#Trade Smart Using Technical Analysis ( Basic+ Advanced)

Explore tagged Tumblr posts

Text

Trade Smart Using Technical Analysis (Basic + Advanced) | Learn to Read the Markets

Gain a competitive edge in the stock market with our all-in-one guide to Technical Analysis, covering both basic and advanced concepts. This program is tailored for traders and investors who want to make informed decisions using price action, chart patterns, indicators, and volume analysis. Start with the fundamentals—like trendlines, support and resistance, and moving averages—and progress to advanced tools such as candlestick patterns, Fibonacci retracements, Bollinger Bands, RSI, MACD, and more. Whether you're a beginner or an experienced trader, this course will empower you to analyze market trends, time entries and exits, and develop high-probability trading strategies with confidence. Trade smart, minimize risk, and maximize your potential returns with structured technical insights.

0 notes

Text

Oscilloscope Price Dubai – Compare Leading Brands

When it comes to purchasing an oscilloscope in Dubai, understanding and comparing oscilloscope price in dubai UAE prices among leading brands is key to making an informed decision.

Oscilloscopes are essential diagnostic tools used in electronics for observing varying signal voltages and waveforms, making them indispensable for engineers, technicians, students, and professionals in sectors ranging from telecommunications and industrial

automation to automotive electronics and research labs. Dubai, being a central hub for technology and trade in the Middle East, offers an extensive range of oscilloscopes from top international manufacturers including Tektronix, Rigol, Siglent, Keysight, and Hantek.

Each brand has its own strengths in terms of performance, price, features, and after-sales support. For instance, Tektronix is known for its premium quality and reliability, often preferred by high-end labs and industries where precision and advanced functionality are critical. However, it typically comes with a higher price tag.

On the other hand, Rigol and Siglent offer a fantastic balance between performance and affordability, making them popular choices among students, startups, and general electronics users.

Hantek is particularly well-suited for budget-conscious buyers who still want decent features for basic signal analysis. When comparing oscilloscope prices in Dubai, buyers will notice that the cost varies widely depending on specifications such as bandwidth (e.g., 50 MHz, 100 MHz, 200 MHz, or 1 GHz), the number of channels (2 or 4), sample rate, screen size, and additional features like FFT analysis, USB connectivity, or protocol decoding for signals like I2C and SPI.

Entry-level digital oscilloscopes from Rigol or Hantek might start from AED 600–1,000, while mid-range models suitable for academic and light industrial use could range between AED 1,500 and AED 4,000. Advanced scopes from Tektronix or Keysight designed for professional and research applications can exceed AED 10,000,

especially those offering high bandwidth and deep memory. Dubai-based electronic retailers and online platforms often provide side-by-side comparison tools that allow users to evaluate features and pricing to make the best choice. Many vendors also run seasonal promotions or bundle offers that include probes, carrying cases, or free software upgrades, adding significant value to your purchase.

Additionally, most authorized dealers in Dubai provide local warranty, technical assistance, and calibration services, which are vital for long-term performance and reliability.

Comparing brands and models not only helps in finding the best price but also ensures you are investing in an oscilloscope that truly meets your testing and measurement requirements.

With Dubai's strong logistics and trade infrastructure, customers benefit from readily available stock, fast delivery, and access to the latest global models without long delays.

Whether you're shopping in Al Quoz's electronics markets or browsing online electronics stores, the city offers transparent pricing and a wide selection to suit every budget and need. In conclusion, if you're looking for competitive oscilloscope prices in Dubai, taking the time to compare leading brands can help you secure the best deal with the right features and support. t's a smart move for anyone serious about accurate and efficient electronic testing in the UAE.

follow more information:

https://www.empiricalts.com/our-products/test-equipment/electrical/oscilloscopes.html

0 notes

Text

Why Traders Are Actively Looking for a BullX Neo Alternative

Understanding the Appeal of BullX Neo

In the evolving landscape of automated crypto trading, platforms like BullX Neo have emerged as attractive options for traders seeking simplified trading tools. With automation, portfolio tracking, and beginner-friendly dashboards, BullX Neo has made it easier for novice traders to enter the world of algorithmic crypto strategies. However, as users mature and markets grow more sophisticated, many begin to feel the limitations of such platforms, prompting the search for a better bullx neo alternative.

Limitations That Drive the Search for Alternatives

While BullX Neo offers a streamlined experience, it doesn’t necessarily cater to traders who demand advanced functionalities, more control, or deeper analytics. Here are a few critical areas where BullX Neo often falls short:

Limited Customization: Most of the trading bots are preset, offering minimal flexibility for advanced users who want to create or modify their own strategies.

Basic Technical Tools: Traders who rely on in-depth technical analysis might find the charting tools underwhelming.

Lack of Multi-Exchange Integration: Support for only a few exchanges can be restrictive, especially for users with assets spread across different platforms.

Opaque Execution: Without full transparency on how trades are executed, many users question whether their strategies are being carried out optimally.

Security Concerns: The absence of detailed documentation on encryption methods, API key handling, and data privacy may be unsettling to users dealing with high-value trades.

These factors contribute to growing dissatisfaction among experienced traders, many of whom are actively seeking alternatives that can support their more complex trading needs.

What an Ideal Alternative Should Offer

The ideal replacement for BullX Neo should address its shortcomings while delivering additional benefits that enhance the trading experience. Here’s what traders should look for in an alternative:

Advanced Trading Features: The ability to use trailing stops, OCO orders, take-profits, and other advanced order types is a must.

Full Exchange Coverage: Integration with dozens of top crypto exchanges ensures seamless access to assets and markets.

Custom Bot Creation: Users should be able to program or fine-tune bots with unique parameters tailored to market conditions.

Mobile and Web Functionality: A fully-featured mobile app that syncs with web access lets traders manage positions on the go.

Security Transparency: Clear policies on API key usage, multi-factor authentication, and data handling provide peace of mind.

Real-Time Analytics: Insightful dashboards that provide portfolio health, trade success rates, and P&L metrics help traders optimize their strategies over time.

With these features, users can graduate from entry-level automation tools to comprehensive trading ecosystems that are better aligned with their goals.

Why GoodCrypto Is the Preferred BullX Neo Alternative

As traders explore alternatives, many are turning to bullx neo alternative platforms like GoodCrypto, which is quickly gaining a reputation as one of the most powerful and flexible crypto trading tools on the market.

GoodCrypto supports over 35 major exchanges, giving traders complete control over a diversified portfolio. It enables users to execute sophisticated trading strategies, set smart orders, and monitor real-time charts with professional-level indicators. Whether you’re a swing trader, scalper, or long-term holder, the platform gives you everything needed to succeed.

Another major advantage of GoodCrypto is its commitment to security and transparency. Unlike platforms that mask how your trades are executed, GoodCrypto offers detailed trade histories, uses encrypted API key storage, and never requests withdrawal rights, ensuring users remain in control at all times.

