#TraderTips

Explore tagged Tumblr posts

Text

10 essential trading skills every trader should have

Trading isn’t just a game of numbers; it’s a sophisticated dance of strategy, emotion, and intellect. For those ready to plunge into the thrilling world of financial markets, mastering a blend of essential skills can make the difference between striking gold and striking out. Buckle up, because here’s your guide to the ten trading skills that will help you turn the market’s chaos into your playground.

1. Market Analysis: The Art of Decoding the Market’s Secrets

Imagine being a market detective, unraveling the clues that dictate price movements. That’s what market analysis is all about. Whether you’re delving into fundamental analysis—crunching numbers from earnings reports and economic indicators—or the art of technical analysis, which involves interpreting charts and patterns, being able to read the market’s secret language is key. Think of it as having a map to navigate the market’s maze.

2. Risk Management: Your Financial Safety Net

Risk management is like having a safety net beneath your tightrope. It’s all about knowing your limits and setting boundaries to protect your capital. Think of stop-loss orders as your market parachute, designed to slow your fall when things go wrong. By balancing risk and reward, you’re not just protecting your assets—you’re building a sturdy foundation for future trading.

3. Discipline: The Power of Sticking to Your Guns

In the fast-paced world of trading, discipline is your anchor. It’s the ability to stick to your trading plan no matter how turbulent the waters get. Imagine it as your personal trading GPS, guiding you through the fog of market emotions and keeping you on course. Discipline helps you avoid impulsive decisions and stay true to your well-thought-out strategies.

4. Patience: The Virtue of Waiting for the Perfect Wave

Patience isn’t just a virtue in trading; it’s a superpower. In a world where immediate gratification can be tempting, waiting for the right trade setup or signal can feel like an eternity. But much like a surfer waiting for the perfect wave, the rewards for those who wait can be immense. Mastering patience means knowing when to sit tight and when to strike, ensuring you’re always in the right place at the right time.

5. Adaptability: The Ability to Pivot with Precision

The market is an ever-shifting landscape, and adaptability is your ability to pivot when conditions change. Imagine it like a skilled dancer adjusting to a new rhythm. Whether it’s reacting to economic shifts, new technologies, or unexpected events, being adaptable allows you to stay ahead of the curve and seize new opportunities as they arise.

6. Technical Proficiency: Navigating Your Trading Tools Like a Pro

In today’s digital age, being technically savvy is a must. Think of trading platforms and tools as your trading cockpit—knowing how to operate them efficiently ensures you’re not fumbling when the market is moving fast. From charting software to trading algorithms, mastering these tools helps you execute trades with precision and clarity.

7. Emotional Control: Keeping Your Cool When the Market’s Hot

Emotions in trading can be like a double-edged sword. They can fuel your enthusiasm or lead to rash decisions. Emotional control is your ability to keep your cool, much like a zen master in a high-stakes poker game. Techniques such as mindfulness and journaling can help you manage stress and make decisions based on logic, not emotion.

8. Research Skills: The Quest for Knowledge

In the realm of trading, knowledge is power. Think of research as your treasure hunt for valuable insights. Staying updated with news, market trends, and economic developments equips you with the information needed to make informed decisions. The more you know, the better you can anticipate market movements and position yourself advantageously.

9. Networking: Building Your Trading Tribe

In trading, it’s not just what you know but who you know. Networking is about building relationships with fellow traders and financial experts. Imagine it as creating your own trading support network where ideas are exchanged, strategies are discussed, and opportunities are uncovered. Being part of a trading community provides valuable insights and fosters collaboration.

10. Strategic Thinking: Crafting Your Master Plan

Strategic thinking is your blueprint for success. It’s about setting clear goals, defining your trading style, and crafting a plan to achieve those goals. Picture it as designing a roadmap for your trading journey. With a solid strategy in place, you’ll navigate market challenges with confidence and purpose.

Conclusion

Trading is as much an art as it is a science, requiring a unique blend of skills and attributes. By mastering these ten essential skills—market analysis, risk management, discipline, patience, adaptability, technical proficiency, emotional control, research skills, networking, and strategic thinking—you’ll be well-equipped to transform market chaos into opportunity. So gear up, sharpen your skills, and get ready to make your mark in the exhilarating world of trading.

