-filing season since your divorce when you have primary custody of your children and really should be filing as the more tax-beneficial head of household.

Filers have five filing status options, and each could make a difference in your ultimate tax bill.

The IRS' online Interactive Tax Assistant can help you pick the proper filing status. E-file software also helps prevent mistakes here.

Advice from the IRS in Form 1040 instructions.

5. Using whole, rounded numbers: Yes, round numbers are easier to add and subtract. Yes, your tax software rounds entries.

And yes, even the IRS says you can round your dollars and cents on your Form 1040.

But when it comes to deductions and business expenses, it tends to make the IRS think that you're, uh, making up amounts.

OK, I tend to add tip amounts so that meal checks come out to even numbers. But I have those receipts. Other financial transactions, however, rarely end in .00.

At best, all those rounded numbers make it look like you didn't keep good records showing precise amounts. And that could encourage the IRS to take a closer look at all your entries.

6. Entering incorrect bank account numbers: You can have your tax refund directly depositing into a bank account or accounts or retirement plan. That's easy for you and the IRS. Unless you enter the wrong account number and accompanying routing number.

The more numbers you enter on a tax form, the more chances you have to enter them incorrectly. And a wrong account or routing number could cause you to lose your refund entirely.

You can divide your refund deposit into three accounts by filing Form 8888 along with your individual return. It's not a difficult document to complete, but if you put in wrong account numbers, your refund could end up in someone else's account or be sent back to the IRS.

Incorrect account numbers aren't just a problem when a refund is split multiple ways. Even if your refund is going to just one account, make very sure you enter that account and bank routing numbers correctly.

7. Overlooking additional income: Did you have a side job this year? If so, as a contractor you probably received a Form 1099-MISC detailing the extra earnings.

What about savings and investment accounts? For these, you should have received Form 1099-INT and Form 1099 DIV statements.

In these 1099 situations, the IRS knows precisely how much extra money, either as wages or unearned investment income, you made because it got copies of those forms, too.

If you forget to include any of these earnings on your return, IRS examiners will let you know you that it knows and that you owe taxes on that money, too. And depending on when your oversight is discovered, you also could owe penalties and interest on the unreported earnings.

8. Missing charitable contributions: You were very generous last year and you're taking tax advantage of your philanthropic nature this filing season. Good for you in both cases. But make sure you don't overlook any charitable donations.

All types of donations, from cash to cars, could be valuable tax deductions, so make sure you count them all when you file.

In addition to these cash and property donations, you also may deduct mileage, parking fees, postage and long-distance phone calls made while performing charitable work.

9. Not signing your tax return: A tax return that's unsigned gets the same treatment as ones missing Social Security numbers. A return lacking a signature — or signatures: when married couples file a joint return, both spouses must sign the 1040 — isn't valid and the IRS won't process it.

The easiest way to avoid this oversight is to file electronically and digitally sign it before sending it to the IRS. Your tax software, either the package you bought or the one you're using on Free File, will walk you through the e-signature process.

If, however, you're still mailing your return, don't be in such a hurry to be done with the job that you stuff your 1040 in the envelope sans signature.

10. Making credit or deduction mistakes: Here's a non-news flash. The tax code is complicated (and will stay that way despite the tweaks to the Internal Revenue Code made by the Tax Cuts and Jobs Act). That means there are lots of opportunities to make mistakes as you look for tax-saving credits and deductions.

Errors are frequently made by folks claiming the Earned Income Tax Credit (EITC) and additional child tax credit. That's part of the reason the IRS now must hold refunds related to these tax breaks until mid-February.

But the IRS also sees each year errors by filers figuring their child and dependent care credit and even in selecting their standard deduction amount. For example, a taxpayer who’s 65 or older and/or blind, can claim a larger standard deduction.

Follow the tax filing instructions carefully, either those in IRS publications and forms or as part of your tax software. The IRS' online Interactive Tax Assistant also can help you determine if you're eligible for certain tax credits or deductions.

11. Math miscalculations: The IRS is all about the numbers. So it's no surprise that the most common error on tax returns, year after year, is bad math.

Arithmetic errors range from simple addition and subtraction to more complex tax items, like those credits and deductions just mentioned in mistake #10. Figuring things like the EITC or the taxable portion of a retirement account distribution, for example, is more difficult and results in more math errors.

In processing 2016 tax returns, the IRS caught more than 2.5 million math errors, according to the agency's 2017 Data Book. Considering that most of us use tax software, in large part because it does the math for us, that's astounding.

Source: IRS 2017 Data Book

Of course, the adage garbage in/garbage out applies here. The wrong number on one form's line produces a wrong calculation that gets transferred to another form, exponentially compounding the math error.

So pay close attention when you enter your numerical data into your tax return.

12. Missing the deadline: Finally, don't make the biggest tax season mistake of all, missing the filing deadline.

Millions of taxpayers put off filing until the very last minute. That's OK as long as your mailed paper return is postmarked by the April filing deadline or you hit "enter" to e-file your 1040 by midnight of the deadline day.

The good news for 2017 taxes is that the April 15 due date is pushed to April 17 because of the weekend and the federal Emancipation Day holiday in Washington, D.C. But if even with a couple of extra days you still just can't finish your forms by the deadline, get an extension.

Filing Form 4868 will give you six more months, until Oct. 15, to get all your forms filled out and into the IRS. You can do so by either mailing a paper form or electronically, again by next Tuesday's due date.

Just remember that an extension to file applies only to the forms. You still must send by April 17 any tax you owe with your extension request. If you don't, you could face late-filing or non-filing penalties.

Nobody wants to pay Uncle Sam a penny more than necessary, so don't make the mistake of missing the filing deadline.

OK. That's my, to borrow an IRS term, Dirty Dozen tax filing errors. Don't make them this year. And if you have others on your own tax errors list, please share them in the comments below.

Advertisement

// <![CDATA[ // <![CDATA[ // &lt;![CDATA[ // &amp;lt;![CDATA[ // &amp;amp;lt;![CDATA[ // &amp;amp;amp;lt;![CDATA[ // &amp;amp;amp;amp;lt;![CDATA[ // &amp;amp;amp;amp;amp;lt;![CDATA[ // &amp;amp;amp;amp;amp;amp;lt;![CDATA[ // &amp;amp;amp;amp;amp;amp;amp;lt;![CDATA[ // &amp;amp;amp;amp;amp;amp;amp;amp;lt;![CDATA[ // &amp;amp;amp;amp;amp;amp;amp;amp;amp;lt;![CDATA[ (adsbygoogle = window.adsbygoogle || []).push({}); // ]]&amp;amp;amp;amp;amp;amp;amp;amp;amp;gt; // ]]&amp;amp;amp;amp;amp;amp;amp;amp;gt; // ]]&amp;amp;amp;amp;amp;amp;amp;gt; // ]]&amp;amp;amp;amp;amp;amp;gt; // ]]&amp;amp;amp;amp;amp;gt; // ]]&amp;amp;amp;amp;gt; // ]]&amp;amp;amp;gt; // ]]&amp;amp;gt; // ]]&amp;gt; // ]]&gt; // ]]> // ]]>

from Tax News By Christopher http://www.dontmesswithtaxes.com/2018/04/12-common-tax-filing-mistakes-to-avoid.html

0 notes