Automation Meets Intelligence

GoodCrypto doesn't just offer automation for the sake of convenience; it’s designed to empower intelligent trading. Users can set up automated bots that are adaptable and condition-based, taking into account multiple market signals and user-defined triggers. This flexibility is exactly what advanced traders need to outperform in volatile markets.

Conclusion: Trade Smarter, Not Just Easier

BullX Neo may have provided a good starting point, but as the crypto market grows in complexity, so too should the tools used to navigate it. If you’ve outgrown the basic functions of BullX Neo, switching to a more powerful platform could significantly enhance your performance and decision-making process.

In that search, GoodCrypto stands out as the go-to bullx neo alternative—a platform designed not just for automation, but for optimization, strategy, and security. It’s time to take your trading to the next level.

0 notes

Text

Explore Profitable Stock Market Courses Online by ICFM Today

Are you ready to dive into the world of trading and investing but don’t know where to begin? In today’s digital age, stock market courses online are the easiest and most effective way to gain the knowledge and confidence to enter the stock market. And when it comes to trusted and professional learning, ICFM (Institute of Career in Financial Market) offers the most reliable and career-focused stock market courses online that are changing lives across India.

Whether you are a college student, working professional, or even a retiree wanting to grow your money, stock market courses online by ICFM are made just for you. They are easy to follow, packed with practical insights, and taught by real market experts. If you are serious about learning the stock market from home, ICFM’s stock market courses online are your best choice.

Why Stock Market Courses Online Are the Future

In today’s fast-moving world, not everyone has the time to join regular classroom training. That’s where stock market courses online become so powerful. You can learn at your own speed, from the comfort of your home, and still get the same quality of education. ICFM understands this modern need and has designed flexible, easy-to-understand, and highly interactive stock market courses online for students across the country.

Learning online gives you the freedom to repeat lessons, clear doubts with mentors, and practice trading anytime. ICFM’s online platform is user-friendly and accessible even on mobile devices, so you can study anywhere, anytime.

What Makes ICFM’s Stock Market Courses Online Unique

There are many websites offering stock market courses online, but most of them are too technical or just theoretical. ICFM takes a different route. Their courses are designed to teach the stock market in a way that’s simple, clear, and practical. Everything is taught in plain English, and even a beginner with no finance background can easily understand the concepts.

From learning the basics like how stocks work to advanced strategies in trading, ICFM’s stock market courses online cover every important topic in detail. You learn through real-life examples, charts, market analysis, and even live trading demonstrations. This kind of training is hard to find elsewhere.

Step-by-Step Learning Approach

The best part about ICFM’s stock market courses online is the step-by-step learning method. You don’t need any prior knowledge. The course starts with the basics and slowly moves into technical and fundamental analysis, risk management, options trading, market psychology, and more.

Each topic is explained with visual tools and simple language so you don’t feel lost. Plus, you get regular assessments to test your knowledge and build confidence as you progress.

Learn From Experts With Real Market Experience

One big reason why ICFM’s stock market courses online are so successful is because they are taught by professionals who actually trade in the market. These are not just trainers — they are experienced traders and analysts who share their practical insights with students.

They teach you what works in real trading, what mistakes to avoid, and how to read the market with a smart approach. This kind of expert guidance makes a huge difference in how you understand and use your skills in the real world.

Live Market Practice and Doubt Solving

While many online courses offer only recorded videos, ICFM goes the extra mile. Their stock market courses online include live market sessions, doubt-clearing webinars, and mentoring support. This means you’re not learning alone. You are guided and supported throughout your journey.

These live sessions help you apply what you’ve learned in real-time and see how the stock market behaves. Watching professionals analyze the market live gives you practical exposure that books and videos cannot offer.

Career Opportunities After Stock Market Courses Online

Once you complete your stock market courses online from ICFM, you are ready to explore a wide range of career opportunities. Many students go on to become traders, investment advisors, research analysts, or even start their own investment businesses.

The best thing is that ICFM also helps students with career support, job guidance, and internships in the financial sector. If you’re someone looking for a stable and rewarding career in the stock market, these stock market courses online can be your launchpad.

Flexible Timing and Lifetime Access

Another big advantage of ICFM’s stock market courses online is the flexibility they offer. You can learn in the morning, at night, or on weekends — whatever suits your schedule. Once enrolled, you also get lifetime access to course material and updates. This means you can always go back and revise whenever needed.

Learning never stops at ICFM. They keep updating their content according to the latest market trends and ensure that all students get the most current knowledge at all times.

Affordable Pricing for Everyone

Unlike many courses that charge high fees without real value, ICFM believes in providing quality education at a reasonable price. Their stock market courses online are designed to be budget-friendly so that everyone, regardless of background, can benefit from them.

It’s one of the few institutes where you get premium learning, live sessions, and expert mentoring without burning a hole in your pocket. This makes ICFM a top choice for thousands of learners across India.

Join the ICFM Community Today

When you sign up for stock market courses online at ICFM, you’re not just buying a course — you’re becoming part of a strong community. You get access to forums, market discussions, trading groups, and regular events that keep your learning fresh and exciting.

Being part of this community also helps you stay motivated, find like-minded learners, and keep improving your skills even after the course ends.

Conclusion

If you are serious about learning the stock market and want a course that’s practical, flexible, and taught by real experts, then ICFM’s stock market courses online are made for you. They are designed to take you from zero to expert — all from the comfort of your home.

These stock market courses online are more than just videos and notes. They are a complete learning experience that prepares you for real-world trading, investing, and financial success. Thousands of students have already changed their lives by choosing ICFM. Now it’s your turn.

Don’t wait for the market to change your life. Take control. Learn the smart way with ICFM’s stock market courses online and build your future in the world of finance.

#Stock market courses online#Stock market courses online free with certificate#Stock market courses for Beginners#Share market courses#Stock market courses online with certificate#Indian stock market courses online#Online Stock Market courses for beginners

0 notes

Text

Free Futures Trading Course: Learn to Trade Without Spending a Dime

Introduction to Futures Trading

Futures trading is all about making deals on the future price of assets like oil, gold, or even the stock market. You’re not buying the asset—you’re betting on where its price will go. Sounds exciting, right? It is—but only if you know what you're doing.

If you’ve ever wanted to jump into this fast-paced world, a Free Futures Trading Course is the best way to start.

Why Learn Futures Trading?

Futures trading can be profitable and is often used by investors, traders, and even big companies to protect against price changes. It offers:

High potential profits

Low trading costs

24-hour market access

Great opportunities for day traders

But it’s also risky. That’s why proper education is a must.

What is a Futures Contract?

A futures contract is an agreement to buy or sell something (like oil or gold) at a set price on a future date. Traders use these contracts to bet on whether prices will rise or fall.