#TradingPlan#Laabhum#TradeSmart#RiskManagement#TradingStrategy#MarketResearch#InvestmentGoals#FinancialPlanning#TraderTips#MarketSuccess#TradingGuide#SmartInvesting#PlanYourTrades#StockMarket#TradingSuccess

0 notes

Photo

Tips To Become The Best Forex Traders https://www.westernfx.com/blog/tips-to-become-the-best-forex-traders/

#Forextradingstrategies#FearofLosing#chartingtools#tradertips#tradingmarkets#Forexdemo#Missingouttrade#Traderegrets#forexnews#tradersir

0 notes

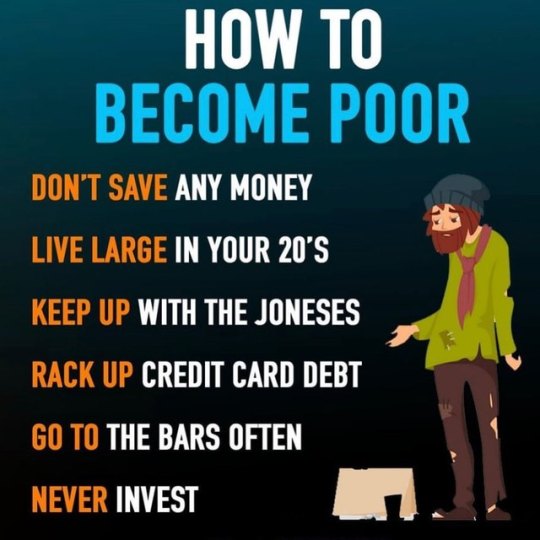

Photo

I saw this I thought I share it with you guys. This is exactly what not to do.. . . Respect your money and how you make it and how you spend it... . . . #financetips #moneysavingtips #simplysmarter #forextradingtips #tradertips #wallstreetstyle #daytrader #investing101 #cryptotips #budgetingtips g#investmenttips #invest #forexmarket #forexlife #options #forexsignals #financialfreedom #investortips #wealthtips #moneytips #network #businessideas #debtfreecommunity Dm for credits: https://www.instagram.com/p/BxabuAdnazb/?utm_source=ig_tumblr_share&igshid=ffwaqxyebyhw

#financetips#moneysavingtips#simplysmarter#forextradingtips#tradertips#wallstreetstyle#daytrader#investing101#cryptotips#budgetingtips#investmenttips#invest#forexmarket#forexlife#options#forexsignals#financialfreedom#investortips#wealthtips#moneytips#network#businessideas#debtfreecommunity

0 notes

Photo

Critical aspects of trading that every trader need to know.

0 notes

Text

RT tradertip: Can you actually make real money on FootballIndexUK?’ 👀👀👀 The proof is in the pudding. Quite an eye-opener isn’t it? #footballindex https://t.co/RKH34rmyNK | Visit https://t.co/8JxplwvarO

RT tradertip: Can you actually make real money on FootballIndexUK?’ 👀👀👀 The proof is in the pudding. Quite an eye-opener isn’t it? #footballindex pic.twitter.com/RKH34rmyNK | Visit https://t.co/8JxplwvarO

— Hextris (@Hextris5) March 31, 2019

from Twitter https://twitter.com/Hextris5

0 notes

Text

Tweeted

“A trader is someone who does his own work, has his own game plan, and makes his own decisions. Only by acting and thinking INDEPENDENTLY can a trader hope to know when a trade isn't working out.” - Linda Bradford Raschke #DayTrading #TraderTips

— Aaron (lυcιd тrader) (@MrAaronKlein) March 12, 2018

0 notes

Text

- @GileadSciences discloses China manufacturing plans on a recruitment website https://t.co/vedgcOLRbf #pharma #trade #TraderTips

— HCSM News (@HCSMnews) April 7, 2017

0 notes

Text

How to create a trading plan

Trading in financial markets can be a rewarding endeavor, but it requires a strategic approach to be consistently successful. A well-crafted trading plan serves as a roadmap, guiding traders through the complexities of the market with a clear strategy and defined objectives. Whether you're a beginner or an experienced trader, a trading plan is crucial for staying disciplined, managing risks, and achieving long-term success.