Who Should Take a Free Futures Trading Course?

Whether you’re:

A beginner looking to learn the basics,

A stock trader wanting to explore futures,

Or someone interested in trading commodities like gold, oil, or wheat,

A Free Futures Trading Course can help you understand the market and avoid beginner mistakes.

Benefits of a Free Futures Trading Course

1. No Risk, All Learning

You don’t have to spend any money. That means you can focus on learning without worrying about wasting cash.

2. Build Confidence

You’ll understand the trading tools, how futures contracts work, and how to use platforms like MetaTrader or Thinkorswim.

3. Practice with Demo Accounts

Courses often include access to virtual trading platforms where you can practice with fake money—perfect for beginners.

Top Topics You’ll Learn

A good free course will cover:

What are futures contracts?

How to read charts and market data

Technical analysis (using tools and indicators)

Risk management (protecting your money)

Trading psychology (staying calm and smart)

Where Can You Find a Free Futures Trading Course?

One of the best places to start is Coursocean. They offer beginner-friendly futures trading courses that are both free and high quality. Their easy-to-understand lessons make them one of the best options for learners on a budget.

Free vs Paid Courses: What’s the Difference?

Free Courses:

Great for learning the basics

Short and to the point

No cost or risk involved

Paid Courses:

Offer advanced strategies

Include mentorship or group access

Often come with certificates

Start with free, and if you love it, consider upgrading.

How Long Does It Take to Learn Futures Trading?

With a good course and regular practice, most people can understand the basics within a few weeks. Becoming skilled may take a few months. The key is to learn consistently and use demo accounts to practice.

Is Futures Trading Safe for Beginners?

It can be—if you learn properly. Futures markets are very active and can move quickly. This means you can win or lose money fast. That’s why taking a Free Futures Trading Course is such a smart move before you risk your own money.

Success Stories From Free Course Students

Emma’s Story

Emma, a college student, took a free futures course on Coursocean. She practiced using demo trades and learned how to manage her risks. After 2 months, she started trading small live positions with confidence.

John’s Story

John was already a stock trader but wanted to try futures. Instead of jumping in, he completed a free course first. Today, he’s a full-time futures day trader, thanks to what he learned for free.

Important Tips for New Traders

Start small. Don’t risk big money right away.

Use a demo account. Practice until you feel confident.

Keep learning. Markets change, so keep studying.

Don’t trade with emotions. Stay calm and follow your plan.

Do You Need a Lot of Money to Start Trading Futures?

No! Some brokers let you start with $100 or even less. But the more important thing is the knowledge you bring. That’s why starting with a Free Futures Trading Course makes all the difference.

What Platforms Are Used for Futures Trading?

MetaTrader 5 (MT5)

Thinkorswim

NinjaTrader

TradingView (for chart analysis)

These platforms let you analyze charts, place orders, and manage trades—all from your laptop or phone.

The Future of Futures Trading Education

The world of trading education is evolving. Today’s free courses offer:

Interactive lessons

Quizzes and tests

Live webinars

Access to communities

This means you can learn from real traders and improve faster than ever.

Conclusion: Start Learning Without Spending a Penny

Trading futures can be a great way to grow your money, but it starts with education. And thanks to platforms like Coursocean, you don’t have to pay to get started.

A Free Futures Trading Course gives you the basics, helps you avoid mistakes, and sets you on the path to becoming a smart, confident trader.

0 notes

Text

Stock Market Trading Courses: Your Door to Financial Independence

The stock market can be a great way to make money, but it can also be confusing. Stock market trading courses can teach you the basics and give you the skills you need to trade confidently. Whether you're new to investing or you've been doing it for a while, a good course can help you reach your financial goals.

Why Join the Stock Market Trading Course?

1. Understanding Fundamentals of Market

A good stock market course will begin with the fundamentals. You'll learn how the market works, the different instruments you can trade (stocks, commodities, and currencies), and how exchanges function. Knowing these basics will help you make smart choices instead of just assuming.

2. Explore Proven Market Strategies

A good stock market course will let you understand various trading methods, including intraday trading, swing trading, and long-term investing. Learning proven strategies helps you identify opportunities and minimize risks.

3. Risk Management Skills

Professional traders know how to avoid big losses and make the most money possible. Trading courses teach you how to manage risk, like using stop-loss orders, diversifying your investments, and analyzing the right amount to invest. These techniques help protect your money.

4. Hands-on Practical Experience

Many courses let you practice with real-time market data and "paper trading." This means you can try out different trading strategies without risking any real money, which helps you get confident before you start trading for real.

5. Expert Mentorship

A major advantage of stock market trading courses is that you get to learn from experienced traders. These experts have seen it all in the market, and they can share valuable tips and ideas that you won't find in books or free stuff online.

Types of Stock Market Trading Courses

1. Beginner-Level Courses

This course is ideal for those new to trading, these courses include basic topics such as stock market basics, how to read charts, understanding technical and fundamental analysis, and trading psychology.

2. Intermediate-Level Courses

This type of course is generally designed for traders with some experience; intermediate courses focus on advanced technical indicators, trend analysis, swing trading strategies, and options trading basics.

3. Advanced-Level Courses

Advanced-level courses are basically created for professional traders; these courses include topics like algorithmic trading, advanced risk management techniques, and market-making principles.

Important Factors to Look for Before Joining a Trading Course:

1. Comprehensive Syllabus

The course should teach you both the basics and how to actually use them. It should cover chart reading, company analysis, and how emotions affect your investing decision.

2. Interactive Learning Methods

Courses that provide video tutorials, live webinars, trading simulations, and one-on-one mentorship provide a better learning experience than those limited to reading materials.

3. Certification and Credibility

Choose courses from well-known institute, experienced traders, or trusted online platforms. Getting certified can add weight to your resume and might help you get a good job in the finance industry.

How to Choose the Right Course for You?

1. Know Your Trading Goals

What do you want to achieve? Do you want to trade full-time, looking for a second source of income, or just learn about the stock market? Knowing your goal will help you find the right course.

2. Analyze Your Experience Level

If you’re a fresher, start with a fundamentals course. If you have some experience, choose an intermediate course focusing on advanced strategies and risk management.

3. Reviews

Check out real reviews and feedback to see if a course is actually trustworthy.

4. Compare Fees

Free resources are available, but paid courses often offer better structure and mentoring. Compare the course fee and benefits before choosing.

Conclusion

A good stock market trading course can really change things for you financially. Whether you're thinking about making some extra earnings, maybe even trading full-time, or just want to get a better handle on how the markets work, investing in a trading course is the first thing you should do.

Start your journey to financial freedom by joining a good stock market trading course today. Get the knowledge and skills you need to trade confidently and efficiently.

0 notes

Text

Demand and Supply Trading: The Only Concept You Need

If you’re tired of juggling indicators, confused by complex strategies, or overwhelmed by market noise — you’re not alone. Thousands of aspiring traders start with enthusiasm, only to burn out trying to understand candlesticks, moving averages, and countless strategies. At Chart Monks, our mission is clear — strip away the clutter and make trading simple, practical, and powerful. And at the core of this simplicity lies one powerful concept: Demand and Supply Trading.

Whether you’re just starting with a trading course in Hindi or looking for technical trading courses to upgrade your skills, mastering demand and supply can completely transform how you see the markets.

What is Demand and Supply Trading?

Demand and supply trading is based on a simple truth: price moves where there's imbalance. When buyers outnumber sellers, prices move up — plain and simple. When supply overwhelms demand, price falls.

This is the silent language of markets — no indicators, no lagging signals, just raw, price-based logic.

By learning to identify zones where big institutions and smart money are active, you can position yourself to trade alongside them, not against them.

Why Demand and Supply is All You Need

Many online trading courses for beginners overcomplicate trading. They pile on RSI, MACD, Bollinger Bands, and a dozen other indicators — but seasoned traders know that clarity comes from clean charts and pure price action.

How Demand and Supply Zones Can Transform Your Trading Approach:

High Accuracy: These zones help you predict market turning points with precision.

Better Risk-Reward: Precise entries with tighter stops and higher profit potential.

Works Across Markets: Whether it’s stocks, forex, crypto, or commodities — the principle remains valid.

Simplifies Decision Making: No conflicting signals or analysis paralysis.

This is exactly what we teach in our basic trading course and technical analysis stock market course at Chart Monks.

Who Should Learn Demand and Supply Trading?

If you're in any of these categories, demand and supply trading is for you:

New traders taking first steps in online trading classes

Investors looking for a free online trading training resource to understand market structure

Intermediate traders tired of inconsistent results from indicators

Advanced traders seeking a professional trading course based on real market logic

Learn with Chart Monks: No-Nonsense Trading Education

At Chart Monks, we offer a series of online trading courses that follow one principle: keep it simple, practical, and psychology-aware. Our approach doesn’t rely on 10 indicators or paid tools. Instead, we focus on real price movement, market psychology, and clear trade planning.

Here’s what sets our trading for beginners course apart:

Structured Learning PathWe start with free online trading lessons for absolute beginners and gradually move to advanced strategies using demand and supply zones. Whether you're exploring an investment course for beginners free or ready for a paid course, we’ve got you covered.

Available in Hindi & EnglishPrefer to learn in Hindi? Our trading course in Hindi makes sure language never becomes a barrier in your learning journey.

Deep Focus on PsychologyLearning the psychology of trading is essential. Understanding fear, greed, and discipline can be more powerful than any strategy. We help you develop a trader’s mindset from day one.

Real Charts, Real PracticeAll our technical analysis courses include real-life chart examples, back testing sessions, and practice scenarios so you gain confidence.

What You'll Learn in Our Online Trading Course

When you enroll in a Chart Monks online trading course for beginners, here's what you can expect:

How to identify high-probability demand and supply zones

The importance of market structure in decision making

How to avoid traps set by institutions

Building a risk-reward model that fits your lifestyle

Developing emotional control and trading discipline

Crafting a technical analysis stock market course that fits your goals

Whether you're learning through our free online trading training or premium programs, you’ll be guided step by step — no fluff, no filler.

Start Trading the Right Way – Enroll Today

If you're serious about learning the silent language of markets, demand and supply trading is where you should start. It’s not just another concept — it's the foundation of our learn professional trading course at Chart Monks.

Whether you're investing long-term or trading short-term, understanding how price behaves around key zones gives you the edge you need.

Join Chart Monks Now

Learn from experienced traders

Access beginner to advanced level courses

Practice with real market examples

Learn in English or Hindi

Understand the psychology behind every trade

We offer trading courses online that are affordable, practical, and focused on what actually works. Don’t waste years chasing magical strategies. Grasp the core principle that truly moves the markets — not the noise, but the force behind every price shift.

Reach out Call or WhatsApp at +91-9220943789 and start your trading journey or visit our website to explore our complete range of courses.

Final Thoughts

The markets speak a language — and it’s not made of indicators or algorithms. It’s made of demand and supply. Learn this language, and you'll never look at a chart the same way again.

Ready to simplify your trading journey? Chart Monks is here to help you start trading training for beginners with clarity, confidence, and conviction.

#trading courses online#online trading classes#online trading course#online trading courses for beginners#basic trading course#technical trading courses#trading course in Hindi#investment course for beginners free#investment course#stock market training#technical analysis course#silent language of markets#psychology of trading#learn professional trading course#start trading training for beginners#technical analysis stock market course#trading for beginners course#free online trading training#free online trading lessons#online trading course for beginners#chart monks

0 notes

Text

Types of Investments in India with Brokerage Charges Online

In today’s digital world, investing in India has become more accessible than ever. Whether mutual fund return calculator you're a beginner looking to step into the stock market or someone interested in exploring mutual funds and SIP calculators, it's essential to have a basic understanding of the tools and options available. This guide walks you through the most important elements of investing—starting from reading stock market blogs to using brokerage calculators and selecting the right investment type.

Stock Market Blogs for Beginners: Start Your Learning Journey

If you're new to investing, the Indian stock market can seem overwhelming. Thankfully, several beginner-friendly stock market blogs simplify the concepts for you. Blogs such as , and MoneyIsle offer well-structured lessons, articles, and tutorials. These blogs explain everything—from the meaning of stocks and IPOs to technical analysis and risk management Best Mutual Funds India—in easy-to-understand language. Reading such content daily helps build a strong foundation, reduces common mistakes, and enables you to invest with confidence.

Best Mutual Funds in India: Reliable Options for Every Investor

Mutual funds are one of the most popular investment vehicles in India. They offer diversification, professional management, and options suited for every risk profile. In 2025, some of the best-performing mutual funds include:

Mirae Asset Large Cap Fund – Ideal for stable, long-term growth.

Parag Parikh Flexi Cap Fund – Known for its consistent returns and global exposure.

Axis Small Cap Fund – Suitable for those looking for high-growth opportunities.

When choosing a mutual fund, consider factors like the fund’s past performance, expense ratio, fund manager experience, and your own financial goals.

Calculate Returns on SIP: Use SIP Calculators for Future Planning

Systematic Investment Plans (SIPs) are a smart way to invest in mutual funds. With SIPs, you invest a fixed amount regularly—monthly or quarterly—and benefit from compounding over time. Online SIP calculators allow you to estimate how much wealth you can create based on your investment amount, tenure, and expected returns.

For instance, investing ₹5,000 per month for 10 years at an expected return of 12% annually could give you over ₹11.6 lakhs. These calculators help you Brokerage Charges Online set realistic goals and decide how much you need to invest to meet your future financial needs.