1. Define Your Trading Goals

The first step in creating a trading plan is to clearly define your trading goals. Ask yourself what you want to achieve through trading. Are you looking to generate a steady income, grow your wealth over time, or achieve financial independence? Your goals will influence your trading style, risk tolerance, and the strategies you choose.

Example Goals:

Generate a 10% annual return on investment.

Achieve a monthly income of Rs.2,000 from trading.

Grow your trading account by 20% within a year.

2. Choose Your Trading Style

Your trading style should align with your personality, time commitment, and goals. Different trading styles require different approaches and strategies. The main trading styles include:

Scalping: Involves making numerous trades within a single day, aiming to profit from small price movements.

Day Trading: Focuses on taking advantage of intraday price movements and closing all positions by the end of the trading day.

Swing Trading: Involves holding positions for several days or weeks to capture short- to medium-term price movements.

Position Trading: Focuses on long-term trends, with trades lasting from weeks to months or even years.

Choose a style that fits your lifestyle and risk tolerance. For example, if you can't monitor the markets constantly, swing or position trading might be more suitable than day trading.

3. Develop a Risk Management Strategy

Risk management is one of the most important components of a trading plan. It protects your capital and ensures you can stay in the game even during losing streaks. Key elements of a risk management strategy include:

Position Sizing: Determine how much of your capital you will risk on each trade. A common rule of thumb is to risk no more than 1-2% of your trading account on a single trade.

Stop-Loss Orders: Set a predetermined level at which you will exit a losing trade to prevent further losses.

Risk-Reward Ratio: Establish a minimum risk-reward ratio for your trades. For example, you might aim for a 1:3 risk-reward ratio, meaning you're willing to risk $1 to potentially gain $3.

4. Choose Your Markets

Decide which markets you'll trade in based on your knowledge, interests, and trading style. Whether it's stocks, forex, commodities, or cryptocurrencies, specializing in a few markets allows you to become more familiar with their behavior, improving your trading decisions.

5. Develop Your Trading Strategy

A trading strategy outlines the specific criteria and rules you'll follow when entering and exiting trades. Your strategy should be based on thorough analysis and backtesting. Key components of a trading strategy include:

Entry Criteria: Define the conditions under which you'll enter a trade. This could be based on technical indicators, chart patterns, or fundamental analysis.

Exit Criteria: Determine when you'll exit a trade, whether it's for taking profits or cutting losses. This can include setting target prices, trailing stops, or using time-based exits.

Trade Management: Plan how you'll manage trades once you're in them, such as adjusting stop-loss levels or scaling out of positions.

6. Keep a Trading Journal

A trading journal is a valuable tool for evaluating your performance and improving your strategy over time. Record details of each trade, including entry and exit points, the rationale behind the trade, and the outcome. Regularly review your journal to identify patterns, mistakes, and areas for improvement.

7. Maintain Discipline and Follow the Plan

A trading plan is only effective if you stick to it. Emotional trading, such as chasing losses or overtrading, can lead to poor decisions and significant losses. Discipline is key to staying consistent and avoiding impulsive actions that deviate from your plan.

8. Review and Adapt Your Plan

Financial markets are dynamic, and what works today may not work tomorrow. Regularly review and update your trading plan to adapt to changing market conditions, refine your strategies, and incorporate lessons learned from your trading experience.

Conclusion

Creating a trading plan is an essential step for anyone serious about trading. It provides a structured approach to navigating the markets, helps manage risks, and keeps emotions in check. By setting clear goals, choosing the right trading style, developing a solid strategy, and maintaining discipline, you increase your chances of achieving long-term success in trading. Remember, the markets are unpredictable, but a well-crafted trading plan can help you stay on the path to profitability.

#TradingSkills#Laabhum#EssentialSkills#TraderEducation#StockMarketTips#TradingSuccess#InvestmentSkills#FinancialGrowth#TradingStrategies#MarketMastery#TraderTips#SmartInvesting#LearnToTrade

0 notes

Photo

9 Things You Didn’t Know About Successful Forex Traders

https://zurl.co/e9M6

0 notes