Mutual Fund Return Calculator: Track Performance with Accuracy

If you're already investing in mutual funds, you may want to know how your funds have performed. A mutual fund return calculator helps you calculate the actual returns on your investments over a specific time period. You can compute absolute returns, annualized returns (CAGR), and compare funds easily.

These calculators are available on platforms like Groww, Moneycontrol, and ET Money. They help you make informed decisions—whether you want to continue with a particular fund or switch to a better-performing one.

Brokerage Charges Online: What You Need to Know Before Trading

When trading in stocks or derivatives, brokerage charges can significantly impact your profits. Brokerage fees are the commissions charged by brokers to execute your trades. These charges vary based on the broker and the type of trade (delivery, intraday, or F&O).

For example:

charges ₹0 for delivery and ₹20 per intraday or F&O trade.

offers a similar pricing structure.

Traditional brokers like ICICI Direct may charge a percentage-based fee (e.g., 0.55%).

Always check for hidden charges like STT, SEBI charges, GST, and exchange fees in addition to the brokerage.

Brokerage Calculator: Know Your Costs in Advance

To avoid surprises, use a brokerage calculator before placing Types of Investments in India any trade. These tools let you calculate the total cost involved in a trade, including brokerage, taxes, and regulatory charges. By entering the buy/sell price, quantity, and segment (equity, options, futures), you can see the final cost and break-even point.

Popular brokers like Zerodha, Upstox, and Angel One provide free brokerage calculators on their websites. Using them helps you understand the profitability of a trade even before you execute it.

Types of Investments in India: Find What Fits Your Goals

India offers a wide variety of investment options to suit different financial goals and risk appetites. Here are the main types:

Stocks – High-risk, high-return investments ideal for long-term wealth creation.

Mutual Funds – Diversified portfolios managed by professionals, suitable for moderate risk takers.

Fixed Deposits (FDs) – Low-risk investments with guaranteed returns.

Public Provident Fund (PPF) – Long-term savings

0 notes

Text

Trade Smart with Technical Analysis | Basic to Super Advanced Course

Master the art of smart trading with our comprehensive Technical Analysis Course designed for all levels—Basic, Advanced, and Super Advanced. This course equips you with powerful tools and strategies to understand market trends, price movements, chart patterns, and technical indicators. Whether you're just starting or looking to fine-tune your trading strategies, you’ll gain in-depth knowledge of candlestick analysis, support & resistance, moving averages, oscillators, Fibonacci retracement, price action, and advanced trading setups. Ideal for aspiring traders, investors, and finance professionals, this course helps you make confident, data-driven trading decisions. Learn from experienced mentors, get real-time market insights, and trade smart with technical precision.

0 notes

Text

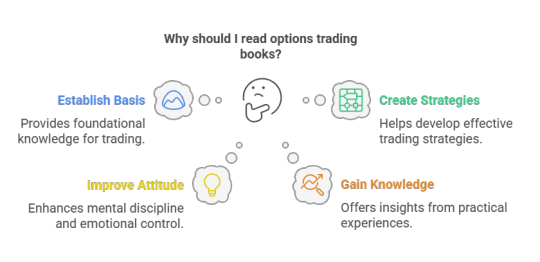

8 Books That Will Level Up Your Options Trading Game

Options trading might seem intimidating to some, but with the right education, it becomes a tool that can support nearly any trading goal—from reducing risk to increasing gains.

And when it comes to self-education, books are one of the most powerful tools at your disposal.

Here are eight Best books that provide in-depth knowledge and practical advice:

Options Trading Crash Course by Frank Richmond A well-organized starter guide that explains all the basics in a friendly tone. Great for first-timers who want to build a solid understanding before they risk their first trade.

Options as a Strategic Investment by Lawrence McMillan Packed with detailed analysis and strategy breakdowns, McMillan’s work is essential reading for those ready to explore advanced trading techniques and risk management tools.

The Options Playbook by Brian Overby A strategic guide for traders who want to move beyond theory. Overby presents 40+ strategies using real-life examples and clear diagrams that help visualize each concept.

Option Volatility and Pricing by Sheldon Natenberg This book focuses on volatility’s influence on option pricing. It’s especially helpful if you’re interested in how to adjust your trades based on shifting market conditions.

Get Rich with Options by Lee Lowell Don’t let the title mislead you—this book is all about discipline and smart planning. Lowell details four strong strategies and supports them with real-world scenarios.

Fundamentals of Futures and Options Markets by John Hull Perfect for traders who want to understand both futures and options. Hull includes important topics like interest rates and swaps, helping you see the full picture.

How to Make a Million Dollars Trading Options by Cameron Lancaster Lancaster cuts straight to the point, offering actionable advice for traders looking to turn potential into profit. It’s focused, readable, and grounded in experience.

Options Trading for Dummies by Joe Duarte A friendly introduction to options and technical analysis, this book teaches how to read charts and use market signals to make smarter trades.

Why You Should Start Reading

Books help bridge the gap between curiosity and confidence. They’re filled with lessons learned through experience and can help you avoid mistakes that cost time and money.

Final Word

Trading options can open doors to exciting financial opportunities. With these books, you’ll gain the insights and tools needed to navigate the market smarter—not harder.

0 notes

Text

Global Investors Club in USA – Why Straddleco Is Leading the Way

In the dynamic world of investing, being part of a community can significantly impact your success. That’s where the Global Investors Club in USA plays a pivotal role. It connects investors of all experience levels with valuable tools, expert knowledge, and networking opportunities. And when it comes to leading the charge in this transformative movement, Straddleco stands out as the ultimate platform of choice.

The Rise of the Global Investors Club in USA

The Global Investors Club in USA is more than just a concept — it’s a powerful network of individuals who are passionate about smart investing, global financial trends, and portfolio growth. This club isn’t limited by borders or backgrounds; it invites investors from all walks of life to collaborate, learn, and profit together. The goal is clear: provide access to global markets, exclusive insights, and personalized investment strategies.

As one of the primary drivers of this club, Straddleco provides a cutting-edge platform that supports every investor’s journey. Whether you’re just starting or already managing a complex portfolio, Straddleco offers tools and services designed to help you thrive.

Why Straddleco Is the Heart of the Global Investors Club in USA

1. Global Market Access

Straddleco enables members of the Global Investors Club in USA to seamlessly trade across U.S. and international markets. This global access ensures that investors don’t miss out on profitable opportunities around the world — from booming tech stocks in the U.S. to emerging markets in Asia and Europe.

2. Low-Cost, High-Efficiency Trading

Straddleco is known for its low brokerage fees, making it an ideal choice for both frequent traders and long-term investors. By reducing the cost of investing, members can maximize their returns and take advantage of diversified strategies without worrying about high transaction costs.

3. Smart Tools and Analytics

To make informed decisions, investors need data. Straddleco equips its users with AI-driven insights, real-time market data, risk analysis tools, and intuitive dashboards. Members of the Global Investors Club in USA benefit from these smart tools to develop strategies based on facts — not guesswork.

4. Community and Collaboration

One of Straddleco’s most valuable assets is its thriving investor community. Through webinars, forums, chat rooms, and live events, the Global Investors Club in USA brings like-minded individuals together to share strategies, trends, and success stories. This collective knowledge base accelerates learning and minimizes investment risks.

5. Educational Resources

Straddleco understands that empowered investors make smarter decisions. That’s why it offers a full suite of educational content — articles, tutorials, video lessons, and expert interviews. New investors can quickly learn the basics, while advanced users can explore complex techniques in trading, technical analysis, and portfolio diversification.

Join the Future of Investing with Straddleco

Becoming part of the Global Investors Club in USA through Straddleco means aligning yourself with innovation, opportunity, and a network of passionate investors. Whether you’re looking to grow wealth, plan for retirement, or simply learn how the markets work, Straddleco is your trusted partner.

With Straddleco, you’re not just using a trading platform — you’re joining a movement. You’re stepping into a global investors’ network that’s shaping the future of finance.

So if you’re ready to elevate your investing experience, now is the time. Join Straddleco today and become a proud member of the Global Investors Club in USA. Empower your future with smarter investments, better tools, and a stronger community — only at Straddleco.

0 notes

Text

Join ICFM’s Stock Market Courses Online and Start Trading Now

Are you looking to learn the stock market from the comfort of your home? Do you want flexible learning with expert guidance? Then ICFM’s stock market courses online are exactly what you need. The Institute of Career in Financial Market (ICFM) offers high-quality, practical, and affordable stock market courses online that help you start your journey into the world of trading and investing, no matter where you are.

ICFM is a trusted name when it comes to financial market education. Their stock market courses online are designed for everyone — whether you are a student, working professional, business owner, or homemaker. You don’t need any prior knowledge to get started. Everything is explained in simple English, step by step, so that anyone can understand and apply it.

Why Choose ICFM’s Stock Market Courses Online?

ICFM believes that quality education should reach everyone. That’s why they created online versions of their popular offline courses. These stock market courses online are structured in a way that you can learn at your own pace. Whether you want to study in the morning, evening, or weekend — the choice is yours.

With ICFM’s stock market courses online, you get the same content, the same expert teaching, and the same personal attention that you’d get in a physical classroom. The only difference is that you can access it all from your home.

Learn Stock Market from Scratch with Expert Trainers

The stock market courses online at ICFM begin with the basics. You will learn what the stock market is, how shares work, how to open a trading account, and how to buy and sell stocks. Slowly, you move into more advanced topics like technical analysis, candlestick patterns, fundamental analysis, and intraday trading strategies.

You will also be introduced to futures, options, commodities, and forex trading. All lessons in these stock market courses online are taught by experienced market professionals who explain everything in an easy-to-understand language. Even if you are a complete beginner, you won’t feel lost at any point.

Real-Time Learning with Practical Exposure

Even though these are stock market courses online, they don’t lack in practical training. You will get access to real market data, live charts, and demo trading accounts. You will practice how to analyze stock movements, identify entry and exit points, and make smart trading decisions.

ICFM’s approach is “learn by doing.” These stock market courses online are not just about theory. You will practice live trading strategies under the guidance of mentors. This helps you build confidence and makes you market-ready.

Certified Courses That Boost Your Career

After completing ICFM’s stock market courses online, you will receive a certificate that is recognized in the industry. This certificate can help you build your resume and open doors to job opportunities in stock broking firms, financial consultancies, research houses, and investment companies.

ICFM also offers job support and career guidance to students who wish to work in the finance industry. Many students who completed these stock market courses online are now working in top firms or earning independently as traders.

Flexible Learning with Lifetime Access

One of the biggest advantages of ICFM’s stock market courses online is the flexibility it offers. You can learn at your own speed, rewatch the lectures, and clear your doubts anytime. There’s no pressure, no deadlines. You get lifetime access to the course content, which means you can go back and revise whenever you want.

This kind of flexibility makes learning easier and more comfortable, especially for those who are working or studying.

Simple Language, Easy Examples, and No Jargon

Many online courses use complicated terms that confuse learners. But ICFM’s stock market courses online are made with simplicity in mind. Everything is explained using real-life examples and plain English. No tough formulas, no difficult words.

You will understand how the market works, how to read stock charts, how to follow market trends, and how to make smart trading decisions — all without getting confused.

Join from Anywhere in India

It doesn’t matter if you live in a metro city or a small town. With ICFM’s stock market courses online, you get the same level of training and support. As long as you have an internet connection and a phone or laptop, you can start learning.

Many students from different parts of India — from Delhi to Mumbai to villages in Bihar — have joined ICFM’s stock market courses online and are now confidently trading in the market.

Support Even After the Course Ends

The learning doesn’t stop when the course ends. ICFM stays connected with its students even after course completion. You will get updates on market trends, extra sessions, live webinars, and answers to your queries anytime.

This lifetime support is what makes ICFM’s stock market courses online truly special. You’re not just buying a course — you’re joining a learning family that grows together.

The Smartest Step Toward Financial Freedom

If you want to learn how to grow your money, trade like a pro, or even build a career in the financial market, then don’t wait. ICFM’s stock market courses online are the smartest, safest, and most flexible way to enter the stock market world.

Learning the stock market on your own can be risky and confusing. With ICFM, you learn with expert support, step-by-step lessons, and real practice. Whether you want to become a full-time trader or just invest wisely, these stock market courses online will help you achieve your goals.

Start Your Journey Today with ICFM

There are many courses out there, but not all are reliable. ICFM has years of experience, trained thousands of students, and built a strong reputation for offering the best stock market courses online in India.

If you are serious about your financial future, then this is your chance. Take control of your learning. Enroll in ICFM’s stock market courses online and turn your interest in the market into a skill you can use for life.

#Stock market courses online#Stock market courses online free with certificate#Stock market courses for Beginners#Share market courses#Stock market courses online with certificate#Indian stock market courses online#Online Stock Market courses for beginners

0 notes

Text

Which is the Best Institute to Learn Stock Market Investment in Nagpur?

If you want to learn how to invest or trade in the stock market, the first step is to join a good institute that gives you proper training and knowledge. In Nagpur, many people are now interested in stock market investment. But many don’t know where to learn it from.

One of the best and most trusted stock market institutes in Nagpur is Stock Market Vidya.

About Stock Market Vidya

Stock Market Vidya was started in 2004 and is helping students and working people learn share market in a simple and practical way. The institute is run by Mr. Prashant Sarode, who has been working in the stock market since 2002. He has helped many people understand trading and investing with real knowledge.

What You Will Learn in the Course

The institute offers a 1-month course. This course is made in such a way that even beginners can learn everything step-by-step. The course is divided into 4 weeks, and each week focuses on a different topic:

Week 1 – Basics & Fundamental Analysis

Learn what the stock market is and how it works.

Learn how to check a company’s balance sheet, profit/loss, and cash flow before investing.

Week 2 – Derivative Strategies

Understand how Futures and Options work.

Learn how to read the option chain and how to use options for profit and safety.

Week 3 – Technical Analysis

Learn how to read charts and find price patterns.

Use indicators like Moving Averages, RSI, MACD to understand when to buy and sell.

Week 4 – Trading Strategies & Risk Management

Learn how to do intraday trading and swing trading.

Learn how to control your loss and protect your capital with risk management methods.

This course gives a full idea of stock trading and investing – from beginner level to advanced.

Online and Offline Classes Available

Stock Market Vidya offers both online and offline classes. So, whether you live in Nagpur or outside, or if you are busy with work or studies – you can choose the timing and format that suits you best.

Live Market Practice

This is not just a theory course. You will also get to practice in the live market, where you can see real charts and try your knowledge. This helps you build real confidence and prepares you for actual trading.

Learn from an Experienced Mentor

You will learn directly under Mr. Prashant Sarode, who has more than 20 years of experience in the stock market. He gives personal attention to students and shares his own market tips and tricks.

Who Can Join This Course?

Beginners who don’t know anything about the stock market

College students who want to learn early

Working people who want to earn extra income

Housewives who want to learn from home

Retired people who want to manage their money smartly

Anyone above 18 years can join.

Conclusion

If you are living in Nagpur and want to know “Where can I learn stock market investment?, then Stock Market Vidya is one of the best places to start.

With easy language, practical learning, and expert support, this institute helps you become a smart trader or investor.

📍 To know more or join the course, visit: 👉 https://stockmarketvidya.com

#stock market#course#share market#share market courses#share market classes in pune#share market institute

1 note

·

View note

Text

Unlock Financial Freedom: Enroll in the Best Option Trading Course in Chandigarh

In today’s fast-paced financial world, having a deep understanding of the stock market is a valuable skill. One of the most powerful yet often misunderstood tools in the trading world is options trading. Whether you're looking to generate passive income, diversify your portfolio, or become a full-time trader, learning options trading can open the doors to countless opportunities. And if you’re located in Chandigarh or nearby areas like Mohali or Panchkula, there’s no better place to start than with a professional Options Trading Course in Chandigarh.

What is Options Trading?

Options trading involves buying and selling contracts that give you the right (but not the obligation) to buy or sell an asset at a specific price within a certain timeframe. These contracts are known as options, and they come in two types: Call options (betting the price will go up) and Put options (betting the price will go down). Traders use options for hedging, speculation, or income generation.

Unlike traditional stock investing, options trading requires a deeper understanding of strategies, pricing models, and market behavior, making proper training essential.

Why Choose an Options Trading Course in Chandigarh?

Chandigarh has rapidly become a hub for financial education and professional development. With a growing interest in personal finance, stock trading, and wealth creation, the demand for specialized trading courses has soared.

Here’s why enrolling in an options trading course in Chandigarh is a smart move:

Expert Trainers: Learn from certified, experienced traders who bring real-world market insights and years of trading expertise.

Interactive Learning: Courses are designed to be hands-on, with practical sessions, live market analysis, and real-time trading examples.

Personalized Attention: With small batch sizes and one-on-one mentoring, students get the attention and support they need to truly understand the concepts.

Strategic Curriculum: Courses are structured for beginners to advanced learners, covering everything from basic concepts to complex strategies like Iron Condors, Straddles, and Spreads.

Flexible Modes: Attend sessions in-person at Chandigarh’s centrally located training centers, or opt for online classes if you prefer learning from home.

What You Will Learn

The Options Trading Course in Chandigarh is designed to provide a comprehensive and practical understanding of the options market. Key topics include:

Introduction to Options: Understanding calls, puts, strike price, expiry, premium, and underlying assets.

Options Pricing Models: Learn how options are priced using factors like volatility, time decay, and the Greeks (Delta, Gamma, Theta, Vega, Rho).

Options Strategies: Master a range of trading strategies for bullish, bearish, and neutral market conditions.

Risk Management: Discover how to minimize losses and protect capital using stop-losses, hedging techniques, and portfolio balancing.

Technical Analysis: Learn how to read charts, spot trends, and use indicators to make informed trading decisions.

Live Market Sessions: Apply your knowledge in live trading scenarios under the guidance of expert mentors.

Trading Psychology: Develop the mindset of a disciplined and consistent trader.

Who Can Join?

The course is open to:

Beginners with no prior knowledge of the stock market

Stock market enthusiasts looking to expand into derivatives

Full-time professionals wanting to generate side income

Retirees, homemakers, and students interested in personal finance

Traders seeking to upgrade their skills and strategies

Whether you're just starting out or already dabbling in equity, this course will give you the tools to trade smarter and more strategically.

Benefits of Learning Options Trading

Higher Returns: Options offer leverage, allowing you to potentially earn more with a smaller capital investment.

Risk Control: With proper strategies, you can limit your risk while maintaining decent profit potential.

Income Generation: Many traders use options to generate consistent monthly income through strategies like covered calls.

Market Neutral Strategies: Trade in any market condition – uptrend, downtrend, or sideways.

Hedge Existing Investments: Use options to protect your stock holdings from unexpected market downturns.

Course Highlights

Live trading sessions with expert guidance

Access to trading tools, charts, and software

Strategy building workshops

Lifetime mentorship support

Certification upon course completion

Affordable fees and EMI options

Career guidance and trading desk assistance (in select institutes)

Final Thoughts

If you’re ready to explore the world of options trading, Chandigarh is the place to begin. With expert-led training, practical exposure, and a supportive learning environment, you’ll be equipped with the skills and confidence to trade options successfully.

Whether your goal is to earn a side income, grow your portfolio, or build a career in trading, this Options Trading Course in Chandigarh offers everything you need to succeed.

Start your trading journey today — your future self will thank you.

0 notes

Text

Crypto Trading

Crypto trading is a fast-paced, high-risk, high-reward game—and if you approach it right, it can be a powerful part of your trading journey. Here's a full beginner-friendly breakdown of how to get started and trade smart, not just fast:

🚀 What Is Crypto Trading?

Crypto trading is the act of buying and selling digital currencies like:

Bitcoin (BTC)

Ethereum (ETH)

Solana (SOL)

Dogecoin (DOGE)

The goal is to profit from price movements, either short-term (trading) or long-term (investing/HODLing).

🧠 Step-by-Step: How to Start Crypto Trading

1️⃣ Choose a Crypto Exchange

Pick a platform that’s safe, beginner-friendly, and liquid.

Top exchanges:

Binance (global)

Coinbase (great for beginners)

Kraken (advanced features + security)

Bybit / KuCoin (for altcoin access, leverage)

👉 Look for:

Low fees

Security (2FA, cold wallets)

Wide selection of coins

Good user interface

2️⃣ Understand Trading Styles

Style

Time Frame

Risk Level

Scalping

Seconds–minutes

Very High

Day Trading

Intraday

High

Swing Trading

Days–weeks

Medium

HODLing

Months–years

Low–Medium

3️⃣ Learn Technical Analysis (TA)

TA is key in crypto due to 24/7 price movement and volatility.

Start with:

Candlestick patterns

Support & resistance

Moving averages (EMA 50/200)

RSI (overbought/oversold)

Volume spikes

Bonus tools:

TradingView (charting)

best stock strategy

CoinGlass (funding rates, open interest)

Fear & Greed Index (sentiment)

4️⃣ Master Risk Management

Crypto is wild—never trade without a plan.

Risk 1–2% of capital per trade

Use stop-loss orders

Don’t chase pumps

Avoid leverage early on (especially 10x+)

5️⃣ Pick a Few Coins & Focus

Don't try to trade everything. Stick to:

BTC/ETH (stable and liquid)

1–3 high-volume altcoins you research well

6️⃣ Keep a Trading Journal

Track:

Entry & exit

Reason for trade

Emotions during trade

Outcome & lesson

This builds discipline fast.

7️⃣ Avoid Emotional Traps

🚫 FOMO (fear of missing out)

🚫 FUD (fear, uncertainty, doubt)

🚫 Revenge trading after losses

🚫 Following hype influencers blindly

🛡️ Extra Tips for Crypto Trading

Use cold wallets for storage (Ledger, Trezor)

Stay updated on news (Fed, regulations, ETFs)

Join a Discord or Twitter/X community for learning

Beware of rug pulls and scams in low-cap coins

🧭 Want to Start Right Now?

I can help you:

Pick your first few coins to trade

Build a basic crypto trading plan

Choose between spot, futures, or swing trading strategies

Just let me know your risk tolerance, time availability, and whether you’ve traded anything before

0 notes

Text

Trading Course for Beginners: A Step-by-Step Guide to Market Success

Entering the stock market can feel overwhelming, especially for those who are just starting out. With so many strategies, tools, and opinions, beginners often find it difficult to know where to begin. That’s why online trading courses for beginners are more important than ever. At Chart Monks, we offer a structured and simplified approach through our basic trading course that is specially designed to guide new traders toward success in the markets.

Why Beginners Need a Structured Trading Course

Before placing your first trade, it's essential to build a solid foundation. A trading course for beginners helps you understand the core principles of market behavior, technical analysis, and trading psychology. Lack of proper trading education often causes new traders to make common mistakes that result in financial losses. Choosing the right trading course means you’re investing in your long-term success.

What to Expect in Our Basic Trading Course

At Chart Monks, our beginner-friendly course is crafted to take you from zero to confident. This trading basics course covers everything a new trader needs:

Understanding Market StructureLearn how price moves and how trends form, so you can make informed trading decisions.

Candle Patterns & Chart ReadingRecognize common candlestick patterns and what they indicate about future price action.

Risk Management TechniquesProtect your capital with smart risk-to-reward ratios and position sizing.

Trading PsychologyOne of the most important but overlooked areas. Our course dives into the psychology of trading—helping you control emotions, stick to your plan, and build discipline.

Technical Analysis of Stocks Course SegmentGet introduced to the tools of technical analysis, including support and resistance, indicators, and chart patterns that traders use to predict price movement.

Learn at Your Own Pace

One of the best features of our online trading courses for beginners is flexibility. With the flexibility to learn trading online, you can start your trading journey anytime and from anywhere that suits you best. Whether you’re a student, a working professional, or someone looking to build a second income stream, our course fits into your schedule. Each module is designed in simple language, with visual examples, making complex topics easy to understand.

Real Strategies, No Fluff

Many trading courses promise quick success but deliver only vague theories. At Chart Monks, we focus on teaching practical, time-tested strategies that work in real markets. This is not just another trading training for beginners—it’s a mentorship-driven learning experience. You’ll walk away with strategies you can apply immediately, whether in day trading, swing trading, or positional trading.

Choosing a Financial Trading Course Wisely

When choosing a financial trading course, it's important to consider several key factors:

Instructor Credibility: Learn from real traders with experience in various market conditions.

Course Structure: Does it build step-by-step or throw you into advanced strategies too soon?

Support System: Is there a way to ask questions, clarify doubts, or get feedback?

Chart Monks checks all the boxes, with a curriculum developed by seasoned professionals and ongoing support for learners.

Learn the Silent Language of Markets

The market speaks a silent language through price movement, volume, and patterns. Understanding this silent language of markets is a game-changer. Our course teaches you how to read between the lines and recognize the subtle cues that precede big market moves. This skill gives you an edge that most retail traders never develop.

Why Technical Analysis Matters

Technical analysis serves as a core framework for making informed and strategic trading decisions. Our technical analysis of stocks course section introduces you to:

Trend Lines and Moving Averages

RSI, MACD, and Volume Indicators

Breakouts and Pullbacks

These tools enable you to study historical market patterns and make well-informed predictions about potential future price movements.

Psychology of Trading: Your Secret Weapon

No matter how much technical knowledge you have, success in trading often comes down to mindset. Emotions like fear, greed, overconfidence, and impatience can severely impact your decisions and put your trading account at risk. Our module on the psychology of trading gives you techniques to build mental discipline, patience, and emotional control—key traits of consistently successful traders.

Who Is This Course For?

Complete beginners looking for structured trading courses online

Anyone interested in understanding how the market works

Individuals who want to learn trading online with real-world applications

Traders looking to strengthen their basics and improve decision-making

Take the First Step with Chart Monks

Chart Monks is committed to making quality trading education accessible to everyone, regardless of their background or experience level. That’s why our beginner trading course is priced affordably and packed with value. You’ll not only learn the trading basics course content but also gain a deeper understanding of how the market truly works—from the inside out.

Whether you’re starting with a demo account or looking to enter the markets with real capital, our training equips you with the tools and confidence to succeed.

Start Your Journey Today. Ready to master the markets? Join one of the top online trading courses for beginners by visit Chart Monks or calling us at +91-9220943789.

#Online Trading Courses for Beginners#Basic Trading Course#Trading Course Beginners#Trading Basics Course#Technical analysis of stocks course#Trading Training for Beginners#Choosing a financial trading course#Right Trading Course#Psychology Of Trading#Trading Courses Online#Learn Trading Online#Chart Monks

0 notes